#crypto exchange like kucoin

Text

KuCoin Clone Script: Launch Your Own Crypto Exchange Platform with iMeta

Nowadays, the Cryptocurrency industry is booming and has been earning haulage for the past decade. Here Crypto Exchange Platforms like Kukoin are trending in the market and can rapidly enter the market and gain a wide range of popularity among worldwide investors and traders.

In this blog, Let’s discuss the Kucoin clone definition, its core features, technical aspects, and benefits, and how to launch your Own Crypto Exchange Platform like Kucoin.

What is Kucoin Clone Script?

Kucoin Clone Script is a ready-to-use software made for entrepreneurs. This script is for people who don't have a team to develop the Crypto Exchange Development from scratch. A Kucoin clone is a well-developed crypto exchange platform that can be modified with any implementation. iMeta Technologies provides Whitelabel kucoin clone software for your business in 7 days. Let's see the Kucoin core features, and benefits one by one.

Core Features of KuCoin Clone Script

User-Friendly Interface

The KuCoin Clone Script is designed with an intuitive, user-friendly interface, ensuring seamless navigation for traders of all proficiency levels. This aspect is crucial in attracting and retaining a broad user base, spanning from novice traders to seasoned investors.

High-Level Security Measures

In the volatile realm of digital currencies, security is paramount. The KuCoin Clone Script comes fortified with robust security protocols, including SSL encryption, two-factor authentication, and anti-DDoS measures, safeguarding the platform against various cyber threats.

Advanced Trading Features

The script encompasses a suite of advanced trading functionalities such as real-time price tracking, automated trading bots, and detailed analytical tools, offering users a comprehensive trading experience.

Customization and Scalability

Personalizing the User Experience

A standout feature of the KuCoin Clone Script is its high degree of customization. This flexibility allows platform owners to tailor the user interface, add unique features, and thus create a distinctive brand identity in the competitive crypto exchange market.

Adapting to Market Trends

The ability to scale and evolve with the ever-changing market trends is vital. The KuCoin Clone Script is designed for scalability, enabling seamless integration of new features and updates, thereby ensuring the platform remains relevant and efficient.

Technical Aspects of the KuCoin Clone Script

Blockchain Technology and Security Protocols

At the heart of the KuCoin Clone Script is cutting-edge blockchain technology, ensuring transparent and immutable transaction records. Combined with advanced security protocols, the platform guarantees a secure and trustworthy trading environment.

Integration with Other Cryptocurrencies and Payment Gateways

The script supports a wide array of cryptocurrencies and integrates with multiple payment gateways. This inclusivity enhances user convenience, making it easier to trade a variety of digital assets and execute transactions.

Launching Your Platform: Steps and Strategies

Planning and Development

Launching a crypto exchange platform using the KuCoin Clone Script involves meticulous planning and strategic development. This phase encompasses understanding the market, defining target audiences, and developing a unique value proposition.

Marketing and User Acquisition

Effective marketing strategies are crucial for attracting and retaining users. Leveraging social media, SEO, and content marketing can significantly enhance the platform's visibility and user base.

Regulatory Compliance and Legal Considerations

Navigating the legal landscape and ensuring compliance with regulatory standards is essential for the platform's legitimacy and long-term success.

Benefits:

Quick Development

Budget-Friendly

Features

Customizable

Support

ROI

Security

Sum-it Up:

A Kucoin Clone Script is the solution for entrepreneurs who are looking to venture into crypto exchange business. It provides a cost-effective solution and benefits with various ways of revenue streams to build a unique platform with cutting-edge security features and designs.

Getting Kucoin clone script from a reliable provider can help you to customize the exchange as per your business needs. If you need a Free demo for this Kucoin clone script just Contact iMeta Experts.

#kucoin clone script#kucoin clone software#kucoin clone app#whitelabel kucoin clone script#crypto exchange like kucoin

0 notes

Text

KuCoin Clone Script

The KuCoin clone script is a software solution replicating the renowned KuCoin cryptocurrency exchange platform. It is designed to provide startups with the opportunity to launch their own customized crypto exchange platforms quickly and efficiently. It encompasses all the essential features and functionalities of the original KuCoin platform. Know more in detail via, https://bit.ly/3Yqn4uu

#KuCoin Clone Script#KuCoin Clone app#KuCoin Clone Software#startups#business#crypto exchange like KuCoin#cryptocurrency Exchange

0 notes

Text

In the fall of 2020, as crypto scammers and thieves began to realize the full potential of a financial privacy tool called Tornado Cash—a clever new system capable of shuffling users' funds to cut the trail of crypto transactions recorded on the Ethereum blockchain—Alexey Pertsev, one of the creators of that service, sent a note to his fellow cofounders about this growing issue. He suggested crafting a standard response to send to victims pleading with Tornado Cash for help with stolen funds laundered through their service. “We must compose a message that we will send to everyone in similar cases,” Pertsev, the then-27-year-old Russian living in the Netherlands, wrote to his colleagues.

Tornado Cash cofounder Roman Semenov answered three minutes later with a draft of their stock response—essentially pointing to the fact that the service's novel design meant it ran on the Ethereum blockchain, not on any server they owned, and was thus out of their hands. “It is a decentralized software protocol that no one entity or actor can control,” the message read. “For that reason, we are unable to assist with respect to any issues relating to the Tornado Cash protocol.”

That statement would remain Tornado Cash's position two days later when hackers affiliated with the North Korean government stole roughly $275 million worth of coins from the crypto exchange KuCoin and funneled a portion of the loot through Tornado Cash to cover their tracks. Tornado Cash would maintain that stance as, according to Dutch prosecutors, a billion-plus dollars more of stolen funds flowed through the service over the next two years, part of at least $2.3 billion in total funds from criminal and sanctioned sources that made up more than 30 percent of the service's overall transactions from 2019 to 2022.

Now, two years after Pertsev's arrest and indictment for money laundering, that “out-of-our-hands” decentralization defense has become one of the central arguments for his innocence. On Tuesday, it will be put to the test when a panel of three Dutch judges rules on the criminal charges that could send Pertsev to prison for years. Privacy advocates believe the result of the case—the first of two, as the New York prosecution of another Tornado Cash cofounder, Roman Storm, is expected to go to trial this coming September—could also shape the future of cryptocurrency privacy and may determine the limits of services like Tornado Cash or other open source software creations to offer a safe haven from financial surveillance.

Dutch prosecutors have accused Pertsev of essentially creating the perfect money laundering machine by designing Tornado Cash to work as a set of “smart contracts”—a type of decentralized service made possible by Ethereum's unique features, in which code is copied to the thousands of Ethereum nodes that store the cryptocurrency's blockchain—and thus preventing Tornado Cash's creators from identifying or controlling who used the service to hide the origins and destinations of their funds.

Pertsev's defenders, on the other hand, point out that those properties are also exactly what makes Tornado Cash such a powerful tool for privacy. “This is the entire point of a decentralized system,” says Sjors Provoost, a Dutch cryptocurrency developer and author of Bitcoin: A Work in Progress, who attended Pertsev's trial. “These are completely clashing worldviews. There's the worldview of privacy and decentralization, and there's the government worldview of surveillance, in which you need to be able to check every transaction.”

Since US and Dutch prosecutors indicted Tornado Cash's cofounders and the US Treasury sanctioned the service in 2022, the case has become a cause célèbre in some cryptocurrency circles, many of whose adherents argue that a guilty verdict could not only damage financial privacy but also set a dangerous precedent that developers of open source software can be held liable for the actions of those who use their tools. Ethereum's inventor, Vitalik Buterin, has noted publicly that he used Tornado Cash to anonymize a donation to Ukraine following Russia's invasion, as an example of the service's legitimate use for privacy. US National Security Agency whistleblower Edward Snowden has compared Tornado Cash's functioning on the Ethereum's blockchain to a water fountain built in a park—a kind of public utility where “you push a button and privacy comes out”—and has called the crackdown on Tornado Cash and its cofounders “deeply illiberal and profoundly authoritarian."

Yet the Dutch prosecutors and Netherlands' financial law enforcement agency, known as FIOD, which led the investigation of Pertsev, argue that the case isn't actually about a fundamental conflict between privacy and security, or liability for open source code, or any other larger principle. Instead, they say, it's about Pertsev's specific, informed decisions to enable thieves on an enormous scale. “It's all about the choices of our suspect,” M. Boerlage, the case's lead prosecutor, tells WIRED in an interview. “He made choices writing the code, deploying the code, adding features to the ecosystem. Choice after choice after choice, all while he knew that criminal money was entering his system. So it's not about code. It's about human behavior.”

A Room Without a Lock—or Walls

Dutch prosecutors contend that, despite the Tornado Cash creators' claims, they did exert control over it. Aside from its decentralized “smart contract” design, they point to Tornado Cash's web-based user interface for interacting with its blockchain-based smart contract: a fully centralized tool running on infrastructure the creators built and managed, which nonetheless had no monitoring or safeguards to prevent its abuse by criminals for money laundering. In fact, prosecutors found that during the time of their investigation, 93.5 percent of users sent their transactions to Tornado Cash through that web interface, which was far simpler to use than directly interacting with the blockchain-based service.

Pertsev's defense didn't respond to WIRED's repeated requests for an interview. But his lead defense attorney, Keith Cheng, has countered that there would have been no point in monitoring or blocking users on that web interface when anyone could circumvent the website altogether to interact directly with the smart contract or even to build their own interface. “The Tornado Cash smart contracts could be accessed directly at any point of time,” Cheng told an audience at the ETHDam cryptocurrency conference in Amsterdam last year. “Implementing checks within the surrounding infrastructure is akin to adding extra locks to a door that lacks surrounding walls.”

The prosecution points out that Tornado Cash could have at least tried to put locks on that door, given that the vast majority of their users, both legitimate and criminal, were walking through it. More fundamentally, they argue that it was Pertsev's decision to put into place a system that he knew from the start would include basic elements he couldn't control. “Building and deploying something unstoppable is also a decision,” says Boerlage.

That question of decentralization and control nonetheless makes the Tornado Cash case a far less straightforward prosecution than those against the founders of simpler bitcoin-based “mixer” services like Bitcoin Fog or Helix, which were similarly intended to prevent cryptocurrency tracing. In each of those earlier cases, the administrators—now both convicted of money laundering conspiracy—hid their connections to the services. By contrast, Pertsev and his cofounders appear to have been confident enough in their remove from the money launderers who used Tornado Cash that they operated fully in the open, under their real names. “This complete transparency does not exactly indicate criminal activity,” Pertsev's attorney Cheng told ETHDam.

At the same time, the prosecution argues that Pertsev was both aware of and untroubled by the millions and ultimately billions of dollars in stolen cryptocurrency flowing through Tornado Cash, which reached a peak in the spring of 2022. They argue that Pertsev continued to maintain and develop pieces of the system—such as its centralized frontend—even as the service was used to launder the stolen funds from 36 distinct cryptocurrency heists, many of which prosecutors say he and his cofounders discussed in their communications. In the meantime, he also profited handsomely, in part from Tornado Cash's issuing its own crypto token, ultimately making more than $15 million and buying himself a Porsche.

When North Korean hackers stole more than $600 million from the blockchain-based game Axie Infinity in March of 2022, Tornado Cash cofounder Semenov wrote anxiously to Pertsev and Storm that “the fucking disaster is about to begin,” perhaps fearing that their service would be used by the perpetrators of that massive heist, as it already had been in well over a dozen others. Pertsev weighed in 10 minutes later, writing “noticed after 5 days, lol," an apparent reference to how long it seemed to have taken Axie Infinity to discover the theft. Sure enough, less than a week later, hundreds of millions of dollars in stolen Axie Infinity funds began to pour into Tornado Cash.

Prosecutors have pointed to Pertsev's “lol” as a sign of his flippant disregard for the victims whose funds, they argue, he was helping to launder. His defense has countered that he was merely expressing surprise.

That same month, perhaps in response to the growing spotlight on Tornado Cash's use by criminals, Pertsev and his cofounders did, in fact, implement a free tool from blockchain analysis firm Chainalysis that would block transactions from sanctioned Ethereum addresses via their web interface. The prosecution has pointed out that the free tool was easily circumvented—hackers could merely move their stolen coins to a different address before sending them into Tornado Cash—and described the effort as “too little and too late."

In their statement to the court, Dutch prosecutors suggest a different solution, if Pertsev had actually cared about Tornado Cash's exploitation by criminals. “What was the simplest option? Take the UI offline and stop advertising. Plain and simple,” they write. “Stop offering the service.”

In the conclusion of that same statement to the court, they point out that under Dutch law the maximum prison sentence for money laundering at the scale Pertsev allegedly committed is eight years, and they ask that Pertsev be sentenced to five years and four months if he's found guilty.

The Tornado Rolls On

Cryptocurrency advocates focused on privacy and civil liberties will be closely watching the outcome of Pertsev's case, which many see as a bellwether for how Western law enforcement and regulators will draw the line between financial privacy and money laundering—including in some immediate cases to follow.

The US trial of Tornado Cash's Storm in a New York court later this year, as well as the US indictment last month of the founders of Samourai Wallet, which prosecutors say offered similar privacy properties to Tornado Cash's, are more likely to directly set precedents in US law. But Pertsev's case may suggest the direction those cases will take, says Alex Gladstein, the chief strategy officer for the Human Rights Foundation and an advocate of bitcoin's use as a human rights tool.

“What happens in the Netherlands will color the New York case, and the Tornado Cash cases are really going to color the outcome of the Samourai case,” Gladstein says. “These cases are going to be historic in the precedents they set.”

Gladstein, like many crypto privacy supporters, argues that anyone weighing the value of tools like Tornado Cash should look beyond its use by hackers to countries like Cuba, Venezuela, and India, where activists and dissidents need to hide their financial transactions from repressive governments. “For human rights activists, it’s essential that they have money the government can’t surveil,” Gladstein says.

Regardless of the verdict in Pertsev's case or that of his cofounder Roman Storm in the fall, Tornado Cash's founder's core argument—that Tornado Cash's underlying infrastructure has always been out of their hands—has proven to be correct: Tornado Cash lives on.

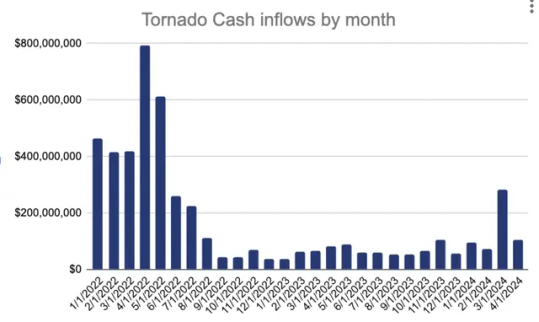

True to its promise of decentralization, Tornado Cash still persists after its cofounders indictment in the fall of last year—and is now out of their control. In March, $283 million flowed into the service. Courtesy of Chainalysis

When the tool's centralized web-based interface went offline last year in the wake of US sanctions and the two cofounders' arrests—Roman Semenov, for now, remains free—Tornado Cash transactions dropped by close to 90 percent, according to Chainalysis. But Tornado Cash has remained online, still functioning as a decentralized smart contract. In recent months, Chainalysis has seen its use tick up again intermittently. More than $283 million flowed into the service just in March.

In other words, whether it represents a public utility for financial privacy and freedom or an uncontrollable money laundering machine, its creators' claim has borne out: Tornado Cash remains beyond their control—or anyone's.

9 notes

·

View notes

Text

KUCOIN TRADING PLATFORM

What is KUCOIN?

KuCoin is a large cryptocurrency exchange offering the ability to buy, sell, and trade cryptocurrencies. In addition to basic trading options, the platform offers margin, futures, and peer-to-peer (P2P) trading. Users can also choose to stake or lend their crypto to earn rewards. Compared to some competitors, KuCoin offers low trading fees, making it an attractive option.

KuCoin offers a wide selection of cryptocurrenciesIt’s the fifth largest exchange by trade volume2Advanced trading options, like margin and futures trading, are availableKuCoin offers a comprehensive support center that helps users with common questions about its tools and features.

KuCoin is a cryptocurrency exchange that operates in over 200 countries. While experienced traders might appreciate some of this exchange’s features.

KuCoin users can earn interest on their crypto by staking certain assets or lending them to others and charging interest. Earning rewards on your crypto can help you build a larger portfolio. Wide selection of cryptocurrencies: Unlike some exchanges that offer a few dozen cryptocurrencies available for trade, KuCoin offers over 600.Low fees: Compared with other major exchanges, KuCoin offers relatively low trading fees. Users can expect to pay between 0.0125% and 0.10% per trade.

So why not? Join now and earn by the way they give 100dollar bonus for just signing in which is free click in the link below 👇👇 to start

https://www.kucoin.com/r/rf/rPXMZFH

2 notes

·

View notes

Text

Chancla Coin: How to Buy and Invest in the Future of Cryptocurrency

As the world of cryptocurrency continues to expand, new coins are emerging to capture the interest of investors. One such coin is Chancla Coin, a unique digital asset that has garnered attention for its playful branding and potential for growth. If you’re interested in How to Buy Chancla Coin, this guide will walk you through the steps you need to take to make your purchase securely and confidently.

Understanding Chancla Coin

Before diving into the buying process, it’s essential to understand what Chancla Coin is. Chancla Coin is a cryptocurrency designed to offer a fun and engaging way for users to participate in the digital economy. With its community-driven approach and innovative features, Chancla Coin aims to bring together like-minded individuals who value both the playful aspects of crypto and its investment potential.

Step 1: Do Your Research

The first step in purchasing any cryptocurrency, including Chancla Coin, is to conduct thorough research. This involves understanding the coin’s purpose, its underlying technology, and its market performance. Visit the official Chancla Coin website and read their whitepaper to gain insights into its vision and roadmap. Engage with community forums and social media channels to hear what other investors and users are saying. Being informed will help you make educated decisions and mitigate risks.

Step 2: Choose a Cryptocurrency Wallet

Once you’ve done your research, the next step is to select a cryptocurrency wallet. A wallet is necessary for storing your Chancla Coin safely. There are several types of wallets available, including:

Software Wallets: These are apps or software programs that can be installed on your computer or mobile device. They are user-friendly and suitable for everyday transactions.

Hardware Wallets: These are physical devices that store your cryptocurrency offline, providing enhanced security. They are recommended for those who plan to hold their Chancla Coin long-term.

Web Wallets: These wallets are accessible through a web browser and offer convenience, but they may be less secure than other options. Use reputable platforms to minimize risks.

Choose a wallet that suits your needs and ensure you have the necessary security measures in place, such as two-factor authentication.

Step 3: Find a Cryptocurrency Exchange

To buy Chancla Coin, you’ll need to find a cryptocurrency exchange that supports it. Some popular exchanges where you might find Chancla Coin include:

Binance

Coinbase

Kraken

KuCoin

Make sure to create an account on the exchange of your choice. This typically involves providing some personal information and verifying your identity to comply with regulations. Always choose exchanges with a good reputation and positive reviews from users.

Step 4: Fund Your Account

After your account is set up, you’ll need to fund it. Most exchanges allow you to deposit funds via bank transfer, credit/debit card, or even other cryptocurrencies. Choose the funding method that works best for you and complete the transaction. Be mindful of any fees associated with deposits, as these can vary between exchanges.

Step 5: Buy Chancla Coin

Once your account is funded, it’s time to purchase Chancla Coin. Navigate to the trading section of the exchange, search for Chancla Coin (often listed as “CHANCLA” or similar), and select the trading pair that matches your deposited currency (e.g., USD/CHANCLA or BTC/CHANCLA). Decide how much Chancla Coin you want to buy and place your order.

You can choose between a market order, which buys at the current market price, or a limit order, which allows you to set a specific price at which you want to buy. Once your order is executed, the Chancla Coin will be credited to your exchange wallet.

Step 6: Transfer to Your Wallet

For added security, it’s advisable to transfer your Chancla Coin from the exchange to your personal wallet. Navigate to your wallet and select the option to receive funds. Copy your wallet address and paste it into the withdrawal section of the exchange. Confirm the transaction, and your Chancla Coin will be securely stored in your wallet.

Conclusion

Buying Chancla Coin can be an exciting venture into the world of cryptocurrency. By following these steps — conducting thorough research, selecting a secure wallet, choosing a reliable exchange, funding your account, and making your purchase — you can confidently invest in Chancla Coin. If you’re wondering How to Buy Chancla Coin, remember to stay informed about market trends and developments in the cryptocurrency space to maximize your investment potential. Happy investing!

0 notes

Text

Chancla Coin: How to Buy and Invest in the Future of Cryptocurrency

As the world of cryptocurrency continues to expand, new coins are emerging to capture the interest of investors. One such coin is Chancla Coin, a unique digital asset that has garnered attention for its playful branding and potential for growth. If you’re interested in How to Buy Chancla Coin, this guide will walk you through the steps you need to take to make your purchase securely and confidently.

Understanding Chancla Coin

Before diving into the buying process, it’s essential to understand what Chancla Coin is. Chancla Coin is a cryptocurrency designed to offer a fun and engaging way for users to participate in the digital economy. With its community-driven approach and innovative features, Chancla Coin aims to bring together like-minded individuals who value both the playful aspects of crypto and its investment potential.

Step 1: Do Your Research

The first step in purchasing any cryptocurrency, including Chancla Coin, is to conduct thorough research. This involves understanding the coin’s purpose, its underlying technology, and its market performance. Visit the official Chancla Coin website and read their whitepaper to gain insights into its vision and roadmap. Engage with community forums and social media channels to hear what other investors and users are saying. Being informed will help you make educated decisions and mitigate risks.

Step 2: Choose a Cryptocurrency Wallet

Once you’ve done your research, the next step is to select a cryptocurrency wallet. A wallet is necessary for storing your Chancla Coin safely. There are several types of wallets available, including:

Software Wallets: These are apps or software programs that can be installed on your computer or mobile device. They are user-friendly and suitable for everyday transactions.

Hardware Wallets: These are physical devices that store your cryptocurrency offline, providing enhanced security. They are recommended for those who plan to hold their Chancla Coin long-term.

Web Wallets: These wallets are accessible through a web browser and offer convenience, but they may be less secure than other options. Use reputable platforms to minimize risks.

Choose a wallet that suits your needs and ensure you have the necessary security measures in place, such as two-factor authentication.

Step 3: Find a Cryptocurrency Exchange

To buy Chancla Coin, you’ll need to find a cryptocurrency exchange that supports it. Some popular exchanges where you might find Chancla Coin include:

Binance

Coinbase

Kraken

KuCoin

Make sure to create an account on the exchange of your choice. This typically involves providing some personal information and verifying your identity to comply with regulations. Always choose exchanges with a good reputation and positive reviews from users.

Step 4: Fund Your Account

After your account is set up, you’ll need to fund it. Most exchanges allow you to deposit funds via bank transfer, credit/debit card, or even other cryptocurrencies. Choose the funding method that works best for you and complete the transaction. Be mindful of any fees associated with deposits, as these can vary between exchanges.

Step 5: Buy Chancla Coin

Once your account is funded, it’s time to purchase Chancla Coin. Navigate to the trading section of the exchange, search for Chancla Coin (often listed as “CHANCLA” or similar), and select the trading pair that matches your deposited currency (e.g., USD/CHANCLA or BTC/CHANCLA). Decide how much Chancla Coin you want to buy and place your order.

You can choose between a market order, which buys at the current market price, or a limit order, which allows you to set a specific price at which you want to buy. Once your order is executed, the Chancla Coin will be credited to your exchange wallet.

Step 6: Transfer to Your Wallet

For added security, it’s advisable to transfer your Chancla Coin from the exchange to your personal wallet. Navigate to your wallet and select the option to receive funds. Copy your wallet address and paste it into the withdrawal section of the exchange. Confirm the transaction, and your Chancla Coin will be securely stored in your wallet.

Conclusion

Buying Chancla Coin can be an exciting venture into the world of cryptocurrency. By following these steps—conducting thorough research, selecting a secure wallet, choosing a reliable exchange, funding your account, and making your purchase—you can confidently invest in Chancla Coin. If you’re wondering How to Buy Chancla Coin, remember to stay informed about market trends and developments in the cryptocurrency space to maximize your investment potential. Happy investing!

0 notes

Text

Best Crypto Exchange & Crypto Trading Platform: A Guide for Traders

:Discover the best crypto exchanges and trading platforms for 2024. Learn how to choose the ideal platform based on security, fees, liquidity, and supported cryptocurrencies. Explore top exchanges like Binance, Coinbase, Kraken, and KuCoin to find the perfect fit for your crypto trading needs.

0 notes

Text

0 notes

Text

Start Your Multi-Crypto Support Crypto Exchange Like Kucoin Within 7 Days!

In the dynamic realm of cryptocurrency, starting your own exchange offers a significant opportunity for revenue and impact. You'll need a reliable and adaptable solution to dive into this thriving market. The KuCoin Clone Script is a robust option for creating a cryptocurrency exchange similar to KuCoin, with extensive multi-crypto integration and additional features. With Plurance, a top provider of ready-to-use crypto exchange scripts, you can launch your trading platform quickly and effectively.

Why Choose a KuCoin Clone Script?

KuCoin is renowned for its user-friendly interface, extensive range of cryptocurrencies and advanced trading features. By choosing a KuCoin Clone Script, you benefit from a pre-built solution that replicates the success of KuCoin, customized to fit your unique requirements. This script offers a comprehensive platform with multi-crypto support, allowing you to cater to a diverse range of digital assets.

Plurance's Phenomenal KuCoin Clone Script

Plurance stands out as a top-tier provider of ready-made crypto exchange scripts, offering a KuCoin Clone Script that is both feature-rich and highly adaptable. Their KuCoin Clone Software comes with a host of attractive features designed to enhance the user experience and streamline operations. Here’s why Plurance’s KuCoin Clone Script is your ideal choice:

Multi-Crypto Support: The KuCoin Clone Script supports a wide variety of cryptocurrencies, providing your users with the flexibility to trade and invest in multiple digital assets. This feature helps keep your platform at the forefront of the ever-changing crypto market.

Advanced Trading Features: Just like KuCoin, Plurance’s clone software includes advanced trading features such as spot trading, futures trading, margin trading, and staking. These functionalities are crucial for attracting experienced traders and satisfying their diverse trading needs.

Scalability and Security: The KuCoin Clone Software from Plurance is designed to scale with your business. Whether you're handling a few transactions or millions, the platform can accommodate your growth. Additionally, top-notch security measures are embedded to protect against cyber threats and ensure the safety of user funds.

White Label Customization: Plurance offers White Label KuCoin Clone Software, allowing you to brand the exchange with your unique logo, color scheme, and other customizations. This feature enables you to build a distinct identity in the crypto space while utilizing a proven platform.

Quick Launch: With Plurance’s KuCoin Clone Script, you can launch your multi-crypto exchange within just 7 days. This rapid deployment ensures you capitalize on market opportunities without delay.

Creating a Crypto Exchange Like KuCoin

Starting your own crypto exchange like KuCoin involves several key steps. With Plurance’s KuCoin Clone Script, the process is streamlined:

Define Your Requirements: Determine the specific features and cryptocurrencies you want to include in your exchange. Plurance’s script is flexible, allowing you to tailor the platform to your preferences.

Customize Your Platform: Use the White Label KuCoin Clone Software to add your branding elements and customize the user interface. Plurance provides support throughout this process to ensure your vision is realized.

Test and Launch: Before going live, thoroughly test the platform to ensure it operates smoothly and securely. Plurance offers comprehensive testing support to identify and fix any issues.

Market Your Exchange: Once your exchange is live, focus on marketing strategies to attract users. Highlight the unique features of your platform and leverage social media, advertising, and partnerships to build your user base.

Conclusion

With Plurance’s KuCoin Clone Script, starting your own multi-crypto exchange like KuCoin has never been easier. The ready-made solution provides all the essential features and support you need to launch a competitive trading platform within just 7 days. Embrace the opportunity to enter the dynamic cryptocurrency trading world and position yourself for success with Plurance’s cutting-edge KuCoin Clone Software. Start your journey today and make your mark in the crypto exchange market!

#crypto exchange#bitcoin trading#bitcoin exchange#crypto trading#kucoin clone#kucoin clone script#kucoin clone software#kucoin exchange clone#kucoin clone app

0 notes

Text

6 Top Crypto Grid Trading Bot Apps (Earn Automated Profits)

Automation has emerged as a crucial element in the rapidly changing landscape of cryptocurrency trading. Among the various automated strategies, grid trading bots have gained significant popularity for their ability to optimize profits while mitigating risks. These bots systematically place buy and sell orders at specified intervals within a predetermined price range, enabling traders to take advantage of market volatility.

This blog will explore the six best crypto grid trading bots that can help you make automated money. We'll also delve into the importance of Crypto Grid Trading Bot Development and how it can enhance your trading strategy.

1. Pionex

Pionex is a top contender in the realm of grid trading bots, offering an intuitive interface and pre-configured bots suitable for both novices and seasoned traders. It features various grid trading options, such as Spot-Futures Arbitrage and Smart Trade Terminal, to help users refine their strategies. Thanks to its low trading fees and a broad selection of supported cryptocurrencies, Pionex is a preferred option for automated trading.

2. Bitsgap

Bitsgap is another powerful platform that offers an extensive suite of trading tools, including a highly efficient grid trading bot. The bot is designed to execute orders within a specified price range, ensuring continuous profit-taking. Bitsgap's interface is intuitive, and it integrates with multiple exchanges, providing a seamless trading experience. The platform also offers a demo mode for users to test their strategies without risking real money.

3. KuCoin Trading Bot

KuCoin is a well-known cryptocurrency exchange that also offers an integrated trading bot. The KuCoin Trading Bot supports various strategies, including grid trading, and is designed to help traders automate their trades effortlessly. With features like customizable grids and risk management tools, KuCoin's bot is an excellent choice for those looking to optimize their trading strategy.

4. 3Commas

3Commas is a comprehensive trading platform that provides a range of automated trading solutions, including grid trading bots. The platform's grid bot allows users to create and manage grids across multiple exchanges, offering flexibility and control over their trading activities. 3Commas also offers backtesting features, enabling traders to refine their strategies based on historical data.

5. Coinrule

Coinrule is a versatile platform that empowers traders to automate their strategies without requiring any coding skills. The platform's grid trading bot is designed to execute trades based on predefined rules, making it ideal for both novice and experienced traders. Coinrule supports multiple exchanges and provides a wide range of templates to help users get started quickly.

6. HaasOnline

HaasOnline is a powerful trading platform that offers advanced automation tools, including grid trading bots. The platform's bots are highly customizable, allowing traders to fine-tune their strategies to match their specific needs. HaasOnline also provides backtesting and simulation features, enabling users to test their strategies before deploying them in live markets.

The Importance of Crypto Grid Trading Bot Development

Crypto Grid Trading Bot Development plays a crucial role in the effectiveness of these automated tools. A well-developed grid trading bot can significantly enhance your trading strategy by:

1. Maximizing Profit Potential:

By executing trades at optimal intervals, a grid trading bot can capture profits from market fluctuations, ensuring continuous revenue generation.

2. Minimizing Risks:

Automated bots can help manage risks by executing trades based on predefined rules, reducing the impact of emotional decision-making.

3. Saving Time:

Automation eliminates the need for constant market monitoring, allowing traders to focus on other important tasks.

4. Enhancing Efficiency:

With a well-developed grid trading bot, traders can execute multiple trades simultaneously across various exchanges, increasing their overall trading efficiency.

Conclusion

In conclusion, grid trading bots offer a powerful way to automate your cryptocurrency trading and maximize your profits. Platforms like Pionex, Bitsgap, KuCoin Trading Bot, 3Commas, Coinrule, and HaasOnline provide excellent tools for implementing grid trading strategies. Investing in Crypto Grid Trading Bot Development can further enhance your trading experience, ensuring you stay ahead in the competitive world of cryptocurrency trading. Whether you are a beginner or an experienced trader, these bots can help you achieve your financial goals with ease.

Happy trading!

0 notes

Text

The Entrepreneur's Guide to Setting Up a Triangular Arbitrage Bot for Crypto Investment

Cryptocurrency trading has been seen as a rich business proposition for the people involved in the business. Another trading strategy that is being adopted by traders is triangular arbitrage bot. Using this guide, you will learn how to implement triangular arbitrage in cryptocurrency investment that offers one technical advantage over rivals in the related market.

What is a Triangular Arbitrage Bot?

The triangular arbitrage bot means the exchange of three different crypto currencies on an exchange with the view of earning profits from the price differentials. It is designed to make a profit through buying a currency pair at a particular price and selling at a higher price in other trading pairs with limited risk. This method has to be executed swiftly and accurately, something that can be accomplished by the use of automated bots.

Why Choose Triangular Arbitrage?

Low-Risk Trading: Because it takes advantage of price changes within the same exchange, it eliminates the risks associated with price differences across exchanges.

Future-Proof: Since the market of digital assets is constantly growing and changing, arbitrage strategies remain effective for future trading.

Multi-Coin Trading: It refers to multiple cryptocurrencies meaning that traders get to trade and make profits from a variety of coins.

Triangular Arbitrage Bot: How to Get Started

Select an Exchange: Select a suitable exchange like Kucoin that provides several trading pairs and all the required API for bot trading.

Understand the API: Learn about the API documentation of the chosen exchange. This is important while incorporating the bot to the exchange.

Develop or Purchase a Bot: They can create one on their own if they know how to program or buy one from any reputable service provider. Make sure it allows trading of multiple coins, and that the trades can be executed efficiently.

Backtest Your Bot: When launching your bot, make sure that you use historical data to backtest the bot. This will assist you in noting any problems that might be affecting it and how to make it better.

Monitor and Adjust: This means that even after the start-up, monitoring is crucial as the market environment may change. The crypto market is an unpredictable market, and these changes might need to be adjusted frequently to make decent profits.

Key Technical Aspects

API Integration: Make sure your bot is integrated well enough with the API of the exchange in question.

Speed and Latency: This requires the bot to trade quickly in order to take advantage of the price disparity.

Risk Management: Use stop loss and some other measures to minimize your risk exposure to the market.

Why invest in a triangular arbitrage bot?

Investing in a triangular arbitrage bot offers several benefits for entrepreneurs:

Automated Trading: Reduces time and energy required and frees the time to address other aspects of the business.

Profitability: Takes advantage of price differentials that may not be easily noticed in manual trading.

Consistency: Avoids acting based on emotions; keeps strict control over the trading processes.

Conclusion

The triangular arbitrage bot development for crypto investment is highly recommendable to improve your trading way because of its low risk trading and automated gateway. This is an elaborate but easy method for business people, and all the corporate individuals in the industry, thus helping them to expand and stabilize their crypto-related investments.

When it comes to the best services in triangular arbitrage bot development, Fire Bee Techno Services is the company to turn to. This guarantees you an efficient trading bot that meets your needs and returns the profitability you expect. Start making your investments in the future of crypto trading only with Fire Bee Techno Services!

0 notes

Text

Less Than Three Months Left for STC Wallet Users to Redeem Their Tokens!

Student Coin (STC), a well-known crypto project, is closing.

Thus, it requires all token holders within the STC Wallet to redeem their tokens before October 9, 2024, by submitting a Redemption Request and requires direct contact with the Student Coin team.

How to Redeem Your STC Tokens

The Student Coin team has implemented a multi-stage redemption process that has been in place for over five years to ensure transparency and user support.

The first and second deadlines for redeeming tokens within the STC wallet (automatically) and through centralized exchanges have already passed in June.

The third stage, set to end on October 9, 2024, involves submitting a Redemption Request and requires direct contact with the Student Coin team.

The final phase, which will continue until April 9, 2029, allows users to sell their tokens on-chain.

Moreover, according to recent announcements, 82,86% of the total supply of STC and 100% of the tokens held by the team have already been burned. Additionally, between May 30 and June 15, the tokens were delisted from KuCoin, ProBit Global, HitBTC, and all remaining centralized exchanges.

Manual Redemption via OTC Redemption Request: This method requires KYC/KYB procedures, AML checks, and submitting documents until October 9, 2024.

On-chain Redemption: This option is available until April 9, 2029, and allows users to choose between converting tokens to USDC on Uniswap V3 (recommended for smaller volumes) or sending tokens directly to the burn address (recommended for larger volumes).

As an alternative, recommended for larger amounts, you can use an on-chain burn procedure by simply sending all your STC tokens to the burn address directly from your self-custody wallet. In return, the STC team will transfer you an adequate value in USDC.

The redemption prices range between $0.006 and $0.0137 per token and vary based on particular accounts’ purchase history and activity. This approach rewards loyal users, long-term holders, Premium Program members, and direct purchases via STC Wallet.

About Student Coin

Student Coin, a project launched in 2019 in a Polish business school aimed to explore blockchain technology, is now shutting down. The project led to further initiatives, including creating the STC Wallet, launching the STC Academy, and, finally, establishing Coinpaper, currently one of the leading crypto news portals.

However, economic turmoil, industry scandals, and regulations slowed their momentum.

Despite navigating these challenges and prioritizing user protection during major crypto crashes, the Student Coin team made the difficult decision to sunset the STC token and related projects.

Learn More

Visit Student Coins‘ official website and follow them on social media platforms like X (Twitter) and Telegram to stay updated with the redemption process.

0 notes

Text

Less Than Three Months Left for STC Wallet Users to Redeem Their Tokens!

Student Coin (STC), a well-known crypto project, is closing.

Thus, it requires all token holders within the STC Wallet to redeem their tokens before October 9, 2024, by submitting a Redemption Request and requires direct contact with the Student Coin team.

How to Redeem Your STC Tokens

The Student Coin team has implemented a multi-stage redemption process that has been in place for over five years to ensure transparency and user support.

The first and second deadlines for redeeming tokens within the STC wallet (automatically) and through centralized exchanges have already passed in June.

The third stage, set to end on October 9, 2024, involves submitting a Redemption Request and requires direct contact with the Student Coin team.

The final phase, which will continue until April 9, 2029, allows users to sell their tokens on-chain.

Moreover, according to recent announcements, 82,86% of the total supply of STC and 100% of the tokens held by the team have already been burned. Additionally, between May 30 and June 15, the tokens were delisted from KuCoin, ProBit Global, HitBTC, and all remaining centralized exchanges.

Manual Redemption via OTC Redemption Request: This method requires KYC/KYB procedures, AML checks, and submitting documents until October 9, 2024.

On-chain Redemption: This option is available until April 9, 2029, and allows users to choose between converting tokens to USDC on Uniswap V3 (recommended for smaller volumes) or sending tokens directly to the burn address (recommended for larger volumes).

As an alternative, recommended for larger amounts, you can use an on-chain burn procedure by simply sending all your STC tokens to the burn address directly from your self-custody wallet. In return, the STC team will transfer you an adequate value in USDC.

The redemption prices range between $0.006 and $0.0137 per token and vary based on particular accounts’ purchase history and activity. This approach rewards loyal users, long-term holders, Premium Program members, and direct purchases via STC Wallet.

About Student Coin

Student Coin, a project launched in 2019 in a Polish business school aimed to explore blockchain technology, is now shutting down. The project led to further initiatives, including creating the STC Wallet, launching the STC Academy, and, finally, establishing Coinpaper, currently one of the leading crypto news portals.

However, economic turmoil, industry scandals, and regulations slowed their momentum.

Despite navigating these challenges and prioritizing user protection during major crypto crashes, the Student Coin team made the difficult decision to sunset the STC token and related projects.

Learn More

Visit Student Coins‘ official website and follow them on social media platforms like X (Twitter) and Telegram to stay updated with the redemption process.

0 notes

Text

0 notes

Text

Cryptocurrency exchange Binance has secured registration with the Indian Financial Intelligence Unit (FIU). This marks a significant milestone for the platform as it continues to expand its presence in the Indian Market. The registration will enable Binance to operate legally within the country and comply with regulatory requirements.

Click to Claim Latest Airdrop for FREE

Claim in 15 seconds

Scroll Down to End of This Post

const downloadBtn = document.getElementById('download-btn');

const timerBtn = document.getElementById('timer-btn');

const downloadLinkBtn = document.getElementById('download-link-btn');

downloadBtn.addEventListener('click', () =>

downloadBtn.style.display = 'none';

timerBtn.style.display = 'block';

let timeLeft = 15;

const timerInterval = setInterval(() =>

if (timeLeft === 0)

clearInterval(timerInterval);

timerBtn.style.display = 'none';

downloadLinkBtn.style.display = 'inline-block';

// Add your download functionality here

console.log('Download started!');

else

timerBtn.textContent = `Claim in $timeLeft seconds`;

timeLeft--;

, 1000);

);

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

Binance, the world's largest cryptocurrency exchange, has recently registered with the Indian Financial Intelligence Unit (FIU) following a ban imposed by the Indian government in December 2023. Alongside Binance, rival exchange KuCoin has also obtained registration with the FIU after being among the platforms banned last year.

The approval by India's anti-money laundering unit marks a significant step for offshore crypto entities. While KuCoin paid a fine of $41,000 for registration, the amount paid by Binance remains undisclosed at this time.

The question on everyone's mind is when Binance will resume operations in India. Despite registering with the FIU, the exchange is still awaiting a final verdict from its ongoing hearing. It is anticipated that Binance will face a substantial fine before being able to resume services in the country.

The development surrounding Binance, KuCoin, and other crypto platforms being targeted by the FIU last year is rooted in non-compliance with anti-money laundering laws. The FIU highlighted that these offshore entities catering to Indian users were not adhering to the Anti Money Laundering (AML) and Counter Financing of Terrorism (CFT) framework.

For Binance, a return to the Indian Market would be a positive move considering the country's significant crypto user base. India stands as one of the largest cryptocurrency markets globally, making it a crucial Market for exchanges like Binance to tap into.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_2]

1. What is the significance of Binance obtaining registration with the Indian Financial Intelligence Unit?

Binance obtaining registration with the Indian Financial Intelligence Unit shows that the cryptocurrency exchange is now legally recognized and regulated in India.

2. Does this mean Binance can now operate freely in India?

While obtaining registration with the Indian Financial Intelligence Unit is a positive step, Binance still needs to comply with other regulations and requirements to operate in India.

3. Will Indian users be able to trade on Binance without any restrictions now?

Indian users may still face restrictions or limitations when trading on Binance, depending on the regulations and guidelines set by the Indian government.

4. How does this registration benefit Binance and its users?

Obtaining registration with the Indian Financial Intelligence Unit improves Binance's credibility and trustworthiness, which can benefit both the exchange and its users in terms of security and transparency.

5. What should Indian users do if they want to start trading on Binance?

Indian users who want to start trading on Binance should

first ensure they are compliant with all local regulations and then create an account on the platform to begin trading.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

Claim Airdrop now

Searching FREE Airdrops 20 seconds

Sorry There is No FREE Airdrops Available now. Please visit Later

function claimAirdrop()

document.getElementById('claim-button').style.display = 'none';

document.getElementById('timer-container').style.display = 'block';

let countdownTimer = 20;

const countdownInterval = setInterval(function()

document.getElementById('countdown').textContent = countdownTimer;

countdownTimer--;

if (countdownTimer < 0)

clearInterval(countdownInterval);

document.getElementById('timer-container').style.display = 'none';

document.getElementById('sorry-button').style.display = 'block';

, 1000);

1 note

·

View note