#cma report for small business

Text

Crucial Need for CMA Reports in Business Management

In the dynamic landscape of modern business, making informed decisions is paramount for sustainable growth and profitability. The Cost Management Accounting (CMA) report stands as an invaluable tool that equips businesses with essential insights into their financial operations. This comprehensive document not only aids in understanding costs but also plays a pivotal role in strategic planning, resource allocation, and performance evaluation.

Understanding CMA Reports

The CMA report is a detailed analysis that delves into a company's cost structure, revenue streams, and overall financial health. Unlike traditional financial statements, which focus on historical data, CMA reports provide real-time and forward-looking information. This enables business leaders to make proactive decisions that can positively impact the company's future.

The Need for CMA Reports

Effective Cost Management: In a competitive market, optimizing costs is essential for maintaining profitability. A CMA report identifies cost drivers, analyzes cost behavior, and pinpoints areas where expenses can be minimized without compromising product or service quality.

Strategic Decision-making: Businesses must adapt to changing market conditions swiftly. A CMA report aids decision-makers by providing accurate data on costs, revenue trends, and market dynamics. This empowers them to adjust strategies and seize opportunities effectively.

Performance Evaluation: Evaluating the performance of various departments or product lines is critical for identifying strengths and weaknesses. CMA reports provide insights into which areas are contributing the most to the company's bottom line and which might need improvement.

Resource Allocation: Efficient resource allocation ensures optimal utilization of assets. CMA reports assist in determining where resources are most effective and how to allocate them strategically for maximum returns.

Budgeting and Forecasting: Planning budgets and forecasts becomes more accurate with CMA reports. These reports provide a clear understanding of expected costs, revenues, and profitability, enabling businesses to plan ahead effectively.

Pricing Strategies: Determining the right price for products or services requires a deep understanding of costs. CMA reports help in setting competitive prices that cover costs and maintain profitability.

Risk Management: Businesses operate in an environment fraught with risks. By analyzing costs and revenue patterns, CMA reports enable businesses to identify potential financial risks and take preventive measures.

Creating a CMA Report

Constructing a comprehensive CMA report involves various steps:

Data Collection: Gather accurate data on costs, revenues, production volumes, and other relevant factors.

Cost Classification: Categorize costs into fixed, variable, and semi-variable, as well as direct and indirect costs.

Cost Analysis: Analyze cost behavior, break down costs by department or product line, and assess cost-volume-profit relationships.

Variance Analysis: Compare actual costs with budgeted costs to identify variations and their underlying causes.

Trend Analysis: Examine historical data to identify patterns and trends that can guide future decisions.

Conclusion

The world of business demands precision, adaptability, and informed decision-making. In this context, CMA reports emerge as a critical tool for success. By offering insights into cost structures, revenue streams, and overall financial performance, these reports empower businesses to navigate challenges, capitalize on opportunities, and pave the way for sustained growth in a competitive landscape

#cma report#cma report for small business#prepare cma report online#need cma report#bank loan project report

0 notes

Text

Micro-Business Empowerment: Unveiling 5 Key Insights into CGTMSE Loan Schemes for Sustainable Growth

Micro-Business Empowerment: Unveiling the Pros and Cons of CGTMSE Loan Schemes for Sustainable Growth: Key Insights into CGTMSE Loan Schemes for Sustainable Growth

India’s vast network of Micro, Small, and Medium Enterprises (MSMEs) forms the backbone of the nation’s economy. However, securing funding for these small businesses often proves challenging due to their perceived higher risk profile.…

View On WordPress

#Business Development#CGTMSE Loans#CMA Data#Credit Guarantee Fund Scheme#Empowerment#Entrepreneurship#Financial Consulting#Financial Empowerment#Loan Schemes#Micro-business#MSMEs#Project Reports#Pros and Cons#Small Business Financing#Sustainable Growth

0 notes

Text

Importance of CMA data to SME owners

CMA (Credit Monitoring Arrangement) data is crucial for SME (Small and Medium Enterprises) owners for several reasons:

1. Assessment of Financial Health

Comprehensive Overview: CMA data provides a detailed snapshot of a business's financial status, including income, expenses, and cash flow. This helps SME owners assess their financial health and make informed decisions about their operations and growth strategies.

2. Loan Application and Creditworthiness

Lender’s Requirement: When applying for loans or credit facilities, lenders require CMA data to evaluate the business’s creditworthiness. This data helps lenders understand the business’s financial stability, profitability, and ability to repay the loan.

Improving Loan Terms: Well-prepared CMA data can lead to more favorable loan terms, including lower interest rates and higher credit limits, as it demonstrates the business’s financial discipline and management.

3. Financial Planning and Management

Cash Flow Management: CMA data helps in tracking cash flow patterns, allowing SME owners to manage working capital effectively and avoid liquidity issues.

Budgeting and Forecasting: It assists in creating accurate budgets and financial forecasts, essential for planning future expenditures and investments.

4. Monitoring Business Performance

Trend Analysis: By reviewing CMA data, SME owners can analyze financial trends over time, identify areas of improvement, and make strategic adjustments to enhance performance.

Benchmarking: It allows businesses to benchmark their financial performance against industry standards or historical data, providing insights into areas where they are excelling or need improvement.

5. Strategic Decision Making

Informed Decisions: Access to accurate and detailed financial information enables SME owners to make informed strategic decisions, such as expanding operations, investing in new projects, or adjusting pricing strategies.

Risk Management: Understanding financial data helps in identifying potential risks and implementing strategies to mitigate them, ensuring long-term business stability.

6. Compliance and Reporting

Regulatory Requirements: Maintaining accurate CMA data ensures compliance with regulatory and financial reporting requirements, helping avoid legal issues and penalties.

Transparency: It promotes transparency in financial reporting, which is important for maintaining trust with stakeholders, including investors, partners, and regulatory bodies.

7. Relationship with Financial Institutions

Building Trust: Regular and accurate CMA data can strengthen relationships with banks and financial institutions, as it demonstrates reliability and financial responsibility.

Future Financing: A solid record of CMA data can facilitate easier access to future financing needs, as lenders are more likely to trust a business with a proven track record.

In summary, CMA data is a vital tool for SME owners to manage their finances effectively, secure funding, make strategic decisions, and ensure long-term business success. It provides essential insights into financial health and helps in maintaining a robust relationship with financial institutions.

0 notes

Text

Report on a comprehensive financial study that details the performance, risks, and opportunities of a company. beneficial for making well-informed decisions.

0 notes

Text

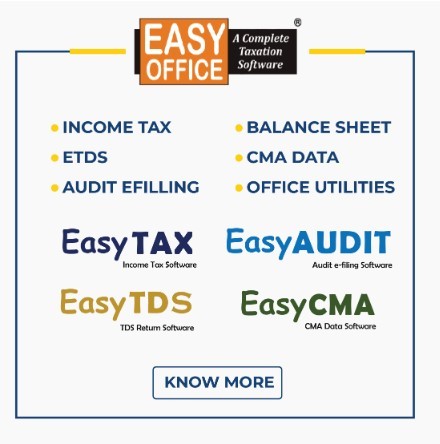

cma report software, best software for cma data preparation, cma software for chartered accountants

Cma Software Price

.

EasyCMA

cma software

Preferred Choice & Best Software for CMA Report

cma software download

EasyCMA is a module of EasyOFFICE software for CMA Report generation. EasyCMA - CMA Data preparation software is a comprehensive software for preparing and calculating CMA Data, MPBF calculation, depreciation chart, DFDR, interest calculation, present and maturity value calculations & also includes other financial tools, all these features makes this a useful solution for CMA Report preparation. EasyCMA is the best software for preparing and calculating CMA Data.

.

Best Cma Data Software

CMA Data Preparation

Multi-Year CMA Data Preparation in an operating statement on the basis of a percentage (%) increase.

MPBF statement

cma data software free download

Automatic preparation of the comparative statement, Analysis of Balance Sheet, MPBF (Maximum Permissible Bank Finance) statement, Fund flow and Ratio Statement.

Depreciation chart

cma report software

Preparation of Depreciation chart on Written down Value and Straight Line Method

Financial Tools

Many useful Financial Tools

.

best software for cma data preparation

GST complaint Fully Accounting Software EASYACC is specific software of Financial Accounting. The software is an integrated business accounting software for Small and Medium traders and as well as for professionals.

.

cma software for chartered accountants

The software due to its user-friendly interfaces, Advanced Features, robustness, convenience and speed is being extensively used by Chartered Accountants, Tax Professionals, Consultants, Accountants, Traders and industries..

.

Cma Data Software

Contact Us

Address :- 505, Sukhsagar Complex, Nr. Hotel Fortune Landmark, Usmanpura Cross Road, Ashram Road, Ahmedabad - 380013. Gujarat (INDIA).

Call :- +91-079-27562400, 079-35014600, 079-35014601, 079-35014602

Email :- [email protected] Website :- www.electrocom.in

0 notes

Text

How to Find and Select the Right Accountant for Your Small Business

Running a small business comes with its fair share of financial challenges and responsibilities. As your business grows, so do the complexities of managing your finances. That’s where a qualified accountant can make a significant difference. They can help you navigate the intricacies of tax laws, financial reporting, and more, ensuring that your business remains on solid financial footing. However, finding and selecting the right accountant for your small business is crucial. In this comprehensive guide, we’ll walk you through the steps to help you find the perfect financial partner for your entrepreneurial journey.

1.Determine Your Needs

Before you start searching for an accountant, you need to clarify what your specific financial needs are. Consider the following questions:

What accounting services do you require? (e.g., bookkeeping, tax planning, payroll management)

Are there any industry-specific requirements or regulations you need your accountant to be familiar with?

Do you prefer working with a local accountant or are you open to remote or online accounting services?

Are you looking for a full-time, part-time, or contract accountant?

Having a clear understanding of your needs will guide your search for the right accountant.

2. Look for Qualified Candidates

Once you’ve defined your needs, it’s time to start your search. Here’s how to find qualified candidates:

a. Referrals: Begin by asking fellow small business owners, friends, or your professional network for recommendations. Personal referrals can be an excellent way to find trustworthy accountants.

b. Online Directories: Utilize online directories and professional networks like LinkedIn, the American Institute of CPAs (AICPA), or your local chamber of commerce to find accountants in your area.

c. Professional Organizations: Look for accountants who are members of reputable professional organizations like the AICPA or the National Association of Enrolled Agents (NAEA). Membership in such organizations often signifies a commitment to professional excellence.

d. Online Platforms: Consider using online platforms that connect small businesses with accountants and financial professionals. These platforms often provide reviews and ratings to help you make informed decisions.

3. Assess Qualifications and Experience

After compiling a list of potential candidates, it’s time to assess their qualifications and experience. Look for the following:

Educational Background: Ensure that the accountant has the necessary educational qualifications, such as a degree in accounting or finance.

Certification: Many accountants hold certifications like Certified Public Accountant (CPA) or Certified Management Accountant (CMA), which demonstrate their expertise.

Industry Knowledge: If your business operates in a specific industry, consider an accountant with relevant industry experience and knowledge of industry-specific regulations.

Years of Experience: Assess how many years of experience the accountant has working with small businesses, especially those of a similar size and complexity to yours.

Client References: Ask for and check client references to gain insights into the accountant’s performance and client satisfaction.

4. Evaluate Compatibility and Communication

Beyond qualifications, compatibility and communication are crucial factors. Arrange meetings or interviews with potential accountants to:

Assess their communication style. Effective communication is essential to ensure you can understand and work well with your accountant.

Discuss fees and pricing structures to ensure they align with your budget and financial expectations.

Gauge their availability and responsiveness. You want an accountant who is accessible when you need them.

Clarify their approach to financial advice and decision-making, ensuring it aligns with your business values and goals.

Determine if they use modern accounting software and technology for efficiency and accuracy.

5. Check Ethical Standards and Trustworthiness

Your accountant will have access to sensitive financial information, so trustworthiness is paramount. To ensure you are working with an ethical accountant:

Check for any past ethical violations or disciplinary actions through state boards or professional organizations.

Request a copy of their code of ethics or professional conduct, which they should adhere to.

Trust your instincts. If something feels off or if you have any doubts about their integrity, consider other candidates.

6. Clarify Terms and Engagement

Once you’ve identified a potential accountant, it’s time to clarify the terms and engagement details:

Discuss the scope of work, including the specific services they will provide and the expected timeline.

Clarify the fee structure, whether it’s hourly, monthly, or project-based. Ensure there are no hidden fees.

Establish a clear engagement contract that outlines responsibilities, deliverables, deadlines, and confidentiality agreements.

Agree on how you will communicate and share financial information securely.

Discuss how often you will review financial reports and assess progress.

Conclusion

Hiring the right accountant for your small business is a critical step in ensuring your financial health and success. By following these steps, you can find an accountant who not only meets your technical and ethical requirements but also understands your business goals and values. Remember that the right accountant can become a valuable partner in your business journey, providing insights and guidance to help you make informed financial decisions. Take your time in the selection process, and don’t hesitate to seek professional advice if needed, as the right accountant can be a long-term asset to your business.

Follow Our Blog page for more details.

0 notes

Text

The role of a chartered accountant in nation’s progress

CAs (chartered accountants) play a major role in the progress of a country as they, more often than not, work behind the scenes to make sure that the country is financially growing and stable. It is not that their role is limited to crunching numbers only. They also don the hats of financial advisors, compliance experts, and advisors. Thus, as you can see for yourself, they played a multifaceted role and their expertise does indeed contribute to a country’s economic development.

Financial stewardship

This is at the core of the work that CAs do. They help both businesses and individuals with efficient management of their finances. As far as businesses are concerned, they are instrumental in areas such as budgeting, cost management, and financial planning. They make sure that financial resources are being allocated with wisdom and this is how they contribute to economic growth. Their work enhances the sustainability and profitability of businesses. This, in turn, contributes to the government earning higher tax revenues and more jobs being created in the market.

Ensuring compliance

The regulatory environment has become complex nowadays and you must be compliant with all tax laws that apply to you. The same also goes for other essential regulations such as financial reporting standards. CAs can be regarded as experts in these areas and they always make sure that both individuals and businesses are meeting the legal obligations they are supposed to in this regard. By doing so they make sure that there are no penalties or legal disputes. After all, it is common knowledge that both these phenomena can have a detrimental effect on the financial health of businesses which will spill over to the greater economy as well.

CA's make sure that businesses have a level playing field. They also promote economic stability and fair competition.

Financial auditing

This is perhaps the most critical of all the functions that CAs perform. They review financial statements and make sure that they are accurate and in compliance with the applicable accounting standards. Not only does this instil confidence in stakeholders and investors but also assists with the prevention and detection of financial mismanagement and fraud. When investors and other participants in a financial market are able to trust the veracity of financial information it helps with the flow of capital and promotion of investment. Both these factors are important for a country to grow economically.

Apart from what we have said so far, these professionals are also experts in taxation and play a vital role in supporting small businesses and start-ups. The same can also be said of their proficiency in domains such as ethical standards and risk management. So, in the end, it can be said without a degree of exaggeration that they are the unsung heroes of the road traversed by a country towards economic progress. It is their expertise in areas such as financial management, taxation, compliance, risk management, and auditing that underpins the economic growth and stability of a country. They promote financial transparency, good governance, and ethical conduct too!

N.B - Navin Classes is a reputed CA CS CMA coaching center in India.

0 notes

Text

Accelerate Your Career With an Accounting Certification!

Certified Management Accountant (CMA)

CMA is again a new career prospect for students with a commerce background. It comprises management accountancy that can help in financial accounting and strategic business management. CMA professionals do not go into auditing, taxing, or general accounting, but assist an organization in business management and forming strategies.

Eligibility criteria

CMA is gaining popularity over the last few years and many students are aspiring to become CMA professionals. But before you sail your ship toward the destination, you need to understand the eligibility criteria before getting into the ship. Here is a small list that can help you:

You should be a member of the Institute of Management Accountants (IMA)

Bachelor’s degree

2 years of relevant experience

Passing both parts of CMA examination

Exams in the route

The CMA exam is divided into 2 parts of 4 hours each. You have to clear or pass the exam within 3 years of enrolling for CMA. It covers everything from financial reporting and cost management to corporate finance and risk management. You can appear for these exams in January, February, May, June, September, and October.

When it comes to pursuing a certification or an educational qualification, the aim is to add credibility and earn respect. In both cases, you need something really solid foundation built which will bring you to the level you want to see yourself. The courses we discussed so far are exactly going to help you bring out the best in you in the long run.

Also, read Top 5 Accounting Certifications for Best Career!

#cpa exam#certified public accountant#cpa full form#cpa in India#CPA review#cpa training institute#cpa salary in India#cpa syllabus#cpa license#cpa cost#cpa fees#us cpa exam#cpa exam fees in India#cpa details#cpa average salary in India#cpa highest salary India#best institute for CPA in India#cpa course details and fees#US Certified Public Accountant Exam

0 notes

Text

Commerce Coaching in Boring Road, Patna- Sukrishna Commerce Academy

Sukrishna Commerce Academy has established itself as the best commerce coaching in Boring Road, Patna. With a team of highly experienced faculty members, a comprehensive curriculum, and a student-centric approach, Sukrishna Commerce Academy has consistently produced outstanding results, making it the go-to destination for commerce aspirants in Patna.

Sukrishna Commerce Academy is the best commerce institute in Patna and has built a strong reputation for its consistent success in commerce education. Over the years, the institute has helped countless students achieve their goals and secure top ranks in commerce exams. The institute's commitment to excellence is reflected in its remarkable track record of producing toppers in various commerce examinations, including the CBSE Board exams, CA Foundation, CS Foundation, and CMA Foundation. This consistent success is a testament to the institute's unwavering focus on quality education and personalized attention to each student.

Visit us: www.sukrishna.in

One of the key factors that sets Sukrishna Commerce Academy apart from other coaching institutes is its team of highly experienced and dedicated faculty members. The institute provide top commerce classes in Patna prides itself on having a faculty pool comprising seasoned educators with extensive subject knowledge and a passion for teaching. These educators bring a wealth of industry experience and expertise to the classroom, enabling students to gain practical insights and a holistic understanding of commerce concepts. The faculty members at Sukrishna Commerce are not just teachers but also mentors who provide personalized guidance to each student, ensuring their academic growth and overall development.

Sukrishna Commerce Academy is the best commerce coaching in Patna, that offers a meticulously designed curriculum that covers all aspects of commerce education. The institute understands the importance of a well-rounded education and aims to provide best CA classes in Patna, to students with a strong foundation in commerce subjects such as Accountancy, Business Studies, Economics, and Mathematics. The curriculum is regularly updated to align with the latest examination patterns and industry requirements. Additionally, Sukrishna Commerce Academy focuses on building the analytical and problem-solving skills of students, enabling them to tackle complex commerce problems with ease. The institute also provides comprehensive study materials, reference books, and online resources to supplement classroom teaching and facilitate self-study.

Being the best CA institute in Patna, At Sukrishna Commerce Academy, students are at the center of everything. The institute believes in nurturing the potential of each student and tailors its teaching methodology to cater to their individual needs. Small batch sizes ensure personalized attention and allow for interactive classroom sessions, where students can actively participate and clarify their doubts. The faculty members at Sukrishna Commerce Academy are easily approachable and encourage students to seek guidance whenever required. Regular parent-teacher interactions and progress reports keep parents updated on their child's performance and help in fostering a supportive learning environment.

Visit us: www.sukrishna.in

Sukrishna Commerce Academy is the best CA coaching in Patna, provide CS CA classes in Patna, and understands the importance of a conducive learning environment and provides state-of-the-art infrastructure to facilitate effective learning. The institute is the best commerce coaching in Bihar, and boasts well-equipped classrooms with modern teaching aids, including audio-visual systems, projectors, and smart boards. The library is stocked with a wide range of reference books, textbooks, and study materials to cater to the diverse needs of students. Additionally, the institute offers a computer lab with internet facilities for students to access online resources and practice tests. The infrastructure at Sukrishna Commerce Academy is designed to create a comfortable and inspiring atmosphere for students to thrive academically.

#Bestcommercecoachinginpatna#bestcommerceinstituteinpatna#bestcainstituteinpatna#bestcaclassesinpatna#commercecoachinginboringroad#bestcacoachinginpatna#cacsclassesinpatna#bestcommercecoachinginbihar

0 notes

Text

Online Accounting Jobs in India: Opportunities and Trends

The advent of the digital age has revolutionized the way businesses operate across the globe, and India is no exception. With the widespread adoption of technology, online accounting jobs have gained immense popularity in India. This article explores the opportunities and trends in online accounting jobs in India, highlighting the benefits, challenges, and the evolving landscape of remote accounting work.

Rise of Online Accounting Jobs

The rapid growth of internet connectivity and the proliferation of cloud-based accounting software have paved the way for online accounting jobs in India. Small businesses, startups, and freelancers are increasingly seeking the convenience and cost-effectiveness of remote accounting services. This has led to the rise of various online platforms, job boards, and freelance marketplaces that connect accounting professionals with clients in need of their expertise.

Advantages of Online Accounting Jobs

Online accounting jobs offer numerous advantages for both professionals and businesses. For accountants, remote work provides flexibility, independence, and the ability to work with clients from diverse industries and locations. It eliminates the need for commuting and offers a better work-life balance. On the other hand, businesses benefit from reduced overhead costs, access to a larger talent pool, and the convenience of outsourcing their accounting needs to experts.

Key Roles and Responsibilities

Online accounting jobs encompass a wide range of roles and responsibilities. These include bookkeeping, financial analysis, tax preparation, payroll processing, audit support, and financial reporting. Accountants may also specialize in areas such as management accounting, forensic accounting, or cost accounting. Additionally, professionals in this field are expected to stay updated with changing regulations and industry best practices.

Required Skills and Qualifications

To excel in online accounting jobs, individuals should possess a strong foundation in accounting principles, as well as proficiency in accounting software and technology. Key skills include financial analysis, attention to detail, problem-solving, and communication skills. Furthermore, obtaining relevant certifications such as Chartered Accountant (CA), Certified Public Accountant (CPA), or Certified Management Accountant (CMA) can enhance career prospects in this field.

Challenges and Mitigation Strategies

While online accounting jobs offer numerous benefits, they also come with certain challenges. Communication barriers, data security concerns, and maintaining trust with remote clients can pose difficulties. However, these challenges can be mitigated through clear and effective communication channels, implementing robust cybersecurity measures, and building strong professional relationships based on transparency and integrity.

Emerging Trends in Online Accounting

The landscape of online accounting jobs in India is continuously evolving. Technological advancements such as artificial intelligence (AI), machine learning, and automation are transforming traditional accounting processes. Cloud-based accounting software, mobile applications, and digital payment systems are gaining popularity, streamlining workflows and enhancing collaboration. Additionally, the COVID-19 pandemic has accelerated the shift towards remote work, further driving the demand for online accounting services.

Online accounting jobs in India or Best accounting jobs in India offer promising opportunities for accounting professionals and businesses alike. The convenience, flexibility, and cost-effectiveness of remote work, coupled with technological advancements, have propelled the growth of this sector. As the digital landscape continues to evolve, online accounting is set to play an increasingly pivotal role in India's business ecosystem.

0 notes

Text

Know from Expert How to Become a Successful Accountant.

Accounting is the process of measuring, processing, and communicating financial information about economic entities such as businesses and corporations. An Accounting Course typically covers the fundamental principles, concepts, and techniques used in accounting to record financial transactions and prepare financial statements. Topics covered in an Accounting Course may include financial statement analysis, bookkeeping, taxation, cost accounting, auditing, and managerial accounting. Graduates of an accounting course can pursue careers in various fields such as public accounting, corporate accounting, government accounting, or nonprofit accounting. In addition, accounting is a critical skill for entrepreneurs and small business owners who need to track their financial performance and make informed decisions.

Structured Learning Assistance - SLA is known for its excellence in education sector who provides Accounting Course in Delhi, Noida Mumbai, Pune, Hyderabad & Bangalore fortified with a well established infrastructure with advanced lab facility, senior industry expert and modern training system to enhance the knowledge of students. SLA is well known entity having Accounting & Taxation Institute. It is built with all convenient facilities and positive study ambiance for the students. Fulfill the main task of placement, SLA aids in 100% Job Placement after completion of 70% course.

If you're interested in becoming a successful accountant, here is a guide to help you get started:

Earn a Degree in Accounting or a Related Field:- To become an accountant, you will need at least a bachelor's degree in accounting or a related field. Some employers may also require or prefer a master's degree in accounting, finance, or business administration.

Obtain Professional Certifications:- To increase your job prospects and demonstrate your expertise in accounting, consider obtaining professional certifications such as the Certified Public Accountant (CPA), Certified Management Accountant (CMA), or Certified Internal Auditor (CIA). Accounting Course in Laxmi Nagar Delhi, Noida Mumbai, Pune, Hyderabad & Bangalore

Gain Practical Experience:- Internships, part-time jobs, and volunteer opportunities can help you gain practical experience in the field of accounting, as well as network with professionals in the industry.

Develop Strong Analytical Skills:- As an accountant, you will be required to analyze financial data, prepare financial reports, and provide financial advice to clients. Strong analytical skills are essential to becoming a successful accountant.

Stay Current with Industry Trends and Regulations:- The field of accounting is constantly evolving, so it's essential to stay up-to-date with industry trends and regulations. This can be achieved through attending industry conferences, seminars, and workshops, as well as reading industry publications.

Develop Excellent Communication Skills:- As an accountant, you will be required to communicate financial information to clients, colleagues, and other stakeholders. Excellent communication skills are essential to becoming a successful accountant. Accounting Course in Laxmi Nagar

Build a Professional Network:- Networking with other accounting professionals, attending industry events, and joining professional organizations can help you build a professional network that can help you advance your career.

Consider Specializing in a Specific Area of Accounting:- Specializing in a specific area of accounting, such as tax accounting or forensic accounting, can help you become an expert in your field and increase your job prospects.

Pursue Continuing Education:- Continuing education is essential to staying current with industry trends and regulations, as well as maintaining professional certifications. Accounting Course in Noida, Noida Mumbai, Pune, Hyderabad & Bangalore

Develop a Strong Work Ethic:- A strong work ethic is essential to becoming a successful accountant. This includes being reliable, diligent, and ethical in your work.

In conclusion, becoming a successful accountant requires a combination of education, certification, practical experience, strong analytical and communication skills, staying current with industry trends and regulations, building a professional network, specializing in a specific area of accounting, pursuing continuing education, and developing a strong work ethic.

1 note

·

View note

Text

New Post has been published on All about business online

New Post has been published on http://yaroreviews.info/2023/01/green-claims-on-household-basics-investigated

Green claims on household basics investigated

Getty Images

By Dearbail Jordan

Business reporter, BBC News

“Green” claims made in advertising for household basics, such as washing-up liquid, are to be scrutinised to see if they are misleading.

The Competition and Markets Authority (CMA) said it is concerned consumers are “paying a premium for products that aren’t what they seem”.

It will examine the accuracy of environmental claims on goods such as cleaning products and toiletries.

CMA boss Sarah Cardell said she is concerned companies are “greenwashing”.

This is when a firm exaggerates its environmental credentials for marketing purposes.

“As more people than ever try to do their bit to help protect the environment, we’re concerned many shoppers are being misled and potentially even paying a premium for products that aren’t what they seem, especially at a time when the cost of living continues to rise,” Ms Cardell said.

She said it would be looking at both big and small firms’ products to see if the environmental claims they made were true.

The investigation will also look into the accuracy of green claims made about food and drink. The CMA said last year shoppers spent £130bn on household essentials.

It said “a significant number” of household products are marketed as green or environmentally friendly, including almost all dishwashing items and toilet products.

The watchdog said it is worried about a number of areas including products that use “vague and broad” statements such as claiming packaging is sustainable or “better for the environment” with no evidence.

It will also look at claims over the use of recycled or natural materials in products, as well as whether entire ranges are being incorrectly branded as “sustainable”.

More on this story

Glass bottles excluded from deposit return plans

5 days ago

Why inflation is falling but prices are still rising

7 days ago

0 notes

Text

CMA refers for Credit Monitoring Arrangement in the context of banking and finance, and CMA reports are crucial records used by banks and financial institutions to evaluate the creditworthiness and financial health of its clients, particularly corporate entities. These reports are essential for controlling credit risk and making wise loan decisions.

0 notes

Text

Container Fleet Market Unidentified Segments - The Biggest Opportunity Of 2022

Global Container Fleet Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, players market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans and make informed decisions to improved profitability. In addition, the study helps venture or private players in understanding the companies in more detail to make better informed decisions.

Major Players in This Report Include

Maersk (Denmark)

CMA CGM (France)

MSC (Switzerland)

China COSCO Shipping (China)

Evergreen Marine Corporation (Taiwan)

Hanjin Shipping (South Korea)

Hapag-Lloyd (Germany)

Hyundai Merchant Marine (South Korea)

Kawasaki Kisen Kaisha Ltd. (K Line) (Japan)

Mitsui O.S.K. (Japan)

A container fleet includes a cargo ships which carry all of their load in truck size intermodal containers, with the help of a method known as containerization. It is a common means of commercial intermodal freight transport and now carry most seagoing non-bulk cargo. The initiation of the container fleeting forms one of the most remarkable developments in the maritime cargo industry. Container fleets, have transformed the mode in which cargo supplies are carried and transported across the globe, by offering assurance of safety and security of thus transported cargo supplies.

Market Drivers Growing Intermodal Transportation

Rising Global Demand from Reefer Container Fleets

Rising Globalization Process and the Large-Scale Adoption of the Container

Market Trend Increasing Use of Fleet Management System

Opportunities Advancements in the Overall Operations and Manufacturing of Container Fleets

Challenges Trade Inequality Causing Low Back-Haul Utilization Rate

The Container Fleet market study is being classified by Type (Dry Container Fleet, Reefer Container Fleet, Tank Container Fleet), Application (Automotive, Oil, Gas and Chemicals, Mining and Minerals, Food and Agriculture, Retail), Container Size (Small Containers (less-than or equal to 20 Feet), Large Containers (20-40 Feet), High Cube Containers (40 Feet))

Presented By

AMA Research & Media LLP

0 notes

Text

Nashville, TN, reasons for why people move

There are so many reasons why people love to move to Nashville, TN. They move for different reasons. According to Forbes, Nashville is considered the fastest-growing city in the US, with a population growth of 10% over the last five years. This growth is double the national average. The economy is booming, and there’s no sign of slowing. It’s No.7 in the real estate market, 8.5/10 when it comes to real estate market health, and 0.1% of the homes have negative equity, and based on the report, there are no homeowners delinquent on their mortgage. It ranks A+ for small business friendliness and 13 for state business, and the vast healthcare industry, over 300 companies and 250 related professional service companies are providing more and more jobs.

1-bedroom apartments near me in Nashville, TN

You may be looking for a one-bedroom apartment near me in Nashville, TN. Fallyn Apartments is the best choice. I like the curated collection of apartments and penthouses that boasts beautiful finishes and spectacular views. I like the neighborhood of Fallyn Apartments; I’m sure you’ll fall in love with Nashville. You can sit alongside the Music Row and the steps from Midtown’s endless cafes, food, shops, and nightlife. There is much to do and see in this 1-bedroom apartment. You can quickly go to parks, dine, and have fun from the apartment. You have plenty of options, no worries. For more information, contact 629-216-0657.

Country Music Hall of Fame in Nashville, TN

One of the popular destinations in Nashville, TN, is the Country Music Hall of Fame in Nashville. You can find the museum at John Lewis Way S. Nashville. It’s open daily from 9:00 AM to 5:00 PM. I like the shopping, dining, and entertainment at the museum. It’s adorable to visit and enjoy the museum. There are some giveaways that you’ll surely enjoy visiting. The exhibits and the calendar are perfect for people. The CMA Theatre is also excellent because it hosts various musical performances such as folk, bluegrass, country, and the latest Americana acts. So, catch a show if you still have some time.

Deadly shootings are high in Nashville this year.

It’s sad that Nashville, TN, is no longer safe as it used to be. Gun violence is on the rise, and there are already eight cases of homicides in 2023, considering that the year has just begun. Last year, there were also several cases of homicide. Now, just so recently, two teenagers are dead while the other two teenagers are in the hospital because of the shooting that happened over the weekend, and the thing is that there’s no clear trend connecting the shootings. Also, two shootings in Madison on Gibson Drive left a person in critical condition. Read more.

Link to Map

Driving Direction

Country Music Hall of Fame and Museum

222 Rep. John Lewis Way S, Nashville, TN 37203, United States

Head southwest on Demonbreun St toward Rep. John Lewis Way S

0.3 mi

Turn right onto 8th Ave S

0.2 mi

Turn left onto Broadway

0.7 mi

Use the left 2 lanes to turn left to stay on Broadway

0.3 mi

Turn right

Destination will be on the left

161 ft

Fallyn

110 19th Ave S

Nashville, TN 37203, USA

#1 bedroom apartments near me#2 bedroom apartments near me#3 bedroom apartments near me#luxury penthouses near me#apartments for rent in Nashville

0 notes

Text

Employment trends in the Field of Accounting

What are the current trends in employment in the field of Accounting?

Employers are constantly looking for accountants with the skills and talent to stay up with the ever-evolving accounting landscape. Accounting is no longer limited to just creating financial statements or tax returns as more transactional activities are getting automated these days. Accountants who wish to succeed and do well in the field of accounting need to have a firm grasp of technology, comprehend data analytics, and have a good hand at interacting with clients. There are many factors that come into play with the labor market, regional economy, and global economy that directly impact employment trends across the globe. Broader accounting employment patterns are determined by a wide range of variables that impacts the local, national and international economy and labor market. Going in deep and learning more about the sector, the shifts in finance and accounting industries have an impact on the employment trends for accountants, particularly for courses like ACCA (Association of Chartered Certified Accountants), CMA (Cost Management Accountant), Chartered Accountant and more. Changes in the finance and accounting industries will definitely impact the ACCA employment patterns.

A Sage report states that about 90% of accountants believe that accountancy is experiencing a cultural shift that is more skewed toward technology. This cultural shift is driven by many factors, including generational change and client demands.

In this article, we will touch upon 11 accounting trends that you need to keep a close eye on and perhaps adopt and implement for your firm.

Let’s dive into it a bit deeper

Remote jobs/workforce - The older way of conducting business has gone for a toss since the pandemic. Employees are no longer expected or bound to a physical workspace, and businesses should take good advantage of this trend. The accounting industry is no different and is on that can easily adapt to this change in comparison to other fields. More and more accountants are working remotely due to the pandemic and software such as the cloud is contributing largely to this paradigm shift. Cloud-based software allows employees to complete their assigned tasks without being in the same building. This trend will likely continue as well. There are many perks to working remotely, this includes flexibility and a decrease in overhead costs.

To ensure that remote work is happening successfully, it is crucial to get the right technology solutions such as virtual communication tools, cloud-based accounting software and secure online data storage and sharing.

If an accounting firm wishes to remain competitive it should consider implementing a remote work policy. It is very clear that there is more than one way to manage employees, but one thing that goes without saying is that you need to provide a flexible, customizable work environment in order to retain talent. With the support of the right technology and tools, this is very feasible.

Data Security - In order for remote work to be feasible it is crucial to share data. As large amounts of data are shared electronically between accounting firms and their clients, hackers are also refining the way they hack. Accounting firms have to protect themselves from cyber attacks and other security issues, so it is vital to provide adequate cybersecurity training to the employees.

They can provide 2 factor authentication so that only authorized users will have access to sensitive data. With the level of confidential data that is shared in accounting firms, even a small breach could lead to the loss of millions if not more. Having a good data security plan in place will decrease the risk of exposure by protecting the organization's most valuable asset - which is your customer's financial information.

Accountants with diverse skills - To keep up with the ever evolving accounting terrain, firms as on the lookout for commerce professionals who have a wide and diverse skill set. Accounting is no longer confined to areas such as preparing financial statements and filing tax returns because such transactional work is becoming more and more automated. In order to be successful, accountants should be tech savvy and should utilize existing technology, be able to comprehend data analytics and convert facts and figures successfully with clients. They also have to be well-verses in all aspects of business concepts so that they can provide valuable insights to their clients.

As the world is becoming more and more complex, businesses will need more specialized services from their accountants, this means that you as an accountant have to constantly update your skills to make sure you are ahead of the curve.

Cloud-based accounting software - As mentioned earlier, in order to function effectively in an remote setting businesses need to move to the cloud and accounting firms are no different. Cloud-based accounting systems will help you to access data from any device anywhere as long as you have an internet connection. This is perfect for firms that work in different locations and have employees who work remotely.

Cloud-based solutions make it easier for employees to easily share files and collaborate with others in a remote setting. It will help accountants on the team to have instant access to their accounting data without wasting any time. This will help businesses from substantial upfront costs in comparison to traditional in-house accounting software and services and it will also help increase security as well.

Cloud-based software also creates workflows, saving businesses valuable time duplicating work and recreating repeatable tasks. Overall, this accounting trend saves time, and costs and increases accessibility and security.

Big Data -As data is getting increasingly more complex, accountants are expected to effectively manage and analyse data effectively. There will be a boom in demand for those who can analyze and manage analyse data.

Firms will be on the look out for individuals who have strong data and analytical skills and have experience in analyzing data to help firms to understand and break down information effectively. This is where big data will come into play.

Big data is essentially the term used to describe large volumes of data that organizations collect from various sources. Accounting firms should store the data, mine for insights and turn this into actionable knowledge so as to remain competitive. It helps to recognise trends and correlations that we could miss otherwise. Such data will also enable firms to get insights and suggest recommendations to clients. They can analyse risks, predict the future or a client's finances and make the right judgement call.

Automated Process and Artificial Intelligence -

Gone are the days when accountants or accounting firms are expected to input data manually into a spreadsheet. If a firm wishes to stay competitive that they need to automate this process as quickly as possible. This will save both time and money.

Accounting to the study conducted by sage in 2019, 58 % of accounting professionals will be automating tasks with the help of intelligence solutions in the coming years.

Software such as robotic process automation (RPA) that uses artificial intelligence (AI) will help to finish repetitive tasks quickly and with more accuracy. It will also help to analyze and study documents and will help prepare reports. This is a great way to cut back on the firm's time and money, and free up employees' time so that they can divert their attention to activities that bring bigger impact and value.

As AI is continuously evolving, the role of accountants will change along with it as well. Many industries have already started using this to automate manual tasks. Accounting firms should also start using such software to ease the complex functions handled by human beings.

Taxation -

Taxation is going to be an active area of significance with respect to job opportunities expanding. The last 3 to four years have seen a lot of changes as the government is trying to measure to reduce the incidence of tax evasion and tax avoidance, so we see a change in the way people view taxes. The nation's laws and compliance standards have also undergone drastic shifts. Asset declaration regulations have also been amended and such things affect taxation as well. Due to such reasons accountants are in high demand and their salaries have also grown exponentially cause of this.

Conclusion

To sum up, a career in accounting is definitely a wise choice, as per the positive job outlook in the field. With a good accounting course degree, you will be well-qualified for management and senior-level positions and will be in great demand when you enter the job market. Many students get hired by accounting and finance firms even before they finish due to the high demand for accounting degrees like the ACCA, CMA, and CA. Learn to advance your accounting profession by considering the abovementioned points, and you are ready to launch your career.

0 notes