#filing itr

Text

How Income Tax Return Online Filling

Filing your income tax return online can feel like navigating a labyrinth, but with the right guide, it’s more like a walk in the park. We’ll break down each step, simplify the jargon, and get you filing with confidence. Let’s dive in!

Why File Your Income Tax Return Online?

Filing your income tax return online isn’t just about following trends; it’s about leveraging modern technology to make your life easier. Here’s why you should consider it.

Convenience and Accessibility

Gone are the days of standing in long queues or filling out mountains of paperwork. Online filing lets you submit your return from the comfort of your home, anytime. It’s like having a tax office at your fingertips!

Accuracy and Efficiency

Online portals are designed to minimize errors. With built-in calculators and validation checks, you’re less likely to make mistakes. Plus, it speeds up the whole process, so you can get your refund quicker.

Step-by-Step Guide to Filing Your Income Tax Return Online

Ready to get started?

Follow these steps to file your income tax return online efficiently and correctly.

Step 1: Gather Necessary Documents

Step 2: Register or Login into the Income Tax Portal

Step 3: Select the Appropriate ITR Form

Step 4: Fill in Your Personal Details

Step 5: Provide Income Details

Step 6: Claim Deductions and Exemptions

Step 7: Review and Verify Your Return

Give your return a thorough once-over. Check for any errors or missing information. Think of it as proofreading an important email.

Step 8: Submit Your Return

Once satisfied, hit the submit button.

Congratulations, you’ve filed your return!

Step 9: E-Verify Your Return

E-verification is the final step to validate your return. You can do this through methods like Aadhaar OTP, net banking, or EVC. It’s like signing off on your work.

Common Mistakes to Avoid

Even with the best tools, mistakes happen. Here are common pitfalls to watch out for.

Incorrect Personal Information

Ensure all personal details are correct. Errors in your name, PAN, or bank details can lead to processing delays.

Misreporting Income

Be accurate with your income details. Misreporting can trigger unwanted scrutiny and penalties.

Not Claiming All Deductions

Maximize your tax savings by claiming all eligible deductions. Missing out means paying more tax than necessary.

Benefits of E-Verifying Your Return

Why bother with e-verification?

It’s not just a formality—it comes with real benefits.

Faster Processing

E-verified returns are processed quickly, meaning you’ll get your refund sooner. Who doesn’t like faster refunds?

Reduced Chances of Manual Errors

E-verification reduces the chances of manual errors in data entry, making your filing experience smoother and more reliable.

Conclusion

Filing your income tax return online doesn’t have to be daunting. With the right preparation and a systematic approach, you can navigate the process smoothly.

Happy filing!

By Paisainvests.com

#digital tax return#e-filing taxes#e-verifying tax returns#filing ITR#filing taxes online#income tax documents#income tax guide#income tax portal#income tax return#online tax filing#online tax return benefits#online tax submission#revised tax return#step-by-step tax filing#tax deductions#tax filing deadline#tax filing mistakes#tax filing tips#tax return process#tax return tips

0 notes

Text

Salaried Individuals must wait until June 15 to file ITR

Salaried Income Tax Returns: As of April 1, the online income tax return (ITR) filing process for the financial year 2023–24 (assessment year 2024–25) is now available due to the e-filing income tax portal. In addition, utilities for the ITR forms that are utilized the most frequently have also been made available. The Income Tax Department has activated all the necessary utilities and enabled…

View On WordPress

0 notes

Text

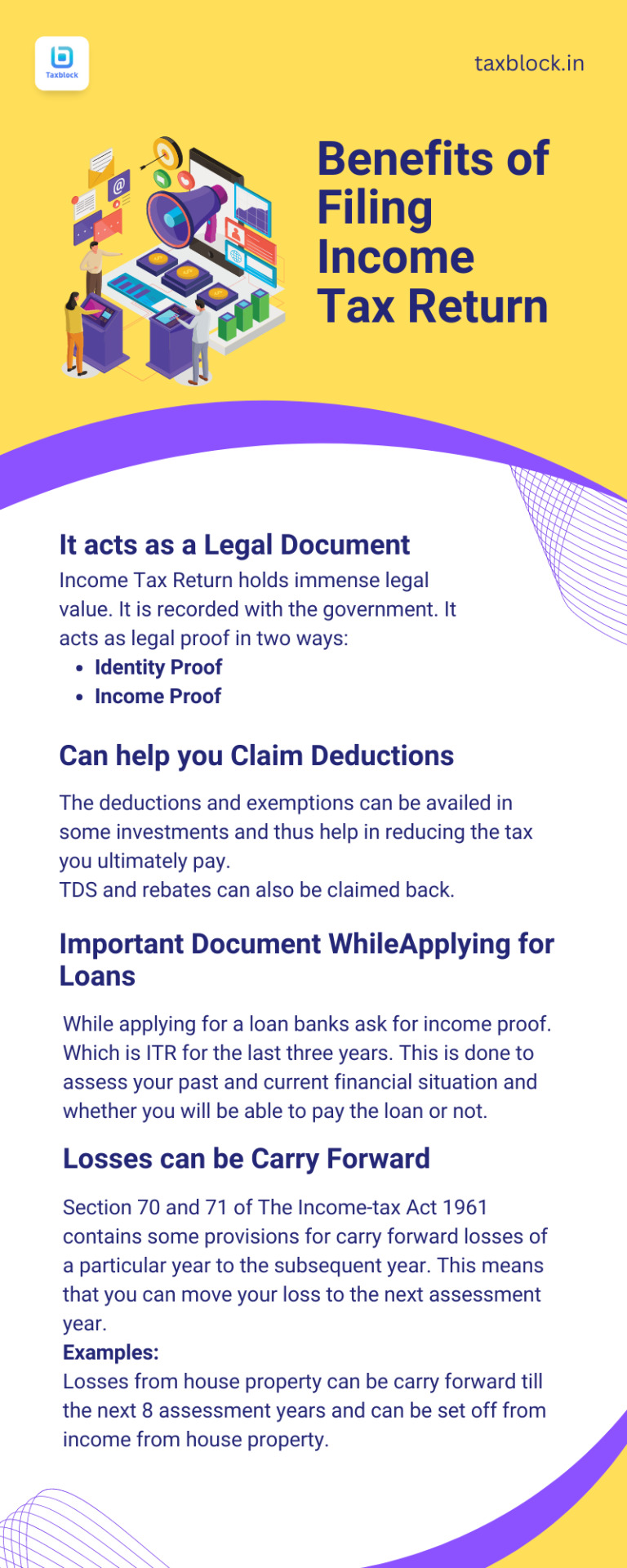

To know more visit our website.

Follow for more.

#ITR#filing itr#income tax#gst tax#benefits of itr#claim deduction#financialservices#tax#entrepreneur#gst#taxblock#fintech

0 notes

Text

Our ITR Filing Plan Starting from for salaried person rs749 but now we offer only rs 499 , offer valid only 21 july 2024 so hurry up file your ITR with taxring Why choose taxring read Description Click here to choose the plan that suits you best! https://taxring.com/service/top-plan…

File your ITR with TaxRing and enjoy:

- Easy and quick filing process

- Expert assistance from our team of CAs

- Maximum refund guaranteed

- Filing for last 3 years' returns

- Tax planning and consultation

- Refund claims and follow-up

Don't wait, file your ITR now and avoid unnecessary penalties and fees!

whatsapp now - +91 9711296343

Visit us - https://taxring.com

#itr filing#taxring#income tax#taxation#itr#taxes#taxation services#itr filing last date#itr filing for fy 2023-24#income tax filing#income tax calculator#income tax department#income tax return#income tax notice#file itr#capital gain#file itr for salaried#file itr for business#itr filing online#return filing

2 notes

·

View notes

Text

Pan Card Services, Income tax return (ITR), GST Registration

Money Transfer Services, Bill Payments, Mobile Recharge, Sim Cards, Mobile Accessories, Mobile Repairing, DTH Recharge, Loan Payment, Zero Balance Account, Pan Card Services, Gazzate, Udhyog & Gumasta Licence, Income tax return (ITR), Home Loan & Business Loan, GST Registration, Leave & Licence agreement with Notery, PF Withdrawal, etc...

#money transfer#mobile repair#mobile accessories#sim cards#bill payment#pan card online#pan card update#itr filing#gst registration

3 notes

·

View notes

Text

Feeling Lost? Here’s Your Roadmap to How to find a good tax consultant in India?

Are you searching for the best online tax consultant India? There’s nowhere else to look! Our team of tax experts specializes in offering knowledgeable solutions catered to your particular financial circumstances. We ensure everyone, individual or business, can easily manage the complicated tax environment.

Navigating the world of taxes can feel overwhelming, especially with the complexity of income tax laws in India. Finding the right tax consultant is key to ensuring your financial health stays in check. If you’re confused about where to start, don’t worry. We’re here to help guide you on the path to finding a good tax consultant in India. And if you want to skip the search, look no further than TaxDunia — recognized as one of the best income tax consultant in India.

Why You Need a Tax Consultant

Handling taxes involves a lot of details, deadlines, and paperwork. Even a small mistake can lead to penalties or lost money. A qualified tax consultant ensures that your tax filings are done correctly and on time, while also helping you save as much money as possible. Best Income Tax Advisors can also guide you through complex tax laws, so you’re always on the right side of the law. We are registered with recognized as qualified professionals, best accounting tax and advisory services in India.

Steps to Find a Good Tax Consultant

Look for Experience and Expertise The first step in finding the right tax consultant is to check their experience. An expert who has been in the field for years will know how to handle various tax situations, from income tax filings to audits. Our Company, for example, brings years of experience and a strong reputation for helping clients with a wide range of tax needs.

Check for Certification Your tax consultant should be certified by recognized authorities. Look for Chartered Accountants (CAs) or Certified Public Accountants (CPAs) in India. This ensures that the person you hire is fully trained and knowledgeable about the latest tax laws and regulations.

Ask for Recommendations Getting recommendations from friends, family, or business associates is a great way to start. If a consultant comes highly recommended, they are likely to provide good service. Our company has earned positive reviews from clients all over India, thanks to its transparent and reliable service.

TaxDunia is widely recognized as the Top 10 best income tax consultant in India. The company stands out with its team of skilled professionals who provide comprehensive tax solutions tailored to both individuals and businesses. From income tax filings and strategic tax planning to managing complex tax laws, we offer expertise that you can trust.

Our Complete Services: -

At TaxDunia, we offer a range of professional services designed to meet your needs. This blog provides an overview of our offerings and how we can assist you with various business and tax requirements in India.

Private Limited Company Registration Service in India

Starting a business in India involves several steps, with one of the most crucial being Private Limited Company Registration Service in India. This process ensures that your business is legally recognized and offers you the benefits of limited liability, credibility, and easier access to capital. At our company, we streamline this process for you, handling all necessary paperwork and compliance requirements to set up your pvt ltd company registration service seamlessly.

Online Company Registration in India

For those who prefer convenience, our Online Company Registration in India service is an ideal choice. We understand that time is valuable, so we offer a user-friendly online platform to simplify your Company Registration Service in India. Our team ensures that your registration process is quick and efficient, allowing you to focus on growing your business while we take care of the formalities.

One Person Company (OPC) and Public Limited Company Registration

If you’re considering starting a business on your own, our One Person Company Registration Service in India is tailored for solo entrepreneurs. This structure offers limited liability while allowing you to retain full control. Our OPC Registration Service simplifies ensuring compliance and a smooth process.

Public Limited Company Registration

Alternatively, if you’re looking to form a larger corporation, our Public Limited Company Registration Service is designed to help you meet the requirements for public trading and raising capital.

Firm Registration Services

For those in need of Firm Registration Services, we provide comprehensive solutions to get your partnership or LLP firm officially recognized. Our services include handling all necessary documentation and compliance requirements, ensuring that your firm is legally established and ready to operate.

Income Tax Return Filing Service in India

Managing taxes can be daunting, but with our Income Tax Return Filing Service in India, you can ease your worries. We offer expert assistance in ITR Return Filing Service, ensuring that your income tax returns are filed accurately and on time. Our consultants are skilled in handling various tax scenarios, from individual to corporate tax returns.

NRI Tax Consultancy and Filing Services

If you’re an NRI, navigating Indian tax regulations can be particularly challenging. Our NRI Tax Consultancy Service is designed to provide you with expert advice on handling your Indian income and tax obligations. We also offer NRI ITR Filing Service in India to ensure that your returns are filed correctly, complying with all relevant tax laws.

GST Return Filing Services

Managing GST compliance can be complex, but with our GST Return Filing Services in India, you get expert support for all your GST needs. From GST Registration Service to Online GST Return Filing, we cover all aspects of goods and services tax filing. Our team ensures that you remain compliant with GST regulations and avoid any potential penalties.

Trademark Registration Services

Protecting your intellectual property is crucial. Our Trademark Registration Consultants offer comprehensive best Trademark Registration Service in India, including trade mark online registration. We guide you through the entire process to ensure your brand is legally protected.

Copyright Registration Services

Similarly, for those needing best Copyright Registration service in India, our Best Copyright Consultant services help you safeguard your creative works with ease.

Patent Registration Services

Innovation is a key driver of business success. With our Patent Registration Service in India, you can protect your inventions and ideas. Our team of Best Patent Consultants in India provides expert guidance throughout the online Patent Registration Services in India process, helping you secure your intellectual property rights.

Sole Proprietorship Firm Registration

For solo entrepreneurs and small business owners, we offer Sole Proprietorship Registration Service. Our services ensure that your business is properly registered and compliant with all relevant regulation.

Proprietorship Firm Registration

Setting up a proprietorship firm is a straightforward way for solo entrepreneurs to start a business. We offer comprehensive Proprietorship Firm Registration services to help you establish your business efficiently. You can also register proprietorship firm online with our user-friendly platform, ensuring a quick and hassle-free registration process. We handle all the necessary paperwork and compliance, allowing you to focus on your business.

TDS Return Filing Service & Top Consultants

Managing TDS (Tax Deducted at Source) can be complex. Our TDS Return Filing Service in India ensures accurate and timely submission of your TDS returns. We are recognized as Top TDS Return Consultants in India, offering expert guidance to ensure compliance with tax regulations and avoid penalties. Trust us to simplify your TDS management and keep your finances in order.

Foreign Company Registration in India

Expanding into the Indian market requires understanding local regulations. Our Foreign Company Registration in India service assists international businesses in setting up operations in India. We handle all the paperwork and compliance requirements, helping you establish your presence in the Indian market smoothly.

Conclusion

At TaxDunia, we are dedicated to offering comprehensive solutions for all your business and tax needs. From Private Limited Company Registration to GST Return Filing Services, our expert team supports you at every step. If you’re searching for online tax consultant services near me, look no further. Visit our website www.taxdunia.com to explore how we can assist you in achieving your business and tax goals. With our expertise, you can concentrate on your core activities while we handle the complexities of registration and compliance efficiently.

#Top Income Tax Consultants#Best Income Tax Advisors#Tax Consultant Services#best income tax consultant in india#Best online tax consultant India#online Tax consultant services near me#Top 10 best income tax consultant in india#tax consultants#finance#itr filing#gst filling#itr filling#taxdunia#income tax#gst return

0 notes

Text

At Taxring.com, we offer a wide range of expert tax and business services designed to support your financial and regulatory needs. Our seasoned professionals provide precise ITR filing, efficient GST registration and GST filing, and thorough audit services. We also assist with company registration and a variety of other essential business functions. Whether you’re an individual or a business, Taxring.com is your go-to partner for navigating complex tax regulations and ensuring compliance. Trust us to simplify your financial processes and help you achieve your business goals with confidence.

#ITR Filing 2024#How to Register for GST Online in 2024#income tax return#tax refund#How to check Tax Refund status#TDS#TDS and TCS Under GST 2024 Latest Rules#How to File TDS and TCS Returns Under GST

1 note

·

View note

Text

Filing ITR Online: The Basics of Hassle-Free Tax Return

Filing an Income Tax Return (ITR) is something every Indian has to do every year. Thanks to the Indian government’s emphasis on digital services, you can now do it online only. This article will guide you through the simple steps of filing an ITR online and explain why it’s beneficial to process it from the comfort of your home.

What is an Income Tax Return?

Income Tax Return is the document used by all Indian citizens to declare their annual income to the Income Tax Department. A taxpayer’s tax liability is calculated based on the income declared. Certain categories of taxpayers are required to file ITRs based on their income, business results or other government-mandated procedures.

Filing ITR is not just an administrative process, it also ensures refund in case of overpayment of tax, supports credit approval and proof of income in various financial markets.

Tax Salah Provide good ITR FIling services.

0 notes

Text

Annual Income Tax Returns Filing for Private Limited Company Service

Get expert assistance for Private Limited Companies Annual Filing. Simplify compliance, and ensure accuracy. Paper Tax is your financial governance trusted partner. https://bit.ly/3ZgjYvC

#Annual Filing Private Limited Company#Annual Filing Pvt Ltd Company#accounting#finance#Private Limited Annual Filing support#Annual Return Filing For Company#Annual ITR Filing for Pvt Ltd Company#investing

0 notes

Text

ITR-3 Filing Made Simple with Services Plus

At Services Plus, we make filing your ITR-3 return easy. If you have a business, work as a freelancer, or are a partner in a firm, this form helps you report your income. We’ll handle the whole process—doing the calculations and filing—so you don’t have to stress about it. Our goal is to help you save on taxes and stay on track, so you can focus on your work. Let us take care of the tax part!

Address- C 203, 3rd Floor, Sector 63, Noida

Call- +91 9899184918

Website- www.servicesplus.in

Email- [email protected]

#ITR-3 filing#Business tax return#Freelancer tax filing#Income tax return for professionals#ITR-3 for sole proprietorship

0 notes

Text

Business & Company Registrations | MCA Compliance Simple

Global Taxman India Ltd offers expert services in business and company registrations and MCA compliance. Our dedicated team of Chartered Accountants, Company Secretaries, and legal professionals ensures efficient and user-friendly solutions tailored to your needs.

Business Registration

We offer specialized services including Legal Metrology, Business Registration and Certification, as well as ISO Certification.

Company Registration

Our services offer expert insights, strategies, and solutions tailored to your company registration, trademark, and design needs.

MCA Compliance

Our consulting services provide expert insights, strategies, and solutions tailored to your MCA compliance, including GST filing, ITR, and other regulatory requirements.

Contact us +91-9811099550

www.globaltaxmanindia.com

0 notes

Text

1 lakh notices sent for not filing income tax returns: Nirmala Sitharaman

Not filing income tax returns: Nirmala Sitharaman, the Union Finance Minister, reported that the 1 lakh notices sent for not filing income tax returns and misrepresentation of income by government. The minister said, “The notices were sent where the income was found to be close to Rs 50 lakh and they are expected to be cleared by the end of this fiscal.”

Read Also: Income Tax Payment with PhonePe…

View On WordPress

0 notes

Text

ITR filing in Dwarka

At Garg Goyal in Dwarka, we offer expert ITR filing services tailored to individuals, freelancers, and businesses. Our experienced professionals ensure accurate filing, compliance with tax laws, and timely submissions to maximize your benefits. We handle all paperwork and complexities, making the process stress-free for you. Whether you seek advice or complete tax solutions, Garg Goyal is your trusted partner in Dwarka for all your income tax filing needs. Let us simplify your tax journey today.

0 notes

Text

Income Tax Return (ITR) Filing Consultant in Delhi NCR | Noida & Gurgaon Experts. We provide top-notch Income Tax Return (ITR) filing consultant services in Delhi, Noida, and Gurgaon. Benefit from expert guidance, timely submissions, and peace of mind.

#ITR Filing consultant Services#ITR Filing consultant Services in Delhi#ITR Filing consultant Services in Noida#ITR Filing Consultant Services in Gurgaon#Income Tax Return Services

0 notes

Text

#CA#Chartered Accountants#Accountants#Online Accounting Services#GST Accountants#Accounting Consultants#Balance Sheet Preparation#Accounting Services for Shares#GST Returns#ITR#Income Tax returns#Audit#Taxation#Service Tax#ROC Filing#Corporate Accounting#Company Compliance#Payroll Accounting Services#Online International Accounting Services#Financial Accounting Services#Online CA Services

1 note

·

View note

Text

7 Forms of Income Tax Return: Which ITR should I file - Tax Craft Hub

The "7 Forms of Income Tax Return" typically refers to various tax forms used in the U.S. for different types of taxpayers and income situations. These include Form 1040, the standard form for individuals, and its variations like Form 1040-SR for seniors and Form 1040-NR for non-resident aliens. Form 1040-X is used for amending previous returns. Other forms like Form 1065 are for partnerships, Form 1120 for corporations, and Form 990 for tax-exempt organizations. Each form is designed to accommodate specific tax filing needs based on the taxpayer's status, income sources, and entity type.

For More Information About 7 Forms of Income Tax Return

0 notes