#cryptocurrency consulting firm dubai

Text

Navigating the Digital Horizon: The Evolution of Crypto License Dubai and Crypto License UAE

In recent years, the United Arab Emirates (UAE), particularly Dubai, has emerged as a key player in the global blockchain and cryptocurrency landscape. The embracement of digital innovation has been met with a forward-thinking regulatory approach, culminating in the introduction of comprehensive crypto licensing frameworks. This article delves into the intricate world of crypto licenses in Dubai and the UAE, exploring the regulatory landscape, the impact on the crypto industry, and the implications for businesses and investors.

1. The Genesis of Crypto Regulation in Dubai:

The journey towards crypto regulation in Dubai has been marked by a deliberate and progressive approach. Recognizing the transformative potential of blockchain and digital assets, regulatory authorities have sought to create a framework that fosters innovation while ensuring consumer protection and financial integrity. The regulatory groundwork has been laid with the aim of positioning Dubai as a global hub for crypto-related activities.

2. Dubai's Regulatory Authority and the Crypto License Framework:

The emergence of Dubai’s Virtual Assets Regulatory Authority (VARA) along with the regulatory framework established by them has been a massive gamechanger for the industry. Leaving all the major “pro-technology” cities behind, Dubai has created its own mark in the world.

As its name suggests, Virtual Assets Regulatory Authority (VARA) aims to bring order in the virtual assets space and to offer a world-class regulatory framework in the emirate of Dubai to safeguard investors, maintain high levels of risk assurance, and encourage virtual asset innovation. No virtual assets service providers (VASPs) are permitted to carry out their operations in Dubai without obtaining license from VARA in accordance with the activities carried out by the VASPs.

Crypto license Dubai and crypto license UAE cover a spectrum of activities, including cryptocurrency exchanges, wallet services, and other blockchain-based businesses. Applicants for these licenses must undergo a rigorous vetting process, demonstrating financial stability, adherence to anti-money laundering (AML) and know your customer (KYC) regulations, and robust security measures.

3. Regulatory Compliance and the Varied Crypto Ecosystem:

One of the primary objectives of the crypto license framework is to ensure regulatory compliance across the diverse crypto ecosystem. From cryptocurrency exchanges facilitating the trading of digital assets to wallet services securing users' holdings, the licensing process aims to create a transparent and accountable environment. The compliance standards set by VARA are designed to address potential risks and vulnerabilities inherent in the crypto space.

4. Impact on Businesses and Investor Confidence:

The introduction of crypto license Dubai and crypto license UAE has had a profound impact on businesses operating in the digital asset space. Obtaining a crypto license not only grants legal legitimacy but also instils confidence in investors and users. The assurance of regulatory oversight contributes to a more secure and transparent environment, attracting both local and international investments in the burgeoning crypto market.

Businesses that have successfully acquired crypto licenses find themselves at the forefront of the industry, positioned to provide services with a seal of regulatory approval. This legitimacy fosters trust, an essential factor in an industry that has historically grappled with scepticism.

5. Dubai's Position in the Global Crypto Landscape:

Dubai's proactive stance on crypto regulation places the city at the intersection of traditional finance and emerging digital technologies. The regulatory clarity provided by VARA positions Dubai as a favourable destination for crypto businesses seeking a supportive regulatory environment. It also attracts blockchain innovators and enthusiasts, fostering an ecosystem where ideas can flourish.

Moreover, Dubai's regulatory framework aligns with international best practices, contributing to the city's integration into the global crypto landscape. This alignment facilitates cross-border collaborations, potentially positioning Dubai as a conduit for international investments and partnerships in the crypto space.

6. Future Prospects and Evolving Regulations:

As the crypto industry continues to evolve, so too will the regulatory frameworks governing it. Dubai's commitment to staying abreast of technological advancements and market dynamics positions it to adapt and refine its regulations accordingly. VARA is likely to play a key role in shaping the future of crypto regulation in the region, potentially introducing amendments and expansions to accommodate emerging trends.

The future prospects for crypto licenses in Dubai are intertwined with the broader global dialogue on digital assets. The city's agile regulatory approach positions it to attract further investments and contribute to the development of innovative solutions in blockchain and cryptocurrency technologies.

The introduction of crypto licenses in Dubai and the UAE reflects a strategic vision to leverage the potential of blockchain and digital assets while safeguarding the interests of investors and the integrity of the financial system. Dubai's journey from a bustling financial centre to a burgeoning crypto hub underscores the adaptability of regulatory frameworks in the face of technological innovation.

As businesses and investors continue to navigate the digital landscape, the crypto license framework in Dubai serves as a beacon of legitimacy and security. The dynamic synergy between regulatory authorities, businesses, and investors is poised to shape the future of crypto in Dubai and position the city as a leader in the global crypto revolution.

#cryptocurrency license#cryptocurrency exchange license#cryptocurrency consulting services#.Crypto exchange license uae#crypto consulting firm#cryptocurrency consulting firm dubai#cryptocurrency consulting#crypto investment consulting#blockchain consulting services

0 notes

Text

Trafficked Indians Forced into Cybercrimes at ‘Chinese-Controlled Scam Centres’: CBI FIR

Global Trafficking Network

In a dramatic revelation, the Central Bureau of Investigation (CBI) has unveiled a chilling international human trafficking network that forces Indian nationals into cybercrimes at operations controlled by Chinese entities. This disturbing disclosure, detailed in a newly filed FIR, sheds light on the sinister mechanisms behind the trafficking of Indians to Southeast Asian countries where they are coerced into executing elaborate fraud schemes.

The Trafficking Operation

According to the FIR, an intricate global network is involved in luring Indian citizens with the promise of lucrative job opportunities in countries like Thailand, Dubai, and Bangkok. Once these individuals arrive at their destinations, they are covertly transported to Southeast Asian nations, particularly Cambodia, Laos, and Myanmar. There, they are held under duress and forced to participate in cybercriminal activities at “Chinese-controlled scam centres.”

The CBI’s investigation into this complex operation is part of a broader probe that began after significant leads emerged from the Indian Cyber Crime Coordination Centre (I4C), a division of the Ministry of Home Affairs (MHA). Rajesh Kumar, CEO of I4C, highlighted that many cybercrimes reported in India have links to these Southeast Asian countries, with numerous fraudulent web applications written in Mandarin, indicating a connection to China.

The FIR Details

The FIR describes a disturbing case involving Saddam Sheikh, a resident of Palghar, Maharashtra. Sheikh was approached by individuals from a South Delhi-based manpower consultancy firm who offered him a job in Thailand. After paying Rs 1.4 lakh for visa and travel expenses, Sheikh traveled to Bangkok, only to be deceived and sent to Laos. There, he encountered additional agents and was introduced to the Chinese and Indian operators in the Golden Triangle Special Economic Zone.

In Laos, Sheikh was forced to work on fraudulent social media schemes designed to cheat individuals in India, Canada, and the United States through cryptocurrency investment scams. After enduring forced labor and exploitation, Sheikh managed to escape from the scam centre and returned to India on April 19.

Response from Authorities

The FIR, lodged after multiple discussions between the MHA, Telecom Ministry, Reserve Bank of India, and CBI, highlights efforts to identify and address vulnerabilities in the banking and telecom sectors that enable such cybercrimes. The investigation has prompted calls for enhanced measures to prevent and mitigate human trafficking and cyber fraud.

The discovery of potential explosive devices in the suspect’s car further complicates the case, suggesting that some traffickers may expect to survive their criminal operations. The devices, along with the AR-15-style rifle used in the crimes, have been sent to the Bureau’s lab in Quantico, Virginia, for analysis.

Broader Implications

The revelation has significant implications for the upcoming political discourse in India and beyond. As India grapples with the fallout from these revelations, the trafficking network’s ties to global cybercrime and organized criminal operations raise urgent questions about international cooperation and the effectiveness of current anti-trafficking and cybercrime strategies.

In response to the unfolding situation, both Indian and international authorities are intensifying their efforts to dismantle the trafficking network and provide support to the victims. The scale and sophistication of this operation underscore the need for a coordinated global response to combat human trafficking and cybercrime.

As investigations continue, the CBI and its partners are working diligently to uncover the full extent of the trafficking network and bring those responsible to justice. The case serves as a stark reminder of the vulnerability of individuals lured by promises of a better life and the need for vigilance and robust measures to protect against such exploitation.

#HumanTrafficking#Cybercrime#CBI#InternationalCrime#ChinaScamCenters#SoutheastAsia#FraudInvestigation#CriminalNetwork#CyberFraud#IndianVictims

0 notes

Text

Top 10 Crypto Advertising Company 2024

A business's reputation and visibility are critical factors that determine its success. Every sector is affected by this axiom, but the crypto world is particularly affected. While it can be difficult to make your brand stand out from the plethora of other initiatives that are similar, experienced Crypto advertising company and PR agencies have a wealth of experience that can help you achieve this aim.

The typical services of a digital marketing and PR agency are:

Social media marketing is crucial for broad audience reach and community building.

Content marketing drives brand awareness and website traffic.

Influencer marketing harnesses the influence of key figures in the blockchain space for sponsored content or events.

Email marketing is a smart and cost-effective strategy for building relationships with your customers.

Community building, through forums and events, strengthens customers’ loyalty and amplifies the brand’s presence.

Certain Crypto marketing agency offer services that are not included in this exhaustive list. Which firm is a true specialist in promoting recognition and building a favorable reputation is the crucial question. In order to help cryptocurrency startups gain traction and market share, this evaluation reveals the top PR and crypto advertising company.

1. 7Search PPC

7Search PPC, the leading pay-per-click ad network, helps crypto businesses thrive with it’s cutting-edge crypto advertising company. Choosing us as your publishing partner can also be a game-changer for your website or blog and convert your traffic into real cash without a hassle.

2. Ptoken

Ptoken is a marketing and consulting firm that helps Web3 companies outperform their rivals. This crypto advertising company has more than five years of experience in the cryptocurrency sector and is well-represented in Europe and Australasia, with locations in London, Zurich/Zug, Seoul, Dubai, and Melbourne.

3. 2PMarketing

Being an agile full-cycle crypto advertising agency, 2PMarketing creates unique marketing tactics that appeal to FinTech and blockchain enterprises.

4. Outset PR

Leading the way in crypto ads media engagement, Mike Ermolaev, is the CEO of Outset PR, a vibrant digital marketing and PR firm.

5. Wachsman

Wachsman ensures that their clients' communications are effective in the tech-savvy media landscape by fusing traditional financial competence with DeFi and FinTech.

6. LaunchIT

LaunchIT is a marketing and PR agency helping promote crypto sites and FinTech startups boost their brand awareness.

7. MarketAcross

MarketAcross is a key player in blockchain PR and marketing. It provides end-to-end promotional services, achieving high efficiency through personal relations with influential editors and writers.

8. LeanMarketing.Crypto

LeanMarketing.Crypto is a blockchain marketing agency offering a range of marketing services for DeFi projects.

9. Token Agency

Token Agency offers a comprehensive suite of PR and marketing services tailored for success in the advertise crypto business.

10. Melrose PR

Melrose PR is a crypto-focused marketing agency, steering Web3 companies toward communication success.

Conclusion:

In 2024, the Crypto advertising company landscape has witnessed significant growth, with numerous companies vying for attention and market share. The top 10 crypto advertising companies of this year have demonstrated innovation, reliability, and effectiveness in promoting blockchain projects, cryptocurrencies, and related services. As the crypto industry continues to evolve, these companies will play a crucial role in shaping its future by providing cutting-edge advertising solutions to businesses and investors worldwide.

FAQs (Frequently Asked Questions):

Q1. What criteria were used to determine the top 10 crypto advertising companies?

Ans. The top 10 crypto advertising companies were selected based on factors such as reputation, track record, client satisfaction, innovation, reach, and effectiveness of advertising campaigns.

Q2. Are these companies suitable for all types of crypto projects?

Ans. While the top 10 companies cater to a wide range of crypto projects, it's essential for businesses to research each company's strengths, specialties, and target audience to determine the best fit for their specific needs.

Q3. How can I choose the right crypto advertising company for my project?

Ans. To choose the right crypto advertising company, consider factors such as your project goals, target audience, budget, and the company's expertise in reaching your desired market segment.

Q4. What types of advertising services do these companies offer?

Ans. The top 10 crypto advertising companies offer a variety of services, including display advertising, social media marketing, influencer partnerships, content marketing, email marketing, and more. They may also provide specialized services such as ICO/STO promotion, community management, and PR campaigns.

Q5. Are these companies regulated?

Ans. Regulations surrounding crypto advertising vary by region, and it's essential for businesses to ensure compliance with relevant laws and guidelines. While some of the top crypto advertising companies may adhere to industry best practices and self-regulatory measures, it's crucial to conduct due diligence and seek legal advice if needed.

Q6. How can I measure the success of my advertising campaign with these companies?

Ans. The success of a crypto advertising campaign can be measured using various metrics such as website traffic, conversions, engagement rates, brand awareness, and ROI (Return on Investment). Most advertising companies provide analytics and reporting tools to track the performance of campaigns and optimize strategies accordingly.

0 notes

Text

Corporate Giants: Big Tech's Influence in the Middle East

In the ever-evolving landscape of technology, the Middle East stands as a burgeoning hotspot for innovation, where traditional cultures intertwine with cutting-edge advancements. From the bustling streets of Dubai to the historic neighborhoods of Jerusalem, the region is witnessing a transformative journey driven by digitalization, entrepreneurship, and a thirst for progress.

Smart Cities Revolution

The concept of smart cities is taking root across the Middle East, with governments and urban planners embracing technology to enhance efficiency, sustainability, and quality of life. Cities like Dubai, Riyadh, and Doha are investing in IoT (Internet of Things) infrastructure, smart transportation systems, and data-driven governance to create connected urban ecosystems that cater to the needs of residents and businesses alike.

Blockchain and Cryptocurrency Innovation

Blockchain technology and cryptocurrencies are gaining traction in the Middle East, fueled by a growing interest from both public and private sectors. Countries like the UAE are leading the way with initiatives such as the Dubai Blockchain Strategy, which aims to leverage blockchain to transform government services and industries like real estate and healthcare. Tech News Middle East Additionally, startups and fintech firms are exploring the potential of cryptocurrencies to revolutionize financial transactions and cross-border payments.

Renewable Energy Revolution

With abundant sunlight and vast desert landscapes, the Middle East is embracing renewable energy as a key pillar of its future sustainability. Countries like Saudi Arabia and the UAE are investing heavily in solar and wind energy projects, aiming to diversify their economies away from oil dependence and mitigate the impact of climate change. The region is also becoming a hub for renewable energy innovation, with research institutes and startups developing breakthrough technologies in solar panels, energy storage, and grid optimization.

Women in Tech Empowerment

Women are playing an increasingly vital role in the Middle East's tech ecosystem, breaking barriers and driving innovation across various sectors. Initiatives like Womena and Womentum are empowering female entrepreneurs and professionals, providing them with access to funding, mentorship, and networking opportunities. Governments and companies are also implementing policies to promote gender diversity in the workplace, recognizing the untapped potential of women in driving economic growth and innovation.

Healthtech Revolution

The COVID-19 pandemic has accelerated the adoption of healthtech solutions in the Middle East, as governments and healthcare providers seek innovative ways to manage public health crises and improve patient outcomes. Telemedicine platforms, AI-driven diagnostics, and digital health records are becoming increasingly prevalent, enabling remote consultations, personalized treatments, and efficient healthcare delivery. Moreover, the region is witnessing a surge in investments in biotech startups and research institutes, driving breakthroughs in areas like genomics, precision medicine, and drug discovery.

Conclusion

As we navigate the complexities of a rapidly changing world, the Middle East emerges as a beacon of hope and innovation, embracing technology to shape a brighter future for generations to come. Tech News Middle East From smart cities and renewable energy to blockchain and women empowerment, the region is at the forefront of global tech trends, charting a course towards prosperity, sustainability, and inclusivity. As we embark on this transformative journey, one thing is certain – the future of technology in the Middle East is filled with endless possibilities, waiting to be unveiled.

0 notes

Text

crypto consulting firms in Dubai play a crucial role in unlocking the potential of blockchain and cryptocurrency technologies for businesses and entrepreneurs. From regulatory compliance to strategic advisory services, these firms offer a wide range of specialized services tailored to the unique needs of clients operating in the crypto space.

0 notes

Text

AML UAE vs KYC UAE: Safeguarding Financial Integrity in the Emirates

In the bustling financial hub of the Middle East, the United Arab Emirates (UAE) stands as a beacon of economic prowess, attracting businesses from diverse sectors. With the burgeoning financial activities, the risk of money laundering and financial crimes becomes pronounced. To counter these threats, the UAE government has implemented stringent regulations, emphasizing the importance of Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) measures. In this landscape, AML UAE and KYC UAE emerge as key players, each contributing uniquely to the financial integrity of the region.

AML UAE: Safeguarding Against Financial Crimes

As an AML consulting firm in the UAE, AML UAE plays a crucial role in supporting businesses across Dubai and other Emirates in complying with AML laws. The UAE's financial landscape, encompassing large banks, financial institutions, exchange houses, jewelers, and other enterprises, necessitates robust measures to combat money laundering activities and financial crimes.

The UAE government has demonstrated a commitment to tackling money laundering and terrorism financing, with AML and CTF topping its list of priorities. Organizations in the UAE are obligated to align with government initiatives, implementing AML compliance measures, frameworks, and risk profiling strategies.

AML UAE's expertise lies in navigating the complex regulatory landscape, assisting businesses in developing and implementing AML frameworks that are tailored to their specific needs. By offering comprehensive AML solutions, AML UAE supports organizations in their efforts to curb illicit money movements and prevent the funding of terrorism activities.

KYC UAE: Elevating Identity Verification with Cutting-Edge Solutions

On the other side of the spectrum, KYC UAE positions itself as a pioneer in identity verification solutions, providing an advanced ecosystem to help businesses prevent fraud, manage risk, achieve regulatory compliance, and deliver frictionless user experiences. Leveraging sophisticated technologies such as machine learning, facial recognition, and liveness biometrics, KYC UAE stands out in the market for its secure and touchless identity verification services.

KYC UAE's products are designed to operate without human involvement, offering a competitive edge in terms of efficiency and accuracy. Their commitment to providing cost-effective global identity verification services, coupled with partnerships with leaders in the data technology industry, ensures a reliable and comprehensive approach to authenticating the identities of individuals and businesses.

In the UAE, where personal data privacy is highly valued, KYC UAE adheres to rigorous identity verification procedures implemented across various data repositories and channels. These measures are in place to ensure the utmost safety and reliability of confidential information, making KYC UAE an ideal choice for businesses across sectors such as banking, finance, cryptocurrency, eCommerce, and more.

AML UAE vs KYC UAE: A Comparative Analysis

While both AML UAE and KYC UAE contribute significantly to the financial integrity of the UAE, a comparative analysis reveals distinct strengths and focus areas for each.

AML UAE excels in guiding businesses through the intricate landscape of AML compliance. With a focus on regulatory adherence, risk profiling, and tailored AML frameworks, AML UAE is a valuable ally for organizations navigating the complex world of anti-money laundering.

KYC UAE, on the other hand, specializes in cutting-edge identity verification solutions. Through the use of advanced technologies, KYC UAE ensures secure and touchless identity verification, making it a preferred choice for businesses seeking efficient and accurate identity authentication.

Conclusion: KYC UAE - The Premier Choice

In conclusion, both AML UAE and KYC UAE play pivotal roles in upholding the financial integrity of the UAE. However, the advanced and comprehensive nature of KYC UAE's identity verification solutions, coupled with its commitment to privacy and efficiency, positions it as the premier choice for businesses across various sectors. In the ever-evolving landscape of financial regulations and technological advancements, KYC UAE stands out as the best KYC solution provider, offering a holistic approach to identity verification and compliance in the United Arab Emirates. As businesses continue to navigate the complexities of financial regulations, KYC UAE emerges as a reliable partner in the journey toward a secure and compliant future.

#compliance#kyc#kyc compliance#kyc solutions#kyc and aml compliance#kyc api#kyc services#kyc verification#digital identity#kyc uae

1 note

·

View note

Text

Financial Advisory firm - Gulf Analytica

Wealth consulting for family offices in Gulf region: We are the Dubai market research experts, equipped to handle speaking events, recruitment event management, and specialized training for financial companies, particularly in areas such as hedge funds, private equity, and portfolio management, with a specific focus on their impact on business development in the Middle East.

Gulf Analytica services in Dubai: Recent examples of our involvement in major industry events include panel member participation at the AIM Alternatives Summit Dubai in November 2018, where we discussed topics related to "Family Offices - Entering the Majlis." We delved into the position of families and their businesses in GCC society, family portfolios, diversification, risk reduction, investment processes, and Sharia-compliant investment strategies for family offices.

0 notes

Text

Automatic BUSD Payment gateway Development Company

For More Details Please Contact

Call / Whatsapp: +971 50 912 5616

Website: https://OGSStechnologies.ae

Office 101, Juma Al Majid Technic Building,

Salah Al Din St., Deira,

Dubai - UAE.

Automatic BUSD Payment gateway Development Company

Cryptocurrency Payment Gateway Development Company

Develop cryptocurrency payment gateway development services that are highly responsive, blockchain-powered, feature-rich, and scalable by working with our top-rated cryptocurrency payment gateway development firm.

Make Secure Crypto Transactions with Our BUSD Crypto Payment Gateway Development

We provide BUSD payment gateway development services with market-leading security and trade capabilities as a leading cryptocurrency payment gateway development firm. To ensure a quick and secure transaction that accepts a variety of currencies, has cheap transaction fees, and has robust security, use our crypto payment gateway development. Get in touch with us right away to see how our cutting-edge crypto payment gateway app development solution can transform your company!

Our Supreme Cryptocurrency Payment Gateway Development Services

Multi-Cryptocurrency Payment Gateway

We offer a multi-cryptocurrency payment gateway that enables customers to perform transactions with whatever cryptocurrency they like.

Defi Crypto Payment Gateway

Users have complete control over their cash thanks to our DeFi's bitcoin payment gateway creation services, which do away with the necessity for intermediaries.

Crypto Payment Marketing Services

Through social media marketing, cryptocurrency influencer videos, campaigns, etc., our digital marketing team advertises the cryptocurrency payment gateway platform.

Crypto Business Consulting Services

Our crypto advisors help you analyze current crypto trends, assist in blockchain selection and address your business problems with blockchain solutions.

Mobile Application Development

We provide top-notch, highly scalable crypto payment gateway app development that works with both Android and iOS devices.

API Integration Services

We provide intriguing services for developing BUSD payment gateway that include high-quality trading and security APIs.

Features that make our Cryptocurrency Payment Gateway distinct

Cross border payments

Multiple wallets

Multilingual support

Multi-currency support

Real-time confirmations

User-friendly interface

Two-factor authorization

Peer-to-peer transaction

Easy integration

Real-time exchange

OS Compatibility

Auto Settlement option

Donation facility

White-Label Cryptocurrency Payment Gateway Development Solutions

One of the top developers of cryptocurrency payment Gateway Company is OGSS Technologies. A tried-and-true solution that has grown in favor among cryptocurrency businesses as an alternative to investing time and resources in developing a custom crypto payment gateway is white-label software.

Our industry-specific white-label solutions ensure an exceptional user experience and hasten the launch of your cryptocurrency business. Our services for developing white-label bitcoin payment gateways offer fully customized, bug-free platforms with cutting-edge trading and security features. Supply chains, healthcare, education, entertainment, real estate, and other sectors are transformed by our white-label bitcoin payment gateway creation services.

Payment Options Offered by Our Cryptocurrency Payment Gateway

Bitcoin (BTC)

Bitcoin Cash (BCH)

Ethereum (ETH)

Binance USD (BUSD)

Ripple (XRP)

USD coin (USDC)

Gemini USD (GUSD)

Solana (SOL)

Celo(CELO)

Dogecoin (DOGE)

Litecoin (LTC)

Zcash (ZEC)

Why choose OGSS Technologies For BUSD Payment Gateway Development?

Our development of crypto payment gateway apps is dependable and affordable. Building web3 crypto solutions, our knowledgeable experts, who are well-versed in blockchain technology, put their best foot forward. With the help of our services for developing cryptocurrency payment gateways, you may take cryptocurrency payments from clients all around the world by providing practical QR codes, NFC, or URL payment alternatives. Use our superb white-label crypto payment gateway solution to transform the online finance industry. As a well-known cryptocurrency payment gateway development firm, we put a lot of effort into giving you the best cryptocurrency payment gateway software so you may expand your crypto enterprises globally.

Agile methodology

24/7 Technical support

On-Time project delivery

100% client satisfaction rate

Proficient and skilful experts

Vast years of industrial experience

0 notes

Text

A New Blockchain Association In Abu Dhabi

A new blockchain and cryptocurrency-focused association has been launched within Abu Dhabi’s free economic zone that aims to further the development of blockchain and crypto ecosystems across the Middle Eastern, North Africa, and Asian regions.

The Middle East, Africa & Asia Crypto & Blockchain Association (MEAACBA) was officially launched on Nov. 8 in the Abu Dhabi Global Market (ADGM), a free economic zone based in the center of the city subject to its own set of civil and commercial laws. The zone was designed to further the growth of fintech companies in the United Arab Emirates (UAE).

The nonprofit organization will aim to facilitate regulatory solutions, create commercial opportunities and invest in education to support industry growth, according to its website.

The association will be spearheaded by board chairman Jehanzeb Awan, founder of an international risk and compliance consulting firm headquartered in Dubai.

Other supporting the association include Binance’s regional head of Middle East and North Africa (MENA), Richard Teng, Crypto.com’s general manager of Middle East and Africa, Stuart Isted, and Ola Doudin, the CEO of BitOasis, a cryptocurrency exchange in the region.

0 notes

Photo

New Post has been published on https://coinprojects.net/middle-east-asia-and-africa-blockchain-association-launches-in-abu-dhabi/

Middle East, Asia and Africa blockchain association launches in Abu Dhabi

A new blockchain and cryptocurrency-focused association has been launched within Abu Dhabi’s free economic zone that aims to further the development of blockchain and crypto ecosystems across the Middle Eastern, North Africa, and Asian regions.

The Middle East, Africa & Asia Crypto & Blockchain Association (MEAACBA) was officially launched on Nov. 8 in the Abu Dhabi Global Market (ADGM), a free economic zone based in the center of the city subject to its own set of civil and commercial laws. The zone was designed to further the growth of fintech companies in the United Arab Emirates (UAE).

The nonprofit organization will aim to facilitate regulatory solutions, create commercial opportunities and invest in education to support industry growth, according to its website.

The association will be spearheaded by board chairman Jehanzeb Awan, founder of an international risk and compliance consulting firm headquartered in Dubai.

Other supporting the association include Binance’s regional head of Middle East and North Africa (MENA), Richard Teng, Crypto.com’s general manager of Middle East and Africa, Stuart Isted, and Ola Doudin, the CEO of BitOasis, a cryptocurrency exchange in the region.

Awan said he hopes the organization will bring about a collaborative and community-based approach to further industry growth in the MENA region and “create wide-reaching benefits for this highly dynamic and exciting space.”

“The industry will benefit from the Association as it provides a coordination mechanism between regulators, government agencies, banks, legal, tax, and advisory firms to address the most pressing challenges,” he added.

ADGM’s chairman Ahmed Jasim Al Zaabi also stated that MEAACBA’s addition would contribute to a much more “progressive financial sector” in the region.

Related: UAE Web3 ecosystem houses almost 1.5K active organizations: Report

MEAACBA’s launch comes as the Financial Services Regulatory Authority (FSRA) — the financial regulator of ADGM’s free economic zone — published a set of “Guiding Principles” on its approach to navigate the regulatory complexities brought to it by the digital asset industry in September.

The principles are said to be “crypto-friendly” while still complying with some of the strict international standards on Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) by the United Nations.

The MENA region is also the fastest-growing cryptocurrency market in the world, according to a recent study. During a 12-month stretch from July 2021 and June 2022, transaction volume in MENA reached $566 billion, an increase of 48% from the previous 12 months.

The use case for cryptocurrencies in many of these emerging markets has come in the form of savings preservation and remittance payments to counter the effects of inflation in highly unstable economies.

Source link By Cointelegraph By Brayden Lindrea

#Altcoin #Binance #Bitcoin #BlockChain #BlockchainNews #BNB #Crypto #CryptoExchange

0 notes

Photo

We are a team of professional business setup consultants in Dubai, UAE. We offer comprehensive company formation services to all aspiring entrepreneurs, SMEs, and international firms looking to set up their businesses in Dubai.

https://kwsme.com/blog/how-to-setup-a-cryptocurrency-exchange-in-dubai/

#businesssetupdubai#companyregistrationindubai#companyformationindubai#businesssetupconsultantsindubai#companysetupindubai#llccompanyformationindubai#businesssetupservicesindubai#cryptocurrencylicenseindubai

0 notes

Text

Review FRX Token - DeFi Hedge Fund

FRX TOKEN- MAKING HEDGE FUND INVESTMENT MORE PROFITABLE AND WORTHWHILE

INTRODUCTION:

Guys, If you want to know about FRX First you need to know about is DeFi?

DeFi:

DeFi is an open financial ecosystem where you can build various small financial tools and services in a decentralized manner.

We see Decentralized Finance (DeFi) market began its meteoric rise in early 2020. it’s very good time for crypto community and investors.

Iast 6 months, the total value of all assets locked in DeFi has grown by a factor of 15 - from $600 million to $9 billion. Such changes indicate an increase in interest from the crypto community and investors. DeFi can be safely called the ‘hot hit’ of 2020.

FRX is a globally decentralized hedge fund token, a combination of different alpha-powers of hedge funds with the freedom granted by a denied ecosystem.

Forex Advisors is a registered firm that specializes in providing crypto trading advice to established and potential crypto exchange platforms and its clients. It was established in 2013 in Dubai, a market in the United States.

They operate derivative accounts for some business and external clients and have developed and developed derivative strategies for several for-profit businesses around the world over the past decade. Their main goal is to set and achieve a high interest rate for their clients with an investment target of at least 30% per year. They also offer cryptocurrency managed accounts that help achieve return rate rates.

Be Your Own Hedge Fund

#PoW & overload causing tremendous fees for Ethereum, all the competing chains are on the rise, Tron, Polkadot, BNB, Matic, even Avalanche.

Join the party with #FRX, making #TronNetwork professional, be your own hedge fund.

Seed Round live at: http://feroxadvisors.com/frx

Introduction to Crypto Derivatives, Advanced Bitcoin Trading Strategies, Bitmex Update 2019 & 2020

https://youtu.be/8ru7iv99mUI

Ferox Advisors(FRX):

Native Token of Ferox Advisors Limited FRX Token Platform. Demand for FRX Coins will increase with the development of Forex Advisors Ltd. With a professional and systematic marketing strategy, high interest rates and attractive rewards, it is certainly a project that is suitable for investment.

Why Choose Ferox Advisors??

The Ferox Advisor platform works using liquidity pools. These are token pools that are locked in the smart contract, these tokens so that you can be able to exchange with each other using AirTX as hydraulic. Lots of tokens (TRC-20) and all kinds of tokens that are currently supported by Firix Advisors. Also, a new liquidity pool can create a new exchange pair for any token at any time.

Private companies:

As a private company, FRX is an open platform for anyone who wants to join and invest in it individually or for company owners. As part of the FRX platform, you can benefit from a number of programs:

Key Features: Provides high liquidity, provides returns up to 300% / year, Full Intraday Trading Optionality, Low Fees at Trading,

Combining IT experts with today's technology.

As a platform that combines high technology and technology and business experts, the FRX platform hedge fund trading platform aims to:

Maximum income, profits of up to 399% per annum, is open to all without exception.

Derivatives:

Investors and users can benefit from this system. This is because derivatives are secured deposits / tokens that are guaranteed under certain agreements so that they can buy and sell transactions in exchange. And besides, investors will be able to sell first even if they haven’t bought before.

Managed Accounts:

By creating profitable strategies for investors and traders, the FRX platform can help you grow your business without imposing large fees for the trading transactions you make. Because it is definitely the main attraction for its users by providing up to 300% profit per year.

FRX VISION:

The project seeks to maintain an annual return on net equity

The minimum is 30%, with the ability to further increase the price of free gamma. We have successfully achieved both crypto options and derivatives as of 2017.

At Bitmax, we doubled our equity in less than a month's trading in 2012. We have achieved a standard fit with stock options of technology by 2020.

Now we want to provide a better profit profile for outside investors.

Removes the fund structure, banks and depositors from the equation and allows the investor to own shares of a decentralized hedge fund directly with 0 operating or operating fees.

FRX Token

Ferox Advisors is not just a hedge fund firm, it provides token hedge funds called FRX Tokens. The FRX token is a TRC20 token designed in the Tron blockchain. With this combination, Forex Advisor Alpha Hedge Fund provides a decentralized token hedge fund with productivity capabilities and the benefits of the DFI ecosystem. FRX tokens can be purchased and received by users through the Seed Round program. Users can get multiple bonus rates up to 300% in this program. The bigger the investment, the higher the bonus.

The utilities of the FRX token

In addition to participating in hedge funds, FRX is the preferred token of betting directly from the Firx Consulting website. These bets will be dynamic versions of binary options (or bets on a consistent spread), allowing users to make daily predictions on the prices of large cryptocurrencies and products such as gold, silver and crude oil via the FRX token in the payment structure.

Ferox Advisor Tokenomics:

Forex Advisors is a private limited company in which they have invented a crypto token - for investors to share its profits and for partners to participate. The FRX token will feature liquidity mining and standard yield cultivation, allowing its holders to retain tokens and generate dividends.

The project plans to deliver a total of 70,000 million TRX tokens The company said The 400 million tokens will be minted in the first year of the first year and sold and distributed in the second year. The rest will be set aside for split funding, special promotions and development roadmaps.

TOKEN INFORMATION:

Name: FEROX (FRX)

Contract : TKTENn9v56yVKHu4obmdQGpe8wFVimczxq

Symbol: FRX

Decimals: 8

Circulating Supply : 700,000,000.00000000FRX

FRX Pre-Sale is now Live!

The FRX mentioned in the previous paragraph is a trading company that focuses on trading cryptocurrencies and derivatives. The company specializes in account management for investors and earning returns based on their investments. FRX has created their platform token called FRX which is tron based. The token is designed in Tron Blockchain, one of the fastest, scalable, secure and highly efficient blockchain networks in the world. FRX is the domestic token of the FRX decentralized hedge fund platform.

FRX PRESALE INVESTMENT TIER is as follows :

10,000 TRX investment , 1 TRX = 3 FRX , Investors will get 27,000 FRX by transferring 9000 TRX to FRX wallet above

Investment worth 10,000 TRX to 50,000 TRX ( 1 TRX - 3.3 FRX) Deposit 33,000 worth of TRX, you will get 99,000 FRX

Investment up to 50,000 TRX to 300,000 TRX ( 1 TRX - 3.6 FRX) Depositi100, 000 TRX , you will receive 360,000 FRX

Investment up to 300,000 TRX and above attracts ( 1 TRX - 4FRX) Depositing 500,000 TRX will , you will receive 2,000,00 FRX

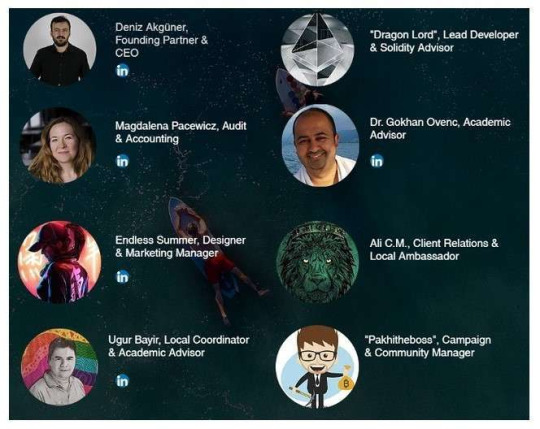

TEAM member:

CALCULATION:

An investment is an activity that is managed by allocating a certain amount of money to tools such as gold, real estate, etc. for future profit. Currently, many companies provide investment services for attractive return users. But there are risks to investing, users must be prudent in investing their money so that they do not lose their assets.

Above all, to guarantee the traceability, and authentication of ownership, the FRX Token transactions are registered into the blockchains, and these will enable the mobility, liquidity, and trading of physical gold. Now is the right time for crypto enthusiasts and investors to enjoy the great benefits which FRX Defi Investment offers by investing in tins amazing, highly secure, and valuable token (FRX Token)

MORE INFORMATION:

Website: http://feroxadvisors.com/team

Twitter: https://twitter.com/feroxadvisors

Telegram: https://t.me/FRXalpha

Medium: https://frx.medium.com/

Github: https://github.com/opentron/opentron

AUTHOR:

Bitcointalk Username: Manuel Akanji

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2954998

Tron Wallet: TCNg5eeoLS4QkfRLWZKzBRAdSNNQ4Pf4x5

2 notes

·

View notes

Text

Cryptocurrency Trading Business Setup in Dubai

Entrepreneurs who want to set up cryptocurrency or other online businesses have faced digital challenges as a result of the expansion of the global village.

Many people who are new to the internet business world don’t know what steps they must follow to get full access to their virtual business.

Dubai is the platform that provides the best business opportunities. It also creates connections with consumers in order to make a profit.

To avoid unfavourable consequences, there are certain details that you must know before starting an online company in Dubai.

License to Cryptocurrency Business in Dubai.

A business without a valid license is a problem for both your business and your deals.

Dubai has strict regulations regarding permit registration. These rules are very useful for continuing your work in Dubai while you live there.

For entrepreneurs and new businessmen, the process of approving licenses is confusing.

Make My Firm Business Setup is a company that specializes in solving business problems in the UAE.

Make My Firm can assist you in setting up a cryptocurrency company in Dubai. They will also help you obtain a legal trade licence from the Department of Economic Development.

Once you have registered with Dubai Economic Development you will be able to freely trade or obtain any Dubai online business license.

Register.

After obtaining your Dubai cryptocurrency business license, you can register your company with a unique company name, logo, mission statements and slogans. This will show Dubai ans that your business has entered the most active market of the UAE.

Although registry criteria can be complicated, with the right guidance you will be able to obtain all agreements and reserve a domain name for your online company.

Make My Firm best consultants can resolve registration benchmarks. They will list you in commercial register, including an online brand licence issued by the Department of Economic Development.

Choosing a site/Renting an office.

Although cryptocurrency trading in Dubai can be profitable, it is not possible to keep the business going for the long-term unless you have a place where you can expand or start up new branches.

It is essential to have an office. If you don’t know the area, it can be very difficult for you and your colleagues to establish a workplace.

Make My Firm is connected to most major companies that rent offices to entrepreneurs or businessmen from offshore who wish to start an internet business in Dubai.

Understanding Arabic Language.

If there is a language barrier, it can make it difficult to set up a cryptocurrency company in Dubai. This could cause confusion and damage your professional reputation.

Make My Firm native language negotiators are the best in the business. They can talk with landowners to find a place for you to start your new business.

Most paperwork is done in Arabic. If you don’t know the local language of UAE, it will be difficult to rent your office.

They will handle all paperwork and send you documents as quickly as possible.

Choosing the Domain for Cryptocurrency Mining.

The next step in starting a cryptocurrency company is to choose a website address and create a user-friendly website.

You should think outside the box before you choose a domain name for your brand. This will ensure that you are supported in every step of developing a website.

The domain name should be easy to pronounce, and it shouldn’t be too long. Visitors will have a better experience with your website if your domain address is professional.

Make My Firm has been providing a team of highly skilled and experienced professionals to help you find the best ideas for your domain.

They will show you how to increase SEO-friendly visits to your website, and minimize errors when registering your site with Dubai.

Opening a Bank Account

Technology has allowed money transactions to be done online. If you have a Dubai cryptocurrency business license that is linked with cryptocurrency, or any other business, a bank account must be opened.

There are many banks in Dubai, but it can be difficult to find the one that suits your needs.

Make My Firm can also help you set up bank accounts for your business. They have the best Arabic-speaking staff and will handle any banking issues to prevent loss or troubleshooting.

The Advantages of Cryptocurrency Business in Dubai:

Dubai is a place that attracts newcomers and local business owners.

If you plan to make a living here, it does not necessarily mean that you will have to deal with unsettling issues.

There are many advantages that will encourage you to start a successful business that can last a long time.

You can start your business faster if you plan well and contact professional business firms.

You will not have to worry about complicated laws and rules. This will allow you to focus on your business activities.

Less expensive:

Dubai offers a range of packages that promise to cover the cost for the registration or trading license. You can also rent a large area in a variety of areas depending on your needs.

VISA More than One:

Make My Firm Business Setup offers some amazing bundles to get UAE/Dubai Visa for you, your family, and business partners or for personal use.

Imagine opening a cryptocurrency business setup in Dubai, and reaping the benefits of appropriate bundles. This is a win-win situation.

Visit the Make My Firm Business Setup website to learn more about key factors for starting an E-business in Dubai.

0 notes

Photo

New Post has been published on https://primorcoin.com/degens-can-stake-crypto-to-help-the-ukrainian-people/

Degens can stake crypto to help the Ukrainian people

Laura K. Inamedinova is a marketing agency CEO from Lithuania who started early with ICOs, a journey that has led her to launch UkrainianPool, an initial staking pool offering raising money for the Ukrainian government.

Inamedinova got into ICOs right out of university in 2016 and is shy to mention the name of the first crypto fundraising project she worked for. “There were definitely not only bad projects, but you didn’t know at that time,” she explains, referring to the early days of the industry. “You didn’t know that anything was off at the time,” she says with a chuckle.

Inamedinova’s early plunge into the industry may not have met with success, but after a number of more successful projects such as Waves and CoinGate, her experience has led to a most interesting development: a humanitarian fundraiser in collaboration with the Ukrainian government.

Laura Inamedinova created Ukrainian Pool.

UkrainianPool is a Cardano staking pool that works by allowing anyone to deposit Cardano into the pool, which grows at 5% per year, according to Cardano’s staking rewards schedule. Inamedinova explains that this form of charitable support is effectively risk-free because staked tokens can be un-staked at any time and never leave the owner’s wallet. Inamedinova explains:

“Every five days, accumulated rewards get passed on to the Ukrainian government’s wallet.”

The project became possible after Inamedinova, who was close to a DeFi project that incorporated the ISPO strategy, came to the realization that the staking pools could be used for charity. She shared the idea with Nadiia Dvoinos, a serial entrepreneur who used to run Quadrate 28 — an in-house marketing firm for startups. Inamedinova met her on her first visit to Dubai and describes Dvoinos as a mentor.

Dvoinos got in touch with her former business partner Valeriya Ionan, who now serves as Ukraine’s deputy minister for eurointegration at the Ministry of Digital Transformation. A zoom call was arranged with various government figures on March 8, and UkrainianPool went live soon after.

Only 10 days after the call, Ukrainian Deputy Minister of Digital Transformation Alex Bornyakov explained the project to The New York Times:

“Participants do not need to directly donate assets to raise money. Instead, they ‘stake’ their funds temporarily, which generates high-interest yields that are transferred to a wallet owned by our ministry.”

He added that the pool’s goal is to raise $10 million “for humanitarian efforts” — things such as food, medicine and protective equipment, including helmets and ballistic vests, according to other publications by the ministry.

“As far as I know, this is the first charitable project using the ISPO model,” Inamedinova notes, referring to an initial staking pool offering.

A publication posted on Twitter shows donations made by the ministry. Source: Ukrainian Ministry of Digital Transformation

LKI Consulting

Inamedinova runs LKI Consulting, which has a team of 10 staff members distributed across Europe. “We have two Ukrainians; we just hired a refugee,” she notes.

The company represents Inamedinova’s return to the blockchain marketing niche. As we meet in Dubai’s Marina Mall in an office overlooking a yacht club, she recounts a meeting she just left. “I had to sit through the whole hour to be polite, though I knew within five minutes that it wasn’t going to work — these guys don’t even know what they are building,” she laments regarding her prospective clients.

“The industry sucked me in without me even planning that,” Inamedinova recounts regarding her return to the blockchain industry in 2020 after having previously left behind the glamorous life of an initial coin offering consultant in the 2016–2017 bull market.

This time, the cryptocurrency market was different, as the ICO funding mechanism had gone out of style in part owing to the fact that the majority of ICO investors had lost money during the 2017 cryptocurrency bubble, during which anonymous teams were raising tens of millions of dollars with just a white paper or vague slideshow.

The famous meme detailing exactly how many ICOs played out.

The initial stake pool offering was thought up as an alternative by DeFi project Meld, which conducted one to successfully raise millions in October 2021 after 40,000 users staked over $1 billion of Cardano’s ADA. While discussing Meld’s success with a close friend in the early days of the Russian invasion of Ukraine, they came to a realization that “ISPO and Ukraine — these two words just made sense,” Inamedinova recounts. In addition to Inamedinova, the initiative includes Paulius Vaitkevičius, Ugnius Šeškas and Karolis Gogaitis, all of whom are from Lithuania.

ICO promoter

Though Inamedinova was born in Lithuania’s capital, Vilnius, she spent much of her childhood abroad, first in Vietnam and later in Thailand, where her father worked in the real estate industry. The family moved back to Lithuania as Inamedinova reached her teens, and at 14, she was excited to get a job with a home appliance business owned by a family friend.

“My first job wasn’t glamorous. It was literally cleaning used washing machines and refrigerators,” she recalls, adding that the 15 Litas she made per machine was a significant amount for someone her age in pre-euro Lithuania.

Upon graduating high school, she began a Bachelor of Physics on a full scholarship at Vilnius University in 2012. Despite her love of science, Inamedinova soon decided, “I’m not going to be a scientist; I don’t want to be in the lab for extended periods of time, as I’m more of a people person.” As she excelled in giving group presentations, Inamedinova “felt that my role could be to communicate difficult concepts in a way that is easy to understand” and began pursuing internships outside the lab.

Her first internship was in cybersecurity with Barclays bank. The experience broadened her horizons, fuelling a deeper interest in economics and finance. Describing herself as always having held a libertarian outlook, Inamedinova joined a free-market think tank, which she saw as a way to break into the field of economics. After some time in what she describes as a male-dominated industry, Inamedinova says that “it was quite clearly communicated between the lines that I’m never going to be taken seriously in that sector due to my gender,” so she changed course toward the technology industry.

She began helping a friend with a startup that resembled a “Kickstarter for startups, where the best ideas get funded,” but the project failed to take off.

She also interned at Vinted, a company selling used clothing that went on to become the first unicorn tech company in Lithuania. “They were still a small company at the time; I was doing customer support,” she recalls.

Inamedinova tells her story from a conference room overlooking the Dubai Marina. Photo by Elias Ahonen

Though she had no real experience in public relations, she was hired as a communications for Plag, a social media app, whose hiring manager told her, “You talk a lot, so I think you’ll be good with journalists.” While taking care of marketing for her employer, Inamedinova came to realize that she also wanted to build a personal brand as an expert in the business and technology sector.

While attending Web Summit in Ireland, Inamedinova met Forbes managing editor Bruce Upbin, who mentioned that the magazine was looking for someone to cover technology in the Baltics, which is where Lithuania is located. “I think he liked that I was hustling and building something,” and he offered her the opportunity. Beginning in April 2016, she wrote pieces such as “20 Growth-Hacking Strategists You Should Follow In 2016” and, in July, began contributing what she calls “thought leader articles” to Huffington Post as well.

Her career as a reporter came to an end, however, when a new managing editor took issue with Inamedinova’s work in marketing and told her that she should choose to be either a journalist or a public relations person. “I was, like, ‘Sorry, I’m going to be a PR person,’” she recalls telling her manager.

It was around this time that “crypto came knocking at my door” in 2016 when, due to her experience in public relations, a friend of a friend asked for assistance in launching an initial coin offering, or ICO. Though Inamedinova knew little about the blockchain industry, she felt she had nothing to lose.

“Laura, why don’t you help us fundraise money for our project? We’re only gonna have three Ws: Website, White paper, and a Wallet. We’re going to be rich. That was his pitch.”

The team managed to raise a few million dollars, and Inamedinova realized that she had a unique opportunity at hand. “When you do one ICO and talk about it, others start approaching you. This was a huge opportunity for me, as I was only 21 at the time,” she recounts. With a year in the industry, she knew she could build a personal brand. “I can actually make a difference here. I can be listened to and build something,” she reasons, with the existing technology marketing world being far more competitive for a newcomer.

The ICO consulting industry gave Inamedinova the opportunity to travel the world, attending conferences and often giving speeches. Companies she worked with in this time included CoinGate and Waves, both of which “were proper and are still operational,” she notes.

“I was speaking about crypto everywhere — in London, Belgrade and a workshop in New York. So, basically, after a year and a half doing crypto, I was the OG, honestly,” she says with a laugh.

“The clients I worked with in 2016–2017 raised more than $200 million via crypto funding methods — ICOs, STOs, everything like that.”

Despite loving the spotlight, Inamedinova took a break for a year as the ICO market dried up. After some reflection, she decided that “my career, my business is the most important thing for me” and, in 2019, returned to PR work — her bread and butter — taking the lead of communications at both Cybernews, a technology media outlet, and Aurora Cannabis’ hemp division. “I was always doing at least two things at a time,” she explains, adding that she ultimately developed a dislike for the cannabis industry and its promotion of recreational use.

As signs of optimism returned to the crypto market around 2020, so did the need for crypto PR.

“I started to get a lot of inquiries from my old acquaintances — they needed everything related to crypto marketing.”

The future of ISPOs

Considering Cardano’s 5% annualized payout, the $10-million goal would require $200 million of ADA to be staked for one year — a little less than 1% of the $23.4 billion of ADA, which is currently staked. So far, however, only about $200,000 is staked in the pool, meaning that the biweekly payout to the ministry would amount to a measly $400 — funding is 0.1% complete, in other words.

This lack of engagement is somewhat surprising, considering that the vast majority of Cardano staking pools operate in countries considered supportive of Ukraine’s cause, which would suggest that the Cardano community might also be generally supportive. That said, the drawback of ISPO strategies as they exist so far is that they are limited to single cryptocurrencies, meaning that promotion must target a highly specific community as opposed to cryptocurrency holders in general.

Adatainment.com collects information on the locations of Cardano staking pool operators.

ISPOs can be conducted using “any token that offers API for staking,” possibly including Ethereum later on.

Inamedinova believes that the ISPO model has a bright future both in charity donations and startup funding because the psychology of contributing money from staking is different from that of more traditional philanthropy or investing, which typically involves budgeting and allocating money away from other competing purposes. Since “the whole idea of the staking pool offering is that you don’t actually have to give away money,” participating in an ISPO does not feel like money is actually being spent.

“When people invest, they think there needs to be a certain percentage likelihood of it actually working — I could see ISPOs becoming a fun way of funding moonshots.”

Source link

#ADA #Blockchain #Cardano #Crypto #CryptoNews #TraedndingCrypto

0 notes

Text

The in-principle approval from the Abu Dhabi Global Market allows Binance to operate as a broker-dealer in digital assets including cryptocurrencies.

Binance, the world’s biggest crypto exchange in terms of trading volume, received in-principle approval to operate in Abu Dhabi, marking its third regulatory approval in the Middle Eastern region after Bahrain and Dubai. The in-principle approval from the Abu Dhabi Global Market (ADGM) allows Binance to operate as a broker-dealer in digital assets including cryptocurrencies — marking yet another milestone for the crypto exchange, which envisions to operate as a fully-licensed firm.@binance, one of the world's leading #blockchain and #cryptocurrency platforms, received an IPA from the #ADGM Financial Services Regulator Authority. pic.twitter.com/jhHenzaahE— Abu Dhabi Global Market (@ADGlobalMarket) April 10, 2022

ADGM serves as an international financial free zone within the capital of the United Arab Emirates, which historically has played an important role in regulatory and supervisory oversight of the financial services provided within its jurisdiction. Reciprocating Binance’s efforts to score regulatory licenses across the globe, ADGM stated:“The IPA is part of Binance’s plans in establishing itself as a fully-regulated virtual asset service provider in an internationally recognized and well-regulated financial center.”The ADGM also shared its intent to provide similar regulatory approvals for local as well as global crypto companies to further position Abu Dhabi as the “fast-growing virtual assets hub and digital economy.”Dhaher bin Dhaher, CEO of ADGM, too, welcomed the move by promising to aid Binance’s efforts to establish their presence in Abu Dhabi. Apart from Binance, prominent crypto exchange FTX has previously been awarded operational licenses in Dubai, the second biggest city in the UAE after Abu Dhabi. Related: Abu Dhabi rolls out draft recommendations for NFT tradingOn Mar. 22, ADGM published a consultation paper, which proposed that ADGM-licensed companies will be allowed to facilitate NFT trading in the jurisdiction. As Cointelegraph highlighted, the free zone’s chief regulator, the Financial Services Regulatory Authority (FSRA), described NFTs in the ADGM consultation paper as intellectual property rather than “specified investments or financial instruments.”However, the allowance of NFT trading will most likely require licensed companies to comply with ADGM’s Anti-Money Laundering (AML) and Sanctions Rules.

Go to Source

0 notes

Text

Gisec 2022: du plans to offer bug bounty as a service to its customers

Emirates Integrated Telecommunications Company, known as du, is planning to offer a bug bounty as a service to its customers following the success of its trial programme.

A bug bounty is a reward given to ethical hackers who are able to discover and report a vulnerability – a bug – in a computer app or software, enabling solutions to be programmed before the bug becomes widespread.

The pilot phase of du's bug bounty programme, which was completed in two months and included the participation of several “elite security people”, allowed the telecom company to explore vulnerabilities before the services go to market, said Jasim Al Awadi, head of government and key accounts at du.

“We have concluded our bug bounty programme and the results are phenomenal. Very soon we will start implementing it in our network. We will have an on-premises server, then we will offer it as a service to our customers,” Mr Al Awadi told The National in an interview at the Global Information Security Expo and Conference in Dubai.

The UAE National Cybersecurity Council launched the bug bounty programme in August 2020 with the goal of strengthening the country's cyber security systems.

Du, along with e& — then known as Etisalat Group — and the Telecommunications and Digital Government Regulatory Authority, were among the first to trial it.

Abu Dhabi-based telecom operator e& – which rebranded last month – completed the first bug bounty programme in October during Gitex Technology Week.

The two-month pilot was conducted in collaboration with Yogosha, a Paris-based crowdsourced bug bounty platform, and Abu Dhabi-based defence consulting firm Beacon Red.

The global bug bounty market was valued at $223.1 million in 2020 and is projected to hit almost $5.5 billion by 2027, growing at a compound annual rate of 54.4 per cent from 2017-2027, according to California-based data provider All The Research

By industry, internet and online services is the most served category with almost a quarter of market share, followed by computer software (16 per cent), financial services and insurance (8 per cent), media and entertainment (7 per cent) and cryptocurrency and blockchain (4 per cent), according to data from Statista.

Regionally, North America has the largest share of the market at almost 50 per cent, followed by Europe and Asia-Pacific each, with about 20 per cent. Latin America, and the Middle East and Africa account for roughly 3 per cent each, All The Research said.

Companies, most notably in Big Tech, have recruited the hacker community to assist them in this endeavour.

Google, the world's biggest internet company, handed out a record $8.7m in bounty payouts in 2021, with the biggest a $157,000 reward for a security issue found within its Android mobile operating system.

In 11 years, the company made almost $38m in payouts.

Apple's Security Bounty programme, meanwhile, is more lucrative. Successful hunters can earn as much as $1m, and the iPhone maker will even match donations of the bounty payment to qualifying charities, according to its website.

Mr Al Jasim did not provide details of du's bug bounty rewards scheme, but said the efforts of their participants have been well recognised.

“For the bounty programme, we are part of the community and we are engaging by rewarding them based on the agreement between us and Yogosha,” he said.

The bug bounty programme is part of the wider efforts of the UAE’s wider efforts to strengthen its cyber defences at a time of an increased threat, Mr Al Jasim said.

Du, he said, continues to invest “billions” on an annual basis on its telecom infrastructure, with security “having a good chunk of that".

“We are investing in engineers, people and processes to build all of these defence mechanisms to protect the nation and the people living in it,” he said.

“About 10 to 15 years back, cyber security was a luxury item to have, but now it’s now a necessity. Cyber security is [part of our] DNA – it is something that we need to live with on a daily basis.”

0 notes