#cpi report

Text

US Inflation Report Impacts Bitcoin: Price Dips Below $49K

The recent release of the US Consumer Price Index (CPI) report, disclosing an inflation rate of 3.1%, has sent shockwaves across the financial sector, impacting various investment realms, including both cryptocurrencies and equities. Bitcoin, in particular, experienced a decline, dropping to $49,601, signifying a 0.89% fall within a 24-hour period. While this unexpected surge in CPI prompted immediate market reactions, the resilience of Bitcoin is evident as it shows a 12% increase over the last week, indicating potential for recovery.

Santiment, a platform providing on-chain and social cryptocurrency metrics, conducted a comprehensive analysis of Bitcoin's price movements following the US CPI report. Despite the recent setback, the broader trajectory of Bitcoin over the past week paints a more positive picture. With a substantial 12% increase, there is a tangible possibility for Bitcoin to regain momentum and surpass the $50,000 threshold once again. On the flip side, sustaining further losses could challenge investors to maintain critical support levels, particularly around the $46,000 mark.

The impact of the inflation data extends beyond immediate market reactions, sparking discussions among investors and analysts. Over the past three months, social media platforms have been buzzing with conversations surrounding CPI reports, reflecting potential market turnarounds based on historical data and trends.

A closer examination of incremental CPI increases reported in the months leading up to February 2024 provides critical insights. Each report, from the 0.2% rises in November and December 2023 to the 0.3% upticks in January and February 2024, serves as essential analysis points. These data points play a pivotal role in understanding market dynamics and investor sentiment, especially regarding their correlation with movements in cryptocurrency and equity markets.

This nuanced approach to analyzing inflation data underscores the complexity of financial markets, emphasizing the interconnectedness between macroeconomic indicators and market performance. The coming weeks will be crucial in determining whether Bitcoin and other assets can withstand the pressures of inflationary concerns and chart a course back to growth. As the landscape evolves, investors and analysts will closely monitor market reactions, seeking cues for potential recoveries and broader market trends.

0 notes

Text

Stocks Hunting Their DCL - Update

Despite the July CPI Report showing that inflation reaccelerated in July, for the1st time in 13 months, stocks managed to close higher for the day.

Thursday was day 32, placing stocks in their timing band for a DCL. A daily cycle decline typically lasts 7 to 10 days so stocks are due for their DCL to form. A swing low and a close back above the 10 day MA will signal the new daily cycle. Stocks…

View On WordPress

0 notes

Text

Canadian Inflation (January 2023) - February 21, 2023

Canadian prices, as measured by the Consumer Price Index (CPI), rose 5.9 per cent on a year-over-year basis in January, a decrease from the 6.3 per cent rate in December. Slower appreciation in prices of cellular services and passenger vehicles contributed to slowing the overall pace of price appreciation. Rising interest rates contributed to an increase in mortgage interest costs, which were up…

View On WordPress

0 notes

Text

The Story of the Menominee River Sugar Company 1903-1955

The Story of the Menominee River Sugar Company 1903-1955

Menominee, Michigan, situated far from the world’s financial centers a hundred years ago, much as it is today, nevertheless placed itself directly in the middle of one of the hottest business booms of the early twentieth century – sugar. The small community that dared to plant a footprint in world commerce occupies a slivered point of land that dips into Lake Michigan at a point so close in…

View On WordPress

#alex jones the one show#alex jones wife#beatrice egli#beatrice egli 2022#beatrice egli freund#cachorro#cpi data release today#cpi report#cpx#gaspar rivas#gato#muharem huskovic#oostende#river plate#tottenham vs eintracht frankfurt#universidad de chile vs

0 notes

Link

0 notes

Text

I LITERALLY FORGOT ABOUT CALEB MAUPIN. I hate his tomato looking ass so much I hope he kills himself

#yeet talks#he used to be funny bc he was just a weird ass guy talking shit on the internet while looking like a 12 year old who stole his dad's suit#but after that report from former CPI members came out hes just straight up disgusting#not saying he wasnt before but now its like. i cant even make fun of him.

1 note

·

View note

Photo

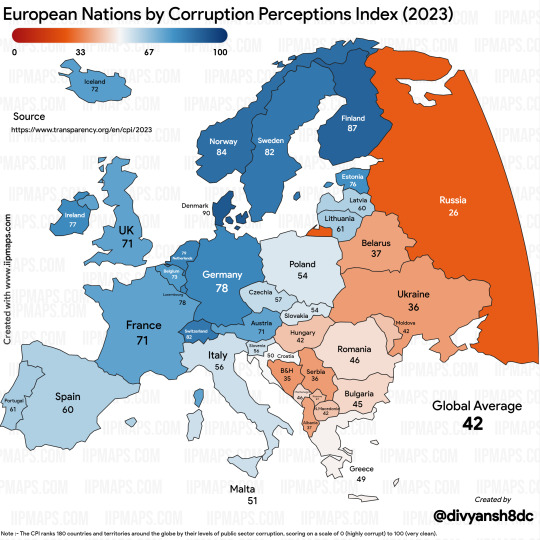

European Nations by Corruption Perceptions Index(2023)

by Specific_Ad_685

Note :- Corruption Perceptions Index is a report released annually by Transparency International for generally Public Sector and Public Institutions based corruption.

It measures corruption on a scale of 0 to 100 with 0 meaning highly corrupt(basically fully corrupt) and 100 meaning no corruption and fully clean.

The CPI is calculated using 13 different data sources from 12 different institutions that capture perceptions of corruption within the past two years.

13 data sources were used to construct the Corruption Perceptions Index (CPI)

2023:

1. African Development Bank Country Policy and Institutional Assessment 2021

2. Bertelsmann Stiftung Sustainable Governance Indicators 2022

3. Bertelsmann Stiftung Transformation Index 2024

4. Economist Intelligence Unit Country Risk Service 2023

5. Freedom House Nations in Transit 2023

6. Global Insight Country Risk Ratings 2022

7. IMD World Competitiveness Center World Competitiveness Yearbook Executive Opinion Survey 2023

8. Political and Economic Risk Consultancy Asian Intelligence 2023

9. The PRS Group International Country Risk Guide 2023

10. World Bank Country Policy and Institutional Assessment 2022

11. World Economic Forum Executive Opinion Survey 2023

12. World Justice Project Rule of Law Index Expert Survey 2023

13. Varieties of Democracy (V-Dem v. 13) 2023

113 notes

·

View notes

Text

If you complain about how expensive something is compared to before, and no part of your analysis includes the words "adjusted for inflation", I think you should be forced to wear stereotypical old people clothes until you finish a 2 page report on the CPI.

77 notes

·

View notes

Text

Amee Vanderpool at SHERO:

Congressional disclosures by the US Senate and House — that detail the report of gifts received from outside organizations — show that the Conservative Partnership Institute (CPI) has sponsored elaborate trips held between February 2021 and April 2024. The CPI, which describes itself as the the place “Where Conservatives Go to Win,” advertises that they “train, equip, and unite Conservative leaders in Washington and across the country.” Essentially, the lobbying group is a conservative bankroll that seeks to cement a political bond between the mainstream Republican Party and far right election-denial extremists.

Between February 2021 and April 2024, the CPI held 21 disclosed events for Conservative Members of Congress and US Senators, based on House Ethics Committee filings provided by Congressional staff. Thanks to the mandatory description required for each filing of the travel gift, its estimated value, the identity of the donor and the date received, we know that CPI held lavish training sessions for congressional staff at their lush Maryland ranch, as well as retreats at several luxurious Florida resorts.

While the submitted record of disclosure forms for these events are online in separate House and Senate repositories, and available for download, there is no way to directly search through the forms by using a specific term or donor organization. I have compiled a list of all of the disclosed CPI trips for Members and staff of the US House for the Year 2024 here, so that you can easily view who was in attendance at these locations during the specified times.

The CPI is currently led by former Trump Chief of Staff Mark Meadows, who was recently indicted in Arizona for his alleged role in a fake electors scheme in 2020, and former Heritage Foundation president Jim DeMint. At their lavish events, the Conservative political powerhouse enlists approved organizations and far-right extremist organizations to help promote their agenda in a resort vacation setting.

[...]

The main objective for CPI is to further develop MAGA partnerships and implement a stronger network that was not in place during the Trump administration. Meadows, was critical in implementing Trump’s agenda which included the "Schedule F" executive order. This ongoing plan was developed and refined in secret over most of the second half of Trump’s term, and launched 13 days before the 2020 election with the goal of radically reshaping the federal government and eradicating thousands of civil servants in order to fill career posts with Trump lackeys and his America First ideology.

Ultimately, this elite group provides the resort clubhouse for a secret fraternity of Trump loyalists, who are currently developing the Human Resources department that will implement the MAGA infrastructure to incorporate the federal government.

The Conservative Partnership Institute (CPI) is creating an army of far-right MAGA loyalists to serve in government roles.

5 notes

·

View notes

Text

Donald Luskin, an economist andTrendMacro CIO said that “deflation is coming” and it will cause a stock market crash. Ahead of the December meeting, Luskin argued the Federal Reserve’s “dangerously high” interest rate hikes are transitory, and that the Fed will make cuts in the first quarter of next year.

“Please, please, please, can we all stop listening to Jay Powell? Please. Mr. Inflation is transitory. He is still so embarrassed about that one. He’s now insisting that his dangerously high interest rates are not transitory. Oh, they will be,” Luskin said according to a report by Fox News. “Inflation is collapsing and he knows it. It’s turning into deflation like I warned last time we talked. There will be rate cuts in Q1.”

Lusking made the comments on “Mornings with Maria,” as he explained his frustration with the Fed’s rate hike campaign and his economic outlook.

The Fed has raised interest rates sharply over the past year, approving 11 rate increases in the hopes of crushing inflation and cooling the economy. In the span of just 16 months, interest rates surged from near zero to above 5%, the fastest pace of tightening since the 1980s.

The Fed voted during meetings in both September and November to hold interest rates steady at a range of 5.25% to 5.5%, the highest level in 22 years. -Fox Business

Luskin claims that the signs are pointing to deflation now as inflation has already hit hard. “We did four back-to-back 75 basis point rate hikes in the middle of last year. That’s never happened before. The last of them was over a year ago. Don’t you think we’d start seeing that right now?” Luskin said.

Investors now see a near 100% chance that Fed officials will hold interest rates steady at their final meeting of the year on December 12-13, according to data from the CME Group’s FedWatch tool, which tracks trading. Other investors also expect the central bank to begin cutting rates in the middle of next year amid signs the economy is cooling.

“In two weeks, the next time CPI reports, it’s going to be the second back-to-back monthly number with a minus sign in front of it. We are at the beginning of the wavefront of outright deflation,” Luskin predicted.

“We are going to have statistical deflation, which I think is a very good thing after the big inflation we’ve had. That doesn’t mean the Fed won’t panic. That doesn’t mean the market won’t panic. So I think, probably sometime late first quarter of next year, second quarter, we’re going to have a severe correction in stocks. It will be a buyable dip.”

10 notes

·

View notes

Text

Cyprus Buying Investment Property - How to handle CGT

Cyprus Buying Investment Property – How to handle CGT

The Capital Gains Tax rate in Cyprus is 20% of the chargeable gain as adjusted for inflation, but certain lifetime exemptions apply to individuals for the disposal of their main residence. The first CYP10,000 of a gain is exempt. This exemption limit rises to CYP50,000 if the seller has lived in the property continuously for the previous five years. Further allowances are granted in relation to…

View On WordPress

#alex jones the one show#alex jones wife#beatrice egli#beatrice egli 2022#beatrice egli freund#cachorro#cpi data release today#cpi report#cpx#gaspar rivas#gato#muharem huskovic#oostende#river plate#tottenham vs eintracht frankfurt#universidad de chile vs

0 notes

Text

Brazil Intelligence Agency sees connections between Jan. 8 riots and companies involved in transport, farming, and illegal mining

Reports delivered to the 1/8 Parliamentary Commission of Inquiry mention the low presence of self-employed truck drivers in the protests

Intelligence reports produced by Abin (Brazilian Intelligence Agency) indicate the participation of carriers, truck owners, and companies suspected of involvement with illegal mining in the actions of Bolsonarists contrary to Lula's (PT) election.

In documents delivered to the CPI (Parliamentary Commission of Inquiry) on the acts of January 8, the agents claim that 272 trucks entered Brasília from November onwards to participate in the demonstrations concentrated in front of the Army headquarters, in addition to the destruction of the headquarters of the Three Powers.

About half of the vehicles belonged to companies, according to the report. Most of the remaining fleet was new or semi-new and registered by individuals with participation in companies in the agricultural sector.

Continue reading.

#brazil#politics#democracy#january 8#environmental justice#brazilian politics#farming#mining#transportation#mod nise da silveira#image description in alt

12 notes

·

View notes

Text

A new cost of living adjustment (COLA) prediction for Social Security has many seniors scratching their heads at how they'll stretch their benefits amid inflation.

The Senior Citizens League (TSCL) just predicted the COLA for 2025, saying beneficiaries can expect a 2.66 percent bump in benefits. Earlier in the year, the estimate was set at 2.6 and 2.4 percent.

If a 2.66 percent boost is implemented, it would likely increase monthly payments by around $50 for most recipients.

While the jump in monthly benefits would be better than the earlier predictions, many seniors were expecting a higher boost to deal with the impacts of inflation.

The Social Security Administration adjusts Social Security payment amounts every year based on the consumer price index, but not everyone feels the change would be enough to get by.

"While COLA payments will increase to offset the effects of inflation, the problem many have with the potential percentage jump is it won't get far enough to meet most of the financial needs of seniors," Alex Beene, a financial literacy instructor at the University of Tennessee at Martin, told Newsweek. "Obviously daily expenses for this age group continue to rise, but the uptick in healthcare costs are putting an additional strain on them, and COLA payments may not be enough to match that uptick."

Seniors will also likely be dealing with higher Medicare Part premiums, according to TSCL.

In the Medicare Trustee report from this month, Part B premiums were predicted to grow by $10.30 a month to a total of $185. That increase is on top of nationwide inflation on groceries, housing and transportation.

"For 2024, the average Social Security benefit rose by $50 and after subtracting $9.80 to cover Medicare Part B Premium increases, the total change in benefits came out to just $40.20 a month. With the forecast of a 2.66 percent COLA for 2025, it appears seniors will continue to suffer financial insecurity as much next year as they have this year," Shannon Benton, executive director of TSCL, said in a statement.

The COLA for each year depends on the rise of the consumer price index for urban wage earners and clerical workers (CPI-W) for the third quarter of the last year. That means the official COLA for 2025 won't be calculated until later in the year.

Many finance experts have questioned whether the CPI-W even stands as a good measure of what seniors can expect inflation wise, with many saying the consumer price index for the elderly (CPI-E)

In 2024, Social Security checks rose by 3.2 percent due to the COLA after a more generous increase of 8.7 percent last year. Many seniors, roughly 71 percent, reported in TSCL 2024 Senior Survey that the increase in household costs they saw went beyond the 3.2 percent jump from the COLA.

"The majority of seniors still feel like their costs are rising faster than those annual adjustments," Michael Ryan, a finance expert and founder/CEO of michaelryanmoney.com, told Newsweek. "So while the COLA certainly helps, it often still doesn't fully cover the real inflation draining seniors' buying power."

Due to the insufficient funds from Social Security for seniors, many will need additional income streams, including a 401(k), IRA or other investment accounts.

"At the end of the day, any COLA increase is better than none to prevent total Social Security stagnation," Ryan said. "But the 2.6 percent projection for 2025 underscores the need for policymakers to reexamine whether metrics like CPI-E would better serve seniors by more accurately reflecting their unique spending habits. We just want to make sure government benefits retain as much purchasing power over time as possible on those fixed incomes."

2 notes

·

View notes

Text

Steps from the Capitol, Trump allies buy up properties to build MAGA campus | The Washington Post

At first glance, the flurry of real estate sales two blocks east of the U.S. Capitol appeared unremarkable in a city where such sales are common. In the span of a year, a seemingly unrelated gaggle of recently formed companies bought nine properties, all within steps of one another.

But the sales were not coincidental. Unbeknown to most of the sellers, the limited liability companies making the purchases — a shopping spree that added up to $41 million — are connected to a conservative nonprofit led by Mark Meadows, who was Chief of Staff to President Donald Trump. The organization has promoted MAGA stars like Reps. Marjorie Taylor Greene (R-Ga.) and Lauren Boebert (R-Colo.).

The Conservative Partnership Institute, as the nonprofit is known, now controls four commercial properties along a single Pennsylvania Avenue block, three adjoining rowhouses around the corner, and a garage and carriage house in the rear alley. CPI’s aim, as expressed in its annual report, is to transform the swath of prime real estate into a campus it calls “Patriots’ Row.”

The acquisitions strike some Capitol Hill regulars as puzzling, considering that Republicans have long made a sport of denigrating Washington as a dysfunctional “swamp,” the latest evidence being a successful GOP-led effort to block local D.C. legislation to revise the city’s criminal code.

“So you don’t respect how we administer our city and then you secretly buy up chunks of it?” said Tim Krepp, a Capitol Hill resident who works as a tour guide and has written about the neighborhood’s history. “If it’s such a hellhole, go to Virginia.”

Reached on his cellphone, Edward Corrigan, CPI’s president, whose name appears on public documents related to the sales, had no immediate comment on the purchases, which were first reported by Grid News and confirmed by The Washington Post. “I’ll get back to you,” Corrigan said. He did not respond to follow-up messages.

Former senator Jim DeMint, CPI’s founder, and Meadows, a senior partner at the organization, did not respond to emails seeking comment. Cameron Seward, CPI’s general counsel and director of operations, whose name appears on incorporation documents related to the companies making the purchases, did not respond to a text or an email.

As Congress’s neighbors, denizens of the Capitol Hill neighborhood are accustomed to existing in close quarters with all varieties of official Washington. Walk the neighborhood and you might catch a glimpse of Senate Minority Leader Mitch McConnell (R-Ky.), Sen. Bernie Sanders (I-Vt.) or former Trump strategist Stephen K. Bannon, among those who own homes near the Capitol. The Republican and Democratic national committees both have offices in the neighborhood.

But it’s rare, if not unprecedented, for a nonprofit to purchase as many properties in such proximity and in so short a period of time as CPI has assembled through its related companies, a roster with names like Clear Plains Holdings, Brunswick Partners, Houston Group, Newpoint and Pennsylvania Avenue Holdings. The companies list Seward as an officer on corporate filings, as well as CPI’s Independence Avenue headquarters as their principal address.

Now, in what may be an only-in-Washington vista, a single Pennsylvania Avenue block is occupied by Public Citizen, the left-leaning consumer advocacy group, the Heritage Foundation, the conservative think tank, and CPI, which bought four properties through its affiliates.

In addition to the nine D.C. parcels CPI’s network has bought since January 2022, another affiliated company, Federal Investors, paid $7.2 million for a sprawling 11-bedroom retreat on the Eastern Shore. In 2020, CPI, under its own name, also spent $1.5 million for a rowhouse next to its headquarters, which it leases, a few blocks from the Capitol.

DeMint, a former Republican congressman from South Carolina, started CPI in 2017, shortly after he was ousted as Heritage’s leader amid criticism that the think tank had become too political under his direction. Meadows joined in 2021, after working as Trump’s Chief of Staff. He was by Trump’s side during the administration’s final calamitous days, before and after the Jan. 6, 2021, attack on the Capitol and as the President’s allies were seeking to overturn election results.

On its 2021 tax returns, CPI reported $45 million in revenue, most of it generated through contributions and grants, and paid DeMint and Meadows compensation packages of $542,000 and $559,000, respectively. Its current offices, a three-story townhouse at the corner of Third Street and Independence Avenue SE, is a hub of GOP activity. During the chaotic lead-up to Rep. Kevin McCarthy’s election as House Speaker, dissident Republican lawmakers were observed congregating at CPI.

CPI also provides grants to a cluster of nonprofits headed by Trump allies. Former Trump adviser Stephen Miller, for example, leads America First Legal, which received $1.3 million from CPI in 2021 and bills itself as a check on “lawless executive actions and the Radical Left.”

Cleta Mitchell, an attorney who was on the call Trump made to Georgia Secretary of State Brad Raffensperger seeking to reverse votes in the 2020 election, runs what the organization bills as its “Election Integrity Network,” which has cast doubt on the validity of President Biden’s 2020 victory.

“The election was rigged,” EIN tweeted last July. “Trump won.”

CLOSE TO THE CAPITOL

At an introductory meeting in December, recalled Gerald Sroufe, an advisory neighborhood commissioner on Capitol Hill, a CPI representative said the group planned to move its headquarters to a three-story building it had bought on Pennsylvania Avenue, next to Heritage’s office. Until the pandemic forced it to close, the Capitol Lounge had occupied the 130-year-old building. The bar had served a nightly bipartisan swarm of congressional staffers and lobbyists for more than two decades.

The CPI official, Sroufe said, indicated that the group planned to use the new Pennsylvania Avenue properties to “expand” its offices and “provide new retail.” But the official made no mention of Patriots’ Row, Sroufe said, or the three rowhouses the group’s affiliates had bought around the corner on Third Street SE. All of the properties are in the neighborhood’s historic district, which protects them from being altered without city review.

“This is much grander than what we were talking about,” Sroufe said after learning from a reporter about the other purchases. “On the Hill, people are always talking about how wonderful it is to be close to the Capitol and Congress. It’s kind of like a curse.”

As in many commercial corridors hit hard by the pandemic, businesses along Pennsylvania Avenue have struggled over the past couple of years. Tony Tomelden, executive director of the Capitol Hill Association of Merchants and Professionals, said CPI could energize a strip pocked with vacant storefronts.

“I welcome any business because the only thing opening right now are marijuana shops,” said Tomelden, an H Street NE bar owner who helped open the Capitol Lounge in 1996 and, as it happens, instituted a rule that patrons could not talk politics while imbibing. “If they’re going to pay a lot of money and raise property values, I’m all for it. I don’t care about anybody’s politics as long as they pay their tab.”

In an overwhelmingly Democratic city, finding those who are less sanguine about CPI’s growing footprint is not exactly difficult.

Yet politics is only part of the issue, as far as Krepp is concerned. CPI’s purchases, he said, threaten the area’s neighborhood vibe, as would be the case if any group, no matter its ideological leaning, bought as many properties. “I don’t want to create another downtown on Capitol Hill,” he said. “There’s a glut of available office space downtown. You don’t have to buy up neighborhoods.”

Rep. Jamie B. Raskin (D-Md.), a regular commuter to the Capitol from his home in Montgomery County, sees CPI’s acquisitions in terms more political than geographic.

“It just seems like a massive real estate coming-out party for the extreme right wing of the Republican Party,” Raskin said. “This is a very explicit and well-financed statement of intent. They set out to take over the Republican Party and they’re very close to clenching the power.”

Instead of Patriots’ Row, Raskin suggested an alternative name: Seditionist Square.

“Maybe Marjorie Taylor Greene can be their advisory neighborhood commissioner,” he said.

A ‘PERMANENT BULWARK’ IN D.C.

On its 2021 tax return, CPI said its mission is to be a “platform” for the “conservative movement,” and to provide “public policy” training for “government and nonprofit staffers” and meeting space for gatherings and policy debates.

Although not required to identify donors, CPI reported seven contributions in excess of $1 million, including one of more than $25 million. Trump’s Save America political action committee gave $1 million in 2021, according to campaign finance records. Billionaire Richard Uihlein, a major Republican donor, gave $1.25 million a couple of years ago through his foundation, records show.

A CPI-related entity, the Conservative Partnership Center, rented space to two political action committees as of early January, the House Freedom Fund and Senate Conservative Fund, according to campaign finance records. CPI also received $4,000 from Rep. Matt Gaetz (R-Fla.), who has recorded his “Firebrand” podcast at the group’s studio, as has the host of the “Gosar Minute,” Rep. Paul A. Gosar (R-Ariz.), according to the group’s annual report. Greene paid CPI $437.73 for “catering for political meetings” in 2021, the records show.

“No one stood up to the Left as courageously as Rep. Marjorie Taylor Greene,” CPI declared in its 2021 annual report, hailing her as a “hero” who “endured sexist fury that always lurks just beneath the progressive surface.” The report described Boebert as a “gun rights advocate” who “wants to protect our environment more than anyone else.”

It was in CPI’s 2022 annual report that the group briefly referred to its expansion plans, writing that it has strengthened “its ability to serve the movement by beginning renovations to Patriots’ Row on Pennsylvania Avenue.”

“In 2022, the Left tried to drag America further into a dark future of totalitarianism, chaotic elections and cultural decay,” the report asserts in an introduction from DeMint and Meadows. “The Washington establishment, per usual, did nothing to stop them. But neither the Left nor the establishment could stop the culture and community we’re building here at the Conservative Partnership Institute.”

“With our expanded presence in D.C.,” they add, “we’re launching CPI academy — a formal program of training for congressional staff and current and future members of the movement.”

“Even if we can’t change Washington, we can create a permanent bulwark against its worst tendencies.”

A SPATE OF SALES

CPI began its expansion in 2020, purchasing the rowhouse next door to its headquarters and christening it “The Rydin House” for Mike Rydin, a construction magnate and prominent conservative donor. When Federal Investors bought the Eastern Shore property, the group named it “Camp Rydin.”

On Capitol Hill, several property owners who sold their buildings to CPI-linked companies were surprised to learn that the buyers were connected to a group led by Meadows and DeMint.

“I did not know,” said Jacqueline Lewis, who sold a townhouse on Third Street SE to 116 Holdings for $5.1 million in July. The company’s officer, according to its corporate filing, is Seward, and the principal address it lists is the same as CPI’s headquarters. A trust document related to the transaction is signed by Corrigan, CPI’s president.

Brunswick Partners, which lists CPI and Seward as contacts on its corporate filing, bought the neighboring rowhouse for $1.8 million in January, according to property records. Brian Wise, the seller, said he did not know of the company’s CPI connection. An attorney who approached him and his wife, he said, “asked if we were willing to sell and we agreed on a price. It was a business sale.”

Keith and Amanda Catanzano also were unaware of CPI when they sold a garage in the alley behind Third Street SE to Newpoint for $1 million in June. Newpoint lists Seward as an officer and the same mailing address as CPI. “We had no idea,” said a woman who answered the phone at a number listed for the Catanzanos before hanging up.

Eric Kassoff, who sold the former site of the Capitol Lounge to Clear Plains, said he knew of the company’s CPI ties before the $11.3 million deal was finalized in January. He also sold the group a carriage house behind the building for $400,000.

Kassoff said he did not want to lease the space to a fast-food restaurant or a convenience store. He said CPI’s political leanings were not a factor in his decision to sell to the organization.

“Why would I have any issue selling my property to proud Americans?” asked Kassoff, who described himself as an independent. “We need to get past the labeling and demonizing and talk to each other, and that’s true in politics as well as commerce. If we were all to take that position we wouldn’t have much of a country left, would we?”

Although the Capitol Lounge closed more than two years ago, vestiges of its past remain on the building’s exterior, including a rendering of Benjamin Franklin beneath a quote concocted by the bar’s founder, Joe Englert: “Beer is proof that God loves us and wants us to be happy.”

James Silk, the bar’s former owner, said he left behind memorabilia when he vacated the building that could be suitable for the new owner: Richard M. Nixon campaign posters still hanging on the walls of what the owners cheekily dubbed the Nixon Room (located across from the Kennedy Room).

“Nixon is finally with his people,” Silk said. He laughed and added: “Nixon was a Republican, right?”

#us politics#news#the washington post#republicans#conservatives#gop#mark meadows#Conservative Partnership Institute#political action committees#washington dc#Patriots’ Row#Jim DeMint#Cameron Seward#heritage foundation#capitol hill#America First Legal#Election Integrity Network#steve bannon#Cleta Mitchell#Capitol Lounge#Save America pac#Richard Uihlein#Conservative Partnership Center#House Freedom Fund#Senate Conservative Fund#Rep. Matt Gaetz#firebrand podcast#Gosar Minute#rep. paul gosar#Mike Rydin

21 notes

·

View notes

Text

Financial safety reminder: Don’t buy scalped Fanfest tickets.

Don’t let FOMO push you to spend irresponsibly. It’s okay if you’re not getting the chance to go go. After dealing with SE NA since FFXI’s golden years, just wish for the best for those who managed to buy tickets.

Whether you’re going or not, be careful with using credit. CPI reported a 6.0% rate of inflation (https://www.bls.gov/cpi/), and interest rates are projected to increase again next week.

20 notes

·

View notes