#gst certification

Explore tagged Tumblr posts

Text

Top 9 GST Certification Courses In India With Placement Opportunities

Explore the top 9 GST certification courses in India, offering certified GST courses, GST accounting courses, and placement opportunities. Get your certificate course in GST now!

#gst certification course india#gst certification course#online certificate course in gst#best gst certification course#gst certification course online#gst practitioner certification course#gst courses in india#gst practitioner certificate course#gst course with placement#diploma in gst course#gst certification#course for gst practitioners#gst certificate course online#gst certification courses#gst courses#online gst course certificate#certified gst course#certification course on gst#gst course#course on gst#gst accounting course#certificate course in gst#gst courses in kolkata#gst course online#gst training online

0 notes

Text

The Impact of GST on Exporters: New Opportunities

The introduction of the Goods and Services Tax (GST) represented a watershed moment in India's taxation environment, impacting many industries, including the export industry. GST presented both obstacles and possibilities for exporters, transforming the way international commerce is done. This detailed handbook examines the effect of GST on exporters, examining the changes, advantages, and tactics that have resulted. Exporters may manage the difficulties of global commerce with more efficiency and success by exploring the various pathways and opportunities that GST has opened up.

1. Introduction

GST was implemented in India to simplify the tax system, reduce cascading effects, and streamline tax administration. GST brought substantial changes that impacted different areas of exporters' business.

2. The Evolution of Export and GST Taxes

Exporters have experienced difficulties due to complicated tax regimes, export taxes, and administrative impediments. The GST Mumbai attempted to solve these concerns by establishing a consistent tax framework.

3. Important GST Changes for Exporters

GST brought various reforms that benefited exporters, such as zero-rated supply, streamlined refund methods, and access to Input Tax Credit (ITC) on inputs and input services.

4. Improving Export Compliance and Documentation

GST simplified export paperwork by standardizing processes such as export invoices and freight bills. The Letter of Undertaking (LUT) has become an essential document for exporters.

5. Increasing Competitiveness and Saving Money

The abolition of the Central Sales Tax (CST) and decreased levies under GST increased exporters' competitiveness in the global market while lowering overall tax burdens.

6. Exporters' Difficulties

Despite the favorable developments, exporters faced obstacles such as operating capital obstruction owing to delayed reimbursements and refund processing complications.

7. Export Benefits Maximization Strategies

Exporters may use tactics to successfully handle difficulties. Efficient refund claim handling, technology integration for compliance, and capitalizing on export promotion programs are all required.

8. Global Perspective: Implications for International Trade

GST influences India's boundaries, altering international trade dynamics, supply chain optimization, and the worldwide competitiveness of Indian exports.

9. Prospects for the Future and Potential Reforms

Potential GST revisions may solve issues experienced by exporters, improve refund procedures, and provide an even more hospitable climate for foreign commerce as the system evolves.

Conclusion

The effect of GST on exporters demonstrates the fluidity of taxation policies. Exporters may position themselves as nimble participants in the global trade arena by embracing the changes and possibilities afforded by GST. Understanding the subtleties of GST and its effects is critical for exporters to negotiate obstacles, grasp new opportunities, and drive development in the international market as the export environment transforms.

0 notes

Text

NIFM Institute in Mumbai — Best Stock Market Training Courses in Mumbai

NIFM Institute in Mumbai is the best share market classes in Mumbai for stock market trading & training. At NIFM, we’ve always been partial to independent thinkers. Where we’ll teach you not only how to trade in the share or financial market but also how to make a living out of it in our stock market courses in Mumbai. NIFM share market training programs are simple to understand and easy to follow with practical case studies in an organized manner with a systematic flow. In our stock market courses, we will teach you to learn every factor that can affect stock market industry ups and downs, when to enter or exit, money-making strategies, discipline in the stock market, and control risk and loss.

Overview of Stock Market Courses in Mumbai

Trading in the stock market is a process that requires constant thinking, analysis, and discipline. What you think and what you choose determines your success in the business.

NIFM is the pioneer institute of stock market trading courses in Mumbai. Our institution has been focusing on providing qualitative stock market trading knowledge for over a decade in India. NIFM believes in classroom & practical sessions where the interaction of experienced trainers and other participants brings out the best results and clears all doubts about the toughest topics and makes them crystal clear. NIFM has helped thousands of investors learn the skills necessary to have the ability and confidence of the pros. We are the only stock market institution having 20+ branches all over India, where 50,000+ students have done certification of stock market courses, Job oriented courses, investor & trader courses under the supervision of industry experts. We have exclusively developed job oriented courses with 100% placement assistance for those who want to make a career in the stock market. NIFM has 6+ branches or institutes for stock market courses in Maharashtra.

Services offered by NIFM — Share Market Courses in Mumbai

Here in Mumbai, NIFM is offering 20+ stock market courses with certification and 100% placement assistance in top companies. They focus on more practical (75%) training than theoretical (25%) training. Students work on practicalities with the budget in hand to get more enhanced knowledge of trades, when to buy or sell stocks, market ups, and downs. This builds more confidence in students to find out when is the best time to enter the market or the right time to invest in stocks.

NIFM has courses for all 12th pass out students, graduated students, businessmen, investors, traders, housewives, retired persons. The availability of every generation of students makes our atmosphere more interesting, where all students can learn with the life experiences of others.

Stock Market Beginners Courses: If you are a fresher or beginner in the stock market then this certification course is for you. We helped you to learn all the basics of the share market with experts and be a market expert within 3 months.

Beginners to Advance level courses: NIFM offers Diploma & Advance Diploma courses in the stock market. Learn fundamental, technical analysis, industry up and down, the best time to buy and sell stocks. These courses offer 100% job assistance.

Job Oriented Courses: NIFM has exclusively developed job oriented courses for those who want to make their careers in the financial market or the stock market. They trained students according to the best industry requirements.

Trading and Investment Courses: This is one of the best courses to become a trader or investor in the stock market.

Technical Analysis Courses: Technical Analysis not only helps you understand the profit target but also aware of the risk involved in the trade. We teach the secrets of successful traders, We teach unique ideas to trade in Intraday, Swing trade, Short term delivery, Futures & Options.

NCFM NSE certification courses: Courses for NCFM Certification exam, and exclusively developed mock test papers which covers all syllabus for the examination.

NISM SEBI certification courses: NISM Certification courses to help students to crack the examination.

Diploma in Equity Sales Certification: This course is divided into 6 modules: Capital Market Module, Derivative Market Module, Currency derivatives module, Mutual Fund Distributors module, Investment Advisor (Level 1) and Equity Sales module.

Fundamental Analysis Crash Course: This course will help to understand all these aspects analysis of data, news, events, correlation, the impact of these while trading in the stock market or investing in other market segments.

Online Stock Market Courses: NIFM also offers online courses for those who want to learn online about day trading, trading basic terminology, how online trading systems work, Forex trading, swing trading, stock prices, live trading, and the stock exchange.

Why Choose NIFM, Best Stock Market Courses in Mumbai

Depth knowledge with practical exposure

75% practical exposure, 25% theoretical exposure

Certification after completion of course

Faculties over 30+ years of experience.

We work for all-round development for the student.

Students visits in NSE, BSE, SEBI offices

100% job assistance in topmost companies

100% support given to pass out students if any updating took place in course.

Conducting regular seminars for students by experts & industry.

Some unique courses are available only with NIFM.

Advance lab equipment/software for practical training.

Stock Market Courses Free Videos

NIFM made stock market trading learning easy for you with these free videos, you can watch and learn fast and earn fast with NIFM.

Click to enjoy your free videos today!

NIFM Preferred Employers

Our clients- Axis Securities, HDFC Securities, Kotak Securities, ICICI Direct, Motilal Oswal, Standard Securities, NIIT, Tradebulls, Bajaj Capital, SMC, Angel Broking, Advisory Mandi, Indiabulls Ventures, Nirmal Bang, Safe Express, IDBI Capital, Elite Wealth, Bonanza, Karvy Stock Broking, SAS Online, Mansukh, Silver skills, Parasram, Trustline, Zerodha, Jana Bank, LKP, BLB, etc

Seminars & Workshops at NIFM MUMBAI

NIFM organized seminars, events, and workshops to get engaged with our students and keep them up-to-date according to industry requirements. Click the link to watch some glimpse of our NIFM Capital Market Conclave 2019.

Any Doubts or Enquiries?

If you have any doubts and inquiries regarding the stock market industry or want brief counseling for your course, please reach us by filling this form — Contact Us for stock market courses enquiries. Our Counselor will reach and help you to suggest the best courses for your career, investment or trading purposes.

Reach NIFM MUMBAI

We are established in a prominent location in Parel, Mumbai. It is an effortless task in commuting to our establishment as there are various modes of transport readily available. It is at Shop №6, Kingston Tower, GD Ambekar, Road, Parel East, Mumbai, Maharashtra 400033

Source of Content: https://www.nifm.in/blog-details/387/stock-market-courses-in-mumbai.php

#stock broking courses in mumbai#share market training in mumbai#share trading courses in mumbai#stock market classes in mumbai#accounting taxation course in mumbai#stock market institute in mumbai#stock trading courses in mumbai#market investment courses in mumbai#stock market courses in mumbai#share market courses in mumbai#share market classes in mumbai#trading institute in mumbai#share market coaching in mumbai#trading classes in mumbai#share market institute in mumbai#best stock market institute in mumbai#accounting & taxation courses in mumbai#gst certification course in mumbai#gst course online in mumbai#gst online classes in mumbai#gst filing course in mumbai#gst online course with certificate in mumbai#gst certification course online in mumbai#gst course in mumbai#stock market trading in mumbai#share market trading in mumbai#trading course in mumbai#stock market for beginners in mumbai#financial accounting in mumbai#online accounting courses in mumbai

2 notes

·

View notes

Text

All GST registered businesses have to file monthly or quarterly GST returns and an annual GST return based on the type of business. GST Return Filing is mandatory in nature and non – filing will attract penalty and may result of GST Cancellation also. Simplify the GST return filing process for your small business with our comprehensive guide. Stay compliant with India’s GST regulations effortlessly.

Read More >> https://setupfiling.in/gst-return-filing/

#gst registration check#tax system#e file income tax return#tax portal#tax tutorial#free online certificate courses in taxation in india#apply for gstin number#one tax#gst account opening#gst registration requirements#tax ser#file your taxes login#gst website india#invoice without tax#search gst number by name#my gst certificate#online tax app#us gov tax filing#goods and services tax e invoice system#apply for gstin#tax filing india#register with gst#new gst registration online

1 note

·

View note

Text

Looking for the best GST return filing online course? You are in the right place. The Course covers How to prepare & Claim GST Refund from the Basic to Advanced level, covering all Taxation parts related to GST Refund, legal aspects, major compliances and Procedures. Join today! For more information, you can call us at 7530813450.

#gst registration service#income tax certification course#partnership firm registration services#best income tax course#gst filing training#best income tax course online#basic gst course online#best income tax preparation courses

0 notes

Text

Digital Signature Certificate (DSC) Registration: Complete Guide for Individuals & Businesses

1. 🧾 What is a Digital Signature Certificate (DSC)? A Digital Signature Certificate (DSC) is a secure digital key issued by certifying authorities to validate and authenticate the identity of the certificate holder. DSC is used to sign documents electronically and ensure data integrity, authenticity, and non-repudiation during online transactions. It is mandatory for various regulatory filings…

#Digital Signature Certificate#DSC eligibility#DSC for GST#DSC for TDS#DSC registration#eMudhra DSC#Indian DSC process#MCA DSC filing#taxcrux DSC guide#USB token DSC

0 notes

Text

Digital Signature Certificate Services in Noida

In today’s fast-paced digital world, securing online transactions and documents is more important than ever. Whether you're filing income tax returns, incorporating a company, participating in e-tendering, or signing PDFs electronically, a Digital Signature Certificate (DSC) is essential. Businesses and professionals in Noida can now benefit from quick and reliable Digital Signature Certificate Services in Noida provided by Aarya Solutions, a trusted name for compliance and digital solutions.

What is a Digital Signature Certificate?

A DSC is a secure digital key issued by certifying authorities to validate and authenticate the identity of the certificate holder. It is widely used for:

e-Filing of Income Tax Returns (ITR)

GST filings

MCA/ROC compliance filings

e-Tendering and e-Procurement

Signing digital documents and agreements

Types of DSCs Offered

Aarya Solutions provides all classes of DSCs based on user needs:

Class 3 DSC for e-Tendering, Trademark Filing, and E-auctions

DGFT DSC for import-export code holders

Individual & Organizational DSCs for various legal and business purposes

Why Choose Aarya Solutions?

Authorized provider of government-approved Digital Signatures

Hassle-free online and offline DSC application process

Fast turnaround with doorstep delivery in Noida

Expert support for renewal and usage guidance

With Aarya Solutions, getting your Digital Signature Certificate in Noida is now simple, fast, and fully compliant with government norms.

👉 Apply now: https://aaryasolutions.in/digital-signature-certificate-services-in-noida.html

#Digital Signature Certificate Services in Noida#DSC Provider in Noida#Buy Class 3 DSC Online#Apply Digital Signature Noida#DGFT DSC Services#eTender DSC Provider#Digital Signature for ROC Filing#DSC for GST Return Filing#Digital Signature Certificate for Individuals#Noida Digital Signature Agent

1 note

·

View note

Text

What Is a Company Registration Certificate and Why Is It Important?

Starting a business in India involves several crucial legal steps, one of which is obtaining a Company Registration Certificate. This certificate is the official proof that your business is registered with the Ministry of Corporate Affairs (MCA) and is legally recognized under Indian law. Whether you're planning to start a Private Limited Company, LLP, or Section 8 Company, having a company registration certificate is essential for legality, credibility, and long-term growth.

In this blog, we’ll explore what a company registration certificate is, its importance, and how you can get one through trusted services like Smartcorp.

What Is a Company Registration Certificate?

A Company Registration Certificate is a legal document issued by the Registrar of Companies (ROC) that confirms the incorporation of your business. Once your business is officially registered, the certificate serves as proof of existence and allows you to operate legally.

For instance, if you're registering a Private Limited Company in Coimbatore, you will receive a certificate upon successful registration through services like Private Limited Company Registration in Coimbatore.

Why Is It Important?

1. Legal Recognition

Having a registration certificate means your company is recognized as a legal entity. It allows you to open a business bank account, enter into contracts, and receive legal protections.

Explore your options with LLP Registration in Coimbatore or OPC Registration in Coimbatore for simplified structures with limited liability.

2. Builds Trust and Credibility

Clients, vendors, and investors prefer working with registered companies. A registered business with a valid certificate signals transparency and trustworthiness.

This is especially important for NGOs and non-profits. Check out Section 8 Company Registration in Coimbatore to set up a charitable organization with government recognition.

3. Mandatory for Certain Registrations

You need a company registration certificate to apply for:

GST Registration in Coimbatore

FSSAI Registration in Coimbatore

Import Export Code (IEC) Registration in Coimbatore

ISO Certification in Coimbatore

All these certifications are crucial if you plan to operate in regulated industries, deal with food products, or trade internationally.

How to Get a Company Registration Certificate in Coimbatore?

Getting your business registered is easy with professional support. Services like Trust Registration in Coimbatore and Partnership Firm Registration in Coimbatore ensure your company is structured correctly and gets legally certified.

Step-by-Step Process:

Choose Your Business Type – Decide if you want a Private Limited Company, LLP, Section 8 Company, or Nidhi Company.

Obtain Digital Signatures (DSC) – Required for all directors or partners.

Apply for Name Approval – Get a unique company name through the MCA portal.

File Incorporation Forms – Submit forms with relevant documents.

Receive the Certificate – Once verified, you'll receive the Certificate of Incorporation.

Additional Legal Benefits

Once you have your certificate, you can move ahead with further legal protections like:

Trademark Registration in Coimbatore – Protect your brand identity.

Patent Registration in Coimbatore – Safeguard your innovations.

ISO Certification in Coimbatore – Boost operational quality and international credibility.

These registrations enhance your business profile and protect your intellectual property, which is crucial for long-term sustainability.

Why Register Through Smartcorp?

Smartcorp is a trusted name for Company Registration in Coimbatore. With a full range of services including LLP Registration, Nidhi Company Registration, and FSSAI Licensing, they provide end-to-end legal assistance.

They ensure fast processing, affordable pricing, and expert advice for:

Private Limited Companies

One Person Companies

Trusts and NGOs

Final Thoughts

A Company Registration Certificate is more than just a formality — it’s the foundation of your business's legal identity. Whether you’re launching a startup, NGO, or family-owned partnership, starting with proper registration ensures you're set up for success.

If you're ready to take your business to the next level, visit Smartcorp and explore all their specialized services from GST Registration to Trademark Filing and beyond.

0 notes

Text

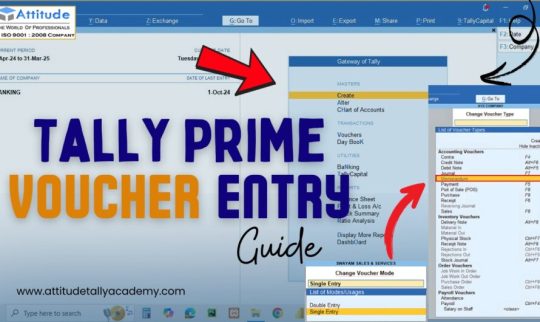

Master e-Accounting with TallyPrime: Learn Smart Financial Management

Level up your accounting skills with an in-depth e-Accounting course using TallyPrime. Designed for beginners and professionals, this course covers everything from manual accounting to GST, TDS, payroll, bank reconciliation, inventory management, and financial reporting. Learn how to create accurate books of accounts and manage real-time transactions using one of the most trusted accounting software solutions in the industry.

Whether you're looking to boost your resume or manage business finances efficiently, mastering TallyPrime is a smart investment in your career.

Start today and build a strong foundation in digital accounting!

Visit Attitude Academy📚

📍 Visit Us: Yamuna Vihar | Uttam Nagar

📞 Call: +91 9654382235

🌐 Website: www.attitudetallyacademy.com

📩 Email: [email protected]

📸 Follow us on: attitudeacademy4u

#TallyPrime Course#e-Accounting Course#Tally with GST Training#Learn TallyPrime#TallyPrime Online Course#Tally Accounting Software#GST with Tally Course#Tally Course for Beginners#Financial Accounting with Tally#Payroll in TallyPrime#TDS and TCS in Tally#Advanced Tally Course#TallyPrime with e-Invoicing#Business Accounting Course#Tally Certification Course

0 notes

Text

best computer coaching near rieva hospital | best digital marketing coaching near Rai Purwa | one of the best tally|gst course free with certificate

Unlock Your Future with the Best Computer Coaching Near RIEVA Hospital Looking to enhance your skills and kickstart a promising career in IT and business? ASDC Kanpur is your destination for the best computer coaching near RIEVA Hospital. Whether you're a beginner or someone aiming to polish your skills, our comprehensive courses are designed to meet industry demands. What’s more, our dedicated placement support ensures you get real opportunities once you complete your course.

Top-Rated Digital Marketing Coaching Near Rai Purwa In today's digital-first world, mastering online marketing is a smart move. ASDC offers the best digital marketing coaching near Rai Purwa, taught by industry experts with real-world experience. From SEO to social media and email marketing, our curriculum equips you with everything you need to excel. And yes, you’ll get full placement assistance to help you land the right job right after completing your training.

One of the Best Tally Courses in Kanpur – Now with GST & Free Certification ASDC is proud to offer one of the best Tally training programs in Kanpur, which now comes bundled with a free GST course and certificate. This combo is perfect for aspiring accountants, entrepreneurs, and commerce students looking to boost their career prospects. With hands-on learning and practical examples, you’ll gain confidence to manage real-world financial data. And our placement program will connect you with top companies hiring in this field.

Why Choose ASDC Kanpur? Our institute stands out due to its experienced trainers, state-of-the-art infrastructure, and a strong track record of student success. Whether it’s our best computer coaching near RIEVA Hospital, the top digital marketing coaching near Rai Purwa, or our Tally+GST free certificate course, every offering is tailored to help students grow. Don’t just take our word for it—check out our student success stories on our placements page.

Join ASDC Kanpur Today and Start Building Your Career The right training makes all the difference. With ASDC Kanpur, you get high-quality education, free certifications, and guaranteed placement support. From digital marketing to accounting, we’re here to prepare you for tomorrow’s jobs. Ready to make the leap? Explore our placement opportunities and see how far your skills can take you.

#best computer coaching near rieva hospital#best digital marketing coaching near Rai Purwa#one of the best tally|gst course free with certificate

0 notes

Text

How to pay income tax? What are the slab rates? Speak to experts to understand every aspects of accountings such as #GST, #TAX, #TDS, #taxfiling process. Visit us online at http://omkarstaffing.com

0 notes

Text

GST for Online Business and E-commerce: A Step-by-Step Guide

E-commerce and online businesses have totally transformed the global economy. Entrepreneurship is made easy now since it is much simpler for entrepreneurs to sell goods and services across geographical boundaries. But ease brings along with it the problem of compliance, particularly in the case of the Goods and Services Tax (GST). In this blog post, we will look at how GST has impacted e-commerce and online businesses, main compliance requirements, and how businesses can remain compliant while also obtaining maximum returns.

GST for E-commerce Businesses

GST is an indirect tax that is imposed on the supply of goods and services. It consolidates various indirect taxes such as VAT, service tax, and excise duty into one uniform tax system. E-commerce companies are governed by certain provisions of the GST Act, hence it is critical for online sellers, marketplaces, and service providers to know their tax liability.

Who Have to Get Registered Under GST in E-commerce?

E-commerce Operators (Marketplaces): Marketplaces in e-commerce such as Amazon, Flipkart, and Shopify who process sales on sellers' behalf must follow GST law.

Online Sellers & Vendors: Companies which sell products or services online either through third-party marketplaces or their own web pages are necessary to get registered for GST without regard to turnover.

Dropshipping Businesses: Those businesses running dropshipping models need to be GST compliant too, if they sell taxable goods or services.

Freelancers & Digital Service Providers: Freelancers offering digital services like graphic designing, content writing, programming, or consulting services through digital platforms need to get GST registered, if their turnover exceeds the threshold limit.

GST Registration Threshold for E-commerce Businesses

Unlike regular business units, GST registration is required only when turnover exceeds ₹40 lakhs for goods and ₹20 lakhs for services (₹10 lakhs for special category states), while e-commerce vendors have to mandatorily register under GST irrespective of turnover under Section 24 of the CGST Act.

Tax Collected at Source (TCS)

E-commerce operators (marketplaces) need to collect 1% TCS (0.5% CGST + 0.5% SGST or 1% IGST) from the sellers on the platform. The amount is withheld while paying sellers and has to be remitted to the government.

GST Return Filing

E-commerce companies need to file GST returns from time to time, depending upon their registration type:

GSTR-1: Quarterly or monthly return of outward supplies (sales).

GSTR-3B: Combined monthly tax liability return.

GSTR-8: Filed by e-commerce operators reporting TCS collected.

Place of Supply & GST Applicability

Place of supply plays an important role in identifying whether CGST, SGST, or IGST applies. For e-commerce transactions:

Intra-state sales (seller and buyer within the same state) attract CGST + SGST.

Inter-state sales (seller and buyer in different states) attract IGST.

Exports are considered zero-rated supplies, and firms are entitled to recover refund of GST paid on inputs.

Reverse Charge Mechanism (RCM)

E-commerce firms need to understand RCM, where the purchaser is required to pay GST in lieu of the supplier in certain situations (i.e., obtaining services from unregistered persons).

GST Benefits & Problems for E-commerce Firms

Benefits:

✅ Uncomplicated Tax Structure: GST is a change from several indirect taxes, making compliance less complex.

✅ Input Tax Credit (ITC): Enterprises can take credit of GST paid on procurement.

✅ Ease of Doing Business: Easy inter-state business due to GST.

✅ Promotes Compliance: Compulsory registration helps ensure transparency.

Concerns:

❌ Mandatory Registration: Small online vendors too must register, thereby enhancing cost of compliance.

❌ Different Return Filing: Multiple GST returns complicate the job of small sellers.

❌ Cash Flow Problems: TCS deduction impacts suppliers' working capital.

How Online Businesses Can Remain Compliant

Register GST Timely: Avail GST registration before initiating an online business.

Keep Proper Invoices & Documents: Provide invoices with GST compliance and keep procurement records.

Submit Returns Timely: Avoid charges by following the due dates of GST returns.

Be Aware of TCS & RCM: Be aware of deductions and liability that apply.

Claim Input Tax Credit: Record GST paid while procuring to minimize tax outgo.

Conclusion

GST compliance is required for online and e-commerce businesses in India. While it brings about challenges such as compulsory registration and TCS deductions, it also offers advantages such as uniformity of tax and input tax credit. If e-commerce companies learn about GST rules and adopt best practices, they can stay compliant while growing their business economically.

For expert assistance with GST registration and filing, consider consulting a tax professional or using online tax compliance tools. Staying informed and proactive can help businesses navigate GST complexities effectively!

#gst course in delhi#gst certification course in delhi#tally gst course in delhi#gst course duration#gst course fee#what is gst course#gst practitioner course in hindi#gst practitioner course in delhi#gst certification course online#gst certification course by government#gst courses in delhi#gst course in delhi by govt

0 notes

Text

Free GST certification Course by Government

Find a comprehensive reference to understanding GST and a free GST certification course by government.

GST is a significant change in circular levies. It has created new openings, but it has also introduced further complications. GST was introduced in 2017 to mixed responses. While large companies had the structure and were well-equipped to apply GST throughout their association, small enterprises and MSMEs demanded help grasping how GST operated and related to their operations. While GST has dropped the number of circular levies and obediences, it has also introduced several return forms and a complex invoicing structure that most enterprises need to be apprehensive of. The system got more transparent, yet there remained obstacles to overcome.

Because of the difficulties and queries, numerous enterprises outsource their GST return forms to Chartered Accountants or third-party advisers. This is where the free GST instrument training online comes in.

A GST instrument course online will enable people to help individuals and small merchandisers calculate their GST and timely submit GST returns to take advantage of the duty credit system and misbehave with statutory conditions.

But before we get into the details, let's review some fundamentals.

What is GST, and Why is it important?

Before starting our trip, let us define GST and its importance. Hence, the Goods and Services Tax( GST) is a general circular duty for selling goods and services. It streamlines taxation and fosters a united request across the country. You may facilitate your professional capacities and remain up to speed on duty legislation by studying GST ideas.

What exactly is duty?

Duty is an obligatory fiscal charge the government places on its taxpayers to finance its considerable public charges. Taxpayers must fulfill their duties, and duty avoidance is illegal.

Duty is generally classified into two types.

Direct duty A duty levied' directly' on a person's income or earnings, similar to income duty. TDS stands for duty subtracted at Source and is a type of direct duty. Direct taxation varies according to a person's income. As a result, if a person's income falls below the specified threshold, they're exempt from paying duty.

Circular duty This is assessed' laterally' on products and services rather than directly on a person's income. So, whether you buy a pencil or a Mercedes or are the CEO of an establishment or an office director, the circular duty will apply regardless of your income. Circular taxation doesn't discriminate against individuals depending on their income. Unless expressly exempted, everyone and everything is subject to circular levies. The GST is an illustration of a circular duty.

Features of the Free GST Certification Course

Find a comprehensive companion to understanding GST and a free GST certification course by government.

The GST certification course offered by the government through free training provides an excellent opportunity to broaden your knowledge without incurring fiscal costs. They are some of the course's essential features.

Comprehensive Curriculum The course covers colorful GST motifs, including enrollment, return forms, input duty credit, and more. It offers a comprehensive overview of the duty system.

Engage in interactive literacy modules, quizzes, and practical exemplifications to comprehend the ideas. This course is designed with the learner in mind.

Government Recognition Upon completion, you'll gain a certification from the government attesting to your GST knowledge.

Boost Your Career Prospects

Hence, Carrying a GST certification validates your knowledge and commitment to professional development. It improves your capsule and opens up new work opportunities. Employers award workers who completely understand GST rules, making them desirable in today's competitive work environment.

How to Enroll in the Free GST Certification Course

Enrolling in the gst certification course by government free is a simple process. Then there is a step-by-step procedure.

As a result, go to the government's GST training program's sanctioned website.

Produce an account by entering your introductory information.

Launch literacy at your own pace by penetrating the course content.

Track your progress by completing the tests and quizzes.

Download your government-issued instrument once you've finished the course.

Once you have completed the course, download your government-issued instrument.

OVERVIEW OF GST

What Exactly is GST?

GST is a significant step towards achieving' One Nation, One Duty.' GST, an acronym for Goods and Services Tax, was enacted on July 1, 2017. GST has superseded preliminary applicable levies similar to

Service duty This was assessed based on services performed by the service provider.

Value Added Tax. This duty was assesse on the trade of products by providers. On the other hand, Handbasket has yet to be completely excluded and remains applicable to some goods, similar to the trade of spirits.

This duty was levied on room deals at luxury hospices.

Customs are still in effect for significance, although GST has replaced the BCD element for businesses.

GST is divided into the following orders

IGST The Integrate Products and Services Tax( IGST) is levied when products or services are deliver from one state to another, i.e., interstate inventories.

CGST & SGST The Central Products and Services Tax( CGST) and the State Goods and Services Tax( SGST) are levied when products or services are delivered inside the same state, also known as intra-state inventories. The duty is resolve unevenly between the center and the States.

Some immunity and GST Rate Applicability

Depending on the HSN law, the GST rates are 5, 12, 18, or 28. Nearly all goods and services are subject to GST governance. Still, certain products and services are pure from GST. Although, unlike tax governance, no exclusive negative list is supplied, GST doesn't apply to many particulars and services.

GST Certification Course Online for Free

GST certification courses are accessible online through a variety of providers. Hence, you may become a good GST practitioner by taking these courses. Some may be free but give different benefits than a paid GST certification course. Still, colorful styles give GST certification at a fair price and may give far lesser returns than the costs spent.

The IIPTR Institute

The IIPTR Institute offers top-notch online GST training to meet the demands of implicit GST practitioners. Their GST certification course provides an overview of the GST laws taught by various GST professionals. The path leads you through an in-depth understanding of GST's experimental processes, making you GST-ready at the conclusion. Scholars, CAs, CSs, commerce graduates, and anyone interested in taxation can enroll in the course.

We provide Tax Consultant Course, GST Certification Course, Diploma in GST, GST Online Courses, Govt Practitioner Pro, and other services.

ICT Academy

It offers free mindfulness sessions on GST, which feature a series of videotape sessions by subject-matter experts, famed industrialists, and commercial leaders. ICT Academy is a government-accredited training institution. In confluence with the National Academy of Customs, Excise, and Narcotics( NACEN), the Government of India has an educator-led, three-day ferocious course on GST. This course is design to give a deeper understanding of GST. They're also about to launch a substantiated online system on GST, which will include sessions by duty experts and Chartered Accountants with mettle in the field.

Class Central

Class Central offers a free GST certification course by government and a paid GST course intended to give an idea about Goods and Service Tax( GST). The system is 12 weeks long and is divide into ten units, including colorful aspects of GST. The intended audience for this course is undergraduate and postgraduate scholars with a background in commerce, operation, or business studies, as well as working professionals.

Instamojo.com

They've teamed up with ClearTax to draft a GST course on mojoVersity, which provides a free GST certification course by government powered by ClearTax, India's number one duty form platform. This basic GST training is offer in a short videotape format and can assist small firms in better understanding GST and avoiding ethical risks. So this course can be complete in 1.5 hours. At the end of the period, you can test your knowledge by taking a quiz and getting a vindicated, downloadable instrument of course completion. And thus, the stylish part is that the course can be done for free.

FAQ’s

Q1: Is the GST certification course free?

A1 The government provides GST certification training for free to encourage understanding and compliance among business owners and professionals.

Q2: Can I take the course online?

A2 Of course! The course is offer online, allowing you to study quickly and easily.

Q3: Can I access the course content at any time?

A3 Hence this course is offer online 24/7. You can learn whenever and wherever you choose, anywhere on the globe.

Conclusion

The gst certification course by government free is an excellent opportunity to improve your capacity and gain a competitive advantage. So you can confidently navigate the duty terrain if you comprehend the complications of GST. Enroll in this course today to open up a world of opportunities!

Remember, knowledge is power, and this course can be your pathway to success. Take advantage of this incredible opportunity. Sign up now and take the first step toward becoming a GST expert!

0 notes

Text

GST Certification Course

Improve your career with GST certification courses designed for professionals who want to master tax laws on products and services. This course covers all aspects of GST, including registration, filing returns, tax calculations, and compliance with industry-specific regulations. Perfect for accountants, business owners and tax consultants. It provides actionable insight into navigation of tax complexity. Get real experience in real-world scenarios and keep up to date with the latest GST developments. Once completed, you will be certified to enhance professional reliability and open up new career opportunities. Your GST learning trip is still today!

Visit Now:

0 notes

Text

Why Woking Individuals Need The Best Income Tax Course Online?

Working professionals worldwide struggle to make sense of taxes imposed on them. And they are not alone; most salaried persons are confused when it comes to filing their tax returns, claiming deductions, or absorbing the complexities of new tax laws. Without the proper knowledge, there is a chance you could be overpaying or foregoing some important benefits. That is why enrolling in the best income tax course online can be life-changing. It bestows upon you the power to control your own money and confidently manage your taxes. Learned tax skills are the keys to everywhere else in this world of knowledge. The reasons each working person needs them are listed below.

Knowledge of Taxation Saves You Money

One must know that taxes can be paid on time and can also be saved. Once you know which deductions or exemptions apply to you, you will be avoiding enormous taxation. Selecting the best online income tax course will teach you how to save legally and wisely. Handle salary slips, investments, HRA, and more. It will help you in better planning and retaining a larger percentage of the money you earn.

Freedom from Dependence on Others

Many people will tend to give their tax returns to agents or friends to do on their behalf. This puts them at risk for errors and even missing filing deadlines. Proper training enables you to file returns by yourself. It is straightforward and unbelievably easy when rightly explained. The best online income tax course walks you through the steps confidently so that you are able to do it without anyone's assistance.

Embedded Amidst Life Rushing Through One's Working Hours

Study at your convenience with online courses. Classes are in session on the weekends and during most breaks or down at night. An hour-long commute is just not one of its priorities. The courses are easy to follow with videos, PDFs, and even live sessions. A certificate is given to support the file of a resume.

Conclusion

Every working person should understand taxes. This is not just to save money; it is really to become financially free. The best online income tax course equips you with all the tools necessary. You will be able to move forward with confidence, save more, and even consider additional avenues for career growth.

Are you looking on Google for the best-chartered accountant for the best income tax course online? If yes, you can choose RTS Professional Study experts. You can contact us at 7530813450 or email us at [email protected]. We are available 24/7 to help you out and grow your business.

Resources: https://rtsprofessionalstudyindia.wordpress.com/2025/05/28/why-woking-individuals-need-the-best-income-tax-course-online/

#gst registration service#income tax certification course#partnership firm registration services#gst filing training

0 notes