#csp provider

Text

What is Bank Mitra Registration?

The Government of India launched Bank Mitra to bring banking services to rural residents. Financial inclusion of rural citizens and direct delivery of benefits from government schemes are at the heart of the Bank Mitra Registration scheme.

The following conditions must be met before registering as a Bank Mitra:

Banks have appointed the following already effective classes to serve as Bank Mitras rather than employing personnel to do the job.

• The Retired Officials of Any Bank

• Those who have taught and then retired

• Retired public servants

• Bank Mitras might be ex-servicemen.

• Medical businesses, kirana stores, fair pricing shops, public call booths, and others are eligible to become Bank Mitras.

Look around or ask your local bank to find a Bank Mitra and contact them if you need access to banking services in your area.

The Function of Bank Mitra

Bank Mitra is a tool that extends the banking industry into locations that would otherwise be unreachable. He would be in charge of making low-priced financial services easily accessible to customers whenever they need them.

Bank Mitra Duties in the Jan Dhan Scheme

Bank Mitra is in charge of several of the banking institutions' services, including:

• Bank Mitra's mission is to raise public consciousness about the value of saving money and inform the public about the best tools and resources for budgeting and paying down debt.

• Collect and process preliminary deposit and verification forms so prospective customers can avoid entering the branch.

• To assist consumers in completing account application paperwork

• Account holders' funds would be collected for deposits, and withdrawals would be processed if necessary.

• Mini account statements and confirmation of certain transactions will be available to account holders via Bank Mitra.

Conclusion

Mitra Bank BC is a well-regarded All Bank CSP Provider, serving clients' banking needs throughout the country. They are dedicated to ensuring that their partners give the highest quality service to their customers. Mitra Bank BC offers dependable financial services, so call them immediately if needed. The staff is eager to assist you with all of your banking requirements.

Blog Source: https://www.bankmitrabc.co.in/what-is-bank-mitra-registration

0 notes

Text

Why Trust Online CSP Provider for SBI Kiosk Banking

In today's digital age, the world has become a global village where everything is just a click away. Banking has also evolved over time, making accessing financial transactions easier and more convenient than ever. One such innovation in banking is SBI Kiosk Banking, which allows you to take advantage of various banking features such as cash deposits, withdrawals, and money transfers at your nearest CSP. However, many are reluctant to trust online CSP providers for this service. This blog post explains why you should trust an Online CSP Provider to start SBI Kiosk Banking and how it can help you in the long run.

Why join SBI kiosk Banking

You should trust this online CSP provider to start SBI Kiosk Banking for many reasons. First, they have the expertise and experience to do the job quickly and easily. We can also provide all the resources and support you need to succeed. In addition, they can offer competitive prices and terms that can save you money.

Working with an online CSP provider ensures that your financial information is secure. We use the latest security measures to protect your data and keep your account safe. You can also be sure that your transactions will be processed quickly and efficiently. With an Online CSP Provider, you can focus on running your business without worrying about financial security.

Why trust your online CSP provider for sbi kiosk bank CSP

This online CSP provider is authorized and regulated by the Reserve Bank of India (RBI). They are authorized to provide banking services on behalf of SBI. CSPs must comply with regulatory requirements and security standards set by the RBI. This allows CSPs to maintain high security and provide reliable services to their customers. Additionally, these online CSP providers use advanced security technologies to protect customer data and transactions. We use encryption, firewalls, and other security measures to ensure the security of our customer's data. Additionally, we provide customer support services to address any concerns or issues our customers may have.

You should trust this online CSP provider for SBI Kiosk Banking for many reasons.

• First, the provider has extensive experience in creating and managing such processes.

• Second, the provider can offer a comprehensive service package that meets all your needs.

• Third, service providers can offer competitive rates that will help save costs.

• Finally, service providers are willing to provide support and assistance when needed.

In conclusion, partnering with an online CSP provider is a safe and reliable option to start SBI kiosk banking. The provider is authorized and regulated by the RBI and uses advanced security technology to protect customer data and transactions. Online CSP service providers who provide reliable service and customer support are trusted partners of SBI Kiosk Banking.

Blog Source: https://bankmitraregistration.wordpress.com/2023/05/08/why-trust-online-csp-provider-for-sbi-kiosk-banking

#csp provider#all bank csp#online csp provider#csp registration#bank mitra registration#kiosk csp registration#bank csp

0 notes

Text

Why Applying for CSP Online is a Game-Changer?

Over the years, the tremendous changes that have taken place in the banking sector have been witnessed. One of the most significant changes is the introduction of CSP (Customer Service Point) facilities. CSPs have become a crucial part of the banking ecosystem, providing access to banking services to people in remote areas where traditional bank branches are not feasible. In this blog, I will share my thoughts on why choosing CSP Online Apply is a game-changer.What is CSP?

For those who are not familiar with CSP, it is an initiative taken by the Government of India to provide basic banking services to people living in remote areas. CSPs are small outlets that act as mini-bank and offer services such as account opening, cash deposit, withdrawal, and fund transfer. These CSPs are typically run by entrepreneurs who partner with banks and provide banking services to people in their locality.

Why Applying for CSP Online is a Game-Changer?

Applying for CSP online has many advantages. Firstly, it is a time-saving process. Entrepreneurs interested in setting up CSPs can now apply online, saving them the time and effort of visiting the bank physically. Secondly, it is a convenient process. Entrepreneurs can opt for CSP Online Apply from anywhere, at any time, as long as they have an internet connection. This makes it easier for entrepreneurs who live in remote areas to apply for CSPs.

Moreover, the online application process is more transparent and efficient. Entrepreneurs can track the status of their applications online and receive updates on the progress of their applications. This helps to reduce the time taken to process applications and ensures that entrepreneurs receive timely updates on the status of their applications.

Perks of Applying for CSP Online

Apart from the advantages mentioned above, there are several other perks of applying for CSP online. Firstly, the online application process is more secure. Entrepreneurs can submit their applications online without worrying about their personal and financial information being secure. Secondly, the online application process is more user-friendly. Entrepreneurs can easily fill in the application form and submit it online without the need for any technical knowledge.

In conclusion, applying for CSP online is a game-changer. It saves time and is convenient, transparent, and secure. The expert Bank CSP Provider believes this initiative will help improve financial inclusion and provide access to basic banking services to people living in remote areas. It is recommended that all entrepreneurs who are interested in setting up CSPs apply online and take advantage of this initiative.

Blog Source: https://cspbankmitrabc.blogspot.com/2023/04/why-applying-for-csp-online-is-game.html

#Bank CSP Registration#All Bank CSP#Bank CSP#Bank CSP Provider#CSP Provider#SBI CSP Apply#SBI Kiosk Banking

0 notes

Link

Bank CSP is a leading CSP provider that has been powered by 15 years of service excellence in the digital business of micro payments of services and remittances in a real time environment and is India's largest Payment Solutions Provider. Its business involves service aggregation and distribution utilising mobile, PoS and web for online payment processing and online money transfer services. With a strong innovation team, their proprietary technology and application are available for retailers, merchants and consumers, on any preferences of access. For more details, visit https://www.bankcsp.com/.

0 notes

Text

What can you Accomplish through your Bank CSP Apply Process?

The Bank CSP Apply process will empower you to carry out the services of micropayments as well as remittance digital business in real-time. You will become the most sought-after payment solutions provider not only for your parent bank but also for the citizens living in your neighborhood. The business revolves around banking service aggregation as well as delivery, web for online money transfer as well as payment processing services. There is a range of CSP services you can offer to your area people, which can help in the additional processing of services that you can handle effortlessly and effectively as an agent between your parent bank and the citizens in your rural area.

Your Bank CSP Apply will provide you an opportunity to offer a quick and simple solution for the entire bank transaction problems of people in your neighborhood. You will be capable of functioning as a one-stop source for their wide array of banking transaction as well as other payment needs. You can help them in several ways and at the same time play a crucial role in the overall development of your parent bank.

If you are running an SBI Kiosk Banking outlet in your village, you can help your customers perform a variety of acquisitions, avail a range of banking facilities, as well as the benefits of the country's social welfare schemes. You will be capable of using the enormous development of the service segment as well as expending the power of the average consumer, as well. You will be working with the mission of bringing convenience to the doorstep of people in your area and facilitating them to access a varied range of services through a vivacious delivery mechanism.

As an operator of an SBI Kiosk Banking outlet, you can also fulfill the banking needs of all classes of people, including low-income people as well as middle-income groups. You will be capable of connecting them to your parent bank right from the comfort of your kiosk outlet to resolve their variety of money transactions as well as payment problems. Above all, you can empower the young population in your neighborhood with entrepreneurial opportunities, as well.

Blog Source: https://thenictcsp.wordpress.com/2023/01/24/what-can-you-accomplish-through-your-bank-csp-apply-process

#Bank Mitra Registration#SBI Kiosk Banking#SBI CSP Apply#CSP Provider#Bank CSP Provider#PNB CSP Apply#PNB CSP Registration

0 notes

Text

What Does It Take To Be A Customer Service Point Provider?

Are you looking to become a CSP (Customer Service Point) provider? If so, you have come to the right place. In this blog post, we will discuss what it takes to become a CSP provider, what their duties are, and how to apply for CSP. So if you're ready to learn more about the world of CSP providers, let's dive in!

Providing high quality customer service

Customer Service Point (CSP) providers are responsible for ensuring that customers receive the highest quality of service possible. As a CSP provider, you need to be patient, organized, and have excellent communication skills in order to provide outstanding customer service. You must be able to effectively answer customer questions, solve customer issues, and build positive relationships with customers. In order to become a CSP provider, you must apply online for a bank CSP. After you have applied and been approved, you will begin your training program to become certified as a CSP provider. Once certified, you will be responsible for providing exceptional customer service and meeting the needs of customers.

Building positive relationships with customers

As a customer service point (CSP) provider, it’s important to build strong, trusting relationships with customers. This involves being friendly and professional, displaying a high level of customer service, and being able to provide solutions to their issues. To achieve this, CSP providers should take the time to get to know their customers by asking questions about their needs and wants. They should also stay up-to-date on the latest products and services and be able to explain them clearly.

In addition, it’s important to stay organized so that records of customer interactions are kept and updated regularly. This helps ensure that customer complaints or concerns are addressed promptly.

Handling customer inquiries and complaints

Customer Service Point (CSP) providers play an important role in helping customers resolve issues and providing support. It is essential that CSP providers take a proactive approach when handling customer inquiries and complaints.

The first step in resolving a customer’s inquiry or complaint is to listen. CSP providers should carefully listen to the customer’s concerns and pay attention to their needs. This will help the provider better understand what the customer needs and how they can best help.

Once the provider has an understanding of the customer’s issue, they should work with the customer to find a solution that is mutually beneficial. CSP providers should also make sure to provide accurate information and ensure that customers understand any processes, such as how to apply online for bank CSP, before moving forward.

Maintaining records of customer interactions

When it comes to customer service, one of the most important aspects is keeping accurate records of customer interactions. This includes all information collected from customers such as personal data, feedback on services, and any requests they may have. By having this data readily available, customer service providers are able to look back and provide the best possible experience for their customers.

0 notes

Link

As one of the leading CSP provider, Bank CSP delivers an array of business and financial services through a cost efficient platform comprising Mobile, Web and POS delivery. Over the last decade, Bank CSP has been at the forefront of financial inclusion in India. By digitizing cash, they are transforming lives. With a strong innovation team, their proprietary technology and application are available for retailers, merchants and consumers, on any preferences of access. For more details, visit https://www.bankcsp.com/.

0 notes

Text

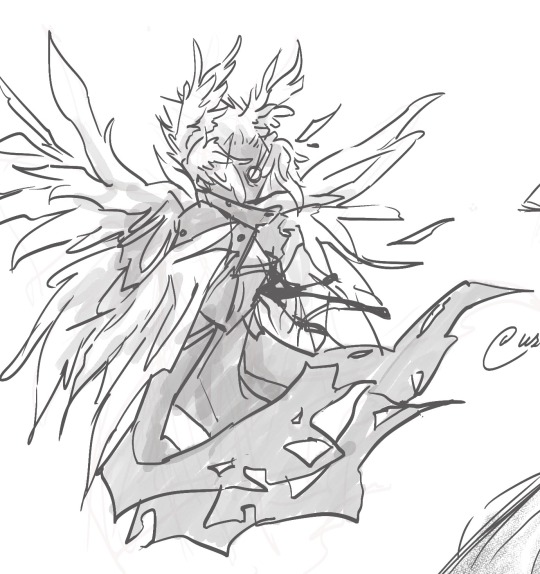

this dog does in fact bite ((cropped the full sketch page bc i didnt like the other pieces on it oops))

#adjusting to a new art program is actually the worst#im trying to provide terrible sketches for the sake of learning how to use csp instead of prcreate#but god going from ipad to laptop is visually fucking w my eyes too#we ball but at what cost#trigun#trigun stampede#tristamp#trigun maximum#trimax#vash the stampede#look at my son#pride is not the word im looking for

969 notes

·

View notes

Text

Eldest son, rotten with greed...

Justice family my beloved

I actually really love season one (no suprise lol its good) but like the characters are so fun and getting to know the Drawtectives is great

I love this grieving family and their shitty shitty kids

☆

Reblogs appreciated 💜

#more drawtectives art!#sorry you will not get me to shut up about these keychains in the next 2 weeks#hopefully tho i can also provide more cool drawtectives art#so it isnt me just yapping abt my keychains#but also#buy my keychains plz#drawtectives#drawfee#drawfee fanart#drawtectives fanart#Emery justice#drawtectives emery#lotta justice#drawtectives lotta#sorin justice#drawtectives sorin#my art#digital art#clip studio paint#csp#fanart#fan merch#keychains#🪱#artists on tumblr#small business

79 notes

·

View notes

Text

drawin....

#RRAAARRGJH its pretty much done but theres a comic that has to go with itn💀#TWO ACTUALLY LMAO 💀💀💀💀#listrn. therrs nothing by way of laishuro. i MUST provide a strong front#I DONT REMEMBER HOW TO COLOR ON CSP i approximated how i do it nowadays on sai but..... rip#ALSO LEED IM FUCKING LOVE YOU!!!!!#tade is just out of frame and theres half of hien there lmao

177 notes

·

View notes

Text

How PNB CSP Registration Helps you Provide Financial Services to your Community

PNB (Punjab National Bank) is one of India's largest public sector banks with an extensive branch network across the country. As part of the financial inclusion program, PNB launched a Customer Service Point (CSP) program to provide banking services to the non-banking and banking sector in rural and remote communities.

PNB CSP Registration is a great opportunity for individuals and business people to become a part of the banking system and provide financial services to society. As a CSP, you can act like a small bank and provide services such as account opening, cash deposits, cash withdrawals, money transfers, and other basic banking services.

PNB CSP aims to reach out to the domestic unbanked and underbanked and provide convenient banking services at their doorsteps. By becoming a PNB CSP, you can bridge the gap between banks and individuals and play a key role in the country's financial inclusion.

How to apply for PNB CSP registration and what are its benefits

You must meet certain eligibility criteria in order to apply for PNB CSP registration that, includes the following:

• Over 18 years of age,

• Valid identification

• A suitable workspace and equipment

PNB CSP can apply online by visiting the official website of PNB or visiting the nearest PNB branch. You can also rely on a repeatable Bank CSP Provider if you want to apply for PNB CSP. Once your application is accepted, you will be required to attend a training program conducted by PNB to understand the banking systems and services you offer as a CSP.

As a PNB CSP, you earn a commission on every transaction you make on behalf of your bank. The commission rates are competitive and depend on the type of service provided. Also, you can earn from providing other financial services to our customers, such as insurance, mutual funds, and other investment products.

By becoming a CSP, you can benefit from PNB's brand value and trust and offer your customers a wide range of banking services. You can also build a loyal customer base by providing quality service and gain a reputation as a reliable and trustworthy Bank CSP Provider.

In conclusion, by becoming a PNB CSP, you can play an important role in the country's financial inclusion and have a stable source of income. If you meet the eligibility criteria and have the necessary infrastructure and resources, consider applying for the PNB CSP Registration and become a part of the country's banking revolution.

Blog Source: https://allbankcsp.wordpress.com/2023/03/13/how-pnb-csp-registration-helps-you-provide-financial-services-to-your-community/

#Apply For CSP#CSP Application#Bank CSP Registration#CSP Online Apply#CSP Registration#Bank Mitra Registration#Digital CSP Registration#CSP Provider

0 notes

Text

Are you looking for a certified online CSP provider?

cspbankmitrabc.net.in is the most trusted online CSP provider all over India. A bank CSP provider in India offers an online CSP registration service. It is very important that your CSP provider has the authority to provide you with a bank CSP. As an online CSP provider, we make sure that we give you a certified bank CSP. For more info visit our website.

0 notes

Text

Explore all the Benefits of Bank Registration Kiosk SBI

In today's fast-paced world, banking has become an integral part of daily life. From paying bills to sending money, the reliance on banks for financial needs is growing rapidly. However, not everyone has access to traditional banking services for various reasons such as distance, lack of infrastructure, and difficulties meeting bank account opening requirements. This is where SBI Kiosk Banking can be a boon for those who do not have access to traditional banking services.

SBI kiosk banking introduction and what are its benefits

SBI Kiosk Banking is a service provided by the State Bank of India (SBI) where banks have set up kiosks in remote locations to provide basic banking services to the local population. Kiosks are staffed by SBI Business Correspondents (BCs) who act as bank agents and provide services such as deposits, withdrawals, money transfers, and other financial services to customers.

One of the key benefits of SBI Kiosk Banking is providing banking services to people living in remote areas where traditional banking services are unavailable. SBI's kiosks are located in areas where the population is dispersed, and traditional bank branches cannot be opened. The service brought banking services to the doorstep of people living in rural and remote areas and helped them save time and money.

Another advantage of choosing SBI CSP Apply is that it is a cost-effective method of banking. Opening a traditional bank branch requires a large investment in infrastructure and human resources. However, SBI kiosks are cost-effective and require minimal infrastructure. The cost of setting up a kiosk is much lower than setting up a traditional bank branch, making it an attractive option for SBI.

SBI Kiosk Banking is also useful for those who do not have the necessary documents to open a traditional bank account. SBI Kiosk Banking allows customers to open a Basic Savings Bank Deposit Account (BSBDA) with just an Aadhaar card and a PAN card, making banking services accessible to a wider range of people.

Another advantage of SBI Kiosk Bank is to provide employment opportunities for the rural population. SBI Business Correspondents (BCs) in charge of kiosks are typically locals trained by SBI to provide banking services. This will create jobs for people in rural areas and help promote economic inclusion.

In conclusion, SBI CSP Apply offers many benefits to both banks and customers. It is a cost-effective banking method to provide basic banking services to people living in remote areas. It also provides employment opportunities for people in rural areas and promotes economic inclusion. With the growth of digital banking and the increasing use of mobile banking, SBI Kiosk Banking has become an important tool to provide basic banking services to those who cannot access traditional banking services.

Blog Source: https://applyforcspbank.finance.blog/2023/03/16/explore-all-the-benefits-of-bank-registration-kiosk-sbi/

#CSP Bank#Digital CSP Registration#Bank CSP#Bank CSP Provider#CSP Provider#SBI CSP Apply#SBI Kiosk Banking#Bank Mitra Registration

0 notes

Text

getting that itch to draw something ik i’m not skilled enough for lmao

#this is vee speaking#don’t try to understand that screenshot lol ameyume lowkey suffering over their craft in hang out was what came to mind lol#if i attempt to draw it tho it’ll be good practice for a piece i want to make for kuukou’s bday week#i still don’t have fcking internet at home tho and since csp teeters that bum edge i wouldn’t be able to save my progress without it#*wriggles like a worm* but i wanna draw………… try to be creative…………#play around with shit i’m not comfy with……………… let me be free from the shackles of capitalism and ass internet providers……………..

22 notes

·

View notes

Text

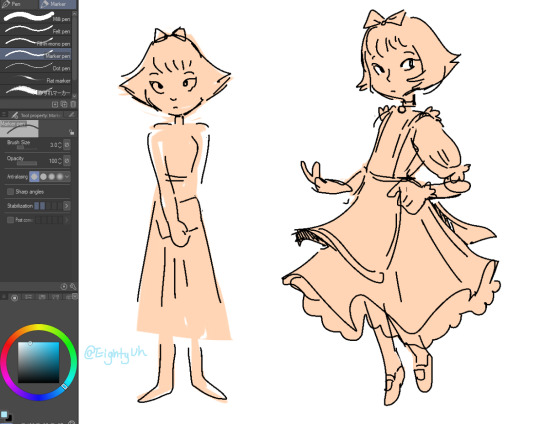

look im excited for her okay

#wip#WICK'S END#she doesn't come until the third act but aksdfjlajflaj#btw that ^^^^ is the brush i use for wick's end now#CSP default “marker pen” at 3px with no anti-aliasing and stabilization set to 2#sweet spot of thick enough to keep me from getting TOO detailed but small enough to capture detail -- imo#the pixelization provides a unique “rough” texture while also letting me fill quickly without artifacts#calico

27 notes

·

View notes

Note

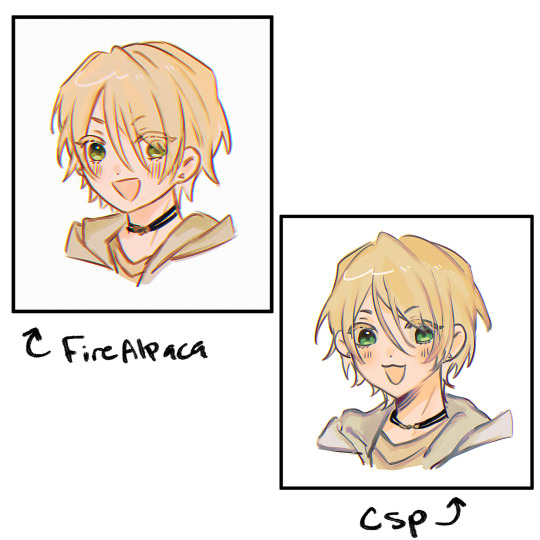

what art program do you use nowadays? in what ways do you prefer it to firealpaca?

I use clip studio paint! If you'd asked this a couple yrs ago I would've given you a CSP salespitch but actually rn CSP has switched to a subscription based model and have discontinued the download of their 1.0 version, which I currently use (CSP 2.0 and any other newer versions are subscription based I think).

So. I decided to give firealpaca a fair chance before I got back to you because I'm petty and I think any program that isn't subscription based is better than CSP ❤️ I used firealpaca like (redacted) years ago so there's been many changes since I last used it, so I tried to draw smth on it

(More under the cut sorry I'm rambling)

And tbh it doesn't look THAT different😭 I mean obviously my CSP Aira is more polished bc I'm currently more used to it, but otherwise my process was pretty much the same. I'm sure if I used firealpaca more I could probably achieve a replica. If I tried hard enough

The biggest difference between CSP and FireAlpaca is that CSP has a wider variety of assets and brushes. FireAlpaca does have like a brush asset store, which is very cool, but it doesn't have as many as CSP.

But usually artists don't use that many brushes when drawing anyways, a lot of us just like downloading them and not using them so even if you don't have access to the entire library of CSP assets you'll survive probably

However, when it comes to brushes, CSP has better default brushes (especially their airbrush). FireAlpaca's default brushes aren't bad, but they aren't the best either, although this can be rectified by just downloading a brush in their brush store 💀 FireAlpaca does give me some trouble with pen lag and stuff but it's pretty minor

I didn't use this in my drawing, but CSP has a 3D asset function that's useful for posing and drawing objects, which is convenient for me but if you're the type of person that doesn't have trouble with anatomy and stuff, you'll be fine even without it.

Overall, I do prefer CSP because I'm used to it and I like the assets there, but you can draw just fine with FireAlpaca even without the excessive assets. Honestly with all the additions over the years, I'm surprised FireAlpaca is still free 😭

#sorry for rambling anon i am a csp user but also csp's biggest hater after the stunt they pulled with that subscription model#they got ratioed in every language for that on twt its serious business😭#but tldr i like the 3d assets and the brushes on csp but its not Necessary to create good art#if youre just drawing and you dont require fancy assets or 100 million brushes firealpaca will work just fine#also they have a chromatic aberration function so . thats a W#btw anon ur question caught me off guard its giving undercover firealpaca employee asking for deets#but i yeah i will provide it in full detail just for u. insert finger heart

8 notes

·

View notes