#barrick gold

Text

Executive summary

Since launching its brutal war of aggression against Ukraine in February 2022, the Russian Federation has been locked into a long and costly conflict. Russia has been diplomatically marginalized, subjected to sanctions, and shunned by most of the Western world. Many multinational companies have been forced by international pressure to shutter or sell their Russian operations, and profiting from cooperation with the Russian state is no longer considered acceptable. Russia has found itself in dire need of new allies and resources.

In this environment, the Kremlin-financed Private Military Company Wagner, or Wagner Group, has served as an increasingly important source of revenue for the Russian state. Founded in 2014 to support pro-Russian forces in Donbas, since then Wagner Group has evolved into a complex international network of private military contractors, disinformation campaign infrastruc-ture, and corporate front companies. It has deployed fighters, propaganda and disinformation campaigns, and financing as a proxy for the Russian state in numerous conflicts, from Syria and Libya to Mali, Central African Republic, and beyond

Wagner has most often been described as an independent mercenary group. This status has provided Russia with a thin veil of deniability, particularly in relation to the numerous plausible accusations of murder, rape, torture, and war crimes raised against Wagner fighters. But in reality, Wagner has always operated with the political and material backing of the Russian Federation to advance Russian state interests.

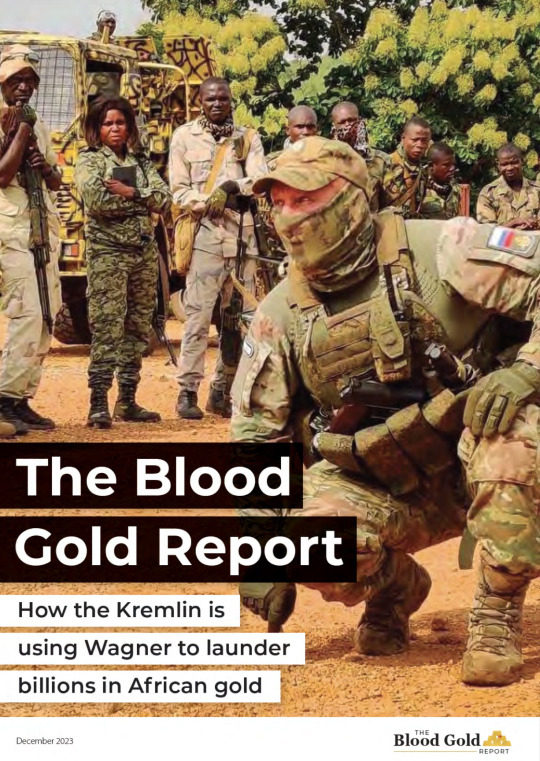

In Africa, Wagner has been deployed in a number of countries across the continent since 2017. In each country it enters, Wagner deploys military trainers, mercenary fighters, and propaganda experts to support anti-democratic regimes, drive instability, and commit human rights abuses. The mercenary group's ostensible provision of "security services" creates a framework for lucrative business contracts for the extraction of natural resources including diamonds, oil, timber, and especially gold.

This report focuses on the Kremlin's 'blood gold': Gold extracted from African countries and laundered into international markets that provides billions in revenue to the Russian state, thereby directly and indirectly financing Russia's war on Ukraine and global hybrid warfare infrastructure.

The Blood Gold Report's analysis suggests that Wagner and Russia have earned more than US$2.5 billion from blood gold since the full-scale invasion of Ukraine in February 2022. The report focuses on the case studies of Wagner's blood gold operations in the Central African Republic, Sudan, and Mali. In each of these coun-tries, Russia profits from the blood gold trade in different ways:

In CAR, the mercenary group has been granted exclusive extractive rights for the Ndassima mine, the country's largest gold mine, in return for propping up President Touadera's authoritarian regime. Wagner's Ndassima operations are understood to produce US$290 million of gold annually, while local miners have been pushed aside or murdered by the mercenary group.

In Sudan, through control of a major refinery, Wagner has become the dominant buyer of unprocessed Sudanese gold as well as a major smuggler of processed gold. Russian military transporter flights laden with gold have been identified by Sudanese customs officials. While tracking Sudan's unreported gold market is near impossible, estimates suggest that almost Us$2 billion in gold is smuggled out of the country unreported every year, with 'the Russian Company' in prime position to take advantage.

In Mali, Wagner is paid a monthly retainer - estimated at US $10.8 million per month - to prop up a brutal military junta Meanwhile the junta is in turn dependent on a small number of Western mining companies for the revenue it needs to pay Wagner. Mining companies contributed more than 50% of all tax revenues to the Malian state for 2022. Barrick Gold Corporation, a Canadian listed company and Mali's single biggest tax contributor, paid US$206 million in the first half of 2023 alone.

The junta is increasing its financial demands on gold mining companies. Meanwhile, the four largest gold mining companies (weighted by tax contribution) continue to plan further investments in the country, despite the well-documented abuses of the military junta and growing influence of the Wagner Group.

Wagner's blood gold operations in CAR and Sudan have been subject to sanctions, and the Kremlin-backed mercenaries have developed increasingly complex smuggling routes and corporate subterfuge tactics to move blood gold out of these countries and convert this gold into cash.

In contrast, the Malian blood gold system enables Wagner to remain one degree removed from gold production. Instead, legitimate multinational mining companies convert gold into cash for the Malian military junta without triggering international sanctions.

To secure its position in a target country's political and natural resource extraction landscape, Wagner's African playbook consists of a four-pronged attack on the host country's civic institutions and civilian population - suppressing political opposition, spreading disinformation, silencing free media and terrorising civilians.

The ultimate objective of Wagner's playbook is to increase its clients' dependence on Wagner forces to stay in power, thereby securing a long-term revenue stream for the Kremlin and fostering authoritarianism and instability throughout the region as part of Russia's wider geopolitical strategy to distract and bog down the democratic West.

Since the death of Wagner's leader Yevgeny Prigozhin, the mercenary group has formally come under the control of the Russian State. Yet the Kremlin's focus on Africa, and its blood gold operations, show no signs of changing.

(continue reading)

#politics#ukraine#russia#africa#wagner group#syria#libya#russian imperialism#russian colonialism#blood gold#money laundering#mercenaries#barrick gold#barrick gold corporation#russia is a terrorist state#russian fascism ☭

34 notes

·

View notes

Text

Beyond the Gold Rush: Barrick Gold's Ethical Predicament

by: Alejandro, Amank, Aubrey, Edwin, Shardul, Shruti

Company Overview

Known for its diversified collection of gold and copper assets, Barrick Gold operates in 13 countries and owns 16 active sites. It was founded by Peter Munk who made it a global mining giant. Its production history is quite impressive while its market value is close to CAD$40 billion thus making it one of the kings of the game. Notwithstanding these achievements; however, Barrick Gold has encountered great moral, human rights and legal problems which has led to its bad name.

Ethical, Human Rights, and Legal Challenges

Though Barrick Gold professes to abide by lofty ethical principles, it has been engaged in various disputes over contraventions of human rights and degradation of the environment, especially within the bounds of Papua New Guinea and Tanzania. The corporation’s Porgera Joint Venture mine has faced challenges accusing it of employing too much violence towards surrounding populations and causing significant harm to nature. Furthermore, Barrick Gold has also been charged with polluting water bodies and invading animal territories. Such claims have raised doubts regarding its true commitment towards sustainable mining operations hence resulting into a host of lawsuits in addition to public investigations.

PESTEL Analysis

To gain a deeper understanding of the external factors influencing Barrick Gold's operations, a PESTEL analysis is essential:

Political: In nations where Barrick Gold operates, political instability has the potential to introduce unpredictability and impede the company’s operations. For instance, the company’s past encounter with challenges attributed to government regulations and taxation in Tanzania indicates that political landscapes should be navigated with care.

Economic: Barrick Gold’s profitability can significantly be affected by economic factors such as exchange rate fluctuations and prices for commodities. Therefore, it is important for the company to mitigate the effects of economic risks in order to adapt well to changing market scenarios that will enable it survive at long-term.

Social: Social issues are critical in Barrick Gold´s operations like community relations or indigenous rights. The firm must balance between its economic goals and the fulfillment of its social obligations with regard to respect as well as collaboration when dealing with local communities.

Technological: Enhancements in technology can help an organization increase its effectiveness and productivity in the mining sector. Barrick Gold has invested more funds into technology to boost its profitability while minimizing adverse ecological effects. Nonetheless, the firm must be aware of such issues as job losses due to automation or other adverse effects on neighboring communities that may arise from new technologies.

Environmental: The mining sector faces numerous challenges due to serious environmental problems including climate change, water shortage and extinction of species. To ensure that it survives for long; Barrick Gold should adopt sustainable methods so as reduce its impact on environment.

Legal: The operations of Barrick Gold can be fundamentally affected by legal regulations on mining, environmental protection and human rights. For this reason, it needs to observe the law in order to avoid any legal proceedings and build a good image.

Conclusion

Barrick Gold Corporation is in a difficult position trying to balance between making money and being responsible. They earned a good sum of money anyhow they also face different problems such as human rights abuses, ethical and lawful problems arisen from their operations. Another strategy which can help Barrick Gold in minimizing reputational risks and boosting trust among its partners is enhancing responsible corporate conduct through more engagement of stakeholders and sustainable development initiatives.

#Barrick Gold#PESTL Analysis#MBA Ethics#business strategy#Corporate Social Responsibility#CSR#mining industry#environmental impact#ethical business practices#Political Risk#Global Economics#sustainability#ethical decision making

1 note

·

View note

Text

#kirill klip#lithium#copper#gold#silver#royalties#tnr gold#gem royalty#gold in usa#shotgun gold#barrick gold#NOVAGOLD#dunlin gold#alaska#fed#us dollar#bitcoin#crypto

0 notes

Text

Marape flags new resources regime for Papua New Guinea

'In 2025, we will shift all licenses and projects that have had no substantial progress into a new hybrid production-sharing regime': Marape flags new resources regime for Papua New Guinea #png #pngbusiness

Opening the 16th Papua New Guinea Mining and Petroleum Investment Conference in Sydney, Prime Minister James Marape has warned investors that changes are coming to Papua New Guinea’s resources regime. Business Advantage PNG reports from the conference.

Prime Minister James Marape addressing the 16th PNG Mining and Petroleum Investment Conference in Sydney this week. Credit: BAI

Developers of the…

View On WordPress

#Barrick Gold#P&039;nyang#Papua LNG#Papua New Guinea Chamber of Mines and Petroleum#Porgera#TotalEnergies

0 notes

Text

Are you interested in Barrick Gold Stock? Junior Miners will help you dive into the world of junior mining stocks, which offer potential high returns amidst market volatility. Explore the nuances of trading in this sector, balance risk and reward, and stay informed about market trends to make strategic investment decisions.

0 notes

Text

The “death map” tells the story of decades of sickness in the small northwest New Mexico communities of Murray Acres and Broadview Acres. Turquoise arrows point to homes where residents had thyroid disease, dark blue arrows mark cases of breast cancer, and yellow arrows mean cancer claimed a life.

Neighbors built the map a decade ago after watching relatives and friends fall ill and die.

Dominating the top right corner of the map, less than half a mile from the cluster of colorful arrows [...] : 22.2 million tons of uranium waste left over from milling ore to supply power plants and nuclear bombs. “We were sacrificed a long time ago,” said Candace Head-Dylla, who created the death map with her mother after Head-Dylla had her thyroid removed and her mother developed breast cancer. [...]

Beginning in 1958, a uranium mill owned by Homestake Mining Company of California processed and refined ore mined nearby. The waste it left behind leaked uranium and selenium into groundwater and released the cancer-causing gas radon into the air.

State and federal regulators knew the mill was polluting groundwater almost immediately after it started operating, but years passed before they informed residents and demanded fixes. [...]

---

Uranium mining and milling left a trail of contamination and suffering, from miners who died of lung cancer while the federal government kept the risks secret to the largest radioactive spill in the country’s history. But for four decades, the management of more than 250 million tons of radioactive uranium mill waste has been largely overlooked, continuing to pose a public health threat. [...] At Homestake, which was among the largest mills, the company is bulldozing a community in order to walk away. Interviews with dozens of residents, along with radon testing and thousands of pages of company and government records, reveal a community sacrificed to build the nation's nuclear arsenal and atomic energy industry. [...]

In 2014, an EPA report confirmed the site posed an unacceptable cancer risk and identified radon as the greatest threat to residents’ health. Still, the cleanup target date continued shifting, to 2017, then 2022. Rather than finish the cleanup, Homestake’s current owner, the Toronto-based mining giant Barrick Gold, is now preparing to ask the Nuclear Regulatory Commission, the independent federal agency that oversees the cleanup of uranium mills, for permission to demolish its groundwater treatment systems and hand the site and remaining waste over to the U.S. Department of Energy to monitor and maintain forever. Before it can transfer the site to the Department of Energy, Homestake must prove that the contamination, which exceeds federal safety levels, won’t pose a risk to nearby residents [...].

Part of Homestake’s strategy: buy out nearby residents and demolish their homes. [...] Property records reveal the company had, by the end of 2021, purchased 574 parcels covering 14,425 acres around the mill site. This April, Homestake staff indicated they had 123 properties left to buy. One resident said the area was quickly becoming a “ghost town.”

---

Even after the community is gone, more than 15,000 people who live nearby, many of them Indigenous, will continue to rely on water threatened by Homestake’s pollution. [...]

At the state level, New Mexico regulators waited until 2009, 49 years after first finding water pollution, to issue a formal warning that groundwater included substances that cause cancer and birth defects. [...] Other uranium mines and mills polluted the area’s main drinking water aquifer upstream of Homestake. [...]

More than 500 abandoned uranium mines pockmark the Navajo Nation [...].

Leaders of communities downstream from Homestake, including the Pueblo of Acoma, fear that wishful thinking could allow pollution from the waste to taint their water. The Acoma reservation, about 20 miles from Homestake’s tailings, has been continuously inhabited since before 1200. Its residents use groundwater for drinking and surface water for irrigating alfalfa and corn, but Donna Martinez, program coordinator for the pueblo’s Environment Department, said the pueblo government can’t afford to do as much air and water monitoring as staff would like. [...]

Most days, Billiman contemplates this “poison” and whether she and Boomer might move away from it [...]. “Then, we just say ‘hózho náhásdlii, hózho náhásdlii’ four times.” “All will be beautiful again,” Boomer roughly translated. [...] Now, as a registered nurse tending to former uranium miners, Langford knows too much about the dangers. When it’s inhaled, radon breaks down in the lungs, releasing bursts of radiation that can damage tissue and cause cancer. Her patients have respiratory issues as well as lung cancer. They lose their breath simply lifting themselves out of a chair.

---

Text by Mark Olalde and Maya Miller. “A Uranium Ghost Town in the Making.” ProPublica. 8 August 2022. [Some paragraph breaks and contractions added by me.]

84 notes

·

View notes

Text

A top American diplomat who used to be the US ambassador to Bolivia has been arrested for allegedly secretly working as a Cuban spy.

Manuel Rocha, 73, was taken into custody in Miami on Friday in what marked the culmination of a long-running FBI counterintelligence investigation, according to the Associated Press.

Two sources told the agency that Mr Rocha is accused of secretly working to promote the Cuban government’s interests.

Investigators allege that this is a violation of the Foreign Agents Registration Act – a law which requires any individual lobbying and doing the political bidding of a foreign government on US soil to register with the Justice Department.

Further details about the 73-year-old’s alleged work as a Cuban government agent are expected to be revealed on Monday when he appears in federal court.

Neither the DOJ or Mr Rocha has yet publicly commented on his arrest.

Mr Rocha’s wife Karla Wittkop Rocha refused to comment and hung up the phone when reached for comment by the AP.

The bombshell arrest comes after Mr Rocha has spent 25 years working as a top US diplomat in several Latin American countries.

His diplomatic postings included a stint at the US Interests Section in Cuba during a time when the US lacked full diplomatic relations with Fidel Castro’s communist government.

Born in Colombia, Mr Rocha was raised in a working-class home in New York City and went on to obtain a succession of liberal arts degrees from Yale, Harvard and Georgetown before joining the foreign service in 1981.

He was the top US diplomat in Argentina between 1997 and 2000 as a decade-long currency stabilisation program backed by Washington was unraveling under the weight of huge foreign debt and stagnant growth, triggering a political crisis that would see the South American country cycle through five presidents in two weeks.

At his next post as ambassador to Bolivia, he intervened directly into the 2002 presidential race, warning weeks ahead of the vote that the US would cut off assistance to the poor South American country if it were to elect former coca grower Evo Morales.

“I want to remind the Bolivian electorate that if they vote for those who want Bolivia to return to exporting cocaine, that will seriously jeopardise any future aid to Bolivia from the United States,” Mr Rocha said in a speech that was widely interpreted as a an attempt to sustain US dominance in the region.

The gambit worked but three years later Bolivians elected Morales anyway and the leftist leader would expel Rocha’s successor as chief of the diplomatic mission for inciting “civil war”.

Mr Rocha also served in Italy, Honduras, Mexico and the Dominican Republic, and worked as a Latin America expert for the National Security Council.

Following his retirement from the State Department, Mr Rocha began a second career in business, serving as the president of a gold mine in the Dominican Republic partly owned by Canada’s Barrick Gold.

More recently, he’s held senior roles at XCoal, a Pennsylvania-based coal exporter; Clover Leaf Capital, a company formed to facilitate mergers in the cannabis industry; law firm Foley & Lardner and Spanish public relations firm Llorente & Cuenca.

9 notes

·

View notes

Text

Boom vs. Doom - How Different Asset Classes Are Connected And Influence Each Other

As a refreshing change, on the In It To Win It Podcast, Steve Burton and I dive into both his questions and the ones coming in from those who were in attendance.

Watch The Video Here

Questions and topics that Steve asked me about include:

What do you do at The Technical Traders?

What technical indicators do you like to use?

What do you see happening down the road for the S&P 500?

How does the US dollar (DXY) look?

Is Gold a good play right now?

How does a cup and handle pattern work? What does it indicate?

Can you give your analysis on Newmont?

The chart of Barrick Gold – what do you see?

Moving onto silver, what is your analysis?

How do trend lines work?

Can you look at the Pan American Silver chart and let us know what you see?

The ETF SILJ, what are your thoughts?

What are your thoughts on the technical analysis of the underlying uranium spot price?

Looking at the big picture of oil, what do you see?

Is there a good ETF for natural gas?

Watch The Video Here

2 notes

·

View notes

Text

#kirill klip#lithium#copper#gold#silver#royalties#tnr gold#gem royalty#shotgun gold#gold in usa#alaska#barrick gold#novagold#donlin gold#fed#us dollar#crypto#bitcoin#debt

1 note

·

View note

Link

Neo-Colonialism! – Legal and Illegal Gold Mining and other Extractive Industries vs Indigenous Peoples, Wildlife and Water!

2 notes

·

View notes

Text

Gold as an Investment

Before jumping on the gold bandwagon, let us first put a damper on the enthusiasm around gold and examine some reasons why investing in gold poses some fundamental issues.

The main problem with gold is that, unlike other commodities such as oil or wheat, it does not get used up or consumed. Once gold is mined, it stays in the world. A barrel of oil, on the other hand, is turned into gas and other products that are expended in your car's gas tank or an airplane's jet engines. Grains are consumed in the food we and our animals eat. Gold, on the other hand, is turned into jewelry, used in art, stored in ingots locked away in vaults, and put to a variety of other uses. Regardless of gold's final destination, its chemical composition is such that the precious metal cannot be used up—it is permanent.

Because of this, the supply-demand argument that can be made for commodities such as oil and grains doesn't hold so well for gold. In other words, the supply will only go up over time, even if demand for the metal dries up.

History Overcomes the Supply Problem

Like no other commodity, gold has held the fascination of human societies since the beginning of recorded time. Empires and kingdoms were built and destroyed over gold and mercantilism. As societies developed, gold was universally accepted as a satisfactory form of payment. In short, history has given gold a power surpassing that of any other commodity on the planet, and that power has never really disappeared.

The U.S. monetary system was based on a gold standard until the 1970s.

1

Proponents of this standard argue that such a monetary system effectively controls the expansion of credit and enforces discipline on lending standards because the amount of credit created is linked to a physical supply of gold. It's hard to argue with that line of thinking after nearly three decades of a credit explosion in the U.S. led to the financial meltdown in the fall of 2008.

From a fundamental perspective, gold is generally viewed as a favorable hedge against inflation. Gold functions as a good store of value against a declining currency.

2

Investing in Gold

The easiest way to gain exposure to gold is through the stock market, via which you can invest in the shares of gold-mining companies. Investing in gold bullion won't offer the leverage you would get from investing in gold-mining stocks. As the price of gold goes up, miners' higher profit margins can boost earnings exponentially. Suppose a mining company has a profit margin of $200 when the price of gold is $1,000. If the price rises 10%, to $1,100 an ounce, the operating margin of the gold miner goes up to $300—a 50% increase.

Of course, there are other issues to consider with gold-mining stocks, namely political risk (because many operate in developing nations) and the difficulty of maintaining gold production levels.

The most common way to invest in physical gold is through an exchange-traded fund (ETF) like the SPDR Gold Shares (GLD), which simply holds gold.

When investing in ETFs, pay attention to net asset value (NAV), as the purchase price can at times exceed NAV by a wide margin, especially when the markets are optimistic.

A list of gold-mining companies includes Barrick Gold Corp. (ABX.TO), Newmont Corp. (NEM), and Agnico Eagle Mines Ltd. (AEM), among others. Passive investors who want great exposure to the gold miners may consider the VanEck Vectors Gold Miners ETF (GDX), which includes investments in all the major miners.

Alternative Investment Considerations

While gold is a good bet on inflation, it's certainly not the only one. Commodities in general benefit from inflation because they have pricing power. The key consideration when investing in commodity-based businesses is to go for low-cost producers. More conservative investors would also do well to consider inflation-protected securities like Treasury Inflation-Protected Securities, or TIPS. The one thing you don't want is to be sitting idle—in cash, thinking you're doing well—while inflation is eroding the value of your dollar.

Gold Price Performance

The price of gold depends on a complex array of factors. Because gold is priced in dollars, the value of the U.S. currency can have a significant impact on the performance of the precious metal. A strong dollar makes gold more expensive for buyers in other countries, potentially leading to lower gold prices. On the other hand, a weaker dollar makes gold more affordable for international purchasers and may bring increased prices. Since gold is seen as a hedge against inflation, the decline in value of fiat currencies and the market's expectations surrounding inflation can also affect gold prices.

3

These factors seem to be evident in the yellow metal's recent price history. Throughout most of 2022, despite soaring levels of inflation, gold prices actually dipped, likely driven lower by sustained strength in the dollar against other currencies. More recently, with inflation remaining stubbornly persistent despite the Federal Reserve's attempts to bring it under control, gold prices have recovered to more than $1,875 per ounce in January 2023, from around $1,656 per ounce in September 2022.

3

What's to Come

You can't ignore the effect of human psychology when it comes to investing in gold. The precious metal has always been a go-to investment during times of fear and uncertainty, which tend to go hand in hand with economic recessions and depressions.

In the articles that follow, we examine how and why gold gets its fundamental value, how it's used as a form of money, and which factors subsequently influence its price on the market—from miners to speculators to central banks. We will look at the fundamentals of trading gold and what types of securities or instruments are commonly used to gain exposure to gold investments. We'll look at using gold both as a long-term component of a diversified portfolio and as a short-term day trading asset. We'll look at the benefits of gold but also examine the risks and pitfalls and see if it lives up to the "gold standard."

What Makes Gold Valuable?

Aside from its literal shine and the symbolic relationship with wealth that has lasted throughout human civilization, gold plays an important role as a store of value and a medium of exchange. Unlike other commodities, gold does not get used up or consumed, imbuing the precious metal with a sense of everlasting value. Gold serves as a hedge against the declining value of currencies through inflation, which leads many investors to consider gold an alternative asset and a way of safeguarding their wealth.

What Is the Gold Standard?

Under the gold standard, the value of a currency is pegged to the value of gold. The Bretton Woods Agreement, which formed the framework for global currency markets starting at the end of World War II, established that the U.S. dollar was convertible to gold at a fixed rate of $35 per ounce, with other world currencies valued in relation to the dollar.

4

President Nixon ended the convertibility of the dollar to gold in 1971, signaling the end of the gold standard.

How Can I Invest in Gold?

There is a wide variety of options for investors who want exposure to gold. It's possible to invest directly in gold bullion, although the costs of storing and insuring physical gold can be significant. Investors also can turn to exchange-traded funds (ETFs) that hold the precious metal or purchase shares of mining companies whose stock prices are correlated to gold's price performance.

The Bottom Line

Gold has held a special place in the human imagination since the beginning of recorded time. From an investment perspective, gold is attractive because of its potential to remain strong in difficult financial environments and to hedge against inflationary declines in the value of fiat currencies.

Although the U.S. dollar and other world currencies are no longer pegged to gold—as was the case when many countries operated under the gold standard—the precious metal continues to play an important role in the global economy.

ARTICLE SOURCES

PART OF

Investing in Gold

Investing in Gold1 of 30

Why Gold Matters: Everything You Need to Know2 of 30

Why Has Gold Always Been Valuable?3 of 30

What Drives the Price of Gold?4 of 30

What Moves Gold Prices?5 of 30

Gold Standard: Definition, How It Works, and Example6 of 30

Gold: The Other Currency7 of 30

How to Invest in Gold: An Investor’s Guide8 of 30

Gold Bug9 of 30

8 Good Reasons to Own Gold10 of 30

4 Ways to Buy Gold11 of 30

Does It Still Pay to Invest in Gold?12 of 30

The Best Ways To Invest In Gold Without Holding It13 of 30

How to Buy Gold Bars14 of 30

The Best Strategy for Gold Investors15 of 30

The Most Affordable Way to Buy Gold: Physical Gold or ETFs?16 of 30

The Better Inflation Hedge: Gold or Treasuries?17 of 30

Has Gold Been a Good Investment Over the Long Term?18 of 30

Trading the Gold-Silver Ratio19 of 30

How to Trade Gold in 4 Steps20 of 30

Gold Option21 of 30

How To Buy Gold Options22 of 30

Using Technical Analysis in Gold Miner ETFs23 of 30

Day-Trading Gold ETFs: Top Tips24 of 30

Gold ETFs vs. Gold Futures: What's the Difference?25 of 30

Should You Get a Gold IRA?26 of 30

How to Buy Gold With Your 401(k)27 of 30

Gold IRA Definition28 of 30

When and Why Do Gold Prices Plummet?29 of 30

The Effect of Fed Funds Rate Hikes on Gold30 of 30

Related Articles

Business man trader investor analyst using mobile phone app and laptop

INVESTING

How to Invest in Commodities

Pile of Gold Bars

GOLD

Does It Still Pay to Invest in Gold?

Gold Bars

STOCKS & BOND NEWS

Top Gold Stocks for Q2 2023

GOLD

The Better Inflation Hedge: Gold or Treasuries?

GOLD

The Best Ways To Invest In Gold Without Holding It

Gold bars are placed on United States banknote

INVESTING

How to Invest in Gold and Silver

Related Terms

Gold IRA Definition

A gold IRA is a retirement investment vehicle used by individuals who hold gold bullion, coins, or other approved precious metals. more

Troy Ounce: Definition, History, and Conversion Table

A troy ounce is a unit of measurement for precious metal weight that dates to the Middle Ages. One troy ounce is equal to 31.10 grams. more

Gold Bug

A “gold bug” is somebody who is especially bullish on gold. more

Dollar Bear

A dollar bear is an investor who is pessimistic, or "bearish," about the prospects of the U.S. dollar (USD). They are the opposite of a dollar bull. more

Gold Standard: Definition, How It Works, and Example

The gold standard is a system in which a country's government allows its currency to be freely converted into fixed amounts of gold. more

Precious Metals: Definition, How to Invest, and Example

Precious metals are rare metals that have a high economic value, such as gold, silver, and platinum.

Invest with us today with Royallis Gold.

2 notes

·

View notes

Text

Are you looking for insights into Barrick Gold Stock Prices? Junior Miners is an expansive platform featuring a myriad of mining companies. If you're a junior mining firm or a supplier catering to small miners, this is your ideal space to promote and advertise your business effectively. Contact us!

0 notes

Video

youtube

Eight Ways to Buy Gold

For many years, gold has been the most loved precious metal for both making beautiful and important jewelry and furthermore as a store of significant worth for the investor. While gold jewelry stays well known as an enhancing workmanship, it bombs as an investment generally because of the enormous markup buyers pay. There are exemptions, yet those are for the most part restricted to those individuals who click here to learn more can bear to have novel gold jewelry pieces planned and made, instead of the efficiently manufactured things typically seen.

If you have any desire to invest in gold, there are numerous different possibilities accessible. Certain individuals like the vibe of the gold in their grasp, while others need to claim it, however not need to stress over putting away it safely.

For the people who would rather not hold the actual gold, buying partakes in a Trade Exchanged Fund (ETF) is one way to go. You should have a record with a stock dealer, since ETF's exchange like a stock. You will likewise have to do some examination, on the grounds that not all gold ETF's invest the same way. Some buy gold bullion, store it and sell shares in view of some negligible part of an ounce of gold. SPDR Gold Trust (GLD) is set up along these lines.

Others, as ProShares Ultra Gold (UGL), utilize monetary instruments like prospects and choices agreements to attempt to match the development of the gold market. UGL really endeavors to move with two times the arrival of gold's cost developments.

Then again other ETF's invest in gold mining shares. These will generally change in a different way than spot gold, since mining stocks can go up or down contingent upon many factors as opposed to only the cost of gold.

Gold Common Funds are one more way to invest in gold without actually holding it. They might invest in numerous gold mining organizations as well as Etf's, choices and fates. Shared funds are a piece different than stocks and Etf's. You can't simply go on the web and buy right away. At the point when you put in your request, your buy cost will be the fund cost toward the finish of that exchanging day. Once more get your work done. A few common funds likewise charge a "heap", which is an expense either while buying, while selling or even the two ways. There are quite a large number "no heap" funds too so chack carefully prior to investing.

Obviously, you can buy portions of gold mining organizations straightforwardly on many stock trades. Once more you really want to get your work done, on the grounds that organizations range in size from a Barrick Gold (NYSE: ABX) which delivers and sells a large number of ounces each year to more modest organizations which might possess a few cases, yet have not yet created an ounce of gold. A portion of these more modest organizations exchange not many offers, so if you own them, you will be unable to sell them at a sensible cost in a rush.

Put away gold is one more way to buy gold without the issues of capacity. Organizations like the Perth Mint and Bullionvault permit you to buy gold which is then put away in your name in their vaults.

3 notes

·

View notes

Text

Feasibility Study on Lumwana Super Pit Expansion Expected by Year-End

All amounts expressed in US dollars

TORONTO, Sept. 11, 2024 (GLOBE NEWSWIRE) — Barrick Gold Corporation (NYSE:GOLD) (TSX:ABX) – The feasibility study for the expansion of Barrick’s Lumwana mine in Zambia is expected to be completed by the end of the year, paving the way for construction to start in 2025 the company said today.

Speaking during a webinar focused on updating the market on the…

View On WordPress

0 notes

Text

Barrick Gold Corporation Jobs in Karachi September 2024 Advertisement

Barrick Gold Corporation Jobs in Karachi September 2024 has been announce thorugh Latest Advertisement Reko Diq Mining Company, a subsidiary Barrick Gold Corporation, is recruiting a high-caliber team of individuals for the development of its outstanding, world-class mining project – the Reko Diq copper-gold mine in Balochistan.In these Latest Govt Jobs in Sindh both Male and Female candidates…

View On WordPress

0 notes