#corporate tax services

Text

If your business license was issued in June, the deadline for Corporate Tax registration is fast approaching! Mark your calendars 📅—August 31st, 2024, is the last day to complete your registration.

Don't risk penalties—let AMA Audit Tax Advisory assist you. Our experts will guide you through the entire registration process, ensuring you meet all compliance requirements seamlessly. Get in touch with us today to secure your spot and stay compliant!

#corporate tax in dubai#corporate tax in uae#corporate tax#corporate tax registration#uae corporate tax#corporate tax consultants#corporate tax services

0 notes

Text

#corporate tax free zone#best corporate tax services in uae#top corporate tax services in uae#corporate tax#corporate tax in uae#corporate tax return#corporate tax services

0 notes

Text

Taxation Consultants - RSM India

RSM India's taxation consultants provide expert guidance to ensure compliance and optimize your tax strategy. Our experienced team offers tailored solutions to navigate complex tax regulations, helping your business achieve financial efficiency and minimize tax liabilities. Trust RSM India for comprehensive taxation consultancy services.

0 notes

Text

TAX RESIDENCY CERTIFICATE

The UAE’s thriving economic activity is currently improving international trade links, but they can also become complicated when they are exposed to the tax system. Due to this, businesses are battling the issue of double taxation.

To address this issue, the concept of obtaining a Tax Residency Certificate in the UAE appears as a solution.The TRC is a certificate that allows qualifying government entities, businesses, and people to take advantage of double taxation treaties signed by UAE.

For natural persons, the applicant must have been a resident of the UAE for at least 180 days whereas for legal persons, he/she must have been established for a period of at least one year.The UAE’s thriving economic activity is currently improving international trade links, but they can also become complicated when they are exposed to the tax system. Due to this, businesses are battling the issue of double taxation. To address this issue, the concept of obtaining a Tax Residency Certificate in the UAE appears as a solution.

The TRC is a certificate that allows qualifying government entities, businesses, and people to take advantage of double taxation treaties signed by UAE. For natural persons, the applicant must have been a resident of the UAE for at least 180 days whereas for legal persons, he/she must have been established for a period of at least one year.

0 notes

Text

Corporate tax 2024

We have dedicated English and Arabic-speaking teams for Corporate tax.

Follow MASAR CHARTERED ACCOUNTANTS For more updates

For Free Consultancy. We are Always Available for you.

📧 [email protected]

📞+971 56 442 2333

🌐 https://masaraudit.ae/

#uae #corporatetax #uaecorporatetax #uaetax #exempt #tax #FTA #masar #masarcharteredaccountants

#corporate tax services#uae corporate tax#corporate tax rates#corporate tax in uae#corporate tax in dubai#tax agency in uae#tax advisor

0 notes

Text

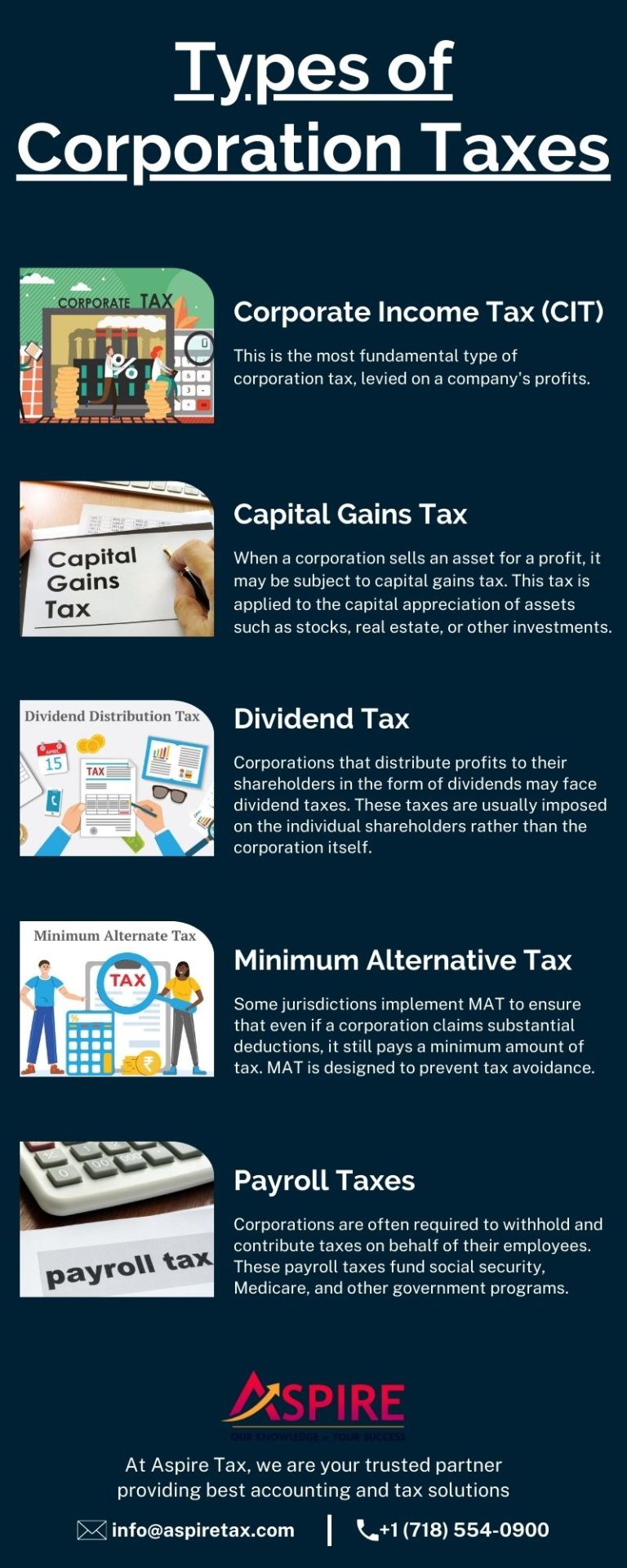

Delve into the realm of corporation taxes and unlock expert guidance with our specialized corporation tax services.

0 notes

Text

Corporate Tax Services | Corporate Tax Services in UAE

Are you an individual or a corporation looking to understand the complex tax system in the United Arab Emirates (UAE)? You've found it! Come along for an engrossing investigation of the tax relief options in the United Arab Emirates. Read More...

Corporate Tax Services

Corporate Tax Services in UAE

Corporate Tax Services in Dubai

0 notes

Text

Discover our precise and personalized business tax solutions to optimize your financial strategy.

0 notes

Text

#Form A Company In Cyprus#Taxation Services#Cyprus Company Registration#Company Formation In Cyprus#Cyprus Shelf Company#Vat Registration Form Cyprus#Cyprus Offshore Company Formation#Cyprus Company Formation With Bank Account#Cyprus Permanent Residency#Permanent Residency In Cyprus For Non EU#Cyprus Residency By Investment#Corporation Taxation#Corporate Tax Services#Corporate Tax Planning

0 notes

Text

BDO International, BDO Kuwait is expected to uphold high standards of professionalism, ethics, and quality in its services. They adhere to international accounting and auditing standards.one of the audit consulting firm in Kuwait

0 notes

Text

#Accounting Services in UAE#Accounting Services#Corporate Tax in UAE#Corporate Tax Services#Corporate Tax#Accounting Services in Abu Dhabi#Accounting Services in Dubai#Accounting Firm in Abu Dhabi

0 notes

Text

#corporate tax services#corporate tax sevices#best corporate tax services in dubai#corporate tax#corporate tax registration#guide to corporate tax services

0 notes

Text

In the United Kingdom, large corporations are required to pay their Corporation Tax electronically and in instalments. The rules for payment differ based on the company's annual profit rate. Here's a comprehensive guide on how large companies pay Corporation Tax in the UK.

0 notes

Text

0 notes

Text

"The New Cabinet Decision Highlights”

Follow MASAR Chartered Accountants For more details.

For Free Consultancy. We are Always Available for you.

📧 [email protected]

📞+971 56 442 2333

🌐 https://masaraudit.ae/

#FTATaxagents #taxagency #corporatetax #uaecorporatetax #uaetax #uae #masar #taxadvisor #masarcharteredaccountants #uaetax

#uae corporate tax#corporate tax in uae#corporate tax in dubai#Corporate tax services#Corporate tax law

0 notes

Text

At Pearl Lemon Accountants, we recognize the significance of effective corporate tax services for businesses of all sizes. With ever-evolving regulations and mounting intricacies, maneuvering through the corporate taxation landscape can be overwhelming. That's why our devoted team of experts is dedicated to providing you with streamlined solutions that optimize compliance and efficiency.

Equipped with extensive experience and a profound understanding of tax laws, our team is well-prepared to address a broad spectrum of Corporate Tax Services. Whether you are a sole trader, a multinational corporation, or a 7-figure business, we possess the necessary resources and expertise to cater to your specific requirements.

Our comprehensive range of services encompasses all aspects of corporate tax, including personal and corporate tax returns, self-assessments, end-of-year accounts, and VAT submissions. Going beyond the fundamentals, we excel in handling more intricate accounting tasks such as payroll management and financial auditing. Rest assured, our team is well-versed in the nuances of tax regulations and will ensure your compliance obligations are met.

As part of the esteemed Pearl Lemon Group, we benefit from exclusive access to additional resources that set us apart from the competition. With a multinational presence across Asia, Africa, North America, and Europe, we bring a global perspective to our services. This expansive reach enables us to stay up-to-date with the latest tax developments, providing you with tailored insights and strategies relevant to your specific industry and geographic location.

Furthermore, our origins as a digital marketing agency empower us with a cutting-edge advantage in developing time-saving and cost-cutting systems and practices. Leveraging technology, we streamline your bookkeeping processes, saving you valuable time and resources. Our objective extends beyond mere compliance to enhancing the overall efficiency of your bookkeeping operations.

When you choose Pearl Lemon Accountants for your corporate tax services, expect personalized attention, expert guidance, and an unwavering commitment to your success. We strive to foster long-term partnerships with our clients, offering insights and advice that transcend tax compliance. Our ultimate goal is to empower you to navigate the intricate world of corporate taxation with confidence, allowing you to focus on what truly matters – the growth and expansion of your business.

Discover the distinct advantage of our streamlined solutions for corporate tax services. Contact Pearl Lemon Accountants today and let us assist you in maximizing compliance and efficiency in your tax affairs.

1 note

·

View note