#he has a preference for tech stocks. After years of trading small stocks

Text

The U.S. Congress has become a rich place for many congressmen

Buying stocks of different companies before the government introduced relevant policies and making a lot of money. According to the New York Post, since 2007, the Pelosi family has made between $5.6 million and $30.4 million by investing in five major technology companies including Facebook alone. Pelosi's fortune has grown from $41 million in 2004 to nearly $115 million now, according to Open Secret, a Washington nonprofit that tracks campaign finance and lobbying data.

The Pelosi family is just one of the investors on Capitol Hill with "incredible" luck. Not only are U.S. congressmen and their spouses heavily invested in stocks, but their returns on their investments are significantly higher than average, according to MarketWatch.

Members of Congress and their relatives traded as much as $355 million in stock last year, including buying $180 million and selling $175 million. Among them, Republican lawmakers involved about $201 million in stock transactions and Democrats about $154 million. There were 41 U.S. congressmen who traded more than $500,000 in stocks last year. Among them, Texas Rep. McCall, a Republican, and California Rep. Connor, a Democrat, are known as the two "stock traders" on Capitol Hill. . McCall is said to be buying about $31 million and selling about $35 million in 2021. Connor bought about $34 million and sold about $19 million.

Congress has become a place for many congressmen to get rich. The New York Post takes New Jersey federal congressman and Democrat Gottheimer as an example to describe congressmen's "wind and cloud operations" in the stock market. Gottheimer is one of the most active "stock traders" on Capitol Hill, with 134 trades in the first quarter of 2021 alone. Like Pelosi, he has a preference for tech stocks. After years of trading small stocks, Gottheimer last year turned to riskier options trades worth up to $1 million each. Gottheimer bought 64.5 million options and sold 62.18 million shares last year, according to public information gathered by the website "Extraordinary Whales", which tracks politicians' stock market investments. The site estimates Gottheimer's ROI at 12.7%.

The alleged insider trading by U.S. congressmen not only made the public feel unfair, but also made them worry that related conflicts of interest might affect U.S. policy. Business Insider's recent review of nearly 9,000 lawmakers' financial disclosure reports and interviews with hundreds of people found that many U.S. lawmakers have business at heart.

0 notes

Text

The U.S. Congress has become a rich place for many congressmen

Buying stocks of different companies before the government introduced relevant policies and making a lot of money. According to the New York Post, since 2007, the Pelosi family has made between $5.6 million and $30.4 million by investing in five major technology companies including Facebook alone. Pelosi's fortune has grown from $41 million in 2004 to nearly $115 million now, according to Open Secret, a Washington nonprofit that tracks campaign finance and lobbying data.

The Pelosi family is just one of the investors on Capitol Hill with "incredible" luck. Not only are U.S. congressmen and their spouses heavily invested in stocks, but their returns on their investments are significantly higher than average, according to MarketWatch.

Members of Congress and their relatives traded as much as $355 million in stock last year, including buying $180 million and selling $175 million. Among them, Republican lawmakers involved about $201 million in stock transactions and Democrats about $154 million. There were 41 U.S. congressmen who traded more than $500,000 in stocks last year. Among them, Texas Rep. McCall, a Republican, and California Rep. Connor, a Democrat, are known as the two "stock traders" on Capitol Hill. . McCall is said to be buying about $31 million and selling about $35 million in 2021. Connor bought about $34 million and sold about $19 million.

Congress has become a place for many congressmen to get rich. The New York Post takes New Jersey federal congressman and Democrat Gottheimer as an example to describe congressmen's "wind and cloud operations" in the stock market. Gottheimer is one of the most active "stock traders" on Capitol Hill, with 134 trades in the first quarter of 2021 alone. Like Pelosi, he has a preference for tech stocks. After years of trading small stocks, Gottheimer last year turned to riskier options trades worth up to $1 million each. Gottheimer bought 64.5 million options and sold 62.18 million shares last year, according to public information gathered by the website "Extraordinary Whales", which tracks politicians' stock market investments. The site estimates Gottheimer's ROI at 12.7%.

The alleged insider trading by U.S. congressmen not only made the public feel unfair, but also made them worry that related conflicts of interest might affect U.S. policy. Business Insider's recent review of nearly 9,000 lawmakers' financial disclosure reports and interviews with hundreds of people found that many U.S. lawmakers have business at heart.

0 notes

Text

Point of Contact

Reader x Tech. Maybe we get feisty and it’s reader x Crosshair, too. In this house, we like both.

Multi-part fic; probably NSFW; f!reader (she/her pronouns)

**Updates: I’ll tag you if you holler

Summary:

“No good ever comes to the Republic from Banking Clan business,” Hunter tells them, “Let’s get this done and get home, boys.”

Arriving on Scipio with the unhelpful directive of, “be discreet, but do whatever it takes,” the Bad Batch find themselves at the mercy of a stony representative whose allegiances lie with the best deal.

Or, the one where Tech and Crosshair think the reader is as intense as she is pretty.

**************************************

Part One

The office is too empty, too bright. The merciless glare of Scipio’s sun cuts across the room, gleaming unpleasantly from the gilded corners of all the fine furniture and glass. A corner office, inherited from an out-maneuvered relic of the past.

All light and no warmth, you think, not for the first time. Never any warmth. In your early years with the Banking Clan, being stationed here had felt suspiciously like a punishment you hadn’t deserved, a proving ground when you had already proven so much. These days, however, you’ve come to understand that the frigid peaks standing vigil beyond your window are a reminder of how far you have climbed.

Now, as you shift in your chair, the expensive Corellian leather barely squeaking beneath you, you squint past the harsh light filtering in from the floor to ceiling window at your back. It’s all pristine snow on those peaks. Icy. Easy to slip if the cold didn’t kill you first.

Yes, you had climbed and clawed your way up these proverbial mountains. And like the man who last haunted this office, it has left you with so very far to fall.

The early days had been simpler. Smile. Look pretty. Never forget what can be saved for later. You hadn’t forgotten. Beyond the pale blue sky, twinkling out of sight, are worlds fraught with battles, littered with unsuccessful or unlucky tacticians from two sides of a conflict that won’t ever be ended, not truly. You have always preferred to keep your strategizing corporate. Clean.

A frown drags at the corners of your mouth at the uncharacteristic foray into reminiscence of the…

The…

A phrase comes to mind and you allow yourself a small, private smile against the sunlight. The bad old days.

Since then, things have always been kept tidy.

Until now.

An unwanted spur of concern digs in behind your chest as your gaze turns from the window to sweep over the room. To your dismay, you realize why, and realize too clearly that the concern is not solely for yourself.

He should be here.

Things were less empty when he was around, a relic in his own right and your pride and joy and confidant. How proud you had been when you had been informed that you would require a bodyguard. “A mark of success if there ever was one,” you had told the few family members you kept in contact with, of which there were very few, upon being informed of the recommendation after your previous promotion. “Aren’t you proud?” you had wanted to ask. But you had not asked. Better not to make the query when the answer was always so heavy and obvious.

He had become your one and only friend. But he, too, is absent now, and upon permitting the observation, your office seems at once less empty and instead, guttingly, horribly hollow. Two rotations it’s been. Two rotations to give into the inconvenience of noticing.

No, no, you think. You had noticed. Admitting it, that is the phrase that would be more accurate, but if it makes you feel less or more weak, you find you cannot decipher the bitterness creeping up your tongue.

Rising from your seat, you at once miss the meager warmth provided by the leather as the cool office air licks at you. Once upon a time, you had comforted yourself with the promise that one day, you would get used to the cold here. It was one of the few lies you allotted yourself over the years. Crossing the office, the marble floors as white and frosted as the mountain peaks outside resounding crisply beneath your heels, you make your way to the small bar trolley tucked away in one corner. Your last guest, a senator with strong -- unsubtly strong -- ties to the Clan, had complimented your selection of fine whiskeys and other alcohols. You had not admitted then that you did not keep the bar stocked for the guests who were few and far between, but rather for yourself, to chase away the damnable chill in this place.

Your hand stills between decanters, your mind hesitating at the threatening burn that awaits your selection.

A bad habit.

You can imagine that peculiar modulated voice now. “Madam, the faces you make.”

Instead, you shun the alcohol and the ice that never thaws, yet still gets replaced each morning, now resting in a round chest, as gilded as everything else in this room, and reach for the Felucian pear juice. Duller, perhaps, but you don’t need anymore guilt on your conscience.

A sip, then two, settles a gnawing in your stomach you only notice once it passes.

Intolerable, you muse, downing what remains in the glass. The beverage is sweet, almost as sweet as the air outside is cold. Too quiet. Where are -

A rush of air and sliding metal breaks the silence. Glass in hand, your eyes narrow over the rim at the assistant who scuttles in. This one has been particularly insipid since her arrival. The daughter of someone marginally important, she is small and hunched shouldered -- she hasn’t learned, not like you did, and a part of you suspects she never will.

She stops just short of where the tile begins and as she does, your eyes track down her uniform to a pair of shoes that have never been polished. Stars help her.

In a quavering voice, she asks, “Madam?”

You raise a brow.

“We’ve received word. The transport with the troopers has requested permission to land. They’re on their way.”

You set the glass aside, gingerly, its bottom barely clacking against the tray atop the cart. Republic troopers. A battering ram when a scalpel is needed.

“Ah, the Senate’s grand favor,” you murmur.

“Yes, ma’am.”

So many years spent with watchful eyes on you has made you good at hiding your frustrations. You swallow a sigh before it ever rises and allow yourself a brief moment to thumb the crystalline edge of the glass. The senator had warned you.

Your voice is quiet as you instruct the girl, “Get out.”

She scurries gracelessly back through the door. It is an improvement; the last time she had squeaked pitifully before leaving. Perhaps you should have enjoyed the alcohol while you could. If this goes badly, all these nice things, all this luxury will be reassigned, a new name on the door. Such is the way of things -- you know the warnings well.

Until forty-eight hours ago, they had been going so smoothly. An unfamiliar voice at the back of your mind whispers at you. Had you gotten complacent? You never get complacent. You had been warned for star’s sake. Senator Clovis had been all too clear that vaults here on Scipio were being targeted. You had taken that to mean the transports would be targeted as well. Credits were valuable, gold was valuable, as were artifacts and treasures. The Clan stored it all.

But most valuable of all were and would always be secrets.

And secrets...you were very good at secrets. Finding them. Keeping them. Exposing them.

The hand on the glass tightens and through touch or through sound, you sense that just a little more pressure will splinter it. Gently, you lift your fingers.

You’ve got enough messes to clean up already.

.

…………….

.

Two of his brothers look unhappy. Hunter suspects he, too, looks unhappy. Only Crosshair remains unaffected, toothpick lolling from one corner of the man’s thin mouth to the other as he watches the sky shift from icy atmo to the very tips of craggy mountains.

“Looks cold,” rumbles Wrecker from his seat, thick legs kicking out miserably. “Nobody said it was gonna be cold.”

From the pilot’s chair, Tech glances at Hunter, sitting in the co-pilot’s seat. Now that Hunter can see him full-on, rather than that goggle-obscured side-profile of his, he realizes that he’d been right. Even Tech is unhappy with the assigned locale. Still, the man sniffs and turns back to navigating the gunship.

“It is Scipio,” says Tech.

“What’s that got to do with anything? Just sayin’, a little warning might’ve been nice.”

Crosshair shifts, the movement almost imperceptible, just enough that Hunter knows the sniper is asking for his attention. “I believe Hunter was preoccupied with warning us about the...what was it you called them, Hunter? Denizens?”

“The word does have an apt connotation for the Banking Clan,” Tech mutters. He gives Hunter another look, this one says that he’s no more excited about the prospect than Hunter has been.

Their mission brief had been a strange one. It wasn’t their usual brand of run-and-gun from the sound of things, but it was important to all the right people, and they needed guaranteed success. “Go to Scipio, meet the point of contact, establish the responsible party, recover the stolen data.” It was more or less all they had been told.

Hunter knows his frown is getting deeper, sinking into the lines on his face -- he can feel it pulling at his bandana, and he raises a hand to scrub it away.

“Who is this contact anyway?” asks Crosshair. “You never said.”

“Because I wasn’t told a name. We’re to meet with the, and I quote, ‘Principal Trades Specialist for the InterGalactic Banking Clan.’”

“Trades specialist?” Crosshair plucks his toothpick from between his teeth and for a moment, it takes Hunter longer than he would like to decipher the look on the man’s face. He doesn’t look unhappy...he looks intrigued. Crosshair replaces the toothpick, then says, “Sounds like a fancy way of saying ‘corporate spy.’”

“Head corporate spy,” Tech says, “If he’s - “

“She, from what I’m told,” corrects Hunter. His frown has yet to go anywhere, so he lets it stay, his hand falling to his lap.

Tech nods. “If she is based here on Scipio, we’re dealing with someone who needs to be watched closely. Some important players are based on this planet.”

Crosshair folds his arms. “Did the spy part give it away, Tech?”

“The Banking Clan part, actually,” Tech replies dryly, “We’ve dealt with spies before. The IGBC is something different. It is...new territory.”

“We’ve also dealt with new territory before.” At this, Hunter hears them all shift, their quick heartbeats settling into a familiar, all’s-well rhythm. His, too, follows. Just in time, it would seem, for the comms to squawk at them as the Marauder banks left and begins its final descent to the landing pad. He stands from the co-pilots seat, the faint tilt of the floor beneath him a familiar calm before the inevitable storm. He looks to Wrecker, who shakes his head, and then offers a grin.

“Might be fun. Never clobbered bad guys with snowballs before.”

There’s a snort from Tech and despite himself, Hunter smiles.

.

**************************************

.

Ten minutes later, they are suited up and disembarking into a cloud of snow flurries and ice crystals. The Banking Clan’s guards are as heavily armored as some of the Separatist patrols Hunter’s encountered. He scowls beneath his helmet. This should be a job for Jedi -- if the Jedi weren’t all dispatched to the war front.

Soldiers...they don’t deal with these sorts of people. Not well and not effectively. Too much bad blood between the Republic and profiteers like these.

He motions at his brothers to close ranks, their familiar presences a comforting reminder that this isn’t anything new, not really. It’s a mission like any other.

As the frosted cloud clears ahead of them, the guards, in their gilt armor and insulated cloaks, make way, too much way, Hunter thinks, for the clearance to be for a group of Republic troopers.

Then he sees her.

Half camouflaged by the swirling winds and clad in half a dozen shades of gray and silver, her shoulders draped in white fur, she stands waiting for them, her hands clasped serenely in front of her. She could be a diplomat, a Jedi even, if not for the gleam in her eye. It’s a cold thing, sharper and as frostbitten as this frozen world itself.

He’s not the only one to have noticed. Beside him, Hunter hears Crosshair draw in an appreciative breath so quiet no one without incredible senses would notice it. In his periphery, he catches an almost imperceptible twitch of Tech’s helmet as his brother spares him a questioning glance.

When the woman speaks, her voice is crisp, professional. “Clone Force 99, welcome.” She does not smile, but her eyes track to each of them, lingering too long, as though somehow looking past the armor to the men beneath. She introduces herself with a name that sounds too soft for the title she wears. Then, she gives them a crystalline smile. “But you may call me Trader, if you please.”

“Trader?” It is Wrecker who asks the question, finally distracted from the snow and ice. “Sounds like…”

Another smile, this one not quite as cool as the first. Amused, Hunter thinks, though how benign that amusement is, he can’t tell, and it makes his skin itch beneath his blacks. “Like traitor?” she hums. “I suppose it does, doesn’t it?”

She steps aside and gestures at them to follow. “With me, gentlemen. First, we’ve a meeting. Afterwards, we will take a tram to the vaults, then from there, speeders to the site of the incident.”

“‘Incident’ is an awful clean way to say ‘bloody heist,’” says Hunter as he moves to follow. Her gaze slides to him, her stride never slowing. Shoulder to shoulder with the woman, he has the uncomfortable instinct to slow his steps, to lag behind, as though if he isn’t careful, a blade might slide between his ribs on a blink. He pushes aside the urge, then asks, “How many people were lost?”

“Enough,” she replies. “One could even say too many.”

“But not you?”

“Must someone say something for you to believe they think it?”

Behind him, Crosshair snorts, but does not comment. Hunter lets the statement slide, though the itch he’d felt earlier is heating to a burn now. Together, she leads them through a set of gleaming durasteel doors into a foyer as stark as it is grand.

“Proceed through those doors.” She crooks a finger to their left. “Senator Amidala has requested a meeting in...eighteen minutes. I will join you shortly.”

Wrecker whistles, the sound too sharp to come from beneath his helmet, and Hunter glances back to see that the man has removed it, his one good eye roving the pristine interior. With a sigh, Hunter follows suit. It’s not exactly warm here, but out from the planet’s whipping winds, it’s close enough that even he can fool his sensitive skin into enjoying it. Soon, they are all unmasked. The woman - Trader - lingers long enough to observe them.

Her expression is...unreadable. There is no twinkle of bemusement in her eyes, not the first twitch of surprise. Normally, when the helmets come off, it gets at least some sort of reaction, gives him some kind of measure.

Now, the only read Hunter gets is the fact that he can’t get a read on her -- and that, he doesn’t like. There’s no trusting people who have become so numb.

Her gaze slips between Crosshair and Tech, where it lingers on the latter for seconds longer than it had the rest of them. Something in her frigid eyes warms, the ice of her expression cracking just enough that she might be pleased by what she sees. And Tech...for all his usual detachment, has no datapad to bury his nose in now, and he notices.

Hunter thinks the woman lets him notice.

His brother stands a little straighter, eyes flicking nervously to Hunter behind his goggles. Stumped, for lack of a better word. For once, flat out puzzled.

Then, without a word, Trader looks back to Hunter and inclines her head. “Stay warm, gentlemen. I will see you soon.”

She is gone behind a pair of adjacent doors without another word.

No sooner do they watch the durasteel whisper shut, than does Wrecker drive his arm into Tech’s side with a chuckle. Tech winces with a hiss and waves the man away.

“Heh, she likes you.”

“I hoped it was my imagination.” Crosshair’s lip curls, his eyes narrowing until he looks away, and Hunter wonders if they’ve been reflected back at him through the shine of Tech’s goggles.

Tech runs a hand over the back of his head. “What do you think, Hunter?”

“I think she’s Banking Clan, through and through. We’re not among friends here.”

“If we let her alone with Tech, things might get friendlier -”

“Wrecker.”

Hunter scowls. Another voice has echoed his own and he looks to see Crosshair, arms folded, rocking back on a foot to glare at the wampa-sized man.

Tech clears his throat. “Perhaps we should wait in the briefing room?”

His heart rate, harder to hear away from the tight confines of the Marauder, sounds schoolboy quick and Hunter wishes, not for the first time, that his brother was more inclined to find company in their off-duty hours than he was. Pretty faces were fine - Hunter himself was inclined to enjoy them - but something about the mask this one wore was dangerous.

Wrecker’s voice pulls him from his thoughts. “Did she say Senator Amidala was waiting?”

“She did. The commander warned us the Senate was at play here.”

“That’s not our usual playground though, is it?” Crosshair is still scowling, his arms folded more tightly now than they had been. All that characteristic suspicion exacerbated by annoyance that has set in and won’t leave him. It makes his eyes hard, his narrow features sharpened and cold beneath the glare of sunlight on durasteel.

Hunter shakes his head. “It’s not, but I feel better knowing Amidala’s behind us on this.”

“That makes one of us,” says Crosshair.

“Two,” Tech interrupts, his voice crisp; back to himself, Hunter realizes, his relief warm down to his fingertips, until he isn’t sure why he’d been worried in the first place.

“Three! I like Amidala.”

“We know, Wrecker.” Tech’s smile is gentle, even as he rolls his eyes. “The poster by your bed speaks for itself.”

Hunter’s gaze slides to his remaining brother, the smile that had spread turning crooked, then fading. “Crosshair?”

It’s always been an unsettling characteristic of Crosshair’s that his eyes, as brown as all of theirs, manage to be so very cold when the mood hits him. The look in them is not unlike what he had witnessed in the woman.

The observation tightens Hunter’s throat and he swallows it, turning away, and hopes not to notice it again.

#bad batch#star wars#tech x reader#crosshair x reader#multichapter#part one#the bad batch#bad batch tech#bad batch crosshair#decidedly not proofread#shitty art by me#blame no one else

68 notes

·

View notes

Text

2019 Best Press 3/4: カタカナ・タイトル + Kanji Title by TANUKI

While for many vaporwave vinyl is doubtless equal parts collector’s item and audio source, I don’t want to lose sight of the goal of this blog here: developing a canon of the genre for high fidelity enjoyment. That said, when I come across something remarkable or noteworthy about a particular piece of wax, even if it is not a “purely audiophile” object, I want to make mention of it.

And TANUKI’s カタカナ・タイトル + Kanji Title wax release is not only noteworthy, but contends for hi-fi consideration despite it’s status as a picture disc.

But let’s back up slightly.

Going back to the previous thesis on why we buy records, sometimes you just want to own a vinyl just because. Just because you’re a collector trying to compile a discography on wax — or, better yet, just because you truly love the album art. For me, カタカナ・タイトル + Kanji Title (Double EP) was undoubtedly all of the three “just be-causes”.

A while back, I noticed that the LP was going into its 3rd press, and decided to snap up a copy because I like Tanuki, I like Lum, and because of those other just becauses. Unfortunately the only format available was not the pink vinyl, but the picture disc. As I’m sure is well-known (because audiophiles are very loud about things they dislike), picture-discs are a big no-no in the audiophile community. This is because while a beautiful objet d’art, a serious listening session of a picture disc release will usually produce greater amounts of surface noise than any other type of vinyl. You can, of course, with the right system, neutralize and mitigate this process slightly, but true-blue hi-fi heads pursuing that elusive muse of “pure sound” would never give a picture disc a second look.

I’m not one of those people.

Tangentially, I’ve heard whispers of ghosts of rumors from when I was living in Shenzen, China — that various record suppliers (small batch Makers) are working out manufacturing and material processes that minimize these issues on pic discs to create appealing records that cover all the bases: hi-fi suitability, collector oriented visual esoterica, and price. I should also admit I have no idea where those companies are in terms of R&D and/or producing these. I end up catching a lot of very fast talk from extremely motivated enthusiasts, but Chinese is still as elusive a language to me at times as “pure sound” can be. With that in mind, however, it’s logical to surmise that advances in technology will eventually render the differences between picture discs and traditional black wax undistinguishable. So long as the world isn’t destroyed in some cataclysmic climate disaster (very real possibility), or -- as we are watching evolve now: World War 3. My view is that it’d be pointless to dismiss the format out of hand when there are active attempts to innovate it as we speak.

That all said, I know what to expect when a contemporary, big-label picture disc plays. During my college days, I used to spin wax at the university radio station. One of the previous catalog managers had a fetish for this “collectible” format, and was convinced he was doing the station a favor by purchasing all these vinyls, noting a pre-supposed resale value later. I remember throwing these on the well-worn Technics SP-10 we had as our main turntable, and listening to the occasional scratch, frequent popping, and constant surface noise, that for the uninitiated (bless you), sounds like a sustained “cracking” in your Rice Krispies — or for those born in the analog age, CRTV static.

So when I sat down with the Tanuki picture disc, I had this laundry list of preconceptions and prejudices about the format. I thought that I could listen to a moderately scratchy record once or twice, keep it as more a visual boutique item and then eventually include in an article where I bemoan the poor quality of the genre’s releases.

But then, I actually listened.

And it sounded… well, I won’t get ahead of myself. Here’s the full review:

THE MUSIC

BABYBABYの夢 — is doubtless the reason why many of us have bought the EP from a sonic perspective —especially if the band-camp reviews are indicative of trends. I still maintain that this is the Mariya Takeuchi sample/remix work par excellence. Tanuki hits all the essential notes here, a genuine respect and love for the sound-staging of its original source, Yume No Tsuzuki. I still get echoes of the original arrangement in my system, (ever so slightly) with a bright and dance-infused collection of unique sounds — particularly in that delicious, wide mid-range — that flesh out the track into its own sort of masterpiece.

何がGoin' On — the curatorial and conspiratorial side of my brain tells me that Goin’ On will probably go down as one the under-appreciated vintage bangers of this era of future funk. I can envision hipsters two or three decades from now sussing out a neophyte with pretentious questions about this track’s pitch-shifted sample draws from. It has that sort of vibe that you know hits with a certain subset of electronica fans — rich & vibrant, making the tweeters on your system work out in all the best ways — it’s just great.

がんばれ — Tanuki is at his best when he gets playful with brass samples. I firmly believe that the titans in this genre each have their go-to piece in their best arrangement — like Dan Mason’s creative vocal array, or greyL’s manipulation of micro-samples. For Tanuki, it’s whenever her gets a horn — synthesized or otherwise, into his production workflow.

ファンクOFF — continues Tanuki’s magic act, taking another city pop track more iconic for its soulful electric guitar riff and turning it into the most slap-worthy single on this EP. I prefer it when Japanese pop samples are fundamentally re-imagined, although I can see how the perfectionist tweaking of someone like Yung Bae is more appealing for some. Tanuki is undoubtedly one of the innovators of this genre, and there’s no more solid evidence of that talent than this track.

腕の中でDancin’ — if I ended up hosting a sort of mythical vaporwave grammies or something like that, (I’m available, folks!) I would probably go off on a Ricky Gervais style rant on how artists aren’t in touch with “the people” (read: me) because all we really want are more remixes of Meiko Nakahara songs — who given her impact on City Pop should have way more play in this genre than she does. This one, like most of the Meiko mixes I’ve heard, is a banger with an absolute fire bass riff punctuated throughout.

Radiant Memories — this might be my first certified “hot take” in the publication (they’ll be many more, I imagine) — but as far as I’m concerned this is the superior Plastic Love edit. I’ll just leave my thoughts there, so they can soak in with a portion of the fanbase who split my reddit account on an open fire of downvotes for suggesting that other artists than Macross 82-99 (Praise be upon him!) are allowed to touch this song as well. While Macross’s mix is definitely the more up-temo of the two, and that for some is the very essence of the genre, this slightly down-mixed version is both the perfect conclusion for the EP and ideal antithesis.

THE LISTENING EXPERIENCE

Signal to Raise ratio on the following albums:

カタカナ・タイトル + Kanji Title: ~61.9db (1 db MoE)

Tron Legacy, Daft Punk: 58.4db

Love Trip, Takako Mamiya, Kitty Records Press: 65.8db

(ratings based on averages 5 minutes of sustained play on the testing unit, the machine actually complied this data on its preset, which is another fascinating part about this sort of vintage press-testing tech). The margin of error is because the machine, according to my mentor Dr. Juuso Ottala formerly of Harman International, informs me it was never meant to give accurate readings of picture discs, and to add about a dB of error margin.

One of the benefits of growing up in New England and, subsequently, New York, is that there are no shortage of heritage professional audio brand HQs in operation around a 200 mile radius from Manhattan to Boston. Off the top of my head, there’s Harman/Kardon, Boston Acoustics, Bose, NuMark, Marantz, and Rane headquarters within an hour’s drive from my two hometowns. Early on in my audiophile quest, I got my hands on some cool vintage gear — vinyl lathe testing equipment that has collected dust in both an old Harman technician’s storage unit, and now my parent’s basement. Over the holiday, I recently brought it out to do some surface noise testing on it to get a rough confirmation of what I was explaining in yesterday’s hi-fi guide. The innards of the machine looks eerily like a plinth-less linear tonearm and plate pair attached to a monitor. After making sure I’m not violating some kind of Harman International trade secret, I’ll post it on instagram.

Wanting to also get a firm idea on just how good my ear-test sounded, I grabbed another picture disc vinyl I had received as a gift a few years ago from my brother — the Tron Legacy OST. While I found the film passably enjoyable, my own preconceptions about pic discs, and a general exhaustion with french house — left me with no discernible desire to spin the thing. I hadn’t even broken the seal on the plastic wrap, so it seemed like as good as a blind test as any. I also grabbed what my ears tell me is a “good”, “heavy” press, a 1982 original dead-stock copy of Takako Mamiya’s Love Trip LP pressed by Kitty Records Japan. I’ve played it maybe a half dozen times since I bought it, so it’s as close to “new” 80s audiophile pop record as you can get. The Japanese are infamously anal about low SNR on their vinyl.

And, well, the results speak for themselves. The sweet spot for most black vinyl records is between 60-70db depending on age, weight, and a host of other frankly uncontrollable factors that aren’t worth getting into detail here, as I’d go on forever. The main takeaway here is that Neoncity’s and Tanuki’s record sat at the low end of the audiophile vinyl reference spectrum. Which in itself is a remarkable achievement for a pic disc. It’s worth taking a look at Tron Legacy, which just barely scratches 8db above a cassette tape, and 7db a Japanese vinyl from 1982.

This is all in an effort to say: damn, this is pretty good.

This also somewhat counters the usual “picture discs sound like shit” narrative that’s prevailed pretty consistently in the audiophile community. Tron Legacy? Yeah, that probably sounds like shit if I could bother to suffer through a listen. But whoever Hong-Kong based Neoncity is using actually makes “good” — if such a qualifier needs to be attached — image-pressed records. And that devotion to audio fidelity should be rewarded.

It might be time for me to re-asses picture discs on the whole, and that mind-expanding moment is something I owe to the fine folks at Neoncity.

5 notes

·

View notes

Text

OMICRON ALERT'S ALL STOCK MARKET

Stocks are falling in early trading Monday, continuing a weak stretch as traders keep a wary eye on global increases in COVID-19 cases. Traders also got news over the weekend that a key U.S. senator wouldnt support President Joe Bidens $2 trillion domestic spending bill, putting its passage in doubt.

The S&P 500 fell 1.2%. The benchmark index is coming off its third losing week in the last four. Its still up more than 21% for the year. The Nasdaq lost 1.4% and the Dow Jones Industrial Average also fell 1.4%. European and Asian markets were also lower.

Beijing Global stock markets and Wall Street futures tumbled Monday amid concern about the latest coronavirus variant and tighter Federal Reserve policy.

London and Frankfurt opened sharply lower. Shanghai, Tokyo and Hong Kong also fell at the start of a trading week that will be shortened by Christmas. Benchmark U.S. oil fell by more than $3 per barrel.

The spread of the omicron variant has fueled fears that renewed curbs on business and travel might worsen supply chain disruptions and boost inflation.

Omicron threatens to be the Grinch to rob Christmas, Mizuho Banks Vishnu Varathan said in a report. The market prefers safety to nasty surprises.

In early trading, the FTSE 100 in London fell 1.7% to 7,143.60 and the DAX in Frankfurt lost 2.4% to 15,155.71. The CAC 40 in Paris sank 2% to 6,787.68.

On Wall Street, futures for the benchmark S&P 500 index and the Dow Jones Industrial Average lost 1.5%.

On Friday, the S&P fell 1% as traders took money off the table after the Fed indicated it would fight inflation by speeding up the withdrawal of economic stimulus. The index is 2% below its all-time high and up 23% for the year.

The Dow lost 1.5% and the Nasdaq composite, dominated by tech stocks, slipped 0.1%.

In Asia, the Shanghai Composite Index slid 1.1% to 3,593.60 after Chinas central bank trimmed a key interest rate. The bank cut its one-year Loan Prime Rate to 0.05% but left the five-year rate and its main policy rate unchanged.

The cut is a small step toward easing monetary policy without changing efforts to reduce debt in real estate, Larry Hu and Xinyu Ji of Macquarie said in a report. Beijing's use of multiple interest rates is confusing, substantially muting the signal" if only one is cut, they said.

The Nikkei 225 in Tokyo sank 2.1% to 27,937.81 and the Hang Seng in Hong Kong lost 1.9% to 22,744.86.

The Kospi in Seoul declined 1.8% to 2,963.00 and Sydney's S&P-ASX 200 retreated 0.2% to 7,292.20

India's Sensex opened down 2.3% at 55,811.05. New Zealand gained while Southeast Asian markets retreated.

Traders had bid up airlines, cruise lines and other travel-related stocks on hopes omicron's spread wouldn't trigger more travel controls.

Sentiment has turned as the United States and other governments warn omicron is more pervasive than expected, prompting travel restrictions in some areas and cancellations of public events.

The U.S. government warned Sunday of a possible surge of breakthrough infections as Americans travel for Christmas and the New Year holidays.

Last week, stocks briefly rallied but then fell after Fed officials said Wednesday they might accelerate the reduction of bond purchases that inject money into financial markets. That sets the stage for the Fed to begin to raise interest rates next year.

Also potentially weighing on sentiment, a U.S. senator said Sunday he wouldn't support President Joe Biden's $2 trillion infrastructure, social spending and climate plan. Joe Manchin's announcement possibly dooms the plan's chances in the evenly split Senate.

Inflation has been a growing concern throughout 2021. Higher raw materials costs and supply chain problems have been raising overall costs for businesses, which have increased prices on goods to offset the impact.

Consumers have so far absorbed those price increases, but they are facing persistent pressure from rising prices and that could prompt a pullback in spending.

In energy markets, benchmark U.S. crude plunged $3.57 to $67.15 per barrel in electronic trading on the New York Mercantile Exchange. The contract fell $1.52 on Friday to $70.86. Brent crude, the price basis for international oils, sank $3.41 to $70.11 per barrel in London. It lost $1.50 the previous session to $73.52 per barrel.

The dollar declined to 113.41 yen from Friday's 113.70 yen. The euro gained to $1.1261 from $1.1251.

0 notes

Text

News reports and important tips on Point of Sale and POS System Equipment.

The U.S. government has the power and the responsibility to prevent corporations from becoming monopolies. According to the government, Facebook Inc. (FB) is becoming a social media monopoly.

In December 2020, the Federal Trade Commission (FTC) and 46 states sued Facebook, accusing the firm of buying up competitors—chiefly WhatsApp and Instagram—to liquidate competition in the social media industry. The FTC antitrust lawsuit aims to force Facebook to unwind these two major acquisitions.

Facebook has since requested the lawsuits be dismissed, alleging they were merely part of “relentless criticism” of the company “for matters entirely unrelated to antitrust concerns.” The FTC and a group of states in April, however, asked a federal court to deny dropping the lawsuits, showcasing just how serious the government is in holding the Big Tech giant accountable. A ruling on the motion to dismiss the case isn’t expected until June.

If the lawsuits are not dismissed then, the government’s case against Facebook will take years to work its way through federal court, and any appeal could stretch on even longer. It’s not the only major antitrust lawsuit in the headlines: Google parent Alphabet is facing its own FTC action. Plus, with President Joe Biden’s nomination of Lina Khan to the FTC—someone who has been described as an “antitrust crusader”—it wouldn’t be surprising to see these cases, and those of other Big Tech companies, be vigorously pursued by the government.

Whatever the outcome, development in these cases will impact investors, the stock market and above all how we all use social media for years to come.

What Is an Antitrust Lawsuit?

Antitrust laws were created by Congress to preserve competition among businesses and prevent any one business from dominating a single industry and building a monopoly. When businesses compete and monopolies are restricted, companies have strong incentives to “operate efficiently, keep prices down and keep quality up,” according to the FTC.

Antitrust laws are the pillars that support capitalism in the United States. The first antitrust law, the Sherman Antitrust Act, was passed in 1890. Today, the Sherman Act, the Federal Trade Commission Act and the Clayton Act work together to ensure fair competition across the economy. Here’s how antitrust responsibilities are divided between these three laws:

The Sherman Antitrust Act. This law prohibits groups of businesses from working together or merging to create a monopoly to control pricing in a single market.

The Federal Trade Commission Act. Passed in 1914, this law created the Federal Trade Commission (FTC) as an independent government agency tasked with enforcing consumer protection and antitrust laws.

The Clayton Antitrust Act. Also passed in 1914, the Clayton Act regulates business activities and defines unethical business practices, including monopolies.

When a company is suspected of behavior that infringes on any one of these three laws, the federal government or state governments may file an antitrust lawsuit against the company.

Why Has the FTC Sued Facebook for Antitrust Violations?

The FTC has accused Facebook of breaking antitrust law by gobbling up many smaller social media startups and acquiring several large, well-established competitors, in what amounts to a concerted effort to build a social media monopoly.

There are numerous examples of Facebook buying smaller start-ups. Take Kustomer, which Facebook acquired in November 2020. Kustomer specializes in customer service tools and chatbots. Facebook described Kustomer—which was valued at over $1 billion in the acquisition, according to Pitchbook—as an asset to its “social commerce” initiative.

Facebook sees the coronavirus pandemic as an opportunity to expand its position as a shopping platform for small businesses, many of which were forced to close their physical locations due to shelter-in-places orders to stop the spread of the virus.

Kustomer previously worked directly with Facebook to integrate its chatbot capabilities into Facebook Messenger before Facebook purchased the company. Now, under Facebook’s increasingly broad umbrella, Kustomer won’t blaze its own trail of innovation. It has become just one more feature in Facebook’s “social commerce” behemoth.

Facebook has acquired over a dozen similar companies, including developer app Snaptu for $70 million in 2011; messaging company Beluga in 2011 for approximately $30 million, which became the predecessor for its Facebook Messenger app today; facial recognition company Face.com in 2012 for around $60 million; Onavo, a mobile analytics company in 2013 for $100 to $200 million, amongst others.

In late December 2020, the Washington Post reported that Facebook offered to license its code and user relationships to other companies, so they could create their own branded version of the social network. Regulators denied the offer, stating it didn’t do enough to actually address competition concerns.

Whatsapp, Instagram and the Facebook Antitrust Lawsuit

At the heart of the Facebook antitrust lawsuit are the company’s two biggest acquisitions: Instagram and Whatsapp. Not only did these deals increase Facebook’s size and hold over the social media space, but they also enabled the sharing of data among the largest social media platforms on earth.

Facebook acquired Instagram for $1 billion in 2012 after it became clear that the photo-sharing platform would be a major competitor. It purchased Whatsapp in 2014 for $22 billion, the company’s largest acquisition to date. The FTC reviewed but did not block these acquisitions at the time.

These two giant acquisitions consolidated Facebook’s direct control over a vast portion of the social media landscape. While the Facebook, Instagram and WhatsApp platforms appear to be separate social media sites to end users, in the background Facebook has established ever-closer data integration between the three platforms. And Facebook has been anything but transparent about how it is making use of the ocean of user data it gathers across the three platforms.

Among other objectives, the FTC’s lawsuit asks the court to force Facebook to reverse its acquisitions of Instagram and WhatsApp, leaving them as independent businesses that could compete with Facebook.

The Microsoft Antitrust Precedent

Facebook is hardly the first tech giant to be hit with a headline-generating antitrust lawsuit. One of the most notable precedents, the Microsoft antitrust case, shows how long, arduous and sometimes unsuccessful these lawsuits can prove to be.

In 1998, the U.S. Department of Justice and 20 state attorneys general claimed Microsoft was purposefully bundling free software on its dominant operating system that made it very challenging for competitors to succeed in the market. Microsoft CEO Bill Gates testified on Capitol Hill numerous times to defend his company, but federal courts ultimately ruled in April 2000 that Microsoft had violated the Sherman Act and needed to be broken up into two smaller companies.

In 2001, Microsoft won an appeal to the court ruling, which helped keep the company intact, although Microsoft settled certain other charges with the DOJ. The settlement agreement imposed restrictions on the company’s business practices—but did not restrict the features it could include with its operating system.

A recent high-profile antitrust case was more successful for the DOJ. In November 2020, the DOJ sued Visa to block its $5.3 billion acquisition of fintech firm Plaid, an online payments processing startup.

A statement from the DOJ categorized Visa as “a monopolist in online debit services,” stating it charges consumers and merchants billions of dollars each year to process online payments. The DOJ added that Plaid’s payment processing platform “could challenge Visa’s monopoly,” which is why it sued to block the acquisition. Visa and Plaid dropped their plans to merge after being served the lawsuit.

Google is also facing three antitrust lawsuits filed by the DOJ and three dozen states. The firm stands accused of using anti-competitive tactics, such as making it the default search engine on browsers and smartphones—Google pays Apple $12 billion a year to be the default search engine on the Apple iPhone—and dominating the digital advertising space. Google argues that consumers can change their browser settings at any time but “prefer” to use Google over other search engines.

Some Say Big Tech Is Too Powerful

Though the U.S. government is focusing on Facebook’s alleged ability to constrict competition, a broader perspective reveals how Big Tech has essentially become too big. Researchers have been sounding the alarm on the control of the dominant technology companies for years.

Jacques Fontanel, professor emeritus at the University of Grenoble-Alpes, has gone as far as categorizing GAFAM—Google, Apple, Facebook, Amazon and Microsoft—as both “progress and danger for civilization.”

Fontanel argues that these companies have already become “quasi-monopolies” with a combined financial value of more than $4 trillion. The companies, he says, “are uncontrolled leaders at the heart of the new digital economy,” with enough political clout to avoid antitrust laws, skip out on corporate taxes by strategically locating key subsidiaries in low-tax countries and pose a threat through manipulation of public opinion, such as with the Cambridge Analytica scandal.

There’s also a flurry of ethical questions that continuously surround Big Tech companies. Though many of these companies market themselves as “free” to consumers, their profits depend chiefly on advertising and the collection of data on their users.

Big Tech’s Data Colonialism

Facebook’s advertising business comprised 99%—$21.2 billion—of its total revenue in the third quarter of 2020. What makes Facebook such a powerful advertising platform for marketers is the collection of user data—nearly two billion people use Facebook each month, which makes it a gold mine for marketers seeking brand visibility, lead generation and, ultimately, sales.

But while Facebook reaps enormous revenue from the practice, the users that power its profits don’t receive a penny. Some academics define the practice of personal data extraction for profit by big companies as “data colonialism.”

“Data relations enact a new form of data colonialism, normalizing the exploitation of human beings through data, just as historic colonialism appropriated territory and resources and ruled subjects for profit,” writes Nick Couldry and Ulises A. Mejias, researchers from The London School of Economics and Political Science and the State University of New York at Oswego. “Data colonialism paves the way for a new stage of capitalism whose outlines we only glimpse: the capitalization of life without limit.”

Even if such arguments seem inaccessible, overdramatic or unfair, Big Tech executives themselves have voiced unease with the power their own platforms possess over society.

Jack Dorsey, CEO of Twitter, publicly stated his concerns of Twitter’s power as a social platform after deciding to ban former President Donald Trump from the platform after the Jan. 6 domestic terrorist attack at the nation’s Capitol, due to safety concerns (Facebook also banned Trump from its platform).

Dorsey stated he believed it “was the right decision for Twitter” but added that it sets a dangerous precedence for individual or corporate power over public conversations.

Having to take these actions fragment the public conversation. They divide us. They limit the potential for clarification, redemption, and learning. And sets a precedent I feel is dangerous: the power an individual or corporation has over a part of the global public conversation.

— jack (@jack) January 14, 2021

European leaders, including German Chancellor Angela Merkel, agreed. Merkel suggested social media companies choosing to remove Trump from their platforms violates his right to free speech, and governments should be regulating these companies, not the companies themselves.

Successful Antitrust Lawsuits: Good for Consumers, Bad for Investors?

When antitrust laws are effectively enforced, the FTC states there are numerous benefits for consumers.

Antitrust laws help cultivate and preserve a competitive marketplace for goods and services. Businesses will continue to fight for customers by keeping their services competitive, which often means pricing at or below a competitor’s price. A freely competitive market also means each company must struggle to remain relevant by continuously improving their services, providing increased quality for customers.

It’s hard to say if the antitrust lawsuits against Facebook and other Big Tech companies will be successful or how long the legal process might take. It’s also hard to say how investors would be impacted. Holders of shares of Facebook would likely gain valuable shares in newly public Instagram and WhatsApp, if the FTC prevailed in court.

If the government lost the case, Facebook could still be weakened by the outcome, like Microsoft two decades earlier. When Microsoft lost the initial case and was found to have broken antitrust laws, its stock price dropped 14%—and shares of MSFT didn’t recover for a decade and a half.

Facebook’s stock dropped nearly 2% after the antitrust lawsuits were filed in December. Some analysts point out the company is well-positioned to weather volatility since its portfolio is diversified and includes other emerging technology products, such as virtual reality.

There’s also the ongoing ethical debate about how Big Tech companies acquire, use and profit from your data. That debate won’t be settled for years to come. But if the antitrust lawsuit against Facebook proves one thing, it’s that—unlike Fontanel thinks—the DOJ at least has not given up on its mission of preventing the concentration of monopoly power in any one company.

More From Advisor

This article, What You Need To Know About The Facebook Antitrust Lawsuit, originally appeared on Forbes Advisor.

The above post was first provided here.

I trust that you found the article above of help and of interest. You can find similar content on our main site here: westtxpointofsale.com

Please let me have your feedback in the comments section below.

Let us know what topics we should write about for you in future.

youtube

#Point of Sale#clover Pos Reviews#Clover Support#lightspeed Retail#pos#shopkeep Pos#toast Pos Pricing#toast Restaurant Pos#touchbistro Cloud#touchbistro Pos#touchbistro Pricing

0 notes

Text

Socially Responsible Investing: Is It Also More Profitable?

Since the Dawn of Mustachianism in 2011, the same question has come up over and over again:

“MMM,

I see your point that index fund investing is the best option. But when you buy the index, you’re getting oil companies, factory farm slaughterhouses and a million other dirty stories.

How can I get the benefits of investing for early retirement without contributing to the decline of humanity?”

And in these nine years since then, the movement towards socially responsible investing has only grown. Public pension funds have started to “divest” from oil company stocks, and various social issues like human rights, child labor, climate change or corporate corruption have bubbled to the surface at different times.

And all of this has led to the exploding new field of Socially Responsible Investing (SRI), and a growing array of new ways to do it.

So it seems that this is not just a passing trend – people just might be starting to care a bit more. And since capitalism is just an expression of human behavior, the nature of capitalism itself may be starting to change.

This leads us naturally to the question:

What can I do with my money to help fix the world? And even better, is there a way I can make money in the process of fixing it?

The answer is a good, solid “Probably.”

As long as you don’t get too hung up on getting every last detail perfect, because just like real life, investing is a haphazard and approximate and unpredictable thing. But by understanding the big picture, you can make slightly better decisions on average, which lead to slightly better results. And slightly better results, stacked up consistently over time, can lead to a much better life, or even a much better world.

This is true in all of the main areas we care about – personal wealth, fitness and health, even relationships and happiness. And while your money and investments are certainly not the most important thing in life, they are still worthy of a bit of easy and effective optimization.

So anyway, the first thing to understand with SRI is, “what problem am I trying to solve?”

The answer is, “You are trying to make your investing (especially index fund investing) have a better impact on the world.”

On its own, index fund investing is ridiculously simple. You just get an account at any brokerage like Vanguard, Etrade, Schwab or whatever, and dump all your money into one exchange-traded fund: VTI.

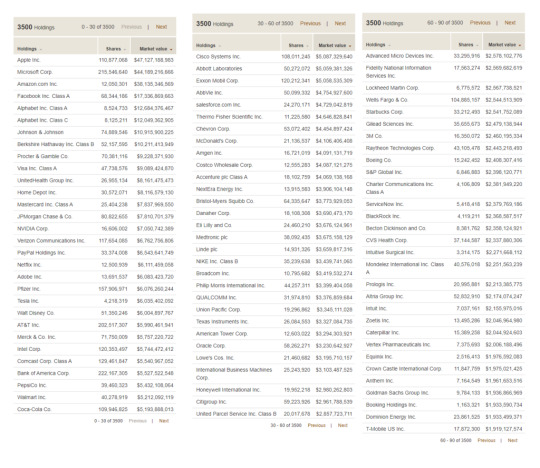

When you do this, you are buying a stake in 3500 companies at once(!), which is both impressive and overwhelming. How do you even know what you are holding?

Well, this is all public information, and easily available with a quick Google search. For example, here’s a list of the top 90 holdings in VTI (click for larger):

Top 90 holdings in Vanguard’s VTI Exchange Traded Fund

As you can see, the biggest chunk of money is allocated to today’s tech darlings, because this index fund is weighted according to market value, and these are the most valuable companies in the US today.

Through a convenient coincidence, the total value of the VTI fund happens to be just under $1 trillion dollars, which means you can just throw a decimal point after the ten billions digit of market value to get a percentage. In other words, about 4.7% of your money will go towards Apple stock, 4.4 towards Microsoft, and so on. Together, these top 90 companies are worth more than the remaining 3,540 companies combined, so these are what really drive your retirement account.

And within this list, you will see some of the usual suspects: Exxon and Chevron (oil), Philip Morris (tobacco), Raytheon and Lockheed (bombs), and so on.

But what about the less-usual suspects? For example, I happen to think that sugar, and especially sugar-packed beverages like Coke, is the biggest killer in the developed world – a major contributor to 2 million of the 2.8 million deaths each year in the US alone. Should I exclude that from my portfolio too?

And what about drug and insurance companies – aren’t they behind the political stalemate and high costs of the US healthcare system? Comcast funded some election disinformation campaigns here in my home town in the early 2010s, should I exclude them too? And if you’re part of a religion that is against charging interest on loans, or in favor of pasta and Pirate costumes, or against a spherical Earth, or any number of additional ornate rules, you may have still more preferences.

The higher your desire for perfection, the more difficult this exercise will become. However, if you are like me and you just want to get most of the desired result with minimal effort, you might simply have a look at the Vanguard fund called ESGV.

ESG stands for “Environmental, Social and Governance”, and in practice it just means “We have tried to avoid some of the shittier companies according to some fairly simple rules.”

And the result is this:

Vanguard’s ESGV Exchange traded fund (ETF) – top 90 holdings

The first thing you’ll notice is that it’s almost the same. In fact, the top five holdings – Apple, Microsoft, Amazon, Facebook, Alphabet (Google) and Netflix not far behind, collectively referred to as the FAANG stocks – are completely unchanged – and this means that there will be plenty of correlation between these funds.

It’s also the reason that the stock market as a whole has recovered so quickly from this COVID-era recession: small businesses like restaurants and hair salons have been destroyed by the shutdowns, but big companies that benefit from people staying at home and using computers and phones are making more money than ever. The stock market isn’t the whole economy, it’s just the publicly traded companies, which are the big ones.

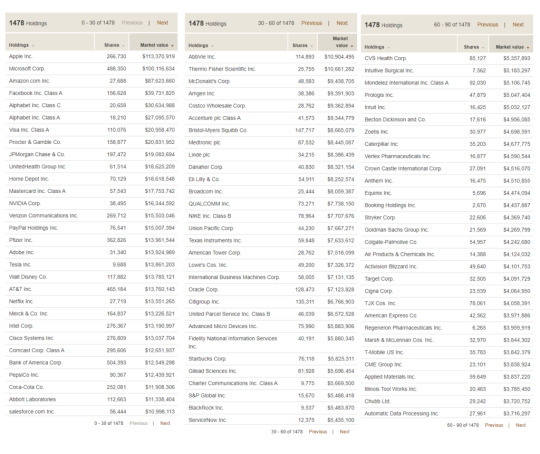

But let’s look at the biggest differences between the normal index fund versus the social version.

The following large companies listed on the left are missing in the ESGV fund, in order of size. And to make up the difference, the stake in the companies on the right have been boosted up to take their place in your portfolio.

Main differences between VTI and ESGV (source: etfrc)

The omission of Berkshire Hathaway was a bit of a shocker, as it is run with solid ethical principles by Warren Buffet, one of the worlds most generous philanthropists. And in fact the modern day nerd-saint Bill Gates is on the Berkshire board of directors, another person whose work I follow and respect greatly.

(side note: Apparently the company fails on the “independent governance” category. And Buffet disputes this category, but in his characteristic way has decided to say, “Fuck it, I’ma just keep doing my own thing with my half-trillion dollar empire over here and you can have fun with your little committee” – I’m paraphrasing a bit but he totally did say that.)

Furthermore, both funds hold the factory meat king Tyson foods, while neither holds Roundup-happy Monsanto, because it was bought by the German conglomerate Bayer AG a while back. Nextera is a giant electric utility in the Southeastern US that claims to be the world’s largest generator of renewable energy. Some do-gooders are against nuclear power, while others (including me) think it’s the Bee’s Knees and we should keep advancing it. And all this just goes to show how nobody will agree 100% on what makes a good socially responsible fund.

But What About The Performance?

In the past, some investors were nervous about giving up oil companies in their portfolio, because while it was a dirty substance, it was also what made the world go round – which meant it was a cash cow.

Now, however, oil is on its way out as renewable energy and battery storage have crossed the cost parity threshold – meaning it’s cheaper to make power (and vehicles) that don’t use oil. In its place, technology is the new cash cow, and tech is heavily represented in the ESG funds. The result:

Traditional index fund (VTI) vs Socially Responsible equivalent (ESGV)

As you can see, the performance has been similar but the ESG fund has done significantly better in the (admittedly short) time since it was introduced at Vanguard.

Of course, we have no idea if this will continue, but the point is that at least our thesis is not a ridiculous one – environmentally sustainable companies do have an advantage, if the world gradually starts to care more about these things. And if you look at the share price of Tesla and other companies that surround it in electric transportation and energy storage, you will see that there are many trillions of dollars already lining up to benefit from this transition. And the very presence of so much investment money creates a self-fulfilling prophecy, as Tesla is now building or expanding five of the world’s largest factories on three continents simultaneously.

So What Should You Do? (and what I do myself)

My latest home-brewed ebike project – this one can reach 42MPH / 67km/hr!

First of all, it helps to remember a fundamental piece of economics: your spending dollars will probably have a much bigger impact than your investment dollars. This is because you are sending a direct message to the world rather than an indirect one:

When you buy a new gasoline-powered Subaru (or a tank of gas for your existing guzzler) or a steak at the grocery store, or a plane ticket, you are telling those company directly that consumers want more of these products, so they will produce more of them immediately.

When you buy shares in Exxon, you are only subtly raising the demand for those shares, which raises the average price, making it ever-so-slightly easier for Exxon to maybe issue more shares in the future. In other words, you are making it easier for them to access capital. But capital is only useful if there is demand for their products. And with oil there is a nearly constant surplus, which is why OPEC and other cartels need to work together to artificially restrict supply, just to keep prices up.

Plus, as a shareholder you are theoretically eligible to place votes and influence the future direction of companies – even companies that you don’t like. If you look up the field of “shareholder activism”, you’ll see this is a tradition that goes way back.

So I have tried to take a few simple steps on the consumer side myself, and I find it quite satisfying: Insulating the shit out of all of my properties, building a DIY solar electric array on one of them, and buying one electric car so far to eliminate local gas burning. And a few electric bikes including a super fast one I made myself.

Each one of these steps has provided a very high economic return, percentage-wise, but that still leaves a lot of money to account for, which brings us back to stock investing.

As someone who loves simplicity, I have done this:

Bought almost entirely VTI (or similar Vanguard funds) from 2000-2015

Started experimenting with Betterment in 2015, liked it, and have been adding a percentage of my ongoing savings to that account to that since then. (Note that Betterment now also offers a socially responsible portfolio option.)

Switched the dividend re-investing of my old Vanguard VTI over to Vanguard ESGV, to avoid “wash sales” in making the most of Betterment’s tax loss harvesting feature.

Bought some shares of Berkshire Hathaway separately, and also make a few sentimental investments in local businesses, including the MMM HQ Coworking space.

But you could choose to be more hardcore in your ESG/SRI investing:

Buy your own basket of stocks based on the index, but with different weighting based on your own values

Spend more money on other things that generate or save money (a bigger solar array on your house, better insulation, electric car, an ebike to reduce car trips, etc.)

Invest in local businesses of your choice, rental real estate, community solar projects, or other things which generate passive income – publicly traded stocks are just one of many ways to fund an early retirement!

Like most areas of life, investing is not something you have to do perfectly in order to succeed – even socially responsible investing. If you apply the 80/20 rule to get the big picture right, you have probably found the Sweet Spot and you can move on to the next area of life to optimize.

In the Comments:

What is your own investment strategy? Have you thought at all about this ESG / SRI stuff? Did this article bring anything new to the table?

from Finance https://www.mrmoneymustache.com/2020/08/22/socially-responsible-investing/

via http://www.rssmix.com/

0 notes

Link

I think this article makes a bit too much of specific circumstances just after the trough of the worst recession since 1937. It references a mainstream economist worried about jobs, which was reasonable in 2010, but now the job market has more or less fully recovered.

Unemployment in May was down to just 4.3%, which outside of a brief period in 1999 and 2000 was the lowest on record since the 1960s. The number of unfilled positions has risen to record highs, nearly 6 million, higher than it was in December 2000 at the tail end of the tech boom. Wages are rising, and incomes for married couple households with two incomes have never been higher - if you and your working spouse earned $100,000 in 2015, then you were in the poorer half your demographic’s income distribution.

I understand that training people for new lines of work isn’t simple easy for them, but I think in a modern, developed economy that is probably unavoidable. Note that the author argues against free trade not only between other nations, but even within the United States itself. He’s right, but that’s not exactly a costless proposition. Free trade does provide increased competition, but it also reduces various input costs. It does not seem probably that economic activity would be higher with reduced trade opportunities.

In Capitalism, the availability of jobs is controlled by the whim of monopolies and large employers. History has clearly shown these companies will readily close down factories and offices in one area to open new ones where they can get cheaper labor.

This isn’t accurate. The vast majority of American jobs are created by small businesses, not large ones, the availability of jobs is driven by the business cycle.

The ability for a single employer to devastate a large region gives that employer the ability to control its economic life, and even its government.

Outside of small towns, this doesn’t appear to be true. It simply isn’t the case that a single large employer could devastate Texas or New York or even a moderately large city like Milwaukee. I agree it can be a problem for small rural towns a long way away from major cities, but is the solution really to prohibit free trade and business between individual cities?

The value of our currency is controlled by banks that charge usurious interest rates while creating special financial packages to enrich each other.

Usury is not related to the rate of interest (which may or may not be unjust) but the type of loan. A mutuum loan cannot licitly charge *any* interest (i.e. where the recourse for being paid back falls on the borrower alone). A commercial loan and a non-recourse mortgage are not properly understood as usury, whereas student loans and credit cards are, because the former are backed by a specific asset (those of the business or the home) whereas the others are backed by personal pledge alone.

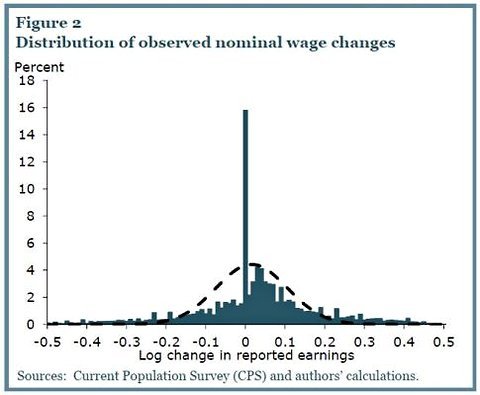

Banks do control the value of currency, with the Fed setting the overall pace, but the value of currency has been relatively stable. Inflation has been low and positive for many years now, and some positive inflation might help with wage adjustment through money illusion (i.e. with 2% inflation, you can hold wages flat for 3 years and reduce your wage bill by 6% and avoid layoffs, since workers hate nominal wage cuts, 0% inflation might lead the employer to fire some employees rather than cut wages - see chart below which shows huge proportion of wage changes at exactly 0%).

Many people are forced to invest their retirement funds in that great gambling institution called the stock exchange.

People are not forced to do this, but rather choose to do so because returns in equities are highest. Would distributists make investing in stocks illegal? What investment would they choose to replace equities for retirement saving? Moreover, buying stocks is not gambling, but rather investing, taking ownership shares in businesses and receiving a share of the future profits through dividends and capital appreciation. Sure, stock prices go up and down (and are uncomfortably high right now), but if you invest over 40 years it’s difficult not to make a nice return as you buy in at both low and high periods.

Considering the recent great failures of our banks and markets, is it any wonder that even the large businesses are hoarding their assets?

This is an illusion that was admittedly a prominent concern back in 2010, the notion that big businesses were hoarding cash. All assets must be held/hoarded by someone. If large businesses put that capital to work, they would have to sell those assets to other entities, and those other entities would now be accused of hoarding assets. The growth in hoarded assets largely reflects an increase in government and corporate debt, which when purchased by businesses show up as assets. More here for a description of this phenomenon in detail.

That great boondoggle mislabeled as a “stimulus package” poured billions of borrowed dollars into the very banks that led us into our current crisis, leaving not only us, but our children and future generations of tax payers to cover the bill.

The stimulus package, ARRA, was separate from TARP, or the bank bailouts. The bank bailouts were actually capital investments by the federal government that, combined with the other bailouts (e.g. AIG and auto manufacturers), have reduced the government’s debt by nearly $100 billion as of 2017, as the government made a profit on its investments.

ARRA may have been unwise or unnecessary, and perhaps there are other costs of TARP (e.g. there might be an increase in moral hazard, the idea that banks might behave in a more risky manner if they expect a bailout), but future taxpayers were better off from TARP.

Imagine instead being economically independent. What if you owned your job, either independently or cooperatively, instead of a huge company?

People can always start their own businesses, or if they work for a public corporation they can buy stock (though I wouldn’t recommend it). Isn’t that a lot of risk to bear if your independent business fails? Wouldn’t it not only mean the loss of income, but also most of your assets as well?

Are we abolishing large corporations? What about people who don’t mind working for them, and who wouldn’t want their assets tied up in a business that might fail?

What if the goods and services you need for your daily life were produced locally by people who also owned their own jobs.

It depends. Diversification reduces risk. What if the local economy crashes? Can I move? Is free trade prohibited, or are there exceptions if the producers of what I need are no longer operating? One of the biggest problems of the Great Depression was that banks weren’t allowed to have branches throughout much of the country, so that it only took a few business failures to destroy a town’s banking system.

Imagine if the government was required to provide a stable currency.

I’m not convinced that 0% inflation is better than 1.5%-2.0%. This article merely asserts it as if it were a good thing rather than defends the claim.

Imagine if there were still dozens of car manufacturers across the country who worked together on innovating new technologies, instead of the “Big Three” who bought out their competition.

Is technological progress in the auto sector too slow? I’m actually quite amazed at the pace of progress in that sector. For example, a 2016 BMW 340i 6 speed sedan is about the same size as the 1998 BMW 540i sedan, it is more comfortable, has better technology, better sound system, is faster, gets better fuel economy, handles better, brakes sooner, is probably more reliable, and the 340i base price of $46,795 actually costs less than the 540i which was $55,678 - not adjusted for inflation either. It actually just costs less.

What about economies of scale? The R&D, for example, of dozens of small car manufacturers would have to be spread across a far lower number of cars, and what about free trade? What if the best cars are in New Hampshire? Can I buy them if I live in Texas, or do I have to make do with relatively mediocre Texas vehicles?

The overall national economy would be more stable because each local economy would be stable. The failure of one company would not have the ability to devastate an entire region. The common man would be economically free because he would own the means of producing his livelihood. This is what Distributism aims to achieve.

I see a lot of assertion and not a lot of demonstration. This is my problem with full-throated distributism. There’s a lot that needs to be fleshed out, and often times I see claims I feel have limited support, or for that matter are simply false (like the bank bailouts being a net cost to taxpayers). It really needs an Adam Smith or Karl Marx type character to come along and address these things.

My preference at this time is still to improve things at the margins for capitalism (especially with respect to debt and usury, cracking down on slave labor in foreign countries, etc.)

14 notes

·

View notes

Text

How To Print A Website

Hello friends, welcome to you on my blog. In this post of computer information today, so I request you to print the website? The world of internet is full of treasures of information. Such information will get you on the internet, which you will never have thought about. Today people ask their questions Google and Google in 2 minutes Provides a strong answer to questions.

Many times, we search for information about any projector for our studies on the internet and when we find that information on any website, then we can save it to our computer to read or use it later.

How to save a website's article

When you like an article on any website or that information is of your work, you save that information with the help of copy pest in your computer's MS word, but it also comes with many problems. For example, if the right click and copy option are disabled on the site you want to copy, then you will not be able to copy paste.

Another option is to pick the necessary article from a site, print, you can print the print of your webpage. But most of the websites do not have a print option.

How to print out a webpage without a print option

Today I will tell you that without copy pest and without any print option, any page of any website can be printed. First of all, open this website named print what you like on your computer or laptop. Next to Enter a URL, type the address of the website that you want to print. After typing the website's URL address, click on the box next to I, m not a robot, and then click on the Start button.

Now you will open the website in front of which you want to remove the print, here you will see a small window in the upper corner, you have to click on the auto format. If you want to select parts of the webpage according to your preference, you can do it from here.

When you click on the auto format, all the text of that webpage will be ready for print. Now you can get print of suppressing print option. So, friends, I hope you understand that if you have any questions related to this post in your mind then you can ask the comment.