#bitcoin bull rally

Text

Bitcoin Breaks $64,000, But This Pattern Could Mean Bull Run Isn't Safe

Keshav is currently a senior writer at NewsBTC and has been attached to the website since June 14, 2021.

Keshav has been writing for many years, first as a hobbyist and later as a freelancer. He has experience working in a variety of niches, even fiction at one point, but the cryptocurrency industry has been the longest he has been attached to.

In terms of official educational qualifications,…

#bitcoin#Bitcoin Break#bitcoin bull run#Bitcoin Pattern#bitcoin rally#Bitcoin Supply In Profit#btc#btcusd

0 notes

Text

Navigating Short-Term Corrections: Bitcoin Signals Amidst Fluctuating Premiums

CryptoQuant.com, a renowned crypto analytics platform, has shed light on the current market conditions using two crucial indicators: Korea Premium and Coinbase Premium. The Korea Premium refers to the price difference of Bitcoin on South Korean exchanges compared to global platforms. When this premium turns positive, it suggests increased buying activity by South Korean retail investors.

Simultaneously, the Coinbase Premium, indicating the difference in BTC prices between Coinbase and other exchanges, has turned negative. Historically, these conditions have been associated with short-term corrections during bull markets. The narrative unfolds as South Korean retail investors actively buy Bitcoin, while US investors seem to be selling, leading to a temporary market pullback.

It's crucial to emphasize that these signals don't necessarily point towards a bear market. Instead, they suggest a momentary pullback within the broader context of the ongoing bull rally. The Bitcoin market is known for its resilience and ability to recover from such corrections, and traders should view this as an opportunity to reassess their positions.

#BTC#Bitcoin#Korea Premium#Coinbase Premium#short-term correction#bull rally#whale deposits#GBTC ETF#market fluctuations#CryptoQuant#market dynamics#cryptotale

0 notes

Text

Digifinex Labs: Bitcoin Bulls Eye $45K, Potentially Boosting UNI, OP, TIA, and STX

The S&P 500 Index (SPX) achieved its highest close of the year last week, and Bitcoin (BTC) also hit a new 52-week high, indicating that risky assets remain strong going into the final few days of the year.

Usually, the first leg of the rally of a new bull market is driven by the leaders, but after a significant move, profit-booking sets in and traders start to look at alternative opportunities. Although Bitcoin has not rolled over, several altcoins have started to move higher, signaling a potential shift in interest.

Bitcoin Price Analysis

Bitcoin has been consolidating in a tight range near the minor resistance at $44,700, indicating that the bulls are not rushing to the exit as they anticipate another leg higher.

Get your $550

Registering DigiFinex now grants you a newcomer’s package worth $550: Click to register

3 notes

·

View notes

Text

⭐ Bitcoin on February 18th 2023 🚀✨

The price as I'm writing this is $24,470 per btc.

youtube

Astro 🔮💫

Venus is approaching a conjunction to Bitcoin's moon in Aries starting today, then subsequently Jupiter (On March 2nd). This likely points to a boost in people's investments (especially the jupiter conjunction). The stock market is likely to rally as well. Venus rules money & investments.

Super positive for bitcoin 👍

Cup & Handle Pattern:

- Invalidation vs. Breakout zones: $24,300 ❌ & $24,950 ✅

- Triple Bullish Scenario ♉♉♉

Cup Handle - 4h chart

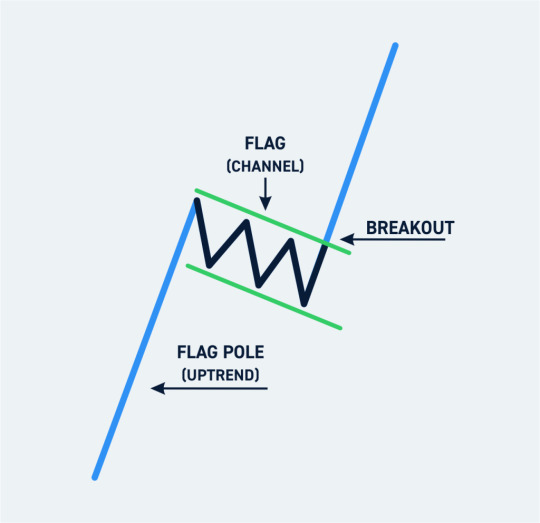

Bull flag - 1h chart

W-pattern (2x-bottom) - 15m chart

-=-=-=-

1: 💹 Trends

Monthly, we are in a downtrend 📉.

Meaning, we can expect prices less than $17,000 Bitcoin in the next 12 months.

Weekly, we are in an uptrend 📈.

Meaning we can expect prices higher than $25,300 Bitcoin within the next 8 weeks

So long as we close Sunday above $23,900 btc (So far, ✅)

Daily, we are in an uptrend* 📈

IF we close the day above $24,300 BTC. (@ 7pm EST)

However yesterday, we have made lower highs than the 15th, when we retested $25,000. Which is bearish.

4h we are in a seeming downtrend. Marked by a distinct lower high in the chart. Simply one strong candle downwards on this timeframe is confirmation and We are looking horrendous for Bitcoins price over the next 3 days.

Right now, it seems we are in this ambiguous/pivotal energy like yesterday. So it's a time for relative inaction. Volume is eerie and low at the moment. Not much pressure from either the bull or the bears 😐

Hourly, we are in a downtrend 📉

Meaning we can expect prices lower than $24,300 bitcoin within the next day.

That is just the fact of the matter... Despite that we are forming a sort of distribution pattern known as a bull flag. A sort of last minute attempt to break the down trend. If that is validated, this could lead us powerfully to our next leg up. The measured move would lead us precisely to our next target: $26,250 dollar btc. ⚠️

The bull flag would be confirmed by any intraday closure above the "pole" of the flag: ~ 24,950. Usually by bullish candles with high volume

2: 🔮 Conclusion

I am in a small long position as of the bottom of the bullflag Entered at ~$24,480. I will add more once there is confirmation of a breakout. Placing my stop-loss price at the bottom of the flag (channel).

And taking some profits at $25K!

3: 💰 Current Portfolio

18.5% USDs (+8.65%)

17.15% BTC (-4%)

64.35% Alts (-4.65%)

In Alts [24% is ETH 🔵, 17% is BNB 🟡, Rest is a combination of ADA, LINK, LTC & SHIB]

That's all For now!

2 notes

·

View notes

Text

US Fed’s Anticipated Quantitative Easing Cycle Boosts Bitcoin (BTC) to Surpass Key Support Levels

Key Points

Bitcoin (BTC) price has closed above crucial support levels, following the start of the US Federal Reserve’s quantitative easing cycle.

The decrease in Bitcoin supply on centralized exchanges and the bullish crypto outlook for Q4 could push Bitcoin towards a new all-time high.

Bitcoin (BTC) saw a nearly 3% increase in its price over the last 24 hours, reaching a high of approximately $62,508 before settling around $62,138. This rally has resulted in Bitcoin closing above the 50-day Moving Average (MA) for two consecutive days, and surpassing the 50% level on the Relative Strength Index (RSI).

Despite a daily death-cross between the 50 and 200 MAs, Bitcoin has maintained a strong support level above $53,697 since early July. This has led to a triple bottom and a bullish divergence on the daily RSI.

Factors Driving Bitcoin’s Price Increase

The price rally of Bitcoin over the past 24 hours can primarily be attributed to the Federal Funds Rate cut, which initiated the quantitative easing cycle. The Federal Reserve reduced its benchmark interest rate by 50 bps, more than the 25 bps cut expected by Wall Street analysts. This move aligns the United States with the European Central Bank (ECB) and the Bank of Canada in stimulating their economies through lower interest rates.

The correlation between Gold and Bitcoin prices due to their common use as safe havens is another factor that could drive a major bullish recovery in the Bitcoin price. The supply of Bitcoin on centralized exchanges is at a multi-year low of approximately 2.35 million, down from over 2.7 million at the start of the year. This decrease is largely due to high demand from institutional investors and US spot Bitcoin ETFs.

Future Predictions

From a technical perspective, if the bulls remain in control, Bitcoin is on track to retest its all-time high in the near future. However, to ensure a rally towards $68k, Bitcoin must consistently close above $62k in the coming days.

If the bulls fail to defend the current rising trend, Bitcoin could retrace towards $54k before rebounding in the fourth quarter.

0 notes

Text

Understanding Bitcoin’s Price Fluctuations and Exploring Singular Coin

Bitcoin, the pioneering cryptocurrency, has captured global attention with its sharp price movements and massive volatility. While some i nvestors see these fluctuations as an opportunity for profit, others remain wary of its unpredictable nature. Bitcoin’s price is influenced by a range of factors, including market sentiment, regulatory changes, technological advancements, and global economic events. Additionally, emerging cryptocurrencies like Singular Coin aim to address Bitcoin’s limitations, offering unique benefits that are attracting new investors.

In this article, we will dive into the core reasons behind Bitcoin’s price volatility and explore the promising potential of Singular Coin as a new player in the crypto space.

Key Drivers of Bitcoin’s Price Fluctuations

Supply and Demand

One of the fundamental factors influencing Bitcoin’s price is its supply and demand dynamic. Bitcoin has a fixed supply of 21 million coins, and once all of them are mined, no new Bitcoins will be produced. This scarcity plays a significant role in driving its price. As demand increases—especially during bull markets—prices rise due to the limited availability of new coins. Conversely, when demand decreases, prices fall.

Demand for Bitcoin can spike when institutional investors, like corporations or hedge funds, make large purchases, or when retail investors enter the market en masse, spurred by the fear of missing out (FOMO). Additionally, halving events, where the reward for mining Bitcoin is cut in half, reduce the rate at which new coins are introduced, tightening supply and often leading to price increases.

2.Market Sentiment and Investor Psychology

Market sentiment plays a major role in Bitcoin’s price movements. News, social media, and influencers can significantly sway public opinion on Bitcoin. Positive sentiment—such as news of major companies accepting Bitcoin or countries adopting it as legal tender—tends to drive prices higher. Negative sentiment, on the other hand, such as regulatory crackdowns or security breaches, can lead to sharp declines.

Fear, uncertainty, and doubt (FUD) in the market also contribute to wild swings in Bitcoin’s price. Investors who panic during downturns may sell off their holdings, exacerbating price drops. On the other hand, FOMO can drive investors to purchase during price rallies, pushing prices higher.

3.Technological Developments and Forks

Bitcoin is powered by blockchain technology, and any updates or changes to its core protocol can influence its price. Hard forks—where the blockchain splits into two separate chains—can create uncertainty in the market. For example, when Bitcoin Cash forked from Bitcoin in 2017, both coins experienced price volatility. Moreover, advancements in the scalability and security of the Bitcoin network, such as the Lightning Network, can boost confidence and lead to price appreciation.

Similarly, the development and adoption of blockchain technology across industries—whether for supply chain management, finance, or decentralized applications (dApps)—can indirectly influence Bitcoin’s value by raising the overall profile of cryptocurrencies.

4.Global Economic Events and Geopolitical Issues

Bitcoin is often viewed as a hedge against traditional financial markets, especially during times of economic uncertainty. Events like inflation, currency devaluation, or geopolitical tensions can lead investors to seek refuge in Bitcoin as a “safe haven” asset, driving its price upward. For instance, during the COVID-19 pandemic, Bitcoin’s price surged as traditional markets suffered.

Conversely, government interventions, such as regulatory crackdowns or bans on Bitcoin trading and mining, can negatively impact its price. For example, China’s 2021 ban on cryptocurrency mining caused a significant drop in Bitcoin’s price due to the exodus of miners from the country.

Blog Source URL :

#singular#singular wallet#dex#perpetuals#bitcoin’s price#singular crypto#singular coin#Dex Trades#Trading Dex#Defi Trading Platforms#Decentralized Perpetual Exchanges#Dex Perpetuals

0 notes

Text

Declining Ethereum ETFs: Is market enthusiasm for ETH fading?

Key Points

Ethereum ETFs have been experiencing constant outflows, hinting at low investor interest.

Despite the current bearish trend, top traders are taking long positions, suggesting a potential market shift.

Ethereum Exchange Traded Funds (ETFs) have been witnessing a steady outflow, contradicting earlier expectations that ETFs would stimulate demand.

This trend has been noted by several market analysts, some of whom speculate it could be a factor contributing to Ethereum’s bearish performance.

Ethereum ETF Outflows and Market Impact

On September 17th, Ethereum’s spot ETF net outflows hit a high of $15.114 million, as reported by Wu Blockchain.

Additionally, most Ethereum ETFs did not record positive inflows throughout the week, with outflows dominating.

These outflows are believed to have significantly influenced Ethereum’s recent performance, aligning with the subdued market sentiment and resulting in decreased network activity.

This lack of investor enthusiasm was reflected in Ethereum’s latest price action.

While Bitcoin saw a rise of over 14% from the month’s lowest point, Ethereum only increased by approximately 7.7%.

This underperformance underscored the dwindling demand for Ethereum, which traded at $2,321 at the time of reporting.

Prospects for a Strong Ethereum Comeback

Despite Ethereum’s Relative Strength Index (RSI) struggling to surpass the 50% level, indicating low bullish momentum, its Money Flow Index (MFI) suggests that some liquidity is still entering the coin, albeit in small amounts.

A strong rally is not entirely out of the question.

Ethereum’s current situation is the result of several factors, including ETF outflows and decreased on-chain activity.

However, a change in these factors could stimulate strong demand, particularly if Ethereum ETFs begin to see healthy inflows.

Ethereum’s current price level could also be seen as a stable zone.

Yet, the prevailing uncertainty has impacted its performance in the derivatives segment as well.

For instance, Open Interest levels dropped significantly in the last 24 hours, accompanied by a decrease in buy volume.

Interestingly, these trends in Ethereum’s performance could be linked to whale manipulation.

The number of long positions among top traders decreased during Tuesday’s trading session but rebounded later, indicating a shift back to a bullish sentiment.

This suggests that Ethereum bulls might assert their dominance as the weekend approaches.

However, this is contingent on Ethereum garnering sufficient demand and momentum to push its price back on an upward trajectory.

0 notes

Text

Bitcoin rally to $60K raises traders’ interest in FET, SUI, AAVE and INJ

Bitcoin (BTC) reclaimed the $60,000 level on Sept. 13, indicating a solid comeback by the bulls. Bitcoin’s rally of about 10% this week has helped buyers turn around September’s returns to positive.

Next week, investors will focus on the FOMC meeting scheduled for Sept. 18. CME Group’s FedWatch Tool shows a 50% probability of a 50-basis point rate cut. However, if the Federal Reserve delivers a…

1 note

·

View note

Text

Crypto Watch: Anticipating Major Impact on Bitcoin Price with Upcoming Release

Key Points

The Federal Open Market Committee (FOMC) meeting could have a significant impact on the cryptocurrency market.

Crypto analyst Ash Crypto predicts a potential price spike in the crypto market following the meeting.

Today is a significant day in the financial market, and it could be a historic one for cryptocurrencies. The Federal Open Market Committee (FOMC) is meeting today, and many, including crypto expert Ash Crypto, believe this could be the most important meeting in four years.

Impact of FOMC Meeting on Crypto

Investors are closely watching the outcome of the meeting as the US Federal Reserve (Fed) is expected to implement its first interest rate cut since March 2020. Ash Crypto suggests that the market anticipates a rate cut of 50 basis points (bps), which could be a bullish signal for the crypto ecosystem.

A lower interest rate could potentially increase the demand and prices of cryptocurrencies. However, the focus will be on Jerome Powell’s speech, as his words could determine the market’s direction.

If the Federal Reserve Chairman mentions any risk factor regarding recessionary pressures, the crypto market could experience a quick price dump. However, if Powell’s speech is positive and he talks about cutting interest rates, it could have a significant positive effect on the crypto market.

Interest Rates and Crypto Market

Many top banks predict that interest rates will decrease in 2024, with predictions between 1% and 1.25%. This expected change in monetary policy and global availability of cash could make it easier for people to invest in riskier assets like Bitcoin and other cryptocurrencies.

Ash Crypto is confident that the fourth quarter will be more bullish for the crypto market, as current conditions seem to align with this prediction.

Bitcoin’s Future

Before making his post, Ash Crypto predicted that Bitcoin could reach $100,000 to $150,000. He noted that BTC has bottomed out and the crypto market could soon experience a major bull run.

Bitcoin has continued to trade sideways since March, consolidating between $71,000 and $53,000. If the major support at around $52,000-$53,000 price levels holds, the chances of a major price dip will be curbed. This could allow the price to continue the pattern seen in the past two bull runs.

For a spike to the predicted $100,000 range, a breakout of the six-month-long consolidation (since March) is needed. Perhaps bullish news from FOMC today could trigger this move.

However, the 200-day simple moving average could potentially serve as resistance to further price growth as it is currently above the price. Thus, major bullish news is expected to encounter various resistance at different price levels; overcoming this is important for a sustained BTC rally.

0 notes

Text

Bitcoin Surpasses 5-Year Dominance Milestone: Mega Rally on the Horizon?

Key Points

Bitcoin’s dominance level has reached 57.68%, a figure not seen since April 2019.

Indicators suggest potential bullish volatility and buying opportunities for Bitcoin.

Bitcoin’s dominance in the cryptocurrency market has surged past 57.68%. This is a significant milestone, as it’s the first time since April 2019 that Bitcoin has achieved such a level of dominance. Historically, this level has often preceded a prolonged uptrend, pushing dominance as high as 71%.

At the time of writing, Bitcoin is trading at $59,179, a 0.73% increase in the last 24 hours. This recent price increase, coupled with the surge in dominance, has led to speculation about a possible massive rally for Bitcoin.

Technical Indicators Point to Potential Upside

The Relative Strength Index (RSI) of Bitcoin is currently at 51, indicating a neutral market with no extreme buying or selling pressure. The Bollinger Bands, on the other hand, show Bitcoin near the upper band, often signaling potential upward price volatility.

If Bitcoin can break above the $59,000 threshold with substantial volume, it could indicate further price growth and maintain or even expand its market dominance.

On-Chain Activity and Exchange Reserves

Bitcoin’s exchange reserves stand at 2.585 million BTC, with a minor 0.04% increase over the last 24 hours. Although this suggests short-term selling pressure, the overall trend shows a decline in reserves throughout the week. This decline could indicate a move of Bitcoin from exchanges to cold storage, a sign of long-term confidence.

Bitcoin’s network activity remains strong, with over 8.4 million active addresses, a 1.13% increase in the past day. The transaction count also rose to 515,260 in the last 24 hours, a 0.83% increase, according to CryptoQuant data.

MVRV Ratio Suggests Buying Opportunity

The 60-day Market Value to Realized Value (MVRV) ratio of Bitcoin stands at -1.81%. This suggests that, on average, investors are holding Bitcoin at a slight loss. Historically, negative MVRV values have signaled undervaluation, suggesting a potential buying opportunity for Bitcoin.

With dominance above 57.68%, strong on-chain fundamentals, and technical indicators aligning, Bitcoin may be preparing for another major rally. However, key levels like $59,000 and ongoing network activity will be crucial in confirming whether Bitcoin can extend its dominance and trigger a broader bull market.

0 notes

Text

How Drastic Interest Rate Cuts Could Fuel a Bitcoin Surge

In just a few days, on September 18th, all eyes will be on the Federal Reserve as they make their next move on interest rates. Speculation is running high that the Fed may drastically cut rates, signaling a potential shift toward a more accommodative monetary policy. For most investors, this news means one thing: inflation is likely on the horizon. But for those in the know, this could mark the beginning of something even bigger—another major surge in Bitcoin's value.

The relationship between interest rate cuts and Bitcoin might not be obvious at first, but once you dig a little deeper, it becomes clear that Bitcoin is positioned to thrive in environments where traditional currencies falter. Let’s explore why a drastic Fed rate cut could light the fuse for a Bitcoin price explosion.

The Impact of Interest Rate Cuts on Traditional Markets

Interest rate cuts typically signal that the Federal Reserve is aiming to stimulate the economy by making borrowing cheaper. When rates go down, businesses and consumers tend to borrow more, which can spur economic activity. However, there’s a flip side to this: when rates are cut too aggressively or for too long, inflation tends to creep in. This is because the influx of cheap money devalues the dollar, reducing its purchasing power.

For traditional assets like stocks, bonds, and real estate, this can be a double-edged sword. Lower rates can boost prices in the short term, but inflation eats away at real returns over time. That’s where Bitcoin comes in.

Bitcoin: A Hedge Against Inflation

Bitcoin, unlike fiat currencies, has a fixed supply of 21 million coins. This scarcity is a key feature that makes it an attractive hedge against inflation. As central banks continue to print money and increase liquidity in the system, the purchasing power of fiat currencies like the dollar diminishes.

Enter Bitcoin: a decentralized, deflationary asset that is immune to government intervention. When inflation rises and fiat loses value, Bitcoin becomes more appealing to those seeking to protect their wealth from devaluation. Its "digital gold" narrative is more relevant than ever in times of monetary easing, when people are searching for assets that can hold value over the long term.

Why a Drastic Rate Cut Could Spark a Bitcoin Price Pump

So, what does this mean for Bitcoin if the Fed announces a drastic interest rate cut? First and foremost, it means a weaker dollar. When the dollar weakens, investors look for ways to preserve their purchasing power, and Bitcoin is an increasingly popular option.

A drastic rate cut would likely send a signal to the markets that the Fed is willing to let inflation rise in order to stimulate the economy. This could lead to more institutional investors seeking refuge in hard assets, especially Bitcoin, which has shown resilience during periods of fiat instability. As more capital flows into Bitcoin, driven by both retail and institutional investors, the price is likely to experience a sharp rise. We’ve seen this play out in the past, and all the signs suggest that we could be on the verge of another price pump.

Historical Precedents: Bitcoin’s Response to Fed Policy

History provides some clues as to how Bitcoin might respond to this latest round of monetary easing. Take, for example, the massive stimulus packages rolled out in 2020 in response to the COVID-19 pandemic. As the Fed slashed rates and flooded the market with liquidity, inflation concerns grew, and Bitcoin began a historic bull run that saw its price rise from around $10,000 to an all-time high of over $60,000 in just over a year.

It wasn’t just retail investors driving that rally. Institutional players, from hedge funds to public companies, started to view Bitcoin as a viable alternative to traditional stores of value. As monetary policy loosened and inflation fears grew, Bitcoin's fixed supply made it an increasingly attractive asset. The same dynamics are at play today, with the added weight of broader adoption and a maturing Bitcoin ecosystem.

The Bigger Picture: Bitcoin’s Role in a Changing Financial System

The potential for a Bitcoin price pump following the Fed’s interest rate cuts is significant, but it’s part of a larger narrative that has been building over the past few years. Bitcoin is no longer just a fringe asset for tech enthusiasts and libertarians—it’s becoming a serious contender as a global reserve asset.

As central banks continue to struggle with inflation and monetary policy, Bitcoin stands apart as a decentralized alternative that doesn’t rely on government intervention or manipulation. More people are beginning to recognize its potential, not just as a store of value, but as a fundamental part of the future financial system. In an era where fiat currencies are increasingly seen as unreliable, Bitcoin’s deflationary design and decentralized nature make it a beacon of financial stability.

Conclusion: Stay Ahead of the Curve

As we approach September 18th, the Fed’s decision on interest rates will have ripple effects across global markets. For Bitcoin, a drastic rate cut could be the catalyst for another major price surge, as investors seek out alternatives to a weakening dollar.

If history is any guide, Bitcoin is likely to benefit from the Fed’s actions, making now a crucial time to stay informed and consider how this asset fits into your long-term financial strategy. The world of finance is changing rapidly, and those who understand Bitcoin’s role in this shifting landscape will be best positioned to thrive.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

Thank you for your support!

#Bitcoin#Cryptocurrency#CryptoNews#BitcoinPrice#FedInterestRates#InflationHedge#DigitalGold#BitcoinSurge#BitcoinInvestment#FinancialFreedom#Blockchain#BitcoinAdoption#HyperBitcoinization#CryptoBlog#BitcoinEconomy#MonetaryPolicy#BitcoinToTheMoon#BTC#financial empowerment#globaleconomy#digitalcurrency#financial experts#unplugged financial#financial education#finance

0 notes

Photo

2024.08.31アナリストは爆発的なビットコイン(BTC)の強気市場上昇を予見(Analyst Foresees Explosive Bitcoin (BTC) Bull Market Rally) カテゴリ:ビットコインAnalyst Foresees Explosive Bitcoin (BTC) Bull Market Rallyアナリストは爆発的なビットコイン(BTC)の強気

0 notes

Text

Past rate cuts indicate potential crypto bull market catalyst — 21Shares

Speaking at the annual Jackson Hole Symposium, United States Federal Reserve Chair Jerome Powell sent his strongest signal yet that interest rate cuts are on the immediate horizon.

The price of Bitcoin (BTC) rallied past $63,000 on the news, and analysts think further gains are expected when the Fed begins cutting rates.

Leena ElDeeb, a researcher at exchange-traded product issuer 21Shares,…

0 notes

Text

Considering Whether Bitcoin Will Reach New Record Highs Before The US Election

Technical analyst SuperBro highlighted that Bitcoin’s third-quarter bottoms in 2012, 2016 and 2020 were followed by strong upward momentum, often leading to price rallies and new record highs after US presidential elections.

0 notes

Text

Bitcoin Set For Explosive Growth As Super Bull Run Is On The Horizon - Expert

Bitcoin‘s current decline could have triggered speculations and doubt about an upcoming rally, however Dealer Tardigrade, a crypto analyst and fanatic, has addressed these views by predicting an imminent giant bull run for BTC within the subsequent few months, underscoring his confidence within the crypto asset’s potential to amass large good points in the long run.

New All-Time Excessive Looms…

0 notes

Link

Bitcoin's 2024 bull run was mainly driven by institutional inflows, which could be the key to unlocking the next leg up. #Blockchain #Crypto

0 notes