#e-invoice software

Explore tagged Tumblr posts

Text

Best e-invoice software under GST .

0 notes

Text

Streamlining Business Operations: The Power of Integration with Vendor Invoice Management Systems

Digital enterprises function in a fast-paced environment, and increasing productivity requires integrating cutting-edge technology. How can TYASuite Vendor Invoice Management Systems seamlessly integrate with other business systems to elevate your operations?

Integration for Seamless Workflows: Ever wondered how your Vendor Invoice Management System can effortlessly collaborate with existing business platforms? Explore the transformative benefits of integration, ensuring a seamless flow of information between your invoicing system and other vital tools. How does this integration enhance accuracy and reduce manual errors in financial processes?

Automation Revolution: Unlock the true potential of your business with recurring invoice software that embraces automation. Discover the ease of managing repetitive tasks, from invoice generation to payment reminders, and witness the significant time and resource savings. How does automation empower your team to focus on strategic initiatives rather than tedious manual tasks?

AI-Powered Precision: Delve into the realm of Artificial Intelligence within e-invoice software. Explore how AI algorithms enhance data accuracy, reduce discrepancies, and predict potential issues. How does the infusion of AI elevate the intelligence of your invoicing system, providing actionable insights for smarter decision-making?

Supplier Invoice Management System Excellence: Ensure a harmonious relationship with suppliers through a robust Supplier Invoice Management System. Learn how integrating this system with your overall business infrastructure fosters transparent communication and strengthens supplier relations. What role does integration play in creating a cohesive ecosystem?

Embrace the future of business operations by unlocking the potential of integration, automation, and artificial intelligence within your Vendor Invoice Management System. Elevate your efficiency, accuracy, and overall success in the competitive business landscape.

#vendor invoice management system#recurring invoice software#e-invoice software#supplier invoice management system

0 notes

Text

Courier Service Management Software by @hrsoftbd Bangladesh

#mobile app design bd#mobile app development bd#accounting software bd#accounting software development bd#advocate dairy management bd#website desing bd#website development bd#omr solution bd#omr development bd#Courier service management software bd#doamin and hosting bd#bulk sms bd#prescription software bd#e-commerce solution bd#online education system bd#spa management software bd#parlor management software bd#ballot counting software bd#dairy farm software bd#shop management software bd#invoice software development bd#salon management software bd#ERP solution bd#vehicle manageent bd#Coaching Management Software bd#hrsoftbd

3 notes

·

View notes

Text

OMR Solution for MCQ Exam from @hrsoftbd Bangladesh

#mobile app design bd#mobile app development bd#accounting software bd#accounting software development bd#advocate dairy management bd#website desing bd#website development bd#omr solution bd#omr development bd#Courier service management software bd#doamin and hosting bd#bulk sms bd#prescription software bd#e-commerce solution bd#online education system bd#spa management software bd#parlor management software bd#ballot counting software bd#dairy farm software bd#shop management software bd#invoice software development bd#salon management software bd#ERP solution bd#vehicle manageent bd#Coaching Management Software bd#hrsoftbd

2 notes

·

View notes

Text

HRsoftBD offer Bluk SMS

#mobile app design bd#mobile app development bd#accounting software bd#accounting software development bd#advocate dairy management bd#website desing bd#website development bd#omr solution bd#omr development bd#Courier service management software bd#doamin and hosting bd#bulk sms bd#prescription software bd#e-commerce solution bd#online education system bd#spa management software bd#parlor management software bd#ballot counting software bd#dairy farm software bd#shop management software bd#invoice software development bd#salon management software bd#ERP solution bd#vehicle manageent bd#hrsoftbd

2 notes

·

View notes

Text

Expanding your business to multiple locations can be a great way to increase sales, reach new customers, and grow your brand. However, it can also be a challenge to manage multiple locations effectively. Suvit is an all-in-one accounting automation platform that strives to make finance cool again! Suvit is more than just a platform; it's a financial game-changer.

#tally solutions#automation for accountants#accounting automation software#automated bank statement processing#1950s#e invoice in tally#tally on cloud#tally automation

2 notes

·

View notes

Text

Stop Losing Money: How Revenue Management Systems Prevent Revenue Leakage

Revenue leakage is a silent profit killer that many businesses overlook, but it can cost companies up to 9% of their annual revenue. Whether you're in hospitality, travel, retail, or SaaS, even small pricing errors or missed invoices can lead to massive financial losses over time.

In a world where profit margins are thin and competition is fierce, preventing revenue leakage is not optional—it's essential.

This is where an AI-powered Revenue Management System (RMS) like ZettaPrice comes in. From dynamic pricing to automated invoicing, RMS software can seal the leaks and boost your bottom line. In this blog, we’ll explore how a robust revenue management solution can transform financial performance across industries.

✅ What Is Revenue Leakage?

Revenue leakage refers to the unnoticed loss of potential revenue due to inefficiencies, manual errors, or poor pricing strategies. Common causes include:

Incorrect or inconsistent pricing

Contract non-compliance

Billing inefficiencies or missed invoices

Mismanaged discounts and promotions

Poor data visibility and tracking

🔍 Revenue leakage affects 42% of companies—costing businesses an average of 9% of total sales annually. The worst part? It often goes undetected until the damage is done.

🧠 What Is a Revenue Management System (RMS)?

A Revenue Management System is a data-driven, AI-powered software solution that helps businesses:

Optimize pricing based on market demand and competition

Forecast demand and adjust inventory or services accordingly

Automate critical revenue processes (e.g., invoicing, contract compliance, and discount approvals)

Detect and plug revenue gaps before they escalate

Popular in hotels, airlines, retail, and subscription-based businesses, an RMS ensures you’re not leaving money on the table.

🔐 How to Prevent Revenue Leakage Using Revenue Management Software

Here’s how an advanced revenue optimization software like ZettaPrice RMS helps businesses detect, prevent, and eliminate revenue leakage:

1. AI-Powered Dynamic Pricing

Adjust prices in real time based on market trends, competitor pricing, and demand.

Prevent underpricing or over-discounting that erodes profit margins.

Maximize revenue during high-demand periods without sacrificing customer satisfaction.

2. Contract and Compliance Monitoring

Automatically track contract terms, service-level agreements, and payment cycles.

Flag discrepancies, missed invoices, or unapproved discounts.

Ensure full revenue recognition from every agreement.

3. Demand Forecasting and Inventory Optimization

Use predictive analytics to forecast customer demand with high accuracy.

Minimize stockouts and overstocking—both major causes of revenue loss.

Optimize resource allocation and reduce holding costs.

4. Identifying Revenue Gaps and Errors

Real-time dashboards highlight where revenue is leaking and why.

Actionable insights help you fix issues proactively instead of reacting later.

Improve financial reporting and transparency.

🚀 Benefits of Implementing a Revenue Management System

1. Increased Profitability

With smart pricing strategies, businesses can ensure they’re charging the right price at the right time. This boosts revenue without alienating customers.

📌 Example: Hotels using RMS increase RevPAR (Revenue per Available Room) by adjusting room prices during peak and off-peak seasons.

2. Improved Operational Efficiency

Manual revenue tracking and billing are prone to errors. Automation through RMS helps:

Save time and reduce human errors

Standardize pricing and billing processes

Ensure regulatory compliance

📌 Example: Airlines use RMS to automate fare updates, reducing fare leakage due to outdated pricing.

3. Enhanced Customer Experience

Personalize pricing and promotions using customer data.

Improve conversion rates and brand loyalty.

Deliver better value to different customer segments.

📌 Example: E-commerce retailers apply dynamic discounts based on browsing behavior and purchase history.

4. Competitive Advantage

Stay one step ahead by responding to market changes in real time. With RMS:

React instantly to competitor pricing

Maintain market share without sacrificing margin

Improve price transparency and customer trust

5. Smarter, Data-Driven Decisions

Access to real-time analytics empowers your teams to:

Identify new revenue opportunities

Predict churn in subscription models

Avoid pricing blind spots and inefficiencies

📌 Example: SaaS platforms use RMS data to prevent downgrades and maximize lifetime customer value.

🧩 Why Choose ZettaPrice RMS to Prevent Revenue Leakage?

ZettaPrice Revenue Management System is a cutting-edge solution designed to plug revenue gaps and increase profitability. It helps your business:

✅ Dynamically optimize pricing using AI & machine learning ✅ Eliminate revenue loss from underpricing or outdated rates ✅ Automate invoicing, billing, and discount tracking ✅ Monitor contracts and ensure compliance ✅ Uncover hidden revenue opportunities using data analytics

ZettaPrice RMS is ideal for industries like:

Hotels and Resorts

Online Travel Agencies (OTAs)

Retail Chains & E-commerce

SaaS and Subscription Services

With ZettaPrice, you don’t just stop revenue leakage—you unlock long-term financial stability and growth.

🏁 Conclusion: Seal the Leaks Before It’s Too Late

Revenue leakage is preventable—but only if you have the right tools. In today’s data-driven world, investing in a revenue management system is no longer a luxury but a necessity. With AI-powered software like ZettaPrice RMS, you can:

Prevent revenue losses

Improve operational efficiency

Gain a competitive advantage

Maximize profitability

Don’t wait until your profits vanish through cracks you can’t see.

👉 Start your journey to leak-free revenue with ZettaPrice RMS today!

#Revenue leakage#Revenue management system (RMS)#Dynamic pricing software#Prevent revenue loss#AI pricing tool#Hotel revenue management#SaaS pricing optimization#E-commerce revenue software#Data-driven pricing strategies#Automate invoicing and billing#Contract compliance tracking#Retail pricing automation#Optimize demand forecasting#Revenue analytics software#ZettaPrice RMS

0 notes

Text

Simple Online Invoicing

Aninvoice is an online invoicing platform designed to simplify billing processes for small businesses and freelancers. It offers features such as customizable invoice templates, automated billing, and secure payment processing to streamline financial transactions and enhance cash flow management. For more information Visit Us: https://aninvoice.com/

0 notes

Text

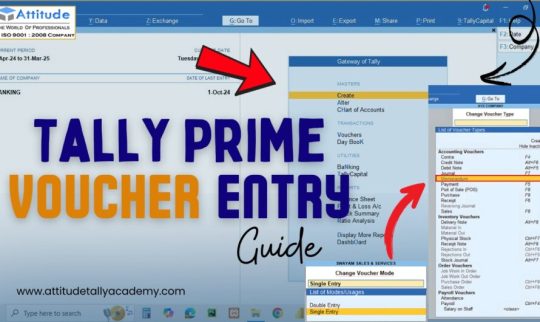

Master e-Accounting with TallyPrime: Learn Smart Financial Management

Level up your accounting skills with an in-depth e-Accounting course using TallyPrime. Designed for beginners and professionals, this course covers everything from manual accounting to GST, TDS, payroll, bank reconciliation, inventory management, and financial reporting. Learn how to create accurate books of accounts and manage real-time transactions using one of the most trusted accounting software solutions in the industry.

Whether you're looking to boost your resume or manage business finances efficiently, mastering TallyPrime is a smart investment in your career.

Start today and build a strong foundation in digital accounting!

Visit Attitude Academy📚

📍 Visit Us: Yamuna Vihar | Uttam Nagar

📞 Call: +91 9654382235

🌐 Website: www.attitudetallyacademy.com

📩 Email: [email protected]

📸 Follow us on: attitudeacademy4u

#TallyPrime Course#e-Accounting Course#Tally with GST Training#Learn TallyPrime#TallyPrime Online Course#Tally Accounting Software#GST with Tally Course#Tally Course for Beginners#Financial Accounting with Tally#Payroll in TallyPrime#TDS and TCS in Tally#Advanced Tally Course#TallyPrime with e-Invoicing#Business Accounting Course#Tally Certification Course

0 notes

Text

0 notes

Text

0 notes

Text

Mobile App Development by @hrsoftbd Bangladesh

#mobile app design bd#mobile app development bd#accounting software bd#accounting software development bd#advocate dairy management bd#website desing bd#website development bd#omr solution bd#omr development bd#Courier service management software bd#doamin and hosting bd#bulk sms bd#prescription software bd#e-commerce solution bd#online education system bd#spa management software bd#parlor management software bd#ballot counting software bd#dairy farm software bd#shop management software bd#invoice software development bd#salon management software bd#ERP solution bd#vehicle manageent bd#Coaching Management Software bd#hrsoftbd

3 notes

·

View notes

Text

E-Commerce Solution from HRsoft Bangladesh

#mobile app design bd#mobile app development bd#accounting software bd#accounting software development bd#advocate dairy management bd#website desing bd#website development bd#omr solution bd#omr development bd#Courier service management software bd#doamin and hosting bd#bulk sms bd#prescription software bd#e-commerce solution bd#online education system bd#spa management software bd#parlor management software bd#ballot counting software bd#dairy farm software bd#shop management software bd#invoice software development bd#salon management software bd#ERP solution bd#vehicle manageent bd#Coaching Management Software bd#hrsoftbd

2 notes

·

View notes

Text

fingerprint scanner software by @hrsoftbd

visit:

#mobile app design bd#mobile app development bd#accounting software bd#accounting software development bd#advocate dairy management bd#website desing bd#website development bd#omr solution bd#omr development bd#Courier service management software bd#doamin and hosting bd#bulk sms bd#prescription software bd#e-commerce solution bd#online education system bd#spa management software bd#parlor management software bd#ballot counting software bd#dairy farm software bd#shop management software bd#invoice software development bd#salon management software bd#ERP solution bd#vehicle manageent bd#Coaching Management Software bd#hrsoftbd

2 notes

·

View notes

Text

Common Mistakes to Avoid When Managing GST Ledgers in Tally

Goods and Services Tax (GST) is a comprehensive indirect tax levy on the manufacture, sale, and consumption of most goods and services in Bharat. It was introduced on July 1, 2017, to subsume multiple indirect taxes, such as excise duty, value-added tax (VAT), service tax, and central sales tax (CST). GST ledgers in Tally are used to record all GST transactions, such as sales, purchases, and expenses. It is important to avoid mistakes in GST ledgers, as this can lead to penalties from the GST authorities.

#accounting automation software#GST Ledgers#GST#tally on cloud#automated bank statement processing#e invoice in tally#tally solutions

2 notes

·

View notes

Text

The Evolution and Importance of Software for E-Invoicing

In the modern business landscape, the shift towards digital transformation has been nothing short of revolutionary. Among the many technological advancements, the adoption of software for e-invoicing has emerged as a critical component for businesses aiming to streamline their financial operations. E-invoicing, or electronic invoicing, refers to the digital generation, delivery, and processing of invoices. This method has largely replaced traditional paper-based invoicing, offering a more efficient, accurate, and environmentally friendly alternative. As businesses continue to embrace digital solutions, the role of software for e invoicing has become increasingly significant.

The Rise of E-Invoicing in the Digital Age

The concept of e-invoicing is not entirely new, but its adoption has accelerated in recent years due to advancements in technology and the growing need for businesses to optimize their operations. In the past, invoicing was a manual process that involved creating paper invoices, printing them, and sending them via postal mail. This method was not only time-consuming but also prone to errors and delays. With the advent of the internet and digital technologies, businesses began to explore more efficient ways to manage their invoicing processes.

The introduction of software for e-invoicing marked a turning point in how businesses handle their financial transactions. E-invoicing software automates the entire invoicing process, from generating invoices to sending them to customers and tracking payments. This automation has significantly reduced the time and effort required to manage invoices, allowing businesses to focus on more strategic tasks. Moreover, e-invoicing software has made it easier for businesses to comply with tax regulations and reporting requirements, which can vary significantly from one country to another.

Key Features of E-Invoicing Software

E-invoicing software comes with a range of features designed to simplify and enhance the invoicing process. One of the most important features is the ability to generate invoices automatically. This feature allows businesses to create invoices based on predefined templates, reducing the risk of errors and ensuring consistency across all invoices. Additionally, e-invoicing software often includes tools for managing customer data, such as contact information and payment terms, making it easier to generate accurate invoices quickly.

Another key feature of e-invoicing software is the ability to send invoices electronically. This can be done via email or through a secure online portal, depending on the preferences of the business and its customers. Electronic delivery not only speeds up the invoicing process but also reduces the costs associated with printing and postage. Furthermore, e-invoicing software typically includes tracking and reporting tools that allow businesses to monitor the status of their invoices in real-time. This visibility is crucial for managing cash flow and ensuring that payments are received on time.

Integration with other business systems is another important feature of e-invoicing software. Many e-invoicing solutions can be integrated with accounting software, enterprise resource planning (ERP) systems, and customer relationship management (CRM) platforms. This integration ensures that all financial data is synchronized across different systems, reducing the risk of discrepancies and improving overall efficiency. For example, when an invoice is generated in the e-invoicing software, it can automatically be recorded in the accounting system, eliminating the need for manual data entry.

The Benefits of Using E-Invoicing Software

The adoption of software for e-invoicing offers numerous benefits for businesses of all sizes. One of the most significant advantages is the reduction in administrative costs. By automating the invoicing process, businesses can save time and resources that would otherwise be spent on manual tasks. This cost savings can be particularly important for small and medium-sized enterprises (SMEs) that may have limited resources to dedicate to administrative tasks.

Another major benefit of e-invoicing software is the improvement in accuracy and efficiency. Manual invoicing processes are prone to errors, such as incorrect amounts, missing information, or duplicate invoices. These errors can lead to delays in payment and strain relationships with customers. E-invoicing software minimizes the risk of such errors by automating the generation and delivery of invoices. Additionally, the software can flag potential issues, such as overdue payments or discrepancies in invoice amounts, allowing businesses to address them promptly.

E-invoicing software also enhances the overall customer experience. With electronic invoicing, customers receive their invoices quickly and can easily access them online. This convenience can lead to faster payments and improved customer satisfaction. Moreover, e-invoicing software often includes features that allow customers to view their payment history, track the status of their invoices, and make payments online. These self-service options can further enhance the customer experience and reduce the burden on the business's customer support team.

Compliance with tax regulations is another critical benefit of using e-invoicing software. Many countries have implemented e-invoicing mandates that require businesses to issue and store invoices electronically. E-invoicing software is designed to meet these regulatory requirements, ensuring that businesses remain compliant and avoid potential penalties. The software can also generate reports and audit trails that may be required for tax purposes, further simplifying compliance.

The Future of E-Invoicing Software

As technology continues to evolve, the future of e-invoicing software looks promising. One of the key trends in the e-invoicing space is the adoption of cloud-based solutions. Cloud-based e-invoicing software offers several advantages, including scalability, flexibility, and accessibility. Businesses can access their invoicing data from anywhere, at any time, making it easier to manage their finances on the go. Additionally, cloud-based solutions often come with automatic updates, ensuring that businesses always have access to the latest features and security enhancements.

Another emerging trend is the integration of artificial intelligence (AI) and machine learning (ML) into e-invoicing software. These technologies can further automate the invoicing process by analyzing historical data and predicting future trends. For example, AI-powered e-invoicing software can identify patterns in customer payment behavior and suggest strategies for improving cash flow. Machine learning algorithms can also be used to detect anomalies in invoice data, such as potential fraud or errors, and alert businesses to take corrective action.

Blockchain technology is also expected to play a role in the future of e-invoicing. Blockchain offers a secure and transparent way to record and verify transactions, making it an ideal solution for e-invoicing. By using blockchain, businesses can create a tamper-proof record of their invoices, reducing the risk of fraud and ensuring the integrity of their financial data. Additionally, blockchain can facilitate cross-border transactions by providing a decentralized platform for exchanging invoices and payments.

Conclusion

In conclusion, software for e invoicing has become an indispensable tool for businesses looking to streamline their financial operations and stay competitive in the digital age. The automation, accuracy, and efficiency offered by e-invoicing software have transformed the way businesses manage their invoicing processes, leading to significant cost savings and improved customer experiences. As technology continues to advance, the capabilities of e-invoicing software will only continue to grow, offering even more benefits for businesses in the future. Whether you are a small business owner or a large enterprise, investing in e-invoicing software is a smart move that can help you stay ahead in today's fast-paced business environment.

0 notes