#get fund for startup

Explore tagged Tumblr posts

Text

Navigating Startup Funding Websites: Essential Tips to Get Funding For Business Start Up

Securing funding for start up businesses is one of the most critical steps in turning a business idea into reality. Whether an entrepreneur is launching a tech venture or a local small business, having access to the right financial resources is essential. The rise of startup funding websites has made it easier than ever to connect with investors and secure the necessary capital. This blog provides a comprehensive guide on how to effectively navigate these platforms to get funding for business start up.

Understanding the landscape of startup funding websites

In recent years, startup funding websites have revolutionised the way entrepreneurs access capital. These platforms provide a bridge between startups and potential investors, offering a range of funding options, including equity crowdfunding, peer-to-peer lending, and traditional venture capital. For those seeking funding for start up businesses, understanding the types of platforms available is crucial.

Equity crowdfunding platforms allow entrepreneurs to raise capital by offering a stake in their business to a large number of investors. Websites like Seedrs, Crowdcube, and AngelList are popular choices for startups looking to attract investors who are interested in owning a piece of the company.

Venture capital-focused platforms, like Crunchbase and Gust, help entrepreneurs connect with venture capital firms and angel investors who provide larger sums of capital in exchange for equity. These startup funding websites are often used by startups with high growth potential and a clear path to profitability.

Tips for success on startup funding websites

Navigating startup funding websites can be daunting, especially for first-time entrepreneurs. However, there are several strategies that can increase the likelihood of securing funding for business start ups.

Create a compelling pitch: The key to attracting investors is a well-crafted pitch. This includes a clear explanation of the business model, market opportunity, and financial projections. A compelling pitch should also highlight the unique value proposition of the startup and the problem it aims to solve.

Prepare thorough documentation: Investors will want to see detailed documentation that supports the claims made in the pitch. This includes a business plan, financial statements, and any relevant market research. Being prepared with this information shows professionalism and increases investor confidence.

Engage with the community: Many startup funding websites have active communities of investors and entrepreneurs. Engaging with these communities, whether through forums, networking events, or social media, can help build relationships and increase visibility for the startup.

Leverage platform resources: Most startup funding websites offer resources to help entrepreneurs succeed, such as guides, templates, and mentoring opportunities. Taking advantage of these resources can provide valuable insights and improve the chances of securing funding.

Be transparent and responsive: Transparency is key when dealing with potential investors. Be upfront about the risks and challenges the business may face, and be responsive to investor inquiries. Building trust is essential in securing funding for start up businesses.

Alternative funding options: Exploring beyond the websites

While startup funding websites are a powerful tool, they are not the only option for entrepreneurs looking to get funding for business start ups. Traditional methods, such as approaching local banks for loans or seeking out government grants, are still viable options. Additionally, revenue-based financing from companies like Klub offers a flexible alternative, allowing businesses to secure capital without giving up equity.

Klub is a notable player in the startup ecosystem, offering multiple alternative options that allow startups to access capital without diluting ownership. This innovative approach is particularly beneficial for businesses that are looking to scale quickly while retaining control.

Conclusion: securing your startup's financial future

Navigating startup funding websites can be a complex process, but with the right approach, entrepreneurs can successfully secure the funding needed to launch and grow their businesses. By creating a compelling pitch, preparing thorough documentation, and engaging with the investor community, startups can increase their chances of success. In addition to online platforms, exploring alternative funding options like those offered by Klub can provide the flexibility and resources necessary to thrive in today’s competitive business landscape.

#funding for start up businesses#startup funding website#get fund for startup#funding for business start up

0 notes

Text

I'm going to apply to a lecturer position in London as a way to maybe start my independent career rather than starting as a group leader in Berlin where I currently am (where I'm almost guaranteed a place) and I'm! Feeling! Mixed about it!!

#i was maybe getting ready to settle down in a place??#and I like germany a lot!!#but i LOVED the UK when I lived there#and on one hand- total academic freedom#no more fights with my boss about how to do things#on the other hand- no guardrails. having to scrape to get funding asap. Shitty startup package. Lower pay#but living in my favorite city??#the closest thing to coming back to a home town that I have left???#idkkkkkkk

4 notes

·

View notes

Text

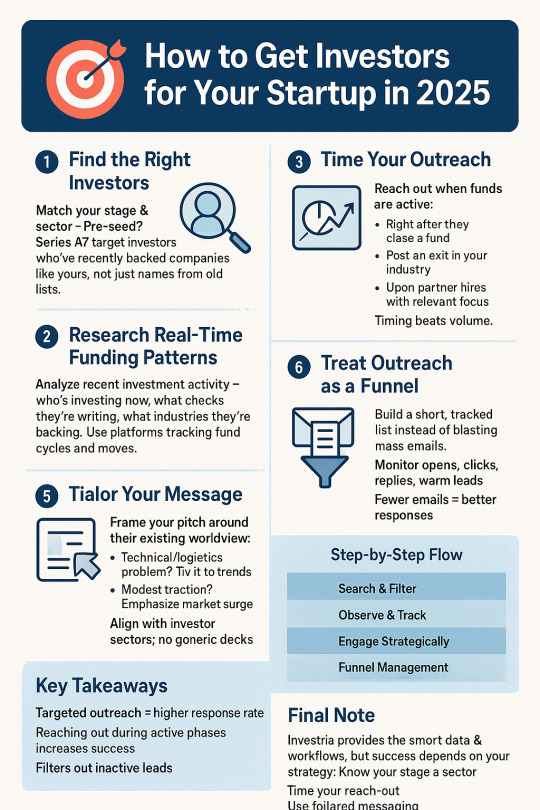

Discover the essential strategies to attract investors for your startup in 2025 with this complete guide by Investria. Learn how to identify the right investors based on your startup’s stage and industry, research real-time funding trends, and master the timing of your outreach. This blog also dives into how to personalize your pitch, use tech tools wisely, and manage your investor pipeline like a sales funnel. Whether you're at the pre-seed stage or scaling up for Series A, this guide offers actionable tips to improve your fundraising efforts and connect with the right investors at the right time. Stay ahead in the competitive startup ecosystem with smart, data-driven outreach that truly resonates with modern investors.

#investors for your startup#find investors for my startup#startups looking for investors#investors for business ideas#ways to get capital for your business#sources of funding for businesses#find investors for your business

0 notes

Text

Collateral-Free Business Loans for Startups in India – Get Funded Instantly in 2025!

Looking to expand your business but stuck with funding issues? You’re not alone. In 2025, more Indian entrepreneurs than ever are searching for instant, collateral-free business loans that can be approved online, with no income proof, no security, and low interest rates.

Whether you're a startup dreaming big or a small business needing quick working capital, this guide offers all the practical insights and comparisons to help you choose the best business loan options in India today.

Why Business Loans Are Booming in 2025

The Indian startup ecosystem and SME sector are growing rapidly, but access to capital remains a hurdle. Traditional banks often demand heaps of paperwork, collateral, and a strong credit score. But that’s changing fast in 2025, with fintechs, NBFCs, and even government initiatives offering:

Instant digital loan for business

Collateral-free business loan application

Loan against property for business expansion

Funding options for startups in India with no income proof

Common Problems Entrepreneurs Face When Seeking Business Loans

Let’s address the real challenges:

“How do I get a business loan online without a CIBIL score?”

“I need a short-term loan for daily business expenses—where do I apply?”

“Are there any micro-loans for small businesses like mine?”

“Which lender offers the lowest interest rate for a business loan in India?”

We’ve compiled this in-depth guide to help you solve all of these problems—fast.

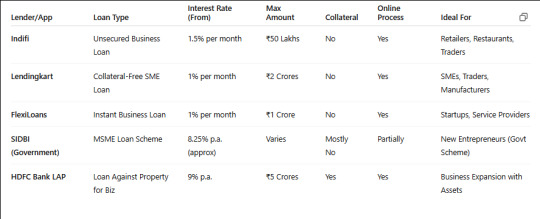

Top 5 Instant & Collateral-Free Business Loans in India – 2025

Funding Options for Startups in India – 2025 Overview

Startups with zero revenue or early traction often find it hard to get traditional funding. Here's what they can do in 2025:

Government Loan Scheme for New Entrepreneurs – Like the Stand-Up India Scheme, Mudra Loans, and PMEGP, which support new businesses with subsidized loans.

NBFCs and Fintechs – Offering instant digital loans for business without heavy documentation.

Startup Accelerators – Many offer grants, seed funding, and convertible debt.

Loan Against Property for Business – For those with real estate assets but no steady income proof.

“In 2025, over 70% of startup loans are now digitally approved—often within 24 to 48 hours.”

Microloans for Small Businesses – What You Should Know

If you run a local business, like a small store, salon, or Kirana, you can access micro loans starting from just ₹10,000. These are usually:

Short-term (3 to 12 months)

Offered by NBFCs, banks, or even UPI-based apps

Approved with minimal documentation

Platforms like Paytm Business Loan, KreditBee, and NeoGrowth are leading this segment in 2025.

How to Get a Business Loan Online in 2025 (Step-by-Step)

Applying for a business loan has never been easier. Here’s how:

Choose Your Loan Type – Short-term, long-term, micro, or loan against property.

Select a Lender or App – Compare interest rates, tenure, and eligibility.

Fill Out the Digital Application – Using PAN, Aadhaar, bank statements.

Upload Documents Digitally – Or use Aadhaar-based e-KYC.

Get Instant Approval – Many platforms offer loans within 24–48 hours.

No need to visit a bank

Zero collateral needed for most digital loans

No income proof required for select NBFCs

Commercial Loan for Business Expansion – Who Should Apply?

If you’re looking to scale operations, buy inventory, or expand branches, consider:

Loan Against Property for Business – High amount, longer tenure

Unsecured Commercial Loans – Quick processing but lower amount

Government Schemes like CGTMSE – For MSME expansion without collateral

Pro Tip: Combine a short-term working capital loan with a long-term commercial loan for better flexibility.

Short-Term Loans for Daily Business Expenses

Running low on working capital? Need funds to pay salaries or manage operations?

Apply for short-term loans like:

Working Capital Loans

Overdraft Facilities

Line of Credit for Small Businesses

These loans range from ₹50,000 to ₹10 Lakhs and are often approved within hours by NBFCs.

Government Loan Scheme for New Entrepreneurs – 2025 Update

Here are the 3 top-performing government-backed loan schemes in India this year:

PMEGP (Prime Minister’s Employment Generation Programme)

Up to ₹25 lakhs

Subsidy up to 35%

For new manufacturing & service businesses

MUDRA Loans (Under PMMY)

Shishu (up to ₹50,000), Kishor (up to ₹5L), Tarun (up to ₹10L)

For small and micro-businesses

No collateral required

Stand-Up India Scheme

Loans between ₹10L–₹1Cr

For SC/ST and women entrepreneurs

Collateral-free under CGTMSE

Frequently Asked Questions (FAQs)

1. Which loan is best for a startup in India with no income proof?

NBFCs like Lendingkart and FlexiLoans offer instant loans without income proof if you have decent bank statements or digital transactions. MUDRA loans are also ideal.

2. What is the lowest interest rate for business loans in India in 2025?

Government schemes offer starting rates from 8.25% p.a. Private lenders and NBFCs offer from 1% per month (i.e., ~12% annually).

3. Can I get a loan for business expansion using property?

Yes, most banks like HDFC, ICICI, and Axis offer loan against property for business purposes up to ₹5 Crores.

4. Are there collateral-free options for small businesses?

Absolutely. Most fintech lenders now offer collateral-free business loan applications with fast approval.

5. How fast can I get an online business loan in India?

With digital lenders, approval can be instant, and disbursal may happen within 24–48 hours, depending on document verification.

Final Thoughts

2025 is the best time for Indian entrepreneurs to take control of their financial growth. Whether you're launching a new venture, managing daily cash flow, or expanding operations, there’s a loan tailored to your needs.

From instant digital loans and micro business loans to government-backed schemes and low-interest funding, the options are wide—and accessible. And the best part? Most don’t need collateral or extensive paperwork.

“Don’t let a lack of capital stop your business dreams. The right funding option is just a few clicks away.”

#commercial loan for business expansion#lowest interest rate for business loan in India#micro loans for small businesses#funding options for startups in India#government loan scheme for new entrepreneurs#loan against property for business#how to get a business loan online#instant digital loan for business#collateral-free business loan application#short-term loan for daily business expenses

0 notes

Text

How a Single Press Release Can Attract Investors

When you're looking to raise capital or gain investor attention, your startup pitch and business plan are only part of the equation. Visibility, credibility, and public interest also play major roles — and that’s where a well-timed press release can make all the difference.

Investors are constantly scanning the market for promising opportunities. But they don’t just invest in ideas — they invest in momentum. A single press release, when professionally written and strategically distributed, can present your brand as active, relevant, and newsworthy.

Announcing a product launch, strategic partnership, new funding round, or milestone achievement through a press release signals growth and traction. And when that release is published across trusted media platforms, it lends instant credibility to your brand — something that makes investors sit up and take notice.

Additionally, press releases help you control the narrative. You can showcase your brand story, mission, and competitive edge on your terms — all while improving your SEO and digital footprint. For investors researching your company, those media mentions and backlinks serve as validation.

Want to make your press release investor-ready and media-worthy? Sitefy’s Press Release Writing & Submission Service is the perfect solution. From powerful headlines to strategic distribution, we handle it all — so your story reaches the right eyes at the right time.

In a world where perception matters, one press release can do more than inform — it can attract opportunity.

#press release for investors#how to attract investors 2025#startup press release#Sitefy press release service#investment ready PR#media exposure for funding#get noticed by investors#PR for startups#business press release strategy#increase investor interest

0 notes

Text

Personal Credit-Based Funding Services with Poor Credit

Secure personal credit-based funding even with poor credit. No credit check options available to help you achieve your business goals today!

#business funding with bad personal credit#business funding poor credit#business funding with no credit check#business funding with poor credit#startup business funding bad credit#business funding no credit#start up business funding bad credit#business funding credit#small business funding no credit check#same day business funding bad credit#get business funding no credit check#new business funding bad credit#poor credit business funding#business funding without credit check#business funding good credit#small business funding bad credit

0 notes

Text

oh my god ragdoll I get that you can’t doxx your secret identity on reddit but you’re leaving out so much relevant information

#unreality#im pretty sure this thread is fake so i feel fine making dumb jokes about it#‘how do you get these funds?’ ‘…i work at a tech startup’ ‘oh okay sure’

0 notes

Text

Attracting investors for your startup can be challenging, but with the right strategies, it becomes achievable. By understanding your market, developing a realistic business model, building a skilled team, and crafting a compelling pitch, you can significantly increase your chances of securing funding. Focus on gaining market traction, setting a realistic valuation, and networking with key players in the startup ecosystem. Events like the 21By72 Global Startup Summit provide excellent opportunities for exposure, allowing you to practice your pitch and connect with potential investors.

#Attracting Investors#Attract Investors#Winning Investors#Attract investors for startup#How to approach investors#How to attract investors for startups#How to get startup funding#Startup Founders#Startup fundraising tips

0 notes

Text

Quick Cash Solutions at Payday Loans EloanWarehouse

Introduction

Understanding Financial Emergencies

Financial emergencies can occur unexpectedly and often require immediate attention. These situations can include a variety of urgent expenses, such as:

Medical Expenses: Sudden health issues or accidents may lead to unexpected medical bills that need to be paid promptly, often before insurance claims are processed.

2. Car Repairs: A vehicle breakdown can disrupt daily life, making necessary repairs urgent to maintain transportation for work or other obligations.

3. Unexpected Bills: From home repairs to utility bills, unforeseen costs can arise at any time, creating financial strain.

4. Job Loss or Reduced Income: Sudden unemployment or a decrease in hours can leave individuals struggling to cover essential expenses until they secure new employment.

The Role of Payday Loans

Payday loans play a significant role in providing immediate financial relief for individuals facing unexpected expenses. Designed as short-term, high-interest loans, they are intended to help borrowers manage cash flow issues until their next paycheck arrives. Here are some key aspects of their role:

Immediate Access to Cash: Payday loans offer a quick solution for urgent financial needs, allowing borrowers to access funds often within hours or even minutes of applying. This speed is crucial during emergencies when time is of the essence.

Minimal Requirements: Unlike traditional loans that may require extensive documentation, payday loans typically have simpler application processes and fewer eligibility criteria. This accessibility makes them an option for individuals who may not qualify for conventional loans due to credit history or other factors.

Short-Term Solution: Payday loans are designed for short-term borrowing, enabling individuals to address immediate financial challenges without long-term debt commitments. Borrowers can use these funds for necessities like medical bills, car repairs, or urgent household expenses.

Convenient Repayment: Repayment is generally aligned with the borrower’s pay schedule, which means they can repay the loan when they receive their next paycheck. This feature can make it easier for borrowers to manage their finances without falling behind.

Building Financial Literacy: For some borrowers, taking out a payday loan can be a learning experience that highlights the importance of budgeting and financial planning. It can serve as a catalyst for developing better financial habits.

Definition of Payday Loans

What Are Payday Loans?

Payday loans are short-term, high-interest loans designed to provide quick financial assistance to individuals facing immediate cash needs.

Key Characteristics of Payday Loans:

Short-Term Nature: Payday loans are generally due within a few weeks, aligning with the borrower’s next paycheck. This makes them suitable for covering urgent expenses that cannot wait for longer-term financing solutions.

High-Interest Rates: These loans often come with high-interest rates compared to traditional loans. Borrowers should be aware of the total cost of borrowing, as interest can accumulate quickly if the loan is not repaid on time.

Simple Application Process: The application process for payday loans is typically straightforward and can often be completed online. Borrowers usually need to provide basic personal information, proof of income, and bank account details.

Minimal Credit Requirements: Unlike traditional loans that often require a good credit score, payday loans usually have fewer eligibility criteria. This accessibility can benefit individuals with poor credit histories who might struggle to secure financing through conventional means.

Quick Approval and Funding: One of the main advantages of payday loans is the speed at which funds can be accessed. Many lenders provide instant approval, and funds can be deposited into the borrower’s bank account within a day or even hours.

Key Features of Payday Loans

Payday loans come with several distinctive features that set them apart from traditional lending options. Understanding these characteristics is essential for borrowers considering this type of financial solution. Here are the key features of payday loans:

Short-Term Borrowing: Payday loans are designed for short-term use, typically ranging from a few days to a few weeks. Borrowers are expected to repay the loan by their next payday, making it a quick fix for immediate financial needs.

High-Interest Rates: These loans often carry significantly higher interest rates compared to other forms of credit. While the upfront cash may seem appealing, the cost of borrowing can escalate quickly if the loan is not repaid on time.

Simple Application Process: The application process for payday loans is usually straightforward and can often be completed online. Borrowers are typically required to provide basic information, such as identification, proof of income, and bank account details.

Minimal Credit Checks: Unlike traditional loans that may require extensive credit evaluations, payday loans usually involve minimal credit checks. This makes them accessible to individuals with poor or no credit histories, allowing those in urgent need of funds to apply.

Quick Approval and Funding: One of the main attractions of payday loans is the speed at which funds can be accessed. Many lenders offer instant approval, and once approved, the money can be deposited into the borrower’s bank account within hours or the same business day.

Flexible Loan Amounts: Payday loans typically range from $100 to $1,000, allowing borrowers to request amounts that suit their specific financial needs. This flexibility can be particularly beneficial in emergencies.

Repayment Timing: Repayment is usually aligned with the borrower’s pay schedule, making it easier for them to manage repayments when they receive their next paycheck.

Purpose of Payday Loans

Immediate Financial Relief

One of the primary reasons individuals turn to payday loans is the need for immediate financial relief. When unexpected expenses arise, having quick access to cash can be essential for maintaining stability. Here’s how payday loans provide this urgent support:

Quick Access to Funds: Payday loans are designed to offer fast financial assistance. Borrowers can complete the application process online, often receiving approval within minutes. Once approved, funds are typically deposited into their bank accounts within hours or by the next business day, allowing them to address urgent needs without delay.

Emergency Expense Coverage: Whether it’s a medical bill, car repair, or unexpected household expense, payday loans can help cover these costs when other resources are unavailable. This immediate funding allows individuals to manage their obligations without further financial stress.

No Lengthy Approval Process: Unlike traditional loans that may require extensive documentation and take days or weeks for approval, payday loans have a streamlined application process. This efficiency is crucial for borrowers who need cash quickly and cannot afford to wait for lengthy procedures.

Flexible Use of Funds: Borrowers can use payday loans for any purpose, providing them with the flexibility to allocate funds where they are most needed. This can help prevent more significant financial issues from arising and allows individuals to focus on stabilizing their situation.

Short-Term Commitment: Since payday loans are intended for short-term use, borrowers can obtain the cash they need without long-term debt obligations. This feature is particularly beneficial for those looking to resolve immediate financial challenges without committing to a prolonged repayment plan.

Conclusion

In today’s fast-paced world, financial emergencies can strike unexpectedly, leaving individuals in urgent need of cash. Payday loans offer a convenient solution, providing quick access to funds for immediate expenses like medical bills or car repairs. Platforms like EloanWarehouse enhance this experience by simplifying the application process and connecting borrowers with a network of lenders, allowing for swift approval and funding.

1 note

·

View note

Text

Startup Finance 101: How To Secure Funding for Your New Business

Starting a new business is an exciting journey, but it requires significant capital to turn ideas into reality. For many entrepreneurs, the question isn't whether to seek funding, but how to get funding for startup effectively. This blog provides an overview of the essential strategies for obtaining funding and managing startup finance, helping you navigate the often complex world of business finance.

Understanding Startup finance

Startup finance is crucial for turning a business idea into a functioning entity. It involves understanding various funding options and determining the best fit for your startup. Entrepreneurs should familiarise themselves with the different types of funding available, including equity financing, debt funding, and alternative financing options.

How to get funding for your startup

To get funding for startup, start by creating a detailed business plan. This plan should outline your business model, market analysis, and financial projections. A well-prepared business plan is essential in convincing potential investors of the viability of your startup. Additionally, entrepreneurs should be ready to present a compelling pitch, demonstrating not only their business idea but also their team’s capability and market understanding.

Networking is another critical component in securing funding for business startups. Attend industry events, engage with potential investors, and connect with mentors who can provide valuable introductions. Building relationships within the industry can significantly increase your chances of finding the right investors to get fund for startup.

Funding for business startups: Key options

Equity financing: This involves selling a portion of your company in exchange for investment. It’s a popular choice among startups as it doesn’t require repayment. However, it does mean giving up some control over your business. Venture capitalists and angel investors are common sources of funding for business startups.

Debt financing: Unlike equity financing, debt financing requires repayment over time, often with interest. This can be a suitable option for businesses that need capital but prefer to retain full ownership. Bank loans and personal savings are typical sources of debt funding.

Alternative financing: Crowdfunding and revenue-based financing are innovative ways to get funding for your startup. Crowdfunding platforms allow you to raise money from a large number of people, while revenue-based financing involves raising funds based on future revenue projections.

Managing Startup Finance

Once funding is secured, managing startup finance effectively is crucial for long-term success. This includes budgeting wisely, keeping track of expenses, and maintaining a clear financial strategy. Regularly reviewing financial statements and adjusting your strategy as needed can help ensure your business remains on track.

In addition to traditional funding options, platforms like Klub offer unique solutions for startups seeking capital. Klub provides alternative financing solutions that can solve for the limitations of traditional methods, offering flexibility and additional resources for business growth —helping you get funding for your startup with ease.

Conclusion

Securing funding for business startups involves a combination of strategic planning, effective pitching, and understanding various financing options. By focusing on how to get funding for your startup, utilising available resources, and managing finances efficiently, entrepreneurs can increase their chances of achieving success. Whether you opt for equity financing, debt funding, or alternative methods, the key is to align your financial strategy with your business goals. Platforms like Klub can also support startups by offering more flexible and innovative ways to get fund for startups.

0 notes

Text

How to Get Startup Funding: A Guide for Small Businesses

Securing funding for your small business is key to growth. Explore various options like loans, grants, crowdfunding, and angel investors. Learn how to craft a strong business plan, improve your credit, and present to investors effectively. This guide will help you navigate the funding process, ensuring your startup gets the financial support it needs.

For More:

0 notes

Text

If anyone wants to know why every tech company in the world right now is clamoring for AI like drowned rats scrabbling to board a ship, I decided to make a post to explain what's happening.

(Disclaimer to start: I'm a software engineer who's been employed full time since 2018. I am not a historian nor an overconfident Youtube essayist, so this post is my working knowledge of what I see around me and the logical bridges between pieces.)

Okay anyway. The explanation starts further back than what's going on now. I'm gonna start with the year 2000. The Dot Com Bubble just spectacularly burst. The model of "we get the users first, we learn how to profit off them later" went out in a no-money-having bang (remember this, it will be relevant later). A lot of money was lost. A lot of people ended up out of a job. A lot of startup companies went under. Investors left with a sour taste in their mouth and, in general, investment in the internet stayed pretty cooled for that decade. This was, in my opinion, very good for the internet as it was an era not suffocating under the grip of mega-corporation oligarchs and was, instead, filled with Club Penguin and I Can Haz Cheezburger websites.

Then around the 2010-2012 years, a few things happened. Interest rates got low, and then lower. Facebook got huge. The iPhone took off. And suddenly there was a huge new potential market of internet users and phone-havers, and the cheap money was available to start backing new tech startup companies trying to hop on this opportunity. Companies like Uber, Netflix, and Amazon either started in this time, or hit their ramp-up in these years by shifting focus to the internet and apps.

Now, every start-up tech company dreaming of being the next big thing has one thing in common: they need to start off by getting themselves massively in debt. Because before you can turn a profit you need to first spend money on employees and spend money on equipment and spend money on data centers and spend money on advertising and spend money on scale and and and

But also, everyone wants to be on the ship for The Next Big Thing that takes off to the moon.

So there is a mutual interest between new tech companies, and venture capitalists who are willing to invest $$$ into said new tech companies. Because if the venture capitalists can identify a prize pig and get in early, that money could come back to them 100-fold or 1,000-fold. In fact it hardly matters if they invest in 10 or 20 total bust projects along the way to find that unicorn.

But also, becoming profitable takes time. And that might mean being in debt for a long long time before that rocket ship takes off to make everyone onboard a gazzilionaire.

But luckily, for tech startup bros and venture capitalists, being in debt in the 2010's was cheap, and it only got cheaper between 2010 and 2020. If people could secure loans for ~3% or 4% annual interest, well then a $100,000 loan only really costs $3,000 of interest a year to keep afloat. And if inflation is higher than that or at least similar, you're still beating the system.

So from 2010 through early 2022, times were good for tech companies. Startups could take off with massive growth, showing massive potential for something, and venture capitalists would throw infinite money at them in the hopes of pegging just one winner who will take off. And supporting the struggling investments or the long-haulers remained pretty cheap to keep funding.

You hear constantly about "Such and such app has 10-bazillion users gained over the last 10 years and has never once been profitable", yet the thing keeps chugging along because the investors backing it aren't stressed about the immediate future, and are still banking on that "eventually" when it learns how to really monetize its users and turn that profit.

The pandemic in 2020 took a magnifying-glass-in-the-sun effect to this, as EVERYTHING was forcibly turned online which pumped a ton of money and workers into tech investment. Simultaneously, money got really REALLY cheap, bottoming out with historic lows for interest rates.

Then the tide changed with the massive inflation that struck late 2021. Because this all-gas no-brakes state of things was also contributing to off-the-rails inflation (along with your standard-fare greedflation and price gouging, given the extremely convenient excuses of pandemic hardships and supply chain issues). The federal reserve whipped out interest rate hikes to try to curb this huge inflation, which is like a fire extinguisher dousing and suffocating your really-cool, actively-on-fire party where everyone else is burning but you're in the pool. And then they did this more, and then more. And the financial climate followed suit. And suddenly money was not cheap anymore, and new loans became expensive, because loans that used to compound at 2% a year are now compounding at 7 or 8% which, in the language of compounding, is a HUGE difference. A $100,000 loan at a 2% interest rate, if not repaid a single cent in 10 years, accrues to $121,899. A $100,000 loan at an 8% interest rate, if not repaid a single cent in 10 years, more than doubles to $215,892.

Now it is scary and risky to throw money at "could eventually be profitable" tech companies. Now investors are watching companies burn through their current funding and, when the companies come back asking for more, investors are tightening their coin purses instead. The bill is coming due. The free money is drying up and companies are under compounding pressure to produce a profit for their waiting investors who are now done waiting.

You get enshittification. You get quality going down and price going up. You get "now that you're a captive audience here, we're forcing ads or we're forcing subscriptions on you." Don't get me wrong, the plan was ALWAYS to monetize the users. It's just that it's come earlier than expected, with way more feet-to-the-fire than these companies were expecting. ESPECIALLY with Wall Street as the other factor in funding (public) companies, where Wall Street exhibits roughly the same temperament as a baby screaming crying upset that it's soiled its own diaper (maybe that's too mean a comparison to babies), and now companies are being put through the wringer for anything LESS than infinite growth that Wall Street demands of them.

Internal to the tech industry, you get MASSIVE wide-spread layoffs. You get an industry that used to be easy to land multiple job offers shriveling up and leaving recent graduates in a desperately awful situation where no company is hiring and the market is flooded with laid-off workers trying to get back on their feet.

Because those coin-purse-clutching investors DO love virtue-signaling efforts from companies that say "See! We're not being frivolous with your money! We only spend on the essentials." And this is true even for MASSIVE, PROFITABLE companies, because those companies' value is based on the Rich Person Feeling Graph (their stock) rather than the literal profit money. A company making a genuine gazillion dollars a year still tears through layoffs and freezes hiring and removes the free batteries from the printer room (totally not speaking from experience, surely) because the investors LOVE when you cut costs and take away employee perks. The "beer on tap, ping pong table in the common area" era of tech is drying up. And we're still unionless.

Never mind that last part.

And then in early 2023, AI (more specifically, Chat-GPT which is OpenAI's Large Language Model creation) tears its way into the tech scene with a meteor's amount of momentum. Here's Microsoft's prize pig, which it invested heavily in and is galivanting around the pig-show with, to the desperate jealousy and rapture of every other tech company and investor wishing it had that pig. And for the first time since the interest rate hikes, investors have dollar signs in their eyes, both venture capital and Wall Street alike. They're willing to restart the hose of money (even with the new risk) because this feels big enough for them to take the risk.

Now all these companies, who were in varying stages of sweating as their bill came due, or wringing their hands as their stock prices tanked, see a single glorious gold-plated rocket up out of here, the likes of which haven't been seen since the free money days. It's their ticket to buy time, and buy investors, and say "see THIS is what will wring money forth, finally, we promise, just let us show you."

To be clear, AI is NOT profitable yet. It's a money-sink. Perhaps a money-black-hole. But everyone in the space is so wowed by it that there is a wide-spread and powerful conviction that it will become profitable and earn its keep. (Let's be real, half of that profit "potential" is the promise of automating away jobs of pesky employees who peskily cost money.) It's a tech-space industrial revolution that will automate away skilled jobs, and getting in on the ground floor is the absolute best thing you can do to get your pie slice's worth.

It's the thing that will win investors back. It's the thing that will get the investment money coming in again (or, get it second-hand if the company can be the PROVIDER of something needed for AI, which other companies with venture-back will pay handsomely for). It's the thing companies are terrified of missing out on, lest it leave them utterly irrelevant in a future where not having AI-integration is like not having a mobile phone app for your company or not having a website.

So I guess to reiterate on my earlier point:

Drowned rats. Swimming to the one ship in sight.

36K notes

·

View notes

Text

0 notes

Text

Connect with Investors: Smart Funding Solutions for Startups

Are you a startup looking for investors to turn your vision into reality? Investria.org is your trusted partner in bridging the gap between groundbreaking ideas and forward-thinking investors. We specialize in helping startups looking for investors secure the funding they need to scale, innovate, and thrive in today’s competitive market. Whether you're in the early stages or ready to expand, our platform connects you with a wide network of angel investors, venture capitalists, and funding professionals eager to support high-potential ventures. At Investria, we believe in empowering entrepreneurs with tailored funding strategies, pitch support, and investor matchmaking services. Don’t let a lack of capital hold you back—get noticed by the right investors today and take the next big leap in your startup journey. Join Investria.org now and unlock doors to smarter funding opportunities built for future-focused startups.

#funding opportunities for startups#need investment for my startup#best way to get investors#funds to start a small business#fund my startup business#best investors for startups#funding your small business#find investors for your startup#startups that need funding

0 notes

Text

Unlocking the Future: Startups Fundraising and Getting Business Funding Online

In the ever-evolving landscape of entrepreneurship, securing funding remains a critical step for startups aiming to transform innovative ideas into successful businesses. Fundraising for Startups Fundraising has evolved significantly over the years, with online platforms playing a pivotal role in democratising access to capital. In this article, we'll explore the modern approaches to startup fundraising and how entrepreneurs can Get Business Funding Online.

The Changing Landscape of Startups Fundraising

Traditionally, fundraising involved navigating through a complex network of venture capitalists (VCs), angel investors, and financial institutions. While these avenues are still relevant, the rise of digital platforms has revolutionized the fundraising process, making it more accessible, efficient, and inclusive.

Traditional Fundraising Methods

Venture Capital: Venture capital firms invest in startups with high growth potential in exchange for equity. This method often requires startups to have a robust business plan, a clear revenue model, and a compelling value proposition.

Angel Investors: Angel investors are wealthy individuals who provide capital for startups during their early stages. Unlike VCs, angels might be more flexible in terms of investment size and conditions, but they also expect a significant return on investment.

Bank Loans: Traditional banks offer loans to startups, but this requires a strong credit history and collateral. The approval process can be lengthy, and the terms may not always be favorable for fledgling businesses.

Modern Fundraising Methods

Crowdfunding: Platforms like Kickstarter, Indiegogo, and GoFundMe allow startups to raise small amounts of money from a large number of people. This method not only provides capital but also helps validate the business idea by attracting early adopters.

Equity Crowdfunding: Websites such as SeedInvest, Crowdcube, and OurCrowd enable startups to sell shares to a large number of investors. This method combines the benefits of crowdfunding and traditional equity investment.

Online Lending Platforms: Companies like LendingClub and Funding Circle offer peer-to-peer lending, where individual investors fund loans for startups. This provides an alternative to bank loans with potentially more favorable terms.

Accelerators and Incubators: These programs, like Y Combinator and Techstars, provide seed funding, mentorship, and resources in exchange for equity. They also help startups connect with a network of investors.

How to Get Business Funding Online

Securing online funding requires a strategic approach. Here are some steps to guide Startups Fundraising through the process:

1. Build a Compelling Business Plan

A well-crafted business plan is essential. It should clearly articulate your business idea, market opportunity, revenue model, competitive landscape, and growth strategy. Investors need to see a realistic and achievable plan that demonstrates the potential for substantial returns.

2. Leverage Digital Platforms

Choose the right platform based on your funding needs and business stage. For instance, early-stage startups might benefit from crowdfunding or angel investors, while more established companies might look towards equity crowdfunding or online lending platforms.

3. Create an Engaging Pitch

Your pitch should capture the essence of your business in a concise and compelling manner. Use visuals, data, and storytelling to highlight your unique value proposition, market opportunity, and the impact of your solution. Platforms like Pitcherific and Slidebean can help in creating professional pitch decks.

4. Engage with Your Audience

Engagement is crucial in online fundraising. Use social media, email marketing, and other digital channels to reach potential investors and customers. Share your journey, milestones, and successes to build trust and credibility.

5. Offer Incentives

Incentives can attract more investors. For crowdfunding, consider offering rewards or early access to your product. For equity crowdfunding, highlight the potential for high returns and any perks associated with investing in your startup.

6. Build a Strong Online Presence

A professional website, active social media profiles, and positive online reviews can enhance your credibility. Investors often research startups online before committing funds, so ensure your digital footprint reflects your brand positively.

7. Network and Collaborate

Online platforms provide opportunities to network with other entrepreneurs, investors, and industry experts. Join online communities, attend virtual events, and participate in forums to expand your network and gain valuable insights.

The Future of Startups Fundraising

The future of startup fundraising lies in further digitalization and democratization. Technologies like blockchain and smart contracts are poised to make fundraising more transparent and secure. Decentralized finance (DeFi) platforms are emerging, allowing startups to access funding without intermediaries.

Moreover, the rise of artificial intelligence (AI) and big data is enabling more personalized and efficient funding solutions. AI can analyze vast amounts of data to match startups with the most suitable investors, while big data can provide deeper insights into market trends and investor behavior.

Conclusion

Securing funding is a critical milestone for any startup, and the evolution of online platforms has made it more accessible than ever. By leveraging these digital tools, entrepreneurs can navigate the fundraising landscape with greater ease and efficiency. Whether you're seeking seed capital or looking to scale, understanding the nuances of online fundraising will empower you to unlock the future of your business.

At Your Ven, we believe in the power of innovation and the potential of startups to drive economic growth. Our mission is to support entrepreneurs in their fundraising journey, providing the resources and connections they need to succeed. Explore our platform today and take the first step towards transforming your vision into reality.

0 notes

Text

In the dynamic financial landscape of India, Non-Performing Assets (NPAs) have emerged as a significant challenge for banks and financial institutions. At Finlender, we aim to demystify NPA funding, providing clarity and insight into its mechanisms and implications.

What are NPAs?

NPAs, or Non-Performing Assets, are loans or advances for which the principal or interest payment remains overdue for a period of 90 days. NPAs are classified into three categories: substandard assets, doubtful assets, and loss assets. They indicate a deterioration in the quality of the bank's loan portfolio, impacting profitability and financial stability.

The Impact of NPAs

The high volume of NPAs has multiple adverse effects:

1- Reduced Profitability: Banks face reduced income due to non-receipt of interest payments.

2- Increased Provisions: Financial institutions must set aside a portion of their profits as provisions to cover potential losses, impacting their overall financial health.

3- Erosion of Capital: Persistent NPAs can lead to a significant erosion of a bank's capital base, affecting its ability to lend further.

NPA Funding: An Overview

NPA funding involves financial strategies and instruments designed to manage and resolve NPAs. It includes the following key aspects:

1- Asset Reconstruction Companies (ARCs): ARCs purchase NPAs from banks at a discounted rate, thereby cleaning up the banks' balance sheets. They then work on recovering the loan amounts through various strategies, including restructuring the loans or liquidating the underlying assets.

2- Debt Restructuring: Financial institutions may restructure the terms of the loan, such as extending the repayment period, reducing the interest rate, or converting a part of the debt into equity. This helps in making the debt more manageable for the borrower and increases the likelihood of recovery.

3- Government Initiatives: The Indian government has introduced various schemes and measures to address the NPA issue. Initiatives like the Insolvency and Bankruptcy Code (IBC) and the establishment of the National Asset Reconstruction Company Limited (NARCL) aim to streamline the resolution process and enhance recovery rates.

4- Stressed Asset Funds: Specialized funds are set up to invest in distressed assets. These funds have a higher risk tolerance and expertise in turning around non-performing assets, providing a viable solution for banks to offload their NPAs.

How Finlender Can Help

At Finlender, we offer a range of services to assist banks and financial institutions in managing NPAs effectively:

Advisory Services: Our team of experts provides strategic advice on NPA management, helping institutions devise effective resolution plans.

Asset Valuation: Accurate valuation of distressed assets is crucial for effective resolution. Finlender offers comprehensive asset valuation services.

Investment Solutions: We facilitate investments in stressed assets through our network of investors and specialized funds.

In conclusion, NPA funding is a critical component in maintaining the health of the banking sector in India. At Finlender, we are committed to providing innovative solutions and expert guidance to navigate the complexities of NPA management. By leveraging our expertise, financial institutions can achieve better recovery rates and ensure long-term financial stability.

READ MORE...NPA and OTS Finance Private Equity Project Finance Corporate Finance Company in India Finlender

#project finance and consulting#startup funding consultants in india#how to get private equity funding in india

0 notes