#export job circular 2022

Text

EPB Job Circular

EPB Job Circular 2022 Export Promotion Bureau Job Circular 2022 recently has been published today on http://www.epb.gov.bd by the authority of the Export Promotion Bureau. Export Promotion Bureau Job Circular is a good chance for educated unemployed people who want to join at Bangladesh Export Promotion Bureau in 2022.

According to the official job appointment notice, anyone can accept this…

View On WordPress

#ditf 2022 circular#epb application#epb exam date#epb fair calendar 2022#EPB Job Circular 2022#epb notice board#epb result 2022#export job circular 2022#www ditf epb gov bd 2022

0 notes

Text

Get Ahead on the CA Final IDT Exam with These Insider Tips and Strategies!

Introduction to CA Final IDT

The Chartered Accountancy (CA) journey in India reaches its pinnacle with the CA Final, the last and most challenging phase. The CA Final Indirect Tax (IDT) exam stands out as a significant hurdle in this prestigious qualification process. Taking place twice a year in May and November, this examination demands meticulous preparation and strategic planning for success.

Syllabus Overview

The CA Final IDT paper, classified into three key sections, plays a pivotal role in shaping a candidate’s success:

Central Excise

Rules, Circulars, and Notifications related to the Central Excise Act of 1944 and the Central Excise Tariff Act of 1985.

Service Tax

In-depth exploration of the Service Tax framework.

GST (Goods and Services Tax)

Detailed coverage of GST, encompassing the levy and collection of CGST and IGST, concept of supply, place of supply, time and value of supply, input tax credit, and more.

Study Material for CA Final IDT

Effective preparation for the CA Final IDT exam begins with the right study material. The Institute of Chartered Accountants of India (ICAI) provides comprehensive study material, covering all essential chapters and units. This official material can be complemented with additional course books and online resources for a holistic understanding.

CA Final IDT Study Material:

Module-wise breakdown including chapters like Supply Under GST, Charge Of GST, Place of Supply, Exemptions from GST, Time of Supply, and more.

Vsmart Academy offers valuable notes and techniques for effective preparation.

Previous Year Exam Papers

Practicing with previous year exam papers is a strategic approach to excel in the CA Final IDT exam. This practice provides insights into the exam pattern, question formats, and the level of difficulty. Here are essential resources for candidates:

CA Final IDT Question Papers with Suggested Answers 2024:

Access to previous year’s question papers for May 2022, December 2021, July 2021, and January 2021.

CA Final IDT Paper Mock Test Papers 2024:

Utilize revised mock test papers for Series I and Series II to gauge your preparation level and enhance performance.

CA Final IDT Paper 2024 Weightage - Chapter Wise for New Course

Sections

Part I – GST (75 Marks)

Weightage

Section IChapter 1: Levy and collection of CGST and IGST – Application of CGST/IGST law; Concept of supply including composite and mixed supplies, inter-state supply, intra-state supply, supplies in territorial waters; Charge of tax (including reverse charge); Exemption from tax; Composition levy45%-65%Section IIChapter 1(vii): Procedures under GST including registration, tax invoice, credit and debit notes, electronic waybill, accounts and records, returns, payment of tax including tax deduction at source and tax collection at source, refund, job work Chapter 1(viii): Liability to pay in certain cases<10%-30%Section IIIChapter 1(xi): Demand and Recovery Chapter 1(xii): Offences and Penalties Chapter 1(xiii): Advance Ruling Chapter 1(xiv): Appeals and Revision10%-25%Section IVChapter 1: Introduction to GST in India including Constitutional Aspects Chapter 1(ix): Administration of GST; Assessment and Audit Chapter 1(x): Inspection, Search, Seizure, and Arrest Chapter 1(xv): Other Provisions5% -10%

Sections

Part II – Customs and FTP (25 Marks)

Weightage

Section IChapter 1(ii): Levy of and exemptions from customs duties – All provisions including the application of customs law, taxable the event, a charge of customs duty, exceptions to levy of customs duty, exemption from customs duty Chapter 1(iii): Types of customs duties Chapter 1(iv): Classification of imported and export goods Chapter 1(iv): Valuation of imported and export goods40% -65%Section IIChapter 1(vi): Import and Export Procedures including special procedures relating to baggage, goods imported or exported by post, stores Chapter 1(ix): Drawback Chapter 1(x): Refund Foreign Trade Policy Chapter 2(ii): Basic concepts relating to export promotion schemes provided under FTP20% – 45%Section IIIChapter 1(1): Introduction to customs law including Constitutional aspects Foreign Trade Policy Chapter 2(1): Introduction to FTP – legislation governing FTP, salient features of an FTP, administration of FTP, contents of FTP and other related provisions Chapter 2(i): Basic concepts relating to import and export10% – 20%

Preparation Tips for CA Final IDT

Paper Pattern:

Understand the subjective nature of the paper.

Total questions: 100

Exam duration: 3 hours

Maximum marks: 100

Answering 5 out of 6 questions.

Must Read – https://www.vsmartacademy.com/blog/preparation-strategy-to-score-good-marks-in-ca-final-idt/

Assessment Pattern Ratio:

30:70 ratio for analytical skills, comprehensive knowledge, and reporting efficiency.

Verb Usage:

Follow ICAI’s list of verbs with illustrations, such as recommend, evaluate, advice, produce, prioritize, interpret, discuss, and more.

Weightage Allocation:

Chapter-wise weightage for GST, Customs, and FTP to prioritize preparation effectively.

Revision Techniques:

Regular revisions of important chapters.

Utilize ICAI’s recommended reference for quick revision.

Sample questions for the 30:70 assessment to enhance learning.

Conclusion

In conclusion, success in the CA Final IDT exam requires a strategic and comprehensive approach. By understanding the syllabus, utilizing study materials effectively, practicing with previous year’s papers, and following the recommended preparation tips, candidates can position themselves for success in this challenging examination.

0 notes

Text

Trudeau's Triumph: Canada Leads Globally

Resilience and Sustainability at the Core

Under the theme of "Creating a Resilient and Sustainable Future for All," Prime Minister Justin Trudeau's presence at this year's Asia-Pacific Economic Cooperation (APEC) Leaders’ Meeting in San Francisco marked a significant stride toward reinforcing Canada's commitment to open trade and economic cooperation. The summit saw leaders from 21 partner economies coming together to address critical global issues and advance economic collaboration.

Bilateral Meetings Steer Economic Diplomacy

While in San Francisco, Prime Minister Trudeau engaged in strategic bilateral meetings with key leaders from Japan, Thailand, Australia, Vietnam, Mexico, and Malaysia. These meetings aimed at fostering stronger ties and partnerships, positioning Canada as a reliable trade partner and destination for investment across various sectors.

Progress under Canada’s Indo-Pacific Strategy

Since the launch of Canada's Indo-Pacific Strategy in 2022, the nation has made significant strides in its implementation. Key milestones include the announcement of the Canada-ASEAN Strategic Partnership and the appointment of Special Envoy Ambassador Ian McKay and Canadian Indo-Pacific Trade Representative Paul Thoppil. These developments signify Canada's commitment to deepening relations with Southeast Asia and advancing its interests in the region.

Technological Advancements and Security Measures

On the margins of the APEC meeting, the Prime Minister met with leaders from the business and artificial intelligence (AI) fields. A multi-million-dollar agreement between BlackBerry and the Government of Malaysia was signed, reinforcing Canada's leadership in technology. This agreement will leverage BlackBerry's Canadian technology to enhance Malaysia's cybersecurity capacity and counter cyber-based threats.

Global Issues in the Spotlight

Prime Minister Trudeau used the APEC platform to address pressing global issues, including Russia's illegal war in Ukraine and the ongoing situation in Israel, Gaza, and the West Bank. These discussions underscored Canada's commitment to promoting peace and stability on the international stage.

Climate Leadership and Sustainable Growth

As a leader in climate change mitigation and green technologies, Canada championed the APEC Bio-Circular-Green Award. A contribution of US$45,000 towards this initiative reflects Canada's dedication to recognizing individuals and organizations driving sustainable and inclusive growth.

Indigenous Economic Empowerment and Trade Cooperation

Minister of Export Promotion, International Trade, and Economic Development Mary Ng marked the launch of the Indigenous Peoples Economic and Trade Cooperation Arrangement Partnership Council on the margins of the APEC meeting. This initiative aims to facilitate cooperation among participating economies, focusing on removing barriers to Indigenous Peoples' economic empowerment and participation in trade.

Strengthening North American Partnerships

In June 2022, Canada and California announced a Climate Action and Nature Protection Partnership, supported by a Memorandum of Cooperation (MOC). This collaborative effort between Environment and Climate Change Canada and California’s Environmental Protection Agency aims to deepen exchange and technical cooperation on climate and environmental priorities.

Building a Stronger Future Across the Pacific

In his concluding remarks, Prime Minister Trudeau emphasized Canada's pivotal role in the global economy. From AI and clean energy to agriculture, the world looks to Canada as a hub for innovation and business. By fostering partnerships in the Asia-Pacific region, Canada aims to create middle-class jobs and build a stronger, healthier future for people on both sides of the Pacific.

Sources: THX News & The Canadian Government.

Read the full article

#APECBio-Circular-GreenAward#APECLeaders’Meeting#CanadaIndo-PacificStrategy#Canada-ASEANStrategicPartnership#CanadianGlobalEconomicCollaborations#CanadianTechnologyLeadership#ClimateActionandNaturePartnership#CybersecurityCapacityMalaysia#IndigenousPeoplesEconomicCooperation#PrimeMinisterTrudeau#SanFrancisco

0 notes

Text

English plastic recycling plants make clean diesel and naphtha

An ecoPlant in England

Clean Planet Energy[1] is going to build ten advanced factories in England, where plastic waste that is difficult to recycle will be converted into clean diesel for trucks and machines and circular naphtha to make new plastic.

The first of these so-called ecoPlants is already under construction in Teesside[2], in North East England. To finance that plant and the next nine, the company has entered into a joint venture with private equity firm Crossroads Real Estate[3]. In total, an investment of GBP 400 million is required.

75 percent less diesel emissions

With the construction of the recycling plants, the companies want to tackle the plastic waste crisis together. The ecoPlants process non-recyclable and difficult-to-recycle plastic waste that would otherwise be landfilled, something that is prohibited in the Netherlands but still happens in England. Each factory can process 20,000 tons of plastic waste per year. This is converted into ultra-low sulphur fuels that can replace fossil diesel for trucks or heavy machinery. That can reduce greenhouse gas emissions by 75 percent compared to using traditional diesel, the companies say.

200,000 tons of plastic recycled

Circular naphtha can also be made from it, the basic raw material from which the chemical industry makes plastic. By using this naphtha for new plastic, refineries no longer need to use fossil raw materials such as petroleum.

When all the factories of the joint venture will be actually built, 200,000 tons of plastic waste per year can be reused. Sites have already been designated in Lincolnshire, Gloucestershire, Lancashire and South Wales. More locations will be selected in the coming months.

2.5 million tonnes of plastic waste in UK

According to the latest data from 2021, the United Kingdom will produce more than 2.5 million tonnes of plastic waste per year. Only 12 percent of household waste is recycled. More than 60 percent of waste is difficult to recycle, according to a report[4] released this month by the House of Commons Environment, Food and Rural Affairs Committee (EFRA). The British Parliament is therefore considering a ban on exporting plastic waste in 2027 to reduce waste and encourage recycling. Clean Planet Energy[5] and Crossroads Real Estate[6] want to contribute to this and reduce the mountain of waste that ends up in landfills in the UK, while reducing greenhouse gas emissions by offering low-carbon alternatives.

Ecological impact

David Gillerman, founder and CEO of Crossroads Real Estate, invests primarily in green opportunities and projects that have an impact. “The negative impact of plastic waste on our environment, plus the challenges we face due to excessive carbon emissions, made the joint venture with Clean Planet Energy a very compelling opportunity. With this investment, we have the opportunity to have a significant environmental and social impact in the UK,” he said.

Less waste in landfill

Bertie Stephens, group CEO of Clean Planet Energy, wants to convert and reuse even 1 million tons of non-recyclable plastic waste in the long term. “We are now contacting local authorities and private partners in the UK who could benefit from a reduction in plastic waste going to their landfill,” he says. Earlier this year, the company announced a partnership with BP to market the circular products of its ecoPlants. The new factories will also create 750 new jobs.

Source

André Oerlemans, Engelse plastic recyclingfabrieken maken schone diesel en nafta, in: Change Inc, 17-11-2022; https://www.change.inc/industrie/engelse-plastic-recyclingfabrieken-maken-schone-diesel-en-nafta-39207

[1] Clean Planet Energy was founded and registered in London in 2018. It turns non-recyclable waste plastic into ultra-clean fuels & circular naphtha, with proprietary ecoPlants and sustainable technologies. In 2019 CPE chooses Stopford as their EPCM partner for the design & build of their ecoPlants, in 2020 CPE announced their R&D and Investment arm: Clean Planet Regeneration. In 2021 CPE announced a breakthrough products with sustainable marine fuels. IN 2022 Clean Planet Energy launches 10 new roles to support global expansion. https://www.cleanplanetenergy.com/about

[2] Teesside is a built-up area around the River Tees in the north of England, split between County Durham and North Yorkshire. The name was initially used as a county borough in the North Riding of Yorkshire.

[3] Crossroads is a European real estate private equity and special situations fund manager with a thematic approach to investing. Based in Luxembourg, Crossroads' key target markets are Germany, UK, The Netherlands, Belgium, Italy and Spain with potential target markets including Iberia, Central and Southern Europe and the Nordics. Since inception in 2015, Crossroads has generated an exposure to approximately €1 billion of European real estate assets and more than 69 properties across 23 transactions on behalf of its various investors. https://www.crossroadsre.eu/

[4] https://committees.parliament.uk/publications/31509/documents/176742/default/

[5] See note 1

[6] See note 3

0 notes

Link

0 notes

Text

BEPZA Public School and College Job Circular 2022

BEPZA Public School and College Job Circular 2022

The BEPZA Public School and College recently announced a vacancy for Bangladeshi People. Welcome to the BEPZA Public School and College Job Circular Updates. As you know, The BEPZA Public School and College started on 15 December in1999. This institution started up with the favor of the sixth executive chairman of the Bangladesh Export Processing Zone Authority during his tenure. The activities…

View On WordPress

0 notes

Text

45TH GST Council Meeting Discussion & Recommendations

A press release was issued concerning the 45th GST Council held on 17th September 2021 in Lucknow, chaired by the Honorable Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman. The recommendations made in the council covered some reliefs in view of the COVID Pandemic situation, compensation cess utilization, changes in GST laws and procedures, interest on ineligible ITC and many more.

These recommendations would be given effect through issuing circulars and notifications as and when deemed fit.

Here, in this text, we have tried to briefly cover all the highlights of the said press release and other significant recommendations made by the council.

1: Relief measures, given the COVID Pandemic situation-

Concessional rates were being charged on some Covid treatment drugs up to 30th September 2021. The period now has been extended till 31st December 2021.

Rates on some other Covid treatment drugs would also be reduced to 5%.

2: A recommendation was also made to change the rates of some goods.

A list of goods was released mentioning the change in tax rates on goods like cancer medicines, Cartons, boxes, bags, packing containers of paper, Specified Renewable Energy Devices and parts, and some other items.

Mentha oil being supplied by an unregistered person would be covered under reverse charge mechanism, and in case of its export, refund of ITC should only be allowed against LUT.

The composition scheme would also cover brick kilns (threshold limit-Rs 20 Lakhs). Bricks without ITC would attract the rate of 6%, and with ITC would attract a 12% rate of tax.

3: A problem of accumulated ITC was faced by the dealers of footwear and textiles due to the wrong inverted duty structure on them. This incorrect inverted duty structure is now being rectified by changing the applicable rates of GST. This change would be brought w.e.f. 1st January 2022.

4: The council also had a discussion over the matter of petroleum products to be included or not under the purview of the GST Act. It was decided that it is not appropriate to take this step at this point.

5: Exemptions and change in rates of tax in case of a supply of services were also taken into account, and among them, some of the worth noting exemptions and changes were-

The exemption on the transport of goods by vessel or air from India to a place outside India has now been extended up to 30th September 2022

Electronic Commerce Operators (ECOs) are being made liable to pay tax on the following services-

1: Transport of passengers by a motor vehicle

2: Restaurant services (with some exceptions)

6: Clarifications in relation to rates on goods and services. Some important points to be considered are-

Coaching services to students provided by coaching institutes and NGOs under '‘Scholarships for students with Disabilities” are exempt from GST.

Supply of already manufactured ice-creams by ice-cream parlours would attract the rate of 18%

''Carbonated Fruit Beverages of Fruit Drink" and "Carbonated Beverages with Fruit Juice" would attract 28% of GST and 12% of Cess.

A uniform rate of 18% would be charged on all paper and paper board containers.

Overloading charges at toll plazas are exempt.

Entry tickets in amusement parks would now attract 18% GST, and if casino facilities are being provided, then the rate will be 28%.

Alcoholic liquor is not to be considered as food, and the job workers providing the services related to alcoholic liquor is liable to pay the tax at the rate of 18% instead of 5%.

A presentation was made on the issue of usage and exhausting of the compensation cess collection from June 2022 to April 2026. It was decided that the amount should be used in respect of the repayment of borrowings and debt servicing made to bridge the arising gap in 2020-21 and 2021-22. Council also thought it through to set up a group of ministers to look into the matter of inverted duty, rationalizing rates and exemptions under the GST Act.

ADVICE ON GST LAW AND PROCEDURE

Relaxation in filing FORM GST ITC-04 (Details of goods/capital goods sent to job worker and received back)-

1: The report is to be furnished once in six months, in case the annual aggregate turnover in preceding financial exceeds Rs 5 crores.

2: The report is to be furnished annually, in case the annual aggregate turnover in preceding financial is up to Rs 5 Crores.

Retrospective change in the law that the interest to be paid by a taxpayer will be on Ineligible ITC availed and utilized instead of ineligible ITC availed. The rate of interest will be 18% with effect from 01.07.2017A change may also be introduced in the provisions of transfer of unutilized ITC balance in cash ledger between distinct persons without going through the whole process of refund.

It was also discussed and decided to issue clarifications for removing ambiguousness through circulars for the taxpayers to benefit from. The issues and disputes are related to-

Scope of intermediary services

Interpretation of “merely establishment of distinct person” in case of export of services.

Some other clarifications related to debit note issuance date need of carrying a physical copy of tax invoices under Rule 48(4).

Provisions regarding procedure and time limit for filing refund of tax paid wrongfully.

FACILITATING AND STREAMLINING OF GST COMPLIANCES

1: Aadhar authentication has now been made mandatory for taxpayers wanting to take the refund and applying for revocation or cancellation of registration.

2: A refund of GST will be made in the same bank account to which the PAN is linked.

3: The late fee for Form GSTR-1 will now be auto-populated in the next return in Form GSTR-3B.

4: A registered person shall not be allowed to furnish FORM GSTR-1 if he has not furnished the return in FORM GSTR-3B for the preceding month. (w.e.f. 01.01.2022)

These recommendations were made after thorough deliberations and discussions. Many issues were brought up in view of the current COVID situation, problems related to GST structure, ambiguity and hardships that a taxpayer goes through. Many steps are to be taken which will prove to be beneficial and welcoming for the taxpayers.

The above-mentioned points were made only in the form of recommendations and are yet to be enforced through issuing notifications and circulars.

Authored by CA Manish Gupta & assisted by Khushi Khandelwal

For any queries or suggestions, reach at [email protected]

Disclaimer-The information given above by the author is to provide a general guidance to the readers. This information should not be sought as a substitute for legal opinion.

Source:https://www.manishanilgupta.com/blog-details/45th-gst-council-meeting-discussion-recommendations

0 notes

Text

CREATE bill to boost employment recovery policy with 2M new jobs

#PHnews: CREATE bill to boost employment recovery policy with 2M new jobs

MANILA – Department of Trade and Industry (DTI) Secretary Ramon Lopez said Monday the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act aiming to reduce corporate income tax will attract investments that will create more jobs.

The recent bicameral approval of the game-changing CREATE Act can also provide a big boost to the National Employment Recovery Strategy (NERS) Task Force chaired by the DTI and co-chaired by the Department of Labor and Employment (DOLE) and the Technical Education and Skills Development Authority (TESDA), which was signed last Feb. 5 by several agencies.

“The landmark tax and incentives reform bill that we expect to be signed by the President is expected to bring in (a) massive inflow of investments that will create more jobs, especially as we focus efforts in the National Employment Recovery during this period of the pandemic and beyond. The passing of CREATE will firm up the tax and incentive reforms that will make the investment climate significantly more attractive than the current tax and incentive regime,” Lopez said in a statement.

He said the bill will certainly encourage more investments with the lowering of the corporate income taxes rate from 30 percent to 20 percent for micro, small and medium enterprises (MSMEs), and 25 percent for large corporations.

“Modernizing the incentives system likewise makes the incentives such as income tax holiday (ITH), special corporate income tax rates (SCIT) or enhanced deductions (ED), available to industries considered strategic, critical or export oriented," he added.

The Trade chief said the length of incentives, such as four to seven years of ITH plus five or 10 years of SCIT or ED, will depend on the nature of industry, export or domestic oriented, degree of technology and value adding, and geographical location, with additional years outside the Metro Manila and urban centers.

“There is also (a) longer transition period for those currently granted incentives. Thus, incentives are now made more performance-based, focused and timebound,” Lopez said.

CREATE is a bill certified urgent by President Rodrigo Roa Duterte upon the recommendation of the economic team led by Finance Secretary Carlos Dominguez III.

Lopez also thanked the legislators at the Senate and the House of Representatives, with Sen. Pia Cayetano and Rep. Joey Salceda, respectively, as principal authors, for the hard work of the committee members in bringing the CREATE bill to fruition.

“The passing of CREATE will unleash the growth potential of investments by removing uncertainties during the period that the bill was under deliberation,” Lopez said. "Based on our estimate and those from Cong. Joey Salceda, CREATE can bring in over PHP200 billion of new investments that can generate 1.4 (million) to 2 million incremental jobs."

CREATE will help boost investments in the Philippines, which would support the 2021 target of the Board of Investments (BOI) of PHP1.25-trillion investment approvals.

A report by the United Nations Conference on Trade and Development (UNCTAD) had also estimated that the Philippines bucked the trend in Southeast Asia, and had increased its foreign direct investments (FDIs) during the pandemic by 29 percent last year.

Meanwhile, the NERS 2021-2023 is a medium-term plan anchored on the updated Philippine Development Plan 2017-2022 and ReCharge PH by expanding the Trabaho, Negosyo, Kabuhayan initiative and improving access and security of employment.

The strategy also takes into consideration the changes in the labor market brought about by the pandemic and the fast adoption of Fourth Industrial Revolution (FIRe) technologies.

"NERS shall also consolidate all measures, programs, and institutions that influence the demand and supply of labor, as well as the functioning of labor markets," Lopez said.

Members of NERS Oversight Committee include the Departments of Transportation (DOTr), Tourism (DOT), Public Works and Highways (DPWH), Science and Technology (DOST), Social Welfare and Development (DSWD), Agriculture (DA), Agrarian Reform (DAR), Interior and Local Government (DILG), Information and Communications Technology (DICT), Environment and Natural Resources (DENR), Education (DepEd), Commission on Higher Education (CHED), and National Security Council (NSC), as well as the Office of the Cabinet Secretary (OCS), Departments of Finance (DOF) and Budget and Management (DBM), and the National Economic and Development Authority (NEDA).

DOLE Secretary Silvestre Bello III said: “This JMC (joint memorandum circular) will fortify our collective undertaking as a Task Force working to develop a policy environment that encourages the generation of more employment opportunities, improves employability and productivity of workers, and supports existing and emerging businesses.”

Lopez further stressed the importance of continuing with the calibrated and safe reopening of the economy to allow the country to regain the growth momentum that it had before the pandemic.

The vaccine rollout is also another complementary program that will help further improve consumer and business confidence as immunity of the majority of the population is achieved, he said.

“Vital wide-ranging and integrated policy measures are needed. These should focus on: stimulating the economy and jobs; supporting enterprises, employment and incomes; and protecting workers in the workplace, including occupational safety and health,” he added. (PR)

***

References:

* Philippine News Agency. "CREATE bill to boost employment recovery policy with 2M new jobs." Philippine News Agency. https://www.pna.gov.ph/articles/1129972 (accessed February 08, 2021 at 10:26PM UTC+14).

* Philippine News Agency. "CREATE bill to boost employment recovery policy with 2M new jobs." Archive Today. https://archive.ph/?run=1&url=https://www.pna.gov.ph/articles/1129972 (archived).

0 notes

Photo

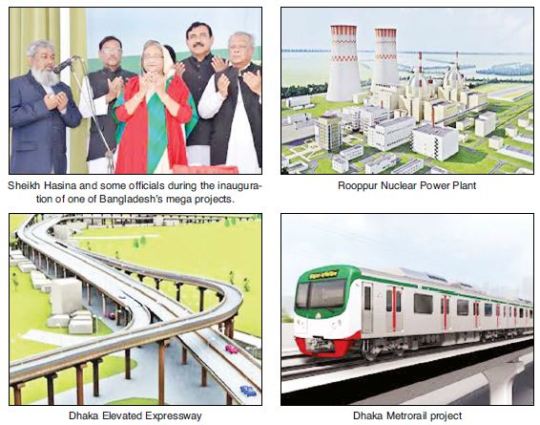

Mega projects transforming Bangladesh economy

Country to achieve high mid-income country status by 2041

KUWAIT CITY, Jan 12: It is often said that infrastructure-megaprojects are crucial drivers for accelerating economic growth in a developing country like Bangladesh where average GDP growth in the last eleven years (2008-2019) is nearly 7% per annum.

This economic growth is usually required both for capital accumulation to fund the mega projects and to earn the benefits of these projects for boosting the growth rate in two digit number.

Even before the 'Agenda 2030' was adopted, the present government in Bangladesh under the leadership of Sheikh Hasina envisaged implementing a few mega projects in Bangladesh to deliver the economic and social goods for millions of people in different parts of Bangladesh and to create the economic growth that will benefit the population.

It is expected that these large infrastructural undertakings and mega projects would transform the country's communications, transportation, ports and energy scenario by 2030 and help the country to achieve high mid-income country status by 2041.

Padma Multipurpose Bridge

A self-funded project of Bangladesh government worth $ 3.65 billion, the 6.1 km double-deck bridge is expected to be open for traffic by 2022 connecting southern part of Bangladesh with the capital city as well as eastern part of the country. As of 10 December 2020, around 90% of the construction of the Padma Multipurpose Bridge has been completed. The bridge will have road and rail linkages in two separate decks. China Major Bridge Engineering Company Ltd, has been selected to construct the long aspired bridge on the river Padma. It is expected that the construction of the bridge will comprehensively transform the pace of economy in the region improving lives of millions of people on the both sides of the river.

Matarbari Deep Sea Port

Bangladesh exports worth nearly $ 40bn and imports of goods worth nearly $ 60bn majority of which carried through seaways. Presently, the country's two seaports– Chittagong and Mongla — have up to 9.5-metre where draft vessels holding up to 2,000 teu can anchor. Bangladesh planned to develop its first deep-sea port as part of a publicprivate partnership with Japan. Matarbari deep seaport will have a 16-meter water draft and will be able to accommodate 8,000 teu post-Panamax vessels, lessening Bangladesh's dependence on the feeder vessels to ferry export-import goods from the hub ports in Singapore, Colombo and Port Klang. Matarbari deep sea port will be made functional by 2025.

Payra Deep Sea Port

The construction work of Payra Deep Sea Port has been going rapidly since 2016. Payra will have rail, road, and waterway links with the capital of Dhaka, around which most of the country's garment industry is based and which by extension is the primary destination for imports and origin point for exports. The total cost of the port is estimated to be 11- 15 billion USD. Once deep-sea port is built, the neighboring India, Nepal and Bhutan can make use of this port while it facilitates the domestic economy with faster export and import activities. The port will be fully operational by 2023.

Dhaka Metrorail Project

It is a part of the 20-year long Strategic Transport Plan (STP) outlined by the Dhaka Transport Coordination Authority (DTCA), a governmental agency. With an aim to provide a safe, fast, affordable and modern means of transportation for the city dweller, the project will have total 8 lanes connecting different parts of Dhaka City. Presently, 20.1 kilometers long Line 6, costing $ 2.8 billion is under construction. Each train will hold up to 1800 passengers. With 56 trains to be in service by 2021, Dhaka Metro is projected to serve more than 60,000 passengers per hour by 2021, with wait times of approximately 4 minutes. The entire route will be able to be traveled in less than 40 minutes at a speed of 100 km / h (62 mph). The project is expected to be completed by 2021.

Dhaka Elevated Expressway

Dhaka Elevated Expressway is Bangladesh's first elevated expressway project. It is one of the largest infrastructure projects taken up by the incumbent government to ease traffic congestion in the capital. It will be 46.73 km long including the connecting roads and will cost around US $ 1.4 billion. The Italian-Thai Development Corporation Limited has entered a $ 1.062 billion contract with China Railway Construction Corporation (CRCC) for building the Dhaka Elevated Expressway. It is expected that the project might be completed by 2022.

Rooppur Nuclear Power Plant

The Rooppur Nuclear Power Plant will be a 2.4 GW nuclear power plant in Bangladesh. It will be the country's first nuclear power plant and the commissioning of unit 1 is planned in 2022 while the commissioning of Unit 2 is planned in 2023. The VVER- 1200/523 Nuclear reactor and critical infrastructure are being built by the Russian Rosatom State Atomic Energy Corporation. The project will provide low-cost electricity and create new jobs in Bangladesh. The power production in Bangladesh currently exceeds 4GW a year. The new plant will increase the country's power production and enable it to achieve energy independence. Karnaphuli Underwater Tunnel Chinese President Xi Jinping and Bangladesh Prime Minister Sheikh Hasina laid the foundation of Karnaphuli Underwater Tunnel worth $ 2.49 billion in 2016. The boring work beneath the tunnel has been inaugurated by the Prime Minister Sheikh Hasina in February 2019. The 3.5km-long four-lane tunnel, the first of its kind in Bangladesh and region, will be built to make the port city of Chittagong “One City Two Towns,” based on a model of East and West Shanghai in China. The construction of the Karnaphuli Tunnel is expected to bolster industrial development, enhance tourism, and expand trade and commerce near the project area, creating employment for thousands of people and boosting exports and there will be a very positive impact on the total economy of the country .

Other prospective Mega Projects

Dhaka-Chittagong Express Way (rail or road), Circular Road around Dhaka City, Construction of an International Airport in the center of Bangladesh, Dhaka Underground Train / Tube Rail and Construction of second bridge on river Padma are a few of the other prospective mega projects that are in the offing in Bangladesh and for which opportunities exist for direct foreign investment. Bangladesh's development story, especially implementation of the on-going and future mega projects, has earned it the reputation in the region as a hot spot for global investment. The role of these mega infrastructure projects is expected to be fundamental in the overall national development process as they will contribute positively in employment generation, connectivity, regional trade, economic integration as well as energy security of the country. With the completion of the mega-projects the government envisages the economy to grow at a faster, which in turn will foster longterm sustainable development.

The post Mega projects transforming Bangladesh economy appeared first on ARAB TIMES - KUWAIT NEWS.

#world Read full article: https://expatimes.com/?p=16695&feed_id=28089

0 notes

Text

'We really need to get rid of that plastic now'

If Europe wants to be climate neutral by 2050, then measures such as recycling and bio-based plastics are not enough. We also need to use less plastics.

We cannot live without plastic. That is obvious. But it confronts the world with a huge problem. Plastics are hardly degradable and remain in the environment for centuries. Researchers and politicians now agree that recycling alone cannot solve the problem.

Alarming figures were quoted during a recent discussion at the University of Natural Resources and Applied Life Sciences (BOKU)[1] in Vienna. In Europe alone, 200 million tons of plastic are currently produced every year. In the world's oceans, this represents a waste share of 80 to 85 percent. In 1999 the ratio between plastic and plankton was still 6:1. By 2009 this ratio had increased tenfold to 60:1. If we do not deal with plastic differently, according to the predictions there will be more plastic in the sea than fish by 2050.

Plastic hardly biodegradable

Plastics eventually break down into smaller and smaller fragments. However, the actual mass remains unchanged. These microplastics migrate to the bottom of the sea and eventually end up in the human body via food. Microplastics are already found in almost everyone's blood and urine. This is problematic, as some additives are toxic. Moreover, it is not known what exactly is in plastics.

The European Union has taken on a pioneering role. It was the first continent in the world to ban the production of single-use plastics. Equally unique in the world are legally binding recycling quotas, Martin Selmayr[2] told the discussion meeting at the University of Vienna. Selmayr is representative of the European Commission in Austria. By 2022, nine out of ten bottles should be recycled.

Improving recycling conditions

But if Europe really wants to be climate neutral by 2050, recycling options must be improved. That is why the European Commission wants to increase the share of recyclable plastic waste. In July 2020, the way was cleared when a plastics tax for businesses was passed. In the future, they will have to pay 80 cents per kilo of non-recyclable plastic waste. “This will be felt by the industry and consumers alike,” Selmayr says. “Because only what is expensive is ultimately not purchased.” The implementation of the legal standard is, of course, the responsibility of the Member States.

Let's take Austria as an example. Currently, one billion tons of plastic waste is produced in that country every year. Only 25 percent of this is recycled. Most of it is burned. And that causes CO2 emissions. Recycling ultimately leads to a circular economy in which waste becomes a raw material again. At present, only ten percent of Austria's economy is recyclable, according to Austrian Environment Minister Leonore Gewessler.

Avoid plastic

In addition to recycling and switching to biological plastics, it is also necessary to reduce the production and use of plastic. “Because the global cropland will not be sufficient to grow the required amount of suitable vegetable raw materials,” said Gewessler. That is why she is also committed to avoidance and wants to reduce the amount of plastic waste by 20 percent. Most of it comes from packaging. Gewessler is currently working on a long list. She questions both the plastic binding of school books and the plastic bags in which magazines are packed when they are sent by post.

Gewessler wants to reduce the large amount of waste from plastic bottles with a two-pillar model. From January 2024, a quota for reusable products will come into effect. Then consumers will be able to choose between one-time deposit systems and reusable systems. This is an important step. Because at the moment large parts of the food retail sector have no offer of reusable products at all, according to the environment minister. At the same time, it is “simply the most ecologically sensible option to use bottles more often”. Austria is also the only country in the EU that has made this regulation so binding.

Uncontrollable number of plastics

When plastic ends up in the environment, it presents a threat to people and nature. That is why the researchers argued in favour of a strict collection system during the discussion in Vienna. However, this does not work because there are so many different types of plastic. Not every type of plastic is suitable for every application. Environmental biotech Ines Fritz[3] explains: “We are already able to shape and modify the properties of plastics in such a way that they are suitable for all kinds of applications. As a single substance, they are purely theoretically 100 percent recyclable.” However, they would also have to be collected separately in all households. With the current amounts, this seems almost impossible.

Just as there is no single type of plastic that is suitable for all applications, there is also no single bioplastic that replaces all synthetic plastics and is better in all areas. “But where we cannot prevent certain residues from ending up in the environment, biodegradable plastics are superior to all conventional plastics,” says Fritz. She is convinced that we can use biodegradable plastics to reduce the environmental problems we have caused for the past 70 years.

Non-recyclable composites

“Our biggest problem right now is composites and multi-component materials that cannot be broken down with existing recycling methods,” said Dr. Doris Ribitsch[4] of the Institut für Umweltbiotechnology of the BOKU Vienna. The researcher has developed a green process for the extraction of plastic from mixed fibres. She uses enzymes from naturally occurring bacteria as biocatalysts. These are capable of breaking down synthetic plastics.

But regardless of whether the plastic is synthetic or 'bio-based', "we should really develop a separate method to recycle each type of plastic," said the researcher. The existing methods can only be used for the recycling of certain plastics and not all methods are environmentally friendly. Ribitsch: “The goal should be to reduce the number of plastics. The smaller the range of plastics and also bioplastics, the easier recycling will be. And that should be the goal. We need to collect as much as possible so it doesn't end up in the environment, and recycle what we collect – not incinerate,” said Ribitsch.

Control of world production

However, European policy alone cannot solve the plastic waste problem. Plastics are also produced outside Europe and inevitably end up here. “Those who produce in a climate-friendly way should also have an advantage in world trade. Unfortunately at the moment it is the other way around. We also need to change this system,” Gewessler said.

Selmayr believes that a market mechanism such as the European Emissions Trading System (ETS)has little practical use for the plastic problem. He pleaded for a more direct approach, which already exists through the EU plastics levy[5] in production.

International legal standards

In terms of cooperation with third countries, it is Europe that exports plastic waste to the rest of the world and not the other way around, he said. China has banned importing plastic waste since 2018. That is precisely what has made the circular economy popular in Europe, he said. “Suddenly it was realized that the circular economy can be a business and that up to 700,000 jobs can be created,” said Selmayr.

But of course Europe is not one of the main producers in the plastics sector. It is precisely these producers who need to be convinced. This will succeed if Europe sets a good example and international legal standards are also adopted.

Source

Hildegard Suntinger, ‘We moeten nu toch echt een keer van dat plastic af', in: Change Inc, 16-07-2021, https://www.change.inc/circulaire-economie/we-moeten-nu-toch-echt-een-keer-van-dat-plastic-af-36797 & https://innovationorigins.com/nl/

[1] https://boku.ac.at/

[2] Martin Selmayr (born 5 December 1970) is a European civil servant from Germany who was Secretary-General of the European Commission from 2018 to 2019 and Chief of Staff to Commission President Jean-Claude Juncker from 2014 to 2018.During his time in the Juncker Commission, Selmayr was widely described as one of the most influential figures within the European Union.

[3] Ass.Prof. Dipl.-Ing. Dr.nat.techn. at University of Natural Resources and Life Sciences, Vienna

[4] Mag. Dr.- Senior Scientist

[5]https://www.cep.eu/fileadmin/user_upload/cep.eu/Studien/cepInput_EU_Plastic_Tax/cepInput_EU_Plastic_Tax.pdf

0 notes

Text

Ovijat Food and Beverage Industries Job Circular 2022

Ovijat Food and Beverage Industries Job Circular 2022

The Ovijat Food and Beverage Industries recently announced a vacancy for Bangladeshi People. Welcome to the Ovijat Food and Beverage Industries job circular Updates. As you know, The Ovijat food & beverage industries ltd is an emerging and growing international company in Bangladesh. Ovijat food & beverage industries ltd is a 100% export-oriented company that starts its journey in 2006. It is…

View On WordPress

0 notes

Text

Federation of companies from Belgium wants to link circular economy and competitiveness

The VBO-FEB wants to decouple GDP-increase and the use of raw materials. Ambitious.

“The time is no longer for experimentation but for acceleration ”in everything related to the circular economy, argues Vanessa Biebel, executive manager of the Sustainability & Circular Economy competence center within the VBO-FEB, the Federation of companies from Belgium. “We have to invest to move from a linear economy to a circular economy”, continues Pieter Timmermans, CEO of VBO-FEB. “Elio Di Rupo [1] did it ten years ago to develop the pharmaceutical sector in Wallonia[2]”, he admits, and he even insists. “And fortunately Wallonia has bet on it. We can see the benefits today. It is time to do the same for this sector, ” he adds. For the employers' federation, this is essential.

“Going beyond certain measures, this is a way of thinking that must completely change,” continues Pieter Timmermans when asked what, in concrete terms, the VBO-FEB wants to see in order to promote the development of this type of economy. “We must not impose things on companies because we must not forget their need for competitiveness. But research and development must be increased. We need public support, ” he says. “The circular economy has a double advantage because it enables companies to become more competitive and to reduce costs. More ambitious goals must be set so that, by 2030, Belgian industry can consolidate itself as a leader in the circular economy,” explains Vanessa Biebel. To put it into practice, the VBO-FEB wants to develop, "in collaboration with its sectoral federations, a scoreboard based on ten Eurostat indicators" and will monitor it every two years. The first progress report is scheduled for 2022.

GDP and use of raw materials

“Some public markets are still too strict and refuse, for example, the use of secondary materials. We need a framework, a political support ”, insists Vanessa Biebel. “One also has to bet on Europe and strengthen collaboration between the regions and the federal government. Product standards, for example, depend on the federal government, while waste management is a regional responsibility. Certain legal obstacles must also be removed, such as the standards concerning transborder waste. It's not about reinventing the wheel, it's about improving what already exists, ”she says. “The goal of the circular economy is to achieve this decoupling of GDP and the use of raw materials. Whereas today, the more the GDP grows, the more the consumption of resources increases. The idea is to lower that while maintaining our prosperity, ”says Vanessa Biebel. Ambitious goal. If the two remain difficult to reconcile, or, precisely, “decouplable”, the VBO-FEB wants to be confident. “The European Green Deal aims to make Europe the first climate neutral continent. To achieve this carbon neutrality in 2050, the European Commission plans to mobilize at least 1 trillion euros in public and private funds for the next ten years. The actions will create opportunities for businesses and jobs,”argues the VBO-FEB. “It's good to hear about Belgian beers, waffles, chocolates, but Belgium needs to become an exporter of circular economy products. For this, we need politicians collaborate with us ”, further advocates Pieter Timmermans. In fact, securing the supply of raw materials by implying “urban mine” of electronic waste on which the VBO-FEB relies, is not so simple. Recycling is energy intensive and material recovery is often unprofitable, especially in small electronics. The VBO-FEB specifies that "up to 80% of the impact of products on the environment is determined during the design phase".

But investing in the sector would therefore make it possible to move forward and make the process profitable, specifies the employers' federation. Moreover, given that it is a European target, the compulsory aspect will still come sooner or later if we want to meet the carbon neutrality objectives. So we might as well take advantage of European wishes and put the means on the table to move forward in this direction as quickly as possible, in order to be competitive and a leader. "Those who derive financial benefits from their deliberate strategy of non-compliance[3] must be sanctioned systematically and effectively", specifies the VBO-FEB in its sixty-page report detailing its objectives. Which has the merit of being clear.

Source

Antonin Marsac, La FEB veut lier économie circulaire et compétitivité, in La Libre Belgique, 27-05-2021

[1] former Prime Minister, PS, Editor's note

[2] The Southern region of Belgium

[3] with the environmental requirements, Editor's note

0 notes