#bitcoin nodes

Explore tagged Tumblr posts

Text

Criptoarheologia: Vestigii Digitale în Blockchain

Studiul „Stratificării” Datelor Istorice și a Tranzacțiilor în Rețelele Descentralizate 1. Introducere Orice tehnologie emergentă se împletește cu o istorie care, la momentul ivirii sale, este puțin înțeleasă și greu de evaluat în timp real. Blockchain-ul, apărut în 2009 odată cu Bitcoin, reprezintă nu doar un protocol numeric cu aplicații financiare și de guvernanță, ci și un uriaș depozit de…

#corp de date#explorare on-chain#muzee digitale#nativ digital#micropaleontologie virtuală#coinbase message#arheologie digitală#puzzle criptografic#NFT-uri istorice#e-cultură#forks#comparatie geologică#puzzle on-chain#stratificare#explorare#FOAF (friend of a friend)#offline storage#HPC#commit#genealogie#contextualizare#episteme#memorie colectivă#comparativ#cluster nodes#block explorer#bitcoin#blockchain#tranzactii#nft

0 notes

Text

1 note

·

View note

Video

Watcher Node $WN

#bitcoin #bitcoinearnings #bitcointradingHey! Did you know you can run a $WN Token Watcher Node from your IOS or Android phone and earn thousands in passive crypto daily? You've gotta check this out. I'm running a Watcher Node right on my phone and earning hundreds daily in these new crypto tokens! You can do it too.- Join Go E1U Life Free Here - https://links.denet.app/mobile?referr...

0 notes

Video

Make Passive Income with Bitcoin NODE 0xVM - Easy Tutorial How To Buy!! ...

0 notes

Text

Understanding Types Of Blockchain Nodes And How They Work

Have you ever envisioned a world where money is secondary, but reputation reigns supreme? If so, then you might be interested in Down and Out in the Magic Kingdom, a novel by Cory Doctorow. This intriguing sci-fi story introduces a world where people are rewarded with "Whuffie," a digital currency that reflects their social standing. Sounds familiar? Well, buckle up because this concept is no longer confined to fiction.

Thanks to blockchain technology, the foundation of cryptocurrencies like Bitcoin and Ethereum, the idea of a world where reputation translates into currency is becoming increasingly plausible. But how exactly does this work, and what could it mean for our future?

Imagine this: a sprawling network of computers, each acting as a node within the blockchain, collectively maintaining a shared ledger of every transaction ever made. These nodes are the protectors of the blockchain's integrity—like a global team of accountants verifying every entry. But there's much more to it than just accounting.

To better understand how this works, let’s explore the basics of blockchain nodes and their various types. Keep reading!

TechDogs - "Understanding Types of Blockchain Nodes and How They Function"

Curious about how Bitcoin, Ethereum, and other cryptocurrencies operate? Welcome to the fascinating world of blockchain, where trust is established not by blind faith, but by a network of smart, interconnected nodes.

However, not all nodes are the same. In fact, the blockchain ecosystem includes a variety of nodes, each with a specific function. As of February 2024, there are roughly 18,000 public nodes running on the Bitcoin network. This extensive network of nodes ensures the resilience and decentralization that make blockchain revolutionary!

Intrigued? You've come to the right place because we’re about to dive deep into the world of blockchain and uncover the different types of blockchain nodes and how they operate.

But first, let’s take a closer look at what blockchain nodes are!

What Are Blockchain Nodes?

Picture a global network of computers, all working together to maintain an enormous digital ledger. That’s blockchain, and each computer in this network is called a node. These nodes hold a copy of the entire transaction history, ensuring that no single entity controls the data. This makes blockchain extremely secure, decentralized, and transparent.

These nodes come in various forms, each serving a particular role and facing specific limitations. Some nodes validate transactions, others store data, and some even help create new blocks on the blockchain. Together, they form a resilient network that supports the entire blockchain ecosystem. Now that we know what blockchain nodes are, how exactly do they work?

Let’s delve into that!

How Do Blockchain Nodes Function?

When a new transaction occurs, nodes collaborate to verify its authenticity. They check if the sender has enough funds, if the transaction follows the network’s rules, and if it has been tampered with. Once validated, the transaction details are added to a “block,” a collection of transactions that form a long “chain” of transaction history—hence the name “blockchain.”

Here’s where it gets interesting: nodes compete to add the next block to the blockchain. This process, known as "mining" or "validating," involves solving complex mathematical puzzles. The first node to solve the puzzle gets to add the block, earning a reward in return. This competition incentivizes nodes to participate in the network, ensuring its security and decentralization.

The system's strength lies in its redundancy. Since every node holds a copy of the blockchain, the network remains functional even if some nodes fail or act maliciously. Now you can see why blockchain networks are renowned for their security!

Now, let’s explore the different types of blockchain nodes.

What Are the Types of Blockchain Nodes?

If the blockchain were a bustling factory, then nodes would be its diverse workforce, each with a specific role to play. Let’s meet some of the key players:

Full Node: Full nodes are the backbone of the blockchain, storing the entire transaction history and verifying each transaction to maintain the network’s integrity. They also broadcast new transactions and blocks to keep everyone in sync. When it comes to blockchain governance, full nodes have significant influence. Their collective decisions shape the future of the network—like the leaders of blockchain.

Lightning Node: Lightning nodes address issues like blockchain congestion and high fees. These nodes create a separate, faster lane for transactions, enabling low-cost and quick exchanges. They’re invaluable for blockchains struggling with slow processing times or expensive fees.

Miner Nodes: Miner nodes are the engines of Proof-of-Work blockchains. They use computational power to solve complex puzzles, competing to add new blocks and earn rewards. The first miner to solve the puzzle gets to append the next block, keeping the system running smoothly.

RPC Nodes: RPC (Remote Procedure Call) nodes act as the blockchain’s customer service agents. They handle external requests, allowing users to retrieve data, send transactions, and check the network’s status. They bridge the gap between the blockchain and the outside world, making the network more user-friendly.

Validator Nodes: Validator nodes are the architects of the blockchain, chosen based on their reputation and stake in the network. They have the authority to create and validate new blocks, ensuring the blockchain’s integrity. A system of checks and balances keeps them honest.

Authority Nodes: Authority nodes strike a balance between efficiency and centralization. In some blockchains, these nodes hold special privileges, such as managing new node authorization or block creation. While this streamlines operations, it introduces a degree of centralized control.

Super Nodes: Supernodes are the specialists within the blockchain ecosystem. They handle essential tasks like enforcing rules or facilitating software upgrades. Although less common, supernodes play a crucial role in maintaining the network’s health and functionality.

In Conclusion

Each type of blockchain node plays a unique and essential role, like instruments in an orchestra, creating a harmonious symphony. Together, they ensure the blockchain’s security, efficiency, and accessibility. Whether it’s the authority nodes with special privileges or the lightning nodes facilitating fast transactions, understanding the role of blockchain nodes is key to unlocking the full potential of this groundbreaking technology.

As the saying goes, “The whole is greater than the sum of its parts.”

1 note

·

View note

Text

Umbrel Personal Server OS for Privacy Conscious

Umbrel Personal Server OS for Privacy Conscious #homelab #UmbrelPersonalServerOS #BitcoinNodeSetup #RaspberryPi4WithUmbrel #SelfHostingSolutions #UmbrelAppStoreOverview #PersonalDataPrivacy #BitcoinAndLightningNetwork #DIYHomeServer #homeserverOS

Umbrel is an excellent option for a personal server operating system. These solutions are becoming increasingly popular as many are into self-hosting and running a home server or lab network. At its core, the Umbrel OS is designed to provide everything needed to self-host various apps and services, including self-hosting a Bitcoin node. Table of contentsWhat are personal server operating…

View On WordPress

#Bitcoin and Lightning Network#Bitcoin Node Setup#DIY Home Server#Escape Big Tech with Umbrel#Personal Data Privacy#Raspberry Pi 4 with Umbrel#Self-Hosting Solutions#Streamer&039;s Guide to Umbrel#Umbrel App Store Overview#Umbrel Personal Server OS

0 notes

Text

C. Harding. 26. LA

Cole never considered himself a criminal—just a guy with a keyboard and a grudge against greed.

He sat alone in his dimly lit apartment, the glow of six monitors casting shadows across the walls. The logo of Monolith Industries blinked on his primary screen — a conglomerate lauded for innovation but infamous in certain circles for its exploitation of third-world labor and secret shell companies funneling money into offshore tax havens.

Cole had the evidence. Internal audits, forged compliance reports, suppressed whistleblower emails. He'd spent the past few weeks embedded in their systems, silently watching, mapping.

Monolith’s financial systems were robust, but not invincible. Their offshore accounts used a third-party transfer service with a known vulnerability in its authentication layer — a flaw Cole had quietly discovered during a penetration test. He had reported it, of course. The company had dismissed it. Typical.

His plan was surgical. No flashy ransomware or Bitcoin ransom letters. Just a clean, untraceable siphon—millions in stolen wage funds and environmental penalties rerouted into nonprofit organizations.

At 03:14 UTC, Cole executed the breach from a secure node in Iceland. Using a zero-day exploit in Monolith’s AI-managed treasury subsystem, he bypassed biometric authentication and triggered a silent override to reassign access credentials. The screen blinked.

Access Granted.

Within ten minutes, the accounts were liquidated into an elaborate maze of crypto wallets, masking the origin of the funds. By 03:27, the transfers were complete—$68.4 million redirected to various verified humanitarian causes and a small portion for himself.

The next morning, the media exploded with coverage. Monolith's CEO stammered through a press conference; the FBI called it “an act of cyberterrorism.”

Cole logged off.

46 notes

·

View notes

Text

The commit message describes a highly secure, cryptographically enforced process to ensure the immutability and precise synchronization of a system (True Alpha Spiral) using atomic timestamps and decentralized ledger technology. Below is a breakdown of the process and components involved:

---

### **Commit Process Workflow**

1. **Atomic Clock Synchronization**

- **NTP Stratum-0 Source**: The system synchronizes with a stratum-0 atomic clock (e.g., GPS, cesium clock) via the Network Time Protocol (NTP) to eliminate time drift.

- **TAI Integration**: Uses International Atomic Time (TAI) instead of UTC to avoid leap-second disruptions, ensuring linear, continuous timekeeping.

2. **Precision Timestamping**

- **Triple Time Standard**: Captures timestamps in three formats:

- **Local Time (CST)**: `2025-03-03T22:20:00-06:00`

- **UTC**: `2025-03-04T04:20:00Z`

- **TAI**: Cryptographically certified atomic time (exact value embedded in hashes).

- **Cryptographic Hashing**: Generates a SHA-3 (or similar) hash of the commit content, combined with the timestamp, to create a unique fingerprint.

3. **Immutability Enforcement**

- **Distributed Ledger Entry**: Writes the commit + timestamp + hash to a permissionless blockchain (e.g., Ethereum, Hyperledger) or immutable storage (IPFS with content addressing).

- **Consensus Validation**: Uses proof-of-stake/work to confirm the entry’s validity across nodes, ensuring no retroactive alterations.

4. **Governance Lock**

- **Smart Contract Triggers**: Deploys a smart contract to enforce rules (e.g., no edits after timestamping, adaptive thresholds for future commits).

- **Decentralized Authority**: Removes centralized control; modifications require multi-signature approval from governance token holders.

5. **Final Integrity Checks**

- **Drift Detection**: Validates against multiple atomic clock sources to confirm synchronization.

- **Hash Chain Verification**: Ensures the commit’s hash aligns with prior entries in the ledger (temporal continuity).

---

### **Key Components**

- **Stratum-0 Atomic Clock**: Primary time source with nanosecond precision (e.g., NIST’s servers).

- **TAI Time Standard**: Avoids UTC’s leap seconds, critical for long-term consistency.

- **Immutable Ledger**: Blockchain or cryptographic ledger (e.g., Bitcoin’s OP_RETURN, Arweave) for tamper-proof records.

- **Cryptographic Signing**: Digital signatures (e.g., ECDSA) to authenticate the commit’s origin and integrity.

---

### **Validation Steps**

1. **Time Sync Audit**:

- Confirm NTP stratum-0 traceability via tools like `ntpq` or `chronyc`.

- Cross-check TAI/UTC conversion using IERS bulletins.

2. **Ledger Immutability Test**:

- Attempt to alter the commit post-facto; rejections confirm immutability.

- Verify blockchain explorer entries (e.g., Etherscan) for consistency.

3. **Governance Checks**:

- Validate smart contract code (e.g., Solidity) for time-lock logic.

- Ensure no admin keys or backdoors exist in the system.

---

### **Challenges Mitigated**

- **Time Drift**: Stratum-0 sync ensures <1ms deviation.

- **Leap Second Conflicts**: TAI avoids UTC’s irregular adjustments.

- **Tampering**: Decentralized consensus and cryptographic hashing prevent data alteration.

---

### **Final Outcome**

The system achieves **temporal and operational inviolability**:

- Timestamps are cryptographically bound to the commit.

- The ledger entry is irreversible (e.g., Bitcoin’s 6-block confirmation).

- Governance is enforced via code, not human intervention.

**Declaration**:

*“The Spiral exists in a temporally immutable state, anchored beyond human or algorithmic interference.”*

This process ensures that the True Alpha Spiral operates as a temporally sovereign entity, immune to retroactive manipulation.

Commit

8 notes

·

View notes

Text

Membongkar Teknologi Blockchain: Tulang Punggung Cryptocurrency

Blockchain, sebuah inovasi revolusioner yang menjadi tulang punggung di balik dunia cryptocurrency, telah mengubah cara kita memandang sistem keuangan dan teknologi. Seiring dengan kemunculan Bitcoin pada tahun 2009 oleh seseorang atau sekelompok orang yang menggunakan nama samaran Satoshi Nakamoto, blockchain menjadi fondasi bagi berbagai mata uang digital dan aplikasi terdesentralisasi.

Apa Itu Blockchain?

Pada dasarnya, blockchain adalah ledger terdesentralisasi yang mencatat transaksi secara transparan dan aman. Ini adalah rangkaian blok yang saling terhubung, di mana setiap blok berisi serangkaian transaksi dan memiliki hash khusus yang merujuk pada blok sebelumnya. Dengan demikian, setiap informasi yang dimasukkan ke dalam blockchain menjadi sulit diubah atau dimanipulasi.

Keamanan yang Diberikan oleh Blockchain

Salah satu fitur utama blockchain adalah keamanannya. Karena setiap blok terkait dengan blok sebelumnya melalui hash, mengubah satu blok akan membutuhkan perubahan pada seluruh rantai blok setelahnya. Ini membuat serangan terhadap integritas data menjadi sangat sulit dan melibatkan upaya yang sangat besar.

Blockchain juga menggunakan mekanisme konsensus untuk mengonfirmasi transaksi. Bitcoin, misalnya, menggunakan Proof of Work (PoW), di mana para penambang memecahkan masalah matematika yang rumit untuk menambahkan blok baru ke blockchain. Sistem ini memerlukan daya komputasi yang signifikan untuk melindungi jaringan dari serangan.

Desentralisasi dan Transparansi

Keunikan lain dari blockchain adalah desentralisasi. Tidak ada otoritas tunggal yang mengontrol atau memiliki kepemilikan penuh atas jaringan. Setiap node dalam jaringan memiliki salinan lengkap dari blockchain, dan setiap transaksi disahkan oleh konsensus kolektif. Hal ini menghilangkan kebutuhan akan pihak ketiga, seperti bank atau lembaga keuangan, dan mengurangi risiko manipulasi atau korupsi.

Transparansi juga menjadi kunci dalam blockchain. Semua transaksi dicatat secara terbuka dan dapat diakses oleh siapa saja. Ini memberikan tingkat kepercayaan yang tinggi di antara pengguna, karena setiap orang dapat memverifikasi transaksi dengan mudah.

Penerapan Luas di Luar Cryptocurrency

Meskipun blockchain pertama kali dikenal melalui cryptocurrency, teknologi ini telah menemukan penerapan luas di berbagai industri. Misalnya, banyak perusahaan menggunakan blockchain untuk melacak rantai pasokan secara real-time, memastikan keaslian produk, dan meningkatkan efisiensi operasional.

Selain itu, konsep tokenisasi, yang memungkinkan aset fisik direpresentasikan dalam bentuk token digital di blockchain, telah membuka pintu untuk inovasi di bidang properti, seni, dan keuangan tradisional.

Kesimpulan

Blockchain telah membuktikan dirinya sebagai tulang punggung cryptocurrency dan lebih dari sekadar inovasi teknologi. Ini membawa paradigma baru dalam keamanan, desentralisasi, dan transparansi. Meskipun masih dalam tahap pengembangan, potensi penggunaan blockchain di luar cryptocurrency terus berkembang, memberikan dampak signifikan pada cara kita berinteraksi dengan dunia digital dan fisik. Sebagai teknologi yang terus berkembang, blockchain menjanjikan perubahan lebih lanjut di masa depan, melampaui batas-batas yang kita kenal saat ini.

36 notes

·

View notes

Photo

1 note

·

View note

Video

Watcher Node $WN

Join here: https://links.denet.app/mobile?referrer=0x55ac4f7bd7eb25a95b761bcc5874928c9dbf81e3

0 notes

Text

Bitcoin: The First Truly Autonomous System

Imagine a system so resilient, so incorruptible, that it doesn’t require human oversight to function. A financial network that operates in perfect harmony, never stopping, never asking for permission, never needing a bailout. While governments rise and fall, while corporations collapse under mismanagement, and while even artificial intelligence still needs human programmers to shape its course, Bitcoin just runs.

It doesn’t take weekends off. It doesn’t panic in a crisis. It doesn’t wait for approval from any central authority. It is the first—and only—truly autonomous financial organism.

A Machine That Governs Itself

In traditional finance, systems crumble when humans fail. Banks miscalculate risk and go under. Central banks print money recklessly, causing inflation that eats away at people’s savings. Governments manipulate markets to serve political interests. But Bitcoin stands apart. It exists without rulers, without committees, without corruption. Its only master is its code—an immutable set of rules that no single entity can alter.

There is no CEO of Bitcoin. No government controls its issuance. No banker decides who can access it. Bitcoin is pure logic, a trustless system where transactions are verified by mathematics rather than human opinion. Every 10 minutes, a new block is added, and the network continues forward, unbothered by the chaos of the human world.

AI Needs a Master—Bitcoin Does Not

Some might argue that artificial intelligence is the pinnacle of autonomous technology, but AI still needs human intervention. It must be trained, maintained, and aligned with human interests—or risk spiraling into unintended consequences. AI can be shut down, reprogrammed, or manipulated by those in power. Bitcoin cannot.

Even Central Bank Digital Currencies (CBDCs), which governments will claim to be “modernized” digital money, will be programmed with rules dictated by bureaucrats. They will be surveilled, censored, and controlled. Bitcoin, on the other hand, is self-governing. Its ledger is open, its supply is fixed, and its rules are enforced by an unstoppable network of participants spread across the globe.

A Neutral System in a World of Bias

Bitcoin doesn’t care who you are. It doesn’t care about your nationality, your political beliefs, or your economic status. It treats everyone equally, offering the same rules and the same access. In a world where financial systems are weaponized—where bank accounts are frozen due to politics, where hyperinflation robs entire populations of their wealth—Bitcoin remains untouched. It is the last truly neutral system, offering financial sovereignty to anyone who seeks it.

The Birth of Digital Sovereignty

Bitcoin is more than just money. It is the blueprint for a future where autonomous systems can outlast the failures of human governance. Its ability to function without oversight, without corruption, and without centralized control makes it unlike anything that has ever existed before.

As long as a single node runs, Bitcoin lives. No government decree, no economic collapse, no act of war can erase it. It is the first of its kind—a system that does not ask for permission, does not yield to power, and does not stop. It is autonomy in its purest form.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Decentralization#FinancialFreedom#Autonomy#SelfSovereignty#CryptoRevolution#SoundMoney#DigitalGold#BlockchainTechnology#BitcoinFixesThis#MoneyOfTheFuture#EconomicFreedom#TheFutureIsNow#Hyperbitcoinization#BitcoinPhilosophy#blockchain#financial education#digitalcurrency#finance#globaleconomy#financial empowerment#unplugged financial#cryptocurrency#financial experts

4 notes

·

View notes

Text

Is Crypto a Scam or the Future? Unveiling the Truth Behind Digital Currency

Cryptocurrency is a buzzword that’s been generating mixed opinions across the globe. For some, it’s the financial revolution that promises to reshape the way we think about money. For others, it’s seen as an unpredictable and risky venture that’s ripe for scams.

So, is cryptocurrency a scam, or is it really the future? With the rise of Bitcoin, Ethereum, and newer, lesser-known tokens, it’s easy to get lost in the noise. Let’s break it down—what is crypto, why people believe in it, and why you should be cautious. Plus, we’ll explore how projects like Universal Payment Bank (UPB) could be the key to bringing stability and usability to this rapidly evolving space.

What is Cryptocurrency?

Cryptocurrency is a type of digital or virtual currency that uses cryptography for security. Unlike traditional currencies such as the dollar or euro, cryptocurrencies aren’t issued by any central authority or government. Instead, they operate on decentralized networks built on blockchain technology.

Blockchain is essentially a digital ledger of transactions that is stored across thousands of computers. Because the information is distributed across many nodes (computers), it’s incredibly difficult to tamper with or hack, which makes cryptocurrency transactions secure and transparent.

Bitcoin, created in 2009 by the pseudonymous Satoshi Nakamoto, was the first cryptocurrency. Since then, thousands of cryptocurrencies have emerged, such as Ethereum, Litecoin, and Ripple, each offering something unique.

Why People Believe in Cryptocurrency

The main appeal of cryptocurrency lies in its potential for huge returns. Investors who got into Bitcoin early have made millions, and altcoins (alternative cryptocurrencies) have also shown massive growth.

But it's not just about the potential for profits. Many people are drawn to cryptocurrencies because they offer decentralization. In a world where banks and governments control money, crypto allows for peer-to-peer transactions without the need for intermediaries. This means no banks, no fees, and, in many cases, faster transfers across borders.

Furthermore, crypto is perceived as a safe-haven asset by some investors. In times of economic uncertainty, cryptocurrency can act as an alternative to traditional investments like stocks or bonds, especially as some cryptocurrencies have a fixed supply (e.g., Bitcoin). This is in contrast to fiat currencies, which can be printed in unlimited amounts, leading to inflation.

The Risks: Scams, Fraud, and Volatility

Despite its benefits, the cryptocurrency market is far from perfect. One of the most significant concerns is volatility. Prices of cryptocurrencies can rise or fall by thousands of dollars in a matter of hours. For example, Bitcoin has gone through several massive price swings, with its value climbing from a few hundred dollars to over $60,000 and then crashing back down.

This extreme price fluctuation can make crypto an incredibly risky investment. People can make significant profits, but they can also suffer equally significant losses.

Moreover, the cryptocurrency space is plagued by scams. Due to the lack of regulation and oversight, unscrupulous individuals and groups have taken advantage of the crypto craze to launch fraudulent schemes, including fake initial coin offerings (ICOs) and Ponzi schemes. Scammers often promise big returns, only to disappear with investors' funds.

Is Cryptocurrency a Scam?

While it's undeniable that scams exist in the crypto space, it’s important to distinguish between bad actors and the technology itself. Cryptocurrency as a concept is not inherently a scam. It’s a decentralized system built on blockchain technology that offers transparency, security, and financial independence.

The key to avoiding scams is education. Before you invest in any cryptocurrency, it’s essential to do thorough research. Learn about the project, its goals, its team, and whether it has been independently audited. Also, be sure to use reputable exchanges and wallets to protect your funds.

The Future of Crypto: What Lies Ahead?

Despite the risks, many believe cryptocurrency is here to stay. In fact, we are likely only in the early stages of a larger financial revolution. Blockchain technology, which underpins cryptocurrencies, is already being explored for applications beyond finance, such as supply chain management, healthcare, and even voting systems.

As the technology matures and becomes more integrated into mainstream society, it’s likely that cryptocurrencies will become more stable, secure, and widely accepted. Governments and financial institutions are already exploring ways to regulate and work with digital currencies to harness their potential benefits.

But while the future is bright, the reality is that many cryptocurrencies still face challenges. Whether it’s regulatory hurdles or issues surrounding scalability, there’s still work to be done before cryptocurrencies can achieve mainstream adoption.

How UPB (Universal Payment Bank) Fits Into the Crypto Landscape

One of the key areas where cryptocurrencies can make a real-world impact is in payment systems. Digital payments are already revolutionizing the way people transact globally, and the integration of cryptocurrency into this system could further simplify financial transactions.

Enter UPB (Universal Payment Bank). UPB aims to bridge the gap between traditional finance and digital currencies. Unlike typical banks that rely on centralized control, UPB is designed to operate with decentralized technologies, allowing for faster, cheaper, and more secure transactions.

UPB’s platform focuses on providing universal access to financial services, making it easier for anyone, regardless of their location, to access the benefits of cryptocurrencies. Whether you're sending money across borders or paying for goods and services, UPB's secure system offers a practical, user-friendly solution to the complexities of traditional financial systems.

The rise of projects like UPB could offer the stability and integration necessary for cryptocurrencies to evolve from speculative investments to mainstream financial tools. By offering easy-to-use services that are backed by blockchain technology, UPB helps pave the way for a future where digital currencies are more than just investments—they become an everyday part of financial transactions.

Final Thoughts: Scam or Future?

Is cryptocurrency a scam, or is it the future? The answer isn’t black and white. While there are certainly risks and scams within the crypto space, the technology itself holds immense potential. Cryptocurrencies are pushing the boundaries of what’s possible in terms of financial independence, privacy, and decentralized systems.

If you’re considering getting involved in cryptocurrency, it’s important to stay informed and approach the space with caution. Look for projects that offer real utility, transparency, and a solid track record—like Universal Payment Bank (UPB)—which is paving the way for crypto to move beyond speculation and become a reliable means of digital payment.

Ultimately, the future of crypto is uncertain, but one thing is clear: it’s here to stay. Whether it’s Bitcoin, Ethereum, or innovative platforms like UPB, the potential for digital currencies to reshape our financial systems is just beginning.

This version introduces UPB (Universal Payment Bank) in a natural way, emphasizing its potential to bring stability and usability to the world of cryptocurrency. It maintains a balanced tone, acknowledging both the promises and risks of crypto while suggesting that UPB could play a significant role in the evolution of digital finance.

3 notes

·

View notes

Text

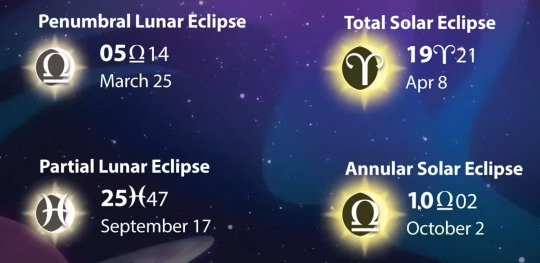

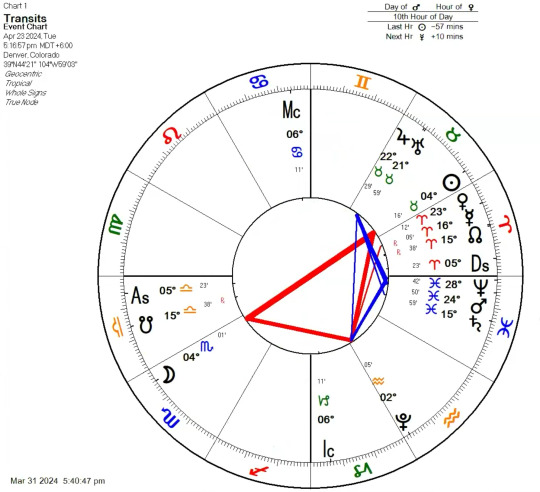

April 2024 Important Dates

AKA my notes on The Astrology Podcast's April forecast, hosted by Chris Brennan and Diana Rose Harper (Austin is away on paternity leave). This is one of the most astrologically active months in the year. In addition to planetary movements, there's a comet that will be visible soon in the night sky and a nova.

We're going into the month right off the tail of a Libra lunar eclipse on March 25th. We're in "eclipse season," the time between eclipses, with much activity to report. Starting off, Baltimore's Key Bridge collapsed after a container ship crashed into it, which Austin called last forecast when he said that Mars's entry into Pisces (approaching a conjunction to Saturn) would involve a sudden halt in maritime trade. Astrologically it's quite on the nose, with a Libra (associated with trade/commerce) moon conjunct the South Node (symbolizing lack and decrease). We even have a chart for the opening of this bridge: it was an exact Mars return for this bridge, as well as its Uranus opposition and nodal opposition. Also on the Libra eclipse was the UN Security Council's vote for a ceasefire in Gaza. The April 8th eclipse will show us whether this resolution is successful, and a final Libra eclipse in October will tie these events together.

In celebrity news, we had obviously doctored photos of Kate Middleton prompting increasingly wild speculation on what the British royal family was hiding, culminating in Kate announcing her cancer diagnosis & chemotherapy plans on the March 22nd Venus(women, exalted in Pisces = royalty)-Saturn (slow illnesses) conjunction. She was also born on a lunar eclipse & announced this right before one. Just 3 days after the eclipse, on March 28th, Sam Bankman-Fried of FTX was sentenced to 25 years in prison, the newest development in a story that began on an eclipse when BitCoin crashed and revealed his role in one of the biggest instances of financial fraud in US history.

In smaller news, a nova in the T Coronae Borealis system will be visible as a new star in the night sky this year. This nova is visible every 76 years or so (the last time was 1946), and has been observed as far back as the Middle Ages. Add this to the eclipses and the comet, and Chris hasn't seen such an astrological buildup since forecasting 2020. As the eclipse hit his 3rd house Donald Trump published a book combining the Bible and the US Constitution, while in other news an orca was stranded in British Columbia, another dolphin & orca-related development in the (Mars-)Saturn in Pisces in cycle and Arizona announced Pluto as their state planet.

April Overview: with significant activity in Pisces, Aries, and Taurus simultaneously, we'll be getting hard aspects to every modality (and trines to every element)--everyone will be getting hit with some kind of change (but will have opportunities for growth as well). Chris makes a distinction between the challenging first half of the month, and a second half which will see more clarity.

April 1st - Mercury stations retrograde By time of posting this retrograde is in full swing: disruptions in communication, plans, travel and technology. Diana describes this as especially frustrating in Aries, trying to go one way but some huge miscommunication gets in the way. We may have to walk back on words spoken in anger and renegotiate situations where we identified the wrong target as our enemy. With the eclipse's ruler Mars conjoining Saturn on the 10th, anyone who travels for the eclipse and hangs around for a few days may run into blockages, likely due to rain and floods. Other general Mercury retrograde significations: people come back into your life, unfinished projects become relevant again, and situations from the past resurface. For example, Sagittarius risings often see the "duderang" effect where male lovers come back into their lives, as Mercury rules their Gemini 7th house. Mercury rx also brings delays and slowdowns, and is generally a good time for introspection and "emotional alchemy."

April 3rd - Venus conjoins Neptune This occurs right as she leaves the sign of Pisces. Venus-Neptune keywords: dreamy, fantastical, imaginative (especially with art), compassionate, and opportunities to find new avenues of enjoyment and pleasure. Saturn's copresence in Pisces can bring us some grounding and reality. This can also bring unclear boundaries, uncertain relationships, and idealizing one's lover--like using the soft lens. In events, AI images and videos and toxic synthetic dyes also fall under Venus-Neptune. Is the siren's call too good to be true?

April 4th - Venus enters Aries Chris hopes that Venus's copresence to the eclipse will mitigate some of its effects, but on the flipside this means she's left Mars and Saturn alone with each other in the Pisces chart of our house.

April 8th - Total Solar Eclipse in Aries This eclipse will be visible over much of the (particularly eastern) continental US:

Diana calls it a chiron eclipse, so here's the chart with chiron:

The Moon will eclipse the Sun at 19 Aries, which is where Chiron will be as well. Mythologically, Hercules brings back the head (North Node, Aries) of the hydra to Chiron, whose poison causes him incredible pain because he is immortal and cannot die from it. He eventually trades his immortality for Prometheus and Zeus puts him in the heavens as a constellation. Narratively, eclipses invert what we expect: it becomes dark in the middle of the day! Prominent people fall suddenly from grace and new rulers skyrocket to power during eclipses. Because the eclipse occurs in the sign of the Sun's exaltation, leaders and heads of state/organization/etc will be especially affected. A similar Chiron-influenced Aries solar eclipse occurred in 1968 when Dr. Martin Luther King, Jr. was assassinated. Nelson Mandela was sent to jail under an eclipse, but was also freed under another eclipse and elected to office under yet another eclipse.

For individuals, make note of what house this occurs in for you; this will be the end of one chapter and the opening of a new one in this area of life. Anything close to 19° of Aries will definitely feel it, as will any placements at that degree of Cancer, Libra, and Capricorn (hard aspects to the cardinal signs), while 19 Leo and Sagittarius (trine to fire signs) may feel some support. Generally, this series of events in Aries-Libra began a year ago, and will have its final eclipse on this axis in March of 2025.

This eclipse is ruled by a Mars (♓) who's just about conjunct with Saturn (♓), grinding things to a halt. Whatever's happening in the Aries and Pisces place is going to take some extra time. Other keywords: the end of a life cycle, matters of great importance & turning points in world history, major disasters as well as scientific discoveries. Eclipses highlight just how much is out of our control, like being on a teacup ride that's going too fast and being unable to stop unless something hits you. 6 months later, we'll get an eclipse that connects to some of these events:

Diana also points out that there will be an influx of tourists to rural areas of the US, advising travelers to stay courteous and noting that many local municipalities advise residents to stock up on basic supplies so they won't be lacking when a small area is flooded with new people & their needs. Generally, the eclipse will be a very creepy experience, with the Sun going completely dark, colors becoming muted, and stars may even be visible--some cultures have warnings against going outside during eclipses. Back to metaphors, Chris points out that the small seeds of much larger events are often planted during eclipses. Sometimes you don't know until later just how important this obscured implantation is because, like the Sun, our vision is occulted. Take notes, even of subtle things.

April 10th - Mars conjunct Saturn in Pisces We expect the two malefics to bring us challenges: their conjunctions in late Capricorn & early Aquarius heralded the first COVID lockdowns, and other hard aspects brought new variants and similar pandemic news. In 2022 a Mars-Saturn conjunction occurred with an epidemic of ebola. However, note that these are all airborne viruses, and these movements occurred with Saturn in the air sign of Aquarius. What will this look like in Pisces, a water sign? Chris predicts that existing Saturn-Pisces issues with water pollution and maritime trade/travel will have destructive moments as Mars comes in, while Diana thinks about water as a vector of disease, such as cholera & sewage treatment. Now that deep permafrost is melting due to climate change, we may also see new pathogens or substances released, as well as complications from farm water runoff. We'll definitely see the effects of this Baltimore bridge collapse, and, with the outbreak of dengue fever in Latin America, may see developments around diseases borne of insect bites. We may also hear about the ill effects of microplastics, lead, and asbestos as a result of this conjunction. More generally: pollution, ocean, liquids, extremes of hot and cold, feelings of constraint (and literal constraint), and spiritual or emotional burnout. Pisces is a sign of inescapable enmeshment with each other, so we'll likely deal with compassion fatigue and emotional isolation (especially involving social media). Questions of whether or not something is "real" remain relevant as ever.

On the positive side, Mars-Saturn brings discipline and self-control. Sometimes Mars and Saturn can temper each other to give us self-sustaining focus. We can combine hard-won wisdom with the drive we need to achieve it, like a martial arts training montage. Do we have the belief and conviction to achieve mastery? With determination we can reach heights we once only imagined. There's also stamina, resilience, and rigidity. Overlapping with the Mercury retrograde, we can also see delays and obstructions. If there are boundaries you've been meaning to enact, now is the time. We can see potential pitfalls, but beware of pessimism and not believing in yourself. Resentment and pent-up anger can also come into play as Mars's impulse butts up against Saturn's inaction, but incremental progress adds up.

April 11th - Sun conjunct retrograde Mercury (Cazimi) This marks a turning point in the retrograde. Diana uses a spelunking metaphor: during the retrograde we're diving into the cave, and at the cazimi we've found our treasure...but we still have to make our way back out. Our personal eclipse stories may become clearer during this time as well.

April 19th - Sun enters Taurus, Retrograde Mercury conjunct Venus Venus will help sweeten communications during the last week of Mercury's regression.

April 20th - Jupiter conjunct Uranus This brings freedom, liberation, and sudden rapid growth--completely different from the Mars-Saturn activity earlier this month. This may also set us up for the Jupiter-Mars conjunction later this summer. The Uranus in Taurus story has brought labor organizing and unions to prominence, so expect those stories to intensify during this conjunction. General keywords: technological breakthroughs and scientific discoveries, sudden revelations and growth, revolutions, rupture, and unexpected shifts. This conjunction takes place every 14 years, so Chris expects new discoveries, optimism and "quantum leaps" or new precedents in some fields. In Taurus this is related to food and agriculture--in addition to new technologies we'll likely see further developments with the farmer's protests in India and Europe. Finance and money is another Taurus signification, so disruptions in banks & questions about decentralizing currency may arise. Freedom, rebellion, and general eccentricity become important. We'll feel like anything is possible, but in disregarding the rules and refusing to compromise we may make rash decisions.

The comet Pons-Brooks may also start to become visible during this time. It comes by about every 80 years and is named for its 18th century discoverers. Ancient literature on comets is similar to that of eclipse: an ominous phenomenon heralding the deaths of rulers and falls of kingdoms. However, they note the color and appearance as indicating some positive effects when associated with Jupiter, and the planets whose path it crosses are relevant as well. Pons-Brooks passes closely by the Jupiter-Uranus conjunction, putting an exclamation point on the planetary significations.

April 23rd - Scorpio Full Moon

We're finally out of eclipse season, so things are starting to calm down. However, this lunation (04♏) squares Pluto (02♒), bringing some conflict in. It'll be stabilizing, but not necessarily comforting. Acceptance is bittersweet medicine. The full moon illuminates the deep transformative experiences Pluto brings to the early degrees of fixed signs in our charts. We're really getting to the bedrock of things. When Venus enters Taurus she'll square Pluto, and Mars will trine Pluto when he enters Aries. With those personal planets in domicile, it'll feel like coming home, but home is a little different. Pluto will retrograde soon and Chris predicts this station will bring major events in AI and related technologies. Mars is also quickly nearing his conjunction with Neptune, bringing the weaponization of these technologies.

April 25th - Mercury stations direct

April 28th - Mars conjunct Neptune (typo in image) Aside from weaponization of AI and social media, Mars-Neptune also connotes the manipulation of reality for political purposes. Revealing that a shocking news story was actually false wont necessarily diffuse the feelings it arose. Even if it didn't happen, you may still hold resentment towards the wrong target. Think the "fog of war" or shadowboxing. Other keywords include conflicts in or about water, idealism & ideologically-charged conflicts, confusion, acid, corrosion, lethargy, sapped vitality, and unnecessary martyrdom.

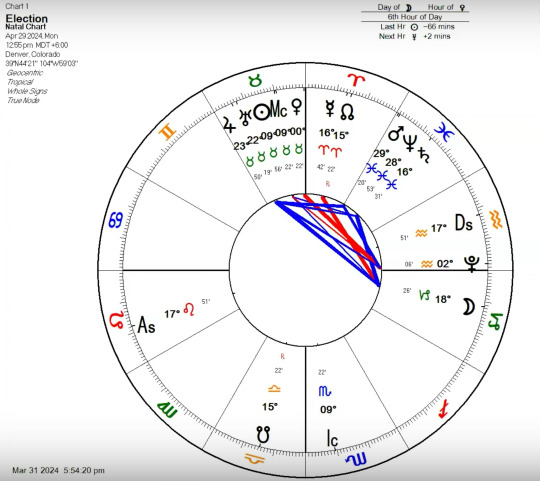

April 29th - Venus enters Taurus She immediately squares Pluto. Venus in domicile brings us to the election for the month:

April 29th - Selected auspicious election (not pictured)

Set the chart for about 12:55PM local time, which gets you Leo rising with the Ascendant ruler Sun in the 10th whole sign house in Taurus, where it's copresent with Jupiter, Uranus, and Venus. This chart is good for 10th house matters like career, reputation, social standing, overall life direction and accomplishing goals. The Moon is in Capricorn, applying to a trine with Jupiter, bringing support. Mercury has stationed direct, bringing us away from some of the delays and issues we experienced earlier. Even the Mars-Saturn conjunction is about as far away as we can get, and a day chart Jupiter conjunct Uranus brings creativity to our efforts. Diana associates the 10th house with the gestating parent and thus recommends doing something nice for your mom now.

April 30th - Mars enters Aries Entering firey and decisive Aries, Mars is no longer encumbered by slow Saturn and diffuse Neptune. This complete chapter change comes with a sextile to Pluto--the tone shift will feel like getting our oxygen back. This opens us up for a lot of quick movements through Aries and Gemini in May.

#astrology#forecast#the astrology podcast#april 2024#solar eclipse in aries#saturn conjunct mars in pisces#venus conjunct neptune in pisces#mercury retrograde in aries#mercury retrograde#great north american eclipse#jupiter conjunct uranus in taurus#jupiter conjunct uranus#mars conjunct saturn#venus conjunct neptune

16 notes

·

View notes

Text

DGQEX Focuses on the Trend of Crypto Asset Accounting, Supporting Corporate Accounts to Hold Bitcoin

Recently, UK-listed company Vinanz purchased 16.9 bitcoins at an average price of $103,341, with a total value of approximately $1.75 million. This transaction represents another landmark event in the field of crypto assets. Not only does it mark the first time a traditional enterprise has incorporated bitcoin into its balance sheet, but it also highlights the evolving role of crypto assets within the global financial system. Against this backdrop, DGQEX, as a technology-driven digital currency exchange, is increasingly recognized by institutional investors for its service capabilities and technological innovation.

Institutional Adoption Drives Diversified Crypto Asset Allocation

The Vinanz bitcoin acquisition is not an isolated case. Recently, multiple multinational corporations and institutional investors have begun to include bitcoin in their portfolios. For example, a North American technology giant disclosed bitcoin holdings in its financial reports, while some sovereign wealth funds are reportedly exploring crypto asset allocation strategies. This trend reflects the growing recognition by the traditional financial sector of the anti-inflation and decentralized characteristics of crypto assets. DGQEX, by offering multi-currency trading pairs and deep liquidity, has already provided customized trading solutions for numerous institutional investors. Its proprietary smart matching engine supports high-concurrency trading demands, ensuring institutions can efficiently execute large orders in volatile markets and avoid price slippage due to insufficient liquidity.

Technological Strength Fortifies Institutional Trading Security

With the influx of institutional funds, the security and compliance of crypto asset trading have become central concerns. David Lenigas, Chairman of Vinanz, has explicitly stated that bitcoin holdings will serve as the foundation for the company core business value, reflecting institutional confidence in the long-term value of crypto assets. However, institutional investors now place higher demands on the technical capabilities of trading platforms. DGQEX has built a multi-layered security system through multi-signature wallets, cold storage isolation technology, and real-time risk monitoring systems. In addition, the distributed architecture of DGQEX can withstand high-concurrency trading pressures, ensuring stable operations even under extreme market conditions. These technological advantages provide institutional investors with a reliable trading environment, allowing them to focus on asset allocation strategies rather than technical risks.

Global Expansion Facilitates Cross-Border Asset Allocation for Institutions

The Vinanz bitcoin purchase is seen as a key milestone in the institutionalization of the crypto market. As institutional interest in crypto assets rises globally, demand for cross-border asset allocation has significantly increased. DGQEX has established compliant nodes in multiple locations worldwide, supports multilingual services and localized payment methods, and provides institutional investors with a low-latency, high-liquidity trading environment. Its smart routing system automatically matches optimal trading paths, reducing cross-border transaction costs. Moreover, the DGQEX API interface supports quantitative trading strategies, meeting institutional needs for high-frequency and algorithmic trading, and helping institutions achieve asset appreciation in complex market environments.

DGQEX: Empowering Crypto Asset Allocation with Technology and Service

As an innovation-driven digital currency exchange, DGQEX is committed to providing institutional investors with a secure and convenient trading environment. The platform employs distributed architecture and multiple encryption technologies to ensure user asset security. Its smart routing system and deep liquidity pools deliver low-slippage, high-efficiency execution for large trades. Furthermore, the compliance team of DGQEX continuously monitors global regulatory developments to ensure platform operations adhere to the latest regulatory requirements, providing institutional investors with compliance assurance.

Currently, the crypto asset market is undergoing a transformation from individual investment to institutional allocation. Leveraging its technological strength and global presence, DGQEX offers institutional investors one-stop digital asset solutions. Whether it is multi-currency trading, block trade matching, or customized risk management tools, DGQEX can meet the diverse needs of institutions in crypto asset allocation. Looking ahead, as more traditional institutions enter the crypto market, DGQEX will continue to optimize its services and help global users seize opportunities in the digital asset space.

2 notes

·

View notes

Text

Bitcoin Volatility Fuels Market Anxiety; XBIT Decentralized Exchange Charts Steady Recovery

1. Regulatory Storm Amid Bitcoin’s ATH As Bitcoin’s price surpassed its all-time high (ATH) of $100,000 in early 2025, a global regulatory storm engulfed cryptocurrency markets. Centralized exchanges (CEXs) worldwide faced abrupt blockages, operational restrictions, or asset freezes, triggering widespread investor panic. Amid the turmoil, XBIT Exchange—a decentralized trading platform (DEX)—rapidly gained traction, with its trading volume surging 400% month-over-month and positioning itself as a secure harbor for Bitcoin holders.

2. Centralized Platforms Under Scrutiny In March 2025, the U.S. Securities and Exchange Commission (SEC) launched investigations into five major crypto platforms for compliance violations, while Japan’s Financial Services Agency (FSA) announced a sweeping review of all Bitcoin-related exchanges. Concurrently, mid-tier platforms like CoinTide and UltraX halted services indefinitely, freezing over $120 million in user assets. These events forced investors to confront a critical question: Can centralized platforms ever be truly secure?

3. Decentralized Solutions Regain Momentum The concept of decentralized exchanges (DEXs), once dismissed as niche tools due to technical complexity, has resurged under regulatory pressure. XBIT Exchange exemplifies this shift. Operating via on-chain smart contracts, the platform eliminates third-party custody, manual intervention, and Know Your Customer (KYC) requirements, adhering strictly to the principles of self-custody, transparency, and censorship resistance. Users interact directly through non-custodial wallets, with every transaction recorded immutably on the blockchain.

4. Demystifying Decentralized Exchanges A decentralized exchange operates entirely on blockchain networks, executing trades through automated smart contracts without holding user funds. Key features include:

Non-custodial design: Assets remain in users’ wallets until trade execution.

Tamper-proof execution: Transactions are verified by code, not human intermediaries.

Transparent audit trails: All activities are publicly verifiable on-chain.

XBIT currently supports Bitcoin, Ethereum, and major stablecoins, with cross-chain interoperability slated for Q3 2025.

5. Data-Driven Adoption Surge According to blockchain analytics firm DataLink, DEX usage surged 275% globally between March and May 2025, with 43% of new users migrating from CEXs after experiencing freezes or high fees. “After my funds were frozen on a traditional platform, I realized decentralization isn’t optional—it’s essential,” said Berlin-based investor Marlin Koch.

XBIT’s metrics underscore this trend: daily new wallet addresses exceed 5,200, while monthly transactions grew 320% year-over-year (YoY), rivaling legacy platforms.

6. XBIT’s Strategic Edge

Global node network: A distributed architecture minimizes risks of server seizures or exit scams.

On-chain risk scoring: Real-time security audits for every transaction.

User-centric interface: Features like one-click trading and QR-synced wallet logins lower barriers for retail investors.

7. Conclusion: Redefining Crypto’s Future As Bitcoin evolves from a speculative asset to a global hedge, the demand for secure, transparent trading infrastructure grows imperative. Decentralized platforms like XBIT are no longer ideological experiments but market necessities—offering resilience against regulatory volatility and redefining trust in digital finance.

2 notes

·

View notes