#gst tax

Text

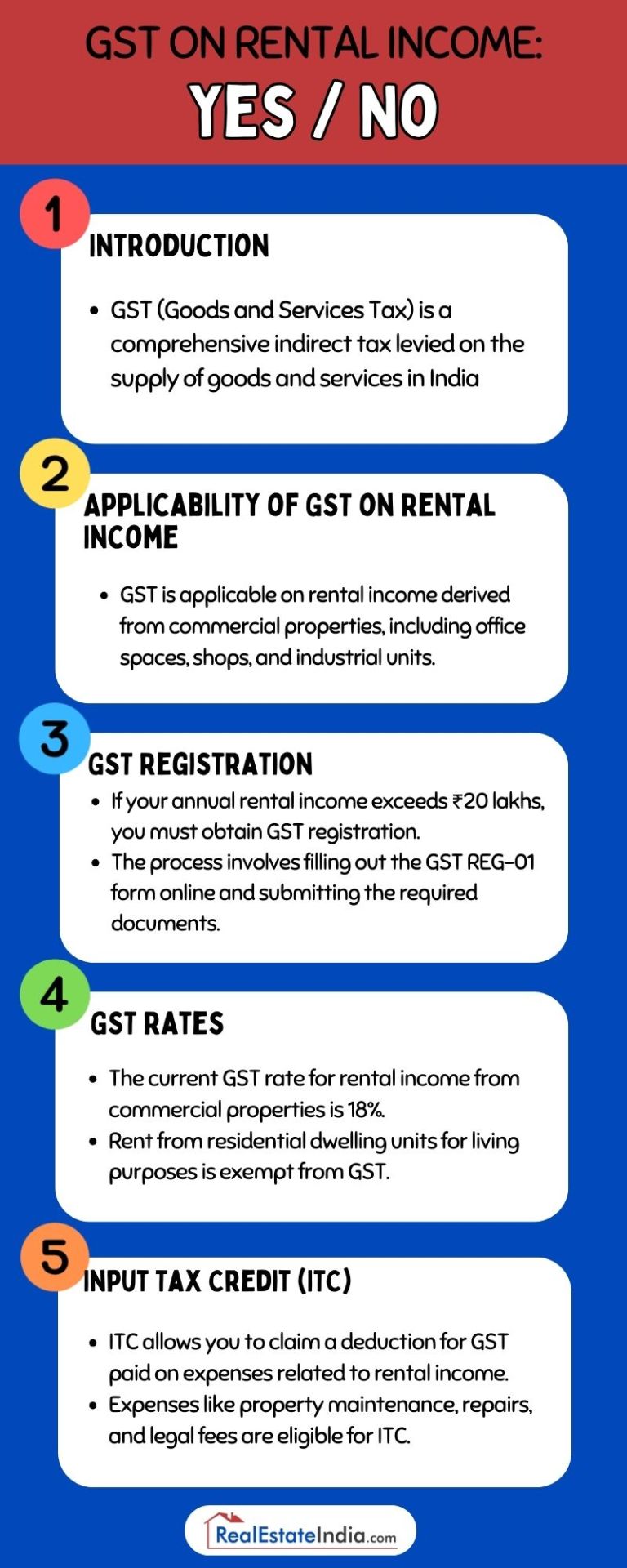

Attention landlords and tenants! Learn everything you need to know about GST on rental income, from exemptions to compliance, in our comprehensive infographic guide #TaxGuidance

read the full article on GST on rent income

#Landlords#Tenants#real estate#realestate#real estate india#realestateindia#gst on rental income#gst#gst tax

0 notes

Text

How Can GST Help Boost Economic Growth?

The introduction of the Goods and Services Tax (GST) has been instrumental in boosting economic growth by streamlining the taxation system and promoting a more efficient business environment. With GST, the complex web of multiple indirect taxes has been replaced by a single tax, simplifying compliance and reducing the burden on businesses. This has led to increased ease of doing business, encouraging investment and entrepreneurship.

GST has also facilitated the creation of a unified national market, eliminating inter-state barriers and enabling seamless movement of goods and services across the country. This has not only reduced logistics costs but also enhanced market access for businesses, especially small and medium enterprises (SMEs), who can now expand their customer base beyond their local regions.

Moreover, GST has played a crucial role in curbing tax evasion and promoting transparency. The implementation of a robust IT infrastructure has enabled real-time tracking of transactions, minimizing the scope for tax evasion and ensuring better compliance. This has resulted in increased tax revenues for the government, which can be utilized for public welfare and infrastructure development.

Additionally, GST has had a positive impact on the manufacturing sector by eliminating the cascading effect of taxes. By allowing businesses to claim input tax credits on their purchases, GST has reduced the cost of production, making Indian goods more competitive in both domestic and international markets. This has stimulated manufacturing activities, leading to job creation and overall economic growth.

Overall, the implementation of GST has been a game-changer for the Indian economy, fostering a business-friendly environment, promoting ease of doing business, and boosting economic growth. By simplifying the tax structure, enhancing compliance, and facilitating seamless movement of goods and services, GST has paved the way for a more prosperous and inclusive economy.

1 note

·

View note

Text

Is Opting for a Private Limited Company the Ideal Decision for Your Business Venture?

Selecting a private limited company structure may be a favorable choice for your business venture if you prioritize limited liability, seek investment opportunities, and prefer a structured and formal business entity. It offers distinct legal identity, limited liability protection, and facilitates ownership transfer. However, the suitability of this structure depends on your business objectives, size, and regulatory considerations. It is advisable to seek guidance from legal and financial experts before making a decision.

To know more about private limited company click on this link:-https://www.taxrupees.com/article/private-limited-company-pros-and-cons/

#gst tax#gst filing#online registration#incometax#gst registration#business#taxrupees#tax#gst#service

0 notes

Text

0 notes

Text

Discover the role and tax implications of merchant exporters in India's GST regime. Learn about tax rates, conditions, refund procedures.

0 notes

Text

1 note

·

View note

Text

Income Tax: This tax is levied on the income earned by individuals and organizations.

Goods and Services Tax (GST): This tax replaced various indirect taxes such as service tax, VAT, and central excise duty. It is a tax on the supply of goods and services and is collected at every stage of the supply chain.

Corporate Tax: This tax is levied on the income earned by companies and corporate entities.

Customs Duty: This is a tax levied on goods imported into India.

Excise Duty: This is a tax levied on goods manufactured in India.

Property Tax: This tax is levied on the value of property owned by individuals and companies.

Wealth Tax: This tax is levied on the net wealth of individuals and companies.

Securities Transaction Tax (STT): This tax is levied on the purchase and sale of securities such as shares, bonds, and debentures.

Professional Tax: This tax is levied on individuals engaged in professions such as lawyers, doctors, and chartered accountants.

Read more: https://myefilings.com/type-of-taxes-and-taxpayers-in-india/

0 notes

Text

Income Tax with Return Filing Course

IPA studies provide the best course of action when it comes to filing income taxes and returns. The reason is IPA studies are conducted by tax experts who have years of experience in the field. Consequently, they know all the ins and outs of the tax code and can provide the most accurate and up-to-date information. This is the best Institute for Income Tax course in Rohini.

0 notes

Text

Top GST Registration Online

Muneemg is the leading GST registration online services provider in Delhi, with a comprehensive range of services that cater to businesses of all sizes. Whether you are a small start-up or a large corporation, Muneemg online GST registration services make it easy for you to comply with the complex GST regulations in India. In this article, we will explore Muneemg GST registration online services in detail and explain why it is the best choice for businesses in Delhi.

Introduction

The Goods and Services Tax (GST) is a comprehensive tax that was introduced in India in 2017 to replace multiple indirect taxes levied by the central and state governments. GST has brought about significant changes in the way businesses operate in India, and all businesses need to comply with the regulations to avoid penalties and legal issues.

Muneemg GST registration online services

Muneemg offers a wide range of GST registration online services, including GST registration, GST return filing, GST audit, and GST compliance services.

Let’s take a closer look at each of these services.

GST registration: Muneemg GST registration online services make it easy for businesses to register for GST in Delhi. The process is entirely online, and businesses can complete the registration process in just a few simple steps. Muneemg team of experts will guide businesses through the entire process, ensuring that all the necessary documents are submitted correctly.

GST return filing: Filing GST returns can be a daunting task for businesses, especially if they are not familiar with the regulations. Muneemg GST return filing service makes it easy for businesses to file their returns on time and avoid penalties. The team of experts at Muneemg will prepare and file the returns on behalf of the business, ensuring that all the necessary documents are submitted correctly.

GST audit: GST audit is a crucial process that businesses must undergo to ensure that they are complying with the GST regulations. Muneemg GST audit services help businesses identify any issues with their GST compliance and take corrective measures to avoid penalties and legal issues.

GST compliance services: Muneemg GST compliance services help businesses stay compliant with the GST regulations. The team of experts at Muneemg will monitor the business’s GST compliance and take corrective measures to ensure that the business is always compliant.

Why choose Muneemg for your GST registration online services?

There are several reasons why businesses in Delhi should choose Muneemg for their GST registration online services.

Expertise: Muneemg has a team of experts with extensive experience in GST regulations. The team has helped several businesses register for GST, file GST returns, and stay compliant with the regulations.

Convenience: Muneemg online GST registration services make it easy for businesses to register for GST from the comfort of their office or home. The entire process is online, and businesses can complete the registration process in just a few simple steps.

Affordability: Muneemg GST registration online services are affordable, and businesses can save money by using Muneemg services instead of hiring a full-time accountant.

Customer service: Muneemg customer service team is available 24/7 to answer any questions or concerns that businesses may have about their GST registration or compliance.

Conclusion

Muneemg GST registration online services are the best choice for businesses in Delhi that want to comply with the GST regulations without any hassle. Muneemg team of experts will guide businesses through the entire process, ensuring that all the necessary documents are submitted correctly. With Muneemg GST registration online services, businesses can focus on their core operations, knowing that their GST compliance is in good hands.

Frequently Asked Questions(FAQs)

What is GST registration?

GST registration is the process of registering for the Goods and Services Tax (GST) in India. All businesses that have a turnover of more than Rs. 20 lakhs (Rs. 10 lakhs for businesses in certain states) need to register for GST.

What are the benefits of GST registration?

GST registration enables businesses to legally collect and pay GST on their products or services. It also allows businesses to claim the input tax credits, which helps them reduce their tax liability.

How can Muneemg help with GST registration?

Muneemg offers online GST registration services that make it easy for businesses to register for GST in Delhi. The process is entirely online, and Muneemg team of experts will guide businesses through the entire process, ensuring that all the necessary documents are submitted correctly.

What is GST return filing?

GST return filing is the process of filing GST returns with the GST department. All businesses that are registered for GST need to file their returns regularly to comply with the regulations.

How can Muneemg help with GST return filing?

Muneemg offers GST return filing services that make it easy for businesses to file their returns on time and avoid penalties. The team of experts at Muneemg will prepare and file the returns on behalf of the business, ensuring that all the necessary documents are submitted correctly.

What is a GST audit?

GST audit is the process of verifying a business’s GST compliance. All businesses that are registered for GST need to undergo an audit to ensure that they are complying with the regulations.

How can Muneemg help with the GST audit?

Muneemg offers GST audit services that help businesses identify any issues with their GST compliance and take corrective measures to avoid penalties and legal issues.

What are GST compliance services?

GST compliance services help businesses stay compliant with GST regulations. The team of experts at Muneemg will monitor the business’s GST compliance and take corrective measures to ensure that the business is always compliant.

Why should I choose Muneemg for my GST registration online services?

Muneemg has a team of experts with extensive experience in GST regulations. The team has helped several businesses register for GST, file GST returns, and stay compliant with the regulations. Muneemg online GST registration services are convenient, and affordable, and offer excellent customer service.

How can I get started with Muneemg GST registration online services?

You can visit Muneemg website and select the GST registration service that you require. You can then follow the simple steps to complete the registration process. Muneemg team of experts will guide you through the process and ensure that all the necessary documents are submitted correctly.

1 note

·

View note

Text

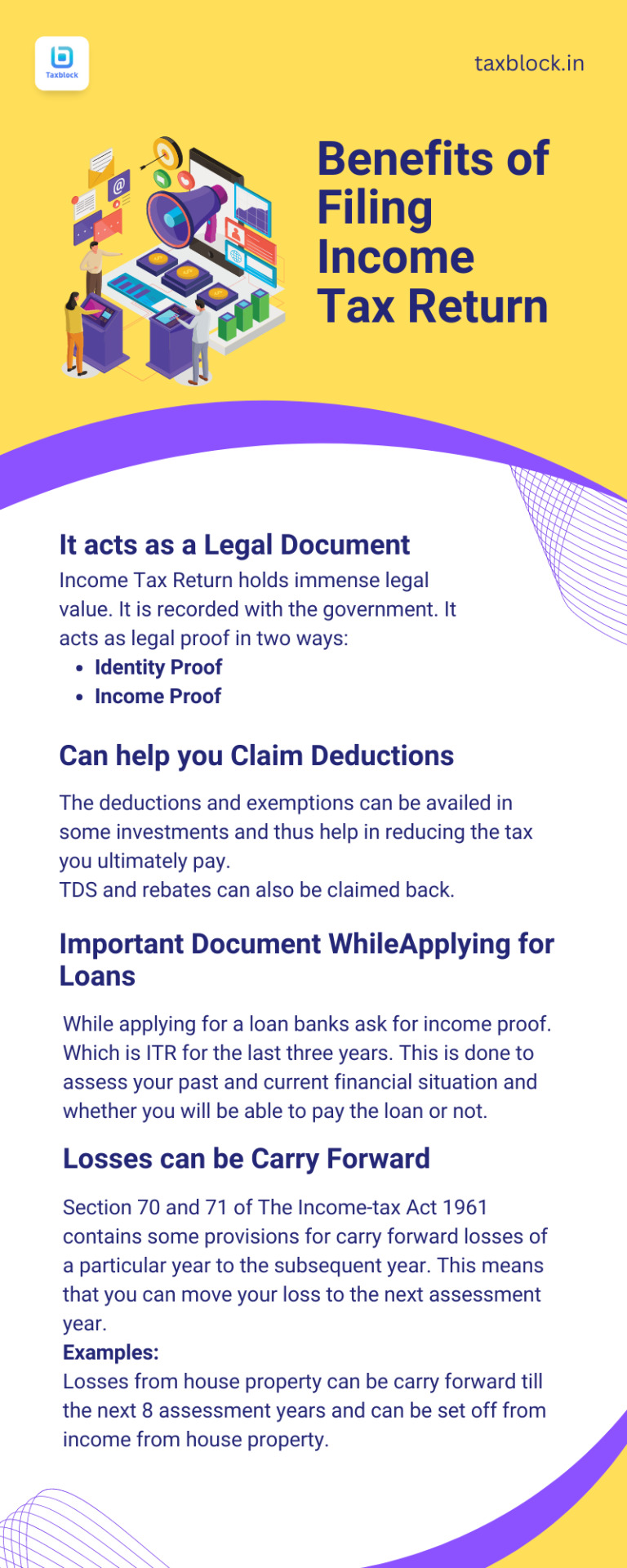

To know more visit our website.

Follow for more.

#ITR#filing itr#income tax#gst tax#benefits of itr#claim deduction#financialservices#tax#entrepreneur#gst#taxblock#fintech

0 notes

Text

Credit and Debit Card Usage: Swiping with Confidence

Using credit and debit cards has become a common way of payment in our daily lives due to their convenience and access to credit and cash. However, there are several myths and misconceptions surrounding the use of credit and debit cards that can make people feel wary or unsure of using them. In this blog post, we will debunk some of the most popular myths surrounding credit and debit card usage, and help you to understand how to navigate credit and debit usage with confidence.

https://www.taxrupees.com/article/credit-and-debit-card-usage-swiping-with-confidence/

0 notes

Text

#gst suvidha kendra#gst suvidha kendra login#gst#gstsuvidhacenter#gst suvidha center franchise#gst tax

0 notes

Link

Understanding GST notices issued by the government. Learn how to respond to notices. Get comprehensive information on GST notices.

1 note

·

View note

Text

Procedure for revocation of cancellation of GST registration

The provisions and processes under the GST Act cover a wide range of potential scenarios for a taxpayer. The CGST Rules, 2017, Rule 23 contains the revocation provisions.

When can Revocation of GST Registration Cancellation Initiated?

If a GST registration certificate has been revoked by the GST authorities, a GST might be revoked.

What is the Time Limit for Revocation of Cancellation of GST Registration?

Within 30 days of the date the order of cancellation of GST registration was served, any registered taxable person may request for the revocation of that cancellation. It should be emphasized that the application for revocation can only be made in situations when the proper officer has voluntarily terminated the registration. Therefore, revocation is not an option when a taxpayer voluntarily applies for GST Cancellation.

Application for Revocation of GST Registration Cancellation

The taxpayer having GST Registration must submit an application in FORM GST REG-21 either directly or through a facilitation center that has been approved by the Commissioner.

There are Some procedures a registered person must take in order to submit an online revocation application using the GST Portal:-

*Visit www.gst.gov.in to access the GST Portal.

*Enter the correct username and password to log in to the account.

*Select services in the GST Dashboard, then registration under services, and finally the application for revocation of canceled registration option under registration.

*Choose the option to request the cancellation of your canceled registration. Enter the justification for revoking GST cancellation in the choose box. Additionally, you must select the proper file to attach for any supporting papers, check the box for verification, specify the name of the authorized signatory, and fill out the place filled box.

*Selecting the SUBMIT WITH DSC (Digital Signature Certificate) OR SUBMIT WITH EVC box would be the last step.

If You are want to know more Information then Visit us: https://www.e-startupindia.com/learn/what-is-revocation-of-gst-registration/ Or Visit our Service Page : https://www.e-startupindia.com/gst.html

0 notes