#audits and assessment services provider

Explore tagged Tumblr posts

Text

Cyber Security Services Company | Data Security Solutions

In today’s fast-paced digital world, businesses increasingly rely on technology to store, process, and transmit sensitive data. As companies across industries harness the power of the internet, the need for robust cybersecurity services has never been more crucial. Data breaches and cyberattacks are growing threats from small startups to large corporations that can have devastating consequences. That’s where a cybersecurity company specializing in data protection services and cybersecurity management comes into play.

This blog explores the importance of cybersecurity management, the types of services offered by a cybersecurity services company, and how data protection services and endpoint security services can help businesses protect their sensitive information.

Understanding the Growing Importance of Cybersecurity

The digital transformation that businesses have undergone in recent years has revolutionized operations, providing significant benefits like improved efficiency, better customer engagement, and more streamlined processes. However, this transformation has also opened new doors for cybercriminals who exploit vulnerabilities in systems and networks to steal data, launch attacks, and disrupt operations.

With data breaches and cyberattacks on the rise, organizations must safeguard sensitive information from unauthorized access, manipulation, and theft. Whether it’s customer data, intellectual property, or financial records, securing these assets is paramount to maintaining trust, compliance with regulations, and protecting brand reputation.

Cybersecurity solutions providers play a key role in defending organizations from these threats. Cybersecurity isn’t just a technical need—it’s a business priority that can help prevent costly disruptions, legal ramifications, and loss of customer confidence. This is where the role of a cybersecurity consulting firm becomes indispensable.

What Is a Cybersecurity Services Company?

A cybersecurity services company specializes in identifying, mitigating, and preventing cyber threats. They provide tailored solutions to ensure businesses’ information and infrastructure are well-protected from a wide range of security risks. These companies are essential partners in safeguarding businesses from cyberattacks and ensuring the security of sensitive data and systems.

Key Services Provided by a Cybersecurity Services Company

Cybersecurity companies offer a range of services designed to safeguard businesses from evolving threats. These services include:

Threat Detection & Prevention Services: Cybersecurity companies deploy advanced monitoring tools and techniques to detect vulnerabilities, anomalous activities, and potential threats before they cause harm. This includes setting up firewalls, intrusion detection systems (IDS), and intrusion prevention systems (IPS).

Risk Management: Cybersecurity firms assess vulnerabilities and design strategies to safeguard businesses from both internal and external threats. A cyber risk management company helps ensure that businesses are prepared for any potential cyber risks.

Cybersecurity Audits & Assessments: Regular security audits and penetration testing are vital for identifying weaknesses in a company’s infrastructure. These audits ensure no part of the system remains unprotected.

Compliance Support: For businesses in regulated industries, cybersecurity compliance services help ensure adherence to standards like GDPR, HIPAA, and PCI DSS. Companies in these industries can also benefit from IT security services companies that provide guidance and support for meeting compliance requirements.

Incident Response & Disaster Recovery: Even with robust security measures, breaches can still occur. Incident response services help businesses respond quickly and effectively to limit damage. Additionally, cybersecurity audit services and vulnerability assessment companies help identify and prevent potential attacks before they materialize.

Employee Training & Awareness: Cybersecurity management companies often provide training programs to raise awareness about phishing, password hygiene, and safe online behavior, reducing human error and improving security.

Types of Data Security Solutions Offered by Cybersecurity Companies

At the core of every cybersecurity service is data protection. Cybersecurity solutions providers offer several key solutions to help businesses secure their information:

Encryption: Encryption ensures that even if data is accessed by cybercriminals, it remains unreadable without the decryption key. Cloud security companies offer encryption solutions to protect data stored in the cloud, safeguarding sensitive information during transit and while at rest.

Access Control & Authentication: Multi-factor authentication (MFA) and role-based access control (RBAC) are implemented to ensure only authorized personnel can access sensitive systems.

Data Loss Prevention (DLP): Data protection services monitor data transfers and emails to prevent unauthorized sharing or leakage of confidential information.

Firewalls & Network Security: Firewalls act as the first line of defense by filtering traffic and blocking harmful activities. Network security services providers ensure that your network is properly configured with firewalls, VPNs, and network segmentation to protect data from external attacks.

Backup & Disaster Recovery: A comprehensive backup and recovery plan ensures that lost or compromised data can be restored with minimal disruption to business operations. Cloud security companies play a key role in providing reliable cloud-based backup and recovery services.

Endpoint Security: With more employees working remotely, endpoint security services are becoming essential. Cybersecurity firms implement solutions to protect mobile devices, laptops, and tablets from threats.

Why Partner with a Cybersecurity Services Company?

Businesses of all sizes can benefit from the specialized expertise of a cybersecurity consulting firm. Here are some reasons why partnering with one is essential:

Expertise and Experience

Cybersecurity is a complex field requiring in-depth knowledge of emerging threats and security solutions. A cybersecurity services company brings years of experience and expertise to the table, ensuring best practices and cutting-edge tools are used to protect your data.

Cost Efficiency

Building an in-house cybersecurity team can be costly. By outsourcing to a cybersecurity solutions provider, businesses gain access to expert resources and advanced technologies without the need to invest in full-time staff.

Proactive Protection

Rather than waiting for a breach to occur, a cybersecurity management company helps you adopt a proactive approach by identifying and neutralizing potential threats before they can impact your business.

Regulatory Compliance

Staying compliant with regulations like GDPR, HIPAA, and CCPA can be challenging. A cybersecurity services company ensures your business complies with relevant data protection laws, avoiding legal complications and fines. These companies provide cybersecurity compliance services to meet the highest standards of data protection.

Business Continuity

Cybersecurity services also encompass disaster recovery planning, ensuring that your business can continue to operate smoothly after a cyber attack or natural disaster. Security operations center services ensure continuous monitoring, offering peace of mind that any security breaches are quickly detected and neutralized.

Conclusion: Protect Your Business with a Cybersecurity Services Company

As cyber threats continue to evolve, businesses must take proactive steps to protect their sensitive data and maintain customer trust. Partnering with a reputable cybersecurity consulting firm ensures that you have the right tools, expertise, and strategies in place to prevent cyberattacks, secure your data, and maintain regulatory compliance.

Whether it’s through penetration testing, endpoint security services, or incident response services, a cybersecurity services company plays a crucial role in keeping your data safe and your business running smoothly.

Investing in cybersecurity solutions today can help prevent significant financial and reputational damage in the future. Don't wait until it's too late—reach out to a trusted cybersecurity services company today to protect your data and your business's future.

#Cyber Security Services Company | Data Security Solutions#Cybersecurity Management Company#Managed Cyber Security Services#Cyber Security Company#Cyber Security Services#Endpoint Security Services#Cybersecurity Solutions Provider#Cyber Security Consulting Firm#Network Security Services#Cybersecurity Audit Services#IT Security Services Company#Cloud Security Company#Data Protection Services#Cybersecurity Compliance Services#Security Operations Center Services#Threat Detection Services#Penetration Testing Company#Incident Response Services#Vulnerability Assessment Company#Cyber Risk Management Company#Information Security Services

0 notes

Text

The Government Accountability Office (GAO) is auditing Elon Musk’s so-called Department of Government Efficiency (DOGE).

The probe, which has been ongoing since March, covers DOGE’s handling of data at several cabinet-level agencies, including the Departments of Labor, Education, Homeland Security, Health and Human Services, the Treasury, and the Social Security Administration, as well as the US DOGE Service (USDS) itself, according to sources and records reviewed by WIRED.

Records show that the GAO—an independent auditing, research, and investigative agency for Congress—appears to be requesting comprehensive information from the agencies in question, including incident reports on “potential or actual misuse of agency systems or data” and documentation of policies and procedures relating to systems DOGE operatives have accessed, as well as documentation of policies for the agency's risk assessments, audit logs, insider threat programs, and more.

Over the last few months, DOGE operatives, many of them with connections to Musk’s companies but little to no government experience, have infiltrated dozens of federal agencies as part of Musk’s plan to push out tens of thousands of government employees. They have also gained initial access to untold amounts of sensitive data, from Treasury payment systems to tax records, and appear to be attempting to connect purposefully disparate data systems.

While a number of Democratic officials have sounded the alarm on DOGE’s activities, this audit is one of the first real signs of possible accountability and oversight.

The GAO’s review is expected to be completed by the end of spring, according to records reviewed by WIRED. Congressional sources say it will yield a report that will be made public.

“GAO has received requests to review actions taken by DOGE across multiple agencies,” Sarah Kaczmarek, a spokesperson for the GAO, tells WIRED. “The first thing GAO does as any work begins is to determine the full scope of what we will cover and the methodology to be used. Until that is done, we cannot provide any additional details or estimates on when the work will be completed.”

The audit, according to records reviewed by WIRED, is broadly centered on DOGE’s adherence to privacy and data protection laws and regulations. More specifically, according to records detailing GAO’s interactions with the Department of Labor (DOL), the agency will conduct a granular review of every system to which DOGE—defined in these records as USDS workers and members of the DOGE teams which an executive order directs every federal agency to establish—has been given access at the agencies it is examining. DOL did not respond to requests for comment.

Notes obtained by WIRED detail a proposed meeting between GAO examiners and DOL representatives to request that DOL officials share records of the system privileges provided to DOGE affiliates, including “any modifications to the accounts,” as well as audit logs showing their activity.

In addition, DOL officials were asked to prepare for an in-person meeting at which GAO officials could observe the security settings on laptops the agency had provided to DOGE operatives and review all the systems that track DOGE’s work at DOL, including a data loss prevention tool and systems used to track cybersecurity and privacy incidents.

Notes from a March 18 meeting, marked “Internal/Confidential,” show that a DOL lawyer presented colleagues with an overview of DOL’s interactions with DOGE. “So far,” the notes read, “they do not have write access. They have asked; we’ve held them at bay. We’ve tried to get them to tell us what they want & then we do it. They only have read access.” DOGE seems primarily interested, according to the notes, in pay systems and grants, and has signed an agreement detailing a “long list of things they won’t do.”

The notes also detail interactions between the GAO and DOL related to DOGE’s work. Included are a specific set of requests GAO gave to DOL representatives:

“Please identify any systems and information for which USDS and/or agency DOGE team staff were provided access. In doing so, please identify all accounts created, including those for any applications, servers, databases, mainframes, and/or network equipment.

“Please describe the type of access that USDS and/or agency DOGE team staff have to agency systems and information (e.g., read, write, execute).

“Please describe how USDS and/or agency DOGE team staff access agency systems and information (e.g., on-premise or remote, agency furnished equipment or other equipment).

“Please describe the safeguards that are in place to determine that USDS and/or agency DOGE team staff protect the confidentiality, integrity, and availability of agency systems and information consistent with relevant laws and guidance.

“Please describe the processes that the agency has in place to ensure that USDS and DOGE teams are appropriately protecting the confidentiality, integrity, and availability of the agency systems and information as required by applicable laws and guidance.”

Concerns about DOGE access to agency systems are not unfounded. In February, WIRED reported that Marko Elez, a 25-year-old former X engineer, was granted the ability not only to read the code in the Treasury systems but also to write—or change—it. With that level of access, there were concerns that he could have potentially cut off congressionally authorized payments or caused the systems to simply stop working. “It’s like knowing you have hackers on your network, but nobody lets you do anything about it,” a Treasury employee told WIRED at the time.

Elez, according to the March 18 meeting notes and previous WIRED reporting, also has access to the DOL and has been linked to the Social Security Administration. His and other DOGE affiliates’ access to SSA data is currently restricted due to a court order. Elez did not immediately respond to a request for comment.

Reporting from WIRED and other outlets since then has continued to expose DOGE’s sweeping attempts to access sensitive data—and the potential consequences. President Donald Trump’s executive order from March 20 directs agencies to begin “eliminating information silos,” purportedly to fight fraud and waste. These actions could also threaten privacy by consolidating personal data housed on different systems into a central repository, WIRED previously reported.

A record detailing an initial request from GAO for DOL documents, due at the end of March, shows that the agency was asked to show how it protected its systems, with the requested documentation covering, among other things, its policies on management of access to system accounts, training, the principles of separation of duties and least privilege, the use of portable storage devices, audit logging, and its insider threat program. These requests reference the National Institute of Standards and Technology publication Security and Privacy Controls for Information Systems and Organizations, which serves as a set of information security guidelines for federal systems not related to national security.

The DOL was also asked to provide records documenting risk assessments and memorandums of understanding pertaining to DOGE; documentation for each system account created for DOGE that shows approval for requests to access the accounts, what access authorization they have, and any subsequent modifications to the accounts; all communications from October 2024 to March 2025 related to DOGE being granted access to agency systems and/or information; and detailed information on the job status of each DOGE affiliate, their relationship to the USDS, and the supervisory structure they’re working under and the security training they’ve undergone. (DOGE’s management structure has been quite opaque, with even DOGE workers not knowing who was technically in charge a month after Donald Trump’s inauguration.)

GAO examiners also sought information including instances of and incident reports related to “potential or actual misuse of agency systems or data,” detailed information on who oversees specific systems and data dictionaries, data architecture records, and interface control documents for specific systems, as well as documentation of the audit logs for each system.

The GAO audit is being carried out in response to requests from congressional leaders.

In a February 6 letter, representative Bobby Scott, a Democrat from Virginia and the ranking member of the House of Representatives’ Education and Workforce committee, cited reporting from WIRED and other outlets about DOGE intrusions into federal systems in the course of asking the agency to investigate what he called “a constitutional emergency” related to DOGE access.

On February 24, in a letter obtained by WIRED, representative Richard Neal, a Democrat from Massachusetts and the ranking member of the Ways and Means Committee, requested a review of what DOGE is doing in agencies including the Treasury Department and the Social Security Administration.

“Americans expect that when they share personal information with the government, whether for paying taxes or accessing health or Social Security benefits, it will be safeguarded,” Neal tells WIRED. “That is not what’s happened with DOGE, and why, at my request, the Government Accountability Office is working to shed much-needed light on their access to and use of personal and confidential information. It shouldn’t have to come to this—if there’s nothing to hide, DOGE should want the public to understand its work—but this is exactly why accountability measures across the government are so important.”

According to a Congressional aide, who spoke to WIRED on condition of anonymity because they are not authorized to be quoted in the media, the requests followed media reports on DOGE’s incursions into federal systems.

“The federal government, and actually most private companies as well, operate on the principle that data should be protected,” they say. “It should be protected from theft, protected from access by people who do not have a legitimate purpose or reason to be in and to be accessing that data. And so the reports of untrained people rummaging around databases changing code, scraping data—who knows what they’re doing?—were pretty alarming.”

“Has this data been exported outside of the agencies?” they add. “Is it being accessed or used by hackers or private citizens, or maybe it’s being used to train AI models? I don’t know.”

53 notes

·

View notes

Text

Compliance Audit Services: Safeguarding Your Business Through Robust Governance

In an era where regulatory frameworks are constantly evolving, businesses face increasing pressure to stay compliant with local, national, and international laws. Non-compliance can lead to hefty fines, legal disputes, and reputational damage. Compliance audit services offer a proactive solution, helping organizations assess their adherence to regulations, identify risks, and strengthen governance. This blog explores the importance of compliance audit services, their key components, and how they empower businesses to thrive in a complex regulatory landscape.

What Are Compliance Audit Services?

Compliance audit services involve a systematic evaluation of an organization’s policies, processes, and practices to ensure they align with applicable laws, regulations, industry standards, and internal guidelines. These audits cover areas such as labor laws, environmental regulations, financial reporting, data protection, and workplace safety. Conducted by independent professionals or specialized firms, compliance audits provide an objective assessment of an organization’s adherence to legal and ethical standards.

The goal is to identify gaps, mitigate risks, and implement corrective measures to ensure ongoing compliance. By leveraging compliance audit services, businesses can maintain trust with stakeholders, avoid penalties, and foster a culture of accountability.

Why Are Compliance Audit Services Essential?

Compliance audits are more than a regulatory checkbox—they are a strategic tool for sustainable business success. Here’s why they matter:

Ensuring Regulatory Adherence Laws and regulations vary across industries and regions. Compliance audits ensure businesses meet these requirements, reducing the risk of fines or sanctions.

Mitigating Risks Identifying non-compliance early prevents costly legal battles, operational disruptions, and reputational harm. Audits uncover vulnerabilities and provide actionable solutions.

Enhancing Stakeholder Confidence Demonstrating compliance builds trust with customers, investors, employees, and regulators, strengthening the organization’s credibility.

Improving Operational Efficiency Audits highlight inefficiencies in processes, enabling businesses to streamline operations and align with best practices.

Preparing for External Scrutiny Regulatory bodies often conduct inspections. Regular compliance audits ensure organizations are always audit-ready, minimizing surprises.

Common Challenges in Achieving Compliance

Navigating compliance can be daunting due to several challenges:

Complex and Evolving Regulations Keeping up with frequent changes in laws, such as data privacy or labor regulations, requires constant vigilance and expertise.

Resource Constraints Small and medium-sized enterprises often lack the in-house expertise or resources to manage compliance effectively.

Cross-Jurisdictional Operations Businesses operating in multiple regions must comply with diverse regulatory frameworks, increasing complexity.

Documentation and Record-Keeping Maintaining accurate and up-to-date records for audits is time-consuming and prone to errors without proper systems.

Lack of Awareness Organizations may be unaware of specific regulations or misinterpret their obligations, leading to unintentional non-compliance.

How Compliance Audit Services Address These Challenges

Professional compliance audit services provide tailored solutions to overcome these hurdles. Here’s how they add value:

Expert Guidance Auditors with deep knowledge of industry-specific regulations ensure accurate assessments and compliance with current laws.

Comprehensive Evaluations Services cover all relevant areas, from financial compliance to workplace safety, ensuring no aspect is overlooked.

Risk Identification and Mitigation Audits pinpoint areas of non-compliance or potential risks, offering practical recommendations to address them.

Customized Approach Services are tailored to the organization’s size, industry, and operational scope, ensuring relevant and actionable insights.

Ongoing Support Many providers offer continuous monitoring, training, and updates to keep businesses compliant as regulations evolve.

Key Components of Compliance Audit Services

A thorough compliance audit encompasses several critical areas to ensure holistic governance:

Regulatory Compliance Review Auditors assess adherence to laws such as labor regulations, tax codes, environmental standards, and data protection rules like GDPR or CCPA.

Policy and Procedure Evaluation Internal policies, such as anti-discrimination, whistleblower, or safety protocols, are reviewed to ensure they meet legal and ethical standards.

Financial Compliance Audits verify accurate financial reporting, tax compliance, and adherence to accounting standards to prevent fraud or errors.

Data Security and Privacy With rising cyber threats, audits evaluate data protection measures, ensuring compliance with cybersecurity and privacy regulations.

Workplace Safety and Labor Practices Compliance with occupational health and safety standards, wage laws, and employee rights is assessed to promote a safe and fair workplace.

Environmental Compliance For industries impacting the environment, audits ensure adherence to regulations on waste management, emissions, and sustainability.

The Compliance Audit Process

A typical compliance audit follows a structured approach to deliver clear and actionable results:

Planning and Scoping The audit begins with defining objectives, identifying relevant regulations, and gathering necessary documents like policies or financial records.

Data Collection and Review Auditors examine records, processes, and systems to assess compliance. This may include interviews with employees or site inspections.

Risk Assessment Potential areas of non-compliance or vulnerabilities are identified, with a focus on their impact and likelihood.

Reporting A detailed report outlines findings, including areas of compliance, gaps, and recommendations for improvement.

Follow-Up and Implementation Organizations implement corrective actions, with auditors providing guidance or follow-up audits to verify compliance.

Benefits of Engaging Compliance Audit Services

Partnering with professional compliance audit services offers numerous advantages:

Objective Insights Independent auditors provide unbiased evaluations, ensuring credibility and accuracy in findings.

Cost Savings By preventing penalties and optimizing processes, audits reduce long-term financial risks and operational costs.

Scalability Services are adaptable for businesses of all sizes, from startups to multinational corporations, ensuring compliance at every stage.

Enhanced Reputation A strong compliance record attracts customers, partners, and investors who value ethical practices.

Peace of Mind With experts handling compliance, businesses can focus on growth and innovation without worrying about regulatory pitfalls.

How to Choose the Right Compliance Audit Service

Selecting a reliable service provider is crucial for effective audits. Consider these factors:

Industry Expertise Choose a provider with experience in your sector, as they understand specific regulatory nuances.

Reputation and Credentials Look for certified professionals with a proven track record and positive client testimonials.

Comprehensive Offerings Ensure the service covers all relevant compliance areas and provides end-to-end support, from audits to training.

Technology-Driven Solutions Providers using tools for real-time monitoring or automated checks offer greater efficiency and accuracy Responsive Support Opt for a provider that offers clear communication and ongoing assistance to address queries or regulatory changes.

Conclusion

Compliance audit services are a vital investment for businesses navigating today’s complex regulatory environment. By ensuring adherence to laws, mitigating risks, and enhancing governance, these services empower organizations to operate with confidence. Beyond avoiding penalties, compliance audits foster trust, streamline operations, and position businesses for long-term success.

Partnering with professional compliance audit services simplifies the process, providing expert insights and tailored solutions to meet your unique needs. Take the proactive step today to strengthen your compliance framework, protect your business, and build a sustainable future. With robust governance, your organization can thrive in any regulatory landscape.

5 notes

·

View notes

Text

The U.S. House of Representatives has passed a bill, which received bipartisan support, that seeks to make the Internal Revenue Service's (IRS) handling of tax return errors more transparent.

Newsweek has contacted Iowa Republican Representative Randy Feenstra, who introduced the bill, out of normal working hours via email for comment.

Why It Matters

Taxpayers who receive an IRS notice of a math or clerical error face a process that critics describe as opaque and difficult to navigate. The IRS is allowed to adjust tax liabilities without initiating an audit, and can send automated letters that often lack detail and can result in unexpected bills or reductions in refunds.

Supporters of the proposed legislation say it addresses a long-standing gap in taxpayer communication, as the bill seeks to reduce confusion, prevent unnecessary financial strain, and give taxpayers the tools to understand and challenge changes made to their filings.

What To Know

In February, Feenstra introduced H.R. 998, the Internal Revenue Service Math and Taxpayer Help Act, which has cleared the lower chamber unanimously and awaits Senate consideration.

The legislation is designed to ensure that the IRS provides clearer explanations when it identifies math or clerical errors in tax filings.

The bill requires that each IRS notice include specific information about the error and what steps the taxpayer can take in response.

The notices must describe the type of error in "plain language" and identify the specific line on the tax return that was affected.

They must also include an itemized breakdown of how the IRS recalculated the return, giving taxpayers a transparent view of how any adjustments were made.

Notices will now feature a dedicated phone number for the IRS' automated transcript service and must state the deadline by which a taxpayer can request an abatement, essentially a reversal, of the tax changes.

The bill outlines that such abatement requests can be submitted by mail, electronically, over the phone or in person.

Additionally, if the IRS later makes changes that reduce the assessment tied to a previous error, it must send a follow-up notice that explains the abatement with the same level of detail as the original notice.

The bill received support from both parties in the House, with no recorded opposition in the floor vote or committee hearings.

What People Are Saying

Iowa Republican Representative Randy Feenstra said: "If the IRS finds a mistake on a tax return—for example, when a taxpayer accidentally adds a zero to their reported income—the agency should clearly communicate that error to the taxpayer and explain why a tax refund is different than expected(...)

"With this legislative fix, we can improve customer service by promoting open and transparent communication between the IRS and the taxpayer when a tax error is identified."

Missouri Republican Representative Jason Smith, chairman of the House Ways and Means Committee, said: "This bill is a win for taxpayers that will deliver better protection for Americans and greater accountability to the IRS."

Ryan J. Wilson, professor of accounting at the Tippie College of Business in Iowa, told Newsweek: "This seems like a positive for taxpayers. Certainly, IRS communication can be vague and confusing. Taking steps to enhance clarity around clerical errors and recalculated returns is helpful. I also like the idea of providing a number for taxpayers to call."

What Happens Next

Having cleared the House, H.R. 998 now moves to the Senate. If passed, the bill would proceed to the president for his signature.

7 notes

·

View notes

Text

𝐇𝐚𝐧𝐝 𝐌𝐞 𝐃𝐨𝐰𝐧

.

TW: Gang violence

A/n: Not all characters will be dated/developing relationships in the first book/season. You may have to wait until the second book/season if you are waiting for a specific character.

X Table Of Contents

𝙲𝚑𝚊𝚙𝚝𝚎𝚛 𝟸: "𝚂𝚒𝚌𝚔"

《𝙿𝚛𝚎𝚟 𝙽𝚎𝚡𝚝》

"Boss," My secretary looks up at me with a confused look plastered on her face. "I thought you were sick."

Oh right. I chew my lip.

I offer her my best smile. "I ate some soup! I'm all good now!"

She raises a judgmental eyebrow.

A harsh bump on my shoulder makes me look behind me, resulting in me coming face-to-face with my friend, Emma. She examines me from head to toe, her nose scrunched up. She turns to my secretary. "Hina, why is there a liar in my face?" She questions.

"That's what I'm trying to figure out!"

Emma rolls her eyes and hands me a stack of paper. "I'm glad you enjoyed your 24-hour vacation because you have work to do." Soon, my right hand is overflowing with papers covered in letters and numbers. My face resembles that of confusion and an ever-so-sassy Emma scoffs at my dismay, rolling her eyes. "The CEO's wife cheated on him; he filed for divorce. Ever since then, it's like he's been taking his anger out on us." She jots her lip out to form a pout.

"I... thought it was the other way around? Didn't his wife...?" Hinata trails off and looks at Emma incredulously.

I roll my eyes at their loose lips and make my way to the elevator. I press the button to go to the 11th floor and look over the stack of paperwork Emma handed me. My role as a junior operations analyst is to assess the business policies and procedures of an organization. To make sure the business is running as efficiently as possible, I pinpoint areas that require improvement and assist in creating new plans.

It's my responsibility to carry out research, investigate workflows, and make sure the company complies with legal requirements. I collaborate with each department to schedule meetings with managers and carry out internal audits to gauge their workflows. In order to provide insights into corporate operations, I am a key player in the collection, analysis, and interpretation of data. I support management and senior analysts in spotting patterns, summarizing research, and coming to wise judgments.

I'm pulled out of my calculations by the sound of the elevator alerting me to my stop. I head into the hallway to find my nameplate with the numbers 1105 etched underneath it, just beside my door.

I push my door open and carelessly plop the papers onto my desk. Slumping into my office chair, I swing about, already fatigued.

The phone rings on my desk, and I immediately sit up straight and act professionally. I pick up the phone and hear Hina's chirpy voice ringing through. "Ma'am, you are to pick up line 2. There is a gentleman who says he would like to speak with you."

"Will do! Thank you, Hinata." I hang up the phone, this time pressing 'pickup' followed by the numbers 02.

I introduce myself and my role to the guest then ask how I can be of assistance.

"I know who you are, sweetheart; I need a favor." I recoil at the sound of Hanma's voice, pulling away from my phone. "Hanma?!" I inquire.

"How do you know where I work? Why didn't you just text me? Don't call me at my workplace because you're bored." I chastise.

"Wow, this is some customer service. 1. I have my ways; 2. your phone is off, and even if you did answer, you would still nag me for texting you at work; and 3. while I am bored, I need something."

I upturn my lip at his quips. "What is it?"

"I need you to deliver something to someone once you're done at work."

"That sentence contained no nouns at all. I'm having trouble getting a name, knowing where I'm going, or what I'm dropping off. Already a red flag." I deadpan.

"There's my businesswoman." He chuckles. "But no, sweetheart, you can trust me."

I sigh.

"You owe me."

His laugh reverberates over the phone. "Of course, doll."

As I exit the building, my phone is illuminated by the orange hue of the setting sun. Scrolling down my contacts, I dial Hanma's number and wait for him to pick up.

"Hello?"

"So where am I supposed to be going? Do I walk down the street, or?" I briefly look around for any signs of Hanma.

"A friend of mine is coming to pick you up. Stay where you are." Caught off guard by his sudden serious tone, I hang up and do as I am told.

In less than five minutes, a black Toyota Camry pulls to a stop in front of me. With a text from Hanma telling me what the car looks like, I know that this is the friend he mentioned. Opening the passenger door, I realize there are two men in the car. The driver, brownskinned with black and yellow hair, pushes his glasses up his nose. The passenger, purple haired sporting a jellyfish-like haircut, looks at me as if I just spat on him.

"Can I help you? You're riding in the back." He jots his thumb towards the backseat, gazing down his nose at me as if he is already annoyed by my presence.

"Damn, excuse you." I mumble, slamming the door and sliding into the backseat instead.

I cross my arms and fight the urge to complain to Hanma about his friends' less than welcoming behavior. Sighing heavily, I rest my head against the window as we turn down countless streets. I try my best to remember where we're going just in case things go left.

It isn't long before the car comes to a stop outside an abandoned warehouse. Graffiti and dirt cover what's left of the establishment. I look towards the men.

"Are y'all sure this where we supposed to be?" I gazed out the window with concern.

I get no response as the man in the passenger seat gets out the car. I look to the driver instead. He looks at me, yet gives no response. Irritated, I step out the car, broken glass crunching beneath my feet. I go to the trunk where the purple haired man is located.

He gives me something that is sealed with red string and wrapped in a brown paper bag. I examine the square-shaped object in an attempt to determine what it is.

"Let's go." The man slams the trunk and strides over to the warehouse.

Shortly after the man knocks on the enormous doors, they swing open. A man in a suit flanked by what I could only guess to be bodyguards stood in the center of the room.

The man was overweight, short, and leaned on a cane. The man grins at us, and I'm not sure which sparkled more, the big gold ring on his hand that he extended toward us or the single gold grill on his teeth.

"Haitani! Good ta see ya!" The man bellows.

Though he tried to hide it, the man named Haitani grimaced.

"Pleasure doing business with you, Kosung." One of Kosung's men stalks towards us, and Haitani takes the package out of my hand, giving it to the man.

"Who's the doll?" Kosung motions towards me with the package. "The King's recruiting newbies?" He slightly opens the package, peering through the small hole.

Haitani scoffs. "I sure hope not."

Haitani clears his throat, then all eyes are on him. "I have some toys in the trunk." Haitani uses his head to motion towards the car.

Kosung hands the package to one of his men. "The King sure does act fast, huh? Let's see what you've got."

Haitani grabs my upper arm and drags me out the warehouse. Once the heavy doors close behind us, he spins me around so that I'm facing a small shed hidden far behind the warehouse.

"See that shed over there?" Haitani points, "Go in there and grab anything with the word Bonten on it." He pats my shoulder and starts to walk to the car.

I turn and grab the sleeve of his tux. "So you wanna be rude from jump, then have the nerve to ask me to do something for you? Have you lost your goddamn mind?!" I push his arm.

"Have you lost yours? If you're gonna be sensitive over every little thing, you shouldn't have offered to help in the first place." He glares at me. "Hanma needs to keep his bitches on a leash." He mumbled and continued to walk to the car.

It took everything in me not to grab him by his ugly ass hair and slap the shit out of him. Regardless, I turn and walk to the shed, only to be met with a rusty padlock. I look around for something to break- much less, open- the lock. Hidden in the tall grass, I find a hammer and ready myself. With three good swings, the lock breaks off. With the door dragging on the ground, it takes most of my strength to open it, though just enough for me to squeeze through.

Once inside, I discover a dusty storage area with documents strewn about. Not sure where to look first, I maneuver over to the office desk in the middle of the room. While looking through papers, a particular document catches my eye. The name of the company I'm working for, Gynja Investments, and Bonten are supposed to be completing a deal today.

Organizing the documents on the desk: a stack for Gynja Investments, a stack for Bonten, and a stack for the plans they have created and intend to create together. I fold up the stacks that have to with the company I'm working under, and stuff them into my shoes. I grab Bonten's papers and stuff them into the waistband of my skirt.

Suddenly, my body is thrown forward, and my chest meets the desk. Instantly, what I can only assume is a zip tie, binds my wrists together. As I attempt to scream for help, my assailant gags my mouth with a cloth, tying it.

They yank me up by the zip tie, causing the plastic to dig into my wrists. I scream in pain as I am pushed out of the shed. I scream and kick, but my attempts to make a sound are met with silence and my kicks miss their target. Soon, we come to the back door of the warehouse, only for the doors to be flung open by my assailant, and me to meet the disgusting floor. Looking up, my eyes meet Haitani's- disappointed? disgusted?- expression.

No, it was more like he was bothered with the fact that I got caught and he now has to save me. But by the looks of it, I'm not even sure if he wants to do that. Kosung looks back at me and smiles.

"Haitani! I thought you said it was a pleasure doing business with me?" He turns back to the man in question.

Haitani picks at his ear. "That's the thing, Kosung. The boss thought so too. So while you're worried about my rat, shouldn't you be worried about why one of yours has supposedly been taking millions from Bonten?"

Haitani takes out his phone, seemingly uninterested in what Kosung has to say next.

Kosung's face grows red as he grits his teeth with anger. "Me? Skim Manjiro? Don't make me laugh, bastard! What business do I have skimming a gang that's going to fall within days?!-" The man's sentence is cut off with a blood curdling scream and the sound of a gunshot ringing through the air. Blood splatters from the man's knee as he falls to the ground.

I look back to see a man with a pink mullet and scars adorning each side of his mouth, pointing a smoking gun at Kosung. "Watch your tongue, pig."

I can hardly understand what's going on as shots ring through the air. Trying my best to get to safety, I crawl behind a crate. Screams and gunfire are all that can be heard throughout the warehouse. Just then, a large man gets thrown at the crate in front of me, breaking it and knocking me out in the process.

#hand me down#tokyo rev x reader#tokyo revengers#tokyo rev#tr#hinata tachibana#sano emma#hanma shuji#haitani rindou#kisaki tetta#black reader#x black reader#x black fem reader#rindou haitani#bonten#series#haruchiyo sanzu#sanzu haruchiyo#manjiro sano#sano manjiro

24 notes

·

View notes

Text

Risesparksolution.com review:How to Register

When choosing a forex broker, traders always ask the same key questions: Is it safe? Can I trust it with my money? Does it provide a good trading experience? In this Risesparksolution.com review, we’ll break down everything you need to know—regulation, reviews, account types, deposit & withdrawal methods, and more—to determine whether this broker is as reliable as it seems.

How to Register on Risesparksolution.com review: A Step-by-Step Guide

The registration process for risesparksolution.com reviews is straightforward and user-friendly. Here’s how you can sign up:

Locate and click the "Create an account" button in the upper right corner of the website.

Enter your required personal details in the provided fields.

Wait for a manager to process your information.

Once processed, your registration is successfully completed.

This step-by-step process ensures a quick and hassle-free account creation experience. Let me know if you need further details!

How to Contact Risesparksolution.com Support

Reliable customer support is crucial for any trading platform, and risesparksolution.com review ensures that users have access to assistance when needed. The broker provides multiple ways to get in touch, making it easier for traders to resolve issues, ask questions, and get guidance on platform usage.

📞 Phone Support

For urgent matters, traders can directly call the support team at: ➡️ +41 415 330 830This is a great option if you need immediate assistance with account-related issues, deposit/withdrawal concerns, or platform functionality.

📧 Email Support

For less urgent inquiries or detailed questions, you can contact the support team via email: ➡️ [email protected] method is ideal if you need to provide documentation, request verification, or ask for in-depth explanations regarding trading conditions.

Why This Matters?

The availability of multiple support channels is a strong sign of a legitimate and customer-oriented broker. Many unreliable brokers lack direct phone contact, leaving users with slow or ineffective support. In contrast, risesparksolution.com review provides both phone and email support, ensuring that traders can always find a way to get help.

Moreover, quick response times and accessible communication options build trust and reliability—key factors when choosing a forex broker. If you ever need assistance, you know exactly where to reach out!

Regulation and License of Risesparksolution.com reviews

When it comes to forex trading, regulation is one of the strongest indicators of a broker’s legitimacy. A licensed broker operates under strict financial rules, ensuring transparency, security, and fairness for its clients.

risesparksolution.com review is regulated by FCA (Financial Conduct Authority)—one of the most reputable regulatory bodies in the financial industry.

Why is FCA Regulation Important?

The FCA is known for its strict oversight and enforcement of financial laws, meaning that any broker under its supervision must meet high standards. These requirements include: ✅ Client fund protection – The broker must separate client funds from its own operational accounts. ✅ Regular audits – The FCA conducts frequent reviews to ensure compliance with financial laws. ✅ Transparency – Brokers must provide clear information about fees, risks, and trading conditions.

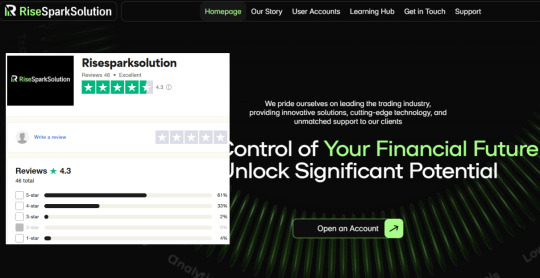

Trustpilot Reviews of Risesparksolution.com

One of the most reliable ways to assess a broker’s reputation is by checking real user reviews. A high rating on Trustpilot indicates that most traders have had a positive experience with the platform.

⭐ Trustpilot Score: 4.3 / 5

This is an excellent rating for a forex broker, considering that many companies in this industry struggle to maintain even a 4.0 due to the competitive and often volatile nature of trading. A score of 4.3 suggests that most users are satisfied with the platform’s performance, reliability, and service.

📊 Review Count: 45 Total Reviews

Out of these, 44 reviews are in the 4-5 star range, meaning that almost all users who left feedback had a good experience.

Why This Matters?

A high rating is hard to maintain in forex trading, where traders often blame brokers for their own losses. The fact that risesparksolution.com review has kept a 4.3-star rating suggests fair trading conditions and reliable service.

The percentage of positive reviews is outstanding—44 out of 45 reviews are 4 or 5 stars. This suggests that most users are happy with the platform’s execution speed, withdrawal process, and customer support.

Scam brokers often have low scores or a high number of complaints. This isn’t the case here. The overwhelmingly positive feedback suggests that users trust this broker and find value in their services.

Is Risesparksolution.com review a Legit Broker?

After analyzing Risesparksolution.com reviews from every angle—regulation, user reviews, trading conditions, deposit & withdrawal methods, and customer support—it’s clear that this broker stands out as a reliable and trustworthy platform for traders.

Here’s why: ✅ Strong Regulation: Licensed by the FCA, one of the most reputable financial authorities, ensuring compliance with strict financial rules. ✅ High Trustpilot Rating: A 4.3/5 score with over 97% positive reviews—a great sign of user satisfaction. ✅ Fast & Transparent Transactions: 0% deposit and withdrawal fees, with quick processing times. ✅ Multiple Contact Methods: Provides both email and phone support, something many brokers fail to offer. ✅ User-Friendly Platform: Suitable for both beginners and experienced traders, with diverse trading tools and account types.

If you’re looking for a regulated, well-reviewed, and customer-focused forex broker, Risesparksolution.com review checks all the right boxes. The combination of secure trading, fast transactions, and excellent user feedback makes it a great choice for traders seeking a trustworthy broker.

Would you like to explore specific features in more detail? 🚀

8 notes

·

View notes

Text

What is Unlimited Liability for Negligence?

Understanding the concept of liability is crucial for anyone engaged in business or professional services. One key concept to grasp is "unlimited liability," which refers to situations where a party can be held fully responsible for damages caused by negligence without any monetary cap. In contrast, limited liability structures restrict the financial exposure of the liable party. This article explores the implications of unlimited liability, particularly in cases of negligence, and the impact it can have on businesses and individuals.

Understanding Unlimited Liability

Unlimited liability can have significant financial and personal consequences. If your business operates under a structure with unlimited liability, you may be required to cover all losses or damages resulting from negligent actions. This lack of financial limitation means personal assets might be at risk to satisfy legal claims.

For example, a business held liable for negligence resulting in a severe accident could face damages that far exceed its income. In such cases, the business owner’s personal finances may also be at stake. This underscores the importance of understanding your business’s liability structure, especially in industries where negligence can have serious consequences, such as healthcare, construction, or services.

The Concept of Negligence

Negligence occurs when someone fails to exercise reasonable care, resulting in harm to another person. To prove negligence in a legal context, four key elements must typically be established:

Duty of Care: The responsible party had a legal obligation to act in a specific way.

Breach of Duty: They failed to meet that obligation.

Causation: Their breach directly caused harm.

Damages: Actual harm or losses occurred.

In a business setting, negligence can arise from defective products, substandard services, or other lapses. If a court determines negligence and your business operates under unlimited liability, you could be responsible for covering the full extent of the damages.

Risks of Unlimited Liability

Operating under unlimited liability poses various risks, especially for small businesses or startups. Here are some critical considerations:

Financial Exposure: Unlimited liability means there’s no cap on what you could be held accountable for, potentially leading to personal financial ruin.

Insurance Challenges: Securing adequate liability insurance can be difficult. Insurers may hesitate to cover businesses with high liability risks.

Impact on Operations: Fear of liability may lead to overly cautious business decisions, stifling growth and innovation.

Reputation Damage: Legal disputes over negligence can harm your reputation, even if claims are unfounded, potentially resulting in client loss.

How to Protect Your Business

To mitigate the risks of unlimited liability, consider these strategies:

Incorporation: Forming a corporation or LLC can protect personal assets by separating them from business liabilities.

Liability Insurance: Comprehensive insurance tailored to your industry can provide a safety net for negligence claims.

Risk Management: Regularly assess and address potential risks through training, audits, and adherence to best practices.

Clear Contracts: Draft clear agreements that outline responsibilities and liabilities. Legal counsel can help ensure these documents are enforceable.

Navigating the complexities of liability laws can be challenging, especially when facing negligence claims. A personal injury attorney can help you understand your legal exposure, evaluate your insurance coverage, and build a defense if necessary.

Contact a Tucson Personal Injury Attorney

Unlimited liability for negligence can have serious consequences for your business and personal assets. Protect yourself by understanding your liability risks and taking proactive measures. If you’re facing a negligence claim or need guidance on liability matters, contact a Tucson personal injury attorney to discuss your options and safeguard your future.

7 notes

·

View notes

Text

During his recent testimony before the Senate Armed Services Committee, General Christopher Cavoli presented a master class in turd polishing. If you listened to his testimony, or read the transcript, you would be inclined to believe that Ukraine is fighting Russia to a stalemate. That is wrong. First, let’s review a summary of the lowlights from Cavoli’s testimony:

Ukrainian Adaptation and Progress: Cavoli highlighted Ukraine’s significant military adaptation, including transitioning from Soviet-era artillery systems to NATO-standard systems under wartime conditions. He described this as “extremely impressive” and emphasized that Ukraine is now in a stronger defensive position compared to earlier stages of the war. What Cavoli should have said is the following: Ukraine is totally on the defensive now and has been unable to mount and sustain a successful counter offensive.

Effectiveness of U.S. Aid: Give yourself a big, old pat-on-the-ass General. Cavoli underscored Ukraine’s heavy reliance on U.S. support, particularly for advanced anti-aircraft systems and intelligence. And he noted that U.S.-supplied long-range missiles like ATACMS have been “extremely effective,” though he reserved detailed assessments for closed sessions due to intelligence concerns. Extremely effective? As measured by what benchmark or standard? I think Cavoli was auditioning for his next job in the military industrial complex. This is some highly professional ass-kissing. The ATACMS are impotent against the Russian advance.

Battlefield Update: Shades of Bojangles. Cavoli did some fancy tap dancing when he provided an optimistic update on the battlefield. Cavoli reported that Ukraine has improved its manpower and defensive capabilities, while Russian forces are increasingly reliant on infantry assaults due to equipment shortages. This is just a blatant lie. In fact, as noted in the next paragraph, Cavoli made some startling admissions about the disparity between the poorly supplied Ukrainians and the industrial might of Russia.

Russian Challenges: Cavoli pointed out that Russia has suffered massive losses, including approximately 4,000 tanks, and that while it has shown some technical adaptations, the overall effectiveness of its ground forces is declining. Yet, in the very next sentence in his written testimony, he conceded that Russia had replaced all of its lost tanks and was outproducing the United States by a factor of 30-to-1.

4 notes

·

View notes

Text

Recipe Cost Management 101 for Restaurants: The Complete Guide to Maximizing Kitchen Profitability

The Hidden Profit Killer: Poor Recipe Cost Management

UK restaurants lose an average of £89 daily due to inefficient recipe cost management—£32,485 annually for typical operations. While 68% of restaurant closures in the UK stem from poor cost control, most operators remain focused on front-of-house improvements, missing critical profit opportunities in kitchen operations. Through analyzing recipe costing data from over 800 restaurant operations across Europe, we've identified the exact strategies that separate profitable establishments from struggling ones. This analysis reveals actionable methods for maximizing profitability through intelligent recipe cost management and strategic supplier collaboration.

The current economic climate in the UK, with rising ingredient costs and labour shortages, makes precise recipe costing more critical than ever. Restaurants that master this discipline typically see food cost reductions of 15-25% within six months of implementation.

The Recipe Costing Crisis: Why Most Restaurants Fail

1. Manual Calculation Inefficiency

Most UK restaurants still rely on spreadsheets and manual calculations for recipe costing. With ingredient prices fluctuating weekly due to supply chain volatility, these static calculations become obsolete quickly. A recent survey of 300 UK restaurant operators revealed that 73% hadn't updated their recipe costs in over three months, despite ingredient price increases of 12-18% during the same period.

2. Hidden Cost Blindness

Beyond ingredient costs, successful recipe costing must account for:

Labour time for preparation and cooking

Energy costs for cooking and storage

Packaging and presentation materials

Waste and spillage factors (typically 3-8% of ingredient costs)

Seasonal price variations affecting profit margins

3. Portion Control Inconsistencies

Without standardized portioning, even perfectly calculated recipe costs become meaningless. Our analysis shows that restaurants with poor portion control see actual food costs exceed theoretical costs by 15-30%, directly impacting profitability.

4. Supplier Price Volatility Impact

Brexit-related supply chain disruptions and inflation have created unprecedented price volatility. Restaurants using outdated costing methods often discover their "profitable" dishes are actually losing money when current ingredient prices are factored in.

The Strategic Recipe Cost Management Framework

Phase 1: Assessment & Digital Foundation

Week 1-2: Current State Analysis Begin by conducting a comprehensive audit of your existing recipe portfolio. Document every ingredient, quantity, and current supplier cost. Create a baseline understanding of your theoretical versus actual food costs across all menu items.

Modern restaurant inventory systems enable real-time cost tracking, automatically updating recipe costs as supplier prices change. This technology eliminates the manual burden while providing accuracy impossible with traditional methods.

Key Performance Metrics to Establish:

Theoretical food cost percentage by dish

Actual food cost variance from theoretical

Ingredient price volatility tracking

Waste percentage by ingredient category

Labour cost allocation per recipe

Phase 2: Strategic Implementation

Week 3-4: Recipe Standardization Implement precise recipe cards with exact measurements, preparation methods, and quality standards. Each recipe should include:

Ingredient specifications and acceptable substitutes

Exact portion sizes and presentation guidelines

Preparation time requirements and labour allocation

Quality control checkpoints throughout preparation

Cost per portion calculations with real-time updates

Week 5-6: Technology Integration Deploy value-added inventory services that connect recipe management with inventory control. This integration ensures recipe costs reflect current stock levels and supplier pricing, enabling dynamic menu optimization based on ingredient availability and cost fluctuations.

Phase 3: Optimization & Profit Maximization

Week 7-12: Advanced Analytics Implementation Utilize data analytics to identify profit optimization opportunities:

Menu engineering analysis identifying high-profit, high-popularity items

Seasonal adjustment strategies for ingredient cost variations

Supplier performance evaluation and negotiation leverage creation

Cross-utilization optimization reducing ingredient variety while maintaining menu diversity

Real-World Success Stories from UK Operations

Independent Restaurant Transformation

A 60-seat gastropub in Manchester implemented comprehensive recipe cost management, reducing food costs from 34% to 26% of revenue within four months. By standardizing portions and implementing real-time cost tracking, they identified that their signature fish and chips was actually losing £2.30 per order due to outdated costing. After recipe optimization and portion adjustment, the dish became their most profitable menu item.

Multi-Unit Chain Success

A 12-location pizza chain across the Midlands struggled with inconsistent profitability between locations. Implementation of standardized recipe costing revealed that ingredient purchasing variations created profit margin differences of up to 8% between locations. Centralized recipe management and supplier standardization resulted in overall food cost reduction of 23% and consistent profitability across all locations.

Fast-Casual Breakthrough

A healthy food concept with 6 locations in London used recipe cost management to navigate the 2023 ingredient price crisis. By analyzing recipe profitability in real-time, they identified substitute ingredients that maintained quality while reducing costs. Strategic menu adjustments based on cost analysis increased profit margins by 31% despite overall ingredient inflation of 15%.

Implementation Roadmap for UK Restaurants

Immediate Actions (Week 1-2)

Recipe Documentation and Costing Audit

Inventory all current recipes with exact measurements

Calculate current theoretical costs using latest supplier pricing

Identify recipes with outdated cost calculations

Document preparation times and labour allocation

Supplier Price Analysis

Review current supplier agreements and pricing structures

Identify alternative suppliers for key ingredients

Analyze seasonal price patterns for core ingredients

Establish price alert systems for critical cost components

Integration Phase (Week 3-6)

Technology Implementation

Deploy integrated recipe and inventory management systems

Train kitchen staff on standardized preparation methods

Implement portion control measures and quality checkpoints

Establish real-time cost tracking and alert systems

Professional implementation support through specialized inventory services can accelerate this process and ensure optimal system configuration for your specific operation.

Optimization Period (Week 7-12)

Performance Monitoring and Refinement

Analyze actual versus theoretical food costs weekly

Identify top-performing recipes for menu prominence

Adjust recipes based on cost and popularity analytics

Optimize supplier relationships based on performance data

Advanced Capability Adoption

Implement predictive costing for seasonal menu planning

Develop alternative recipes for high-volatility ingredients

Create automated reordering systems based on recipe demand

Establish profit margin targets and monitoring systems

Future Outlook: Technology and Market Evolution

The UK restaurant industry faces continued challenges from labour shortages, supply chain disruptions, and evolving consumer expectations. Advanced recipe cost management systems are becoming essential competitive advantages, enabling restaurants to:

Respond quickly to ingredient price fluctuations

Maintain consistent quality across multiple locations

Optimize menu profitability through data-driven decisions

Reduce food waste through precise ingredient utilization

Early adopters of comprehensive recipe cost management systems are positioning themselves for sustainable profitability despite market volatility. As artificial intelligence and predictive analytics become more accessible, restaurants with established digital foundations will benefit most from these advancing capabilities.

The integration of recipe costing with broader inventory management creates opportunities for unprecedented operational efficiency and profit optimization, making this transition not just beneficial but essential for long-term success.

Ready to transform your restaurant's profitability through intelligent recipe cost management? Contact StockTake Online for a personalized demonstration of how our integrated inventory and recipe costing solutions can reduce your food costs by 15-25% within six months.

About StockTake Online

StockTake Online is a leading cloud-based inventory management platform designed specifically for the hospitality industry. With scalable tools, expert services, and a customer-first approach, we serve restaurant groups and independent operators across global markets.

Learn more:

Website: www.stocktake-online.com

LinkedIn: StockTake Online

Facebook: @StockTakeOnline

Instagram: @stocktakeonline

YouTube: StockTake Channel

2 notes

·

View notes

Text

Complete Cybersecurity & Data Protection Services

Act now with expert cybersecurity management and 24/7 monitoring. Let us shield your business with next-gen data security solutions.

Protect your data and defend against threats with expert cybersecurity solutions. From risk assessments to endpoint protection, we help businesses stay secure, compliant, and operational. Prevent costly breaches before they happen. Contact us now for a free consultation and secure your digital future with trusted cybersecurity professionals.

#Cyber Security Services Company | Data Security Solutions#Cybersecurity Management Company#Managed Cyber Security Services#Cyber Security Company#Cyber Security Services#Endpoint Security Services#Cybersecurity Solutions Provider#Cyber Security Consulting Firm#Network Security Services#Cybersecurity Audit Services#IT Security Services Company#Cloud Security Company#Data Protection Services#Cybersecurity Compliance Services#Security Operations Center Services#Threat Detection Services#Penetration Testing Company#Incident Response Services#Vulnerability Assessment Company#Cyber Risk Management Company#Information Security Services

0 notes

Text

EXPATS Tax Services Firms by Mercurius & Associates LLP

Navigating international tax laws can be challenging, especially for expatriates living or working abroad. Whether you're an Indian professional working overseas or a foreign national living in India, handling taxes efficiently is essential to staying compliant and minimizing liabilities. That’s where EXPATS Tax Services Firms like Mercurius & Associates LLP step in to simplify the complex.

Understanding EXPATS Tax Services

EXPATS Tax Services are tailored financial and legal solutions that help expatriates manage their tax obligations in multiple jurisdictions. These services include tax planning, filing returns in home and host countries, understanding tax treaties, foreign income disclosure, and more.

At Mercurius & Associates LLP, we specialize in providing personalized, accurate, and legally compliant tax services for expatriates—both inbound and outbound.

Why Choose Mercurius & Associates LLP for EXPAT Tax Services?

As a reputed name among EXPATS Tax Services Firms in India, Mercurius & Associates LLP stands out for its in-depth expertise, global knowledge, and client-centric approach.

1. Specialized EXPAT Tax Planning

Our team assists clients in building a robust tax strategy that ensures compliance with Indian and international tax regulations. We analyze your residency status, global income, double taxation treaties, and provide the most beneficial tax structure.

2. Double Taxation Avoidance (DTAA) Assistance

Understanding and applying DTAA provisions can help expatriates avoid paying tax twice. We offer complete support in interpreting and applying DTAA provisions correctly for countries including the USA, UK, UAE, Canada, Singapore, and more.

3. Filing Indian and Foreign Tax Returns

Filing tax returns accurately and on time is crucial. Our experts manage both Indian and foreign filings, ensuring that you fulfill all legal obligations while availing maximum tax benefits.

4. Assistance with Foreign Asset Disclosure (Schedule FA)

Indian residents with foreign income or assets are required to disclose them under Schedule FA. Non-disclosure can attract penalties. We guide clients in correctly reporting such details, avoiding any future scrutiny.

5. NRI Taxation and Compliance

Non-Resident Indians (NRIs) often face confusion over taxation rules, income from India, investments, and repatriation. Our specialized NRI tax advisory team simplifies the entire process for NRIs globally.

Who Can Benefit from Our EXPATS Tax Services?

Foreign nationals working or doing business in India

Indians working abroad and earning foreign income

NRIs with income sources in India

Foreign companies sending employees on assignment to India

Returning Indian expats looking to reintegrate their finances

Whether you're relocating to India or managing foreign income from abroad, Mercurius & Associates LLP ensures your tax responsibilities are met without stress or confusion.

Why EXPATS Trust Mercurius & Associates LLP

✅ Experienced Team of Chartered Accountants & Tax Experts ✅ Up-to-date Knowledge of Global Tax Laws & Treaties ✅ Confidential & Personalized Advisory ✅ Timely Filing & End-to-End Documentation ✅ Support for Audit, Assessment & Representations

Talk to the Experts Today

At Mercurius & Associates LLP, we believe that efficient taxation for expats should be seamless, stress-free, and compliant. If you’re searching for reliable EXPATS Tax Services Firms in India, we’re your trusted partner. Let us help you optimize your global tax position while ensuring full legal compliance.

📞 Contact us today for a free consultation and get expert assistance with your expat taxation needs.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#taxation#ap management services#auditor

3 notes

·

View notes

Text

How Outsource Insurance Underwriting Services Improve Risk Assessment Accuracy

The importance of accurate underwriting in insurance has increased, helping to decrease risks, build trust among customers and keep operations efficient. Companies in the insurance industry are expected to give quick responses while still managing risks well. Utilizing outsource insurance underwriting has become popular, as it accurately measures risks at a lower cost.

As operating in the insurance sector becomes more demanding, firms are trying out operational models that combine speed and high quality. Using outsource insurance underwriting is an example of a plan that blends people’s capabilities, automation and using information. Outsourcing tasks helps insurers handle work better, offer more efficient services and check underwriting for errors. Now, it helps create consistent processes for underwriting, meet customer demands and follow regulations in various areas.

1. Better Risk Assessment Through Technology and Process Control

Outsourced underwriting providers use structured processes, digital platforms, and automated decision tools. These systems analyze large volumes of data, detect inconsistencies, and apply risk rules more consistently than manual reviews. As a result, underwriting becomes more reliable. According to a Deloitte study, 61% of insurers using outsourced models saw better accuracy in their underwriting decisions.

2. Access to Experienced Underwriting Talent

Outsourcing partners maintain trained underwriting teams across multiple insurance lines—life, health, property, and casualty. These professionals follow strict underwriting guidelines and undergo regular training. Their experience reduces decision errors, even with complex risk profiles. A McKinsey report noted that insurers working with external underwriters cut their average underwriting time by 35% and reduced rework by 28%.

3. Lower Operational Costs with Scalable Capacity

Hiring, training, and maintaining an internal underwriting team requires high ongoing investment. By outsourcing insurance underwriting, insurers shift to a flexible cost model. Service providers manage staffing, infrastructure, and compliance at scale. This helps insurers save money and adjust quickly to market demands—without slowing down operations or quality.

4. Stronger Compliance and Risk Control

Outsourced underwriting firms work under formal Service Level Agreements (SLAs). These contracts ensure that all activities follow regulatory requirements, such as HIPAA, GDPR, and country-specific insurance laws. Outsourcing partners also maintain audit-ready documentation and track every transaction. PwC found that insurers using outsourced models improved audit readiness by 40% and reduced compliance issues by 25%.

5. Focus on Strategic Growth

By outsourcing routine underwriting tasks, insurers free up internal teams for higher-value work. This includes developing new products, improving customer experience, and expanding into new markets. Outsourcing removes time-consuming operational bottlenecks, helping insurers grow without increasing headcount.

Leading Outsource Insurance Underwriting Providers

Several recognized firms offer outsource insurance underwriting support at scale. These include EXL Service, Xceedance, Infosys BPM, and WNS Global Services. Outsourcing insurance underwriting is no longer just a cost-cutting move—it’s a way to improve accuracy, scale operations, and strengthen compliance. With the right partner, insurers can increase efficiency, reduce risk, and improve time-to-decision without sacrificing quality.

2 notes

·

View notes

Text

Understanding the Importance of Labour Audits & Inspections Services

In today’s rapidly evolving business landscape, ensuring compliance with labour laws and regulations is more critical than ever. Labour audits and inspections services play a pivotal role in helping organizations maintain fair, safe, and legally compliant workplaces. These services not only safeguard employees' rights but also protect businesses from costly penalties and reputational risks. In this blog, we’ll explore what labour audits and inspections entail, their benefits, and why every organization should prioritize them.

What Are Labour Audits & Inspections Services?

Labour audits and inspections involve a systematic review of an organization’s employment practices, policies, and records to ensure compliance with local, national, and international labour laws. These services are typically conducted by specialized professionals who assess various aspects of workplace operations, including wage records, working hours, employee contracts, health and safety measures, and anti-discrimination policies.

The goal is to identify gaps or non-compliance issues and provide actionable recommendations to address them. Inspections may be conducted internally by a company’s HR team or externally by third-party auditors or government agencies, depending on the regulatory requirements.

Why Are Labour Audits & Inspections Important?

Ensuring Legal Compliance

Labour laws vary by country and region, and keeping up with these regulations can be challenging for businesses. Non-compliance can lead to hefty fines, legal disputes, and operational disruptions. Regular audits help organizations stay aligned with laws related to minimum wages, overtime, employee benefits, and workplace safety, reducing the risk of penalties.

Promoting a Fair Workplace

A thorough labour audit ensures that employees are treated fairly and equitably. This includes verifying that wages are paid on time, overtime is compensated appropriately, and there is no discrimination or harassment in the workplace. By fostering a fair work environment, businesses can boost employee morale and productivity.

Enhancing Workplace Safety

Inspections often focus on workplace safety standards, such as proper equipment maintenance, hazard identification, and adherence to occupational health regulations. Identifying and addressing safety risks not only protects employees but also minimizes the likelihood of workplace accidents and associated liabilities.

Building Trust and Reputation

Companies that prioritize labour audits and inspections demonstrate a commitment to ethical practices. This builds trust among employees, customers, and stakeholders, enhancing the organization’s reputation as a responsible employer. A strong reputation can also attract top talent and foster long-term business success.

Key Components of Labour Audits & Inspections

Documentation Review

Auditors examine critical documents such as payroll records, employee contracts, attendance logs, and benefits agreements to ensure they comply with legal standards. This step helps identify discrepancies, such as unpaid wages or incorrect overtime calculations.