#forex trading against the trend

Text

Unveiling the Magic of Shooting Star Candlestick Pattern

Title: Unveiling the Magic of Shooting Star Candlestick Pattern: A Step-by-Step Guide

Introduction:Candlestick patterns are essential tools for technical analysts in the world of trading. Among the myriad patterns, the Shooting Star stands out as a powerful indicator of potential trend reversals. In this blog post, we will delve into the nuances of the Shooting Star candlestick pattern,…

View On WordPress

#candlestick#candlestick chart#candlestick patterns#candlestick trading#candlestick trading patterns#candlestick trading setup#candlestick trading strategies#candlesticks#candlesticks pattern#elemer of the briar#forex trading against the trend#history of the elder scrolls#japanese candlesticks#making of the elder scrolls#swing trading guide#swing trading patterns#technical analysis chart patterns#the elder scrolls: arena - a complete retrospective

1 note

·

View note

Text

Understanding the Core PPI and Its Impact on Currency and Gold Markets!

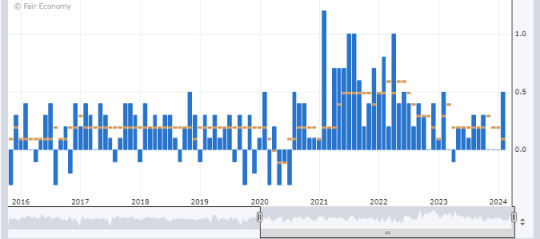

The Producer Price Index (PPI) serves as a vital economic indicator, shedding light on changes in the prices of finished goods and services sold by producers. However, when analyzing PPI data, one must pay close attention to the Core PPI, which excludes the volatile components of food and energy prices. This exclusion is significant because food and energy prices often exhibit erratic fluctuations that can skew the overall PPI reading.

A noteworthy shift occurred in February 2014 when the calculation formula for the Core PPI underwent a modification. This alteration aimed to provide a more accurate representation of underlying inflation trends by eliminating the influence of volatile food and energy prices.

It's crucial to recognize that food and energy prices typically constitute around 40% of the overall PPI. Consequently, when analyzing the Core PPI, which excludes these volatile components, one may find a more stable and reliable measure of inflationary pressures.

Now, let's delve into the implications of Core PPI releases on currency and gold markets.

When the Core PPI data release exceeds market expectations, it signals that inflationary pressures are building up in the economy. This can lead to an appreciation of the dollar as investors anticipate potential interest rate hikes by the central bank to curb inflation. A stronger dollar makes gold, which is priced in dollars, relatively more expensive for investors holding other currencies. As a result, the price of gold may decline in response to a stronger dollar.

Conversely, if the Core PPI data release falls below expectations, it suggests subdued inflationary pressures. In such a scenario, the dollar may weaken as investors adjust their expectations regarding future monetary policy actions. A weaker dollar tends to make gold more attractive as a hedge against currency depreciation, leading to an increase in its price.

For instance, let's consider a hypothetical scenario where the Core PPI data release indicates a higher-than-expected increase in producer prices. This prompts investors to anticipate tighter monetary policy by the Federal Reserve, causing the dollar to strengthen. Consequently, the price of gold, denominated in dollars, declines as it becomes less appealing to investors.

On the other hand, if the Core PPI data release comes in below expectations, signaling subdued inflation, investors may interpret this as a dovish signal from the central bank. In response, the dollar weakens, leading to an increase in the price of gold as investors seek refuge in the precious metal amid currency uncertainty.

In conclusion, the Core PPI serves as a crucial economic indicator that can influence both currency and gold markets. By understanding its significance and the factors driving its movements, traders and investors can make informed decisions to navigate the ever-changing landscape of financial markets.

2 notes

·

View notes

Text

How to Short Forex: Short Selling Currency Details

This article explores the basics of short selling forex, using the EUR/USD currency pair as an example to explain the steps involved. It also advises on suitable risk management throughout the trade journey.

What does short selling currencies involve?

The term ‘short selling’ often confuses many new traders. After all, how can we sell something if we don’t own it?

This is a relationship that began in stock markets before forex was even thought of. Traders that wanted to speculate on the price of a stock going down created a fascinating mechanism by which they could do so.

Traders wanting to speculate on price moving down may not own the stock they want to bet against; but likely, somebody else does. Brokers began to see this potential opportunity; in matching up their clients that held the stock with other clients that wanted to sell it without owning it. The traders holding the stock long (buy position) can be doing so for any number of reasons. Perhaps they have a low purchasing price and do not want to enact a capital gains tax.

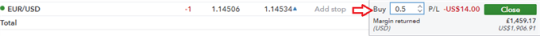

How to short forex: EUR/USD short selling example

Taking a short position in forex involves understanding currency pairs, trading system functionality and risk management.

First, each currency quote is provided as a ‘two-sided transaction.’ This means that if you are selling the EUR/USD currency pair, you are not only selling Euros; but you are buying dollars. Because of this, no ‘borrowing,’ needs to take place to enable the short sale. As a matter of fact, quotes are provided in a very easy-to-read format that makes short-selling more simplistic.

Want to sell the EUR/USD?

Easy. Just click on the side of the quote that says ‘Sell.’ After you have sold, to close the position, you would want to ‘Buy,’ the same amount (if you end up buying at a lower price than where it was sold, you would end up with a profit — excluding commission and fees). You could also choose to close a partial portion of your trade.

For example, let’s assume we initiated a short position for $100 000 and sold EUR/USD when price was at 1.29.

If the price has moved lower, the trader could realize a profit on the trade (excluding commissions and fees). But let’s assume for a moment that our trader expected further declines and did not want to close the entire position. Rather, they wanted to close half of the position to cover the initial cost, while still retaining the ability to stay in the trade.

Our trader, at that point, would have realized the price difference on half of the trade (50k) from their 1.29 entry price to the lower price they were able to close on. The remainder of the trade would continue in the market until the trader decided to buy another 50k in EUR/USD to ‘offset,’ the rest of the position.

How to manage the risk of short selling currencies

Short selling forex carries high risk as there is no maximum loss on a trade. Losses are unlimited, as forex values can theoretically increase to infinity. On a long (buy) trade, the value of a currency can never fall below zero which provides a maximum loss level.

Managing risk on accounts was a trait we discovered with successful traders. Fortunately, there are ways to mitigate this short selling risk:

Implement stop losses.

Monitor key levels of support and resistance for entry/exit points.

Stay up to date with the latest economic news and events for potential downside risk.

Employ price alerts on trades is a good way to stay informed when you’re away from your platform. Price alerts are mobile/email notifications that update traders when certain price levels are reached on a specific market. These price alerts can be predetermined to suit the traders key levels.

Short selling forex is preferred for down trending markets, however careful consideration is required before trading as it brings extra risk even with a bearish outlook. It has been utilised by large institutions/traders as hedges, or by traders looking to trade descending markets. Risk management is essential for proper application, and the methods mentioned in this article should be given the utmost consideration as adverse movements in price can be detrimental.

Further reading recommendations

Many forex traders have significant experience trading in other markets, and their technical and fundamental analysis is often quite good. However, this is not the case 100% of the time. Take a look at What is the Number One Mistake Forex Traders Make? for more insight.

Successful trading requires sound risk management and self-discipline. Find out how much capital to risk on your open trades.

We host multiple webinars throughout the day, covering a lot of topics related to the Forex market like central bank movements, currency news, and technical chart patterns being followed.

To get involved in the large and exciting world of forex check out our Forex for beginners trading guide.

#financialservices#forextrading#gambit#marketing#youtube#forexbot#accounting#forex online trading#wealthmanagement#forex

2 notes

·

View notes

Text

Forex For Dummies: A Hobbyist’s Guide to Currency Trading

Hello there, fellow traders and aspiring enthusiasts! I’ve been navigating the fascinating world of Forex trading as a hobby for a good few years now. If you’re considering diving into this exhilarating pastime, you’ve come to the right place. This article will serve as your introduction to Forex trading, breaking down the key terms, concepts, and processes you’ll need to know.

Quick Plug: Hey, I’m Ingrid Olsen, dabbling in Forex trading whenever I get a chance. I’ve been using decodefx.com (by Decode Global) for my trades and seriously, it’s a game-changer. User-friendly, secure, and filled with useful features — it’s got everything you need for a smooth trading experience. Give it a go, and you’ll see what I mean!

The ABCs of Forex

Forex — short for foreign exchange — is all about trading one currency for another. It’s the world’s most liquid financial market, with daily trading volumes exceeding a staggering $5 trillion. What’s unique about Forex is that it’s decentralized — there’s no central exchange, and trades happen directly between two parties, round the clock, five days a week.

Let’s Talk Pairs

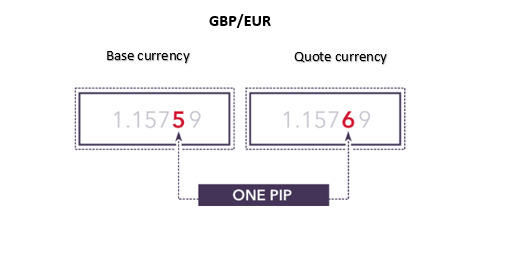

In the Forex market, currencies are traded in pairs, like EUR/USD (Euro/US Dollar). The first currency listed (EUR) is known as the ‘base’ currency, and the second one (USD) is the ‘quote’ or ‘counter’ currency. The value of a currency pair indicates how much of the quote currency it takes to buy one unit of the base currency. So, if EUR/USD is trading at 1.20, it means you need 1.20 US dollars to buy 1 Euro.

Interpreting Forex Quotes

When you see a Forex quote, you’ll notice two prices: the ‘bid’ and ‘ask’ price. The ‘bid’ is the price you can sell the base currency for, while the ‘ask’ is the price you can buy it. The difference between these two prices is the ‘spread’ — which is essentially your broker’s commission for the trade.

Going Long or Short

In Forex trading, you can ‘go long’ or ‘go short’. Going long means you’re buying the base currency because you believe it will increase in value against the quote currency. Conversely, going short means you’re selling the base currency as you think its value will decrease.

The Power of Leverage

One distinctive aspect of Forex trading is the use of ‘leverage’. Leverage is like a loan from your broker, allowing you to control a much larger amount than your actual investment. For instance, with 100:1 leverage, you can control $100,000 with just a $1,000 investment. But be careful — while leverage can amplify your gains, it can also magnify your losses.

The Art of Analysis

Successful Forex trading involves market analysis. This usually involves:

Fundamental Analysis: Examining economic data, political events, and social factors that could affect currency values. These can range from policy changes to economic reports and global events.

Technical Analysis: Using charts and statistical indicators to predict future price movements. Techniques might include analyzing trend lines, support and resistance levels, and using mathematical indicators.

Minimizing Risk

Forex trading, like any investment, carries risk. It’s crucial to manage this risk by setting stop-loss orders to limit potential losses, never risking more than a small percentage of your trading capital on a single trade, and keeping emotions out of trading decisions.

Finding a Broker

To start trading Forex, you’ll need to open an account with a Forex broker. Look for a regulated broker with a user-friendly platform, competitive spreads, good customer service, and hassle-free deposit and withdrawal options.

Final Thoughts

Forex trading can be a thrilling hobby, but it’s important to understand the basics before jumping in. Take the time to learn and practice (many brokers offer demo accounts), and don’t be afraid to ask for advice. Remember, the aim is not just to make profits, but also to enjoy the journey of becoming a savvy Forex trader. Happy trading!

Ingrid Olsen

3 notes

·

View notes

Text

Proven Forex Advice That Will Help You Succeed

Learning about the forex market can be a highly complex thing to do. You will have to do much research and practice before you want to invest your money. This article will show you how to gain income from using the forex market. Need more information please click here https://www.sectorspdrs.com/

Practice with a demo account before putting in real money. Forex trading can be risky and complicated. Using a demo brokerage account will allow you the time to get over the learning curve without risking your skin. Use the time in the demo to test your ideas and skills and see what works.

When trading Forex, you mustn't fight the trends or go against the market. It is essential for your peace of mind, as well as your financial well-being. If you follow the trends, your profit margin might not be as immediately high as if you were jumping on a rare trade. However, the chance you take with the alternative and the added stress is not worth the risk.

Begin trading only in your currency. Though potentially profitable, the world market can be highly confusing and challenging to navigate as a newbie. If you start only with your currency, you'll give yourself a chance to get used to the market terms and conditions, which will better prepare you for more diverse trading in the future.

When trading, try to avoid placing protective stops on obviously round numbers. Put it below those round numbers and on short positions when setting a stop. Round numbers include 10, 20, 35, 40, 55, 60, 100, etc.

You now see that learning and starting in the forex market is not such an easy thing to do. It will take hard work and dedication. If you stick with it and take time to learn everything, it will pay off for you in the long run.

0 notes

Text

Automated trading | Auto trading software | Algoji

In the fast-paced world of financial markets, staying ahead means leveraging the latest technology. Algoji brings you a game-changing solution with our advanced automated trading software, designed to streamline your trading experience and maximize your profits. Let’s dive into how Algoji’s auto trading software can revolutionize your trading strategy.

The Power of Automation in Trading

Gone are the days of manual trading, where every decision had to be made in real-time. With automated trading, you can execute trades based on pre-defined criteria, removing emotions from the equation and ensuring consistent execution of your strategy.

Key Features of Algoji’s Auto Trading Software

Robust Algorithm Development: Our software empowers you to create custom algorithms tailored to your trading style and objectives. Whether you’re a seasoned trader or new to the game, our intuitive interface makes algorithm development accessible to everyone.

Backtesting and Optimization: Test your strategies against historical data to fine-tune performance and optimize for better results. Algoji’s backtesting capabilities give you the confidence to deploy strategies that have been rigorously tested and proven effective.

Real-time Market Monitoring: Stay informed with real-time market data and trends. Our software continuously monitors market conditions, enabling you to seize opportunities as they arise and adapt to changing dynamics swiftly.

Risk Management Tools: Protect your investments with built-in risk management features. Set stop-loss levels, position sizing parameters, and other risk controls to mitigate downside risk and preserve capital.

Multi-Asset Support: Trade across multiple asset classes, including stocks, forex, cryptocurrencies, and more. Algoji’s auto trading software is versatile, allowing you to diversify your portfolio and capitalize on opportunities in different markets.

Why Choose Algoji for Automated Trading?

Reliability and Performance: Our software is engineered for speed and reliability, ensuring seamless execution of trades even during periods of high market volatility.

User-friendly Interface: Navigate our platform with ease, thanks to a user-friendly interface designed for traders of all experience levels. Accessible yet powerful, Algoji’s software puts advanced trading tools at your fingertips.

Customer Support: At Algoji, we prioritize customer satisfaction. Our dedicated support team is available to assist you with any technical issues or questions, ensuring a smooth trading experience.

Get Started with Algoji Today

Experience the future of trading with Algoji’s automated trading software. Whether you’re looking to automate your existing strategies or explore new trading opportunities, our platform empowers you to trade smarter and achieve your financial goals. Sign up with Algoji today and take your trading to new heights.

Also view :-

algo trading , automated trading , auto trading software , algo trading software , algo trading zerodha , amibroker , omnesys nest , Best algo trading software in india , Tradingview algo trading , Tradingview automated trading

0 notes

Text

Unveiling the Power of Easy Pro Scalper: A Game-Changer in Forex Trading

As an avid trader in the dynamic world of foreign exchange, I've come across a plethora of tools promising to revolutionize my trading experience. Among them, Easy Pro Scalper stands out as a formidable contender. This review encapsulates my firsthand experience with this highly converting Forex product digital software.

User-Friendly Interface: A Seamless Trading Experience

Upon integrating Easy Pro Scalper into my trading routine, I was immediately struck by its user-friendly interface. Navigating through the various features was a breeze, even for someone relatively new to the intricacies of Forex trading. The intuitive design streamlines the process, allowing traders to focus on making informed decisions rather than grappling with complex software.

Precision and Accuracy: Maximizing Profit Potential

One of the standout features of Easy Pro Scalper is its remarkable precision and accuracy in generating trading signals. Through advanced algorithms and real-time data analysis, the software identifies lucrative trading opportunities with impressive consistency. This reliability has translated into tangible results for my trading portfolio, significantly enhancing my profit potential.

Customization Options: Tailoring Strategies to Individual Preferences

Flexibility is paramount in the world of Forex trading, and Easy Pro Scalper delivers in this aspect with its extensive customization options. From adjustable risk parameters to personalized trading strategies, the software empowers users to tailor their approach according to their individual preferences and risk tolerance. This level of adaptability ensures that traders can optimize their trading experience to suit their unique circumstances.

Comprehensive Support: Empowering Traders Every Step of the Way

Navigating the complexities of Forex trading can be daunting, especially for those just starting. However, Easy Pro Scalper offers comprehensive support to empower traders every step of the way. From detailed tutorials to responsive customer service, assistance is readily available to address any queries or concerns promptly. This commitment to customer satisfaction fosters a supportive environment conducive to long-term success.

Risk Management Tools: Safeguarding Capital in an Uncertain Market

In the volatile world of Forex trading, effective risk management is paramount to safeguarding capital. Easy Pro Scalper incorporates a range of risk management tools designed to mitigate potential losses and preserve trading capital. From stop-loss orders to risk-reward ratio analysis, these features provide invaluable protection against market fluctuations, instilling confidence in traders regardless of prevailing market conditions.

Continuous Updates: Staying Ahead of the Curve

The Forex market is constantly evolving, necessitating adaptability and innovation to stay ahead of the curve. Easy Pro Scalper excels in this regard, with regular updates and enhancements that reflect the latest trends and developments in the industry. This commitment to continuous improvement ensures that users have access to cutting-edge tools and strategies, enabling them to remain competitive in a rapidly changing landscape.

Final Verdict: Unlocking the Full Potential of Forex Trading

In conclusion, Easy Pro Scalper represents a paradigm shift in the world of Forex trading, offering a potent combination of user-friendly design, precision, and comprehensive support. Whether you're a seasoned trader or just starting, this highly converting digital software has the potential to elevate your trading experience to new heights. With its intuitive interface, customizable features, and unwavering commitment to excellence, Easy Pro Scalper is truly a game-changer in the realm of Forex trading.

Buy Now Buy Now Buy Now

0 notes

Text

Final thoughts on achieving success in Forex trading with Baron Learning Pvt Ltd

Introduction

Forex trading offers an exciting and potentially profitable opportunity for investors. However, the complexity and risks associated with currency trading demand a thorough understanding and strategic approach. This is where the educational expertise of Baron Learning Pvt Ltd becomes invaluable. Specializing in financial education, Baron Learning Pvt Ltd provides comprehensive training that equips beginners and seasoned traders with necessary tools and knowledge.

Understanding Forex Trading

Forex, or foreign exchange, involves trading currencies against one another. It's the largest financial market in the world, known for its liquidity and 24-hour trading cycle. Key terms every trader should know include 'pip,' 'spread,' and 'margin.' These fundamentals form the backbone of Forex trading strategies and are critical for anyone looking to enter the market.

The Role of Education in Forex Trading

The volatile nature of Forex markets makes them both attractive for potential high returns and risky. Education is crucial in mitigating these risks and maximizing profitability. Through its tailored courses, Baron Learning Pvt Ltd helps traders understand market trends, economic factors that influence currency values, and the technical skills required to trade effectively.

Strategies for Successful Forex Trading

Successful Forex trading is not just about predictions and luck; it’s about informed decisions and strategic planning. Key strategies include mastering technical analysis to interpret market data and understanding the psychological aspects of trading, such as dealing with losses and maintaining discipline. Additionally, risk management must be prioritized to safeguard investments.

Leveraging Baron Learning Pvt Ltd for Forex Mastery

Baron Learning Pvt Ltd offers a range of courses that cover from basics to advanced trading strategies. These courses are designed to provide real-world applications and hands-on experience. Testimonials from successful traders who have taken Baron Learning Pvt Ltd courses often highlight the practical, immediately applicable nature of the teachings.

Conclusion

In conclusion, while Forex trading offers substantial financial opportunities, it requires a deep understanding of the market dynamics and a disciplined approach to risk management. With the educational services provided by Baron Learning Pvt Ltd, traders of all levels can enhance their trading skills and strategies. Embracing this expert guidance is a vital step toward achieving Forex trading success.

0 notes

Text

Importance of trading.

Trading, in its essence, is the buying and selling of financial instruments such as stocks, bonds, commodities, currencies, and derivatives with the goal of making a profit. It's a dynamic and complex field that requires a combination of knowledge, skill, and discipline. In this comprehensive guide, we'll explore the world of trading, including different types of trading, strategies, tools, and tips to help you navigate the markets successfully.

Understanding Trading

Trading is conducted on various financial markets, including stock markets, forex (foreign exchange) markets, commodity markets, and others. Each market has its own unique characteristics and factors that influence prices. Traders aim to profit from price movements by buying low and selling high or selling high and buying low, depending on the type of trade they're making.you can also use this platform for trade because this platform is highly comission paid

Types of Trading

Day Trading: Day traders buy and sell financial instruments within the same trading day, aiming to profit from short-term price movements. Day trading requires quick decision-making, analysis, and a good understanding of market dynamics.

Swing Trading: Swing traders hold positions for a few days to several weeks, aiming to capture medium-term price movements. This type of trading requires patience and the ability to analyze trends and patterns.

Position Trading: Position traders hold positions for weeks, months, or even years, aiming to profit from long-term trends. Position trading requires a deep understanding of fundamental analysis and macroeconomic factors.

Scalping: Scalping is a high-frequency trading strategy where traders aim to profit from small price movements. Scalpers typically make numerous trades throughout the day and rely on tight spreads and quick execution.

Trading Strategies

Trend Following: This strategy involves identifying and following the direction of a prevailing trend. Traders aim to buy in an uptrend and sell in a downtrend, riding the trend for as long as possible.

Counter-Trend Trading: Contrary to trend following, this strategy involves trading against the prevailing trend. Traders aim to identify potential reversals and profit from short-term price corrections.

Range Trading: Range traders aim to profit from price movements within a defined range. They buy near the bottom of the range and sell near the top, expecting the price to remain within the range.

Breakout Trading: Breakout traders aim to profit from significant price movements that occur when the price breaks out of a consolidation phase or a trading range. They enter trades when the price breaks above or below a key level of resistance or support.

Trading Tools

Charting Platforms: Charting platforms like Trading View and Meta Trader provide traders with tools to analyze price charts, apply technical indicators, and identify trading opportunities.

Trading Platforms: Online trading platforms like Interactive Brokers, TD Ameri trade, and E*TRADE allow traders to execute trades, manage their portfolios, and access real-time market data.you can also use this platform because this platform is highly comission pay.

News and Analysis Tools: Tools like Bloomberg Terminal, CNBC, and Reuters provide traders with up-to-date news, market analysis, and economic data that can influence trading decisions.

Risk Management Tools: Risk management tools like stop-loss orders, position sizing calculators, and risk/reward ratios help traders manage their risk and protect their capital.

Tips for Successful Trading

Educate Yourself: Continuously educate yourself about trading strategies, market dynamics, and risk management principles to improve your trading skills.

Develop a Trading Plan: Create a trading plan that outlines your trading goals, strategies, risk tolerance, and money management rules.

Manage Your Risk: Use risk management tools like stop-loss orders and position sizing to protect your capital and minimize losses.

Stay Disciplined: Stick to your trading plan and avoid emotional decision-making. Discipline is key to long-term trading success.

Diversify Your Portfolio: Diversification can help spread risk across different asset classes and reduce the impact of market volatility on your portfolio.

Conclusion

Trading is a challenging but potentially rewarding endeavor that requires a combination of knowledge, skill, and discipline. By understanding the different types of trading, developing a solid trading plan, using the right tools, and following sound risk management principles, you can improve your chances of success in the markets. Remember, trading involves risk, so always trade with money you can afford to lose and seek professional advice if needed.

Disclaimer.this cotains is affilliate.

1 note

·

View note

Text

The Benefits of Trading: How Financial Markets Can Transform Your Life

Trading, in its various forms, has been a fundamental part of human civilization for centuries. From the barter system to modern financial markets, the act of exchanging goods, services, or assets has played a crucial role in shaping economies and societies around the world. In recent decades, the rise of electronic trading platforms and the democratization of financial markets have opened up new opportunities for individuals to participate in trading, offering a wide range of benefits that can transform lives. In this blog post, we will explore the key benefits of trading and how it can positively impact your financial well-being and lifestyle. you can also buy member ship in this plateform for your financial growth.

1. Potential for High Returns

One of the most attractive aspects of trading is the potential for high returns. Unlike traditional forms of investment, such as saving accounts or bonds, trading allows you to capitalize on market fluctuations and profit from both rising and falling prices. With the right strategy and risk management, traders can achieve significant returns on their investments, far surpassing what is possible with more conservative investment options.

2. Diversification of Investment Portfolio

Trading offers a way to diversify your investment portfolio beyond traditional asset classes such as stocks and bonds. By trading in different markets, such as foreign exchange (forex), commodities, or cryptocurrencies, you can spread your risk and reduce the impact of market volatility on your overall portfolio. This can help to protect your investments and increase the potential for long-term growth.

3. Access to Global Markets

Thanks to the internet and electronic trading platforms, individuals now have unprecedented access to global financial markets. Whether you are based in New York, London, or Tokyo, you can trade in markets around the world 24 hours a day, five days a week. This global access allows you to take advantage of opportunities in different time zones and markets, diversifying your trading activities and potentially increasing your profits. you can also buy member ship in this plateform for your financial growth.

4. Flexibility and Independence

Trading offers a high degree of flexibility and independence compared to traditional forms of employment. As a trader, you have the freedom to set your own schedule, work from anywhere in the world, and be your own boss. This flexibility allows you to pursue other interests and commitments while still actively participating in the financial markets.

5. Ability to Hedge Against Risks

Trading also provides a valuable tool for hedging against risks in other areas of your life. For example, if you are a business owner, you can use trading to hedge against currency fluctuations or commodity price changes that may impact your business. Similarly, if you are an investor, you can use trading to hedge against risks in your investment portfolio, reducing the impact of market downturns on your overall wealth.

6. Opportunity for Continuous Learning and Growth

Trading is a dynamic and ever-evolving field, offering plenty of opportunities for continuous learning and personal growth. Whether you are a beginner or an experienced trader, there is always something new to learn, whether it's new trading strategies, market analysis techniques, or emerging trends in the financial markets. This continuous learning can not only help you become a better trader but also enhance your overall financial literacy and decision-making skills.you can also buy member ship in this platform for your financial growth.

7. Potential for Financial Independence

For many people, trading represents a path to financial independence and freedom. By building a successful trading career, you can potentially generate a substantial income that allows you to live life on your own terms, without having to rely on a traditional 9-to-5 job. This financial independence can provide you with the freedom to pursue your passions, travel the world, or retire early, giving you a greater sense of fulfillment and happiness in life.

Conclusion

In conclusion, trading offers a wide range of benefits that can transform your life in many ways.

Discaimer.This contents affiliate link.

1 note

·

View note

Text

Earn More Money With These Forex Tips

Figuring out how to make a business prosper in this difficult economy isn't easy. It takes hard work and patience to start your own business and market your product. This is why many are turning to forex in order to trade currencies as a business opportunity. Presented below is some invaluable forex trading advice which will help you on your journey towards making a regular income from the currency exchange markets.

Forex depends on the economy even more than stock markets do. It is crucial to do your homework, familiarizing yourself with basic tenants of the trade such as how interest is calculated, current deficit standards, trade balances and sound policy procedures. Trading before forex mentorship grasp these concepts is only going to lead to failure.

If you want to be a successful forex trader, you need to be dispassionate. Making trades based on emotion will increase the risk factor and the odds that your decisions will be without merit and prompted by impulse. Emotions are always a factor but you should go into trading with a clear head.

Both down market and up market patterns are visible, but one is more dominant. One of the popular trends while trading during an up market is to sell the signals. You should aim to select the trades based on the trends.

Don't just blindly ape another trader's position. Traders on the currency exchange markets are no different than other people; they emphasize their successes and try to forget about their failures. Even if someone has a lot of success, they still can make poor decisions. Do what you feel is right, not what another trader does.

You should try Forex trading without the pressure of real money. By practicing live trading under real market conditions, you can get a feel for the forex market without using actual currency. You can also get some excellent trading advice through online tutorials. Gather as much information as you can, and practice a lot of trading with your demo account, before you move on to trading with money.

Relying heavily on software can make you more likely to completely automate your trading. You could end up suffering significant losses.

Make intelligent decisions on which account package you will have based on what you are capable of. You'll do best when you have a realistic understanding of your level of experience. You will not become a great trader overnight. When dealing with what kind of account is the best to hold in Forex you should start with one that has a low leverage. If you are just starting out, get a smaller practice account. These accounts have only a small amount of risk, if any at all. Begin with small trades to help you gain experience and learn how to trade.

It's common for new traders in the forex market to be very gung-ho about trading. Most people can only give trading their high-quality focus for a few hours. Take breaks when trading, remember that it will still be going on when you return.

Going against the market trend will work only if you can invest on the long run and have enough evidence showing that the trend is going to change. If you are beginning, you should never try to trade opposite the market.

Utilize resources at hand, such as exchange market signals, to facilitate purchases or sell-outs. Most software allows you to set alerts that sound once the market reaches a certain rate. Figure out your exit and entry points ahead of time to avoid losing time to decision making.

The forex market is not tied down to one specific place. Unless the entire world suffers from a disaster, the forex market will be fine. There is no panic to sell everything when something happens. Of prop trading mentorship , a major event could and probably will affect the market, but won't affect the currency pair that you dealing with.

Now, you need to understand that trading with Forex is going to require a lot of effort on your part. Just because you're not selling something per se doesn't mean you get an easy ride. Just remember to focus on the tips you've learned above, and apply them wherever necessary in order to succeed.

0 notes

Text

Daily Forex Signals

I can't provide real-time daily forex signals, but I can certainly help you understand how forex trading works, including strategies often used to analyze and predict market movements, and important factors to consider when trading.

Forex trading involves buying and selling currency pairs based on their expected changes in value against one another. Here are some of the key strategies and tools traders use for making decisions in forex trading:

1. Technical Analysis: This strategy uses historical price charts and market statistics to try to predict future price movements. Tools commonly used in technical analysis include:

- Trend Lines and Channels: Identifying upward, downward, and sideways trends.

- Moving Averages: Smoothing out price data to identify the direction of the trend.

- Indicators: Such as MACD (Moving Average Convergence Divergence), RSI (Relative Strength Index), and Fibonacci retracement levels.

2. Fundamental Analysis: This involves analyzing economic indicators, central bank decisions, political events, and other macroeconomic factors that could affect currency values. Key indicators include:

- Interest Rates: Decisions by central banks on interest rates can greatly affect currency values.

- Economic Reports: Including employment figures, GDP data, and inflation readings.

- Political Stability and Performance: Changes in political leadership or economic policies can affect a country’s currency strength.

3. Sentiment Analysis: Assessing the overall mood of the market through various reports and surveys, or by analyzing data such as the Commitment of Traders (COT) reports.

4. Risk Management: Essential in forex trading, this involves setting appropriate stop-loss and take-profit levels, managing the size of your trades, and understanding your risk tolerance.

If you're interested in getting started with forex trading or improving your trading strategy, it might be helpful to:

- Use a Demo Account: Practicing with a simulation allows you to get used to market conditions without financial risk.

- Stay Informed: Follow financial news and updates regularly.

- Learn Continuously: Consider courses or materials from experienced traders, and keep updating your knowledge.

Always remember, forex trading involves significant risk, and it's important to approach it with caution and thorough preparation.

0 notes

Text

Forex as an Alternative Stream of Passive Income: Understanding the Risks

The allure of Forex trading as a passive income stream is undeniable. The possibility of earning money without constant monitoring of trades or markets can be very appealing. However, it's crucial to understand that passive Forex trading is not without its risks. Here, we will explore some key risks associated with Forex as a passive income source and provide insights on navigating them.

Market Volatility

One of the most significant risks in Forex trading is market volatility. The Forex market is known for its high volatility, which can lead to substantial gains as well as losses. When engaging in passive trading strategies, such as algorithmic trading or copy trading, one must be prepared for the possibility of sudden market shifts that could impact investments adversely.

Leverage-Related Losses

Leverage allows traders to control large positions with a relatively small amount of capital. While this can amplify profits, it also increases the risk of significant losses, especially if the market moves against the trader's position. Passive traders need to be particularly cautious with leverage, as they may not be actively monitoring their trades to respond to market changes.

Complexity and Risk Management

Successfully trading Forex for passive income requires a nuanced understanding of global markets and the ability to navigate complex trading platforms and strategies. It's not just about setting up a strategy and letting it run; it's also about understanding the underlying mechanisms and being able to adjust the strategy as market conditions change.

Reliance on Automated Systems

Automated trading systems are a core component of passive Forex trading. However, these systems can malfunction or perform poorly during unexpected market conditions. The lack of human oversight in automated trading means that technical glitches or algorithmic errors can lead to significant losses before they are corrected.

Economic and Geopolitical Events

Forex markets are highly sensitive to economic reports, political events, and geopolitical tensions. Such events can cause substantial market movements, which can be challenging for passive traders who are not actively managing their positions. It's essential to have mechanisms in place to protect investments from these unpredictable factors.

Choosing the Right Platform and Strategy

Selecting the appropriate passive Forex trading platform and strategy is vital. Factors to consider include the platform's reliability, fees and commissions, and the ability to customize and monitor your strategy. It's also crucial to understand the platform and its features before investing.

For traders looking to refine their approach or expand their toolkit, here are three Forex strategies to consider:

Price Action Trading

Price action trading is a strategy that relies on the analysis of historical prices to inform trading decisions. This method can be used alone or with other indicators, often focusing on technical analysis. Traders who use this strategy scrutinize past price movements to identify patterns that might indicate future activity. It's a versatile approach that can be applied across various time frames, making it suitable for long, medium, and short-term trades.

Trend Trading Strategy

The trend trading strategy is based on the principle that 'the trend is your friend.' This strategy involves identifying the direction of the market trend and making trades in alignment with that trend. It requires a good understanding of technical analysis and may involve the use of trend lines, moving averages, and other indicators to spot the overall direction and strength of the market. This strategy can be particularly effective in markets with strong directional movements.

Carry Trade Strategy

The carry trade is a strategy used by many Forex traders looking to profit from the difference in interest rates between two currencies. In a carry trade, a trader sells a currency with a low interest rate and uses the funds to purchase a currency with a higher interest rate, earning the differential. This strategy can offer lucrative returns if the exchange rates remain stable or move in the trader's favour, but it also carries risks, particularly related to interest rate changes and market volatility.

Each of these strategies has its set of advantages and considerations. Price action trading offers flexibility and can be tailored to different time frames. Trend trading aligns with market momentum and can yield results in markets with clear directions. The carry trade strategy can provide interest income but requires careful monitoring of interest rate trends and currency movements.

Conclusion

Forex trading can offer an alternative stream of passive income, but it's important to approach it with caution and due diligence. Understanding the risks and having a solid risk management strategy in place is key to navigating the Forex market successfully. Remember, passive does not mean 'set and forget'; it requires ongoing oversight and a readiness to adapt to changing market conditions. By being aware of the potential pitfalls and preparing accordingly, traders can work towards achieving a balance between the benefits of passive income and the inherent risks of Forex trading.

For more detailed insights into passive Forex trading strategies and risk management, you can go ahead and explore further resources and guides available online.

Disclaimer: Forex trading involves a significant risk of loss and is not suitable for all investors. The strategies mentioned are for informational purposes only and should not be taken as financial advice. Always conduct your research and consult a financial advisor before making any trading decisions.

0 notes

Text

FN Markets Review

FN Markets Review - Is this broker legitimate or a fraud?

Given the growing evidence pointing to FN Markets's involvement in fraudulent operations, potential investors are advised to proceed with care before investing, particularly in areas prone to forex scams, cryptocurrency scams, dating scams, and CFD scams. We provide a complete study and throw light on the broker's operations and any red flags with our in-depth FN Markets Review. Even though you should always do your research, the information at hand suggests that FN Markets is quite likely to be a scam broker.

FN Markets Website - https://fnpmarkets.co/

Website Availability - No

FN Markets Address - NA

FN Markets Warning - Alberta Securities Commission

Domain Age -

Domain Name: fnpmarkets.co

Registry Domain ID: D0AA32BE5229D4E94829880DF118C6839-GDREG

Registrar WHOIS Server: whois.dynadot.com

Registrar URL: https://www.dynadot.com/

Updated Date: 2023-11-26T03:51:25Z

Creation Date: 2023-09-11T07:56:04Z

Registry Expiry Date: 2024-09-11T07:56:04Z

Exposing the Negative FN Markets Reviews

The number of unfavorable FN Markets reviews on several websites is a major element in the classification of FN Markets as a possible fraud. Reputable websites like Trustpilot, Sitejabber, Scam Bitcoin, and others are quickly examined and show a steady flow of complaints against FN Markets. It is crucial to examine every detail carefully to determine a broker's reliability.

Taking Preventative Actions Against Unreliable Brokers like FN Markets

Conduct Comprehensive Research

Before engaging with any broker, such as FN Markets, safeguard your interests by conducting an extensive investigation to thwart potential scams. Ensure their legitimacy by delving into various sources, including an FN Markets review. Scrutinize reviews, testimonials, and user feedback from credible outlets to gauge their trustworthiness.

Verify Regulatory Credentials

Ensure that the broker holds accreditation and operates under the oversight of a recognized financial regulatory authority in your jurisdiction. This step provides a crucial layer of oversight and protection for traders.

Prioritize Secure Payment Methods

Prioritize the use of secure payment options that offer buyer protection. It's essential not to divulge sensitive financial information to unfamiliar or untrustworthy brokers.

Beware of Unattainable Promises

Exercise caution when encountering brokers that make extravagant claims of substantial profits with minimal risk. Such promises often serve as warning signs of potential scams.

Stay Informed

Staying informed is your shield against financial fraud. By keeping up with the latest fraud trends and warning signs in the financial sector, you enhance your ability to spot potential scams and protect your investments. Vigilance and knowledge are essential in identifying red flags, particularly when dealing with brokers.

File a Complaint against FN Markets if scammed

Seeking Justice: File Complaints against FN Markets at Scam Bitcoin

If you suspect you have been a victim of the FN Markets scam or any other forex scam, cryptocurrency scam, binary scam, or investment fraud, you should first know that recovery is possible from scams. Scam Bitcoin Team is a valuable resource, including the FN Markets review, that offers assistance to victims of fraudulent schemes. Our consultation is free and we guide you through the process of recovering from financial losses.

File a Quick Complaint Here

More Scam Broker Reviews

Moreover, we offer insights through the FN Markets review and other relevant reviews to raise awareness about potential scams.

Keep in mind that staying informed and aware is important if you want to safeguard yourself against fraud and make wise choices in trading and investing. If you believe you've been scammed, seeking help from reputable organizations like Scam Bitcoin can be crucial to recovering and preventing future incidents.

Read Scam Brokers 2024

Scam Broker Reviews

Our Social Pages

Facebook Page

Twitter

Reddit

Read the full article

0 notes

Text

Guidelines And Advice For Making Money With Forex

Many people are starting to shy away from investment opportunities due to the unforeseen nature of the beast, like the great housing collapse of 2008. However, some are learning how to manage the risks associated with investment and are pursuing profits through Forex. Find out how you can profit with this platform. Learn more information please click here "SPDR ETF"

Trading against trends can be a mistake if you're in it for the long haul. The main forces of market momentum can become very obvious quickly and should be paid close attention to. Not doing so has ruined more than one trading career.

After becoming familiar with the forex market's peculiarities, a successful trader may have surplus cash, so it is vital to manage these profits carefully. The nature of the forex market dictates that tomorrow's losses may cancel out yesterday's gains. Handling profits prudently can protect a forex trader from the vicissitudes of the market.

While familiarising yourself with the forex market, you want to avoid potentially disastrous margin calls. Leveraging your fledgling account too profoundly could wipe you out before you get established in the market. To avoid such possible catastrophes, limit the amount of your total account you risk on any one trade. One or two per cent of your account is the limit you should wager while learning the ropes.

Remember that Forex trading is about probabilities rather than certainties. You can follow a solid trading plan and still have a trade against you, so don't expect to have a negative trade. If every trade you make is technically correct, you will make money in the long term.

Throughout this article, you have learned that Forex is a bit complicated and will require your full attention. But make sure not to mistake this for Wall Street-like complication with derivatives and other frustratingly tricky aspects of trading. Forex is a little simpler to understand. Just ensure you're following the tips in the letter before you trade.

0 notes

Text

Rupee Strengthens to 83.16 Against Dollar on April 10

The Indian Rupee strengthened by 15 paise to 83.16 against the U.S. dollar early on April 10, following gains in other Asian currencies and a positive trend in the domestic stock market.

This increase in the Rupee's value was supported by a decline in crude oil prices. In the foreign exchange market, the Rupee started at 83.23 against the dollar and later reached 83.16, up 15 paise from the previous close on April 8.

Forex experts expect the Rupee to rise further to 83.21 against the dollar, as the dollar remained stable and other Asian currencies strengthened. The dollar index, which measures the dollar's strength against other currencies, was at 104.14.

Brent crude oil futures, the global benchmark, were trading at $89.46 per barrel, slightly down from recent highs. This was due to potential increases in U.S. oil inventories and ongoing ceasefire talks between Israel and Hamas.

Asian currencies, including the Chinese yuan (CNH), rose against the dollar. The market is also waiting for U.S. consumer price index (CPI) data, expected at 3.4%, up from last month's 3.2%. The U.S. Federal Open Market Committee (FOMC) meeting minutes and Federal Budget Balance are also awaited.

In the domestic stock market, the BSE Sensex rose by 273.65 points to 74,957.35, and the NSE Nifty increased by 83.85 points to 22,726.60 in early trade.

Foreign Institutional Investors (FIIs) were net sellers in the capital markets on April 9, selling shares worth ₹593.20 crore.

0 notes