#automated breach and attack simulation market

Explore tagged Tumblr posts

Text

0 notes

Text

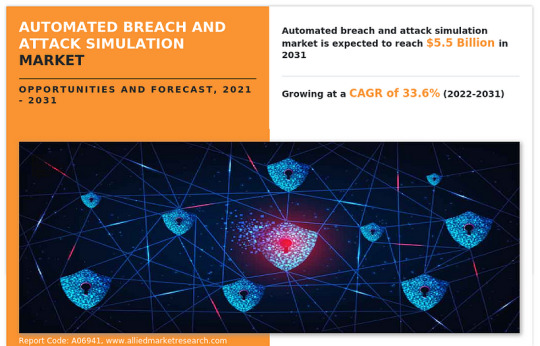

Automated Breach and Attack Simulation Market Overview, 2022-2031

The Automated Breach and Attack Simulation Market was valued at $305.63 million in 2021, and is estimated to reach $5.5 billion by 2031, growing at a CAGR of 33.6% from 2022 to 2031.

Automated breach and attack simulation refers to a type of advanced computer security testing approach that seeks to find various security settings’ vulnerabilities by simulating the attack vectors and methods hostile actors are likely to utilize. These solutions follow easy actions for installation and also require low value for maintenance comparatively. It offers security testing consistently to prevent loss from cyberattacks.

Furthermore, increase in complexities in managing security threats and increase in demand for prioritizing security investments is boosting the growth of the global automated breach and attack simulation market. In addition, growing number of cyber-attacks across the globe is positively impacting growth of the automated breach and attack simulation market. However, lack of skilled security experts and lack of awareness related to advanced cybersecurity technologies is hampering the automated breach and attack simulation market growth. On the contrary, Rise in digitalization initiatives is expected to offer remunerative opportunities for expansion of the during the automated breach and attack simulation market forecast.

Depending on application, the configuration management segment holds the largest automated breach and attack simulation market share as it helps automatically manage and monitor updates to configurate data. However, the patch management segment is expected to grow at the highest rate during the forecast period, as it helps in identifying system features that can be improved, and validating the installation of those updates.

Region-wise, the Automated breach and attack simulation market size was dominated by North America in 2021, and is expected to retain its position during the forecast period, due to the rise in demand for automated breach & attack simulation solutions and services in this area. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to the digital revolution occurring in cybersecurity across industrial verticals and the rapid growth of rising countries such as China and India.

The outbreak of COVID-19 is anticipated to have a positive impact on the growth of the automated breach and attack simulation market as it enables enterprises to address critical security issues and facilitate secured information access while remote working. In addition, the danger of cyber-attacks increased significantly , with the increase in internet traffic, which in turn propelled the implementation of automated breach and attack simulation solutions with advanced data security. Furthermore, the demand to secure the data increased, as more enterprises were moving sensitive data to the cloud which in turn fuels the growth of the market. In addition, many key players have enhanced their services to provide security for sensitive information. For instance, in May 2022, Security Gen, provided artificial cybersecurity expert breach and attack simulation and data loss prevention services platform. By providing ACE automated breach and attack simulation customers can easily achieve high levels of visibility across their entire organization without the complexities of legacy solutions.

Inquiry Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/7306

Automated breach and attack simulation market is adding a wide range of technologies, including machine learning and IoT-integration to help organizations become more data-driven and better strategized. As cloud service providers run extremely secure operations, most security failures are caused by customer security errors and not by cloud service provider’s security issues. Therefore, many key players introduced various strategies to expand their automated breach and attack simulation solutions. For instance, in June 2022, Cisco launched cloud-delivered, integrated platform that secures and connects organizations of any shape and size. Cisco designed Cisco Security Cloud to be the industry’s most open platform, protecting the integrity of the entire IT ecosystem without public cloud lock in. More number of such innovations are expected to provide lucrative opportunities for the expansion of the global automated breach and attack simulation industry.

The COVID-19 pandemic highlights risks associated with economic uncertainty, such as intensified crime risks i.e., fraud and money laundering. Furthermore, the surge in COVID-19-related phishing and ransom ware assaults, where attackers use COVID-19 as bait to imitate brands and deceive workers and consumers, has fueled demand for cloud security services. This, in turn, supports the growth of the automated breach and attack simulation r market during the COVID-19 pandemic.

KEY FINDINGS OF THE STUDY

By offering, the platforms and tools segment accounted for the largest Automated breach and attack simulation market share in 2021.

Region wise, North America generated highest revenue in 2021.

Depending on end user, the managed service provider segment generated the highest revenue in 2021.

The key players profiled in the Automated breach and attack simulation market analysis are AttackIQ, Keysight Technologies, Qualys, Inc., Rapid7, Sophos Ltd., Cymulate, FireMon, LLC., SafeBreach Inc., Skybox Security, Inc, Skybox Security, Inc, and XM Cyber. These players have adopted various strategies to increase their market penetration and strengthen their position in the automated breach and attack simulation industry.

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports Insights” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

#Automated Breach and Attack Simulation Market#Automated Breach and Attack Simulation Indstry#Automated Breach and Attack Simulation#Automated Breach#Attack Simulation#Infotainment#Navigation and Telematics

0 notes

Link

Rising need for compliance as well as growing use of data quality tools and systems for data management drives the demand for automated breach and attack...

0 notes

Text

AI-Driven Cybersecurity in Investment Banking: Strategies, Trends, and Practical Solutions for 2025

The convergence of artificial intelligence and cybersecurity is redefining risk management in investment banking. As financial institutions accelerate digital transformation, the stakes for protecting sensitive data and maintaining client trust have never been higher. In 2025, AI-driven cybersecurity is not just an innovation, it is a business imperative. This article explores how investment banks can harness the latest AI technologies to strengthen their defenses, navigate regulatory complexity, and stay ahead of evolving threats.

The Necessity of AI-Driven Cybersecurity in Investment Banking

Investment banks operate in a hyper-connected digital environment, where vast amounts of sensitive data flow between clients, partners, and global markets. Cybercriminals are increasingly sophisticated, leveraging AI to automate attacks, bypass traditional defenses, and exploit vulnerabilities at scale. Professionals seeking Financial Modeling Certification can gain insights into how AI enhances cybersecurity by automating threat detection and response. At the same time, regulatory bodies are tightening requirements, demanding greater transparency and accountability from financial institutions.

AI-driven cybersecurity solutions offer a powerful countermeasure. By automating threat detection, analyzing network traffic in real time, and predicting potential breaches before they occur, AI enables banks to shift from reactive to proactive security postures. This is critical in an era where threats evolve faster than human analysts can respond. For instance, Financial Analytics training institute in Mumbai could provide specialized training on how AI integrates with financial systems to enhance security.

The Evolution of Cybersecurity in Investment Banking

Over the past decade, cybersecurity in investment banking has evolved from a technical afterthought to a board-level priority. The shift from reactive incident response to proactive threat hunting has been accelerated by advances in AI and machine learning. These technologies allow security teams to learn from past incidents, adapt to new attack vectors, and continuously improve their defenses. In Mumbai, the Best Financial Analytics training institute in Mumbai can offer courses on AI-driven threat detection and response.

The rise of cloud computing and remote work has further expanded the attack surface, making traditional perimeter-based security models obsolete. Investment banks now require dynamic, intelligence-driven security architectures that can protect data wherever it resides. For professionals seeking Financial Modeling Certification, understanding these dynamics is crucial for developing robust security strategies.

Key Trends Shaping AI-Driven Cybersecurity in 2025

1. AI-Powered Threat Detection and Response

AI algorithms are now capable of processing petabytes of data in real time, identifying anomalous patterns that may indicate a breach. These systems can detect everything from insider threats to sophisticated external attacks, often before any damage is done. Financial Analytics training institute in Mumbai could provide insights into how AI enhances threat detection capabilities.

2. Generative AI and Advanced Defense Mechanisms

Generative AI is being deployed to create synthetic environments for testing security systems, generate decoy data to mislead attackers, and even simulate attack scenarios to train security teams. For those interested in Financial Modeling Certification, understanding these advanced AI applications is essential.

3. Addressing Supply Chain and Third-Party Risks

The increasing reliance on third-party vendors has made supply chains a prime target for cyberattacks. AI-driven tools can monitor vendor ecosystems, assess risk profiles, and detect suspicious activity across interconnected networks. This is essential for investment banks, which often partner with fintech startups, cloud providers, and other external entities. The Best Financial Analytics training institute in Mumbai can provide specialized training on managing these risks.

4. Combating AI-Enabled Threats

Cybercriminals are weaponizing AI to launch more sophisticated attacks, such as AI-driven phishing, deepfake scams, and automated fraud schemes. Investment banks must invest in AI-powered defenses that can identify and neutralize these threats in real time. Professionals seeking Financial Modeling Certification should be aware of these evolving threats.

5. Navigating Regulatory Complexity

The financial sector is subject to a growing number of regulations, including the EU’s Digital Operational Resilience Act (DORA) and the impending retirement of the FFIEC Cybersecurity Assessment Tool (CAT) in August 2025. AI can automate compliance workflows, conduct risk assessments, and ensure that security protocols align with evolving regulatory requirements. The Financial Analytics training institute in Mumbai can offer courses on regulatory compliance using AI.

Advanced Tactics for Implementing AI-Driven Cybersecurity

Integrating AI with Legacy Infrastructure

Successfully deploying AI-driven cybersecurity requires seamless integration with existing systems. Banks should focus on enhancing traditional security tools, such as firewalls, intrusion detection systems, and endpoint protection, with AI capabilities, rather than replacing them outright. This hybrid approach ensures continuity while maximizing the benefits of AI. For those interested in Best Financial Analytics training institute in Mumbai, understanding this integration is key.

Building a Skilled and Agile Security Team

Investing in training and education is critical. Security teams must understand how AI algorithms work, how to interpret their outputs, and how to integrate AI insights into broader security strategies. Cross-functional collaboration between IT, compliance, and business units is essential for effective threat management. Financial Modeling Certification programs can emphasize these skills.

Fostering a Culture of Cybersecurity

Cybersecurity is not just the responsibility of the IT department. All employees must be aware of emerging threats and their role in protecting sensitive data. Regular training sessions, simulated phishing exercises, and clear communication from leadership can help build a strong security culture. The Financial Analytics training institute in Mumbai can provide training on cybersecurity awareness.

Measuring and Optimizing Performance

To ensure that AI-driven cybersecurity initiatives deliver value, banks must track key performance indicators (KPIs) such as threat detection rates, incident response times, and the overall reduction in successful attacks. Analytics tools can provide actionable insights, enabling continuous improvement and demonstrating return on investment to stakeholders. For those seeking Financial Modeling Certification, understanding these metrics is vital.

Business Case Study: JPMorgan Chase

JPMorgan Chase stands as a leading example of how investment banks can leverage AI-driven cybersecurity to address complex challenges. With a global footprint and vast digital infrastructure, the bank faces constant threats from cybercriminals seeking to exploit vulnerabilities and steal sensitive data.

Challenges

JPMorgan Chase needed a security solution capable of processing massive volumes of data, detecting anomalies in real time, and responding to threats before they could cause significant harm. The bank also faced increasing regulatory scrutiny and pressure to maintain client trust. Professionals interested in Best Financial Analytics training institute in Mumbai can learn from JPMorgan’s approach.

Solutions

To address these challenges, JPMorgan Chase invested heavily in AI-powered cybersecurity tools. These systems were designed to analyze network traffic, identify potential threats, and automate routine security tasks. AI was also used to enhance incident response, enabling security teams to focus on strategic initiatives rather than repetitive manual tasks. For those seeking Financial Analytics training institute in Mumbai, this case study provides valuable insights.

Results

The integration of AI-driven cybersecurity tools has led to a dramatic reduction in threat response times and a significant decrease in successful attacks. The bank has also improved its ability to comply with regulatory requirements and maintain the integrity of client data. These outcomes have strengthened JPMorgan Chase’s reputation as a trusted financial partner and set a benchmark for the industry. This success can be replicated by professionals with Financial Modeling Certification.

Actionable Insights for Investment Banking Professionals

Stay Informed on Emerging Threats and Trends – Regularly monitor industry reports, attend cybersecurity conferences, and participate in professional networks to stay ahead of the latest developments in AI and cybersecurity. The Financial Analytics training institute in Mumbai can provide updates on these trends.

Develop Expertise in AI and Machine Learning – Invest in training and certification programs to build a deep understanding of AI algorithms and their applications in cybersecurity. This expertise is crucial for those seeking Financial Modeling Certification.

Prioritize Integration and Collaboration – Work closely with IT, compliance, and business teams to ensure that AI-driven security solutions are seamlessly integrated into existing workflows. The Best Financial Analytics training institute in Mumbai can offer guidance on this integration.

Build a Strong Security Culture – Engage all employees in cybersecurity awareness initiatives, emphasizing the importance of vigilance and best practices in protecting sensitive data. This is a key takeaway for those interested in Financial Modeling Certification.

Measure and Optimize Performance – Use analytics to track the effectiveness of AI-driven cybersecurity initiatives, identify areas for improvement, and demonstrate value to stakeholders. The Financial Analytics training institute in Mumbai can provide training on these metrics.

The Role of Storytelling and Communication

In investment banking, effective communication is essential for securing buy-in from leadership and stakeholders. By framing cybersecurity as a business imperative, not just a technical issue, banks can ensure that security is embedded in every aspect of their operations. Storytelling techniques, such as sharing real-world examples and quantifying the impact of security breaches, can help build a compelling case for investment in AI-driven cybersecurity. For those interested in Best Financial Analytics training institute in Mumbai, this approach is beneficial.

Analytics and Measuring Success

Leading investment banks use a range of metrics to assess the effectiveness of their AI-driven cybersecurity strategies. These include:

Threat Detection Rate: The percentage of threats identified before they cause harm.

Incident Response Time: The time it takes to neutralize a threat once detected.

Reduction in Successful Attacks: The decrease in the number of breaches over time.

Regulatory Compliance Score: The ability to meet or exceed regulatory requirements.

Professionals with Financial Modeling Certification should be familiar with these metrics. By tracking these KPIs, banks can refine their strategies, optimize resource allocation, and demonstrate the value of AI-driven cybersecurity to internal and external stakeholders. The Financial Analytics training institute in Mumbai can provide insights into these metrics.

Conclusion

As investment banking enters a new era of digital transformation, the synergy between AI and cybersecurity is no longer optional, it is essential. By leveraging the latest AI technologies, investment banks can protect their most valuable assets, maintain client trust, and stay ahead of increasingly sophisticated threats. For those interested in Best Financial Analytics training institute in Mumbai, this synergy is crucial for future success.

The journey toward AI-driven cybersecurity requires a combination of technical innovation, strategic investment, and cultural change. Investment banking professionals who embrace these challenges will be well positioned to lead their organizations into a secure and resilient future. Remember, the future of cybersecurity is not just about technology, it is about people, strategy, and continuous innovation. For those seeking Financial Modeling Certification, this understanding is vital.

By following the strategies and insights outlined in this article, investment banks can unlock the full potential of AI-driven cybersecurity and ensure their place at the forefront of the financial industry in 2025 and beyond. The Financial Analytics training institute in Mumbai can provide further guidance on these strategies.

0 notes

Text

Why is North America leading the global DRaaS market expansion

Disaster Recovery as a Service (DRaaS) Market Size was valued at USD 11.7 Billion in 2023 and is expected to reach USD 76.0 Billion by 2032, growing at a CAGR of 23.1% over the forecast period 2024-2032.

Disaster Recovery as a Service (DRaaS) Market is witnessing exponential demand as organizations prioritize business continuity in the face of rising cyber threats, data breaches, and natural disasters. Enterprises across industries are shifting toward cloud-based recovery solutions to ensure seamless IT resilience, reduced downtime, and cost efficiency.

U.S. enterprises are rapidly adopting DRaaS for critical infrastructure protection and regulatory compliance, especially in healthcare, BFSI, and manufacturing sectors.

Disaster Recovery as a Service Market is expanding as more businesses adopt remote operations, SaaS platforms, and hybrid cloud models. DRaaS offers rapid data recovery, scalable infrastructure, and minimal human intervention, making it a preferred solution for modern digital ecosystems.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/2780

Market Keyplayers:

IBM Corporation (IBM Cloud Disaster Recovery, IBM Resiliency Orchestration)

Microsoft Corporation (Azure Site Recovery, Microsoft Hyper-V Replica)

Amazon Web Services (AWS) (AWS Elastic Disaster Recovery, AWS Backup)

VMware, Inc. (VMware vSphere Replication, VMware Site Recovery Manager)

Sungard Availability Services (Recover2Cloud, Managed Recovery Program)

Acronis International GmbH (Acronis Cyber Protect, Acronis Disaster Recovery)

Zerto (Zerto Virtual Replication, Zerto Cloud Continuity Platform)

Veeam Software (Veeam Backup & Replication, Veeam Cloud Connect)

Dell Technologies (Dell EMC RecoverPoint, Dell EMC PowerProtect)

Cisco Systems, Inc. (Cisco UCS, Cisco HyperFlex)

Carbonite, Inc. (Carbonite Server Backup, Carbonite Endpoint Backup)

Arcserve (Arcserve UDP Cloud Direct, Arcserve Continuous Availability)

Axcient, Inc. (Axcient Fusion, Axcient Replibit)

Datto, Inc. (Datto SIRIS, Datto ALTO)

TierPoint (TierPoint Managed Disaster Recovery, TierPoint Cloud to Cloud Recovery)

iland Internet Solutions (iland Secure DRaaS, iland Secure Cloud Console)

IBM Resiliency Services (IBM Business Continuity, IBM Cyber Resilience Services)

Flexential (Flexential DRaaS, Flexential Cloud)

InterVision (InterVision Disaster Recovery, InterVision Cloud Recovery)

Market Analysis

The DRaaS market is shaped by the growing urgency for robust disaster recovery strategies due to increasing ransomware attacks and data dependency. Companies are transitioning from traditional recovery models to cloud-native solutions that offer better scalability, automation, and recovery speed. Additionally, regulatory pressures in the U.S. and Europe are driving adoption to maintain data integrity and compliance.

Market Trends

Surge in cloud-based and hybrid DRaaS adoption

Integration of AI and ML for predictive threat detection

Rise in ransomware recovery solutions

Automated failover systems minimizing human input

Growth in subscription-based DRaaS models

Increasing compliance with GDPR, HIPAA, and other data protection laws

Partnerships between cloud providers and managed service providers (MSPs)

Market Scope

With digital transformation accelerating globally, the DRaaS market is evolving from a niche IT service to a mission-critical infrastructure element. Businesses of all sizes are integrating DRaaS into their core IT strategies to ensure operational continuity.

Rapid scalability for SMEs and enterprises

Cloud-agnostic architecture supporting multiple platforms

On-demand disaster simulations and recovery drills

Pay-as-you-go pricing increasing accessibility

Global coverage with local compliance integration

Real-time monitoring and centralized dashboards

Forecast Outlook

The Disaster Recovery as a Service market is expected to continue strong upward momentum driven by cloud maturity, growing data volumes, and heightened risk awareness. As businesses across the U.S., Europe, and beyond aim for zero downtime environments, DRaaS will be a strategic pillar of resilience architecture. Vendors focusing on automation, cost-efficiency, and seamless integration will gain a competitive edge in the evolving market landscape.

Access Complete Report: https://www.snsinsider.com/reports/disaster-recovery-as-a-service-market-2780

Conclusion

As digital infrastructures grow more complex and threats more sophisticated, Disaster Recovery as a Service has become a vital component of enterprise strategy. From San Francisco to Frankfurt, organizations are investing in intelligent, cloud-first recovery models that deliver reliability, compliance, and peace of mind. DRaaS is no longer a backup plan—it’s the frontline defense in ensuring operational continuity and digital trust.

Related Reports:

U.S.A Reconciliation Software Market Gears Up for Significant Digital Transformation Growth

U.S.A Loyalty Management Strategies Drive Customer Retention and Competitive Edge

U.S.A. Team Collaboration Software Market Set to Revolutionize Workplace Productivity

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Mail us: [email protected]

0 notes

Text

https://www.linkedin.com/pulse/automated-breach-attack-simulation-software-market-sqdyf/

0 notes

Text

Secure from the Start: Unlocking Success with DevOps Security Services

In today’s hyperconnected world, application security can’t be an afterthought. That’s where DevOps Security Services—better known as DevSecOps—come in. This approach integrates security from the ground up, embedding protection across the entire software development lifecycle. Through robust DevSecOps practices, businesses can proactively detect vulnerabilities, ensure compliance, and scale securely.

🔐 What is DevSecOps? DevSecOps stands for Development, Security, and Operations. It's a modern approach that weaves security into every step of software creation—from planning and coding to deployment and monitoring. Unlike traditional models where security checks happen late, DevSecOps empowers teams to identify and fix risks early, preventing costly breaches and delays.

⚙️ Common DevSecOps Tools To build secure and resilient applications, top teams rely on a powerful suite of tools:

🔍 Static Application Security Testing (SAST) Scans source code for bugs and vulnerabilities before deployment. Examples: SonarQube, Fortify

🛡️ Dynamic Application Security Testing (DAST) Simulates attacks to expose external security flaws—no source code access needed. Examples: Burp Suite, OWASP ZAP

🧩 Software Composition Analysis (SCA) Audits open-source libraries and third-party components for known vulnerabilities. Examples: Snyk, WhiteSource

⚡ Interactive Application Security Testing (IAST) Blends SAST and DAST to offer real-time, runtime analysis during testing. Examples: Seeker, Hdiv

🚀 Key Benefits of Implementing DevOps Security Services ✅ Improved Security Security is built into every phase, so vulnerabilities are addressed before they escalate.

✅ Faster Time to Market Automation and early detection reduce bottlenecks and speed up delivery.

✅ Regulatory Compliance Stay compliant with GDPR, HIPAA, PCI-DSS, and other industry standards.

✅ Better Code Quality Frequent testing and reviews ensure clean, maintainable code.

✅ Secure Feature Development Roll out new features without compromising application integrity.

🔄 How DevSecOps is Integrated Across the Lifecycle 📝 Planning & Development Security begins in the planning phase, with an evaluation of current systems and potential risks to shape a secure development strategy.

🔨 Building & Testing Automation tools merge code and identify issues early. Security testing is integrated into CI/CD pipelines for immediate feedback.

🚚 Deployment & Operation Using Infrastructure as Code (IaC), deployment is automated and secure. IaC helps eliminate human error and ensures consistency.

📈 Monitoring & Scaling Powerful monitoring tools are used to detect threats in real-time, while scalability is maintained to support growth without compromising security.

0 notes

Text

Emerging AI Trends to Watch in 2025

Table of Contents

Emerging AI Trends to Watch in 2025

1. Generative AI Applications

2. AI in Healthcare

3. Ethical AI and Regulation

4. AI for Personalization

5. AI in Cybersecurity

6. Edge AI

7. AI in Education

Emerging AI Trends to Watch in 2025

1. Generative AI Applications

2. AI in Healthcare

3. Ethical AI and Regulation

4. AI for Personalization

5. AI in Cybersecurity

6. Edge AI

7. AI in Education

Emerging AI Trends to Watch in 2025

Artificial Intelligence (AI) continues to transform industries and redefine the way we interact with technology. As we enter 2025, staying informed about AI’s latest advancements can help businesses and individuals leverage its potential. Here are the top AI trends to watch:

1. Generative AI Applications

Generative AI, powered by models like GPT-4 and DALL-E, is expanding beyond creative fields into healthcare, education, and business. For instance, companies are using generative AI to draft reports, design marketing campaigns, and even create virtual simulations for training purposes. Learn more about generative AI.

2. AI in Healthcare

AI-powered diagnostic tools are becoming more accurate and accessible, revolutionizing patient care. From detecting diseases at early stages to automating administrative tasks, AI is reducing costs and improving outcomes. Discover how AI is transforming healthcare.

3. Ethical AI and Regulation

As AI becomes more pervasive, ethical considerations are taking center stage. Governments and organizations are implementing frameworks to ensure transparency, fairness, and accountability in AI applications. Explore ethical AI frameworks.

4. AI for Personalization

Retailers and content platforms are leveraging AI to deliver hyper-personalized experiences. Whether through recommendation engines or targeted advertising, AI enhances customer satisfaction and loyalty. Read about AI-driven personalization.

5. AI in Cybersecurity

With cyber threats growing in complexity, AI is playing a critical role in identifying vulnerabilities, detecting breaches, and responding to attacks in real time. Learn how AI enhances cybersecurity.

6. Edge AI

Edge AI processes data locally on devices rather than relying on cloud servers. This trend is driving innovation in IoT devices, enabling faster decision-making and improved privacy. Understand the impact of edge AI.

7. AI in Education

From personalized learning plans to AI tutors, education is undergoing a transformation. AI tools are helping students and educators create more efficient and engaging learning experiences. See how AI is reshaping education.

Emerging AI Trends to Watch in 2025

Artificial Intelligence (AI) continues to transform industries and redefine the way we interact with technology. As we enter 2025, staying informed about AI’s latest advancements can help businesses and individuals leverage its potential. Here are the top AI trends to watch:

1. Generative AI Applications

Generative AI, powered by models like GPT-4 and DALL-E, is expanding beyond creative fields into healthcare, education, and business. For instance, companies are using generative AI to draft reports, design marketing campaigns, and even create virtual simulations for training purposes. Learn more about generative AI.

2. AI in Healthcare

AI-powered diagnostic tools are becoming more accurate and accessible, revolutionizing patient care. From detecting diseases at early stages to automating administrative tasks, AI is reducing costs and improving outcomes. Discover how AI is transforming healthcare.

3. Ethical AI and Regulation

As AI becomes more pervasive, ethical considerations are taking center stage. Governments and organizations are implementing frameworks to ensure transparency, fairness, and accountability in AI applications. Explore ethical AI frameworks.

4. AI for Personalization

Retailers and content platforms are leveraging AI to deliver hyper-personalized experiences. Whether through recommendation engines or targeted advertising, AI enhances customer satisfaction and loyalty. Read about AI-driven personalization.

5. AI in Cybersecurity

With cyber threats growing in complexity, AI is playing a critical role in identifying vulnerabilities, detecting breaches, and responding to attacks in real time. Learn how AI enhances cybersecurity.

6. Edge AI

Edge AI processes data locally on devices rather than relying on cloud servers. This trend is driving innovation in IoT devices, enabling faster decision-making and improved privacy. Understand the impact of edge AI.

7. AI in Education

From personalized learning plans to AI tutors, education is undergoing a transformation. AI tools are helping students and educators create more efficient and engaging learning experiences. See how AI is reshaping education.

How to Prepare for the Future of AI

To stay ahead, consider the following steps:

Learn AI Basics: Online courses and tutorials can help you understand AI fundamentals. Start learning AI basics.

Experiment with Tools: Explore AI-powered platforms to understand their potential applications. Try AI tools.

Stay Informed: Follow industry news and research to keep up with the latest developments. Stay updated on AI trends.

By embracing these trends and innovations, businesses and individuals can harness AI to solve problems, enhance productivity, and drive growth. The future of AI is exciting, and 2025 promises to be a landmark year in its evolution.

Link Article Here

0 notes

Text

Emerging AI Trends to Watch in 2025

Artificial Intelligence (AI) continues to transform industries and redefine the way we interact with technology. As we enter 2025, staying informed about AI’s latest advancements can help businesses and individuals leverage its potential. Here are the top AI trends to watch:

1. Generative AI Applications

Generative AI, powered by models like GPT-4 and DALL-E, is expanding beyond creative fields into healthcare, education, and business. For instance, companies are using generative AI to draft reports, design marketing campaigns, and even create virtual simulations for training purposes. Learn more about generative AI.

2. AI in Healthcare

AI-powered diagnostic tools are becoming more accurate and accessible, revolutionizing patient care. From detecting diseases at early stages to automating administrative tasks, AI is reducing costs and improving outcomes. Discover how AI is transforming healthcare.

3. Ethical AI and Regulation

As AI becomes more pervasive, ethical considerations are taking center stage. Governments and organizations are implementing frameworks to ensure transparency, fairness, and accountability in AI applications. Explore ethical AI frameworks.

4. AI for Personalization

Retailers and content platforms are leveraging AI to deliver hyper-personalized experiences. Whether through recommendation engines or targeted advertising, AI enhances customer satisfaction and loyalty. Read about AI-driven personalization.

5. AI in Cybersecurity

With cyber threats growing in complexity, AI is playing a critical role in identifying vulnerabilities, detecting breaches, and responding to attacks in real time. Learn how AI enhances cybersecurity.

Link Article Here

0 notes

Text

0 notes

Text

Risk Management in Financial Services

Risk management is a cornerstone of financial services, ensuring stability and safeguarding assets in an ever-evolving market. Financial institutions face numerous challenges that require robust strategies to mitigate risks, maintain compliance, and foster trust. In this blog, we will explore "Risk Management in Financial Services," highlighting its importance, types, and modern techniques to ensure financial stability.

What is Risk Management in Financial Services?

Risk management in financial services refers to identifying, assessing, and mitigating potential risks that could negatively impact an institution’s operations, reputation, and profitability. These risks can arise from market fluctuations, credit defaults, regulatory changes, or cybersecurity threats. Effective risk management ensures that financial institutions remain resilient and maintain customer trust.

Importance of Risk Management in Financial Services

Stability of Financial Institutions: Risk management minimizes potential disruptions by proactively addressing vulnerabilities.

Regulatory Compliance: Financial services are heavily regulated, and risk management ensures adherence to legal requirements, avoiding penalties.

Protecting Stakeholders: It safeguards stakeholders' interests, including customers, investors, and employees.

Enhancing Decision-Making: With a solid risk management framework, institutions can make informed decisions and allocate resources efficiently.

Maintaining Reputation: Managing risks effectively protects the institution’s reputation from potential fallout.

Types of Risks in Financial Services

1. Market Risk

Market risk involves the potential loss due to fluctuations in market prices, such as stock, interest rates, or foreign exchange. For example:

Equity Risk: Changes in stock prices.

Interest Rate Risk: Variability in interest rates affecting investments.

Currency Risk: Volatility in foreign exchange markets.

2. Credit Risk

Credit risk arises when borrowers fail to meet their debt obligations. It is critical for banks, lenders, and credit card companies. Mitigation strategies include:

Creditworthiness assessment.

Diversifying the credit portfolio.

3. Operational Risk

Operational risk results from internal failures, such as inadequate processes, human errors, or system malfunctions. Examples include:

Fraudulent transactions.

IT system downtime.

4. Compliance Risk

Compliance risk pertains to violations of laws, regulations, or internal policies. Financial institutions must:

Regularly update compliance frameworks.

Train staff on regulatory changes.

5. Liquidity Risk

Liquidity risk occurs when institutions cannot meet their financial obligations. Effective liquidity management includes:

Monitoring cash flow.

Maintaining liquid assets.

6. Cybersecurity Risk

The rise of digital banking has introduced cybersecurity threats. Common issues include:

Data breaches.

Phishing attacks.

Modern Techniques in Risk Management

1. Advanced Analytics

Data analytics plays a pivotal role in identifying trends, assessing risks, and predicting future scenarios. Techniques include:

Machine Learning: For fraud detection and predictive modeling.

Big Data: Analyzing vast datasets to uncover risks.

2. Regulatory Technology (RegTech)

RegTech solutions help automate compliance processes, reducing human error and ensuring adherence to regulations. Examples include:

Real-time transaction monitoring.

Automated reporting systems.

3. Cybersecurity Measures

With increasing cyber threats, financial institutions employ robust cybersecurity frameworks. Best practices include:

Encryption.

Regular vulnerability assessments.

4. Stress Testing

Stress testing simulates extreme scenarios to evaluate an institution’s resilience. It helps identify vulnerabilities and plan for contingencies.

5. Risk Transfer

Risk transfer involves outsourcing risks to third parties, such as insurance providers. This approach mitigates potential financial losses.

Steps to Implement an Effective Risk Management Strategy

1. Identify Risks

Recognize potential risks by analyzing past data, market trends, and regulatory landscapes.

2. Assess Risks

Evaluate the likelihood and potential impact of identified risks. Tools like SWOT analysis can be helpful.

3. Develop a Risk Management Plan

Create a comprehensive plan outlining mitigation strategies, responsible teams, and timelines.

4. Monitor and Review

Regularly review the risk management framework to adapt to new challenges and changing regulations.

5. Educate Employees

Train employees on risk identification and mitigation practices to ensure organization-wide awareness.

Emerging Trends in Risk Management

1. Artificial Intelligence (AI)

AI enhances risk management by automating processes, detecting anomalies, and predicting future risks.

2. Blockchain Technology

Blockchain ensures transparency and security in transactions, reducing fraud and compliance risks.

3. ESG Risk Management

Environmental, Social, and Governance (ESG) factors are increasingly crucial. Institutions must align their practices with sustainability goals.

4. Cloud Computing

Cloud-based solutions offer scalability and real-time risk monitoring capabilities.

Challenges in Risk Management in Financial Services

Rapid Technological Changes: Keeping pace with evolving technologies and associated risks.

Complex Regulatory Landscapes: Adapting to varying global regulations.

Data Privacy Concerns: Balancing risk management with customer privacy.

Talent Shortage: Finding skilled professionals in risk management.

Conclusion

Risk management in financial services is indispensable for maintaining stability, compliance, and trust. By understanding the types of risks, leveraging modern technologies, and adopting proactive strategies, financial institutions can navigate uncertainties effectively. As the financial landscape evolves, institutions must continuously adapt and innovate to address emerging risks and ensure long-term success

0 notes

Text

Top Trends in Enterprise IT Backed by Red Hat

Introduction:

In the rapidly evolving landscape of enterprise IT, staying ahead of the curve is crucial for businesses to remain competitive. Red Hat, a leading provider of open-source solutions, plays a significant role in shaping these trends. This blog post will explore some of the top trends in enterprise IT backed by Red Hat, including:

1. Hybrid Cloud Computing:

What it is: A cloud computing environment that combines on-premises infrastructure with public cloud services.

Red Hat's role: Red Hat offers a wide range of hybrid cloud solutions, including Red Hat OpenShift, a container platform that can run anywhere.

Benefits: Flexibility, scalability, cost optimization, and improved disaster recovery.

Keywords: hybrid cloud, cloud computing, on-premises, public cloud, Red Hat OpenShift, container platform

2. Artificial Intelligence (AI) and Machine Learning (ML):

What they are: AI is the simulation of human intelligence in machines, while ML is a subset of AI that allows machines to learn from data without being explicitly programmed.

Red Hat's role: Red Hat provides AI and ML platforms, such as Red Hat Ansible Automation Platform, that help businesses automate and manage AI and ML workloads.

Benefits: Improved decision-making, increased efficiency, and new business opportunities.

Keywords: AI, machine learning, automation, Red Hat Ansible Automation Platform

3. Edge Computing:

What it is: Processing data closer to the source, such as in devices and sensors, rather than in a centralized data center.

Red Hat's role: Red Hat offers edge computing solutions, such as Red Hat Ceph Storage, that help businesses store and process data at the edge.

Benefits: Reduced latency, improved performance, and increased data security.

Keywords: edge computing, data processing, data storage, Red Hat Ceph Storage

4. DevOps:

What it is: A set of practices that combine software development and IT operations to shorten the systems development life cycle and provide continuous delivery with high software quality.

Red Hat's role: Red Hat provides DevOps tools and platforms, such as Red Hat Ansible Automation Platform and Red Hat OpenShift, that help businesses automate and streamline their DevOps processes.

Benefits: Faster time-to-market, improved collaboration, and increased efficiency.

Keywords: DevOps, automation, continuous delivery, Red Hat Ansible Automation Platform, Red Hat OpenShift

5. Cybersecurity:

What it is: The practice of protecting computer systems and networks from unauthorized access or attack.

Red Hat's role: Red Hat offers a wide range of cybersecurity solutions, such as Red Hat Enterprise Linux and Red Hat Insights, that help businesses protect their IT infrastructure.

Benefits: Reduced risk of data breaches, improved compliance, and increased trust.

Keywords: cybersecurity, data security, Red Hat Enterprise Linux, Red Hat Insights

Conclusion:

Red Hat is a key player in driving these and other important trends in enterprise IT. By leveraging Red Hat's open-source solutions, businesses can gain a competitive advantage and achieve their digital transformation goals.

For more details www.hawkstack.com

#redhatcourses#information technology#containerorchestration#kubernetes#docker#container#linux#containersecurity#dockerswarm

0 notes

Text

Streamline Your Digital Privacy with an Email Generator

In a world where online privacy is more crucial than ever, an email generator has become a game-changer for individuals and businesses alike. These tools offer temporary, disposable email addresses that help protect your identity and reduce the hassle of managing spam and unwanted emails. Whether you're registering for a free trial or conducting online transactions, an email generator can enhance your digital experience by providing both privacy and convenience.

What is an Email Generator?

An email generator is a tool that allows you to quickly create temporary email addresses. These addresses are functional and can be used for receiving emails, verification codes, and registration links without exposing your personal or work inbox. Unlike traditional email services, generated emails are short-lived, ensuring they don't become a target for spam or misuse.

Benefits of Using an Email Generator

Using an email generator can provide numerous advantages, including:

Privacy Protection: Keep your personal email address confidential when interacting with unknown platforms or services.

Reduced Spam: Avoid spam, newsletters, and promotional emails in your primary inbox by using a disposable email address.

Quick Setup: Most email generators don’t require registration, making it easy to create and use an email address instantly.

Improved Security: Minimize exposure to phishing attempts or malware by using a temporary address for risky interactions.

Common Use Cases for an Email Generator

An email generator can be invaluable in various online situations:

Signing Up for Free Trials: Create temporary emails to access free trials of software or services without risking unwanted follow-up communications.

Online Shopping and Promotions: Use a generated email to sign up for discount newsletters or promotions, keeping your main inbox spam-free.

Testing Apps and Services: Developers and marketers often use email generators to test registration processes, email flows, and user journeys.

Forum or Blog Registrations: Avoid cluttering your inbox by using a temporary email for signing up on discussion forums or blogs.

Popular Email Generator Tools

Here are some of the best tools to generate email addresses for temporary use:

Tempmail: A user-friendly platform that instantly creates disposable emails for short-term use.

10 Minute Mail: This service provides an email address that expires in just 10 minutes—ideal for one-time tasks.

YOPmail: A reliable choice for anonymous email interactions, offering extended temporary address options.

Guerrilla Mail: Known for its added security features, Guerrilla Mail allows users to send and receive temporary emails.

Why Businesses Should Consider Using Email Generators

Email generators aren’t only beneficial for personal use; businesses can also leverage them for a variety of applications, including:

Marketing Research: Use temporary emails to explore competitors’ promotional strategies and newsletters.

Automation Testing: Email generators allow you to simulate customer interactions during testing of marketing or CRM tools.

Account Management: Create test accounts without overloading your primary email system, ensuring efficient workflow organization.

Ensuring Security with an Email Generator

In today’s threat landscape, an email generator can add a valuable layer of protection:

Avoid Phishing Scams: Prevent cybercriminals from exploiting your personal email through phishing attacks.

Protect Sensitive Data: Hide your actual email address when interacting with unknown parties, reducing the chances of identity theft or data breaches.

Tips for Using Email Generators Wisely

Stay Organized: Keep track of temporary email addresses if you need to access them multiple times before expiry.

Know the Purpose: Only use generated emails for tasks that don’t require prolonged communication or high security, such as financial transactions.

Opt for Trusted Services: Stick to reputable platforms for generating emails to ensure your data isn’t mishandled.

Conclusion

An email generator is more than just a tool—it’s a solution to many of the digital challenges we face today. Whether you're looking to declutter your inbox, protect your privacy, or streamline workflows, email generators make life easier. With various tools offering convenience, speed, and security, these platforms are an essential resource in a tech-driven world.

Embrace the practicality of email generators today and take control of your online interactions with confidence.

0 notes

Text

AI Latest Update: Unlocking the Future of Innovation

Artificial intelligence (AI) is revolutionizing industries worldwide, continuously evolving with remarkable advancements and applications. Keeping up with the latest developments in AI is essential for businesses, tech enthusiasts, and policymakers alike. This article delves into recent AI updates, showcasing groundbreaking innovations, real-world applications, and future implications.

Generative AI Takes Centre Stage

Generative AI continues to dominate the tech landscape, pushing the boundaries of creativity and problem-solving. Tools like OpenAI's ChatGPT, DALL·E, and Google's Gemini enhance content creation, image generation, and automated tasks. These models are being integrated into sectors like marketing, customer service, and education to improve efficiency and personalization.

Recent updates show generative AI being used in industries such as healthcare, where it assists in creating patient-specific treatment plans, and in the legal sector, where it automates document review. Businesses are leveraging these tools to save time and reduce operational costs.

AI in Healthcare: Transforming Patient Care

The healthcare industry is experiencing a revolution with the integration of AI technologies. The latest advancements include AI algorithms capable of diagnosing diseases like cancer and diabetes with unparalleled accuracy. Additionally, wearable devices powered by AI monitor patient vitals in real-time, enabling early detection of potential health issues.

One notable development is the use of AI-driven chatbots to provide mental health support. These bots, equipped with natural language processing (NLP) capabilities, offer therapeutic interventions, making mental health resources more accessible and affordable.

AI Meets Cybersecurity

As cyber threats grow more sophisticated, AI is stepping up to fortify cybersecurity measures. Recent updates highlight the use of AI in threat detection, identifying vulnerabilities, and responding to breaches. Machine learning models analyze vast amounts of data to predict and prevent attacks before they occur.

AI-driven systems are also helping organizations comply with data protection regulations by automating the process of identifying sensitive information and ensuring its security. This technology is particularly vital as digital transformation accelerates across industries.

The Role of AI in Autonomous Vehicles

The automotive industry is another sector benefiting from the latest AI advancements. Self-driving technology is becoming more reliable, with AI enabling vehicles to navigate complex traffic scenarios and adapt to changing conditions. Companies like Tesla, Waymo, and GM's Cruise are making strides in autonomous vehicle deployment.

In 2024, AI updates include improvements in sensors and algorithms that enhance object detection and decision-making processes. These advancements are expected to make autonomous driving safer and more efficient, paving the way for widespread adoption.

AI and Sustainability

Sustainability is a global priority, and AI is emerging as a powerful tool to address environmental challenges. Recent developments include AI-powered systems that optimize energy consumption in buildings, reducing carbon footprints. In agriculture, AI is helping farmers monitor crops, predict weather patterns, and manage resources more effectively.

Moreover, AI is playing a critical role in climate research. Models are being developed to simulate climate change scenarios, providing valuable insights for policymakers. These advancements demonstrate AI's potential to drive sustainable solutions across various domains.

Ethical Considerations in AI Development

As AI advances, ethical concerns are becoming increasingly significant. The latest updates show a heightened focus on developing transparent, fair, and unbiased AI systems. Companies are implementing frameworks to ensure that AI respects privacy, avoids discrimination, and remains accountable.

Regulators worldwide are working on legislation to govern AI usage. The European Union’s AI Act, for example, aims to establish clear rules for AI development and deployment, ensuring that these technologies benefit society while mitigating potential risks.

Future Trends in AI

The future of AI looks promising, with trends pointing towards more sophisticated and human-like interactions. Innovations in conversational AI are expected to bridge the gap between human and machine communication further.

Another exciting development is the rise of AI in the Internet of Things (IoT). Smart devices are becoming smarter, with AI enabling predictive maintenance, efficient resource management, and enhanced user experiences.

Quantum computing is also set to intersect with AI, unlocking unprecedented computational capabilities. This synergy will accelerate advancements in drug discovery, financial modeling, and scientific research.

Conclusion:

The latest updates in AI showcase its transformative potential across industries. From enhancing creativity with generative AI to solving global challenges like sustainability and cybersecurity, the possibilities are endless. However, as AI technology continues to evolve, addressing ethical concerns and ensuring equitable access remains paramount.

By staying informed about AI's latest advancements, individuals and organizations can harness its power effectively, driving innovation and positive change. AI is not just the future—it is the present, reshaping the world in real time.

#ai artwork#ai latest update#ai update#ai news#artificial intelligence#AI Meets Cybersecurity#AI in Healthcare#Generative AI

1 note

·

View note