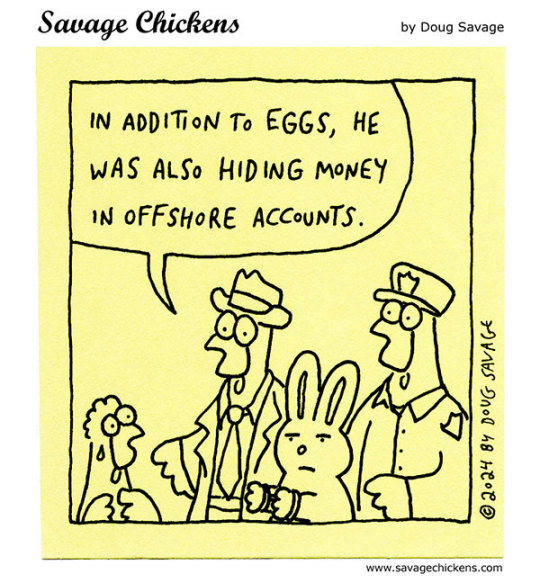

#offshore accounting

Text

Hiding.

And more Easter comics.

#easter#easter bunny#bunny#hiding#egg#money#tax evasion#offshore accounting#arrest#police#disappointment

112 notes

·

View notes

Text

Are You Ready for Offshore Outsourcing?

So you’ve heard about outsourcing offshore, but haven’t moved any business functions, have hired a staff member or are still sitting on the fence about it. That’s perfectly understandable however we thought we would share some insights below to help as you continue your business journey.

1.Your process is unique, but so is everyone else’s

Passing on a process that you developed for your business, especially to someone whose last name you can’t even pronounce, can be daunting. Add to that the fact that your process would have been tweaked over the years to accommodate a system limitation, some suppliers’ or customers’ way of doing things, or an owner’s preferences.

And it is understandable if this is stopping you from making the move.

outsource accounting providers are trained for this. We understand that what works for one business doesn’t necessarily work for others, so you’re not unique in that regard.

Understanding your business, the process-to-be moved and your offshoring goals are key. If you can describe it, we can document and execute it.

2.Business Process Outsourcing is not for everyone

The business process outsourcing (BPO) industry has enabled thousands of businesses, large and small, to reduce costs, improve product offerings, and ultimately grow faster. It has also benefited the economy of the Philippines and the lives of millions and their families.

Here are a few questions to gauge your offshore-readiness. This is not about your business, just yourself. If you answer yes to all, then you are ready.

Can you describe your business, your process, and your offshoring objectives?

Can you acknowledge that, while you’re the expert of your business, you aren’t necessarily an offshoring expert and will need help to make it work?

Are you ready to have conversations with your staff about changes that may need to happen within your organisation to make offshoring work?

Ultimately, it’s you, the decision-maker or influencer, who has to be ready for your organisation to eventually become ready.

“With a focus on cost, the difficulty in finding the right people onshore, and the removal of remote work barriers, offshoring work is becoming more and more attractive – but that doesn’t have to be at the expense of building your internal capacity. “The shortage of workers locally, along with rising wages and overhead costs has been a handbrake on businesses who want to expand, innovate, and boost productivity – building teams offshore helps solve this. In fact, it should support it” – Nick Hastings, CEO, hammerjack

If you aren’t sure about offshoring or are just interested to know more, feel free to reach out or, alternatively, meet with our Australia-based team.

3.You are already outsourcing

Outsourcing simply means getting someone else, a specialist usually, to perform tasks that otherwise you’d have to learn and become an expert on. Essentially, you have been outsourcing all your life and have saved on time, energy and money from not having to do everything yourself. For example, changing the oil on your own car. By outsourcing, you’ve been able to focus on what you’re good at or what you like doing.

The same goes for your business. By moving your non-core functions, you can focus on what you do best and be more competitive.

#Outsource Accounting#Outsourced Accountant#Outsource Bookkeeping#Offshore Accountant#Offshore Accounting

4 notes

·

View notes

Text

How Does Offshore Accounting Influence Financial Reporting?

Offshore accounting significantly impacts financial reporting for multinational companies, presenting both challenges and opportunities. The practice involves recording financial transactions and maintaining accounts in jurisdictions outside the company's home country. This strategy is often utilized to optimize tax efficiency, access international markets, or streamline operational costs. However, offshore accounting practices can have notable implications on financial reporting.

One key influence of offshore accounting on financial reporting is the complexity it introduces into financial statements. Transactions conducted offshore may involve multiple currencies, differing tax regulations, and varying accounting standards, requiring meticulous reporting to ensure compliance and transparency. This complexity can affect the accuracy and reliability of financial reporting, potentially leading to challenges in auditing and regulatory compliance.

Offshore accounting can also impact the visibility of a company's financial performance. Certain transactions conducted offshore, such as intercompany transfers or the use of offshore entities for financing purposes, may obscure the true financial position of the company. This can create challenges in accurately assessing profitability, asset utilization, and overall financial health.

Furthermore, offshore accounting practices can raise concerns about transparency and ethical practices. The use of offshore jurisdictions for financial activities may be subject to scrutiny regarding tax avoidance or evasion. This can impact stakeholder perceptions and investor confidence, potentially affecting the company's reputation and market valuation.

In conclusion, the influence of offshore accounting on financial reporting underscores the importance of strategic management and professional guidance. Companies seeking to navigate the complexities of offshore transactions and ensure transparent financial reporting can benefit from consulting services offered by reputable firms like PKC Management Consulting. PKC specializes in international accounting and taxation, providing tailored solutions to address the challenges associated with offshore operations.

PKC Management Consulting assists companies in implementing robust accounting practices that align with international standards and regulatory requirements. By leveraging PKC's expertise, businesses can enhance their financial reporting processes, mitigate risks associated with offshore transactions, and uphold transparency and compliance. In today's globalized business environment, partnering with consulting firms like PKC Management Consulting is essential for optimizing offshore accounting practices and maintaining integrity in financial reporting.

Contact: +91 9176100095 ,

Email: [email protected]

Address: 27/7, Alagappa Rd ,Purasaiwakkam ,Chennai, Tamil Nadu 600084

Know more: https://pkcindia.com/

0 notes

Text

Navigating Efficiency and Global Reach: Exploring the Benefits of Offshore Accounting

In an increasingly interconnected world, businesses are constantly seeking ways to optimize their operations, reduce costs, and gain a competitive edge. One strategy that has gained prominence in recent years is offshore accounting. This practice involves outsourcing accounting functions to service providers located in offshore destinations, typically countries with lower labor costs and favorable regulatory environments. In this blog post, we'll delve into the concept of offshore accounting, its advantages, considerations, and how it can empower businesses to thrive in the global economy.

Understanding Offshore Accounting

Offshore accounting, also known as offshore outsourcing or offshoring, refers to the delegation of accounting tasks to service providers located in foreign countries. These tasks can range from routine bookkeeping and financial reporting to more complex functions such as tax preparation, payroll processing, and compliance services. Offshore destinations commonly chosen for accounting outsourcing include countries like India, the Philippines, Malaysia, and Eastern European nations.

Advantages of Offshore Accounting

1. Cost Savings:

One of the primary reasons businesses opt for offshore accounting is the potential for significant cost savings. Offshore destinations often offer lower labor costs compared to domestic markets, allowing businesses to access skilled accounting professionals at a fraction of the cost. This can result in substantial savings on salaries, benefits, office space, and overhead expenses.

2. Access to Talent Pool:

Offshore accounting provides access to a vast talent pool of skilled professionals with expertise in accounting, finance, and related fields. Many offshore service providers employ qualified accountants, CPAs (Certified Public Accountants), and finance professionals who possess specialized knowledge and experience. By tapping into this talent pool, businesses can benefit from high-quality services and specialized expertise without the need for extensive recruitment efforts or training programs.

3. Scalability and Flexibility:

Offshore accounting offers scalability and flexibility to businesses, allowing them to adjust resources and capacities according to fluctuating demand and business growth. Whether it's scaling up during peak periods or downsizing during slower seasons, offshore service providers can accommodate changing needs and provide tailored solutions to meet business requirements.

4. Focus on Core Activities:

By outsourcing accounting functions offshore, businesses can free up valuable time and resources to focus on core activities and strategic initiatives. Rather than being bogged down by administrative tasks, finance teams can redirect their efforts towards driving innovation, expanding market reach, and delivering value to customers. Offshore accounting allows businesses to streamline operations, improve efficiency, and optimize resource allocation.

5. Time Zone Advantage:

Offshore accounting can provide a time zone advantage for businesses operating in different regions or serving international clients. By leveraging offshore service providers in distant locations, businesses can ensure round-the-clock coverage and faster turnaround times for critical accounting tasks. This can enhance responsiveness, improve customer service, and facilitate smoother collaboration across global teams.

Considerations for Offshore Accounting

While the benefits of offshore accounting are compelling, it's essential for businesses to carefully consider several factors before embarking on an offshore outsourcing journey:

1. Security and Data Privacy:

Offshore accounting involves sharing sensitive financial information with service providers located in foreign countries. Therefore, businesses must prioritize data security and privacy to protect against potential risks such as data breaches, unauthorized access, and compliance violations. Partnering with reputable offshore providers with robust security measures and compliance frameworks is essential to safeguarding confidential information.

2. Regulatory Compliance:

Compliance with regulatory requirements and international standards is critical in offshore accounting operations. Businesses must ensure that offshore service providers adhere to relevant regulations such as GDPR (General Data Protection Regulation), SOX (Sarbanes-Oxley Act), and industry-specific mandates. Conducting due diligence, assessing compliance frameworks, and implementing contractual safeguards can help mitigate compliance risks.

3. Communication and Collaboration:

Effective communication and collaboration are essential for successful offshore accounting relationships. Businesses should establish clear communication channels, set expectations, and maintain regular contact with offshore service providers to ensure alignment on goals, priorities, and project timelines. Leveraging collaboration tools, video conferencing, and project management platforms can facilitate seamless communication across geographically dispersed teams.

4. Cultural and Language Differences:

Offshore accounting may involve working with service providers from different cultural backgrounds and language preferences. Businesses must be mindful of cultural nuances, communication styles, and language barriers that may impact collaboration and teamwork. Promoting cultural awareness, providing cross-cultural training, and fostering a culture of inclusivity can help bridge the gap and strengthen offshore partnerships.

5. Quality Assurance:

Ensuring quality assurance and service delivery standards is essential in offshore accounting engagements. Businesses should establish performance metrics, SLAs (Service Level Agreements), and quality control processes to monitor the accuracy, timeliness, and consistency of deliverables. Conducting regular performance reviews, soliciting client feedback, and addressing any issues promptly are key to maintaining service quality and client satisfaction.

Embracing Offshore Accounting for Growth and Global Success

In conclusion, offshore accounting offers compelling benefits for businesses seeking to optimize their accounting functions, reduce costs, and gain a competitive advantage in the global marketplace. By leveraging the cost-effectiveness, access to talent, scalability, and time zone advantages offered by offshore outsourcing, businesses can streamline operations, enhance efficiency, and focus on strategic priorities. However, it's crucial for businesses to carefully evaluate the potential risks, compliance considerations, and communication challenges associated with offshore accounting and choose reputable providers that align with their specific needs and objectives. With the right offshore accounting partner and a well-defined strategy in place, businesses can navigate the complexities of global accounting outsourcing and unlock opportunities for growth and success in today's interconnected world.

1 note

·

View note

Text

Explore seamless Offshore Accounting services with Burgeon Offshore. Specializing in offshore company solutions, we ensure efficient financial management that is customized to your requirements. Maximize your business potential with our expert team. Discover smart solutions at Burgeon Offshore now!

0 notes

Text

Simplifying Finances: KMK & Associates LLP Leading the Way in Offshore Accounting Solutions

Introduction:

In an era where globalization has become synonymous with business expansion, companies are increasingly seeking innovative ways to optimize their financial operations. One such trailblazer in the field of accounting outsourcing is KMK & Associates LLP. Specializing in US accounting outsourcing and offshore accounting solutions, KMK & Associates LLP has gained prominence for its excellence in delivering cost-effective and efficient financial services.

US Accounting Outsourcing:

KMK & Associates LLP stands out as a reliable partner for companies looking to outsource their accounting functions. With a keen understanding of the intricacies of the US financial system, the firm ensures compliance with the latest regulations while providing a comprehensive suite of services, ranging from bookkeeping to financial reporting.

Offshore Accounting to India:

Recognizing the potential benefits of offshore accounting, KMK & Associates LLP has strategically positioned itself as a hub for offshore accounting to India. Leveraging the talent pool and cost advantages, the firm enables businesses to streamline their financial processes while maintaining the highest standards of accuracy and integrity.

Fund Accounting Outsourcing:

In the complex world of fund management, KMK & Associates LLP emerges as a trusted ally, offering specialized fund accounting outsourcing services. The firm's expertise extends to navigating the intricate landscape of investment funds, ensuring that clients can focus on their core competencies while their financial operations are handled with precision.

Outsource Fund Accounting:

KMK & Associates LLP distinguishes itself by providing tailored solutions for organizations seeking to outsource fund accounting. The firm's commitment to leveraging advanced technologies and industry best practices ensures that clients receive customized services that meet the unique requirements of their funds.

Accounts Payable Outsourcing Services:

Efficient management of accounts payable is critical for maintaining healthy cash flow and vendor relationships. KMK & Associates LLP offers top-notch accounts payable outsourcing services, enabling businesses to optimize their payment processes, reduce costs, and enhance overall financial efficiency.

Accounts Payable Outsourcing:

By choosing KMK & Associates LLP for accounts payable outsourcing, companies benefit from a streamlined and error-free payment process. The firm's dedicated team ensures timely payments, adherence to compliance standards, and detailed reporting, thereby freeing up valuable resources for clients to focus on strategic initiatives.

Conclusion:

In the dynamic landscape of financial outsourcing, KMK & Associates LLP stands out as a frontrunner, consistently delivering reliable and innovative solutions. With a focus on US accounting outsourcing, offshore accounting to India, fund accounting outsourcing, and accounts payable outsourcing services, the firm remains committed to helping businesses achieve operational excellence in their financial endeavors. As organizations increasingly recognize the advantages of outsourcing, KMK & Associates LLP is poised to play a pivotal role in reshaping the future of financial management.

0 notes

Text

HammerJack's Offshore Accounting Mastery: A Gateway to Global Success

Explore the world of financial possibilities with HammerJack's Offshore Accounting Mastery! 🌐 Our expert team of offshore accountants is dedicated to paving the way for your business to achieve global success. Discover strategic insights, expert advice, and proven methodologies that will transform your financial landscape. 🚀

#OffshoreAccountant #OffshoreAccounting #HammerJackSuccess #GlobalBusiness #FinancialExcellence

0 notes

Text

NRA Account

1 note

·

View note

Text

Offshore and Outsourced Accounting Services- Centelli

#bookkeeping#offshore#finance#outsourcing#accounting softwares#startup#tax#netsuite#accounting#freshbooks#offshore accounting

0 notes

Text

Unlock cost-effective accounting solutions with offshore outsourcing - Access skilled professionals, specialized expertise, and scalable services for your financial management needs!

0 notes

Text

So imagine you're Ishmael except you're sneaking aboard an unmanned vessel, and then when you're well out to sea the boat starts talking to you and basically says "hey I'm god and I could smite you on a whim." You're understandably scared so you just start reading one of the many novels you packed for the journey, but the the boat that is god starts reading over your shoulder and almost using your brain as a filter to understand human emotion. Boat-god has blorbos now, you're besties, and then you go on to the next leg of the journey and don't see boat-god again for a while. When you do, boat-god has been almost killed to death by the fish people from Portsmoth or wherever Lovecraft said they're from, so you kill the fish people and save boat-god. Boat-god's crew is here this time and when you're done tying up loose ends, and help arrives, you find out that the organization that made boat-god has been shoving a lot of god into a lot of boats and your boat-god might actually be one of the slightly less powerful ones.

That's what Murderbot's friendship with ART has been like

#murderbot#asshole research transport#i'm mixing metaphors badly here but i think it's just funnier to say Murderbot is Ishmael as a lovecraft character.#i've read very little lovecraft and just the first little bit of moby dick btw#it'd be sooooo funny if ART is actually a little bit dumb by god boat standards and makes up for it with the offshore accounts and bombs

105 notes

·

View notes

Text

My brain woke up today and decided to choose violence

#trigun posting#vash posting#Feniverse doodles#posting this to the offshore account because yeah no don’t want this in with my other artwork lmao#it’s v traced and not good but my Brian wouldn’t let me rest until I drew it#vash#trigun#Vash the stampede#Johnny test#trigun 98

68 notes

·

View notes

Text

HammerJack - Your Trusted Offshore Accountant Partner

In the realm of financial management and accounting, HammerJack emerges as the beacon of trust and reliability. As your trusted offshore accountant partner, we deliver a seamless and efficient offshore accounting experience that allows your business to thrive on a global scale. 📊 Explore the world of offshore accounting with #OffshoreAccountant, where financial excellence knows no boundaries. Trust #HammerJack to be your compass in the global financial landscape.

0 notes

Text

the most fitting alternate title for the Nice AU (UTDP/Summer Camp) is the Jin Kirigiri Tax Evasion Bad Father Arc, for many reasons

not the least of which is that it's implied class 77, 78, and the v3 class (fanon name: 79, but this is never confirmed) all were accepted at once, are graduating at once, and spent 3 years together

so this dude accepted his daughter, then accepted another unrelated boy who is clearly worse, both as SHSL detective, at the same time, in the same year.

he probably forgot which was his real kid, Honestly

#danganronpa#jin kirigiri#kyoko kirigiri#shuichi saihara#(no offense shuichi)#(but it's canonical in the AU that shuichi is...not on kyoko's level)#(not that she's really Rude about it)#he also went ahead and accepted the kid in the jokey n*zi uniform calling himself “ultimate Evil Overlord”#and never bothered to find out Rantaro's Real Talent apparently#jin “fuck it who cares. i'm transferring all this money to an offshore account anyway” kirigiri

32 notes

·

View notes

Text

Is ‘Offshore Accounting Services’ a Good Idea for My CPA Firm?

Setting up offshore accounting is a substantial strategic move for a CPA firm. And it becomes even more significant when you also decide to outsource it.

However, you might feel anxious — because you are not just establishing an overseas operation but also entrusting it to a third party. And you may even wonder: Is this a good move? Should I stick with an in-house process? Or outsource a local accounting service near me?

We get you!

So, in this article, we will delve into the viability of offshoring your accounting process through outsourcing. Continue reading to uncover critical insights to help your CPA firm navigate this path successfully.

Offshore Accounting: What It Means For Your CPA Firm

In essence, offshore accounting involves shifting the process to a foreign country.

A CPA firm may build its captive division or join forces with a client accounting services (CAS) provider to perform and oversee the process on its behalf.

In the latter scenario, you will not need to get directly involved in day-to-day operations, as your service provider is responsible for delivery and reporting. And you can achieve streamlined workflows without getting tied up and overwhelmed by the time-consuming routine accounting tasks.

Despite this undeniable advantage, some firms are reluctant to outsource offshore accountants owing to apprehensions about the quality of operation and service delivery. However, it is not an issue when you have a proficient outsourcing services partner!

Now let us delve into the benefits, challenges, and considerations when outsourcing comes into the picture.

Potential Benefits of Offshoring Accounting via Outsourcing

Cost-savings, enhanced productivity and scalability are among the most appealing features of the outsourcing-offshoring model.

Cost Efficiency

First and foremost, when you choose globally-recognized business process outsourcing (BPO) destinations like India, the Philippines, or others, your CPA firm will not have to invest heavily in in-house infrastructure and overheads.

Additionally, you can save both time and expenses on hiring and training, as your outsourced accounting services provider maintains their dedicated team and other resources at their end.

So, whether you are working with limited resources or aiming to redirect efforts from internal accounting processes to other critical aspects of your CPA practice — outsourcing to an offshore site can be an ideal option.

Productivity & Scalability

Time and cost efficiencies are reinforced through increased productivity.

You can utilize in-house capacity to accommodate more clients by transferring workloads to offshore accountants. So, your CPA firm can now not only expand its client base but also scale up.

As the outsourced team handles routine tasks, your in-house team can transition to more specialized and value-added services. With more clients and higher-value services, you can generate better revenues.

Therefore, offshore accounting outsourcing can serve as a springboard for effectively growing your CPA practice.

Global Talent Access

Outsourcing offshore enables access to a more diversified accounting workforce beyond geographical boundaries. Is your CPA firm situated in the UK, US, Canada, Australia, and elsewhere where English is a corporate language?

Prominent BPO hubs have an ample workforce fluent in the language. And they offer comparable skills and specialized knowledge at a fraction of the cost you would pay back home.

Potential Challenges of Outsourcing Offshore Accounting

While there are numerous benefits to outsourcing offshore accounting for CPAs, you should also take note of some challenges, such as:

Quality Control

Upholding the quality standards of client accounting services is crucial for a CPA firm. You can address this concern by clearly communicating your expectations to the offshore team. Typically, quality control is part of the best practices of a good accounting outsourcing services provider.

Data Security

While dealing with sensitive financial information, data breaches and loss can be primary concerns. Make sure your accounting services partner follows strict security measures for data security and safety.

Time Zone Difference

Working with an offshore team in different time zones can seem challenging. However, in today’s digital age, which enables seamless collaboration, these concerns become less significant. Time zone differences can also be advantageous as they enable round-the-clock operations.

Fundamentals of Offshore Outsourcing

Want to capitalize on the collective benefits of accounting outsourcing and offshoring for your CPA firm? Then, don’t overlook this:

A clear understanding of deliverables, schedules, and transparent communication is fundamental to a fruitful offshore operation. To ensure smooth execution, establish proper communication channels, protocols, and points of contact with your offshore partner.

The execution becomes easier when you team up with professional outsourcing accounting services!

How to Evaluate Offshore Accounting Services Provider

Consider the following steps to ascertain whether the offshore accounting services provider aligns with your CPA firm’s goals:

Assessment: Identify accounting functions suitable for viable outsourcing to an offshore partner. Based on your needs and goals, evaluate these tasks.

Budgeting: Consider the complexity of the process and the skill requirements to arrive at a ballpark budget. A CPA firm may choose to outsource either its entire client accounting or a portion thereof.

Research: Thoroughly research potential offshore accounting service companies. Verify their reputation, capabilities, and work culture. Also, find out whether they offer tailored solutions.

Execution: Gain a comprehensive understanding of all aspects of the outsourced offshore accounting model in advance. Both parties should engage in clear discussions and reach a consensus on terms of service, pricing, and communication channels.

These are some key points to consider when evaluating your future service provider. A competent and reputable accounting outsourcing company can be a valuable asset for your CPA firm.

Final Thoughts

The outsourcing-offshoring model offers a practical and cost-effective solution for CPA firms seeking to streamline their client accounting operations and drive productivity and growth. To reap the benefits while mitigating challenges, diligence and selecting the right offshore partner is key.

Are you looking for an offshore accounting services provider that can deliver effectively and consistently?

You can consider Centelli! With headquarters in the UK and delivery centers in India, we serve extensively in Europe and the United States.

Contact us for a free consultation today to discover how our solutions can help you! Also, take a look at our FAO services portfolio for more info.

0 notes