#bankingsolution

Text

Best ERP Software in the world

ERA developed Orbits ERP Solution which have the capability to do the job in style to win the battle. Smart, AI Driven, BI tools can give you timely, accurate, and complete information whilst the Management Dashboard give the Realtime representation of the Organization on the smartphone. Best ERP solution in the world.

Instant Realtime information help you respond to customers quicker and nurture your business more profitably.

Manage your critical business functions across Supply Chain, Accounting, Management, in one, solitary unified system to save you resources and time.

Orbits offers a wide range of features entirely configurable by each enterprise

Cost Effective ERP – Value for Money

Low Bandwidth Requirement

Return on Investment can be maximized by buying application specific licenses.

End-to-end real time processing

Extensive multilevel security

Image capture utility

Interfaces with Barcode Reader

#erpsoftware#erp#erpsolutions#businesssolutions#enterprisesolutions#bankingsolution#Erainfotechltd#humanresource#hr#humanresources#payroll#humanresourcesmanagement#hrm#marketing#sales#procurement#administration#audit#humanresourcemanagement#business#recruitment#outsourcing#employee#hrms#bank#agentbanking#corebaking#RPA#united states#australia

3 notes

·

View notes

Text

Beacon Launches With CAD $5.25M Seed Round To Develop Purpose-Built Super App Supporting Canadian Immigrant Journey

Beacon, a revolutionary solution created to facilitate seamless transitions for immigrants relocating to Canada, has recently concluded a seed funding round, securing CAD $5.25 million. This investment, backed by prominent figures in the Canadian private and angel investor community, as well as institutional investors from the United States, represents a significant milestone for the company. With this funding, Beacon aims to expedite the development of its Super App—a comprehensive platform tailored to cater to the unique requirements of Canadian immigrants.

The concept for Beacon originated from the personal experiences of its co-founder, Aditya Mhatre, who encountered numerous challenges upon immigrating to Canada in 2014 with his family. Recognizing the necessity for a more efficient and supportive system for newcomers, Mhatre and his team embarked on the creation of Beacon, envisioning it as a solution to streamline the settlement process and empower immigrants to establish successful lives in their new homeland.

Canada, with its diverse population comprising over eight million individuals born outside the country, presents both opportunities and obstacles for immigrants. Despite the country's endeavors to attract and integrate newcomers, recent studies have shed light on the difficulties immigrants face in establishing themselves in Canada, resulting in concerning rates of emigration. Beacon aims to tackle this issue by offering a range of purpose-built financial and technological solutions designed to assist immigrants throughout their journey of settling in Canada.

At the heart of Beacon's offerings lies its Super App, which serves as a comprehensive resource for immigrants, providing pertinent content, digital information, and customized checklists to cater to their needs even before they arrive in Canada. Furthermore, Beacon Money, an innovative financial solution, is currently being developed to address the specific financial requirements of immigrants, offering everyday financial services and support.

Read More - https://www.techdogs.com/tech-news/business-wire/beacon-launches-with-cad-525m-seed-round-to-develop-purpose-built-super-app-supporting-canadian-immigrant-journey

0 notes

Text

Credit Cooperative Society Software and Free Agent Mobile App and Customer mobile App

#SocietySoftware

Best and Affordable Society Software for all Banking requirements, suitable for Rural and Urban Cities.

Software modules includes member and share management software,dividend declaration, saving account, loan management, fixed deposit, general accounting, saving accounting and so on.

Contact us:-https://cooperative-society-software.com/contact-us

https://chat.google.com/dm/hXrOmMAAAAE/gqvytzj_Kg8/gqvytzj_Kg8

or call: 93294–22917

#bankingsoftware #ruralbankingsoftware #loanmanagementsoftware

#creditmanagementsoftware #savingaccount #sharemanagement

#fixeddeposit #generalaccounting #savingaccounting

#nidhisoftware #employeesoftware #hrsoftware

#Accounting #Accountingsoftware #loansoftware

#navratrispecial #navratri2024 #navratrioffer

#creditcooperativesocietysoftware#mobileappdevelopment#nidhicompanysoftware#bestcreditcooperativesocietysoftware#bankingsolutions#navratrioffer2024

0 notes

Text

Gridlines - Revolutionizing Banking with Specialized API Solutions

Gridlines is transforming the banking industry with bespoke API solutions designed to meet rigorous regulatory standards. Our state-of-the-art technology enables banks to bolster compliance, optimize operations, and guarantee a smooth customer onboarding experience. With a track record of over 500 million lifetime API calls, more than 100 APIs, and 100 million successful verifications, Gridlines provides powerful fraud detection, efficient KYC procedures, and immediate verifications.

Effortlessly incorporate our modular solutions into existing banking systems and concentrate on core skills while maintaining regulatory compliance. From fraud detection and KYC procedures to immediate verification and improved customer experience, Gridlines APIs cater to every use case, including identity, business, asset, employment, Aadhaar, PAN, facematch, liveness check, Digilocker, MSME, company, and GSTIN verification. Enhance your banking operations with Gridlines sophisticated KYC solutions and effortlessly achieve regulatory excellence.

#BankingSolutions#KYCSolutions#RegulatoryCompliance#FintechInnovation#CustomerOnboarding#FraudDetection#StreamlinedKYC#APIs#GridlinesKYC

0 notes

Text

How To Open a Free Zone Company Bank Account

Ready to set up your free zone company? Find out how to open a free zone company bank account for your business with our helpful tips and tricks.

#sabindia#freezonecompanybankaccount#bankaccount#businessbanking#companyregistration#financialservices#businesssetup#uaefreezone#bankingsolutions#internationalbusiness#corporatebanking

0 notes

Text

Seamless Banking Solutions in Dubai: Transcend Accounting Leads the Way

Embark on a financial journey in Dubai with ease, thanks to Transcend Accounting's seamless bank account opening services. Dubai, renowned for its luxurious lifestyle and booming economy, presents unparalleled opportunities for both individuals and businesses alike. Whether you're an expatriate exploring new horizons or an entrepreneur aiming to establish your presence in the Middle East, having a bank account in Dubai is a fundamental step towards financial success.

Streamlining the Process: Our Expertise

Navigating the intricacies of bank account opening in a foreign country can be overwhelming. However, at Transcend Accounting, we specialize in simplifying this process. Collaborating with top financial institutions in Dubai, we ensure a hassle-free experience from start to finish. Our team of professionals is well-versed in local regulations and requirements, guaranteeing a smooth account opening journey for our clients.

Tailored Solutions for Your Unique Needs

Understanding that each client has distinct financial goals and preferences, we pride ourselves on offering personalized solutions. Whether you're a multinational corporation or a sole proprietor, we have the perfect banking solutions tailored to your requirements. From corporate accounts to personal savings accounts, our wide range of options ensures that we cater to all your financial needs effectively. Our experts work closely with you to grasp your objectives and recommend the most suitable banking services available in Dubai.

Convenience at Your Fingertips

With Transcend Accounting, opening a bank account in Dubai is as simple as a few clicks. Our user-friendly online platform enables you to initiate the account opening process from the comfort of your home or office. Just provide the necessary documents, and our dedicated team will take care of the rest. Bid farewell to the hassle of visiting multiple banks and enduring long queues – Transcend Accounting brings unparalleled convenience right to your fingertips.

Your Gateway to Financial Success in Dubai

We stand out for its exceptional bank account opening services in Dubai. With our expertise, bespoke solutions, and convenient online platform, we transform your financial aspirations into reality.

#DubaiBanking#TranscendAccounting#FinancialFreedom#BankingSolutions#FinancialServices#BankAccountOpening#TranscendYourFinances#SeamlessBanking

1 note

·

View note

Text

Bank Account Opening Services in UAE - MNA Business Solutions

Embark on your entrepreneurial journey in Dubai, UAE with MNA Business Solutions! We handle everything from kickstarting your business to setting up individual and corporate bank accounts. Pay only upon account activation. Your success, our priority!

#DubaiBanking#BankAccountOpening#mnabusinesssolutions#DubaiFinance#UAEBanking#DubaiAccounts#BankingServices#DubaiMoneyMatters#UAEFinance#BankingInDubai#DubaiBankingServices#BankingSolutions#UAEFinancialServices#OpenBankAccount#BankingOptions#DubaiFinancialInstitutions#UAEAccounts#BankingRequirements#DubaiBankingSector#UAEFinanceOptions#BankingFacilities#businessadvisor#financialadvisor

0 notes

Text

Navigating the Future: Unlocking Integrated Banking Solutions

Dive into a new era of financial innovation with our Integrated Banking Solutions. Picture a world where banking is not just a service but a personalized, seamless experience. Our approach combines advanced technology, robust security measures, and intuitive interfaces to bring you a comprehensive suite of banking solutions. From real-time transaction monitoring to intelligent financial planning tools, we've redefined the landscape of banking services. Whether you're an individual seeking a user-friendly banking app or a business in need of streamlined financial management, our integrated solutions cater to your unique needs.

Embrace the future of finance and enjoy the freedom to navigate, transact, and grow with confidence. Integrated Banking Solutions—it's not just banking; it's a financial evolution.

0 notes

Text

Descubre cómo hallar el número de enrutamiento de ABA | Find Your ABA Routing Number Quickly

Unlock the secrets to finding your ABA routing number with our quick and easy guide! 🚀 Whether you're a banking pro or just getting started, this video has got you covered. Say goodbye to confusion and hello to simplicity! 🌐💳 Don't miss out—watch now and take control of your financial journey.

#ABARoutingNumber#BankingTips#FinancialFreedom#MoneyMatters#RoutingNumber101#FinanceMadeEasy#BankingSolutions#EmpowerYourFinances#SmartMoneyMoves#KnowledgeIsPower#WatchAndLearn

0 notes

Text

#Banking#FinancialServices#OnlineBanking#BankingSolutions#DigitalBanking#MobileBanking#SavingsAccount#CheckingAccount#CreditCard#PersonalFinance#Investment#WealthManagement#FinancialPlanning#Fintech#BankingIndustry#CustomerService#ATM#Loan#CreditScore#BankingTechnology#kotak bank#bank

0 notes

Photo

(via Internet Banking)

#bankingsolutions#onlinefinance#ebanking#VirtualBanking#securebanking#bankingtechnology#fintechservices#digitalfinance#onlinebanking#internetbanking

0 notes

Text

Digital Procurement Revolution: Unveiling SBI's E-Procurement Excellence

State Bank of India (SBI), one of the largest and most trusted banking institutions in India, has embarked on a transformative journey in procurement through its state-of-the-art e-procurement system. In this in-depth exploration of SBI eprocurement platform, we delve into its significance, multifaceted benefits, and the profound impact it has on revolutionizing the procurement landscape.

The Evolution of Procurement: E-Procurement Defined

The transition from traditional, paper-based procurement processes to e-procurement signifies a paradigm shift in how organizations manage their procurement needs. SBI, a pioneer in this regard, has embraced digitalization to streamline its procurement operations, minimize inefficiencies, and enhance transparency.

Understanding SBI's E-Procurement System

What Is SBI E-Procurement?

SBI's e-procurement system is a sophisticated digital platform meticulously designed to facilitate every facet of the procurement lifecycle. From initial requisitions to final payments, this system orchestrates seamless interactions between SBI and its extensive network of suppliers and service providers. It not only revolutionizes procurement within the organization but also sets a benchmark for the industry.

The Multi-Faceted Benefits of SBI E-Procurement

The adoption of SBI's e-procurement system unfolds numerous benefits:

Heightened Efficiency: The digital platform expedites procurement processes by reducing manual interventions and paperwork, translating into significant time savings.

Unprecedented Transparency: SBI eprocurement ensures complete transparency in procurement transactions. Real-time visibility into the procurement cycle simplifies tracking and facilitates comprehensive auditing.

Cost Optimization: Through process automation and error reduction, SBI achieves cost savings, which ultimately benefits the bank and its stakeholders.

Navigating the Vast Terrain of SBI's E-Procurement Platform

SBI's e-procurement platform encompasses a wide array of procurement categories, including:

Goods Procurement: This category encompasses the acquisition of various goods and materials essential for the bank's operations.

Service Procurement: SBI leverages the platform to engage with service providers for specific projects and services.

Infrastructure Projects: For major infrastructure and construction projects undertaken by SBI, the e-procurement system plays a pivotal role in project management and procurement.

Empowering Suppliers and Service Providers

SBI's e-procurement system isn't solely advantageous for the bank. Suppliers and service providers within its network can also reap significant benefits:

Level Playing Field: The digital platform ensures equal opportunities for all suppliers and service providers to participate in procurement processes, fostering healthy competition.

Efficient Bidding: Suppliers can conveniently submit bids electronically, streamlining and expediting the bidding process.

Payment Visibility: Suppliers gain transparent insights into payment statuses and invoice tracking through the platform, leading to better financial planning.

The Future of SBI E-Procurement: Embracing Technological Advancements

As technology continues its relentless evolution, SBI eprocurement system is poised for continuous enhancement. Integrating emerging technologies such as artificial intelligence (AI) and blockchain will further boost efficiency, security, and the platform's overall effectiveness.

Conclusion: A Digital Leap in Procurement

In conclusion, SBI eprocurement marks a monumental digital leap in how one of India's foremost banking institutions manages its procurement operations. It brings forth unparalleled efficiency, transparency, and cost savings, benefiting both SBI and its extensive network of suppliers and service providers. As the digital transformation of procurement continues to evolve, SBI's e-procurement platform serves as an exemplary model for the industry to emulate.

Empowering Your Procurement with Tendersniper

To harness the full potential of digital procurement and explore a world of opportunities, SBI has partnered with Tendersniper, a leading procurement platform. Tendersniper offers real-time notifications, access to a vast array of procurement opportunities, and the latest in procurement technology. By joining forces with Tendersniper, SBI takes its commitment to efficient and transparent procurement to the next level, offering unparalleled opportunities for both the organization and its procurement partners.

#EProcurement#SBI#DigitalTransformation#ProcurementEfficiency#Transparency#CostSavings#SupplierEmpowerment#EmergingTechnologies#Innovation#Tendersniper#DigitalProcurementRevolution#SupplyChain#BlockchainInProcurement#AIinProcurement#SustainableProcurement#BankingInnovation#ProcurementNetwork#FuturisticProcurement#BankingSolutions#SBIProcurement#facebook#instagood#linkedin#naruto#instadaily#instafood#my writing#funny posts#100 days of productivity#microsoft

0 notes

Text

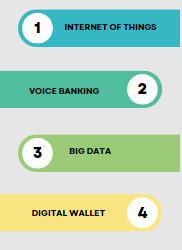

Revolutionize Your Banking Experience: 5 Important Trends in Mobile Banking Apps for 2023 Get in touch with us today.

#MobileBanking#BankingInnovation#MobilePayments#BankingSolutions#DigitalPayments#BankingTech#MobileBankingApp

0 notes

Text

What Is the Meaning of Central Bank Digital Currency (CBDC)?

What Is a Central Bank Digital Currency (CBDC)?

In the swiftly evolving realm of finance today, digital currencies have emerged as a prominent subject of discourse. One term that has garnered substantial attention is CBDC, an acronym denoting Central Bank Digital Currency. In this exposé, we shall plunge into the labyrinthine world of CBDCs, delving into their objectives, classifications, the quandaries they seek to resolve, and the conundrums they may engender, all while juxtaposing them with the realm of cryptocurrencies.

What Is the meaning of Central Bank Digital Currency (CBDC)?

Central Bank Digital Currencies, or CBDCs, represent the digital incarnations of a nation's fiat currency, underwritten by the aegis of the central bank. These digital currencies serve a manifold array of pivotal purposes:

Understanding Central Bank Digital Currencies (CBDCs)

CBDCs aspire to extend the purview of financial services to a wider demographic, encompassing even those bereft of access to conventional banking infrastructures. This endeavor holds the potential to mitigate economic disparities and foster financial equilibrium.

Objectives of Central Bank Digital Currencies (CBDCs)

In the United States and various other nations, a significant portion of the population lacks access to financial services. Within the United States alone, statistics from 2020 reveal that 5% of adults did not possess a traditional bank account. Furthermore, an additional 13% of U.S. adults who did maintain such accounts opted for expensive alternative financial solutions, such as money orders, payday loans, and check-cashing services.

This information is sourced from the "Report on the Economic Well-Being of U.S. Households in 2020" published by the Board of Governors of the Federal Reserve System.

The primary objectives of Central Bank Digital Currencies (CBDCs) encompass the provision of privacy, transferability, convenience, accessibility, and financial security to both businesses and consumers. CBDCs possess the potential to alleviate the financial system's complexity-related maintenance costs, curtail cross-border transaction expenses, and offer more economical alternatives to individuals currently reliant on alternative money transfer mechanisms.

Additionally, CBDCs hold the potential to mitigate the inherent risks associated with the utilization of existing digital currencies and cryptocurrencies. These digital assets are renowned for their extreme volatility, characterized by incessant fluctuations in value. This instability can potentially exert considerable financial strain on households and pose a threat to overall economic stability. In contrast, CBDCs, being government-backed and subject to central bank control, furnish households, consumers, and enterprises with a secure avenue for the exchange of digital currencies.

Optimizing Transactional Efficiency

CBDCs possess the capacity to streamline the labyrinthine web of payment systems, expediting transactions, ameliorating their cost-efficiency, and fortifying their security. This transformation assumes paramount significance in a progressively digitized milieu.

Resisting the Onslaught of Cryptocurrencies

In the wake of the ascendancy of cryptocurrencies such as Bitcoin, central authorities are canvassing the realm of CBDCs as a stratagem to assert dominance over their monetary policies and safeguard the stability of their fiscal edifices.

Taxonomy of CBDCs

CBDCs assume an eclectic array of incarnations, each characterized by its distinctive attributes and modalities:

Retail CBDCs

Retail CBDCs extend accessibility to the masses and facilitate everyday transactions, mirroring the functionality of tangible currency, albeit in a digital semblance.

In the realm of fiscal innovation, Retail Central Bank Digital Currencies (CBDCs) emerge as sanctioned digital tender, catering to the needs of both consumers and enterprises. One distinguishing facet of Retail CBDCs lies in their potential to obliterate the looming specter of intermediary jeopardy. This pertains to the unnerving likelihood that private purveyors of digital currencies may, at any juncture, succumb to insolvency, thereby endangering the assets entrusted to them by their clientele.

The universe of Retail CBDCs unfolds in two distinct variations, each diverging significantly in the manner through which individual users are bestowed access and leverage over their pecuniary resources:

Token-based Retail CBDCs, an embodiment of cryptographic prowess, grant entry through the deployment of private keys, public keys, or an amalgamation of both. This labyrinthine method of authentication bestows upon users the cloak of anonymity when engaging in financial transactions of their choosing.

In stark contrast, the realm of Account-based Retail CBDCs mandates a digital entreaty of one's unique identity before the vault of financial assets unveils itself for perusal and utilization.

This intricate tapestry of Retail CBDCs underscores the pivotal intersection between the digital epoch and conventional fiscal paradigms. It is an alchemical fusion where security and accessibility coalesce in a symphony of innovation, offering a tantalizing glimpse into the future landscape of currency and finance.

Wholesale CBDCs

Tailored for the consumption of financial institutions and governmental bodies, wholesale CBDCs primarily cater to interbank settlements and large-scale financial transactions.

Token-Based CBDCs

Operating on the bedrock of blockchain technology, token-based CBDCs offer a conduit for transactions marked by invulnerability and transparency. They are frequently lauded for their potential to curtail fraudulent activities and augment traceability.

Issues Created by CBDCs Explained

In the event of a substantial transformation in the financial framework of the United States, the repercussions on household expenditures, investment portfolios, banking reserves, interest rate dynamics, the financial services sector, and the overall economy remain shrouded in uncertainty.

The potential impacts of transitioning to a Central Bank Digital Currency (CBDC) on the stability of the financial system also dwell in the realm of the unknown. To illustrate, there might not be an ample reservoir of central bank liquidity to facilitate withdrawals amidst a financial upheaval.

Central authorities employ monetary policies as instruments for shaping the trajectories of inflation, interest rates, lending practices, and consumer spending, all of which, in turn, exert profound influences on the state of employment rates. It is imperative for central banks to ensure that they possess the requisite tools to exert constructive influences on the broader economic landscape.

The paramount motivation behind the ascent of cryptocurrencies lies in the preservation of privacy. However, the introduction of Central Bank Digital Currencies raises the specter of an inevitable degree of intrusion by regulatory entities in their pursuit of vigilance against financial misconduct. The surveillance apparatus is indispensable as it bolsters the collective resolve to combat the scourge of money laundering and the financing of terrorism.

Cryptocurrencies have, time and again, found themselves within the crosshairs of cybercriminals and malefactors. A digital currency backed by a central bank would invariably attract the same cohort of nefarious actors. Consequently, the fortifications against system breaches and the pilfering of assets and sensitive information must be robust and impervious.

The Vicissitudes Addressed and Unfurled by CBDCs

While CBDCs proffer a plethora of merits, they concurrently unfurl a tapestry of quandaries:

Vexations of Privacy

The inherently digital character of CBDCs ushers forth concerns pertaining to individual privacy, as central banks gain the means to meticulously monitor transactions. Striking an equilibrium between transparency and privacy looms as a formidable challenge.

Cybersecurity Perils

CBDCs stand susceptible to the malevolent machinations of cyber assailants, thereby underscoring the imperative of fortifying the security apparatus to shield the bulwark of the financial framework.

Economic Ramifications

The introduction of CBDCs can usher in a gamut of ramifications for traditional banking systems, potentially sowing the seeds of disruptions and catalyzing transformations within the financial landscape.

CBDCs vs. Cryptocurrencies: A Comparative Discourse

It becomes imperative to demarcate the demesne of CBDCs from that of cryptocurrencies, as they share semblances yet remain underpinned by profound disparities:

Centrally Orchestrated Governance

CBDCs emanate from the sanctums of central banks, ensconced within the ambit of governmental regulation, thereby buttressing governmental control over the financial matrix. In contrast, cryptocurrencies navigate a trajectory independent of any central overseer.

Tenacity in Valuation

CBDCs, as a rule, inhabit a realm of greater stability concerning their valuation, given their moorings to the fiat currency of the land. Cryptocurrencies, conversely, frequently traverse terrain marked by capricious price fluctuations.

Legal Tender Status

CBDCs enjoy the hallowed status of legal tender, signifying their recognition and acceptance for all transactions transpiring within the precincts of a nation. Cryptocurrencies may not bask in the same legal imprimatur.

Conclusion

In summation, Central Bank Digital Currencies (CBDCs) emerge as a momentous chapter in the annals of financial evolution, casting their gaze upon the modernization of payment systems, the augmentation of financial inclusivity, and the endowment of governments with heightened dominion over their monetary policies. Despite their manifold virtues, CBDCs unfurl a complex tapestry, one replete with intricacies that mandate judicious contemplation and a regimen of judicious regulation. As the financial cosmos continues its inexorable metamorphosis, CBDCs are poised to play a seminal role in sculpting the visage of the forthcoming monetary order.

Read the full article

0 notes

Text

🏦 Elevate Your Banking Operations with Odoo ERP! 🚀

💼 Seeking a Centralized Solution for Your Bank's Data Management and Automated Processes? Look no further! Odoo ERP offers the perfect fit for the banking sector. Here's why you should choose Odoo ERP.

#odoo#odooerp#bank#banking#finance#BankingSolutions#AutomatedProcesses#bankingsystem#opensourcesoftware#ChooseOdooERP

1 note

·

View note

Text

Discover the HDFC Millennia Credit Card Lounge Access List and unlock exclusive benefits. Read reviews, explore the benefits, and apply online for 2023.

#HDFCMillenniaCreditCard#LoungeAccessBenefits#Review2023#ApplyOnlineNow#ExclusivePerks#CreditCardOffers#BankingSolutions#FinancialServices#OnlineApplication#SmartSpending#banking

0 notes