#Corporate Tax

Text

18 up to 21-01-2023 97-100/100 DOP

I studied corporate tax because I had the exam on the 25th.

So I finished these 100 days of productivity but I still have one exam to go. It's international taxation and I have no idea what to expect lol but I have an entire week to study so I'm not too worried :)

#studyblr#mystudydiary#mystudydiary-blog#my post#studying#study place#100 days of productivity#100 dop#exams#snow#corporate tax#january 2023

67 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

March 1, 2024

HEATHER COX RICHARDSON

MAR 2, 2024

Today, President Joe Biden signed the continuing resolution that will give lawmakers another week to finalize appropriations bills. Lawmakers will continue to hash out the legislation that will fund the government.

Republicans have been stalling the appropriations bills for months. In addition to inserting their own extremist cultural demands in the measures, they have demanded budget cuts to address the fact that the government spends far more money than it brings in.

As soon as Mike Johnson (R-LA) became House speaker, he called for a “debt commission” to address the growing budget deficit. This struck fear into the hearts of those eager to protect Social Security and Medicare, because when Johnson chaired the far-right Republican Study Committee in 2020, it called for cutting those popular programs by raising the age of eligibility, lowering cost-of-living adjustments, and reducing benefits for retirees whose annual income is higher than $85,000. Lawmakers don’t want to take on such unpopular proposals, so setting up a commission might be a workaround.

Last month, the House Budget Committee advanced legislation that would create such a commission. The chair of the House Budget Committee, Jodey C. Arrington (R-TX), told reporters that Speaker Johnson was “100% committed to this commission” and wanted to attach it to the final appropriations legislation for fiscal year 2024, the laws currently being hammered out.

Congress has not yet agreed to this proposed commission, and a recent Data for Progress poll showed that 70% of voters reject the idea of it.

This week, a new report from the Institute on Taxation and Economic Policy (ITEP), a nonprofit think tank that focuses on tax policy, suggested that the cost of tax cuts should be factored into any discussions about the budget deficit.

In 2017 the Trump tax cuts slashed the top corporate tax rate from 35% to 21% and reined in taxation for foreign profits. The ITEP report looked at the first five years the law was in effect. It concluded that in that time, most profitable corporations paid “considerably less” than 21% because of loopholes and special breaks the law either left in place or introduced.

From 2018 through 2022, 342 companies in the study paid an average effective income tax rate of just 14.1%. Nearly a quarter of those companies—87 of them—paid effective tax rates of under 10%. Fifty-five of them (16% of the 342 companies), including T-Mobile, DISH Network, Netflix, General Motors, AT&T, Bank of America, Citigroup, FedEx, Molson Coors, and Nike, paid effective tax rates of less than 5%.

Twenty-three corporations, all of them profitable, paid no federal tax over the five year period. One hundred and nine corporations paid no federal tax in at least one of the five years.

The Guardian’s Adam Lowenstein noted yesterday that several corporations that paid the lowest taxes are steered by chief executive officers who are leading advocates of “stakeholder capitalism.” This concept revises the idea that corporations should focus on the best interests of their shareholders to argue that corporations must also take care of the workers, suppliers, consumers, and communities affected by the corporation.

The idea that corporate leaders should take responsibility for the community rather than paying taxes to the government so the community can take care of itself is eerily reminiscent of the argument of late-nineteenth-century industrialists.

When Republicans invented national taxation to meet the extraordinary needs of the Civil War, they immediately instituted a progressive federal income tax because, as Representative Justin Smith Morrill (R-VT) said, “The weight [of taxation] must be distributed equally, not upon each man an equal amount, but a tax proportionate to his ability to pay.”

But the wartime income tax expired in 1872, and the rise of industry made a few men spectacularly wealthy. Quickly, those men came to believe they, rather than the government, should direct the country’s development.

In June 1889, steel magnate Andrew Carnegie published what became known as the “Gospel of Wealth” in the popular magazine North American Review. Carnegie explained that “great inequality…[and]...the concentration of business, industrial and commercial, in the hands of a few” were “not only beneficial, but essential to…future progress.” And, Carnegie asked, “What is the proper mode of administering wealth after the laws upon which civilization is founded have thrown it into the hands of the few?”

Rather than paying higher wages or contributing to a social safety net—which would “encourage the slothful, the drunken, the unworthy,” Carnegie wrote—the man of fortune should “consider all surplus revenues which come to him simply as trust funds, which he is called upon to administer…in the manner which, in his judgment, is best calculated to produce the most beneficial results for the community—the man of wealth thus becoming the mere trustee and agent for his poorer brethren, bringing to their service his superior wisdom, experience, and ability to administer, doing for them better than they would or could do for themselves.”

“[T]his wealth, passing through the hands of the few, can be made a much more potent force for the elevation of our race than if distributed in small sums to the people themselves,” Carnegie wrote. “Even the poorest can be made to see this, and to agree that great sums gathered by some of their fellow-citizens and spent for public purposes, from which the masses reap the principal benefit, are more valuable to them than if scattered among themselves in trifling amounts through the course of many years.”

Here in the present, Republicans want to extend the Trump tax cuts after their scheduled end in 2025, a plan that would cost $4 trillion over a decade even without the deeper cuts to the corporate tax rate Trump has called for if he is reelected. Biden has called for preserving the 2017 tax cuts only for those who make less than $400,000 a year and permitting the rest to expire. He has also called for higher taxes on the wealthy and corporations, which would generate more than $2 trillion.

Losing the revenue part of the budget equation and focusing only on spending cuts seems to reflect a society like the one the late-nineteenth-century industrialists embraced, in which a few wealthy leaders get to decide how to direct the nation’s wealth.

In other news today, Alexei Navalny’s parents held a funeral for the Russian opposition leader and buried him in Moscow. Navalny died two weeks ago at a penal colony in Siberia where Russian president Vladimir Putin had imprisoned him on trumped-up charges after failing to kill him with poison. Navalny fought against Putin’s control of Russia by emphasizing the corruption and illicit fortunes of Putin and his associates.

Russia specialist Julia Ioffe of Puck News noted that a million Russians have fled the country since the February 2022 invasion of Ukraine and that many of them were Navalny supporters. Still, many thousands turned out for the funeral and the procession, throwing flowers at the hearse as it made its way to the cemetery.

A woman at Navalny’s funeral compared Navalny and Putin. “One sacrificed himself to save the country, the other one sacrificed the country to save himself.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Corporations#taxes#Corporate tax#trickle down economics#democracy#finance#Heather Cox Richardson#Letters from An American#theocracy#social security

6 notes

·

View notes

Text

3 notes

·

View notes

Quote

Mishra added that India’s taxation policy is partly to blame. “Taxation policy is a major reason for inequality in India. It is harsher on the poor than the rich.” India used to have a wealth tax, but it was abolished by the government in 2015. This is despite the country having more than 142 billionaires. The Indian government also slashed its corporate tax in 2019 which led to a financial loss of nearly $ 22 million in two years.

Srishti Jaswal, ‘This Country Has 70 New Millionaires Every Day. Why Is it Among the World’s Hungriest?’, VICE

#VICE#Srishti Jaswal#Pravas Ranjan Mishra#taxation policy#India#income inequality#wealth tax#Government of India#corporate tax

5 notes

·

View notes

Text

Everything You Need to Know About Corporate Tax in UAE

Corporate tax is an essential aspect of running a business in the UAE. With its favorable tax laws and a favorable business environment, the UAE has become a hub for foreign investors. It makes it crucial to have a deep understanding and read the information on the corporate tax system in the UAE, in order to make the most of its benefits. This article will help you understand corporate tax in the UAE by explaining rules, regulations and its benefits in the UAE.

Introduction to Corporate Tax in UAE

There is no personal income tax in the UAE, because of which UAE has a tax-free environment, making it an attractive country to live in for most people. However, corporations are subject to corporate tax on their income earned in the UAE. The introduction of CT in this region was intended to help UAE with the transformation and development that the government has strategically planned to achieve. The country’s tax laws are enforced and implemented by The UAE Federal Tax Authority (FTA). The authority also provides guidelines and regulations for corporations and businesses operating in the UAE. Corporations need to be abiding by these laws and regulations to avoid getting penalized.

The Corporate Tax Law in the UAE

The corporate tax law in the UAE is regulated by the Federal Tax Authority, which oversees the implementation and enforcement of the country’s tax laws. The CT law applies to all businesses operating in the UAE, regardless of their size or structure. The tax is levied on a company’s profits, and the rate at which the tax would be at, depends on the type of business and the industry in which it operates.

Corporate Tax Rates in the UAE

The CT rate depends on the type of business and industry that it operates in, hence there is no standard CT rate in UAE. Oil and gas, insurance, and banking are however, some industries that are exempt from CT. The tax rate for other industries ranges from 0% to 55%.

Benefits of Corporate Tax in UAE

The UAE offers several benefits for corporations, including:

No personal income tax

A favorable tax environment for businesses

A stable and predictable tax system

A streamlined process for tax registration and compliance

Access to a large pool of potential customers and investors

Corporate Tax Filing and Compliance in the UAE

It is necessary for corporations operating in the UAE to file their tax returns on an annual basis. The tax returns must be filed with the Federal Tax Authority(FTA) by the end of the financial year. The tax returns must include detailed information on the corporation’s income and expenses, and must be supported by financial statements and other relevant documents.

Common Mistakes to Avoid in Corporate Tax in UAE

To ensure compliance with the CT laws in the UAE, it is important to avoid common mistakes, including:

Not registering for CT

Filing incorrect or incomplete tax returns

Failing to keep accurate financial records

Not seeking professional advice

FAQ

Q: Is there personal income tax in the UAE?

A: No, there is no personal income tax in the UAE.

Q: Who is responsible for implementing and enforcing corporate tax laws in the UAE?

A: CT laws are enforced and implemented by The Federal Tax Authority (FTA) in the UAE.

Q: What is the standard corporate tax rate in the UAE?

A: The rate depends on the type of business and the industry in which it operates. There is no standard ct in the UAE.

2 notes

·

View notes

Text

Everything You Need to Know About Corporate Tax in UAE

Corporate tax is an essential aspect of running a business in the UAE. With its favorable tax laws and a favorable business environment, the UAE has become a hub for foreign investors. It makes it crucial to have a deep understanding and read the information on the corporate tax system in the UAE, in order to make the most of its benefits. This article will help you understand corporate tax in the UAE by explaining rules, regulations and its benefits in the UAE.

Introduction to Corporate Tax in UAE

There is no personal income tax in the UAE, because of which UAE has a tax-free environment, making it an attractive country to live in for most people. However, corporations are subject to corporate tax on their income earned in the UAE. The introduction of CT in this region was intended to help UAE with the transformation and development that the government has strategically planned to achieve. The country’s tax laws are enforced and implemented by The UAE Federal Tax Authority (FTA). The authority also provides guidelines and regulations for corporations and businesses operating in the UAE. Corporations need to be abiding by these laws and regulations to avoid getting penalized.

The Corporate Tax Law in the UAE

The corporate tax law in the UAE is regulated by the Federal Tax Authority, which oversees the implementation and enforcement of the country’s tax laws. The CT law applies to all businesses operating in the UAE, regardless of their size or structure. The tax is levied on a company’s profits, and the rate at which the tax would be at, depends on the type of business and the industry in which it operates.

Corporate Tax Rates in the UAE

The CT rate depends on the type of business and industry that it operates in, hence there is no standard CT rate in UAE. Oil and gas, insurance, and banking are however, some industries that are exempt from CT. The tax rate for other industries ranges from 0% to 55%.

Benefits of Corporate Tax in UAE

The UAE offers several benefits for corporations, including:

No personal income tax

A favorable tax environment for businesses

A stable and predictable tax system

A streamlined process for tax registration and compliance

Access to a large pool of potential customers and investors

Corporate Tax Filing and Compliance in the UAE

It is necessary for corporations operating in the UAE to file their tax returns on an annual basis. The tax returns must be filed with the Federal Tax Authority(FTA) by the end of the financial year. The tax returns must include detailed information on the corporation’s income and expenses, and must be supported by financial statements and other relevant documents.

Common Mistakes to Avoid in Corporate Tax in UAE

To ensure compliance with the CT laws in the UAE, it is important to avoid common mistakes, including:

Not registering for CT

Filing incorrect or incomplete tax returns

Failing to keep accurate financial records

Not seeking professional advice

FAQ

Q: Is there personal income tax in the UAE?

A: No, there is no personal income tax in the UAE.

Q: Who is responsible for implementing and enforcing corporate tax laws in the UAE?

A: CT laws are enforced and implemented by The Federal Tax Authority (FTA) in the UAE.

Q: What is the standard corporate tax rate in the UAE?

A: The rate depends on the type of business and the industry in which it operates. There is no standard ct in the UAE.

4 notes

·

View notes

Text

Corporate Tax in UAE

On January 31, 2022, the Ministry of Finance of the United Arab Emirates (UAE) announced the introduction of a federal Corporate Tax (“CT”) on business profits, effective from the financial year beginning June 1, 2023. Pursuant to the aforementioned announcement, the Ministry of Finance published a consultation document to collect and appraise the responses of stakeholders (“Consultation Document”) with regard to the most prominent features of the legislation and its implementation, ahead of the release of the draft CT legislation.

If you want to know more about corporate tax in UAE you can contact us at +971526406240 or can visit our website at corporate tax in UAE

Visit at: - https://www.mbgcorp.com/ae/taxation/direct-taxes/corporate-tax-in-uae/

#Corporate Tax in UAE#Corporate Tax#Company tax in UAE#taxation in uae#direct tax in uae#direct taxation in uae

2 notes

·

View notes

Text

#corporate tax#corporate tax uae#corporate tax services in uae#corporate tax services in low cost#corporate tax busienss#business services

0 notes

Text

#corporate tax#corporate tax services in uae#best corporate tax services in uae#corporate tax planning#corporate tax advisor#best corporate tax in dubai#corporate tax registration#toontown corporate clash

0 notes

Text

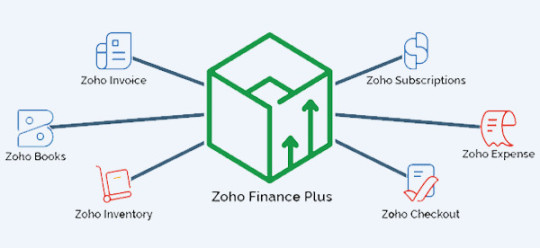

Ribs Technologies: Powering Software Businesses with Zoho Finance Plus

At Ribs Technologies, we understand the unique challenges software services companies face. Streamlining finances can be a struggle when your focus is on innovation and client satisfaction. That's where Zoho Finance Plus comes in. This all-in-one financial suite empowers businesses like ours to achieve:

Simplified Accounting with Zoho Books: Zoho Books, the core of Zoho Finance Plus, offers a powerful accounting software solution specifically designed for businesses like yours. Manage your Zoho accounts with ease - create and send invoices, categorize income and expenses, and gain real-time insights into your financial health. The user-friendly interface makes it simple for even non-accountants to navigate.

Effortless Corporate Tax Management: Tax season doesn't have to be a hurdle. Zoho Books integrates with popular tax platforms and provides clear reports, simplifying corporate tax filing and saving you valuable time. Stay compliant and focus on what matters most - delivering exceptional software services.

Enhanced Collaboration: Zoho Finance Plus fosters seamless collaboration between your finance team and other departments within Ribs Technologies. Assign roles and permissions for Zoho accounts access, share reports securely, and leverage customer and vendor portals for improved transparency.

Increased Productivity with Automation: Free up your team's time for core software development by automating repetitive tasks. Zoho Finance Plus allows you to automate sending invoices, generating reports, and managing reminders. This ensures financial accuracy while maximizing efficiency.

Data-Driven Decisions: Gain a holistic view of your finances with Zoho Finance Plus' comprehensive reporting tools. Generate insightful reports on your cash flow, profitability, corporate tax liabilities, and more. Use these insights to make data-driven decisions and optimize your financial strategy for continued growth.

Conclusion

Zoho Finance Plus goes beyond just Zoho Books. It's a comprehensive suite offering integrated solutions like Zoho Invoice, Zoho Subscriptions, and Zoho Expense. This empowers Ribs Technologies to manage all our financial needs, from generating invoices to streamlining subscriptions and tracking expenses. With Zoho Finance Plus as our partner, we can achieve greater financial control, streamline processes, and focus on delivering innovative software solutions for our clients.

1 note

·

View note

Text

📢 Attention all new UAE businesses with licenses issued in January or February! A gentle reminder that the deadline for Corporate Tax registration is fast approaching - May 31st, 2024 📆 . AMA Audit Tax Advisory can assist you in navigating the registration process efficiently and ensuring your business remains compliant. Avoid potential penalties and contact us today to discuss your registration needs. 💹

#corporate tax in uae#corporate tax#uae corporate tax#corporate tax registration#corporate tax consultants in uae#Corporate tax updates#Corporate tax alerts#corporate tax deadline

0 notes

Text

Forgot to post because I had so much stuff to do, so here we go. It's going to be a long one.

05-12-2022 54/100 DOP

*read in my VAT textbook on the train

*attended corporate tax class

*registered for a slot for the oral exam

06-12-2022 55/100 DOP

*watched a tax strategy lecture about transfer pricing and it was horrible

*did some administration for my internship

*went to the library to study the transfer of family businesses

07-12-2022 56/100 DOP

*was in the library all day studying inheritance law

08-12-2022 57/100 DOP

*went to international tax class

*studied tax strategy again in the library, but this time with a friend :)

09-12-2022 58/100 DOP

*went to VAT class

*made my part of the presentation of our research paper

10-12-2022 59/100 DOP

*worked on an assignment for the legal part of research methods class

11-12-2022 60/100 DOP

*worked on our presentation

12-12-2022 61/100 DOP

*had our presentation, it went well but the questions they asked were hard lol

*attended corporate tax class

*stressed about my internship contract and sent some e-mails

*studied transfer pricing

13-12-2022 62/100 DOP

*we had to solve a transfer pricing case during tax strategy class

*stressed some more about my internship

*finished my legal assingment and submitted it a couple days early (who am I??)

*submitted the peer assessment for our research assignment

14-12-2022 63/100 DOP

*had a one day student job cleaning communal fridges in the dorms and it was absolutely disgusting but it pays well

15-12-2022 64/100 DOP

*my stress level was at an all-time high because the deadline for my internship contract was approaching so I decided to call the coordinator because he didn't respond to my e-mail

*eventually got my contract signed by the coordinator and sent it to my internship place

*this all happened while I was sitting in the library trying to study tax strategy

16-12-2022 65/100 DOP

*went to VAT class, hopefully my last lecture in university!

*submitted my internship contract before the deadline :)

Decided to take the day off on the 17th because that stress was too much lol, I went to the Christmas market in Antwerp with my parents

18-12-2022 66/100 DOP

*did some exam planning, I'm home for 3 weeks now and in January it's exam time :(

#studyblr#mystudydiary#mystudydiary-blog#my post#studying#study place#exams#100 days of productivity#100 dop#tax strategy#corporate tax#research methods#research methodology#international tax#vat#value added tax#assignment#internship#december 2022#student job

66 notes

·

View notes

Text

#corporate tax services#corporate tax sevices#best corporate tax services in dubai#corporate tax#corporate tax registration#guide to corporate tax services

0 notes

Text

4 notes

·

View notes

Text

Discover India's corporate tax landscape: varying rates for domestic and foreign companies, concessional options under Sections 115BAA and 115BAB, and crucial conditions for exemptions.

#taxation#corporate tax#domestic companies#foreign companies#Section 115BAA#Section 115BAB#exemptions#India

0 notes

Text

What Is Transfer Pricing & How Does It Impact My UAE-based Business?

What is Transfer Pricing?

Since the implementation of Corporate Tax in UAE, The notion of Transfer Pricing (TP) is receiving more attention in the Ministry of Finance (MoF) released Questions and Answers along with public Consultation documents.

This idea could be new for many local-owned companies, leading to numerous concerns and Transfer Pricing considerations for implementation. The topic of this article is Transfer Pricing, and its implications within The UAE will be reviewed to provide more information for businesses.

The standard definition of the term “transfer pricing” is commonly referred to as:

“The prices of goods and services sold or purchased between the entities with associated parties.”

When a related party refers to an entity or person who has a prior connection with a business by control, ownership, or family kinship (in instances of natural people).

Naturally, related-party transactions may allow entities to shift profits artificially. Therefore, this UAE corporate tax introduction strongly emphasizes transfer pricing.

The world’s tax justice network defines Transfer Pricing as “a technique used by multinational corporations to shift profits out of the countries where they operate and into tax havens.”

Both definitions explain that transfer prices are a way to make money. But it’s helpful to go back and expand the definition. It is essential to clarify that Transfer Pricing refers to the following:

A tax law to prevent abuse was enacted to implement the “arm’s length” principle.

It is a requirement that the price of the goods and services that the respective parties charge must be precisely the same as they would have been being the parties involved in each transaction were connected.

The goal of the arm’s-length rule and the Transfer Pricing (“TP”) regulations is to ensure that there isn’t any price mispricing of transfers, which can be due to fraudulent transfer Pricing methods, in which the prices of transfers are deliberately manipulated to obtain certain tax benefits which benefit several related entities.

Transfer pricing is of crucial importance to corporate taxation. Transfer prices directly impact the distribution of losses and profits for companies that are who are taxed by the corporate tax. The Transfer Pricing practices of taxpayers could have an immediate impact on the tax revenues of a nation.

When the corporate tax rates of the countries concerned differ substantially, related parties might be motivated to establish their transfer rates so that they can allocate profits to the less tax jurisdiction, thus reducing the total (group) global tax burden for corporations.

Even when a country has lower tax rates and is not governed by Transfer Pricing laws, transfer mispricing can take away significant tax revenue.

For instance:

Company A, a tax resident of Bangladesh, manufactures electronic devices and personal computers in a country taxed at a rate of 32.5 percent. It sells its items to the UAE-related tax-resident company B which pays 0 percent or 9% corporate tax on the resale of its products in third markets and UAE.

In this scenario, company A will be driven to offer the product at a price or with a lower profit percentage to Company B. In contrast, Company B will be able to resell the product with the highest possible profit margin and take the more significant part of the profits to ensure that both entities pay corporate taxes at a lower efficient tax rate.

Tax authorities in Bangladesh are likely to audit and modify the tax on corporate income paid by company A, thereby taxing a substantial portion of the profits that the UAE taxes.

Suppose company B was to pay taxes on corporate income in the UAE.

In that case, company B is likely to be keen to reduce the tax paid by the UAE to reduce and eliminate the phenomenon known as “economic double taxation” through the Transfer Pricing adjustment. That’s why countries with corporate tax systems should create transfer pricing laws and an administrative capacity to deal with the request for adjustment.

Additionally, as accounting and legal tax laws and practices vary from country to country, It is of the utmost importance to be aligned with the Transfer Pricing law to ensure that the adjustments to TP are based on the same rules and principles as the Transfer Pricing method.

Will It Impact A UAE-Based Business?

The simple answer is yes. The official MoF documents ( Press release and Public Consultation) stipulate that UAE businesses must adhere to Transfer Pricing rules and the requirements for documentation by the Transfer Pricing Guidelines.

As part in the Corporation Tax introduction as part of the Corporate Tax introduction, the UAE will implement Transfer Pricing rules, which means that all transactions with related parties and those that involve connected individuals (“intercompany transaction”) will have to conform to the applicable TP requirements according to the principle of arm’s length that is outlined in the OECD Transfer Pricing Guidelines.

Who are the Related Parties?

By the UAE Corporate Tax Consultation Document [2(the (“Consultation Paper”), A related person is an individual or an entity with already established a connection to a business by control, ownership, or family kinship (in cases of natural people).

The document also lists these relationships in the form of related parties:

Two or more people connected with the 4th degree of kinship, affiliation, or kinships such as marriage, birth, or adoption.

When alone or in conjunction with a partner, a person, or a legal entity, the individual directly or indirectly holds more than 50% of this legal entity.

A legal entity or two in which one legal entity or in conjunction with a related entity directly or indirectly, has more than 50% part in or controls each legal entity

More than two legal entities, if an individual taxpayer or together with a partner who directly or indirectly owns 50 percent of each.

A taxpayer, its branch, or permanent establishment

The partners in the same unincorporated partnership and

Business activities that are exempt and non-exempt of the same individual (for instance, an exempt-free zone-based business).

Who Are Connected Persons?

Consultation Paper Consultation Paper stresses that in the absence of taxation on personal income in the UAE, individuals who own tax-deductible companies would be encouraged to reduce the UAE corporate tax base through excessive payments to themselves and others who are associated with them.

So, benefits or payments offered by a company for the “Connected Persons” will be tax-deductible only if the company can prove that the benefit or payment conforms to “arm’s length” or the “arm’s length principle” and that the cost is incurred entirely and solely for the benefit of your business.

Connected Persons differ as Related Parties. A person is regarded as being ‘connected’ to a business in the scope of the UAE Corporate Tax regime it is:

A person who directly or indirectly holds an ownership control or interest in the taxable person

Director or Officer of a taxable person.

An individual who is related to the director, owner, and Officer of the tax-paying person in four degrees of affinity or kinship, such as through marriage, birth, or adoption.

If the tax-paying person is a member of an unincorporated partnership or any other partner of the same partnership and

The term “related party” refers to a Related Party of any of the above.

What Are the Compliance Obligations?

Transfer Pricing rules usually shift the burden of proof (burden of evidence) on the taxpayer. It is the responsibility of any taxpayer who has intercompany transactions that have more than a certain threshold, in the applicable tax year, to create documents for Transfer Pricing and demonstrate that the intercompany transactions were conducted at “arm’s length”.

The value of intercompany transactions has yet to be defined and is anticipated to be clarified following the implementation of UAE Corporate Tax Legislation. This Consultation Paper specifies the mandatory Transfer Pricing documentation consisting of a local file and a Master File (according to the formats and content required in OECD BEPS’s Action 13 and by the World’s Best practices).

Additionally, the arm’s-length nature of the transactions must be confirmed using one of the internationally recognized Transfer Pricing methods or another approach when the business can prove that the method specified can’t be used reasonably.

If the requirements are met, companies must complete and submit the Transfer Pricing disclosure form with details about their transactions with inter-company entities. It needs to be clarified how this Transfer Pricing disclosure form must be filed simultaneously with your tax returns (i.e., in the first (9) months from the expiration of the applicable period of tax) or with an earlier date.

3 notes

·

View notes