#blocksize

Explore tagged Tumblr posts

Text

youtube

The Insane World of Bitcoin (Part 2)

The insane world of Bitcoin and cryptocurrencies has only become more complex and intriguing with time. But underlying the hype are serious problems and questions that are important to understand, especially if Bitcoin were to gain mass adoption...

#youtube#bitcoin#crypto#crypto scam#scam#crypto currency#financial#financial scams#token#blockchain#insane#ponzi scheme#blocksize war#bitcoin whales

1 note

·

View note

Text

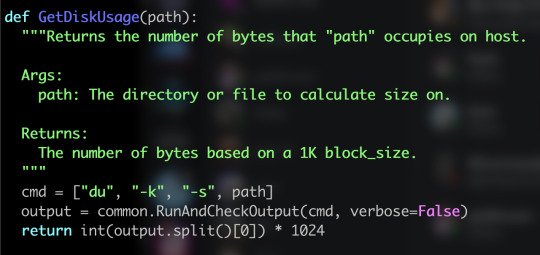

Android's so cool they forgot about disk compression... and just non-1k blocksizes at all 🤔

3 notes

·

View notes

Text

package main

import (

"bytes"

"crypto/aes"

"crypto/cipher"

"crypto/md5"

"crypto/sha256"

"encoding/base64"

"fmt"

"io"

)

/*

There are three encryption algorithms, RSA AES SHA. but there are not same logic. there are three different encrypted logic.

1.symmetrical encryption

like AES

2.asymmetric encryption

like rsa

3.Data fingerprint

like md5 sha

golang provide go-crypto package to do this.

"crypto/aes"

"crypto/rsa"

"crypto/sha"

"crypto/md5"

*/

func AesEncrypt(orig string, key string) string {

origData := []byte(orig)

k := []byte(key)

block, _ := aes.NewCipher(k)

blockSize := block.BlockSize()

origData = PKCS7Padding(origData, blockSize)

blockMode := cipher.NewCBCEncrypter(block, k[:blockSize])

cryted := make([]byte, len(origData))

blockMode.CryptBlocks(cryted, origData)

return base64.StdEncoding.EncodeToString(cryted)

}

func AesDecrypt(cryted string, key string) string {

crytedByte, _ := base64.StdEncoding.DecodeString(cryted)

k := []byte(key)

block, _ := aes.NewCipher(k)

blockSize := block.BlockSize()

blockMode := cipher.NewCBCDecrypter(block, k[:blockSize])

orig := make([]byte, len(crytedByte))

blockMode.CryptBlocks(orig, crytedByte)

orig = PKCS7UnPadding(orig)

return string(orig)

}

func PKCS7Padding(ciphertext []byte, blocksize int) []byte {

padding := blocksize - len(ciphertext)%blocksize

padtext := bytes.Repeat([]byte{byte(padding)}, padding)

return append(ciphertext, padtext...)

}

func PKCS7UnPadding(origData []byte) []byte {

length := len(origData)

unpadding := int(origData[length-1])

return origData[:(length - unpadding)]

}

func use_md5() {

h := md5.New()

io.WriteString(h, "md5 encrypt test!")

fmt.Printf("%x\n", h.Sum(nil))

fmt.Printf("%X\n", h.Sum(nil))

}

func use_sha() {

h := sha256.New()

h.Write([]byte("sha256 encrypt test!"))

fmt.Printf("%x\n", h.Sum(nil))

fmt.Printf("%X\n", h.Sum(nil))

}

func main() {

orig := "hello world"

key := "123456781234567812345678"

fmt.Println("encrypt begin:", orig)

encryptCode := AesEncrypt(orig, key)

fmt.Println("encrypt end:", encryptCode)

decryptCode := AesDecrypt(encryptCode, key)

fmt.Println("decode:", decryptCode)

use_md5()

use_sha()

}

1 note

·

View note

Link

The 2015 Spam Attacks: Lessons in Bitcoin’s Resilience and Debate In the summer of 2015, Bitcoin faced a series of disruptive spam attacks that tested the network’s resilience and reignited debates over its future. These attacks, orchestrated by #Blockchain #Crypto

0 notes

Text

Block size là gì? Thông tin về kích thước khối trong blockchain

Blogtrading sẽ cung cấp đến các trader thông tin phân loại, đặc điểm nổi bật, vai trò, ảnh hưởng, ứng dụng của blocksize…, chi tiết liên hệ tại: https://blogtrading.net/block-size-la-gi/ Hastag: #blogtrading #sangiaodichtienforex #dangkysangiaodich #blocksize

0 notes

Text

Linux CLI 29 🐧 fsck, mkfs and dd commands

New Post has been published on https://tuts.kandz.me/linux-cli-29-%f0%9f%90%a7-fsck-mkfs-and-dd-commands/

Linux CLI 29 🐧 fsck, mkfs and dd commands

youtube

a - fsck command fsck is used to verify the intergrity of a file system It checks for error( corrupted inodes, bad sectors, or broken file system structures) It can attempt to fix those errors before you check a filesystem you have to unmount it with umount sudo fsck -N /dev/sda → displays what it will do without doing anything sudo fsck /dev/sda → performs the check sudo fsck -n /dev/sda → perform a check but do not repair sudo fsck -f /dev/sda → forces a check -a → repairs errors automatically -v → verbose mode -t → test for bad sectors b - mkfs command mkfs → Make File System mkfs is used to create and format file systems write sudo mkfs and use TAB key to show the supported filesystem types Create a file system on a partition sudo mkfs -t ext4 /dev/sda or sudo mkfs.ext4 /dev/sda Note that mkfs creates a new filesystem on existing partition or drive It does not resize or delete it. For this task you can use fdisk c - dd command dd → Data description dd is used to copy and convert data from one place to another syntax → dd if=inputfile [bs=blocksize] [count=numcopies] Of=outputfile if → input file, where to read data from bs → sets the block size, default is 512 bytes (optional) count → specifies how many blocks will be transferred. All is default (optional) of → output file, where the data will be transferred to d - dd command examples dd If=input.txt Of=backup.txt → copy a file dd If=/dev/sda bs=4M count=10240 of=image.img → create an image file from /dev/sda dd If=/dev/sda Of=/dev/sdc → clone a disk to another dd if=/dev/sda1 of=~/sda1partition.img → backup a partition dd if=sda1partition.img of=/dev/sda1 → restore the previous backup and if you need to create an CD-ROM ISO dd if=/dev/cdrom of=tgsservice.iso bs=2048

0 notes

Text

SINAMICS S120- An Enhanced Automation Solution

The modular solution for high-performance motion control applications in the building of industrial plants and machines is the SINAMICS S120 drive. Tailored solutions can be executed through various elements and features that are best synchronized. For example, servo or vector capabilities in coordinated drives and high-performance single-motor drives (multi-axis applications). The SINAMICS S120 drive is a system that provides increased productivity, flexibility, and performance for its users.

Overview of Strengths:

Enhanced machine performance is possible with SINAMICS S120, regardless of whether the application calls for continuous material webs or cyclic, highly dynamic processes. These industries include packaging and printing machines, machines for processing plastics, textiles, paper, and wood, cranes and hoisting gear, handling and assembly systems, machine tools, rolling mills, test beds, and machines in the renewable energy sector.

Universal:

Power and control performance can be freely combined thanks to SINAMICS S120's architecture.

Centralized control intelligence enables greater flexibility.

Free performance selection for vector and servo control

Precise:

reduced lifecycle expenses for the plant's operation.

With the Totally Integrated Automation (TIA) engineering platform, all components may be parameterized, programmed, and commissioned without causing any disruptions to the system.

The primary functionality is implemented with elaborate “embedded” software.

Universal, standardized safety concept – Safety Integrated

STO, SBC, SS1, SS2, SOS, SLS, SDI, SSM, SLP, SP, and SBT are examples of integrated safety functions.

smooth execution of safety features in compliance with PL d (EN ISO 13840-1) and SIL 2 (EN 61508)

System Overview:

High-performance applications can be served by a modular system like the SINAMICS S120 drive system. For multi-axis applications, it provides coordinated DC/AC drives as well as single AC/AC drives. On the other hand, modular plant and machine concepts are also available in a distributed version.

Types of construction – Advanced single- and multi-axis applications using modular drive systems.

Blocksize (AC/AC):

The SINAMICS S120 Blocksize (AC/AC) is a high-performance frequency converter, often known as a servo drive, that consists of a power module and control unit. Its power range is very wide, ranging from 0.55 kW to 250 kW.

Blocksize (DC/AC):

The booksize-format SINAMICS S120 (DC/AC) converter or servo drive is made up of a control unit, an infeed, and a motor module. It can produce power in the range of 1.6 kW to 107 kW.

Chasis (DC/AC):

The SINAMICS S120 DC/AC Chasis is a high-performance frequency converter, often known as a servo drive, that is comprised of a motor module, infeed, and control unit. Its power range is incredibly wide, spanning from 110 kW to 6840 kW.

Chasis (AC/AC):

The SINAMICS S120 Chasis (AC/AC) is a high-performance frequency converter that includes a motor module, infeed, and control unit within the chassis. It can handle power levels between 110 and 250 kW.

SINAMICS Cabinet Modules:

SINAMICS S120 Cabinet Modules-2 are control cabinets that are ready to connect and have undergone type testing. They are designed to maximize the benefits of the SINAMICS S120 Chasis 2 built-in units and are suitable for all customer solutions. 4.8 kW to 5700 kW is the power range.

SINAMICS S120 CM Application Marine Drive:

SINAMICS S120 Cabinet Modules- Custom cabinets with all the benefits of the S120 CM standard system, designed for the marine industry. Power spectrum: 560 kW–5700 kW.

Distributed servo drive S120M:

Compact and ready to connect, the distributed SINAMICS S120M drive unit consists of an integrated power unit (Motor Module) and a synchronous servo motor with multi-turn absolute encoder. Range of power: 0.25 kW to 1.1 kW.

To summarize, the robust SINAMICS S120 AC Drive has been produced as an adaptable solution to a huge range of industrial purposes, including those based on harsh operating environments. One reason for this is the modular nature of its design, which combines maximum flexibility with state-of-the-art control features to meet stringent power consumption targets while adapting easily to changing demands. Therefore, by incorporating SINAMICS S120 into your automation plant, you will be able to improve running costs in the short term and protect yourself from technological obsolescence in the future. Encompass the brilliance of Siemens engineering through SINAMICS S120 for limitless productivity and creativity.

For more information visit here

#sinamics s120#siemens servo drive s120#sinamics s120 modular high performance drives#Siemens Automation Products#Siemens#Siemens Industrial Automation

0 notes

Link

0 notes

Text

30.3. 개발환경 프레임워크 쿠다(CUDA)에서의 미래 예측 및 전망

개발환경 프레임워크 쿠다(CUDA)의 향후 업데이트 예측

쿠다(CUDA)는 NVIDIA에서 개발한 병렬 컴퓨팅 플랫폼 및 프로그래밍 모델로, GPU를 사용하여 고성능 연산을 수행할 수 있게 해줍니다. 쿠다는 현재도 지속적으로 업데이트되고 있으며, 향후에도 더 많은 기능과 성능 향상이 기대됩니다. 쿠다의 향후 업데이트 예측 중 하나는 더 많은 최적화와 효율성을 위한 기능 강화일 것입니다. 더 빠른 연산을 위한 새로운 알고리즘 및 기술이 도입될 것으로 예상됩니다. 또한, 머신 러닝 및 딥 러닝 분야에서의 쿠다 활용을 위한 라이브러리와 도구들이 더욱 발전할 것으로 예상됩니다. 예를 들어, 향후 쿠다 업데이트에서는 더욱 효율적인 메모리 관리를 위한 기능이 추가될 수 있습니다. 메모리 할당 및 해제 과정에서 발생하는 오버헤드를 줄이고, 메모리 사용량을 최적화하는 방법들이 개선될 것으로 예상됩니다. #include #include int main() { int *d_data; cudaMalloc(&d_data, sizeof(int) * 10); // Perform operations using d_data cudaFree(d_data); return 0; }

개발환경 프레임워크 쿠다(CUDA)에서의 미래 테크놀로지 변화 예상

쿠다(CUDA)는 GPU 컴퓨팅을 위한 프레임워크로, 미래에는 더욱 발전된 기술과 기능을 통해 더 많은 혁신을 이룰 것으로 예상됩니다. 여러 가지 테크놀로지 변화가 예상되며, 그 중 일부를 살펴보겠습니다. 첫째로, 쿠다에서는 머신러닝 및 딥러닝 분야에서의 활용이 더욱 강화될 것으로 예상됩니다. 더 높은 성능과 효율성을 위한 최적화된 알고리즘 및 라이브러리가 개발될 것이며, 이를 통해 더욱 복잡한 모델을 학습하고 처리할 수 있을 것입니다. 둘째로, 쿠다에서는 실시간 렌더링 및 시각화 기술이 발전할 것으로 예상됩니다. 더 높은 해상도와 성능을 제공하는 그래픽 카드를 활용하여 더 생생하고 현실적인 시각화를 구현할 수 있을 것입니다. 예제 코드: #include #include __global__ void matrixMultiplication(int *a, int *b, int *c, int N) { int row = blockIdx.y * blockDim.y + threadIdx.y; int col = blockIdx.x * blockDim.x + threadIdx.x; if (row < N && col < N) { int sum = 0; for (int i = 0; i < N; i++) { sum += a * b; } c = sum; } } int main() { int N = 4; int *a, *b, *c; int *d_a, *d_b, *d_c; // 메모리 할당 및 초기화 // CUDA 메모리 할당 // 데이터 복사 dim3 blockSize(2, 2); dim3 gridSize((N + blockSize.x - 1) / blockSize.x, (N + blockSize.y - 1) / blockSize.y); matrixMultiplication(d_a, d_b, d_c, N); // 결과 복사 및 출력 return 0; }

개발환경 프레임워크 쿠다(CUDA)에서의 시장 성장 전망

CUDA(Compute Unified Device Architecture)는 GPU(Graphics Processing Unit)를 이용한 병렬 컴퓨팅을 위한 프레임워크로, 고성능 연산을 수행하는 데 사용됩니다. 현재 시장에서 CUDA는 높은 성능과 효율성으로 인해 인기를 얻고 있으며, 앞으로의 성장 전망도 밝습니다. CUDA의 시장 성장 전망은 주로 빅데이터, 인공지능, 딥러닝, 과학 및 엔지니어링 분야에서의 활용이 늘어나는 추세에 기반합니다. 이러한 분야에서는 대규모 데이터 처리와 복잡한 계산이 필요한데, CUDA는 이러한 요구사항을 충족시키는 데 탁월한 성능을 발휘합니다. 또한, CUDA를 활용한 개발 환경은 지속적으로 발전하고 있어, 더 많은 기업과 연구 기관에서 채택될 것으로 예상됩니다. CUDA를 사용한 예제 코드를 살펴보면, 아래와 같이 간단한 벡터 덧셈 연산을 수행하는 코드가 있습니다. 이 코드는 CUDA의 병렬 처리 능력을 활용하여 벡터의 각 요소를 동시에 더하는 방식으로 작동합니다. #include __global__ void vectorAdd(int *a, int *b, int *c, int n) { int i = blockIdx.x * blockDim.x + threadIdx.x; if (i < n) { c = a + b; } } int main() { int n = 1000; int *a, *b, *c; int *d_a, *d_b, *d_c; // 메모리 할당 및 초기화 // CUDA 커널 호출 // 결과 출력 return 0; }

개발환경 프레임워크 쿠다(CUDA)에서의 미래 사용자 수 예측

CUDA는 병렬 컴퓨팅을 위한 프레임워크로, GPU를 이용하여 ���른 연산을 수행할 수 있습니다. 미래에 CUDA를 사용하는 사용자 수는 계속해서 증가할 것으로 예측됩니다. GPU 기술의 발전과 함께 CUDA의 활용 범위가 더욱 확대될 것으로 보이기 때문입니다. CUDA의 미래 사용자 수를 예측하기 위해서는 현재의 추세를 고려하고 기술적인 발전을 예측해야 합니다. GPU 기술이 더욱 발전하고, 인공지능, 빅데이터, 과학 연구 등 다양한 분야에서 CUDA를 활용하는 추세가 강화될 것으로 예상됩니다. 따라서 CUDA의 사용자 수는 계속해서 증가할 것으로 예측됩니다. 예제 코드: #include #include __global__ void kernel() { // CUDA 커널 함수 정의 printf("Hello, CUDA!n"); } int main() { // CUDA 커널 실행 kernel(); cudaDeviceSynchronize(); return 0; }

개발환경 프레임워크 쿠다(CUDA)에서의 미래 기업 활용도 전망

쿠다(CUDA)는 NVIDIA에서 개발한 병렬 컴퓨팅 플랫폼으로, GPU를 사용하여 고성능 연산을 수행할 수 있게 해주는 프레임워크입니다. 쿠다는 주로 과학 및 엔지니어링 분야에서 병렬 처리를 통해 연산 성능을 향상시키는 데 활용됩니다. 미래에는 기업들이 쿠다를 활용하여 더욱 복잡하고 대용량의 데이터를 처리하고 더 빠른 속도로 결과를 얻는 데 활용할 것으로 전망됩니다. 쿠다를 기업 환경에서 활용하는 예시로는 빅데이터 분석, 인공지능 및 기계 학습, 그래픽 처리 등이 있습니다. 이를 통해 기업은 더 빠른 의사 결정과 혁신적인 제품 및 서비스를 개발할 수 있게 될 것입니다. 아래는 간단한 쿠다 예제 코드입니다. 이 예제는 두 벡터의 합을 계산하는 간단한 벡터 덧셈 연산을 보여줍니다. #include #include __global__ void vectorAdd(int *a, int *b, int *c, int n) { int index = threadIdx.x + blockIdx.x * blockDim.x; if (index < n) { c = a + b; } } int main() { int n = 1000; int *a, *b, *c; int *d_a, *d_b, *d_c; // 메모리 할당 및 초기화 cudaMalloc(&d_a, n * sizeof(int)); cudaMalloc(&d_b, n * sizeof(int)); cudaMalloc(&d_c, n * sizeof(int)); // 데이터 복사 cudaMemcpy(d_a, a, n * sizeof(int), cudaMemcpyHostToDevice); cudaMemcpy(d_b, b, n * sizeof(int), cudaMemcpyHostToDevice); // 커널 실행 vectorAdd(d_a, d_b, d_c, n); // 결과 복사 cudaMemcpy(c, d_c, n * sizeof(int), cudaMemcpyDeviceToHost); // 메모리 해제 cudaFree(d_a); cudaFree(d_b); cudaFree(d_c); return 0; } Read the full article

1 note

·

View note

Link

The blocksize conflict marked a pivotal chapter in Bitcoin’s nascent historical past, illuminating the power of node operators to face up to systemic modifications that would undermine the community’s foundational rules of decentralization and censorship resistance. On the crux of the controversy was the problem of scaling Bitcoin to accommodate rising transaction volumes. Whereas one camp advocated sacrificing a level of decentralization via a block dimension enhance, their opponents maintained that the price to Bitcoin’s core ethos was untenable. The following impasse culminated in a contentious change, Segregated Witness (SegWit). By restructuring how transactions are saved, SegWit supplied a reasonable capability enhance whereas additionally fixing the transaction malleability difficulty that had hindered superior performance. SegWit underscores the resilience of Bitcoin’s governance mannequin in upholding its core values amidst inner strife. The deliberations stay extremely related as the talk continues on methods to scale Bitcoin whereas respecting the decentralization and censorship resistance properties that empower its customers.“Malleability is a problem for developers and users who want to reference a previous transaction in a new spending transaction before the previous transaction has been confirmed on the blockchain. This problem arises because, in order to spend bitcoin created by a previous transaction, the spending transaction must reference the txid of the previous transaction. If this txid can change, the reference will fail, and the spending transaction will be rendered invalid. Specifically, transaction malleability was a problem preventing the adoption of the Lightning Network, which relies on the exchange of unconfirmed Bitcoin transactions.”The activation of SegWit was a pivotal precursor to the event of the Lightning Community, a layered protocol resolution that allows speedy Bitcoin funds. By settling transactions off-chain and solely broadcasting opening/closing balances to the Bitcoin base layer, the Lightning Community goals to bolster Bitcoin’s scalability and transaction capability with out compromising its core safety mannequin. Since its inception, Lightning has witnessed exceptional progress as a fee rail, permitting for immediate micropayments that spotlight Bitcoin’s viability as an environment friendly medium of change. As Lightning continues to mature, it supplies a real-world take a look at case for layered scaling options that will form Bitcoin’s technological roadmap in reconciling its objectives of censorship resistance, decentralized safety, and mainstream fee utility.A key lesson that emerged from Bitcoin’s early scaling debates is the understanding that “Bitcoin scales in layers.” This design philosophy acknowledges that Bitcoin’s base layer serves as a safe, decentralized basis for supporting higher-layer protocols that increase performance and transaction capability. By leveraging the bottom layer as a belief anchor, revolutionary options may be developed to enhance Bitcoin’s scalability and utilization with out compromising its core values of decentralization and censorship resistance. As Bitcoin matures, the layered scaling mannequin goals to fulfill the objectives of mainstream utility and fee effectivity whereas respecting the consensus-driven governance and safety assurances afforded by its permissionless structure. With continued technical progress, layer-two improvements might present a pathway for Bitcoin to succeed in a worldwide scale whereas upholding its foundational rules.Whereas the “Bitcoin scales in layers” paradigm was a constructive conceptual step, some have interpreted it dogmatically as an excuse for the overall ossification of Bitcoin’s base layer. Pushed by an overzealous want to reduce threat and protect Bitcoin as a pristine retailer of worth, they argue that no modifications ought to ever once more be made to the underlying protocol. Nonetheless, this excessive place overlooks nuances and unintended penalties. Strictly confining performance expansions to increased layers might finally undermine Bitcoin’s self-sovereignty and censorship resistance – qualities deeply valued by its customers in the present day. As transaction charges and congestion on the bottom layer enhance over time, solely wealthier entities might be able to afford instantly interfacing with the bottom layer, centralizing on a regular basis customers onto custodial options. Whereas warning and conservative progress are prudent, mindlessly rejecting any base layer enhancement out of paranoia dangers inadvertently centralizing Bitcoin over the long run and disempowering common customers. Tradeoffs exist between scaling ambition and technical stability, however reflexive ossification fails to have interaction in nuanced cost-benefit evaluation of proposals that will judiciously enhance person expertise with out sacrificing decentralization.Bitcoin’s core worth proposition stems from its means to supply customers true self-sovereignty and censorship resistance. By design, Bitcoin empowers customers with impartial management of their funds, eliminating reliance on exterior third events like banks or governments for transaction validation or custodianship. Customers can really personal their bitcoin, holding personal keys that make funds irreversible and impervious to interference. This establishes Bitcoin as the primary permissionless and politically impartial financial system, upholding monetary autonomy no matter nationality or institutional standing. In distinction to conventional finance, no centralized authority can simply freeze, seize, or block funds on the Bitcoin community. These interlinked attributes foster decentralization and mitigate systemic dangers, as Bitcoin has no single level of failure and is resilient even in adversarial environments. Now not should customers place absolute belief in exterior establishments to have interaction in finance – Bitcoin permits direct peer-to-peer digital money on a worldwide scale. The oft-cited chorus “Not your keys, not your coins” neatly encapsulates Bitcoin’s provision of self-sovereignty, censorship resistance, and escape from permissioned techniques.As Bitcoin positive factors wider adoption, there arises financial constraints round scaling capability to satisfy rising transactional demand. Bitcoin’s block area is inherently restricted, higher utilization creates extra competitors for this scarce useful resource. Fundamental supply-demand dynamics point out that charges would unpredictably admire as international utilization grows, pricing out smaller transactions. Whereas initially absorbable, sustained payment progress has externality results that impression Bitcoin’s accessibility and ethos. Exorbitant charges make on-chain transactions unviable for normal customers, forcing migration to custodial providers opposite to Bitcoin’s premise of self-sovereignty.To cite Anthony Cities in his piece: PUTTING THE B IN BTC“the headroom there isn’t unlimited — expect it to show up as fee pressure and backlogs and less ability to quickly resolve transaction storms. And that will in turn make it hard and expensive for people with small stacks to continue to do self-custody on the main chain. At that point, acquiring new high value users means pricing out existing low value users.”To cite James O’Beirne in his piece: Ideas on scaling and consensus modifications“The quiet part out loud here is that by the time 1 billion people want to use bitcoin, the main chain is very expensive to transact on. Note that I say “very expensive” and never “impossibly expensive,” as a result of if customers lose the power to take some type of layer 1 bodily custody, bitcoin is simply gold with much less friction: a paper market will develop and all the good properties of bitcoin will diminish”Lastly, the immortal Hal Finney mentioned this again in 2010“Actually there is a very good reason for Bitcoin-backed banks to exist, issuing their own digital cash currency, redeemable for bitcoins. Bitcoin itself cannot scale to have every single financial transaction in the world be broadcast to everyone and included in the block chain. There needs to be a secondary level of payment systems which is lighter weight and more efficient. Likewise, the time needed for Bitcoin transactions to finalize will be impractical for medium to large value purchases.Bitcoin backed banks will solve these problems. They can work like banks did before nationalization of currency. Different banks can have different policies, some more aggressive, some more conservative. Some would be fractional reserve while others may be 100% Bitcoin backed. Interest rates may vary. Cash from some banks may trade at a discount to that from others.George Selgin has worked out the theory of competitive free banking in detail, and he argues that such a system would be stable, inflation resistant and self-regulating.I believe this will be the ultimate fate of Bitcoin, to be the “high-powered money” that serves as a reserve foreign money for banks that difficulty their very own digital money. Most Bitcoin transactions will happen between banks, to settle web transfers. Bitcoin transactions by personal people will probably be as uncommon as… effectively, as Bitcoin based mostly purchases are in the present day.”The decision of this urgent financial dilemma stays shrouded in uncertainty. Whereas we might unearth revolutionary technical engineering options, it's equally believable that this predicament is rooted in a foundational and inescapable financial constraint—a veritable fixed that necessitates acknowledgment and adaptation in any respect echelons. It's crucial to brace ourselves for the prospect that sure financial trade-offs and limitations are inherently woven into the material of our established system. If we're to embrace custodianship as an inevitability, our foremost responsibility is to diligently impose stringent constraints upon custodians, successfully curbing dangers whereas nurturing an ecosystem ripe with constructive free-market financial incentives. Moreover, they have to fortify themselves in opposition to the encroachment of state authority, preserving their autonomy to make sure unfettered participation in an unbridled free market.Irrespective of 1’s stance on the scalability of self-custody or the inevitability of custodianship, it's paramount to ardently oppose the phenomenon of ossification for as protracted a interval as potential. The paramount lesson gleaned from the crucible of the blocksize conflict is that the growth of Bitcoin necessitates enhancements at its foundational degree. The arrival of the Lightning Community, a transformative growth, would have remained a pipe dream had it not been for the important improve to Segregated Witness (SegWit). This underscores a vital correlation: the efficacy of secondary layers is inextricably tied to the efficacy of the bedrock base layer protocol. Bitcoin’s evolution should persist if we aspire to realize the scalability of self-custody and the imposition of constraints upon custodians, with a steadfast dedication to free-market incentives and the fortitude to face up to state coercion via sturdy censorship resistance.Enable me to make clear that my stance doesn't advocate for the endorsement of reckless habits nor the indiscriminate implementation of each proposed change. Fairly, we should always undertake a stance of utmost warning, rigorously analyzing every proposal with meticulous scrutiny. Our overarching mindset ought to revolve across the query of methods to modify components that we could also be hesitant to change however acknowledge as crucial. The linchpin of this method lies in fostering an setting of candid and constructive discourse inside our group. Sadly, the presence of actors with in poor health intentions, accompanied by their misleading advertising methods, poses a considerable hindrance to our growth endeavors. They not solely devour our helpful time but in addition divert the eye of these genuinely in search of data. It's incumbent upon us to actively contribute to the creation of genuine areas the place significant discussions can unfold, and people can interact in steady studying.It’s potential that my argument for the need of change in Bitcoin has not but persuaded you. It's possible you'll maintain the idea that the present state of affairs is passable and that any challenges encountered in the course of the scaling course of are outweighed by the potential dangers related to unknown uncertainties. Your perspective is legitimate, for if a vital mass shares your viewpoint, we might certainly have already arrived at a degree of protocol ossification, and we should adapt to this actuality accordingly.The continuing narrative of Bitcoin stays an unfolding story. As this groundbreaking financial innovation continues to mature, its exact trajectory stays an enigma, formed by a mess of unpredictable and numerous influences. Whereas Bitcoin’s decentralized construction precludes any single entity from wielding absolute management, the people working nodes wield vital sway over its course. Their values, philosophies, and visions for Bitcoin’s future will inevitably depart their mark on the protocols and techniques they select to embrace. What lies forward for Bitcoin is a story but to be written, and solely time will reveal the route it in the end takes.Supply: https://bitcoinmagazine.com/technical/coming-to-terms-with-the-economic-reality-of-scaling

0 notes

Text

Analyst: Bitcoin Developers Can Change Supply Limit, Miners Unlikely To Agree

Bitcoin developers have the ability to remove the 21-million supply limit from the cryptocurrency's source code, according to one analyst. However, miners, who validate and secure Bitcoin transactions, are unlikely to accept such a change. The 21-million supply limit is a fundamental principle of the Bitcoin network, providing scarcity and reflecting the gap between limited resources and unlimited wants.

The limit is written in the open source code by Bitcoin's anonymous creator, Satoshi Nakamoto, and can be found in the code file called "validation.cpp". While the source code can be modified, any changes must be accepted by the miners to be effective. A Bitcoin analyst at Trezor, Josef Tětek, explained that developers can introduce changes, but they cannot force them on anyone.

In the past, a similar situation occurred during the "Blocksize War" in 2017, where proposed changes to increase the size of Bitcoin's block were rejected by node runners, fearing greater centralization. Commenters in the Bitcoin community also expressed confidence that miners would not support removing the supply cap. Bitcoin has a passionate community that values the stability and principles of the cryptocurrency.

To read the full article, click here.

#Bitcoin #cryptocurrency #blockchain #BitcoinMiners

0 notes

Text

youtube

History's Largest Financial Scam - Cryptocurrency (Part 1)

Cryptocurrency, led by Bitcoin have exploded to a near 2 trillion dollar market cap, but as the industry grows, the danger rises. Crypto is not just a risky investment, it is also a wealth redistribution mechanism that funnels capital from the poor, to the rich.

Crypto is misunderstood in one of the most dangerous ways possible, while functioning as an elitist and criminal safe haven of the worst kind.

#youtube#upper echelon#crypto#crypto scam#scam#crypto currency#bitcoin#financial#financial scams#tether#token#blockchain#insane#ponzi scheme#blocksize war#bitcoin whales

0 notes

Text

[ad_1] At present is fifteen years from the date of the publication of the Bitcoin whitepaper. Lots has occurred in that fifteen years. Bitcoin went by way of the blocksize struggle. A nation state has adopted Bitcoin. We're presumably on the verge of a Bitcoin ETF approval. Bitcoin in nearly each approach is nothing prefer it was described within the unique whitepaper all of the years in the past. The community has grown, it has modified, it has advanced. On a social stage, an financial stage, and a technical stage it is a utterly totally different animal than it was all these a few years in the past. I really feel like on today, yearly, individuals are inclined to deal with Bitcoin because it was all the way in which again in 2008. Folks get nostalgic concerning the primary design with no point out of mining swimming pools, or ASICs, or second layer protocols. This yr I wished to do one thing totally different than wax poetic about part 10 on privateness, or part 4 on Proof-of-Work. In fifteen years extra improvement has occurred on Bitcoin than one individual can simply maintain observe of. There have been a very good variety of whitepapers over that point interval for the reason that unique Bitcoin whitepaper itself. So why will we maintain focusing simply on the one unique whitepaper yearly on today? In simply the final yr alone, out of the previous fifteen, 5 main whitepapers have been launched that would utterly change how individuals work together with Bitcoin. Bitcoin itself simply persevering with to exist as it's proper now's an enormous and world altering achievement, however that isn't sufficient to create the world that many people need to see. Bitcoin can not but meet the dimensions and performance to serve all the world in the way in which it serves individuals utilizing it at the moment. There's a variety of work left to do, a variety of issues to resolve, and a variety of whitepapers to jot down. Let us take a look at a number of the massive papers written in simply the final yr trying to clear up a few of Bitcoin's excellent shortcomings. BitVMReleased on October 9, 2023, simply this month, BitVM utterly shattered the notion of what Bitcoin is or just isn't able to. Robin Linus of Zerosync printed a paper describing an off-chain scheme for utilizing arbitrary computation to safe the conditional switch of Bitcoin in opposition to stated computation. The core worth of Robin's proposal is that it requires zero modifications to the Bitcoin protocol to perform. There are two novel insights that contribute to this concept being viable. First is that it's potential to create a NAND logic gate utilizing current Bitcoin script in a approach that validates on the stack that the NAND operation is finished accurately. For instance, if a consumer offers 0 and 1 as inputs to the script, and if the output that they supply is something however a 1, the script will really fail execution as a result of the NAND operation is invalid. The second perception is that hashlocks can be utilized to decide to which inputs a consumer needs to offer to a computation in an irrevocable approach. A consumer commits to enter bits by revealing one or two preimages equivalent to a 1 or a 0, after which a consumer can not change the dedicated inputs as revealing each preimages to anyone logic key will permit the opposite consumer to submit a penalty transaction and declare all of their funds. From this level it's merely a matter of working the computation off-chain, and if one celebration tries to lie or withhold output, the opposite can merely problem them on-chain. From right here the difficult celebration both claims cash after a timelock, or after the opposite consumer reveals each preimages making an attempt to cheat. This design permits for an incentivized off-chain computation to safe Bitcoin, with the assure that finally issues will settle accurately on-chain, even when it takes an extended collection of transactions to again the dishonest

consumer into the nook of both revealing each preimages to be penalized, or giving up and letting the opposite consumer declare after a timelock. BitVM has utterly modified the diploma to which Bitcoin is programmable, without having any change to the Bitcoin protocol itself. Timeout BushesOn September 8, 2023 John Legislation posted his paper "Scaling Lightning With Simple Covenants" to the Lightning-dev mailing listing. Within the paper he described an idea he referred to as a Timeout Tree as an answer to scaling the channel creation and closure for informal Lightning customers. Some of the well-known scaling limitations of the Lightning Community is the variety of customers that may open or shut channels inside any given block. This presents a big problem to on-boarding customers onto the community in the long run. As soon as somebody has a Lightning channel it may be used to their coronary heart's content material off-chain, however there may be solely a lot blockspace obtainable each ten minutes for brand new customers to open channels. Even the unique Lightning whitepaper calculated that if every of the 7 billion individuals on Earth solely opened two channels per yr, Bitcoin would require 133 MB blocks in an effort to on-board all the world to Lightning. This isn't an unknown, or just lately found limitation, it was all the time identified. Timeout trees current another answer to a blocksize improve. The essential idea is that an LSP can make the most of CHECKTEMPLATEVERIFY(CTV) to batch open channels to a really giant group of customers in a single UTXO, however with a catch. The entire channels expire, and in the event that they have not been unilaterally closed (or not less than the funding transaction really confirmed on chain as an alternative of being left dedicated to by CTV) by the tip of that expiry, the LSP can sweep the entire funds within the group of channels. This permits a really environment friendly channel opening footprint, probably hundreds of channels all opened with a single UTXO, and within the cooperative case a really environment friendly closing footprint, with all customers merely routing funds over the Lightning Community from the expiring Timeout Tree to a brand new one off-chain and letting the LSP sweep the outdated tree after the expiry. Timeout Bushes are an extremely easy thought that gives an enormous diploma of flexibility in overcoming one in every of Lightning's largest identified limitations. ArkArk is one other second layer proposal that was released by Burak Keceli on May 22, 2023. Ark provides a wholly new layer two design proposal making an attempt to beat a number of the limitations of the Lightning Community. It is rather comparable conceptually to a channel manufacturing facility, however the important thing distinction is in how it's used. A channel manufacturing facility hosts a traditional Lightning channel that can be utilized repeatedly to ship and obtain, an Ark manufacturing facility permits customers to regulate an off-chain UTXO that may solely be despatched in its entirety a single time, like a money be aware. Customers spend their off-chain UTXO by atomically linking it to the creation of a brand new off-chain UTXO in a brand new Ark to switch that UTXO. New Ark's are created recurrently to permit customers to switch cash in a rotation scheme from outdated Ark to new Ark. That is achieved utilizing one thing referred to as an ATLC. Within the switch scheme, the Ark Service Supplier (ASP, analogous to an LSP) is fronting the liquidity to facilitate transfers. When an current Ark off-chain UTXO is spent, the transaction spending it to the ASP in compensation for fronting liquidity to the receiver is signed utilizing an enter from the brand new Ark during which the receiver is gaining management of the funds. This ensures that if the brand new Ark, the place the receiver is getting cash, by no means confirms, the ASP can not declare the sender's cash. Ark is a cash-like

system, with no liquidity constraints requiring a particular consumer to have receiving capability forward of time to have the ability to spend cash, however due to this it has a a lot greater liquidity value than a standard LSP. This would possibly nonetheless be well worth the greater overhead for the service supplier in change for offering a extra cash-like consumer expertise. ZeroSyncOn Might 12, 2023 Robin Linus printed the Zerosync proposal to the bitcoin-dev mailing listing. The scheme is a wholly software aspect zero information proof system for bootstrapping a Bitcoin node. Composed of three separate proofs, Zerosync has the potential to allow trustless bootstrapping of a brand new Bitcoin node with out having to truly obtain and course of all the historic blockchain. The primary of the three proofs covers the validity of block headers within the blockchain, offering a succinct proof on the order of kilobytes that the issue requirement for every block header is efficiently met. The second proof validates the UTXO set at every block top by utilizing Utreexo, a previous proposal to permit nodes to validate blocks with out having all the UTXO set. Lastly, the ultimate proof will really present a assure that every one historic signatures and different witness information within the blockchain are legitimate. Collectively, these three proofs would permit a node to easily obtain the present UTXO set along with a small proof at most a number of kilobytes in measurement and immediately having a totally trustless and validating node working. It will utterly change the price of customers totally validating the system when interacting with Bitcoin. Civ PackageOn Might 1, 2023 Antoine Riard posted the Civ.Kit: A Peer-to-Peer Electronic Market System whitepaper written in collaboration with Nicholas Gregory and Ray Youssef to the Bitcoin-dev mailing listing. Civ Package proposed a decentralized market for buying and selling every thing from fiat forex for Bitcoin to items and companies constructed on prime of the Nostr protocol. Due to the dependence on Nostr, and the way that protocol works, each consumer of Civ.Package would inherently possess an id key to authorize messages posted in the marketplace place, in addition to kind a part of a reputational system. Together with locked funds on the blockchain constituting a bond, market board operators can set up bond requirement insurance policies to permit customers to put up provides for orders. With the premise for a reputational system, a resilient broadcast and communication mechanism, and Bitcoin itself as the premise for escrow contracts for trades, Civ.Package has the potential to be a powerhouse protocol facilitating peer-to-peer financial exercise utilizing Bitcoin as a method of change. Some of the necessary axioms long-term for Bitcoin's success is its use as a method of change in a round economic system. With out this peer-to-peer monetization, it dangers falling sufferer to the trimmings of regulatory seize. Civ.Package might be a framework and basis to stop that end result. To The Subsequent Fifteen YearsThese aren't even the entire proposals which have been launched this yr; some floating round aren't even formal whitepapers. However this can be a small style of the huge progress that has occurred within the Bitcoin ecosystem in simply the final yr. There's nonetheless every thing that occurred the yr earlier than that. And the yr earlier than that. To not point out going again one other fourteen years. Folks love to speak about how Bitcoin is not going wherever or doing something fascinating, or that no technical improvement happens and it's a stagnating and dying coin. After going by way of simply some of the large proposals in solely the final yr, does Bitcoin look like a stagnant and dying challenge to you? Ought to we simply hand over, pack all of it in, and go house? After fifteen years of time, exhausting work on the a part of many, and the quite a few potential

avenues to discover to proceed bettering and increasing this challenge, does it really feel useless to you?It does not to me. [ad_2]

0 notes

Text

Servidor BTCPay do serviço de pagamento Bitcoin agora mais fácil de integrar com aplicativos React

O BTCPay Server percorreu um longo caminho desde que Nicolas Dorier decidiu pela primeira vez construir um projeto de software com o objetivo de tornar obsoleto o processador de pagamentos BitPay em resposta às suas ações durante as Blocksize Wars de 2017. Desde então, floresceu em um dos, se não opilha de processamento de pagamentos auto-hospedada mais amplamente usada para usuários de…

View On WordPress

0 notes

Text

BTCPay Server has come a long way since Nicolas Dorier first decided to build out a software project with the goal of obsoleting the payment processor BitPay in response to their actions during the 2017 Blocksize Wars. It has blossomed since then into one of, if not the, most widely used self-hosted payment processing stack for Bitcoin users. It's not even just small eshop operators and merchants using it anymore, major companies like Namecheap (a domain registrar) and CheapAir (an airline booking company) have shifted over to using self-hosted BTCPay instances instead of centralized payment processors. The software stack is geared up to support easy integration into almost every major merchant stack: WooCommerce, Shopify, WordPress, as well as their own Greenfield API for custom integration. Internally it supports easy wallet management, on-chain hot wallet and cold wallet integration is a breeze, Lightning support does require the user source their own receiving liquidity but the rest of the process to spin up a node is well supported and simple, the suite even supports Payjoin and Wabisabi coinjoins. It really has built itself up into a full stack supporting just about every way to use Bitcoin that would be desirable for a merchant. Even without the use of pre-packaged platforms like WooCommerce or Shopify, the BTCPay Button is designed to make custom integration of basic receive functionality into any web project smooth sailing that works out to a few configuration settings on the BTCPay Server side and pasting a few lines of code into your project. While the BTCPay Server platform provides code snippets that can be directly dropped into HTML and PHP projects, more work is required to get these snippets to work in single page app frameworks like React. There just hasn't been a similar easy out of the box integration solution for Javascript React applications, one of the biggest web frameworks out there for developers. That is no longer the case. Ant (of TimechainStats fame) and TC (creator of Timechain Calendar) have both done an implementation of the BTCPay Pay Button natively in React. Working to integrate BTCPay into their apps, both of which were written in React, they both encountered the challenges and were confronted with a multitude of choices refactoring the frontend code provided by BTCPay and getting it to work in the "React way". So they built the tool to make that easier for others. The React BTCPay Pay Button is a full reimplementation of the standard Pay Button functionality for React applications. It provides the Button as a single component that can easily be embedded into any React application, and provides full customization inside of that component without needing to reconfigure or alter settings on the BTCPay Server side. Simply drop in the button, connect it to the server, and everything from that point on can be re-configured or altered from the application side of the connection. Ant had this to say:"TC and I wanted to build a simple way for other React devs to use the BTCPay Pay Button's awesome functionality seamlessly within their React apps, a move inspired by our initial attempts to integrate BTCPay into our React projects Timechain Calendar and TimechainStats. Now, with just two props — the Store ID and Domain — any React app can fully integrate BTCPay Pay Button. It's a native implementation that aims to fill a small but impactful gap for React developers. Think of it as a bridge: On one side, you have the robust and highly customizable BTCPay Server Pay Button; on the other, you have the React developers who need an easy-to-integrate, native solution.Our component allows for a high level of customization built with "the React way" in mind. It's a specialized tool, ideal for donations or tip jars, that simplifies the integration process while offering the freedom to tweak UI elements as needed."Prior to the release of the React BTCPay Server Pay Button, integration into one of the

largest web application frameworks in the world required a full custom implementation from the app developer in order to integrate BTCPay functionality into a React application. Now it is as simple and easy as the vanilla BTCPay Pay Button is to integrate into HTML or PHP projects. There's even word on the street that Nicolas Dorier plans to formally integrate this into the BTCPay suite itself. While this is in the grand scheme of things a small project reimplementing existing work, it will make BTCPay integration into React projects for future developers much simpler and less time consuming than it was for Ant and TC to build this from scratch for their own projects. That's the exact type of open source attitude and action that has built up so many of the tools and software stacks used in this ecosystem today.Learn more about the React BTCPay Server Pay Button by visiting the Github repository.

0 notes

Text

Recover Database When Current Redolog File Is Lost

SQL> SELECT * from v$log; GROUP# THREAD# SEQUENCE# BYTES BLOCKSIZE MEMBERS ARC STATUS FIRST_CHANGE# FIRST_TIM NEXT_CHANGE# NEXT_TIME CON_ID ---------- ---------- ---------- ---------- ---------- ---------- --- ---------------- ------------- --------- ------------ --------- ---------- 1 1 19 209715200 512 1 YES INACTIVE 2801844 26-MAY-23 2914294 13-JUN-23 0 2 1 20 209715200 512 1 YES INACTIVE…

View On WordPress

0 notes