#banks day 18.4

Text

Maia quickly changes and hurries downstairs to see what I have planned for us. I direct her to the living room.

Wade: I cleared some space and bought new yoga mats because I know how much yoga means to you.

I can’t see her face, but I can hear the smile in her voice.

Maia: This is amazing, Dub - you are amazing.

Wade: Well, it wasn’t completely for unselfish reasons. I might need your help with my yoga class.

Maia: I’ll be glad to help.

We both step on our mats and Maia shows me a starting pose. She places her hands in front of her.

Maia: This is called Pranamasana. It’s the praying pose.

Okay, so far so good. I didn’t think I’d be learning terminology, too. I’m feeling smarter already.

Maia: Balance is essential in yoga, symbolizing the balance we seek in life.

Maia sticks her foot out and balances on one leg. I attempt it but can’t pick my leg up from the floor without falling.

Maia: It’s all in your core. The core is your everything - your center.

37 notes

·

View notes

Text

U.S. Treasury Secretary Janet Yellen mentioned the G7 finance leaders on Thursday agreed to supply Ukraine the monetary assets it wants in its battle in opposition to Russia's invasion, and that policymakers are decided to satisfy their inflation targets.

Yellen, chatting with reporters after the primary day of a G7 finance ministers and central financial institution governors' assembly right here, declined to substantiate an $18.4 billion (€17.3 billion) determine pledged within the group's draft communiqué seen by Reuters.

The assembly wraps up on Friday.

Yellen mentioned that funding pledges to Ukraine in the course of the assembly exceeded the $15 billion that Kiev has estimated it wants over the subsequent three months to make up for misplaced revenues because the warfare devastates its financial system.

A $40 billion U.S. help package deal underneath anticipated to be accredited by the U.S. Senate this week would come with $7.5 billion in new financial help, whereas the European Commission pledged 9 billion euros for Ukraine, Yellen mentioned. Other international locations, together with Canada and Germany, pledged extra quantities.

"The message was, 'We stand behind Ukraine. We're going to tug along with the assets that they should get by this,'" Yellen mentioned.

She mentioned that top international inflation was a major matter, however not one of the policymakers had mentioned they had been contemplating elevating their focused inflation charges.

"What was mentioned was the vital significance of central banks taking the actions which are wanted to indicate they're dedicated to the inflation targets that they've set," Yellen mentioned.

Yellen mentioned the officers felt that financial circumstances had not modified " so essentially, that it could be price dislodging what we felt it turn out to be a secure anchored set of inflation expectations."

She mentioned that she nonetheless believed that the U.S. Federal Reserve may obtain a "gentle touchdown" of the financial system with out inflicting a recession, however how Fed officers obtain that is as much as them although it "requires each ability and luck."

Discussions about mechanisms to scale back Russia's revenues from oil exports to Europe had been restricted on Thursday, Yellen mentioned, including that there's a lot of curiosity within the idea.

U.S. officers have floated the concept of imposing tariffs on Russian oil to restrict the quantity of income that Moscow can accumulate whereas protecting Russian crude provides available on the market as EU officers pursue a phased embargo by yr finish.

Yellen mentioned that a consumers' cartel that may not purchase oil above sure costs could possibly be profitable whether it is giant sufficient.

"Nothing is actually crystallized as an apparent technique," she added.

X

0 notes

Photo

Water Container (Mizusashi) with Grasses, late 1500s–early 1600s, Cleveland Museum of Art: Japanese Art

Mizusashi are jars used to hold water for the preparation of tea at tea gatherings. This one was produced in the Mino area of present-day Gifu prefecture in central Japan, and is considered one of the finest of its type in existence, based on the complex aesthetic sensibilities developed around the tea ceremony in Japan. It is called a “picture Shino” (e-shino) mizusashi, as it has an abstracted design said to resemble an ink painting of reeds along a river bank and small boats in a river on one side, and a geometric pattern on the other. With its irregular shape and thick, luminous glaze, it is of a variety favored by eminent tea masters of the Momoyama period.

Size: Diameter: 19.6 cm (7 11/16 in.); Lid: 2.9 x 14.7 cm (1 1/8 x 5 13/16 in.); Container: 18.4 cm (7 1/4 in.)

Medium: Stoneware with underglaze iron oxide slip decoration (Mino ware, Shino type)

https://clevelandart.org/art/1972.9

81 notes

·

View notes

Text

ɴᴏᴡ ᴘʟᴀʏɪɴɢ: Fireflies by Owl City

───────────────⚪───────────────────

◄◄⠀▐▐ ⠀►►⠀⠀ ⠀ 1:17 / 3:48 ⠀ ───○ 🔊⠀ ᴴᴰ ⚙ ❐ ⊏⊐

Can you believe that these glowing light in the waters are sea fireflies? Everything is indeed never as it seems.

I bet you were awestruck[cod]!

Now, these millions of sea fireflies would like to wave “Hi!” as you go through the blog and get to know the bioluminescent ostracods under genus Vargula.

CLASSIFICATION

Kingdom: Animalia

Subkingdom: Bilateria

Infrakingdom: Protostomia

Superphylum: Ecdysozoa

Phylum: Arthropoda

Subphylum: Crustacea

Class: Ostracoda

Subclass: Myodocopa

Order: Myodocopida

Suborder: Myodocopina

Superfamily: Cypridinoidea

Family: Cypridinidae

Genus: Vargula

Species Name: Vargula annecohenae

(ITIS nd ; Cohen and Morin, 2010)

BIOLOGY

Cod you see me?

Ostracods can be found in basically every aquatic environment ranging from marine, freshwater, and estuarine habitats. These organisms are either swimming in the surface waters or crawling on the sea bed and moist land. Their distribution depends on their adaptations to environmental parameters, mainly salinity and water temperature. Vargula species inhabit the Pacific Ocean and Caribbean Sea coastal landmasses (Wilkinson, 1996; Ogoh & Ohmiya, 2005).

Although they are everywhere, ostracods rarely grow to a few millimeters long; small but (Pechenik, 2015). A single organism can’t be easily seen unless we look closely. Still, they’re small but widespread.

What do you mistake me as?

Ostracoda is an ancient group of crustaceans. Surprised?

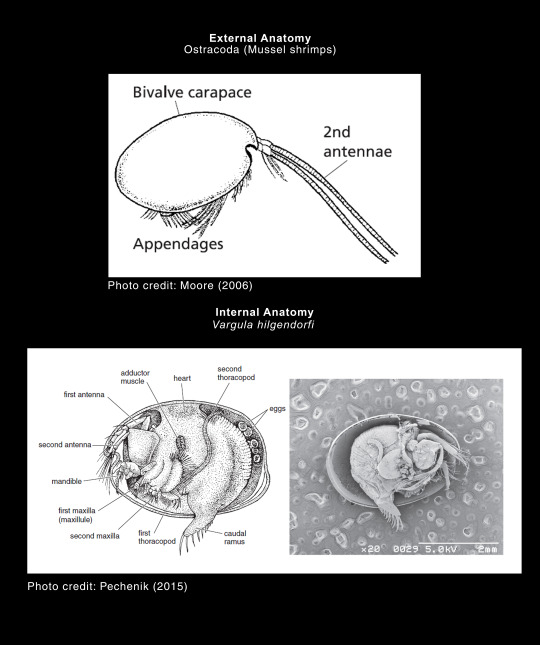

The unsegmented external feature separates them from other crustaceans (Pechenik, 2015). Besides this, they resemble bivalves by having their entire body laterally enclosed inside a pair of partially calcified carapace or shells held by adductor muscles, even during early development; hence, the common name — mussel shrimp (Moore, 2006).

They are also similar to branchiopods Conchostraca (clam shrimps) such as water fleas, but the appendages, lack of growth rings, and smooth swimming of mussel shrimps gave it away. Another feature that differentiates both is the carapace formation. Clam shrimps add material to their carapace as they grow, while mussel shrimps shed their carapace with each molt (UC Museum of Paleontology, 1995).

Mussel shrimps are mostly head which means that the other body parts are greatly reduced. Their trunk is merged to the head. Usually, they have seven pairs of appendages adapted for locomotion, grasping, feeding, cleaning the carapace, or as sense organs. Vargula uses two pairs of antennae for swimming, some species only utilize one pair or the other. Notably, they have setae or tiny hairs protruding through the carapace pores that function for sensory mechanisms (Wilkinson, 1996; Pechenik, 2015).

youtube

A light show to remember

Bioluminescence is often used, but only by males of the species V. annecohenae, for mating displays. Males of each species, like fireflies on land, use distinct patterns of light flashes (seen as a series of dots) that only attract females of the same species. By performing brief dances in which they release short bursts of light as they pass towards the surface of the water, males show off just how sparkling they can be. They start their "dance," which lasts 45 minutes on average, with a stationary period in which brief (second-long or shorter) flashes of bright blue light are produced, attracting the interest of possible female mates. Then in the next process, males spiral up the water column vertically, producing quicker light bursts that are less bright (Gonzales, 2017).

(Courtesy of Gretchen Gerrish)

We compete to procreate

The male grabs onto his newfound partner with his antennae if a male is successful and an interested female arrives, and the pair will mate. Competition is intense, sometimes a woman's attention is won by the brightest male, but males can also impress by synchronizing their lighting display with other males or creeping up and taking a mate from another male (Gonzales,2017).

Life cycle

V. annecohenae has a long life cycle of up to about 1 year. It typically develops slowly for 3 months before adulthood. It has several broods of a few offspring numbering between 10-15, and has no free-living larval stage (Gerrish and Morin, 2008).

Five juvenile instars constitute the life cycle of Photeros annecohenae The life cycle of an ostracod in the genus Vargula (now Photeros) are divided by molts (that occur by the ecdysis) as well as an adult instar that is followed by a final molt (Gerrish and Morin, 2008).

The total growth period of ostracod eggs and embryos in females was 26 days, with an average of 7.84 days for the interval between mating and brood deposition, and an average of 18.4 days for the eventual release from the brood chamber. Eggs initially become evident within the female's body during development. While inside the mother's body, eggs increase in size but exhibit no other noticeable morphological changes. Females discharge fertilized embryos as translucent, spheroidal, or ovoidal masses into the marsupium or brood chamber (Gerrish and Morin, 2008).

(a) One egg of this female has been released into the marsupium and the four remaining eggs are visible in the female ovary. (b) The eggs are extruded into a marsupial brood pouch after 7-8 days. Each egg consists of a large yolk mass at this stage, and the cells inside are barely visible. C) Cell division has created a defined, cloudy cellular mass that fills the egg by day nine in the brood pouch. D) The first apparent structures include the naupliar eye, a red speck, and the intestine as the embryo develops its organs. E) The embryos appear as A-V instars with a large brown eye spot and a fully developed and functioning light organ just before release (Gerrish and Morin, 2008).

I have a sperm bank?

Female V. annecohenae can produce several broods without male re-exposure. suggesting that sperm is stored between broods (Gerrish and Morin, 2008).

I’m a natural

15-17 days after a previous cohort was released new broods can be formed (Gerrish and Morin, 2008).

ECOLOGY

youtube

Ostracods are considered to be useful paleoenvironmental indicators because their ecology is often reflected in the shape and structure of their carapaces and also considering their wide distribution in aquatic environments. They can range from warm waters of the tropics to very cold environments such as polar seas and are found from intertidal zones to many thousands of meters depth in the deep sea. They can also thrive in freshwater niches such as rivers, lakes, and even temporary ponds (Brandão & Karanovic, 2020). Generally, ostracods are characterized as omnivorous scavengers because they mainly feed on tiny organisms like algae, diatoms, bacteria, molds, and pieces of organic detritus that are present in the water or on vegetation. Some ostracods are also predatory. Being relatively smaller, they attack their prey in groups so that they can eat organisms larger than them. However, ostracods are also often preyed by small fishes (MESA, 2020).

youtube

Freshwater ostracods usually have smooth, thin, weakly calcified simple bean-shaped carapaces and feed on diatoms, bacteria, and detritus. On the other hand, pelagic ostracods may also have thin, smooth shells but they have long powerful swimming appendages or antennules. The formation of rostral incisures at the anterior of the carapace of pelagic ostracods allowed freer movement of these appendages. Furthermore, benthic ostracods are commonly detritivores or filter feeders. Their carapace is usually smooth, small, robust, and sometimes elongated because they tend to burrow into the substrate. Epifaunal ostracods have flattened ventral surfaces sometimes with projecting alar wings, frills, keels, or lateral spines while those found on coarser substrates in higher energy environments tend to have more robust heavily ribbed or reticulated carapaces (Olney, 2002).

RELATIONSHIP TO HUMANS

Generally, ostracods are useful for scientific purposes. According to Boomer et al. (2013), ostracods are being used in studies of earth science and related disciplines such as archaeology, ecology, and genetics. This is because ostracods are widely distributed and are easily preservable. Their assemblage and morphology are some of the important ecological proxies. For instance, in recent research conducted by McCormack et al. (2018) wherein ostracods are being used as a bioindicator. Their research has shown the sensitivity of ostracods’ faunal assemblage (Candona sp.) to changes in water salinity and alkalinity in Lake Van.

Next, valves of ostracods are also being used in paleoenvironmental studies. Valves of ostracods are said to absorb trace elements from host waters (Palacios-Fest et al., 1994). This characteristic makes these microcrustaceans ideal models for reconstructing and analyzing past environments that could range from deep-seas to small lakes. Aside from this, the diversity and variety of reproductive modes of ostracods are also one of the main reasons why they are being used as model organisms for laboratory and research studies (Martens & Hornes, 2009).

Moreover, laboratories have started culturing bioluminescent ostracods. The culture of these organisms is done to determine the biosynthetic pathways of bioluminescent substrates that could lead to the discovery of new tools for biotechnology and biomedicine. For instance, in the study conducted by Goodheart et al. (2019) wherein they cultured California Sea Firefly (V. tsuji) for studies regarding the biosynthetic pathway of cypridinid luciferin and genomic manipulation of an autogenic bioluminescent system.

youtube

Serve the Teaaaaa!

The T in Osctracod means Teaaaaa! 5 amazing facts you need to know about ostracods.

1. OLD BUT GOLD

Colymbosathon ecplecticos, a species of ostracod, holds the record of oldest known fossil penis. The historical penis was discovered from a 425 million-year-old rock in England. It was said that a wide variety of animals living in the sea 425 million years ago were killed by an ash fall from a volcanic eruption. However, the ash preserved the animals, including their soft parts. Through technology, the painstaking 3-D reconstructions of a preserved male ostracod revealed amazing details such as the hairs on limbs, gills, and a penis.

2. LIGHT IT UP LIKE A DYNAMITE

youtube

Some species of Myodocopida ostracods produce a bright blue light. These are known in Japan as Umi-Hotaru or sea-fireflies. The light is produced by mixing two chemicals together in the presence of oxygen and is for mating displays. Each species flash at different rates to stop any confusion in the dark. Japanese army collected Umi-Hotaru in baited traps during the Second World War. They dry them out and ground them down to a powder. Adding a small amount of water to the powder produces a low-intensity light used by soldiers to read orders or maps without giving their position away to the enemy during battles.

3. ULTIMATE SURVIVOR

Ostracods can survive being eaten by fish. Experiments with the ostracod Cypridopsis vidua showed that 26% of specimens eaten by small bluegill sunfish came out the other end alive and unharmed. This is possible because ostracods can close their shells very tightly inside their carapace to survive passage through the gut of the fish eventually to be excreted out by the fish.

4. OSTRACODS ARE OMNIPRESENT

Ostracods are found in almost every aquatic habitat, even in some very small and isolated places. They are found deep in the sea, on the shore, on wet leaf litters, springs, groundwaters, puddles, small pools, rice fields, ponds, lakes, and rivers. Some species have a global distribution and are found from the subarctic to the tropics. Their dispersal abilities caused this massive distribution of ostracods. For example, the eggs and adults can hitch a lift on the feet of birds and are displaced because of migration.

5. WE DON’T DIE, JUST DRY

The ostracod eggs can be viable many years after being dried. This is the reason why many freshwater ostracods can be found in temporary water bodies, such as puddles and rice fields. These eggs start to develop and hatch when water is already available in their environment

References

Boomer, I., et al. (2003). The Use of Ostracods in Palaeoenvironmental Studies, or What can you do with an Ostracod Shell? The Paleontological Society Papers. https://doi.org/10.1017/S1089332600002199

Brandão, S.N.; Karanovic, I. (2020). World Ostracoda Database. Accessed at http://www.marinespecies.org/ostracoda on 2020-11-15. doi:10.14284/364

Cohen, A. C.; Morin, J. G. (2010). Two New Bioluminescent Ostracode Genera, Enewton And Photeros (Myodocopida: Cypridinidae), with Three New Species from Jamaica. Journal of Crustacean Biology. 30(1): 1-55., https://doi.org/10.1651/08-3075.1

Gonzales, M.R. (2017). You Light Up My World! Smithsonian. https://ocean.si.edu/ocean-life/invertebrates/you-light-my-world

Goodheart, J., et al. (2019). Laboratory culture of the California Sea Firefly Vargula tsujii (Ostracoda: Cypridinidae): Developing a model system for the evolution of marine bioluminescence. Research Gate. https://www.researchgate.net/publication/334600678_Laboratory_culture_of_the_California_Sea_Firefly_Vargula_tsujii_Ostracoda_Cypridinidae_Developing_a_model_system_for_the_evolution_of_marine_bioluminescence

Gretchen A. Gerrish, James G. Morin, Life Cycle of a Bioluminescent Marine Ostracode, Vargula Annecohenae (Myodocopida: Cypridinidae), Journal of Crustacean Biology, Volume 28, Issue 4, 1 October 2008, Pages 669–674, https://doi.org/10.1651/07-2934.1

Horne, D. J. & Smith, R. J. (2004). First British record of Potamocypris humilis (Sars, 1924), a freshwater ostracod with a disjunct distribution in northern Europe and southern Africa. Bollettino della Societe Paleontologica Italiana, 43 (1-2), 297-306.

Laessle, A. M. 1961. A micro-limnological study of Jamaican Bromeliads. Ecology, 42, 499-517.

Martens, K., and Horne, D.J. (2009). Ostracoda. https://doi.org/10.1016/B978-012370626-3.00184-8

McCormack, J., et al. 2019. Ostracods as ecological and isotopic indicators of lake water salinity changes: the Lake Van example. Biogeosciences, 16, 2095–2114, 2019 https://doi.org/10.5194/bg-16-2095-2019

MESA. 2020. Ostracods. Marine Education Society of Australia. http://www.mesa.edu.au/crustaceans/crustaceans03.asp

Moore, J. (2006). An Introduction to the Invertebrates (2nd ed.). Cambridge University Press.

Morin, J. G. and Cohen, A. C. 1991. Bioluminescent displays, courtship, and reproduction in ostracodes. In R. Bauer and Martin, J. (Eds.), Crustacean Sexual Biology:1 16. New York:Columbia University Press.

Ogoh, K. Ohmiya, Y. (2005). Biogeography of Luminous Marine Ostracod Driven Irreversibly by the Japan Current. Molecular Biology Evolution, 22(7):1543-1545. https://doi.org/10.1093/molbev/msi155]

Olney, M. (2002). Ostracods. Microfossil image recovery and circulation for learning and education. https://www.ucl.ac.uk/GeolSci/micropal/ostracod.html

Palacios-Fest, M.R., et al. (1994). Use of ostracodes as paleoenvironmental tools in the interpretation of ancient lacustrine records. Revista Espanola de Paleontologia 9(2):145-164. https://www.researchgate.net/publication/291990499_Use_of_ostracodes_as_paleoenvironmental_tools_in_the_interpretation_of_ancient_lacustrine_records

Pechenik, J. A. (2015). Biology of Invertebrates (7th ed.). McGraw-Hill Education.

Sars, G. O. 1895. On some South-African Entomostraca raised from dried mud. Skrifter i Videnskabs-selskabet. I. Mathematisk-Naturvidenskabs Klasse 1895 (8): 1-56.

Sars, G. O. 1896. On some west Australian Entomostraca raised from dried sand. Arch. Math. Naturv. 18, 1-35.

Seidel, B. 1989. Phoresis of Cyclocypris ovum (Jurine) (Ostracoda, Podocopida, Cyprididae) on Bombina variegata (L.) (Anura, Amphibia) and Triruris vulgaris (L.) (Urodela, Amphibia). Crustaceana 57, 171-176.

Siveter, D. J., Sutton, M. D., Briggs, D. E. G. & Siveter, D. J. 2003. An ostracod crustacean with soft parts from the Lower Silurian. Science, 302, 1749 - 1751.

UC Museum of Paleontology. (1995). Introduction to the Ostracoda. https://ucmp.berkeley.edu/arthropoda/crustacea/maxillopoda/ostracoda.html

13 notes

·

View notes

Photo

cacall2021’s Top 7 Online Payment Trends You Should Know

We hail from an era that has made tremendous technological advancements in every sector, whether that’s healthcare, fashion, food, sports, financial, etc. However, we will mainly focus on the massive advances made in the financial sector when the whole payment system shifted rapidly to digital mode..

Gone are the days when we used to check our wallets twice before leaving home. All we need is our mobile phone to make digital payments, or smartwatches can also do the work. Digital payment has attracted billions globally, even before the pandemic scenario. However, it acted as a turning point from 2020 where people wanted to make contactless payments and maintain social distance..

Contact-free payment tech became the safer option for people enabling the global online payment industry to hit USD 5.4 trillion in 2020. Digitalization has given people the opportunity to make faster payments with convenience and security. Cashless payment systems are putting in more effort to make the payment systems safer and secure.

Mobile app development companies are looking towards some more advancements to the current digital payment systems. Well, here are some of the best 2021 trends you want to know to boost your company’s success.

Top Cashless Payment Trends to Change the Dynamics of FinTech Industry

1. EMV Technology Shifting from reading the number printed on the cards, EMV tech is more secure. Europay, Mastercard, Visa (EMV) tech is a new payment method computerized and has higher security measures. Conventional magstripe cards stored all the data in a single magnetic strip, and one swipe was adequate to complete the transaction. Simultaneously, EMV cards have microprocessor smart chips with encoded data to save you from being scammed.

EMV is a super-advanced tech to finish transactions in offline mode too. Since the cards have microprocessors to interact with terminals, cardholder validation & offline transaction validation is possible. Enhanced security with no need for internet connectivity to the banks makes this new payment system one of the top payment trends.

2. Smart Speakers

With the revolution in payment technology, voice assistants are used to paying the dues. Smart speakers receive your voice command & answer your queries. Everything is possible, from booking a taxi to ordering food with these incredible speakers. All you need is to order Alexa, and the payment is made! Home assistants can be used to shop for products like groceries, home care, clothing, etc.

As per Business Insider, the use of smart speakers will rise from 18.4 million users in 2017 to 77.9 million users in 2022.

3, Biometric Verification

This is one of the most anticipated technologies of the online payment world. Biometrics authentication methods can make payments safely and securely. The biological & structural attributes of a human will help the system to verify him/her. The digital payment will be made after evaluating the biometrics through face recognition, heartbeat analysis, iris recognition, vein mapping, and fingerprint scanning.

This verification system can prevent thefts and frauds. Biometric authentication will secure the Tap-and-Go payment method with improved security in place. Efficiency, accuracy, & security are the three tiers of this payment trend..

4. mPOS Payment Technology

mPOS stands for mobile point-of-sale, and its demand is rising each day. Everyone is looking ahead on accepting payment through this mobile, be it a retail store or any street merchant. An mPOS is movable and can be plugged into the charging ports of smartphone devices.

A great mPOS tech can gather data and help you in expanding your business. This payment tech can make a substantial difference in making your business more efficient & well-organized. According to Global Market Insights, a CAGR of 19% is expected between 2020 to 2026. 5. Artificial Intelligence & Machine Learning-based Payments AI and ML are the future of the payment industry. The most crucial aspect of every payment method is to be secure and safe. AI integration into the payment system can guarantee convenience and safety. An online payment system can have chatbots to offer 24*7 assistance to the users and respond to their queries. AI-based digital payment tech can flag unusual bills and tips that are higher than normal. AI eliminates the need for payment verification from banks. Amazon’s Deepens Tech eliminates the need to visit the cashier to bill your items.

6. e-Wallet Solutions

As reported by RetailDive, approximately 2.1 billion customers were using e-wallets in 2019. Mobile wallets are the new payment method acting as a virtual wallet, saving a person’s payment information on the smart device. You can send & receive funds virtually through a digital payment system. Transactions take no more time than a single tap, consuming less energy and time compared to net banking. Some of the advantages of this payment system include getting discounts, gift cards, vouchers, and great deals.

7. NFC Technology

You can pay money through your smartphone or credit card without having any physical contact. Besides being quick, smartphones or credit card systems ensure safety from viruses and bacteria. NFC (Near field communication) tech powers contactless payments through RFID (radio frequency identification).

A particular radio frequency enables the payment to be made via smartphone or card when the payment reader device and the payment tools are close to each other. Contactless payments are safer than magnetic stripe cards. These strips use obsolete tech, which is easily prone to become the victim of frauds and identity thefts.

Digital Payment Methods Will Continue To Boom

Digital payment tech, with the help of the top app development companies are reshaping the fintech industry. Several companies are investing heavily to make online payment systems more advanced and secure worldwide. There are several benefits of using these new payment methods, and in 2021 we may come across more. While digital payment trends will continue to boom, we must remember that the essential aspect is ‘Security.’

1 note

·

View note

Text

30 Amazing Things You Didn’t Know About American Express

American Express, the American worldwide money related organization is prevalent in the United States as well as everywhere throughout the world. Prevalently alluded to as Amex, the organization is renowned for its Visas, voyager’s check and charge card.

On the off chance that you as of now an esteemed client of the organization or intending to add an Amex card to your wallet, here are 30 stunning things that you didn’t think about American Express:

1. It was with the merger of three expedited delivery organizations that the American Express was shaped in 1850. The three organizations, Wells and Company was possessed by Henry Well, Livingston, Fargo and Company claimed by William Fargo and the third organization was Wells, Butterfield and Company, which was possessed by John Warren Butterfield.

2. A few executives of the American Express were against growing the business to California. It was then that Henry Wells and William Fargo shaped Wells Fargo in the year 1852.

3. Today, American Express is generally prominent in the card business. Be that as it may, it was following 108 years of its beginning that it forayed into this fragment.

4. In the year 1891, American Express propelled the explorer’s check, which was very mainstream till the 1990s. Nonetheless, after the presentation of the electronic installment strategy, the utilization of Traveler’s check saw a decrease in its necessity.

5. From the year 1981 to 1994, the organization was associated with the speculation banking part. Be that as it may, in 1994, it sold off the fragment as Lehman Brothers Holding Inc.

6. As a team with Warner Communication, American Express made the broadcasting companies, MTV, The Movie Channel and furthermore Nickelodeon in the year 1979. Inside 5 years, the benefits were anyway sold to Viacom.

7. American Express has in excess of 110 million cards. What’s more, each card has a normal spending of $17,216, which records for just 23 percent of the all out volume of charge card exchange in the United States.

8. American Express offers the most top of the line charge card, the Centurion, which requires an inception expense of $7500 and the yearly charges is $2500. Another esteemed card from the organization is the American Express Platinum card, which was presented in the year 1984.

9. American Express is among the most important brands on the planet and its name alone is esteemed to be worth $18.4 billion.

10. Warren Buffett is one of the real financial specialists and keeps on being with Amex, despite the fact that its plan of action is enduring an onslaught.

11. American Express offers enormous sign-up reward to new clients. The organization forcefully attempts to lure clients to unite the family with these rewards.

12. American Express has application rules, under which an individual can apply for a charge card each 5 days moving period however for 90 days moving period, they can have two affirmed Mastercards.

13. For business Visas, American Express does not answer to the individual credit department.

14. Amex used to postpone off the yearly charges for clients who drop their card inside a month’s time. Be that as it may, since a year ago, this office has been halted.

15. For American Express cards, you can get an a lot higher credit limit, which is multiple times of the credit furthest reaches that you began at.

16. It is just ideal that you can get the sign-up reward from American Express. In this way, it is best that before you apply, look at the sign-up rewards and consider on the off chance that it is the best arrangement that you are getting.

17. With an American Express Visa, you can reallocate as far as possible online by moving it from a card that you once in a while use and the one that you much of the time use.

18. On the off chance that inside several days of joining, you see a higher sign-up reward being offered for a similar card, the organization will offer you generosity focuses once you demand, But, the reward won’t be something that you will get.

19. In the event that your Amex card has been declined, you can call for reevaluation. You will be posed a few inquiries before you get an endorsement from American Express.

20. On the off chance that your American Express card has a high yearly expense, you can look for downsizing. With this, you can pick a card that has zero yearly charges however offers participation reward focuses.

21. It is a smart thought to call up American Express every 90 days to enquire about ideas for you. They truly do have some extraordinary ideas for their cardholders, yet you should get up to discover.

22. Consistently, American Express maintains the Small Business Saturday battle. The point is to pull in little shippers with the goal that they begin tolerating the Amex cards. Offers like $10 buys or free treats are advertised.

23. For Mastercards from American Express, you can have a limit of 4 cards whenever. In any case, this standard does not have any significant bearing to charge cards, which you can have the same number of as you like.

24. Some fortunate clients can get their new charge card numbers right away, which means when you have your card endorsed. Notwithstanding, it is a fortunate draw, some get it, however other don’t.

25. Regardless of whether you have a current card with American Express, the organization can dismiss your application for another card.

26. On the off chance that Amex neglects to give you as far as possible at the time guaranteed, the organization will offer you a reward to compensate for the fizzled guarantee. However, you should put over your solicitation to get it.

27. You can have your record reestablished subsequent to having your American Express card shut and that too absent much force. Be that as it may, you should put over your solicitation inside 30 days.

28. Intermittently American Express ideas up-degree rewards or offers to its card holders.

29. For including an approved client card, American Express may offer you a reward. Do make sure to check for such offers.

30. For lost or stolen charge cards, American Express will accelerate the transportation of the cards. In spite of the fact that this is consequently connected for some excellent items, you should check if your card is material to get such an office.

1 note

·

View note

Text

30 Amazing Things You Didn’t Know About American Express

American Express, the American worldwide money related organization is prevalent in the United States as well as everywhere throughout the world. Prevalently alluded to as Amex, the organization is renowned for its Visas, voyager’s check and charge card.

On the off chance that you as of now an esteemed client of the organization or intending to add an Amex card to your wallet, here are 30 stunning things that you didn’t think about American Express:

1. It was with the merger of three expedited delivery organizations that the American Express was shaped in 1850. The three organizations, Wells and Company was possessed by Henry Well, Livingston, Fargo and Company claimed by William Fargo and the third organization was Wells, Butterfield and Company, which was possessed by John Warren Butterfield.

2. A few executives of the American Express were against growing the business to California. It was then that Henry Wells and William Fargo shaped Wells Fargo in the year 1852.

3. Today, American Express is generally prominent in the card business. Be that as it may, it was following 108 years of its beginning that it forayed into this fragment.

4. In the year 1891, American Express propelled the explorer’s check, which was very mainstream till the 1990s. Nonetheless, after the presentation of the electronic installment strategy, the utilization of Traveler’s check saw a decrease in its necessity.

5. From the year 1981 to 1994, the organization was associated with the speculation banking part. Be that as it may, in 1994, it sold off the fragment as Lehman Brothers Holding Inc.

6. As a team with Warner Communication, American Express made the broadcasting companies, MTV, The Movie Channel and furthermore Nickelodeon in the year 1979. Inside 5 years, the benefits were anyway sold to Viacom.

7. American Express has in excess of 110 million cards. What’s more, each card has a normal spending of $17,216, which records for just 23 percent of the all out volume of charge card exchange in the United States.

8. American Express offers the most top of the line charge card, the Centurion, which requires an inception expense of $7500 and the yearly charges is $2500. Another esteemed card from the organization is the American Express Platinum card, which was presented in the year 1984.

9. American Express is among the most important brands on the planet and its name alone is esteemed to be worth $18.4 billion.

10. Warren Buffett is one of the real financial specialists and keeps on being with Amex, despite the fact that its plan of action is enduring an onslaught.

11. American Express offers enormous sign-up reward to new clients. The organization forcefully attempts to lure clients to unite the family with these rewards.

12. American Express has application rules, under which an individual can apply for a charge card each 5 days moving period however for 90 days moving period, they can have two affirmed Mastercards.

13. For business Visas, American Express does not answer to the individual credit department.

14. Amex used to postpone off the yearly charges for clients who drop their card inside a month’s time. Be that as it may, since a year ago, this office has been halted.

15. For American Express cards, you can get an a lot higher credit limit, which is multiple times of the credit furthest reaches that you began at.

16. It is just ideal that you can get the sign-up reward from American Express. In this way, it is best that before you apply, look at the sign-up rewards and consider on the off chance that it is the best arrangement that you are getting.

17. With an American Express Visa, you can reallocate as far as possible online by moving it from a card that you once in a while use and the one that you much of the time use.

18. On the off chance that inside several days of joining, you see a higher sign-up reward being offered for a similar card, the organization will offer you generosity focuses once you demand, But, the reward won’t be something that you will get.

19. In the event that your Amex card has been declined, you can call for reevaluation. You will be posed a few inquiries before you get an endorsement from American Express.

20. On the off chance that your American Express card has a high yearly expense, you can look for downsizing. With this, you can pick a card that has zero yearly charges however offers participation reward focuses.

21. It is a smart thought to call up American Express every 90 days to enquire about ideas for you. They truly do have some extraordinary ideas for their cardholders, yet you should get up to discover.

22. Consistently, American Express maintains the Small Business Saturday battle. The point is to pull in little shippers with the goal that they begin tolerating the Amex cards. Offers like $10 buys or free treats are advertised.

23. For Mastercards from American Express, you can have a limit of 4 cards whenever. In any case, this standard does not have any significant bearing to charge cards, which you can have the same number of as you like.

24. Some fortunate clients can get their new charge card numbers right away, which means when you have your card endorsed. Notwithstanding, it is a fortunate draw, some get it, however other don’t.

25. Regardless of whether you have a current card with American Express, the organization can dismiss your application for another card.

26. On the off chance that Amex neglects to give you as far as possible at the time guaranteed, the organization will offer you a reward to compensate for the fizzled guarantee. However, you should put over your solicitation to get it.

27. You can have your record reestablished subsequent to having your American Express card shut and that too absent much force. Be that as it may, you should put over your solicitation inside 30 days.

28. Intermittently American Express ideas up-degree rewards or offers to its card holders.

29. For including an approved client card, American Express may offer you a reward. Do make sure to check for such offers.

30. For lost or stolen charge cards, American Express will accelerate the transportation of the cards. In spite of the fact that this is consequently connected for some excellent items, you should check if your card is material to get such an office.

1 note

·

View note

Text

30 Amazing Things You Didn't Know About American Express

American Express, the American global money related organization is prominent in the United States as well as everywhere throughout the world. Prevalently alluded to as Amex, the organization is renowned for its Mastercards, explorer's check and charge card.

On the off chance that you as of now an esteemed client of the organization or intending to add an Amex card to your wallet, here are 30 astounding things that you didn't think about American Express:

1. It was with the merger of three expedited delivery organizations that the American Express was shaped in 1850. The three organizations, Wells and Company was possessed by Henry Well, Livingston, Fargo and Company claimed by William Fargo and the third organization was Wells, Butterfield and Company, which was possessed by John Warren Butterfield.

2. A few chiefs of the American Express were against extending the business to California. It was then that Henry Wells and William Fargo framed Wells Fargo in the year 1852.

3. Today, American Express is generally well known in the card business. In any case, it was following 108 years of its origin that it forayed into this fragment.

4. In the year 1891, American Express propelled the voyager's check, which was amazingly well known till the 1990s. Be that as it may, after the presentation of the electronic installment strategy, the utilization of Traveler's check saw a decrease in its necessity.

5. From the year 1981 to 1994, the organization was associated with the speculation banking segment. In any case, in 1994, it sold off the portion as Lehman Brothers Holding Inc.

6. As a team with Warner Communication, American Express made the telecom companies, MTV, The Movie Channel and furthermore Nickelodeon in the year 1979. Inside 5 years, the benefits were anyway sold to Viacom.

7. American Express has in excess of 110 million cards. Furthermore, each card has a normal spending of $17,216, which records for just 23 percent of the all out volume of Mastercard exchange in the United States.

8. American Express offers the most top of the line Visa, the Centurion, which requires a commencement expense of $7500 and the yearly charges is $2500. Another lofty card from the organization is the American Express Platinum card, which was presented in the year 1984.

9. American Express is among the most profitable brands on the planet and its name alone is esteemed to be worth $18.4 billion.

10. Warren Buffett is one of the significant financial specialists and keeps on being with Amex, despite the fact that its plan of action is enduring an onslaught.

11. American Express offers colossal sign-up reward to new clients. The organization forcefully attempts to allure clients to unite the family with these rewards.

12. American Express has application rules, under which an individual can apply for a Visa each 5 days moving period yet for 90 days moving period, they can have two endorsed Visas.

13. For business Visas, American Express does not answer to the individual credit department.

14. Amex used to postpone off the yearly charges for clients who drop their card inside a month's time. Nonetheless, since a year ago, this office has been ceased.

15. For American Express cards, you can get an a lot higher credit limit, which is multiple times of the credit furthest reaches that you began at.

16. It is just unique that you can get the sign-up reward from American Express. Thus, it is best that before you apply, look at the sign-up rewards and consider in the event that it is the best arrangement that you are getting.

17. With an American Express Mastercard, you can reallocate as far as possible online by moving it from a card that you seldom use and the one that you often use.

18. In the event that inside two or three days of joining, you see a higher sign-up reward being offered for a similar card, the organization will offer you generosity focuses once you demand, But, the reward won't be something that you will get.

19. On the off chance that your Amex card has been declined, you can call for reevaluation. You will be posed a few inquiries before you get an endorsement from American Express.

20. On the off chance that your American Express card has a high yearly charge, you can look for minimizing. With this, you can pick a card that has zero yearly charges yet offers participation reward focuses.

21. It is a smart thought to call up American Express every 90 days to enquire about ideas for you. They truly do have some incredible ideas for their cardholders, however you should get up to discover.

22. Consistently, American Express maintains the Small Business Saturday crusade. The point is to draw in little vendors with the goal that they begin tolerating the Amex cards. Offers like $10 buys or free treats are advertised.

23. For Visas from American Express, you can have a limit of 4 cards whenever. Be that as it may, this standard does not make a difference to charge cards, which you can have the same number of as you like.

24. Some fortunate clients can get their new Mastercard numbers in a split second, which means when you have your card affirmed. In any case, it is a fortunate draw, some get it, yet other don't.

25. Regardless of whether you have a current card with American Express, the organization can dismiss your application for another card.

26. On the off chance that Amex neglects to give you as far as possible at the time guaranteed, the organization will offer you a reward to compensate for the fizzled guarantee. Be that as it may, you should put over your solicitation to get it.

27. You can have your record restored in the wake of having your American Express card shut and that too absent much force. Be that as it may, you should put over your solicitation inside 30 days.

28. Occasionally American Express ideas up-degree rewards or offers to its card holders.

29. For including an approved client card, American Express may offer you a reward. Do make sure to check for such offers.

30. For lost or stolen Visas, American Express will accelerate the delivery of the cards. Despite the fact that this is consequently connected for some excellent items, you should check if your card is relevant to get such an office.

1 note

·

View note

Text

30 Amazing Things You Didn't Know About American Express

American Express, the American worldwide money related organization is prevalent in the United States as well as everywhere throughout the world. Prevalently alluded to as Amex, the organization is renowned for its Visas, voyager's check and charge card.

On the off chance that you as of now an esteemed client of the organization or intending to add an Amex card to your wallet, here are 30 stunning things that you didn't think about American Express:

1. It was with the merger of three expedited delivery organizations that the American Express was shaped in 1850. The three organizations, Wells and Company was possessed by Henry Well, Livingston, Fargo and Company claimed by William Fargo and the third organization was Wells, Butterfield and Company, which was possessed by John Warren Butterfield.

2. A few executives of the American Express were against growing the business to California. It was then that Henry Wells and William Fargo shaped Wells Fargo in the year 1852.

3. Today, American Express is generally prominent in the card business. Be that as it may, it was following 108 years of its beginning that it forayed into this fragment.

4. In the year 1891, American Express propelled the explorer's check, which was very mainstream till the 1990s. Nonetheless, after the presentation of the electronic installment strategy, the utilization of Traveler's check saw a decrease in its necessity.

5. From the year 1981 to 1994, the organization was associated with the speculation banking part. Be that as it may, in 1994, it sold off the fragment as Lehman Brothers Holding Inc.

6. As a team with Warner Communication, American Express made the broadcasting companies, MTV, The Movie Channel and furthermore Nickelodeon in the year 1979. Inside 5 years, the benefits were anyway sold to Viacom.

7. American Express has in excess of 110 million cards. What's more, each card has a normal spending of $17,216, which records for just 23 percent of the all out volume of charge card exchange in the United States.

8. American Express offers the most top of the line charge card, the Centurion, which requires an inception expense of $7500 and the yearly charges is $2500. Another esteemed card from the organization is the American Express Platinum card, which was presented in the year 1984.

9. American Express is among the most important brands on the planet and its name alone is esteemed to be worth $18.4 billion.

10. Warren Buffett is one of the real financial specialists and keeps on being with Amex, despite the fact that its plan of action is enduring an onslaught.

11. American Express offers enormous sign-up reward to new clients. The organization forcefully attempts to lure clients to unite the family with these rewards.

12. American Express has application rules, under which an individual can apply for a charge card each 5 days moving period however for 90 days moving period, they can have two affirmed Mastercards.

13. For business Visas, American Express does not answer to the individual credit department.

14. Amex used to postpone off the yearly charges for clients who drop their card inside a month's time. Be that as it may, since a year ago, this office has been halted.

15. For American Express cards, you can get an a lot higher credit limit, which is multiple times of the credit furthest reaches that you began at.

16. It is just ideal that you can get the sign-up reward from American Express. In this way, it is best that before you apply, look at the sign-up rewards and consider on the off chance that it is the best arrangement that you are getting.

17. With an American Express Visa, you can reallocate as far as possible online by moving it from a card that you once in a while use and the one that you much of the time use.

18. On the off chance that inside several days of joining, you see a higher sign-up reward being offered for a similar card, the organization will offer you generosity focuses once you demand, But, the reward won't be something that you will get.

19. In the event that your Amex card has been declined, you can call for reevaluation. You will be posed a few inquiries before you get an endorsement from American Express.

20. On the off chance that your American Express card has a high yearly expense, you can look for downsizing. With this, you can pick a card that has zero yearly charges however offers participation reward focuses.

21. It is a smart thought to call up American Express every 90 days to enquire about ideas for you. They truly do have some extraordinary ideas for their cardholders, yet you should get up to discover.

22. Consistently, American Express maintains the Small Business Saturday battle. The point is to pull in little shippers with the goal that they begin tolerating the Amex cards. Offers like $10 buys or free treats are advertised.

23. For Mastercards from American Express, you can have a limit of 4 cards whenever. In any case, this standard does not have any significant bearing to charge cards, which you can have the same number of as you like.

24. Some fortunate clients can get their new charge card numbers right away, which means when you have your card endorsed. Notwithstanding, it is a fortunate draw, some get it, however other don't.

25. Regardless of whether you have a current card with American Express, the organization can dismiss your application for another card.

26. On the off chance that Amex neglects to give you as far as possible at the time guaranteed, the organization will offer you a reward to compensate for the fizzled guarantee. However, you should put over your solicitation to get it.

27. You can have your record reestablished subsequent to having your American Express card shut and that too absent much force. Be that as it may, you should put over your solicitation inside 30 days.

28. Intermittently American Express ideas up-degree rewards or offers to its card holders.

29. For including an approved client card, American Express may offer you a reward. Do make sure to check for such offers.

30. For lost or stolen charge cards, American Express will accelerate the transportation of the cards. In spite of the fact that this is consequently connected for some excellent items, you should check if your card is material to get such an office.

1 note

·

View note

Text

Reiwa era yen bills -- a speed bump on the road to the cashless future

It is rather odd of the Japanese government to mark the start of a new Imperial era with the launch of something as old-fashioned as a bank note at a time when it keen to encourage a switch to a cashless society.

After all, Japan is already well behind China and other Asian neighbors in changing out of cash and into electronic payments.

Moreover, the newly-designed bills of 1,000, 5,000 and 10,000 yen will not go into circulation until 2024. Surely, there is some element of the switch to cashless that could have been launched to coincide with the new Emperor's reign. A new cashless card, perhaps.

The process needs every encouragement. Admittedly, the ratio of the value of cashless payments in total household payments has risen from 11.9% in 2008 to 18.4% in 2015 according to the latest government report. But this falls well short of 55% in China in 2015, which is fast-emerging a global driver of change in this crucial sector. The Japanese government is targeting 40% but only by 2027.

The problems involved in Japan's high dependence on cash have been highlighted by the recent surge in inbound tourists, led by visitors from China. Where Japanese consumers are cautious about changing to payment cards or apps, their Chinese counterparts show unbounded enthusiasm and are genuinely puzzled when confronted by cash-only Japanese vendors. They don't seem to worry about privacy and security, about which Japanese people are often obsessive.

The Japanese attachment to cash is born of safety and convenience. Living in a country with little street crime and limited experience of counterfeiting money, consumers have not had to consider alternatives. Banks, largely protected from full-blooded competition by rules and traditions, have invested heavily in a convenient network of ATMs, which retailers have supplemented with their own machines, making 200,000 altogether.

The fact that Japanese consumers are rapidly aging means that old habits are dying particularly hard in this country.

But Japan cannot afford to ignore economic reality. Cash involves a costly supply chain. As the nation faces a severe labor crunch, the stubborn adherence to cash eats up valuable labor which could be put to more productive use elsewhere -- including in fintech-based financial innovation.

Consider a classic beverage vending machine. Not only do the operators fill each machine with cans, they must also collect the cash at the end of a day, bring the cash-filled bag back to their offices, run the coins through coin counters, record the amounts then carry the sorted cash to a bank branch solemnly accompanied by security guards. All this manual labor with little value-added in a country with notoriously high labor costs.

The cost associated to operating physical cash is estimated to be over 2 trillion yen annually, equivalent to 0.4% of national gross domestic product. The technology to replace it already exists.

It is not that Japan has made no progress toward digital payments. For example, the IC cash cards issued by railway companies together have reached 130 million in 2016, slightly over the Japanese population. Since the first launch in 2001, their use has expanded from transport tickets to retail and food.

The use of IC cash cards issued by railway companies has expanded from transport tickets to retail and food. (Photo by Kosaku Mimura)

It is so convenient that as a Tokyo resident I feel comfortable with a travel card even if I accidentally leave my purse at home. Within limits, we Japanese love convenience. The cashless future is already here. It is just not well distributed.

What then can we do to accelerate trend toward cashless? We would be fooling ourselves to think that change will be uniformly smooth.

Cash will survive as the most reliable currency in mom-and-pop stores which are still common in Japan, even in Tokyo. It is not worth the investment for small individual outlets to install a new card-reading device or pay margins as high as 3% on their limited turnover. Particularly in remote regions, conservative older consumers will not likely be swayed by shorter waiting times in checkout queues to switch to payment by cards or mobile apps.

Frankly, I do not see this as particularly bad, at the margin. Cash is a comfort for the digitally-challenged and the elderly. If everything is done to minimize economic friction, would life be as varied as it is today? For tourists, including foreigners, one of the charms of a visiting a quaint old town, is the chance to indulge in its quaint customs. Including paying by cash.

Meanwhile, big businesses which stand to gain the most from operational efficiency by going cashless will most quickly recoup the investment. The boldest will go for no-cash outlets, with some food service operators already starting trials. While such moves may alienate a few cash loyalists, they will cut costs and even increase sales among the go-ahead urbanites attracted by the novelty.

Furthermore, large retailers can leverage cashless to deepen bonds with consumers. Cashless means an end to total anonymity. Analyzing customers' transaction histories, even on an anonymous basis, will enable tailored offerings and discounts which maximize commercial opportunities.

For now, many urban retailers offer multiple transaction methods including cash and cashless. But as long as they maintain the cash option, the back-end operations will be tied to cash, and its inefficiencies.

The government can encourage consumers to go 100% cashless, for example by prodding people to pay for public services without cash. The Singaporean government, for example, offers QR code options for paying fines. Meanwhile, in a perverse twist, the new bills may just do that. Daunted with the new investment required to update machines such as bill counters, retailers may seize the chance to get rid of cash altogether. Similarly banks may accelerate the rate of scrapping ATMs, a process that has already started.

The ultimate goal is a better, more modern, shopping experience for consumers and lower operating costs for retailers. But for many years to come, Japan will remain a mixture of traditional and modern. So, it was a shame it missed an opportunity to promote the future. But hardly a surprise.

-Nobuko Kobayashi

2 notes

·

View notes

Text

Just like I thought, the cat completely ignores my demands. Now I’m pissed. I complain out loud to myself as I go upstairs.

Wade: I hate cats! I f’ing hate cats!

I haven’t seen Hiro since the stupid thing arrived. Hiro probably hates cats, too.

I can still hear Maia in the shower. I angrily flop down on the bed to wait for her, planning what I want to say when she enters the room. I could start with something like, ‘Look, Maia, I don’t think this whole cat thing will work. You can stay, but the cat - ‘ Hot damn!

Suddenly Maia enters the room with nothing on but a few drops of water from the shower and a smile. It’s the most beautiful thing I’ve ever seen, and I suddenly can’t remember what the hell I was just thinking. Watcher, have mercy.

30 notes

·

View notes

Text

New Post has been published on Cryptonewz.com

New Post has been published on http://cryptonewz.com/finance-and-beyond-an-infographic-map-of-bitcoin-and-the-emerging-blockchain-ecosystem/

Finance and Beyond: An Infographic Map of Bitcoin and the Emerging Blockchain Ecosystem

This popular article and its infographic, originally published on November 15, 2015, have been updated by Michael Gord to reflect the major developments since then in the world of Bitcoin and blockchain. In the fall of 2015, BitPay and BTC Media (parent company of Bitcoin Magazine) commissioned Josh Dykgraaf, an artist based in Amsterdam who specializes in 3D and photo illustrations, to design an infograph as a guide to navigating the emerging Bitcoin and blockchain ecosystem. The infographic has been so popular, and the growth in the ecosystem so dynamic, that BTC Media commissioned Dykgraaf to create an updated poster which made its debut in March at SXSW®, and is available as a digital download (JPEG, PDF) or printed copy.

On January 3, 2009, the Genesis block, or the first block in the Bitcoin blockchain, was created. In the coinbase parameter, there was a simple message: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” From that one block, Bitcoin was born.

Bitcoin has come a long way from that initial statement by Bitcoin’s pseudonymous founder, Satoshi Nakamoto. The technology is growing up and changing, from its early days as a project adopted by impassioned technologists and libertarians to a technology widely researched and used by financial institutions worldwide.

Bitcoin had a rough road ahead of it, as did many early technologies, including the Internet. It dealt with newspaper headlines lambasting Bitcoin because of its connection to Silk Road and drugs. Early adopters suffered millions of dollars in losses when early exchange Mt. Gox imploded. “Bitcoin is Dead,” many prophesied.

And yet, as Bitcoin approaches its eighth birthday, we see things changing. It is turning into that curious, wide-eyed technology with ideas as widespread as any normal eight-year-old. Cross-border payments, machine-to-machine transactions, smart contracts, microtransactions and stock settlements all have been discussed and developed. Nothing is off limits; no question goes unasked.

From the early days of mining using a laptop computer, now Bitcoin miners have industrial-sized data centers with hundreds of thousands of high-powered, specialized machines. In January 2014, the Bitcoin network hashrate was only 10 million GH/s. Today, it is more than 1 billion GH/s and growing quickly as new mining machines are built and sold. Around January 2014, there were around 50,000 Bitcoin transactions daily. That measure of network utility has increased to more than 200,000 Bitcoin transactions daily.

A big part of this growth in transactions is linked to the growth in Bitcoin-accepting merchants. In mid-2014, there were approximately 65,000 merchants who accepted Bitcoin. Now, there are more than 100,000, which represents a 50 percent increase. TigerDirect, a publicly traded online electronics retailer, has seen incredible results. Of all the buyers that used Bitcoin, 46 percent of them were brand new to TigerDirect. Further, orders placed with Bitcoin were 30 percent larger.

BitPay, a Bitcoin payment processor, also has seen a significant increase in volume. It announced in a blog post written at the beginning of 2016 that it has experienced a transactional increase of 50 percent in the last two months and an increase of 110 percent in the past 12 months. BitPay also saw record-breaking months for Bitcoin transactions in November and December of 2015, with more than 100,000 BitPay invoices processed each month. BitPay explains in the post, “At these rates, every 25 seconds a shopper somewhere in the world was spending Bitcoin at a BitPay merchant.” In Latin America, total transactions were up 1,747 percent in 2015. Bitcoin as a tool of transaction is growing.

Bitcoin as an asset class is also maturing. For the majority of 2015, the price stayed relatively nonvolatile and constant, fluctuating between $200 and $300. It was only toward the end of 2015 that the price experienced a significant increase, reminiscent of the early years, to finish the year as the world’s top performing currency (down from -67 percent in 2014 to +35 percent in 2015). From January 1, 2013 to January 1, 2014, the price went from $13.41 to $808.05, going as high as $1,147.25 on December 4. Just one month earlier, on November 4, 2013, the price was $225.20. Even the “bubbles” in Bitcoin are maturing. On the other hand, the market cap of Bitcoin is down from an all-time high of nearly $14 billion to around $6.5 billion at the time of writing.

Venture capital funding continues to pour into the space. In 2013, Bitcoin companies raised only $93.8 million. In 2014, firms raised $314.7 million. In 2015, Bitcoin and blockchain companies raised more than $1 billion.

Regulations are also changing. Before, there were politicians decrying Bitcoin because of its use on the underground marketplace Silk Road. Now, organizations such as Coin Center and the Chamber of Digital Commerce work to help these politicians and regulators draft rules that will ensure Bitcoin can continue to grow worldwide. New York has led the regulatory charge with its recent BitLicense initiative. The European Union also recently ruled that Bitcoin was not subject to VAT, providing significant clarity for those participating in the ecosystem.

Finally, the development of blockchain companies and enterprise solutions continues to grow. In 2015, Bitcoin and blockchain enterprise development generated over $1 billion in capital investments, with the first quarter of the year surpassing the total amount of funding for the entire previous 12 months. To date, more than 65 banks and financial institutions have made investments in the industry, and businesses in diverse fields ranging from health care to insurance to global supply chain trade networks have entered the arena.

The year 2016 has seen Augur, a decentralized prediction market, announce that it had raised $5.1 million in a crowdsale. Ethereum, the smart contract and publishing platform, raised $18.4 million in its own crowdsale. It is expected that OpenBazaar, the completely decentralized peer-to-peer ecommerce site, will launch in the coming months. Blockchain technology is rapidly ushering in a new world of data integrity that will impact industry and commerce on a magnitude comparable to the dawning of the Internet.

Bitcoin is not just on the fringes anymore; it is becoming mainstream. Whether it’s miners, payment processors, wallets, developer tools, large-enterprise blockchain solutions or innovative new fintech accelerators, the reality is simple. Bitcoin and its blockchain are growing up. And the future they are opening to the world is as vast as that unlocked by any of the greatest technologies in history.

The post Finance and Beyond: An Infographic Map of Bitcoin and the Emerging Blockchain Ecosystem appeared first on Bitcoin Magazine.

1 note

·

View note

Photo

Water Container (Mizusashi) with Grasses, late 1500s–early 1600s, Cleveland Museum of Art: Japanese Art

Mizusashi are jars used to hold water for the preparation of tea at tea gatherings. This one was produced in the Mino area of present-day Gifu prefecture in central Japan, and is considered one of the finest of its type in existence, based on the complex aesthetic sensibilities developed around the tea ceremony in Japan. It is called a “picture Shino” (e-shino) mizusashi, as it has an abstracted design said to resemble an ink painting of reeds along a river bank and small boats in a river on one side, and a geometric pattern on the other. With its irregular shape and thick, luminous glaze, it is of a variety favored by eminent tea masters of the Momoyama period.

Size: Diameter: 19.6 cm (7 11/16 in.); Lid: 2.9 x 14.7 cm (1 1/8 x 5 13/16 in.); Container: 18.4 cm (7 1/4 in.)

Medium: Stoneware with underglaze iron oxide slip decoration (Mino ware, Shino type)

https://clevelandart.org/art/1972.9

18 notes

·

View notes

Text

Traffic returning to pre-Covid levels after bank holiday rush, says AA

The return of music festivals, international travel restrictions and scepticism about the safety of public transport will lead to 18.4 million car journeys being made over the three days, according to the motoring association.

The number of cars on the road will increase by 37% on last year’s August Bank Holiday weekend total, according to the AA, after 2020 was severely affected by coronavirus restrictions. สล็อตออนไลน์

0 notes

Text

3 Stocks to Cash in on Higher Consumer Borrowing This Year

Consumer borrowing increased 10% in May, according to the latest Fed report. That $ 35.28 billion increase was well above market projections of $ 18.4 billion. In March and April consumer credit rose 5.5% and 5.7%, respectively.

The components of total borrowing, which are composed of non-revolving and revolving loans, increased by 9.5% and 11.4%, respectively. Non-revolving loans include auto and student loans, while revolving loans include service sector spending.

Borrowing jumps

This increase in consumer credit is the highest one-month gain in five years. As of May 31, 2021, consumer credit outstanding was $ 4.235 trillion. The latest data shows that consumers are using their credit cards more often today than in the past. This is clearly due to a backlog, rising consumer confidence, higher purchasing power and a better employment scenario, led by an improving economic scenario. In 2020, card spending was weak as economic uncertainty and the restriction on staying at home forced a cut in purchasing capacity.

Credit card usage here to stay

This revival in consumer borrowing will continue, supported by prevailing optimism. When it comes to consumer credit growth, economists predict that revolving credit will pick up pace in the months ahead. This is driven by consumers’ consistency in spending on services that were withheld from them over the past year, such as travel and recreation, dining and entertainment, etc.

This growth in credit card spending will benefit businesses at various hubs across the ecosystem, from card issuance to final payment. The main companies involved in the credit card business are banks and payment processors. While banks benefit from annual fees and other fees when customers use credit cards, payment processors benefit from processing fees every time a card is swiped or used in a transaction. With that in mind, we will select a few companies that are ready to take advantage of the current scenario.

The story goes on

Our selection

Visa Inc. V: You will probably notice this name when you mention a debit or credit card. This is because it is the leading payment processor followed by Mastercard Inc. MA. While it doesn’t issue a card, it just facilitates payment through its payment network. In 2020, the company processed 140.8 billion worth of transactions on its globally distributed network, and that number has only grown over the years.

The company’s high-tech payments infrastructure, brand security, reliability, and partnerships with merchants and banks position it strongly to capitalize on the surge in credit. It is a leader among payment intermediaries to allow crypto transactions on its network. The company allows customers to conduct their transactions in USD Coin (USDC), a stable coin powered by the Ethereum blockchain, and intends to add such coins to its settlement platform. Visa’s strategies are clearly geared towards long-term growth. In the year to date, the share has gained 8.5% compared to the industry’s 7.3% decline.

The stock is currently ranked # 2 (Buy) in Zacks. You can see the full list of current Zacks # 1 Rank (Strong Buy) stocks here.

Zacks Investment Research

Image source: Zacks Investment Research

American Express Co.AXP’s AXP credit cards are highly sought after due to their high profile and wealthy user base. The company is sure to benefit from the surge in revolving credit growth as its cards are primarily geared towards travel and entertainment categories. American Express Platinum cards offer lounge, concierge and other luxury services in addition to other rewards. The company recently relaunched its Platinum card to make it more lucrative for customers.

The company is doing good business, as evidenced by the brisk demand for new cards. In the first quarter of 2021, it issued two million new cards for the first time since the pandemic began. The company is currently showing solid prospects. The stock is up 39.8% so far this year, compared to the industry’s 12.4% growth.

The stock currently ranks # 3 in Zacks (Hold).

Zacks Investment Research

Image source: Zacks Investment Research

Capital One Finance COF is a large credit card issuer and in 2020 generates almost 60% of its revenue in the form of interest and swipe fees. Although it was hit in its largest business unit last year due to a pandemic-induced slump, things are now looking better for this fifth largest credit card issuer in the United States.

The partnership with Walmart and the acquisition of the credit card business from Cabela’s Incorporated in 2017 bodes well for the credit card business. Strong growth opportunities are also expected for card loans and purchase volumes.

With manageable debts and strong debt servicing capabilities, the company is also well positioned financially. The stock is up 55% so far this year, compared to the industry’s 41.6% growth

The stock currently has a Zacks rank of 3.

Zacks Investment Research

Image source: Zacks Investment Research

Breakout biotech stocks with three-digit profit potential

The biotech sector is projected to surge to over $ 775 billion by 2024 as scientists develop treatments for thousands of diseases. They are also finding ways to manipulate the human genome to literally eliminate our susceptibility to these diseases.

Zacks just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors take advantage of 7 stocks that are ready to outperform. Our most recent biotech recommendations saw gains of + 50%, + 83% and + 164% in just 2 months. The stocks in this report could do even better.

Now Check Out These 7 Breakthrough Stocks >>

Would you like the latest recommendations from Zacks Investment Research? Today you can download the 7 best stocks for the next 30 days. Click here to get this free report

Mastercard Incorporated (MA): Free Stock Research Report

Visa Inc. (V): Free Stock Research Report

Capital One Financial Corporation (COF): Free Stock Analysis Report

American Express Company (AXP): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

source https://seedfinance.net/2021/07/09/3-stocks-to-cash-in-on-higher-consumer-borrowing-this-year/

0 notes

Link