#benefits of filing income tax return

Text

How Income Tax Return Online Filling

Filing your income tax return online can feel like navigating a labyrinth, but with the right guide, it’s more like a walk in the park. We’ll break down each step, simplify the jargon, and get you filing with confidence. Let’s dive in!

Why File Your Income Tax Return Online?

Filing your income tax return online isn’t just about following trends; it’s about leveraging modern technology to make your life easier. Here’s why you should consider it.

Convenience and Accessibility

Gone are the days of standing in long queues or filling out mountains of paperwork. Online filing lets you submit your return from the comfort of your home, anytime. It’s like having a tax office at your fingertips!

Accuracy and Efficiency

Online portals are designed to minimize errors. With built-in calculators and validation checks, you’re less likely to make mistakes. Plus, it speeds up the whole process, so you can get your refund quicker.

Step-by-Step Guide to Filing Your Income Tax Return Online

Ready to get started?

Follow these steps to file your income tax return online efficiently and correctly.

Step 1: Gather Necessary Documents

Step 2: Register or Login into the Income Tax Portal

Step 3: Select the Appropriate ITR Form

Step 4: Fill in Your Personal Details

Step 5: Provide Income Details

Step 6: Claim Deductions and Exemptions

Step 7: Review and Verify Your Return

Give your return a thorough once-over. Check for any errors or missing information. Think of it as proofreading an important email.

Step 8: Submit Your Return

Once satisfied, hit the submit button.

Congratulations, you’ve filed your return!

Step 9: E-Verify Your Return

E-verification is the final step to validate your return. You can do this through methods like Aadhaar OTP, net banking, or EVC. It’s like signing off on your work.

Common Mistakes to Avoid

Even with the best tools, mistakes happen. Here are common pitfalls to watch out for.

Incorrect Personal Information

Ensure all personal details are correct. Errors in your name, PAN, or bank details can lead to processing delays.

Misreporting Income

Be accurate with your income details. Misreporting can trigger unwanted scrutiny and penalties.

Not Claiming All Deductions

Maximize your tax savings by claiming all eligible deductions. Missing out means paying more tax than necessary.

Benefits of E-Verifying Your Return

Why bother with e-verification?

It’s not just a formality—it comes with real benefits.

Faster Processing

E-verified returns are processed quickly, meaning you’ll get your refund sooner. Who doesn’t like faster refunds?

Reduced Chances of Manual Errors

E-verification reduces the chances of manual errors in data entry, making your filing experience smoother and more reliable.

Conclusion

Filing your income tax return online doesn’t have to be daunting. With the right preparation and a systematic approach, you can navigate the process smoothly.

Happy filing!

By Paisainvests.com

#digital tax return#e-filing taxes#e-verifying tax returns#filing ITR#filing taxes online#income tax documents#income tax guide#income tax portal#income tax return#online tax filing#online tax return benefits#online tax submission#revised tax return#step-by-step tax filing#tax deductions#tax filing deadline#tax filing mistakes#tax filing tips#tax return process#tax return tips

0 notes

Text

Top 5 Websites for Filing Income Tax Returns (ITR) Online in India

Introduction:

Filing income tax returns (ITR) is a necessary task for individuals and businesses in India. With the convenience of the internet, online platforms have made it easier than ever to file your ITR. In this blog post, we will be highlighting the top 10 websites in India that offer efficient and user-friendly online ITR filing services. These websites have been selected based on their reputation, ease of use, features, and customer reviews.

Income Tax India Official Website:

The official Income Tax India website is one of the most trusted platforms for filing income tax returns online. It provides a user-friendly interface and comprehensive support for taxpayers. The website offers various e-filing services, including ITR filing, tracking refunds, and accessing tax-related information and forms. Additionally, it provides resources and guides to help users navigate the taxation process easily.

Clear Tax

ClearTax is a popular platform for filing income tax returns in India. It offers a simple, fast, and secure way to e-file your ITR. ClearTax provides step-by-step guidance throughout the process and ensures accuracy in calculations. The platform also offers additional features such as tax-saving guides, investment declarations, and expert support. ClearTax is widely recognized for its user-friendly interface and excellent customer service.

My ITReturn

MyITReturn is a reliable website that specializes in online ITR filing services. It offers a seamless user experience with its easy-to-use interface and straightforward process. MyITReturn ensures that users have access to all the necessary forms and documents required for smooth filing. The platform also provides expert assistance and tax-saving tips for individuals and businesses. With a high customer satisfaction rate, MyITReturn stands out as a trusted choice for ITR filing.

TaxBuddy

TaxBuddy is a comprehensive online platform for tax-related services, including ITR filing. It offers a range of features to ensure a hassle-free experience for users. TaxBuddy simplifies the entire process by providing a step-by-step guide and built-in error checks. The platform also offers tax planning tools, refund tracking, and dedicated customer support. With its user-friendly interface and value-added services, TaxBuddy is a suitable choice for filing income tax returns.

The Tax Heaven (https://www.thetaxheaven.com):

The Tax Heaven is a trusted website that provides efficient online tax filing services in India. It offers hassle-free ITR filing for both individuals and businesses. The platform guides users through the entire process and ensures compliance with regulatory requirements. The Tax Heaven boasts a user-friendly interface and a team of experienced experts who ensure accurate and timely filing of ITRs. Their services come at an affordable price, making them an excellent choice for taxpayers.

Conclusion:

Filing income tax returns online has become the preferred method for individuals and businesses in India. The convenience, accuracy, and efficiency provided by online platforms have simplified the ITR filing process. In this blog post, we highlighted the top 5 websites, including the official Income Tax India website, ClearTax, MyITReturn, TaxBuddy, and The Tax Heaven. These platforms offer user-friendly interfaces, expert assistance, and additional features to enhance the filing experience. We recommend exploring these websites to find the one that best suits your needs for a smooth and hass.

#ITR Benefits for Salaried Individuals#itr return services#itr return services in jaipur#The Tax Heaven#Filing Income Tax Returns (ITR) Online in India

0 notes

Text

On Thursday, Canada’s fiscal watchdog outlined how an automated tax filing system would benefit some Canadians, particularly those in low-income and vulnerable households who have never previously filed a return, or might have gaps in their filing histories.

According to a 2020 study(opens in a new tab) conducted by two Carleton University professors, between 10-to-12 per cent of Canadians do not annually file their returns and might, as a result, miss out on benefits they're otherwise entitled to.

The PBO revealed that if the automated system were to roll out now, eligible taxpaying households would receive more than $1.6 billion in benefits this current fiscal year. In five years, it will reach $1.9 billion.

Continue Reading

Tagging: @newsfromstolenland

92 notes

·

View notes

Text

The IRS will do your taxes for you (if that's what you prefer)

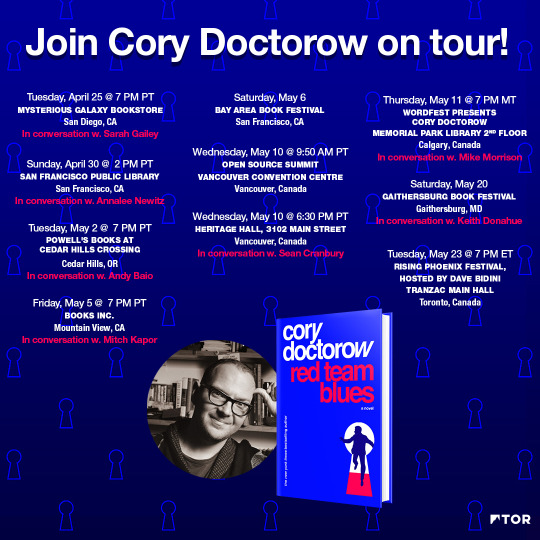

This Saturday (May 20), I’ll be at the GAITHERSBURG Book Festival with my novel Red Team Blues; then on May 22, I’m keynoting Public Knowledge’s Emerging Tech conference in DC.

On May 23, I’ll be in TORONTO for a book launch that’s part of WEPFest, a benefit for the West End Phoenix, onstage with Dave Bidini (The Rheostatics), Ron Diebert (Citizen Lab) and the whistleblower Dr Nancy Olivieri.

America is a world leader in allowing private companies to levy taxes on its citizens, including (stay with me here), a tax on paying your taxes.

In most of the world, the tax authorities prepare a return for each taxpayer, sending them a prepopulated form with all their tax details — collected from employers and other regulated entities, like pension funds and commodities brokers, who must report income to the tax office. If the form is correct, the taxpayer signs it and sends it back (in some countries, taxpayers don’t even have to do that — they just ignore the return unless they want to amend it).

No one has to use this system, of course. If you have complex finances, or cash income that doesn’t show up in mandatory reporting, or if you’d just prefer to prepare your own return or pay an accountant to do so for you, you can. But for the majority of people, those with income from a job or a pension, and predictable deductions, say, from caring for minor children, filing your annual tax return takes between zero and five minutes and costs absolutely nothing.

Not so in America. America is one of the very few rich countries (including Canada, though this is changing), where the government won’t just send you a form containing all the information it already has, ready to file. As is common in complex societies, America has a complex tax code (further complexified by deliberate obfuscation by billionaires and their lickspittle Congressjerks, who deliberately perforate the tax code with loopholes for the ultra-rich):

https://pluralistic.net/2021/08/11/the-canada-variant/#shitty-man-of-history-theory

That complexity means that most of us can’t figure out how to file our own taxes, at least not without committing scarce hours out of the only life we will ever have to poring over the ramified and obscure maze of tax-law.

Why doesn’t the IRS just send you a tax-return? Well, because the tax-prep industry — an oligopoly dominated by a handful of massive, ultra-profitable firms — bribes Congress (that is, “lobbies”) to prohibit this. They are aided in this endeavor by swivel-eyed lunatic anti-tax obsessives, like Grover Nordquist and Americans for Tax Reform, who argue that paying taxes should be as difficult and painful as possible in order to foment opposition to taxation itself.

The tax-prep industry is dominated by a single firm, Intuit, who took over tax-prep through its anticompetitive acquisition of TurboTax, itself a chimera of multiple companies gobbled up in a decades-long merger orgy. Inuit is a freaky company. For decades, its defining CEO Brad Smith ran the company as a cult of personality organized around his trite sayings, like “Do whatever makes your heart beat fastest,” stenciled on t-shirts worn by employees. Other employees donned Brad Smith masks for selfies with their Beloved Leader.

Smith’s cult also spent decades lobbying to keep the IRS from offering a free filing service. Instead, Intuit joined a cartel that offered a “Free File” service to some low- and medium-income Americans:

https://www.propublica.org/article/inside-turbotax-20-year-fight-to-stop-americans-from-filing-their-taxes-for-free

But the cartel sabotaged Free File from the start. They blocked search engines from indexing their Free File services, then bought Google ads for “free file” that directed searchers to soundalike programs (“Free Filing,” etc) that hit them for hundreds of dollars in tax-prep fees. They also funneled users to versions of Free File they were ineligible for, a fact that was only revealed after the user spent hours painstaking entering their financial information, whereupon they would be told that they could either start over or pay hundreds of dollars to finish filing with a commercial product.

Intuit also pioneered the use of binding arbitration waivers that stripped its victims of the right to sue the company after it defrauded them. This tactic blew up in Intuit’s face after its victims banded together to mass-file thousands of arbitration claims, sending the company to court to argue that binding arbitration wasn’t enforceable after all:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

But justice eventually caught up with Intuit. After a series of stinging exposes by Propublica journalists Justin Elliot, Paul Kiel and others, NY Attorney General Letitia James led a coalition of AGs from all 50 states and DC that extracted a $141m settlement for 4.4 million Americans who had been tricked into paying for Turbotax services they were entitled to get for free:

https://www.msn.com/en-us/news/us/turbotax-to-begin-payouts-after-it-cheated-customers-new-york-ag-says/ar-AA1aNXfi

Fines are one thing, but the only way to comprehensively end the predatory tax-prep scam is to bring the USA kicking and screaming into the 20th century, when most of the rest of the world brought in free tax-prep for ordinary income earners. That’s just what’s happening: the IRS is trialing a free tax prep service for next year’s tax season:

https://www.washingtonpost.com/business/2023/05/15/irs-free-file/

This, despite Intuit’s all-out blitz attack on Congress and the IRS to keep free tax-prep from ever reaching the American people:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

That charm offensive didn’t stop the IRS from releasing a banger of a report that made it clear that free tax-prep was the most efficient, humane and cost-effective way to manage an advanced tax-system (something the rest of the world has known for decades):

https://www.irs.gov/pub/irs-pdf/p5788.pdf

Of course, Intuit is furious, as in spitting feathers. Rick Heineman, Intuit’s spokesprofiteer, told KQED that “A direct-to-IRS e-file system is wholly redundant and is nothing more than a solution in search of a problem. That solution will unnecessarily cost taxpayers billions of dollars and especially harm the most vulnerable Americans.”

https://www.kqed.org/news/11949746/the-irs-is-building-its-own-online-tax-filing-system-tax-prep-companies-arent-happy

Despite Upton Sinclair’s advice that “it is difficult to get a man to understand something, when his salary depends on his not understanding it,” I will now attempt to try to explain to Heineman why he is unfuckingbelievably, eye-wateringly wrong.

“e-file…is wholly redundant”: Well, no, Rick, it’s not redundant, because there is no existing Free File system except for the one your corrupt employer made and hid “in the bottom of a locked filing cabinet stuck in a disused lavatory with a sign on the door saying ‘Beware of the Leopard.’”

“nothing more than a solution in search of a problem”: The problem this solves is that Americans have to pay Intuit billions to pay their taxes. It’s a tax on paying taxes. That is a problem.

“unnecessarily cost taxpayers billions of dollars”: No, it will save taxpayers the billions of dollars (they pay you).

“harm the most vulnerable Americans”: Here is an area where Heineman can speak with authority, because few companies have more experience harming vulnerable Americans.

Take the Child Tax Credit. This is the most successful social program in living memory, a single initiative that did more to lift American children out of poverty than any other since the days of the Great Society. It turns out that giving poor people money makes them less poor, which is weird, because neoliberal economists have spent decades assuring us that this is not the case:

https://pluralistic.net/2023/05/16/mortgages-are-rent-control/#housing-is-a-human-right-not-an-asset

But the Child Tax Credit has been systematically sabotaged, by Intuit lobbyists, who successfully added layer after layer of red tape — needless complexity that makes it nearly impossible to claim the credit without expert help — from the likes of Intuit:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It worked. As Ryan Cooper writes in The American Prospect: “between 13 and 22 percent of EITC benefits are gulped down by tax prep companies”:

https://prospect.org/economy/2023-05-17-irs-takes-welcome-step-20th-century/

So yes, I will defer to Rick Heineman and his employer Intuit on the subject of “harming the most vulnerable Americans.” After all, they’re the experts. National champions, even.

Now I want to address the peply guys who are vibrating with excitement to tell me about their 1099 income, the cash money they get from their lemonade stand, the weird flow of krugerrands their relatives in South African FedEx to them twice a year, etc, that means that free file won’t work for them because the IRS doesn’t actually understand their finances.

That’s a hard problem, all right. Luckily, there is a very simple answer for this: use a tax-prep service.

Actually, it’s not a hard problem. Just use a tax-prep service. That’s it. No one is going to force you to use the IRS’s free e-file. All you need to do to avoid the socialist nightmare of (checks notes) living with less red-tape is: continue to do exactly what you’re already doing.

Same goes for those of you who have a beloved family accountant you’ve used since the Eisenhower administration. All you need to do to continue to enjoy the advice of that trusted advisor is…nothing. That’s it. Simply don’t change anything.

One final note, addressing the people who are worried that the IRS will cheat innocent taxpayers by not giving them all the benefits they’re entitled to. Allow me here to simply tap the sign that says “between 13 and 22 percent of EITC benefits are gulped down by tax prep companies.” In other words, when you fret about taxpayers being ripped off, you’re thinking of Intuit, not the IRS. Just calm down. Why not try using fluoridated toothpaste? You’ll feel better, and I promise I won’t tell your friends at the Gadsen Flag appreciation society.

Your secret is safe with me.

Catch me on tour with Red Team Blues in Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

If you’d like an essay-formatted version of this thread to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

[Image ID: A vintage drawing of Uncle Sam toasting with a glass of Champagne, superimposed over an IRS 1040 form that has been fuzzed into a distorted halftone pattern.]

#pluralistic#earned income tax credit#eitc#irs#grover nordquist#guillotine watch#turbotax#taxes#death and taxes#freefile#monopoly#intuit

177 notes

·

View notes

Text

Maximize Efficiency with Expert Cash Management Solutions

In today’s fast-paced business environment, effective cash management is crucial for maintaining financial stability and supporting growth. Expert cash management solutions can help businesses streamline their operations, optimize liquidity, and enhance overall financial efficiency. This article explores how leveraging advanced cash management solutions can maximize efficiency and drive business success.

What is Cash Management?

Cash management involves the collection, handling, and use of cash in a business. The goal is to ensure that a company has enough cash on hand to meet its short-term obligations while optimizing the use of its funds. Effective cash management helps businesses avoid liquidity problems, reduce financing costs, and invest surplus cash wisely.

Key Benefits of Expert Cash Management Solutions

Improved Cash Flow Visibility

Expert cash management solutions provide real-time insights into cash flow. By integrating these solutions with your financial systems, you can gain a comprehensive view of your cash position, including incoming and outgoing funds. This visibility allows for better forecasting and planning, helping you anticipate cash needs and avoid potential shortfalls.

Enhanced Liquidity Management

Managing liquidity effectively is essential for ensuring that your business can meet its obligations without holding excessive cash. Advanced cash management tools help optimize liquidity by analyzing cash flow patterns and recommending strategies to manage working capital more efficiently. This includes managing accounts receivable and payable, optimizing cash reserves, and reducing idle cash.

Streamlined Cash Collection and Disbursement

Automated cash management solutions streamline the collection and disbursement processes. For example, electronic invoicing and payment systems can accelerate the receipt of payments, reducing the time it takes to convert receivables into cash. Similarly, automated disbursement systems help manage outgoing payments, ensuring that bills and payroll are processed efficiently and on time.

Enhanced Fraud Prevention and Security

Security is a critical aspect of cash management. Expert solutions offer robust security features to protect against fraud and unauthorized transactions. This includes encryption, multi-factor authentication, and transaction monitoring. By implementing these security measures, businesses can safeguard their cash and reduce the risk of financial losses due to fraud.

Optimized Investment Opportunities

Efficient cash management doesn’t just involve managing daily transactions; it also includes investing surplus cash to generate returns. Expert cash management solutions help identify and evaluate investment opportunities that align with your company’s risk tolerance and financial goals. Whether it’s investing in short-term instruments or managing liquidity portfolios, these solutions provide insights to make informed investment decisions.

Regulatory Compliance

Adhering to regulatory requirements is essential for avoiding penalties and maintaining financial integrity. Advanced cash management systems help ensure compliance with relevant regulations by automating reporting and record-keeping. This includes managing tax-related cash flows, regulatory filings, and maintaining accurate financial records.

Implementing Expert Cash Management Solutions

To maximize efficiency with expert cash management solutions, consider the following steps:

Assess Your Needs

Begin by evaluating your business’s cash management needs. Identify areas where improvements are needed, such as cash flow forecasting, liquidity management, or fraud prevention. This assessment will help you choose the right solutions that align with your business objectives.

Choose the Right Tools

Select cash management solutions that offer the features and functionality you need. Look for tools that integrate with your existing financial systems, provide real-time insights, and offer robust security measures. Consider solutions that are scalable and can grow with your business.

Implement and Integrate

Once you’ve selected the appropriate solutions, implement them within your organization. This may involve integrating the solutions with your current financial systems, training staff on how to use the tools, and establishing processes for managing cash flow effectively.

Monitor and Optimize

Regularly monitor the performance of your cash management solutions to ensure they are delivering the expected benefits. Use the insights provided by these tools to make data-driven decisions, optimize cash flow, and adjust your strategies as needed.

Review and Adjust

Periodically review your cash management practices and solutions to ensure they remain effective. As your business evolves, your cash management needs may change, requiring adjustments to your strategies and tools.

Conclusion

Expert cash management solutions are essential for maximizing efficiency and achieving financial stability in today’s competitive business landscape. By leveraging advanced tools and strategies, businesses can gain better visibility into their cash flow, optimize liquidity, streamline processes, and enhance security. Implementing these solutions helps ensure that your business can meet its financial obligations, invest wisely, and maintain a strong financial position. Embracing expert cash management practices not only improves day-to-day operations but also supports long-term growth and success.

For more details, visit us:

expense tracker software

Expense Management Software

invoice management system

best expense reimbursement software

2 notes

·

View notes

Text

Late Thursday, President Biden’s son, Hunter Biden, was charged on nine counts relating to unpaid federal taxes on income from overseas enterprises. This marks the second indictment against Hunter Biden this year, an issue that Republicans have centered as grounds for a potential impeachment of President Biden. A California Central District grand jury charged Hunter Biden with three counts each of tax evasion, failure to file and pay taxes, and filing a false tax return, as stated in the 56-page indictment. According to special counsel David C. Weiss, Hunter Biden “engaged in a four-year scheme to not pay at least $1.4 million in self-assessed federal taxes he owed for tax years 2016 through 2019.” Weiss initially began investigating Hunter Biden five years back as a Trump-appointed U.S. attorney for Delaware. This new indictment follows previous charges linked to Hunter Biden’s failure to confirm his drug usage when purchasing a handgun in 2018. The news arrives amid the Republican-led House’s efforts to formalize its impeachment inquiry into President Biden, largely based on non-confirmed allegations of benefiting from his son’s consulting work for Ukrainian and Chinese companies. The charges against Hunter Biden denote a rare move by Weiss, as they also coincide with the disintegration of a plea deal that might have concluded the investigation without jail time. With these latest charges, Hunter Biden could be facing two federal criminal trials in the midst

11 notes

·

View notes

Text

Do you need help with your Tax services in USA?

If you live in the United States, you are required to file a tax return every year. This can be a complex and time-consuming process, especially if you have a lot of income or deductions. That's where Tax services in USA come in.

Masllp can provide a variety of services, including:

Tax services in USA

Tax preparation and filing

Tax planning and consulting

Audit representation

Bookkeeping

How to choose Tax services in USA

There are many different tax services to choose from, so it's important to do your research before you decide on one. Here are a few things to consider:

Experience: Choose a tax service with a good reputation and a team of experienced tax professionals.

Services offered: Make sure the tax service offers the services you need.

Fees: Get quotes from a few different tax services before you make a decision.

Location: You may want to choose a tax service that is located near you.

Benefits of using a Masllp for Tax services in USA

There are many benefits to using a tax service, including:

Saves time and money: Tax services can help you save time and money by preparing and filing your taxes accurately and efficiently.

Reduces stress: Filing taxes can be stressful, but a tax service can take the stress out of the process.

Maximizes your refund: Tax services can help you make sure you are claiming all of the deductions and credits you are entitled to.

How to find Tax services in USA

There are many ways to find a tax service, including:

Masllp

Once you have found a few tax services that you are interested in, be sure to schedule consultations to discuss your needs and get quotes.

Conclusion

Using Tax services in USA can save you time, money, and stress. If you are looking for help with your taxes, be sure to do your research and choose a qualified tax service.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services

3 notes

·

View notes

Text

How to file a claim for lost wages after a car accident

Car accidents can result in not only physical injuries, but also financial setbacks, particularly if the victim is unable to work and earn a living due to the injuries sustained. If you have been involved in a car accident and have lost wages as a result, you may be entitled to compensation. However, filing a claim for lost wages after a car accident can be a complex and daunting process. This article provides a comprehensive guide on how to file a claim for lost wages after a car accident with the assistance of a Putnam County car accident attorney.

Step 1: Seek Medical Attention and Keep Records

The first and most crucial step after a car accident is to seek medical attention, even if you do not feel any immediate pain or discomfort. Some injuries may not be immediately apparent and can worsen over time if left untreated.

It is also important to keep records of all medical expenses, including doctor visits, hospitalization, medication, and therapy.

Step 2: Notify Your Employer

If you are unable to work due to your injuries, you should notify your employer as soon as possible. This is important because your employer may have specific requirements for reporting injuries and filing for disability leave.

Step 3: Gather Evidence of Lost Wages

To file a claim for lost wages, you need to prove the amount of income you have lost due to your injuries. This includes gathering evidence such as pay stubs, tax returns, and bank statements. Your Putnam County car accident attorney can help you gather and organize this evidence to ensure it is admissible in court.

Step 4: Calculate Your Lost Wages

To calculate your lost wages, you need to determine your average weekly earnings before the car accident. This includes any regular pay, overtime pay, and bonuses. You also need to subtract any income you earned during the time you were unable to work, such as sick leave or disability pay.

Step 5: File Your Claim for Lost Wages

To file a claim for lost wages, you need to submit a written claim to the at-fault driver's insurance company. This claim should include documentation of your lost wages, medical expenses, and other damages. Your Putnam County car accident attorney can help you draft and submit this claim to ensure it is properly documented and meets all legal requirements.

Step 6: Negotiate with the Insurance Company

The insurance company may dispute your lost wage claim, or they may offer a settlement that is less than what you are entitled to. Your Putnam County car accident attorney can negotiate with the insurance company on your behalf to ensure you receive fair compensation for your lost wages and other damages.

Step 7: Litigate if Necessary

If negotiations with the insurance company are unsuccessful, your Putnam County car accident attorney can file a lawsuit on your behalf. This is a last resort and can be a lengthy and costly process.

Conclusion

Filing a claim for lost wages after a car accident can be a complicated and overwhelming process. However, with the help of a Putnam County car accident attorney, you can navigate the legal system and obtain fair compensation for your lost wages and other damages.

You May Also Read:

2 notes

·

View notes

Text

A California man has pled guilty to concealing his mother's death for three decades and collecting more than $800,000 in benefits meant for her.

Donald Felix Zampach, 65, of Poway, California, faces up to 25 years in prison after pleading guilty in federal court this week to money laundering and Social Security fraud, admitting he hid the death of his mother, who died in 1990, and forged her signature on documents and income tax returns to continue getting her government benefits, according to the U.S. Attorney's office for the Southern District of California.

“This crime is believed to be the longest-running and largest fraud of its kind in this district,” said U.S. Attorney Randy Grossman in a news release. “This defendant didn’t just passively collect checks mailed to his deceased mother. This was an elaborate fraud spanning more than three decades that required aggressive action and deceit to maintain the ruse."

Zampach told authorities that before his mother died in Japan in 1990, he fraudulently conveyed her home to himself and filed for bankruptcy. After she died, he forged her signature on eligibility certificates to continue receiving her widow’s pension from the Social Security Administration and an annuity from the Department of Defense Finance Accounting Service, the attorney's office said.

Zampach also said he used his mother’s identity to open credit accounts with at least nine different financial institutions, causing them to suffer a loss of more than $28,000, authorities said. Zampach said he laundered the stolen money to pay off the mortgage on his Poway home. Overall, Zampach said he received at least $830,238 in stolen public money between November 1990 and September 2022.

"He filed false income tax returns, posed as his mother and signed her name to many documents, and when investigators caught up to him, he continued to claim she was still alive," Grossman said. "As a result of this fraud, he received more than $800,000 in stolen public money."

Under the plea agreement, Zampach has agreed to pay more than $830,000 and forfeit his Poway home in restitution. He was released on bail pending a Sept. 20 sentencing hearing.

6 notes

·

View notes

Text

Simplifying Your Taxes: The Latest Tips and Tricks for 2023!!

Introduction

As the yearly calendar cycle moves forward, the taxes season creeps up like an unwanted shadow. It’s a time of immense pressure and uncertainty for both individuals and businesses, particularly in light of the ever-evolving tax laws and regulations. However, with the correct information and tools, it is feasible to ease the tax process and increase your tax savings.

2023 Tax Code Changes: A Cautionary Tale

With the recent tax changes for 2023, your tax obligation is about to undergo a transformation. Ignorance is not bliss in this case, as staying informed and comprehending the alterations is vital to making informed financial decisions. Don’t be caught off guard; stay ahead of the curve.

Maximize Your Tax Savings with Deductions

Deductions serve as a means of reducing your tax obligation and can come in handy in a time of need. From medical expenses to charitable donations, there are numerous deductions available for individuals and businesses to claim and lower their tax bill. Don’t let the opportunity slip away.

Investing with Tax Efficiency in Mind

Investing is a crucial aspect of financial planning, but it also holds the potential to significantly impact your taxes. By comprehending the tax implications of your investments and executing tax-efficient strategies, you can minimize your tax bill and maximize your investment returns.

Retirement Accounts: The Tax-Saving Secret

Retirement accounts, such as IRAs and 401(k)s, offer substantial tax benefits that aid in saving for the future while reducing your tax obligation. By comprehending the various types of retirement accounts and taking advantage of their tax benefits, you can include this as a key aspect in your financial planning.

Avail Tax Credits for Increased Savings

Tax credits offer a dollar-for-dollar reduction in your tax obligation and can significantly impact your bottom line. From the Child Tax Credit to the Earned Income Tax Credit, there are several credits available for individuals and families to claim and reduce their tax bill. Make the most of the opportunities at hand.

The Self-Employment Tax: A Guide

Self-employed individuals have unique tax considerations, one of which is the self-employment tax. Comprehending the self-employment tax, including its calculation and payment process, can help prevent any unexpected tax liabilities and ensure a smooth process.

Tax-Loss Harvesting: Maximize Your Savings

Tax-loss harvesting is a strategy aimed at minimizing your tax bill by offsetting capital gains with capital losses. Understanding the workings of tax-loss harvesting and how to implement it can help you take advantage of this valuable tax strategy.

Tax Preparation Services and Software: Your Key to Ease

With the rise of technology, tax preparation services and software have become abundant and accessible. From do-it-yourself options to full-service tax preparation, comprehending the various options and choosing the right one for your needs can simplify the tax process and bring ease to a stressful time.

Avoid Costly Tax Errors – Common Missteps to Steer Clear-Of

Despite having the best intentions, it’s inevitable to make mistakes while filing taxes.

However, by recognizing the most common tax pitfalls, such as neglecting to claim deductions or neglecting to report all your income, you can steer clear of hefty penalties and errors.

A Tax Professional – The Advantages of Hiring One

Hiring a tax professional comes with a multitude of advantages – from ensuring accuracy to maximizing tax savings.

Understanding the perks of having a tax professional by your side, including their proficiency and experience, will assist you in making an informed choice about whether it’s the right fit for you.

Accurate Record Keeping – The Key to a Smooth Tax Process

Accurate and organized record keeping is a crucial aspect of a seamless tax experience.

By maintaining records that are thorough and organized, you’ll have the information you need at your fingertips, ensuring you file your taxes efficiently and accurately.

Tax Planning – Getting a Head Start on Next Year

Tax planning is an ongoing process, and getting a head start on next year can help reduce anxiety and unexpected surprises during tax season.

Knowing the steps you can take now, such as making adjustments to your withholding or making estimated tax payments, can put you in a proactive stance, ensuring a smooth tax process next year.

Understanding Tax Reform: A Path to Minimizing Liabilities

Tax reform is a dynamic and evolving phenomenon that can greatly impact the way you plan and file your taxes.

Staying informed about the latest tax reforms and comprehending their implications can help you make informed decisions, thereby reducing your tax liabilities.

Simplifying Taxation with Software

Maximizing the use of tax software can streamline the tax filing process, making it a much simpler and more manageable task.

Knowing the different varieties of tax software, from basic and beginner-friendly to more intricate and advanced options, can allow you to pick the perfect tool for your specific requirements.

Maximizing Tax Deductions

Optimizing your tax deductions can significantly lower your taxable income, thereby reducing your tax obligation.

Through comprehending the various tax deductions accessible, such as donations to charity or medical expenses, you can seize opportunities to maximize your tax savings.

State Taxes: A Pragmatic Approach

Understanding the specifics of state taxes, which can vary greatly, is the key to making informed decisions.

Keeping abreast with the latest state tax laws and regulations not only helps you remain compliant but also minimizes liability.

CONCLUSION:

Preparing and filing taxes can be a Herculean task. Stay informed, make use of the right tools, and adopt the latest tips and tricks to simplify the process and maximize your savings.

Whether you’re a seasoned tax professional or a beginner, staying updated with the latest tax information and strategies will help make tax season a resounding success.

#Tags#2023Taxes#TaxPlanning#TaxSeason#TaxTips#writers on tumblr#cryptocurrency#business#blogger#finance

3 notes

·

View notes

Text

Everything You Need to Know About Corporate Tax in UAE

Corporate tax is an essential aspect of running a business in the UAE. With its favorable tax laws and a favorable business environment, the UAE has become a hub for foreign investors. It makes it crucial to have a deep understanding and read the information on the corporate tax system in the UAE, in order to make the most of its benefits. This article will help you understand corporate tax in the UAE by explaining rules, regulations and its benefits in the UAE.

Introduction to Corporate Tax in UAE

There is no personal income tax in the UAE, because of which UAE has a tax-free environment, making it an attractive country to live in for most people. However, corporations are subject to corporate tax on their income earned in the UAE. The introduction of CT in this region was intended to help UAE with the transformation and development that the government has strategically planned to achieve. The country’s tax laws are enforced and implemented by The UAE Federal Tax Authority (FTA). The authority also provides guidelines and regulations for corporations and businesses operating in the UAE. Corporations need to be abiding by these laws and regulations to avoid getting penalized.

The Corporate Tax Law in the UAE

The corporate tax law in the UAE is regulated by the Federal Tax Authority, which oversees the implementation and enforcement of the country’s tax laws. The CT law applies to all businesses operating in the UAE, regardless of their size or structure. The tax is levied on a company’s profits, and the rate at which the tax would be at, depends on the type of business and the industry in which it operates.

Corporate Tax Rates in the UAE

The CT rate depends on the type of business and industry that it operates in, hence there is no standard CT rate in UAE. Oil and gas, insurance, and banking are however, some industries that are exempt from CT. The tax rate for other industries ranges from 0% to 55%.

Benefits of Corporate Tax in UAE

The UAE offers several benefits for corporations, including:

No personal income tax

A favorable tax environment for businesses

A stable and predictable tax system

A streamlined process for tax registration and compliance

Access to a large pool of potential customers and investors

Corporate Tax Filing and Compliance in the UAE

It is necessary for corporations operating in the UAE to file their tax returns on an annual basis. The tax returns must be filed with the Federal Tax Authority(FTA) by the end of the financial year. The tax returns must include detailed information on the corporation’s income and expenses, and must be supported by financial statements and other relevant documents.

Common Mistakes to Avoid in Corporate Tax in UAE

To ensure compliance with the CT laws in the UAE, it is important to avoid common mistakes, including:

Not registering for CT

Filing incorrect or incomplete tax returns

Failing to keep accurate financial records

Not seeking professional advice

FAQ

Q: Is there personal income tax in the UAE?

A: No, there is no personal income tax in the UAE.

Q: Who is responsible for implementing and enforcing corporate tax laws in the UAE?

A: CT laws are enforced and implemented by The Federal Tax Authority (FTA) in the UAE.

Q: What is the standard corporate tax rate in the UAE?

A: The rate depends on the type of business and the industry in which it operates. There is no standard ct in the UAE.

2 notes

·

View notes

Text

Everything You Need to Know About Corporate Tax in UAE

Corporate tax is an essential aspect of running a business in the UAE. With its favorable tax laws and a favorable business environment, the UAE has become a hub for foreign investors. It makes it crucial to have a deep understanding and read the information on the corporate tax system in the UAE, in order to make the most of its benefits. This article will help you understand corporate tax in the UAE by explaining rules, regulations and its benefits in the UAE.

Introduction to Corporate Tax in UAE

There is no personal income tax in the UAE, because of which UAE has a tax-free environment, making it an attractive country to live in for most people. However, corporations are subject to corporate tax on their income earned in the UAE. The introduction of CT in this region was intended to help UAE with the transformation and development that the government has strategically planned to achieve. The country’s tax laws are enforced and implemented by The UAE Federal Tax Authority (FTA). The authority also provides guidelines and regulations for corporations and businesses operating in the UAE. Corporations need to be abiding by these laws and regulations to avoid getting penalized.

The Corporate Tax Law in the UAE

The corporate tax law in the UAE is regulated by the Federal Tax Authority, which oversees the implementation and enforcement of the country’s tax laws. The CT law applies to all businesses operating in the UAE, regardless of their size or structure. The tax is levied on a company’s profits, and the rate at which the tax would be at, depends on the type of business and the industry in which it operates.

Corporate Tax Rates in the UAE

The CT rate depends on the type of business and industry that it operates in, hence there is no standard CT rate in UAE. Oil and gas, insurance, and banking are however, some industries that are exempt from CT. The tax rate for other industries ranges from 0% to 55%.

Benefits of Corporate Tax in UAE

The UAE offers several benefits for corporations, including:

No personal income tax

A favorable tax environment for businesses

A stable and predictable tax system

A streamlined process for tax registration and compliance

Access to a large pool of potential customers and investors

Corporate Tax Filing and Compliance in the UAE

It is necessary for corporations operating in the UAE to file their tax returns on an annual basis. The tax returns must be filed with the Federal Tax Authority(FTA) by the end of the financial year. The tax returns must include detailed information on the corporation’s income and expenses, and must be supported by financial statements and other relevant documents.

Common Mistakes to Avoid in Corporate Tax in UAE

To ensure compliance with the CT laws in the UAE, it is important to avoid common mistakes, including:

Not registering for CT

Filing incorrect or incomplete tax returns

Failing to keep accurate financial records

Not seeking professional advice

FAQ

Q: Is there personal income tax in the UAE?

A: No, there is no personal income tax in the UAE.

Q: Who is responsible for implementing and enforcing corporate tax laws in the UAE?

A: CT laws are enforced and implemented by The Federal Tax Authority (FTA) in the UAE.

Q: What is the standard corporate tax rate in the UAE?

A: The rate depends on the type of business and the industry in which it operates. There is no standard ct in the UAE.

4 notes

·

View notes

Text

Here are just two of the corporate giveaways hidden in the rushed, must-pass, end-of-year budget bill

Yesterday, Congress finally voted through the must-pass, end-of-year budget bill. As has become routine, this bill was stalled right until the final moment, so that Congressjerks could cram the 4,000-page, $1.7 trillion package with special favors for their donors, at the expense of the rest of the country.

This year’s budget package included a couple of especially egregious doozies, which were reported out for The American Prospect by Lee Harris (who covered a grotesque retirement giveaway for the ultra-rich) and Doraj Facundo (who covered a safety giveaway to Boeing and its lethal fleet of 737 Max airplanes).

Let’s start with the retirement scam. The budget bill includes Rep Richie Neal’s [DINO-MA] SECURE Act 2.0, which gives savers with retirement funds until age 75 to cash out their retirement savings — netting an extra three years of tax-free growth for the lucky, tiny minority with substantial retirement savings. This follows on Neal’s SECURE Act 1.0 of 2019, when the age was raised from 70.5 to 72.

The tax-exempt retirement savings account is a Carter-era bargain that replaced real pensions — ones that guaranteed that you wouldn’t starve or freeze to death when you retired — with accounts that let people gamble on the stock market, to be the suckers at Wall Street’s poker table:

https://pluralistic.net/2020/07/25/derechos-humanos/#are-there-no-poorhouses

The market-based gambler’s pension is a catastrophic failure. Half of Americans have no retirement savings. Of the half that have any savings, the vast majority have almost nothing saved:

https://www.federalreserve.gov/econres/scf/dataviz/scf/chart/#series:Retirement_Accounts;demographic:all;population:all;units:have

All in all, America has a $7 trillion retirement savings shortfall:

https://crr.bc.edu/wp-content/uploads/2019/10/IB_19-16.pdf

But for a tiny minority of the ultra-rich, tax-free savings accounts like ROTH IRAs are a means of avoiding even the paltry capital gains tax that you have to pay if you own things for a living, rather than doing things for a living. Propublica’s IRS Files revealed how ghouls like Peter Thiel avoided tax on billions in “passive income” by abusing tax-free savings accounts that were supposed to benefit the “middle class”:

https://pluralistic.net/2021/06/26/wax-rothful/#thiels-gambit

Meanwhile, Social Security is crumbling, thanks to a sustained attack on it by the business lobby and its friends in both parties. Progressive Dems had sought to amend SECURE Act 2.0 by inserting some clauses to shore up Social Security, and none of these were included in the final bill.

One of the fixes that died was the Savings Penalty Elimination Act, introduced by Senators Sherrod Brown [D-OH] and Rob Portman [R-OH]. This act would have tweaked the means-testing for Supplemental Security Income, which supports 8m low-income disabled adults and kids. Right now, you can’t collect SSI if you have $2k in the bank, a limit that hasn’t been adjusted for inflation since the 1980s (adjusted for inflation, $2k in 1980 is $7226.00 in 2022).

The $2k savings cap means that you have to be substantially below the poverty level to receive $585/month in SSI assistance — this being the only source of income for the majority of SSI recipients. Means-testing is a self-immolating fetish for corporate Dems and in retrospect, this betrayal seems inevitable:

https://pluralistic.net/2022/05/03/utopia-of-rules/#in-triplicate

(Notice how no one proposes means-testing billionaires when they get PPP loans or hundreds of millions in IRS “refunds” — like Trump, who paid substantially less tax than you did:)

https://www.cnbc.com/2022/12/21/trump-income-tax-returns-detailed-in-new-report-.html

And it was a betrayal: progressive Dems bargained with Neal and co not to publicly condemn SECURE Act 2.0 if they could get some concessions for the 8 million poorest disabled people in America. In the end, Neal rug-pulled them. Of course he did! This is Richie Fucking Neal, the best friend the Trump tax giveaway ever had:

https://pluralistic.net/2020/07/13/youre-still-the-product/#richie-neal

As with everything Neal touches, this screws poor people in multiple ways. First, it leaves the SSI cap intact. But it also creates a giant unfunded liability in the federal budget. Technically, there’s no reason this should lead to cuts. The US Treasury can’t run out of dollars, and giveaways to the rich are only mildly inflationary, since rich people put their money in the bank and mostly spend it on buying politicians, not goods.

But because of the delusion that currency producers like the US Treasury have the same constraints as currency users like you and me, Congress will need to come up with “Pay Fors” in future budgets to “make up for” the money they’re giving to rich people with SECURE Act 2.0. Dollars to toenail clippings, they’ll do that by hacking away at the tattered remains of the US social safety net.

Fear not, you don’t need to be a desperately poor disabled person or child to get fucked over by late additions to a 4,000 page must-pass bill! If you can afford to get on an airplane, Congress has something for you, too!

Remember when Boeing (the monopoly US airplane manufacturer that squandered $43b on stock buybacks and had to borrow $14b from the US public to survive the pandemic) told the FAA that it could self-certify its 737 Max airplanes, and then killed hundreds and hundreds of people with its defective planes?

https://pluralistic.net/2020/03/12/boeing-crashes/#boeing

The 737 Max was unsafe for many reasons, but one glaring factor was the fact that Boeing sold some of its core safety as “extras” — like they were downloadable content for your Fortnite character — leading to multiple crashes in which all lives were lost:

https://apnews.com/article/ethiopia-indonesia-accidents-ap-top-news-international-news-140576a8e9d4449eae646c8c479fdc3a

Boeing was forced to take the 737 Max out of service, but it eventually brought the plane back, “fixing” the problems by renaming the “737 Max” to the “737 8”:

https://pluralistic.net/2020/08/20/dubious-quantitative-residue/#737-8

Supposedly, Boeing has been diligently working on fixing the problems with its defective jets that can’t be addressed by a rebranding campaign. This wasn’t voluntary: the 2020 Aircraft Certification, Safety, and Accountability Act required Boeing — and every other manufacturer whose aircraft were certified by the FAA — to meet new minimum safety standards by December 27, 2022.

Every manufacturer met that deadline, except Boeing, and someone amended the budget bill to give the company three more years to meet these security standards. Critically, the new security measures, when they come, will be certified by an FAA that Republicans will control, thanks to the House changing hands.

https://prospect.org/infrastructure/transportation/government-spending-bill-waives-aircraft-safety-deadline/

Boeing is slated to ship 1,000 new 737 Maxes, which will fetch $50b for the company. Many of these planes will fly directly over my house, which is on the approach path for Burbank airport. Southwest Air flies dozens of 737 Maxes right over my roof every single day.

As Facundo points out, the FAA can ill afford any more hits to its credibility. It was once the case that if the FAA certified an aircraft, every other country in the world would waive any further certification, so trusting were they of the FAA’s judgment. That is no longer the case: today, the European Aviation Safety Agency does its own aircraft testing, holding jets that enter EU airspace to a higher standard than the FAA does for US planes.

It’s just another reminder that the US doesn’t have “corporate criminals” because the US doesn’t have any meaningful enforcement for corporate crimes. In America, we love our companies like we love our billionaires: too big to fail and too big to jail:

https://pluralistic.net/2021/10/12/no-criminals-no-crimes/#get-out-of-jail-free-card

Image:

Ryan Lee (modified)

https://www.flickr.com/photos/190784293@N05/50862532686

CC BY 2.0

https://creativecommons.org/licenses/by/2.0/

Henry Wadey (modified)

https://commons.wikimedia.org/wiki/File:Flames_%2858765896%29.jpeg

CC BY 3.0

https://creativecommons.org/licenses/by/3.0/deed.en

[Image ID: A living room scene, featuring a sofa in the background and a sofa in the foreground. A man's hand reaches into the frame to lift up the corner of the sofa. A broom enters the frame to sweep a pile of dirt under the rug. Mixed in with the dirt are a crashed WWI biplane with Southwest Airlines livery, and an old lady in a rocking chair.]

#pluralistic#secure 2.0#ssi#means testing#irsleaks#fidelity#vanguard#regulatory capture#faa#retirement crisis#retirement#finance#social security#pensions#corruption#congress#aviation#boeing#737 max#must-pass#irs files

83 notes

·

View notes

Text

Why hire a tax preparer?

Taxes are notoriously complex and hard to digest. With that said, many people find themselves anxious and overwhelmed during tax season. If this rings true for you, consider hiring a professional to help with your taxes. With a tax preparer at your disposal, you can bid farewell to the stress that comes with filing your taxes. If you are not sure if a tax preparer is right for you, here are some reasons why you should enlist the helping hands of a professional.

You Made Mistakes The Year Prior

If you lack the necessary expertise, it’s all too easy to make mistakes on a tax return. If you’ve found yourself in this unfortunate situation, a financial expert can breathe clarity into these affairs. Your tax professional will review the return, subsequently making the necessary adjustments. As a result, you minimize the damage, gain peace of mind, and rid yourself of a financial fiasco.

You're Newly Married

If you’ve recently gotten hitched, filing your taxes might prove more difficult. Fortunately, a tax professional can advise you on how to take advantage of your new marital status. What’s more, they’ll show you what documents you need to collect now that you have two incomes to report. Navigating these unfamiliar waters isn’t something you should do alone. Set you and your spouse up for tax season success when you hire a tax preparer.

You’ve Started A Small Business

If you’ve pursued an entrepreneurial endeavor within the last year, consider employing a tax professional. Not only will they help you gather the necessary paperwork, but they’ll also tell you how you can benefit financially as a sole proprietor. Unfortunately, most small business owners don’t consult with a specialist until a few years after they’ve launched their company. Consequently, they miss out on tax exemptions and other perks. With that in mind, if you’re new to the entrepreneurial realm, work with a tax professional so that you can boost your tax refund.

You’ve Sold/Purchased Real Estate

It is no secret that buying or selling real estate influences your finances. Therefore, filing your taxes demands extra legwork. From capital gains to deductions, there’s a lot to consider, making it crucial to partner with a tax expert. Most notably, working with a specialist ensures that you get the most out of your investment. Instead of getting bogged down in the details, allow a professional to handle the intricacies for you.

You’ve Adopted A Child

If you’ve adopted a child, consulting with a tax preparer is wildly beneficial. Using their insight, they’ll let you know what financial perks you’re entitled to. In 2015, for example, the IRS offered a tax credit of up to $13,400 per child. To make sure that you do not overlook anything, place your trust in a professional. For optimal results, reach out to a tax specialist early on in the process. In addition to being prudent, this also guarantees that you cover all your bases before filing your taxes.

You Have Foreign Assets

If you have a foreign bank account or investments, you must report this information to the IRS. Otherwise, you’re liable to get audited by the IRS. With an accountant, you can calculate exchange rates and file the correct forms with ease. In essence, you don’t risk leaving out pertinent information. Foreign assets can be confusing enough, but when you’re entering this information into your tax return, it can complicate matters even further. For your sake, give a tax professional the financial reins.

You’re Self-Employed

If you’re self-employed, you likely don’t have any taxes withheld. While this might seem favorable, it can make tax season a nightmare. In most cases, self-employed individuals have to pay self-employment tax. If you are not familiar with this territory, that is where a tax professional comes in. With their tax help, you will learn the ins and outs of self-employment tax while keeping the IRS happy.

0 notes

Text

The Benefits of Hiring an Accountant for Tax Preparation

Your need for a tax accountant depends on your personal situation. You might consider using an accountant if you're self-employed, or if you experienced significant life changes during the tax year. You might also want to use an accountant if you need to amend a previous year's tax return.

It can be worth the expense, as many people find that they actually save money by going to an accountant because their tax refund increases significantly. But there are also cases where you may want to file your return on your own.

In this guide, learn when you would (and wouldn't) need an accountant and how their services would impact you.

Key Takeaways

You might be better off using an accountant if you own your own business, are self-employed, have had major life changes like a new house or a new baby, or if you've failed to file taxes in the past.

You may be able to skip the expense of an accountant if your tax situation is simple and you have no spouse, dependents, mortgage, or business to worry about.

If you choose not to use an accountant, you could try IRS Free File if your income qualifies, or use readily available tax preparation software.

When You Need an Accountant

A few circumstances will wave a flag that you might be better off using an accountant than trying to handle preparation of your tax return on your own. In most cases, there are advantages in going to an accountant if you have a complicated situation.

As tax season approaches, many individuals wonder whether they need an accountant to file their taxes. The answer depends on several factors, including the complexity of your tax situation, your comfort level with tax laws, and the time you have available.

Benefits of Hiring an Accountant:

Expertise: Accountants stay up-to-date on tax laws and regulations.

Accuracy: Accountants minimize errors, ensuring maximum refunds.

Time-Saving: Accountants handle paperwork, freeing up your time.

Audit Protection: Accountants represent you in case of audits.

Tax Planning: Accountants provide guidance on tax-saving strategies.

Signs You Need an Accountant:

Complex Tax Situation: Self-employment, investments, or rental income.

Multiple Income Sources: More than one job or income stream.

Deductions and Credits: Uncertainty about eligible expenses.

Tax Audits: Previous audit experience or concerns.

Business Ownership: Small business or side hustle.

When to Seek Professional Help:

Unfamiliarity with tax laws or forms.

Complex tax calculations or deductions.

Previous tax errors or audits.

Significant life changes (marriage, divorce, etc.).

Business or self-employment income.

Conclusion

If you are confused or have any questions about your financial situation when filing returns, it never hurts to reach out to a CPA for small business In some cases, they will answer your questions at little to no charge.

0 notes

Text

TDS Return Filing Services | Accurate, Timely, and Hassle-Free Compliance |LegalMan

TDS (Tax Deducted at Source) return filing services is a crucial requirement for businesses and individuals responsible for deducting tax before making payments. Here's a detailed overview of TDS return filing services, what it entails, and why it's essential for taxpayers to adhere to regulations.

1. Understanding TDS

Tax Deducted at Source (TDS) is a system introduced by the Income Tax Department in which tax is deducted at the source of income. It is the government's way of collecting tax at the time of generating income. Common examples include salaries, interest on deposits, and contractor payments. The person deducting the tax is known as the "deductor," while the person receiving the payment is the "deductee."

TDS is applicable to a wide range of payments, including:

Salaries

Interest payments by banks

Rent payments

Contractor fees

Commission payments

2. TDS Return Filing: What It Involves

TDS return filing services is a process where individuals or businesses that deduct tax at the source submit a statement to the tax authorities. This statement contains details of the tax deducted and the corresponding payments made to the tax department.

Key components of the return filing process include:

PAN Details: Both the deductor’s and deductee’s PAN must be submitted correctly.

Challan Details: Information about the taxes paid to the government, including the challan number, date, and amount, should be included.

Tax Payment Information: A complete summary of all tax deductions, payments, and deposits must be recorded.

Form Selection: Depending on the type of payment, different TDS forms apply, such as:

Form 24Q for salary payments

Form 26Q for other payments

Form 27Q for non-resident payments

Form 27EQ for tax collected at source (TCS)

3. Why TDS Return Filing Is Essential

Failure to file TDS return filing services can result in severe penalties. Businesses need to ensure that they comply with the guidelines to avoid hefty fines or legal consequences. Here are some key reasons why TDS return filing is crucial:

Compliance: TDS returns are mandatory for businesses or individuals who deduct tax, ensuring they comply with tax laws.

Avoiding Penalties: Failure to file returns on time can attract penalties under Section 234E, with fines of ₹200 per day until the return is filed.

Tax Credit: Properly filed TDS returns ensure that the deducted tax is credited to the deductee's account, avoiding discrepancies during tax assessments.

Transparency: TDS returns create a transparent record of tax deductions, ensuring smooth tax audits and assessments.

4. Common Mistakes to Avoid in TDS Return Filing

Incorrect PAN Details: Providing incorrect or mismatched PAN details is one of the most common mistakes, which can lead to delays and penalties.

Late Filing: Missing the due date can result in penalties, so it’s crucial to stay updated on deadlines.

Mismatch in Challan Details: Ensure that challan details, such as numbers and dates, are accurate to avoid complications during processing.

Ignoring Amendments: Not staying updated with the latest tax amendments can lead to incorrect filings.

5. The Role of Professional TDS Filing Services

Given the complexities of TDS return filing services, many businesses opt to outsource this task to professional service providers. These experts ensure accurate and timely filings, helping businesses avoid penalties and ensure compliance. Key benefits of using professional services include:

Expertise: Tax professionals are well-versed in the intricacies of TDS regulations and can navigate changes in tax laws efficiently.

Time-Saving: Outsourcing TDS return filing allows businesses to focus on their core operations while ensuring timely compliance with tax regulations.

Error Minimization: Professionals reduce the chances of errors in filings, ensuring that all details are correctly reported.

Up-to-Date Compliance: Professional service providers stay updated on the latest changes in tax laws, ensuring your filings are always compliant.

6. Penalties and Consequences for Non-Compliance

Late Filing Fee: Under Section 234E, a late fee of ₹200 per day is applicable until the return is filed, subject to a maximum penalty of the tax amount.

Interest on Late Payment: If tax is deducted but not paid to the government, an interest of 1.5% per month may be levied until the payment is made.

Prosecution: In severe cases of non-compliance, prosecution may be initiated against the defaulter.

7. Conclusion

TDS return filing services is an essential part of tax compliance for businesses and individuals responsible for tax deduction. Ensuring timely and accurate filing helps avoid penalties and ensures the smooth functioning of tax assessments. While the process can be complex, professional TDS filing services provide a reliable solution to managing compliance, minimizing errors, and staying up to date with the latest tax laws.

Regular and accurate TDS return filing helps maintain a seamless flow of tax deductions, credits, and refunds, benefiting both the deductor and deductee in the long run.

#TDS return filing services#TDS/TCS return filing services#Prime Minister Employment Generation Programme

0 notes