#bank of america cash

Text

Muhammad Ali : Photographed by Richard Meek at Bank of America in Los Angeles, CA (1963)

#muhammad ali#Richard Meek#photography#money#cash#bank#vault#vintage#fashion#style#boxing#legend#ali#bank of america#aesthetic#missinginaesthetic

74 notes

·

View notes

Text

3 notes

·

View notes

Text

Your Chance to get $750 to your Cash Account!

Rewards US is giving away $750 to lucky winners! 🤑

How to Win:

Join Rewards US: Sign up for free today.

Complete Simple Tasks: Earn points by completing easy activities.

Redeem for Cash: Once you've reached the required points, cash out directly to your account!

Don't miss out on this amazing opportunity! 💰

#flash rewards review#rewards#flash rewards#750 flash rewards shein#flash rewards 750 shein#is flash rewards legit#is flash rewards a scam#flash rewards uk review#is flash rewards uk legit#chase ultimate rewards#cash rewards#shein 750 reward#boa cash rewards card#$750 shein gift card#max rewards#level rewards hack#ulta rewards#amex rewards#card rewards#level rewards#cash rewards bank of america#travel rewards#rewards wizard#up level rewards

0 notes

Text

What Are the Best Ways to Utilize US Bank’s Financial Planning Services?

1. Start with a Comprehensive Financial Assessment

US Bank’s financial planning services begin with a detailed assessment. This is an important first step. The assessment helps understand your financial situation. It covers your income, expenses, and savings. For example, you might discover areas to cut back on spending. This initial review sets the stage for future planning. The financial advisor helps you identify your goals. Whether it’s saving for a home or retirement, this process is key. Many clients find this assessment eye-opening. It provides a clear picture of their financial health.

2. Create a Personalized Financial Plan

After the assessment, US Bank helps you create a tailored plan. This plan focuses on your specific goals. It includes strategies to save, invest, and manage debt. For instance, if you’re planning for college, the advisor can suggest 529 plans. These plans offer tax benefits for education expenses. The personalized plan also considers your risk tolerance. This ensures your investments match your comfort level. Many clients appreciate this customized approach. It makes financial planning less daunting and more effective.

3. Regularly Review and Adjust Your Plan

Financial planning is not a one-time event. US Bank recommends regular reviews of your plan. This helps ensure your plan stays on track. Life changes, such as a new job or a child, can impact your goals. For example, a salary increase might allow you to save more. During reviews, your advisor can adjust your plan as needed. This keeps your financial strategy relevant and effective. Many clients value this ongoing support. It provides peace of mind knowing their finances are well-managed.

In summary, US Bank’s financial planning services offer a structured approach to managing your finances. Starting with a comprehensive assessment, creating a personalized plan, and regularly reviewing it ensures your financial goals are met. This systematic method helps you utilize US Bank’s expertise effectively. Trust US Bank to guide you on your financial journey.

0 notes

Text

Rewards US - Cash

Join Now :

bank of america cash rewards,rewards,us bank shopper cash rewards,us bank shopper rewards card,cash rewards,bank of america cash rewards credit card review,cash rewards card,us bank shopper cash rewards card,bank of america cash rewards review,bank of america unlimited cash rewards,bank of america travel rewards card,cash rewards secured credit card,credit card rewards,us bank shopper cash rewards review,unlimited cash rewards credit card

#bank of america cash rewards#rewards#us bank shopper cash rewards#us bank shopper rewards card#cash rewards#bank of america cash rewards credit card review#cash rewards card#us bank shopper cash rewards card#bank of america cash rewards review#bank of america unlimited cash rewards#bank of america travel rewards card#cash rewards secured credit card#credit card rewards#us bank shopper cash rewards review#unlimited cash rewards credit card

1 note

·

View note

Text

What are Personalized Financial Offers?

These days, people have come to expect great offers from the credit card companies, lenders and financial lenders they work with. There are tons of competition in finance and fintech, so these offers attract customers while providing ongoing enticing rewards. While some big names in finance provide introductory offers to every new customer, some are moving toward a more personalized approach.

With an app for personalized financial offers, you don't have to settle for pre-existing solutions. Instead, you can find products that work for your exact needs. So, what is a personalized offer?

Personalized Offers: All About Individual Needs

At its core, a personalized offer is about deeply understanding the customer and their needs. In the past, having a one-track solution was okay. But these days, everyone's needs are different. You might see many great offers that compel you to explore more of what a financial company can do for you. However, you'll be hard-pressed to find something that meets your needs to a tee.

For example, credit cards with generous cashback rates might be great. But what if they come with higher annual fees or specific spending categories that don't apply to you? Suddenly that offer becomes less appealing than it looked on paper.

A personalized financial offer goes beyond face-value benefits. It's an offer customized to you, allowing the financial company to provide product and service solutions that are perfect for you!

While personalized offers can be a big boon for businesses, it's about more than increasing sales. An app for personalized financial offers can provide a much better customer experience. It makes working with the financial company smoother, builds brand loyalty and ensures you're getting all the rewards and features you need to see financial success!

Personalized offers can vary from person to person, but that's the entire point. Companies use progressive profiling to understand your needs and recommend products to help you reach your goals. Through a mix of core and supplementary services, personalized offers ensure that you're getting precisely what you need and taking advantage of every perk available.

Read a similar article about cash advance for utility bills here at this page.

#quick cash app#receive your paycheck early#app for money transfers#app for personalized financial offers#app for promo codes#discover credit card payment assistance#help with paying bank of america card

0 notes

Text

The Collapse of Silicon Valley Bank

Silicon Valley Bank collapsed after years of bad investments, harming the millions who falsely trusted SVB with their money. The bank lost its customers billions of dollars, continuing a horrifying trend of recent implosions in the financial industry.

The fall of one of the world’s biggest banks could be explained by two major mismanagement events. The first reason for the fall was their…

View On WordPress

0 notes

Text

im finding this really hard to articulate but it's absolutely infuriating to see the level of government power and pressure that can be applied against "antisemitism" when what "antisemitism" means is 'not approving of how the USA props up israel to further its military objectives in the middle east', while every year since 2015 in america has gotten scarier and more dangerous for the jews who actually live here and are citizens.

like it's been year after year of rising hate crimes, temples bombed and burned, women and men attacked on the streets, harassed online, and our elected officials mouth vague platitudes at hannukah about it. dozens of pundits make serious cash money saying that the holocaust never happened. conspiracy theories about child trafficking and one world bank are now just commonly accepted as fact. and we were told that there wasn't any more that anyone could actually do about any of this. because free speech. because freedom of religion. because everyone has a right to their opinions.

but for israel, for the IDF, suddenly the cops can start making arrests? the same cops that protected proud boys all this time at their rallies are hustling to shut down crowds protesting palestinian genocide. suddenly politicians are getting in real trouble and staffers are getting fired and online there's waves of accounts getting deleted. suddenly antisemitism is driving a whole lot of action!

but none of the machinery of empire was ever used to actually protect jews. none of it was for us at all. america has proved itself deeply and profoundly indifferent to our lives and our voices. the only thing that actually matters here is the material usefulness of israel as a proxy state.

there's your "antisemitism".

3K notes

·

View notes

Text

Letting Someone Go - Part 2

Benny Cross X Female Reader

A/n: part 1 is here!

Word Count: 2014

Warnings: cursing, alcohol use

Taglist: @real-lana-del-rey @putherup

Fifteen months. That was all it took for you to find Benny, love him, and lose him. The easy version of your story went like this: it was Kathy Bauer’s fault. Simple as pie, like your mama used to say.

The truth was a lot different. The truth was messy and it hurt a hell of a lot more. Because the truth was that you hadn’t lost Benny at all. To lose something, you have to have it in the first place. And when you were being really honest with yourself, you knew that you never had Benny Cross. You had as much of a claim to him as a kite does to the wind. That was to say, none at all.

You didn’t like the truth. But, you weren’t the kind of girl who could live a lie either. So, you did the only thing you could think of: you ran away. Kathy Bauer’s first night in the Vandals bar was early November, Benny broke it off with you in early December. You spent Christmas drunk and stoned. And by New Years, you were gone.

You thought putting Chicago - and Benny - in the rearview mirror would help. You’d banked on it helping. Running was your only plan. There wasn’t any other choice, really. Sure, some of the Vandals had pitched you on sticking around, club president Johnny among them. Your waitressing pal Sheila had asked you to move in with her, given that you were now two months’ behind on rent without Benny’s side-hustle cash around to help pay the bills. Hell, Cal had even offered you a soft place to land on the left side of his queen sized mattress.

None of those offers had tempted you for even an instant. So, while the rest of America was counting down the final seconds of 1965 from their couches, you were sitting on the back of your fully customized Sportster, driving like a bat out of hell on the back roads leading west out of Chicago. Your only destination was the fuck out of here.

It took you fifteen months to figure out what love was and to lose it again. You weren’t sure how long it was going to take you to do something approximating move on, but you figured it would be a lot longer than fifteen months. And you were right.

***********************

Your phone rang at 3:13am in the morning on September 19th, 1969. The first thing you thought was that your daddy must have finally died. Sonofabitch had been fighting a chainsmoker’s strain of lung cancer for almost six months now, and damn had it been a hard fight. Your mama had actually begged you not to come home and see him. Nothin’ you can do here, baby she said in her soft, sad voice each time you called and asked if you should come home. Your daddy, for his part, couldn’t talk anymore, on account of the laryngectomy the doctors gave him a few weeks prior. He’d declined one of those robotic voice boxes. Figured he’d said all he needed to at this point. Nobody wanted to hear the ramblings of an old biker on death’s door at this point. Especially himself.

But it wasn’t your mama’s voice on the other end. It was Johnny Davis.

“Hey, kid.” Not a question, not a hey, how are ya. It had been almost four years since the last time you’d talked to Johnny. Four years since you’d last seen a Vandals cutte. You wished you could say it had been that long since you’d thought about the club, but that would be a damn lie. Your mind drifted back to a certain handsome blonde-haired blue-eyed biker almost every day.

It took you a minute to place the voice on the other end. It was familiar in the way a dream is familiar, but between the fog of leftover whiskey, a deep sleep, and buried memories, it didn’t come to you quickly.

“Who’s this?” you asked, wiping the tired out of your eyes.

“Oh, uh, well. It’s Johnny.”

There it was.

“Johnny? Johnny Davis?”

“Yeah, yeah it’s me, kid. Listen. How you been?”

You couldn’t help but let out a short, sad chuckle. The easy answer to that question was oh, I been alright Johnny, you? But the truth was something more like, well Johnny, let’s see, since I last saw you in Chicago I’ve been on the road pretty much constantly for four years, running for so long I can’t tell if I’m running to or away from something, much less what that thing is. I’ve picked up about a dozen bad habits, like drinking too much and riding too fast and going home with the first guy who’ll buy me a brew at a bar. Oh, and by the way, my daddy’s dying.

But Johnny didn’t deserve your bitterness. Especially not at 3:14 in the morning.

“You know me, Johnny, I’ve been doin’ just fine. Why’re you callin’ so early?”

There was a heavy silence on the other end of the line. An image of Johnny, taking a deep drag on one of those Pall Malls he loved to smoke, came to you in the darkness. In the quiet of his reply, you heard a dense grief. You braced yourself for what you were sure was bad news and flicked on the bedside lamp on your nightstand. Next to you, the latest biker boy of the week stirred grumpily and waved at you to turn the light off. You ignored him, throwing off the covers and dangling your feet over the side of your mattress.

“Well, kid. It’s Brucie.”

Brucie. It took the air out of your lungs. You could have named a half-dozen Vandals you’d expect to kick the bucket before Brucie. Zipco, Wahoo, Corky. Hell, even Johnny himself. And Benny, of course. You couldn’t help but feel the knot in your chest relax an inch to know that Johnny wasn’t calling to tell you that it was Benny. But damnitall, Brucie? Careful, pragmatic, thoughtful Brucie? What the fuck was Gail gonna do?

“Brucie? What the fuck happened?”

Another jagged inhale on the other end. Johnny was crying, you realized. It gutted you.

“Oh, you know. 1967 Pontiac came outta nowhere, you know, just caught him in a bad way. It’s always the ones you don’t see comin’, y’know? Fuckin’ Pontiac.”

“Jesus, Johnny. Brucie? Shit.”

You lit a cigarette of your own as you let your mind wander back to your time in Chicago. Brucie was solid, Johnny’s right-hand man and a kind, gentle sorta guy. You’d liked him instantly, and Gail too. Real good folk.

“Yeah, yeah, it’s been hard, y’know, I mean, club is real beat up over it.”

“Fuck, Johnny, I don’t even know whatta say. I’m so sorry.”

You and Johnny took matching drags and tried to swipe away your tears. The guy in your bed next to you rolled over and fixed you with a bleary-eyed glare. You couldn’t remember his name - Steve, maybe. You covered the receiver with your hand, told him to get the fuck out, and drank down the last swallow of whiskey in the only upright glass on your nightstand.

“Yeah, well, I ‘preciate that, kid, I really do. Listen, we’re havin’ a get together for Brucie. Next weekend. Entire club, all charters gonna be there. Invited a few others, too. Ones that knew Brucie. I know he’d want you there.”

Of all the things Johnny had said to you tonight, this was the one that stole the air from your lungs. Go back to Chicago, to the Vandals? You weren’t sure how you’d do that. Or if you physically could.

“Aw, shit Johnny. I dunno…”

“I know you got history here,” Johnny interrupted quickly. “I know you got… I know you got a lot you’re tryin’ not to come back to. I get it.”

Lots of people might have tried to tell you they understood how you felt. You’d opened up about Benny to a few people since you’d left Chicago. Most people you met on the road were a little bit broken, like you. They were running, just like you, and they weren’t strangers to heartbreak and dead-endings and being fucked over. But, no matter how many times you tried to tell your story, you just never felt like you got it right. So nobody really understood it, because you weren’t sure you did. But Johnny? Johnny didn’t need to hear you tell it. He’d watched it happen. Maybe he really did get it.

Still, was that enough for you to go back? Unsure of what to say, you just stayed silent. Behind you, maybe-Steve was dragging himself out of bed, untangling his clothes from yours, and doing a shitty job of trying to stay quiet.

“You think about it, aight? But I know you’ll come. For Brucie.”

You let out a breath you hadn’t realized you’d been holding. Johnny was right. ‘Course you’d go back for Brucie.

“Aight well, I’ll let ya go then. Sorry for wakin’ you up.”

“Johnny, wait.”

He hesitated. “Yeah, kid?”

“How’d you get my number?”

There were about a million questions you wanted to ask Johnny, although you knew yourself enough at this point to know that you wouldn’t want the answers. So you asked the safest one you could think of.

He chuckled softly. “I keep an eye on my friends,” he replied cryptically before he said goodnight again, and the line went dead. You wished you knew what that meant, although just knowing that there was someone out there in the darkness who cared for you enough to go to the trouble of checking in with whatever backwater charters you shacked up with (because realistically that was the only way Johnny would ever be able to keep up with you) made your heart warm.

“Who the fuck was that?” demanded maybe-Steve. He was halfway out the door of the dingy room you’d rented in this roadside motel, hoping you might still ask him to stay.

“Old friend,” you said brusquely as you stood up and threw an old tshirt over your bare chest, heading for the door behind him. “Time for you to hit the road,” you told him by way of invitation, pointing towards his bike in the parking lot.

“It’s fuckin’ 3:30 in the mornin’, you sure I can’t just sleep it off here?”

“Nah, fuck that. Get lost.”

He grimaced and spat thickly on the ground. For an instant you wondered if he was going to give you trouble, but he just shook his head in disgust and left you there to curl up on the rickety plastic chair outside your motel room with plans to chain-smoke until sunrise. You watched him go, his tail light streaking across the long, dark, flat expanse of Iowa farmland until it melted with blackness around it. Your mind was fluttering with all kinds of memories and thoughts that Johnny’s voice had stirred up. Rather than try and fight it, you let yourself sink beneath the surface and zone out, wading through a chapter of your life that you’d deluded yourself into believing was over. The sun had climbed up over the horizon by the time you came back to yourself with a bleak glance around the ramshackle motel. Your Sportster was gleaming like a lighthouse over in the corner of the lot under the only tree around for miles, a huge black walnut that seemed to be holding up its branches and asking the sky to sweep it up and take it away from here. Exactly how you felt.

Unable to fight against yourself anymore, you splashed cold water on your face, tied your hair up, shoved your belongings into the leather saddlebags you’d been living out of for the last four years, and got on the back of your Sportster. As soon as you kickstarted your bike, you knew where you were going. Straight back to Chicago, back to the Vandals, to Benny. Straight back home.

read part 3 here

**let me know if you want to be tagged in future parts!

#the bikeriders imagine#the bikeriders#benny cross x reader#benny cross x you#benny cross x y/n#benny cross imagine#bikeriders imagine#austin butler x you#austin butler x y/n#austin butler x reader#austin butler imagine

248 notes

·

View notes

Text

'We buy ugly houses' is code for 'we steal vulnerable peoples' homes'

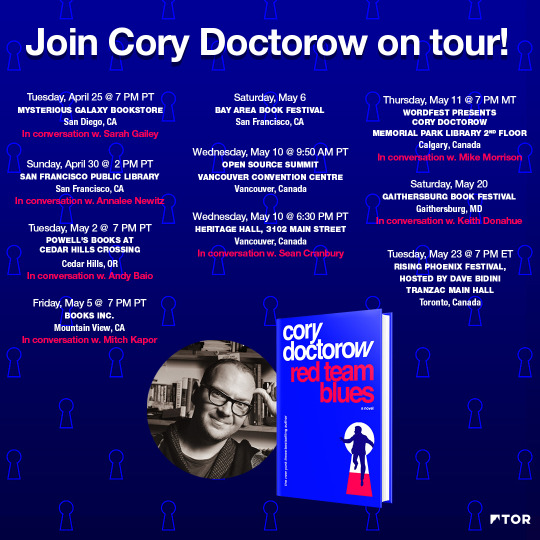

Tonight (May 11) at 7PM, I’m in CALGARY for Wordfest, with my novel Red Team Blues; I’ll be hosted by Peter Hemminger at the Memorial Park Library, 2nd Floor.

Home ownership is the American dream: not only do you get a place to live, free from the high-handed dictates of a landlord, but you also get an asset that appreciates, building intergenerational wealth while you sleep — literally.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/11/ugly-houses-ugly-truth/#homevestor

Of course, you can’t have it both ways. If your house is an asset you use to cover falling wages, rising health care costs, spiraling college tuition and paper-thin support for eldercare, then it can’t be a place you live. It’s gonna be an asset you sell — or at the very least, borrow so heavily against that you are in constant risk of losing it.

This is the contradiction at the heart of the American dream: when America turned its back on organized labor as an engine for creating prosperity and embraced property speculation, it set itself on the road to serfdom — a world where the roof over your head is also your piggy bank, destined to be smashed open to cover the rising costs that an organized labor movement would have fought:

https://gen.medium.com/the-rents-too-damned-high-520f958d5ec5

Today, we’re hit the end of the road for the post-war (unevenly, racially segregated) shared prosperity that made it seem, briefly, that everyone could get rich by owning a house, living in it, then selling it to everybody else. Now that the game is ending, the winners are cashing in their chips:

https://doctorow.medium.com/the-end-of-the-road-to-serfdom-bfad6f3b35a9

The big con of home ownership is proceeding smartly on schedulee. First, you let the mark win a little, so they go all in on the scam. Then you take it all back. Obama’s tolerance of bank sleze after the Great Financial Crisis kicked off the modern era of corporations and grifters stealing Americans’ out from under them, forging deeds in robosigning mills:

https://www.marketwatch.com/story/us-breaks-down-93-bln-robo-signing-settlement-2013-02-28

The thefts never stopped. Today on Propublica, by Anjeanette Damon, Byard Duncan and Mollie Simon bring a horrifying, brilliantly reported account of the rampant, bottomless scams of Homevestors, AKA We Buy Ugly Houses, AKA “the #1 homebuyer in the USA”:

https://www.propublica.org/article/ugly-truth-behind-we-buy-ugly-houses

Homevestors — an army of the hedge fund Bayview Asset Management — claims a public mission: to bail out homeowners sitting on unsellable houses with all-cash deals. The company’s franchisees — 1,150 of them in 48 states — then sprinkle pixie dust and secret sauce on these “ugly houses” and sell them at a profit.

But Propublica’s investigation — which relied on whistleblowers, company veterans, court records and interviews with victims — tells a very different story. The Homevestor they discovered is a predator that steals houses out from under elderly people, disabled people, people struggling with mental illness and other vulnerable people. It’s a company whose agents have a powerful, well-polished playbook that stops family members from halting the transfers the company’s high-pressure salespeople set in motion.

Propublica reveals homeowners with advanced dementia who signed their shaky signatures to transfers that same their homes sold out from under them for a fraction of their market value. They show how Homevestor targets neighborhoods struck by hurricanes, or whose owners are recently divorced, or sick. One whistleblower tells of how the company uses the surveillance advertising industry to locate elderly people who’ve broken a hip: “a 60-day countdown to death — and, possibly, a deal.” The company’s mobile ads are geofenced to target people near hospitals and rehab hospitals, in hopes of finding desperate sellers who need to liquidate homes so that Medicaid will cover their medical expenses.

The sales pitches are relentless. One of Homevestor’s targets was a Texas woman whose father had recently been murdered. As she grieved, they blanketed her in pitches to sell her father’s house until “checking her mail became a traumatic experience.”

Real-estate brokers are bound by strict regulations, but not house flippers like Homevestors. Likewise, salespeople who pitch other high-ticket items, from securities to plane tickets — are required to offer buyers a cooling-off period during which they can reconsider their purchases. By contrast, Homevestors’ franchisees are well-versed in “muddying the title” to houses after the contract is signed, filing paperwork that makes it all but impossible for sellers to withdraw from the sale.

This produces a litany of ghastly horror-stories: homeowners who end up living in their trucks after they were pressured into a lowball sales; sellers who end up dying in hospital beds haunted by the trick that cost them their homes. One woman who struggled with hoarding was tricked into selling her house by false claims that the city would evict her because of her hoarding. A widow was tricked into signing away the deed to her late husband’s house by the lie that she could do so despite not being on the deed. One seller was tricked into signing a document he believed to be a home equity loan application, only to discover he had sold his house at a huge discount on its market value. An Arizona woman was tricked into selling her dead mother’s house through the lie that the house would have to be torn down and the lot redeveloped; the Homevestor franchisee then flipped the house for 5,500% of the sale-price.

The company vigorously denies these claims. They say that most people who do business with Homevestors are happy with the outcome; in support of this claim, they cite internal surveys of their own customers that produce a 96% approval rating.

When confronted with the specifics, the company blamed rogue franchisees. But Propublica obtained training materials and other internal documents that show that the problem is widespread and endemic to Homevestors’ business. Propublica discovered that at least eight franchisees who engaged in conduct the company said it “didn’t tolerate” had been awarded prizes by the company for their business acumen.

Franchisees are on the hook for massive recurring fees and face constant pressure from corporate auditors to close sales. To make those sales, franchisees turn to Homevana’s training materials, which are rife with predatory tactics. One document counsels franchisees that “pain is always a form of motivation.” What kind of pain? Lost jobs, looming foreclosure or a child in need of surgery.

A former franchisee explained how this is put into practice in the field: he encountered a seller who needed to sell quickly so he could join his dying mother who had just entered a hospice 1,400 miles away. The seller didn’t want to sell the house; they wanted to “get to Colorado to see their dying mother.”

These same training materials warn franchisees that they must not deal with sellers who are “subject to a guardianship or has a mental capacity that is diminished to the point that the person does not understand the value of the property,” but Propublica’s investigation discovered “a pattern of disregard” for this rule. For example, there was the 2020 incident in which a 78-year-old Atlanta man sold his house to a Homevestors franchisee for half its sale price. The seller was later shown to be “unable to write a sentence or name the year, season, date or month.”

The company tried to pin the blame for all this on bad eggs among its franchisees. But Propublica found that some of the company’s most egregious offenders were celebrated and tolerated before and after they were convicted of felonies related to their conduct on behalf of the company. For example, Hi-Land Properties is a five-time winner of Homevestors’ National Franchise of the Year prize. The owner was praised by the CEO as “loyal, hardworking franchisee who has well represented our national brand, best practices and values.”

This same franchisee had “filed two dozen breach of contract lawsuits since 2016 and clouded titles on more than 300 properties by recording notices of a sales contract.” Hi-Land “sued an elderly man so incapacitated by illness he couldn’t leave his house.”

Another franchisee, Patriot Holdings, uses the courts aggressively to stop families of vulnerable people from canceling deals their relatives signed. Patriot Holdings’ co-owner, Cory Evans, eventually pleaded guilty to to two felonies, attempted grand theft of real property. He had to drop his lawsuits against buyers, and make restitution.

According to Homevestors’ internal policies, Patriot’s franchise should have been canceled. But Homevestors allowed Patriot to stay in business after Cory Evans took his name off the business, leaving his brothers and other partners to run it. Nominally, Cory Evans was out of the picture, but well after that date, internal Homevestors included Evans in an award it gave to Patriot, commemorating its sales (Homevestors claims this was an error).

Propublica’s reporters sought comment from Homevestors and its franchisees about this story. The company hired “a former FBI spokesperson who specializes in ‘crisis and special situations’ and ‘reputation management’ and funnelled future questions through him.”

Internally, company leadership scrambled to control the news. The company convened a webinar in April with all 1,150 franchisees to lay out its strategy. Company CEO David Hicks explained the company’s plan to “bury” the Propublica article with “‘strategic ad buys on social and web pages’ and ‘SEO content to minimize visibility.’”

https://www.propublica.org/article/homevestors-aims-to-bury-propublica-reporting

Franchisees were warned not to click links to the story because they “might improve its internet search ranking.”

Even as the company sought to “bury” the story and stonewalled Propublica, they cleaned house, instituting new procedures and taking action against franchisees identified in Propublica’s article. “Clouding titles” is now prohibited. Suing sellers for breach of contract is “discouraged.” Deals with seniors “should always involve family, attorneys or other guardians.”

During the webinar, franchisees “pushed back on the changes, claiming they could hurt business.”

If you’ve had experience with hard-sell house-flippers, Propublica wants to know: “If you’ve had experience with a company or buyer promising fast cash for homes, our reporting team wants to hear about it.”

Catch me on tour with Red Team Blues in Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

[Image ID: A Depression-era photo of a dour widow standing in front of a dilapidated cabin. Next to her is Ug, the caveman mascot for Homevestors, smiling and pointing at her. Behind her is a 'We buy ugly houses' sign.

Image:

Homevestors

https://www.homevestors.com/

Fair use:

https://www.eff.org/issues/intellectual-property

#pluralistic#the rents too damned high#house flipping#llc brain#scams#elder abuse#ripoffs#weaponized shelter#predators#homevestors#we buy ugly houses#ugly houses#real estate#propublica

2K notes

·

View notes

Text

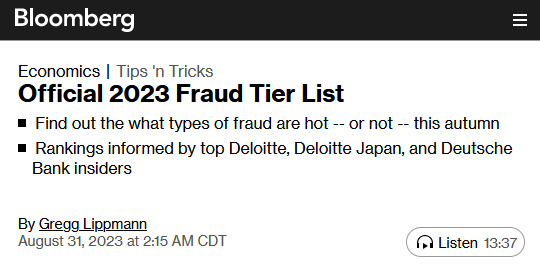

"This event ends the moment you write us a check, and it better not bounce, or you're a dead motherfucker"

-- Big Bill Hell

There was a time when you'd see little old ladies paying for the groceries with a hand-written personal check, holding up the line, causing an immediately-forgiven slight sense of annoyance with those behind her. Buddy. Those days are over. They've been over. What, did you think you were going to just pop a couple extra zeroes on the end of your paycheck there? Maybe scan your paycheck, open it in photoshop, make a template, print em out all nice? You think you're the first to think of that, dipshit?

It takes the law a long time to catch up with the state of the art. You're reading this on the internet, which means you never use checks. The law has caught up. Your ass will be going to prison immediately and you will see zero return.

You can't even kite checks anymore, and hell, nobody under 40 will even know what that means, due to the blazing fast, two day settlement on all ACH transactions. Let me paint you a picture.

You get paid on Friday, but it is Monday, and bills are due on Tuesday. And you're broke: $0 in the bank. Goose egg. Pop open your checkbook, go to a store, "buy" some things, write a check for the amount. The cashier takes it!

Now take those things you "bought", across town, to another store location, and return them for cold hard cash. Sweet. Bills paid. Friday rolls around, and you just make it to the bank to deposit your paycheck before it closes. After the weekend, the checks you wrote finally post, and they don't bounce! You've kited a check. You've surreptitiously taken a zero-interest loan. And we know your broke ass. The interest rate on that short-term payday loan should have been straight up usurious. We're talking 29%. That makes predatory fuckers like us horny for sex. We're so mad. Now you are going to Federal Prison. For a good minute. Fuckface.

COST: $0.10 (With banks offering free checking accounts + Bic pen)

"Neither snow nor rain nor heat nor sleet, if you fuck with the mail, we'll rip your nuts off"

-- Ronald Mail (Inventor of Mail)

Many people have this misnomer that the most powerful people in politics are democratically elected. The president, of the United States, of America, is a stupid cartoon hotdog. All of them, I don't care. Way less clout than you'd think. Brilliantly, it is the people that the hotdog president appoints who are actually doing anything significant. The director of the CIA. The fucking chairman of the Federal Reserve. Probably the, like, most senior, uh, general of the military, and shit too. I don't know, we don't "do" army here at Bloomberg. You probably don't even know their names! I don't! These are the ones you should be seeing in your sleep.

There's another position like that. Appointed directly by the hotdog. The Postmaster General. That's a real title. He's the CEO of the mail, and buddy, what he may lack in political power relative to the director of the CEO, he makes up in raw sexual energy. Total Tom Selleck energy. Like an airline pilot. We're talking Donald Sutherland in Invasion of the Body Snatchers. I'm tentpoling in my black business slacks just writing this, and all my Bloomberg newsroom bros are peering over my shoulder and also tent-poling. We're not gay though, and especially me, I'm probably the least gay, but sometimes I just lay awake for hours at night what that mustache would feel like pressed against my lips, the unbelievable and utter, total sense of security I'd feel burying my head into his hard chest.

You get it. He's your dad. And if you fuck with the mail, you've fucked with the tools in your dad's garage. And dad's been drinking. You're in for it, bucko, you are in trouble. Do you think the United States Postal Service actually makes any money? Hell no. It costs like five bucks to mail a box basically anywhere I can think of and they give you the boxes for free. You can just walk in the post office and take them. I do that, and then just throw them away, I don't know why, some kind of compulsion. Being able to move shit around like this, quickly, cheaply -- Jesus H, I've got a huge amount of money in my bank account, probably tens of trillions of dollars (due to financial knowledge gained from reading Bloomberg articles) and I could probably mail every single person ever something and still come out in the black.

No way pal. They've thought of that already. The Postmaster General is going to know every time, and he's going to grab you by the shirt collar, wearing his cool as fuck hat, and you're going to get your pants pulled down, and your bare ass spanke...I need to go use the restroom real quick.

We rely on the mail system to get important shit done. It's not something to be taken lightly, and it isn't. Trust me. This is why, like almost every other person who receives mail in this year 2023, I just fucking put a wastebasket under my mail slot. I don't even shred that shit anymore. I just burn it. Takes less time.

COST: $0.63 (Postal stamp)

"Can call all you want, but there's no one home //

And you're not gonna reach my telephone //

Out in the club, and I'm sipping that bubb //

And you're not gonna reach my telephone"

-- Lady Gaga

I read something wild that the children of today do not know what a dial tone is, because of how fucked up and stupid they are. Isn't that super fucked up?

While it's not really our style, allow me to fill you in on some ancient, arcane knowledge about the telephone. You can turn it on, and then you can punch in numbers. Any numbers. Random ones, or maybe not random ones. If the ten numbers you punch in are the same as the numbers in someone else's telephone number, their phone will ring, and then you are talking to them. This is called "Phreaking".

Here's the kicker: You can tell that jackass anything you want. "Oh, Hi, Yes, I am Reginald Sumpter calling from Avalon Consulting LLC, we are just following up on the invoice we sent you. Please remit to ###### routing ###### account."

BOOM! Your name isn't Reginald whatever and that company doesn't exist, but you just received a deposit. It's fucking beautiful. What have you done wrong? It isn't your responsibility to handle who your business' clients/etc are, it's their's. If they want to just pay you money for no real reason, well, that's kind of on them, isn't it? I haven't stuck a pistol in your face and demanded everything in the register.

Well, it's too clever. It's too slick. This is the United States of America. It's one thing to commit a felony like armed robbery, it's another thing to piss off someone in charge of the accounting division who uses a special bathroom you need a key to get into.

You can do it on the computer too, I use a PC Computer at work and send email, so you can see how it'd work there. You can make a document that is indifferentiable from a real invoice and, straight up, 1/3 of the time they will pay that shit. Lmfao.

It's called wire fraud because, uhh, duhhhh, there's wires. What do you think that thing is strung between the telephone receiver and the dialer? And computers? Give me a break. There's so many wires with those.

COST: $0.25 (Coin for payphone)

"People calculate too much and think too little."

-- Charlie Munger

It is insane how dumb the common man can be when it comes to our world of expertise. I hear this same sentiment, like, ALL THE TIME:

"Durr hurr I will buy an insurance policy for my car or house or whatever so that in case something happens to it I will get money". And then that same person proceeds to drive safely or not burn their house down. Dumbest crap imaginable.

Let me break it down for you. Insurance is a two player competitive game. There is a winner and there is a loser. Go take out an expensive insurance policy on your American sports car. Buy a neck brace, a football helmet, and pack that bitch with throw pillows. Then get in the left lane of a major highway at like noonish, let it rip and then SLAM on your brakes. Hit from behind! Your fault! Congratulations. You have won insurance. How this gets past people is beyond me.

You can only do this once or twice before the insurance companies catch on. Then they don't want to fuck with you. It is also..I don't know man...something feels off about taking a car or a house, which like, some guy had to build and just destroying it, but that is only a weird emotional thing, since you're making money, more than whatever the destroyed thing is worth, so in reality you've built that house plus some extra. You've contributed.

COST: $106.00 (Average monthly car insurance payment)

~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~

SUBSCRIBE TO MY WHATEVER FOR PART TWO, COMING SOON. i'll post it later today probably. whatever time frame will juice the numbers. have a sneaky peaky

disclaimer | private policy | unsubscribe

1K notes

·

View notes

Text

2 notes

·

View notes

Text

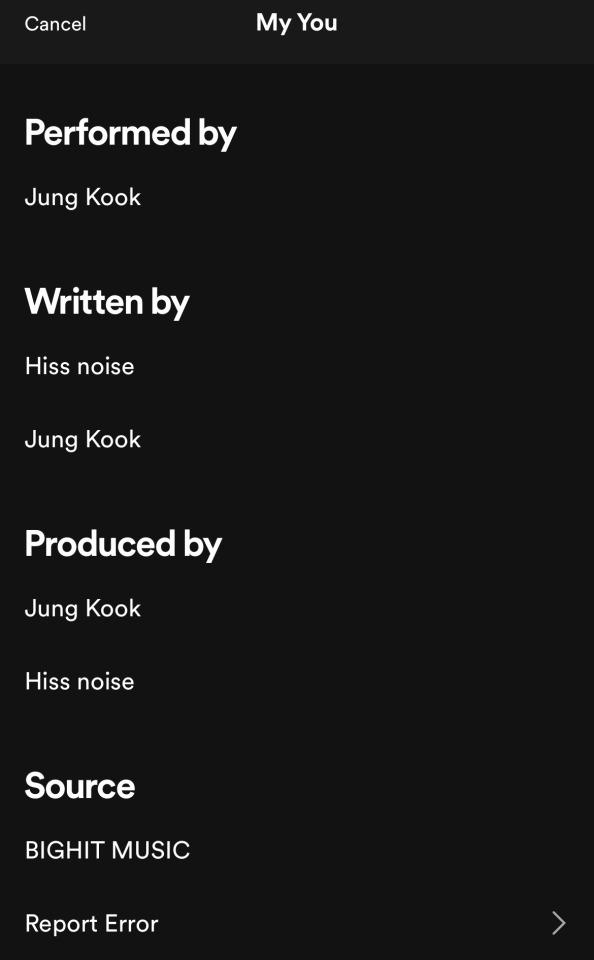

Lol.

This will be short. I’ll go on a little tangent but I’ll tie this back to Jungkook and BTS at the end.

You know, I was mostly ambivalent about the feud between HYBE and Min Heejin until I heard her call Bang Sihyuk and his sycophants “bastards” for ‘overpaying for garbage and forcing everyone to eat it because they think the price makes the music good.’ - I’m paraphrasing a bit because her language was more crude. That made me sit up a bit, because her sentiments mirrored my thoughts about the direction Bang Sihyuk has been taking the company in for some time now.

Another random connection is that, to me at least, it seems clear BigHit is still trying to make the HYBE America investment worth it, given:

1. The unnecessarily long credit lists filled with Scooter-linked writers that appear to have become a fixture of most HYBE releases. Bang PD is clearly taking advantage of Scooter’s connections although it’s yet to yield any significant improvement in music quality, and in terms of chart performance the results are mixed at best;

2. The fact that in addition to HYBE paying US$1.05 Billion in cash for Scooter’s company, essentially overpaying for Ithaca Holdings by consensus estimates (a deal Min Heejin also openly criticized as being hare-brained), HYBE America still generated hundreds of millions of dollars in losses as of the last fiscal year, two years after the acquisition was finalized.

But this is old news, we all knew that.

The thing about Min Heejin’s comments that concerned me is that, despite what is now clearly an underperforming investment both in terms of Scooter Braun himself and the man at HYBE that arranged the deal in the first place, Lee Jae-sang, rather than work to correct course and minimize losses, Bang Sihyuk appears to be doubling down on the deal by rewarding these two men in particular with more music and business opportunities within HYBE, even if the music quality suffers as a result, even if HYBE continues overpaying for shit, and even if the artists/idols are negatively impacted in the process. And according to Min Heejin, one big reason Bang Sihyuk allows it is because those men are adept at greasing his arse and eating it out.

Basically, it’s become an expensive joke. But he’s brute forcing the deal to work because so long as BTS is involved and so ARMYs are involved, it’s a joke that Bang PD is guaranteed to take laughing all the way to the bank.

This is where I say I realized shortly after Jungkook’s fan song for Festa was announced, that I wasn’t excited to hear it. I’m saying this only because now that the song is out, it’s confirmed everything I expected. And also because that apathetic feeling was so at odds with how I’ve been feeling about Jungkook as a person for the last year. If it’s not been clear from my reblogs and gush posts, I’ve been spending the better part of this hiatus loving Jungkook extremely. Jungkook is an empathetic songwriter, an emotive vocalist, a talented producer.

But nothing about Never Let Go is exciting. Who wants to listen to a fan song written by people who’ve never had fans? And on top of that, Jungkook is making less money from that song than any fan song he’s written before. Meaning, the song is mediocre, it feels blatantly insincere in ways only a crowdsourced fan song can be, and Jungkook has to split his revenue from the song with about 10 white people. Just look at this.

I’m actually laughing typing this out, but this turn of events is at least a little tragic.

Golden worked as a concept album because it was a collection of songs Jungkook felt represented his taste, he could take on the challenge of putting out a full English album with some help from the writers, and he showcased new vocal techniques and styles that only showed an evolution from his prior work in BTS. The songs themselves were just okay, good decent pop, but as a collection it worked.

Everything about Never Let Go feels almost audaciously soulless. Not quite a slap on the face but it’s like someone coming all up in your face with a bad case of halitosis and their nose barely touching yours, daring you to do something about it.

I have no issue with HYBE working with Scooter-linked writers or producers if it means something actually good comes of it. But it seems HYBE seems to believe their work is better simply because they slap on as many foreign names in the credits as they can fit. It betrays a worrying mentality about the head honchos in the company. Looking at the peak quality in FACE by Jimin, or in Right Place, Wrong Person by RM, which included acclaimed Korean, other Asian, and Black talent supposedly hand-picked by Jimin and Joon themselves, it’s clear HYBE has access to remarkable home-grown and foreign talent that could improve the work of the members. But what I’m seeing with too much frequency is HYBE picking off the bottom of the barrel in the unending list of Scooter’s contractors and otherwise choosing to do the bare minimum.

And that’s how we end up with a Festa fan song with a topline that sounds like an AI-generated jingle written by a soccer team of hired help.

Or idk, maybe I’m being just a bit too full of it. Maybe I’ve been brainwashed by the witch Min Heejin, maybe this was just one more song Jungkook worked on with his Golden team as he had no time to write a proper fan song, nothing more. And maybe as a silver lining, there are no glaring grammatical errors though I found the ones in My You very charming, and honestly part of the appeal. To hear the way Jungkook sees the fans who have been with him till now, even if in English it didn’t quite make sense.

I said this would be short but I’ve rambled, as usual. Sorry for that. When I started out writing this post, I did intend to keep it short.

To end things on a somewhat lighter note, for me the only thing I’m excited about this Festa, is SeokJin coming back. I’ll be working on a deal during the fanmeet so I didn’t bother participating in the raffle, but I’m happy for the ARMYs who get the opportunity to hug Jin, and for Jin who gets to spend time with his fans after so long. With him returning, things are starting to feel more right, even though there are worrying signs in high places. We’ve got about 1 year left to endure most of the members enlisted and then, the crew will be rounded up again.

Now more than ever, I find myself looking forward to that.

117 notes

·

View notes

Text

Kai Venom's Masterlist

This masterlist will have all of the fandoms and then you can enter the specific one you like.

Having in mind that this blog is relatively new, there will be a lot of blank spaces on the masterlist for now, but i hope that we can fill it up, in some time.

Under the fandom, there will be the characters i write for, but you can always try to request something new (i am full on with surprises).

New fandoms and characters will be added will be added.

Original Writings

HCS for fandoms (new species, cannon world expansions, etc)

OC's

Original writtings ideas, stories and updates

Bridgerton

Anthony Bridgerton

Benedict Bridgerton

Colin Bridgerton

Cobra Kai

Miguel Díaz

Robby Keene

Eli "Hawk" Moskowitz

Demetri Alexopoulos

Johnny Lawrence

Daniel Larruso

Dc Comics

Bruce Wayne "Batman"

Dick Grayson "Nightwing"

Jason Todd "Red Hood"

Damian Wayne "Robin"

Tim Drake "Red Robin"

Conner Kent

Jonathan Kent

Clark Kent "Superman"

Barry Allen "Flash"

Wally West "Kid Flash"

Nate Heywood "Steel"

Rick Flag

Christopher Smith "Peacemaker"

Adrian Chase "Vigilante"

George Harkness "Captain Boomerang"

Billy Batson "Shazam"

Descentants

Ben Florian

Harry Hook

Gil

Carlos D Vil

Jay

Harry Potter World

Harry Potter

Fred Weasley

George Weasley

Ominis Gaunt

Sebastian Sallow

Garreth Weasley

Heartbreak High

Spencer "Spider" White

Anthony "Ant" Vaughn

Douglas "Cash" Piggott

Malakai Mitchell

Dusty Reid

Jujutsu Kaisen

Itadori Yuuji

Sukuna Ryomen

Nanami Kento

Megumi Fushiguro

Toji Fushiguro

Gojo Satoru

Choso

Julie and the phantoms

Luke Patterson

Reggie Peters

Marvel

Spiderman (the 3 versions)

Miguel O'hara

Steve Rogers "Captain America"

Tony Stark "Ironman"

Quicksilver (the 2 versions)

Peter Quill "Starlord"

Loki

Thor

Bucky "Winter Soldier"

Stephen Strange "Dr. Strange"

Venom/Eddie Brock

Moon Knight

Ciclops

Angel

Havok

One Piece

Monkey D. Luffy

Roronoa Zoro

Vinsmoke Sanji

Ussop

Trafalgar Law

Eustass Kidd

Killer

Dracule Mihawk

Sir Crocodile

Donquixote Doflamingo

Shanks

Smoker

Portgas D. Ace

Sabo

Outer Banks

JJ Maybank

Rafe Cameron

Peaky Blinders

Thomas Shelby

John Shelby

Arthur Shelby

Finn Shelby

Michael Gray

Slashers

Bowers Gang

Ghostface

Sinclair brothers (from House of Wax)

Stranger things

Garreth Emerson

Eddie Munson

Steve Harrington

Billy Hargrove

Supernatural

Sam Winchester

Dean Winchester

Gabriel "The Trickster"

Jack Kline

Castiel

The Bear

Carmy Berzatto

Luca

The umbrella academy

Five Hargreeves

Klaus Hargreeves

Diego Hargreeves

Ben Hargreeves

Vikings

Ivar the boneless

Ubbe Ragnarson

Hvitserk Ragnarson

Bjorn Ironside

Sigurd Ragnarson

196 notes

·

View notes

Text

What Are the Most Popular Investment Products at US Bank?

1. US Bank Mutual Funds

US Bank Mutual Funds are a popular choice. They offer a diverse range of investment options. For example, you can invest in funds focused on stocks, bonds, or a mix of both. This allows you to spread your risk. Many investors like mutual funds for their simplicity. You can invest with a relatively low amount. For instance, if you start with $1,000, you gain exposure to a broad market. These funds are managed by experts. They select investments to meet specific goals. Clients appreciate the professional management and ease of use.

2. US Bank Certificates of Deposit (CDs)

Certificates of Deposit (CDs) from US Bank are favored for their security. They offer a fixed interest rate for a set period. For example, you might choose a 12-month CD with a guaranteed rate. This means you know exactly how much you will earn. CDs are great for those who want a safe investment. Many people use them to park cash while earning interest. US Bank’s CDs come with various terms and rates. This flexibility helps clients match their investment goals. It’s a reliable option for conservative investors.

3. US Bank Retirement Accounts

US Bank offers several retirement account options. These include Traditional IRAs and Roth IRAs. Each account type has specific tax benefits. For example, a Roth IRA allows tax-free withdrawals in retirement. Clients can choose the account that best suits their needs. US Bank also provides retirement planning tools. These help clients plan their savings strategy. Many people appreciate the guidance and support. Retirement accounts at US Bank are designed to grow your savings over time. They are a solid choice for long-term investment.

In summary, US Bank offers a range of popular investment products. Mutual funds provide diversification and professional management. CDs offer a secure, fixed return. Retirement accounts help build savings for the future. Each product is designed to meet different investment needs and goals. Choose the US Bank investment product that aligns with your financial plans.

#usa news#usa#united states#united states of america#us bank shopper cash rewards#business#business info

0 notes

Text

i come from a low frequency environment, and i've only used cash my entire life. the only time i ever held a card was when i borrowed my cousin's bank of america debit card to slice open a funnel cake at the county fair when i took my daughter there on a trip amidst a lengthy child custody battle with my ex-wife, attempting to prove to the judge that i'm a responsible father, but we know all know i'm fuckin' not! i got the kid's ears pierced at 2 years old, and she already knows what red bull tastes like. i'm fucked! judge, if you're seeing this, please let me have mckenzie back. i even wore my nice 8-ball jean jacket to the last court hearing. i'm ready to change!

101 notes

·

View notes