#financialtransactions

Text

The Advantages of Having a Verified Payoneer Account for Secure and Global Online Payments

Payoneer is a payment service that provides verified accounts to individuals and businesses worldwide. It offers a secure and convenient way to manage online payments, which is highly essential in today's digital economy. Verified Payoneer accounts offer an unparalleled level of security and convenience when making and receiving payments.

The benefits of using a verified Payoneer account are numerous. It enables you to manage online payments securely and conveniently, saving you both time and money. In addition, it provides the highest level of security when performing financial transactions. Moreover, it allows you to send and receive payments from anywhere in the world, expanding your business opportunities and keeping you ahead of your competitors.

Verified Payoneer accounts are an effective way to manage both personal and business finances. It provides users with a range of powerful services that enable them to send and receive payments, access global markets, and scale their businesses with ease. Payoneer is quickly becoming one of the most popular payment solutions for businesses and individuals worldwide.

By verifying your Payoneer account, you can gain an additional layer of security and enhanced access to the global marketplace. Verified accounts come with benefits such as increased payment limits, fraud protection, and more. Payoneer also provides a wide range of services that make it easy to send and receive payments, manage business accounts, and access global markets. So, if you want to manage your finances more efficiently, consider a verified Payoneer account today.

#verifiedpayoneer#securepayment#onlinepayment#globalpayment#financialmanagement#digitalfinance#businessopportunities#paymentsecurity#paymentconvenience#financialtransactions

5 notes

·

View notes

Text

Navigating IRS Form 1099-S:

Navigating IRS Form 1099-S: This form is used to report proceeds from real estate transactions. It details the sale or exchange of real estate, providing crucial information for tax reporting purposes. Understanding its sections and requirements ensures accurate reporting and compliance with IRS regulations.

#TaxReporting#RealEstate#Form1099S#FinancialTransactions#Form1099online#IncomeReporting#Filing1099S#PropertySales#TaxForms#IRSGuidelines

0 notes

Text

Decoding Payouts vs. Payments in FinTech

In the FinTech realm, the terms "payments" and "payouts" are often conflated, yet their disparities wield significant implications. Let's unpack these distinctions and explore their implications.

Payments:

Fund transfer at the transactional level.

Initiating purchases, charges, etc.

Transactional backbone of digital commerce.

Payouts:

Dispersing collected funds to beneficiaries.

Involves multiple parties (e.g., merchants, partners).

Can be scheduled or instant, posing reconciliation challenges.

Significance:

Payouts fuel the gig economy, enabling seamless earnings.

Essential for platforms like UberEats, managing funds distribution.

Future Outlook:

Financial institutions navigating regulatory complexities.

Solutions like Payouts-as-a-Service streamline operations.

In conclusion, understanding the nuances between payouts and payments is vital in navigating the intricacies of modern finance.

#FinTech#Payments#Payouts#DigitalCommerce#GigEconomy#FinancialTransactions#Technology#Banking#Finance#FutureOfPayments#PayoutsAsAService#RegulatoryCompliance#FinancialInnovation#EconomicEmpowerment#DigitalPayments#Business#Insights

0 notes

Text

SDEX: The Future of Secure Banking Transactions

In the ever-evolving landscape of banking, security is paramount. With the rise of digital transactions and the increasing sophistication of cyber threats, financial institutions are constantly seeking innovative solutions to ensure the safety and integrity of their transactions. Enter SDEX – the future of secure banking transactions.

SDEX is a groundbreaking platform that leverages blockchain technology to revolutionize the way banking transactions are conducted. By harnessing the power of blockchain, SDEX provides an unparalleled level of security, transparency, and efficiency in financial transactions.

One of the key features of SDEX is its use of blockchain technology to create a decentralized and immutable ledger of transactions. Each transaction is cryptographically secured and recorded on the blockchain, making it virtually impossible for malicious actors to alter or tamper with the data. This ensures that every transaction conducted through SDEX is transparent, tamper-proof, and traceable.

Moreover, SDEX employs advanced encryption techniques to safeguard sensitive financial data, such as account information, transaction details, and personal identifiers. This ensures that confidential information remains protected from unauthorized access or interception, providing users with peace of mind when conducting banking transactions.

In addition to its robust security features, SDEX offers unparalleled efficiency in banking transactions. By automating and streamlining processes through smart contract technology, SDEX enables transactions to be executed with greater speed and accuracy. This not only reduces the risk of errors and delays but also enhances the overall efficiency of banking operations.

Furthermore, SDEX provides seamless integration with existing banking systems, allowing financial institutions to easily adopt and integrate the platform into their existing infrastructure. This ensures a smooth transition to SDEX and minimizes disruption to banking operations.

With its innovative approach to secure banking transactions, SDEX is poised to revolutionize the financial industry. By providing unparalleled security, transparency, and efficiency, SDEX is shaping the future of banking transactions and redefining the standards of security in the digital age.

In conclusion, SDEX represents the future of secure banking transactions. With its advanced blockchain technology, robust security features, and unparalleled efficiency, SDEX is set to transform the way financial institutions conduct transactions and safeguard sensitive financial data. As the financial industry continues to evolve, SDEX stands at the forefront, providing a secure and reliable platform for the future of banking.

0 notes

Text

FC-TRS is an RBI-mandated online reporting system for foreign currency transactions involving share transfers between Indian residents and non-residents. Compliance involves timely filing of Form FC-TRS via the FIRMS portal, ensuring accurate documentation and adherence to regulatory guidelines to avoid penalties.

#FC-TRS#ForeignCurrency#FinancialRegulations#Compliance#AntiMoneyLaundering#FinancialTransactions#RegulatoryCompliance#Transparency#FinancialSecurity#InternationalFinance

0 notes

Text

IDFC Bank यूएस-आधारित जीक्यूजी पार्टनर्स ने ब्लॉक ट्रेड लेनदेन में बैंक के 5.07 करोड़ शेयर खरीदे

निजी क्षेत्र के आईडीएफसी फर्स्ट बैंक ने सोमवार को घोषणा की कि अमेरिका स्थित जीक्यूजी पार्टनर्स ने ब्लॉक ट्रेड लेनदेन में एमडी और सीईओ वी. वैद्यनाथन से बैंक के 5.07 करोड़ शेयर खरीदे हैं। आईडीएफसी फर्स्ट बैंक ने कहा, “बैंक को सूचित किया गया है कि एसटीटी की बिक्री और 478.7 करोड़ रुपये के अन्य … Read more

#IDFCBank#GQGPartners#BlockTrade#SharePurchase#BankingInvestment#USInvestors#FinancialTransactions#StockMarketDeal#InvestmentOpportunity#BankShares

0 notes

Text

Income Tax Refunds: Guide to Check and Change Bank Accounts Online

As technology continues to transform the way we handle financial transactions, managing your income tax refunds has become easier than ever before. This blog aims to guide you through the process of checking and changing your bank account for income tax refunds online, ensuring a hassle-free experience and timely access to your funds.

Why Online Matters:

Gone are the days of waiting in long queues and filling out cumbersome paperwork to manage your income tax refunds. The online approach brings convenience to your fingertips, allowing you to make necessary updates from the comfort of your home.

To continue reading click here.

For more detailed information, visit Swipe Blogs.

0 notes

Text

MANAGER G

share market

share market is a trading platform The phrase "stock market" describes a number of marketplaces where shares of publicly traded corporations are purchased and sold. Both official exchanges and over-the-counter (OTC) markets that follow strict guidelines are used for these kinds of financial transactions.

It's common to use the terms "stock market" and "stock exchange" interchangeably. On one or more of the stock exchanges that make up the larger stock market, traders in the stock market purchase or sell shares.

A share market is an online marketplace where buyers and sellers exchange publicly traded company shares.

The primary and secondary markets are the two categories.

Financial instruments that are exchanged on a stock exchange include bonds, shares, mutual funds, and derivatives.

The share market and the stock market operate differently, despite their common usage.

Return on investment As the majority of the listed shares are equity shares their value is directly related to the value of the company, thus when a company is doing well there is a substantial capital appreciation in the shares of the company which provides good returns.

Right to vote ...

Contribution to economic growth ...

Easy to buy and sell ...

Dividend income

HDFC Bank 1,670.85 -15.86 -0.93% 4,070.26

RIL 2,565.05 2.50 0.09% 2,117.17

ICICI Bank 994.30 -10.11 -1.00% 2,087.60

Axis Bank 1,088.30 -7.11 -0.64% 1,162.01

Wipro 462.65 28.65 6.60% 1,049.93

Infosys 1,562.90 26.91 1.75% 1,041.47

0 notes

Link

Link:- https://dailybodh.com/finance/what-is-financial-transactions-know/#What_seems_like_an_accounting_financial_transaction_What_Is_Financial_Transactions

Table Contents hide

1 Financial Transactions

2 Definition of financial records

3 Why do businesses need to journalize their financial transactions

4 What does financial bookkeeping entail?

5 What is the first step in documenting financial transactions?

0 notes

Text

On Wednesday, the Nepal Stock Exchange (... #companies #drops #financialmarket #financialtransactions #increased #investmentopportunities #investorsentiment #marketactivity #marketanalysis #marketbehavior #marketconditions #marketdynamics #marketfluctuations #Marketindicators #marketindices #Marketoutlook #marketparticipants #marketperformance #markettrends #Multiple #nepalstockexchange #nepse #sectoralperformance #shareprices #shares #Stockexchange #stockmarket #stockmarketmovements #stockmarketnews #stockmarketupdate #stockprices #stocktrading #tradingactivities #tradingsession #TradingVolume

0 notes

Text

Aadhaar Enabled Payment System (AePS): Financial Transactions Revolution

#Aadhaarenabledpaymentsystem (AePS) is a government initiative that has been developed to provide easy and secure #financial transactions to the citizens of India. It is a #bankingservice that allows customers to use their Aadhaar number to withdraw cash and conduct other #financialtransactions. In this blog, we will discuss in detail about the #AePS service and how it enables AEPS cash withdrawals through Aadhaar authentication.

Read more on https://digitalbankingservices.wordpress.com/2023/03/02/aadhaar-enabled-payment-system-aeps-financial-transactions-revolution/

0 notes

Link

0 notes

Text

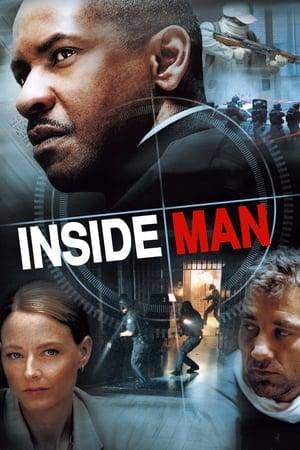

Nonton Film Inside Man (2006)

Nonton Film Inside Man (2006) -- Perampok bank Dalton Russell memasuki bank Manhattan, mengunci pintu dan menyandera, bekerja secara metodis dan tanpa tergesa-gesa. Detektif Frazier ditugaskan untuk bernegosiasi, tetapi pikirannya sibuk dengan tuduhan korupsi yang dihadapinya. Dengan sepasukan polisi di sekeliling bank, pencuri, polisi, dan 'pemecah masalah' tingkat tinggi memasuki perundingan dengan taruhan tinggi.

Read the full article

0 notes

Text

FC-TRS mandates reporting of foreign currency transactions to combat financial crimes and ensure transparency. Applicable to banks and businesses, it requires detailed transaction information. Despite challenges, compliance through technology and training fosters a secure financial ecosystem

#FC-TRS#ForeignCurrency#FinancialRegulations#Compliance#AntiMoneyLaundering#FinancialTransactions#RegulatoryCompliance#Transparency#FinancialSecurity#InternationalFinance

0 notes

Text

Blockchain marches steadily into global financial transaction networks

SWIFT, which runs the world's largest payments messaging network, announced plans to test blockchain as a method of allowing shareholders of financial services clients to cast votes electronically.

News Source - https://www.itworld.com/article/3359244/blockchain-marches-steadily-into-global-financial-transaction-networks.html

1 note

·

View note

Text

Which is the best financial advisors platform?

According to me there are many different platform that can provides financial solution to the customers. But there are very few financial investment platform that provides investment related financial solution to the client.

One of the platform is Rudra Fincare as it is the platform that provides all the financial solution to the client and ensure smooth and transparency of operations and transactions.

0 notes