#benefits of itr filing

Text

How Income Tax Return Online Filling

Filing your income tax return online can feel like navigating a labyrinth, but with the right guide, it’s more like a walk in the park. We’ll break down each step, simplify the jargon, and get you filing with confidence. Let’s dive in!

Why File Your Income Tax Return Online?

Filing your income tax return online isn’t just about following trends; it’s about leveraging modern technology to make your life easier. Here’s why you should consider it.

Convenience and Accessibility

Gone are the days of standing in long queues or filling out mountains of paperwork. Online filing lets you submit your return from the comfort of your home, anytime. It’s like having a tax office at your fingertips!

Accuracy and Efficiency

Online portals are designed to minimize errors. With built-in calculators and validation checks, you’re less likely to make mistakes. Plus, it speeds up the whole process, so you can get your refund quicker.

Step-by-Step Guide to Filing Your Income Tax Return Online

Ready to get started?

Follow these steps to file your income tax return online efficiently and correctly.

Step 1: Gather Necessary Documents

Step 2: Register or Login into the Income Tax Portal

Step 3: Select the Appropriate ITR Form

Step 4: Fill in Your Personal Details

Step 5: Provide Income Details

Step 6: Claim Deductions and Exemptions

Step 7: Review and Verify Your Return

Give your return a thorough once-over. Check for any errors or missing information. Think of it as proofreading an important email.

Step 8: Submit Your Return

Once satisfied, hit the submit button.

Congratulations, you’ve filed your return!

Step 9: E-Verify Your Return

E-verification is the final step to validate your return. You can do this through methods like Aadhaar OTP, net banking, or EVC. It’s like signing off on your work.

Common Mistakes to Avoid

Even with the best tools, mistakes happen. Here are common pitfalls to watch out for.

Incorrect Personal Information

Ensure all personal details are correct. Errors in your name, PAN, or bank details can lead to processing delays.

Misreporting Income

Be accurate with your income details. Misreporting can trigger unwanted scrutiny and penalties.

Not Claiming All Deductions

Maximize your tax savings by claiming all eligible deductions. Missing out means paying more tax than necessary.

Benefits of E-Verifying Your Return

Why bother with e-verification?

It’s not just a formality—it comes with real benefits.

Faster Processing

E-verified returns are processed quickly, meaning you’ll get your refund sooner. Who doesn’t like faster refunds?

Reduced Chances of Manual Errors

E-verification reduces the chances of manual errors in data entry, making your filing experience smoother and more reliable.

Conclusion

Filing your income tax return online doesn’t have to be daunting. With the right preparation and a systematic approach, you can navigate the process smoothly.

Happy filing!

By Paisainvests.com

#digital tax return#e-filing taxes#e-verifying tax returns#filing ITR#filing taxes online#income tax documents#income tax guide#income tax portal#income tax return#online tax filing#online tax return benefits#online tax submission#revised tax return#step-by-step tax filing#tax deductions#tax filing deadline#tax filing mistakes#tax filing tips#tax return process#tax return tips

0 notes

Text

Top 5 Websites for Filing Income Tax Returns (ITR) Online in India

Introduction:

Filing income tax returns (ITR) is a necessary task for individuals and businesses in India. With the convenience of the internet, online platforms have made it easier than ever to file your ITR. In this blog post, we will be highlighting the top 10 websites in India that offer efficient and user-friendly online ITR filing services. These websites have been selected based on their reputation, ease of use, features, and customer reviews.

Income Tax India Official Website:

The official Income Tax India website is one of the most trusted platforms for filing income tax returns online. It provides a user-friendly interface and comprehensive support for taxpayers. The website offers various e-filing services, including ITR filing, tracking refunds, and accessing tax-related information and forms. Additionally, it provides resources and guides to help users navigate the taxation process easily.

Clear Tax

ClearTax is a popular platform for filing income tax returns in India. It offers a simple, fast, and secure way to e-file your ITR. ClearTax provides step-by-step guidance throughout the process and ensures accuracy in calculations. The platform also offers additional features such as tax-saving guides, investment declarations, and expert support. ClearTax is widely recognized for its user-friendly interface and excellent customer service.

My ITReturn

MyITReturn is a reliable website that specializes in online ITR filing services. It offers a seamless user experience with its easy-to-use interface and straightforward process. MyITReturn ensures that users have access to all the necessary forms and documents required for smooth filing. The platform also provides expert assistance and tax-saving tips for individuals and businesses. With a high customer satisfaction rate, MyITReturn stands out as a trusted choice for ITR filing.

TaxBuddy

TaxBuddy is a comprehensive online platform for tax-related services, including ITR filing. It offers a range of features to ensure a hassle-free experience for users. TaxBuddy simplifies the entire process by providing a step-by-step guide and built-in error checks. The platform also offers tax planning tools, refund tracking, and dedicated customer support. With its user-friendly interface and value-added services, TaxBuddy is a suitable choice for filing income tax returns.

The Tax Heaven (https://www.thetaxheaven.com):

The Tax Heaven is a trusted website that provides efficient online tax filing services in India. It offers hassle-free ITR filing for both individuals and businesses. The platform guides users through the entire process and ensures compliance with regulatory requirements. The Tax Heaven boasts a user-friendly interface and a team of experienced experts who ensure accurate and timely filing of ITRs. Their services come at an affordable price, making them an excellent choice for taxpayers.

Conclusion:

Filing income tax returns online has become the preferred method for individuals and businesses in India. The convenience, accuracy, and efficiency provided by online platforms have simplified the ITR filing process. In this blog post, we highlighted the top 5 websites, including the official Income Tax India website, ClearTax, MyITReturn, TaxBuddy, and The Tax Heaven. These platforms offer user-friendly interfaces, expert assistance, and additional features to enhance the filing experience. We recommend exploring these websites to find the one that best suits your needs for a smooth and hass.

#ITR Benefits for Salaried Individuals#itr return services#itr return services in jaipur#The Tax Heaven#Filing Income Tax Returns (ITR) Online in India

0 notes

Text

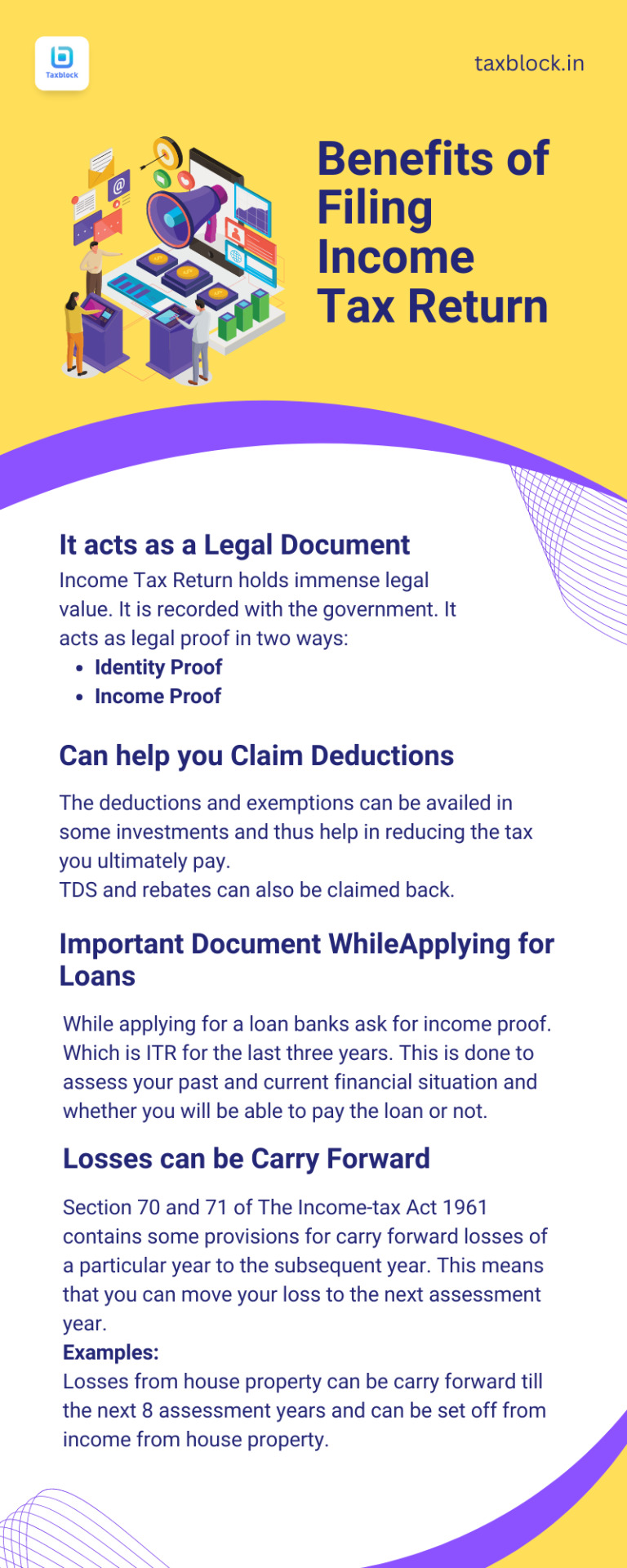

To know more visit our website.

Follow for more.

#ITR#filing itr#income tax#gst tax#benefits of itr#claim deduction#financialservices#tax#entrepreneur#gst#taxblock#fintech

0 notes

Link

ITRs are official records that attest to your on-time tax payments. It is an official document from the Income Tax Department acknowledging a tax return. ITR is used by banks to evaluate your financial situation. However, if you want to apply for a home loan, you are not required to submit an ITR.

0 notes

Text

MSME Registration firm In Rohinis

MSME Registration firm In Rohinis

MSME registration in Rohini. We chartered accountant firm in sec 24 Rohini. Are you looking for your business's GST registration, ITR filing, or Tax consultant? Call us and consult to the best CA in Rohini

MSME refers to Micro, Small, and Medium-Sized Enterprises. According to the Micro, Small & Medium Enterprises Development (MSMED) Act of 2006, Micro, Small, Medium Enterprises (MSME), also known as SSI, are classified into two classes:

Manufacturing Industry

For Micro Enterprises: No more than 20 lakh rupees may be invested in equipment and machinery.

b) For Small Businesses, the maximum amount invested in plant and machinery is 5 crore rupees, but the investment is higher than 20 lakhs.

c) Plant and machinery investments for medium-sized businesses must be more than 5 crore rupees but not more than 10 crore.

Documents Needed for Rohini MSME and SSI Registration:

1. Aadhaar Card (attached in soft copy)

2. Social Classification (General, OBC, SC, ST)

3. The company or business name

4. Organizational Type (LLP, Pvt. Ltd., Partner, Ownership)

5. PAN Card (Owner/Business/Firm)

6. Address of the Office

Mobile number and email address

8. Bank IFS Code and Account Number (Owner/Firm/Corporate)

9. The primary business activity of the company (your work for the firm)

10. The number of workers

11. Purchasing Plant and Machinery and Equipment

The Services Industry

A) micro enterprise's equipment investment cannot exceed 10 lakhs.

b) Small Businesses: Equipment investments totaling more than 10 lakhs but less than two crores.

c) Medium-Sized Businesses: The amount invested in equipment exceeds two crores but does not surpass five crores.

Advantages of MSME Registration with CA Nakul Singhal Associates (Rohini)

Benefits from Banks: MSMEs are eligible for special schemes designed by banks and other financial institutions because they recognize them. This typically involves lower bank interest rates and priority sector lending, which indicates that there is a strong chance that your company will be approved for a loan. If repayment is delayed, special treatment might also be granted.

Benefits from taxes: Depending on your industry, you can be eligible for an excise tax exemption program or be spared from paying some direct taxes during the early stages of your company.

State Government Benefits: Those that have registered under the MSMED Act typically receive subsidies from their respective states for electricity, taxes, and access to state-run industrial estates. Specifically, most states exempt sales taxes, and produced items are given an advantage in purchasing.

advantages of the central government: The loan guarantee program is one of the programs that the central government occasionally offers to assist MSMEs.

The Credit Guarantee Program (CGTMSE).

Credit and the input of income from several sources to support them are two of the biggest challenges small-scale enterprises encounter.

Changes have been made to the Credit Guarantee program, which was created to assist MSME, in increasing its advantages for small traders

The scheme's key components are as follows:

1. Improving the ideal qualifying loan amount to Rs. 50 lakh from Rs. 25 lakh

2. Lowering the one-time guarantee from 1.5% to 0.75% for loans taken out by MSME in Northeastern India.

3. Increasing the guarantee's coverage from 75% to 80% for:

4. Operated by women Small and medium-sized businesses

5. Microbusinesses, up to a 5 lakh loan amount

6. Loans taken out in the country's northeast

7. Lowering the one-time guarantee charge from 1.5% to 0.75% for all loans obtained in North Eastern India.

BecauseMSMECertificate holders can present their certificate ofMSMEregistration when applying, it has become much easier for these businesses to get licenses, approvals, and registrations from the appropriate authorities in any area.

As specified in the government scheme and contingent on economic activity, enterprises with anMSMEregistration may benefit from a direct tax exemption for their first year of operation.

To encourage the participation of small businesses in India, the government has certain bids that are exclusively available toMSMEs.

Ease of approval from federal and state government agencies; businesses registered asMSMEsare given priority when it comes to government certification and licenses.

Our services:- Accounting And AuditingCompany Audit & ROC FilingGST Compliance & AuditCorporate Law ConsultancyIncome Tax ComplianceFormation of companies under ROCTax Planning & Filing.

0 notes

Text

Double taxation is a major hurdle for NRIs filing tax returns in India. Learn how to navigate tax liabilities, avoid penalties, and utilize DTAA benefits.

#DoubleTaxation#NRITaxIssues#ITRFilingChallenges#NRITaxCompliance#TaxationIndia#NRITaxation#DoubleTaxationRelief#IndiaTaxRegulations#NRITaxReturn#GlobalTaxation

0 notes

Text

Why Working with the Best Income Tax Consultant in India is a Smart Decision?

Tax management is a formidable task, not only for a busy businessperson but also for an individual taxpayer. The numerous and complicated rules and regulations on taxation, apart from the frequent changes in statutes, make professional advice quite indispensable. Suppose one happens to be based in India. In that case, an appropriate income tax consultant will make the entire exercise quite seamless and simplify to ensure legitimate retention of one’s earnings while avoiding fines or penalties.

In this blog, we will find out how to find the best income tax consultant in India what services one may expect; and why professional tax guidance is a necessity. Let us also find out how TaxDunia will help you cater to all your tax needs.

Why Do You Need an Income Tax Consultant?

The laws of income tax are usually very complicated, and even a small mistake in the return filing may end up inflicting heavy financial impacts. An income tax consultant aids in coping with such intricacies and making your compliance with all applicable laws. If one need helps in ITR Filing in Jaipur or planning your taxes for the upcoming years, having a trustworthy consultant helps helpful.

What Services Do Top Income Tax Consultants Offer?

Top Income tax consultants offer numerous services that are aimed at helping individuals and businesses develop better ways of handling their taxes. In this regard, some of the prevalent services offered include:

1. Filing of Income Tax Returns

The tax consultants help in preparing and filing your income tax returns quite accurately and on time. Thus, the service relieves you from unnecessary headaches, as there are constant changes in the set of rules regarding taxation. If you are looking forward to seeking the services of ITR Filing in Jaipur, then professional advice will surely help you to move accordingly with the local tax rules and regulations.

2. Tax Planning

Tax planning plays an important role in optimizing your tax savings thereof. The best income tax advisors provide expert strategies in minimizing your legally bound tax liability. It includes analyzing the financial situation and accordingly suggesting measures to reduce tax outgo while maximizing savings.

3. Business Tax Services

The different consultancy services that tax consultants offer to business owners include corporate tax planning, GST filing, and business tax audits. All these services are meant to ensure your business remains compliant with all applicable tax laws so as not to attract penalties. If you seek the Top income tax consultants near me, you may want to search among those who have specialized in business taxation.

4. Tax Dispute Resolution

The income tax consultants can also represent you in case of a tax audit or disputes with the tax authorities and get the problem sorted out on your behalf.

Benefits of Hiring Best Online Tax Consultant in India

Due to flexibility and comfort, a lot more people are considering the best online tax consultants in India. Online consultants offer the same level of service that traditional consultants can but added to this advantage is the accessibility remotely. Certain advantages that make Taxdunia the best online tax consultant in India are given below:

Time-Saving: You can upload your documents online and consult with your tax advisor remotely to save yourself from the hassle and time consumed in visiting their office.

Efficient: Most online consultants use higher-level software systems that keep the process of tax filing fast and accurate.

Affordability: Online tax consultants charge competitively, hence are more affordable than other traditional tax advisors.

Key Qualities to Look for in the Best Income Tax Consultant

Whenever one looks for the most powerful income tax consultant in India, 2024, some of the most vital things one will check to include:

1. Years of Experience and Expertise

The experience a consultant has is what one should ask first. A good tax consultant can boast of experience in both individual taxation and company taxation. TaxDunia boasts of an expert pool of highly qualified tax professionals who stay updated with regulations.

2. Reputation

Check through reviews and testimonials to ensure the consultant has amassed a good reputation based on quality service. The best income tax advisors near me should have a strong track record of customer satisfaction.

3. Accessibility

Living in a digital world, it is a plus if one has access to the services online. The best income tax consultant online in India will be offering services that you can easily access via email, by phone, or through virtual meetings.

Areas in which you can seek TaxDunia consultation

At TaxDunia, we at every step try to make the process of tax filing and planning as smooth and hassle-free as possible. From a team which encompasses the best income tax advisors in India with several years of experience, we assure proven results. No matter if you are a business owners or salaried employees or freelancers, the solutions will always be tailor-made to your needs.

Various ways of managing your finances and legal requirements often turn out to be overwhelming for any person. That is where we step in with a range of services to cater to your specific needs. Let us delve into the various areas wherein you can get the best tax consultant services from our expert consultation.

1. Income Tax Return Filing Service in India

The return of your income tax can be a hassle, but with our Income Tax Return Filing Service in India make the process quicker and more accurate. No matter if you are an individual or a business client, we ensure that your filings are compliant with all current regulations.

2. Public Limited Company Registration Service

Incorporation of a public limited company requires different legalities. TaxDunia provides professional Public Limited Company Registration Services wherein our experts guide you from the paperwork until the final approval to set up the company without hassles.

3. Private Limited Company Registration Service in India

We provide the opportunity to entrepreneurs for starting their business with hassle-free Private Limited Company Registration Service in India. We will look into all the required legalities on behalf of you so that you prepare for the business development.

4. One Person Company Registration Service in India

In case you are a solo entrepreneur, then this service of One Person Company Registration in India is exclusively meant for you. TaxDunia will help you in legally setting up your company while providing personalized services right from the incorporation of your company.

5. GST Return Filing Services in India

Every business needs to be GST compliant. Our services for filing GST returns in India will ensure that all your GST returns are filed on time and accurately to avoid attracting any kind of penalties.

Top 10 best income tax consultant in India

The Top 10 best income tax consultants in India are: -

1. Taxdunia

2. Deloitte India

3. PwC India

4. EY India

5. Grant Thornton India

6. BMR & Associates LLP

7. Dhruva Advisors LLP

8. Nangia Andersen LLP

9. Shardul Amarchand Mangaldas & Co.

10. Lakshmikumaran & Sridharan

Final Thoughts:

Finding the right income tax consultant can make a big difference in your financial work. Indeed, the best income tax consultant in India, 2024, will make sure not only that the returns are filed but also aid in optimizing your tax savings for times to come.

Whether you are looking for the best tax consultant services or the Best online tax consultant India, we at TaxDunia are always on your side to help you out through each step. Kindly contact us today to know the ease of hassle-free tax management.

Other Link: -

Trademark Registration in India

TDS Return Filing Service in India

Copyright Registration in India

Foreign Company Registration in India

Sole Proprietorship Registration Service

Patent Registration Service in India

#Top Income Tax Consultants#Best Income Tax Advisors#Tax Consultant Services#Top income tax consultants near me#ITR Filing in Jaipur#Best income tax advisors near me#Best income tax consultant online in india#Best tax consultant services#Best income tax consultant in india 2024

0 notes

Text

E-filing ITR

E-filing ITR simplifies the tax filing process by allowing individuals and businesses to submit their Income Tax Returns online. This efficient method ensures faster processing, reduced paperwork, and immediate acknowledgment of receipt. By leveraging e-filing, you can easily track the status of your return, access previous filings, and benefit from enhanced security features. Our expert complianceship services make e-filing hassle-free, guiding you through every step to ensure accurate and timely submission. Embrace the convenience of e-filing ITR and ensure your tax returns are filed smoothly and efficiently.

0 notes

Text

Understanding the Annual Compliance Requirements for Private Limited Companies

Introduction

Private limited companies (PLCs) are a famous business structure in many countries, including India. They offer limited liability, a separate legal entity, and the ability to raise funds from shareholders. However, with these benefits comes a host of annual compliance requirements for Private Limited Companies that must be fulfilled to ensure legal standing and operational efficiency.

What are Annual Compliance Requirements?

Annual compliance requirements are the legal obligations that a private limited company must adhere to each financial year. These obligations ensure that the company operates within the law and maintains good standing with regulatory authorities. Failure to comply can result in penalties, legal issues, and reputational damage.

Why are Annual Compliance Requirements Important?

Legal Protection: Compliance ensures that the company is operating legally, protecting it from potential lawsuits or penalties.

Transparency: Regular filings and disclosures promote transparency, which can enhance the company's reputation among stakeholders and investors.

Credibility: Meeting compliance requirements establishes credibility and trust with customers, suppliers, and investors.

Operational Efficiency: Compliance promotes better management practices and can lead to more efficient operations.

Essential Annual Compliance Requirements for Private Limited Companies

Annual Financial Statements

Every private limited company is required to prepare and file its financial statements at the end of each financial year. These statements typically include:

Balance Sheet: This document details the company's financial position at the end of the financial year and includes assets, liabilities, and equity.

Profit and Loss Account: This statement summarises the company's revenues, costs, and expenses during the financial year, providing insight into profitability.

Cash Flow Statement: This statement shows the inflow and outflow of cash, highlighting the company's liquidity position.

Filing Deadline

In India, these financial statements must be filed with the Registrar of Companies (RoC) within 30 days of the Annual General Meeting (AGM).

Conducting an Annual General Meeting (AGM)

Importance of the AGM

Every private limited company must hold an Annual General Meeting (AGM) to discuss its performance, future strategies, and financial statements. The AGM also serves as a platform for shareholders to voice their concerns and provide feedback.

AGM Timing and Notification

The AGM should be held within six months of the end of the financial year, and all members must be given a minimum of 21 days' notice.

Annual Return Filing

Understanding Annual Returns

An annual return is a mandatory document that provides a snapshot of the company's registered office, principal business activities, shareholding pattern, and details of directors and shareholders.

Filing Deadline

The annual return must be filed with the RoC within 60 days from the date of the AGM.

Payment of Annual Fees

Regulatory Fees

Private limited companies must pay annual fees to the Registrar of Companies as prescribed under the Companies Act. The costs vary based on the company's authorised share capital.

Income Tax Filing

Private limited companies are required to file their income tax returns annually. This includes submitting the Income Tax Return (ITR) along with the necessary documents and proofs.

GST Compliance

If a private limited company is registered under the Goods and Services Tax (GST) regime, it must comply with GST filing requirements, including filing GST returns monthly or quarterly.

Maintenance of Statutory Registers

Private limited companies are required to maintain various statutory registers, including:

Register of Members

Register of Directors and Key Managerial Personnel

Register of Charges

These registers must be updated regularly and made available for inspection by the authorities if required.

Penalties for Non-Compliance

Failure to comply with annual compliance requirements can result in severe penalties, including:

Fines: The company may incur penalties for late filings or non-compliance with statutory obligations.

Legal Action: Persistent non-compliance can lead to legal action against the company and its directors.

Revocation of License: In extreme cases, the RoC may revoke the company's license to operate.

Best Practices for Ensuring Compliance

Maintain Accurate Records: Ensure all financial records and statutory registers are accurately maintained and updated.

Regular Reviews: Conduct regular reviews of compliance status to identify and rectify any potential issues.

Seek Professional Help: Consider hiring a company secretary or compliance expert to oversee and manage compliance obligations.

Conclusion

Understanding and adhering to the annual compliance requirements for private limited companies is crucial for legal standing and operational efficiency. By fulfilling these obligations, companies can protect themselves from legal issues, enhance their credibility, and promote transparency. Staying informed about changes in regulations and seeking professional guidance can further aid in maintaining compliance and ensuring the smooth operation of the business.

0 notes

Text

Missed the ITR deadline and concerned about claiming your refund? 😟 Don't worry! You can still file a belated return before December 31st and secure your refund. 💸

Filing your ITR has several benefits:

1. Claim Your Refund– Get back the taxes you overpaid.

2. Avoid Penalties – Minimize additional costs by filing on time.

3. Build Credit History – A good tax record boosts your financial reputation.

4. Stay Compliant– Avoid legal troubles and stay in good standing with tax authorities.

Need help with the filing process? Contact Taxring at 011-41096343 for expert guidance and make the process smooth and stress-free. 📞

0 notes

Text

Why Your Business Needs a DSC: Benefits and Registration Process Explained

The Complete Guide to DSC Registration in India

Are you looking to register your Digital Signature Certificate (DSC) in India? A valid DSC is essential if you need to file taxes, submit government forms, or sign documents electronically. In this comprehensive guide, we'll walk you through the complete process of DSC registration step-by-step.

What is a Digital Signature Certificate (DSC)?

A DSC is a secure digital key to sign documents and transactions electronically. It verifies the signer's identity and ensures the signed document's authenticity. In India, DSCs are issued by Certifying Authorities (CAs) licensed by the Controller of Certifying Authorities (CCA).

There are two main types of DSCs in India:

Class 2 DSC: Issued to individuals and organizations after verifying their identity based on documents.

Class 3 DSC: Issued to individuals and organizations after verifying their identity in person. Provides a higher level of security.

Why is DSC Registration Important?

DSC registration is mandatory for several key purposes in India:

Filing income tax returns (ITR) if your accounts require auditing

Registering and filing returns on the GST portal

Signing documents and forms on the MCA portal

Submitting tenders and auctions electronically

Registering companies electronically

Signing documents on government portals like ICEGATE

How to Register for a DSC in India

Here is the step-by-step process to register for a DSC in India:

Obtain a DSC from a licensed Certifying Authority (CA). Depending on your requirements, ensure you get a Class 2 or Class 3 DSC.

Install the required software and drivers provided by the CA. This typically includes an e-signer utility.

Visit the government portal where you need to use the DSC, such as the Income Tax e-filing portal, GST portal, MCA portal, etc.

Log in to your account and navigate to the "Register DSC" section under your profile.

Select the DSC provider and certificate from the dropdown lists. Enter the necessary details and passwords.

Sign the registration using your DSC. Registration will be completed once you receive a confirmation message.

Troubleshooting DSC Registration Issues

If you face any issues during DSC registration, here are some common problems and solutions:

"The smart card does not perform the requested operation" Ensure you have installed the correct drivers and software provided by the CA.

"PAN is not matching": Double-check that the PAN details entered match your DSC.

"DSC is not showing in the dropdown": Try registering from a different device or browser. Clear your browser cache if needed.

If the issue persists, contact the relevant government portal's helpdesk or your DSC provider for further assistance.

Conclusion

DSC registration is a crucial process for individuals and businesses in India to comply with various legal and regulatory requirements. By following the steps outlined in this guide and troubleshooting any issues, you can successfully register your DSC and use it to securely sign documents, file returns, and access government portals.

0 notes

Text

ITR filing in Dwarka

At Garg Goyal in Dwarka, we offer expert ITR filing services tailored to individuals, freelancers, and businesses. Our experienced professionals ensure accurate filing, compliance with tax laws, and timely submissions to maximize your benefits. We handle all paperwork and complexities, making the process stress-free for you. Whether you seek advice or complete tax solutions, Garg Goyal is your trusted partner in Dwarka for all your income tax filing needs. Let us simplify your tax journey today.

0 notes

Text

Income Tax Return (ITR) Filing Consultant in Delhi NCR | Noida & Gurgaon Experts. We provide top-notch Income Tax Return (ITR) filing consultant services in Delhi, Noida, and Gurgaon. Benefit from expert guidance, timely submissions, and peace of mind.

#ITR Filing consultant Services#ITR Filing consultant Services in Delhi#ITR Filing consultant Services in Noida#ITR Filing Consultant Services in Gurgaon#Income Tax Return Services

0 notes

Text

What Essential Steps Should You Take to Prepare for Tax Filing in the Financial Year 2023-2024?

The financial year 2023-2024 is drawing to a close, and with it comes tax filing season. While it might not be the most exciting prospect, staying organized can make the process smoother. Here are some essential steps to ensure a stress-free tax filing experience for the Assessment Year 2024-2025 with the help of Tax Consultants in Kochi, Kerala.

Gather Your Documents

Income Proofs: Form 16 (salary income), investment statements (dividends, interest), sales receipts (capital gains), and any other income-related documents.

Deduction Proofs: Documents for investments under Section 80C (PPF, ELSS), medical insurance premiums (Section 80D), home loan interest (Section 24), and other eligible deductions.

Tax Forms: Keep your PAN card and Aadhaar card handy, along with Form 26AS (tax credit statement).

Choose the Right ITR Form

There are different Income Tax Return (ITR) forms for various taxpayer categories. Familiarize yourself with the ITR options and choose the one applicable to your income sources (salary, business, capital gains, etc.).

Organize Your Information

Don’t wait until the last minute. Start by making a list of your income sources and deductions throughout the year. This will help you avoid scrambling and ensure accurate filing.

Review Pre-filled Information

The Income Tax Department pre-fills some sections of your ITR form based on information received from employers and banks. Carefully review this pre-filled data and make any necessary corrections.

Don’t Miss Deductions

Many taxpayers overlook eligible deductions that can significantly reduce their tax liability. Explore all potential deductions under various sections (80C, 80D, etc.) to maximize your tax benefit.

Calculate and Pay Tax Dues (if applicable)

Once you’ve determined your tax liability, calculate any taxes owed after considering deductions. Make the payment before the due date to avoid penalties.

E-verify Your Return

E-verification is mandatory for most taxpayers. You can do this electronically using Aadhaar OTP, net banking, or by sending a signed copy of the ITR-V form to the Central Processing Center.

Keep Records for Future Reference

Maintain a well-organized file of all tax documents for at least seven years. This will simplify future tax filings and help in case of any inquiries from the tax department.

By following these essential steps, you can approach tax filing for FY 2023-2024 with confidence. Remember, staying organized and planning ahead can make a significant difference in ensuring a smooth and efficient tax filing process. For additional assistance, consider seeking professional advice from Tax Advisory Services in Kochi.

0 notes

Text

GST Registration Office In Rohini

GST registration in bawana. We chartered accountant firm in sec 24 Rohini. Are you looking for your business's ITR filing, MSME registration, or Tax consultant? Call us and consult to the best CA in Rohini

The biggest industrial hub of Northwest Delhi that has developed over the years is Rohini. It is the place for small and medium businesses or manufacturers to set up a small capital investment. Setting up a business or factory in Rohini will be easy with us. Now, the question comes to your mind that how?

Investing capital in the business and increasing the revenue will be the part of your business. But authorizing or legalizing your business will be the part of a chartered accountant. To legalize your business, you need GST. The term GST was introduced by the government in July 2017. The term GST means Goods and Services Tax which becomes necessary for compliance and operational efficiency.

Rohini: The City of Business Hubs

Before the 2000s, Rohini was a completely rural area where there was no opportunity to start or set up a business. But in the early 2000s, the Delhi government took the initiative to develop the Rohini rural area into Rohini Industrial Area. This initiative was aimed at reducing congestion in residential areas and promoting organized industrial development.

Today, Rohini Industrial Area has many industries like manufacturing, textiles, plastics, electronics, and more. Now after this, we all know how Rohini Industrial Hub became a city. For every new business, you need a legal name for it and this is where GST comes into play. Why do you need to register your business for GST? GST was introduced for business. It is a comprehensive indirect tax levied on the manufacture, sale and consumption of goods and services. The benefits of registering for GST are: When the business crosses the annual turnover and crosses its threshold. The threshold is 10 lakhs for businesses located in the Northeast and hilly states. In other states, it is 20 lakhs. Businesses will get to claim credit for taxes paid on purchases, thereby reducing the overall tax liability. GST registration increases credibility and trustworthiness among businesses.

Some documents are required for GST registration in Rohini-

PAN Card for the business and its owners

Proof of business registration (e.g., partnership deed, certificate of incorporation)

Proof of identity and address for promoters (Aadhaar card, passport, etc.)

Address proof of the business premises (e.g., electricity bill, rent agreement)

Bank account information (cancelled cheque, bank statement).

Why do you need CA Nakul Singhal for GST registration in Rohini?

Applying for GST registration will not be an easy process for a common man. GST can only be registered by a chartered accountant. But no matter who you trust for this, finding a chartered accountant firm will not be easy. Let us help you choose, the reasons to choose us are –

We have highly trained chartered accountants with considerable expertise and experience in various industries, providing the highest quality financial advice and services.

We believe in building long-term partnerships with our clients. Our services are tailored to the specific needs of each client, whether they are individuals or major corporations.

Our organization has extensive experience across a variety of industries, including manufacturing, retail, technology, and healthcare. This enables us to provide insights and solutions tailored to your sector’s unique issues.

Our company has a solid track record of providing high-quality services, as proven by our dedicated clients and countless favorable comments.

We offer open and competitive pricing for our services, ensuring you get great value for your money.

Summary

Rohini, the largest industrial hub in northwest Delhi, is a hub of small and medium businesses and manufacturers. To be legally registered, businesses must meet certain requirements, including registering for the Goods and Services Tax (GST). GST is a comprehensive indirect tax levied on the manufacture, sale, and consumption of goods and services. Businesses in the Rohini industrial area, which includes manufacturing, textiles, plastics, and electronics, need to register for GST to reduce their tax liability and increase their credibility.

Documents required for GST registration in Rohini include PAN card, proof of business registration, proof of identity and address for promoters, address proof of the business premises, and bank account information. CA Nakul Singhal, a chartered accountant, can help with GST registration in Rohini due to their highly trained accountants, experience in various industries, and solid track record of providing high-quality services. They offer competitive pricing and a dedicated clientele, making it easy to set up and operate businesses in the city.

Visit our blog on Blogger - https://canakulsinghalassociates.blogspot.com/2024/08/gst-registration-office-in-rohini.html

Visit our blog on medium - https://medium.com/@canakulsinghalassociates/gst-registration-office-in-rohini-6184bd67c865

0 notes