#bank fraud detection using machine learning

Explore tagged Tumblr posts

Text

3 Benefits of Bank Fraud Detection Using Machine Learning

Bank fraud remains a growing concern in the financial sector, with criminals adopting increasingly sophisticated tactics. To stay ahead, financial institutions are turning to machine learning (machine learning) for fraud detection. This technology revolutionises how banks identify and prevent fraudulent activities. Here are three key benefits of using machine learning in fraud detection.

1. Real-Time Fraud Detection:

Machine learning algorithms analyse massive amounts of data in real time, identifying suspicious patterns or anomalies as they occur. Unlike traditional methods, which often rely on retrospective analysis, machine learning offers proactive fraud detection. This swift response minimises financial losses and protects customer accounts from potential breaches.

2. Improved Accuracy and Reduced False Positives:

Manual fraud detection methods can result in false positives, leading to customer dissatisfaction and operational inefficiencies. Machine learning models continuously learn and adapt to evolving fraud trends, enabling them to distinguish genuine transactions from fraudulent ones with greater precision. This reduces false alarms, allowing banks to focus resources on actual threats.

3. Cost Efficiency and Scalability:

By automating fraud detection processes, machine learning reduces the reliance on manual interventions, cutting operational costs. Additionally, machine learning systems are scalable for banking fraud detection, making them suitable for banks of all sizes, whether handling a few transactions or millions daily.

Embracing machine learning empowers banks to stay ahead of fraudsters, ensuring customer trust and operational efficiency in an ever-evolving financial landscape. The best you can do is to get connected with a reliable software provider. Request a demo today!

0 notes

Text

Machine Learning: A Comprehensive Overview

Machine Learning (ML) is a subfield of synthetic intelligence (AI) that offers structures with the capacity to robotically examine and enhance from revel in without being explicitly programmed. Instead of using a fixed set of guidelines or commands, device studying algorithms perceive styles in facts and use the ones styles to make predictions or decisions. Over the beyond decade, ML has transformed how we have interaction with generation, touching nearly each aspect of our every day lives — from personalised recommendations on streaming services to actual-time fraud detection in banking.

Machine learning algorithms

What is Machine Learning?

At its center, gadget learning entails feeding facts right into a pc algorithm that allows the gadget to adjust its parameters and improve its overall performance on a project through the years. The more statistics the machine sees, the better it usually turns into. This is corresponding to how humans study — through trial, error, and revel in.

Arthur Samuel, a pioneer within the discipline, defined gadget gaining knowledge of in 1959 as “a discipline of take a look at that offers computers the capability to study without being explicitly programmed.” Today, ML is a critical technology powering a huge array of packages in enterprise, healthcare, science, and enjoyment.

Types of Machine Learning

Machine studying can be broadly categorised into 4 major categories:

1. Supervised Learning

For example, in a spam electronic mail detection device, emails are classified as "spam" or "no longer unsolicited mail," and the algorithm learns to classify new emails for this reason.

Common algorithms include:

Linear Regression

Logistic Regression

Support Vector Machines (SVM)

Decision Trees

Random Forests

Neural Networks

2. Unsupervised Learning

Unsupervised mastering offers with unlabeled information. Clustering and association are commonplace obligations on this class.

Key strategies encompass:

K-Means Clustering

Hierarchical Clustering

Principal Component Analysis (PCA)

Autoencoders

three. Semi-Supervised Learning

It is specifically beneficial when acquiring categorised data is highly-priced or time-consuming, as in scientific diagnosis.

Four. Reinforcement Learning

Reinforcement mastering includes an agent that interacts with an surroundings and learns to make choices with the aid of receiving rewards or consequences. It is broadly utilized in areas like robotics, recreation gambling (e.G., AlphaGo), and independent vehicles.

Popular algorithms encompass:

Q-Learning

Deep Q-Networks (DQN)

Policy Gradient Methods

Key Components of Machine Learning Systems

1. Data

Data is the muse of any machine learning version. The pleasant and quantity of the facts directly effect the performance of the version. Preprocessing — consisting of cleansing, normalization, and transformation — is vital to make sure beneficial insights can be extracted.

2. Features

Feature engineering, the technique of selecting and reworking variables to enhance model accuracy, is one of the most important steps within the ML workflow.

Three. Algorithms

Algorithms define the rules and mathematical fashions that help machines study from information. Choosing the proper set of rules relies upon at the trouble, the records, and the desired accuracy and interpretability.

4. Model Evaluation

Models are evaluated the use of numerous metrics along with accuracy, precision, consider, F1-score (for class), or RMSE and R² (for regression). Cross-validation enables check how nicely a model generalizes to unseen statistics.

Applications of Machine Learning

Machine getting to know is now deeply incorporated into severa domain names, together with:

1. Healthcare

ML is used for disorder prognosis, drug discovery, customized medicinal drug, and clinical imaging. Algorithms assist locate situations like cancer and diabetes from clinical facts and scans.

2. Finance

Fraud detection, algorithmic buying and selling, credit score scoring, and client segmentation are pushed with the aid of machine gaining knowledge of within the financial area.

3. Retail and E-commerce

Recommendation engines, stock management, dynamic pricing, and sentiment evaluation assist businesses boom sales and improve patron revel in.

Four. Transportation

Self-riding motors, traffic prediction, and route optimization all rely upon real-time gadget getting to know models.

6. Cybersecurity

Anomaly detection algorithms help in identifying suspicious activities and capacity cyber threats.

Challenges in Machine Learning

Despite its rapid development, machine mastering still faces numerous demanding situations:

1. Data Quality and Quantity

Accessing fantastic, categorised statistics is often a bottleneck. Incomplete, imbalanced, or biased datasets can cause misguided fashions.

2. Overfitting and Underfitting

Overfitting occurs when the model learns the education statistics too nicely and fails to generalize.

Three. Interpretability

Many modern fashions, specifically deep neural networks, act as "black boxes," making it tough to recognize how predictions are made — a concern in excessive-stakes regions like healthcare and law.

4. Ethical and Fairness Issues

Algorithms can inadvertently study and enlarge biases gift inside the training facts. Ensuring equity, transparency, and duty in ML structures is a growing area of studies.

5. Security

Adversarial assaults — in which small changes to enter information can fool ML models — present critical dangers, especially in applications like facial reputation and autonomous riding.

Future of Machine Learning

The destiny of system studying is each interesting and complicated. Some promising instructions consist of:

1. Explainable AI (XAI)

Efforts are underway to make ML models greater obvious and understandable, allowing customers to believe and interpret decisions made through algorithms.

2. Automated Machine Learning (AutoML)

AutoML aims to automate the stop-to-cease manner of applying ML to real-world issues, making it extra reachable to non-professionals.

3. Federated Learning

This approach permits fashions to gain knowledge of across a couple of gadgets or servers with out sharing uncooked records, enhancing privateness and efficiency.

4. Edge ML

Deploying device mastering models on side devices like smartphones and IoT devices permits real-time processing with reduced latency and value.

Five. Integration with Other Technologies

ML will maintain to converge with fields like blockchain, quantum computing, and augmented fact, growing new opportunities and challenges.

2 notes

·

View notes

Text

The AI Revolution: Understanding, Harnessing, and Navigating the Future

What is AI

In a world increasingly shaped by technology, one term stands out above the rest, capturing both our imagination and, at times, our apprehension: Artificial Intelligence. From science fiction dreams to tangible realities, AI is no longer a distant concept but an omnipresent force, subtly (and sometimes not-so-subtly) reshaping industries, transforming daily life, and fundamentally altering our perception of what's possible.

But what exactly is AI? Is it a benevolent helper, a job-stealing machine, or something else entirely? The truth, as always, is far more nuanced. At its core, Artificial Intelligence refers to the simulation of human intelligence processes by machines, especially computer systems. These processes include learning (the acquisition of information and rules for using the information), reasoning (using rules to reach approximate or definite conclusions), and self-correction. What makes modern AI so captivating is its ability to learn from data, identify patterns, and make predictions or decisions with increasing autonomy.

The journey of AI has been a fascinating one, marked by cycles of hype and disillusionment. Early pioneers in the mid-20th century envisioned intelligent machines that could converse and reason. While those early ambitions proved difficult to achieve with the technology of the time, the seeds of AI were sown. The 21st century, however, has witnessed an explosion of progress, fueled by advancements in computing power, the availability of massive datasets, and breakthroughs in machine learning algorithms, particularly deep learning. This has led to the "AI Spring" we are currently experiencing.

The Landscape of AI: More Than Just Robots

When many people think of AI, images of humanoid robots often come to mind. While robotics is certainly a fascinating branch of AI, the field is far broader and more diverse than just mechanical beings. Here are some key areas where AI is making significant strides:

Machine Learning (ML): This is the engine driving much of the current AI revolution. ML algorithms learn from data without being explicitly programmed. Think of recommendation systems on streaming platforms, fraud detection in banking, or personalized advertisements – these are all powered by ML.

Deep Learning (DL): A subset of machine learning inspired by the structure and function of the human brain's neural networks. Deep learning has been instrumental in breakthroughs in image recognition, natural language processing, and speech recognition. The facial recognition on your smartphone or the impressive capabilities of large language models like the one you're currently interacting with are prime examples.

Natural Language Processing (NLP): This field focuses on enabling computers to understand, interpret, and generate human language. From language translation apps to chatbots that provide customer service, NLP is bridging the communication gap between humans and machines.

Computer Vision: This area allows computers to "see" and interpret visual information from the world around them. Autonomous vehicles rely heavily on computer vision to understand their surroundings, while medical imaging analysis uses it to detect diseases.

Robotics: While not all robots are AI-powered, many sophisticated robots leverage AI for navigation, manipulation, and interaction with their environment. From industrial robots in manufacturing to surgical robots assisting doctors, AI is making robots more intelligent and versatile.

AI's Impact: Transforming Industries and Daily Life

The transformative power of AI is evident across virtually every sector. In healthcare, AI is assisting in drug discovery, personalized treatment plans, and early disease detection. In finance, it's used for algorithmic trading, risk assessment, and fraud prevention. The manufacturing industry benefits from AI-powered automation, predictive maintenance, and quality control.

Beyond these traditional industries, AI is woven into the fabric of our daily lives. Virtual assistants like Siri and Google Assistant help us organize our schedules and answer our questions. Spam filters keep our inboxes clean. Navigation apps find the fastest routes. Even the algorithms that curate our social media feeds are a testament to AI's pervasive influence. These applications, while often unseen, are making our lives more convenient, efficient, and connected.

Harnessing the Power: Opportunities and Ethical Considerations

The opportunities presented by AI are immense. It promises to boost productivity, solve complex global challenges like climate change and disease, and unlock new frontiers of creativity and innovation. Businesses that embrace AI can gain a competitive edge, optimize operations, and deliver enhanced customer experiences. Individuals can leverage AI tools to automate repetitive tasks, learn new skills, and augment their own capabilities.

However, with great power comes great responsibility. The rapid advancement of AI also brings forth a host of ethical considerations and potential challenges that demand careful attention.

Job Displacement: One of the most frequently discussed concerns is the potential for AI to automate jobs currently performed by humans. While AI is likely to create new jobs, there will undoubtedly be a shift in the nature of work, requiring reskilling and adaptation.

Bias and Fairness: AI systems learn from the data they are fed. If that data contains historical biases (e.g., related to gender, race, or socioeconomic status), the AI can perpetuate and even amplify those biases in its decisions, leading to unfair outcomes. Ensuring fairness and accountability in AI algorithms is paramount.

Privacy and Security: AI relies heavily on data. The collection and use of vast amounts of personal data raise significant privacy concerns. Moreover, as AI systems become more integrated into critical infrastructure, their security becomes a vital issue.

Transparency and Explainability: Many advanced AI models, particularly deep learning networks, are often referred to as "black boxes" because their decision-making processes are difficult to understand. For critical applications, it's crucial to have transparency and explainability to ensure trust and accountability.

Autonomous Decision-Making: As AI systems become more autonomous, questions arise about who is responsible when an AI makes a mistake or causes harm. The development of ethical guidelines and regulatory frameworks for autonomous AI is an ongoing global discussion.

Navigating the Future: A Human-Centric Approach

Navigating the AI revolution requires a proactive and thoughtful approach. It's not about fearing AI, but rather understanding its capabilities, limitations, and implications. Here are some key principles for moving forward:

Education and Upskilling: Investing in education and training programs that equip individuals with AI literacy and skills in areas like data science, AI ethics, and human-AI collaboration will be crucial for the workforce of the future.

Ethical AI Development: Developers and organizations building AI systems must prioritize ethical considerations from the outset. This includes designing for fairness, transparency, and accountability, and actively mitigating biases.

Robust Governance and Regulation: Governments and international bodies have a vital role to play in developing appropriate regulations and policies that foster innovation while addressing ethical concerns and ensuring the responsible deployment of AI.

Human-AI Collaboration: The future of work is likely to be characterized by collaboration between humans and AI. AI can augment human capabilities, automate mundane tasks, and provide insights, allowing humans to focus on higher-level problem-solving, creativity, and empathy.

Continuous Dialogue: As AI continues to evolve, an ongoing, open dialogue among technologists, ethicists, policymakers, and the public is essential to shape its development in a way that benefits humanity.

The AI revolution is not just a technological shift; it's a societal transformation. By understanding its complexities, embracing its potential, and addressing its challenges with foresight and collaboration, we can harness the power of Artificial Intelligence to build a more prosperous, equitable, and intelligent future for all. The journey has just begun, and the choices we make today will define the world of tomorrow.

2 notes

·

View notes

Text

How Questionnaires and Technology Are Revolutionizing Fraud Prevention

Fraud has become a significant challenge across industries, from finance to healthcare. As criminals become more sophisticated, organizations must adopt advanced methods to detect and prevent fraudulent activities. One powerful combination proving effective is the integration of questionnaires and technology in fraud prevention strategies.

The Role of Questionnaires in Fraud Detection

Questionnaires serve as an essential tool in gathering crucial information from individuals, be it customers, employees, or vendors. Structured questionnaires can help organizations assess risks, verify identities, and detect inconsistencies in responses. By incorporating behavioral and psychological cues, they can reveal red flags indicating potential fraudulent intent.

Technology Enhancing Questionnaires for Accuracy

Modern technology amplifies the effectiveness of questionnaires in fraud prevention. Artificial intelligence (AI) and machine learning (ML) analyze response patterns, detect anomalies, and flag inconsistencies in real-time. Natural Language Processing (NLP) helps identify deceptive answers, while automated data cross-referencing ensures accuracy. Additionally, biometric verification and blockchain technology enhance security by confirming identities and preventing document forgery.

Real-World Applications

Many industries leverage digital questionnaires and AI-driven analytics to prevent fraud. Banks use them to assess loan applicants' credibility, insurance companies detect false claims, and e-commerce platforms verify users to prevent identity theft. Government agencies also employ AI-powered questionnaires in immigration and border security to detect fraudulent intent.

The Future of Fraud Prevention

With fraudsters constantly evolving their tactics, the future lies in adaptive questionnaires powered by AI, where questions change dynamically based on responses. Coupled with real-time data analytics and blockchain verification, this approach will further strengthen fraud detection and prevention.

In conclusion, the synergy between questionnaires and technology is a game-changer in fraud prevention. By leveraging advanced analytics and AI-driven insights, organizations can stay ahead of fraudsters, ensuring security and trust in their operations.

Book a free demo: online panel management platform

fraud detection and reporting tool

2 notes

·

View notes

Text

Artificial Intelligence: Transforming the Future of Technology

Introduction: Artificial intelligence (AI) has become increasingly prominent in our everyday lives, revolutionizing the way we interact with technology. From virtual assistants like Siri and Alexa to predictive algorithms used in healthcare and finance, AI is shaping the future of innovation and automation.

Understanding Artificial Intelligence

Artificial intelligence (AI) involves creating computer systems capable of performing tasks that usually require human intelligence, including visual perception, speech recognition, decision-making, and language translation. By utilizing algorithms and machine learning, AI can analyze vast amounts of data and identify patterns to make autonomous decisions.

Applications of Artificial Intelligence

Healthcare: AI is being used to streamline medical processes, diagnose diseases, and personalize patient care.

Finance: Banks and financial institutions are leveraging AI for fraud detection, risk management, and investment strategies.

Retail: AI-powered chatbots and recommendation engines are enhancing customer shopping experiences.

Automotive: Self-driving cars are a prime example of AI technology revolutionizing transportation.

How Artificial Intelligence Works

AI systems are designed to mimic human intelligence by processing large datasets, learning from patterns, and adapting to new information. Machine learning algorithms and neural networks enable AI to continuously improve its performance and make more accurate predictions over time.

Advantages of Artificial Intelligence

Efficiency: AI can automate repetitive tasks, saving time and increasing productivity.

Precision: AI algorithms can analyze data with precision, leading to more accurate predictions and insights.

Personalization: AI can tailor recommendations and services to individual preferences, enhancing the customer experience.

Challenges and Limitations

Ethical Concerns: The use of AI raises ethical questions around data privacy, algorithm bias, and job displacement.

Security Risks: As AI becomes more integrated into critical systems, the risk of cyber attacks and data breaches increases.

Regulatory Compliance: Organizations must adhere to strict regulations and guidelines when implementing AI solutions to ensure transparency and accountability.

Conclusion: As artificial intelligence continues to evolve and expand its capabilities, it is essential for businesses and individuals to adapt to this technological shift. By leveraging AI's potential for innovation and efficiency, we can unlock new possibilities and drive progress in various industries. Embracing artificial intelligence is not just about staying competitive; it is about shaping a future where intelligent machines work hand in hand with humans to create a smarter and more connected world.

Syntax Minds is a training institute located in the Hyderabad. The institute provides various technical courses, typically focusing on software development, web design, and digital marketing. Their curriculum often includes subjects like Java, Python, Full Stack Development, Data Science, Machine Learning, Angular JS , React JS and other tech-related fields.

For the most accurate and up-to-date information, I recommend checking their official website or contacting them directly for details on courses, fees, batch timings, and admission procedures.

If you'd like help with more specific queries about their offerings or services, feel free to ask!

2 notes

·

View notes

Text

What are the latest technological advancements shaping the future of fintech?

The financial technology (fintech) industry has witnessed an unprecedented wave of innovation over the past decade, reshaping how people and businesses manage money. As digital transformation accelerates, fintech new technologies are emerging, revolutionizing payments, lending, investments, and other financial services. These advancements, driven by fintech innovation, are not only enhancing user experience but also fostering greater financial inclusion and efficiency.

In this article, we will explore the most significant fintech trending technologies that are shaping the future of the industry. From blockchain to artificial intelligence, these innovations are redefining the boundaries of what fintech can achieve.

1. Blockchain and Cryptocurrencies

One of the most transformative advancements in fintech is the adoption of blockchain technology. Blockchain serves as the foundation for cryptocurrencies like Bitcoin, Ethereum, and stablecoins. Its decentralized, secure, and transparent nature has made it a game-changer in areas such as payments, remittances, and asset tokenization.

Key Impacts of Blockchain:

Decentralized Finance (DeFi): Blockchain is driving the rise of DeFi, which eliminates intermediaries like banks in financial transactions. DeFi platforms offer lending, borrowing, and trading services, accessible to anyone with an internet connection.

Cross-Border Payments: Blockchain simplifies and accelerates international transactions, reducing costs and increasing transparency.

Smart Contracts: These self-executing contracts are automating and securing financial agreements, streamlining operations across industries.

As blockchain adoption grows, businesses are exploring how to integrate this technology into their offerings to increase trust and efficiency.

2. Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are at the core of fintech innovation, enabling smarter and more efficient financial services. These technologies are being used to analyze vast amounts of data, predict trends, and automate processes.

Applications of AI and ML:

Fraud Detection and Prevention: AI models detect anomalies and fraudulent transactions in real-time, enhancing security for both businesses and customers.

Personalized Financial Services: AI-driven chatbots and virtual assistants are offering tailored advice, improving customer engagement.

Credit Scoring: AI-powered algorithms provide more accurate and inclusive credit assessments, helping underserved populations gain access to loans.

AI and ML are enabling fintech companies to deliver faster, more reliable services while minimizing operational risks.

3. Open Banking

Open banking is one of the most significant fintech trending technologies, promoting collaboration between banks, fintechs, and third-party providers. It allows customers to share their financial data securely with authorized parties through APIs (Application Programming Interfaces).

Benefits of Open Banking:

Enhanced Financial Management: Aggregated data helps users better manage their finances across multiple accounts.

Increased Competition: Open banking fosters innovation, as fintech startups can create solutions tailored to specific customer needs.

Seamless Payments: Open banking APIs enable instant and direct payments, reducing reliance on traditional methods.

Open banking is paving the way for a more connected and customer-centric financial ecosystem.

4. Biometric Authentication

Security is paramount in the financial industry, and fintech innovation has led to the rise of biometric authentication. By using physical characteristics such as fingerprints, facial recognition, or voice patterns, biometric technologies enhance security while providing a seamless user experience.

Advantages of Biometric Authentication:

Improved Security: Biometrics significantly reduce the risk of fraud by making it difficult for unauthorized users to access accounts.

Faster Transactions: Users can authenticate themselves quickly, leading to smoother digital payment experiences.

Convenience: With no need to remember passwords, biometrics offer a more user-friendly approach to security.

As mobile banking and digital wallets gain popularity, biometric authentication is becoming a standard feature in fintech services.

5. Embedded Finance

Embedded finance involves integrating financial services into non-financial platforms, such as e-commerce websites or ride-hailing apps. This fintech new technology allows businesses to offer services like loans, insurance, or payment options directly within their applications.

Examples of Embedded Finance:

Buy Now, Pay Later (BNPL): E-commerce platforms enable customers to purchase products on credit, enhancing sales and customer satisfaction.

In-App Payments: Users can make seamless transactions without leaving the platform, improving convenience.

Insurance Integration: Platforms offer tailored insurance products at the point of sale.

Embedded finance is creating new revenue streams for businesses while simplifying the customer journey.

6. RegTech (Regulatory Technology)

As financial regulations evolve, fintech innovation is helping businesses stay compliant through RegTech solutions. These technologies automate compliance processes, reducing costs and minimizing errors.

Key Features of RegTech:

Automated Reporting: Streamlines regulatory reporting requirements, saving time and resources.

Risk Management: Identifies and mitigates potential risks through predictive analytics.

KYC and AML Compliance: Simplifies Know Your Customer (KYC) and Anti-Money Laundering (AML) processes.

RegTech ensures that fintech companies remain agile while adhering to complex regulatory frameworks.

7. Cloud Computing

Cloud computing has revolutionized the way fintech companies store and process data. By leveraging the cloud, businesses can scale rapidly and deliver services more efficiently.

Benefits of Cloud Computing:

Scalability: Enables businesses to handle large transaction volumes without investing in physical infrastructure.

Cost-Effectiveness: Reduces operational costs by eliminating the need for on-premise servers.

Data Security: Advanced cloud platforms offer robust security measures to protect sensitive financial data.

Cloud computing supports the rapid growth of fintech companies, ensuring reliability and flexibility.

The Role of Xettle Technologies in Fintech Innovation

Companies like Xettle Technologies are at the forefront of fintech new technologies, driving advancements that make financial services more accessible and efficient. With a focus on delivering cutting-edge solutions, Xettle Technologies helps businesses integrate the latest fintech trending technologies into their operations. From AI-powered analytics to secure cloud-based platforms, Xettle Technologies is empowering organizations to stay competitive in an ever-evolving industry.

Conclusion

The future of fintech is being shaped by transformative technologies that are redefining how financial services are delivered and consumed. From blockchain and AI to open banking and biometric authentication, these fintech new technologies are driving efficiency, security, and inclusivity. As companies like Xettle Technologies continue to innovate, the industry will unlock even greater opportunities for businesses and consumers alike. By embracing these fintech trending advancements, organizations can stay ahead of the curve and thrive in a dynamic financial landscape.

2 notes

·

View notes

Text

Scaling Your Australian Business with AI: A CEO’s Guide to Hiring Developers

In today’s fiercely competitive digital economy, innovation isn’t a luxury—it’s a necessity. Australian businesses are increasingly recognizing the transformative power of Artificial Intelligence (AI) to streamline operations, enhance customer experiences, and unlock new revenue streams. But to fully harness this potential, one crucial element is required: expert AI developers.

Whether you’re a fast-growing fintech in Sydney or a manufacturing giant in Melbourne, if you’re looking to implement scalable AI solutions, the time has come to hire AI developers who understand both the technology and your business landscape.

In this guide, we walk CEOs, CTOs, and tech leaders through the essentials of hiring AI talent to scale operations effectively and sustainably.

Why AI is Non-Negotiable for Scaling Australian Enterprises

Australia has seen a 270% rise in AI adoption across key industries like retail, healthcare, logistics, and finance over the past three years. From predictive analytics to conversational AI and intelligent automation, AI has become central to delivering scalable, data-driven solutions.

According to Deloitte Access Economics, AI is expected to contribute AU$ 22.17 billion to the Australian economy by 2030. For CEOs and decision-makers, this isn’t just a trend—it’s a wake-up call to start investing in the right AI talent to stay relevant.

The Hidden Costs of Delaying AI Hiring

Still relying on a traditional tech team to handle AI-based initiatives? You could be leaving significant ROI on the table. Without dedicated experts, your AI projects risk:

Delayed deployments

Poorly optimized models

Security vulnerabilities

Lack of scalability

Wasted infrastructure investment

By choosing to hire AI developers, you're enabling faster time-to-market, more accurate insights, and a competitive edge in your sector.

How to Hire AI Developers: A Strategic Approach for Australian CEOs

The process of hiring AI developers is unlike standard software recruitment. You’re not just hiring a coder—you’re bringing on board an innovation partner.

Here’s what to consider:

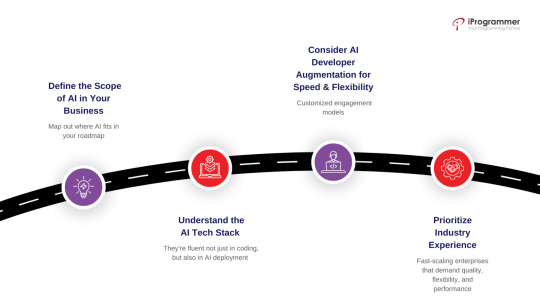

1. Define the Scope of AI in Your Business

Before hiring, map out where AI fits in your roadmap:

Are you looking for machine learning-driven forecasting?

Want to implement AI chatbots for 24/7 customer service?

Building a computer vision solution for your manufacturing line?

Once you identify the use cases, it becomes easier to hire ML developers or AI experts with the relevant domain and technical experience.

2. Understand the AI Tech Stack

A strong AI developer should be proficient in:

Python, R, TensorFlow, PyTorch

Scikit-learn, Keras, OpenCV

Data engineering with SQL, Spark, Hadoop

Deployment tools like Docker, Kubernetes, AWS SageMaker

When you hire remote AI engineers, ensure they’re fluent not just in coding, but also in AI deployment and scalability best practices.

3. Consider AI Developer Augmentation for Speed & Flexibility

Building an in-house AI team is time-consuming and expensive. That’s why AI developer staff augmentation is a smarter choice for many Australian enterprises.

With our staff augmentation services, you can:

Access pre-vetted, highly skilled AI developers

Scale up or down depending on your project phase

Save costs on infrastructure and training

Retain full control over your development process

Whether you need to hire ML developers for short-term analytics or long-term AI product development, we offer customized engagement models to suit your needs.

4. Prioritize Industry Experience

AI isn’t one-size-fits-all. Hiring developers who have experience in your specific industry—be it healthcare, fintech, ecommerce, logistics, or manufacturing—ensures faster onboarding and better results.

We’ve helped companies in Australia and across the globe integrate AI into:

Predictive maintenance systems

Smart supply chain analytics

AI-based fraud detection in banking

Personalized customer experiences in ecommerce

This hands-on experience allows our developers to deliver solutions that are relevant and ROI-driven.

Why Choose Our AI Developer Staff Augmentation Services?

At iProgrammer, we bring over a decade of experience in empowering businesses through intelligent technology solutions. Our AI developer augmentation services are designed for fast-scaling enterprises that demand quality, flexibility, and performance.

What Sets Us Apart:

AI-First Talent Pool: We don’t generalize. We specialize in AI, ML, NLP, computer vision, and data science.

Quick Deployment: Get developers onboarded and contributing in just a few days.

Cost Efficiency: Hire remote AI developers from our offshore team and reduce development costs by up to 40%.

End-to-End Support: From hiring to integration and project execution, we stay involved to ensure success.

A Case in Point: AI Developer Success in an Australian Enterprise

One of our clients, a mid-sized logistics company in Brisbane, wanted to predict delivery delays using real-time data. Within 3 weeks of engagement, we onboarded a senior ML developer who built a predictive model using historical shipment data, weather feeds, and traffic APIs. The result? A 25% reduction in customer complaints and a 15% improvement in delivery time accuracy.

This is the power of hiring the right AI developer at the right time.

Final Thoughts: CEOs Must Act Now to Stay Ahead

If you’re a CEO, CTO, or decision-maker in Australia, the question isn’t “Should I hire AI developers?” It’s “How soon can I hire the right AI developer to scale my business?”

Whether you're launching your first AI project or scaling an existing system, AI developer staff augmentation provides the technical depth and agility you need to grow fast—without the friction of long-term hiring.

Ready to Build Your AI Dream Team?

Let’s connect. Talk to our AI staffing experts today and discover how we can help you hire remote AI developers or hire ML developers who are ready to make an impact from day one.

👉 Contact Us Now | Schedule a Free Consultation

0 notes

Text

How Automated Phone Conversations Are Revolutionizing Customer Support

Introduction

In an age where customer expectations are rising and businesses are striving for efficiency, automated phone conversations have emerged as a game-changing solution. Leveraging artificial intelligence (AI), businesses can now provide seamless, round-the-clock customer service that is efficient, consistent, and scalable. This article explores how automated phone conversations are revolutionizing customer support, the benefits they bring, and how companies can successfully implement this technology.

The Evolution of Customer Support

Traditional customer support has relied heavily on human agents managing phone lines, responding to emails, and handling support tickets. While human interaction remains valuable, this approach has limitations, including long wait times, inconsistent service quality, and scalability challenges.

The digital transformation of customer service began with the introduction of chatbots and self-service portals. However, voice remains a preferred communication channel for many customers, especially in complex or urgent scenarios. This is where automated phone conversations powered by AI voice technology step in. https://www.precallai.com/

What Are Automated Phone Conversations?

Automated phone conversations involve the use of AI-powered voice agents or systems that can interact with customers through natural language. These systems use natural language processing (NLP), machine learning, and speech recognition to understand customer inquiries and provide accurate responses without human intervention.

Whether it’s answering FAQs, processing orders, scheduling appointments, or providing technical support, automated phone systems can handle a wide array of tasks traditionally performed by human agents.

Benefits of Automated Phone Conversations

1. 24/7 Customer Support

One of the most significant advantages of automated phone conversations is the ability to provide round-the-clock support. Unlike human agents who work fixed shifts, AI-powered systems are always available to handle customer queries, even during weekends and holidays.

2. Scalability

AI phone systems can manage thousands of concurrent conversations, making them highly scalable. This is particularly useful during peak hours or promotional periods when customer inquiry volumes surge.

3. Reduced Operational Costs

By automating routine and repetitive tasks, businesses can significantly cut down on customer service costs. AI reduces the need for large customer support teams, allowing human agents to focus on complex and high-value tasks.

4. Consistency in Service Delivery

Automated systems provide consistent responses, minimizing errors and variations that can occur with human agents. This ensures a more uniform customer experience across interactions.

5. Faster Response Times

With AI, there’s no waiting time or call hold. Customers receive instant responses, which improves satisfaction and reduces frustration.

6. Actionable Insights

AI phone systems can analyze call data to provide insights into customer behavior, frequently asked questions, and service trends. These insights help businesses optimize their support strategies and improve customer satisfaction.

Real-World Use Cases

- E-commerce

Retailers use automated phone conversations to confirm orders, handle returns, and answer product-related queries. AI systems can manage high call volumes during sales and holiday seasons without compromising service quality.

- Healthcare

Hospitals and clinics leverage AI voice agents to schedule appointments, send reminders, and provide information about services. Automated phone conversations reduce the burden on administrative staff and enhance patient experience.

- Banking and Financial Services

Financial institutions use automated phone systems for balance inquiries, fraud detection alerts, and customer authentication. This improves security and reduces wait times for critical services.

- Telecommunications

Telecom companies use voice AI to troubleshoot network issues, manage account settings, and promote new plans. Automated systems ensure customers receive timely assistance without navigating long IVR menus.

Implementing AI in Customer Support

1. Choose the Right Platform

Businesses must select an AI voice platform that aligns with their industry needs and customer expectations. Platforms like PreCallAI offer customizable solutions tailored to specific use cases.

2. Define Clear Use Cases

Start with clear, high-impact use cases such as order tracking, appointment scheduling, or password resets. Gradually expand capabilities as the system matures.

3. Integrate with Existing Systems

Seamless integration with CRM, ticketing systems, and other backend tools is critical for delivering personalized experiences and maintaining data continuity.

4. Monitor and Optimize

AI systems require continuous monitoring and training to ensure accuracy. Regularly review performance metrics, customer feedback, and conversation logs to identify improvement areas.

5. Train and Support Human Agents

Rather than replacing human agents, AI systems should complement them. Train agents to handle complex issues and escalate calls from the AI system when needed.

Addressing Common Concerns

- Loss of Human Touch

While automation can feel impersonal, advanced AI voice agents are becoming increasingly human-like. They can recognize emotions, modulate tone, and engage in natural conversations, enhancing the customer experience.

- Security and Privacy

AI platforms must comply with data protection regulations such as GDPR and HIPAA. Secure call recordings, encryption, and authentication protocols are essential to maintain customer trust.

- Customer Acceptance

Transparent communication and user-friendly interfaces encourage customer adoption. Let users know they’re speaking to an AI agent and provide options to speak with a human when needed.

The Future of Automated Phone Conversations

With continuous advancements in AI, NLP, and voice recognition, the future of automated phone conversations looks promising. We can expect more intelligent, context-aware systems that not only respond but anticipate customer needs.

Voice AI will likely integrate with other channels—email, chat, and social media—for an omnichannel support experience. Predictive analytics, sentiment analysis, and real-time personalization will become standard features.

Conclusion

Automated phone conversations are not just a trend—they represent a significant shift in how businesses interact with customers. By embracing AI voice technology, companies can deliver faster, smarter, and more efficient customer support.

From 24/7 availability and cost savings to improved customer satisfaction, the benefits are compelling. As technology evolves, automated phone conversations will become an integral part of every customer service strategy.

Now is the time to invest in AI-powered customer support and stay ahead in the competitive digital landscape.

#Automated phone conversations#Customer support automation#AI customer support#AI phone conversations#Automated customer service#How automated calls improve customer support#Automated phone systems for support#AI-powered phone customer support#Voice AI for automated support calls

0 notes

Text

AI in Fraud Detection: How Smart Technology Fights Financial Crime

Fraud is a growing threat in today’s digital world. As more people shop, bank, and do business online, fraudsters are getting smarter. But thankfully, so is technology. I’ve seen how AI in fraud detection is changing the game—spotting suspicious activity in real time and protecting businesses and customers before damage is done.

What Is AI in Fraud Detection?

AI in fraud detection uses machine learning, pattern recognition, and real-time data analysis to identify unusual behavior. It’s faster and more accurate than traditional systems because it learns over time, adapting to new threats automatically.

Example:

If a customer who always shops in London suddenly makes a purchase in Tokyo five minutes later, AI systems can instantly flag this as suspicious.

Why Is AI Better Than Traditional Methods?

Old fraud detection tools often rely on fixed rules, like: “Flag all transactions over $5,000.” But AI can go deeper.

Key Advantages:

Learns from patterns over time

Reduces false positives (blocking real customers)

Works in real-time

Detects complex fraud involving multiple accounts or steps

How Does AI Detect Fraud?

AI fraud detection usually involves:

Data Collection – Gathering transaction history, device info, location, etc.

Pattern Analysis – Using models to understand normal behavior

Anomaly Detection – Flagging anything that looks out of the ordinary

Risk Scoring – Assigning a threat level to each transaction

Action – Blocking, alerting, or requesting extra verification

Common Use Cases

IndustryAI ApplicationExampleBankingCredit card fraud, identity theftBlocking a hacked account in real timeE-commerceFake transactions, refund fraudDetecting bots or unusual ordersInsuranceClaims fraud detectionFlagging fake accident reportsTelecomSubscription and identity fraudCatching SIM card swapping

Tools and Technologies

Popular tools used for AI-based fraud detection include:

SAS Fraud Management

FICO Falcon Platform

IBM Trusteer

Kount

Darktrace

Amazon Fraud Detector

Most of these use advanced machine learning models, including decision trees, neural networks, and clustering algorithms.

Challenges in AI-Based Fraud Detection

Even with AI, there are a few things to keep in mind:

Data Quality: Poor data leads to poor results

Privacy Concerns: Sensitive customer data must be protected

Evolving Threats: Fraudsters adapt quickly, so models must be updated

Bias Risks: AI must be trained fairly to avoid unfair profiling

The Future of AI in Fraud Detection

AI is expected to become even more powerful through:

Deep Learning for better pattern recognition

Behavioral Biometrics (how you type or move your mouse)

Natural Language Processing to detect fake documents or conversations

Collaborative AI where companies share threat data securely

Final Thoughts

AI in fraud detection is not just a trend—it’s a necessity. With smarter tools, businesses can stay one step ahead of cybercriminals, reduce losses, and keep customers safe. As threats evolve, AI is proving to be the most reliable guard at the gate.

0 notes

Text

Top short-term courses for 2025: AI, data, accounting skills

Whether you're a fresh graduate, a career switcher, or a working professional looking to climb the ladder, investing time in a short-term course can be a game-changer. Traditional degrees may take years, but today's fast-paced job market rewards upskilling, and online short term courses are the smartest way to stay ahead.

UniAthena offers a variety of industry-relevant programs you can complete in just a few weeks. Here’s a closer look at some of the best short-term courses you can start today free of cost, flexible in schedule, and globally recognized.

Top Online Short-Term Courses for Professionals

Basics of Data Science

Data is the currency of the digital world. With the Basics of Data Science short-term certificate course, you’ll learn to make sense of large datasets, uncover insights, and support strategic decisions.

Duration: 4–6 hours

Certification: CIQ, UK

Perfect for: Beginners in tech, business analysts, entrepreneurs

This is one of the best short-term courses for anyone curious about analytics, automation, and business intelligence.

Executive Diploma in Machine Learning

Machine Learning is transforming industries—from healthcare to finance. With the Executive Diploma in Machine Learning, you'll dive into predictive modeling, pattern recognition, and ML algorithms that power recommendation systems and fraud detection tools.

Duration: 2–3 weeks

Certification: AUPD

Ideal for: Tech professionals, data enthusiasts, IT graduates

One of the most impactful short-term IT courses, this diploma arms you with the skills that companies are hiring for—now.

Diploma in Artificial Intelligence

Ready to be part of the AI revolution? The Diploma in Artificial Intelligence gives you a fast-paced introduction to machine vision, neural networks, and smart systems.

Duration: 1��2 weeks

Certification: AUPD

Designed for: Professionals seeking a tech edge, AI-curious learners

AI isn’t just the future, it’s your future.

Accounting Short-Term Course: Mastering Accounting

Want to decode balance sheets and lead budget planning? The Mastering Accounting course offers real-world skills in financial reporting, ratios, and auditing.

Duration: Flexible

Certification: CIQ, UK

Great for: Business owners, finance executives, recent graduates

This is one of the most practical Accounting short term courses that can open doors in any organization.

Basics of Digital Marketing

From social media to SEO, learn how to attract and convert customers online. The Basics of Digital Marketing short-term course covers tools like Google Analytics, email marketing, and paid ad campaigns.

Duration: 4–6 hours

Certification: CIQ, UK

Ideal for: Entrepreneurs, marketing aspirants, content creators

Start building campaigns that convert—without any prior experience.

Diploma in Financial Risk Management Course

Finance doesn’t come without risk, but you can learn how to manage it. The Diploma in Financial Risk Management course teaches you the frameworks and tools used in banking and corporate finance to mitigate losses and forecast risks.

Duration: 1–2 weeks

Certification: AUPD

Targeted at: Finance professionals, bankers, auditors

A powerful choice among the best short-term courses for high-paying finance roles.

Mastering Product Management

Lead with vision and strategy. The Mastering Product Management course walks you through product lifecycle, market fit, user research, and roadmap planning.

Duration: 1 week

Certification: AUPD

Perfect for: Aspiring product managers, startup founders, team leads

Product managers are in demand—make your next move count.

Mastering Supply Chain Management

Learn how global businesses move products efficiently with the Mastering Supply Chain Management course. Cover demand forecasting, logistics, inventory, and resilience planning.

Duration: 1 week

Certification: CIQ, UK

Ideal for: Manufacturing professionals, operations managers, logistics coordinators

A strategic course to level up your supply chain know-how.

Executive Diploma in Procurement & Contract Management

Procurement professionals handle billion-dollar budgets and vendor contracts. Learn negotiation, compliance, and supplier relationship management in the Executive Diploma in Procurement & Contract Management.

Duration: 2–3 weeks

Certification: AUPD

Best for: Project managers, legal advisors, supply chain professionals

A must-have skill set for leadership roles in logistics and procurement.

Diploma in Environment Health and Safety Management

Ensure safe and sustainable work environments with the Diploma in Environment Health and Safety Management. Understand hazards, prevention strategies, and compliance guidelines.

Duration: 1–2 weeks

Certification: AUPD

Great for: HR managers, safety officers, freshers post-12th

This is one of the most valuable short-term management courses after 12th for students and early-career professionals.

Special Focus: Upskilling Opportunities

In a rapidly developing country, digital education is more important than ever. Access to UniAthena’s Online Short Courses provides a gateway for learners to gain global credentials without leaving home.

With high youth unemployment and a growing need for skilled professionals, courses like Diploma in Financial Risk Management, Basics of Digital Marketing, and Mastering Accounting can help build resilient careers.

By enrolling in best short term courses in fields like AI, Procurement, or Supply Chain, professionals can step into international roles or uplift local enterprises with world-class skills.

All courses are 100% online and can be accessed via mobile—ideal for regions with limited infrastructure.

Conclusion: Choose the Right Course, Right Now

The future belongs to those who keep learning. Whether you're looking for an Accounting short term course, aiming to master AI or Data Science, or want to step into Product or Supply Chain Management, there's a course waiting for you on UniAthena.

Every course mentioned above offers:

Flexible schedules

Globally accredited certificates

Career-ready skills

No upfront cost

Bonus Tips

For high-growth tech careers, explore the Executive Diploma in Machine Learning or Diploma in Artificial Intelligence.

Want to switch to business or finance? Consider the Mastering Accounting or Diploma in Financial Risk Management course.

Already in management? Advance with Mastering Product Management or Executive Diploma in Procurement & Contract Management.

The best time to start upskilling was yesterday. The second-best time? Right now.

Explore UniAthena’s Online Short Courses and reshape your career today.

#TopShortTermCourses#ShortTermCourses2025#AICourses#DataAnalytics#AccountingSkills#LearnAI#DataScience#CareerDevelopment#Upskill2025#FutureSkills#TechnologyTraining#OnlineCourses#SkillsForSuccess#ProfessionalGrowth#FastTrackLearning#AITraining#LiveYourPotential#WorkPlaceSkills#LearningJourney

0 notes

Text

How an Artificial Intelligence Course in Dubai Can Boost Your Salary and Job Prospects in 2025?

Artificial Intelligence (AI) has rapidly evolved from a futuristic concept to a core driver of business transformation. From autonomous vehicles to predictive analytics and conversational AI, industries across the globe are harnessing the power of AI to innovate and scale. As a result, the demand for skilled AI professionals is soaring—and so are their salaries.

Dubai, known for its vision-led economy, smart city infrastructure, and tech-forward governance, is emerging as one of the most exciting places to study AI. Enrolling in an Artificial Intelligence course in Dubai in 2025 can be a game-changing decision, not just for your skill set but also for your career growth and earning potential.

In this article, we explore how an AI course in Dubai can significantly boost your salary and open doors to lucrative job opportunities in the fast-growing world of artificial intelligence.

Why AI Skills Are in High Demand in 2025?

AI is no longer a niche. From banking and healthcare to real estate and retail, businesses are integrating AI into their processes to enhance efficiency, reduce costs, and make smarter decisions. According to a 2025 Gartner report, AI-related job roles will increase by 35% year-over-year, with a major focus on data science, machine learning, and AI application development.

Key reasons behind this demand include:

Increased adoption of automation tools

Expansion of smart city initiatives (like Dubai’s Smart Government)

Rise in AI startups and tech incubators in the UAE

Integration of AI in everyday consumer services

How an Artificial Intelligence Course in Dubai Can Advance Your Career?

1. Acquire In-Demand Technical Skills

Completing an Artificial Intelligence course in Dubai equips you with cutting-edge technical capabilities, including:

Machine Learning algorithms

Deep Learning and Neural Networks

Natural Language Processing (NLP)

Computer Vision

AI Deployment on Cloud Platforms (AWS, Azure, GCP)

Python, TensorFlow, and PyTorch

These skills are exactly what top employers are seeking in roles such as AI Engineer, Data Scientist, Machine Learning Specialist, and AI Product Manager.

2. Access to Global Career Opportunities

Dubai’s strategic location as a global business and innovation hub gives learners access to:

UAE-based multinational companies

Regional AI labs and startups

Remote roles in Europe, North America, and Asia

Cross-border freelancing and consulting projects

Many international firms recruit directly from Dubai’s AI talent pool, knowing that graduates from the region are trained in both theory and real-world application.

3. Increased Earning Potential

Let’s talk numbers. Completing an AI course can lead to a salary hike of 40–100%, depending on your background and role.

AI Job Market Trends in Dubai

Dubai is making AI a cornerstone of its Vision 2031 strategy. Some of the most promising areas for AI employment in the region include:

➤ Government & Smart Cities

Intelligent traffic management

Smart policing and surveillance

Automated public services

➤ Finance & Banking

Fraud detection

Chatbots for customer service

Risk analysis using machine learning

➤ Healthcare

AI diagnostics

Predictive healthcare analytics

Medical robotics

➤ Retail & E-Commerce

Recommendation engines

Customer behavior prediction

Virtual shopping assistants

Why Dubai Is the Ideal Location for AI Learning?

✔️ Tech-Driven Ecosystem

Dubai is home to tech parks, AI accelerators, and digital innovation hubs like:

Dubai AI Lab

Dubai Future Foundation

Dubai Silicon Oasis

These entities regularly collaborate with AI course providers for internships, capstone projects, and industry mentorship.

✔️ World-Class Infrastructure

Dubai’s world-class infrastructure, safety, and connectivity make it a top destination for international students and professionals alike.

✔️ Tax-Free Salary Benefits

One of the biggest attractions for working in Dubai is the tax-free income. That means the high AI salaries translate into greater take-home pay compared to many Western countries.

Learn from Industry Experts: Boston Institute of Analytics (BIA) in Dubai

When choosing an Artificial Intelligence course in Dubai, it's important to pick an institute that not only offers a strong academic foundation but also prepares you for real-world roles. One such trusted name is the Boston Institute of Analytics (BIA).

🔍 Why Choose BIA for Your AI Journey?

Industry-Oriented Curriculum: Covers ML, NLP, Deep Learning, AI Ethics, and cloud deployment.

Hands-On Projects: Work on case studies across healthcare, finance, and marketing.

Experienced Faculty: Learn from top-tier professionals currently working in AI/ML domains.

Placement Support: Resume building, mock interviews, and access to Dubai-based job portals.

Flexible Learning: Hybrid online and offline options available for global learners.

Global Certification: Recognized by employers across the Middle East, India, the UK, and beyond.

Whether you're a tech enthusiast, business analyst, or recent graduate, BIA’s program empowers you to confidently transition into the AI workforce.

Final Thoughts

Pursuing an Artificial Intelligence course in Dubai in 2025 is more than just an educational investment—it’s a strategic move that can elevate your salary, enhance your skill set, and fast-track your tech career. With AI integrated into every major industry and global demand on the rise, there’s no better time to upskill.

Institutes like the Boston Institute of Analytics provide the perfect launchpad for international learners to master AI, connect with mentors, and access high-paying roles in Dubai and beyond.

So if you’re ready to future-proof your career, it starts with the right training—and the right city.

#Best Data Science Courses in Dubai#Artificial Intelligence Course in Dubai#Data Scientist Course in Dubai#Machine Learning Course in Dubai

0 notes

Text

How Python Can Be Used in Finance: Applications, Benefits & Real-World Examples

In the rapidly evolving world of finance, staying ahead of the curve is essential. One of the most powerful tools at the intersection of technology and finance today is Python. Known for its simplicity and versatility, Python has become a go-to programming language for financial professionals, data scientists, and fintech companies alike.

This blog explores how Python is used in finance, the benefits it offers, and real-world examples of its applications in the industry.

Why Python in Finance?

Python stands out in the finance world because of its:

Ease of use: Simple syntax makes it accessible to professionals from non-programming backgrounds.

Rich libraries: Packages like Pandas, NumPy, Matplotlib, Scikit-learn, and PyAlgoTrade support a wide array of financial tasks.

Community support: A vast, active user base means better resources, tutorials, and troubleshooting help.

Integration: Easily interfaces with databases, Excel, web APIs, and other tools used in finance.

Key Applications of Python in Finance

1. Data Analysis & Visualization

Financial analysis relies heavily on large datasets. Python’s libraries like Pandas and NumPy are ideal for:

Time-series analysis

Portfolio analysis

Risk assessment

Cleaning and processing financial data

Visualization tools like Matplotlib, Seaborn, and Plotly allow users to create interactive charts and dashboards.

2. Algorithmic Trading

Python is a favorite among algo traders due to its speed and ease of prototyping.

Backtesting strategies using libraries like Backtrader and Zipline

Live trading integration with brokers via APIs (e.g., Alpaca, Interactive Brokers)

Strategy optimization using historical data

3. Risk Management & Analytics

With Python, financial institutions can simulate market scenarios and model risk using:

Monte Carlo simulations

Value at Risk (VaR) models

Stress testing

These help firms manage exposure and regulatory compliance.

4. Financial Modeling & Forecasting

Python can be used to build predictive models for:

Stock price forecasting

Credit scoring

Loan default prediction

Scikit-learn, TensorFlow, and XGBoost are popular libraries for machine learning applications in finance.

5. Web Scraping & Sentiment Analysis

Real-time data from financial news, social media, and websites can be scraped using BeautifulSoup and Scrapy. Python’s NLP tools (like NLTK, spaCy, and TextBlob) can be used for sentiment analysis to gauge market sentiment and inform trading strategies.

Benefits of Using Python in Finance

✅ Fast Development

Python allows for quick development and iteration of ideas, which is crucial in a dynamic industry like finance.

✅ Cost-Effective

As an open-source language, Python reduces licensing and development costs.

✅ Customization

Python empowers teams to build tailored solutions that fit specific financial workflows or trading strategies.

✅ Scalability

From small analytics scripts to large-scale trading platforms, Python can handle applications of various complexities.

Real-World Examples

💡 JPMorgan Chase

Developed a proprietary Python-based platform called Athena to manage risk, pricing, and trading across its investment banking operations.

💡 Quantopian (acquired by Robinhood)

Used Python for developing and backtesting trading algorithms. Users could write Python code to create and test strategies on historical market data.

💡 BlackRock

Utilizes Python for data analytics and risk management to support investment decisions across its portfolio.

💡 Robinhood

Leverages Python for backend services, data pipelines, and fraud detection algorithms.

Getting Started with Python in Finance

Want to get your hands dirty? Here are a few resources:

Books:

Python for Finance by Yves Hilpisch

Machine Learning for Asset Managers by Marcos López de Prado

Online Courses:

Coursera: Python and Statistics for Financial Analysis

Udemy: Python for Financial Analysis and Algorithmic Trading

Practice Platforms:

QuantConnect

Alpaca

Interactive Brokers API

Final Thoughts

Python is transforming the financial industry by providing powerful tools to analyze data, build models, and automate trading. Whether you're a finance student, a data analyst, or a hedge fund quant, learning Python opens up a world of possibilities.

As finance becomes increasingly data-driven, Python will continue to be a key differentiator in gaining insights and making informed decisions.

Do you work in finance or aspire to? Want help building your first Python financial model? Let me know, and I’d be happy to help!

#outfit#branding#financial services#investment#finance#financial advisor#financial planning#financial wellness#financial freedom#fintech

0 notes

Text

How AI is Transforming Risk Management in Indian Financial Institutions

Risk management has always been the cornerstone of any financial institution. But in today’s fast-moving, data-driven world, traditional methods of assessing and managing risk are no longer sufficient. Enter Artificial Intelligence (AI)—a transformative force reshaping how Indian banks and financial institutions approach everything from credit scoring and fraud detection to regulatory compliance.

As financial firms turn to AI to stay competitive, there’s a growing demand for professionals equipped with both domain knowledge and tech fluency. That’s where an online investment banking course becomes especially relevant. These courses are equipping aspiring professionals with the tools and frameworks necessary to navigate the AI-powered landscape of modern risk management.

The New Age of Risk Management: Why AI Matters

Historically, financial risk assessment relied on manual processes, fixed rules, and historical data patterns. These traditional models, while valuable, often failed to capture real-time risks, non-linear patterns, or emerging threats.

AI changes that by introducing:

Predictive analytics that foresee default risks or market volatility

Natural language processing (NLP) that scans news, social media, and legal documents for reputational or regulatory risks

Machine learning (ML) models that adapt over time with new data

Automation of compliance checks, reducing human error and cost

For example, AI can flag irregularities in spending patterns to detect potential credit card fraud, assess borrowers' creditworthiness using alternative data, and even simulate financial stress tests.

Indian Financial Institutions Leading the AI Adoption

Several Indian banks and fintech companies are leveraging AI to revolutionize their risk management frameworks:

1. HDFC Bank

Uses AI to enhance its credit decisioning systems, incorporating not just traditional credit scores but also behavioral and transactional data.

2. ICICI Bank

Deployed AI-powered bots for fraud detection and loan underwriting, reducing turnaround times and improving accuracy.

3. State Bank of India (SBI)

Utilizes AI for regulatory compliance automation, especially in areas involving large document audits and risk reporting.

4. Fintechs like CredAvenue and Lentra

Offer AI-backed infrastructure to help NBFCs and banks with automated credit risk assessment, portfolio monitoring, and loan lifecycle management.

These use cases highlight the growing overlap between finance and data science—a focus area in many leading online investment banking courses that are keeping pace with the changing financial ecosystem.

Key Applications of AI in Risk Management

1. Credit Risk Modeling

AI evaluates borrowers’ repayment ability by analyzing both structured (salary, credit history) and unstructured data (social behavior, transaction patterns). This makes lending more inclusive and accurate.

2. Fraud Detection and Prevention

AI systems track real-time anomalies, identify suspicious activities, and flag them instantly. This minimizes losses and prevents reputational damage.

3. Market Risk Forecasting

Machine learning models assess correlations between assets and macroeconomic trends, offering better portfolio risk assessment and hedging strategies.

4. Regulatory Compliance and Reporting

AI helps institutions adhere to RBI norms and other global standards like Basel III, AML, and KYC by automating report generation and scanning for violations.

Challenges and Ethical Considerations

Despite its advantages, AI in risk management comes with its own set of challenges:

Data Privacy Concerns: Handling sensitive financial data must comply with India’s Data Protection Act and RBI’s digital banking guidelines.

Bias in Algorithms: If not carefully monitored, AI models may discriminate based on skewed or unbalanced datasets.

Black Box Problem: Some machine learning models lack transparency in how they arrive at decisions, making it difficult for auditors or regulators to review.

Hence, understanding the ethical use of AI in finance is now an essential skill—often covered in modern investment banking programs.

Why an Online Investment Banking Course is the Smart Move

In a landscape where AI is no longer a futuristic add-on but a core financial function, professionals need to be well-versed in both financial principles and technology applications. A high-quality online investment banking course prepares learners in:

Financial risk modeling and analytics

AI and machine learning applications in finance

Valuation techniques, portfolio management, and stress testing

Regulatory and compliance frameworks

Use of tools like Python, Excel, Power BI, and SQL in financial analysis

The online format adds flexibility, allowing working professionals and students from non-metro cities to access global-quality education without relocating. It’s also ideal for those looking to upskill quickly for roles in investment banking, credit analysis, fintech, or financial consulting.

Career Opportunities in AI-Driven Finance

As AI integration deepens across financial services, new career roles are emerging:

Risk Analyst – AI Models

Quantitative Analyst

Compliance and RegTech Consultant

Credit Data Scientist

Fintech Product Manager

Employers increasingly seek candidates with hybrid skills—those who can blend investment strategy with technology insight. Enrolling in an online investment banking course with AI and analytics modules is one of the most efficient ways to enter this high-growth space.

Conclusion

AI is no longer a buzzword in finance—it’s the foundation for a smarter, faster, and more accurate risk management system. Indian financial institutions are investing heavily in AI to make better lending decisions, reduce fraud, and ensure compliance. And this transformation is creating exciting career pathways for those pre

Risk management has always been the cornerstone of any financial institution. But in today’s fast-moving, data-driven world, traditional methods of assessing and managing risk are no longer sufficient. Enter Artificial Intelligence (AI)—a transformative force reshaping how Indian banks and financial institutions approach everything from credit scoring and fraud detection to regulatory compliance.

As financial firms turn to AI to stay competitive, there’s a growing demand for professionals equipped with both domain knowledge and tech fluency. That’s where an online investment banking course becomes especially relevant. These courses are equipping aspiring professionals with the tools and frameworks necessary to navigate the AI-powered landscape of modern risk management.

The New Age of Risk Management: Why AI Matters

Historically, financial risk assessment relied on manual processes, fixed rules, and historical data patterns. These traditional models, while valuable, often failed to capture real-time risks, non-linear patterns, or emerging threats.

AI changes that by introducing:

Predictive analytics that foresee default risks or market volatility

Natural language processing (NLP) that scans news, social media, and legal documents for reputational or regulatory risks

Machine learning (ML) models that adapt over time with new data

Automation of compliance checks, reducing human error and cost

For example, AI can flag irregularities in spending patterns to detect potential credit card fraud, assess borrowers' creditworthiness using alternative data, and even simulate financial stress tests.

Indian Financial Institutions Leading the AI Adoption

Several Indian banks and fintech companies are leveraging AI to revolutionize their risk management frameworks:

1. HDFC Bank

Uses AI to enhance its credit decisioning systems, incorporating not just traditional credit scores but also behavioral and transactional data.

2. ICICI Bank

Deployed AI-powered bots for fraud detection and loan underwriting, reducing turnaround times and improving accuracy.

3. State Bank of India (SBI)

Utilizes AI for regulatory compliance automation, especially in areas involving large document audits and risk reporting.

4. Fintechs like CredAvenue and Lentra

Offer AI-backed infrastructure to help NBFCs and banks with automated credit risk assessment, portfolio monitoring, and loan lifecycle management.

These use cases highlight the growing overlap between finance and data science—a focus area in many leading online investment banking courses that are keeping pace with the changing financial ecosystem.

Key Applications of AI in Risk Management

1. Credit Risk Modeling

AI evaluates borrowers’ repayment ability by analyzing both structured (salary, credit history) and unstructured data (social behavior, transaction patterns). This makes lending more inclusive and accurate.

2. Fraud Detection and Prevention

AI systems track real-time anomalies, identify suspicious activities, and flag them instantly. This minimizes losses and prevents reputational damage.

3. Market Risk Forecasting

Machine learning models assess correlations between assets and macroeconomic trends, offering better portfolio risk assessment and hedging strategies.

4. Regulatory Compliance and Reporting

AI helps institutions adhere to RBI norms and other global standards like Basel III, AML, and KYC by automating report generation and scanning for violations.

Challenges and Ethical Considerations

Despite its advantages, AI in risk management comes with its own set of challenges:

Data Privacy Concerns: Handling sensitive financial data must comply with India’s Data Protection Act and RBI’s digital banking guidelines.

Bias in Algorithms: If not carefully monitored, AI models may discriminate based on skewed or unbalanced datasets.

Black Box Problem: Some machine learning models lack transparency in how they arrive at decisions, making it difficult for auditors or regulators to review.

Hence, understanding the ethical use of AI in finance is now an essential skill—often covered in modern investment banking programs.

Why an Online Investment Banking Course is the Smart Move

In a landscape where AI is no longer a futuristic add-on but a core financial function, professionals need to be well-versed in both financial principles and technology applications. A high-quality online investment banking course prepares learners in:

Financial risk modeling and analytics

AI and machine learning applications in finance

Valuation techniques, portfolio management, and stress testing

Regulatory and compliance frameworks

Use of tools like Python, Excel, Power BI, and SQL in financial analysis