#CorporateFinance

Text

My corporate girly era is starting and I love it 💕

#dream girl#that girl#becoming that girl#it girl#self improvement#self care#2023 goals#motivation#glow up#self development#corporatefinance#corporate girly

475 notes

·

View notes

Text

Unlocking Academic Excellence: Your Guide to Expert Online Corporate Finance Assignment Help! 🌐📚

Hey Tumblr fam! 🌟 Are you feeling the pressure of corporate finance assignments looming over you like a dark cloud? Fret not because I've got the perfect solution for you.

Navigating through the intricacies of corporate finance can be challenging, but worry not! The experts at Finance Assignment Help have got your back. 📚💡 Whether you're grappling with valuation methods, capital budgeting, or financial statement analysis, our professionals are here to guide you through the maze of corporate finance concepts.

Imagine the relief of having a dedicated team of experts by your side, ready to assist you with your assignments. No more sleepless nights, no more stress-induced headaches - just smooth sailing through your corporate finance coursework. 🌊😌

Our online corporate finance assignment help services are tailored to meet your specific needs. We understand the importance of timely submissions and top-notch quality, and that's exactly what we deliver. Our team ensures that your assignments not only meet academic standards but also exceed your expectations. 🎓🌟

Why struggle with complex financial models or intricate theories when you can have expert guidance at your fingertips? Online corporate finance Assignment Help is not just a service; it's your academic ally, ready to empower you to conquer the challenges of corporate finance. 💪🎓

8 notes

·

View notes

Text

Top Audit Firm in Qatar | Accounting and Bookkeeping

Discover GSPU, your trusted audit and accounting firm in Qatar! Our experienced professionals offer tailored financial solutions, innovative strategies, and expert guidance to help your business thrive. Get in touch today to streamline your financial processes and drive growth with confidence.

#accounting#taxes#success#startup#tax#tax accountant#property taxes#audit#taxation#taxcompliance#bookkeeping#accounting services#business growth#services#finance#business consulting#outsourced cfo services#corporatefinance#cybersecurity#excise tax

2 notes

·

View notes

Text

Looking for the best tax consultant company in Chennai? Discover SPR&CO, your trusted Chartered Accountant firm, providing expert financial services and guidance.

#SPRandCO#CharteredAccountants#FinancialExperts#TaxConsultants#ChennaiAccountants#FinancePros#AccountingServices#AuditExperts#TaxAdvisors#FinancialConsultants#AccountingFirm#TaxPlanning#BusinessFinance#FinancialSolutions#ChennaiBusiness#CorporateFinance#TaxationServices#AuditandAssurance#SmallBusinessFinance#FinancialAdvisory#FinancialPlanners#SPRandCOChennai#TaxExperts#CharteredAccounting#FinancialStrategy#IncomeTax#AccountingProfessionals#ChennaiConsultants#TaxCompliance#FinancialManagement

2 notes

·

View notes

Text

#VirtualCFO#CorporateFinancialServices#TaxConsultancy#FinancialPlanning#StrategicAnalysis#TaxOptimization#BusinessFinance#FinancialManagement#ExpertGuidance#ProfessionalServices#FinancialSolutions#TaxAdvice#BusinessGrowth#FinancialHealth#TrustedPartner#CorporateFinance#TaxConsultant#FinancialConsulting#CFOservices#FinancialExpertise

1 note

·

View note

Text

From Strategy to Success: Digital Marketing And SEO Charting the Path to Organizational Growth

In the 21st-century business landscape, digital marketing is essential for growth and success. Companies of all sizes leverage digital platforms to reach target audiences efficiently. Digital marketing includes activities like search engine optimization (SEO), social media marketing, content marketing, and email marketing. Among these, SEO is a cornerstone strategy for enhancing online presence and driving organic traffic to websites.

Readmore...

#SEO#hashtag#SearchEngineOptimization#SEOTips#SEOTrends#DigitalMarketing#SEOExpert#SEOStrategy#SEOServices#GoogleSEO#SEOAgency#Corporate#CorporateLife#CorporateWorld#Business#CorporateCulture#CorporateLeadership#CorporateStrategy#CorporateWellness#CorporateFinance#CorporateGrowth#Entrepreneur#EntrepreneurLife#Entrepreneurship#Startups#BusinessOwner#SmallBusiness#StartupLife#EntrepreneurMindset#BusinessGrowth

1 note

·

View note

Text

0 notes

Text

0 notes

Text

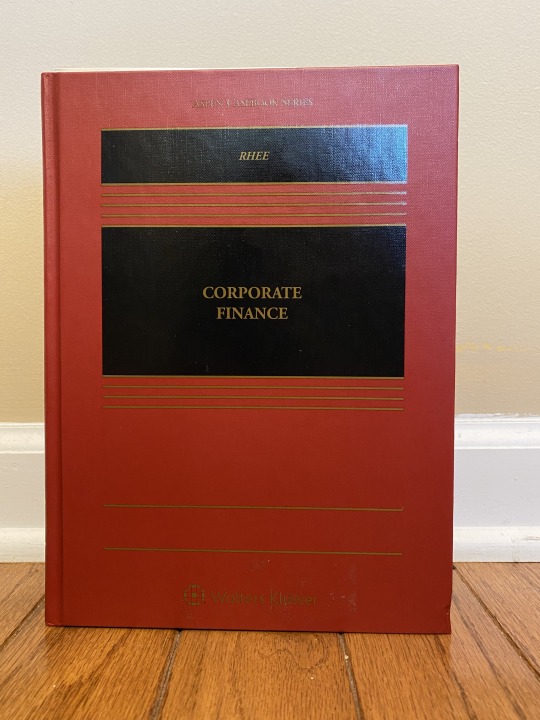

Corporate Finance

Delivering financing and syndication expertise to maximise corporate value

Our Corporate Finance division offers a comprehensive range of financial products and solutions in Project Finance and Syndicated Finance to help you achieve your strategic objectives.

Advisory and financing for greenfield or brownfield projects, and M&A

Deal structuring, syndication and execution expertise across various financing structures

Get in touch with us here.

0 notes

Text

#AccountancyClasses#AccountancyEducation#AccountancyLearning#AccountancyCurriculum#AccountancyCourses#AccountancyInstitute#AccountancyStudies#AccountancyCommunity#AccountancyStudents#AccountancyProfessionals#AccountancyInsights#AccountancyForFuture#AccountancyTheory#AccountancyTeaching#AccountingEducation#FinancialAccounting#ManagerialAccounting#Auditing#Taxation#CorporateFinance#CostAccounting#FinancialManagement#AccountingStandards#SingaporeAccountancy#AccountancyForAllLevels#Account

0 notes

Text

Discover the difference between Share Subscription Agreements (SSA) and Share Purchase Agreements (SPA) in corporate transactions. While SSA involves purchasing new shares, SPA facilitates the sale of existing ones. Understand their nuances for informed investment decisions

#ShareSubscriptionAgreement#SharePurchaseAgreement#CorporateTransactions#Investment#CorporateFinance#LegalContracts#BusinessAgreements

0 notes

Text

B.Com Bachelor Of Commerce

Iexcel's B.Com program is a full-time program that is delivered in a blended format, which combines online and offline learning. The program is designed to be flexible and convenient for students, and it can be completed in three years.

For more information, please visit our website.

Contact: +91 90089 15050

https://iexcel.in/bachelor-of-commerce/

#BCom#CommerceDegree#BusinessStudies#Accounting#FinanceMajor#Economics#CommerceWorld#GraduationGoals#CorporateFinance#FinancialManagement#BComLife#CommerceStudent#BusinessEducation#MarketingStrategies#EconomicTheory#FinancialAccounting#CommerceJourney#BusinessGraduate#CommerceChallenges#AccountingSkills

0 notes

Text

Transform your financial and accounting processes with a PowerBi Dashboard. Join us for insights on the transition from Excel to Enterprise Planning Management (EPM) systems in this blog post.

#executive leader#Salvatore Tirabassi#Financial#data science#product management#analytics#datascience#corporatefinance#productmanagement#strategicplanning

0 notes

Text

Navigating the Nexus: Tax Accounting's Ripple Effect on Corporate Finance 💼💸

Hey Tumblr crew! Let's delve into the intricate web where tax accounting and corporate finance intersect. 🕸️✨

🔍 Understanding the Connection: Tax accounting isn't just about filing returns—it's a strategic element that deeply influences corporate finance decisions. From investment choices to capital structure, tax considerations play a pivotal role in shaping the financial landscape of businesses.

💼 Optimizing Tax Efficiency: Companies strategically leverage tax accounting to optimize their financial position. By structuring transactions and investments in tax-efficient ways, they can minimize tax liabilities and maximize profitability. It's like playing a game of chess, where every move is carefully calculated to achieve the best outcome.

💡 Key Impacts on Corporate Finance:

Capital Budgeting: Tax implications heavily influence capital investment decisions. Companies assess not only the projected returns on investments but also the tax consequences associated with them.

Capital Structure: Tax considerations impact how companies structure their capital, balancing debt and equity to optimize tax benefits while managing financial risk.

Mergers and Acquisitions: Tax accounting plays a crucial role in the valuation and structuring of mergers and acquisitions. Companies evaluate the tax implications of potential deals to ensure they are financially viable.

Financial Reporting: Tax accounting rules affect how companies report their financial performance. Deferred tax assets and liabilities are recorded based on differences between accounting and tax rules, impacting balance sheet figures and financial ratios.

🔄 The Regulatory Landscape: Tax accounting is subject to a complex web of regulations and standards, adding another layer of complexity to corporate finance. Companies must navigate evolving tax laws and accounting standards to ensure compliance while maximizing financial outcomes.

🌟 Striking the Balance: Balancing tax optimization with financial objectives requires careful consideration and expertise. Companies must weigh the short-term tax benefits against long-term financial sustainability, finding the optimal balance to drive value for stakeholders.

💬 Join the Conversation: What are your thoughts on the impact of tax accounting on corporate finance? Share your insights and experiences! Let's keep the discussion going. 💬💼

#BusinessInsights#TaxAccounting#FinancialStrategy#CorporateFinance#finance#payment system#thefinrate#100 days of productivity#financialinsights

0 notes

Text

Driving Success with Afsar Ebrahim - Executive Director, Kick Advisory (Corporate Strategist)

Unlock strategic insights and elevate your corporate trajectory with Afsar Ebrahim, Executive Director at Kick Advisory. As a seasoned corporate strategist, Ebrahim drives success through innovative solutions, guiding organizations toward excellence in a dynamic business landscape.

0 notes

Text

Corporate Finance: Driving Financial Strategy and Growth

Corporate finance serves as the lifeblood of any organization, steering the financial decisions that shape its trajectory, growth, and sustainability. In essence, it’s the strategic management of funds and capital structure to achieve the overarching goals of a corporation. From optimizing capital allocation to navigating financial risks, corporate finance plays a pivotal role in steering companies toward success.

1. Understanding Corporate Finance

At its core, corporate finance involves a spectrum of activities aimed at maximizing shareholder value while managing financial risks. These activities encompass:

Capital Budgeting and Investment Decisions

Corporate finance evaluates potential investments, assessing their profitability and aligning them with the company’s objectives. This process involves careful analysis, considering factors such as expected returns, risks, and available resources to make informed investment decisions.

Capital Structure Management

Determining the right mix of debt and equity financing is crucial in corporate related finance. Balancing the cost of capital against risk, companies aim to structure their finances optimally to minimize costs and maximize returns for shareholders.

Financial Risk Management

Mitigating financial risks is imperative in corporate finance. This includes managing market risks, credit risks, and operational risks to ensure the company’s financial health and resilience against unforeseen challenges.

Dividend Policy

Deciding on dividend distributions requires a thorough understanding of the company’s financial position, profitability, and future growth prospects. Corporate finance strategies help strike a balance between reinvesting profits for growth and rewarding shareholders with dividends.

2. The Role in Business Operations

Strategic Planning

Corporate-related finance aligns financial goals with broader business strategies. It provides the financial framework that guides decision-making across all levels of the organization, ensuring that every initiative supports the company’s overarching objectives.

Financial Forecasting and Analysis

Through financial modeling and forecasting, corporate finance aids in predicting future financial performance. These analyses guide management in making proactive decisions and adjustments to ensure financial stability and growth.

Mergers and Acquisitions (M&A)

Corporate finance plays a critical role in M&A activities. It involves valuation assessments, structuring deals, and analyzing potential synergies to facilitate successful mergers or acquisitions that create value for the company and its stakeholders.

Corporate Governance and Compliance

Ensuring adherence to regulatory standards and corporate governance principles is an integral part of corporate-related finance. It involves implementing robust internal controls, ethical practices, and transparency in financial reporting.

3. The Future

The landscape of corporate-related finance continues to evolve, influenced by technological advancements, global economic shifts, and changing regulatory environments. Some key trends shaping its future include:

Technology Integration

Innovation in financial technology (FinTech) is reshaping how corporate-related finance operates. Automation, AI-powered analytics, and blockchain technology are streamlining processes, enhancing decision-making, and improving operational efficiencies.

Sustainable Finance

The focus on environmental, social, and governance (ESG) factors is reshaping corporate-related finance practices. Companies are increasingly incorporating sustainability goals into their financial strategies, reflecting a shift towards responsible and ethical business practices.

Data-Driven Decision Making

The abundance of data is transforming corporate finance. Advanced analytics and big data tools enable more accurate financial forecasting, risk assessment, and strategic planning, empowering businesses to make informed decisions.

4. International Finance and Global Markets

Corporate-related finance extends beyond national borders, navigating the complexities of global markets and international finance. Multinational corporations face unique challenges in managing currency risks, navigating diverse regulatory frameworks, and optimizing capital allocation across different markets. Understanding the dynamics of global finance is crucial for companies operating on an international scale.

5. Cost of Capital and Financing Strategies

Determining the cost of capital is fundamental in corporate-related finance. It involves evaluating the cost of debt, equity, and other sources of financing. Companies strive to minimize the overall cost of capital while optimizing the capital structure to fund operations and growth initiatives effectively. This includes considerations like issuing bonds, equity offerings, or exploring alternative financing options.

6. Financial Performance Metrics and Analysis

Measuring and analyzing financial performance metrics is a cornerstone of corporate finance. Metrics like Return on Investment (ROI), Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA), and Cash Flow are essential in assessing the health and efficiency of a company. These metrics aid in evaluating profitability, operational efficiency, and financial health, guiding strategic decision-making.

7. Leveraged Buyouts and Restructuring

Corporate-related finance often plays a critical role in restructuring and leveraged buyouts. In scenarios where companies undergo restructuring or face potential buyouts, corporate-related finance strategies come into play. This involves assessing the financial feasibility, negotiating terms, and structuring deals to optimize outcomes for the stakeholders involved.

8. Financial Innovation and Derivatives

Financial innovation continues to shape corporate-related finance. Derivative instruments, such as options, futures, and swaps, provide companies with tools to hedge risks, manage exposures, and optimize financial positions. Understanding and effectively utilizing these financial instruments are crucial in modern corporate-related finance strategies.

9. Behavioral Finance and Decision-Making

Behavioral finance, a relatively newer field, studies how psychological factors influence financial decisions. Understanding human behavior and biases in financial decision-making helps finance professionals mitigate irrational decision-making, improving overall financial management strategies.

Embracing Change for Financial Excellence

The dynamism of corporate-related finance lies in its ability to adapt to ever-evolving economic landscapes, regulatory changes, and technological advancements. Companies that embrace innovation, leverage data-driven insights, and integrate ethical and sustainable practices into their financial strategies are poised to thrive in an increasingly complex and competitive business environment.

In essence, corporate finance serves as the strategic compass guiding businesses through financial intricacies, empowering them to make informed decisions, mitigate risks, and capitalize on opportunities, ultimately driving sustainable growth and success.

Also Read: 17 Steps to Achieve Financial Freedom

#CorporateFinance#FinancialStrategy#BusinessGrowth#InnovationInFinance#SustainableFinance#GlobalMarkets

0 notes