#chartpattern

Explore tagged Tumblr posts

Link

#CandlestickAnalysis#candlestickpatterns#chartpatterns#ForexTrading#markettrends#MomentumTrading#priceaction#ReversalPatterns#riskmanagement#StockMarket#supportandresistance#technicalanalysis#TradingSignals#TradingStrategy#TrendContinuation

2 notes

·

View notes

Text

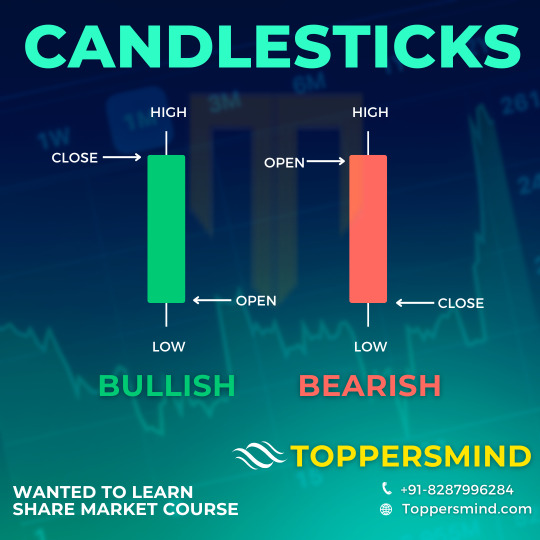

Anatomy of Candlesticks

2 notes

·

View notes

Text

youtube

Learn how to use the Money Flow Index (MFI) — one of the most powerful yet underrated technical indicators.

Perfect for stock traders, technical analysts, and beginners who want to use volume + price in one effective tool.

Read the full blog: https://navia.co.in/blog/money-flow-index-mfi/

Download the app - https://open.navia.co.in/index-navia.php?datasource=DMO-YT

Don't forget to like, share, and subscribe for more trading strategies!

#moneyflowindex#mfiindicator#technicalanalysis#stockmarketindia#tradingforbeginners#stocktradingtips#volumeanalysis#priceaction#tradingstrategies#niftytrading#stockmarketeducation#technicalindicators#overboughtoversold#bullishdivergence#bearishdivergence#breakoutstrategy#tradingtools#momentumtrading#indianstockmarket#naviatrading#chartpatterns#learntrading#intradaytrading#swingtrading#indicatorbasics#investingforbeginners#candlestickpatterns#macdtrading#bollingerbands#Youtube

0 notes

Text

Trading Tick Charts in 2025

In financial markets Trading Tick Charts, traders rely on various tools and strategies to make informed decisions, with charting being one of the most crucial aspects. Among the numerous chart types available, stand out as one of the most innovative and efficient ways to analyze market movements. As we enter 2025, understanding how tick charts work and how they can improve your trading strategies is more critical than ever before.

This guide aims to explore trading tick charts, their significance, and how traders can effectively use them in 2025. We will also discuss the concepts of trade tick chart, trading tick option chain, and the differences between trading tick call vs put, offering an in-depth analysis of how these tools interact to provide a comprehensive view of the market.

What Are Trading Tick Charts?

A trading tick chart is a type of chart used by traders to visualize market data, specifically focusing on the number of transactions (or “ticks”) that occur, rather than traditional time-based charts like minute or hourly charts. Each “tick” represents one completed trade, regardless of the time it takes. This makes tick charts uniquely suited for highly liquid markets, where volume and transaction frequency are high.

Tick charts offer real-time insights into market activity by focusing purely on price movement generated by trades. Unlike traditional time-based charts, which plot data points at fixed time intervals (e.g., every minute, hour, etc.), tick charts adjust based on the number of trades. As a result, a tick chart could feature varying time intervals for each bar depending on how frequently trades are happening.

The primary advantage of using trading tick charts lies in their ability to eliminate the “noise” that often appears in time-based charts. In time-based charts, the price movement can be irregular because a price update might happen quickly or slowly, but with tick charts, you only see actual price changes from executed trades. This results in more accurate and meaningful data that can offer sharper insights into market sentiment and trends.

By ENQUIRE in a reputable ISMT Best Stock Market Course In India (Varanasi) provides both Online & Offline courses to gain knowledge and skills in the world of trading and investment.

#TickCharts#Trading2025#DayTrading#StockMarketTips#TechnicalAnalysis#ScalpingStrategy#AlgoTrading#ChartPatterns#FinancialMarkets#TradingStrategies#FuturesTrading#MarketAnalysis#TradingTools#QuantTrading#StockCharting#DayTraderLife#TradeSmart#ModernTrading#StockTrends2025#DigitalTrading#ISMTInstitute#LearnFromISMT

0 notes

Text

Decoding Advanced Chart Patterns: Double Tops and Head & Shoulders

Understanding Technical Analysis and Chart Patterns

Technical analysis largely depends on identifying visual indicators that hint at potential market movements. Among the array of tools available, chart patterns, such as the double top formation, remain a steadfast choice. The Double Top and Head & Shoulders patterns are among the most reliable and extensively studied formations. These reversal patterns, including the double bottom, aren't mere shapes on a chart—they symbolize the collective psychology of traders and the ongoing battle between buyers and sellers.

The Role of Double Tops and Head & Shoulders in Trading

This guide delves into the formation of these patterns, how traders can leverage them across various markets, and the common pitfalls to avoid. Whether you're involved in forex, stocks, or crypto trading, mastering the Double Top and Head & Shoulders patterns, as well as other continuation patterns, can provide a structured approach to your trading strategy.

What Makes Reversal Patterns So Powerful?

The Importance of Reversal Patterns in Market Analysis

Reversal patterns indicate a change in market direction. They suggest that the current trend—often bullish reversal—is losing steam and that a shift to bearish momentum may follow. This makes them especially useful for traders looking to time exits from long positions or enter new short setups.

Contextualizing Reversal Patterns for Better Trading Decisions

What separates strong patterns from false alarms is context. A Double Top or Head & Shoulders setup means little if the broader trend, volume, and momentum indicators don’t support the narrative. That’s why seasoned traders treat these patterns as part of a wider toolkit—not a standalone signal.

Psychological Insights from Reversal Patterns

Reversal patterns like the Double Top and Head & Shoulders are common reversal patterns are essential for identifying potential trend reversals. These patterns highlight a change in market sentiment, often signaling that the existing trend is weakening. By recognizing these bullish continuation formations, traders can anticipate shifts in the prevailing trend, allowing them to adjust their strategies accordingly. The psychological aspect of these patterns is crucial, as they reflect the collective emotions of market participants—fear, greed, and indecision—leading to potential market reversals.

The Double Top Pattern Explained

Formation and Mechanics of the Double Top

The Double Top forms when price action rallies to a resistance level, pulls back, then rallies again, only to hit the same resistance and drop. The inability to break the previous high shows fading bullish momentum. Once the neckline (the low between the two peaks) is broken, the pattern confirms, and a potential downtrend may begin.

Psychological Insights and Trading Implications

The psychological takeaway is simple: buyers tried twice to push higher but failed. Sellers begin to dominate, and traders may look to capitalize on the shift. This pattern is a classic example of a bearish reversal pattern. It occurs after an upward trend, signaling that the bullish momentum is weakening. The pattern forms when the price hits a resistance level twice, failing to break through, and subsequently declines. This failure to surpass previous highs indicates that buying pressure is diminishing, making it an opportune moment for traders to consider short positions.

Best Conditions for a Double Top Pattern to Work

Optimal Market Conditions

This pattern performs best after a sustained uptrend. If the price has been ranging or consolidating, a double top may not carry as much weight. For maximum effectiveness, traders should confirm the pattern with volume indicators or a trendline break.

Using Technical Indicators for Confirmation

Some traders use oscillators like the RSI to spot bearish divergence at the second peak, which can strengthen the case for a reversal. For the Double Top bearish pattern to be most effective, it is crucial that it follows a strong upward trend. This context provides the pattern with the necessary momentum to signal a reversal. Additionally, confirming the pattern with volume indicators or trendline breaks enhances its reliability. Traders often look for bearish divergence using technical indicators like the RSI to further validate the pattern's potential for signaling a trend reversal.

The Head & Shoulders Pattern: A Stronger Reversal Indicator?

Structure and Significance

The head and shoulders pattern is often viewed as one of the most reliable reversal signals. With its three-peak structure, it reflects a market that's struggling to maintain upward momentum. The left shoulder marks the first rally and pullback, followed by a stronger push upward to form the head. The final rally—the right shoulder—falls short of previous highs, showing weakness in buying pressure.

Confirmation and Trading Strategy

Once the price breaks below the neckline, the pattern confirms. This typically signals a shift from bullish to bearish sentiment. The Head & Shoulders pattern is revered for its reliability as a bearish reversal chart pattern. Its distinct three-peak structure provides a clear visual representation of waning bullish momentum. The pattern's formation, with the head being higher than the shoulders, signifies a weakening of buying pressure. When the price breaks below the neckline, it confirms the pattern, often leading to a significant downward trend.

What Makes Head & Shoulders Patterns So Reliable?

Psychological and Technical Aspects

Institutional traders often watch this pattern because of its psychological clarity. The inability to create a higher high after the head shows that bullish energy is fading. Volume tends to decrease during the formation and then spike during the neckline break, providing additional confirmation.

Versatility Across Timeframes

These patterns also occur across all timeframes, from 5-minute charts in day trading to weekly charts for swing traders. The reliability of the Head & Shoulders pattern, as well as the symmetrical triangle pattern, lies in its clear depiction of market psychology. Institutional traders, in particular, value this pattern for its ability to highlight the exhaustion of buying pressure. As the pattern forms, volume typically decreases, indicating a lack of conviction among buyers. The subsequent volume spike when the neckline breaks serves as a strong confirmation of the bearish reversal. This pattern's versatility across various timeframes adds to its appeal for traders seeking to identify potential trend changes.

Double Top vs. Head & Shoulders: What's the Difference?

While both patterns are bearish reversal signals, they differ in complexity and interpretation.

Double Top is simpler and quicker to form. It shows resistance at a single level and failure to break it.

Head & Shoulders is more gradual and involves a higher high (the head) before the final failure. It's often seen as more reliable but also requires more patience.

In essence, the Double Top reflects rejection at a known resistance, while the Head & Shoulders shows an exhaustion of buyers across three separate waves.

The key distinction between the Double Top and Head & Shoulders patterns lies in their structure and complexity. The Double Top is a straightforward formation, characterized by two peaks at nearly the same level, indicating a clear resistance point. In contrast, the Head & Shoulders pattern is more intricate, featuring three distinct peaks with the head being higher. This complexity often makes the Head & Shoulders pattern more reliable, as it reflects a more gradual exhaustion of buying pressure. However, it also requires traders to exercise patience in waiting for the pattern to fully develop.

How to Trade the Double Top Pattern Effectively?

To trade the Double Top:

Wait for confirmation with a neckline break.

Place a stop-loss slightly above the second peak.

Measure the height from the peak to the neckline and project it downward to estimate your target.

Volume confirmation is important. Ideally, the second peak should form on lower volume, and the break below the neckline should come with a volume spike.

Trading the Double Top pattern effectively requires patience and discipline. Traders should wait for the trend lines and pattern to confirm with a break below the neckline before entering short positions. Setting a stop-loss slightly above the second peak helps manage risk. To estimate a profit target, measure the height from the peak to the neckline and project it downward. Volume plays a crucial role in confirming the pattern's validity, with a lower volume at the second peak and a volume spike during the neckline break serving as key indicators.

How to Trade the Head & Shoulders Pattern?

With the Head & Shoulders:

Identify the three peaks and draw the neckline.

Wait for the price to break below the neckline before entering.

Place your stop above the right shoulder.

Measure the height from the head to the neckline and subtract that from the breakout point to project your target.

Some traders refine this further by using Fibonacci retracement levels for profit-taking zones.

Trading the Head & Shoulders pattern involves a systematic approach. Traders should first identify the three peaks and draw the neckline. Entry should occur only after the price breaks below the neckline, signaling a confirmed reversal. A stop-loss placed above the right shoulder helps protect against potential losses. To determine a profit target, measure the height from the head to the neckline and subtract it from the breakout point.

In addition to these steps, traders often incorporate technical indicators to enhance their strategy. For instance, using the Relative Strength Index (RSI) can help identify overbought conditions, which may coincide with the formation of the right shoulder, further validating the pattern's bearish reversal potential. Moreover, monitoring volume is crucial; a decrease in volume during the formation of the head and shoulders, followed by a volume spike upon the neckline break, strengthens the case for a trend reversal.

Furthermore, it's essential to consider the broader market context. Patterns that align with existing bearish trends or coincide with key resistance levels tend to be more reliable. By integrating these factors, traders can increase their confidence in the pattern and make more informed decisions.

Advanced traders might also look for confluence with other chart patterns or technical indicators, such as moving averages or Bollinger Bands, to confirm the reversal signal. This multi-faceted approach helps in filtering out false signals and improving the accuracy of trade entries and exits.

Overall, the Head & Shoulders pattern, when combined with a comprehensive market analysis and risk management strategy, can be a powerful tool for identifying potential market tops and optimizing trading outcomes.

Can These Patterns Work in Crypto and Forex?

Absolutely. Double Tops and Head & Shoulders appear across all asset classes, including forex and cryptocurrencies. However, in markets like crypto—where price movements, such as during a double bottom formation, are more volatile—false breakouts can be more frequent. That’s why volume and momentum indicators become even more critical in these environments. Traders often rely on these technical indicators to filter out noise and validate genuine trend reversals, ensuring that their trading strategies are robust against market volatility.

In forex, where liquidity and institutional order flow play a larger role, traders often pair these patterns with tools like moving averages, Bollinger Bands, or the ADX to validate breakouts. These additional tools help traders gauge the strength of the trend and the likelihood of a successful breakout, providing a more comprehensive market analysis.

How Institutions and Advanced Traders Use These Patterns?

Institutional traders rarely rely on patterns alone. Instead, they use them in conjunction with order flow, volume profile analysis, and key support/resistance zones. When large players spot a Double Top or descending triangle forming near a major resistance, they may begin building short positions slowly, causing subtle shifts in price that retail traders can learn to recognize. This strategic approach allows them to anticipate market reversals and position themselves advantageously before the broader market reacts.

This deeper layer of pattern interpretation can help traders avoid false signals and better time their entries. By understanding the underlying market dynamics and integrating multiple technical analysis tools, traders can enhance their decision-making process and improve their trading outcomes.

Should You Rely Solely on Chart Patterns?

Not entirely. While patterns like the Double Top and Head & Shoulders can help guide decisions, they’re not predictive guarantees. Successful traders use a combination of chart patterns, market context, volume confirmation, and strict risk management. This holistic approach ensures that they are not solely dependent on one signal but rather have a comprehensive understanding of market conditions.

Combining patterns with indicators like RSI, MACD, or moving averages can increase confidence. Some also use candlestick patterns—like bearish engulfing or shooting stars—as added confirmation near the peaks. This multifaceted strategy allows traders to cross-verify signals, including bullish reversal patterns, and reduce the likelihood of errors.

Real Market Example (Descriptive Only)

Let’s say a currency pair like EUR/USD climbs steadily over two weeks, topping out at 1.1100. After a pullback to 1.1030, it rallies again to 1.1098 but fails to break higher. Shortly after, the price drops below 1.1030 on rising volume. That’s a textbook Double Top. Such scenarios demonstrate the importance of volume analysis in confirming pattern signals, as rising volume during the breakout reinforces the bearish reversal pattern.

Now, imagine a stock forms a high of $150, drops to $140, climbs to $155, and then fails to get past $150 again before collapsing. If you spot the three-peak structure forming over a month and the neckline breaks below $140, you’re looking at a solid Head & Shoulders setup. Recognizing these formations early allows traders to capitalize on potential downward trends, optimizing their profit targets.

Why Learning These Patterns Still Matters in 2025?

1. Enduring Relevance of Chart Patterns

Even in a world dominated by algorithms and high-frequency trading, human behavior doesn’t change. These patterns reflect hesitation, fear, overconfidence, and loss of momentum—all fundamental aspects of market psychology. Understanding these psychological components can give traders an edge in anticipating market reversals and adjusting their strategies accordingly.

2. Improving Timing and Outcomes

Whether you're an active day trader or building a longer-term swing strategy, learning how to confirm Double Tops with volume or spot a Head & Shoulders setup before the neckline break can significantly improve your timing and outcomes. This knowledge equips traders with the ability to navigate complex market environments with greater precision and confidence.

3. Adaptability Across Markets and Timeframes

In addition to their psychological insights, these patterns remain relevant due to their adaptability across various markets and timeframes. As financial markets continue to evolve, the ability to recognize and interpret chart patterns like Double Tops and Head & Shoulders becomes even more crucial for identifying potential bullish reversals. These patterns, as seen on the price chart, provide traders with a framework for understanding market sentiment and potential trend reversals, regardless of the asset class or trading style.

4. Complementing Modern Analytical Techniques

Moreover, as more traders incorporate advanced technical analysis and machine learning tools into their strategies, the foundational knowledge of chart patterns serves as a valuable complement. By combining traditional pattern recognition with modern analytical techniques, traders can enhance their ability to identify profitable opportunities and manage risks effectively.

5. A Timeless Tool for Future Trading

As we move further into the future, the significance of chart patterns in trading will likely persist, offering traders a timeless tool to decode market dynamics and make informed decisions. Whether you're trading stocks, forex, or cryptocurrencies, mastering these patterns will continue to be a critical component of successful trading strategies in 2025 and beyond.

Enhancing Your Strategy with Pattern Recognition

Using chart patterns isn’t about memorizing shapes. It’s about understanding what the market is telling you. When used with the right tools—volume, support, and resistance, momentum indicators—they become powerful allies, including the bullish flag pattern, in building a more disciplined trading plan. This approach encourages traders to focus on data-driven decisions rather than emotional reactions, ultimately leading to more consistent trading success.

Patterns like the Double Top and Head & Shoulders provide structure, helping you avoid emotional trades and focus on setups with a statistical edge. And in a world where markets move fast, having that structure makes all the difference. By integrating these patterns into a broader trading strategy, traders can enhance their market analysis and improve their overall performance.

0 notes

Text

Bitcoin Profit Secrets

Description

Discover the methods and techniques used by the most successful Bitcoin investors so you too can profit and succeed!

Bitcoin has been on the news every single day these past few months. When we turn on the television, visit our favorite news website, or browse our Facebook feed, everyone’s talking about Bitcoin!

The Bitcoin hype is at a fever pitch right now, and everyone wants to make a profit. In fact, many brave souls have tried to profit from the Bitcoin gold rush, but many have failed.

This guide will give you the background on Bitcoin, how it started, who developed it, why it was developed in the first place, and why it’s so much better than any national currency on earth.

Also you will learn how to acquire your first bitcoin, how to mine it, how to trade or invest it, and so much more!

Guide 1: What is Bitcoin and Cryptocurrency Guide 2: How Is The Value of Bitcoin Determined Guide 3: Different techniques to acquiring bitcoin Guide 4: Everything you need to know about Bitcoin Mining Guide 5: Storing your Bitcoin and other cryptocurrency safely Guide 6: Trading and Selling your Bitcoin for profit Guide 7: Using Bitcoin as an investment strategy Guide 8: Accepting and using Bitcoin in your business Guide 9: Protect yourself against fraud and theft Guide 10: The Future of Cryptocurrency

Get access to this ebook forever. Access it offline, anytime, anywhere. Once downloaded, the purchase can't be refunded.

Language: English File: PDF Size: 1,45 MB Pages: 96

#bitcoin#cryptotrading#bitcoinprofit#cryptocurrency#investing#blockchain#financialfreedom#passiveincome#cryptoinvesting#bitcoinsecrets#wealthbuilding#digitalcurrency#cryptocommunity#investmentstrategy#bitcoinwealth#moneymaking#cryptotips#bitcoininvestment#financialliteracy#cryptosuccess#chartpatterns#daytrading#forextrading#investsmart#markettrends#priceaction#riskmanagement#swingtrading#technicalindicators#tradingcommunity

0 notes

Text

Crack the candlestick code, and master the market

#CandlestickPatterns#TechnicalAnalysis#ChartPatterns#TradingSignals#StockCharts#StockMarket#TradingTips#InvestingWisely#MarketTrends#FinancialFreedom

0 notes

Text

Master the art of trading with our Stock Market Technical Analysis Course at Finowings Training Academy! This course is designed to help beginners and experienced traders understand price movements, chart patterns, technical indicators, and trading strategies. Learn how to analyze market trends, identify entry and exit points, and make informed investment decisions.

With expert-led sessions, real-world examples, and practical insights, you'll gain the confidence to navigate the stock market effectively. Whether you're a trader or investor, this course will equip you with essential skills to maximize your profits.

Join Now: Finowings Training Academy

#StockMarket#TechnicalAnalysis#TradingCourse#Investing#ChartPatterns#TradingStrategies#LearnTrading#StockMarketEducation#Finowings

1 note

·

View note

Text

Understanding Momentum and Price Divergence: A Key Trading Edge

In trading, one of the most powerful concepts is that momentum moves before price. The chart below illustrates this beautifully. By observing the momentum oscillator (the lower section of the chart), you’ll notice something critical—divergence.

Divergence occurs when the momentum indicator shows weakness or strength in a direction before the price reacts. For example, as the oscillator begins to decline or lose steam while the price creates higher highs, this signals a potential reversal or weakness in the upward trend. This gives traders a clear indication of what might come next.

Momentum is like the engine behind price action. Paying close attention to it allows you to anticipate market moves before they happen. This means you can position yourself more strategically, rather than reacting after the price has already moved.

Understanding this concept isn’t just a theory—it’s a proven tool that successful traders use daily to predict future market movements. Take the time to analyze momentum and divergence in your charts. It could be the edge you’ve been looking for in your trading journey! 🚀

What do you think about using momentum indicators in your trading? Let’s discuss below! 📈

#forextrading#momentum trading#price action#tradingtips#technicalanalysis#DivergenceTrading#ForexStrategies#MomentumOscillator#TradingEducation#MarketAnalysis#TradingCommunity#LearnToTrade#TradingEdge#DayTrading#ChartPatterns

0 notes

Text

10 Most Powerful Chart Patterns for Traders!

@ParkaviFinance Discover the 10 Most Powerful Chart Patterns for Traders! 📈Unlock the secrets of technical analysis with our comprehensive guide to the 10 most powerful chart patterns. In this video, you'll learn how to identify and trade patterns like Head and Shoulders, Double Top, Double Bottom, and Wedge. Whether you're a beginner or an experienced trader, these patterns can be a game-changer for your trading strategy.

What You'll Learn:

- Identifying Chart Patterns: Spot patterns on stock charts with ease.

- Understanding Patterns: Learn the significance of different parts of a chart pattern.

- Trading Strategies: Utilize bullish, bearish, and neutral patterns in your trades.

- Risk Management: Be aware of common risks involved in trading chart patterns.

- Expert Tips: Enhance your technical analysis and trading strategies.

Watch till the end to gain the confidence to analyze trends and make informed trading decisions. Don't forget to LIKE, COMMENT, and SUBSCRIBE to Parkavi Finance for more stock market insights, tips, and strategies! Hit the notification bell so you never miss an update.

Watch in Tamil:

https://youtu.be/WjhhXfiFOFE

Watch in English:

https://youtu.be/A5udwIpo2p0

Read in English:

https://www.parkavifinance.com/2024/11/10-most-powerful-chart-patterns-every.html

Read in Tamil:

https://tamilparkavifinance.blogspot.com/2024/11/tamil-market-insights-10-chart-patterns.html

chart patterns, stock market trading, head and shoulders, double top, double bottom, wedge trading, bullish patterns, bearish patterns, technical analysis for traders, risk management in trading, trading strategies, top chart patterns, beginner trading tips, #ChartPatterns #TechnicalAnalysis #StockTrading #HeadAndShoulders #DoubleTop #DoubleBottom #TradingStrategies #Bullish #Bearish #WedgePattern #RiskManagement #TopChartPatterns #BeginnerTradingTips

#share market#technical analysis#financial freedom#trading strategies#financial updates#investing stocks#stock market#chartpatterns

0 notes

Text

Bollinger Bands. How does it work?

Bollinger Bands are a popular technical analysis tool for tracking price volatility and trends in commodities, forex, equities, and futures markets. This indicator consists of three bands—Upper, Middle, and Lower—plotted on a two-dimensional chart. The Middle Band is a simple moving average (SMA), while the Upper and Lower Bands represent two standard deviations above and below this SMA.

Bollinger Bands contract when market volatility is low and expand during high volatility, helping traders make more informed decisions. These bands can be applied across various time frames, from hourly and daily to weekly or monthly, making them versatile for both short- and long-term strategies.

How Bollinger Bands Are Constructed?

Learn more: https://www.investchannels.com/bollinger-bands-how-does-it-work/

#BollingerBands#TradingStrategies#ForexTrading#MarketAnalysis#TechnicalIndicators#FinancialMarkets#PriceVolatility#Forex#Commodities#Equities#Futures#TechnicalAnalysis#DayTrading#TradingTools#StockMarket#SwingTrading#InvestmentStrategies#PriceTrends#MarketVolatility#CryptoTrading#ChartPatterns#RiskManagement#TradingCommunity#TradingInsights#FinancialFreedom#InvestingBasics#ForexSignals#ForexTips#SmartInvesting#TradeSmart

0 notes

Text

instagram

#sharemarket#stockmarket#candlesticks#candlestickpatterns#sharetrading#candles#chartpatterns#delhi#Instagram

0 notes

Text

Bitcoin Breakthrough - Training Guide

Bitcoin is a cryptocurrency and a virtual type of money. It’s really like having an online version of money or cash.

You can use Bitcoin to purchase products and services and more and more vendors are accepting Bitcoin as a form of payment these days.

Now is a very good time to take an interest in Bitcoin and invest in it. It has been going strong for 10 years and its popularity has soared.

In order to make the best returns on Bitcoin investments you need to understand what it really is and how it works.

With this step by step guide:

you will learn how to avoid scams in cryptocurrency you will learn how work the blockchain technolog you will be able to keep your bitcoins safe in the best wallets you will know the best way to obtain bitcoins and the best investment strategies you will learn the advice you need to follow to make a good return on your investment

Get access to this ebook forever. Access it offline, anytime, anywhere. Once downloaded, the purchase can't be refunded.

Language: English File: PDF Size: 6,91 MB Pages: 33

#bitcoinbreakthrough#cryptotraining#bitcoinguide#blockchaineducation#investinbitcoin#cryptosuccess#digitalcurrency#bitcointips#learncrypto#cryptoinvesting#bitcoinforbeginners#financialfreedom#cryptoknowledge#bitcoinstrategy#wealthbuilding#bitcoincommunity#cryptotrends#investsmart#futureoffinance#bitcoinjourney#chartpatterns#daytrading#forextrading#technicalindicators#swingtrading#riskmanagement#markettrends#priceaction#tradingcommunity

0 notes

Text

Nifty Index: Is a Market Correction Coming? Analysts Predict a Slide to Key Support Level #200dayexponentialmovingaverage #chartpatterns #marketcorrection #Niftyindex #technicalindicators

#Business#200dayexponentialmovingaverage#chartpatterns#marketcorrection#Niftyindex#technicalindicators

0 notes

Text

youtube

https://tradegenie.com/coaching/ - In this comprehensive 2 hours and 28 minutes session, we're your trusted guide to exploring a plethora of powerful trading methodologies that cater to every market condition and time frame.

Whether you're a seasoned trader or a newcomer, these strategies will arm you with the tools needed to navigate the markets confidently and make strategic trading decisions.

Websites:

Facebook - https://www.facebook.com/thetradegenie/

Head Office:

Trade Genie Inc.

315 South Coast Hwy 101,

Encinitas, CA 92024

Phone Number: 212-408-3000

Contact: [email protected]

#BlackBoxTrading #AdvancedTradingStrategies #ChartPatterns #MovingAverages #TrendTrading #SupportAndResistance #BreakoutTrading #GapTrading #IntraDayTrading #FinancialMarkets #StockMarket #Investing #TradingTips

#BlackBoxTrading#AdvancedTradingStrategies#ChartPatterns#MovingAverages#TrendTrading#SupportAndResistance#BreakoutTrading#GapTrading#IntraDayTrading#FinancialMarkets#StockMarket#Investing#TradingTips#Youtube

1 note

·

View note