#blockchain private key qr code

Explore tagged Tumblr posts

Text

Benefits of Using Blockchain Wallet QR Codes

In the ever-evolving landscape of cryptocurrencies, ease of access and security are paramount. Enter the blockchain wallet QR code—a powerful tool that simplifies transactions while enhancing security. At QR Ocean, we understand the significance of seamless transactions in the crypto world. Let’s dive into how blockchain wallet QR codes can transform your crypto experience.

What is a Blockchain Wallet QR Code?

A blockchain wallet QR code is a visual representation of your cryptocurrency wallet address. Instead of manually entering a long string of letters and numbers, users can scan a QR code to instantly access a wallet for sending or receiving digital assets. This not only speeds up transactions but also minimizes the risk of errors associated with typing out complex wallet addresses.

The Benefits of Using Blockchain Wallet QR Codes

Enhanced Security: Using a QR code reduces the likelihood of mistakes when entering wallet addresses. A single typo could lead to irreversible losses, making QR codes a safer alternative.

Convenience: QR codes streamline the transaction process, allowing for quicker exchanges of cryptocurrencies. Whether you’re at a market or making online payments, a simple scan can initiate a transaction.

User-Friendly: For those new to cryptocurrency, QR codes make it easier to understand and use wallets. This user-friendly aspect can encourage more people to explore the world of digital currencies.

Integration with Mobile Apps: Most crypto wallets now support QR code scanning, making it simple to send or receive funds through your smartphone. This integration allows for a more mobile and flexible approach to managing your assets.

How to Create a Blockchain Wallet QR Code with QR Ocean

Creating a blockchain wallet QR code is simple with QR Ocean. Here’s how you can generate your own QR code:

Visit QR Ocean: Head over to our crypto QR code generator.

Enter Your Wallet Address: Input your cryptocurrency wallet address into the provided field.

Generate the QR Code: Click the "Generate" button to create your unique QR code.

Download and Share: Once your QR code is generated, you can easily download it and share it with others.

Best Practices for Using Blockchain Wallet QR Codes

Keep Your Wallet Secure: While QR codes simplify transactions, ensure your wallet is secure. Use reputable wallets and enable two-factor authentication whenever possible.

Verify Before Scanning: If you receive a QR code from an unknown source, verify its authenticity before scanning. Scammers can create fraudulent codes to steal your funds.

Educate Yourself: Stay informed about the latest developments in cryptocurrency and security practices. Knowledge is your best defense against potential threats.

Conclusion

Blockchain wallet QR codes are revolutionizing the way we interact with digital currencies. They offer a blend of convenience and security that is essential in today’s fast-paced world. At QR Ocean, we are committed to making cryptocurrency transactions accessible for everyone. Start using blockchain QR codes today and experience a smoother, safer way to manage your crypto assets!

For more information on generating your own blockchain wallet QR codes, visit us at QR Ocean and take your first step towards hassle-free cryptocurrency transactions! Explore the power of crypto wallet QR codes and discover how they can simplify your digital transactions.

#crypto qr code#blockchain qr code#blockchain wallet qr code#crypto wallet qr code#blockchain qr code generator#blockchain private key qr code

0 notes

Text

How to Connect Your TON Wallet to STON.fi: A Simple Guide for Everyone

Let’s face it—starting anything new can feel overwhelming, especially in the world of crypto and blockchain. If you’ve ever felt lost trying to connect your wallet to a decentralized app, you’re not alone. But here’s the truth: connecting your TON wallet to STON.fi is simpler than it seems.

Think of it like setting up a digital wallet for your favorite online store. Once it’s done, you’re all set to explore, trade, and take full control of your financial journey. Let me walk you through the process step by step in the most straightforward way possible.

Why Do You Need to Connect Your Wallet

Imagine walking into a store with a shopping list but no wallet. You know what you want, but you can’t buy anything. That’s what it’s like trying to use STON.fi without connecting your TON wallet.

Your wallet acts as your digital access card, allowing you to interact with the blockchain. Without it, you’re just a spectator in the decentralized world. Once connected, you can trade tokens, stake your assets, and fully immerse yourself in decentralized finance (DeFi).

Step 1: Open the STON.fi Application

First, visit STON.fi. Consider this the entrance to a digital marketplace, designed for seamless interaction with the blockchain.

The website is user-friendly and intuitive, so you won’t feel like you’re navigating a maze.

Step 2: Click “Connect Wallet”

On the homepage, find the “Connect Wallet” button and click it. Think of this as saying, “Hey, I’m ready to explore!”

This simple action sets the stage for all your future transactions.

Step 3: Select Your Wallet

Once you click the button, a list of supported wallets will pop up. If you don’t see your wallet immediately, don’t panic—click “View All Wallets” to see the full list.

Still can’t find your wallet? Double-check to ensure you’ve set it up correctly. It’s like looking for a key—you need the right one to unlock the door.

Step 4: Scan the QR Code

Open your wallet app and look for the QR code scanner. Use it to scan the code displayed on STON.fi.

This step is as simple as tapping your card on a payment terminal. It’s quick, efficient, and hassle-free.

Step 5: Confirm the Connection

Your wallet app will ask for confirmation. Once you approve, your wallet is connected!

Here’s a pro tip: your wallet will stay connected until you disconnect it manually or clear your browser cache. This means you don’t have to repeat the process every time you visit STON.fi.

Addressing Common Concerns

Is it safe to connect my wallet?

Absolutely. Connecting your wallet doesn’t mean you’re giving anyone access to your funds. It’s more like logging into an account—secure and private.

What if I make a mistake?

No worries! The process is straightforward, and you can always start over if needed. Plus, plenty of guides are available to help you troubleshoot.

Why This Step Matters

Connecting your wallet is more than just a technical task—it’s a doorway to financial independence. In the traditional financial world, we rely on banks and middlemen. With STON.fi, you’re in control.

Once your wallet is connected, you can:

Trade tokens seamlessly

Stake your assets for rewards

Explore new opportunities in DeFi

Picture this: You’re at a coffee shop and want to pay for your latte. You open your phone, scan a QR code, and the payment is done in seconds.

That’s exactly how connecting your wallet to STON.fi works. Simple, efficient, and secure. Once you’ve set it up, the entire process becomes second nature.

Final Thoughts

Starting your journey in the decentralized world doesn’t have to be complicated. Connecting your TON wallet to STON.fi is one of the easiest and most empowering steps you can take.

Think of it as setting up the foundation for your financial freedom. Once it’s done, you’ll have access to a world of opportunities at your fingertips.

So, what are you waiting for? Dive in and take control of your future—one transaction at a time.

4 notes

·

View notes

Text

UPB Pay Revolutionizing Crypto Transactions in India

In the fast-changing world of digital payments, UPB Pay stands out as a groundbreaking solution combining the ease of UPI with the power of blockchain. Developed by UPB (Universal Payment Bank), this platform is India’s first-ever Crypto UPI system, allowing users to send and receive cryptocurrency with the same simplicity and speed as traditional UPI payments.

While India witnesses increasing adoption of digital finance, UPB Pay emerges as the bridge between crypto freedom and real-world utility. Whether you’re a crypto investor, merchant, or first-time user, UPB Pay simplifies everything with a secure, user-friendly interface.

💡 What is UPB Pay?

UPB Pay is a decentralized payment platform powered by blockchain that allows instant crypto transactions using UPI-style features. You don’t need long wallet addresses, private keys, or complicated exchanges. Just select a contact, enter an amount, and send – just like UPI.

This breakthrough makes crypto accessible to everyday users, without compromising on security, speed, or decentralization.

🔑 Key Features of UPB Pay

🔐 Secure Wallet Integration: Your crypto stays safe in your own wallet – fully decentralized and non-custodial.

⚡ Instant Transactions: Lightning-fast transfers between users across networks.

📱 UPI-Like Simplicity: Send tokens using usernames or contact IDs – no need for long blockchain addresses.

🌐 Multi-Chain Support: UPB Pay supports popular blockchains like Solana, Ethereum, and more.

🪙 Token Utility: Pay directly using UPB Token and other popular coins.

🎁 Airdrops & Rewards: Active users benefit from referral rewards, loyalty bonuses, and UPB token drops.

🔥 Why UPB Pay is the Future

India has millions of UPI users and growing crypto curiosity. But till now, no one combined the ease of Indian payments with the power of digital assets.

UPB Pay does just that. It’s fast, flexible, and built for the future. No centralized banks, no red tape – just direct, borderless, crypto payments, anytime, anywhere.

📈 Who Can Use UPB Pay?

🧑💼 Traders: Move funds quickly between wallets.

🛍️ Merchants: Accept crypto payments instantly with zero settlement delay.

💸 Friends & Family: Send tokens across borders – no conversion fees.

💰 Investors: Use it to transfer UPB Tokens or manage portfolios seamlessly.

🙋♂️ Frequently Asked Questions (FAQ)

🔹 Q1: Is UPB Pay safe to use?

Absolutely. UPB Pay is built on decentralized blockchain networks. It’s non-custodial, meaning you hold your keys, and all transactions are secure and transparent.

🔹 Q2: How is UPB Pay different from normal crypto wallets?

While typical wallets only store coins, UPB Pay acts like a UPI app for crypto – you can send/receive instantly with a familiar interface, and even use contact-based IDs.

🔹 Q3: Do I need KYC to use UPB Pay?

No mandatory KYC for basic usage. However, to access advanced features or fiat on-ramps (coming soon), some verification might be needed.

🔹 Q4: Which tokens can I use with UPB Pay?

Currently, UPB Token, SOL, USDT, and other major tokens are supported. Multi-chain support ensures smooth transfers across compatible blockchains.

🔹 Q5: Can I use UPB Pay for business transactions?

Yes! UPB Pay is ideal for freelancers, merchants, and e-commerce platforms that want to accept fast, secure crypto payments without waiting days for settlement.

🔹 Q6: Is UPB Pay available as an app?

Yes! The UPB Pay app is available (or launching soon) on Android and iOS. You can also access it via web wallet for desktop transactions.

📣 Final Thoughts

UPB Pay is not just another crypto wallet – it's a movement. A bold step towards making crypto payments as common and effortless as scanning a QR code.

Whether you're new to crypto or a seasoned investor, UPB Pay empowers you to control your money, your way – with speed, security, and simplicity.

✅ Call to Action

🎯 Don’t get left behind ��� start using UPB Pay today! Claim your free UPB tokens, invite your friends, and experience the future of payments before the world catches on. 📲 Visit: www.upbpay.com or Download the App.

0 notes

Text

UPB Bank: The Future of Crypto Banking Is Here

The financial world is changing fast, and at the heart of this transformation is UPB Bank—Universal Payment Bank. Whether you're a crypto enthusiast, a merchant, or someone tired of traditional banking restrictions, UPB Bank opens the door to a smarter, faster, and more secure financial future.

What is UPB Bank?

UPB Bank is not just a regular bank—it’s a crypto-powered financial ecosystem designed for the modern age. It blends the best of traditional banking with blockchain technology to create a secure, borderless, and decentralized payment system.

Founded with the vision to make financial services globally accessible, UPB is focused on:

Instant crypto transactions

QR-based payments (like UPI)

Staking and earning opportunities

Safe, smart, and scalable banking for everyone

Whether you're in India, the USA, or any other part of the world, UPB aims to give you complete control over your money—anytime, anywhere.

🔑 Key Features of UPB Bank

1. Crypto UPI-Style Payments

UPB’s most talked-about feature is its Crypto UPI system. You can send and receive crypto just like UPI—scan QR codes, tap to pay, or use mobile numbers linked to wallets.

2. Staking and Rewards

Put your UPB tokens to work! Just like you earn interest in a savings account, UPB lets users stake tokens and earn rewards regularly.

3. Merchant Integration

UPB supports small and large businesses with easy crypto payment acceptance—making it a perfect solution for shops, freelancers, and e-commerce platforms.

4. Multi-Chain Wallet

UPB Wallet supports multiple blockchains—Solana, Ethereum, BSC, and more—so users can manage all their assets in one place securely.

5. Smart Security

With multi-layer encryption, private key protections, and user-side authentication, UPB takes your security seriously.

6. Low Fees, Fast Transfers

Tired of heavy gas fees? UPB makes crypto transactions affordable and fast, perfect for everyday payments or cross-border transfers.

🚀 Why Choose UPB Bank?

Easy to Use: Designed for beginners and experts alike

Instant Payments: Real-time crypto transactions with UPI-style experience

Global Reach: Send or receive payments across borders

Decentralized: No middlemen, no banks holding your funds

100% Transparency: All transactions are on the blockchain

UPB is built for today’s generation—people who want speed, privacy, and financial control in one place.

📲 How to Get Started?

Download UPB Wallet (available on iOS & Android soon)

Create an Account securely with your crypto wallet

Buy UPB Tokens during the airdrop or presale phase

Start Sending, Receiving, or Staking crypto instantly!

You can also join the UPB community on Telegram, Twitter, and Discord for updates and offers.

❓ Frequently Asked Questions (FAQs)

Q1. Is UPB a real bank?

UPB is a crypto-based digital banking ecosystem. While it follows all legal frameworks and privacy policies, it is not a traditional brick-and-mortar bank. Instead, it operates on blockchain technology to provide decentralized financial services.

Q2. What is the difference between UPB Token and UPB Coin?

UPB Token: Used for staking, governance, discounts, and rewards.

UPB Coin: A stable asset used for real-time payments and cross-border transfers.

Q3. Is UPB safe to use?

Yes. UPB uses multi-layer security like private key encryption, cold storage, and smart contract audits to ensure your assets are safe.

Q4. Can I earn money with UPB?

Absolutely! You can stake UPB tokens to earn passive income, refer others to the platform, or use merchant tools to grow your business.

Q5. Do I need to complete KYC?

Basic features may work without KYC, but for higher limits and business tools, KYC may be required as per regulatory standards.

Q6. Is UPB available in India?

Yes! In fact, UPB is highly popular in India due to its UPI-style features and mobile-first design. But it is also usable globally.

📈 UPB’s Roadmap: What’s Coming Next?

✅ Airdrop Campaign & Token Listing

✅ Smart Contract Audits Completed

🔜 Launch of UPB Crypto Debit Card

🔜 Partnership with Global Merchant Networks

🔜 Full-featured UPB App Launch

UPB is not just an idea—it’s a fast-growing community and ecosystem with big plans.

🗣️ Real Talk: Why You Shouldn't Miss Out

When Bitcoin launched, most people ignored it. Today, early adopters are millionaires.

Now, UPB is offering that same kind of opportunity—a chance to get in early on a platform that’s set to change the game.

Whether you're looking to:

Start using crypto in daily life

Grow your savings

Accept crypto for your business

Or simply stay ahead of the curve

UPB is your gateway.

📣 Final Call to Action

🌍 The world is going digital, and UPB Bank is your ticket to the future of money.

✅ Don’t wait. ✅ Don’t regret. ✅ Start your journey with UPB today.🔗 [Join the UPB Community Now!] 🔗 [Visit: www.upbonline.com]

0 notes

Text

Physical Bitcoin: Merging Tradition with Cryptocurrency

Bitcoin is broadly known as a decentralized advanced money, but an expanding number of devotees and collectors are grasping a captivating specialty inside the crypto world physical bitcoin. These are real-world, substantial representations of computerized resources, regularly made from valuable metals or collectible-grade materials and now and then inserted with real BTC values through secure private keys.In this article, we’ll investigate what physical bitcoin is, how it works, its centrality in the world of advanced money, its part as a collector’s thing, and whether it holds any genuine speculation potential in today’s fast-evolving money related landscape.

What Is Physical Bitcoin?

Physical bitcoin alludes to a physical object — usually a coin or token — that symbolizes or contains advanced bitcoin esteem. These things are not legitimate delicate but serve as a oddity or collector’s thing. A few physical bitcoins come with implanted private keys that permit the holder to recover genuine BTC, whereas others are basically commemorative.

Key characteristics include:

Metal coins with laser-etched Bitcoin logos or QR codes

Tamper-proof seals covering up private keys

Designated BTC esteem encoded inside

Often limited-edition things for collectors

While advanced bitcoin remains intangible and exists as it were on the blockchain, physical bitcoin offers a material encounter that resounds with collectors, crypto-curious speculators, and those captivated by the crossing point of craftsmanship, cash, and technology.

A Brief History of Physical Bitcoin

The concept was spearheaded by Mike Caldwell in 2011 with the creation of Casascius coins, the most well-known and broadly conveyed physical bitcoins to date. These coins picked up consideration for inserting real Bitcoin inside a secure tamper-evident visualization, giving an simple and rich way to “hold” BTC.

However, the U.S. government in the long run interceded, concerned almost cash transmission controls. Caldwell ceased generation of stacked coins, but the concept started a development. Since at that point, a few other producers and specialists have made comparable things, including:

Lealana Coins

Satori Coins

BTCC Mint

Titan Bitcoin

Each variation offers one of a kind plans and stacking strategies, in spite of the fact that controls presently constrain pre-loaded coins, particularly in the Joined together States.

Why Do People Buy Physical Bitcoin?

1. Collectible ValueMany physical bitcoins are created in restricted runs and gotten to be uncommon over time. A few early versions are presently worth thousands of dollars, in any case of the BTC they contain, essentially due to collector demand.

2. Blessing and MemorabiliaThese coins make one of a kind and keen endowments for crypto devotees, particularly when customized with engravings or packaging.

3. Substantial RepresentationCrypto can feel unique to numerous. Physical bitcoin permits individuals to encounter the concept in a shape they can touch, making it more relatable.

4. Instructive Purposes Physical bitcoin is too utilized as an instructive instrument in workshops, conferences, and classrooms to clarify blockchain, wallets, and crypto economics.

Are Physical Bitcoins Genuine Money?

Not precisely. Whereas a few physical bitcoins may contain genuine BTC esteem put away inside, they are not lawful cash and are not issued or directed by governments. Their esteem depends on:

The sum of BTC encoded (in the event that any)

The collector showcase and rarity

Metal composition (e.g., gold or silver)

Condition and authenticity

Important Note on Security

If you buy a physical bitcoin that incorporates a private key, it’s fundamental to treat it with the same caution as a advanced wallet. Anybody who picks up get to to that private key can claim the reserves. Therefore:

Never share the key or appear it publicly

Ensure the tamper-proof seal is intaglio upon delivery

Store in a secure, fire-proof secure if esteem is significant

Pros and Cons of Physical Bitcoin

Pros Cons Tangible and outwardly appealing Risk of burglary or physical loss Great for collectors and gifting Not as fluid as advanced BTC No web get to required for viewing Legality changes by region Can incorporate genuine BTC value Some coins are purge (non-funded)

How to Purchase Physical Bitcoin

Buying physical bitcoin can be done online from legitimate sellers and collector marketplaces. Guarantee the taking after some time recently purchase:

The vender has a great notoriety and confirmed reviews

The coin is either fixed or comes with a certificate of authenticity

If pre-loaded, check the current BTC esteem encoded

Avoid bargains that appear as well great to be genuine (they more often than not are)

Recommended stages include:

OpenSea — for crypto collectibles

eBay — for collectors’ coins (work out caution)

Company websites like Lealana or Titan Bitcoin

Always confirm that the item is authentic and secure some time recently making a purchase.

Physical Bitcoin as an Investment

Although physical bitcoin is not broadly acknowledged in standard back, it has ended up a specialty venture for those collecting uncommon advanced memorabilia. In a few cases, early versions have brought five-figure wholes at barters due to scarcity.

A physical bitcoin with 0.01 BTC and uncommon casing may offer for much more than fair its crypto worth.

Market patterns and collector intrigued can be unpredictable.

If you’re contributing simply for BTC esteem, consider equipment wallets or cold capacity. If you’re contributing for oddity and irregularity, physical bitcoin might be a fun and possibly fulfilling niche.

In spite of the fact that physical bitcoin is not broadly recognized in standard back, it has carved out a specialty showcase among crypto devotees and collectors of uncommon advanced memorabilia. These substantial representations of Bitcoin frequently hold request past their genuine cryptocurrency esteem, making them alluring as both collectibles and discussion pieces.

The Esteem of Physical Bitcoin: More Than Fair Crypto

One of the key attractions of physical bitcoin lies in its double value — the inserted BTC it may contain, and its potential as a uncommon collectible. Whereas numerous coins are absolutely typical, others are pre-loaded with genuine Bitcoin, fixed with tamper-evident visualizations or QR codes for verification.

In numerous cases, early physical bitcoin models have gotten five-figure wholes at barters, particularly when they are limited-edition, imaginatively created, or generally critical. For example:

A physical bitcoin coin with 0.01 BTC and a uncommon casing or plan might offer for much more than its real crypto value.

Market intrigued, shortage, and collector assumption play a expansive part in setting the price.

Just like fine craftsmanship or vintage money, physical bitcoins can appreciate based on uniqueness, provenance, and demand — not fair the implanted advanced asset.

However, it’s imperative to separate between collectible esteem and real Bitcoin value:

Aspect Crypto Value Collectible Value Based On BTC sum in the coin Rarity, plan, chronicled significance Volatility Follows Bitcoin showcase trends Influenced by collector request and auctions Liquidity Easy to offer by means of crypto exchanges Niche advertise, may take time to discover a buyer

If your objective is simply contributing in Bitcoin, you may be way better off utilizing equipment wallets or cold capacity arrangements These legitimate concerns change by purview and can carry critical results if overlooked.

International Shipping Confinements: Trading stacked physical coins without legitimate traditions clearance may damage laws in a few countries.

Best Hones for Collectors and Sellers:

Continuously confirm nearby directions some time recently buying, offering, or creating physical bitcoin.

Maintain a strategic distance from shipping stacked coins globally unless all legitimate conditions are met.

Utilize tamper-proof 3d images or security seals to avoid unauthorized get to to pre-loaded wallets.

Counsel a lawful master if you’re fabricating or dispersing pre-loaded coins at scale.

Being cautious with compliance guarantees that your speculation or trade in physical bitcoin remains on the right side of the law.

The Future of Physical Bitcoin

As blockchain and advanced resource innovation proceeds to progress, the concept of physical bitcoin may advance distant past a basic collectible coin. Developments in equipment, savvy contracts, and NFTs seem clear the way for energizing modern applications.

Emerging Patterns and Possibilities:

Integration with NFTs and Increased Reality (AR) Physical coins seem interface straightforwardly to NFT proprietorship or show metadata when seen through AR devices.

Custom-Designed Coins with Energetic QR Codes Next-gen physical bitcoins may incorporate programmable QR codes that overhaul adjust data in genuine time or empower multisig access.

Token-Gated Physical Access

Physical bitcoin might too ended up a instrument for real-world interactions — unlocking premium administrations, gated communities, or events.

AI-Enabled Quick Wallets Embedded in Coins Future physical bitcoins may contain embedded chips or biometric security to authorize trades direct from the coin.

Conclusion: Should to You Contribute in Physical Bitcoin? In rundown, physical bitcoin is more than a novelty — it’s a blend of cryptocurrency, craftsmanship, and collectible regard.Whether you’re a specialist, a crypto history specialist, or a theoretical speculator, physical bitcoins offer:

A unmistakable association to the decentralized advanced money movement

Imaginative and collectible appeal

Potential long-term appreciation based on irregularity and design

Legitimate complexity that must be regarded to dodge compliance issues

If you’re buying for Bitcoin venture purposes, equipment wallets or trades give more liquidity and security. Be that as it may, if you’re looking for a uncommon and curiously way to possess a piece of crypto history, physical bitcoin offers a interesting and energizing road.

Legal and Administrative Considerations

Ownership of physical bitcoin is by and large legitimate, but offering or fabricating pre-loaded coins might run into administrative concerns. In the U.S., the Money related Violations Requirement Arrange (FinCEN) may consider stacking coins with cryptocurrency as an act of cash transmission.

Important considerations:

Always check your neighborhood controls if buying, offering, or manufacturing

Avoid shipping stacked coins universally without appropriate clearance

Know Your Client (KYC) and Anti-Money Washing (AML) rules may apply

Future of Physical Bitcoin

As blockchain innovation proceeds to advance, modern employments for physical bitcoin may rise. Conceivable patterns include:

Integration with NFTs and increased reality

Designer collectible coins with energetic QR codes

Crypto-backed extravagance things (e.g., observes, art)

Educational units for schools and universities

While the future of advanced money is without a doubt online, the substantial request of physical bitcoin guarantees it keeps up a steadfast group of onlookers inside the crypto world.

Conclusion

Physical bitcoin stands at a interesting crossing point of innovation, fund, and craftsmanship. Whether you’re a prepared crypto speculator, a collector, or somebody basically inquisitive approximately computerized resources, these substantial tokens offer a interesting see into the world of decentralized money — made real.

Though they do not supplant computerized wallets or online exchanging, physical bitcoins give esteem in their possess right. Whether as collectibles, discussion starters, or limited-edition speculations, they proceed to include profundity and interest to the developing crypto ecosystem.

#xrp golden cross bitcoin#rexas finance doge shiba inu comparison#physical bitcoin#pi coin news#xrp solana lightchain ai cryptocurrency comparison#wallitiq

0 notes

Text

Secure Your Crypto Future with the SafePal S1 Pro: The Next-Gen Hardware Wallet You Need

In the ever-evolving world of cryptocurrency, securing your assets is more critical than ever. With rising threats of cyberattacks, phishing scams, and exchange vulnerabilities, choosing a reliable hardware wallet isn't just smart—it's essential. That’s where the SafePal S1 Pro comes in, a cutting-edge solution from the trusted SafePal Wallet brand, designed to keep your digital assets safe and in your control.

Whether you're new to crypto or a seasoned investor, the SafePal S1 Pro delivers advanced security, offline storage, and user-friendly features that put you in charge of your assets. And if you're ready to upgrade your crypto security, don't forget to take advantage of exclusive savings with a SafePal Wallet coupon code.

What Makes the SafePal S1 Pro a Game-Changer?

The SafePal S1 Pro isn’t just another hardware wallet—it’s a next-level security device built with state-of-the-art technology and practical design. Here’s why it stands out in a crowded market:

🔒 Air-Gapped Security: Unlike many other wallets, the S1 Pro operates completely offline. It doesn’t rely on Bluetooth, Wi-Fi, NFC, or USB, which dramatically reduces its vulnerability to online threats.

📱 QR Code Authentication: The S1 Pro uses QR codes for signing transactions—keeping your private keys completely isolated from the internet, while still making it easy to manage transactions via the SafePal App.

🔐 EAL 5+ Secure Element: Your private keys are stored in a certified security chip with top-level encryption, ensuring that your crypto is protected even if the device falls into the wrong hands.

💼 Multi-Currency Support: With support for over 100 blockchains and thousands of tokens (including BTC, ETH, BNB, SOL, and NFTs), the SafePal S1 Pro is ideal for diversifying your portfolio.

📲 User-Friendly Interface: A large 1.8-inch screen and physical buttons make navigation simple—even for beginners—while firmware updates keep your wallet current and secure.

Why Choose SafePal Wallet?

SafePal Wallet is more than just a product—it’s a full ecosystem built for modern crypto users. Trusted by over 10 million users worldwide, SafePal offers secure hardware and software wallets, a seamless mobile app, and integration with top DeFi and Web3 platforms.

Whether you’re storing, swapping, or staking, SafePal Wallet gives you the tools to manage your assets without relying on centralized exchanges. Your keys, your crypto.

Save More with a SafePal Wallet Coupon Code

Looking to buy your SafePal S1 Pro at the best price? Make sure to use a SafePal Wallet coupon code during checkout! These exclusive codes give you access to special discounts, helping you save on premium security.

You can find the latest SafePal Wallet coupon codes by signing up for the newsletter at SafePal Wallet, or by following SafePal on social media. Stay connected to get the best deals and updates on new products.

Final Thoughts: Invest in Your Peace of Mind

In the world of crypto, security is non-negotiable. The SafePal S1 Pro offers unmatched offline protection, full control of your assets, and the confidence to navigate the digital finance space securely. Backed by the trusted SafePal Wallet brand, it’s the smart choice for anyone serious about protecting their crypto.

Ready to take the next step? Visit SafePal.com, grab your SafePal S1 Pro, and don’t forget to apply your SafePal Wallet coupon code for exclusive savings!

0 notes

Text

Can You Really Trust Digital Credentials? A Deep Dive into Verification Mechanisms

In a world rapidly transitioning to digital-first interactions, credentials are no longer confined to physical documents or paper certificates. Diplomas, licenses, training certificates, and professional badges are now increasingly issued and stored in digital formats. But as this shift accelerates, a critical question arises: Can you really trust digital credentials?

This is where digital credential verification and verifiable digital credentials come into play, ensuring that digital trust isn’t just a buzzword but a functioning reality.

What Are Digital Credentials?

Digital credentials are electronic versions of certifications, degrees, or licenses issued by trusted authorities such as universities, certification bodies, and training providers. These can be badges, PDFs, or fully encrypted blockchain records that represent a person’s qualifications, skills, or identity.

While convenient and easily shareable, digital credentials are only as trustworthy as the mechanisms used to verify them.

The Problem with Traditional Credentials

Traditional paper-based credentials are vulnerable to forgery, loss, and lengthy manual verification processes. Employers and institutions often spend significant time and resources validating degrees, licenses, and certifications.

With the rise of remote work, global hiring, and digital education platforms, the need for reliable and secure credential verification has never been more pressing.

Enter Verifiable Digital Credentials

Verifiable digital credentials solve many of the problems traditional credentials face. These credentials are:

Digitally signed by the issuing authority.

Cryptographically secure to prevent tampering.

Easily verifiable by any third party in real time.

Portable and user-controlled, allowing individuals to store and present them as needed.

This system empowers both the issuer and the recipient, while giving verifiers a fast, reliable way to confirm the authenticity of the credential.

How Digital Credential Verification Works

Digital credential verification uses several technologies and standards to ensure authenticity, including:

1. Public Key Infrastructure (PKI)

The issuing body uses a private key to sign the digital credential. When someone wants to verify it, they use the corresponding public key to confirm the signature, ensuring the credential hasn’t been altered.

2. Blockchain Technology

Some platforms leverage blockchain to store credentials or their verification metadata. This makes the credential immutable and timestamped, offering a transparent and tamper-proof system of record.

3. Decentralized Identifiers (DIDs)

These are cryptographically verifiable digital identities that provide users with control over their credentials. Combined with verifiable digital credentials, DIDs allow secure, privacy-respecting sharing of information.

4. QR Codes and Digital Wallets

Credentials can be stored in digital wallets or accessed via QR codes that link to verification portals. This adds a layer of usability and convenience for both holders and verifiers.

Real-World Applications

Educational Institutions now issue digital diplomas that can be verified instantly by employers.

Healthcare Licensing Boards use digital credential verification to ensure medical professionals are licensed and up-to-date.

Tech Platforms and MOOCs offer verifiable digital credentials for courses, enabling learners to showcase skills on LinkedIn or job applications.

Government Agencies use digital verification for identity documents and compliance credentials.

Benefits of Verifiable Digital Credentials

Eliminate Fraud: Tamper-proof formats reduce the risk of forged or inflated credentials.

Speed Up Verification: Instant validation saves time for HR departments, universities, and agencies.

Empower Users: Individuals can carry and control access to their credentials securely.

Boost Trust: Stakeholders can trust that credentials are authentic and up to date.

Final Thoughts

The trustworthiness of digital credentials isn’t a question of “if” — it’s a question of how well the verification system is built. Thanks to advancements in cryptography, blockchain, and decentralized identity standards, digital credential verification is more robust than ever.

Verifiable digital credentials aren’t just a trend — they are a foundational element of the digital identity ecosystem. As adoption grows, the ability to verify trust quickly and securely will become an expectation, not a luxury.

0 notes

Text

Blockchain in Agriculture and Food Supply Chain Industry Forecast 2032: Market Size, Scope, and Growth Trends

The Blockchain in Agriculture and Food Supply Chain Market Size was valued at USD 299.1 Million in 2023 and is expected to reach USD 7035.7 Million by 2032, growing at a CAGR of 42.1% over the forecast period 2024-2032.

Blockchain technology is rapidly transforming the agriculture and food supply chain industry by offering a transparent, secure, and immutable digital ledger for tracking the journey of agricultural products from farm to fork. As consumers demand greater traceability, safety, and sustainability in their food, blockchain presents a revolutionary way to ensure accountability across the supply chain. The integration of this technology is helping stakeholders overcome critical challenges such as fraud, data manipulation, food contamination, and inefficiencies in logistics.

Blockchain in the Agriculture and Food Supply Chain Market is emerging as a powerful enabler of trust and operational efficiency. By decentralizing record-keeping and enabling real-time data sharing among farmers, suppliers, retailers, and consumers, blockchain is reshaping how agricultural goods are produced, transported, and consumed. The technology is gaining traction globally as governments, agribusinesses, and startups increasingly invest in blockchain-based solutions to modernize food systems and meet evolving regulatory and consumer demands.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/4792

Market Keyplayers:

IBM (IBM Food Trust, IBM Blockchain Platform)

Microsoft (Azure Blockchain Workbench, Azure IoT)

SAP (SAP Blockchain, SAP Leonardo)

ChainPoint (ChainPoint Platform, ChainPoint Data)

TE-FOOD (TE-FOOD Platform, TE-FOOD Blockchain)

Provenance (Provenance Platform, Provenance Ledger)

Ripe.io (RipeChain, Ripe.io Traceability)

Ambrosus (AMB-NET, AMB-DATA)

AgriLedger (AgriLedger App, AgriLedger Platform)

Everledger (Everledger Wine Platform, Everledger Supply Chain)

Market Trends

Several key trends are driving the adoption and growth of blockchain in agriculture and food supply chains:

Rising Demand for Food Traceability: With growing concerns over food safety and quality, blockchain is enabling end-to-end traceability by recording each step in the supply chain. Consumers can now scan QR codes on products to access detailed information about origin, handling, and quality certifications.

Integration with IoT and Smart Sensors: Blockchain is being paired with IoT (Internet of Things) devices and sensors to provide real-time updates on temperature, humidity, and location during storage and transit. This helps reduce spoilage, ensure compliance with safety standards, and optimize logistics.

Sustainable and Ethical Sourcing: Consumers and brands alike are prioritizing ethical farming practices and sustainable sourcing. Blockchain ensures that product claims—such as organic, fair trade, or pesticide-free—are verifiable and backed by transparent data.

Government and Regulatory Support: Regulatory bodies in regions like Europe, the U.S., and Asia are beginning to support blockchain initiatives for agricultural monitoring and food compliance, fostering innovation and boosting industry credibility.

Enquiry of This Report: https://www.snsinsider.com/enquiry/4792

Market Segmentation:

By type

Public

Private

Hybrid/Consortium

By stakeholders

Growers

Food manufacturers/processors

Retailers

By providers

Application providers

Middleware providers

Infrastructure providers

By Enterprise size

Small and medium-sized enterprises

Large enterprises

By application

Product traceability, tracking, and visibility

Payment and settlement

Smart contract

Governance, risk, and compliance management

Market Analysis

The technology is particularly beneficial in sectors like dairy, seafood, coffee, and organic produce, where provenance and authenticity are crucial.

Asia-Pacific and North America are currently leading the adoption curve, with Europe following closely. Developing regions are also showing increasing interest as blockchain proves its value in improving supply chain efficiency, reducing waste, and ensuring fair trade practices for smallholder farmers.

Future Prospects

The future of blockchain in the agriculture and food supply chain market looks promising, with several innovations and advancements expected to shape the sector:

Wider Use of Smart Contracts: Automated agreements between producers, distributors, and retailers will reduce paperwork, increase trust, and ensure timely payments based on predefined conditions.

Blockchain-Based Marketplaces: Decentralized platforms will empower farmers by connecting them directly with buyers, removing middlemen and increasing profit margins.

Blockchain for Carbon Credits and Sustainability Tracking: Blockchain will play a vital role in helping agribusinesses and food companies track carbon footprints, water usage, and other sustainability metrics to meet ESG (Environmental, Social, and Governance) goals.

Interoperability and Standardization: As adoption increases, the focus will shift toward creating industry-wide standards and cross-platform compatibility to enable a more cohesive global supply chain system.

Access Complete Report: https://www.snsinsider.com/reports/blockchain-in-agriculture-and-food-supply-chain-market-4792

Conclusion

Blockchain in the agriculture and food supply chain market is revolutionizing the way the world grows, processes, and consumes food. By offering transparency, traceability, and trust, blockchain empowers consumers, protects producers, and strengthens supply chains against disruptions and fraud. While challenges such as scalability, digital literacy, and infrastructure gaps remain, ongoing innovation and investment are paving the way for widespread adoption.

As the global food industry faces increasing scrutiny and complexity, blockchain stands out as a powerful tool for building resilient, secure, and sustainable food systems. The technology is not just a trend—it's becoming a foundational layer for the future of agriculture and food logistics.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

0 notes

Text

Generate Secure Blockchain Wallet QR Codes with QR Ocean

Discover how QR Ocean’s Crypto QR Code Generator can enhance your blockchain wallet experience. Easily create secure, scannable QR codes for your cryptocurrency transactions, making sending and receiving digital assets a breeze. Whether you're a seasoned investor or just starting, our user-friendly platform helps you manage your crypto with ease. Visit us at https://qrgenerator.biz/crypto-qr-code-generator/

#crypto qr code#blockchain qr code#blockchain wallet qr code#crypto wallet qr code#blockchain qr code generator#blockchain private key qr code

0 notes

Text

Cryptocurrency Payment Process

Cryptocurrency Payment Process: How Digital Payments Are Changing the Financial Landscape

As digital currencies like Bitcoin, Ethereum, and Litecoin gain widespread recognition, the cryptocurrency payment process is becoming increasingly popular. Businesses and consumers alike are beginning to embrace the advantages of using cryptocurrency for transactions. From providing faster, more secure payments to reducing transaction fees, cryptocurrency payments are revolutionizing the way we think about money in the digital age.

In this article, we’ll explore how the cryptocurrency payment process works, its benefits, the challenges it faces, and why it’s becoming a crucial part of the future of financial transactions.

What is Cryptocurrency?

Before delving into the payment process, it’s important to understand what cryptocurrency is. A cryptocurrency is a form of digital or virtual currency that uses cryptography for security. Unlike traditional currencies issued by governments (such as the U.S. dollar or the euro), cryptocurrencies operate on decentralized networks based on blockchain technology, which ensures transparency and security without the need for a central authority like a bank.

Bitcoin, the first and most widely known cryptocurrency, was introduced in 2009, and since then, thousands of alternative cryptocurrencies have emerged. These digital currencies can be used for a variety of purposes, including online purchases, investments, and cross-border transactions.

How Cryptocurrency Payments Work

The cryptocurrency payment process differs from traditional payment methods such as credit cards, bank transfers, or cash. Here’s a step-by-step breakdown of how it typically works:

Cryptocurrency Wallet: To initiate a cryptocurrency payment, both the sender (payer) and receiver (merchant or individual) need cryptocurrency wallets. These wallets can be software or hardware-based and store the public and private keys necessary to send and receive digital currency. Public keys are similar to bank account numbers, while private keys are used to authorize transactions.

Selecting the Cryptocurrency: The sender selects which cryptocurrency to use for the transaction. Common choices include Bitcoin, Ethereum, or other altcoins. Once the cryptocurrency is chosen, the sender specifies the amount they want to transfer to the recipient.

Payment Address: The recipient provides their wallet’s public address (a string of alphanumeric characters) to the sender. This is where the cryptocurrency will be deposited. Alternatively, some merchants use QR codes that contain their payment address for easier scanning and processing.

Sending the Payment: Once the sender enters the payment details and confirms the transaction, the payment is broadcast to the cryptocurrency network. This process involves verifying the sender’s private key to ensure the transaction is authorized.

Blockchain Verification: The transaction is recorded on a blockchain—a decentralized, public ledger that records every cryptocurrency transaction. The transaction is verified by a network of miners or validators who ensure that the funds are available and have not been double-spent. This verification process is often referred to as proof of work or proof of stake, depending on the cryptocurrency being used.

Confirmation: Once the transaction is validated and confirmed by the network, the recipient’s wallet is credited with the specified amount of cryptocurrency. This typically happens within minutes, though the speed can vary based on the cryptocurrency and network traffic.

Conversion to Fiat Currency (Optional): If the recipient prefers to convert the received cryptocurrency into traditional fiat currency (such as U.S. dollars or euros), they can do so using a cryptocurrency exchange platform. Many payment processors now also offer automatic conversion services, so merchants can instantly convert cryptocurrency payments into their local currency without dealing with the volatility of digital currencies.

Benefits of Cryptocurrency Payments

Cryptocurrency payments offer several advantages over traditional payment methods, especially for online and international transactions. Here are some key benefits:

Lower Transaction Fees: One of the biggest advantages of cryptocurrency payments is the reduction in transaction fees. Credit card companies and payment processors like PayPal often charge merchants significant fees for each transaction (ranging from 2% to 5%). In contrast, cryptocurrency transactions typically have much lower fees, especially for cross-border payments, where traditional banking fees can be exorbitant.

Faster Transactions: Unlike traditional banking methods that can take several days to process (especially for international transfers), cryptocurrency transactions are usually completed within minutes. This speed is particularly beneficial for businesses that need to receive payments quickly, as well as individuals sending money across borders.

Security and Privacy: Cryptocurrency transactions are secured by blockchain Cryptocurrency Payment Process technology, which makes it difficult for hackers to alter or tamper with transaction records. Additionally, cryptocurrency payments offer more privacy compared to credit card payments, where personal information and payment details are often shared with third parties.

Global Accessibility: Cryptocurrency allows for borderless transactions, enabling people and businesses from anywhere in the world to send and receive payments without the need for intermediaries like banks. This is especially valuable for regions with limited access to traditional banking services or for cross-border e-commerce.

No Chargebacks: Unlike credit card transactions, where chargebacks can be initiated by the buyer, cryptocurrency payments are irreversible once confirmed on the blockchain. This can protect merchants from fraudulent chargeback claims, making cryptocurrency payments more secure for businesses.

Challenges of Cryptocurrency Payments

Despite the many advantages, there are still challenges to widespread adoption of cryptocurrency payments:

Price Volatility: Cryptocurrencies are known for their price volatility. Bitcoin, for example, has seen drastic price fluctuations over short periods of time. This makes it risky for merchants to accept cryptocurrency payments without immediate conversion to fiat currency, as the value of the cryptocurrency could drop significantly before they can use it.

Lack of Regulation: The cryptocurrency market remains largely unregulated, which creates uncertainty for businesses and consumers. Without clear legal guidelines, users may be hesitant to adopt cryptocurrencies for everyday payments. However, more governments are starting to develop regulations around cryptocurrency, which could reduce these concerns over time.

Technical Barriers: While cryptocurrency is becoming more user-friendly, there are still technical barriers for many people. Setting up a digital wallet, managing private keys, and understanding blockchain technology can be confusing for new users, potentially limiting the mass adoption of cryptocurrency payments.

Limited Acceptance: Despite growing interest in cryptocurrency, not all businesses accept it as a form of payment. While companies like Microsoft, Overstock, and Shopify have integrated cryptocurrency payments, widespread adoption among smaller businesses remains a challenge.

Cryptocurrency Payment Gateways

To make cryptocurrency payments easier for businesses, several payment gateways have emerged that simplify the process. These platforms allow merchants to accept cryptocurrency payments without having to deal directly with the complexities of wallets and blockchain technology. Popular cryptocurrency payment gateways include:

BitPay: One of the earliest and most well-known cryptocurrency payment processors, BitPay allows businesses to accept payments in Bitcoin and other cryptocurrencies and convert them into fiat currency.

CoinGate: CoinGate offers a variety of payment options, including Bitcoin, Ethereum, and Litecoin. It also provides an automatic conversion service, so merchants can receive payments in fiat currency if desired.

Coinbase Commerce: Part of the popular Coinbase exchange, Coinbase Commerce is a payment gateway that enables businesses to accept cryptocurrency payments directly in their wallets without the need for a third-party processor.

The Future of Cryptocurrency Payments

As cryptocurrency continues to evolve, its role in the global economy is likely to expand. More businesses are beginning to see the value in accepting digital currencies, and innovations in blockchain technology could further streamline the payment process. With the rise of stablecoins (cryptocurrencies that are pegged to the value of fiat currencies), the issue of price volatility may also be mitigated, making cryptocurrency payments even more appealing to businesses and consumers alike.

Additionally, central bank digital currencies (CBDCs), which are being developed by various governments, could integrate blockchain technology with the stability of government-backed currencies. This development could bring the benefits of cryptocurrency payments to a wider audience while maintaining regulatory oversight.

Conclusion

The cryptocurrency payment process represents a transformative shift in the way we conduct financial transactions. With its lower fees, faster processing times, enhanced security, and global accessibility, cryptocurrency has the potential to revolutionize the payment landscape for businesses and consumers alike. While challenges like volatility and regulation still need to be addressed, the growing acceptance of cryptocurrency payments signals that digital currencies are here to stay.

As the world becomes more digitally connected, cryptocurrency is poised to play a key role in the future of commerce, offering a new way for people to exchange value across borders with greater efficiency and fewer barriers.

0 notes

Text

Koala Wallet Extension

Koala Wallet’s emphasis on user control and security is one of its most notable characteristics. Users maintain ownership over their money and private keys with our non-custodial approach. As a result, users are able to fully own and control their cryptocurrency holdings. Ethereum (ETH), Kadena (KDA), and ERC20 tokens are among the several blockchains that Koala Wallet supports. In terms of managing their cryptocurrency assets, this gives customers a plethora of possibilities.

Download and Install Koala Wallet

To download and install Koala Wallet, you can follow these steps:

Download Koala Wallet For Android Users:

Open Google Play Store: Open the Google Play Store on your device to access the app store.

Search for Koala Wallet: Search for “Koala Wallet” in the search field and hit Enter.

Download the App: Find the correct application in the search results; it’s usually the first one. Click “Install.”

Open the App: After installation, hit the app’s icon to launch it from your home screen or app drawer.

Set Up the Wallet: To set up your Koala Wallet, follow the steps displayed on the screen. Creating a new wallet or importing an old one, choosing a robust password or PIN, and storing your recovery phrase are typically included in this.

Download Koala Wallet For iOS Users:

Open the App Store: Open the App Store on your iPad or iPhone.

Search for Koala Wallet: Launch the search by entering “Koala Wallet” into the search bar.

Download the App: From the search results, choose the app and click “Get” or “Install.”

Open the App: Once the app has been installed, tap its icon to launch it from your home screen.

Set Up the Wallet: Follow the in-app instructions to finish the setup, which include importing or creating a wallet, establishing a PIN, and safely storing up your recovery phrase.

Download Koala Wallet For Browser Extension:

Open Your Web Browser: To install the extension, open the web browser that you want to use. The browsers that Koala Wallet most likely supports are Chrome, Firefox, Brave, or Edge.

Visit the Official Extension Store: For Chrome or Brave, go to the Chrome Web Store.

For Firefox, visit the Firefox Add-ons Store. For Edge, visit the Microsoft Edge Add-ons Store.

Search for Koala Wallet: Go to the extension store and type “Koala Wallet” into the search field.

Download and Install: Look through the search results for the official Koala Wallet extension. Select “Add to Chrome/Firefox/Edge” or click “Install.”

Confirm Installation: To add the extension to your browser and confirm, follow the instructions.

Open the Extension: Once installed, the Koala Wallet extension can be used by clicking on its icon next to your browser’s address bar.

Set Up the Wallet: To import an existing wallet or create a new one, follow the on-screen directions. Create a strong PIN or password, and make a secure backup of your recovery phrase.

Start Using the Wallet: Once configured, your browser extension will allow you to directly manage how much cryptocurrency you have.

How to Send and Receive assets into Your Koala Wallet

Receiving

Each asset you have listed in Koala Wallet has its separate balance and comparable value displayed below your final balance on the main screen. To obtain an asset, first choose the desired asset from the list, then click the “Receive” option.

You will see a QR code representing that asset along with your address right away. Anyone you wish to receive something from can have your address and preferred chain or QR code shared with them. In a few seconds, the transaction will show up in your wallet once the assets have been delivered to your address.

You can choose which chain and how much you wish to receive by going to the Receive area of Kadena Assets. Any changes you make to those settings will update the QR code, causing a wallet to scan it and immediately apply those changes when handing you assets. In the end, it makes no difference whether the chain number is utilized to receive it; this feature is merely for added convenience when dividing your funds between chains.

Sending

Choose the asset you wish to send from the list and click the “Send” button after that.

Put the recipient’s address and chain in the fields at the top of the screen. Click the “Contacts” option and choose the recipient from Koala Wallet’s contacts if you have the recipient saved there. Press the “Scan” button to load the data from the recipient’s QR code, if you know it.

You can paste the receiver’s address in the recipient section if you received it as text. We advise against manually entering the address and instead utilizing the options listed above to prevent errors.

Make sure to choose the chain that the recipient needs to receive when transmitting Kadena assets. In order to prevent them from having trouble identifying the transaction, please get in touch with the beneficiary if they fail to notify you of the chain. When sending on blockchains other than Kade, this option is hidden.

Choose the chain you wish to send from on the bottom side of the screen. Your balance will be visible to you on each. To be able to send, you need to have enough balance on each individual chain. If the source and destination chains differ, Koala Wallet will take care of the appropriate conversions for you; you can learn more about that here. For blockchains other than Kadena, this option is hidden.

Lastly, input the amount you wish the recipient to receive. If Koala Wallet knows the price, it will display the corresponding dollar amount beneath it. In the event that you do not utilize the “Max” button, transaction costs will be deducted from the amount you have left.

When everything is ready, click “Continue” to view a summary of the transaction. Then, click “Confirm” to send the information after verifying with your PIN or biometric.

Conclusion

It’s crucial to have a trustworthy wallet like Koala Wallet as the cryptocurrency industry grows. Strong security features, support for several currencies, and an easy-to-use interface make it a reliable entry point into the fascinating and dynamic world of virtual currencies. Koala wallet is a great option for your digital wallet needs, whether you want to trade cryptocurrencies, keep your assets safely, or just learn more about the world of cryptocurrency.

0 notes

Text

How to set up a crypto wallet?

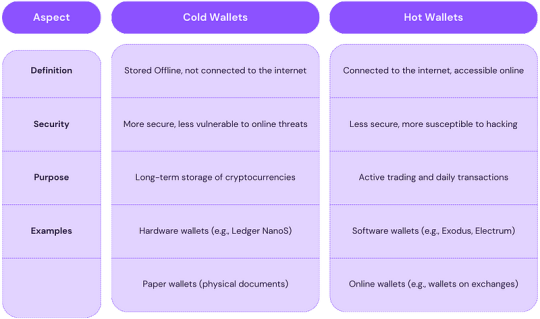

A Cryptocurrency Wallet is used to communicate with the Blockchain network. The three main types of crypto wallets are hardware wallets, software wallets and paper wallets. Based on their performance, they can be further classified as cold or hot wallets. Software-based wallets are more accessible and convenient, while hardware-based wallets are the most secure. Paper wallets are printed on paper and are now unreliable and outdated. In fact, cryptocurrency wallets do not store currency, but act as a means of communication with the Blockchain, i.e. create the necessary information to receive and send money through Blockchain transactions.

The data contains private and public key pairs. Based on those keys, an alphanumeric identifier called an address is created. Basically, it defines the address to which coins can be sent on the blockchain. The address can be shared for money, but the private keys must never be revealed. The private key can be used in any wallet to access cryptocurrency. As long as the private key is known, the money is available on any device. Also, coins are simply transferred from one address to another and never leave the Blockchain.

Why do we need wallets in cryptocurrency?

Crypto wallets are digital tools that keep your digital money safe and give you control over it. They store your private keys, which are like secret codes to securely access your cryptocurrencies. Wallets are important for security because you can send and receive money directly without a bank. They also make transactions quick and easy and at a lower cost than traditional banking services. Whether you use a computer, phone or physical device, wallets ensure your financial independence and privacy in the digital world.

Cryptocurrency Wallet Types

Hardware wallets

Hardware wallets are USB-like devices designed for secure offline cryptocurrency storage. They connect to computers via USB. These wallets offer high security by keeping private keys offline, reducing hacking risks. Popular models include Ledger Nano S and Trezor. While not as user-friendly as web or desktop wallets, they are more accessible than paper wallets. Despite some usability challenges for beginners, hardware wallets are a top choice for robust cryptocurrency protection.

Paper Wallets

A paper wallet is a physical document with a QR code for your cryptocurrency address and private key. They can be created offline, making them safe from hackers. However, they have significant flaws: you can’t send partial funds and the wallet can’t be reused safely. Paper wallets were popular for cold storage but have been largely replaced by more secure hardware wallets. With strict security measures, paper wallets can still be used effectively.

Desktop Wallets

Desktop wallets are apps on your computer for safely storing cryptocurrencies. They’re more secure now but need antivirus protection since they’re online. They’re safer than exchanges for storage.They’re the third safest way to keep crypto and are great for storing on a clean computer. Easy to use, they keep transactions private without involving third parties. Regular computer backups are crucial. Popular choices include Exodus, Bitcoin Core, and Electrum.

Mobile Wallets

Mobile wallets are like desktop wallets but designed for smartphones. They’re convenient for daily transactions using QR codes. But they can be vulnerable to malware, so encryption is crucial to protecting your assets.Mobile wallets are practical and ideal for on-the-go use, but they’re susceptible to viruses. Examples include Coinomi and Mycelium.

Web Wallets

Web wallets, accessed through internet browsers, store private keys online. They can face security risks like DDOS attacks. Hosted versions manage your keys, while non-hosted versions give you full control over your funds, but they’re less secure.Different from hot wallets, web wallets are suitable for small investments and quick transactions. Examples include MetaMask and Coinbase.

Custodial Wallets and Non-Custodial Wallets

Which Should You Choose?

Beginners: Custodial wallets are easier and provide support if you lose access.

Experienced Users: Non-custodial wallets give you more control and security.

How Does Crypto Wallets Work?

Cryptocurrency wallets are digital tools that handle your access to digital money using keys — think of them like passwords. Here’s how they work: When you create a wallet, it gives you a pair of keys. Your public key acts like an address where others can send you cryptocurrencies, while your private key is your secret code to manage and authorize transactions securely. The wallet doesn’t store your actual coins but these keys, which interact with the blockchain to access and control your funds. Wallets come in different types — software ones for computers or phones, hardware devices for extra security, and paper copies for offline safekeeping. Security is key, with wallets using encryption to protect your keys, and backup options like seed phrases to recover your wallet if needed. Understanding how wallets manage keys and connect with blockchain technology is crucial for safely using and managing your digital money.

Why do you need to protect your crypto wallet?

Security of Funds- Your wallet contains private keys that control access to your cryptocurrencies.

Prevention of Theft- Protecting your wallet prevents unauthorized access and potential theft of your digital assets.

Preserving Privacy- Securing your wallet maintains your financial privacy and prevents tracking of your transactions.

Avoiding Loss- Proper security measures and backups prevent the risk of losing access to your funds.

Compliance- Protecting your wallet helps you comply with legal and regulatory requirements.

Peace of Mind- Securing your wallet ensures you have control over your assets and can manage them confidently.

Crypto Wallet Security

Strong Passwords- Use complex passwords that are hard to guess.

Two-Factor Authentication (2FA)-Add an extra layer of security with 2FA for access.

Backup Safely- Keep backups of your wallet’s private keys or seed phrases offline.

Stay Updated- Keep your wallet software updated to get the latest security features.

Secure Networks- Avoid using public Wi-Fi for transactions; use secure, private networks.

Beware of Scams- Be cautious of phishing attempts and avoid clicking on suspicious links.

Consider Hardware Wallets- For extra security, use hardware wallets that store keys offline.

Monitor Activity: Regularly check your wallet for any unusual transactions.

What types of wallets does Nadcab Labs offer, and what services do they provide?

Nadcab Labs offers services for creating cryptocurrency wallets. They are a reputable company specializing in blockchain technology and provide comprehensive solutions for developing secure and user-friendly cryptocurrency wallets.

Services and Wallets Offered by Nadcab Labs -

Custom Wallet Development- Nadcab Labs designs and develops tailor-made wallet solutions to meet your specific requirements. Whether you need a simple wallet for a single cryptocurrency or a complex one that supports multiple currencies, they can create it for you.

Multi-Currency Wallets- They develop wallets that can support a wide range of cryptocurrencies, allowing you to manage different digital assets in one place. This is particularly useful for users who invest in or use multiple types of cryptocurrencies.

Security Features- Security is a top priority for Nadcab Labs. They implement advanced security measures to protect your digital assets. These features can include multi-signature support, biometric authentication (like fingerprint or facial recognition), two-factor authentication (2FA), and encryption techniques to ensure your wallet is safe from unauthorized access and hacking attempts.

Mobile & Web Wallets- Nadcab Labs creates user-friendly mobile applications for both iOS and Android platforms, making it easy to manage your cryptocurrencies on the go. They also develop web-based wallets that can be accessed through any web browser, providing flexibility and convenience for users.

Integration Services- They offer services to integrate the cryptocurrency wallet with your existing systems, whether it’s an e-commerce platform, payment gateway, or any other application. This seamless integration helps in managing transactions efficiently and enhances the user experience.

UI/UX Design- Nadcab Labs focuses on creating an intuitive and attractive user interface and user experience, ensuring that even users who are new to cryptocurrencies can easily navigate and use the wallet.

Backup and Recovery Solutions-They provide robust backup and recovery options to ensure you can restore your wallet in case of data loss or device failure. This often includes features like mnemonic seed phrases and encrypted backups.

Ongoing Support and Maintenance-After the wallet is developed, Nadcab Labs offers ongoing support and maintenance services to ensure the wallet remains updated with the latest security patches and feature enhancements.

Author Profile:

Siddharth Kanojia work at Nadcab Labs, helping businesses succeed online. He uses SEO strategies to make sure companies show up easily when people search the internet. He uses new technology like blockchain to help businesses grow. At Nadcab Labs, our goal is to help businesses get noticed and do well in the digital world with smart digital marketing and innovative solutions.

Twitter — twitter.com/nadcablabs

LinkedIn — linkedin.com/company/nadcablabs

Facebook — facebook.com/nadcablabs

Instagram — instagram.com/nadcablabs

Spotify — spotify.com/nadcablabs

YouTube — www.youtube.com/@nadcablabs

0 notes

Text

How Digital Credential Verification Works: Technology Behind the Trust

In a world where information moves at lightning speed, the need for trustworthy, tamper-proof credentials is more critical than ever. Whether it’s diplomas, professional certifications, or employee IDs, organizations and individuals increasingly rely on digital credential verification to prove qualifications and identity securely.

This article explores how digital credential verification works, the core technologies behind it, and why verifiable credentials are becoming the gold standard for proving legitimacy in the digital era.

🔍 What Are Verifiable Credentials?

Verifiable credentials are digital representations of traditional credentials (like a diploma or certificate) that can be issued, shared, and verified online. Unlike PDFs or images that are easy to forge, verifiable credentials are cryptographically signed, tamper-evident, and verifiable by any trusted party.

They follow standards like the W3C Verifiable Credentials Data Model, which ensures global compatibility and interoperability.

🧠 The Need for Digital Credential Verification

Before diving into the tech, it’s important to understand the problem: traditional credentials are hard to verify at scale. Recruiters, academic institutions, and regulatory bodies often rely on time-consuming phone calls or email confirmations to validate a candidate’s claims.

Digital credential verification solves this by enabling instant, automated, and reliable verification.

🔐 How Does Digital Credential Verification Work?

Let’s break it down into three main components:

1. Issuance of Verifiable Credentials

An issuer (e.g., a university, company, or certifying body) generates a digital credential and signs it cryptographically. This credential includes:

The recipient’s details (subject)

The type of credential (e.g., “Bachelor’s in Computer Science”)

The date of issue and expiry

The issuer’s digital signature

The credential is then shared with the recipient, who stores it in a digital wallet (an app or secure cloud storage).

2. Presentation of Credentials

When the recipient (called the holder) needs to prove their qualification — say, during a job application — they can present the credential to a verifier (e.g., an employer). This is done digitally, often with a QR code or secure link.

The verifier doesn’t need to contact the issuer directly. Instead, they can check the credential’s validity instantly using technology.

3. Verification Process

The verifier uses software or platforms that:

Validate the issuer’s digital signature (proving it was really issued by a legitimate organization)

Check for tampering (ensuring the data hasn’t been changed)

Confirm revocation status (verifying that the credential hasn’t been canceled or expired)

All of this happens in seconds, thanks to the use of public key infrastructure (PKI), blockchain, or decentralized identifiers (DIDs), depending on the system architecture.

🛠️ Core Technologies Behind Verifiable Credentials

✅ Blockchain

A tamper-proof ledger that stores credential metadata and helps verify authenticity without relying on a central authority.

✅ Decentralized Identifiers (DIDs)

Unique identifiers that allow entities (people, organizations, or devices) to be identified without centralized registries.

✅ Public Key Infrastructure (PKI)

A cryptographic system that uses public-private key pairs to secure and verify data.

✅ Digital Wallets

Secure apps or cloud-based tools where users store and manage their verifiable credentials.

🎓 Use Cases of Digital Credential Verification

Education: Universities issue degrees that employers can verify instantly.

Recruitment: Employers validate certifications and experience claims without manual follow-up.

Healthcare: Doctors and nurses prove licensure across jurisdictions.

Government Services: Citizens prove identity and qualifications for visas, benefits, and more.

🧩 Benefits of Digital Credential Verification

Speed: Verify credentials in seconds, not days.

Security: Cryptographically signed and tamper-evident.

Privacy: Users control who sees their data.

Scalability: Works across institutions, borders, and industries.

🔮 The Future of Trust Is Digital

As we move into a more interconnected and remote world, verifiable credentials and digital credential verification will play a vital role in building trust online. From education to employment, the ability to instantly and securely verify someone’s qualifications will streamline processes, reduce fraud, and empower individuals to take control of their credentials.

The technology is here. The trust is digital. The future is now.

0 notes

Text

How to Open a Crypto Wallet: Types of Wallets and How to Create One

Cryptocurrency is one of the ways to save funds during unstable times in the financial market. Moreover, it is an alternative way to carry out various transactions and receive payments from any point in the world, regardless of sanctions and various restrictions. After all, cryptocurrency is not controlled by banks, the state, or specific companies. Let’s figure out the types of crypto wallets, how to create a crypto wallet, and carry out various operations with its help.

What is a Crypto Wallet and Why is it Needed?

A crypto wallet is a service or special program that allows you to store, exchange, trade, and perform various operations with cryptocurrency. To create a crypto wallet, you need to register on a platform/site/cryptocurrency exchange or another resource. You will be issued a cryptographic code in the form of public and private keys that ensure the security of funds.

It functions according to the principle of an ordinary wallet, allowing you to store and spend digital coins and tokens. However, it is essential to understand that it contains data about the keys, and the cryptocurrency itself is stored in the blockchain.

Types of Crypto Wallets