#form 2290 for 2021

Video

undefined

tumblr

Form2290filing.com provides 100%Accurate & 100%Simple to file E-file IRS Form 2290. It's easy to file form 2290 tax for 2021. Call: (316) 869-0948

1 note

·

View note

Link

A 2290 Form must be filed by an truckers whose vehicle with a gross weight of 55,000 pounds or more.

1 note

·

View note

Text

Can IRS form 2290 Be Filed Online?

IRS 2290 is a tax levied on the highway motor vehicles used during the taxable gross weight of 55,000 pounds or more. Figure and pay the tax due on a used taxable vehicle acquired and used during the period and claim suspension from the tax when a vehicle is expected to be used 5,000 miles or less. IRS 2290 can also be used as proof of payment to register your vehicle in the state.

The IRS Form 2290 can be filled online and offline both. The offline process is a bit hectic and time consuming. So online filing of the form 2290 is much more preferable. You can file it electronically through any electronic return originator transmitter or with the help of an intermediate service provider.

Hopes2290 is one of the most trusted service providers which assist you to quickly e-file IRS form 2290. No need to go through all the paperwork, envelopes and stamps, file IRS heavy vehicle use tax online. It is much more easy and fast way to get your e-file tax 2290 in just few minutes. It is a completely secured process and you need not to worry about your documents safety. You even get the proof of the e-filing of the Form 2290 instantly so of course the online procedure is much more convenient and time saving.

0 notes

Photo

Benefits of Form 2290 Electronic Filing.

The foremost is receiving back your IRS stamped Schedule-1 proof instantly, IRS could receive your returns and process it faster than any other way of filing. Choosing online filing or electronic filing eliminated all possible human errors that could happen in a tax return. Let see some of the larger benefits of e-filing with @tax2290.com.

· Faster PROCESSING - e-filed returns are processed much faster than paper filed returns.

· Proof of Receipt - confirmation that your return was received and accepted, IRS stamped Schedule-1 proof is sent to your mail inbox immediately.

· Instant Text Alert – Text Alert on return status once there is an update from IRS

· FAX copies – receive copies of your Schedule-1 to your FAX instantly and a copy to your email inbox.

· Convenience - available online 24 hours a day, 7 days a week. File your 2290 tax returns any time. File amendments and correction on the same day, in less than an hour.

· Ease of use - user friendly, with step-by-step instructions and clear screens indicators to walk you through the filing process. E-file is a cake-walk

· Greater Accuracy in Processing – zero down math errors because Tax2290.com software catches many mistakes and will not sent an incomplete return to IRS.

· Pay Right – while you e-file you pay the tax that you owe not extra or less.

· Electronic Payment - convenience of direct withdrawal of tax due and EFTPS option to make payments.

· Less Hassle, No Mails - no mailing of paper returns and waiting for mails for weeks, everything is managed electronically and digitally.

· Security - safer than mailing your tax return and sent right to the IRS server no more data loss.

· Avoid paying extra – when you e-file you can make sure your return reaches them well in the time frame no late penalties or late filing charges.

· Import tax return – you could import the tax returns from your previous years and no need to look around for details in your files.

· Bulk Upload – when you file for larger fleets you can bulk upload the VIN# from your excel spread sheet and no need of keying in one after the other.

· No more typos – while you e-file you won’t get typos such us 1 for I or 0 for o etc.

Electronic filing is by and large the best way of reporting 2290 heavy vehicle use tax returns with the IRS and through Tax2290.com you get the best available resources. The most trusted and rated website since 2007.

#form 2290 electronic filing#Form 2290 electronic Filing for 2021#Form 2290 HVUT efile for 2021#Form 2290 efiling for 2021#Form 2290 efile for 2021#Form 2290 for 2021#HVUT Form 2290 efile for 2021

0 notes

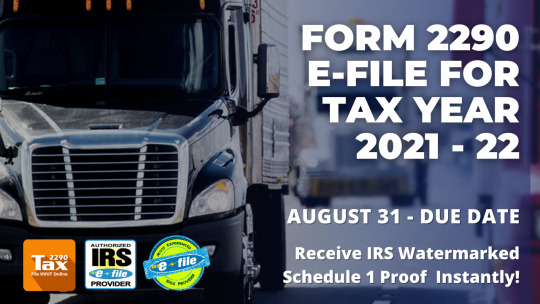

Photo

Form 2290 Electronic filing is Fast, Faster and Fastest!

Choosing the right #2290efiling service is important to efile accurate, on-time #2290taxes with the IRS. Learn what you should be looking for; a real time phone support to help in efile, IRS authorization and truckers reviews on the service. @tax2290 the most trusted& Top Rated! @thinktradeinc @trucktax2290 @tax2290 @2290efile @2290tax @trucktax2290 @2290tax

#Form 2290#form 2290 efile#form 2290 efile for 2021#form 2290 efile now#form 2290 tax efile#form 2290 electronic filing#form 2290 efiling#form 2290 efiling for 2021

0 notes

Photo

Form 2290 efile is Due Now!

Get ready for #Form2290 eFiling for Tax Year July 2021 through June 2022. Efile is the new mantra for #HVUT tax reporting, the best to receive IRS Stamped Schedule 1 proof instantly, 100X faster then any other way of filing 2290 taxes. @Tax2290 is the top rated, most trusted !!!

#Tax Form 2290 efile#Tax 2290 efile#Truck Tax Form 2290#truck tax 2290 efile#tax 2290 efile for 2021#tax2290 online for 2021

0 notes

Photo

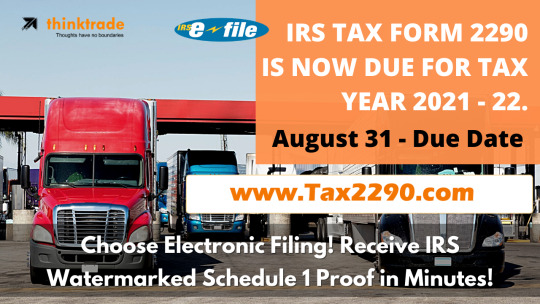

IRS Tax Form 2290 - Due for 2021 - August 31 Deadline

When is Form 2290 Due? The Form 2290 #HVUT returns are due in July 2021 through June 2022, has to be reported and paid between July 1 and August 31. 2290eFiling is the best way to report and pay, to receive the IRS stamped Schedule 1 instantly.

#Truck tax form 2290 for 2021#hvut tax 2290 for 2021#tax 2290 electronic filing#form 2290 due date for 2021#August 31 due date for Tax 2290

0 notes

Photo

IRS Form 2290 Online | Efile 2290 | File Form 2290 Online 2020 | HVUT 2290

Easy IRS Form 2290 Online Filing for 2020 2021 in the US. Call: +1-316-869-0948 to File Form 2290 Online. Efile HVUT 2290 at an affordable price. Pay Heavy Use Tax

#IRS Form 2290 Online#Form 2290 2020 2021#Efile IRS Form 2290#Heavy Vehicle Use Tax#2290 Schedule 1 Proof

0 notes

Photo

File your form 2290 for 2021-22 from everywhere & from any device with easy steps & quick processing correctly. go to: https://www.form2290onlinefiling.com

#Form 2290 Online#File Form 2290 Online#2290 HVUT#2290 Tax Form#File Form 2290#Tax Form 2290#2290 Schedule 1#Form 2290#IRS Form 2290#2290 Online#Download Form 2290#Heavy Highway Use Tax

0 notes

Photo

Form2290 TY 2021 - 2022 Officially Begins Today! E-file Now.

As we prepare to celebrate the 4th of July, it's important to remember that it's time for Tags & Registration Renewal, with the IRS Stamped #Form2290 being one of the most important documents to complete. E-file at www.Tax2290.com today and receive your renewal Schedule-1 copy in minutes.

#Form 2290#Form 2290 For 2021#Form 2290 for TY 2021-22#IRS HVUT#HVUT Form#E-file HVUT#E-file HVUT Form 2290#Efile Truck Tax#Form 2290 renewal for 2021-22

0 notes

Photo

Make sure your #HVUT reporting needs are met by your #Form2290 service provider. At @tax2290, you get #2290efile, Amendment, Claims, VIN Correction, Records keeping, Super fast efile, economic and affordable service. All inclusive with a real time phone, email & chat 2290 support

#Heavy Truck Tax Form 2290 efile#Heavy Truck Tax Form 2290 online#Heavy Truck Tax Form 2290 electronic filing#Heavy Truck Tax for 2021#Heavy Truck Tax eFiling for 2021#Heavy truck tax#heavy truck tax form 2290

0 notes

Photo

Though some taxpayers have the option of filing Form 2290 on paper, the IRS encourages all taxpayers to take advantage of the speed and convenience of filing this form electronically and paying any tax due electronically. Taxpayers reporting 25 or more vehicles must e-file. Here are the benefit that you could enjoy by choosing e-file; The IRS Stamped Schedule-1 proof will be made available in just minutes once IRS accepts.

#Tax 2290#Tax 2290 efile#tax 2290 efile for 2021#truck tax form 2290#tax 2290 electronic filing#2290 tax efile#hvut#Tax 2290 online

0 notes

Photo

Form 2290 for Tax Year 2021 – 2022, Due Now Renew it at www.simpletrucktax.com for only $6.95. It’s time for your 2290 tax form renewal, the heavy highway vehicle use tax is required to be paid annually to the IRS for every truck that drives on the public.

0 notes

Photo

Form 2290 for New Tax Year 2021 – 2022, Due Now Renew it at Tax2290.com

It’s time for your 2290 tax form renewal, the heavy highway vehicle use tax is required to be paid annually to the IRS for every truck that drives on public highways and weighs over 55,000 lbs. Once you file your IRS Tax Form 2290, a Stamped Schedule 1 will be provided to you as your receipt for this heavy highway vehicle use tax. A printed copy is required to register your vehicles each year with the state authorities. A copy of the IRS stamped Schedule 1 for the current year available on your account so you can always have access to it.

Benefits of Form 2290 Electronic Filing with @tax2290, the foremost is receiving back your IRS stamped Schedule-1 proof instantly, IRS could receive your returns and process it faster than any other way of filing. Choosing online filing or electronic filing eliminated all possible human errors that could happen in a tax return.

#Truck tax form 2290#heavy vehicle use tax#heavy truck tax#heavy truck tax for 2021#tax 2290 efile for 2021

0 notes

Text

e-File 2290 Form Online with the IRS

Every year, truckers, owner operators and trucking companies file form 2290 for using the American highways. Vehicles that weigh 55,000 pounds or more and have crossed 5,000 miles in a given tax period must file form 2290 and pay the Heavy Highway Vehicle Use Tax or the HVUT tax.

It is important to file your HVUT tax as you will receive an IRS watermarked Schedule 1 which acts as a proof of tax payment. Without the Schedule 1, users cannot update their vehicle registration and tags at the DMV.

When is the due date to e-file 2290 form?

There are mainly two scenarios that determine when you should start filing your form 2290 online. In the below section you can find the scenarios that determine the due date for filing your form 2290 online.

1.If you have been using your heavy vehicle continuously over the years:

In such scenarios, the due date for filing your form 2290 is August 31st of every year. The tax filing season begins on 1st of July 2021 and ends on the 30th of June 2022.

2.If you have recently purchased a truck or started using your truck recently. New trucks are registered every day in the US. If a truck is purchased in any month other than July, the user needs to file form 2290 and pay the HVUT tax within 30 days of the vehicle’s first use month. The

According Form 2290 IRS instructions, the due date for the newly used truck would be the last day of the month following the month of first use. For example, if you started using your heavy vehicle on the 1st of February then the due date will be on the 31st of March. Filing your form 2290 before the due date will ensure zero penalties for your truck.

0 notes

Video

undefined

tumblr

IRS requires you to file Heavy Vehicle Use Tax (HVUT) Form 2290 each year by August 31. E-File 2290 for Highway vehicles before 2290 Deadline. More details on 2290 Due Date Call: 316-869-0948

0 notes