#gst course with placement

Explore tagged Tumblr posts

Text

Top 9 GST Certification Courses In India With Placement Opportunities

Explore the top 9 GST certification courses in India, offering certified GST courses, GST accounting courses, and placement opportunities. Get your certificate course in GST now!

#gst certification course india#gst certification course#online certificate course in gst#best gst certification course#gst certification course online#gst practitioner certification course#gst courses in india#gst practitioner certificate course#gst course with placement#diploma in gst course#gst certification#course for gst practitioners#gst certificate course online#gst certification courses#gst courses#online gst course certificate#certified gst course#certification course on gst#gst course#course on gst#gst accounting course#certificate course in gst#gst courses in kolkata#gst course online#gst training online

0 notes

Text

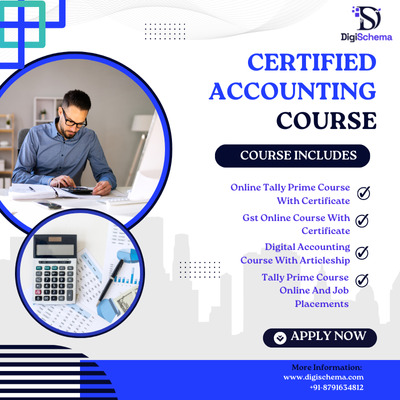

Unlock your Career Potential with Certified Accounting Courses

Get Certified: Accounting Course for Career Growth. A must-attain set of certifications that make the accounting skills and career better. From the core knowledge in accounting principles and tax rules to getting hands-on with the Digital Accounting Course With Articleship that preps you for jobs. Along with this, the Tally Prime Course Online And Job Placements offer job placement assistance as well as connect you with possible employers.

Table Of Content: -

Get Certified: Accounting Course for Career Growth

Master Tally Prime: Online Course With Certificate

Join Now: GST Online Course with Certification

Digital Accounting Course with Articleship Options

Tally Prime Online Course: Job Placement Support

Frequently Asked Questions (FAQs)

Get Certified: Accounting Course for Career Growth

Relevant certification in the modern competitive market can help you grow immensely in your career. Such a Certified Accounting Course, therefore, will be a qualification booster to set you apart from different employers. These courses include skills and knowledge required in accounting.

Benefits of Taking Certified Accounting Courses:

In-depth Knowledge: This helps understand accounting principles, financial reporting, and tax laws.

Professional Development: These certifications tell the employer that you respect your profession and are not willing to compromise on such things.

In addition to these regular courses in accountancy, specializations include online Tally Prime Course With Certificate. This course is based on the software package Tally Prime. As known, this is being largely used by the business fraternity in the country for their needs and purposes of accountancy as well as inventory management. This will improve your technical know-how and thereby enhance the prospects of job opportunities available to you in the marketplace.

Another worth offering is the GST Online Course With a Certificate. An accounting professional in India should know about the Goods and Services Tax, or GST because it has been a game changer in taxation.

Digital Accounting Course With Articleship is an excellent opportunity to learn while working. Here, the theoretical concept will not only be studied but articles, which will include practical hand training.

Tally Prime online course also has Tally Prime Job Placement. Here, you will be connected with the providers of the job opportunity.

Master Tally Prime: Online Course With Certificate

Mastering software tools in accounting is a compulsive requirement and not a choice. Any aspirant accounting professional who is desirous of increasing prospects for his career and aims at higher positions should take up the course designed specifically for mastering Tally Prime, the robust, advanced accounting software. Online Tally Prime Course with certificate provides in-depth Tally Prime knowledge with significant prospects of employability improvement by certification.

Advantages of Online Tally Prime Training

Comprehensive Curriculum: Everything, from basic functions to all the possible features of Tally Prime, will be learned in this online training on Tally Prime to get proper knowledge of the software in totality.

Flexibility: The online training system enables you to study at a flexible pace according to one's convenience. This feature benefits working professionals as the availability of time for work could be flexible and comfortable at the same time.

Certification: Get certified after completion, indicating validation of skills and knowledge gained through Tally Prime.

With all these, it would also be helpful to be able to apply for an accounting course that is qualified such that I will get some better principle knowledge about accountancy. The two courses combined with a GST course which is online results in getting a certificate, so I will be able to fully appreciate the Indian Taxation system.

The Digital Accounting Course With Articleship will then provide you with the on-the-job experience to be completed. Some programs add the Tally Prime Course Online And Job Placements, where you get an opportunity to face employers that are actively in search of the right employee.

Join Now: GST Online Course with Certification

Accountancy professionals have no option other than being updated regarding GST regulations and compliance in a rapidly changing finance world. Our GST Online Course With Certificate will be a comprehensive learning session on the regulation, compliance, and the impact of GST on businesses. This will add much value to your professional profile and enrich your knowledge.

Key Features of GST Online Course

Expert Trainers: Learn from industry experts about the real-life application of GST.

Flexibility: This online program is flexible, and you study at your own pace, very suitable for busy professionals, and

Certification: On completion, you can get a recognized certificate about your expertise in GST.

The additional course can be the GST course, and then support it with a Certified Accounting Course that will enhance building up basic accounting skills. An online Tally Prime Course With a Certificate further will bolster your skills especially since accountancy software is globally utilized in most businesses.

Besides, for the hands-on experience enthusiasts, a digital accounting course with articles is also available. Many of these programs also provide online Tally Prime courses along with job placements, and you'd directly be connected with the employers looking for the right candidates.

Digital Accounting Course with Articleship Options

As the digital world is evolving day by day, there is an exponential growth of demand for skilled accountants. Our Digital Accounting Course With Articleship gives the much-needed accounting skills accompanied by practical experience through articles, making you totally job-ready upon completion of the course.

Benefits of the Digital Accounting Course

The curriculum would focus on digital accounting tools, financial reports, and compliance regulations.

Articleship Experience: Articleship provides practical insight into industry professionals; therefore, you experience in your learning.

Certification: Certification is provided that confirms your digital accounting skill, thus making you a highly competitive one in the job market.

Apart from that, you may choose a certified accounting course that will make your base sound in accounting principles. Then, there is the GST Online Course With Certificate which gives you the necessary knowledge regarding tax regulations, if you wish to go deeper into specialization.

This great Online Tally Prime Course With a Certificate coming to you is one that takes much concern with the mastery of software much in demand anywhere, today. Thousands of these institutes present you with an opportunity like this so that you get complete assurance that no problem may arise at any time before, during, or after your transition from education to employment.

Tally Prime Online Course: Job Placement Support

If you are serious about a career in accounting, then there is no alternative but mastering Tally Prime. We offer Tally Prime online course along with the certificate course with job placement support from us to give that initial boost towards a better career.

What are the advantages of this Tally Prime online course?

Complete Training: Tally Prime training provides all the functionalities from simple to complex so that you are completely prepared for the work field.

Certification: A completion certificate is also included which makes you an impressive candidate in the eyes of the employers.

Job Placement Assistance: Job placement assistance helps students find job placements with organizations that are actively seeking skilled professionals in Tally Prime.

Apart from the Tally Prime course, one can further qualify by doing a Certified Accounting Course that would cover the most basic accounting principles. If there is interest in taxation, then the GST Online Course With Certificate is a very good add-on that would give critical insights into the regulations of GST.

Practical experience can be received through a Digital Accounting Course With Articleship. You will not only become theoretical but also prepared to face the practical world.

Frequently Asked Questions (FAQs)

1. Benefits of doing a Certified Accounting Course

A Certified Accounting Course trains in accounting principles, reporting financial statements, and other tax laws, therefore assuring professional growth. Moreover, it shows that a person is dedicated to this field, and it makes him an excellent candidate for any company.

2. How does the Tally Prime Online Course with Certificate help with placement?

An All-inclusive Tally Prime Training from Basic to Advanced. After you complete the courses, you will be entitled to the recognized certificate you will gain, and it will further make you eligible for acquiring the Tally Prime Course Online And Job Placements with the help of which you will get tied up to the employers on the lookout for adequate professionals.

3. What on-the-job experience do I get through the Digital Accounting Course with Articleship?

The Digital Accounting Course With Articleship merges the article's practical skills training and the theory knowledge so you enjoy practical insight from such people who are in the industry. Prepared Experience: You would have some real-life challenges going on in regard to the accounting profession itself, and making the workforce even more absorptive.

Source url: https://ajmalhabib.com/unlock-your-career-potential-with-certified-accounting-courses-2/

#Certified Accounting Course#Online Tally Prime Course With Certificate#Gst Online Course With Certificate#Digital Accounting Course With Articleship#Tally Prime Course Online And Job Placements#digi schema

0 notes

Text

Tally Training in Chandigarh: Build a Successful Accounting Career

In today’s fast-paced digital economy, proficiency in accounting software like Tally is no longer optional — it’s a necessity. Whether you’re a student, a working professional, or someone planning a career shift into finance, Tally training in Chandigarh offers a golden opportunity to build a solid foundation in business accounting. With growing business activity in the region, mastering Tally can set you apart in the competitive job market.

Introduction to Tally and Its Relevance

Tally is one of the most widely used business accounting software in India. It simplifies complex financial operations such as invoicing, inventory management, taxation, payroll processing, and financial reporting. Tally ERP 9, the earlier version, was known for its robust features, while Tally Prime — the latest iteration — offers an intuitive interface and smarter navigation for enhanced productivity.

In a country where small and medium enterprises form the economic backbone, Tally plays a critical role in helping businesses maintain compliance and streamline operations. From automating GST filings to tracking stock levels in real time, Tally’s capabilities are deeply aligned with the needs of modern Indian enterprises.

Why Choose Tally Training in Chandigarh?

Chandigarh has steadily grown into a major educational and business center in North India. With its well-connected infrastructure and proximity to Punjab, Haryana, and Himachal Pradesh, it attracts students and professionals from across the region.

The city boasts several reputed training institutes that specialize in job-oriented programs, including Tally training in Chandigarh. These institutes not only provide structured learning but also offer real-world exposure through internships and industry interactions. The business-friendly environment of Tricity — comprising Chandigarh, Mohali, and Panchkula — further enhances placement opportunities for Tally-trained individuals.

Key Features of a Good Tally Training Institute

Selecting the right institute can make a big difference in how effectively you master Tally. Look for the following features when choosing your Tally course:

Certified and experienced trainers ensure you’re learning from professionals who understand both the software and its industry applications. Practical exposure through case studies and real-time projects helps you gain confidence in using Tally in real-world scenarios.

Modern Tally courses now include essential modules like GST compliance, inventory control, payroll processing, MIS report generation, and taxation management. Institutes that regularly update their syllabus in sync with government norms and business trends are more valuable.

Personalized mentorship, flexible batch timings (weekend/evening), and career support services like resume building and mock interviews can significantly enhance your learning experience.

Career Scope After Tally Training

Completing a certified Tally course can unlock a variety of career paths. Common roles include:

Accountant

GST Consultant

Billing Executive

Finance Executive

Audit Assistant

Tally skills are especially in demand in sectors like retail, manufacturing, logistics, healthcare, and professional services. Small and mid-sized businesses across the Tricity area consistently hire Tally-certified professionals for daily bookkeeping, tax filing, and reporting.

The average starting salary for a fresher with Tally training ranges from ₹15,000 to ₹25,000 per month, with rapid growth potential as you gain experience and industry exposure.

Tally ERP 9 vs Tally Prime: What You’ll Learn

A well-rounded Tally training program in Chandigarh covers both Tally ERP 9 and the newer Tally Prime. While ERP 9 remains in use across many companies, Tally Prime introduces improved usability with a simplified menu structure, enhanced multi-tasking, and better data tracking.

Key modules you’ll explore include:

Financial Accounting and Ledger Management

Inventory Management and Stock Control

Payroll Setup and Salary Processing

GST and TDS Return Filing

MIS Reports and Business Intelligence

Data Backup and Security Features

You’ll also learn how to use Tally as a business management tool that integrates seamlessly with compliance and audit requirements.

Best Tally Training Institutes in Chandigarh

When choosing an institute, reputation matters. The best Tally training institutes in Chandigarh offer practical curriculum, certified trainers, placement assistance, and flexible learning schedules.

Bright Career Solutions Mohali stands out as a highly rated institute offering in-depth Tally training with practical exposure. With expert faculty, dedicated career support, and strong student feedback, BCS Mohali has become a trusted name in Tally education in the region.

Students regularly highlight the institute’s hands-on training approach, one-on-one mentorship, and successful placement records across local businesses and startups.

FAQs About Tally Courses in Chandigarh

Q. Is Tally useful for non-commerce students? Ans. Yes. Tally is designed to be user-friendly and can be learned by students from non-commerce backgrounds. Institutes usually begin with accounting basics before diving into software-specific training.

Q. What is the typical duration and cost of Tally training? Ans. The duration can range from 1 to 3 months depending on the course level (basic to advanced). Fees generally range from ₹5,000 to ₹15,000. Institutes like BCS Mohali also offer installment plans.

Q. Is a Tally certification necessary to get a job? Ans. While not mandatory, a certification adds credibility to your resume and significantly boosts your chances during hiring. Certified professionals are often preferred for finance and accounts roles.

Conclusion

Tally training in Chandigarh is more than just a short-term course — it’s a launchpad for a rewarding career in finance and accounting. With businesses increasingly relying on Tally for daily operations and compliance, skilled professionals are in high demand.

Whether you’re a student, job seeker, or professional looking to upgrade your skills, enrolling in a Tally course from a reputed institute like Bright Career Solutions Mohali can help you take a decisive step toward career success. The right training, combined with dedication and practice, can turn you into a valuable asset for any business.

2 notes

·

View notes

Text

Master Accounting with DICS Laxmi Nagar

In the era of digital finance and automated bookkeeping, Tally has emerged as one of the most trusted accounting software used by businesses across India. Whether you are a commerce student, aspiring accountant, or business owner, mastering Tally can significantly boost your career. Among various training centers, DICS (Delhi Institute of Computer Science) stands out as the best Tally institute in Laxmi Nagar, offering top-tier education, expert faculty, and industry-relevant curriculum.

Why Choose DICS for Tally?

DICS is renowned for its commitment to quality education and career-focused training. Recognized as the best Tally institute in Laxmi Nagar, it provides a well-structured course that covers all the essential features of Tally Prime, including GST, TDS, inventory management, payroll, and more. The course is designed for both beginners and advanced learners, ensuring that every student gains practical and theoretical proficiency.

Industry-Ready Curriculum

The best Tally course at DICS is not just about software operation—it’s a complete package that equips students with real-time skills. The curriculum includes:

Basics of Accounting & Tally

Company Creation & Ledger Management

Voucher Entry and Reconciliation

GST Implementation and Filing

Payroll Configuration

MIS Reporting and Data Security

Each module is supported by hands-on training, case studies, and real-world examples to give students a competitive edge in the job market.

Experienced Faculty & Supportive Environment

The faculty at DICS are certified professionals with years of industry and teaching experience. Their teaching methodology blends conceptual clarity with practical knowledge, ensuring students can implement their learning effectively. Small batch sizes, interactive sessions, and one-on-one doubt-clearing sessions make the learning process smooth and engaging.

Placement Assistance and Certifications

Upon completion of the course, students receive a government-recognized certification that boosts their professional credibility. DICS also offers dedicated placement assistance, connecting students with reputed firms and accounting jobs. This makes the best Tally course at DICS not just a learning opportunity but a gateway to a promising career.

Conclusion

If you're looking to build a strong foundation in accounting with Tally, DICS is the ideal destination. With a focus on quality training, professional guidance, and job readiness, DICS truly offers the best Tally course for aspiring accountants. Enroll today and take the first step toward a rewarding financial career at the best Tally institute in Laxmi Nagar.

0 notes

Text

Top Degree College in Bangalore After 12th: Why Ebenezer Should Be on Your List

Let’s be honest, picking a college after 12th isn’t easy.

There’s pressure from every side. Rankings, cutoffs, career fears, expectations from home and underneath it all, a simple question that keeps you up at night:

“Will I be okay here?” “Will this place actually help me build something real?”

That’s why more and more students and parents are going beyond the flashy brochures and big names. They’re starting to ask better questions.

Is the curriculum actually relevant today? Will it help me land on my feet when college ends? Can we afford it without drowning in hidden costs?

And if you're asking those same things, then you need to know about Ebenezer Degree College in Bangalore.

This Is a College That Doesn’t Just Teach - It Prepares You

Ebenezer offers programs in Commerce, Science, Nursing, Pharmacy, and Pre-University streams. Sounds like a lot of colleges, right?

But here's the thing: every single course here is built around what happens after college not just in it.

That means more than lectures and last-minute mugging. It means real training, usable skills, and actual career direction.

You’ll find students in the B.Com classrooms learning Tally and GST, not just textbook theory. Nursing and pharmacy students doing rotations in real hospitals, not just practicing on plastic dummies.

And business students exploring add-on certifications in Aviation, Digital Marketing, etc. things that actually matter when you're job hunting.

What Makes the Experience Feel Different?

Honestly? It’s the way you’re treated.

One thing that kept coming up in student conversations was how they felt here.

You’re not a rank. You’re not a roll number. You’re a person.

Whether you’re a quiet first-bencher or someone still figuring out where you belong, the faculty notice. They’ll explain something three times if they have to in three different ways because your understanding matters more than just finishing a chapter.

And that’s rare.

Campus Life? Balanced and Welcoming

There’s structure here but not suffocation.

Classes are focused, labs are well-equipped, and hostels are safe and clean (with separate ones for boys and girls). But there's also space for fun-fests, clubs, talent shows, DJ nights, and group study chaos before internals. (Yes, you’ll bond over that stress.)

It’s not about making everything perfect. It’s about making sure you don’t feel out of place.

Even if you're from a smaller town or you're the first in your family to go to college you won’t feel like an outsider here.

The Career Part? It’s Already Built In

One of the strongest parts of Ebenezer’s system is how closely tied it is to real industries.

If you’re doing Nursing, B.Pharm, or D.Pharm, you’ll see names like Narayana Health, Fortis, Apollo, Cloudnine, and more in your training journey, not just on a poster.

The internships, hospital rotations, and practicals don’t come at the end; they happen along the way, so you’re not panicking in your final year wondering “What now?”

And placement support? Students say it's not just about "clearing interviews" it’s about actually being ready for them.

Let’s Talk About Money, Because It Matters

You shouldn’t have to sell your peace of mind to get a good education.

Ebenezer keeps it transparent and donation-free. The fees are structured fairly, and there’s real financial support

You get the education you need without draining everything your family’s saved. And for most parents, that’s huge.

So… Is This the Right Place for You?

Maybe you didn’t crack a national entrance exam. Maybe you’re still unsure about what you want, just that you want something that counts.

If you're searching for a college that will take you seriously, support you, and treat you like someone with potential (not just someone with marks)… then Ebenezer Degree College is more than worth a visit.

This isn’t a college that promises you the moon and then leaves you to figure things out.

It’s a place that walks with you through your doubts, your late-night study panic, your first presentation, your first win. It’s the kind of place that reminds you: you’re not behind. You’re just getting started.

And that feeling of being seen, guided, and ready can change everything.

#college#student#institute#bangalore#best college in bangalore#topdegreecollegeinbangalore#digital marketing#nursing#bcom#bpharma#pharmacy colleges

1 note

·

View note

Text

Top In-Demand Accounting Jobs in 2025 & How an Accounting Course Can Help, 100% Job, Accounting Course in Delhi, 110075 - Free SAP FICO Certification by SLA Consultants India, GST Certification, ITR & DTC Classes with 2025 Update, Tally Prime Certification,

The accounting profession in 2025 is experiencing a remarkable surge in demand, fueled by digital transformation, regulatory changes, and a persistent talent shortage both in India and globally. As businesses increasingly rely on technology for financial management and compliance, the most in-demand accounting jobs now require a blend of traditional expertise and modern digital skills. For professionals in Delhi (110075), enrolling in a comprehensive accounting course—such as the one offered by SLA Consultants India with free SAP FICO certification, GST certification, ITR & DTC classes with 2025 updates, and Tally Prime certification—is a proven pathway to securing top roles and enjoying robust career prospects.

Accounting Course in Delhi

Among the most sought-after accounting jobs in 2025 are Chartered Accountant (CA), Certified Public Accountant (CPA), Certified Management Accountant (CMA USA), Financial Analyst, Accounts Manager, Tax Advisor, and Forensic Accountant. Chartered Accountants remain at the top of the accounting hierarchy, specializing in auditing, taxation, and financial reporting, with salaries ranging from ₹8–25 lakhs per annum in India. CPAs are highly valued for their expertise in global reporting, auditing, and compliance, commanding even higher salaries—up to ₹30 lakhs per annum—and enjoying international recognition. CMAs, meanwhile, focus on financial management, budgeting, and cost control, making them essential for multinational corporations and consulting firms.

Accounting Training Course in Delhi

Financial Analysts and Accounts Managers are also in high demand, as businesses require professionals who can analyze financial data, manage teams, and support strategic decision-making. CFOs (Chief Financial Officers) oversee financial strategy, risk management, and business growth, earning between ₹15–52 lakhs per annum and playing a critical role in organizational success[5]. Tax Advisors and Forensic Accountants are crucial for ensuring compliance with evolving tax laws and investigating financial discrepancies, respectively, as regulatory complexity continues to increase.

Accounting Certification Course in Delhi

To secure these top roles, professionals need to master both core accounting principles and advanced digital tools. The integration of technology into accounting—especially through automation, AI, and cloud-based platforms—has revolutionized the field, making expertise in software such as SAP FICO and Tally Prime highly desirable. These tools streamline financial processes, enhance accuracy, and enable real-time reporting, which are essential for modern businesses. Additionally, GST certification and up-to-date ITR & DTC training ensure compliance with Indian tax laws, further boosting employability.

A comprehensive Accounting Course in Delhi, like the one offered by SLA Consultants India in Delhi (110075), provides the ideal foundation for aspiring professionals. The curriculum covers essential skills and certifications—including free SAP FICO certification, GST certification, ITR & DTC classes with 2025 updates, and Tally Prime certification—preparing students for the most in-demand roles in the industry. With 100% job placement support, graduates are well-equipped to enter the workforce and thrive in a dynamic, technology-driven environment.

E-Accounting, E-Taxation and E-GST Course Modules Module 1 – Advanced Goods & Services Tax Practitioner Course - By CA– (Indirect Tax) Module 2 - Part A – Advanced Income Tax Practitioner Certification Module 2 - Part B - Advanced TDS Practical Course Module 3 - Part A - Finalization of Balance sheet/Preparation of Financial Statement & Banking-by CA Module 3 - Part B - Banking & Finance Module 4 - Customs / Import & Export Procedures - By Chartered Accountant Module 5 - Part A - Advanced Tally Prime & ERP 9 Module 5 - Part B - Tally Prime & ERP 9 With GST Compliance Module 6 – Financial Reporting - Advanced Excel & MIS For Accounts & Finance - By Data Analyst Trainer Module 7 – Advanced SAP FICO Certification

In summary, the top in-demand accounting jobs in 2025 require a combination of traditional expertise and digital proficiency. By enrolling in a high-quality accounting course in Delhi (110075), professionals can acquire the skills, certifications, and practical experience needed to secure lucrative roles and build a future-proof career in accounting. For more details Call: +91-8700575874 or Email: [email protected]

0 notes

Text

Income Tax Compliance Course with Projects

Income Tax Course: एक Perfect Career Option for Finance Lovers

अगर आप finance field में career बनाना चाहते हैं, तो Income Tax Course आपके लिए एक अच्छा option हो सकता है। यह course ना सिर्फ आपके theoretical knowledge को बढ़ाता है, बल्कि आपको practical world के लिए भी तैयार करता है।

इस article में हम detail में जानेंगे income tax course के बारे में – इसका syllabus, duration, fee structure, benefits, और job opportunities। आइए शुरू करें।

✅ What is an Income Tax Course? – Income Tax कोर्स क्या है?

Income Tax Course ek professional training program होता है जो students को भारत के टैक्स laws और policies की जानकारी देता है।

यह course आपको सिखाता है कैसे आप income calculate करें, deductions apply करें, और returns file करें। इसमें TDS, GST और Advance Tax जैसे important topics भी cover होते हैं।

ये course उन लोगों के लिए useful है जो accounting, finance या taxation field में job करना चाहते हैं।

🎯 Why Should You Learn Income Tax Course? – Income Tax Course क्यों करें?

हर साल government अपने income tax laws में बदलाव करती है। इसलिए इस course की demand हर समय बनी रहती है।

अगर आप accountant बनना चाहते हैं या CA, CS या CMA की तैयारी कर रहे हैं, तो यह course आपके लिए फायदेमंद रहेगा।

इसके अलावा, अगर आप खुद का business चलाते हैं, तो यह course आपकी tax planning में help करेगा।

📘 Income Tax Course Syllabus – Course Syllabus क्या होता है?

Income Tax Course का syllabus काफी wide होता है, जिसमें basic से लेकर advanced concepts शामिल होते हैं।

Syllabus में शामिल topics:

Basics of Income Tax (आयकर की मूल बातें)

Types of Incomes and Heads (आय के प्रकार और हेड्स)

Tax Slabs & Rates (टैक्स स्लैब और दरें)

Deductions under Section 80C to 80U

TDS (Tax Deducted at Source)

Advance Tax and Self-Assessment

Filing of Income Tax Returns

E-filing procedures on Income Tax Portal

Penalties and Prosecution

Practical training भी दी जाती है जिसमें आप ITR forms भरना सीखते हैं।

🕒 Duration & Eligibility – कोर्स की अवधि और योग्यता

Duration: Income Tax Course की duration institute के अनुसार vary करती है। कई institutes 1 month से लेकर 6 months तक के courses offer करते हैं।

Eligibility Criteria: Minimum qualification 12th pass होती है। Commerce background वाले students के लिए यह course ज्यादा easy होता है। Graduates in B.Com, BBA या M.Com भी इस course को कर सकते हैं।

💰 Course Fee Structure – Income Tax Course की फीस क्या है?

Course fee depends करती है institute, course level और city पर।

Average Fees: ₹5,000 से ₹25,000 के बीच होती है। Online course में fee थोड़ी कम हो सकती है जबकि offline training institutes में थोड़ी ज्यादा होती है।

Tip: जब भी आप किसी institute को choose करें, उसका syllabus और faculty जरूर check करें।

📈 Benefits of Doing Income Tax Course – Income Tax Course करने के फायदे

Income Tax Course करने से आपको कई practical advantages मिलते हैं।

Main Benefits:

बेहतर job opportunities in finance and accounting field

खुद का Tax Consultancy business शुरू करने का मौका

Freelancing opportunities for return filing

हर साल changing tax laws के बारे में updated knowledge

Government job के लिए preparation में मदद

इसके अलावा आप friends और relatives की return filing भी कर सकते हैं और extra income earn कर सकते हैं।

💼 Career Opportunities After Income Tax Course – Job Scope and Career Options

Course complete करने के बाद आपके पास कई career options होते हैं।

Job Roles:

Income Tax Return Preparer

Tax Consultant

Accountant

Finance Executive

TDS Executive

Tax Analyst

आप private firms, CA offices, consultancies या corporates में काम कर सकते हैं।

Freelancing और work-from-home options भी available हैं।

🏫 Best Institutes for Income Tax Course – कहां से करें Income Tax Course?

India में कई reputed institutes हैं जो ये course offer करते हैं। कुछ popular institutes में शामिल हैं:

The Institute of Professional Accountants (TIPA), Delhi

ICAI certified taxation workshops

इन institutes में आपको live projects पर काम करने का मौका मिलता है और placement assistance भी दी जाती है।

📑 Certifications – क्या Income Tax Course के बाद Certification मिलता है?

Yes! Course complete करने के बाद आपको एक valid certificate मिलता है।

यह certification आपके resume में value add करता है। Job interviews में यह आपके practical skills को proof करता है।

कुछ institutes government recognized certifications भी offer करते हैं, जिससे आपके employment chances और भी बेहतर हो जाते हैं।

📚 Study Mode – Online vs Offline Course Mode

आप ये course online या offline किसी भी mode में कर सकते हैं।

Online Course के फायदे:

Flexibility to study anytime

Lower cost

Recorded lectures and online doubt support

Offline Course के फायदे:

Classroom interaction

Practical case study-based learning

Direct guidance from faculty

आप अपने time और budget के हिसाब से mode select कर सकते हैं।

🔍 Reference and Legal Framework – Income Tax Rules की जानकारी कहां से लें?

Income Tax Department की official website https://www.incometax.gov.in से आप सभी rules और updates प्राप्त कर सकते हैं।

यह site आपको ITR forms, deadlines और tax calculator जैसी सुविधाएं भी देती है।

इसके अलावा आप ICAI और government blogs भी follow कर सकते हैं।

🎓 Conclusion – Final Thoughts on Income Tax Course

आज के competitive world में सिर्फ graduation से काम नहीं चलता।

Income Tax Course एक ऐसा skill-based course है जो आपके career को fast-track कर सकता है।

चाहे आप student हों, job seeker हों या business owner – यह course सभी के लिए beneficial है।

Financial literacy आज की ज़रूरत है, और यह course उस दिशा में एक मजबूत कदम है।

🔖 FAQs: Income Tax Course

Q1. क्या ये course CA students के लिए useful है? हां, यह course CA students के लिए बहुत beneficial है क्योंकि इसमें practical exposure मिलता है।

Q2. क्या Commerce background जरूरी है? नहीं, लेकिन commerce background होने से concepts जल्दी समझ में आते हैं।

Q3. क्या part-time course options available हैं? हां, online और weekend batches दोनों ही options available हैं।

अगर आपको ये article helpful लगा तो इसे जरूर share करें। और अगर आप Income Tax Course करना चाहते हैं, तो सही institute चुनें और आज ही शुरुआत करें!

Accounting Course ,

Diploma in Taxation Course,

courses after 12th Commerce ,

Courses after b com ,

Diploma in financial accounting ,

SAP fico course ,

Accounting and Taxation Course ,

GST Course ,

Computer Course in Delhi ,

Payroll Management Course,

Tally Course in Delhi ,

One year course ,

Advanced Excel Course ,

Computer ADCA Course in Delhi

Data Entry Operator Course fee,

diploma in banking finance ,

Stock market Course,

six months diploma course in accounting

Income Tax

Accounting

Tally

Career

0 notes

Text

Boost Your Career with the Best Accounting Courses in Kerala

If you're aiming for a successful career in finance, enrolling in accounting courses in Kerala can be your first step. Kerala is home to several reputed institutions offering a variety of programs suited for beginners, professionals, and job seekers. These courses are designed to equip you with the skills needed in today’s competitive business environment.

Why Accounting Courses in Kerala Are in Demand

With a growing number of businesses and startups, the demand for trained accountants has surged. Accounting courses in Kerala are tailored to meet industry standards, providing practical knowledge in areas like taxation, GST, auditing, and financial reporting. These courses are available across various cities such as Kochi, Trivandrum, Calicut, and more.

Learn Flexibly with Online Accounting Courses

For those who prefer to learn at their own pace, online accounting courses are a great option. These courses allow you to study from anywhere, making them ideal for working professionals or students with busy schedules. Many institutes in Kerala now offer online accounting courses that are interactive, affordable, and job-oriented.

Some benefits of online accounting courses include:

Flexible timing

Access to recorded sessions

Certification upon completion

Support from industry experts

Build a Strong Foundation with a Diploma in Accounting

A diploma in accounting is one of the most sought-after qualifications for students who want a fast-track entry into the finance sector. Whether you're a commerce graduate or just starting out, a diploma in accounting offers comprehensive training in areas such as bookkeeping, payroll, GST, and financial software like Tally.

Many institutions in Kerala offer specialized diploma in accounting programs that focus on real-world application and placement support. These programs are typically short-term and highly practical, making them perfect for those who want quick job readiness.

Final Thoughts

Whether you're a student, a job seeker, or a professional looking to enhance your skills, accounting courses in Kerala provide a wide range of opportunities. You can choose from traditional classroom programs or convenient online accounting courses, or even go for a specialized diploma in accounting to stand out in the job market.

Take the next step toward a stable and rewarding career in accounting — explore the best course option that suits your goals today!

0 notes

Text

Popular Tally Course in Mohali - Tally Certifications

Looking to build a career in accounting or finance? Join Bright Career Solutions for the best Tally Course in Mohali and gain the skills you need to succeed in today’s competitive job market. Tally is one of the most widely used accounting software tools in India, essential for managing financial transactions, inventory, GST, payroll, and more. Contact Us

Our Tally training is ideal for commerce students, job seekers, small business owners, and working professionals who want to master Tally Prime. The course covers fundamentals of accounting, voucher entry, taxation (GST, TDS), payroll management, bank reconciliation, and generating reports like balance sheets and profit & loss statements.

At Bright Career Solutions, we focus on practical training. You’ll work on real-life case studies and exercises that prepare you for actual work environments. Our expert trainers provide step-by-step guidance, ensuring you build strong, job-ready skills.

We also offer flexible timings, weekend and weekday batches, and 100% placement assistance. Whether you're starting your career or upgrading your skills, our Tally course will help you achieve your goals.

Enroll today at Bright Career Solutions – Mohali and take your first step toward a successful accounting career. Call now to book your free demo class!

1 note

·

View note

Text

"Mastering Tally: A Comprehensive Guide to Accounting Automation"

What is Tally?

Tally is a popular accounting software used by businesses of all sizes to manage financial records, inventory, taxation, payroll, and more. Renowned for its user-friendly interface and robust features, Tally simplifies accounting tasks and streamlines business operations.

Whether you’re a small business owner or part of a large corporation, Tally helps you automate and maintain your accounting systems with ease, ensuring accurate financial data and compliance with tax laws. With Tally, financial reporting and decision-making become more efficient, allowing businesses to focus on growth and success.

Why Choose Us for Your Tally Course?

If you're considering a Tally course, you’ll want to make sure you’re learning from a trusted and experienced provider. Here’s why our Tally course is the best choice for you:

Comprehensive Curriculum: Our Tally course covers everything from the basics of accounting principles to advanced features like GST integration, payroll management, and data security. Whether you’re a beginner or have prior experience, our course is designed to cater to your needs at every stage.

Practical, Hands-On Learning: Tally is best learned through practice. Our course offers real-time projects, assignments, and exercises that allow you to apply what you learn in real-world scenarios. You’ll walk away with practical knowledge that can be applied immediately in your job or business.

Expert Instructors: Our instructors are certified Tally professionals with years of experience in teaching and using Tally in various business settings. They guide you through the course, ensuring you understand every concept, from basic data entry to complex financial reports.

Certification: Upon successful completion of the course, you’ll receive a Tally certification that validates your skills and knowledge in the software. This certification can boost your career prospects and help you stand out in a competitive job market.

Job Placement Assistance: We don’t just teach you Tally; we help you launch your career. Our job placement assistance program connects you with leading companies that are actively looking for Tally-certified professionals. Whether you’re seeking a job in accounting, finance, or business management, our network helps you find the right opportunity.

Ongoing Support: Our commitment to your success doesn’t end with the course. We offer post-course support through online forums, Q&A sessions, and access to updated learning materials. You’ll always have access to guidance when you need it.

Benefits of Tally After Completing the Course

After completing a Tally course, you’ll gain a wide range of benefits that will enhance your career and skillset:

Master Financial Management: Tally enables you to efficiently manage financial data, including accounts, ledgers, invoicing, and balance sheets. Mastering these concepts will make you proficient in managing both personal and business finances.

Improved Career Opportunities: Accounting and finance professionals who are proficient in Tally are highly sought after. Whether you’re looking for a job as an accountant, bookkeeper, financial analyst, or payroll manager, Tally certification is a valuable asset that sets you apart from others in the job market.

Increased Efficiency and Accuracy: Tally simplifies complex financial processes, helping you to reduce manual errors and improve the accuracy of your reports. By automating calculations, Tally saves time and effort, allowing businesses to focus on their core functions.

Enhanced Compliance with Taxation Laws: Tally is integrated with GST (Goods and Services Tax) features, making tax filing and compliance easier. Once you are trained in Tally, you’ll be able to handle tax calculations, returns, and audits seamlessly, ensuring that your business remains compliant with the latest taxation laws.

Streamlined Inventory and Payroll Management: Tally also supports inventory management, helping businesses keep track of stock, purchases, sales, and invoicing. In addition, it simplifies payroll management by automating salary calculations, deductions, and statutory compliance.

Better Financial Reporting and Decision-Making: Tally generates comprehensive reports that provide valuable insights into the financial health of a business. With accurate and timely reports, business owners and managers can make informed decisions and drive growth.

Wider Industry Applications: Tally is used in various sectors, from retail and manufacturing to education and hospitality. Whether you’re working for a large corporation or a small business, Tally’s versatility makes it applicable across different industries, opening up more career paths.

Final Thoughts: Unlock Your Career Potential with Tally

In the modern business world, accounting software like Tally is indispensable. Whether you're managing finances for a startup or working in a corporate setting, Tally’s power to streamline accounting, tax filing, payroll, and inventory makes it an essential skill for any finance professional.

By completing a Tally course, you’ll not only gain proficiency in one of the world’s leading accounting tools, but you’ll also set yourself up for a successful career in finance and accounting. Tally simplifies complex processes, boosts efficiency, and helps businesses stay compliant, making you an invaluable asset in today’s data-driven world.

So, whether you want to advance in your current career or explore new opportunities, mastering Tally will empower you to manage finances with confidence and precision.

Final Thoughts: Tally – Your Key to Seamless Financial Management

In today’s fast-paced business environment, staying ahead requires efficiency, accuracy, and a deep understanding of financial management. Tally offers a comprehensive solution that empowers businesses to streamline their accounting processes, ensure tax compliance, and manage inventories effortlessly. Whether you’re an aspiring accountant or a business owner looking to simplify financial management, mastering Tally can be a game-changer.

By completing a Tally course, you’re not just learning software; you’re gaining a skill set that will enhance your career prospects, improve job performance, and give you a competitive edge in the finance and accounting world. With Tally’s user-friendly interface and powerful features, you’ll be equipped to manage financial data accurately, automate routine tasks, and generate insightful reports that drive better business decisions.

Ultimately, Tally is more than just accounting software—it’s a tool that bridges the gap between complex financial processes and seamless business management. If you're serious about excelling in the world of finance and accounting, mastering Tally is a must. So, take the leap, enhance your skills, and open the door to a wealth of professional opportunities.

0 notes

Text

GST Online Course With Certificate

GST online course with certificate is the course which you can pursue that can help you add on a great skill in your life. You’ll have good knowledge of Goods And Services Tax, GSTR1, GSTR3B, GSTR2B, GSTR2A, How to do tax calculations and other stuff that accountants do.

GST online course with certificate syllabus/curriculum:

Introduction to GST (Goods And Services Tax)

Types of Gst (CGST, SGST, IGST, and UTGST)

Tax Slabs (5%, 12%, 18%, and 28%)

Input tax Credits

GST valuation

GST Returns

GST Penalties

GST Payments

GST Registration

By the end of the course, you’ll have the skill of Goods And services tax (GST Online Course With Certificate). And will receive the certification after the completion of the course that will help you build a strong portfolio that can help you in your higher education and in also landing an articleship, or in pursuing a job in the financial profession.

For More Information Visit Us: https://www.digischema.com/certified-accounting-course/

#Accounting Course#Online Tally Prime Course#Gst Online Course#Digital Accounting Course#Tally Prime Course Online#Articleship#job placement#Digi Schema

0 notes

Text

Best E-Accounting institute in Delhi

Bookkeeping has grown beyond worksheet plus basic journals in the fast-paced technological world. In the rapid world, in addition to having a solid and excellent grasp of accounting basics, companies right now need specialists who are skilled at using modern applications, i.e., Tally ERP, GST software, and other cloud-based bookkeeping systems. This is where online bookkeeping comes into the picture, and selecting a good institute can have major consequences. Registering at the finest e-accounting school in delhi is the first step toward achieving professional success if you want to work in the finance and bookkeeping industry.

The importance of digital accounting

In the modern industry, employing digital tools and systems to record, oversee, and examine spending is know as digital accounting. Almost all companies, irrespective of size, now use digital bookkeeping systems as a result of the introduction of the gst and the Digital India efforts. whether youre a fresh hire or a seasoned expert looking to advance your career, e-accounting provides you with real-world knowledge that is extremely pertinent to the demands of the industry today. Delhi's top e-accounting school, a step in the right direction with its extensive curriculum, industry-focused training, and placement support, insert institute name here distinguishes itself among the many other institutes in the capital. Here's why its regarded as the greatest.

The premier online accounting institutes main characteristics consist of industry-related curriculum important subjects including tally prime gst filing income tax payroll excel sap and quickbooks are covered in the courses skilled faculty instructors have years of hands on experience in E- accounting and finance and company professionals provides hand on practioners to assist children develop the confidence instructonal vedios like live projects that are incorporated 100 inclusion support that provide students can get employment quickly finishing the education thanks to the institutes partnerships with top businesses reasonably priced tuition instruction at an pocket friendly cost customised batches children and working proffessionals can enroll from the website weekend and evening programs.

Students' feedback

In just three months, I gained more than I did in my whole accounting education in college. In just 30 days i was ready to secure my first job thanks to the employment assistance verma anjali the course material is current, and the staff is very helpful. Highly recommended for anyone who takes bookkeeping seriously. Rohit Sharma's

conclusion

choosing the best electronic accounting systems school is a necessity if you wish to remain active in the employment market delhi an important center of both education and business has a lot to offer yet very few of them are truly worthwhile with its advanced resources practical learning and recruitment assistance insert institute name turns out to be the most worthwhile decision you could possibly make for the days to come

1 note

·

View note

Text

Digital marketing course in Delhi with placement

The Digital Marketing Course offered by Cimetrix Institute of Information Technology (CIIT) in Dwarka Mor, Delhi, is a career-focused program designed for individuals aiming to build a strong foundation in the digital marketing industry. Recognized by various government bodies, including the Ministry of Electronics & IT, MSME, and the Department of Labor, Government of NCT Delhi, CIIT stands out as a trusted and certified institution in professional skill development.

The course spans 3 months and is structured to deliver both theoretical knowledge and hands-on practical training. Students learn key digital marketing components such as Search Engine Optimization (SEO), Social Media Marketing (SMM), Pay-Per-Click (PPC) advertising, Email Marketing, Content Marketing, and Google Ads, all while working on live projects to build real-world experience.

What makes CIIT’s digital marketing course especially attractive is its 100% placement assistance. The institute has a dedicated placement cell that guides students through resume preparation, interview training, and connects them with job opportunities across digital marketing agencies, startups, and corporate firms.

With a course fee of ₹12,000 + GST, CIIT offers an affordable yet high-quality training option for students, job seekers, and professionals looking to upskill. The minimum qualification required is 10th grade, making it accessible to a wide range of learners.

Located near Dwarka Mor Metro Station, the institute is easily reachable for students across Delhi. CIIT's emphasis on practical learning, government recognition, and strong placement support makes it a top choice for digital marketing education in Delhi.

1 note

·

View note

Text

Best Online Degree Programs in India: UGC-Approved UG & PG Courses at Parul Online

Looking to upgrade your qualifications without giving up your job? You are not alone. Many working professionals and lifelong learners in India are now turning to online education. They want flexibility, quality, and career-ready skills. If that sounds like you, then Parul University Online offers some of the best online degree programs in India.

Why Parul University Online?

You need more than just a degree. You need one that is UGC-approved, industry-relevant, and flexible enough to fit into your lifestyle. Parul University Online checks all those boxes. It is backed by a NAAC A++ grade and offers programs that match the expectations of both employers and students.

You get online UG degree courses and online PG courses in India designed for busy schedules. There’s no need to travel. You can attend classes anytime and from anywhere. Whether you are in a metro or a Tier-3 town, you get the same level of access.

Online UG Degree Courses to Build Strong Foundations

Parul Online offers several undergraduate programs that prepare you for modern industries:

Bachelor of Business Administration (BBA) – Ideal if you want to enter the corporate world or start your own business. You learn about marketing, HR, and finance.

Bachelor of Computer Applications (BCA) – Great for tech-savvy students. This course focuses on IT, programming, and software development.

Bachelor of Arts (BA) – A flexible liberal arts degree. Choose from majors like Psychology, Journalism, or English. You can also add minors like Political Science or Sociology.

All these courses are UGC-approved and fully online. The fee starts from ₹18,500 per semester, making them affordable too.

Online PG Programs to Advance Your Career

If you are already working, a master’s degree can take you further. Parul Online offers:

MBA (Master of Business Administration) – One of the most popular online PG courses in India. Over 20 specialisations are available, including Digital Marketing, Business Analytics, and Project Management.

MCA (Master of Computer Applications) – Perfect for those in the tech field. Focuses on data science, AI, and cybersecurity.

M.Com, M.Sc, MA, MSW – Designed for professionals in finance, science, social work, and media.

These degrees carry the same weight as regular on-campus programs. The MBA course costs ₹37,500 per semester. The university even offers free certifications in subjects like GST, Excel, and Project Management.

Flexibility That Fits Your Life

As a working professional, you need flexibility. Parul Online provides:

Recorded video lectures so you can learn anytime

Live interactive sessions for doubt clearing

LMS access with real-time performance tracking

Self-paced modules to study at your convenience

This learning style helps you stay on track without missing out on job responsibilities or family time.

Trusted and Recognised

Parul University is not just another online provider. It holds:

UGC-DEB approval for distance learning

AICTE approval for technical programs

NAAC A++ accreditation – among the highest in India

This means your degree will be recognised by employers, government bodies, and international institutions.

Real Career Opportunities

Employers now value online degrees if they come from accredited institutions. In fact, over 30% more companies are hiring graduates from online BBA and MBA programs, especially when they bring real-world skills and certifications. (Source: India Skills Report 2024)

Parul Online supports your career growth with:

Job placement assistance

Internships through industry tie-ups

Soft skill training and resume support

You get not just a degree, but a complete career package.

Join the Future of Learning

The Indian online education market is growing fast. It's expected to reach $7.57 billion by 2025, with more than 50 million students joining online universities globally by 2029. (Source: Market Research Future, 2024)

Don’t wait for the right time. The right time is now.

Take the Next Step with Parul University Online

Ready to earn a UGC-approved online degree from the best online university in India? Explore Parul University Online’s flexible and affordable programs today. Whether you choose a BBA, MBA, BCA, MCA, or any other course, you will gain knowledge, skills, and credentials that open doors.

Start your journey at Parul University Online. Learn at your pace. Grow at your speed. Succeed your way.

0 notes

Text

Remote Work & Global Opportunities: Why Accounting is a Smart Choice in 2025, 100% Job, Accounting Course in Delhi, 110019 - Free SAP FICO Certification by SLA Consultants India, GST Certification, ITR & DTC Classes with 2025 Update, Tally Prime Certification,

Accounting is a smart career choice in 2025, especially for those seeking remote work flexibility and global opportunities. The digital transformation of finance and accounting has accelerated the adoption of remote roles, allowing professionals to work for companies anywhere in the world from the comfort of their homes. In Delhi and across India, there is a growing demand for accountants who can manage financial records, ensure compliance, and provide strategic insights using advanced accounting software—skills that are highly valued by both domestic and international employers.

Accounting Course in Delhi

Remote accounting jobs are now widely available, with platforms like Indeed and Internshala listing numerous opportunities for roles such as Accounting Executive, Bookkeeper, Senior Accountant, and Financial Analyst. These positions span industries—finance, technology, healthcare, retail, and consulting—and are offered by top companies such as Deloitte, TCS, PwC, Infosys, and Accenture. Remote work in accounting not only provides flexibility and a better work-life balance but also opens doors to global employment, enabling professionals to collaborate with international teams and gain exposure to diverse business practices.

Accounting Training Course in Delhi

To succeed in remote accounting roles, professionals need a strong foundation in both core accounting principles and digital tools. Proficiency in software such as SAP FICO, Tally Prime, and advanced Excel is essential for managing financial data, automating processes, and ensuring compliance with regulations like GST, ITR, and DTC. Additionally, soft skills such as communication, adaptability, and self-discipline are crucial for effective collaboration in remote teams and for building trust with clients and colleagues. The ability to interpret financial data, provide actionable insights, and navigate complex regulatory environments is what sets successful remote accountants apart.

E-Accounting, E-Taxation and E-GST Course Modules Module 1 – Advanced Goods & Services Tax Practitioner Course - By CA– (Indirect Tax) Module 2 - Part A – Advanced Income Tax Practitioner Certification Module 2 - Part B - Advanced TDS Practical Course Module 3 - Part A - Finalization of Balance sheet/Preparation of Financial Statement & Banking-by CA Module 3 - Part B - Banking & Finance Module 4 - Customs / Import & Export Procedures - By Chartered Accountant Module 5 - Part A - Advanced Tally Prime & ERP 9 Module 5 - Part B - Tally Prime & ERP 9 With GST Compliance Module 6 – Financial Reporting - Advanced Excel & MIS For Accounts & Finance - By Data Analyst Trainer Module 7 – Advanced SAP FICO Certification

A comprehensive Accounting Certification Course in Delhi offered by SLA Consultants India, is specifically designed to prepare students for the demands of remote and global accounting careers. The curriculum includes free SAP FICO certification, GST certification, ITR & DTC classes with the latest 2025 updates, and Tally Prime certification. These credentials are recognized by employers worldwide and ensure that graduates are equipped with the technical and regulatory knowledge needed to excel in today’s job market. With a 100% job guarantee and robust placement support, the course provides students with hands-on project experience, real-time client exposure, and the skills needed to secure high-paying, future-proof jobs—whether remote, hybrid, or on-site. In summary, accounting in 2025 offers unparalleled flexibility, global opportunities, and strong career prospects for those who invest in the right education and skills. For more details Call: +91-8700575874 or Email: [email protected]

0 notes

Text

Make a Career After B.Com with These Top Courses

What Can I Do After B.Com Graduation? – B.Com के बाद क्या करें?

B.Com graduation ke baad kya karein? Ye सवाल हर commerce student के mind में आता है। Today’s competitive world में सही career choose करना बहुत जरूरी है। Let’s explore real, practical, और valuable options आपके लिए।

🎓 Understanding Career Scope After B.Com – B.Com के बाद करियर की दिशा

B.Com के बाद बहुत से career options available हैं। Aap apni interest, skill set aur goal ke according चुन सकते हैं। चाहे आप job करना चाहते हों या आगे की पढ़ाई, दोनों के लिए रास्ते खुले हैं।

Career चुनने से पहले अपने strength और weakness को समझना जरूरी होता है। इससे decision लेना आसान हो जाता है।

🧑💼 Government Jobs After B.Com – Sarkari Naukri ke Mauke

अगर आप secure aur stable job चाहते हैं, to government sector एक अच्छा विकल्प है।

✅ Banking Exams – बैंकिंग में करियर

B.Com students ke liye IBPS, SBI PO, Clerk, और RBI जैसे exams काफी popular हैं।

इन exams के लिए आप graduation के बाद eligible होते हैं। Good preparation से आप अच्छी post पा सकते हैं।

✅ SSC & UPSC – Competitive Exams ke Options

SSC CGL और UPSC exams भी एक बड़ी opportunity provide करते हैं। इसमें आपको government officer बनने का मौका मिलता है।

Preparation ke liye time aur dedication दोनों चाहिए, लेकिन result life-changing हो सकता है।

📚 Professional Courses After B.Com – B.Com के बाद Professional पढ़ाई

Professional course आपकी salary aur job options दोनों को boost करता है।

📘 Chartered Accountancy – CA Course

अगर accounts aur auditing में interest है, to CA एक best career option है।

Institute of Chartered Accountants of India (ICAI) ये course conduct करता है। Duration lagbhag 4-5 साल होती है।

CA बनने के बाद salary ₹8-25 LPA तक जा सकती है।

👉 Source: ICAI Official Site – https://www.icai.org

📘 Company Secretary – CS Course

Law aur compliance ke field में interest है, to CS course try कर सकते हैं।

ये course Institute of Company Secretaries of India (ICSI) द्वारा conduct किया जाता है।

CS professionals को MNCs में high level पर jobs मिलती हैं।

👉 Source: ICSI Official Site – https://www.icsi.edu

📘 Cost and Management Accounting – CMA Course

Finance aur costing में अगर आपका interest है, to CMA course आपके लिए perfect है।

CMA professionals manufacturing aur production sectors में काफी demand में होते हैं।

👉 Source: ICMAI Site – https://icmai.in

💼 Job-Oriented Diplomas – B.Com के बाद Short-Term Courses

अगर आप jaldi job करना चाहते हैं, तो diploma courses अच्छा विकल्प हैं।

💻 E-Accounting Course – Practical Knowledge ke Saath

B.Com ke baad Tally, GST, SAP, BUSY जैसे software सीखकर आप accountant बन सकते हैं।

The Institute of Professional Accountants जैसे institutes इन courses में expert हैं।

👉 Duration: 3-6 months 👉 Placement: Local & MNC companies में jobs

💻 Digital Marketing – Online Business ka Superstar

Marketing में interest रखने वालों के लिए ये course best है। SEO, social media aur Google Ads सीखकर आप freelancing भी कर सकते हैं।

Job opportunities IT, fashion, education, और हर sector में मिलती हैं।

🎓 Higher Education Options – B.Com के बाद और क्या पढ़ें?

Agar आप पढ़ाई continue करना चाहते हैं, to आगे भी ��हुत से academic options हैं।

📖 M.Com – Master of Commerce

M.Com ek traditional aur deep study वाला course है। यह आपको teaching aur research field में help करता है।

University aur college lectureship के लिए ये degree important होती है।

📖 MBA – Master of Business Administration

MBA सबसे popular course है। Specializations जैसे finance, HR, marketing में aap अपनी रुचि के अनुसार choose कर सकते हैं।

MBA करने के लिए आपको entrance exams जैसे CAT, MAT, या XAT clear करने होते हैं।

Top B-schools में admission मिलने पर आपकी salary काफी high हो सकती है।

👉 Source: IIMs & MBA portals

🌏 International Options – B.Com के बाद Foreign Studies

B.Com के बाद आप abroad जाकर भी पढ़ सकते हैं।

🌍 ACCA – Global CA Course

ACCA (UK) एक global course है, jo aapko international career देता है। Is course की recognition 180+ देशों में है।

Work visa के chances भी इस course के बाद बढ़ जाते हैं।

👉 Duration: 2-3 years 👉 Source: https://www.accaglobal.com

🌍GRE/GMAT ke Through Masters Abroad

Aap GRE ya GMAT clear karke US, Canada, UK jaise देशों में masters कर सकते हैं।

International exposure se आपको better salary aur growth मिलती है।

Freelancing & Entrepreneurship – खुद का Business शुरू करें

अगर आप खुद के boss बनना चाहते हैं, to freelancing aur business ek great path hai।

💡 Freelancing in Finance & Taxation

TDS, ITR filing, GST return जैसे काम में freelancing के जरिए भी income की जा सकती है।

Proper certification और clients se अच्छे earnings possible हैं।

💡 Start Your Business – Startup ke Options

Small business ideas जैसे coaching, boutique, e-commerce store start किए जा सकते हैं।

B.Com का finance knowledge आपके काम आएगा। Govt schemes जैसे Mudra Loan से मदद मिल सकती है।

📌 Skill Development is Key – Skills Jo Career Banayen

Skill bina career banana mushkil होता है। इसलिए B.Com ke baad in skills पर काम करें:

Communication Skills – Interview aur client dealing में helpful

Excel & PowerPoint – Office jobs के लिए जरूरी

Problem Solving & Decision Making – हर professional field में useful

Time Management – Effective काम के लिए जरूरी

🔍 Final Thoughts – B.Com के बाद क्या सबसे Best है?

To answer the main question: "What can I do after B.Com Graduation?" — options unlimited हैं।

आपका interest, effort aur passion decide करता है कि कौन-सा रास्ता आपके लिए सही है।

Chahe आप CA बनेin, MBA करें, freelancing करें ya business start करें — success possible है।

सिर्फ एक चीज जरूरी है – consistency and smart effort.

📢 Expert Tip: Planning + Action = Success

Career एक marathon है, sprint नहीं। सही information ke साथ plan करें, फिर action लें।

Consult career counsellors, mentors, aur industry experts se जरूर बात करें।

👉 Pro Tip: Start small, think big, grow fast!

✅ Article Summary:

Option

Path

Duration

Career Scope

CA

Professional Course

4-5 Years

High

CS

Legal Compliance

3-4 Years

Moderate

MBA

Post-Graduation

2 Years

High

E-Accounting

Job-Oriented

3-6 Months

Quick

Freelancing

Self-Employment

Flexible

Growing

Government Jobs

Competitive Exams

1-2 Years

Secure

Accounting interview Question Answers

Tax Income Tax Practitioner Course

How to become an income tax officer

Learn Tally free online

Best Accounting Training Institute

journal entries questions with answers

What is B Com full form

Highest Paying Jobs in India

ICWA Course

Short Cut keys in tally

Tally Prime free download

Tally Prime Features

Meaning of sundry debtor creditor

Income Tax Return Filing services

Education Business ideas

Accounting Entry

Income Tax

Accounting

Tally

Career

0 notes