#cfoservices

Text

Why Does a Company Need a CFO?

Chief Financial Officer (CFO)

The term Chief Financial Officer (CFO) refers to a senior executive responsible for managing the financial actions of a company. The CFO’s duties include tracking cash flow and financial planning as well as analyzing the company’s financial strengths and weaknesses and proposing corrective actions. The role of a CFO is similar to a treasurer or controller because they are responsible for managing the finance and accounting divisions and for ensuring that the company’s financial reports are accurate and completed in a timely manner.

The Role of a CFO in Business

A CFO is not just a numbers person, but a strategic thinker who helps steer the business in the right direction. They are responsible for developing financial strategies that align with the company’s goals and objectives. Here are some key responsibilities of a CFO:

Creating financial plans and budgets

Analyzing financial data and presenting reports to stakeholders

Managing accounting and financial operations

Identifying and managing financial risks

Ensuring compliance with financial regulations

Developing and implementing financial policies and procedures

Making strategic decisions that impact the financial health of the business

How can a CFO help your business or organization?

The term chief financial officer (CFO) refers to a senior executive responsible for managing the financial actions of a company. The CFO’s duties include tracking cash flow and financial planning as well as analyzing the company’s financial strengths and weaknesses and proposing corrective actions. The role of a CFO is similar to a treasurer or controller because they are responsible for managing the finance and accounting divisions and for ensuring that the company’s financial reports are accurate and completed in a timely manner.

1. Financial Strategy and Planning

One of the most important roles of a CFO is to develop and execute a financial strategy that aligns with the company’s overall goals. This involves working closely with the CEO and other members of the leadership team to ensure that financial decisions are aligned with the company’s vision and mission. The CFO is also responsible for financial planning, including budgeting and forecasting.

2. Risk Management

In fact, because they have access to all the company’s moving parts, CFOs are uniquely placed to help the company take intelligent risks. Everything comes through finance, including revenues, cost of goods, expenses, investments and capital. Strategic CFOs must, of course, still ensure the company is not making financial mistakes, but they also have to look for opportunities. There is great value to being open-minded as you face the unknown while still exploring business opportunities in a structured way.

3. Cash Flow Management

The role of the accounting and finance department is traditionally one of limiting expenses, which is necessary when expenditures are contemplated on low-return items, but if you limit expenses, by definition you limit growth. In that capacity, accounting and finance departments are sometimes seen, unfairly, as wary of growth.

4. Financial Reporting and Compliance

Once the strategy is in place, your monthly financials tell you if you are on track with your goals. The CFO can interpret the numbers to see where you might need to course correct. Timely, accurate financial statements bring clarity around a company’s current profitability, but the CFO goes beyond to help predict and direct the company’s financial future

5. Mergers and Acquisitions

The CFO will outline a list of financial requirements and benchmarks that stakeholders must understand and agree to before negotiations begin. In order to create this baseline argument and then ensure the end goals can be met upon deal completion, the CFO and their financial team must: Assess for potential synergies.

6. Leadership and Team Management

To be an effective business partner, today’s CFO must have the necessary leadership and communication skills. They must give advice and counsel as well as provide a voice of reason. They are often asked to lead group-wide transformation programs and must be able to translate detailed information into clear, concise, and accessible messaging. It goes without saying that creating a top talent pipeline to ensure the right people and leadership skills are in place within the finance function is also critical.

The Importance of a CFO in Business Operations

A CFO plays a critical role in business operations, providing financial leadership and guidance to the company. By overseeing financial strategy, planning, and analysis, a CFO helps the company make informed decisions about resource allocation, investment opportunities, and risk management.

Moreover, a CFO helps ensure that the company is financially healthy and compliant with all legal and regulatory requirements. The CFO serves as a financial advisor to the CEO and board of directors, helping them understand the company’s financial performance and make informed decisions about the company’s future.

In conclusion, a CFO is an essential role in any company. From financial strategy to risk management and compliance, the CFO plays a critical role in ensuring the financial health and success of the company. By hiring a CFO, a company can benefit from their expertise and guidance, making informed financial decisions that drive business growth and success.

2 notes

·

View notes

Text

#VirtualCFO#CorporateFinancialServices#TaxConsultancy#FinancialPlanning#StrategicAnalysis#TaxOptimization#BusinessFinance#FinancialManagement#ExpertGuidance#ProfessionalServices#FinancialSolutions#TaxAdvice#BusinessGrowth#FinancialHealth#TrustedPartner#CorporateFinance#TaxConsultant#FinancialConsulting#CFOservices#FinancialExpertise

1 note

·

View note

Text

Reliable CFO Services in Nashville

With years of experience in providing top-notch CFO services in Nashville, Jasmine Reeds, CPA, is your go-to financial expert for all of your business needs. From financial planning to budgeting, Jasmine will help bring clarity and organization to your company’s finances.

0 notes

Text

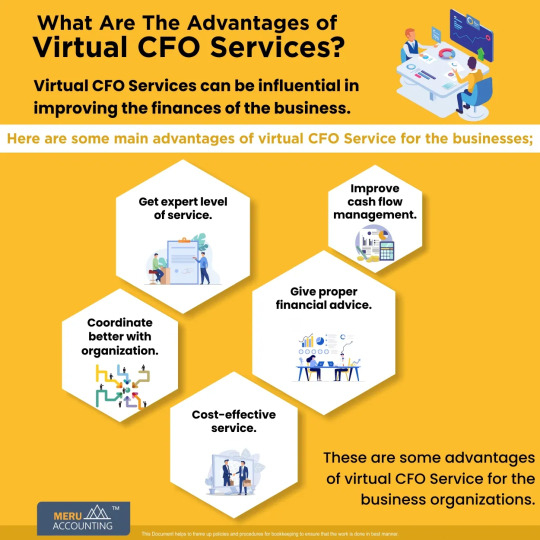

There are many Advantages Of Virtual CFO Services for businesses which can help them to improve their finances.

Read more: https://www.accountsjunction.com/blog/what-are-the-advantages-of-virtual-cfo-service

0 notes

Text

6 Reasons Why Business Strategy and Finance Are Inseparable

Understanding the symbiotic relationship between business strategy and finance is crucial for any company aiming for sustainable growth. This article outlines six compelling reasons why these two aspects are inseparable, especially in the context of modern business environments like Chennai, Bangalore, and Noida. It highlights how virtual CFO services can bridge the gap between strategic planning and financial management, providing a holistic approach to business success.

For companies exploring CFO services in Bangalore or other major cities, this piece offers valuable insights into the importance of integrating financial expertise into strategic decision-making. It's an informative read for businesses seeking to enhance their financial acumen and strategic vision.

Discover the six reasons why business strategy and finance are inseparable and how they impact your company's growth at CFO Bridge.

0 notes

Text

Best Fractional CFO Consulting Services in Florida

Are you ready to take your finances to the next level? Seek out Fractional CFO Consulting Services firms that are experienced in your industry and aligned with your requirements. If you choose the right CFO consultant, you can unlock the secret to financial success.

0 notes

Text

Beyond Boundaries: SAI CPA Services Pioneers Financial Growth with Virtual CFO Solutions

Supercharge your business strategy with SAI CPA Services' Virtual CFO expertise. Our Virtual CFO services offer a scalable solution for businesses seeking financial acumen without the hefty price tag. From financial analysis to budgeting, our seasoned professionals provide strategic insights to drive success. Navigate the complexities of finance with confidence and let SAI CPA Services be your virtual partner for financial excellence in Middlesex County, New Jersey. Optimize your business performance without the overhead—choose Virtual CFO services for a smarter, more agile approach to financial leadership.

#VirtualCFO#StrategicFinance#BusinessStrategy#CFOservices#BusinessTransformation#FinancialPlanning#SAICPAServices#MiddlesexCountyNJ#CostEffectiveFinance#BusinessSuccess#FutureOfFinance#FinancialExcellence

1 note

·

View note

Text

What is a Virtual CFO & How to Become One?

Until recently, only large organizations could afford to hire a chief financial officer (CFO). Now, smaller businesses can invest in virtual CFOs for a fraction of the cost of a traditional CFO.

CFOs help business owners make sound business decisions through services such as cash flow management, forecasting, and strategic planning.

Read more:

https://badacfo.com/virtual-cfo-services

0 notes

Text

Choose NSKT Global│Virtual CFO Near Me │Fractional CFO New York

If you're a forward-thinking business owner located in the bustling metropolis of New York, we have the perfect solution to elevate your financial management. With NSKT Global, you'll have a dedicated financial expert right at your fingertips, ensuring your financial strategies are always on point. Our fractional CFO New York services are designed to empower you with top-notch financial expertise, right where you need it most. With our virtual CFO near me, you can access the strategic financial guidance your business deserves, regardless of your physical location.

0 notes

Text

#VirtualCFO#FinancialStrategy#StartupFinance#CFOservices#FinancialAdvisory#FinancialManagement#BusinessGrowth#StartupSupport#FinancialConsulting#EntrepreneurialFinance

1 note

·

View note

Text

Bookkeeping Services | Virtual Bookkeeping and Accounting Services

Outsourced FinOps help you to reduce your stress of bookkeeping. They offer professional virtual bookkeeping services for small businesses! Contact them today to handle all your financial needs and save time to focus on growing your business.

#Bookkeeping#BookkeepingServices#VirtualBookkeeping#SmallBusinessBookkeeping#AccountingServices#PayrollServicesForSmallBusiness#SmallBusinessAccounting#CFOServices#FractionalCFOServices#VirtualCFOServices

1 note

·

View note

Text

Part-Time CFO Services

Here at JAG CPA & Co., you must check out our part-time CFO services, which provide strategic financial guidance and insight to drive your company's success.

0 notes

Text

Fractional CFO Services Can Double Your Business

Enhance your business with Jasmine Reeds, CPA expertise in fractional CFO services. Let us help you navigate complex financial decisions and improve your company's financial health through strategic planning and analysis. Trust us to provide professional guidance and support to optimize your business growth.

0 notes

Text

Top best virtual cfo services in India - thinksynq

Streamline your financial operations with thinksynq's top virtual CFO services in India. Expert guidance for strategic decision-making and growth

0 notes

Text

Understanding CFO Services: Do You Need One for Your Business?

CFO services are becoming increasingly popular among businesses seeking financial expertise without the commitment of a full-time executive. This article provides a comprehensive overview of what CFO services entail, including virtual CFO solutions and interim CFO services. Companies in cities like Chennai, Bangalore, and Noida are recognizing the value of these services for strategic financial planning and decision-making.

The piece also offers insights into when a business might need CFO services, highlighting scenarios such as rapid growth, financial restructuring, or preparing for fundraising. For businesses considering virtual CFO services in India, this article is an essential read to understand the benefits and determine if it's the right fit for their needs.

Learn more about CFO services and how to determine if your business needs one at CFO Bridge.

0 notes