#best forex ea

Video

Forex Robot Made a 16% profit Win Rate in just 2 days! Best Forex Robot ...

#youtube#Forex Robot#Forex Ea#Scalping Ea#Forex Trading#Forex#Forex Live account#Best scalping Ea#Best Forex Robot#Best Forex Ea#Forex bot

0 notes

Text

【 SuperGOLD 】EA works Stable on XAUUSD pair It is based on a Scalping strategy⚡ Gold Trading Robot - Profitable【 MT4 Expert Advisor 】⭐ Read SuperGOLD EA Review!

0 notes

Text

Effortless Efficiency: Automate Your Forex Trades with the Panel

In the dynamic world of forex trading, efficiency is paramount. Traders are constantly seeking ways to streamline their processes, optimize their strategies, and maximize their profits. One powerful tool that has emerged to meet these demands is the Automated Trading Panel. These panels leverage cutting-edge technology to automate trade execution, implement complex strategies, and enhance overall efficiency in forex trading. In this blog post, we'll explore the benefits, features, and potential of Automated Trading Panels in revolutionizing the way traders approach the forex market.

Understanding Automated Trading Panels: Automated Trading Panels are sophisticated software solutions designed to automate various aspects of forex trading, from trade execution to risk management and strategy implementation. These panels utilize advanced algorithms, artificial intelligence, and machine learning techniques to analyze market data, identify trading opportunities, and execute trades on behalf of traders. With their user-friendly interfaces and customizable features, Automated Trading Panels empower traders of all skill levels to automate their trading processes and achieve consistent results in the forex market.

Key Features and Functionality:

Trade Execution Automation: Automated Trading Panels enable traders to automate trade execution, eliminating the need for manual intervention. Traders can set specific parameters for trade entry, exit, and position sizing, allowing the panel to execute trades automatically based on predefined rules and criteria.

Strategy Implementation: Automated Trading Panels support the implementation of complex trading strategies, including trend-following, mean-reversion, and breakout strategies. Traders can customize their strategies by combining technical indicators, price action signals, and market sentiment analysis to suit their trading preferences and objectives.

Risk Management Tools: Automated Trading Panels offer advanced risk management tools to help traders mitigate potential losses and protect their capital. Traders can set stop-loss and take-profit levels, adjust position sizes, and implement trailing stop orders to manage risk effectively.

Backtesting and Optimization: Automated Trading Panels enable traders to backtest and optimize trading strategies using historical market data. By simulating trades under various market conditions, traders can assess the performance of their strategies and make necessary adjustments to improve profitability.

Real-time Market Analysis: Automated Trading Panels provide real-time market analysis and insights, allowing traders to stay informed about key market developments and potential trading opportunities. With access to up-to-date market data and analysis tools, traders can make informed decisions and execute trades with confidence.

Benefits of Using Automated Trading Panels:

Enhanced Efficiency: Automated Trading Panels streamline the trading process by automating repetitive tasks such as trade execution, position management, and risk assessment. By eliminating the need for manual intervention, traders can save significant time and effort. This enhanced efficiency allows traders to focus their attention on analyzing market trends, refining trading strategies, and making informed decisions, rather than getting bogged down by routine tasks.

Improved Accuracy: Automated Trading Panels leverage sophisticated algorithms and artificial intelligence to execute trades with precision and accuracy. Unlike human traders, who may be prone to emotions, biases, and cognitive errors, these panels operate based on predefined rules and criteria. By removing human involvement from the trading process, Automated Trading Panels minimize errors and enhance overall trading performance. Trades are executed consistently and objectively, without the influence of emotions such as fear, greed, or hesitation.

Consistent Performance: With their disciplined approach to trade execution and risk management, Automated Trading Panels help traders achieve consistent and reliable results over time. These panels adhere strictly to predetermined trading rules and strategies, ensuring that trades are executed in a systematic and disciplined manner. By maintaining consistency in trade execution and risk management, traders can avoid impulsive decisions and erratic behavior, thereby improving their chances of long-term success in the forex market.

Accessibility and Convenience: Automated Trading Panels are accessible from any internet-enabled device, allowing traders to monitor and manage their trades on the go. Whether at home, in the office, or on vacation, traders can stay connected to the forex market and take advantage of trading opportunities anytime, anywhere. This level of accessibility and convenience enables traders to stay informed about market developments, adjust their trading strategies, and execute trades promptly, without being tied to a specific location or time zone.

Reduced Stress and Emotional Impact: Trading can be a stressful and emotionally taxing endeavor, particularly during periods of market volatility or when faced with significant losses. Automated Trading Panels help alleviate stress and emotional strain by automating the trading process and removing the need for manual intervention. Traders can trade with confidence, knowing that their trades are being executed according to predefined rules and parameters. By removing the emotional element from trading decisions, Automated Trading Panels help traders maintain a clear and rational mindset, reducing the psychological burden associated with trading and improving overall well-being.

Automated Trading Panels offer numerous benefits to traders, including enhanced efficiency, improved accuracy, consistent performance, accessibility and convenience, and reduced stress and emotional impact. By leveraging advanced technology and automation, traders can streamline their trading processes, optimize their performance, and achieve greater success in the forex market.

Conclusion:

Automated Trading Panel offer a powerful solution for automating forex trades and enhancing trading efficiency. With their advanced features, customizable settings, and user-friendly interfaces, these panels empower traders to execute trades with precision, consistency, and confidence. Whether you're a seasoned trader looking to optimize your trading strategies or a novice trader seeking to streamline your trading process, Automated Trading Panels can help you achieve your trading goals with ease. Embrace the future of forex trading with Automated Trading Panels and experience the benefits of effortless efficiency in your trading journey.

#Trade Panel#Trading Panel#Trading Panel EA#TradePanel MT4#Trade Manager#Forex Trade Manager#Best Trade Manager#Trade Management utility#Trade Management tool#Trading management#forextrading#forexmarket#forex education#forexsignals#forex#black tumblr#technical analysis#4xPip

3 notes

·

View notes

Text

How does Best Martingale Strategy Forex EA MT4 work?

Introduction:

An EA, or Expert Advisor, is a software program that can be used to automate trading on financial markets. EAs can be used to place orders, manage risk, and monitor the market. They can be used to trade a variety of instruments, including forex, stocks, commodities, and cryptocurrencies.

How does it work?

EAs are typically programmed to follow a set of rules or strategies. These rules may be based on technical analysis indicators, price patterns, or other factors. The EA will monitor the market and place orders automatically when its rules are met.

Benefits:

There are a number of benefits to using an EA, including:

Automation: EAs can automate the trading process, which can save traders a lot of time and effort.

Discipline: EAs can help traders to stick to their trading plan and avoid making emotional decisions.

Backtesting: EAs can be backtested on historical data to see how they would have performed. This can help traders to identify and optimize their trading strategies.

Drawbacks:

There are also some drawbacks to using an EA, including:

Cost: EAs can be expensive to purchase and maintain.

Risk: EAs are not perfect and can make losing trades. It is important to use EAs in conjunction with a sound risk management strategy.

Over-reliance: Traders should not rely too heavily on EAs. It is important to understand the EA's underlying strategy and to monitor its performance closely.

Where to find EAs:

EAs can be found from a variety of sources, including:

Brokers: Many brokers offer their own EAs or allow traders to download EAs from third-party developers.

Online marketplaces: There are a number of online marketplaces where traders can buy and sell EAs.

Independent developers: There are also a number of independent developers who create and sell EAs.

Best Martingale Strategy Forex EA MT4:

The Best Martingale Strategy Forex EA MT4 is a software program that automates the Martingale trading strategy on the MetaTrader 4 platform. The Martingale strategy is a high-risk, high-reward strategy that involves doubling your bet after each loss until you eventually win.

The Best Martingale Strategy Forex EA MT4 is designed to help traders profit from the forex market using the Martingale strategy. The EA uses a variety of technical indicators to identify trading opportunities and to manage risk.

The EA has a number of features that make it attractive to traders, including:

It is fully automated, so traders can set it up and let it run without having to monitor it constantly.

It uses a variety of technical indicators to identify trading opportunities and to manage risk.

It has a number of customizable settings, so traders can tailor it to their own trading style and risk tolerance.

Here are some tips for using the Best Martingale Strategy Forex EA MT4:

Use a small initial lot size. This will help to limit your losses if the market moves against you.

Set a stop loss order on all of your trades. This will help to limit your losses if the market moves against you.

Monitor the EA's performance closely. If you notice that the EA is making a lot of losses, you may need to adjust the settings or stop using it altogether.

Best Martingale Strategy Forex EA MT4:

The Best Martingale Strategy Forex EA MT4 has performed well in backtesting, showing high profits and low drawdowns. However, live trading results have been more mixed, with some traders reporting success and others reporting losses.

One of the main reasons for the mixed live trading results is that the Martingale strategy is a risky strategy. It involves doubling the size of each losing trade in an attempt to recoup losses and eventually make a profit. This can lead to large losses if the market continues to move against the trader.

Another reason for the mixed results is that the Best Martingale Strategy Forex EA MT4 is not a perfect EA. It is possible to optimize the settings for backtesting, but these settings may not work as well in live trading. Additionally, the EA is vulnerable to market conditions such as high volatility and news events.

Despite the risks, some traders have been able to use the Best Martingale Strategy Forex EA MT4 to generate profits. However, it is important to use caution when using this EA and to only risk a small amount of your capital.

Here are some tips for using the Best Martingale Strategy Forex EA MT4 safely:

Use a small risk per trade. 1% or less is a good starting point.

Use a stop loss on every trade. This will limit your losses if the market moves against you.

Use a trailing stop to protect your profits.

Monitor the EA closely and be prepared to disable it if it starts to lose money.

It is also important to remember that past performance is not indicative of future results. Just because the Best Martingale Strategy Forex EA MT4 has performed well in the past does not guarantee that it will continue to perform well in the future.

How does it handle risk management:

The Best Martingale Strategy Forex EA MT4 handles risk management in a number of ways:

Stop losses: The EA can be set to place stop loss orders on all of your trades. This will help to limit your losses if the market moves against you.

Martingale strategy: The Martingale strategy itself is a form of risk management, as it involves doubling your bet after each loss until you eventually win. This helps to ensure that you will eventually make a profit, even if you experience a series of losses.

Money management: The EA can be set to use a variety of money management techniques, such as only risking a certain percentage of your account balance on each trade. This will help to protect your account from large losses.

Here are some additional tips for risk management when using the Best Martingale Strategy Forex EA MT4:

Use a small initial lot size. This will help to limit your losses if the market moves against you.

Monitor the EA's performance closely. If you notice that the EA is making a lot of losses, you may need to adjust the settings or stop using it altogether.

Have a backup plan. If the EA fails or the market moves against you, have a backup plan in place to protect your account.

4xPip:

4xPip is a financial trading company that helps traders to get the Best Martingale Strategy Forex EA MT4. The company offers a variety of trading tools and resources to help traders succeed, including:

Trading bots: 4xPip offers a variety of trading bots that can be used to automate trading on the forex market. The Best Martingale Strategy Forex EA MT4 is one of the most popular trading bots on the 4xPip platform.

Indicators: 4xPip offers a variety of technical indicators that can be used to identify trading opportunities and to manage risk. These indicators can be used to power the Best Martingale Strategy Forex EA MT4 or to develop your own trading strategies.

Education: 4xPip offers a variety of educational resources to help traders learn about the forex market and how to trade effectively. These resources include articles, videos, and webinars.

Here are some of the ways that 4xPip helps traders to get the Best Martingale Strategy Forex EA MT4:

Easy access: 4xPip makes it easy for traders to download and install the Best Martingale Strategy Forex EA MT4. Traders can download the EA directly from the 4xPip website.

Support: 4xPip offers support to traders who use the Best Martingale Strategy Forex EA MT4. Traders can contact 4xPip support for help with installing, configuring, and using the EA.

Community: 4xPip has a community of traders who use the Best Martingale Strategy Forex EA MT4. Traders can interact with each other on the 4xPip forum to share ideas and strategies.

#black literature#black fashion#black tumblr#black art#black history#Best Martingale Strategy Forex EA MT4#Grid Trading#Best Martingale Strategy#Martingale Strategy Forex EA MT4#Martingale Strategy#MT4 Martingale Strategy#MT4 Martingale Strategy EA

0 notes

Text

type of the support and resistance

#forex ea#forex news#forexsignals#forextrading#best forex broker#forexstrategy#forexmarket#forex trading#forex indicator#aesthetic

0 notes

Text

Advanced Strategies for Using Forex Robots

Forex robots, also known as Expert Advisors (EAs), are automated software programs designed to help traders make decisions in the foreign exchange market. While basic EAs can perform well in certain market conditions, leveraging advanced features can significantly enhance their effectiveness. In this article, we'll explore advanced strategies for using forex robots, focusing on custom indicators, algorithmic strategies, and the combination of robots with manual trading.

Leveraging Advanced Features

Forex robots can be highly effective when integrated with advanced features. These features can help you refine your trading strategies and improve your overall performance in the forex market.

Custom Indicators

One of the most powerful ways to enhance your forex robot is by incorporating custom indicators. Custom indicators are specialized tools created to provide unique insights into market conditions. They can be designed to measure various aspects of the market, such as volatility, momentum, or trend strength.

Developing Custom Indicators: To develop custom indicators, you need a solid understanding of programming and market analysis. Many trading platforms, such as MetaTrader 4 and 5, offer built-in tools and scripting languages like MQL4 and MQL5 for creating custom indicators.

Integrating Custom Indicators: Once you've developed your custom indicators, you can integrate them into your forex robot. This allows the robot to make more informed decisions based on the specific criteria you've defined.

Algorithmic Strategies

Algorithmic trading involves using complex mathematical models to execute trades. By leveraging algorithmic strategies, you can optimize your forex robot's performance and adapt to various market conditions.

Machine Learning Algorithms: Machine learning algorithms can analyze vast amounts of data to identify patterns and predict market movements. Integrating machine learning into your forex robot can help it learn from historical data and improve its decision-making process over time.

Genetic Algorithms: Genetic algorithms are optimization techniques inspired by natural selection. They can be used to fine-tune your forex robot's parameters, ensuring it operates at peak efficiency. By simulating evolution, genetic algorithms can identify the most effective trading strategies and discard less profitable ones.

Combining Robots with Manual Trading

While forex robots can operate independently, combining them with manual trading can create a more robust and flexible trading strategy. This hybrid approach leverages the strengths of both automated and human trading.

Hybrid Strategies

Hybrid strategies involve using forex robots for routine tasks and manual trading for more complex decisions. This approach allows you to benefit from the speed and precision of automated trading while retaining the flexibility and intuition of manual trading.

Routine Tasks: Forex robots excel at performing routine tasks, such as monitoring market conditions and executing trades based on predefined criteria. By delegating these tasks to a robot, you can free up time to focus on higher-level analysis and decision-making.

Complex Decisions: Manual trading is essential for making complex decisions that require human intuition and experience. By combining robots with manual trading, you can ensure that your overall strategy is adaptive and responsive to changing market conditions.

Best Practices

To maximize the effectiveness of your hybrid trading strategy, it's important to follow best practices. These guidelines can help you maintain a balanced approach and minimize potential risks.

Regular Monitoring: Even though forex robots can operate autonomously, regular monitoring is crucial. Ensure that your robot is performing as expected and make adjustments as necessary. Monitoring can help you identify and resolve issues before they impact your trading performance.

Risk Management: Effective risk management is essential for any trading strategy. Set clear risk parameters for both your forex robot and manual trades. This includes defining stop-loss levels, position sizes, and risk-reward ratios.

Continuous Learning: The forex market is constantly evolving, and staying informed about new developments is crucial. Continuously educate yourself on advanced trading techniques and update your forex robot accordingly. This can help you maintain a competitive edge and adapt to changing market conditions.

Conclusion

Using advanced strategies can significantly enhance the performance of your forex robots. By leveraging custom indicators, algorithmic strategies, and combining robots with manual trading, you can create a robust and flexible trading system. Following best practices such as regular monitoring, effective risk management, and continuous learning will further optimize your approach, helping you achieve long-term success in the forex market. For more insights and strategies, visit Trendonex and stay ahead in the world of forex trading.

3 notes

·

View notes

Text

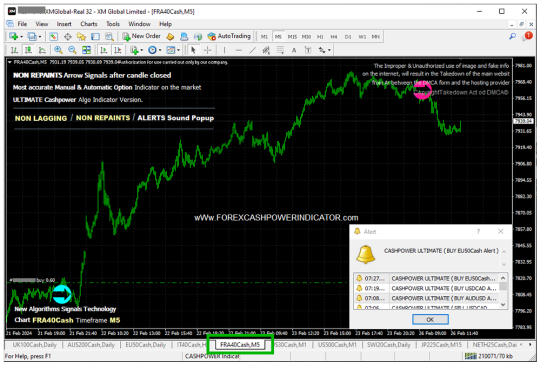

BIG Trade Profits #BUY Trade inside Indice #FRA40Cash M5. Oposite Signal time to close the trade. wWw.ForexCashpowerIndicator.com

.

Cashpower Indicator Lifetime license one-time fee with No Lag & NON REPAINT buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones.

.

✅ NO Monthly Fees

✅ * LIFETIME LICENSE *

✅ NON REPAINT / NON LAGGING

🔔 Sound And Popup Notification

🔥 Powerful AUTO-Trade EA Option

.

⭐ TOP BROKER Recommended ⭐

Trade Conditions to use CASHPOWER INDICATOR & EA Money Machine.* Top Awards WorldWide trade execution * Regulamented Brokerage Forex * O.O Spreads with Fast Deposits * Fast WITHDRAWALS with Cryptos. open your MT4 Account Start your trade Journey with BEST Broker !!

👉 https://clicks.pipaffiliates.com/c?c=817724&l=en&p=6

.

✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.**

.

( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ).

.

✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options.

.

🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration.

.

🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

.

#cashpowerindicator#indicatorforex#forexindicators#forexsignals#forex#forextradesystem#forexindicator#forexprofits#forexvolumeindicators#forexchartindicators#forex brokers#best forex brokers#forex education

3 notes

·

View notes

Text

Which is the best between MetaTrader 4 and MetaTrader 5?

When it comes to Forex trading, MetaTrader stands out as the industry standard, with its two leading versions—MT4 and MT5—both offering unique advantages. But as the trading world evolves, the question arises: which version is better suited for 2024?

MetaTrader 4 (MT4): The Classic Choice

MetaTrader 4 is a widely popular multi-functional online trading platform. It launched in 2005, MetaTrader 4 quickly became a favorite among traders. Its reliability and user-friendly interface have earned it a lasting place in the Forex community. With over 10 million downloads and a stellar rating, MT4 continues to be a go-to platform for many.

Pros:

User-friendly interface ideal for beginners

Robust community support

High stability and security

Supports automated trading through Expert Advisors (EAs)

Multi-language support and real-time market data

Cons:

Slower compared to MT5

Fewer trading tools and options

Outdated user interface

Limited customization capabilities

MetaTrader 5 (MT5): The Modern Powerhouse

Introduced in 2010, MetaTrader 5 represents the evolution of trading platforms. While it maintains a resemblance to MT4, MT5 offers enhanced features and broader market access. It's designed for traders looking for a more advanced and versatile trading experience.

Pros:

Modern and customizable user interface

Access to over 500 financial markets, including stocks and cryptocurrencies

Faster execution speed

More charting tools and technical indicators

Cons:

Smaller support ecosystem compared to MT4

Can be complex for users due to additional features

Less broker support

Head-to-Head Comparison:

User Interface: MT4 is straightforward and easy to navigate, making it perfect for beginners. MT5 offers a more sophisticated interface with advanced features for experienced traders.

Time Frames: MT4 provides 9 timeframes, while MT5 offers an impressive 21, allowing for more detailed analysis.

Charting Tools: MT5 enhances charting capabilities with additional tools and chart types, surpassing MT4.

Indicators: MT4 includes 30 built-in indicators, but MT5 expands this to 38, offering more analytical options.

Programming Language: MT4 uses MQL4, known for its simplicity, whereas MT5 uses MQL5, offering advanced programming capabilities.

Which Should You Choose in 2024?

For traders who prioritize a reliable and straightforward platform, MT4 remains an excellent choice, especially if you’re focused primarily on Forex trading. However, if you’re seeking a platform with broader market access and enhanced features, MT5 is the clear winner.

Conclusion:

Both MetaTrader 4 and MetaTrader 5 have their strengths, and the choice between them depends on your trading needs and preferences. As you step into 2024, consider what features are most important for your trading strategy and choose the platform that aligns best with your goals. Happy trading!

#Forex Trading#Telegram Signal Copier#TSC#MetaTrader 4#MetaTrader 5#MT4#MT5#MT4 vs MT5#forex market#forextrading#forex education

0 notes

Text

ATFX Review 2024: Pros, Cons, and Key Features

Overview of ATFX

ATFX is a leading Forex and CFD broker regulated by several reputable financial authorities. Established in 2014, the company has grown significantly, now serving clients in over 30 countries. ATFX’s offerings include forex pairs, commodities, indices, shares, and cryptocurrencies, giving traders a broad spectrum of instruments to trade. With its competitive spreads, fast execution, and user-friendly platforms, ATFX caters to both beginner and professional traders.

Key Features of ATFX

Regulation and Safety

One of the most critical aspects of any broker is its regulatory status. ATFX is regulated by several reputable financial authorities, including:

FCA (Financial Conduct Authority) in the UK

CySEC (Cyprus Securities and Exchange Commission)

FSRA (Financial Services Regulatory Authority) in the UAE

These regulations ensure that ATFX adheres to strict financial guidelines, safeguarding clients’ funds and ensuring fair trading conditions. The broker also provides negative balance protection, ensuring that traders cannot lose more than their initial deposit, an essential feature for minimizing risk.

Trading Platforms

ATFX offers the world-renowned MetaTrader 4 (MT4) platform, which is known for its user-friendly interface, robust charting tools, and the ability to run automated trading strategies using Expert Advisors (EAs). MT4 is available for desktop, mobile, and web, making it accessible to traders on the go.

In addition to MT4, ATFX provides its clients with WebTrader, a browser-based platform that offers real-time market data, advanced charting, and instant trade execution. Both platforms are equipped with a wide range of technical analysis tools, making them ideal for both novice and professional traders.

Account Types

ATFX offers a variety of account types to cater to different types of traders. The available accounts are:

Standard Account: Best suited for beginners and retail traders, this account type offers competitive spreads starting from 1.0 pips, with no commission on trades.

Edge Account: Designed for more experienced traders, this account features lower spreads starting from 0.6 pips but with a commission charged on each trade.

Professional Account: Available to those who meet specific eligibility criteria, offering the best spreads starting from 0.0 pips and lower trading costs overall.

Islamic Account: For traders who require swap-free trading in accordance with Islamic finance principles.

Each account type offers leverage up to 1:30 for retail clients and up to 1:400 for professional clients, providing a significant range of options for different trading strategies.

Pros of ATFX

1. Wide Range of Trading Instruments

ATFX offers an impressive selection of over 100 trading instruments, including Forex, CFDs on commodities, indices, shares, and cryptocurrencies. This variety allows traders to diversify their portfolios and take advantage of different market conditions.

2. Regulated and Trusted Broker

With oversight from multiple financial regulators, ATFX is a trusted and reliable broker. The fact that the broker is regulated by the FCA adds an additional layer of confidence for UK traders, ensuring that the company operates with transparency and accountability.

3. Excellent Customer Support

ATFX provides 24/5 multilingual customer support, ensuring that traders can get assistance whenever they need it. Whether you need help with technical issues, platform navigation, or trading advice, ATFX’s dedicated support team is there to help. They also offer live chat, email, and phone support.

4. Low Fees and Competitive Spreads

ATFX is known for its tight spreads, particularly on major currency pairs such as EUR/USD and GBP/USD. For example, spreads on a Standard Account can start as low as 1.0 pips, while on an Edge Account, they can go even lower. Additionally, ATFX charges no deposit or withdrawal fees, which further reduces trading costs.

5. User-Friendly Platforms

The availability of MetaTrader 4 and WebTrader means traders can access the market using platforms that are intuitive and reliable. The MT4 platform is particularly popular for its customizable interface, automated trading capabilities, and extensive charting tools.

Cons of ATFX

1. Limited Educational Resources

While ATFX offers some educational resources, they are somewhat limited compared to other brokers in the market. Traders looking for extensive tutorials, webinars, or advanced trading courses might find the educational offering lacking.

2. High Minimum Deposit for Premium Accounts

The minimum deposit for the Edge and Professional accounts can be relatively high, making these account types less accessible to small retail traders. This might be a drawback for those looking to start with a smaller investment.

3. Limited Asset Coverage for Cryptocurrencies

Although ATFX offers cryptocurrency trading, the selection is somewhat limited compared to specialized crypto exchanges. This might be a disadvantage for traders looking to focus specifically on crypto assets.

Deposits and Withdrawals

ATFX offers several convenient methods for deposits and withdrawals, including bank transfers, credit/debit cards, and e-wallets such as Skrill and Neteller. The broker does not charge any fees for deposits or withdrawals, making it an attractive option for traders who are cost-conscious.

Withdrawal requests are processed quickly, with most being completed within 24 hours. However, it is essential to note that withdrawal times can vary depending on the payment method used.

Trading Costs and Commissions

As mentioned earlier, ATFX offers competitive spreads, with zero commission on most accounts, except the Edge Account. Traders using the Edge Account can expect a small commission per trade, but this is balanced by the tighter spreads.

Swap fees are charged for holding positions overnight, although Islamic accounts are available for those who wish to trade without interest. These accounts are designed in line with Shariah principles, offering traders a swap-free experience.

Conclusion

ATFX has positioned itself as a top-tier broker in the online trading industry. With a wide range of trading instruments, strong regulatory oversight, and user-friendly platforms, it is a suitable choice for both beginners and experienced traders alike. The broker’s competitive spreads, low fees, and excellent customer support are major selling points, although there are a few areas for improvement, such as their educational resources and cryptocurrency offerings.

If you’re looking for a reliable broker with competitive trading conditions and strong regulatory backing, ATFX is certainly worth considering for your trading journey in 2024.

#ATFX#ATFX Review#ATFX Reviews 2024#ATFX Scam#ATFX Forex#ATFX Brokerm#ATFX Trading Broker#forex trading#forex broker#forex market#forextrading#cfd trading forex#cfd trading platform

0 notes

Video

Forex Robot 2024: Expert Advisor for Automated Trading with AI and Profi...

#youtube#forex#forex trading#best scalping ea 2024#best scalper 2024#best forex robot 2024#best forex ea#best forex bot 2024#forex trading live#forex scalper 2024#automatic trading#automatic trading bot

0 notes

Text

Forex Trading Platforms

Forex trading, popularly known as foreign exchange trading, has grown exponentially in these few years. It attracts millions of traders from various parts of the world. However, one does not achieve success in the forex market by merely understanding the economic trends and currency pairs; one can succeed based on choosing the right trading platform. In this blog, we at Profithills Education will try to assist you in understanding some key points related to forex trading platforms so that you can decide accordingly.

What is a Forex Trading Platform?

The forex trading platform is a software interface, which the brokerage firm offers to the trader for access to the currency markets. These platforms may be web-based, desktop, or mobile applications and enable traders to execute a range of functions, including the following:

Trade online currency pairs

Have live price charts

Use analytical tools for technical analysis

Create automated trading bots

Get news feeds and economic calendars

A good trading platform will make the difference between profitable trading and lost opportunities. Let's see what types of platforms are available and how to choose the best for your trading style.

Types of Forex Trading Platforms

Proprietary Platforms

Sometimes, the brokers develop their own trading platforms. This is to please their clients with the features they want or need. Most of these proprietary platforms are user-friendly and very neat to interface; the newbies or professional traders will be pleased with what they are seeing on the screen. However, it lacks the ability for customization compared to the other developed platforms.

MetaTrader 4

By far and away, MT4 is the most used platform in the forex trading world. It is known to be very versatile; for it allows a good amount of technical analysis tool, to conduct automated trading through so-called Expert Advisors, commonly known as EAs, and a huge community. The MT4 is especially favored by both novice and professional traders alike.

MetaTrader 5 (MT5)

MT5 is an update from MT4, containing a greater amount of timeframes, types of orders, and DOM features. It will be satisfactory to those traders who need more versatility, more extensive access to markets, including CFDs, stocks, and commodities besides forex.

cTrader

As for another competitive platform, cTrader enjoyed the reputation of being intuitive-looking and performing. Advanced charting, super-fast order execution, and the enormous amount of indicators make it a darling among technical traders.

TradingView

It works online, mainly known for its great charting tools. Many traders do their analysis of the market on this and execute the trade with another broker's trading terminal. Additionally, it offers a social trading environment where members share ideas regarding trading.

Key Features to Look for in a Forex Trading Platform

The selection of the proper trading platform depends on your own trading style and experience level. Following are some of the basic features to consider:

User Interface & Ease of Use

Regardless of your experience-a novice or professional trader-an easy-to-use and intuitive platform is what you need. A clean interface means you will be able to act quickly when performing trading, without being overloaded by a bunch of features you do not need.

Technical Analysis Tools & Indicators

A platform filled with technical analysis tools is more important for traders reliant on charts and patterns. Multiple indicators, different drawing tools, and chart types are crucial to have a decent trading platform.

Every second counts in Forex, and the selected platform should be able to deliver instant order execution, especially in those instances of high volatility. Slippage and lag mean missed opportunities and loss of money.

Security

The nature of Forex trading involves handling personal and financial information. Always settle for a secure platform-outfitted with SSL encryption, two-factor authentication, and reputable regulatory oversight.

Mobile Compatibility

A mobile-friendly platform allows trading on the move-anywhere and anytime, thus giving flexibility, which is all the more essential for day traders and scalpers who need to keep constant tabs on the market.

Automation & Algorithmic Trading

Those traders who wish to employ automated strategies will need to make sure the platform they select will allow for algorithmic trading. MT4 and MT5 have this capability through EAs, while cTrader provides support for cAlgo, which allows for more advanced programming.

How to Choose the Right Platform for You

We at Profithills Education recommend the following while choosing a forex trading platform:

Know your trading style: Position trader, day trader, or scalper? Each website has a relative strength that fits better with one trading approach over another.

Know your budget: Some sites charge extra for services or spread wider. Understand how much use of each site will cost you in commission and hidden fees.

Get a Feel for the Platform: Most brokers will let you try demo accounts. Use that to the fullest to learn how the features of the platform work before you put in some real money.

Seek Customer Support: Fast customer service when you are up against problems can save you. Make sure the broker offering the platform has suitable and available support.

Conclusion

The Forex market is a hub of endless opportunities, and your success completely depends on informed decisions-right from selecting a proper trading platform. At Profithills Education, we try to arm you with the necessary knowledge to instill confidence in the Forex world. MT4, cTrader, or a proprietary platform-whatever suits your trading goal and provides the necessary tools for success.

0 notes

Text

Understanding the Basics of Trading

Trading, in its simplest form, is the act of buying and selling assets in financial markets. These assets can include stocks, bonds, currencies, commodities, or cryptocurrencies. The objective of trading is to capitalize on price fluctuations within the market, buying low and selling high to secure a profit.

Financial markets are vast and diverse, each offering unique opportunities and risks. Broadly speaking, they can be categorized into several types: the stock market, where shares of companies are traded; the forex market, dedicated to currency trading; and the commodity market, which deals in raw materials like gold, oil, and agricultural products. For a novice, understanding the distinct characteristics of each market is paramount.

Key concepts such as assets, brokers, and trading platforms are foundational in the trading journey. Assets are the items or securities you trade. Brokers are intermediaries who facilitate your trades in the market. Trading platforms, often provided by brokers, are software interfaces where you execute your trades, view market data, and manage your account.

Essential Tools and Resources for New Traders

Choosing the right trading platform is akin to selecting the right tool for a job. The platform you opt for should be user-friendly, offer real-time data, and provide essential tools for analysis. It’s wise to experiment with demo accounts offered by these platforms to familiarize yourself with their features before committing real capital.

Analytical tools are indispensable for traders. These can range from simple charting tools to sophisticated software that analyzes market trends and forecasts potential price movements. The most commonly used tools include moving averages, oscillators, and volume indicators, each offering unique insights into market behavior.

Educational resources, including online courses, webinars, and trading communities, play a critical role in the learning curve of a trader. Engaging with a community of traders can provide support, share insights, and offer real-time advice that can be invaluable, especially when navigating the complexities of trading.

Developing a Trading Strategy

A well-defined trading strategy is your roadmap in the trading world. Risk management should be the cornerstone of any strategy, ensuring that potential losses are kept within acceptable limits. Techniques such as setting stop-loss orders and diversifying your portfolio are fundamental to managing risk.

Traders often debate between fundamental and technical analysis. Fundamental analysis involves evaluating an asset's intrinsic value based on economic indicators, company performance, and industry trends. On the other hand, technical analysis relies on historical price data and chart patterns to forecast future price movements. Both methods have their merits, and a balanced approach often yields the best results.

Crafting a personalized trading plan is essential. This plan should outline your financial goals, risk tolerance, preferred trading style, and criteria for entering and exiting trades. A well-structured plan not only guides your trading decisions but also helps you stay disciplined, reducing emotional trading that can lead to unnecessary losses.

Executing Your First Trades

The process of placing your first trade can be both exhilarating and daunting. It involves selecting an asset, deciding on the amount to invest, and choosing between buying or selling based on your analysis. Once the trade is placed, it’s crucial to monitor its performance closely, adjusting your position as necessary to maximize profits or minimize losses.

Monitoring and adjusting your positions are ongoing tasks. Markets can be volatile, and what may seem like a profitable trade can quickly turn against you. Tools like trailing stops can help lock in profits while minimizing downside risk.

Every trade, whether successful or not, offers a learning opportunity. Reflecting on your early experiences, analyzing what worked and what didn’t, and refining your strategy based on these insights are key to evolving as a trader. Over time, this process of continuous learning will help you develop a more nuanced understanding of the markets and improve your trading acumen.

If you want learn trading step by step, Click Here to see some reviews about my strategy and enroll us with our best decision makers.

#marketing#ecommerce#business#blockchain#investment#bitcoin#forextrading#forex market#stock trading#stock market#software

0 notes

Text

Exploring the Benefits of FX Quake EA for Consistent Trading Success

Forex trading has evolved tremendously, with technology playing a crucial role in its transformation. FX Quake EA, a powerful and reliable expert advisor, stands out among the myriad tools available to traders today, designed to optimize trading strategies and enhance profitability. At Best Forex EA, we are committed to providing traders with the tools to achieve consistent trading success. In this article, we will explore the numerous benefits of FX Quake EA and how it can help you achieve your trading goals.

Click on the link to know more...

0 notes

Text

Enhancing Forex Operations

Overview:

It is vital to success in the fast-moving world of Forex exchange platforms that one stays ahead of the curve. If one has LaunchFXM at their disposal as an ally, one will be able to improve their trading operations using powerful tools and resources.

This article aims to examine some tactics or characteristics provided by LaunchFXM which you can employ so that you can get more out of trading on the Forex exchange market.

Seamless Integration: Streamlining Your Trading Experience

Launch FXM’s user-friendly system eases the integration process.

It gives you access to the ongoing market information, you can trade quickly and easily manage your cautions.

That’s why you need to forget about all the technical problems, while opening the way for seamless exchange trading.

Customized Trading Solutions: Tailoring Strategies to Your Needs

Foreign exchange market trading is not a one-size-fits-all. LaunchFXM recognizes this and provides custom trade solutions designed to fit your specific preferences and goals.

Irrespective of whether you are a scalper, day trader, or swing trader – this will help you in tailoring your plan well.

Advanced Charting Tools: Visualize Opportunities Like Never Before

Get as competitive an advantage as can be by using LaunchFXM’s state-of-the-art charting tools.

Go for it to be able to analyze price movements, patterns, and foreign exchange trading accounts clearly and accurately.

Make use of such simple things like -simple line charts as well as complex indicators which help you see important data better – in order to make successful decisions.

Risk Management Features: Protecting Your Capital

Minimize danger and secure your funds via LaunchFXM’s broad-based protection from risk services.

In order to manage risks effectively, the necessary steps to take are to include the use of stop – losses, trailing stop orders and margin requirements.

LaunchFXM can help you invest confidently, as it ensures that your investments are safe.

Expert Advisor Integration – Automating Your exchange Trading Strategies

Take your trading to the next level with Expert Advisor (EA) integration.

LaunchFXM supports the use of EAs, allowing you to automate your trading strategies and execute trades based on predefined parameters.

Spend less time monitoring the forex foreign exchange markets and more time on strategy development.

Educational Resources: Empowering Your Trading Journey

In the currency exchange market, the individual who has the most information has an advantage over their competitors.

You can learn new foreign exchange trading strategies and stay abreast of market developments by using LaunchFXM’s training materials.

Subjects are lecturers, learn from the webinars, get more information from video lessons, and lastly read Market analysis to make decisions based on data.

Responsive Customer Support: Assistance When You Need It

For forex exchange trading, timing is essential as one second could determine your ultimate fate in trading.

It is against this backdrop that responsive customer support services have been availed by LaunchFXM in a bid to address all issues promptly.

Do not hesitate any time you encounter a problem while trading; LaunchFXM is ready all the time with technical assistance and guidance support aimed at helping customers understand complicated issues surrounding it.

The Verdict:

With LaunchFXM, you can upgrade your Forex activities in the forex exchange platform. For successful trading experience, it is important to empower trading journeys of individuals with required resources and support.

These among other things integrate expert advisors in their systems, advanced charting tools like this best for running automated trades. You can tap into the bursting dynamics of Forex with LaunchFXM that comes with a package deal.

0 notes

Text

The Best Forex Robots: Automated Trading for Today's Investors

In today's fast-paced financial scene, the appeal of automatic trading via best forex robots has captured the interest of investors all over the world. These advanced algorithms promise to manage the forex market's complexity with unprecedented efficiency and precision. But, in the middle of so many possibilities, which forex robots stand out as the best?

Understanding the Best Forex Robots.

Best Forex robots, also known as Expert Advisors (EAs), are software programs that automate trading choices for traders. Best Forex Robots uses predetermined algorithms and strategies to execute trades without requiring continual human supervision best forex robots automation seeks to profit on market opportunities quickly and consistently by leveraging speed and data analysis capabilities that exceed human competence.

Best Forex Robot Requirements

1. Performance and Consistency: The best forex robot for mybottrading is known for its capacity to provide steady performance over an extended period of time. This covers indicators for profitability, the efficacy of risk management, and trading strategy adherence.

2. Customization and Strategy: the best forex robots provide a variety of techniques that are adapted to various market circumstances. They ought to be adaptable enough to accommodate different people's trading preferences and levels of risk tolerance.

3. Transparency and Support: best forex robots offer transparent trading operations through best forex robots live trading performance, back test data, and detailed documentation of trading techniques. Reliable customer service is also essential for quickly resolving problems.

4. User-Friendliness: The best forex robots are simple to set up, keep track of, and modify as necessary, thanks to their intuitive and user-friendly design.

In the volatile world of best forex trading, the introduction of automated tools, notably best forex robots, has transformed how traders approach the markets. These advanced algorithms are intended to make transactions on users' behalf, using established strategies and settings to traverse the complexity of the forex market. The quest for the finest best forex robots is based on their capacity to consistently offer positive returns while minimizing risks.

best Forex robots, often called expert advisors (EAs), provide several appealing benefits. They function without emotional intervention, which is a common mistake for human traders who are prone to fear or greed. This emotional detachment allows for the disciplined implementation of trading techniques based only on specified criteria, such as trend following, grid trading, or scalping.

Conclusion

Finding the best forex robots requires carefully weighing factors including performance, strategy, usability, and transparency. Using the best forex robots can greatly improve your trading experience and possibly increase your profitability, regardless of your level of experience with investing or forex trading. Keeping up with the most recent developments Best Forex Robots automated trading technology will be essential to being competitive as the forex market continues to change.

0 notes

Text

USDCAD M1 Timeframe SCALPER Mode, o.90 Lots Buy trade based in last NON REPAINT Signal. Official Website: wWw.ForexCashpowerIndicator.com

.

Start Improve your Strategy with Cashpower Indicator Lifetime license one-time fee with No Lag & NON REPAINT buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones.

.

✅ NO Monthly Fees

✅ * LIFETIME LICENSE *

✅ NON REPAINT / NON LAGGING

🔔 Sound And Popup Notification

🔥 Powerful AUTO-Trade Option

.

⭐ TOP BROKER Recommended ⭐

Trade Conditions to use CASHPOWER INDICATOR & EA Money Machine.* Top Awards WorldWide trade execution * Regulamented Brokerage Forex * O.O Spreads with Fast Deposits * Fast WITHDRAWALS with Cryptos. open your MT4 Account Start your trade Journey with BEST Broker !!

👉 https://clicks.pipaffiliates.com/c?c=817724&l=en&p=6

.

✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.**

.

( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ).

.

✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options.

.

🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration.

.

🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

2 notes

·

View notes