#cpafirms

Text

Our innovative service approach has now arrived in Australia, offering you a unique and exceptional experience. Discover a fresh perspective on service excellence that sets us apart from the rest.

#SafebooksGlobalPvtLtd#bookkeeping#bookkeepingservices#outsourcingservices#accountingservices#accountingfirms#taxservices#cpafirms#australia

3 notes

·

View notes

Text

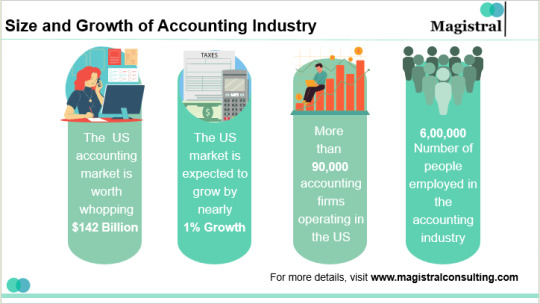

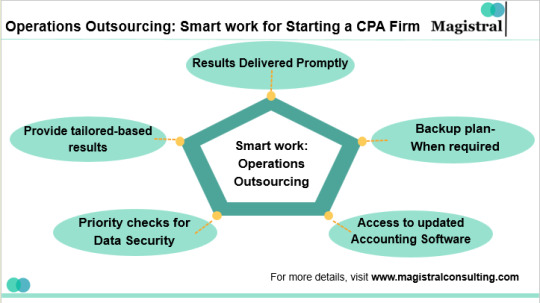

Starting a CPA Firm: Key Strategies for Long-Term Success

#magistralconsulting#accountingindustry#cpafirms#operationsoutsourcing#clientaquisition#datasecurity#leveragenetworks

0 notes

Text

Curtailing the ERC to pay for taxpayer benefits

By Roger Russell

An inside look at the Tax Relief for American Families and Workers Act of 2024 as it works its way through Congress.

0 notes

Text

Why CPA need to Outsource Bookkeeping Services?

Read about why CPA need to outsource bookkeeping service to India By Accounting Outsource Hub LLP.

1 note

·

View note

Text

Top Accounting Firms in Toronto: A Comprehensive Guide

Introduction

Introduce the article and the importance of choosing the right accounting firm in Toronto.

Mention the diversity and competitiveness of the Toronto business environment.

Section 1: The Need for a Top Accounting Firm

Explain why individuals and businesses need professional accounting services.

Discuss the benefits of working with a top accounting firm in Toronto.

Section 2: Toronto's Top Accounting Firms

List and introduce the top accounting firms in Toronto.

Provide a brief history and background of each firm.

Section 3: Services Offered

Detail the wide range of services provided by the top accounting firms in Toronto, such as tax planning, audit and assurance, consulting, and more.

Explain how these services cater to different clients' needs.

Section 4: What Sets Them Apart

Highlight the unique strengths and distinguishing features of each accounting firm.

Discuss their areas of expertise, industry specializations, or innovative approaches.

Section 5: Client Testimonials

Share testimonials or success stories from clients who have benefited from the services of these top accounting firms.

Section 6: Factors to Consider When Choosing an Accounting Firm

Offer readers guidance on how to choose the right accounting firm based on their specific needs and priorities.

Discuss factors such as reputation, expertise, client satisfaction, and fees.

Section 7: Case Studies

Provide detailed case studies or examples of businesses or individuals who found the perfect accounting firm and achieved financial success.

Section 8: How to Get in Touch

Provide contact information for each of the top accounting firms.

Include links to their websites or other relevant contact details.

Section 9: Conclusion

Summarize the key points from the article.

Encourage readers to take action in finding the best accounting firm in Toronto for their needs.

Note: Make sure to conduct thorough research on the top accounting firms in Toronto to provide accurate and up-to-date information. Incorporate images, logos, or any additional resources that can enhance the article's comprehensiveness and engagement for your readers.

#TorontoAccounting#TopAccountingFirms#FinancialExperts#TorontoFinance#AccountingServices#AuditAndTax#CPAFirms#FinancialAdvisors#AccountingProfessionals#TaxExperts#FinanceToronto#FinancialConsultants#AccountingConsulting#AccountingSolutions#BusinessFinance#FinancialIndustry#TorontoBusiness#FinanceManagement#TaxSeason#FinancialPlanners

1 note

·

View note

Text

Houston CPA

At JAG CPA & Co., unlock the full potential of your financial endeavors & embark on a journey of financial excellence with the guidance of trusted Houston CPA.

0 notes

Text

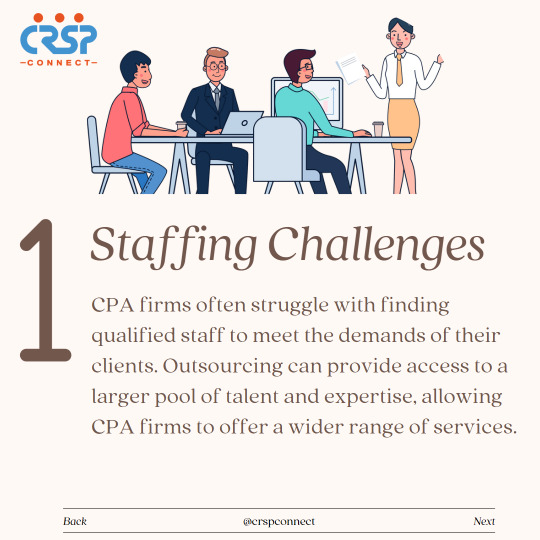

There are several challenges that CPA (Certified Public Accountant) firms face.

CPA and accounting firms are facing challenges on many fronts, but we're proud to be here for you.

We're #yourAccountingTeam and we're here to help you get through any challenges you may face.

#offshorestaffingsolutions#cpafirms#cpa usa#cpa firm#us cpa course#cpa tacoma wa#offshorestaffing#offshore account no minimum#offshore outsourcing services#offshore accounting#offshore staffing#outsourcingaccounting#outsource accounting#outsourceaccounting#outsource accounting services#outsourcingagency#outsource bookkeeping services#payroll#outsource payroll#accounts receivable

1 note

·

View note

Text

Virtual Bookkepers for CPA firms

We offer virtual employees for accounting and CPA firms. Your virtual employees can be bookkeepers, accountants and tax specialists. You can hire them on a part-time basis or full-time basis. Your virtual employee will work exclusively for you. You can direct their work every day or set them tasks for each week. They will report to you directly and work as your own member of the staff.

You can either hire one or two staff or immediately hire a team of people. It all depends on your need and we are flexible to accommodate all your requirements. You can conduct interviews and test their skills before you pick them.

Virtual Bookkeeperss' for CPA firms

#virtualemployees#CPAfirms#accounting#bookkeeping services for accounting firms#online bookkeeping#outsourced bookkeeping services

0 notes

Text

hey hey

just your casual up and coming stock queen

#stocks#stocks and bonds#trust fund#selfie#pretty#cute#blonde#peace sign#business#business school#cpafirm#cpa course details#hedge funds#motivation#adorable#slc#lets go#smart woman#beauty and brains#barbie core#mba#mba specializations#girlblogging#girl#modest fashion#christian girl#short girl

16 notes

·

View notes

Text

Welcome to Syriac CPA Office in Newport Beach!

Your trusted partner for tailored tax and accounting solutions from tax planning to tax prep, accounting & bookkeeping etc.

0 notes

Text

Welcome to Syriac CPA Office in Newport Beach!

Your trusted partner for tailored tax and accounting solutions from tax planning to tax prep, accounting & bookkeeping etc.

0 notes

Text

It is very important to grow your CPA firm. Consider these strategies to grow CPA firm with sustainability

0 notes

Text

CPA Bookkeeping: An In-Depth Guide for Professional Services

#magistralconsulting#financialservices#outsourcing services#cpafirms#bookeepingservices#professionalservices#financialstatements

0 notes

Text

Tax extenders bill throws new uncertainty into tax season

By Michael Cohn

The House Ways and Means Committee reported the text of the Tax Relief for Workers and Families Act after voting last week to advance the bipartisan bill.

0 notes

Text

Why CPA Firms Should Outsource Accounting & Bookkeeping Services?

The Outsourcing of accounting services is growing at an exceptional pace and is affecting firms of all sizes, irrespective of industry.

0 notes

Text

Points To Consider When Hiring Boca Raton Accountants For Your Company

Managing the financial health of your company is not a simple job. While you may specialize in jobs like the offerings of your company, things like managing the regular accounting of your company, compliance, taxes, and payroll issues need specialized expertise. This is where hiring Boca Raton accountants for your company makes sense. However, one thing you need to remember here is that the accountant you hire for your company can even make or break the financial success of your business.

So, to help you out in making the right selection, in this blog we offer some points.

First, identify your requirements: Before you hire an accountant for your business, you must take adequate time and evaluate the financial requirements carefully to decide the expertise required. Businesses usually need accountants to:

Set up proper accounting and bookkeeping systems

Prepare and file new business tax registrations

Help the businesses with business formation, regulations, and licenses

Prepare forecasts and budgets

Understand business credits and tax deductions

File estimated quarterly taxes

Manage employees, contractors, and payrolls

Compile the business’s financial statements

Offer general advice regarding business finance

Now pinpoint all your pain points and other important concerns to assess candidate qualification.

Decide whether you need a part-time or full-time accountant: Lean organizations usually need outsourced or part-time accountants in Boca Raton. So, before making your decision, consider factors like:

Workload and average monthly transactions

Billing cycles or peak seasons

Complexity of the finances and operations

Stage of business- just launched or rapidly growing

Compliance requirements and filing schedule

Whether you are capable enough to afford an accountant with full salary and other benefits

Accessing these details will help you to decide whether hiring an individual accountant or outsourcing one from an accounting firm would suit your requirements.

Research accounting firms or post the job requirement: Depending on your accounting requirements, you can contact a reputable accounting firm or post the job opening to hire an individual. Networking in the community or posting job openings online may help you to find some strong candidates.

Conduct an interview and ask the right questions: Next, it is important to conduct an interview. The interview is important to evaluate the fit and experience of the accountant. Here are a few things that you can check in the prospective candidates.

His familiarity with tax and accounting regulations for businesses in your industry

His experience in helping businesses set up their accounting systems

The accounting tools and software he is expert in using

The way he prefers to communicate with the clients

The way he creates financial forecasts and projections with limited historical data

Features that make him different from other Boca Raton accountants

How he keeps him updated on the best practices and the latest standards of accounting

So, these are some of the points to consider before choosing the right accountant for your company. You can learn more about them by contacting Advantage CPA.

#accounting#payroll#bocaraton#businessservices#taxplanning#accountingfirm#cpafirm#businessconsultation#small business accounting#accounting services#new account#business finance

0 notes