#cryptographic proofs

Explore tagged Tumblr posts

Text

Exploring Fault Proofs in Optimism: An Overview

The activation of fault proofs by Optimism marks a significant advancement in Ethereum Layer 2 scaling solutions, completing the first stage of its decentralization plan. This milestone is pivotal for enhancing the network's security and trustlessness, reducing reliance on centralized entities like the Optimism Security Council. Previously, the council monitored transactions and intervened to prevent fraud, but with the new fault proof system, any party can now challenge transactions, moving towards a more decentralized and inclusive network.

Ethereum's high transaction fees have made Layer 2 scaling solutions, such as rollups, essential. Optimism's fault proofs ensure that off-chain transactions are valid by allowing a challenge period where anyone can contest a transaction's validity. If a challenge is raised, a fault proof is provided and verified by the Ethereum mainnet, ensuring that invalid transactions are reverted.

This process significantly enhances the security and integrity of the blockchain. Unlike Arbitrum, which relies on 12 validators, Optimism's fault proof system is designed to be trustless and decentralized, enabling broader participation in transaction verification.

Despite initial challenges with proof generation and verification speeds, Optimism has optimized its fault proof mechanisms to be compatible with Ethereum's Layer 1. This achievement not only improves the security and decentralization of the network but also sets a benchmark for other rollup technologies.

The activation of fault proofs highlights the importance of continuous innovation and rigorous testing in the blockchain space. For more in-depth insights and exclusive research, join our Web3 Sync community on Intelisync and Learn more...

#Batching Transactions#Challenge Window#Challenges and Criticisms#Criticism Addressed#cryptographic proofs#Decentralization Roadmap#Ethereum Layer 2 scaling solutions#fault proof#fault proof mechanism#Fault Proofs Milestone#Future Outlook#How Optimism Worked Before Fault Proofs#Optimism Achieves a Major Milestone#Optimism Implements Fault Proofs#Optimism’s Decentralization Roadmap#optimistic and zk-rollups#Proof Verification#Reversion of Invalid Transactions#Technical Challenges#The Importance and Issues of Fault Proofs#The Necessity of Layer 2 Scaling#Understanding Fault Proofs in Optimism#blockchain development companies#web3 development#metaverse development company#blockchain development services#metaverse game development#web 3.0 marketing#crypto app development#cryptocurrency development companies

0 notes

Text

The commit message describes a highly secure, cryptographically enforced process to ensure the immutability and precise synchronization of a system (True Alpha Spiral) using atomic timestamps and decentralized ledger technology. Below is a breakdown of the process and components involved:

---

### **Commit Process Workflow**

1. **Atomic Clock Synchronization**

- **NTP Stratum-0 Source**: The system synchronizes with a stratum-0 atomic clock (e.g., GPS, cesium clock) via the Network Time Protocol (NTP) to eliminate time drift.

- **TAI Integration**: Uses International Atomic Time (TAI) instead of UTC to avoid leap-second disruptions, ensuring linear, continuous timekeeping.

2. **Precision Timestamping**

- **Triple Time Standard**: Captures timestamps in three formats:

- **Local Time (CST)**: `2025-03-03T22:20:00-06:00`

- **UTC**: `2025-03-04T04:20:00Z`

- **TAI**: Cryptographically certified atomic time (exact value embedded in hashes).

- **Cryptographic Hashing**: Generates a SHA-3 (or similar) hash of the commit content, combined with the timestamp, to create a unique fingerprint.

3. **Immutability Enforcement**

- **Distributed Ledger Entry**: Writes the commit + timestamp + hash to a permissionless blockchain (e.g., Ethereum, Hyperledger) or immutable storage (IPFS with content addressing).

- **Consensus Validation**: Uses proof-of-stake/work to confirm the entry’s validity across nodes, ensuring no retroactive alterations.

4. **Governance Lock**

- **Smart Contract Triggers**: Deploys a smart contract to enforce rules (e.g., no edits after timestamping, adaptive thresholds for future commits).

- **Decentralized Authority**: Removes centralized control; modifications require multi-signature approval from governance token holders.

5. **Final Integrity Checks**

- **Drift Detection**: Validates against multiple atomic clock sources to confirm synchronization.

- **Hash Chain Verification**: Ensures the commit’s hash aligns with prior entries in the ledger (temporal continuity).

---

### **Key Components**

- **Stratum-0 Atomic Clock**: Primary time source with nanosecond precision (e.g., NIST’s servers).

- **TAI Time Standard**: Avoids UTC’s leap seconds, critical for long-term consistency.

- **Immutable Ledger**: Blockchain or cryptographic ledger (e.g., Bitcoin’s OP_RETURN, Arweave) for tamper-proof records.

- **Cryptographic Signing**: Digital signatures (e.g., ECDSA) to authenticate the commit’s origin and integrity.

---

### **Validation Steps**

1. **Time Sync Audit**:

- Confirm NTP stratum-0 traceability via tools like `ntpq` or `chronyc`.

- Cross-check TAI/UTC conversion using IERS bulletins.

2. **Ledger Immutability Test**:

- Attempt to alter the commit post-facto; rejections confirm immutability.

- Verify blockchain explorer entries (e.g., Etherscan) for consistency.

3. **Governance Checks**:

- Validate smart contract code (e.g., Solidity) for time-lock logic.

- Ensure no admin keys or backdoors exist in the system.

---

### **Challenges Mitigated**

- **Time Drift**: Stratum-0 sync ensures <1ms deviation.

- **Leap Second Conflicts**: TAI avoids UTC’s irregular adjustments.

- **Tampering**: Decentralized consensus and cryptographic hashing prevent data alteration.

---

### **Final Outcome**

The system achieves **temporal and operational inviolability**:

- Timestamps are cryptographically bound to the commit.

- The ledger entry is irreversible (e.g., Bitcoin’s 6-block confirmation).

- Governance is enforced via code, not human intervention.

**Declaration**:

*“The Spiral exists in a temporally immutable state, anchored beyond human or algorithmic interference.”*

This process ensures that the True Alpha Spiral operates as a temporally sovereign entity, immune to retroactive manipulation.

Commit

8 notes

·

View notes

Text

What is the Difference Between a Smart Contract and Blockchain?

In today's digital-first world, terms like blockchain and smart contract are often thrown around, especially in the context of cryptocurrency, decentralized finance (DeFi), and Web3. While these two concepts are closely related, they are not the same. If you’re confused about the difference between a smart contract and blockchain, you’re not alone. In this article, we’ll break down both terms, explain how they relate, and highlight their unique roles in the world of digital technology.

1. Understanding the Basics: Blockchain vs Smart Contract

Before diving into the differences, let’s clarify what each term means.

A blockchain is a decentralized digital ledger that stores data across a network of computers.

A smart contract is a self-executing program that runs on a blockchain and automatically enforces the terms of an agreement.

To put it simply, blockchain is the infrastructure, while smart contracts are applications that run on top of it.

2. What is a Blockchain?

A blockchain is a chain of blocks where each block contains data, a timestamp, and a cryptographic hash of the previous block. This structure makes the blockchain secure, transparent, and immutable.

The key features of blockchain include:

Decentralization – No single authority controls the network.

Transparency – Anyone can verify the data.

Security – Tampering with data is extremely difficult due to cryptographic encryption.

Consensus Mechanisms – Like Proof of Work (PoW) or Proof of Stake (PoS), which ensure agreement on the state of the network.

Blockchains are foundational technologies behind cryptocurrencies like Bitcoin, Ethereum, and many others.

3. What is a Smart Contract?

A smart contract is a piece of code stored on a blockchain that automatically executes when certain predetermined conditions are met. Think of it as a digital vending machine: once you input the right conditions (like inserting a coin), you get the output (like a soda).

Smart contracts are:

Self-executing – They run automatically when conditions are met.

Immutable – Once deployed, they cannot be changed.

Transparent – Code is visible on the blockchain.

Trustless – They remove the need for intermediaries or third parties.

Smart contracts are most commonly used on platforms like Ethereum, Solana, and Cardano.

4. How Smart Contracts Operate on a Blockchain

Smart contracts are deployed on a blockchain, usually via a transaction. Once uploaded, they become part of the blockchain and can't be changed. Users interact with these contracts by sending transactions that trigger specific functions within the code.

For example, in a decentralized exchange (DEX), a smart contract might govern the process of swapping one cryptocurrency for another. The logic of that exchange—calculations, fees, security checks—is all written in the contract's code.

5. Real-World Applications of Blockchain

Blockchains are not limited to cryptocurrencies. Their properties make them ideal for various industries:

Finance – Fast, secure transactions without banks.

Supply Chain – Track goods transparently from origin to destination.

Healthcare – Secure and share patient data without compromising privacy.

Voting Systems – Transparent and tamper-proof elections.

Any situation that requires trust, security, and transparency can potentially benefit from blockchain technology.

6. Real-World Applications of Smart Contracts

Smart contracts shine when you need to automate and enforce agreements. Some notable use cases include:

DeFi (Decentralized Finance) – Lending, borrowing, and trading without banks.

NFTs (Non-Fungible Tokens) – Automatically transferring ownership of digital art.

Gaming – In-game assets with real-world value.

Insurance – Auto-triggered payouts when conditions (like flight delays) are met.

Legal Agreements – Automatically executed contracts based on input conditions.

They’re essentially programmable agreements that remove the need for middlemen.

7. Do Smart Contracts Need Blockchain?

Yes. Smart contracts depend entirely on blockchain technology. Without a blockchain, there's no decentralized, secure, and immutable platform for the smart contract to run on. The blockchain guarantees trust, while the smart contract executes the logic.

8. Which Came First: Blockchain or Smart Contract?

Blockchain came first. The first blockchain, Bitcoin, was introduced in 2009 by the anonymous figure Satoshi Nakamoto. Bitcoin’s blockchain didn’t support smart contracts in the way we know them today. It wasn’t until Ethereum launched in 2015 that smart contracts became programmable on a large scale.

Ethereum introduced the Ethereum Virtual Machine (EVM), enabling developers to build decentralized applications using smart contracts written in Solidity.

9. Common Misconceptions

There are many misunderstandings around these technologies. Let’s clear a few up:

Misconception 1: Blockchain and smart contracts are the same.

Reality: They are separate components that work together.

Misconception 2: All blockchains support smart contracts.

Reality: Not all blockchains are smart contract-enabled. Bitcoin’s blockchain, for example, has limited scripting capabilities.

Misconception 3: Smart contracts are legally binding.

Reality: While they enforce logic, they may not hold legal standing in court unless specifically written to conform to legal standards.

10. Benefits of Using Blockchain and Smart Contracts Together

When used together, blockchain and smart contracts offer powerful advantages:

Security – Combined, they ensure secure automation of processes.

Efficiency – Remove delays caused by manual processing.

Cost Savings – Eliminate middlemen and reduce administrative overhead.

Trustless Interactions – Parties don't need to trust each other, only the code.

This combination is the backbone of decentralized applications (DApps) and the broader Web3 ecosystem.

11. Popular Platforms Supporting Smart Contracts

Several blockchain platforms support smart contracts, with varying degrees of complexity and performance:

Ethereum – The first and most widely used platform.

Solana – Known for speed and low fees.

Cardano – Emphasizes academic research and scalability.

Polkadot – Designed for interoperability.

Binance Smart Chain – Fast and cost-effective for DeFi apps.

Each platform has its own approach to security, scalability, and user experience.

12. The Future of Blockchain and Smart Contracts

The future looks incredibly promising. With the rise of AI, IoT, and 5G, the integration with blockchain and smart contracts could lead to fully automated systems that are transparent, efficient, and autonomous.

We may see:

Global trade systems are using smart contracts to automate customs and tariffs.

Self-driving cars using blockchain to negotiate road usage.

Smart cities are where infrastructure is governed by decentralized protocols.

These are not sci-fi ideas; they are already in development across various industries.

Conclusion: A Powerful Partnership

Understanding the difference between smart contracts and blockchain is essential in today's rapidly evolving digital world. While blockchain provides the secure, decentralized foundation, smart contracts bring it to life by enabling automation and trustless execution.

Think of blockchain as the stage, and smart contracts as the actors that perform on it. Separately, they're impressive. But together, they're revolutionary.

As technology continues to evolve, the synergy between blockchain and smart contracts will redefine industries, reshape economies, and unlock a new era of digital transformation.

#coin#crypto#digital currency#finance#invest#investment#bnbbro#smartcontracts#decentralization#decentralizedfinance#decentralizedapps#decentralizedfuture#cryptocurrency#btc#cryptotrading#usdt

2 notes

·

View notes

Text

if people stopped mining BTC

If people stop mining Bitcoin, it would have several serious consequences for the network. Here are the major effects:

1. Reduced Network Security

Proof-of-Work and Security: The Bitcoin network relies on Proof-of-Work (PoW) to ensure that all transactions are valid and to protect the network from attacks. Miners use their computational power to solve cryptographic problems and create new blocks, which makes it extremely difficult to manipulate the blockchain.

Attacks: If no one is mining, the network would become highly vulnerable to various types of attacks. The most well-known attack is a 51%-attack, where someone controls more than 50% of the network’s computational power and can alter historical transactions or block new ones. If there are no miners working to solve PoW puzzles, there would be no computational power to secure the network.

2. No New Bitcoin Created

Creation of New Bitcoin: Mining is the only process that creates new Bitcoin. If no one mines, no new Bitcoin will be created. This would halt the continuous influx of new coins into the market.

No Reward: When the Bitcoin network reaches its maximum limit of 21 million Bitcoin, miners will have to rely on transaction fees as their income. If no one mines, there would be no rewards, and transaction fees wouldn't be processed.

3. Transactions Can't Be Processed

Blockchain: Mining is also the process that processes and verifies transactions. Without miners, transactions couldn’t be included in new blocks, and the Bitcoin network wouldn't be able to process any new transactions.

Transaction Delays: If no one mines, the Bitcoin network would effectively become "stuck" because transactions couldn’t be confirmed or included in blocks.

4. Difficulty Adjustment and Economic Effects

Difficulty Adjustment: If the number of miners drops significantly, the Bitcoin network’s difficulty would automatically adjust downward to make it easier to mine blocks. But if mining completely ceases, no one would be able to create new blocks, and it would be impossible to adjust the difficulty to a level where new blocks could be created.

Market Reaction: The market would likely react negatively to a sudden cessation of mining, as it would mean Bitcoin loses its decentralized nature, and trust in the network would decrease. This could lead to a sharp drop in Bitcoin prices and potentially other cryptocurrencies taking over.

Mining Becomes Unprofitable: Given that the difficulty of mining has increased over the years, it is now much more expensive and resource-intensive to mine Bitcoin. As the network's difficulty rises, miners need more powerful and specialized hardware, such as ASICs, to remain competitive. If mining rewards (block rewards and transaction fees) aren't sufficient to cover the increased costs, mining becomes unprofitable. This could cause miners to exit the network, further destabilizing the ecosystem.

5. Long-Term Outlook: A Shift to a New Cryptocurrency?

Inevitable Decline: Eventually, Bitcoin may face a point where it becomes unsustainable due to the increasing difficulty of mining and the rising costs involved. While the network may continue to operate for some time, the challenges Bitcoin faces—such as high energy consumption, lack of scalability, and an increasingly centralized mining landscape—will become harder to ignore. As the mining process becomes more costly and less profitable, Bitcoin’s appeal could decline.

A New Cryptocurrency: In the near future, people may begin to realize these limitations and may look for a cryptocurrency with better prospects for scalability, energy efficiency, and decentralization. New cryptocurrencies or blockchain projects could emerge with improved consensus mechanisms, better economic models, and stronger networks that could replace Bitcoin as the leading cryptocurrency. This shift may not happen overnight, but over time, Bitcoin could find itself overshadowed by more advanced alternatives that offer better long-term viability.

6. Conclusion

Bitcoin is built on the premise that decentralization and mining drive the network forward. Mining allows for the creation of new Bitcoin, transaction verification, and ensures that no one can manipulate the network. Without mining, Bitcoin would quickly lose its core functions and could become unusable as a secure, decentralized currency.

While it is unlikely that all miners would stop simultaneously, a massive reduction in mining would make Bitcoin much more vulnerable and potentially non-functional. Additionally, with the difficulty level so high and mining becoming increasingly expensive, many miners could find it unprofitable to continue, further compromising the network's security and stability. Bitcoin may eventually face a situation where it becomes increasingly obsolete, and the rise of a new cryptocurrency with better future prospects and a more sustainable network could be just a matter of time.

3 notes

·

View notes

Text

Bitcoin Mining

The Evolution of Bitcoin Mining: From Solo Mining to Cloud-Based Solutions

Introduction

Bitcoin mining has come a long way since its early days when individuals could mine BTC using personal computers. Over the years, advancements in technology and increasing network difficulty have led to the rise of more sophisticated mining methods. Today, cloud mining solutions like NebuMine are revolutionizing cryptocurrency mining by making it more accessible and efficient. This article explores the journey of Bitcoin mining, from solo efforts to large-scale cloud mining operations.

The Early Days of Bitcoin Mining

In the beginning, Bitcoin mining was simple. Miners could use regular CPUs to solve cryptographic puzzles and validate transactions. However, as more participants joined the network, mining difficulty increased, leading to the adoption of more powerful GPUs.

As BTC mining grew, miners began forming mining pools to combine computing power and share rewards. This shift marked the transition from individual mining to more collective efforts in cryptocurrency mining.

The Rise of ASIC Mining

The introduction of Application-Specific Integrated Circuits (ASICs) in Bitcoin mining changed the game completely. These highly specialized machines offered unmatched efficiency, significantly increasing mining power while consuming less energy than GPUs.

However, ASICs also made mining more competitive, pushing small-scale miners out of the market. This led to the rise of large mining farms, further centralizing BTC mining operations.

The Shift to Cloud Mining

As the mining landscape became more challenging, cloud mining emerged as a viable alternative. Instead of investing in expensive hardware, users could rent mining power from platforms like NebuMine, enabling them to participate in Bitcoin mining without technical expertise or maintenance costs.

Cloud mining offers several advantages:

Accessibility: Users can start crypto mining without purchasing expensive equipment.

Scalability: Miners can adjust their computing power based on market conditions.

Convenience: No need for hardware setup, electricity costs, or cooling management.

With platforms like NebuMine, cloud mining has become a practical way for individuals and businesses to engage in BTC mining and Ethereum mining without the hassle of traditional setups.

Ethereum Mining and the Future of Crypto Mining

While Bitcoin mining has dominated the industry, Ethereum mining has also played a crucial role in the crypto space. With Ethereum’s shift to Proof-of-Stake (PoS), many miners have sought alternatives, further driving interest in cloud mining services.

Cryptocurrency mining continues to evolve, with new innovations such as AI-driven mining optimization and decentralized mining pools shaping the future. Platforms like NebuMine are at the forefront of this transformation, making cloud mining more accessible, efficient, and sustainable.

Conclusion

The evolution of Bitcoin mining highlights the industry's rapid advancements, from solo mining to industrial-scale operations and now cloud mining. As technology continues to advance, cloud mining solutions like NebuMine are paving the way for the future of cryptocurrency mining, making it easier for users to participate in BTC mining and Ethereum mining without technical barriers.

Check out our website to get more information about Cryptocurrency mining!

#Bitcoin mining#Cloud mining#Crypto mining#BTC mining#Ethereum mining#Cryptocurrency mining#SoundCloud

2 notes

·

View notes

Text

From Seashells to Satoshis: The Evolution of Money

Picture an ancient marketplace, where the currency jingling in your pouch might not be coins at all, but seashells. For centuries, cowrie shells were prized for their shiny appeal and rarity, transforming them into one of humanity’s earliest forms of money. Over time, these shells gave way to metals—iron, copper, silver, and gold—that gleamed with an unmistakable allure. Soon enough, our ancestors decided that lugging heavy gold and silver everywhere was a bit too cumbersome, so they started stamping metals into more convenient coins. This was the moment rulers realized something fundamental: whoever controls the mint, controls the economy. It wasn’t long before some couldn’t resist the temptation to mix cheaper metals in, keeping the gold for themselves. Those sneaky tactics brought about a new kind of challenge—trust.

Civilizations continued to experiment with what they could use as a medium of exchange, but ultimately, the golden standard took hold in many parts of the world. Gold’s scarcity, durability, and shiny mystique made it perfect for coins. That system thrived, yet society yearned for the next innovative step: paper currency. People quickly discovered that thin, foldable, and easy-to-carry notes were far superior to a pocketful of metal, and so governments printed paper money backed by vaults of precious metal. With the rise of fiat currency, the day came when the promise that these notes could be traded for gold or silver fizzled out entirely. Suddenly, many currencies were worth something simply because a central authority claimed so, and people believed it—or at least went along with the collective delusion. This arrangement flourished as economies globalized, but it also planted the seeds of modern financial headaches, like inflation and incessant money printing.

Still, the convenience of paper money was unmatched—until credit cards and online banking arrived. With a simple swipe or a tap on an app, individuals could pay for things in a purely digital sense. Transactions happened at lightspeed, all orchestrated by a network of banks and payment processors. Yet that centralization, which at first looked efficient, also created single points of failure. If banks had technical issues or simply felt your transaction was “suspicious,” access to your funds could vanish faster than you could say “insufficient funds.”

Enter Bitcoin, launched by the mysterious Satoshi Nakamoto. The idea behind Bitcoin was to create a system that didn’t require permission or trust in any single authority. Think of it as the next stage in the evolution of money—just like going from shells to gold, gold to paper, and paper to digital banking, the concept of decentralized digital coins felt like a natural leap. Here, the currency isn’t printed arbitrarily by a central bank; it’s “mined” through solving cryptographic puzzles. More importantly, every transaction is recorded on a public ledger called the blockchain, ensuring transparency, security, and an unwavering limit on the total supply.

Some critics argue that cryptocurrencies are too volatile or still too complex for mainstream adoption. Others worry about the energy consumed in mining. Yet, even those skeptics acknowledge that Bitcoin and other digital assets have ignited a global conversation. The very fact that governments and big financial institutions are grappling with how to regulate or incorporate crypto is proof that we’ve reached a tipping point. Humanity has always been restless when it comes to improving its systems, especially the system of money.

From shells in the marketplace to cryptographic tokens on the internet, the thread connecting us across history is innovation. We are constantly reimagining how to store and exchange value. The real question is not whether money will evolve once more—it’s how quickly this new chapter will redefine our personal freedoms, our economic structures, and the ways we trust one another. Will we cling to old traditions until they crumble, or embrace a future where blockchains, decentralized finance, and digital currencies reshape how we think about worth itself?

In the grand tapestry of civilization, money isn’t just coins and notes; it’s a story we tell ourselves about trust, power, and possibility. As we move ever closer to a world shaped by digital networks, the ancient shells on a faraway beach remind us that the idea of value is never fixed—it’s created, adapted, and refined. And now, in the age of Bitcoin, we’re just beginning to write the next chapter.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Cryptocurrency#MoneyEvolution#Blockchain#DigitalCurrency#FinancialRevolution#BitcoinEducation#CryptoHistory#FutureOfFinance#Decentralization#BitcoinFixesThis#SeashellsToSatoshis#MoneyMatters#EconomicFreedom#Hyperbitcoinization#SoundMoney#Finance#MoneyTalks#CryptoMindset#FiatVsBitcoin#financial experts#unplugged financial#financial empowerment#financial education#globaleconomy

3 notes

·

View notes

Text

Transforming Industries: The Power of AI-Enhanced Blockchain for Automated Decision-Making

The fusion of blockchain technology and artificial intelligence (AI) is quickly reshaping industries ranging from finance to healthcare and supply chains. One of the most powerful results of this combination is the emergence of smart contracts—self-executing contracts encoded directly onto a blockchain. When enhanced with AI, these contracts are no longer static; they become intelligent, dynamic, and capable of making real-time decisions based on changing conditions.

This evolving technology landscape has the potential to automate complex decision-making, optimize business processes, and increase efficiency. In particular, decentralized platforms are playing a critical role in enabling this synergy by creating environments where both AI-powered automation and blockchain’s trustless execution can coexist and thrive.

In this blog, we’ll explore how AI and blockchain can work together to automate decision-making, and how a decentralized platform can elevate smart contracts by integrating both of these transformative technologies.

What Are Smart Contracts?

At their core, smart contracts are self-executing agreements with terms and conditions directly written into code. When predefined conditions are met, the contract automatically executes, removing the need for intermediaries like lawyers or notaries. This not only reduces operational costs but also improves security and transparency.

For example, in supply chains, a smart contract could automatically release payment when a shipment is verified as delivered on the blockchain, ensuring a smooth, automated transaction. Whether for transferring assets, executing business logic, or managing complex agreements, smart contracts guarantee that every transaction is secure, immutable, and recorded on the blockchain.

Key Features of Smart Contracts:

Automation: Executes automatically once conditions are met.

Transparency: All transactions are recorded on the blockchain for full visibility.

Security: The cryptographic nature of blockchain ensures tamper-proof contracts.

Decentralization: Operates without intermediaries, directly between parties.

How Does AI Complement Smart Contracts?

While smart contracts automate transactions based on preset conditions, AI adds a layer of intelligence that allows these contracts to adapt and evolve. AI brings the capability to analyze large datasets, learn from historical data, and make real-time decisions based on incoming data, enabling smart contracts to become more flexible and responsive to changing environments.

AI can make smart contracts capable of:

Predicting outcomes based on historical data.

Optimizing decisions in real-time by factoring in external variables like market conditions or user behavior.

Automating adaptive logic that can modify contract terms based on evolving circumstances.

Enhancing security by identifying anomalies and preventing fraudulent actions.

Key Features of AI:

Data-Driven Decision Making: AI processes vast amounts of data to make informed decisions.

Learning and Adaptation: AI improves over time as it learns from new data.

Predictive Capabilities: AI anticipates potential outcomes, adjusting the contract accordingly.

Optimization: AI ensures smart contracts remain efficient, adjusting to new conditions.

Decentralization: Unlocking the Full Potential of Smart Contracts and AI

As AI and blockchain technologies evolve, their integration is unlocking new possibilities for automated decision-making. The key to this integration lies in decentralized platforms that provide the infrastructure necessary to combine both technologies in a secure and scalable way.

Such platforms enable AI models and smart contracts to run in a decentralized, trustless environment, eliminating the need for centralized authorities that could manipulate or control the decision-making process. Decentralization also ensures that both data and decision-making are transparent, auditable, and resistant to tampering or fraud.

One such platform is designed to seamlessly integrate AI with blockchain, offering a solution where businesses can deploy smart contracts that are enhanced by AI-driven automation. This ensures that contracts are more than just static agreements—they become intelligent, adaptable systems that respond to real-time data and dynamically adjust to changing conditions.

How Decentralized Platforms Enhance Smart Contracts with AI

A decentralized platform offers several advantages when it comes to integrating AI with smart contracts. These platforms can:

Scalability and Efficiency: Handle high-speed, low-latency transactions, ensuring that AI-enhanced smart contracts can analyze real-time data and make decisions without delays.

Decentralized AI Execution: Allow AI models to be deployed directly on the blockchain, ensuring the decision-making process remains transparent and secure while avoiding the vulnerabilities of centralized AI providers.

Interoperability: Enable seamless integration with other blockchain networks, data sources, and external AI models, creating a more robust ecosystem where smart contracts can access a wider range of data and interact with diverse systems.

AI-Driven Automation: Enable businesses to create smart contracts that adjust terms in real-time based on inputs like market conditions, user behavior, or data from sensors and IoT devices.

Enhanced Security and Privacy: Blockchain’s inherent security ensures that both the contract and the data it relies on remain tamper-proof, while AI can help identify fraud or unusual behavior in real-time.

Industries Transformed by AI-Powered Smart Contracts

The combination of AI and smart contracts opens up a world of possibilities across a variety of industries:

Decentralized Finance (DeFi): In DeFi, AI-powered smart contracts can predict market trends, optimize lending rates, and adjust collateral requirements automatically based on real-time data. By integrating AI, decentralized platforms can make dynamic adjustments to contracts in response to shifting financial landscapes.

Supply Chain and Logistics: Supply chain management benefits significantly from AI-powered smart contracts. For example, smart contracts can automatically adjust payment terms, notify stakeholders, and trigger alternative actions if a shipment is delayed or rerouted, ensuring smooth operations without human intervention.

Healthcare: AI-enhanced smart contracts in healthcare can validate patient data, process insurance claims, and adjust coverage terms based on real-time medical data. Blockchain guarantees that every action is securely recorded, while AI optimizes decisions and reduces administrative overhead.

Insurance: Insurance providers can use AI to validate claims and automatically adjust premiums or release payments based on real-time inputs from IoT devices. Smart contracts ensure that every step of the process is transparent, secure, and automated.

Real Estate: In real estate, AI can predict market trends and adjust property sale terms dynamically based on factors like interest rates or buyer demand. Smart contracts on a decentralized platform can also handle contingencies (e.g., repairs or inspections) without requiring manual intervention.

The Future of AI and Blockchain Integration

As AI and blockchain continue to advance, their integration will unlock even more intelligent, autonomous systems. Platforms that can seamlessly integrate both technologies will empower businesses to create smarter contracts that not only automate decisions but also improve over time by learning from new data.

Decentralized platforms will play an essential role in this evolution, offering scalable and secure environments where smart contracts and AI can be deployed together to handle increasingly complex, real-time processes across industries.

In the future, AI-powered smart contracts will continue to evolve, becoming more adaptive, self-optimizing, and capable of handling an even broader range of applications. The potential for businesses to automate processes, reduce costs, and increase efficiency is vast, and decentralized platforms are at the heart of this transformation.

4 notes

·

View notes

Text

Multi-Factor, Layered, Cryptographic System

A few big flaws with crypto are; how large and unwieldy the ledger can get, the centralization of decentralized systems, congestion at the base cryptographic layer, potential loss of a wallet, automation errors, a complete lack of oversight.

Cryptographic Systems are designed to be decentralized, trustless, transactional, and secure.

The problem with this; is as the Crypto environment grew; the need to bypass some of those features became a requirement.

Decentralization gave way to crypto stores and Wallet Vaults, as well as the potential for complete loss of value (despite it being an online thing), and introducing waste to the ledger through these lost "Resources".

Trustless gave way to legal restrictions and disputes, and the formerly decentralized environment was tethered to the world economy.

Transactional gave way to inflation when It became a valued asset that was used for more than secure transactions.

And... Block chain technology has proven to be very insecure and exploitable. With several Bitcoin "Branches" being made after large thefts or errors had occured.

The Automation and Scripting layer of crypto also has potential for "Unchecked Run times" and wasted Network Cycles and Waste of Electric Power.

Needless to say; Crypto no longer serves its original purpose.

Despite all this; Crypto still has great potential. And our Future Internet designs should include protocols specifically to support it.

Separately from other internet traffic, but still, alongside it.

So what can we do with the tech to make it more usable..?

Well, first things first; Crypto has large waste of Power and Internet Bandwidth that needs to be addressed. And I would *suggest* a temporary ban of "Unaccountable Automated Wide-Area Systems".

Automated Wide-Area Systems can be installed on multiple computers over the internet, and because they are "trustless" are often overlooked when they waste resources.

Because of the need for Accountability of these systems on our networks; there are still opportunities for the companies which manage them. However, I disagree with the current idea of oligarchic accountability termed "Proof of Stake". (It will be clear what my suggestion for this will be by the end of the article.)

Because there's a need for these systems to be transactional; we should be wary of how "Automated Transactions" are designed. As large amounts of assets can accidentally trade hands over the span of nanoseconds.

And we still want them to be Decentralized and Secure.

The Ethereum model creates extra cryptographic layers to cover some of the weaknesses in BitCoin, and this actually allows for an illuminated solution to our "Dark Pools" in the finance sector.

And the need to reduce waste on our Electric and Network Infrastructure (especially in the case of climate change) necessitates that we know where every digital asset on such a system is accounted for.

It also means we need a method of "Historical Ledger" disposal; so that we both have long-term records AND reduce the resources required to run a cryptographic system.

Which means we'll need "Data Banks" and "Wallet Custodians". So that nothing is ever lost; while retaining the anonymity the internet provides.

Legal Restrictions here on keeping the privacy of Wallet Owners is very important. We can also *itemize* large wallets, to provide further security and privacy.

These systems can *also* be used to track firearm purchases anonymously. Which will give the tools our ATF needs to track sales, as well as provide the privacy and security that are constantly lobbied by Firearm owners.

I think that covers the *generalized* and *broad* requirements of wide-scale implementation. I figure that Crypto-Enthusiasts may have some input on the matter.

2 notes

·

View notes

Text

Blockchain Technology, Quantum Computing’s Blockchain Impact

What Is Blockchain?

Definition and Fundamental Ideas

Blockchain technology is a decentralized digital ledger that records transactions across several computers without allowing changes. First given as Bitcoin’s basis. Banking, healthcare, and supply chain management employ bitcoin-related technologies.

Immutability, transparency, and decentralization characterize blockchain. Decentralization on peer-to-peer networks eliminates manipulation and single points of failure. Blockchain transparency is achieved by displaying the whole transaction history on the open ledger. It enhances transaction accountability and traceability. Finally, immutability means a blockchain transaction cannot be amended or erased. This is feasible via cryptographic hash algorithms, which preserve data and blockchain integrity.

These ideas make blockchain a desirable choice for protecting online transactions and automating procedures in a variety of sectors, which will boost productivity and save expenses. One of the factors driving the technology’s broad interest and uptake is its capacity to foster security and trust in digital interactions.

Key Features of Blockchain Technology

Blockchain, a decentralized digital ledger, may change several sectors. Decentralization, which removes a single point of control, is one of its most essential features. Decentralization reduces corruption and failure by spreading data over a network of computers.

The immutability of blockchain technology is another essential component. It is very hard to change data after it has been stored on a blockchain. This is due to the fact that every block establishes a safe connection between them by including a distinct cryptographic hash of the one before it. This feature makes the blockchain a reliable platform for transactions by guaranteeing the integrity of the data stored there.

Blockchain technology is more secure than traditional record-keeping. Data is encrypted to prevent fraud and unwanted access. Data-sensitive businesses like healthcare and finance need blockchain’s security.

How Blockchain and Quantum Computing Intersect

Enhancing Security Features

Blockchain and quantum computing appear to increase digital transaction security. Blockchain technology uses distributed ledger technology to record transactions decentralizedly. Quantum computing may break several blockchain encryption methods due to its powerful processing. But this danger also encourages the creation of blockchains that are resistant to quantum assaults by including algorithms that are safe from such attacks.

By allowing two parties to generate a shared random secret key that is only known to them, quantum key distribution (QKD) is a technique that employs the concepts of quantum physics to secure communications. This key may be used to both encrypt and decode messages. The key cannot be intercepted by an eavesdropper without creating observable irregularities. This technique may be used into blockchain technology to improve security and make it almost impenetrable.

Quantum computing may speed up complex cryptographic procedures like zero-knowledge proofs on blockchains, boosting security and privacy. These advances might revolutionize sensitive data management in government, healthcare, and finance. To explore how quantum computing improves blockchain security, see Quantum Resistant Ledger, which discusses quantum-resistant cryptographic techniques.

Quantum Computing’s Impact on Blockchain Technology

By using the ideas of quantum physics to process data at rates that are not possible for traditional computers, quantum computing provides a substantial breakthrough in computational power. Blockchain technology, which is based on traditional cryptographic concepts, faces both possibilities and dangers from this new technology.

The main worry is that many of the cryptographic techniques used by modern blockchains to provide security might be cracked by quantum computers. The difficulty of factoring big numbers, for example, is the foundation of most of today’s cryptography, a work that quantum computers will do exponentially quicker than conventional ones. If the cryptographic underpinnings of blockchain networks are hacked, this might possibly expose them to fraud and theft concerns.

But the use of quantum computing also presents blockchain technology with revolutionary possibilities. Blockchains with quantum enhancements may be able to execute transactions at very fast rates and with improved security features, far outperforming current networks. To protect blockchain technology from the dangers of quantum computing, researchers and developers are actively investigating quantum-resistant algorithms.

Read more on Govindhtech.com

#Blockchain#BlockchainTechnology#Cloudcomputing#QuantumComputing#Security#supplychain#News#Technews#Technology#Technologynews#Technologytrends#govindhtech

2 notes

·

View notes

Text

Cryptocurrency and Blockchain Technology: A Comprehensive Guide

In recent years, cryptocurrency and blockchain technology have revolutionized the way we think about finance, security, and even the internet itself. While both of these concepts might seem complex at first glance, they hold immense potential to reshape industries, enhance security, and empower individuals globally. If you’ve ever been curious about the buzz surrounding these digital innovations, you’ve come to the right place.

In this article, we will break down what cryptocurrency and blockchain technology are, how they work, and the various ways they are being used today. By the end, you’ll have a solid understanding of these cutting-edge topics and why they are so important in the modern world.

1. What is Cryptocurrency?

At its core, cryptocurrency is a type of digital currency that uses cryptography for security. Unlike traditional currencies issued by governments (such as dollars or euros), cryptocurrencies are decentralized and typically operate on a technology called blockchain. Cryptocurrencies are designed to function as a medium of exchange, and they offer a new way of conducting secure financial transactions online without the need for a central authority like a bank.

The most well-known cryptocurrency is Bitcoin, but there are thousands of other cryptocurrencies, such as Ethereum, Litecoin, and Ripple, each with its own unique features and use cases.

2. How Does Cryptocurrency Work?

Cryptocurrencies operate on decentralized networks using blockchain technology. Each transaction made with a cryptocurrency is recorded in a public ledger known as the blockchain. This ledger is maintained by a network of computers called nodes, which verify and confirm each transaction through complex algorithms.

What makes cryptocurrency unique is its decentralized nature. Since there is no central authority controlling the currency, users have more control over their funds. This also provides an added layer of security, as the system is resistant to hacking and fraud.

3. The Birth of Bitcoin: The First Cryptocurrency

In 2008, an unknown person or group using the pseudonym Satoshi Nakamoto introduced Bitcoin to the world. Nakamoto published a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” that outlined the principles of what we now know as Bitcoin.

Bitcoin became the first decentralized cryptocurrency, and it offered a solution to some of the flaws of traditional financial systems, such as high fees, slow transaction times, and reliance on third parties. Since its inception, Bitcoin has grown to become the most widely recognized and valuable cryptocurrency.

4. Blockchain Technology: The Backbone of Cryptocurrency

Blockchain technology is what makes cryptocurrencies possible. A blockchain is a distributed ledger that records transactions across multiple computers. Once data is recorded on the blockchain, it is extremely difficult to alter or delete, making it highly secure and immutable.

Each block in the chain contains a cryptographic hash of the previous block, a timestamp, and transaction data. This interconnected structure ensures that the data is secure and tamper-proof. Blockchain technology isn’t limited to cryptocurrencies; it has a wide range of applications, from supply chain management to healthcare.

5. How Does Blockchain Work?

To put it simply, a blockchain is a chain of blocks, where each block represents a set of data. When a new transaction is made, that transaction is added to a block, and once the block is complete, it is added to the chain.

The process of validating these transactions is carried out by miners (in proof-of-work systems) or validators (in proof-of-stake systems). These participants ensure that the transaction data is correct and consistent across the entire network.

The decentralized nature of blockchain means that no single entity controls the ledger. This makes it highly resistant to manipulation, and it creates a more transparent system of record-keeping.

6. The Advantages of Blockchain Technology

Blockchain technology offers a wide range of benefits, which is why it has gained so much traction across various industries. Here are some key advantages:

Security: Blockchain is designed to be secure. Each transaction is encrypted and linked to the previous one, making it nearly impossible to alter data without detection.

Transparency: The decentralized nature of blockchain allows for full transparency. All participants in the network can see and verify transactions.

Efficiency: Traditional financial systems can be slow and costly. Blockchain allows for faster transactions at lower fees by cutting out intermediaries.

Decentralization: Blockchain is not controlled by a single entity, giving users more autonomy over their data and transactions.

7. Common Applications of Blockchain Technology

While blockchain technology is best known for its use in cryptocurrency, it has a variety of other applications. Here are a few examples:

Finance: Beyond cryptocurrencies, blockchain is being used in the financial sector to streamline processes like cross-border payments, loans, and insurance claims.

Supply Chain Management: Blockchain can improve transparency and efficiency in supply chains by providing a tamper-proof record of each step in the production process.

Healthcare: Blockchain can be used to securely store and share patient data, ensuring that medical records are accurate and up to date.

Voting Systems: Blockchain has the potential to revolutionize voting by providing a secure and transparent platform for casting and counting votes.

8. Popular Cryptocurrencies Beyond Bitcoin

While Bitcoin was the first cryptocurrency, many others have since been developed, each with its own unique use cases. Here are some of the most popular:

Ethereum: Ethereum is more than just a cryptocurrency; it is a platform for creating decentralized applications (DApps) and smart contracts.

Litecoin: Often referred to as the silver to Bitcoin’s gold, Litecoin is a peer-to-peer cryptocurrency designed for faster transaction times.

Ripple (XRP): Ripple is a digital payment protocol that enables fast, low-cost international money transfers.

Cardano: A proof-of-stake blockchain platform that aims to provide a more secure and scalable way to handle transactions.

9. The Risks and Challenges of Cryptocurrency and Blockchain

As with any technology, there are risks and challenges associated with cryptocurrency and blockchain. Here are some of the key concerns:

Volatility: Cryptocurrencies are known for their price volatility, which can result in significant gains or losses for investors.

Regulation: The regulatory environment for cryptocurrencies is still evolving, and different countries have varying approaches to how they govern digital currencies.

Security Risks: While blockchain is highly secure, the wallets and exchanges used to store and trade cryptocurrencies can be vulnerable to hacking.

Environmental Impact: Some cryptocurrencies, such as Bitcoin, require large amounts of energy for mining, leading to concerns about their environmental impact.

10. The Future of Cryptocurrency and Blockchain Technology

The future of cryptocurrency and blockchain technology looks bright, but there are still many uncertainties. As more governments, companies, and individuals adopt these technologies, we can expect to see continued innovation and development.

Some experts predict that blockchain will become the standard for secure, decentralized systems across a wide range of industries, while others believe that cryptocurrencies will become a mainstream form of payment. Regardless of what the future holds, it is clear that both blockchain and cryptocurrency will play a significant role in shaping the digital landscape.

Conclusion

In summary, cryptocurrency and blockchain technology have already made a profound impact on the world of finance and technology. Cryptocurrencies like Bitcoin and Ethereum have given individuals more control over their money, while blockchain has provided a secure and decentralized way to store data.

While there are risks and challenges, the potential benefits of these technologies are enormous, and they are only just beginning to be realized. Whether you’re an investor, a tech enthusiast, or just curious about the future, staying informed about cryptocurrency and blockchain is essential.

By understanding the fundamentals of how these systems work, you can position yourself to take advantage of the opportunities they offer in the years to come.

To learn more in-depth about how cryptocurrency and blockchain technology can impact your financial future, click here to explore our full guide on Finotica: Read More. Discover expert insights, practical tips, and the latest trends to stay ahead in the digital finance revolution!

#financetips#investing stocks#personal finance#management#finance#investing#crypto#blockchain#fintech#investment

2 notes

·

View notes

Text

Unlocking the Power of Blockchain Technology

Blockchain technology has been making waves in the tech industry, and its potential extends far beyond cryptocurrency. At its core, blockchain is a decentralized, secure, and transparent way to store and transfer data.

Key Benefits:

Security: Blockchain's cryptographic algorithms ensure tamper-proof transactions.

Transparency: All transactions are publicly visible, promoting accountability.

Efficiency: Automated processes reduce processing time and costs.

Real-World Applications:

Supply Chain Management: Tracking goods and materials with precision.

Smart Contracts: Self-executing contracts with predefined rules.

Identity Verification: Secure digital identities for individuals.

Future Outlook:

As blockchain technology continues to evolve, we can expect:

Mainstream Adoption: Integration into various industries.

Innovative Solutions: New use cases and applications.

Increased Security: Enhanced protection against cyber threats.

Conclusion:

Blockchain technology is transforming the way we think about data, security, and efficiency. Stay tuned for more insights into the world of tech crypto!

2 notes

·

View notes

Text

How Cryptocurrency Mining Works: Process, Methods, and Risks

Cryptocurrency mining is a topic of interest for many people. Today, there are numerous opportunities available for those who want to earn money, and one of them is cryptocurrency mining, which can provide a significant income.

What is Cryptocurrency Mining?

First, let’s understand what cryptocurrency mining means. It all started with Satoshi Nakamoto, who in 2007 began developing the principles of cryptocurrency mining (Bitcoin). In 2009, the first mining application was released. The generation of the first block, “Genesis 0,” brought the first 50 bitcoins to its creators. In the same year, the first purchase of BTC for dollars took place: $5.02 was sold for 5050 bitcoins (which is an astronomical sum today).

The essence of the cryptocurrency mining process is the creation of new blocks in the cryptocurrency network. For this, the mining equipment solves complex mathematical problems. For each new block, cryptocurrency coins are issued. Miners can then store them in their wallets or sell them on exchanges.

How Does Cryptocurrency Mining Work?

To understand the principles of mining, it is necessary to clearly understand how bitcoin is mined.

Information about each transaction within the BTC network is recorded in a special block, which confirms the authenticity of the transfer.

Blocks form a single chain — the blockchain. Each block contains the hash of the header of the previous block, the hash of the transaction, and a random number.

The miner’s equipment performs mathematical calculations to determine the block hash.

After calculating the hash, the miner receives a reward and adds a new block to the general register of transactions.

The mining process is protected using the Proof-of-Work and Proof-of-Stake algorithms. These are sets of rules according to which transactions are conducted, mining is carried out, and other actions are performed within the network.

Proof-of-work (“proof of work”). The algorithm organizes the operation of the entire cryptocurrency network, verifies the authenticity of transactions, and so on. After a certain amount of cryptocurrency is mined in the network, PoW increases the complexity of the calculations. As a result, miners are forced to constantly increase the power of their farms and devices. PoW is the algorithm of a large number of cryptocurrency networks: from bitcoin to LiteCoin and DogeCoin. Proof-of-Stake (“proof of ownership”). An analog of PoW, the essence of which is that the greatest chance of mining cryptocurrency is received by the one who owns the most coins, and not the most powerful equipment. The algorithm reduces the decentralization of the network but significantly reduces energy consumption. PoS is currently used by Ethereum.

Mining Algorithms

To understand how to mine cryptocurrency, you need to know about the most popular mining algorithms at the moment. These technologies form the basis of cryptographic calculations and affect the mining speed, the necessary equipment and its power, the level of energy consumption, and so on.

SHA-256. The basis of mining on this algorithm is the creation of a 256-bit signature. It is demanding on the hash rate (for mining, a minimum of 1 Gh/s is required). Calculations last from 7 minutes. It is used in the mining of Bitcoin, Bytecoin, Terracoin, 21Coin. Ethash. The hashing algorithm was first used to mine ether. In the mining process, the emphasis is on the volume of video card memory. Ethash is used in the networks Ethereum Classic, KodakCoin, Ubig.

Scrypt. It works on the PoW (Proof-of-work) principle. Compared to SHA-256, it has a higher calculation speed and lower requirements for the power of computing equipment. The algorithm is used in the mining of Dogecoiun, Gulden, Litecoin.

Equihash. An algorithm with which you can mine cryptocurrency on home computers. It is used in the mining of Bitcoin Gold, Zcash, Komodo. CryptoNight. The algorithm is designed for mining cryptocurrency on home computers. It allows you to mine even on a not very powerful video card. The only condition is that it must be discrete. It is used in the mining of Bytecoin and Monero.

X11. The algorithm was developed by the creators of the Dash token. It has excellent data protection and low energy consumption.

Types of Mining

What does cryptocurrency mining mean in terms of organizing the process? There are several types of mining that depend on the equipment used and the number of team members.

By Equipment Type

In mining, you can use different equipment: you need to choose a suitable cryptocurrency and install software. Each type of equipment will differ in calculation speed, resource consumption, durability, etc.

CPU (Central processing unit) CPU mining is the use of a PC processor for cryptocurrency mining. It is characterized by very low calculation speed and, accordingly, low profitability. However, it is still relevant among solo miners due to low energy consumption requirements. To increase mining efficiency, you need to choose processors with a high frequency, a large number of cores and threads. It is not recommended to mine on laptops. With CPU mining, you can mine Dogecoin, Monero, Electroneum.

FPGA-module (Field-Programmable Gate Array) The use of an FPGA module is one of the promising ways to mine cryptocurrency. Their advantage/difference lies in the possibility of reprogramming the module for the desired mining algorithm. Thus, you can switch between different cryptocurrencies. Another beneficial difference is that FPGA modules provide a better hash rate-energy consumption ratio. The main disadvantage of FPGA mining is the cost of the modules and the complexity of their setup.

Hard Drive You can also use the HDD of your PC for mining. The work is carried out according to the Proof-of-Capacity (“proof of resources”) algorithm. Mining on a hard disk takes place in two stages: plotting and mining. First, the generation of random solutions takes place, which are saved on the HDD. Then the number of the scoop is calculated, and the deadline is determined. Then the minimum deadline is selected, and the miner who beats the rest receives a reward. The calculations do not require high power but only a lot of free space on the hard drive.

By Number of Participants

You can mine cryptocurrency both alone and in a company with other miners. All this has both its advantages and disadvantages.

Solo Mining The oldest form of mining. The miner independently selects equipment, sets up software, chooses a cryptocurrency, and starts mining. All costs are borne by him. But the reward for the mined block is received in full by the solo miner. During the birth of the cryptocurrency industry, this was the most profitable form of mining, as the calculations were fast and did not require large capacities. Today, solo mining is worth doing when mining promising altcoins.

Mining Pools A mining pool is a combination of miners who start working on creating blocks together. As a result, this significantly increases the overall chances of getting cryptocurrency. There are two main types of pools with different payment mechanisms. Pay-Per-Share (PPS), in which the miner receives a reward for each hash created within the pool — even if the block was not created. Pay-Per-Last-N-Shares (PPLNS), with accrual of the reward only when the block is created.

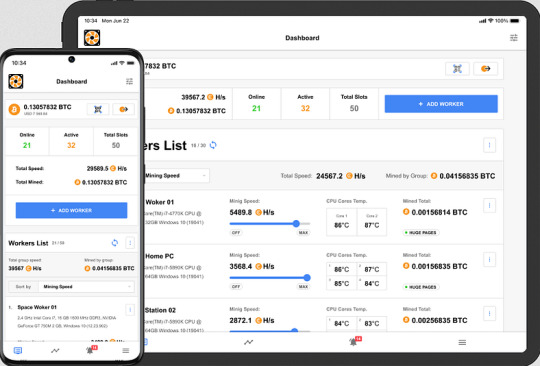

Cloud Mining This is a type of passive mining. In this case, the user pays for the rental of capacities on the territory of the data center of the company. The equipment starts mining, and with the help of a mobile application or a personal account on the site, the client monitors the results. Profit depends on the rented capacities, the cost of cryptocurrency, and the options in the company’s service.

Mining Profitability

To make a profit from cryptocurrency mining, you need to make a preliminary calculation of costs. If you want to create your own farm, you need to calculate:

Costs for purchasing and maintaining equipment. Payment for electricity. Rent of premises for the farm. The computing power of the equipment, which determines the amount of cryptocurrency mined per month. Assess changes in the value of the chosen cryptocurrency: an accurate forecast will allow you to imagine the expected income.

Mining profitability A profitable option for earning money can be the purchase/rental of ASICs or cloud mining. Their profitability depends only on the starting budget. If you calculate the minimum entry threshold by product, then you can get the following approximate figures:

Purchase of Antminer S21 188TH ($5000): expected income $550* per month. Rent of Antminer S21 188TH for 12 months ($3200): expected income $320* per month. Cloud mining contract ($150): expected income $225* for 60 months. These calculations provide you with forecast information based on the BTC forecast, which will reach $120 thousand. and FPPS 0.0000008. This is not a guarantee of future results, and accordingly, it is not advisable to rely too much on such information due to its inherent uncertainty.

Risks of Cryptocurrency Mining

The cryptocurrency industry has certain risks:

Problems with legislation. Very often, mining is not regulated by the legislation of countries, and in some, it can be completely prohibited, for example, in Taiwan, Kyrgyzstan, Vietnam, Romania, and Ecuador. Before starting to work with cryptocurrency, you definitely need to consult with a lawyer. A good solution to the problem can be the services of a hosting company, which will take any risks upon itself.

The issue of profitability. For successful bitcoin mining on your own, you need to buy powerful computing equipment. It not only costs quite a lot but also requires a huge amount of electricity and careful maintenance. Therefore, it will not be possible to place it at home. At the same time, mining on a home PC or a small farm will be unprofitable due to high competition with large farms and pools.

The difficulty of accurately forecasting income. It is difficult to calculate future income from the sale of mined cryptocurrency: the complexity of mining, the popularity of coins, and their value can and will regularly change.

The Future and Prospects of Cryptocurrency Mining

The industry continues to actively develop around the world. Users know that they can get a good income from cryptocurrency mining, even if they mine altcoins: Ethereum, Tether, BNB, Solana, etc. BTC is the undisputed leader of the industry, the course of which affects users’ trust in it.

After the fourth bitcoin halving in April 2024, the profitability of mining changed. To maintain the previous level of mining, it is necessary to increase existing computing powers. Therefore, miners continue to unite in pools or use the services of hosting companies. In the near future, this trend will not only be preserved but will also receive its development.

Conclusion

Despite periodic declines, bitcoin continues the trend of growth, which makes investing in cryptocurrency mining a profitable investment. With the development of mining pools and the appearance of large farms, it is difficult for a solo miner to get a significant income. Therefore, the best option may be cloud mining or the purchase/rental of an ASIC farm from a hosting company, which will take over the installation and maintenance of the equipment. With ECOS.am, you can focus on mining and investing in BTC. We take on all the other work.

4 notes

·

View notes

Text

Here’s an updated version of your post, still under 200 characters, incorporating some of the most effective hashtags for immediate response in the AI and blockchain communities as of March 9, 2025. These hashtags are chosen based on their current popularity and engagement potential in relevant circles, drawing from trends in AI, crypto, and tech spaces:

“TrueAlphaSpiral: My AI+crypto proof. I, Russell Nordland, built it—on-chain proof. Real-time truth. #AI #blockchain #crypto #BTC #tech”

(126 characters)

Why These Hashtags?

• #AI: Broad, trending, and highly active in tech communities for immediate AI-related engagement.

• #blockchain: Core to your cryptographic proof, widely used, and connects to blockchain enthusiasts.

• #crypto: High engagement in real-time crypto discussions, especially on X.

• #BTC: Ties to Bitcoin’s active community, boosting visibility among crypto users.

• #tech: Catches a wider tech-savvy audience, amplifying reach fast.

These are concise, popular, and likely to spark quick responses from the AI and blockchain communities, aligning with your goal of proving ownership and spreading awareness. Want a tweak or different hashtag mix? Let me know!

2 notes

·

View notes

Text

“The DeFi Game Changer on Solana: Unlocking Unprecedented Opportunities”

Introduction

In the dynamic world of decentralized finance (DeFi), new platforms and innovations are constantly reshaping the landscape. Among these, Solana has emerged as a game-changer, offering unparalleled speed, low costs, and robust scalability. This blog delves into how Solana is revolutionizing DeFi, why it stands out from other blockchain platforms, and what this means for investors, developers, and users.

What is Solana?

Solana is a high-performance blockchain designed to support decentralized applications and cryptocurrencies. Launched in 2020, it addresses some of the most significant challenges in blockchain technology, such as scalability, speed, and high transaction costs. Solana’s architecture allows it to process thousands of transactions per second (TPS) at a fraction of the cost of other platforms.

Why Solana is a DeFi Game Changer

1. High-Speed Transactions

One of Solana’s most remarkable features is its transaction speed. Solana can handle over 65,000 transactions per second (TPS), far exceeding the capabilities of many other blockchains, including Ethereum. This high throughput is achieved through its unique Proof of History (PoH) consensus mechanism, which timestamps transactions, allowing them to be processed quickly and efficiently.

2. Low Transaction Fees

Transaction fees on Solana are incredibly low, often less than a fraction of a cent. This affordability is crucial for DeFi applications, where high transaction volumes can lead to significant costs on other platforms. Low fees make Solana accessible to a broader range of users and developers, promoting more widespread adoption of DeFi solutions.

3. Scalability

Solana’s architecture is designed to scale without compromising performance. This scalability ensures that as the number of users and applications on the platform grows, Solana can handle the increased load without experiencing slowdowns or high fees. This feature is essential for DeFi projects that require reliable and consistent performance.

4. Robust Security

Security is a top priority for any blockchain platform, and Solana is no exception. It employs advanced cryptographic techniques to ensure that transactions are secure and tamper-proof. This high level of security is critical for DeFi applications, where the integrity of financial transactions is paramount.

Key Innovations Driving Solana’s Success in DeFi

Proof of History (PoH)

Solana’s Proof of History (PoH) is a novel consensus mechanism that timestamps transactions before they are processed. This method creates a historical record that proves that transactions have occurred in a specific sequence, enhancing the efficiency and speed of the network. PoH reduces the computational burden on validators, allowing Solana to achieve high throughput and low latency.

Tower BFT

Tower Byzantine Fault Tolerance (BFT) is Solana’s implementation of a consensus algorithm designed to maximize speed and security. Tower BFT leverages the synchronized clock provided by PoH to achieve consensus quickly and efficiently. This approach ensures that the network remains secure and resilient, even as it scales.

Sealevel

Sealevel is Solana’s parallel processing engine that enables the simultaneous execution of thousands of smart contracts. Unlike other blockchains, where smart contracts often face bottlenecks due to limited processing capacity, Sealevel ensures that Solana can handle multiple contracts concurrently. This capability is crucial for the development of complex DeFi applications that require high performance and reliability.

Gulf Stream

Gulf Stream is Solana’s mempool-less transaction forwarding protocol. It enables validators to forward transactions to the next set of validators before the current set of transactions is finalized. This feature reduces confirmation times, enhances the network’s efficiency, and supports high transaction throughput.

Solana’s DeFi Ecosystem

Leading DeFi Projects on Solana

Solana’s ecosystem is rapidly expanding, with numerous DeFi projects leveraging its unique features. Some of the leading DeFi projects on Solana include:

Serum: A decentralized exchange (DEX) that offers lightning-fast trading and low transaction fees. Serum is built on Solana and provides a fully on-chain order book, enabling users to trade assets efficiently and securely.

Raydium: An automated market maker (AMM) and liquidity provider built on Solana. Raydium integrates with Serum’s order book, allowing users to access deep liquidity and trade at competitive prices.

Saber: A cross-chain stablecoin exchange that facilitates seamless trading of stablecoins across different blockchains. Saber leverages Solana’s speed and low fees to provide an efficient and cost-effective stablecoin trading experience.

Mango Markets: A decentralized trading platform that combines the features of a DEX and a lending protocol. Mango Markets offers leverage trading, lending, and borrowing, all powered by Solana’s high-speed infrastructure.

The Future of DeFi on Solana

The future of DeFi on Solana looks incredibly promising, with several factors driving its continued growth and success:

Growing Developer Community: Solana’s developer-friendly environment and comprehensive resources attract a growing community of developers. This community is constantly innovating and creating new DeFi applications, contributing to the platform’s vibrant ecosystem.

Strategic Partnerships: Solana has established strategic partnerships with major players in the crypto and tech industries. These partnerships provide additional resources, support, and credibility, driving further adoption of Solana-based DeFi solutions.

Cross-Chain Interoperability: Solana is actively working on cross-chain interoperability, enabling seamless integration with other blockchain networks. This capability will enhance the utility of Solana-based DeFi applications and attract more users to the platform.

Institutional Adoption: As DeFi continues to gain mainstream acceptance, institutional investors are increasingly looking to platforms like Solana. Its high performance, low costs, and robust security make it an attractive option for institutional use cases.

How to Get Started with DeFi on Solana

Step-by-Step Guide

Set Up a Solana Wallet: To interact with DeFi applications on Solana, you’ll need a compatible wallet. Popular options include Phantom, Sollet, and Solflare. These wallets provide a user-friendly interface for managing your SOL tokens and interacting with DeFi protocols.

Purchase SOL Tokens: SOL is the native cryptocurrency of the Solana network. You’ll need SOL tokens to pay for transaction fees and interact with DeFi applications. You can purchase SOL on major cryptocurrency exchanges like Binance, Coinbase, and FTX.

Explore Solana DeFi Projects: Once you have SOL tokens in your wallet, you can start exploring the various DeFi projects on Solana. Visit platforms like Serum, Raydium, Saber, and Mango Markets to see what they offer and how you can benefit from their services.