#getbarter

Text

The Complete Payment Solution you need to thrive in the Global Economy

Flutterwave is a trusted online payment gateway in Nigeria focused on providing individuals and businesses with seamless, intelligent and secure online payment solutions.

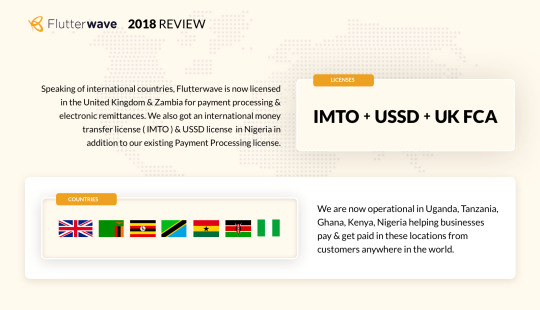

Founded in San Fransisco in 2016 with an office in Lagos, Flutterwave now has an operational presence in Nigeria, Uganda, South Africa, Tanzania, Ghana, and Kenya. In 2018, Flutterwave announced its entry into the United Kingdom and Zambia after obtaining licenses for payment processing and electronic remittances.

Flutterwave boasts of thousands of merchants all over the world with over 100 million transactions worth billions of dollars since inception. Through partnerships with international brands like PayPal, Transferwise, Alipay, Shopify, and VISA, Flutterwave strives to connect its customers with the global economy with ease.

In 2018, Flutterwave got ISO 27001 certification which means Flutterwave has internationally acceptable practices and processes including a robust business continuity plan.

It is worth mentioning that Flutterwave is continuously using technology to shape Africa’s digital economy. In recognition of providing efficient business payment solutions across Africa, Flutterwave received the ‘Best Payments Company’ at the 2018 Ghana eCommerce Award ceremony.

Flutterwave products like Rave, Barter, and Moneywave are modern online payment platforms tailored to drive financial inclusion in the global economy. Whether you are thinking of how to manage your personal finances or looking for the right technology to build and grow your business globally, Flutterwave has a payment solution for you.

Rave by Flutterwave

Rave is unarguably the easiest way for merchants to make and receive payments from anywhere in the world. Rave is used by giant companies like Uber, Booking.com, Flywire, Jumia, Arikair, OjaExpress and several small and medium businesses across Africa. Currently accepting over 150 currencies from over 26,000 merchants, Rave is the ideal merchants' marketplace.

Ravepay offers merchants a fully integrated end-to-end payment gateway with no additional operational cost required and the best technology to achieve zero failed transactions.

Merchants can easily get started on Ravepay with no setup or monthly fees and have control over the acceptance, settlement and transaction analysis process. A reasonable fee is charged per transaction through multiple payment collection channels like;

- In-person through sales mode and the Rave dashboard

- App or Website by installing Rave plugins that allow integration with e-commerce platforms like Alipay, Shopify, Magento, and Woocommerce; SDKs and libraries for customized Apps and websites

- Social media using Rave instant payment links from Instagram or Facebook feeds.

Rave merchants can receive money from customers through:

Credit or Debit cards like Visa, Mastercard, and Verve.

Bank Account Payments from the U.S., Nigeria, and South Africa.

Mobile Wallet Payments on MTN, M-Cash, M-Pesa, and TIGO

How to start and grow your business with Rave

1. Develop a business idea- Identify a need or find a solution to a problem.

2. Conduct a market survey- study your potential customers and how best to serve them, look around for competitors and learn from them.

3. Create a business plan - Set measurable goals and how you intend to achieve them.

4. Raise enough capital

5. Register your business for easy identification

6. Start your business online, in-store or even both.

7. Visit Rave by Flutterwave to create a free Rave account and select a payment feature that meets your needs in less than 5 minutes.

8. Display prices and accept local or global payments in your customer’s preferred currency.

9. Receive payments in your app or website, on social media or in-person through debit or credit cards, bank accounts, and mobile wallets payment in any currency.

10. Manage your funds, expand and pay vendors globally to grow your business.

Already have a business and you want to grow it? Switch to Rave by Flutterwave, accept payment from multiple channels and give your customers the best possible payment experience.

Pros

Cost-effective, all in One Dashboard.

Accept payment from all channels where your business thrives.

Enjoy well managed 24/7 customer support from Flutterwave for even bigger solutions.

Cons

Rave account verification after creating an account might take time so the earlier the better you create a Rave account while deciding to start your business.

Barter

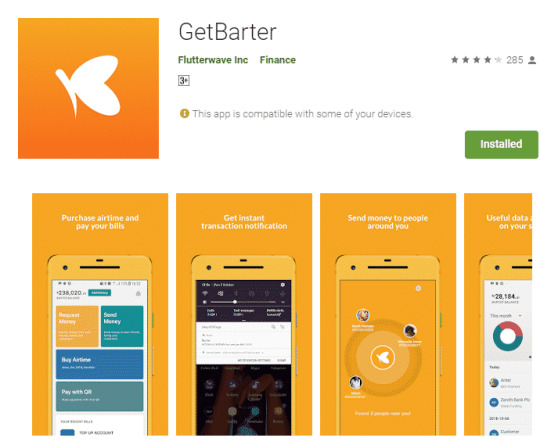

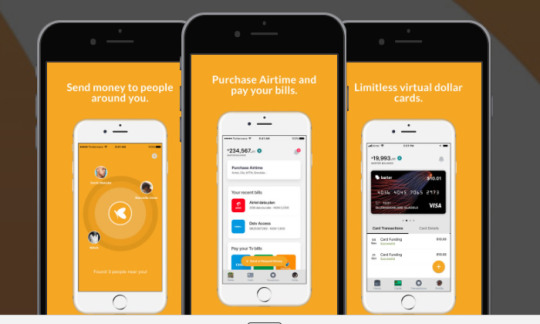

Need a better (financial) half? Get Barter App. Barter by Flutterwave is a payment platform that allows you to manage your personal finances better.

Whether you are sending money to friends, buying airtime, paying utility bills, internet subscription or saving for your next big project, use Barter.

With Barter, you can add your personal bank account to your app dashboard and monitor your funds in your local currency.

Sign up for Barter on the website or download the GetBarter App to join over 30,000 people already using Barter to make their lives better.

Pros

Easy and efficient way to monitor your spendings.

Allows funding through card or bank accounts and bank transfers.

Access to easily repayable short-term loans.

Cons

Allows local currency transactions only.

- Editing of profile and other personal details used in signing up may take time so be careful when signing up.

Moneywave

Moneywave is an omnichannel payment solution that allows you to build customizable money transfer platforms, online banking, mobile banking, and Artificial Intelligent solutions.

Similar to Rave, Moneywave allows you to send money from

- VISA to bank accounts on Mobile

- Bank accounts to VISA on Mobile

- Verve to Discover on ATM

- Discover to Verve on Chat boxes

- Mastercard to Mastercard on Web

- AMEX to AMEX on different bank channels

Sign up for Moneywave to get started.

Flutterwave Developers

Flutterwave is currently home to thousands of developers who have over the years built APIs with easy to use plugins, SDKs, and libraries for the integration of customized payment solutions. Interestingly Flutterwave developer community also offers other developers a playground with the aim of continuously improving the standard of payment technology in the Fintech industry.

The future is all bright for Flutterwave as Olugbenga GB Agboola, the CEO at the beginning of the year reinstated their commitment as a customer-focused brand striving to give their customers the best possible checkout experiences at all times.

#flutterwave#payment solutions#rave#ravebyflutterwave#barter#getbarter#payment gateway#ecommerce#mobile money#moneywave#barterbyflutterwave#flywire#alipay#moneytransfer#personal finance#merchantmarketplace#global economy#how to start a business#how to grow business#online payment#flutterwavenigeria#nigeriaonlinepayment#nigeriafintech#safe online payments#bank to bank transfer#bill payments#payment integration for websites#flutterwavedevelopers#ravesignup#raveaccount

1 note

·

View note

Photo

.Hey fam... . Men must rise and speak against wrong and injustice. . Not to blend in. . Not to suffer and smile. . Let something be done about the rejection of our business cards in Nigeria. . Google is rejecting your Naira MasterCard... . So you can't buy paid apps from the Google Play Store. . Get Barter card does not work on some sites. . Now even Remita.net is telling me my card is invalid, . Young people who must buy and sell online are given unnecessary restrictions. . Limits are not good for man. . . .What aileth thee Nigeria..? . What aileth our fatherland. . How long..? . . #getbarter #paypal #paystack #paymentystems #paymentonline #onlinepayments #googlepay #firstbanknairamastercard #domiciliaryaccount #visagoldcard #firstbankdollarcard #howlong #firstbankvisagoldcard #niger #federalgovtofnigeria #nigeria . @getbarter @opuboikiriko @firstbanknigeria @firstbankngr (at Port Harcourt) https://www.instagram.com/p/CCIYfDSpaLZ/?igshid=1rlxepv4czdm3

#getbarter#paypal#paystack#paymentystems#paymentonline#onlinepayments#googlepay#firstbanknairamastercard#domiciliaryaccount#visagoldcard#firstbankdollarcard#howlong#firstbankvisagoldcard#niger#federalgovtofnigeria#nigeria

0 notes

Text

Flutterwave y Visa lanzan el servicio de pago al consumidor africano GetBarter

Flutterwave y Visa lanzan el servicio de pago al consumidor africano GetBarter

Flutterwave y Visa lanzan el servicio de pago al consumidor africano GetBarter

Jake bright Contribuyente Jake bright Es escritor y autor en la ciudad de Nueva York. Es coautor de La siguiente africa. Más mensajes de este colaborador

Harley Davidson revela más sobre su empuje en vehículos eléctricos

Capital de riesgo, expansión global, blockchain…

View On WordPress

0 notes

Photo

What is Flutterwave:

Flutter wave is a trailblazer in the FinTech industry that seeks to bridge the gap between Africa and the global economy through the building of disruptive and innovative technologies for fast, secure, seamless experience and trusted payment solutions to help Banks and Businesses growth.

Flutterwave, which graduated from Y-Combinator an American seed accelerator which has launched over 2000 companies including Dropbox, Airbnb, Stripe, Reddit, Optimizely, and Zenefits is co-founded by an ex Andelan/co-founder Iyinoluwa Aboyeji who is a Nigerian with a team of engineers, entrepreneurs, and ex-bankers.

Flutterwave’s Competitors:

There’s a saying “that whatever you are doing someone is doing it from another perspective”….African proverb.

With flutterwave it is not different either, her competitors are not limited to

Gravity Payments, Inter switch, vogue pay, and Elavon.

Flutterwave’s Success Stories:

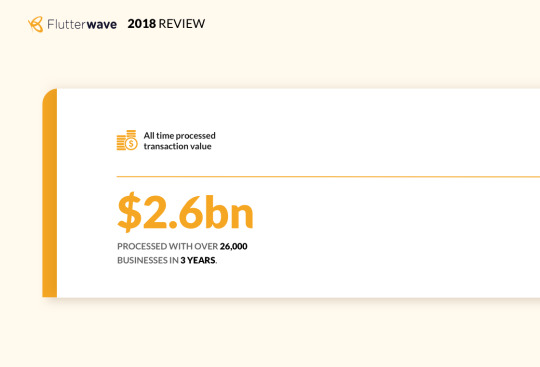

According to QwartzAfrica, Four months from inception flutterwave had already transacted more than $20million with clients including Uber Nigeria, Access Bank, Paystack. Recently with source from flutterwave’s website. Flutterwave has currently scaled in leaps to partnering with over 50 banks in Africa, over $2.6 billion payments processed in more than 100million transactions both in Africa and internationally while over 1200 developers build on Flutterwave.

According to Techcrunch flutterwave is one of the several Africa focused FinTech companies that have established headquarters in San Francisco and operations in Africa to tap the best worlds in VC (Venture Capitalists), developers, clients, and digital finance.

On July 31, 2017, flutterwave announced that it raised over $10million in a Series A round of funding. The round was led by Greycroft Partners and Green Visor Capital with Participation from Y combinator and Glyn Capital, thus showing the viability of fluterwave’s business model.

Flutterwave products:

with the aim of tackling the fragmented payment system in Africa these flutter wave’s products have been a great contribution.

Moneywave: This solution allows individuals and merchant in Nigeria who wants to send payments in whatever form they choose.

Rave: Rave is a payment solution which allows you and your business to accept a range of payment method from customers around the world. These methods are Card Payments, Bank account Payments, and Mobile Wallet Payments.

GetBarter: With GetBarter you can manage payments and subscriptions and peer-lending while you get notified of where your money is moving next, most importantly you have control of how you are spending your money.

Reasons Why you should use flutterwave products and/or integrate them into your business.

Security: As a business owner or an individual one thing is paramount, the security of your money during transactions. Flutterwave rave is a PCIDSS ( Payment Card Industry Data Security Standard) level 1 compliant, and as such all transactions pass through the system are automatically afforded thew highest level of security in online payments.

Also, it offers a proprietory fraud system to block/ban any of your customers which you have identified to be fraudulent or to had carried out processed fraudulent transaction either through card or IP addresses or both.

Rich Customer Data: Rave gives you Incredible insight into who your customers are so that you can understand who they are as well as their transaction habits when using your products

Seamless Transactions: Rave helps you create any type of payment flow from e-commerce to recurring billing on your website and apps across all devices.

Functionalities: Companies on rave allows a business owner with multiple products that receive payments online or multiple brands under a parent company to separate payments in a logical way while still maintaining the same profile.

Utility Bills: With GetBarter you don’t have to queue up to pay for subscriptions. From the comfort of your room, you can subscribe that go-tv, DSTV, data, airtime, in fact, you can reduce pressure on yourself by paying for your child school fees without going to the bank or the school, I won’t forget to mention that getBarter can be a lifesaver in medical emergencies bill payments.

Bonus Information:

Make money using rave:

Yes, you read it right! You can make money using rave’s subdomain. How this works is by offering rave as your service to customers. The interesting thing is the ability to increase fees on your own subdomains which your customers pay, you can as well add individual fees to each customer that signs up with you.

In conclusion, Flutterwave is a solution which is efficiently tackling the fragmented payments issues across Africa with her groundbreaking technologies. With time I hope it penetrates the rural areas starting from Nigeria to support that Fisherman returning from all-night fishing on Cameroun- Nigerian high seas, or that market woman that is not banked but used to tying money around her waist with wrapper as a safety measures and finally, provide Point Of Sales (POS) machines to support Small Scale and Medium Businesses.

2 notes

·

View notes

Text

Flutterwave. . . . The Solution to Reliable Payment

Have you ever imagined a future where there would be a safe, fast, easy, cheap, and reliable online payment platform? Cheer up, that future is here!

Flutterwave offers you that complete payment solution that you have so longed for, as it enables you to accept payments, make payouts and manage your business funds from one integrated platform that helps you connect globally.

In recent times, there have been growing concerns about the safety and reliability of online payment platforms as a result of the activities of fraudsters. Hence, the need for a trusted platform that has a wide range of services targeted at making life a whole lot easier for you when it comes to financial transactions.

Since its inception in 2016, Flutterwave has processed $2.5 billion in payments, 100 million transactions, and is partnered with 50 African banks with over 1200 developers that build on the platform. It has also been able to raise over $20 million in investments.

In 2017, its services were extended by introducing a payment product called Rave. This opens businesses to more opportunities by allowing them to accept a range of payment methods from customers around the world. It creates any type of payment flow, from e-commerce to recurring billing and everything in between. Some of the companies that use this product include Flywire, Arikair, Jumia, Uber, and Booking.com.

In 2019, Flutterwave partnered with Visa to launch a consumer payment product called Barter. The product is aimed at facilitating personal and small payments within countries and across African borders. The payment product also creates a platform for clients on multiple financial platforms, such as Kenyan mobile money service M-Pesa, to make transfers across payment products and national borders, as well as being able to shop online.

Flutterwave serves some of the popular payment service providers in Nigeria including Paystack, AmplifyPay, Paywithcapture, and many others. Some of the payment methods it supports include Visa, MasterCard, Verve, Android Pay and many more. By the end of 2018, Flutterwave had processed $2.6 billion in transaction value.

Are you a businessman, a professional, a student, or even a trader in the market, Flutterwave got you covered with products like Rave, Barter, and other services.

Rave is the easiest way to make and accept payments from anywhere in the world. With Rave, you are guaranteed to make either a simple payment, or payment to many people, with secure and reliable too as it boasts of zero failed transactions and a 24/7 customer service as you set up your business with speed, ease, and functionality, in order to provide your customers with the best possible checkout experience. Also, your business is opened to more opportunities because Rave lets you accept Card Payments(Visa, Mastercard, Verve, etc), Mobile Wallet Payments(M-Cash, M-Pesa, Tigo, etc), and Bank Account Payments for your customers in the US, South Africa, and Nigeria.

The GetBarter app helps you send and receive money as well as manage your finances. With it’s easy to use features, you are certain to have a great experience. With GetBarter, you can Pay your TV and utility Bills, Purchase airtime, and Subscribe for your internet. Also, the app features the latest mobile payment technology, which is the

Pay with QR. GetBarter features online card payment with it’s customized debit/credit card specified for each user. With this card, you can make purchases on Flutterwave supported merchant stores.

2 notes

·

View notes

Text

Flutterwave: The New Way to Pay

Are you in need of a global payment interface to drive a safe, secure and seamless payment integration? Look no more.

Flutterwave is here to ensure your business gets the secure, easy and efficient digital payment infrastructure it needs to compete in today's global market, with integration across virtually all platforms.

With a mission to drive a new wave of financial prosperity by building strong, secure and efficient financial infrastructures which over the years have changed the way business is conducted in Africa. But most interestingly linked Africa to the global economy with the launching rave and mybarter.

The financial technology company was founded in 2016 by Iyinoluw Aboyeji, Olugbenga Agboola as the co-founder and a team of finance experts from the banking industry and engineers from Paypal, google wallet and a host of others.

Since the inception of the company in 2016, it has processed over $ 2 billion worth of payment in over 100 million transactions. In partnership with 50 different banks and counting, flutterwave has about 1200 developers working on their different products and has raised over $ 20 million in funding.

Rave

Rave by flutterwave is designed to open arrays of opportunities for businesses, individuals and organizations to have a free flow of financial transactions through a secure payment integration that is optimized to service some of the most popular financial institutions. Rave enables a payment flow ranging from recurring billings, e-business integration and much more.

The benefits associated with the flutterwave payment infrastructure spans across all industries, lifestyle, and culture. For example, the flywire integrations were specifically designed to meet the needs of students and academic schooling in other parts of the world. The system guarantees swift payments of tuition in all currency from a singular interface, thereby reducing to the barest minimum the huge financial implication of currency conversion and payment delays.

Uber (The ride-hailing company) didn’t need a pitch to identify with the flexibility and scalability flutterwave infrastructures offer, the same can also be said about industry leaders like Arikair, accessbet, access bank, booking.com and a host of other businesses and organizations benefiting from the convenience of a hitch-free payment and collection infrastructure.

The more interesting gist is the flutterwave most recent partnership with the world's largest e-commerce company, alibaba through Alipay. The implication will be a seamless shopping experience from anywhere in Africa and across the world.

To start receiving payments on your e-commerce site, social networks, and other channels, simply login your flutterwave account or signup following these four simple steps and start receiving safe and secure payments in five minutes.

1. Start by clicking on the create account button on the flutterwave site. Then fill out the forms as directed with examples on the rave platform.

2. Choose from the account types, individual business or organization and click on continue.

3. Create your account following the examples on the creation box, be sure to fill out the form correctly.

4. You are all setup. Now start receiving payments.

It will interest you to know that the rave platform is designed to function across almost all payment cards, system and merchants with any currency of choice.

Barter

Designed to make life easier, fun and more enjoyable is the getbarter app that runs on Android, IOS and Windows platforms. Barter helps you organize your finances, send and receive money in all currencies and access loan facilities all from a singular platform. The loan facilities are short term and designed to help you grow your small business, fund that special event for a loved one or support daily family needs. It also affords users the luxury of a virtual card for safe, secure and flexible transactions.

All these can be achieved in two easy steps of account creation using your mobile number and email address.

With barter, one can easily track expenses, pay for utilities and other such services, book a flight, buy movie tickets, and conduct several other transactions in any currency across the world. With over 30,000 users and counting, barter really makes savings, planning and spending stress-free.

Now you tell me what you think about flutterwave and the milestone so far. Keep in mind the successful integration of Africa into a singular payment platform that has made it easy to transact across the continent. With the successful partnership with alipay, flutterwave customers do now have access to over 3 billion potential customers, that is a global reach on a scale!

You must be thinking what I am thinking, integrate your payment infrastructure today, start receiving and making payments and also position yourself for this new wave of prosperity. Signup at rave or take charge of your finances with barter.

Thank you for the time you have taken to read, please do share and follow across all channels.

Twitter:

Facebook

Regards,

VC Odii

2 notes

·

View notes

Text

Flutterwave: The Innovative Digital Payments Platform

The underdevelopment of the financial service industry in Africa posed a very tough, important and widespread problem of payments across the continent. After more than 50 years of banking on the continent, only roughly about 34 percent of adults in sub-Saharan Africa have bank accounts or access to formal financial services.

It is clear the traditional model of banking is too slow, inflexible and incapable of spreading financial access across the continent, and so making payments across globally is proves even more difficult

Fortunately, with the spread of mobile phones and the Internet across Africa, more people are exposed to the better option of digital financial services, both for individuals and businesses. This is a very beneficial advancement as every day more and more people leverage this technology to have access to various online digital platforms to make payments across the globe in ways traditional banking never did as online transactions happen quickly and with ease.

Regardless of the popularity of online digital payments, many businesses, and individuals in Africa still feel very Insecure and do not trust these digital financial service providers.

With so many concerns about making secure and reliable payments online, problems with making payments for products and services both across the continent and globally, the general fear of being a victim of “fraudsters”, consumers are looking for a product and service they can trust.

This is exactly what Flutterwave, a fintech startup from Nigeria hoped to achieve when they came into the scene in May 2016 and completely revolutionized the online digital payment platforms in Africa.

What is this Flutterwave you may ask?

Flutterwave

Flutterwave is an online digital payment platform that is set out to provide complete payment solutions to enable Africans to thrive in the global economy. The company started with a vision to first connect digital payments within Africa and then connecting Africa to the rest of the world. Flutterwave has been to able provide with its various products advance financial technologies and solutions for efficient, reliable and swift and payments across Africa and the globe.

Since they commenced business three years ago, Flutterwave has processed over $2.5 billion in payments, 100million transactions, and is partnered with over 50 African banks like Standard Bank, Ecobank, United Bank for Africa, Guaranty Trust Bank, Zenith Bank, First Bank, and Access Bank and many more to ensure that it provides top-notch service to the ever-growing African market.

Flutterwave raised one of the highest Series A round investments for an African startup and to date has raised over $20 million in investments from companies such as Mastercard, CRE Ventures Fintech Collective, 4DX Ventures, Raba Capital among others. Also as part of the deal, Green Visor Capital Chairman & General Partner and former CEO of Visa, Joseph Saunders, has joined the Flutterwave Board of Directors. Joe, an experienced Venture Capitalist and Chief Executive Officer of a multibillion-dollar financial Services Company added an important factor to the readiness of the company to effectively continue operations post-funding phase.

Flutterwave currently has over 1200 developers that build on its Developer’s playground with a focus on building technology that is not only flexible with awesome user experience but also provides a payment technology that is reliable and secure thereby easing the fears of the average user.

Flutterwave is building digital payments infrastructure accessible via APIs that enable all available payment options across different African countries. This API allows businesses to carry out transactions from MasterCard, Visa, Verve, Mobile Money, ACH — and even cash tokens and e-wallets in different African countries by integrating one API. This is very important because it incorporates the already existing and preferred means of payment by its consumers into its platform. So in plain words, you make and accept payments with methods you are already familiar with and comfortable with. The company currently has its headquarters at San Francisco and also operates out of offices in Lagos, Nairobi, Accra, and Johannesburg.

Flutterwave has built an innovative technology that has been able to connect Africans and African businesses with the global economy in ways never before attained.

Flutterwave products

Flutterwave has been able to open up, and disrupt the traditional financial services in African and improve trust between African businesses and its global consumers with its innovative products, some of which are Rave and Barter

Rave

Rave by Flutterwave

Rave is a payment solution offered by Flutterwave which enables merchants to accept global payments from cards, mobile wallet payments, and Unstructured Supplementary Service Data(USSD) code. It is one of the easiest ways for businesses to accept a range of payment methods from customers around the globe

Rave by Flutterwave is a product that can be integrated into various online websites for a better payment experience. One of such websites to incorporate this product is Megabet. It creates any type of payment flow, from e-commerce to recurring billing and everything in between. Using Rave you can set up an e-commerce store with Shopify in just minutes and begin to receive payments from customers. With a simple sign up on Rave, you have unlimited access to all its features.

Currently, Rave supports over 150+ currencies and its flexibility allow it to display prices and accept payments in its users’ preferred currency, improving their overall experience. With Rave, you avoid high conversion fees and can receive funds in your local currency. Rave payment gateway support payment in Naira, US Dollar, Euro, British Pound and many more.

Flutterwave Rave has various user-friendly features making users enjoy the experience of using the products it meets their specific needs and the ease of use is an added advantage.

Rave provides a payment gateway that is better than others in numerous ways. A payment gateway is a service that securely authorizes a customer’s payment on a website. It is used to accept payments on a website, app or even social media. Rave employs a slew of tools geared at protecting merchants from fraud to make transactions secure and reliable. The instant settlement also assures no delay in money availability once customer made payment

Flutterwave is also PCI DSS Level 1 certified which is the highest level of security and ensures that its user’s information is kept safe and private.

Secure payments in Flutterwave

The Pricing For Rave is listed Below:

Local Payments:

Payment method: MasterCard, Visa, Bank Account, USSD- 1.4%Processing fee

International Payments:

MasterCard, Visa, American Express-3.5% Processing fee

Some of the companies that use this products include Flywire, Arikair, Jumia, Uber, and Booking.com.

To get started on Flutterwave Rave, click here.

Barter

Barter by Flutterwave

Flutterwave partnered with Visa to launch a consumer payment product called Barter. The product facilitates personal and small payments. Barter is a financial app not unlike your typical bank app, but it also gives users more options to manage their finances, make bill payments, pay for various subscriptions and generally just make everyday transactions as seamless and easy as can be. On their official website, the product is described as being designed to help you focus more on enjoying life and less on how to spend, spend and borrow money.

Barter lets the user know how he spends his money and also provides detailed reports that show their spending patterns and insights. This product also allows the user to add their bank account to their app dashboard and manage funds in their local currency. Users can also request for short-term loans on the app with ease. Funds can be added to your barter account from your local bank accounts or cards. With the GetBarter App, you can make and accept payments with just the touch of a few buttons across the continent.

Users who already own Visa cards can also send and receive money at both locally and internationally on the GetBarter App while non-card holders (people with accounts or mobile wallets on other platforms) can create a virtual card to link to the app.

.

Barter Classic plan

Barter classic is the regular Barter plan. Users on the Barter Classic plan can create a maximum of two Dollar cards and there is a ₦50,000 limit on daily bank transfers. Users do not get also cashback on airtime purchases, unlike the premium users. All other features like bank transfers, sending and receiving money, bill payments, all work effectively with very low transaction costs.

One amazing feature about this product is that when you add your Barter card to your Uber app (Naira or dollar), you get 0.5% cash-back after every ride, talk of rewarding your users.

GetBarter also lets you request and send money to any number saved on your phone. You can request as low as N50 or as high as N500,000. Whatever amount you are sent goes right into your Barter Balance.

The Pay with QR feature, which is powered by VISA, allows the user to scan a QR code to make payments with Barter. You can either scan the QR code with your camera directly or upload one from your photos. This feature has been publicly applauded globally.

The GetBarter App is available on Android and IOS

FLUTTERWAVE over time has made major strides in the financial technology space in Africa that has impacted thousands of businesses both in Africa and the global economy.

The recent Partnership of Flutterwave with Alipay has created access for Flutterwave merchants to over 1 billion potential customers in China and across the world. They had previously partnered with PayAttitude to enabled payments to be made using only your phone number. A very convenient method of payment for those without bank accounts.

As with all tech-driven solution providers in the continent, Flutterwave has had its share of difficulties but through it all, they have shown a commitment for excellence and a desire to give its consumers the best experience.

Flutterwave has gotten well deserved global recognition for its contribution to the financial technology industry. Flutterwave won the West Africa Mobile Awards in 2017 for the best commerce and retail service.

Flutterwave’s API is used by many of the payment service providers in Nigeria including Paystack, AmplifyPay, Paywithcapture, and others. With its easy to use and Flexible API that is able to conveniently process millions of transactions both locally and internationally, and with the dedication that the Flutterwave team has shown in just three years in the financial technology space, it is very obvious that this is a company set on changing the world and helping businesses in Africa progressively scale up and be a competition in the growing global economy

1 note

·

View note

Text

The Payment Processing Company Connecting Africa To The World

Every business operating in the 21st century appreciates the importance of having an online presence. Not only does it ensure that you have a platform to directly engage with customers, it also presents the unique opportunity of increased sales as well as the prospect of breaking geographical barriers to deliver products and services to customers who are not in the immediate locality of your business. The prospects are limitless and could see a business that operates in, say Lagos Nigeria, having its customer base stretching as far as Boston Massachusetts in the United States or Hong-Kong in China.

There has however been a problem which has hindered many African Businesses, especially small scale enterprises, over the years from leveraging upon the exposure provided by the internet to grow their businesses, namely payment processing. Carrying out international transactions to Africa have often proven to be a hassle for consumers, with problems spanning from delayed payments, declined transactions, unavailability of payment platforms and a host of others. In the light of the fact that no matter how wonderful a product may be and how much interest it may have generated from consumers, it all comes to nought if people are not able to purchase them, we can see how this problem has been one that had threatened the growth of African businesses over the years.

This was the exact problem Flutterwave set out to tackle back in 2016 when it was founded by the duo of Iyin Aboyeji and Olugbenga Agboola with the vision of 'opening up the global market to Africans and empowering more Africans than ever before to participate in the global economy.'In a market where many popular web services like Stripe, Paypal, and Airbnb had excluded many African countries in their international launches due to the difficulty in processing payments there, Flutterwave has thrived and become the payment platform of choice making it easier to do business across the continent by allowing users to make international payments in their own currencies.

Flutterwave launched it signature product 'Rave' which is targeted at helping businesses and banks build secure and seamless payments solutions for their customers. With Rave, sellers are able to integrate payment gateways into their websites at no upfront cost, making them able to directly trade with customers at home and abroad. One of the unique advantage of Rave is the fact that users get to pay in their local currency, either from their cards, bank accounts or mobile wallets and the sellers get settled instantly. This remarkably improves customer experience, saving them the stress of conversion between amounts and even helps them avoid high conversion fees. Also, Businesses are able to have an up-to-date and detailed account of all transactions from all sources in one place. Flutterwave has also been able to expand its reach to allow international school feed payment and have allowed parents with children schooling abroad make payments with incredible ease as well as settle medical bills abroad, both of which are multi-million dollar industries enjoying patronage of many Africans.

Another financial product which Flutterwave offers is Barter. Officially known as GetBarter, it allows an individuals operate a personal online wallet from which they can make and receive payments, access loans and even manage their personal finances. With Barter, customers can add their existing bank accounts to their app dashboards and manage funds in their local currencies with insights and statistics on their spending patterns.

Flutterwave stays in business by charging a small commission on each transaction processed through its platforms, and this commission is shared with banks and other financial institutions that help keep their API working.

After graduating from reputed Silicon Valley startup accelerator, Y-Combinator and has had two series of funding exceeding $20 million. It has it's head office situated in San-Francisco USA. For a payments company seeking to create payment solutions for the African continent, this may seem like an odd choice, however, co-founder and former CEO , Iyin Aboyeji attributed the reason for this decision to the need to stay within a globally recognised hub for financial technology as well as the need to build trust with investors (and this may point to the unfortunate reputation that some African Nations have as a haven for fraudulent activities).

Flutterwave however also maintains offices in various African Cities including; Lagos Nigeria, Nairobi Kenya, and has plans to expand to over 5 more African countries within the next 2 years.

Flutterwave is passionate about its technology roots and continues to maintain close ties with the developer community. It is known to have recently sponsored programs like the HNG Internship (a virtual internship program organised by hotels.ng) and put together Developer Recruitment events. It of course has a lot at stake in ensuring that as many developers as possible are knowledgeable about integrating it's payment gateways in their websites and choose flutterwave ahead of those of other competitors.

Since it's inception in 2016, Flutterwave has processed over 2.6 Billion Dollars in transaction value via it's platforms, and this number continues to grow as it wins the hearts and patronage of many small businesses around Africa. Flutterwave's recent partnership with Chinese e-commerce giant, Alibaba's payment platform (AliPay) could mean that Flutterwave is at a new frontier and gearing up to unleash, a new spurt of growth in China-Africa trade, a market which is already estimated to be worth over $200 billion.

The payments space in Africa is expected to become even more competitive in years to come especially with the entry of new players O-pay and continuous presence of longtime players Inter-switch and many others, however Flutterwave is definitely blazing the path with it's innovative products and payment technology.

The future is indeed exciting for African Businesses and Africans as they look to take their place in the global economy, unleashing prosperity on the continent like never before.

You can find out more about Flutterwave here: https://www.flutterwave.com/

1 note

·

View note

Text

Finesse, Tact, Growth - Flutterwave Rave and Barter

It takes foresight and tact to pull a unique and beneficial success up within an industry that a lot of people consider as saturated. Flutterwave within a few years has smoothened out the payment, e-wallet, and funds receiving services in Nigeria; and has made a formidable in-road to other countries in and beyond Africa. This has established reliable means of making and receiving payments for goods and services across the African market. Remember the African Continental Free Trade Agreement is now signed by at least 27 African countries. The good news is – Flutterwave has fully latched on to that.

Flutterwave stands comfortably on two major legs - Rave and Barter. These apps are making waves both at home and internationally. As at this day (26th Sept, 2019) Flutterwave is fully operational in Uganda, Kenya, Tanzania, Nigeria, Zambia and United Kingdom. These milestones have effectively positioned Flutterwave at the heart of payments globally. Did I mention that with Rave, you avoid high conversion fees and can receive funds in your local currency? Oh! Yes, you can. And that’s what’s up.

Ever since PayPal stopped Nigerians from receiving money via their app, it’s been really difficult for Nigerians to receive payment from clients outside the shores of Nigeria. Now though, with Flutterwave you are far better. Receive your money easy!

In addition to all these, Flutterwave merchants in Nigeria can now receive instant settlements into their bank accounts. Funds received via Rave can now hit the merchant’s bank accounts immediately. Amazing.

At the heart of this paradigm shift are two key actors – Rave and Barter (GetBarter on Google Play).

Rave

Rave is also known as Flutterwave for Business. It is the app for businesses and merchants to handle their finances with more control and accuracy. Of course, far more sophisticated than most finance apps apps you've known or used. The user signs up on Rave as a business or individual or NGO, connects it to his/her bank account and voila! To add more liberty to the app, the user can add BVN details, thereby taking the limits beyond the sky.

Your customers in the US, South Africa, and Nigeria can pay you safely directly from their bank accounts or mobile wallet. Customers using M-Cash, M-Pesa, TIGO, MTN, and VODAFONE can all pay you directly from their mobile wallets. You can also Accept debit/credit payments from customers in 154+ countries. Visa, Mastercard, Verve and more are all supported.

Barter

Imagine having to send some money to a sibling, friend or spouse; with Barter, it is a breeze. While you are yet blinking, the payment has been sent and received. This is true. Barter is equipped with high level authentication that can detect if you are in close proximity with another user who could be the recepient. So, with just a tap or a click, Joe can receive payment from James without having to ask for Joe’s account details.

What’s sweeter than Naija Jollof?

Nothing… except of course Flutterwave partnership with VISA, Alipay and PayAttitude (Jollof with 'many lives').

Now, from your phone, you can have a dollar card created in an instance. This card(s) can be used on all Flutterwave partner platforms all over the world. You can bet that they are far more than you know and continually increasing. Alipay too? Heck yeah! Order all you want from Aliexpress and Alibaba, checkout with Flutterwave Dollar card. Whoop whoop!

Excited? Click here to sign up on Rave and enjoy huge benefits. Download GetBarter from Google play or Apple store.

Lest I forget, you can request ‘uncle Joe’ to send you some money for the road too. And if uncle Joe is too distracted and has forgotten, you can send a reminder. Awesome.

(Joe and James are hypothetical names)

Written by: Oshabby

1 note

·

View note

Text

Flutterwave: Easiest way to make and receive payment in Africa while powering ecosystem growth.

In 2014 three friends in university co-founded an eCommerce startup but their biggest barrier to entry was a payment aggregator but today Aisha an Instagram merchant, Obi an electronics seller in Alaba Market or Alhaja Toyin fabrics seller at Oshodi Market can receive payment from any part of the world and have it in their accounts immediately because of the amazing work of Flutterwave to democratize payment in Africa. Before the advent of players like Flutterwave into the ecosystem, this was one herculean task with even the available option costing over $500 with a card payment failure rate of over 60%.

Receiving payments is at the core of commerce. For many years African merchants were disconnected from the global economy because of their inability to easily receive payment from different parts of the world but today with the advent of Flutterwave this has become a thing of the past. Flutterwave is driving a new era of commerce by enabling African merchants everywhere from market places to social media to big corporations to receive payments easily.

Looking at the payments system of Africa today one might not be able to see the impact a company like Flutterwave has had in helping to democratize payments and give small and medium enterprises the ability to receive payment. Payment processing in Africa is very different from the United States or other developed countries. If you go to any store in the U.S., they take debit cards, credit cards, and even mobile payments. This is not the case in Africa. To provide that same full-service payment option, merchants and payment service providers have to integrate with each form of payment individually. That means you have a POS that accepts Visa and not Mastercard. Failed transactions are so common that many store owners don’t bother with the POS anymore. The banks didn’t have seamless payment technology that could bring all these solutions to their merchants. Because of this, Africa simply defaulted to cash and then alternative payments like bank accounts or mobile money. Flutterwave’s technology accepts traditional card-based payment processing but also caters to more popular payment processing methods like ACH and mobile money payments.

Rave

Rave by flutterwave, the easier way to make and accept payments from customers anywhere in the world, is a service that enables merchants to accept global payment from a card, bank accounts, and USSD. Rave currently accepts debit/credit card payments from customers in 154+ countries. Visa, Mastercard, Verve are all accepted. Merchants with customers in the US, South Africa, and Nigeria can pay directly from their bank accounts or mobile wallets (M-Cash, M-Pesa, TIGO, etc.)

Today you can easily integrate Flutterwave rave to platforms like Shopify, Quickbooks, Xero, Squarespace, Sage, Zoho, and many others, helping to power new frontiers and enable payment.

Barter

GetBarter app is a lifestyle payment solution that operates globally with an initial user base in Nigeria, Kenya, Ghana, and South Africa. Users can initiate payments within the app and make online and mobile payments with their virtual visa card to Flutterwave merchants. Additionally, GetBarter users can carry out business transactions, pay bills and initiate payments to thousands of merchants anywhere Visa is accepted globally. Barter today has over 30,000 customers.

Recent Development

Flutterwave is now integrated with Alipay so this gives all Flutterwave merchants access to over 1 billion Alipay users. Alipay is available in addition to the card, Barter, Mobile Money and other payment channels on the Rave checkout modal.

Beyond delivering a groundbreaking payment system, Flutterwave is also at the forefront driving the Nigerian tech ecosystem as recently seen in her new drive in organizing a job fair for the recently dropped Andela junior developers, the sponsorship of the HNG6 internship helping to groom the next generation of Nigeria tech talent.

Startups like Flutterwave gives an air of hope that Africa is truly rising and on the right part. We must continue to support innovations that help to make life easier for other Africans.

I will end this article by quoting Fred Swaniker’s Time 100 award speech “All of us who are privileged enough to be healthy, to be alive, to have education and to have influence, our role is not to do small things and to solve small problems,” Swaniker said. “The only way that we can justify privilege is by solving the world’s biggest problems, and by doing hard things.”

1 note

·

View note

Text

Flutterwave: The African Payments Technology Giant

Flutterwave is an African payment technology company founded in 2016 by ex- Andela co-founder Iyin Aboyeji and a team of ex-bankers, entrepreneurs and engineers.

The payments solution company provides uninterrupted and secure payment experiences to banks, businesses and their customers. A merchant can accept local and international payments with their services. Their online payments platform also enables customers to pay for things in their local currency while Flutterwave https//www.flutterwave.com/ takes care of integrating banks payment service providers into its platform so businesses don’t have to take on the expenses and burden.

Businesses that are using flutterwave are Uber, Oja Express, Booking.com, Transferwise, Flywire, etc.

Flutterwave currently has more than 50 bank partners, with over $2.6 billion payments processed in more than 100 million transactions. The company also has more than 60,000 merchants on its platform. The company has more than 1200 developers building for them.

Flutterwave Products

RAVE https://www.ravepay.co/

This is a flutterwave for business product that allows businesses to make and accept payments from customers anywhere in the world. It is a service that enables merchants accept global payments from card, bank accounts and USSD.

BARTER

https://flutterwave.com/online-payments-products/barter/

This is a flutterwave for consumers' product. It’s an app that helps individuals and Small and Medium Enterprises(SMEs) make and receive money from across Africa. The Barter app can also be used for paying TV bills, buying airtime, paying Internet subscription, paying utility bills, buying mobile data subscriptions.

ACHIEVEMENTS

In July 2019, Africa’s integrated payments platform, Flutterwave announced its partnership with Chinese e-commerce company Alipay to offer digital payments between Africa and China in order to boost the Africa-China trade.

Earlier this year, Flutterwave in conjunction with Visa also launched a product for Africa called GetBarter. This is aimed at facilitating personal and small merchant payments within and across Africa’s national borders.

The company in October 2018 completed the Series A extension round of financing with investments from notably Mastercard. This took the total funding the company raised above the $20 million mark.

The company also received the former chairman and CEO of Visa, Joe Saunders to its board of directors despite the setback of its co-founder, Iyin Aboyeji leaving in October 2018.

Flutterwave is now also licensed in the United Kingdom and Zambia for payment processing and electronic remittances.

Advantages of Using Flutterwave

1. Flutterwave is ISO 27001 certified meaning the company has internationally acceptable business practices and processes.

2. The company is diving into the global market with partnership with US and Chinese companies.

3. Rave by flutterwave support payment in US dollar, Euro, British pound and many other currencies.

4. Zero set-up fees for integration by businesses.

5. Has partnership with companies like Mastercard, Visa, Uber, Booking.com, hence very reliable.

6. Rave is a Secure and efficient payment platform by being PADSS certified.

Disadvantages of Flutterwave

1. Poor customer care service.

2. No POS machines for offline transactions for Small and Medium Scale Enterprises (SMEs).

Impact of Financial Technology in driving economic growth in Africa

There is no universal payment method in Africa and only 3% of African’s reportedly own a credit card. This means that African businesses have a hard time accepting payments from Africa.

According to former Flutterwave CEO, Iyin Aboyeji, “Fintech is a fundamental piece to driving the real value of digital economy and the payments solution giant, flutterwave is trying to connect Africa to the digital economy”. Therefore, the importance of financial inclusion cannot be overemphasized. The increased access to financial services has opened new doors to individuals and families, allowing them to smooth out consumption and invest in their futures.

No tech sector has the potential to impact Africans at the bottom of the pyramid as fintech does. By addressing the issues of financial exclusion, fintech companies can equip more people to become financially savvy. It is, therefore, no surprise that fin-tech companies attracted the lion’s share of tech investment on the continent with 50% of total funding in 2018. Fintech has the potential to increase economic growth in Africa by improving capital allocation and increasing efficiency.

Flutterwave, the leading Payments platform in Africa, through the products they provide is championing the cause of leading Africa into the digital economy by providing opportunities for businesses to expand their client base while also gaining access to data that can be used to predict consumer behaviours, spending patterns and emerging trends in financial technology.

1 note

·

View note

Text

This article is tailor to the overview of flutterwave products, her achievement over the years since its existence.

Flutterwave is a payment technology company that focused on helping banks and businesses to provide seamless and secure payment experiences for their customers.

Over the years, there has been an issue with the payment system in Africa and beyond and this payment issue has affected a lot of big and small businesses, loss of confidence and failure to involve in a long and short distance transaction.

Presently the world is now a digital village and the digital economy is the new global economy. Yet despite its incredible promise, some parts of the globe are facing several challenges with it's because of their outdated and fragmented payment system.

Flutterwave is a technology which uses digital payments infrastructure that assists banks and business to build seamless and secure payments for their customers.

Flutterwave was founded in 2016 by Iyinoluma Aboyeyi, co-founder Olugbenga Ajboola, and a team of African payments, technology and banking veterans from the standard bank, Google wallet, Andela and Paypal, amongst others. With a mission to inspire a new wave of prosperity across Africa by building payment infrastructure that will connect Africa to the global economy.

FLUTTERWAVE PRODUCTS

Between the year 2017 and 2019 Flutterwave created a product which is Payment Product called Rave and consumer payment product called Getbarter. I will be looking at just these two flutterwave products.

RAVE

Rave opens businesses to more opportunities by allowing them to accept a range of payment methods from customers around the world. This product creates any type of payment flow, from e-commerce to recurring billing and everything in between. With Rave, you can receive payments locally and globally directly from a bank account, cards, and mobile money wallets with no hassles and zero sets up fees and rave also support cross-currency conversions, click here to sign up to rave . Some of the companies that use Rave include Jumia, marketHub, Booking.com, Uber, flywive, and Arikair.com.

GETBARTET

This product is aimed at facilitating personal and small payments within countries and across African borders. Getbarter which has scaled as a payment option for big companies through its rave product, to pivot to African consumers and traders. The payment product also creates a platform for clients on multiple financial platforms; 'Get barter account'.

One of the most interesting things about this product is that there is an app design where you can make all the transactions. The Getbarter App is a lifestyle payment solution that operates globally with an initial user base in Nigeria, Kenya, Ghana, and South Africa. The app allowed users to receive money from family and friends to their Getbarter app wallet and also carry out a business transaction, pay bills and initial payments to thousands of merchants anywhere, Download app here.

FLUTTERWAVE ACHIEVEMENT

Flutterwave has achieved a lot since her creation. Flutterwave has expanded its license and certifications in counties where they operate which enable them to provide services with the highest level of security and regulatory oversight, They grow by 55% in the customer base of flutterwave for business (Rave) made by a partnership with existing customers, They retained their key partners within the financial industry, Enterprise customers like Uber, Flywine, Booking.com. and above all, they received the best payment company award at the Ghana e-commerce award ceremony.

1 note

·

View note

Text

FLUTTERWAVE

Flutterwave is a technologically driven finance company established in 2016 by Iyinoluwa Aboyeji and co-founded by Olugbenga Agboola. They built a payment platform to help connect Africa with the global community. The need for the company was borne out of payment challenges in Africa, especially as it affects the e-commence milieu. It is currently active in over 30 African countries.

Since inception, flutterwave has processed billions of dollars in payment with over 100million transactions. The company has partnered with over 50 banks, 1200 developers and has raised over $20 million in investment.

Currently, Olugbenga Agboola is the C.E.O., taking over from Aboyeji who resigned in 2018.

PRODUCTS

Some of the products offered by Flutterwave include Rave, Getbarter, Moneywave.

MONEYWAVE: This allows users to send and receive payment in local currencies from around the world. If payment is made in Naira into a Ghanaian’s account using Moneywave, the recipient receives in Ghanian cedis. It can be integrated into business platforms allowing transactions for a fee - of course!

GetBarter: This is an application by Flutterwave. Initially, it was deployed in South-Africa, Nigeria, Kenya, and Ghana. When installed, money can be received from any visa card account (domestic and international) directly into the app wallet. The application comes complete with a GetBarter visa card.

Rave: A product that helps businesses accept global payment. Be it from cards, USSD, or bank accounts, Rave has your back. It can be integrated into websites and online platforms.

WHY USE FLUTTER?

Uber and Shopify have the flutter API integrated into their sites to facilitate their payment processes. Additionally, TV bills (DSTV, GOtv, StarTimes) utility bills (Ikeja Electricity, Eko Electricity), internet subscription (spectranet,swift, smile, and ipNX), and mobile data subscriptions can all be paid using the GetBarter app.

Paying from Nigeria with the Naira to another country? Moneywave has got you covered.

SECURITY CONCERNS?

With Military Grade-Data Encryption, Two-Factor Authentication, being PCI DSS compliant, and Digital Audit Trail,They’ve got you covered.

All round, flutter is solving money problems and making life a little easier for both businesses and everyday life.

1 note

·

View note

Text

FLUTTERWAVE A REVOLUTIONIZED PAYMENT SOLUTION FOR MODERN PAYMENT IN AFRICA

Flutterwave is a modern payment technology company that helps banks and businesses make and accept payment seamlessly from anywhere in Africa on a single platform connecting both people and businesses with the global economy, Flutterwave enables a merchant to replace their multiple payment integrations with one API which enables payment processing in any form in Africa.

Flutterwave was established to solve the payment challenges in Africa where merchants had difficulties processing financial transactions globally, experiencing delays in processing transactions and huge bank charges. Flutterwave founders conceptualised a solution which was to make payment seamless irrespective of the currency across Africa hence their vision to make global payment solution easier to participate in the digital economy so customers can make and accept payment for whatever they want, in whatever currency or payment method they choose across the globe.

Flutterwave has two products currently namely:

Rave is a mobile payment that enables African businesses to accept any type of payments, anywhere across Africa and around the world. Rave is highly recommended to e-business owners that want to integrate an online payment into their business in order to accept payments in any currency seamlessly without thinking of currency conversions.

Barter is a consumer payment gateway that is used for facilitating personal and small merchants payments within African countries and globally. No bank account number is needed for transactions on the GetBarter app provided the person has a valid phone number, a virtual card that can be used to complete online transactions is issued to the customer to make transactions online and subscriptions on merchant sites.

Flutterwave has partnered with various prestigious organisations globally like MasterCard, Paypal, Visa, Verve and just recently Alipay which is to establish digital payment between Africa and China to create the ultimate positive user experience to its clients. Flutterwave has processed transactions for clients such as Uber, Booking.com and Flyme e.t.c.

SECURITY

Security is of utmost importance at Flutterwave, safety guidelines have been put in place by Flutterwave in partnership with Trustwave the global leader in information security to create a program that will make it easier for businesses to be PCIDSS ( Payment Card Industry Data Security Standard) compliant. BVN verification is needed for a customer to get verified and a notification is sent to a client when an irregularity is noticed while making transactions.

However, Flutterwave should look at the blindspot surrounding its process of conflict resolution which takes up to 60 days to resolve, conflicts should be resolved in a quick and timely manner to avoid customer dissatisfaction.

1 note

·

View note

Text

Flutterwave: The Fintech Building Seamless And Secure Payments Solution In Africa

With the quest to fix the fragmented state of online payments in Africa, Flutterwave, a Fintech company, has built one of Africa’s biggest payments technology companies.

Flutterwave provides a technology which leverages on digital payment architecture to assist Africans and African businesses to connect to the global economy.

Flutterwave was founded in 2016 by Iyinoluwa Aboyeji and Olugbenga Agboola with the aim of ‘‘solving the payment challenges for merchant partners across the continent that could unlock billions of dollars”.

Description: Olugbenga Agboola and Iyinoluwa Aboyeji

How Flutterwave connects African businesses to the global economy

Since Flutterwave’s mission is ‘‘to inspire a new wave of prosperity across Africa by building payments infrastructure that will connect Africa to the global market”, a valid question to ask is “how does this Fintech company want to achieve its mission?”.

A payment product called Rave was introduced by Flutterwave a year after the start of the company. With Rave, businesses across the continent now have more possibilities of accepting payments via a wide range of payment methods (Mobile Money, ACH, USSD, Cash tokens) from customers across the globe.

Description: Payment methods

Some of the companies that use Rave include Uber, Flywire, Jumia, and Booking.com.

With the aim of facilitating personal and small payments within countries in Africa and beyond, Flutterwave partnered with Visa card, a renowned name in providing the best in world-class payment gateway services for millions of people around the globe, to introduce a consumer payment product called GetBarter.

Description: The GetBarter app

While through the Rave product, Flutterwave has expanded as a payment choice for big businesses, the GetBarter app caters to African consumers and traders. This payment product has made it easier for clients to make transfers across different payment products (bank, card, mobile wallet payments) and also have the ability to shop online.

Difficulties and Achievements

As innovative as the products of this company are, there are a few lapses that can be improved on. These include, not getting an alert when receiving money via GetBarter. Also, funding your account through bank payment is possible when you use one of only two banks that exists on the app. Some users have also complained that by default, the GetBarter app currency was set to USD and there was no option to change to another currency.

Despite the lapses, Flutterwave has recorded many milestones from being the ‘‘Best Payments Company’ at the Ghana eCommerce Awards ceremony to the successful scaling of the business model to four African countries ( Nigeria, Kenya, South Africa, Rwanda) as well as raising over 20 million USD in investment funding.

There is no doubt that innovative products, like those of Flutterwave, are indeed needed in a continent where the rate of internet penetration is steadily increasing and many people are making payments online.

1 note

·

View note

Text

African fintech firm Flutterwave launches SME e-commerce portal

San Francisco and Lagos-based fintech startup Flutterwave has launched Flutterwave Store, a portal for African merchants to create digital shops to sell online.

The product is less Amazon and more eBay — with no inventory or warehouse requirements. Flutterwave insists the move doesn’t represent any shift away from its core payments business.

The company accelerated the development of Flutterwave Store in response to COVID-19, which has brought restrictive measures to SMEs and traders operating in Africa’s largest economies.

After creating a profile, users can showcase inventory and link up to a payment option. For pickup and delivery, Flutterwave Store operates through existing third party logistics providers, such as Sendy in Kenya and Sendbox in Nigeria.

The service will start in 15 African countries and the only fees Flutterwave will charge (for now) are on payments. Otherwise, it’s free for SMEs to create an online storefront and for buyers and sellers to transact goods.

While the initiative is born out of the spread of coronavirus cases in Africa, it will continue beyond the pandemic. And Flutterwave’s CEO Olugbenga Agboola — aka GB — is adamant Flutterwave Store is not a pivot for the fintech company, which is an alum of Silicon Valley accelerator Y-Combinator.

“It’s not a direction change. We’re still a B2B payment infrastructure company. We are not moving into becoming an online retailer, and no we’re not looking to become Jumia,” GB told TechCrunch on a call.

Image Credits: Flutterwave

He was referring to Africa’s largest e-commerce company, which operates in 11 countries and listed in an NYSE IPO last year.

Flutterwave has a very different business than the continent’s big e-commerce players and plans to stick with it, according to GB.

When it comes to reach, VC and partnerships, the startup is one of the more connected and visible operating in Africa’s tech ecosystem. The Nigerian-founded venture’s main business is providing B2B payments services for companies operating in Africa to pay other companies on the continent and abroad.

Launched in 2016, Flutterwave allows clients to tap its APIs and work with Flutterwave developers to customize payments applications. Existing customers include Uber and Booking.com.

In 2019, Flutterwave processed 107 million transactions worth $5.4 billion, according to company data. Over the last 12 months the startup has been on a tear of investment, product and partnership activity.

In July 2019, Flutterwave joined forces with Chinese e-commerce company Alibaba’s Alipay to offer digital payments between Africa and China.

The Alipay collaboration followed one between Flutterwave and Visa to launch a consumer payment product for Africa, called GetBarter.

Then in January of this year, the startup raised a $35 million Series B round and announced a partnership with Worldpay FIS for payments in Africa.

African fintech firm Flutterwave raises $35M, partners with Worldpay

On the potential for Flutterwave Store, there’s certainly a large pool of traders and small businesses across Africa that could appreciate the opportunity to take their businesses online. The IFC has estimated that SMEs make up 90% of Sub-Saharan Africa’s business serving the region’s one-billion people.

Flutterwave confirmed Flutterwave Store’s initial 15 countries will include Africa’s top economies and population countries of Nigeria, Ghana, Kenya and South Africa.

Those markets already have a number of players driving digital commerce, including options for small businesses to post their wares online. Jumia’s Jumia Marketplace allows vendors register on its platform and use the company’s resources to do online retail.

Facebook has made a push into Africa that includes its overall push to get more users to sell on Facebook Marketplace. The social media giant now offers the service in Nigeria — with 200 million people and the continent’s largest economy.

Flutterwave CEO GB, Image Credits: TechCrunch

eBay has not yet gone live in Africa with its business to consumer website, that allows any cottage industry to create a storefront. The American company does have an arrangement with e-commerce startup MallforAfrica.com for limited sales of African goods on eBay’s U.S. shopping site.

On where Flutterwave’s new product fits into Africa’s online sales space, CEO GB says Flutterwave Store will maintain a niche focus on mom and pop type businesses.

“The goal is not be become like eBay, that’s advocating for everybody. We’re just giving small merchants the infrastructure to create an online store at zero cost right from scratch,” he said.

That’s something Flutterwave expects to be useful to Africa’s SMEs through the COVID-19 crisis and beyond.

0 notes