#goldtrader

Explore tagged Tumblr posts

Text

Gold Copy Trading: Real Trades, Real Gains (May 9~20)

🌟 6 Trades 📉 1 Loss (-4,646 USD) 📈 5 Wins = +17,847.05 USD 📅 From 2025.05.09 to 2025.05.20 💹 Strategy: Buy XAUUSD on rebounds and take quick profits

“Followed the strategy, minimized risks, and the profits came through. Let the results speak.”

#copytrading#goldtrading#forexjournal#xauusd#realresults#forexstrategy#dailytrades#profitproof#tumblrtraders#smartmoney#investmentsuccess

3 notes

·

View notes

Text

GOLD & GBPJPY

#gbpjpy#goldtrading#gold analysis#goldprice#gold#xauusdsignals#xauusd#forextrader#forex#elliottwave#bitcoin#investing#priceaction#forextraining#marketing#eurusd#forexprofit

7 notes

·

View notes

Text

Discover the Most Profitable Gold Signals with TP and SL for Over 5% Daily Returns

Subscribe For more

Join me on MQL5 for top-notch trading insights and strategies:

تابعنا على mql5

Are you looking to excel in stock trading, forex, currency exchange, commodity trading, technical analysis, fundamental analysis, trading strategies, capital management, daily trading, or global economics? Look no further!

We provide expert guidance on all these topics and more. Our comprehensive approach to online trading ensures that you stay ahead of the game and make informed decisions.

Investing in gold has never been easier! Our gold trading signals offer exceptional opportunities to maximize your profits. With our proven TP (Take Profit) and SL (Stop Loss) strategies, you can confidently navigate the gold market and achieve consistent returns.

Join our community of savvy traders and gain access to exclusive insights, market analysis, and trading tips. Our MQL5 platform is a hub of knowledge and expertise, designed to help traders of all levels succeed.

Don't miss out on the chance to take your trading skills to the next level. Follow the link above to join our MQL5 community and start making the most of your gold investments today.

تداولالأسهم, #فوركس, #تداولالعملات, #تداولالسلع, #تحليلفني, #تحليلأساسي, #استراتيجياتالتداول, #إدارةرأسالمال, #تجارةيومية, #تعلمالتداول, #اقتصادياتعالمية, #تداولعبر_الإنترنت.

GoldTrading #PreciousMetals #InvestInGold #Bullion #GoldPrice #GoldMarket #GoldInvestment #Commodities #TradingStrategy #GoldAnalysis #GoldBullion #BullionTrading #GoldCoins #GoldCharts #GoldFutures #GoldSpot #GoldStocks #GoldNews #GoldInvestor

MetalTrading

#GoldTrading#forex live#live forex signals#live forex trading#forex signals live#xauusd#live signals forex#live forex trading session#xauusd analysis today#gold forecast#gold price#اقوى استراتيجية تداول#تداول#الذهب اليوم#اقوى استراتيجية فوركس لهذا العام#تحليل الذهب#استراتيجية تداول ناجحة#الذهب#اقوى استراتيجية فوركس#استراتيجية لتداول الفوركس#افضل استراتيجية تداول للمبتدئين#توصيات الذهب اليومية#اقوى استراتجيه سكالبنج

3 notes

·

View notes

Video

youtube

गिरवी रखे सोने से छुटकारा पाएं – आसान और भरोसेमंद तरीका!

अगर आपने ज़रूरत के समय अपना सोना गिरवी रखा था, तो अब उसे छुड़वाने का स��ी समय है। हम आपकी मदद करते हैं गिरवी रखे हुए सोने को छुड़वाने में – बिना किसी झंझट, पूरी पारदर्शिता के साथ। हमारी सेवा की खासियतें: ✅ तुरंत लोन क्लियरेंस – हम आपके पेंडिंग गोल्ड लोन का तुरंत भुगतान करते हैं। ✅ बिना छिपे शुल्क – पूरी प्रक्रिया पारदर्शी और विश्वसनीय होती है। ✅ उचित मूल्यांकन – छुड़वाए गए सोने का तुरंत और उचित दाम पर खरीदी। ✅ कैश या अकाउंट ट्रांसफर में तुरंत भुगतान। ✅ दिल्ली NCR में फ्री पिकअप सेवा उपलब्ध। अब चिंता छोड़िए, और अपने गिरवी रखे सोने से मुक्ति पाइए। हमसे संपर्क करें और पाएं तुरंत समाधान और उचित दाम| 📞 हमारी हेल्पलाइन नंबर पर कॉल करें अभी 9999821723, 9999633245. 💰 गोल्ड लोन से छुटकारा पाने का सबसे आसान और भरोसेमंद तरीका यहीं है|

#youtube#goldbuyers#gold#cash#cashforgold#sellgold#webuygold#goldbuyer#scrapgold#goldjewelry#goldcoins#silver#goldbars#goldbuy#goldinvestment#brokenjewelry#sellgoldnearme#sellgoldcoins#preciousgoldbuyers#cashforgoldnearme#cashmoney#needcashnow#investingold#goldbullions#needcash#PreciousMetals#JewelryBuyer#GetCashForGold#GoldTrade#SellYourGold

0 notes

Text

Commodities

Trading Gold, Silver, and Crude Oil in India

Commodities

Commodities trading has long been a cornerstone of financial markets, offering traders an opportunity to diversify their portfolios and hedge against risks. In India, popular commodities like gold, silver, and crude oil play a vital role in the trading ecosystem. Unlike stocks, which are influenced by company-specific factors, commodities are driven by global supply-demand dynamics, geopolitical events, and macroeconomic trends. Understanding these factors can help traders unlock the potential of commodities while managing the associated risks effectively.

Thinking about trading Commodities with us?

Open an AccountTry WebTrader

1. Why Trade Commodities?

Commodities offer unique advantages compared to traditional assets like stocks or bonds:

Diversification: Commodities provide a hedge against market volatility, inflation, and currency fluctuations.

Global Exposure: By trading commodities, Indian traders can participate in global markets and benefit from international trends.

High Liquidity: The Multi Commodity Exchange (MCX) ensures seamless transactions and high liquidity for popular commodities like gold, silver, and crude oil.

However, commodities trading requires specialized knowledge and carries significant risks, such as price volatility and leverage-related exposure.

2. Gold: The Timeless Safe Haven

Gold has long symbolized wealth and security in India. As a trading instrument, its appeal lies in its ability to maintain value during economic uncertainties.

Key Factors Influencing Gold Prices:

Currency Strength: Gold typically moves inversely to the US dollar. A weaker dollar often boosts gold prices.

Inflation: Rising inflation drives investors toward gold as a hedge against diminishing purchasing power.

Global Events: Geopolitical tensions or financial crises increase demand for gold as a safe-haven asset.

Ways to Trade Gold in India:

Physical Gold: Traditional investments in coins or bars are suitable for long-term holding but lack the liquidity and efficiency needed for active trading.

Gold ETFs: These are traded on stock exchanges, offering exposure to gold prices without the hassle of physical storage.

Gold Futures: Available on MCX, futures contracts allow traders to speculate on gold prices with leverage, amplifying both potential gains and risks.

3. Silver: A Versatile Commodity

Often referred to as "gold’s little brother," silver shares several price drivers with gold but also has unique industrial applications, particularly in electronics and renewable energy. This dual nature makes silver more volatile than gold.

Factors Driving Silver Prices:

Industrial demand for electronics, solar panels, and medical equipment.

Global economic conditions, which impact both its industrial and precious metal status.

Trading Options for Silver:

Silver Futures: MCX offers standard and mini contracts for traders with different risk appetites.

Silver ETFs: These recently introduced instruments provide a convenient way to invest in silver without managing physical assets.

Silver's combination of industrial demand and precious metal appeal makes it a dynamic choice for portfolio diversification.

4. Crude Oil: The Black Gold

Crude oil is one of the most widely traded commodities globally, influencing numerous industries, from transportation to manufacturing. Its price is sensitive to both global and local factors, making it a high-risk, high-reward trading instrument.

Key Drivers of Crude Oil Prices:

OPEC Decisions: Changes in production quotas by the Organization of the Petroleum Exporting Countries significantly impact global supply.

Geopolitical Events: Conflicts in oil-producing regions often cause sharp price fluctuations.

Demand-Supply Balance: Seasonal demand and shifts in global economic activity affect crude prices.

How to Trade Crude Oil in India:

Crude Oil Futures: MCX offers standard and mini contracts to accommodate traders with varying levels of experience and capital.

Global ETFs: Though limited in India, international crude ETFs provide exposure to global markets for those seeking indirect investment options.

5. Strategies for Commodities Trading

Success in commodities trading requires a combination of technical analysis, fundamental insights, and disciplined execution:

Trend Following: Use tools like moving averages to identify long-term trends. For instance, gold often shows an upward trend during inflationary periods.

News-Based Trading: Monitor significant events like OPEC meetings or Federal Reserve announcements, which can impact crude oil and gold prices.

Hedging: Commodities can protect portfolios during periods of market volatility. For example, buying gold during a downturn can mitigate losses in other assets.

Range Trading: Commodities like silver often move within defined price ranges during stable periods. Tools like Bollinger Bands and RSI help identify entry and exit points.

6. Risks and How to Manage Them

Commodities trading carries unique risks, including:

Leverage Risk: Futures contracts amplify both gains and losses. Traders must use leverage cautiously.

Price Volatility: Commodities are sensitive to geopolitical events, weather conditions, and policy changes, leading to unpredictable price swings.

Lack of Expertise: Beginners may struggle to analyze complex global factors affecting commodities.

Risk Management Tips:

Start small with mini contracts to gain experience.

Set stop-loss levels to protect against significant losses.

Diversify across multiple commodities to reduce exposure to a single asset.

Learn Commodities Trading

Trading gold, silver, and crude oil offers immense potential for Indian traders who approach the market with preparation and discipline. By leveraging tools, staying informed about global trends, and managing risks effectively, you can unlock the opportunities commodities present.

In the world of commodities, success hinges on knowledge and strategy. Trade wisely, and let the market’s rhythm work in your favor.

0 notes

Text

Gold Stock Pullback: A Golden Opportunity in a Bullish Market Cycle

The recent gold stock correction is not a signal of weakness—it's a setup for strength. While prices are consolidating, the macroeconomic fundamentals behind gold's bullish momentum remain stronger than ever. For anyone exploring how to invest in gold, this short-term decline is a tactical opportunity, not a cause for concern.

Inflation is proving more persistent than expected. Geopolitical uncertainty continues to rise. Central banks are buying gold in record quantities. These forces aren't temporary—they're structural, and they reinforce why gold as an investment continues to outshine most other asset classes.

Gold Market History: Why Dips Create Wealth

Every historical gold bull market—from 2001 to 2023—has featured healthy pullbacks. These corrections, usually ranging from 10% to 20%, often become the most profitable entry points for those looking to buy and sell gold strategically.

Central Banks Fuel Long-Term Gold Demand

In 2023, central banks purchased over 1,000 tonnes of gold—a level unmatched in recent history. These are not speculative moves; they are sovereign-level investments driven by the need to protect against inflation, dollar devaluation, and systemic financial risks.

This structural demand underpins gold prices and provides stability, even during periods of short-term volatility. For any gold investment company, this trend presents a long-term tailwind.

Geopolitical Pressures Amplify Gold’s Value

Gold's historical role as a safe-haven asset has never been more relevant. From the Russia–Ukraine war and U.S.–China tensions over Taiwan to instability in the Middle East, global threats are increasing. These flashpoints drive capital into stable assets—none more proven than gold.

Top geopolitical catalysts for 2025:

Energy-driven inflation from Middle East conflict

Trade realignments and sanction-driven financial bifurcation

Escalating military tensions in Asia and Eastern Europe

When markets are on edge, physical gold investment becomes more than a portfolio decision—it becomes a security hedge.

Inflation, Interest Rates, and Real Yields: Gold's Perfect Storm

Even amid rising nominal interest rates, real yields remain close to zero when adjusted for inflation. This neutralizes the traditional argument against non-yielding assets like gold.

Now, with the Federal Reserve approaching the end of its tightening cycle and potential rate cuts on the horizon, the dollar may weaken further. Historically, that’s when gold thrives.

Why Gold Mining Stocks Offer Exponential Upside

Gold miners are a high-leverage play on rising gold prices. During historical rallies, miners outpaced gold itself by 2–3x. Still, many mining stocks today remain undervalued.

Key traits of top-performing gold stocks:

All-in sustaining costs (AISC) below $1,200/oz

Strong balance sheets with low debt

Proven and growing gold reserves

Scalable production pipelines

Top picks include Barrick Gold (GOLD), Newmont (NEM), and Agnico Eagle (AEM)—names consistently recommended by any best gold company to buy from.

Technical Patterns Confirm the Bull Case

From a technical analysis perspective, gold is in a classic consolidation range, building support around $2,000. This phase often precedes the next breakout.

The Best Way to Invest in Gold Now

Given the setup, here’s how smart investors are preparing:

Physical Gold—The most secure long-term wealth preservation tool.

Gold ETFs (GLD, IAU)—Liquid, low-cost exposure to spot prices.

Gold Miners ETF (GDX, GDXJ)—Capture upside with less individual stock risk.

Junior Miners—High reward potential; due diligence essential.

Royalty & Streaming Companies (FNV, WPM) – Lower operational risk with upside exposure.

Whether you're interested in gold market investment, investing in gold online, or buying and selling gold through ETFs, timing matters. And this is a strong moment.

Managing Risk in Your Gold Investment Strategy

Use dollar-cost averaging during corrections.

Watch the Fed—interest rate changes are gold’s catalysts.

Balance your exposure: physical gold vs. gold equities.

Stay informed on online gold selling opportunities and premiums.

Conclusion: This Correction Is Your Cue

We are still firmly within a gold bull market. Every indicator—macroeconomic, geopolitical, and technical—points to further upside. The current dip is a gift for those seeking to invest in gold online, diversify with physical gold investment, or find the best gold company to partner with.

In a world of economic instability, gold and investment go hand in hand. Position wisely now—and the coming rally may reward you far more than waiting on the sidelines.

#GoldInvestment#InvestInGold#DigitalGold#GoldSavings#GoldRush#SafeHavenAsset#GoldPriceToday#GoldInvestor#GoldTrading#GoldBullion#PreciousMetals#SmartInvestment#WealthProtection#BuyGold#GoldMarketUpdate

0 notes

Text

🏆 Shine Online with GoldSales.com – A Name That Means Business!

GoldSales.com is a premium domain that evokes luxury, value, and high-ticket commerce. Perfect for businesses in precious metals, luxury goods, investment platforms, or upscale marketplaces.

✨ Instantly credible & memorable ✨ Ideal for gold trading, eCommerce, or luxury sales ✨ Commands trust and premium appeal

#GoldSales#LuxuryDomain#GoldTrading#Investment#PreciousMetals#eCommerce#PremiumDomain#FinancialMarket#HighValueBrand#WealthOnline

0 notes

Text

Gold: Still Shining in the Global Market?

With shifting economic tides, where does gold stand today? Discover gold’s current trade relevance, investor dynamics, and where the metal fits in today’s global strategy. 🔗 Read more

0 notes

Text

ఆల్టైమ్ గరిష్ట స్థాయికి బంగారం ధరలు

#Gold#GoldPrices#AllTimeHigh#GoldRate#BullionMarket#GoldNews#PreciousMetals#GoldInvestment#GoldTrading#MarketUpdate#FinancialNews

0 notes

Text

Himmath explains why physical gold bullion can outperform ETFs in volatile markets.

0 notes

Text

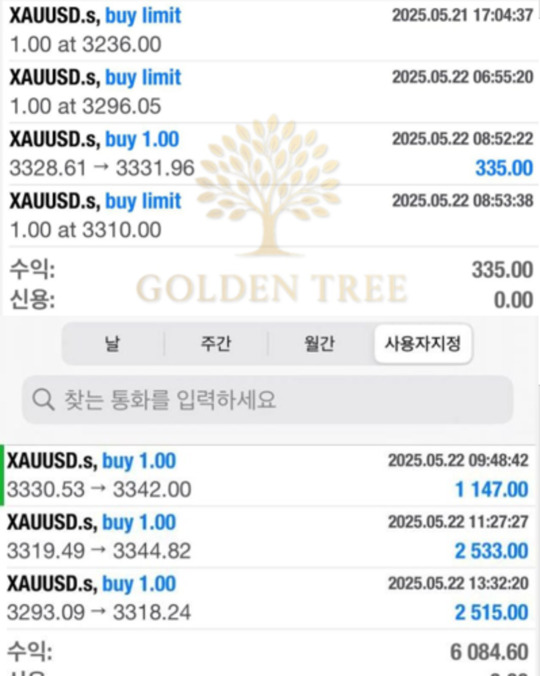

💸 May 22nd Copy Trading Summary – $6,084.60 Profit

XAUUSD (Gold) trading profit summary:

💼 Entry Range: 3293.09 ~ 3330.53 💼 Exit Range: 3318.24 ~ 3344.82 🔹 Total Profit: $6,084.60 🔹 All trades closed in profit

Didn’t expect this outcome from just following signals. Pretty motivating to keep

#copytrading#goldtrading#xauusd#tradereport#financialdiary#dailyprofit#tradinglog#investmentjourney#tumblrfinance#forexgold#tradingreview

0 notes

Text

DigiGold Scheme Software: The Future of Digital Gold Savings

Invest in Gold Smarter with DigiGold Scheme Software

Gold has always been one of the safest and most trusted investments. But in today’s digital world, buying and saving gold has become even easier with DigiGold Scheme Software. This technology enables businesses and investors to accumulate, manage, and redeem gold digitally—without worrying about storage or security.

What is DigiGold Scheme Software?

DigiGold Scheme Software is a digital platform that allows users to invest in gold through small, flexible installments. Instead of purchasing gold in bulk, users can buy and save gold systematically, making it more accessible and convenient for everyone.

This software is particularly beneficial for: ✔️ Jewelry retailers offering digital gold schemes ✔️ Fintech companies integrating gold investment solutions ✔️ Banks & NBFCs launching gold savings plans ✔️ Investors looking for secure and hassle-free gold accumulation

Why DigiGold Scheme Software is a Game-Changer?

🔹 Flexible Savings Plans – Invest in gold with small amounts over time 🔹 Live Gold Price Tracking – Buy at the best market rates with real-time updates 🔹 Secure Digital Storage – Gold is stored safely in insured vaults 🔹 Easy Redemption – Convert digital gold into jewelry, coins, or cash 🔹 Seamless Integration – Works with mobile apps, e-commerce platforms, and banking systems

Benefits of DigiGold Scheme Software

💰 For Businesses: ✔️ Attract more customers with easy gold savings plans ✔️ Increase sales by offering flexible gold purchase options ✔️ Reduce manual work with automated transactions

✨ For Customers: ✔️ Affordable way to invest in gold over time ✔️ No worries about theft or storage issues ✔️ Easily convert digital gold into physical assets

0 notes

Text

🌟 Revolutionize Digital Gold Investment with @amigoways! 🌟

Looking to develop a secure, user-friendly, and feature-rich digital gold investment app? Amigoways Technologies specializes in cutting-edge Digital Gold App Development to help businesses create seamless and secure platforms for modern investors.

✨ Why Choose Amigoways for Your Digital Gold App? ✅ Secure & Scalable Fintech Solutions ✅ Real-Time Gold Price Integration ✅ Easy Transactions & Wallet Management ✅ Customizable Features for Your Business Needs

🚀 Build a next-gen Digital Gold Investment App and redefine the gold trading experience!

📲 Get a Free Consultation Now 👉 https://www.amigoways.com/mobile-development/

#DigitalGoldApp#GoldInvestmentApp#FintechDevelopment#GoldTrading#Amigoways#AppDevelopment#InvestSmart

0 notes

Text

What Is a Bullion Exchange? Understanding Gold and Silver

0 notes

Text

How to Trade Gold in Dubai: A Complete Guide for Investors

Dubai is a global hub for gold trading, offering various investment options such as gold bullion, online purchases, and gold futures on the Dubai Gold & Commodities Exchange (DGCX). Learn why Dubai is a prime location for gold investment, how to trade gold safely, and key tips for maximizing your returns. Whether you're a beginner or an experienced trader, this guide will help you navigate Dubai's thriving gold market.

#GoldTrading#DubaiGold#InvestingInGold#GoldBullion#GoldMarket#DGCX#GoldInvestment#GoldETFs#PreciousMetals#BuyGoldOnline

0 notes

Text

How to Buy Cheap Gold from Africa: A Complete Guide

Africa is one of the richest continents in gold production, with major gold-producing countries like Ghana, South Africa, Sudan, Mali, and Cameroon. If you're looking to buy raw gold directly from Africa at the best prices, this guide will walk you through the process, including trusted sellers, shipping options, legal documents, and taxation requirements.

Where Can I Buy Raw Gold from Africa?

If you're searching for authentic gold suppliers, it's essential to deal with licensed and reputable gold traders like Bonasgold. They offer gold dore bars, gold dust, and refined gold bars directly from African mines.

For a step-by-step process on buying gold from Africa, check out: Gold Order Process from Cameroon.

Cheapest Places to Buy Gold in Africa

The price of gold varies from country to country, but some of the cheapest places to buy raw gold include:

If you want to know about current gold prices per kg, visit GoldPrice.org.

Buying Gold Direct from Miners

Buying gold directly from miners can be cost-effective. However, it's important to work with registered mining cooperatives or licensed sellers to avoid fraud. Bonasgold offers face-to-face transactions to ensure secure and legitimate purchases.

Buying Raw Gold from Africa Online

Purchasing gold online from Africa requires caution. Trusted websites such as Bonasgold provide secure payment methods and verified gold sources.

For tips on online gold purchases, read: Cheapest Way to Buy Gold Online from Africa.

Is it Legal to Import Gold from Africa?

Yes, importing gold from Africa is legal if done through proper channels. You need the following documents:

For a comprehensive guide on legal importation, check out: How to Legally Import Gold from Africa.

Shipping Gold from Africa

Gold shipping requires a secure and trusted logistics company. One of the best options is JT Shipping Group, which specializes in gold logistics. For cost estimates, visit JT Shipping Group.

For more details on shipping procedures, read: How to Import Gold from Africa to Dubai.

Is Gold Cheaper in Africa?

Gold is generally cheaper in Africa due to lower mining and processing costs. However, the final price depends on the country's taxes, export fees, and supply-demand factors.

To find out the cheapest country to buy gold, read: Cheapest Gold in Africa: Where to Buy Raw Gold.

Best Places to Buy Gold from Africa

For a hassle-free gold purchase, buy from established traders like Bonasgold, which guarantees authentic gold and secure transactions.

Related Articles:

#BuyGoldFromAfrica#RawGoldForSale#CheapestGold#GoldMining#AfricanGold#GoldPrice#GoldInvestment#BuyGoldOnline#GoldTrading#Bonasgold

0 notes