#ca intermediate course

Text

Unlocking Success: A Comprehensive Guide to Preparing for the CA Inter Exam

Are you gearing up for the CA Inter Exam? This pivotal moment in your academic and professional journey demands meticulous preparation and a strategic approach. Whether you’re a first-time taker or aiming for a top rank, mastering the art of preparation is key. Here’s a comprehensive guide to help you unlock success in the CA Inter Exam.

Understanding the CA Inter Exam: The CA Inter Exam, conducted by the Institute of Chartered Accountants of India (ICAI), is a stepping stone towards becoming a Chartered Accountant. It consists of eight papers divided into two groups, covering topics such as Accounting, Corporate and Other Laws, Cost and Management Accounting, Taxation, and more.

Creating a Study Plan: Effective time management is crucial for exam preparation. Create a study plan that allocates sufficient time to cover each subject thoroughly. Break down your study sessions into manageable segments, focusing on understanding concepts, practicing problems, and revising regularly.

Utilizing Study Material: ICAI provides study material and practice manuals for each subject. These resources are invaluable for exam preparation, as they are curated by experts and align with the exam syllabus. Make sure to supplement your studies with additional reference books and online resources for a holistic understanding of the topics.

Mock Tests and Previous Years’ Papers: Practice makes perfect, and this holds true for the CA Inter Exam as well. Solve mock tests and previous years’ papers to familiarize yourself with the exam pattern, time management, and question types. Analyze your performance to identify weak areas and work on improving them.

Seeking Guidance: Don’t hesitate to seek guidance from experienced professionals, teachers, or mentors. Joining a coaching institute or online classes can provide structured guidance and help clarify doubts. Engage in group study sessions to gain different perspectives and enhance your learning experience.

Maintaining a Healthy Lifestyle: A healthy body supports a healthy mind. Ensure you get enough rest, eat nutritious meals, and exercise regularly. Avoid stress and burnout by taking breaks and indulging in hobbies or activities that relax you.

Staying Positive and Motivated: The journey to becoming a Chartered Accountant is challenging, but maintaining a positive attitude and staying motivated is key to success. Visualize your goals, stay focused, and believe in your abilities.

Conclusion: The CA Inter Exam is not just a test of knowledge but also a test of determination and perseverance. By following this comprehensive guide, you can prepare effectively and increase your chances of acing the exam. Stay committed to your goals, and success will be yours. Best of luck!

Original Source: CA Intermediate Course

#ca inter exam#ca inter#ca intermediate#ca intermediate course#ca inter subjects#ca inter syllabus#ca intermediate syllabus#ca inter group 1 subjects#ca inter group 2 subjects#ca inter accounts

0 notes

Text

CA Inter Classes Online

Choosing online classes for CA Inter from Lecturewala is a strategic investment in your CA Inter success. The platform's commitment to flexibility, accessibility, expert faculty, and comprehensive study material makes it a reliable ally on your path to becoming a chartered accountant. Elevate your CA Inter preparation with Lecturewala's online classes and set yourself on the path to success. Enroll now for a transformative learning experience.

#ca inter classes#ca inter class#inter classes#ca inter courses#ca intermediate course#ca intermediate classes#ca intermediate courses

0 notes

Text

CA Intermediate Course in Coimbatore

The CA Intermediate course is typically the second level of the CA program, following the CA Foundation course. It consists of a set of subjects and examinations that cover advanced topics in accounting, auditing, taxation, financial management, and other related areas. The course is intended to provide students with a comprehensive understanding of accounting principles and practices, financial reporting, taxation laws, auditing standards, and more.

Overview of CA Intermediate Course

Eligibility: To enroll in the CA Intermediate course, candidates usually need to have completed the CA Foundation course and fulfilled the required eligibility criteria set by the relevant accounting body, such as the Institute of Chartered Accountants of India (ICAI).

Course Structure: The CA Intermediate course consists of eight papers, divided into two groups. Each group comprises four papers. Candidates have the flexibility to appear for the papers of one group at a time or both groups together.

Paper 1 : Advanced Accounting

Paper 2: Corporate And Other Laws

Paper 3: Taxation

Paper 4: Cost And Management Accounting

Paper 5: Auditing And Ethics

Paper 6: Financial Management Andstrategic Management

Examinations: The CA Intermediate exams are held twice a year, typically in May and November. The exams are conducted in a pen-and-paper format.

Syllabus: The syllabus of the CA Intermediate course covers a wide range of topics, including:

Advanced financial accounting and reporting standards.

Corporate and allied laws, including company law provisions.

Cost and management accounting techniques.

Direct and indirect tax laws and practices.

Advanced accounting and financial reporting.

Auditing standards and audit procedures.

Enterprise information systems and strategic management concepts.

Financial management principles and economics for finance.

Training: In addition to passing the Intermediate exams, candidates are required to undergo a practical training program, known as Articleship. This hands-on experience provides practical exposure to various aspects of accounting, taxation, and audit under the guidance of a practicing Chartered Accountant.

Study Material and Coaching: Many candidates opt for coaching from accredited institutes to supplement their self-study efforts. ICAI also provides study materials and practice manuals for each paper.

Passing Requirements: To successfully clear the CA Intermediate level, candidates need to obtain a minimum of 40% marks in each paper and a total of 50% marks in aggregate in a single group.

Progression: Upon clearing the CA Intermediate exams of both groups and completing the prescribed practical training, candidates can proceed to the final level of the CA program, which includes specialized subjects and a more comprehensive examination.

To know more: https://rachithacademy.com/best-ca-intermediate-course-in-coimbatore/

0 notes

Text

CA Online Course By DG Sharma | CA Classes | CA Intermediate & Foundation

CA D.G. Sharma is an eminent and most admired faculty in the student fraternity. He is the epitome of knowledge helping students to realize their own potential and achieve newer heights. Academically he is a rare gem he has qualified the most prestigious exams CA, CS and ICWA.

He believes that the profession of Chartered Accountancy is rewarding and responsible. He opines that CA’s have to be an expert in Accounting and to gain command students should acquire knowledge. He imbibes confidence in students by giving conceptual clarity. His success mantra is, “Do not memorize everything try to understand everything”.

CA D.G. Sharma is the Founder and Managing Director of DG Sharma‘s CAPS, a premier commerce coaching institute in central India. He has penned more than 10 books in accountancy published by renowned publishing houses.

#ca classes#ca online classes#ca intermediate classes#ca foundation classes#ca online course#ca course online classes#ca best online classes#best ca online classes#online ca foundation classes#chartered accountant online classes#chartered accountant online course#best online coaching for ca foundation#ca intermediate online classes#ca final classes online#online ca course#ca online coaching classes#ca foundation coaching#ca foundation online classes

0 notes

Text

An Overview CA Intermediate Exam as Per New Syllabus 2024

With its hard coursework and exams, the Chartered Accountancy (CA) Intermediate level is a critical step on the path to becoming a chartered accountant. To guarantee that prospective chartered accountants (CAs) possess the most recent information and abilities, the Institute of Chartered Accountants of India (ICAI) has unveiled a revised curriculum for the CA Intermediate course. We'll go over the main ideas of the CA Intermediate New Syllabus in this blog, giving candidates an idea of what to expect and how to get through this demanding yet rewarding stage of their career.

Updated Structure and Pattern: The CA Intermediate exam's structure and pattern have been updated in light of the new syllabus. Six papers total are split into two groups, Group I and Group II, each of which has three papers. The framework attempts to offer a comprehensive grasp of many aspects of business, finance, and accounting.

Papers for Group I:

Advanced Accounting: This section of the CA Intermediate New Syllabus 2024 focuses on producing financial statements using Indian Accounting Standards, which are comparable to IFRS, and applying accounting standards to actual business scenarios. It also addresses the financial statement preparation framework and IFRS convergence or adoption.

Corporate and Other Laws: This essay covers business law, other corporate laws, ethics, and legal and regulatory topics. Candidates must understand the laws that control corporations and corporate governance.

Taxation: Both direct and indirect taxes are covered in this paper. To prepare applicants for the complexities of the taxation landscape. It has 2 sections.

Income Tax Laws(IT)

Goods and Service Tax(GST)

Papers for Group II:

a. Cost and Management Accounting: With an emphasis on budgeting, performance analysis, and costing techniques, this paper gives candidates the tools they need to control costs and make decisions in companies.

b. Auditing and Ethics: Understanding the foundational ideas of auditing and becoming acquainted with the well-recognized auditing methods, approaches, and competencies are the main goals. Students will also acquire the skills necessary to successfully apply this information in audit and attestation assignments.

c. Financial Management and Strategic Management: The main goal of financial management is to optimize the value of an organization's finances.

Conversely, strategic management focuses on the broad picture, explaining how to create and carry out plans that will support a business in achieving its objectives in the long run.

FM and SM are two sides of the same coin, not distinct topics. Implementing effective strategy requires strong financial management, and making wise financial decisions requires a solid understanding of the business environment. Through acquiring both FM and SM, students enrolled in CA Inter gain a comprehensive viewpoint.

Strategies for Preparation:

Considering the new syllabus's comprehensive nature, candidates need to implement efficient preparation techniques. This entails making a study schedule that allows enough time for each paper, getting practice with previous exams and practice questions, and consulting mentors or knowledgeable instructors for advice. Furthermore, candidates must stay informed about any modifications or updates issued by ICAI to guarantee that they are adequately prepared for the exams.

In summary, the CA Intermediate New Syllabus represents a major advancement in bringing the CA curriculum into compliance with the needs of the contemporary business world. This stage should be approached by aspiring chartered accountants with a dedication to comprehending both the theoretical and real-world applications of the concepts. Candidates can pass the exams and become well-rounded professionals prepared to make valuable contributions to the finance and accounting industries by assiduously studying the new syllabus and planning ahead.

Start your journey with CA online classes at SPC:

#ca online classes#ca inter online classes#ca intermediate#ca inter classes in pune#ca course#ca classes in pune#ca coaching classes#ca final classes in pune

0 notes

Text

All About CA Course: CA foundation, CA Intermediate and CA Final Syllabus

For those interested in pursuing a career in Commerce or any other stream, chartered accountancy is one of the best career option.

It is a very good job option for individuals who are interested in the field of taxation and accounting. The road to become a chartered accountant is arduous and difficult and hence paid a great amount after completion.

If you want to read more click here

0 notes

Text

1 note

·

View note

Link

Buy CA Intermediate Online Classes & CA Intermediate Pendrive Classes at a Very Affordable Price. Get the High-Quality Video Lectures for CA Intermediate with Unlimited Views, Multiple Faculties, and Language Options facilities at Navkar Digital Institute. To know more details, feel free to call us at 7567712000 / 9081910714 / 6356144000.

#CA Inter Online Classes#CA Intermediate Online Course#CA Intermediate Group 2#Pendrive Classes For CA Inter#CA Inter Classes#Best Video Lectures for CA Intermediate#Online Classes for CA Inter Group 1#CA Inter Auditing Classes#Best Online Classes for CA Intermediate

0 notes

Link

Online Coaching is categorized into Recorded Lectures & Online Video Classes. So the aspirants can study any time, anywhere, on any device. For more details, read our blog post, 10 Major Reasons Why CA Final Students or Repeaters Prefer to Study Through Online (Recorded) Video Lectures. To know more about Navkar Digital Institute, you may contact us at +91 75677 12000 or you can write to us at [email protected]

#CA Online Classes#Best CA Coaching in India#CA Video Classes#CA Course Video Lectures#CA Inter Video Lectures#CA Final Video Lectures#CA Final Pendrive Classes#CA Intermediate Video Lectures Online#CA Foundation Online Classes

0 notes

Text

I'm about to go to bed and I don't particularly feel like translating these wip graphics into english but I wanna scream (affectionate) about the project anyways, so here goes:

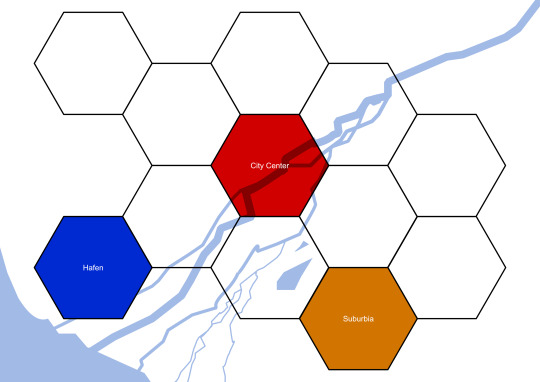

I'm building a cyberpunk city for a shadowrun ttrpg campaign :D

... or not, if it no longer strikes my fancy.

Anywah, I thought long and hard about how best to do this and came to the conclusion that to simulate the experience of a city that you can actually get to know as a player without getting lost in making huge-ass, mostly empty maps is instead making a few large-ish maps that represent a part of a city.

Above you see a symbolic representation of the 12 city parts, currently named after their function more than their history. For each of these maps I'll make a large-ish maps which has a unique feel and represents that city part, e.g. this one, the "worker neighborhood":

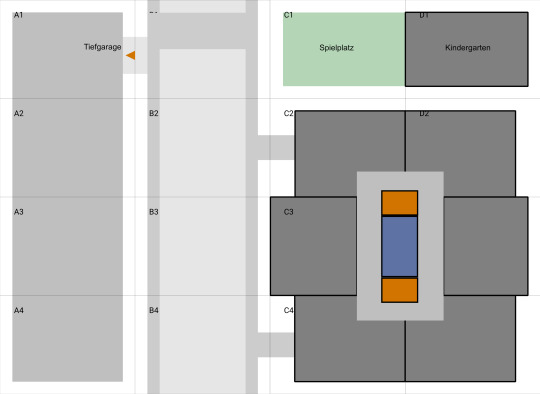

It features, left to right: a supermarket with a parking garage under it, a main street with a bridge over it, a playground (green) with a kindergarten next to it and (below) an apartment complex (orange are lifts, blue are staircase).

Now you might wonder: hey chicken, why are there rectangles and numbers/letters on there?

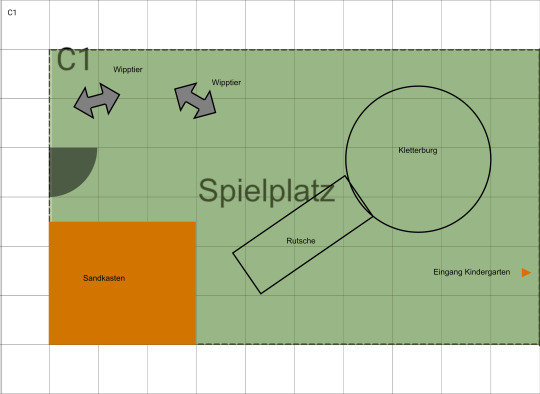

I'm glad you asked! it's because this is only an intermediate-sized map which is supposed to give an overview. The tiles are named A1 to D4 and each of them in its final form can become a battle map if needed, see here:

This is the C1 tile, which is the playground, except zoomed-in. (It features rocking animals, sandbox, climbing tower and slide). As you can see, each map once again has square tiles and I picked a size that has a somewhat generous amount of space for minis.

Each map-tile prints easily on a din-a4 page, so you can either use the intermediate map-size to give an overview of an area ooooor you can print out every single map tile individually and assemble them together into an Din A0 map which should hopefully fit on your kitchen table (ca. 80 cm x 120 cm = ca. 2' 9" x 3' 11")

Of course you could always build upon this by pretending that a mission you thought up yourself or bought takes place in one of the city parts but doesn't connect directly to one of the large-ish maps, oooor you can keep drawing the maps bigger, if you prefer.

One way or the other, you can establish places and come back to them because these maps are big enough and have enough going on in them that they can easily become recurring places (e.g. someone's contact lives in the apartment but also the supermarket becomes relevant in a mission. Also. ALSO... gang territories! The possibilities!!)

I'm so looking forward to filling these out!

9 notes

·

View notes

Text

(In reference to this post)

@andromacheflints those are his titles!

GCH - AKC Grand Champion

CH - AKC Champion

CA - Coursing Ability

DCAT - he's fast. I'll admit FCAT titles confuse me some.

CGCA - Canine Good Citizen Advanced

CGCU - Canine Good Citizen Urban

TKI - Trick Dog Intermediate

ATT - AKC Temperament Title

He also recently got his FDC (Farm Dog Certified) title!

8 notes

·

View notes

Text

The Chartered Accountancy (CA) Course: A Comprehensive Guide

The Chartered Accountancy (CA) course is one of the most prestigious and challenging professional courses in India and around the world. It is regulated by the Institute of Chartered Accountants of India (ICAI), which was established in 1949. Becoming a Chartered Accountant opens up a world of opportunities in various sectors such as finance, taxation, audit, and consultancy. In this article, we will explore the various aspects of the CA course, including its eligibility criteria, exam structure, and career prospects.

Eligibility Criteria: To pursue the CA course, a candidate must have completed 10+2 or its equivalent from a recognized board. Candidates can register for the CA Foundation course after passing the 10th examination, but they can appear for the exam only after passing the 10+2 examination. Additionally, candidates must fulfill certain criteria related to age and educational qualifications as specified by the ICAI.

Course Structure: The CA course is divided into three levels: Foundation, Intermediate, and Final. Each level has a set of papers that candidates need to clear to move to the next level. The course also includes practical training and a series of examinations conducted by the ICAI.

Foundation Course: The Foundation course consists of four papers covering topics such as Accounting, Business Laws, Business Correspondence and Reporting, and Business Mathematics and Logical Reasoning & Statistics.

Intermediate Course: The Intermediate course is further divided into two groups, each consisting of four papers. The subjects covered include Accounting, Corporate Laws and Other Laws, Cost and Management Accounting, Taxation, Advanced Accounting, Auditing and Assurance, Enterprise Information Systems & Strategic Management, and Financial Management & Economics for Finance.

Final Course: The Final course is also divided into two groups, each consisting of four papers. The subjects covered include Advanced Auditing and Professional Ethics, Corporate and Economic Laws, Strategic Cost Management and Performance Evaluation, Financial Reporting and Strategic Financial Management, and Direct Tax Laws and International Taxation.

Articleship and Training: Apart from clearing the examinations, candidates are required to undergo three years of practical training called articleship. During this period, candidates work under the guidance of a practicing Chartered Accountant and gain practical experience in areas such as accounting, auditing, taxation, and financial management.

Career Prospects: Becoming a Chartered Accountant opens up a wide range of career opportunities in both the public and private sectors. Chartered Accountants are in high demand in areas such as auditing, taxation, financial reporting, and consultancy. They can also work in roles such as Chief Financial Officer (CFO), Finance Manager, Tax Consultant, and Auditor. Many Chartered Accountants also choose to start their own practice and provide services to clients.

In conclusion, the CA course is a challenging yet rewarding journey that offers immense opportunities for professional growth and development. It requires dedication, hard work, and perseverance, but the rewards are well worth it. If you have a passion for accounting and finance, and are willing to put in the effort, the CA course could be the perfect choice for you.

#ca course#ca course details#ca course fees#ca course subjects#ca course duration#ca foundation course#ca intermediate course#ca course details after 12th

0 notes

Text

The journey to becoming a Chartered Accountant (CA) in India is a rigorous and rewarding one, requiring candidates to clear the CA Foundation, CA Intermediate, and CA Final exams. In addition to investing time and effort in preparing for these exams, candidates must also consider the associated financial costs. In this blog, we will explore the CA course fees for 2023, as well as introduce you to Lecturewala, a trusted resource for CA aspirants.

CA Foundation Course Fees

The CA Foundation course is the first step on the path to becoming a CA. The registration fee for the CA Foundation course in 2023 is approximately INR 9,000. This fee includes the cost of study materials and online registration. Please note that this fee is subject to change, so it’s essential to check the official website of the Institute of Chartered Accountants of India (ICAI) for the most up-to-date information.

CA Intermediate Course Fees

Once you clear the CA Foundation exam, you can move on to the CA Intermediate level. The registration fee for the CA Intermediate course in 2023 is approximately INR 18,000. This fee includes both groups, and the study materials are provided at no additional cost. However, it’s worth noting that the fee can vary based on the route you choose (i.e., direct entry or after completing the CA Foundation course). To get the exact fee structure for your situation, consult the ICAI’s official website.

CA Final Course Fees

The final leg of the journey is the CA Final course, which prepares you for the last and most challenging set of exams. The registration fee for the CA Final course in 2023 is approximately INR 22,000. Similar to the CA Intermediate course, this fee is for both groups, and study materials are included in the cost. Again, the fee may vary depending on your entry route and other factors, so it’s crucial to consult the official ICAI website for precise information.

Lecturewala: A Valuable Resource for CA Aspirants

One of the key elements of preparing for CA exams is access to quality study material and guidance. This is where Lecturewala, a trusted name in the field of CA education, comes into the picture. Lecturewala offers a wide range of courses, including video lectures and study materials for CA Foundation, CA Intermediate, and CA Final exams. They understand the needs of CA aspirants and provide comprehensive and up-to-date resources to help students succeed.

Key Features of Lecturewala:

Expert Faculty: Lecturewala boasts a team of experienced and knowledgeable faculty members who are well-versed in the CA exam syllabus.

High-Quality Video Lectures: Their video lectures are known for their clarity and depth, making complex topics easier to understand.

Comprehensive Study Materials: Lecturewala provides study materials that are aligned with the latest syllabus and examination patterns, ensuring that students are well-prepared.

Mock Tests and Practice Papers: To help candidates assess their progress, Lecturewala offers mock tests and practice papers, allowing them to gauge their readiness for the actual exams.

Cost-Effective: Lecturewala’s courses are reasonably priced, making them accessible to a wide range of CA aspirants.

Conclusion

Becoming a Chartered Accountant is a noble and rewarding pursuit, but it comes with its share of financial commitments. Understanding the CA course fees for 2023 is essential for planning your journey. Additionally, resources like Lecturewala can play a pivotal role in helping you achieve your CA aspirations by providing you with high-quality study material and expert guidance. So, if you’re embarking on your CA journey in 2023, be sure to stay informed about the latest fees and explore resources like Lecturewala to enhance your preparation and increase your chances of success. Good luck with your CA journey!

0 notes

Text

CA Intermediate Course in Coimbatore

The CA Intermediate course is typically the second level of the CA program, following the CA Foundation course. It consists of a set of subjects and examinations that cover advanced topics in accounting, auditing, taxation, financial management, and other related areas. The course is intended to provide students with a comprehensive understanding of accounting principles and practices, financial reporting, taxation laws, auditing standards, and more.

Overview of CA Intermediate Course

Eligibility: To enroll in the CA Intermediate course, candidates usually need to have completed the CA Foundation course and fulfilled the required eligibility criteria set by the relevant accounting body, such as the Institute of Chartered Accountants of India (ICAI).

Course Structure: The CA Intermediate course consists of eight papers, divided into two groups. Each group comprises four papers. Candidates have the flexibility to appear for the papers of one group at a time or both groups together.

Paper 1 : Advanced Accounting

Paper 2: Corporate And Other Laws

Paper 3: Taxation

Paper 4: Cost And Management Accounting

Paper 5: Auditing And Ethics

Paper 6: Financial Management Andstrategic Management

Examinations: The CA Intermediate exams are held twice a year, typically in May and November. The exams are conducted in a pen-and-paper format.

Syllabus: The syllabus of the CA Intermediate course covers a wide range of topics, including:

Advanced financial accounting and reporting standards.

Corporate and allied laws, including company law provisions.

Cost and management accounting techniques.

Direct and indirect tax laws and practices.

Advanced accounting and financial reporting.

Auditing standards and audit procedures.

Enterprise information systems and strategic management concepts.

Financial management principles and economics for finance.

Training: In addition to passing the Intermediate exams, candidates are required to undergo a practical training program, known as Articleship. This hands-on experience provides practical exposure to various aspects of accounting, taxation, and audit under the guidance of a practicing Chartered Accountant.

Study Material and Coaching: Many candidates opt for coaching from accredited institutes to supplement their self-study efforts. ICAI also provides study materials and practice manuals for each paper.

Passing Requirements: To successfully clear the CA Intermediate level, candidates need to obtain a minimum of 40% marks in each paper and a total of 50% marks in aggregate in a single group.

Progression: Upon clearing the CA Intermediate exams of both groups and completing the prescribed practical training, candidates can proceed to the final level of the CA program, which includes specialized subjects and a more comprehensive examination.

To know more: https://rachithacademy.com/best-ca-intermediate-course-in-coimbatore/

0 notes

Text

The Ultimate Guide to CA Online Classes with Smart Learning Destination: Your Pathway to Success

Introduction

The journey to becoming a Chartered Accountant (CA) is both challenging and rewarding. With Smart Learning Destination, an esteemed provider of online lectures and pen drive classes in India, your pathway to CA success is made easier and more accessible. Our top-notch faculty and comprehensive study materials are designed to help you excel in your CA exams. In this guide, we'll delve into everything you need to know about CA online classes, from the benefits and features to tips for effective learning.

Introduction to CA Online Classes

As the demand for flexible and accessible education grows, CA online classes have become a popular choice among aspiring chartered accountants. These classes provide a convenient way to learn from the comfort of your home, allowing you to balance your studies with other commitments.

Why Choose Smart Learning Destination?

Smart Learning Destination stands out as a premier provider of CA online classes in India. Here's why:

Expert Faculty: Learn from the top CA instructors in India, who bring years of experience and expertise to the table.

Comprehensive Study Material: Access high-quality study materials that cover the entire CA syllabus in depth.

Flexible Learning Options: Choose between live online lectures or pen drive classes that you can access at any time.

Affordable Pricing: Get the best value for your money with our competitively priced courses.

Student Support: Benefit from our dedicated support team, ready to assist you with any queries or issues.

Features of Our CA Online Classes

Our CA online classes are designed to provide a seamless learning experience. Key features include:

Interactive Live Sessions: Engage with instructors and fellow students in real-time during live online lectures.

Recorded Lectures: Access recorded sessions to review topics at your own pace.

Comprehensive Notes: Download detailed notes and study materials for each subject.

Mock Tests and Assessments: Test your knowledge with regular mock tests and assessments.

Doubt Clearing Sessions: Participate in dedicated doubt clearing sessions to resolve any queries.

Benefits of Online Learning for CA Aspirants

Online learning offers numerous advantages for CA aspirants:

Flexibility: Study at your own pace and schedule, making it easier to balance with work or other studies.

Accessibility: Access classes from anywhere, eliminating the need for travel and accommodation.

Cost-Effective: Save on travel and accommodation costs, and benefit from affordable course fees.

Personalized Learning: Revisit difficult topics and spend more time on areas that need improvement.

Time Management: Efficiently manage your time with structured classes and a clear study plan.

Course Structure and Curriculum

Our CA online classes cover all levels of the CA exam – Foundation, Intermediate, and Final. Each course is structured to provide a thorough understanding of the subjects, ensuring you are well-prepared for the exams.

CA Foundation

Foundation Accounting

Business Laws

Quantitative Aptitude

Business Economics

CA Intermediate

Corporate and Other Laws

Cost and Management Accounting

Taxation

Advanced Accounting

Auditing and Ethics

Financial Management & Strategic Management

CA Final

Financial Reporting

Corporate and Economic Laws

Direct Tax Laws and International Taxation

Indirect Tax Laws

Advanced Financial Management

Advanced Auditing Assurance and Professional Ethics

Integrated Business Solutions

Strategic Cost and Performance Management

Tips for Effective Online Learning

To make the most of your CA online classes, consider these tips:

Create a Study Schedule: Plan your study time and stick to a routine.

Stay Organized: Keep your study materials and notes organized for easy access.

Participate Actively: Engage in live sessions and ask questions to clarify doubts.

Take Regular Breaks: Avoid burnout by taking short breaks during study sessions.

Practice Consistently: Regularly practice mock tests and assessments to gauge your progress.

Frequently Asked Questions (FAQs)

Q1: What are the prerequisites for enrolling in CA online classes? A1: You need to have completed your 10+2 education and registered with the ICAI for the CA Foundation course.

Q2: Can I switch between live classes and pen drive classes? A2: Yes, Smart Learning Destination offers flexibility to switch between live and pen drive classes based on your preference.

Q3: How can I access the recorded lectures? A3: Recorded lectures are available on our online portal, which you can access anytime using your login credentials.

Q4: Are there any additional study materials provided? A4: Yes, along with lectures, we provide comprehensive notes, practice questions, and mock tests.

Q5: What support is available if I have doubts? A5: We offer dedicated doubt clearing sessions and a support team to assist you with any queries.

Conclusion

Embarking on the journey to becoming a Chartered Accountant is a significant commitment, but with Smart Learning Destination, you have a reliable partner by your side. Our CA online classes offer the flexibility, resources, and support you need to succeed. Join us today and take the first step towards a successful CA career. With expert guidance and comprehensive study materials, your pathway to CA success has never been clearer.

Invest in your future with Smart Learning Destination and unlock your potential as a Chartered Accountant.

0 notes

Text

10 Effective Networking Strategies in the CA Industry

The most important aspect of every career path is networking, particularly in the field of chartered accounting (CA). Building strong relationships can lead to industry insights, mentorship, and job prospects. These practical networking techniques, which emphasize the value of resources, are geared toward prospective and practicing certified accountants.

1. Engage in Professional Associations and Groups

It can be quite advantageous to join local CA organizations and professional groups such as the Institute of Chartered Accountants of India (ICAI). These platforms provide opportunities for networking with peers and seasoned professionals through seminars, workshops, and networking events. Participating actively in these associations can help you make important connections and keep you informed about trends in the industry.

2. Leverage Social Media and Online Forums

Networking is facilitated well by social media sites like LinkedIn, Twitter, and niche discussion boards like CA clubindia. Engage in conversations on a regular basis, impart knowledge, and establish connections with business titans. Additionally, online study groups focused on CA Foundation Books, provide a space for collaborative learning and networking with fellow aspirants.

3. Attend Industry Conferences and Seminars

Industry conferences and seminars are excellent venues for networking with experts from different CA industry sectors. Expert speakers and panel discussions are frequently featured at these gatherings, offering insights into prevailing issues and trends. Bringing along Books for CA Exam can be an excellent conversation starter, showing your dedication and preparedness.

4. Participate in Workshops and Training Programs

Workshops and training courses provide opportunities for practical learning as well as networking with mentors and peers. Look for sessions that focus on practical skills and knowledge areas covered in your Study Material for CA. These settings foster close-knit networking as participants share a common goal of skill enhancement.

5. Utilize Alumni Networks

The community of former students at your university might be a very useful tool. Speak with former students who choose to work in California. They may also be able to expose you to their professional networks and provide advice and mentoring. Discussing shared experiences, such as preparing for exams with CA Entrance Exam Books, can help build a strong connection.

6. Engage in Study Groups

Forming or joining study groups for exam preparation can be a dual-benefit activity. Not only does it help in mastering the content from Books and CA Intermediate Scanner, but it also provides a platform to build relationships with fellow aspirants. These peers can become future colleagues or industry contacts.

7. Seek Mentorship

Your ability to advance professionally in the CA field might be greatly impacted by finding a mentor. Mentors offer helpful guidance, encouragement, and connections to their professional network. When requesting mentorship, show your dedication by going over particular subjects from your CA course content and how they connect to your desired professional path.

8. Volunteer for Professional Projects

Participating in volunteer work at conferences or professional associations might help you get more recognition and showcase your abilities. It's a great way to build your professional network and put the knowledge from the CA and other exam materials to use in practical situations.

9. Engage in Continuous Learning

The laws and procedures governing the CA industry are always changing, making it a dynamic sector. Keep yourself ahead of the curve by taking advanced classes, attending workshops, and reading current CA Entrance Books and other pertinent Study Materials. By posting your thoughts and learnings on social media sites like LinkedIn, you can expand your professional network by attracting like-minded individuals.

10. Follow Up and Maintain Relationships

Networking involves not only establishing new connections but also fostering and preserving existing ones. Send thank-you messages, follow up with folks you met at events, and stay in touch on a regular basis.

Conclusion

In the Chartered Accountant (CA) field, networking success is mostly dependent on developing sincere connections, going to business gatherings, utilizing social media, and joining associations for professionals. CAs can keep informed about industry developments, expand their professional knowledge, and create new possibilities by actively interacting with peers and mentors. In the fast-paced world of accounting, these tactics not only support professional development but also cultivate the kind of teamwork that is necessary for both individual and professional success.

#ca final books#study material for ca#books for ca exam#ca foundation books#ca intermediate books#ca entrance exam books

0 notes