#excise duty rate

Text

Indirect Tax

Recent changes in Indirect Tax

Indirect taxes are taxes that are assessed by Government on goods and services, rather than on individualities or businesses directly. These taxes are collected by businesses from consumer when they buy goods or services, and also remitted to the government. Indirect taxes are often referred to as consumption taxes because they are based on consumption of goods and services rather than income or wealth. Indirect taxes can take many forms, including sales taxes, value-added taxes (VAT), excise taxes, and tariffs.

During the Union Budget of 2023 “Amrit Kaal”, It was the very first time when the indirect tax proposals were presented before the direct tax proposals. In the Proposal of indirect tax Presented in the Union Budget of 2023 there were 4 major changes which caught the attention of the citizens.

Following are the 4 major changes:

Customs Perspective: In the Union Budget, to promote the ‘Make in India’ campaign and give to a boost to domestic manufacturing and enhance exports, the government and our FM has proposed few changes in the rate of import duties. The import duties on electric chimneys and cigarettes will now be more expensive, while on the other hand import of gold, silver, platinum, coin, etc., will be cheaper. Also, some exemption has been proposed towards goods or machinery used for manufacturing of lithium-ion battery.

GST Returns To Be Filed Within Three Years: GSTR 1, GSTR 3B and GSTR 9and GSTR 9C would now be restricted for filing, post expiry of three years from the due date of filing of the relevant GST return. Until now, there was no threshold on time for filing GST return and any taxpayer could file belated returns along with interest and late fees. However, going forward, in future these dates have been locked so as to have clarity on the timelines for litigation.

Widening of Scope of OIDAR: The Online Information and Database Access and Retrieval (OIDAR) services were brought under the tax bracket in the service tax regime and subsequently, in the GST regime. However, due to some exceptions in OIDAR and non-taxable online recipient, multiple services were escaping tax. In order to remove those exceptions, the Budget proposes to amend both the definitions and make OIDAR a wider segment for taxability purpose.

Taxability of High Sea Sales and Out-And-Out Sales: Out-and-out sales and high-sea sales were inserted in schedule III of the CGST Act, 2017 with effect from Feb. 1, 2019. However, the GST authorities were demanding GST from July 1, 2017 to Jan. 31, 2019. So to clarify this ambiguity and confusion, the budget has stated that such insertion will be with retrospective effect from July 1, 2017. This is a relief for taxpayers who are undergoing a litigation on these aspects. However, if the taxpayer has already paid the taxes for such period on the specified sales, the Budget has clearly specified that no refund of such tax can be claimed.

Although there are other changes as well but from Tax perspective the above 4 are major changes.

2 notes

·

View notes

Text

1. Armed suspects in European Quarter: Two people arrested following assault and kidnapping

Two people were arrested in the search operation that took place in the European district on Monday evening, less than ten days after a stabbing took place in the Schuman metro station in this area. Read more.

2. 'It's a liberation': Belgians increasingly open to polyamorous relationships

Over the past sixty years, the marriage rate among Europeans has declined by 60%, while the divorce rate has more than doubled. Liberals typically applaud these figures as indicative of Western citizens' increasing personal freedom and ability to make key lifestyle choices; conservatives, meanwhile, tend to denounce them as symptomatic of Western society's broader cultural decline. Read more.

3. 'Only logical': Belgium to phase out energy support from April

Belgium's Federal Government reached an agreement on the energy bill reform: higher excise duties will be added to people's bills from April causing them to rise slightly, but the VAT rate will remain at 6%. The extended social rate will also be phased out. Read more.

4. Turkey and Syria earthquakes: Still no information on Belgian casualties

Belgium's Foreign Affairs Department still has no information on Tuesday about whether any Belgian nationals were injured or deceased after deadly earthquakes struck Turkey and Syria. The death toll has already hit 5,000 and continues to rise as rescuers sift through the rubble. Read more.

5. Over half of girls in Belgium have received unsolicited pictures, often from strangers

Young people aged 15 to 25 in Belgium very regularly received unsolicited sexual content online, with half of the girls in this age group indicating they have already received a so-called "dick pic." Read more.

6. Belgium's Royals: Stuck in the past or a family for the future?

Despite being a constitutional monarchy, support for Belgium's royal family is low compared to other European monarchies. The country won't become a republic anytime soon, but with just 58.2% of Belgians in favour of the monarchy, does the family need to reinvent itself? Read more.

7. Today in History: Death of Adolphe Sax, inventor of the saxophone

On this day, 7 February 1894, the Belgian inventor of the saxophone, Adolphe Sax, died of pneumonia in Paris, afflicted by poverty. Read more.

2 notes

·

View notes

Text

Nirmala Sitharaman's prediction for India's economy as IMF cuts global growth

Nirmala Sitharaman said growth will be among the top priorities of the Narendra Modi government and attention will be paid to sustaining the momentum that the Indian economy has got coming out of the Covid-19 pandemic.

Union finance minister Nirmala Sitharaman, who is in the US to attend the annual meetings of the International Monetary Fund (IMF) and the World Bank, on Tuesday forecasted India’s growth rate to be around 7 per cent this financial year.

Sitharaman said growth will be among the top priorities of the Narendra Modi government and attention will be paid to sustaining the momentum that the Indian economy has got coming out of the Covid-19 pandemic.

Her statement comes even as the IMF, in its latest projection, predicted India’s GDP growth to be 6.8 per cent — down from a January projection of 8.2 per cent and in July estimate of 7.4 per cent. However, despite the slowdown, India would remain the fastest-growing major economy.

The IMF said on Tuesday global growth is expected to slow further next year, downgrading its forecasts as countries grapple with the fallout from Russia’s invasion of Ukraine, spiraling cost-of-living and economic downturns.

The world economy has been dealt multiple blows, with the war in Ukraine driving up food and energy prices following the coronavirus outbreak, while soaring costs and rising interest rates threaten to reverberate around the globe.

“I am aware that growth forecasts around the world are being revised lower. We expect India’s growth rate to be around 7 per cent this financial year. More importantly, I am confident of India’s relative and absolute growth performance in the rest of the decade,” she said addressing a gathering in Washington.

Sitharaman, however, observed that the Indian economy is not exempt from the impact of the world economy. “No economy is,” she said.

“After the unprecedented shock of the pandemic, came the conflict in Europe with its implications for energy, fertiliser and food prices. Now, synchronised global monetary policy is tightening in its wake. So, naturally, growth projections have been revised lower for many countries, including India. This triple shock has made growth and inflation a double-edged sword,” Sitharaman said.

After the Russia-Ukraine conflict started in February 2022, there was a sharp increase in food and energy prices. India had to ensure that the rising cost of living did not lead to lower consumption through erosion of purchasing power.

“We addressed these multiple and complex challenges through a variety of interventions. One, India ramped up its vaccine production and vaccination. India has administered over 2 billion doses of vaccine produced domestically. Two, India’s digital infrastructure ensured the delivery of targeted relief Third, in 2022, after the conflict erupted in Europe, we ensured adequate availability of food and fuel domestically, lowered import duties on edible oil and cut excise duties on petrol and diesel. The central bank has acted swiftly to ensure that inflation did not get out of hand and that currency depreciation was neither rapid nor significant enough to lead to a loss of confidence,” the minister said.

Sitharaman said India is discussing with different countries to make Rupay acceptable in their nations.

“Not just that, the UPI (Unified Payments Interface), the BHIM app, and NCPI (the National Payments Corporation of India) are all now being worked in such a way that their systems in their respective country, however, robust or otherwise can talk to our system and the inter-operability itself will give strength for Indians expertise in those countries,” she said.

2 notes

·

View notes

Text

Petrol, Diesel Price today, December 6: Check latest fuel rates in your city

Petrol, Diesel Price today, December 6: Check latest fuel rates in your city

The Center reduced the excise duty on gasoline by Rs 8 per litre and on diesel by Rs 6 per litre in May of this year, which resulted in the last big decrease in fuel prices.

source https://zeenews.india.com/economy/petrol-diesel-price-today-december-6-check-latest-fuel-rates-in-your-city-2544542.html

View On WordPress

1 note

·

View note

Text

All That You Need To Know About Import Duty

Introduction:

Customs Act was passed by the parliament of India in the year 1962. Which gives the government of India the authority to levy a tax on goods imported from foreign country. Import duty is charged on the actual imported value of goods. In addition to this, GST (Goods and Services Tax) came into existence by replacing many forms of taxes which was very cumbersome in nature. After the introduction of GST, it drastically changed the overall taxation system. Under import, IGST (Integrated Goods & Services Tax) is charged and proceeds of which directly goes to the central government.

Different types of duties under customs:

Basic Customs Duty:

This is applicable to all goods falling under section 12 of the Customs Act. These are levies prescribed in the first schedule of the Customs Tariff Act 1975.

Countervailing Duty (CVD):

It is similar to central excise duty, this is charged on goods produced within the geographical boundaries of India. It is calculated on the aggregate value of the goods which include basic customs duty and landing charges.

Education Cess:

The goods are subject to higher education cess which will be charged at 2%

Anti-Dumping Policy:

This is levied when the value of the goods is less than the market price.

Calculation of taxes payable on import of goods:

Actual value of goods imported + Basic Customs Duty = value after customs duty × IGST Rate = Value after IGST

Customs Duty + IGST+GST Cess = Total value of duties payable on imports

Customs Duty Rates:

Depending on the nature of goods, the duty rates vary from 0% to 150%. At the same time, there are some goods which are exempt from paying import duty. Since rates are subject to change from time to time, you could refer to Central Board of Indirect Taxes & Customs

While you plan to import goods from China, you might probably find the above import formalities a little scary. Don’t worry, Oyeexpress is here to make your life easy. We have a specialized team who will take care of all import duty related formalities. You could reach out to us and leave the rest to us.

Read More: Click Here

0 notes

Text

GST registration Service Provider in Delhi

When a company organization registers under the GST Law, it must acquire a unique number from the relevant tax authorities. This number is used to collect taxes on behalf of the government and to claim an Input Tax Credit for taxes paid on the business's inbound supply.

GST Registration

For businesses operating in India, it is necessary to register for GST. If your business revenues exceed certain criteria or fit into a specific category that otherwise requires simple registration, you will need to register in accordance with the rules. With the help of CA Nakul Singhal and Associates, it is easy to get your desired registration. Well, these basic GST registration tips will help you in registering for GST for your business and getting your GST admission done.

Overview of GST Registration Online

Regarding taxpayers with yearly turnover below 1.5 crore, the GST framework provides an option for a composition scheme. With this arrangement, they can pay taxes at a predetermined rate based on their turnover and go through simplified GST procedures. The GST system functions at several phases of the supply chain. This includes acquiring raw materials, production, wholesale, retail, and the eventual sale to the end consumer. Notably, GST registration is imposed at every one of these steps. For instance, the GST money collected is allotted to Uttar Pradesh when a product is produced in West Bengal and used there, highlighting the consumption-based nature of GST. The Goods and Services Tax (GST) is a mandatory tax that has been in effect since July 1st, 2017, for all manufacturers, traders, service providers, and independent contractors that operate in India. Service tax, excise duty, CST, entertainment tax, luxury tax, and VAT were among the state and federal taxes that were replaced by the GST system, which expedited the tax filing procedure. An option for a composition plan is provided by the GST framework for taxpayers with an annual revenue of less than? 1.5 crore. With the help of this program, they can pay taxes at a set rate based on their turnover and go through simplified GST processes. At several points in the supply chain, the GST process is in effect. Purchasing raw supplies, manufacturing, selling at wholesale and retail, and finally making the final sale to the customer are all included. Notably

Service Providers' GST Registration

In India, service providers with a revenue of less than 20 lakhs who supply items either intrastate or interstate are exempt from registration requirements. The decision, made at the 23rd GST Council meeting, modifies the previous rule that required interstate suppliers to file returns and register for GST regardless of their level of revenue.

Person Taxable on a Casual Basis

Under GST, all casual taxable persons are entitled to special treatment. In a State or Union territory where the entity does not have a fixed place of business, the GST Act defines a casual taxable person as someone who periodically engages in transactions involving the supply of goods or services, or both, in the course or furtherance of business, whether as a principal, agent, or in any other capacity. Therefore, individuals operating seasonal enterprises or transient firms at fairs or exhibitions would be considered casual taxable persons for the purposes of the GST. This article examines casual taxable persons' GST registration.

Non-resident Taxable Individual

A non-resident taxable person is an individual who engages in the supply and receipt of commodities without having a permanent business or place of abode in the nation. There is no turnover cap, just like with a Casual Taxable person. In contrast to other taxpayers, an unregistered individual does not need to supply their pan number; instead, they must provide their unique identification number or tax identification number, which can be used to confirm their identity. The individual in question is required to register at least five days before to the start of their business and pay the requisite advance money, for which they are responsible. Notably, a non-registered tax person should submit an application using form GST-REG-09, a shortened version of the standard form.

Throughout the supply chain, the GST system is operational at multiple stages. This includes obtaining raw materials, producing, distributing, selling at retail, and making the last sale to the client. Particularly, a casual taxable person is someone who occasionally conducts business in a state or territory without an established place of business involving the delivery of goods and/or services. No matter how much business they bring in, they have to pay taxes. These taxpayers are not subject to the composition levy. At least five days before the commencement of operation, the interested party must submit an application for registration. In the event that they are accountable, they have to prepay the taxes. He'll be allowed to carry on offering

Extra Guidelines

To register for GST, an individual must have registered for any of the previous tax systems, such as VAT, service tax, or excise duty.

When a firm is transferred from one person to another, the new owner of the rights has to register for GST.

employees of a supplier.

Operator of an online store.

anyone who supplies through an online retailer.

Anybody providing a non-registered Indian citizen with specific information from any place outside of India.

GST Registration for Several Locations

The CGST Act mandates that all providers of taxable goods and services register with the GST in the State or Union territory where the taxable supply of goods or services occurs. In addition, the GST Registration Rules include provisions for branches to get GST registration. We take a close look at branch GST registration in this article.

Records Needed for Enrollment

The following paperwork is needed to register for GST in India:

All Directors' Aadhar cards

Each Director's PAN card

A working mobile number in India

an active email address

Required Paperwork

Proof of business address a. Rental agreement or lease agreement if the firm is located in a rental

b. A NOC from the owner or landlord (even in cases where the location is one of the directors')

A recent electricity bill OR a receipt for property taxes

An authorized signatory who resides in India and possesses the required documentation, including a valid PAN number

At least one member, proprietor, partner, trustee, or Karta with a current PAN

The bank's Indian financial system code (IFSC) and valid Indian bank account number

Details of the jurisdiction

PAN number for the company

Memorandum of Association (MoA) and Incorporation Certificate

For a list of all necessary documents, see this link.

Visit - https://canakulsinghalassociates.com/

Contact us - +9199537 75505

Email ID - [email protected]

1 note

·

View note

Text

A Comprehensive Guide For Calculating Customs Duty On Watches Imported In India

The world of watches, adorned with craftsmanship and precision, often finds itself traversing the boundaries of nations, unveiling a fascinating interplay of customs duties. The allure of a finely crafted timepiece is met with an intricate web of customs regulations. Across countries, a different plethora of duties awaits those who seek horological treasures.

Introduction to Customs Duty

Customs duty on imported goods, including watches, plays a pivotal role in regulating trade and protecting domestic markets. For importers, an accurate calculation of the customs duty is imperative. It directly influences the total expense of importing goods thereby affecting overall profitability.

We will offer an all-encompassing guide on the intricacies of computing customs duty for imported watches in India. It will elucidate the various categories of customs duty, delve into the influencing factors of the calculation and furnish practical tips and examples to enhance your understanding of the procedure.

Luxury watches imports in India grew over 21% in the first half of 2023 reaching $100 million, reported by Mint

Types of Custom Duties Applicable on Watches

In India, imported watches are subject to customs duty in accordance with the Customs Act of 1962 and its associated regulations. This encompasses a spectrum of duties, including but not limited to the following:

Basic Customs Duty (BCD):

The BCD is a percentage-based duty applied to the assessable value of the watch. The assessable value of the goods is determined by summing the cost of the item/s along with the incurred expenses for insurance and freight during the transportation to India.

Customs AIDC:

The Agriculture Infrastructure and Development Cess (AIDC) is imposed on certain goods including wristwatches when imported in India.Top of Form

Additional Customs Duty (ACD):

Additional Customs Duty or Countervailing Duty (CD) is imposed at a rate equivalent to the applicable excise duty on similar goods manufactured in India. It is calculated on BCD.

Social Welfare Surcharge (SWC):

SWC is imposed at 10% of the combined amount of duties, taxes and cesses. This surcharge is intended to bolster the Government's dedication to enhancing education, healthcare and social security initiatives.

Integrated Goods and Services Tax (IGST):

IGST is a tax levied on the total value of the imported watch. It is calculated as 18% of the assessable value plus the duties, taxes and cesses.

Swiss luxury timepieces have captured the interest of enthusiasts across India and esteemed brands seize the flourishing market prospects to attract sales with exclusive timepieces, such as this Vacheron Constantin Overseas Timepiece for India

Calculating Customs Duty for Watch Imports

To compute customs duty for imported watches in India, importers must furnish essential documents, including the bill of entry, invoice, packing list and insurance records. Subsequently, customs authorities assess the value of the goods, such as the assessable value and CIF (Cost, Insurance and Freight), to determine the applicable customs duty.

Similar to various asset classes, Indians are presently making substantial investments in luxury watches. Timepieces like the Patek Philippe 5236P with an in-line display perpetual calendar offer attractive ROI. Despite a 25% price increase for luxury watches in India, the demands face a consistent surge

Similar to various asset classes, Indians are presently making substantial investments in luxury watches. Timepieces like the Patek Philippe 5236P with an in-line display perpetual calendar offer attractive ROI. Despite a 25% price increase for luxury watches in India, the demands face a consistent surge

Factors Influencing Calculation of Customs Duty

The calculation of customs duty is a nuanced process influenced by a myriad of the following factors:

Value of the Item:

The value of the imported item is ascertained by combining the expenses related to the goods, encompassing the cost of the item, insurance charges and the freight charges associated with its transportation to India.

Country of Origin:

As certain nations hold distinct trade agreements and tariff rates with India, the country of origin influences the customs duty calculation.

Classification of Items:

The Harmonized System of Nomenclature (HSN) codes are used to classify goods imported in India. Wristwatches are specifically categorized under clocks and watches and parts thereof.

Their classification as Tariff Item HSN codes 9101 / 9102 and standard rates of duty are defined as under:

Source, Central Board of Indirect Taxes & Customs

Steps for Calculation of Customs Duty for Watches Imported in India

Here is a step-by-step guide on how to calculate the applicable custom duty levied on wristwatch imports:

Determine the Assessable Value of the wristwatch or its CIF:

This is derived by summing the cost of the items, along with the incurred insurance and freight charges.

Identify Applicable Customs Duty Rates and GST Duty:

Identify the applicable Basic Custom Duty (BCD), Customs AIDC, Social Welfare Surcharge (SWC) and IGST Levy based upon classification as per HSN codes.

Calculate Duty:

Calculate the Total Duty percentage by adding all applicable custom duty rates.

The Indian Customs Electronic Gateway (ICEGATE) portal offers a calculator for determining the structure of duty for wristwatches.

Here is a sample calculation of customs duty of a wristwatch imported in India from Switzerland with an assessable value of Rs. 2,00,000:

Total Duty Amount on a wristwatch import with Assessable Value of Rs. 2,00,000:

Source, Central Board of Indirect Taxes & Customs

Basic Customs Duty (BCD) + Customs AIDC + Social Welfare Surcharge (SWC) + IGST Levy

20% (of assessable value) + 20% (of BCD) + 20% (of BCD + AIDC) + 18% (of assessable value + BCD + AIDC + SWC)

40,000 + 8,000 + 4,800 + 45,504 = 98,304 or 49.152% (of assessable value)

Import Duty Exemptions

There might be exemptions or reduced duties for certain categories of watches, based on trade agreements or specific government policies.

Influence on the Watch Market

The imposition of customs duty holds the power to steer the direction of the watch market. Whether it prompts a surge in the demand for domestic alternatives or continues to drive the pursuit of international luxury timepieces is a fascinating aspect to observe.

In 2021, luxury watch imports experienced a notable 19% growth, propelling India beyond nations like Kuwait, Ireland, Bahrain, Belgium, Portugal, Greece and Malaysia. However, waiting periods for sought-after brands such as A. Lange & Söhne persist, extending into periods of months or even years

Impact on Collectors and Enthusiasts

For those passionate about horology, customs duty becomes a pivotal consideration in the pursuit of their coveted timepieces. Some might explore avenues to acquire their desired watches within the confines of duty regulations, while others may weigh the options differently.

The pursuit of an exquisite timepiece isn’t merely about its mechanics or brand - it’s a narrative woven with passion, regulations and the essence of time itself.

#watches#wrist watch for men#luxury watches for men#watches and wonders#custom duty#import duty tx#tax and duty calculater#import calculater

0 notes

Text

Navigating the Impact of GST on Small Businesses: Strategies for Compliance

Introduction: The Goods and Services Tax (GST) has revolutionized the taxation landscape for businesses, particularly small enterprises. Implemented to streamline the taxation system, GST impacts businesses of all sizes, with small businesses often facing unique challenges in compliance. Understanding the nuances of GST and adopting effective compliance strategies are crucial for the success and sustainability of small businesses. In this article, we delve into the impact of GST on small businesses and provide actionable tips for compliance.

Understanding the Impact: GST replaces multiple indirect taxes, such as VAT, service tax, and excise duty, simplifying the tax structure. However, small businesses face several implications:

Increased Compliance Burden: Small businesses must adhere to stringent compliance requirements, including timely filing of returns, maintaining accurate records, and proper invoicing.

Cash Flow Management: GST introduces the concept of Input Tax Credit (ITC), allowing businesses to claim credit for taxes paid on purchases. However, proper documentation and reconciliation are essential to optimize cash flow and minimize tax liabilities.

Pricing Dynamics: GST impacts pricing strategies, as businesses need to incorporate tax implications into their pricing models. Failure to do so can affect competitiveness and profitability.

Tips for Compliance: To navigate the impact of GST effectively, small businesses can implement the following strategies:

Invest in Education and Training: Enroll in GST courses or workshops to gain a comprehensive understanding of GST regulations, compliance procedures, and recent updates. Educating staff members on GST implications is essential for smooth operations.

Leverage Technology: Embrace GST-compliant accounting software to automate invoicing, track expenses, and generate accurate tax reports. Technology streamlines compliance processes, minimizes errors, and ensures timely filing of returns.

Maintain Proper Documentation: Keep meticulous records of sales, purchases, invoices, and expenses to support GST compliance. Organized documentation simplifies audits, facilitates ITC claims, and mitigates compliance risks.

Monitor Changes in Regulations: Stay updated with changes in GST laws, rates, and compliance procedures. Subscribe to reliable sources, such as government portals or professional tax associations, to access timely information and adapt compliance practices accordingly.

Seek Professional Assistance: Consult with tax advisors or chartered accountants specializing in GST compliance for personalized guidance. Professional expertise helps small businesses navigate complex tax requirements, optimize tax planning, and mitigate risks of non-compliance.

Conclusion: The impact of GST on small businesses is profound, influencing various aspects of operations, finance, and compliance. By understanding the implications of GST and implementing effective compliance strategies, small businesses can mitigate risks, optimize tax efficiency, and ensure sustainable growth. Embracing education, technology, and professional assistance empowers small businesses to navigate the complexities of GST online course compliance with confidence and resilience.

0 notes

Text

Gear Oil Prices Trend, Database, Chart, Index, Forecast

Gear Oil Prices: For the Quarter Ending March 2024

Gear Oil prices fluctuate based on several factors, making it crucial for consumers to understand the dynamics influencing these shifts. One primary determinant of gear oil prices is the global crude oil market. Since gear oil is derived from crude oil, any fluctuations in crude oil prices directly impact gear oil costs. Factors such as geopolitical tensions, supply and demand dynamics, and economic conditions all influence crude oil prices, subsequently affecting gear oil pricing. Additionally, the quality and composition of gear oil play a significant role in its price variation. High-performance synthetic gear oils tend to be more expensive than conventional mineral-based oils due to their enhanced properties, including better viscosity index, thermal stability, and resistance to oxidation.

Moreover, market competition among gear oil manufacturers contributes to price variations. Established brands with a strong reputation for quality often command higher prices compared to lesser-known brands. However, aggressive pricing strategies and promotional offers by competitors can lead to temporary price reductions or fluctuations in the market. Furthermore, technological advancements and innovations in gear oil formulations can impact prices. New additives or manufacturing processes that improve performance or environmental sustainability may result in higher production costs, reflecting in the retail price of gear oil.

Get Real Time Prices of Gear Oil: https://www.chemanalyst.com/Pricing-data/gear-oil-1570

Local regulations and taxes also influence gear oil prices. Government policies such as import tariffs, excise duties, and environmental levies can add to the final cost of gear oil products. Additionally, regional variations in demand and distribution logistics can affect prices. Areas with high demand for industrial machinery or automotive applications may experience higher gear oil prices due to increased competition among consumers. Conversely, remote or less populated regions might face higher transportation costs, leading to elevated gear oil prices.

Furthermore, market trends and consumer preferences contribute to price fluctuations. For instance, growing environmental consciousness has led to increased demand for eco-friendly or biodegradable gear oils. While these products may be more expensive to manufacture, they cater to a niche market willing to pay a premium for sustainable solutions. Conversely, economic downturns or shifts in consumer behavior can prompt manufacturers to adjust prices to remain competitive and stimulate demand.

Another factor affecting gear oil prices is the overall health of the automotive and industrial sectors. During periods of robust economic growth, increased industrial activity and vehicle sales drive up demand for gear oil, putting upward pressure on prices. Conversely, economic downturns or recessions can lead to reduced demand, prompting manufacturers to lower prices to stimulate sales. Additionally, fluctuations in currency exchange rates can impact the cost of imported gear oils, especially for countries heavily reliant on imports.

Moreover, the cost of raw materials used in gear oil production, such as base oils and additives, influences pricing. Market volatility in raw material prices, driven by factors like natural disasters, supply chain disruptions, or changes in production capacity, can lead to fluctuations in gear oil costs. Manufacturers may pass these cost fluctuations onto consumers through price adjustments to maintain profitability.

In conclusion, gear oil prices are subject to various influences, including global crude oil prices, product quality, market competition, technological advancements, regulatory policies, consumer preferences, economic conditions, currency exchange rates, and raw material costs. Understanding these factors is essential for consumers to make informed purchasing decisions and navigate the dynamic gear oil market effectively. Whether for automotive or industrial applications, staying abreast of price trends and factors shaping the market is crucial for optimizing costs and ensuring optimal performance and reliability.

Get Real Time Prices of Gear Oil: https://www.chemanalyst.com/Pricing-data/gear-oil-1570

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

0 notes

Text

Celebrating Success: Indirect Tax Collection Surpasses Expectations in FY24

In a recent announcement, the Central Board of Indirect Taxes and Customs (CBIC) has revealed that the indirect tax collections for the Financial Year 2023–24 have surpassed the Revised Estimates (RE) by a significant margin. This achievement, attributed to the diligent efforts of tax officials, has been lauded by CBIC Chairman Sanjay Kumar Agarwal, who described it as a testament to professionalism, teamwork, and perseverance within the CBIC community.

Exceeding the revised estimate of Rs 14.84 lakh crore, the indirect tax collection for FY24 has been described as exceeding expectations. This remarkable feat was made possible by a record Goods and Services Tax (GST) mop-up, marking a milestone in revenue generation for the government.

Chairman Agarwal expressed his appreciation for the relentless efforts of every member of the CBIC, acknowledging their invaluable contributions throughout the year. The gross GST collection for 2023–24 stood at Rs 20.18 lakh crore, representing a substantial increase from the previous year’s figures.

The targets set for central GST, excise duty, and customs were also surpassed, reflecting the robustness of India’s tax revenue system. Despite the challenges posed by the global economic landscape, India’s economy has demonstrated resilience, recording a world-leading growth rate. According to estimates by the National Statistical Office (NSO), India is projected to grow at 7.6% in 2023–24, fueled by domestic consumption and government expenditure.

The consecutive quarters of over 8% growth from April to December underscore the country’s economic momentum. Various agencies, including SBI Research and Moody’s, expect GDP growth for FY24 to be around 8%, while others like Fitch and Barclays have raised their forecasts to 7.8%.

The impressive performance in tax collection reflects the vibrancy of India’s economy and the government’s commitment to fiscal prudence. As we celebrate this success, it’s imperative to recognize the collective efforts that have contributed to this achievement. Moving forward, sustained efforts in tax administration and policy reforms will be crucial in ensuring continued growth and prosperity for the nation.

0 notes

Text

Top Pediatric PCD Pharma Franchise Companies In India

India has a population of more than 253 million infants and adolescents. The demand for pediatric drugs in India is very high and the pediatric healthcare market is expected to grow by 6.35% CAGR during the forecast period. According to the data 5 million children under the age of 5 years of age died in 2020. Infectious diseases like pneumonia, diarrhea, malaria, premature birth, and intra-articular complications remain the top killers among children under 5 years old worldwide. The increasing number of pediatric deaths creates a demand for advanced pediatric health care and drives market growth. Unibyte Kids is a dedicated Top Pediatric PCD Pharma Franchise Company in India.

If you are looking to start your own Pediatric Pharma Franchise in India. If you are looking to start your own Pediatric PCD Pharma Franchise business in India, then Unibyte Kids is the right choice for you. We offer a high-quality pediatric medicines range certified by ISO, WHO & GMP. Our product line includes extensive therapeutic value such as anti-worm medication, anaemia medication, Immunosuppressant and antifoaming medicines to treat various ailments in children such as Bacterial infections, Hay fever, Urticaria etc. Our manufacturing and packaging are supplied through company-owned pharmaceutical manufacturing units. We are proud to offer our associates the opportunity to start their own Pediatric Pharma Distributor business in India. With our presence across India, You can trust that our products are reliable, effective and safe.

Top Pediatric PCD Pharma Franchise Companies In India - Unibyte Kids

Unibyte Kids is the most trusted and reliable pharmaceutical company in India for Pediatric PCD Pharma Franchise. We offer a wide variety of high-quality pharmaceuticals that are highly recommended by many well-known and experienced Paediatricians. We have links with many doctors and paediatricians who keep us informed about the increasing demand for quality medicines for kids. Our production units are well-equipped and air-conditioned. With the increasing demand, our success rate in the pediatric sector is very high. Some of the key features of our company are such as -

Firstly our products are premium in quality and WHO, GMP, and ISO certified.

We are working with several experts and healthcare providers.

The franchise service is provided by the company at the PAN India Level.

Our state-of-the-art storage warehouse is conveniently located on excise duty-free and gnarly in all zones.

We have a wide range of product portfolios in the pediatric range.

Monopoly Rights

Quality Assured Products

24/7 Customer Supports

Quick Delivery

Wide Range and Premium Quality Pediatric Pharmaceutical Products at Unibyte Kids.

Unibyte Kids is a highly reputed and genuine PCD Pharma Franchise company that only sells high-quality products. All the products offered by the company are formulated and manufactured by the top paediatricians in the country. Since the products are intended to be used by children, we ensure that all formulations are safe to consume and have no adverse effects. Our manufacturing plants are equipped with the latest technology and machinery, allowing us to produce high-quality, safe and secure products. We offer a wide variety of products in various segments, such as:

Multivitamin Drops

Anti-allergic/Anti-asthmatic Products

Prebiotic & Probiotics Range

Rexigenic, or Appetite stimulant Medicines

Zinc Syrup

Multivitamin Syrup

Antibiotic Syrups

Anticholinergics/antispasmodics Drops

Anti-Ulcer Medicines

Cholecalciferol/ Vitamin D3 Drops

Digestive enzymes Drugs

Anti-inflammatory Medicines

Anti-Cold & Cough Syrup

Hematinic/Folic Acid (Oral) Products

Worm Medicine (Anthelmintics)

Conclusion

One should keep some important factors by deciding pediatric PCD pharma franchise, for instance, the reputation of the company product range perks and benefits provided by the company, profit margins, etc. You can go through your gained knowledge, to choose the best and reliable Pediatric PCD Franchise company that is most beneficial for you. We can see the increasing demand for Pediatric range medicine ensures massive success in the Pharmaceutical industry.

0 notes

Text

1. Advantages and disadvantages of various vehicle types: Different vehicle types have their own pros and cons. For instance, trucks are best for long-term cargo hauling due to their durability and ample room.

2. Ensuring goods’ safety while being transported: This involves proper packaging, securing the load, regular inspections, adhering to safety regulations, and using reliable transportation methods.

3. Steps to start a truck business: Key steps include performing market analysis, drafting a business plan, developing a brand, formalizing business registration, acquiring necessary licenses and permits, securing funding, setting pricing, and acquiring equipment.

4. Frequency of gasoline tax payment: The central and state governments of India levy taxes on petrol and diesel. The central authorities apply excise duty at the rates of Rs.19.90/litre and Rs.15.80/litre respectively.

5. Completing a contract with a factoring firm: This involves finding a reputable factor, providing them with information about your accounts receivable and customers, selling the approved invoice to the factor, and receiving a percentage of the total amount immediately.

6. Locating a driver: This can be done using the Device Manager in Windows, the Run window, the Command Prompt, or a free third-party utility.

7. Benefits of Hot Shot Loading: Hotshot deliveries are known for their cost-effectiveness, speed, flexibility, and efficient logistics.

8. Using the TMS to look for loads: Avaal TMS is a transportation management software that allows you to find and bid on loads.

9. Discussion with a broker: This involves understanding the broker’s requirements, negotiating terms, and building a professional relationship. It’s important to ask the right questions and provide accurate information about your capabilities and needs.

10. Definition of Rate Confirmation: A rate confirmation is a document that outlines the details of a shipment, including the rate, pickup and delivery locations, and other relevant information. It is agreed upon by both the carrier and the broker or shipper.

11. Bill of Lading: A Bill of Lading is a legal document between the shipper and carrier detailing the type, quantity, and destination of the goods being carried. It serves as a shipment receipt when the carrier delivers the goods at the predetermined destination.

12. Where to look for a job as a dispatcher: Job opportunities for dispatchers can be found on job search websites, company websites, industry-specific job boards, and networking events.

13. Papers necessary for freight clearance: These may include a Bill of Lading, Commercial Invoice, Packing List, and a Certificate of Origin. The exact documents required can vary depending on the nature of the goods and the specific regulations of the importing and exporting countries.

14. Nuances regarding contract termination: This refers to the specific conditions and procedures for ending a contract, which can vary based on the terms of the contract and the laws of the jurisdiction.

15. U.S. trucking industry jargon: This refers to the specific terms and phrases commonly used in the U.S. trucking industry. Examples include “deadhead” (traveling with an empty cargo load), “reefer” (a refrigerated trailer), and “bobtail” (a semi-truck operating without a trailer).

16. Lessons in Marketing: This could cover a wide range of topics, from understanding your target audience and developing a marketing strategy, to leveraging digital marketing tools and measuring the effectiveness of your marketing efforts.

#truckingindustry#trucking factoring#truckinglife#trucking company#avaal#ontario#trucking#truck load#canada#logistics

0 notes

Text

The Parallel Economy in India

Economy consists of economic system of a region in amalgamation with the social factors, the labor, capital and land resources; and the production, exchange, distribution, and consumption of goods and services of that area. Consumption, saving and investment are core components in the economy and determine market equilibrium.

Parallel economy - The functioning of any unaccounted and unsanctioned economic sector whose basic operations run parallel, however against the sanctioned or legitimate sector of the economy. Parallel economy is also known as ‘unaccounted economy’, illegal economy’, ‘subterranean economy’, ‘underground wealth’, ‘black economy’, ‘parallel economy’, ‘shadow economy’, ‘underground’ or ‘unofficial’ economy, or ‘unsanctioned economy’. The parallel economy incorporates all the forms of activities through which black income is generated and those which are usually not accounted for. The money circulated in parallel economy is known as the ‘Black Money’.

Parallel economy negatively impacts the economic system of a country. Due to this, the GDP is reduced to nearly half of what should have been in the absence of the unaccounted component of economy. In other words, the volumes of the accounted and unaccounted components of the Indian economy are almost equal. Also, the black money generated in parallel economy accentuates the inequalities in income and wealth and deepens divide between rich and poor.

There are two possible sources of black money:

Source of income is itself illegitimate, ie. Income from an illegal activity like smuggling, bribery, trafficking etc.

Source of income is legitimate but it is concealed from taxation.

Causes of Black Money Generation

There are many reasons for the creation of back money in India. Some of them are as follows:

1. Controls and licensing system - Before the economic reforms, the private sectors were allowed to produce goods only with a certified license. This gave birth to the License Raj, wherein the license inspectors resorted to corrupt practices to provide licenses. This led to a huge proliferation in black money. Even today, regulatory authorities like the TRAI are known to resort to corrupt practices while dealing with private players.

2. Higher Rates of Taxes - Higher tax rates result into a tendency of tax evasion among the tax payers. Tax evasion is common in income tax, corporate tax, corporation tax, union excise duties, custom duties, sales tax , etc. As per 2022 statistics, only 5% of the Indians are tax-payers.

3. Ineffective enforcement of tax laws and corruption in Tax departments leading to tax evasion even by rich sections of India.

4. Funding of political parties through black money with the objective of influencing the government in power in order to receive undue advantages.

5. Inflation: The addition in prices of commodities like petrol, etc. in international market, boost in prices of commodities due to increase in duties and taxes imposed by the government, the artificial demand created by people with unaccounted or black money- all cause inflation which in turn leads to the circulation and hence creation of black money.

6. The reluctance of governments to bring large agricultural earnings in the ambit of income tax and to reduce the welfare dependent population base has also contributed to creation of black money.The black money accrued from other sources can be easily transformed into white by viewing it on the agricultural returns account.

7. Privatization and Public Private Partnerships (PPP) have a huge scope for generation of black income by ministers and bureaucrats.

8. Activities like smuggling, property deals, bribery,extortion, concealment of income by professionals, etc. also creates black money.

As a result, the circulation of enormous amounts of black income incessantly results in a flourishing parallel economy.

Impact of Black Income on the Indian Economy

Generation of black income, and thereby establishment of parallel economy has been creating the following serious impacts on the social and economic system of the country.

Black income causes underestimation of GDP. The volume of Black economy in India is assessed as being equal to normal economy.

The direct effect of black income is the net loss of tax revenue to the state exchequer, thus resulting in poor levels of development, and lesser government expenditure.

Actual assessment of economy is never achieved

Creates an invisible demand in the market, thus causing inflation.

Black money has resulted in the diversion of resources for the purchase of real estate and luxury housing.

Transfer of funds from India to foreign countries.

The availability of black incomes makes people unduly rich.

Black money causes psychological stress to honest tax-payers and devalues the virtues like hard-work and honesty.

Leads to a decline in moral standards in the society.

Thus, the existence of parallel economy distorts and disrupts the normal functioning of a country, the economic planning does not bear desired fruits and also the ideal pace of development and growth of the country is never achieved.

Government Initiatives

The government has taken a number of steps to curb black money.

Demonetization - A process of discontinuing currency notes in circulation.Demonetization was pursued in 1946, 1978 and in 2016, however, this process has not been successful. It was expected that only the white money will come back, while the black money will be rendered useless. On the contrary, In 1978, 99.3% of the total currency notes, while in 2016, 99.8% of the total currency notes came back to the RBI, even though huge sums of currency notes had been destroyed. This meant that even after destruction of huge sums of currency, almost all notes came back and the amount and holders of black money were not revealed or caught. Almost whole volume of black money was successfully converted into white. Moreover, rolling out of Rs 2000 notes in 2016 made it easier to hoard black money.

Voluntary Disclosure of Income Scheme - Introduced in 1997, the scheme allowed anyone to declare and regularise black money by paying taxes, and with a promise of no legal action against the entity in future.The non-tax compliants declared undisclosed incomes and assets, and ended up paying lesser than normal taxes, with all immunities. The income declared under VDIS had been Rs 33,000 crore, however, the actual value of the assets declared was double the value considered for taxation and also the taxes were paid at less than 50% of the normal rate, with zero interest and penalties. Thus, the scheme was nominally successful. Thus, in a way, the VDIS motivated people to evade taxes and wait for such schemes in future.

Income Declaration Scheme, 2016 - It was proposed by the then Finance Minister Arun Jaitley and launched by the Income Tax Department. The Scheme provides an opportunity to come forward and declare the undisclosed income and pay tax, surcharge and penalty equal to 45% of the undisclosed income declared. Declarations were to be made from 1st June, 2016 to 30th September, 2016. Though the scheme saw a collection of Rs 65,250 Crore, a record in the history of tax collection, only a small portion of big earners with black money came forward and declared a very small portion of their wealth.

Special Bearer Bond Scheme - In 1981, the Government issued Special Bearer Bonds under a scheme which allowed people to invest their black money in these bonds and enjoy freedom from investigations and prosecutions for tax evasion in respect of their holdings of these bonds. The face value of the bond was Rs10,000 and maturity was for 10 years. Anyone could buy the bonds without inviting any scrutiny from the government. The income tax department was prohibited from harassing buyers and the bond could be even bought with anonymity. If one had purchased these bonds in 1981 for Rs10,000, he could redeem it in 1991 for Rs12,000.

All of the aforesaid schemes have hardly fetched Rs. 5000 crore over a period of years. The main drawback in these schemes is that they give a mere cosmetic effect to the problem of black money already created but without addressing the root cause of generation of black money. Governments should understand the importance of reducing tax slabs, improving tax structure and widening the tax base. These are long term measures which will prevent tax evasion and reduce the number of dependents in the Indian population.

India has tried to combat tax evasion by requiring an identification number for all major financial deals. The Permanent Account Number (PAN) card, issued by the Income tax Department is a compulsory 10‐character number issued to taxpayers by the tax department which is needed during any economic transactions such as buying a car or property, investing in the stock market or converting Indian rupees to foreign currency.

The card was issued in order to prevent tax evasion by individuals and entities as it links all financial transactions made by a particular individual or entity. In this way, the Income Tax Department has a detailed record of all major transactions for tax purposes. Indian citizens who are residents of the country as well as NRI (Non Resident Indians), OCI (Overseas Citizen of India) cardholders, PIO (Person of Indian Origin) as well as foreigners who come under the purview of the Income Tax Act of 1961 are eligible to apply for a PAN card. Firms and companies, governments and minors too can apply for a PAN card. But many transactions, especially those related to property, are conducted in cash and are unlikely to be reported.

Money Laundering

Criminal acts generate a huge profit in quick time for the individual or group that carries out the act. Money laundering is the processing of legitimizing these criminal proceeds so that their origin is disguised and they appear to be coming from a legitimate source. This process is of critical importance, as it enables the criminal to enjoy these profits without jeopardising their source. The dirty money from the criminal activity is “laundered” it to make it look clean.

Illegal activities include arms sales, smuggling, activities of organised crime, including for example terrorism, drug trafficking and prostitution rings, cyber-crime, embezzlement, insider trading, bribery etc.

Some money-laundering methods include:

Smurfing or structuring- This is the process of breaking up large chunks of cash into multiple small deposits, and spreading them over many different accounts, to avoid detection.

Investing in commodities such as gems and gold that can be moved easily to other jurisdictions

Investing in valuable assets such as real estate, cars, etc.

Gambling

Counterfeiting goods

Using cryptocurrencies

Using shell companies (inactive companies or corporations that essentially exist on papers only)

Through the use of currency exchanges, wire transfers, and “mules”—cash smugglers, who sneak large amounts of cash across borders and deposit them in foreign accounts, where money-laundering enforcement is less strict.

In response to mounting concern over money laundering, the Financial Action Task Force on money laundering (FATF) was established by the G-7 Summit in Paris in 1989 to develop a co-ordinated international response. One of the first tasks of the FATF was to develop Recommendations, 40 in all, which set out the measures national governments should take to implement effective anti-money laundering programmes.

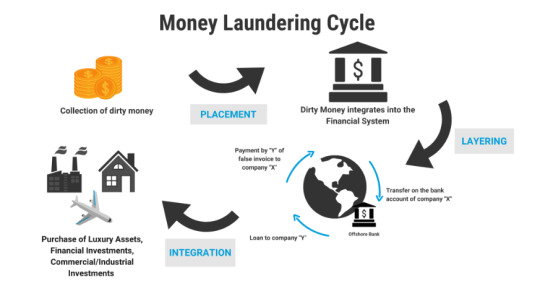

Stages in Money Laundering

1. Placement - Introducing illegal profits into the financial system. This might be done through smurfing, or by purchasing a series of monetary instruments (cheques, money orders, etc.) that are then collected and deposited into accounts at another location.

2. Layering - A series of conversions, transactions or movements of the funds to distance them from their source. The funds might be channelled through the purchase and sales of investment instruments, or the launderer might simply wire the funds through a series of accounts at various banks across the globe. This use of widely scattered accounts for laundering is especially prevalent in those jurisdictions that do not co-operate in anti-money laundering investigations. In some instances, the launderer might disguise the transfers as payments for goods or services, thus giving them a legitimate appearance.

3. Integration -The funds re-enter the legitimate economy.

Social Impacts of Money Laundering

The possible social and political costs of money laundering, if left unchecked or dealt with ineffectively, are serious.

Organised crime can infiltrate financial institutions, acquire control of large sectors of the economy through investment, or offer bribes to public officials and indeed governments.

The economic and political influence of criminal organisations can weaken the social fabric, collective ethical standards, and ultimately the democratic institutions of society.

Most fundamentally, money laundering is inextricably linked to the underlying criminal activity that generated it. Laundering enables criminal activity to continue.

Measures to Tackle Money Laundering

In the wake of such dramatic transformation of the factors that lead to the generation of black money and the globalized development that facilitates them, the Government of India has resorted to a five-pronged strategy, which consists of the following:

Joining the global crusade against black money

Creating appropriate legislative framework

Setting up institutions for dealing with illicit money

Developing systems for implementation

Imparting skills to personnel for effective action.

Prevention of Money Laundering Act

The Prevention of Money Laundering Act (PMLA), 2002 was enacted in January, 2003. The Act came into force with effect from 1st July, 2005.

The act defines offence of money laundering as whosoever directly or indirectly attempts to indulge or knowingly assists or is actually involved in any process or activity connected with the proceeds of crime shall be guilty of offence of money-laundering. It prescribes obligation of banking companies, financial institutions and intermediaries for verification and maintenance of records of the identity of all its clients and also of all transactions and for furnishing information of such transactions in prescribed form to the Financial Intelligence Unit-India (FIU-IND). It empowers the Director of FIU-IND to impose fine on banking company, financial institution or intermediary if they or any of its officers fails to comply with the provisions of the Act as indicated above. FIU-IND is an independent body reporting directly to the Economic Intelligence Council (EIC) headed by the Finance Minister.

PMLA empowers certain officers of the Directorate of Enforcement (ED) to carry out investigations in cases involving offence of money laundering and also to attach the property involved in money laundering.

The PML Act seeks to combat money laundering in India and has three main objectives:

To prevent and control money laundering

To confiscate and seize the property obtained from the laundered money; and

To deal with any other issue connected with money laundering in India.

The Act also proposes punishment under sec.4.

Enforcement Directorate (ED)

The Directorate of Enforcement was established in the year 1956 with its Headquarters at New Delhi. It is the principal agency responsible for investigation and prosecution of cases under the PML, and enforcement of the Foreign Exchange Management Act, 1999 (FEMA).

The Directorate is under the administrative control of Department of Revenue for operational purposes and for policy issues pertaining to PML Act. While the policy aspects of the FEMA, its legislation and its amendments are within the purview of the Department of Economic Affairs.

The Directorate has 10 Zonal offices each of which is headed by a Deputy Director and 11 sub Zonal Offices each of which is headed by an Assistant Director.

Zonal offices- Mumbai, Delhi, Chennai, Kolkata, Chandigarh, Lucknow, Cochin, Ahmedabad, Bangalore & Hyderabad

Sub Zonal offices - Jaipur, Jalandhar, Srinagar, Varanasi, Guwahati, Calicut, Indore, Nagpur, Patna, Bhubaneshwar & Madurai.

Egmont Group

Financial Intelligence Unit-India (FIU-IND) is a member of the Egmont Group, an international organization for stimulating co-operation among FIUs. The Egmont Group serves as an international network fostering improved communication and interaction among FIUs. The goal of the Egmont Group is to provide a forum for FIUs around the world to improve support to their respective governments in the fight against money laundering, terrorist financing and other financial crimes.

India became member of the Egmont Group in May, 2007.

FIU-IND is the national agency responsible for receiving, processing, analysing, and disseminating information relating to suspect financial transactions. It is an independent body reporting to the Economic Intelligence Council headed by the Finance Minister. For administrative purposes, the FIU-IND is under the control of the Department of Revenue, Ministry of Finance.

Under the Rules issued under the PMLA, the following types of reports have been prescribed for the reporting entities:

Cash Transaction Reports (CTRs)

Suspicious Transaction Reports (STRs)

Counterfeit Currency Reports (CCRs)

Non-Profit Organizations Transaction Reports (NTRs)

The Asia/Pacific Group on Money Laundering (APG)

The Asia/Pacific Group on Money Laundering (APG) was officially established as an autonomous regional anti-money laundering body in February 1997 at the Fourth (and last) Asia/Pacific Money Laundering Symposium in Bangkok , Thailand . The APG was formed with the objective to facilitate the adoption, implementation and enforcement of internationally accepted anti-money laundering and anti-terrorist financing standards set out in the recommendations of the Financial Action Task Force (FATF).

The APG's role includes assisting jurisdictions in the region to enact laws dealing with the proceeds of crime, mutual legal assistance, confiscation, forfeiture and extradition. It also includes the provision of guidance in setting up systems for reporting and investigating suspicious transactions and helping in the establishment of financial intelligence units.

India became a member of the APG in March, 1998.

Financial Action Task Force (FATF)

The Financial Action Task Force (FATF) is an inter-governmental body which sets standards, and develops and promotes policies to combat money laundering and terrorist financing.

The Forty Recommendations and Nine Special Recommendations of FATF provide a complete set of counter-measures against money laundering covering the criminal justice system and law enforcement, the financial system and its regulation, and international co-operation. These Recommendations have been recognized, endorsed, or adopted by many international bodies as the international standards for combating money laundering.

India became a member of the FATF in 2010.

0 notes

Text

Demystifying Indirect Taxation in India: Expert Insights from Neeraj Bhagat & Co.

n the complex and ever-changing landscape of Indian taxation, navigating the intricacies of indirect taxation requires expertise, insight, and a deep understanding of regulatory frameworks. As a leading accounting and advisory firm, Neeraj Bhagat & Co. is committed to providing clients with comprehensive guidance and strategic solutions to effectively manage their indirect tax obligations in India.

Here's a closer look at the nuances of indirect taxation in India and how Neeraj Bhagat & Co. can help businesses navigate this challenging terrain:

Understanding Indirect Taxation in India:

Indirect taxation in India encompasses a wide range of taxes levied on goods and services at various stages of production, distribution, and consumption. Some of the key components of indirect taxation in India include:

Goods and Services Tax (GST): Introduced in 2017, GST is a comprehensive indirect tax levied on the supply of goods and services across India. It replaced a multitude of indirect taxes, including central excise duty, service tax, and value-added tax (VAT), bringing about significant reforms in the Indian tax landscape. GST is governed by a dual structure, with both the central and state governments having the authority to levy and administer GST on intra-state and inter-state supplies.

Customs Duties: Customs duties are levied on the import and export of goods into and out of India. These duties include basic customs duty, additional customs duty (countervailing duty), and special additional duty. Customs duties play a crucial role in regulating trade, protecting domestic industries, and generating revenue for the government.

Excise Duties: Excise duties are indirect taxes levied on the manufacture or production of goods in India. These duties are imposed at the point of manufacture and are typically included in the price of the goods. Excise duties are levied by the central government and are an important source of revenue for the exchequer.

How Neeraj Bhagat & Co. Can Help:

Compliance Management: Neeraj Bhagat & Co. provides end-to-end compliance management services to help businesses meet their indirect tax obligations in India. Our team assists clients with GST registration, filing of returns, reconciliation of credits, and compliance with customs and excise duty regulations.

Advisory Services: Our experts offer strategic advisory services to help businesses optimize their indirect tax strategy, minimize tax liabilities, and ensure compliance with regulatory requirements. We provide insights into the latest developments in Indirect taxation in India, including changes in GST rates, exemptions, and compliance procedures.

Representation and Advocacy: Neeraj Bhagat & Co. represents clients before tax authorities and appellate forums, helping them navigate disputes, audits, and assessments related to Indirect taxation in India. Our team advocates on behalf of clients to ensure fair treatment and resolution of tax issues.

4.Technology Solutions: We leverage technology-driven solutions to streamline tax compliance processes, enhance accuracy, and improve efficiency. Our advanced software tools and platforms enable clients to manage their indirect tax obligations more effectively, reducing manual errors and ensuring timely compliance.

Training and Education: Neeraj Bhagat & Co. offers training and education programs to help clients understand the intricacies of Indirect taxation in India. Our workshops and seminars cover topics such as GST compliance, customs and excise duties, and recent developments in indirect tax laws.

Conclusion:

Navigating indirect taxation in India requires a deep understanding of regulatory requirements, compliance procedures, and strategic considerations. With Neeraj Bhagat & Co. as your trusted partner, you can gain access to expert guidance, insights, and solutions to effectively manage your indirect tax obligations and achieve your business objectives with confidence.

Contact us today to learn more about our Indirect taxation in India services and how we can help your business thrive in the complex Indian tax landscape.

#taxation taxplanning taxreturns#accounting#taxauditfirm#income tax#tax services#developers & startups#education#nonprofits#quotes#photography#Indirect taxation in India

1 note

·

View note

Text

How to Find the Cheapest Cigarettes in Australia

Smokers in Australia are paying an astronomical price for their cigarettes. With a pack of 20 costing upwards of $40, it’s no wonder that some are turning to illegally imported cigarettes to save money.

Tobacco prices in high-income countries are generally rising faster than purchasing power. Despite this, smoking rates have declined in many of these countries.

Illegally Imported Cigarettes

Illegal tobacco store online imports are a global problem fuelled by organised crime groups. This black market trade encourages addiction and robs governments of billions in tax revenue. Border Force has been processing record amounts of illicit cigarettes and tobacco in recent months.

The Australian government taxes tobacco products to make them less affordable, based on the average weekly ordinary time earnings (AWOTE). It also requires all cigarettes sold in Australia to be sold in plain packaging with graphic health warnings.

After a Herculean battle against the might of multinational big tobacco, Australia’s anti-tobacco laws are now the world’s gold standard in cutting cancer and premature death from smoking. But the easy availability of cheap, illegally-imported cigarettes undermines these programs. This can be frustrating for the police who work tirelessly in the field. They raid industrial storage sheds and rural safe houses smuggling cigarettes and nicotine-fuelled vapes. They also comb industrial ports in the hunt for boats loaded with contraband.

Chinese Counterfeit Cigarettes

Despite the fact that Australia has one of the lowest rates of daily smoking in the world, criminal syndicates continue to flood the country with illegal cigarettes. Smugglers are bringing them in through sea and air cargo, as well as hiding them in passenger luggage.

The average price of a pack of cigarettes in Australia is more than double that of the top-selling brands in Ireland and New Zealand, according to Numbeo data. However, a pack of cigarettes costs less in Singapore and Hong Kong.

A Chinese man who was arrested in Melbourne last March is awaiting extradition to the US over his role in a tobacco smuggling scheme that generated more than $700 million for North Korea. The Federal Bureau of Investigation alleges that Jin Guanghua helped Pyongyang manufacture counterfeit Western cigarettes to raise money for its nuclear weapons program. He is now facing charges of sanctions violations, bank fraud, and conspiracy. He has pleaded not guilty to the US charges.

Black Market

When people shop online for their online tobacco store Australia products they can explore a much wider selection than what is available in local brick-and-mortar stores. This can be especially beneficial for smokers who are looking for a particular brand or variety of product that is not readily available locally.

Cigarette prices in Australia have risen dramatically following government increases in excise taxes and customs duties. In fact, the country has one of the highest cigarette prices in the world.

Cigarette price hikes are supposed to be an important tool in preventing young people from taking up smoking. But they should not be the only measure that is relied upon, according to public health expert Coral Gartner.

ecChoice

Cigarette taxes in Australia are among the highest in the world, and many smokers have had to turn to illegal websites to find affordable cigarettes. These sites sell packs of the cheapest cigarettes in Australia from overseas for a fraction of the retail price, and will ship them to Australia in discreet packages, gift wrapped to circumvent customs inspections.

Increasing tobacco excise is a widely accepted strategy to reduce smoking rates, but these increases also impact different groups of smokers. For example, younger smokers are more likely to be affected by higher prices than older smokers, since they are less accustomed to paying for their habit.

Tobacco tax increases are one of the main factors driving prices of cigarette store online in Australia, which are among the highest in the world. But some smokers are looking for alternatives to traditional cigarettes, such as e-cigarettes, which are available at a range of prices. Some of these devices are disposable, while others are reusable and offer a range of fruity flavours.

#cheapest cigarettes in Australia#online tobacco store Australia#tobacco store online#marlboro red cigarettes

0 notes

Text

What are the salient features of the GST in India?

Goods and Services Tax (GST) in India is a comprehensive indirect tax levied on the supply of goods and services across the country. Introduced on July 1, 2017, GST replaced multiple indirect taxes at the central and state levels, streamlining the taxation system and fostering ease of doing business. Here are some salient features of GST in India:

Single Taxation System: GST replaced multiple indirect taxes such as central excise duty, service tax, VAT, CST, etc., with a single unified tax, making compliance easier for businesses.

Dual GST Structure: GST in India follows a dual structure, consisting of Central GST (CGST) levied by the central government and State GST (SGST) levied by the state governments on intra-state supplies of goods and services.

Destination-Based Tax: GST is a destination-based tax, meaning it is levied based on the location of consumption rather than the location of production. This promotes fair distribution of tax revenue among states.

Taxation at Multiple Stages: GST is applied at each stage of the supply chain, allowing for input tax credit (ITC) on taxes paid at the previous stage. This reduces the cascading effect of taxes and promotes efficiency in the tax system.

Composition Scheme: Small businesses with turnover below a specified threshold can opt for the composition scheme, which allows them to pay a fixed percentage of their turnover as tax and file simplified quarterly returns.

Threshold Exemption: GST provides threshold exemptions for small businesses, allowing them to be exempt from GST registration if their annual turnover falls below a certain threshold limit (currently INR 20 lakhs for most states, INR 10 lakhs for special category states).

Electronic System for Tax Filing: GST compliance is facilitated through online portals and electronic filing systems. Businesses are required to file GST returns electronically, promoting transparency and reducing paperwork.

Anti-Profiteering Measures: GST incorporates anti-profiteering provisions to ensure that businesses pass on the benefits of reduced tax rates or input tax credits to consumers by lowering prices.

GST Council: The GST Council, consisting of representatives from the central and state governments, is responsible for making decisions on tax rates, exemptions, and other policy matters related to GST.

Tax Rates and Classification: GST adopts a multi-tiered tax structure with different tax rates for different goods and services. Goods and services are classified into different tax slabs, such as 5%, 12%, 18%, and 28%, with certain essential items attracting lower rates or exemptions.

These features of GST in India aim to simplify the tax structure, promote ease of compliance, and create a unified national market for goods and services.

0 notes