#carbon tax

Text

If tax cuts give you $100 back in your wallet yet it gives the rich, $10,000 back in theirs, you are not $100 richer. Money is relative to wealth. When we give handouts or tax breaks and most of it goes to the rich YOU. GET. POORER. Tax the rich, don't just cut carbon taxes.

707 notes

·

View notes

Text

Like a lot of government programs, people don't know about it, so they don't get the benefits of it.

62 notes

·

View notes

Photo

Counties that have introduced a carbon tax.

The carbon tax is imposed on the burning of fossil fuels such as coal, oil, and gas, which release carbon dioxide and other greenhouse gases into the atmosphere.It is based on the idea that the companies that produce and use fossil fuels should bear the costs associated with the damage they cause to the environment and human health.

143 notes

·

View notes

Text

Carbon tax protest this morning on the Nova Scotia and New Brunswick border.

12 notes

·

View notes

Text

4 notes

·

View notes

Text

"An Oxfam analysis with the Stockholm Environment Institute found the following:

The per capita [carbon] emissions of someone in the top 1 percent is 100 times higher than someone in the bottom 50 percent, and 35 times higher than the target for 2030.

Since 1990, the richest 5 percent was responsible for over a third of the growth in total emissions. The top 1 percent was responsible for more than the whole of the bottom 50 percent.

For about 20 percent of the human population — corresponding to the working and lower-middle classes in rich countries, mainly — per capita emissions actually fell from 1990 to 2015...

Looking at the emissions of different income groups and the nature of those emissions has the potential to transform climate policymaking. To maintain any level of fairness, the richest must make by far the biggest cuts to their emissions. This is true in both rich and developing countries.

This means, for example, that we should have not a flat carbon tax but a progressive carbon tax: the more carbon you use, the higher the tax you pay. Polluting investments should have additional punitive taxation put on them or, better still, simply be banned. Luxury goods and private jets should be heavily taxed or heavily restricted. Each national action to tackle climate should be taken progressively, in ways that make the richest, highest emitters shoulder most of the cost, and in turn contribute to increasing equality, not inequality.

General increases in taxes on the richest and on wealth, as well as other moves to rapidly reduce inequality, also take on a whole new climate imperative. Our planet simply cannot afford the very rich."

- Max Lawson, from "The Rich Are the Ones Burning the Planet." Jacobin, 10 October 2022.

#max lawson#quote#quotations#eat the rich#oxfam#stockholm environment institute#climate policy#carbon tax#carbon emissions#economics#climate change#climate crisis#inequality#fossil fuels#environmentalism#capitalism

57 notes

·

View notes

Text

Carbon taxes, for The Economist

Art direction by Ben Shmulevitch

6 notes

·

View notes

Text

The investigation is a sharp turn from the government's position last week when it twice declined to investigate the company in the legislature despite calls from opposing parties.

Birds of a feather flock together...

#enough said#david eby#justin trudeau#bc ndp#liberal party of canada#scandal#corruption#conflict of interest#bribery#mnp#british columbia#canada#politics#carbon tax

2 notes

·

View notes

Text

Toronto Street Photography. Dec 2023

Toronto Freedom Rally.

#toronto street photography#toronto photographer#Toronto Freedom Rally.#Trudeau Must Go#Trudeau.#Toronto Protest#Carbon Tax

3 notes

·

View notes

Text

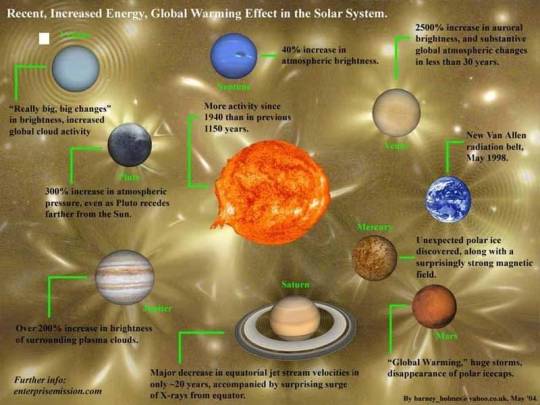

Climate Change Hoax

There is no “National Climate Emergency”

DO NOT BELIEVE when news stations like CNN, Fox News, ABC News, etc. tell you that “climate change/global warming” is 100% man-made. That’s total bullshit. There’s also people like Al Gore, Obama, Biden, and Alexandria Ocasio-Cortez who push Carbon Tax, and think the Earth is going to end in 12 years.

Things like fracking, mining metals, cutting down forests, CHEM-trailing, drilling for oil, and other natural resources are not good for the planet. When you take precious metals, minerals, oil, gas, etc out of the planet, you’re actually damaging the planet. Us humans aren’t used to thinking that Earth is a living organism. Planets are evolving creatures just like animals. When you take something from the Earth, you gotta give it back. Also, building dams is not healthy for the planet either. It stops the natural flow of the elements and can also cause geological shifts. Here on Earth, the resources of our planet are considered to just be for the taking, and most people give the planet no consideration at all; and if they do, it’s just thought of as some giant rock that we live on, and we can do whatever we want with it. These things don’t necessarily cause climate change, but it hurts the planet.

Planets heat up for a while, and they then cool down for a while. This is why we have ice-ages. Humans are NOT the cause of climate change, because there is no “human contribution/or causation” for such a thing. The planet regulates all atmosphere/temperature changes.

This is all a game being brainwashed into our minds, by politicians and people who only want to control our lives.

John Lear, a whistle-blower with many connections to black projects, says that we’ve all been lied to about what makes the temperature on a planet. All of our lives, we’ve been told that it depends on the distance away from the Sun…closer to the Sun is hotter, farther away from the Sun is colder. Well, that may not necessarily be true. The Sun is a electro-magnetic sphere that transmits an electro-magnetic wave, that the atmosphere of each planet regulates, as far as temperature. Most of the planets in our solar system are habitable, and moreover, are undergoing climate change. See image below:

#climate change#global warming#carbon tax#carbon emissions#hoax#government#biden#new world order#gas#oil#mainstream media#united states#politics#planets

18 notes

·

View notes

Text

The federal government's proposed tax credit to incentivize companies to capture and store carbon dioxide underground doesn't exclude projects that also involve extracting more oil, according to policy experts who reviewed a draft of the long-promised legislation.

First announced in the 2021 federal budget, the tax credit is intended to "support and accelerate" carbon capture — a blanket term that refers to technology used to sequester CO2 and store it safely underground — to reach net-zero emissions by 2050.

Projects where the carbon is piped away to an oil field, and injected underground to recover more oil, through a process known as "enhanced oil recovery" (EOR), were not to be included, the government said at the time.

But the latest draft legislation shows the tax credit will be available to projects that are, in part, using the captured carbon for that purpose.

Continue Reading

Tagging @politicsofcanada

#cdnpoli#canada#canadian politics#canadian news#carbon capture#enhanced oil recovery#carbon tax#oil industry#fossil fuels#climate change

58 notes

·

View notes

Link

Excerpt from this story from the New York Times:

Economists have been examining the impact of climate change for almost as long as it’s been known to science.

In the 1970s, the Yale economist William Nordhaus began constructing a model meant to gauge the effect of warming on economic growth. The work, first published in 1992, gave rise to a field of scholarship assessing the cost to society of each ton of emitted carbon offset by the benefits of cheap power — and thus how much it was worth paying to avert it.

Dr. Nordhaus became a leading voice for a nationwide carbon tax that would discourage the use of fossil fuels and propel a transition toward more sustainable forms of energy. It remained the preferred choice of economists and business interests for decades. And in 2018, Dr. Nordhaus was honored with the Nobel Memorial Prize in Economic Sciences.

But as President Biden signed the Inflation Reduction Act with its $392 billion in climate-related subsidies, one thing became very clear: The nation’s biggest initiative to address climate change is built on a different foundation from the one Dr. Nordhaus proposed.

Rather than imposing a tax, the legislation offers tax credits, loans and grants — technology-specific carrots that have historically been seen as less efficient than the stick of penalizing carbon emissions more broadly.

The outcome reflects a larger trend in public policy, one that is prompting economists to ponder why the profession was so focused on a solution that ultimately went nowhere in Congress — and how economists could be more useful as the damage from extreme weather mounts.

A central shift in thinking, many say, is that climate change has moved faster than foreseen, and in less predictable ways, raising the urgency of government intervention. In addition, technologies like solar panels and batteries are cheap and abundant enough to enable a fuller shift away from fossil fuels, rather than slightly decreasing their use.

Robert Kopp, a climate scientist at Rutgers University, worked on developing carbon pricing methods at the Department of Energy. He thinks the relentless focus on prices, with little attention paid to direct investments, lasted too long.

“There was an idealization and simplification of the problem that started in the economics literature,” Dr. Kopp said. “And things that start out in the economics literature have half-lives in the applied policy world that are longer than the time period during which they’re the frontier of the field.”

17 notes

·

View notes

Link

I'm wondering if Trudeau would consider removing the carbon tax from heating? Electrical heating is very expensive, and some of it comes from natural gas anyways. Canada is a resource rich country, it's ridiculous for us to be put in this position artificially.

9 notes

·

View notes

Text

2 notes

·

View notes

Text

View on Twitter

“Since we cannot count on you to act morally, let me propose bribing you to save the planet. Adopt a high global carbon tax. However, cut other taxes… My and future generations will pay higher taxes to service the deficits you run.”

(Source)

4 notes

·

View notes