#costing classes for ca inter

Explore tagged Tumblr posts

Text

Why is CA Parag Gupta the Best Faculty for CA Inter Costing?

One of the most respected mentors in the field of CA Inter Costing is CA Parag Gupta Sir. Numerous CA candidates have benefited from his exceptional teaching methods, wealth of expertise, and student-centered approach. He is the greatest option for students studying CA Inter Costing due to his emphasis on conceptual clarity, practical application, exam methods, and all-encompassing support.

By simplifying difficult ideas, CA Parag Gupta Sir helps pupils understand minute nuances. His extensive study guide is in line with the CA Inter syllabus and offers real-world examples, graphics, and exam-style practice problems. In order to make sure that students are ready for any modifications to the syllabus or exam format, he also refreshes his materials on a regular basis.

Additionally, CA Parag Gupta Sir offers a stimulating and encouraging learning environment that promotes active engagement and offers frequent sessions for clearing up any doubts. In order to meet the various demands of his pupils, he provides flexible learning alternatives, such as both online and offline classes. In summary, CA Parag Gupta Sir's method of teaching CA Inter Costing is essential for students to develop solid fundamental knowledge and boost their self-esteem so they may succeed on tests.

0 notes

Text

ca inter osting best classes

0 notes

Text

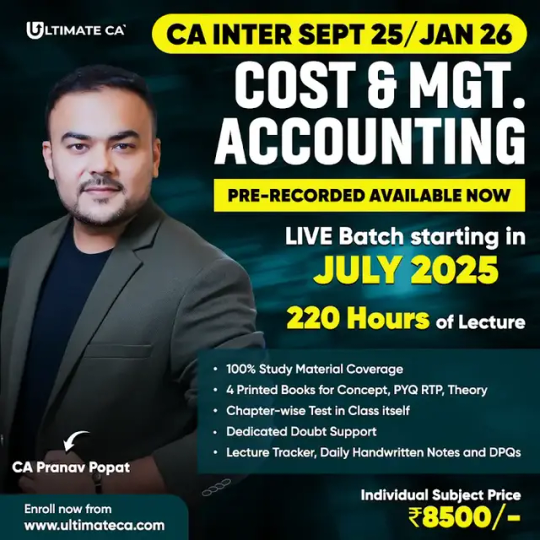

Master Cost & Management Accounting with Ultimate CA! 💡

🚀 Pre-Recorded Available Now!

📅 LIVE Batch Starting in July 2025

🎓 220 Hours of Comprehensive Lectures

✅ 100% Study Material Coverage

📚 4 Printed Books for Concept, PYQ, RTP, and Theory

📝 Chapter-wise Tests & Dedicated Doubt Support

📑 Lecture Tracker & Daily Handwritten Notes

✨ Individual Subject Price: ₹8500/-

Enroll Now from 👉 www.ultimateca.com

#Ultimate CA#Cost and Management Accounting#CA Inter#CA Classes#CA Coaching#Chartered Accountancy#CA Exam Prep#Study Material#CA Inter Costing#CMA#CA Inter May 2025#CA Online Classes

0 notes

Text

Best Faculty for CA Inter Cost and Management Accounting: Top Experts for Exam Success

Selecting the right faculty for Cost and Management Accounting (CMA) in CA Intermediate is crucial for mastering the subject and excelling in exams. In this blog, we provide a detailed look at the top faculty members for CA Inter CMA, their key strengths, teaching styles, and why they are highly recommended by students.

Why Is Faculty Selection Crucial for CA Inter CMA?

The Cost and Management Accounting (CMA) subject in CA Intermediate is known for its complexity. It covers a wide range of topics that include cost analysis, decision-making, and strategic management, which are critical for future CA professionals. A strong foundation in CMA not only helps with exams but also provides valuable insights into practical financial management.

With the right faculty, students can grasp complex concepts more easily, develop practical problem-solving skills, and approach their exams with confidence.

Factors to Consider When Choosing a CA Inter CMA Faculty

Before selecting your faculty, here are a few key factors you should consider:

Teaching Experience: How experienced is the teacher in handling CA Intermediate subjects?

Student Reviews: What do other students have to say about their teaching methods and style?

Conceptual Clarity: Does the teacher simplify complex topics or make them easier to understand?

Focus on Practical Application: How well does the teacher integrate real-world examples and problem-solving techniques?

Study Material Provided: Is the study material comprehensive and aligned with the exam syllabus?

Best Faculty for CA Inter Cost and Management Accounting

Faculty Name

Key Strength

Teaching Style

Link to Course

CA Ashish Kalra

Dynamic teaching

Engaging, real-life examples

CA Inter CMA by CA Ashish Kalra

CA CS Anshul Agarwal

Strategic clarity

Concept-driven, practical

CA Inter CMA by CA Anshul Agarwal

CA Darshan Chandaliya

Practical application

Interactive, exam-focused

CA Inter CMA by CA Darshan Chandaliya

CA Harshad Jaju

In-depth subject knowledge

Interactive, engaging

CA Inter CMA by CA Harshad Jaju

CA Manoj Sharma

In-depth subject knowledge

Real-world application

CA Inter CMA by CA Manoj Sharma

CA Namit Arora

Conceptual clarity

Simplified, practical

CA Inter CMA by CA Namit Arora

CA Navneet Mundhra

Conceptual clarity

Case-based, interactive

CA Inter CMA by CA Navneet Mundhra

CA Nikhil Gokhru

Conceptual clarity

Engaging, simplified

CA Inter CMA by CA Nikhil Gokhru

CA Nitin Guru

Conceptual clarity

Practical, application-based

CA Inter CMA by CA Nitin Guru

CA Parag Gupta

Strategic problem-solving

Step-by-step, engaging

CA Inter CMA by CA Parag Gupta

CA Pranav Popat

Exam-oriented approach

Simplified, engaging

CA Inter CMA by CA Pranav Popat

CA Praveen Khatod

Financial expertise

Detailed, concept-driven

CA Inter CMA by CA Praveen Khatod

CA Purushottam Aggarwal

Conceptual clarity

Practical, exam-focused

CA Inter CMA by CA Purushottam Aggarwal

CA Rakesh Agrawal

Detailed problem-solving

Engaging, concept-driven

CA Inter CMA by CA Rakesh Agrawal

CA Ranjan Periwal

Conceptual depth

Case-based, exam-focused

CA Inter CMA by CA Ranjan Periwal

CA Ravi Sonkhiya

Financial expertise

Detailed, engaging

CA Inter CMA by CA Ravi Sonkhiya

CA RK Mehta

Strategic clarity

Easy-to-follow, interactive

CA Inter CMA by CA RK Mehta

CA Sankalp Kanstiya

Strategic problem-solving

Fast-paced, simplified

CA Inter CMA by CA Sankalp Kanstiya

CA Satish Jalan

Strategic clarity

Engaging, practical

CA Inter CMA by CA Satish Jalan

CA Vinod Reddy

Practical insights

Real-world examples

CA Inter CMA by CA Vinod Reddy

CMA CS Rohan Nimbalkar

Strategic insights

Application-based, simplified

CA Inter CMA by CMA Rohan Nimbalkar

CMA Sumit Rastogi

Conceptual depth

Simplified, interactive

CA Inter CMA by CMA Sumit Rastogi

CIMA Siddhanth Sonthalia

Financial management expertise

Engaging, practical examples

CA Inter CMA by CIMA Siddhanth Sonthalia

CA Aman Agarwal

Strategic clarity

Fast-paced, interactive

CA Inter CMA by CA Aman Agarwal

CA Amit Sharma

Problem-solving skills

Engaging, real-life examples

CA Inter CMA by CA Amit Sharma

CA Anuj Jalota

Strategic clarity

Detailed, step-by-step

CA Inter CMA by CA Anuj Jalota

CA Amit Manek

Conceptual depth

Exam-focused, practical

CA Inter CMA by CA Amit Manek

CA Rakesh Rathi

Strategic insights

Simplified, interactive

CA Inter CMA by CA Rakesh Rathi

CA Vaibhav Jalan

Conceptual clarity

Simplified, exam-focused

CA Inter CMA by CA Vaibhav Jalan

CA Divyank Gyanchandani

Financial insights

Practical, real-world examples

CA Inter CMA by CA Divyank Gyanchandani

CA Saurav Jindal

Strategic clarity

Simplified, exam-oriented

CA Inter CMA by CA Saurav Jindal

CA Abhishek Zaware

Dynamic teaching

Engaging, real-life examples

CA Inter CMA by CA Abhishek Zaware

CA Dhawal Purohit

Strategic insights

Application-based, simplified

CA Inter CMA by CA Dhawal Purohit

Why You Should Learn from Multiple Faculty Members

Learning from multiple faculty members can give you different perspectives and approaches to understanding difficult concepts. While one teacher may help you develop a solid theoretical foundation, another might focus on practical problem-solving and exam-oriented strategies. For example, you could choose CA Sankalp Kanstiya for mastering problem-solving skills and opt for CA Praveen Khatod to build strong conceptual clarity.

Common Mistakes to Avoid in CA Inter CMA

Overlooking Practical Applications: CMA is not just about theory. Many students struggle because they fail to connect theoretical concepts with practical applications.

Ignoring Numerical Questions: Numerical problems form a significant part of the CMA exam. Ignoring these could cost you valuable marks.

Lack of Time Management: Proper time management during the exam is essential. Faculty like CA Satish Jalan and CA Praveen Khatod focus heavily on this aspect.

FAQs

1. Which faculty is best for CA Inter CMA?

It depends on your learning style. CA Sankalp Kanstiya and CA Harshad Jaju are known for their fast-paced and engaging methods, while CA Purushottam Aggarwal and CA Praveen Khatod focus on strong conceptual clarity and exam techniques.

2. Can I study CA Inter CMA with one teacher?

While it's possible, students often benefit from learning from multiple faculty members to get varied perspectives on complex topics.

3. Is practical learning important in CA Inter CMA?

Yes, practical application of concepts is critical in CMA. Most top faculties, like CA Ashish Kalra and CA Satish Jalan, emphasize real-world examples to help students understand practical implications.

If you are looking for CA Inter Cost & Management Account faculties then you purchase it from Smart Learning Destination.

0 notes

Text

Best CA Inter Classes online SM-FM, AUDIT, COSTING,Accounts, Law

Access the best CA Inter classes online for SM-FM, Audit, Costing, Accounts, and Law. Learn from top instructors through interactive sessions, comprehensive study materials, and practice exams designed to ensure your success in the CA Intermediate examinations.

0 notes

Text

Top Faculties for CA Inter Costing

#career#education#students#student#exams#ca classes#cainter#castudents#caintercosting#ca inter costing#Cma#top faculties

1 note

·

View note

Text

youtube

1 note

·

View note

Text

All About CA Industrial Training - Process, Eligibility & Duration

Industrial Training refers to the practical training in a company or an industrial environment that helps the students in developing the required skills which will help them in becoming a professional of the future.

ICAI industrial Training aims to equip the candidates who wish to pursue a career in the industry with the required practical exposure and appreciation about the functioning of the finance department in an industrial environment. It develops a problem-solving attitude amongst future chartered accountants and prepares them for work later on.

In this article, we will be discussing all the important aspects of Industrial training in the Chartered Accountancy course.

Eligibility Criteria for Industrial Training

A candidate desirous of pursuing Industrial Training must fulfill the below-mentioned eligibility criteria:

As per the Chartered Accountant Regulations, A candidate who has passed the ca intermediate or CA IPCC Examination (both groups) is eligible to serve as an industrial trainee in any of the financial, commercial, industrial undertakings as may be specified by the council or such other institution or organization as may be approved by the council from time to time.

An article assistant can serve as an Industrial Trainee only during the last year of his/ her prescribed period of Practical Training/ Articleship.

The article assistant has to intimate to his/ her principal about the intention to take such industrial training at least three months before the date on which such training is to commence.

Procedure for Industrial Training

Candidates who wish to serve in a company as an industrial trainee must register themselves with the ICAI in Form No. 104 electronically on ICAI’s website.

How to fill Form No. 104?

You can fill form no. 104 by following the below steps:

Go to ICAI Self Service Portal (SSP) Log in using your User Id and Password Go to Articleship Cycle Click on the Articleship/ Auditship tab available on the left side of the portal Click on the articleship menu Go to Industrial Training (Form No. 104) option Submit all the required details and click on submit Now your form has been submitted and will be sent to the Principal (under whom industrial training will be done) for approval. Once your application has been approved, go to the “Submitted/ Pending Actions” (in the articleship tab of the articleship cycle option of the SSP Portal) tab, download the PDF of the form, get it signed by the Principal and upload the scanned copy along with the deed in order to complete the registration process.

Duration of Industrial Training

The period of industrial training may range between a minimum of nine months and a maximum of twelve months during the last year of the prescribed period of practical training.

The period of industrial training is treated as service under articles for all purposes of the Chartered Accountant Regulations.

Is it mandatory to pursue Industrial Training during the CA course?

It is not mandatory to pursue Industrial Training. It is entirely up to the discretion of the candidate whether he/she wants to pursue Industrial training or complete 3 years of articleship under his/her existing Principal.

Advantages of Industrial Training

However, it is not mandatory for the candidates to pursue Industrial Training but it definitely provides an edge over the candidates who don’t. Some of the advantages are listed below:

It gives a new learning experience You get to interact with the members of other disciplines Fixed office timings Only five working days a week High Stipend amount Good contacts for future opportunities A Brand Name gets added to your profile Increased opportunities of getting placed in larger organizations (outside of Audit Firms)

Which Companies provide Industrial Training

Only the companies which are approved by the Institute of Chartered Accountants of India can provide Industrial Training.

There is a complete region-wise list of companies offering Industrial Training to CA students on the Institute’s official website which can be accessed by clicking on the given link:

https://www.icai.org/post.html?post_id=823

Some of the Companies are HSBC, Citi Bank, Wipro, HDFC, Kotak, etc.

How to apply for Industrial Training and Selection Process

You can directly apply in the ‘careers’ section of the company’s website where you wish to pursue Industrial training in case there is a vacancy.

You can also enroll yourself on the icai ca inter Articleship and Industrial Training Portal to get an opportunity of pursuing articleship in the companies registered on the portal.

You can also register on various job portals to find an Industrial Training opportunity that best suits you.

Selection Process: The selection process for Industrial Training generally includes a telephonic interview by the company or an online written test or sometimes both.

Working Hours and Days of Industrial Training

Normally, the timings for Industrial Training in most of the companies is 10 am to 6 pm (approximately 8 hours)

And generally, there are five working days during a week during Industrial Training.

Stipend in Industrial Training

The amount of stipend offered varies from Industry to industry, company to company. But generally, it is seen that companies give a handsome amount of stipend to their Industrial Trainees which ranges from Rs.15,000 to Rs.40,000 a month.

Under whom an article can pursue Industrial Training

The industrial training shall be received under a member of the Institute working in the company where you register as an Industrial Trainee.

As per the ICAI guidelines, An Associate who has been a member for a continuous period of at least three years shall be entitled to train one industrial trainee at a time and a fellow shall be entitled to train two industrial trainees at a time, whether such trainees be articled, clerks or audit clerks.

After successful completion of the Industrial Training, a Certificate of service will be issued by the member under whom industrial training was received in Form No. 105.

Exam Leaves allowed during Industrial Training

Every company has a different policy regarding exam leaves to be given to the Industrial Trainees for CA Final Exams. But normally a study leave of 2- 3 months is allowed by the companies.

How to create better chances of selection in companies for Industrial Training

To create better selection opportunities for yourself in Industrial Training you must understand the subject effectively and practically in which you want to join Industrial Training. (e.g, If you wish to pursue your Industrial Training in the field of finance, focusing more on subjects like Financial Management, Risk Management will be of great help)

Article Source: All About CA Industrial Training – Process, Eligibility & Duration

#ca inter#ca intermediate#ca intermediate course#icai intermediate#icai ca inter#ca inter costing#ca inter financial management#icai inter#Ca inter online classes

0 notes

Text

The Beat computer institute in delhi

Arth institute in Saket

Objectives of GST The main objectives of GST are:

To simplify the tax structure: GST aims to consolidate multiple taxes into a single tax, reducing complexity and compliance costs.

To eliminate cascading taxes: GST eliminates the tax-on-tax effect, reducing the overall tax burden on goods and services.

To promote economic growth: By reducing tax rates and simplifying compliance, GST aims to promote economic growth, increase tax revenues, and reduce inflation.

Key Features of GST Some key features of GST include:

Dual GST: GST is levied by both the Central Government (CGST) and State Governments (SGST).

IGST: Integrated GST (IGST) is levied on inter-state supplies of goods and services.

GST Rates: GST rates are divided into five slabs: 0%, 5%, 12%, 18%, and 28%.

GSTN: The Goods and Services Tax Network (GSTN) is a digital platform for GST registration, returns, and payments.

Why is GST important for Class 12 students? Understanding GST is crucial for Class 12 students for several reasons:

Career opportunities: Knowledge of GST is essential for careers in commerce, finance, and accounting.

Business and entrepreneurship: GST affects businesses and entrepreneurs, and understanding its implications is vital for success.

Economic awareness: GST has a significant impact on the economy, and understanding its concepts helps students become informed citizens.

Competitive exams: GST is an important topic in competitive exams like CA, CS, and CMA.

0 notes

Text

Understanding The Basics Of Auditing: A Beginner’s Guide for CA Inter Students

Auditing happens to be a critical function in the financial and corporate worlds as it makes sure that financial statements are accurate, compliant, and transparent. As far as CA Inter students go it is rather important to understand the fundamentals of auditing since it acts as the foundation of their careers in the domains of finance and accounting. In this guide, we will discuss the important areas of auditing like its objectives, principles, kinds, and processes thus helping you get a grip of the necessary concepts properly.

Auditing — what is it?

Auditing can be defined as the systematic evaluation and examination of financial records, operations, and statements of organizations. The aim in this case is to make sure that said elements are accurate, reliable, and complying with regulations. The main parts of such work are verifying transactions, assessing financial reports, and checking internal controls and the premier objective is to provide an opinion on how correct and fair they are.

What are the objectives of auditing?

The objectives of auditing can be classed into two categories — primary objectives and secondary objectives. The primary objective of such work is to express independent opinions on the fair and true view of a financial statement. The secondary objectives of auditing are the prevention and detection of errors, prevention and detection of fraud, making sure of compliance, and verification of liabilities and assets. Auditing aims to identify the unintentional mistakes that have been made in financial records. It also aims to find out cases where the financial statements have been manipulated intentionally. Auditing also verifies if they are adhering to the laws, accounting standards, and regulations that apply to them.

It also confirms the existence, valuation, and ownership of liabilities and assets in such records.

What are the different kinds of audits?

Depending on their scope and purpose audits can be classed into different categories. The most prominent varieties in this case can be enumerated as below:

· statutory audit

· internal audit

· tax audit

· cost audit

· management audit

· operational audit

· forensic audit

Statutory audit is conducted according to the legal requirements that apply to companies, financial statements, and banks. An internal audit is performed by the internal team of an organization to assess the standard of operational efficiency and internal controls. Tax laws mandate tax audits to guarantee that the financial statements comply with the relevant tax rules and regulations. In a cost audit, cost records are evaluated to ensure their accuracy as per cost accounting practices. Management audit focuses on appraising the efficiency and decision-making capabilities of the management.

What are the principles of auditing?

Auditors have to follow the basic principles of auditing to make sure that their work is reliable and that its integrity is not compromised. The most important principles in this case are as follows:

· integrity

· objectivity

· due care and professional competence

· confidentiality

· professional behavior

· independence

Auditors have to be straightforward and honest in their work. They must not at all be biased and they have to be free of any conflict of interest as well. They should also have the requisite skill levels and knowledge so that they can carry out their duties properly.

A stepwise guide to the audit process

The work of auditing uses a structured approach which is inclusive of planning, reporting, and execution. The most important steps in this particular process may be enumerated as below:

· planning the audit

· carrying out risk statement

· assessing internal controls

· gathering proof of audit

· verifying balances and transactions

· documenting audits

· reporting audits

The phase of planning the audit is a critical one as it is here that the auditor defines the audit strategy after gathering information. Before carrying out audit processes, they assess and identify potential risks too.

The most important audit standards

The profession of auditing adheres to certain standards that are referred to as SAs (Standards on Auditing) which are issued by the ICAI (Institute of Chartered Accountants). Some of the most important SAs may be enumerated as below:

· SA 200

· SA 500

· SA 230

· SA 700

· SA 315

All these cover different areas and aspects of auditing. For instance, SA 200 deals with the overall objectives of the conduct of an audit as well as that of an independent auditor. SA 230 deals with audit documentation and SA 315 focuses on assessing and identifying risks related to material misstatement.

Challenges that you face commonly in auditing

Auditors face a whole lot of challenges such as complex business transactions, regulatory changes, risks related to data security, and time constraints. As part of their work, these professionals have to analyze some of the most sophisticated financial structures. They also have to make sure that their work remains confidential and that they stay protected from cyber threats. Auditors have to keep adapting to accounting standards and laws that are always evolving. They also have to complete their work within stringent deadlines.

Some suggestions for CA Inter students

If as a CA Inter student, you want to get on the top of auditing concepts you must first understand them and then practice those with real-life cases. You must stay abreast with the latest amendments in this case and you must also revise the material at regular intervals. Finally, you have to keep getting better as far as your analytical skills in this context are concerned. For starters, you have to focus on the basic standards and principles of auditing, and then analyze previous case studies and audit reports.

Auditing plays a crucial role in making sure that financial transparency and integrity are never compromised. As far as CA Inter students are concerned, it is important to understand the basics so that they can lay the strongest foundation for their careers. When students focus on principles, standards, and processes they can develop the required skills that help them get better in auditing and head towards becoming a chartered accountant one day. We hope that with the information that they have gained from this blog CA Inter students can approach their studies clearly and confidently.

0 notes

Text

Best CA Coaching in Bangalore – Excel with iProledge Academy

Becoming a Chartered Accountant (CA) is a dream for many commerce students, but the CA exams conducted by ICAI are among the toughest in India. Success in CA Foundation, CA Intermediate, and CA Final requires structured preparation, expert guidance, and rigorous practice.

If you're searching for the best CA coaching in Bangalore, iProledge Academy is the perfect choice. With top faculty, exam-focused training, and a high success rate, iProledge ensures that CA aspirants achieve their goals with confidence.

Why Choose CA Coaching in Bangalore?

Many students attempt self-study for CA exams, but the vast syllabus and tricky exam pattern make it difficult to clear without proper coaching. Here’s why enrolling in a top CA coaching institute in Bangalore is crucial:

❌ Difficulty in understanding complex accounting & auditing concepts ❌ No structured preparation & time management strategy ❌ Lack of expert mentorship for clearing doubts ❌ Limited exposure to ICAI-style mock tests & past exam papers

At iProledge Academy, we help students overcome these challenges by offering:

✔ Expert-led classes with top CA faculty ✔ Comprehensive study plans & structured learning ✔ Regular mock tests & answer writing practice ✔ Personalized doubt-solving & mentorship ✔ Flexible learning – Classroom & Online coaching

📢 Want to crack CA exams on the first attempt? Join iProledge Academy today!

What Makes iProledge Academy the Best CA Coaching in Bangalore?

At iProledge Academy, we offer result-oriented coaching with a focus on concept clarity, application-based learning, and strategic exam preparation.

📌 1️⃣ Expert Faculty with Real-World Experience

✔ Learn from ICAI-certified CA professionals with years of teaching experience. ✔ Simplified explanations for tough subjects like Financial Reporting & Taxation. ✔ Live interactive sessions with case studies, practical examples & doubt-solving.

📌 2️⃣ Comprehensive Study Material & Exam-Focused Learning

✔ ICAI-approved study materials, revision notes, and formula sheets. ✔ Chapter-wise tests & full-length mock exams to assess preparation. ✔ Previous year paper analysis to focus on high-weightage topics.

📌 3️⃣ Flexible Learning – Offline & Online Coaching

✔ Classroom Coaching – Face-to-face interaction for better concept clarity. ✔ Live Online Classes – Learn from anywhere with real-time faculty support. ✔ Recorded Lectures – Revisit tough topics anytime before exams.

📌 4️⃣ Personalized Mentorship & Career Guidance

✔ One-on-one doubt-solving sessions with experienced CA mentors. ✔ Career counseling for CA Final and job placements in top firms.

📢 Looking for expert CA coaching in Bangalore? Join iProledge Academy today!

CA Course Structure – Everything You Need to Know

The CA certification is divided into three levels:

📌 CA Foundation Course

The first step in the CA journey, covering: ✔ Principles & Practice of Accounting ✔ Business Laws & Business Correspondence ✔ Business Mathematics, Logical Reasoning & Statistics ✔ Business Economics & Commercial Knowledge

📢 Looking for CA Foundation coaching? Join iProledge Academy today!

📌 CA Intermediate Course

The second stage, covering: ✔ Advanced Accounting ✔ Corporate & Other Laws ✔ Cost and Management Accounting ✔ Taxation ✔ Auditing & Assurance ✔ Financial Management & Strategic Management

📢 Need structured CA Inter coaching? Join iProledge Academy today!

📌 CA Final Course

The last and most challenging level, covering: ✔ Financial Reporting ✔ Strategic Financial Management ✔ Direct & Indirect Tax Laws ✔ Advanced Auditing & Professional Ethics ✔ Corporate & Economic Laws ✔ Risk Management & Governance

📢 Want to ace CA Final? iProledge Academy is here to guide you!

How to Prepare for CA Exams Effectively?

1️⃣ Follow a Structured Study Plan

✔ Allocate 4-6 hours daily for study & practice. ✔ Focus on conceptual understanding, not rote learning.

2️⃣ Focus on High-Scoring Subjects

✔ Accounting, Financial Management, and Taxation have high weightage. ✔ Theory subjects require strong conceptual clarity & frequent revision.

3️⃣ Practice Mock Tests Regularly

✔ Attempt ICAI-style mock tests & past year question papers. ✔ Analyze mistakes & work on weak areas.

4️⃣ Revise Smartly & Clear Doubts on Time

✔ Create summary notes & formula sheets for quick revision. ✔ Clear doubts with expert faculty at iProledge Academy.

📢 Need expert guidance? iProledge Academy is here to help! Enroll now!

FAQs – Most Common Questions About CA Coaching in Bangalore

1️⃣ Why should I join CA coaching instead of self-study?

Self-study is possible, but CA coaching offers: ✔ Structured study plans ✔ Expert faculty guidance ✔ Mock tests & performance tracking ✔ Faster doubt resolution

2️⃣ How long does it take to complete the CA course?

✔ CA Foundation: 6 months ✔ CA Intermediate: 8-12 months ✔ CA Final: 12-18 months

3️⃣ Is CA coaching necessary for passing the exams?

Yes! CA coaching improves passing rates significantly by providing: ✔ Conceptual clarity ✔ Practice with mock tests ✔ Exam-focused learning strategies

4️⃣ What is the passing percentage for CA exams?

✔ Minimum 40% in each paper ✔ 50% aggregate per group

5️⃣ What are the job prospects after completing CA?

After CA, you can work as: ✔ Chartered Accountant ✔ Auditor & Tax Consultant ✔ Corporate Finance Manager ✔ Investment Banker

📢 Want to secure a high-paying CA career? Join iProledge Academy today!

Final Thoughts – Start Your CA Journey with iProledge Academy

Success in CA exams requires a combination of structured coaching, expert mentorship, and disciplined study plans. At iProledge Academy, we provide:

✅ Top CA Faculty & Personalized Mentorship ✅ Exam-Focused Study Plans & Mock Tests ✅ Flexible Learning – Classroom & Online ✅ Proven Success Rate & Career Support

📞 Call/WhatsApp: +91 XXXXXXXXXX 🌐 Register Now: iProledge Academy

🚀 Start your CA journey today with iProledge Academy – Your Path to Success! 🎯

You have not enough Humanizer words left. Upgrade your Surfer plan.

You said:

WRITE A BLOG ON cma test series FOR 100x commerce and interlink

ChatGPT said:

CMA Test Series – The Key to Cracking CMA Exams Successfully

The Certified Management Accountant (CMA) exams, conducted by the Institute of Cost Accountants of India (ICMAI), are known for their challenging syllabus and in-depth financial concepts. Whether you're preparing for CMA Foundation, CMA Intermediate, or CMA Final, practicing with a structured CMA test series is essential for concept clarity, time management, and exam confidence.

At 100X Commerce, we provide high-quality CMA test series designed to help students strengthen their exam preparation, improve their problem-solving skills, and clear the CMA exam on the first attempt.

Why is a CMA Test Series Important?

Many CMA aspirants focus on reading study materials and notes, but they fail to test themselves under real exam conditions. This can lead to:

❌ Poor time management – Inability to complete the exam within the time limit. ❌ Struggles with MCQs, case studies, and complex numerical problems. ❌ Lack of confidence and exam pressure – Difficulty in recalling concepts under stress. ❌ Unawareness of ICAI’s question patterns and marking schemes.

A well-structured CMA exam test series helps students:

✔ Understand ICMAI’s exam pattern and time constraints. ✔ Improve accuracy in numerical and theoretical questions. ✔ Master time management and question prioritization. ✔ Boost confidence by attempting mock exams under exam-like conditions.

📢 Want to evaluate your CMA preparation? Take a CMA mock test with 100X Commerce today!

📌 CMA Exam Test Series – A Must for Every Level

At 100X Commerce, we offer a CMA test series for all three levels, helping students succeed step by step.

📌 CMA Foundation Test Series – Build a Strong Base

The CMA Foundation exam focuses on fundamentals of accounting, business laws, mathematics, and economics. Our CMA Foundation test series helps students:

✔ Master MCQ-based questions with speed and accuracy. ✔ Avoid negative marking by improving precision in answers. ✔ Develop conceptual clarity in fundamental subjects.

📢 Looking for a CMA Foundation test series? Try a free CMA mock test at 100X Commerce today!

📌 CMA Intermediate Test Series – Strengthen Your Concepts

The CMA Intermediate level requires a strong grasp of financial reporting, cost accounting, taxation, and management principles. Our CMA Inter test series helps students:

✔ Practice case-study-based and numerical problems for better accuracy. ✔ Understand high-weightage topics and improve weak areas. ✔ Simulate the real exam environment to improve performance.

📢 Want the best test series for CMA Inter? Take a free CMA mock test with 100X Commerce today!

📌 CMA Final Test Series – The Last Step to Becoming a CMA

The CMA Final exam is highly analytical and requires deep expertise in strategic cost management, corporate finance, and risk assessment. A CMA Final test series helps students:

✔ Develop an exam temperament to handle complex questions. ✔ Practice decision-making and case-study analysis. ✔ Refine answer presentation skills to maximize scoring potential.

📢 Want to clear CMA Final on your first attempt? Practice with 100X Commerce’s CMA test series now!

📌 ICMAI Mock Test vs. CMA Test Series – What’s the Difference?

Many students wonder whether ICMAI mock tests are enough or if they should enroll in a CMA test series. Here’s the difference:FeatureICMAI Mock TestCMA Test Series by 100X CommerceQuestion VarietyICMAI-style papersCovers ICMAI + unique practice questionsDetailed SolutionsBasic solutionsIn-depth explanations & step-by-step approachPerformance AnalysisNot providedPersonalized feedback & score analysisChapter-wise TestsNoYes – Helps in step-by-step learning

While ICMAI mock tests are useful, they don’t provide the detailed insights and structured practice that a high-quality CMA test series does.

📢 Want expert-curated CMA test series? Join 100X Commerce today!

📌 How to Use a CMA Test Series for Maximum Benefit?

To get the most out of your CMA test series, follow these steps:

✔ Attempt Chapter-Wise Tests First – Strengthen individual concepts before attempting full-length mock exams. ✔ Simulate Real Exam Conditions – Take the tests in a quiet place with a timer. ✔ Analyze Mistakes and Weak Areas – Focus on the subjects where you lose marks. ✔ Revise Before Retaking Tests – Attempt the same test again to measure improvement.

💡 This approach ensures maximum retention and higher exam scores.

📌 FAQs – Most Asked Questions About CMA Test Series

1️⃣ How many mock tests should I take before the CMA exam?

It is recommended to take at least: ✔ 5-6 full-length mock tests per subject. ✔ Multiple chapter-wise tests to improve understanding.

2️⃣ Where can I get a free CMA test series?

You can try a CMA test series free of cost at 100X Commerce and experience high-quality mock tests.

3️⃣ Which is the best test series for CMA Inter?

The best test series for CMA Inter includes: ✔ ICMAI-patterned mock tests ✔ Chapter-wise & full-length practice tests ✔ Detailed performance analysis

📢 Get all of this with 100X Commerce’s CMA Inter test series!

4️⃣ What is the difficulty level of ICMAI mock tests?

ICMAI mock tests are moderate to difficult and closely resemble the actual exam, but practicing with a test series helps improve performance significantly.

5️⃣ Is a CMA test series necessary to pass the exam?

Yes! A CMA test series helps students master ICMAI’s exam pattern, improve time management, and build confidence—which are all critical for passing the exam.

6️⃣ Can I take CMA mock tests online?

Yes! 100X Commerce offers online CMA mock tests that you can attempt anytime, anywhere.

📢 Want to boost your CMA exam preparation? Join 100X Commerce today and practice with the best CMA test series!

0 notes

Text

Why is CA Parag Gupta the Best Faculty for CA Inter Costing?

One of the most respected mentors in the field of CA Inter Costing is CA Parag Gupta Sir. Numerous CA candidates have benefited from his exceptional teaching methods, wealth of expertise, and student-centered approach. He is the greatest option for students studying CA Inter Costing due to his emphasis on conceptual clarity, practical application, exam methods, and all-encompassing support. By simplifying difficult ideas, CA Parag Gupta Sir helps pupils understand minute nuances. His extensive study guide is in line with the CA Inter syllabus and offers real-world examples, graphics, and exam-style practice problems. In order to make sure that students are ready for any modifications to the syllabus or exam format, he also refreshes his materials on a regular basis. Additionally, CA Parag Gupta Sir offers a stimulating and encouraging learning environment that promotes active engagement and offers frequent sessions for clearing up any doubts. In order to meet the various demands of his pupils, he provides flexible learning alternatives, such as both online and offline classes. In summary, CA Parag Gupta Sir's method of teaching CA Inter Costing is essential for students to develop solid fundamental knowledge and boost their self-esteem so they may succeed on tests.

0 notes

Text

ca inter costing best classes in bengaluru

#ca inter costing#ca inter classes#icai#cainterbestclasses#caintercostingclasses#caintercostingonlineclasses#cainterclasees#ca intermediate#castudents

0 notes

Text

Perfect Strategy for CA Inter Preparation After CA Foundation

Clearing the CA Foundation exam is a significant milestone for every CA aspirant. However, the journey doesn’t stop there! The next crucial step is CA Intermediate, which demands a structured approach and dedicated preparation. Many students struggle to transition smoothly from Foundation to Inter due to a lack of proper planning. In this blog, we will discuss the best strategy to prepare for CA Inter effectively after clearing the CA Foundation exam.

Understanding the CA Inter Exam Structure

The CA Intermediate exam, conducted by ICAI, is a comprehensive and advanced-level test compared to CA Foundation. It consists of two groups, each with four subjects, covering Accounting, Corporate Laws, Taxation, Costing, Financial Management, and Auditing. To excel in CA Inter, students must focus on conceptual clarity, time management, and regular practice.

Why Early Preparation is Crucial?

Many students tend to delay their CA Inter preparation, believing they have enough time. However, the syllabus is vast, and last-minute studying can be overwhelming. Here’s why starting early is a game-changer:

Stronger Conceptual Clarity: Early preparation helps in understanding concepts deeply rather than memorizing.

Better Time Management: A well-structured study plan allows you to balance all subjects efficiently.

Less Stress & More Confidence: Consistent preparation reduces last-minute pressure and boosts self-confidence.

Ample Time for Mock Tests & Revisions: Starting early ensures you get enough time to solve mock tests and revise thoroughly before exams.

The Ultimate Study Plan for CA Inter Preparation

1. Join a Good CA Coaching Program

Enrolling in CA coaching classes is one of the best ways to stay ahead in preparation. A structured program with expert faculty will help you cover the syllabus systematically. With the rise of CA Online Classes, students can now prepare from the comfort of their homes, saving time and getting access to top educators.

2. Create a Subject-Wise Study Plan

Since CA Inter has two groups, it is essential to divide your preparation wisely:

Group 1 Focus: Accounting, Law, Taxation, and Cost & Management Accounting

Group 2 Focus: Advanced Accounting, Auditing, Financial Management, and Economics for Finance

If you have enough time, aim to clear both groups in one attempt. However, if managing both seems difficult, you can focus on one group at a time.

3. Set Daily & Weekly Study Goals

Allocate 6-8 hours daily for studies.

Dedicate each week to specific topics.

Revise the previous day’s topics before starting new ones.

Practice questions daily to strengthen problem-solving skills.

4. Regularly Solve Mock Tests & Past Papers

Mock tests and previous years' question papers are crucial for understanding the exam pattern and time management. Many CA Inter Online Classes offer test series and practice papers, which help students analyze their performance.

5. Focus on Conceptual Learning, Not Just Rote Memorization

CA Inter is more about application-based learning rather than direct theory. Subjects like Accounting, Costing, and Financial Management require problem-solving skills, while Law and Auditing demand conceptual clarity. Focus on why rather than just what while studying.

6. Revise Regularly

Revising is as important as learning new topics. Follow the 3-2-1 revision strategy:

Revise a topic within 3 days of studying it.

Revisit the same topic in 2 weeks.

Do a final revision before the exam.

This method ensures that you retain information for a longer period.

7. Strengthen Your Weak Areas

Every student has strong and weak subjects. Identify your weaknesses and work harder on them. Take help from CA Inter Online Classes or discuss doubts with mentors to improve your understanding.

8. Stay Consistent & Avoid Procrastination

Many students lose motivation or postpone studies, which leads to a pile-up of topics. Stay disciplined and follow your study plan diligently. Avoid distractions and unnecessary breaks that eat up your productive time.

Visit For More Info:https://ultimateca.com/

Why Choose UltimateCA for CA Inter Preparation?

At UltimateCA, we provide structured CA Inter Online Classes with expert guidance, conceptual clarity, and exam-oriented teaching methods. Our faculty ensures that students not only understand concepts but also excel in exams with mock tests, doubt-solving sessions, and study materials.

Conclusion

Preparing for CA Intermediate after Foundation requires dedication, consistency, and a well-structured study plan. Enroll in the best CA coaching classes, practice regularly, take mock tests, and focus on conceptual clarity. Whether you choose offline coaching or CA Online Classes, staying committed to your preparation will lead you to success in CA Inter.

Start your CA Inter journey today with the right strategy and resources, and you’ll be well on your way to becoming a Chartered Accountant!

#CA Inter#Chartered Accountant#CA Inter Online Classes#CA Coaching Program#UltimateCA#CA Online Classes#CA Inter Preparation

0 notes

Text

Best CA Inter Classes online SM-FM, AUDIT, COSTING,Accounts, Law

Discover the finest CA Inter classes online in India, specializing in SM-FM, Audit, Costing, Accounts, and Law. Access comprehensive study materials, live sessions, and expert guidance for a thorough and successful exam preparation experience.

0 notes

Text

Breaking the Geographical Barriers: Accessing Top CA Classes From Anywhere in India

In the rapidly evolving digital world, geography is no longer a barrier to education. Aspiring Chartered Accountants (CAs) from remote towns, bustling cities, and everything in between can now access top-notch CA classes from anywhere in India. The rise of Online CA courses in India has transformed how students prepare for their CA Foundation, Intermediate, and Final exams, enabling equal access to quality education.

Why Breaking Geographical Barriers Matters

The journey to becoming a Chartered Accountant is demanding, requiring students to have the best guidance and resources. Traditionally, students often needed to relocate to metro cities to access premier CA coaching classes, which added financial and emotional strain. Today, the digital transformation of education ensures that every student, regardless of location, has access to top CA classes in India from the comfort of their homes.

The Power of Online CA Courses in India

Online learning platforms have revolutionized the CA preparation landscape. Here’s how:

Expert Faculty: Students now have access to the best mentors and educators, like those at Swapnil Patni Classes, known for their stellar track record in CA coaching.

Live & Recorded Classes: Flexible learning options through live sessions and recorded lectures allow students to learn at their own pace.

Comprehensive Study Materials: Top-tier CA inter classes and CA foundation classes provide exhaustive study materials, mock tests, and doubt-solving sessions.

Cost-Effectiveness: Students save on relocation and accommodation costs while getting high-quality education at affordable rates.

CA Foundation Classes: Building the Right Base

The CA Foundation course is the stepping stone in a CA’s journey, covering subjects like Principles of Accounting, Business Laws, and Quantitative Aptitude. Online CA Foundation classes ensure students across India can access top-notch training, exam-focused study plans, and personalized guidance to ace the exam on their first attempt.

CA Inter Classes: Bridging the Gap to Success

The CA Intermediate level is crucial, as it tests deeper conceptual knowledge and practical application. Through interactive online CA Inter classes, students can participate in group discussions, solve doubts in real-time, and master key subjects such as Accounting, Taxation, and Auditing—all without stepping out of their homes.

Why Choose Swapnil Patni Classes?

Swapnil Patni Classes is a name synonymous with success in CA coaching. With a blend of expert faculty, innovative teaching methods, and result-oriented approaches, SPC bridges the gap between students and their dreams. The online CA courses in India offered by SPC ensure that every student, whether in a metro city or a rural town, gets the same level of mentorship and resources.

Key features of SPC’s online programs include:

Live and recorded lectures for flexibility

Regular tests and performance analysis

Dedicated doubt-solving sessions

Access to comprehensive study materials and mock exams

Conclusion

The availability of top CA coaching classes through online platforms like Swapnil Patni Classes has truly democratized CA education. Students no longer need to uproot their lives or face additional challenges to access quality education. By leveraging the power of technology and enrolling in CA Foundation classes, CA Inter classes, or advanced-level courses, students across India can now confidently prepare for their exams and achieve their CA dreams, no matter where they are located.

To explore more about SPC's online CA courses and start your journey, visit www.swapnilpatni.com.

#CA Classes In India#CA Inter Classes#CA Foundation Classes#Online CA Course In India#CA Coaching Classes#CA Live Classes#CA inter online classes#Best Ca Online Classes

0 notes