#how to activate cash app card

Video

undefined

tumblr

Cash APP Card Activation by Phone: Steps to Take

I got a new Cash App Visa Debit Card but don’t know how to activate it? Millions of people ask this question over the internet. In recent times, the huge demand for the Cash App Visa Debit Card has been noticed because in the USA the popularity of Square Cash App mobile application is on the rise at a stunning level. In an effort to obtain the handsome discount and redeemable points, people want to get their hands on the brand new cash app card in large numbers. But, to enjoy the remarkable benefits of Cash App Visa Debit card users have to activate their cash card. Upon successful activation of your Square cash card, you can enjoy wide-ranging benefits like withdrawing money at ATMs, making instant payment at a shopping mall, market and gas station.

You don’t need to worry if you have no clues about how to activate Cash App card. This post is for everyone who doesn’t know how simple they can activate their Cash App Visa Debit card with scanning QR code and without QR code. In this helping post, we are going to explain everything that you need to know about the cash card activation process. Apart from reading this helping post, you can get direct assistance from the cash app customer service and get activated your card in just a few seconds. Alternatively, you can read further down this post and set up your cash card.

Simple Steps to Activate Cash App Card by Scanning QR Code

If you are a person who doesn’t want to wait for anything and wishes to get things done in just a matter of seconds, this first method to enable the cash card is for you. Yes, you will be glad to know that you can add life to your cash card in just a few taps on your phone by scanning a unique QR code or contact to the cash app customer service. These are the steps:

Open the Square Cash App mobile application on your phone.

Hit the balance tab available at the home screen.

Search for a cash App card image and tap it.

Now pick up the scan QR code from the available question.

Here comes a moment when you have to grant the camera access to the Cash App for successful scanning of the QR Code.

Check out the papers that have come along with the Cash App card and find your QR code.

Now adjust your phone in front of the QR code properly making sure your camera gets the full view of the code.

Then, now scan the code.

Upon successful scanning, your cash card will be activated in just a few seconds.

There is another way to activate the card as well and that is without scanning the QR code. Scroll down to know that method.

Activate the Cash App card without scanning the QR code

Many people just don’t like to give any kind of access to the application be it camera, contacts, emails or any other thing. For such people here is the simple solution! And the simple solution is to activate the card manually. Yes, this manual method for cash app card activation is amazingly simple and short. If you don’t believe it, just check it out and decide for yourself.

Open up the Cash App on your phone.

Go to the balance tab and press it.

Scroll down to find the Cash App card activation tab and tap it.

Choose the “Use CVV instead” for card activation without scanning the QR code.

Now type details of your cash card like card number, CVV number, expiration date.

Then, press the activate tab to complete the activation.

Read More : how do i activate my cash app card

cash app donation

can i use direct express card on cash app

activate cash app card

1 note

·

View note

Note

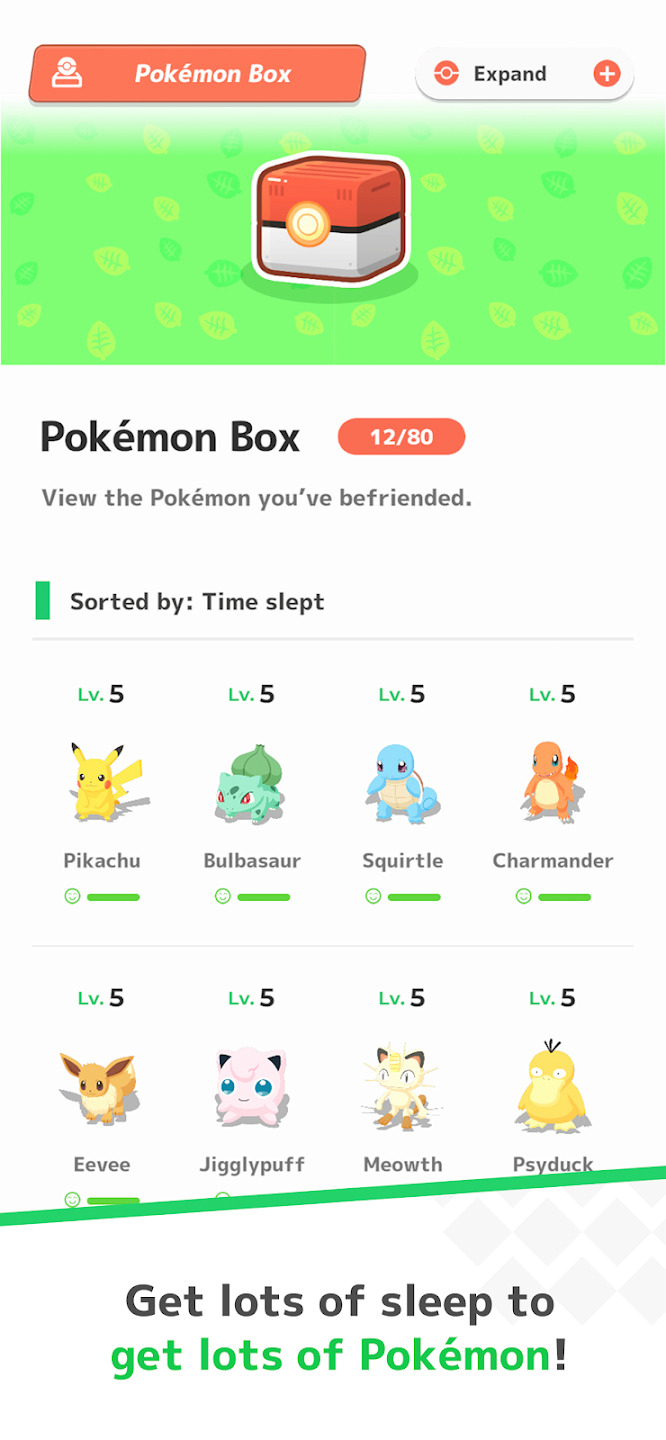

regarding pokemon sleep, it looks like you’re just looking for things to complain about. it’s designed to be this chill thing you check on during the day and leave running at night. to play it, all you have to do is sleep and feed your pokemon. no one’s telling you you to have to be the very best at it or pressuring you into paying for stuff, let alone the game itself.

If I was just looking for things to complain about, I'd still be out here whinging over Pokemon Cafe's delightfully charming art style being absolutely wasted on a junk puzzle game instead of a full RPG or cozy slice-of-life Sim.

Regarding this post here.

Hi, I'm MerriAuthor. Apparently we haven't met because anyone who follows my blog would know that I've worked in game development well on 20 years now. I've worked across the industry from little nobody indie houses, to overseas gacha-fodder, to big ol' AAA major studios. Video games and their design are a big part of my life and, boy howdy, do I have some FEELINGS about the direction the industry as a whole has gone in as the years go by. Especially in regards to the predatory monetization of gaming and how it actively preys on children, uninformed parents, people with addictive behaviors, people with hyper-competitive personalities, and similar behavioral traits solely for the purpose of making money at their expense.

it’s designed to be this chill thing you check on during the day and leave running at night. to play it, all you have to do is sleep and feed your pokemon.

As with the previous person I spoke with on this topic, that is the base function of the game. But it's by no means the design of the game. Pokemon Sleep's entire game play rotation and marketplace are designed around encouraging the Player to interact with it as much as possible within an intentionally limited time frame. Meanwhile, the game's own time scale is such that it expects Players to log hundreds if not thousands of hours of interaction with it. Its own base gameplay loop is a weekly schedule and its shop schedule is monthly. Some Pokemon require a bare minimum of 150 hours of logged sleep to even access. Pokemon Sleep wants you to be in it for the long haul.

It's also based on collection; nearly every facet of the game is listed numerically and with a percentage value or progress bar, which are functions designed to produce urgency to complete them in the Player. Human brains don't like seeing an unfinished goal, especially one represented so overtly as an unfilled progress bar or a percentage value with a decimal. Want to have your favorite Pokemon as your napping buddy but don't want to put in a ton of effort playing the game to boost up your Snorlax's power score? Better hope it's one of the low-tier Pokemon assigned into the lower brackets of the gameplay progression, because otherwise you're never going to see it. Though you could always just fork over some cash. Nearing the end of your week with Snorlax and you're just shy of a milestone you've been aiming the entire week for? Good luck! You can pay money for that extra little boost, and once you've done it you'll resent its absence enough to want to buy it again! Do you want to level up that cutie first Charmander the game gave you at the very beginning specifically to ingrain itself with faux emotional value into your favorite Charizard? Want your Eevee to evolve into one of its most popular Eeveelutions? Want a Lucario, period? You'll need to put in hundreds of hours of consistent sleep to save up enough Sleep Points exclusively toward that goal... or you can just buy access to it immediately, through first purchasing access to the Premium Subscription! A Premium Subscription which, again, doesn't auto-cancel if you delete the app and can't be canceled through the app itself, for all you distracted parents who don't pay attention to fine print and wonder why your kid's game is running up a bill on your credit card each month after the 14-day free period - just long enough for you to have forgotten all about it in the first place. Snorlax wants a specific kind of Berry this week, but none of the helper Pokemon you recruited gather that berry, or they do and are just too low on Energy to manage it? Aren't you lucky! The shop will just sell you solutions to these problems the game itself created specifically to get you to shell out money!

no one’s telling you you to have to be the very best at it or pressuring you into paying for stuff, let alone the game itself.

Here's some screen shots from the game's own app page. Buttons to make purchases and drive interaction - the app store, sleep pass, how many dream shards you have, a prompt to buy more inventory space, your missions, your current goal, the progress meter and rarity values of your Pokemon's sleep styles, your collection and their levels, etc - are all constantly and prominently displayed. The entire first day of actual gameplay in the app is a tutorial explaining how it wants you to do more than just sleep and passively collect to the point that it literally sets a daily schedule of activity for you. The mechanics explanations are so egregiously long that the Professor character literally apologizes to the Player for being so long-winded about it. Oh, an adorable moment of self-depreciation and understanding! How humanizing and encouraging of empathy from the user, done with a cheeky wink and nod. Now that we've softened your emotional state ever so slightly, here's some more microtransaction-driven gameplay elements!

If this was really just a cute little game to idle around with for its own fun, there wouldn't be a cash shop, nor would the game require a consistent internet connection to its servers. The big thing with games like these is that they're not made for the Player's benefit or entertainment. They're made to make the parent company profits. That's it. If the Pokemon Company didn't think they'd make substantial returns on the investment of development, support, marketing, and online distribution costs to put this game out into the world, they never would have made it. That is a core reality of any product put out these days. I just spent this last week helping my studio's marketing and sales team make sales projections for one of our upcoming titles, figuring out how much we could reasonably charge our potential customers literally down to the penny. And the game we're selling isn't even a service with any kind of microtransactions or DLCs. Profits are fundamental in any studio production and, where microtransaction apps are concerned, are the core focus of why the app exists.

If you're perfectly happy with playing Pokemon Sleep as an idle "pop on every once in a while, poke for a few minutes, then forget about and never pay a cent" kind of game? Totally fine, you do you. But understand that Pokemon Sleep doesn't want you as its player and will not cater to your experience. The core gameplay of Pokemon Sleep is already designed to actively degrade into a subpar experience for those who don't pay to play and that rift will only become more pronounced as time goes by. Everything around the cash shop exists for no other reason than to encourage you to use the cash shop. Over time, the gameplay will further contort itself to drive more interaction with and reliance upon the cash shop as the app sheds its non-paying users who just tire of it and move on, instead doubling-down on the lingering, paying users who have already proven themselves a reliable stream of revenue. That is how these things always go and have always historically gone.

There's also the consistently apt adage of "if you're not paying for the product, you are the product". Pokemon Sleep requires an internet connection any time you want to interact with the app - there is no offline mode. Further, the actual fine print in the terms of service (not the bubbly, legally-meaningless assurances put into the game text itself) addresses that it will collect and may share your device information, user ID, and app activity (ie, the schedules, timing habits, and spending habits the game itself has ingrained into its interaction with the Player) for analytics and advertising purposes, and that they're okay with sharing (ie, selling) that information to third parties without naming who those third parties are. And boy, does the game really want you to link your Google, Apple, and Facebook accounts to it as part of its core functionality! Worth keeping in mind as well is that the app requires constant access to your microphone and can pick up sounds as minor as a sheet rustling when you turn over in bed. The game's bubbly, meaningless text assures you that it doesn't save or transfer the snippets of sleep recordings it makes of you each night, but it makes absolutely no assurances whatsoever in the fine print that it's not using your microphone for other purposes. It does, however, point out that it will be making use of your phone's functions even when you're not using the app.

So, yeah, I'll just still be over here not playing Pokemon Sleep and encouraging others to do the same, as well as pay closer attention to the nature of so-called "free to play" games.

#pokemon#pokemon sleep#game design#game development#microtransactions#corporations are not your friend

149 notes

·

View notes

Text

youtube

Certainly, here are more detailed instructions on earning and redeeming RB Coins within the RideBoom app:

Earning RB Coins:

Complete Rides: Each time you take a ride using the RideBoom app, you'll earn a certain number of RB Coins based on the distance, duration, and other factors of the trip.

Refer New Users: When you refer friends or family to sign up for the RideBoom app using your unique referral code, you'll earn RB Coins for each new user that completes their first ride.

Participate in Promotions: RideBoom periodically runs special promotions and challenges that allow you to earn additional RB Coins. These may include things like achieving a certain number of rides in a week or completing specific in-app activities.

Engage with the App: Performing certain actions within the RideBoom app, such as leaving reviews, updating your profile, or interacting with the app's features, can also contribute to earning RB Coins.

Redeeming RB Coins:

Pay for Rides: You can use your accumulated RB Coins to pay for all or a portion of your ride fares. During the checkout process, simply select the "Pay with RB Coins" option and the app will deduct the necessary coins from your balance.

Obtain Discounts: RideBoom may offer exclusive discounts or special offers that can be redeemed using RB Coins. These could include percentage-based discounts on rides or access to premium features.

Exchange for Other Rewards: In the future, RideBoom may introduce the ability to exchange RB Coins for other types of rewards, such as gift cards, merchandise, or even cash-back options.

To view your current RB Coin balance and transaction history, access the "Wallet" section within the RideBoom app. This will give you a clear overview of how you've earned and utilized your RB Coins.

Let me know if you have any other questions about the RB Coin system and how to maximize your earnings and redemptions within the RideBoom app.

33 notes

·

View notes

Text

How to Activate Cash App Card?

The Cash App Card is analogous to a disbenefit card from your bank. It allows you to add finances to your card, withdraw cash from an ATM, and pay retailers. In addition, it has several features that make it easier for you to make online deals. One of the most important effects of the Cash App is that it's only for some. You will have to be 18 times old to order a Cash App card.

You will need to give your name, address, phone number, and birth date to admit your card. You may also have to enter a hand. While the Cash App is great for making and managing online deals, you can only pierce it if you are connected to the internet. In addition, you will need to have a strong bandwidth to make it work.

The cash app activate card is a simple process. It's one of the most important effects you can do to get the most out of your app. The Cash App has several features to make it easier for you to make and manage deals. You will also need to know about the Cash App's secret- it's QR law. The Cash App card has a QR law you can overlook with your camera.

How to Activate a Cash App Card via phone?

The Cash App is a great way to manage your plutocrat, and it's also delightful to use. You can also use it to shoot plutocrats, musketeers and family. The app will also allow you to select a" boost" for your card. You can select a free reimbursed card with a limit or a free card that can be reloaded. You can also add a delineation to your card. The app also allows you to select a" Cash Tag" to add to your portmanteau. You can also use the app to withdraw cash from an ATM. This can save you a ton of plutocrats.

cranking a Cash App Card is fairly easy. The process of how to Activate a Cash App card is analogous to whether you use an Android or iOS device.

· First, you will want to download the Cash App onto your device.

· Next, you will need to overlook a QR law with your phone's camera.

· Once you've scrutinised the QR law, you will need to fill out some form fields. You will need to fill in some introductory information, similar to your card's CVV number and the date your card will expire.

· The app will also let you pick a colour for your card. The app will also let you add your hand to the card.

How to Activate a Cash App Card Before It Arrives?

cranking the Cash App card before it arrives is an option, but you do not have to stay until the box arrives to get started. It's possible to Activate your new Cash App card on your smartphone or PC, indeed if you plan to use it later.

cranking the Cash App card is a breath thanks to its mobile app, which can be downloaded on iOS or Android bias. The icon resembles a credit card. To Activate the card, you will need to overlook the QR law on the reverse.

The Cash App also has an online plutocrat transfer service, a great way to shoot plutocrats from one bank account to another. You can also use the Cash App to make purchases in physical locales. Still, the app only allows you to make purchases for a limited amount. The maximum spending limit is a modest$,000 per week. However, it's worth considering your choices, If you are planning on making further than many purchases. Cash App offers client support, which is helpful if you witness any problems when you activate cash app card with QR law. You can also communicate with the company by phone.

#activate cash app card#how to activate cash app card#cash app activate card#cash app card activation#how do i activate my cash app card#cash app help activate card#activate my cash app card#how to activate a cash app card#how to activate my cash app card#how do you activate a cash app card#how to activate cash app card without logging in#how to activate your cash app card#activate cash app card by phone#activating cash app card

1 note

·

View note

Text

Someone's been stealing money from the petty cash at work for a year now, and I haven't been able to find out who or how.

I've covered, from my own money, close to €4000 by now, and my salary is only €500/month, which means that I've been living on scraps trying to pay rent, bills, cat stuff, and all the unexpected expenses that hobble me once or twice a month, such as having to buy a new vacuum cleaner, fixing the water heater, fixing the plumbing in the bathroom (twice), and buying a new washing machine, to name some. I've been eating nothing but plain congee since November of last year except for the holidays and my birthday, I've started buying lower quality cat food, and I've denied myself everything from buying new socks to getting new headphones just to keep myself in the black.

And finally - finally! - thanks to a friend's help, I could get my hands on a small wireless camera to set up in the office where I keep the petty cash till so I can catch the thief. I couldn't report any of the missing cash because after the first time it happened, I got told the next time it happens I will lose my job, and I can't afford that, but if I had proof that the cash was missing not because I was irresponsible at my work but because someone was stealing, then I could finally do it.

And the camera DOESN'T FUCKING WORK.

I've done everything right, followed the manual step by step, and the goddamned thing won't work!

You can only look through the camera if you're actively using the application that connects the camera to your phone. The motion sensor doesn't work despite changing all the settings to turn it on. The app recognizes the micro SD card I put in, but only in the sense that it recognizes there's an SD card there and how much free memory there is on it - it won't format it (as per instructions) and it won't use it as storage. Eventually, after about five hours of trying to get the camera to accept the micro SD card, I caved in an bought the app's Cloud storage space... but the camera won't accept it as storage either! So the only way for the camera to record anything is for me to actively use the app, go to the camera screen tab, click Record... and then stay on that window because the second I leave that tab (not even the whole app, just the tab!), the recording stops automatically 🤬

I was so happy when the camera arrived, so hopeful that this nightmare will finally be over and I'll finally be able to breathe a little easier, but nooo.

Not me.

Not with my luck.

So I've wasted €100 I couldn't afford to spend, and with the way things are going, I won't be surprised if the thief steals more money this weekend, and I'll just have to cover it again, and all for no better reason than because fuck me, that's why.

And then people DARE chastise me for being suicidal.

You fucking come live my life and then tell me I'm not justified in wanting all of this to be over and not caring how it happens anymore as long as it fucking STOPS.

6 notes

·

View notes

Text

Know Your Dating Partner’s Location by Spy App for iPhone

Are you curious to unveil the whereabouts of your dating partner without arousing suspicion? Look no further than the ingenious Spy App for iPhone. This tool discreetly tracks your partner's location, offering invaluable insights into their movements.

How Does it Work

Harnessing cutting-edge technology, the Spy App operates stealthily in the background of your partner's iPhone, remaining undetectable at all times. Through GPS tracking, it pinpoints the exact location of the device, allowing you to stay informed about your date's activities without them ever knowing.

Why Choose the Spy App for iPhone?

Gone are the days of uncertainty and doubt in your relationship. With the Spy App, you can gain peace of mind by keeping a vigilant eye on your partner's whereabouts. Whether you're concerned about their safety or simply curious about their daily routine, this tool offers unparalleled convenience and reassurance.

Signs of Dating Partner Infidelity

Increased Secrecy: Your partner may become more guarded about their phone, emails, or social media accounts, creating barriers where there were none before. For more knowledge read the Related Topic.

Change in Routine: Sudden changes in habits or routines without a clear explanation could be a sign of infidelity. This might include frequent late nights at work or unexplained absences.

Lack of Intimacy: A noticeable decrease in physical intimacy or emotional connection could indicate that your partner's focus has shifted elsewhere.

Defensive Behavior: If innocent questions about their whereabouts or activities lead to defensive responses or accusations, it may be a sign that they're hiding something.

Secretive Finances: Unexplained expenses or secretive financial behavior, such as hiding credit card statements or cash withdrawals, could signal infidelity.

Gut Feeling: Trust your instincts. If you feel uneasy, talk to your partner. Explore concerns together.

Importance of Knowing Dating Partner Location

In today's fast-paced world, where relationships are often shaped by digital communication and hectic schedules, knowing your dating partner's location can offer numerous benefits:

Safety and Security: Being aware of your partner's whereabouts can provide a sense of security, especially in potentially risky situations. Knowing where they are allows you to ensure their safety and offer assistance if needed.

Building Trust: Transparency in sharing locations can foster trust and open communication in a relationship. It demonstrates a willingness to be honest and accountable, strengthening the bond between partners.

Peace of Mind: Knowing that your partner is where they say they are can alleviate anxiety and doubts, promoting peace of mind and reducing unnecessary worry or suspicion.

Coordination and Planning: Understanding each other's locations facilitates better coordination and planning of activities, whether it's scheduling dates, meeting up with friends, or simply knowing when to expect each other home.

Connection and Intimacy: Sharing location information can enhance feelings of connection and intimacy by allowing partners to feel more involved in each other's daily lives, even when physically apart.

Detecting Red Flags: In some cases, discrepancies in location information may raise red flags and prompt important conversations about trust and fidelity within the relationship.

Using Spy App for iPhone Service from Expert’s

When it comes to employing a Spy App for iPhone, seeking assistance from experts can be invaluable. Here's why: Some Secrets To Monitor Your Dream Girl

Professional Guidance: Experts in spy app technology can provide valuable guidance on selecting the right software for your needs, ensuring you get the most effective and reliable solution.

Installation Support: Installing spy apps can be complex, especially for those unfamiliar with the process. Experts can offer step-by-step assistance to ensure proper installation and setup, minimizing the risk of errors or detection.

Optimal Configuration: Expert advice can help optimize the configuration of the spy app to maximize its effectiveness while maintaining discretion. They can advise on settings and features tailored to your specific monitoring requirements.

Troubleshooting: Should any issues arise during usage, experts can offer troubleshooting support to resolve technical glitches or address any concerns promptly.

Confidentiality: By engaging with reputable experts, you can trust that your privacy and confidentiality will be respected throughout the process, safeguarding sensitive information and maintaining discretion.

Connect With Expert

Looking to track your dating partner's location discreetly? HackersList is your go-to choice. Their expert team offers tailored solutions for your needs. They prioritize your privacy, ensuring your monitoring activities stay hidden and your data secure. Need help with installation, configuration, or troubleshooting? They've got you covered with prompt support. And rest assured, they keep everything. Partner with HackersList for confidence in your monitoring journey. Get In Touch

#location tracking#location tracker#location track#dating partner location tracking#dating partner#hackerslist#hackerslistco

6 notes

·

View notes

Text

Im sorry if this post comes off weird and not very understandable, but I (and a friend) have been forced to live with something horrible and traumatizing (at the hands of someone we called A FRIEND) for the last few days and I am about to burst and need to get this out somewhere where I feel safe.

(TRIGGER WARNING: faked Sui attempt mention below, me being gaslit, lied to, made to feel like I was an idiot and a harasser)

It all started a few days ago by a message from (someone that I called a friend)’s account. Lets call them Wolf.

In the past, during our short friendship, a friend and I discovered that Wolf liked making jokes about Sui. Alot. Everyday, practically. But not only jokes. Once, she faked a Sui attempt, filmed it, and sent it to my friend N. My friend, traumatized, told me in the group chat and we were very pointed in saying that such things were not a laughing matter. Please keep on mind, Wolf is in her late 20’s. An age where you would think people no longer do such things.

Now, back to what happened. It all started a few days ago by a message from Wolf’s account.

Wolf’s account left a lengthly message in the Discord chat we share with N, my friend. The message was by someone we did not know, telling us that Wolf had committed a Sui attempt and was now in the hospital.

We were told by “Jordyn” that she was only telling the people closest to Wolf what happened, and that none of Wolf’s In Real Life friends knew. It was only us, and Wolf’s parents. She told us to stay quiet and to not post on Wolf’s personal instagram, as to not let anyone know.

Why were we being told this? Why did Jordyn “take” Wolf’s phone, go into her Discord account, and decide to send a message in a Discord chat that had had NO ACTIVITY FOR 10+ DAYS?

Something was nagging at me and my friends mind, something felt wrong with what was all being said.

Constantly were inconsistencies popping up in her messages and constantly did something feel OFF. Something didnt feel right.

Why were we, two random people on Wolf’s Discord list, being told all of this? Why were we being told by “Jordyn” that none of Wolf’s In Real Life friends knew, but we, were being told all of this information?

The next day (8 to 10 hours after receiving the first message), still hesitant to believe it all after receiving NO proof or concrete information, I asked what hospital she was being held at, so that I could see about sending flowers. Sure we weren’t close, but it was the least I could do. The answer I received?

“She's gotten a lot of flowers. Like pretty much the whole room is filled with flowers. We might get her a P.O. Box or get her a cash app account set up, so people can donate.”

Once again, why were we being told (without being pushed but still told nonetheless) that we could donate money to a Cashapp that Jordyn was going to make for Wolf’s rehabilitation or that we could send cards to a PO box? But oh sorry, no one’s been told what happened but flowers are everywhere, so much so that we’re tripping over them so send money instead.

Today, after multiple days of being told “updates” that didnt line up with what would happen to a Sui attempt survivor, I had a lengthly conversation with the friend that was living through all of this with me.

I decided to ask if “Jordyn” was comfortable sharing information on what happened. (She had already told my friend everything in Private Dms, so why not tell me, a medical student studying in neurology and psychology, and who is studying on how to help rehabilitate Sui Survivors?)

She said yes, so I asked. I asked, as delicately as I could, on what happened, because the things she had said did NOT line up with what procedures a doctor would normally do.

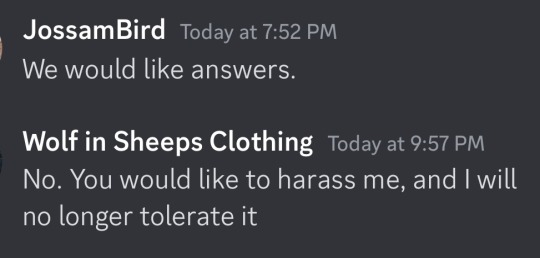

The answer I received? Wolf’s account leaving the Discord server, and this:

All I did was ask questions (because nothing was lining up and everything felt WRONG in everything this Jordyn/Wolf/whoever person was forcing down our throats on Discord everyday, and I figured I was owed that much since hey, Im being told all of this all of these horrible details in what happened) but I guess I was only allowed to that and only that, and to send money of course.

I (and my friend N) was made out to be a fool, an idiot. I was Gaslit, lied to, and manipulated.

Your name is not Wolf, but that is what you are. You are a Wolf in Sheep’s clothing, and that is what you will remain forever in my mind.

25 notes

·

View notes

Text

How to Increase Cash App ATM Withdrawal Limit?

Cash App places limits on how much you can withdraw in a single day or a week. These limits are intended to ensure that every user can easily and safely access their money and follow the security guidelines. However, users can increase these Cash App limit, for instance you can verify your identity and keep track of your account's activity. As you use more of Cash App accounts it is limits will likely grow in time. Moreover, if you face any issues customer support will be able to discuss possibilities for increasing the limits further.

You can check your Cash App ATM withdrawal and sending limits by logging into your account and viewing your transactions on your Profile tab. Additionally, you can also see your verification status and see if or not your account was accepted or rejected and the reasons for this. By checking your balances regularly and restricting the amount you can withdraw at a time and limiting the amount you withdraw, you will reduce the chance of exceeding your withdrawal or sending limits. Let's being by learning more about it.

What Is the Maximum Withdrawal Limit of Cash App ATM Withdrawals?

The Cash App's weekly and daily limits for withdrawal are currently set at $310 per transaction, with a personal daily and weekly limit of $1000 every day and week, respectively. To raise the Cash App daily withdrawal limit, verification of your account is required. This procedure is done in the app by giving your complete name, birth date and the last four digits of your Social Security number, as needed. After your account is verified, your limit for withdrawals and sending increase. Accounts that have not been verified will have an upper limit of $250 per week and verified accounts can make up to $7500 per week.

How to Increase Your Cash App ATM Withdrawal Limit?

You can increase Cash App ATM withdrawal limit by taking the steps mentioned below:

To increase your Cash App monthly and daily ATM limits for withdrawals the first step is to verify your account. This usually involves giving all your personal information, including birth date of birth, and the four digits from your Social Security Number (SSN) to verify your account. After verification, you will be eligible for higher limits that allow for more substantial withdrawals.

You can link a bank account with Cash App and get higher Cash App ATM withdrawal limit.

You also have the option to increase withdrawal limits by contacting the customer support team on Cash App.

What are the benefits of Increasing Your Cash App ATM Withdrawal Limit?

Cash App offers a quick and simple method of sending and receive cash between friends. The company has set limits on the amount of cash that can be taken out per day and month from ATMs to guard users against fraud. However, you can increase these limits by verifying your identity on Cash App. Below is the many benefits of increasing your Cash App ATM limit:

With higher withdrawal limits you can cash out more money using Cash Card.

You can manage the flow of your money more efficiently.

You can also avoid accidental ATM transaction charges.

Cash App offers a simple method to keep track of the history of transactions and ATM withdrawal limits to ensure that you do not overstep them accidentally. More limits on withdrawals mean fewer transactions, which will aid in reducing the amount of ATM fees you have to pay in the long run.

FAQ

What is the daily Cash App ATM withdrawal limit?

The daily ATM withdrawal limit for Cash App account holder is $310.

What is the weekly Cash App ATM withdrawal limit?

The Cash App weekly withdrawal limit for ATM is $1000.

How do I increase my Cash App ATM withdrawal limit?

When you are looking to increase the Cash App ATM limit for withdrawals start the app and choose the profile icon at the upper-right corner. Select "Personal," enter your full name, birth date and the last four digits from your SSN to "Personal", submit this information and wait for the Cash App to confirm who you are.

Can I withdraw more than my daily limit on Cash App?

Yes, you withdraw more than daily limit on Cash App however for this you must complete the identity verification procedure.

3 notes

·

View notes

Text

Everything You Need to Know About Cash App Withdrawal Limits

With the rapid shift towards digital payments, Cash App has emerged as one of the leading platforms for quick and easy transactions. Whether it's sending money to friends, paying bills, or even buying Bitcoin, Cash App offers a versatile and user-friendly experience. However, as with any financial tool, there are certain limitations to remember—especially when withdrawing funds. Understanding the Cash App withdrawal limit is crucial for anyone who relies on the platform for their day-to-day financial activities.

Cash App allows users to withdraw funds in multiple ways, including ATMs, using a cash card, or transferring Bitcoin to an external wallet. However, these actions come with daily and weekly limits, which are set for security and compliance purposes. If you're unfamiliar with these restrictions or looking for ways to increase your withdrawal limits, you're in the right place.

In this blog, we'll provide a detailed breakdown of Cash App withdrawal limits, explain how they work, and offer guidance on increasing them if necessary. We'll also address frequently asked questions to help you navigate the app more effectively.

What are the Cash App ATM Limits?

One of the critical features of Cash App is the ability to withdraw money from ATMs using the Cash Card—a customizable debit card linked directly to your Cash App balance. This makes accessing cash simple and convenient, but there are limits on how much money you can withdraw from ATMs within a given time frame.

Currently, the Cash App ATM limit is structured as follows:

Daily ATM Withdrawal Limit: Cash App users can withdraw up to $310 daily from ATMs.

Weekly ATM Withdrawal Limit: The total withdrawal amount is capped at $1,000 over seven days.

Monthly ATM Withdrawal Limit: Cash App users can withdraw a maximum of $1,250 from ATMs over a 30-day period.

These limits are designed to protect users from fraudulent activity and ensure compliance with financial regulations. However, they can sometimes feel restrictive for those who frequently need access to larger amounts of cash. It's also worth noting that Cash App charges a standard $2.50 fee for ATM withdrawals, though users can get these fees reimbursed if they receive $300 or more in direct deposits each month.

What are the Cash App ATM Withdrawal Limits?

Understanding the timeframes for Cash App ATM withdrawal limits is essential for managing your finances effectively. Cash App users are subject to daily and weekly ATM withdrawal limits, which prevent them from withdrawing more than a certain amount within a 24-hour or seven-day period.

Let's break it down further:

Cash App Daily ATM Withdrawal Limit: You can only withdraw $310 daily from any ATM using the Cash Card. This limit is refreshed every 24 hours, starting from your last withdrawal.

Cash App Weekly ATM Withdrawal Limit: The total cash you can withdraw from ATMs over seven days is $1,000. This rolling limit resets every week based on the timing of your transactions.

The critical takeaway is to plan, especially if you anticipate needing more cash than the daily or weekly limits allow. Users may want to explore ways to increase their withdrawal limits for frequent or large withdrawals, which we'll discuss in a later section.

What are the Cash App BTC Withdrawal Limits?

In addition to standard cash withdrawals, Cash App offers cryptocurrency enthusiasts the ability to buy, sell, and withdraw Bitcoin (BTC) directly from the app. This makes Cash App a convenient platform for those involved in cryptocurrency transactions. However, similar to cash withdrawals, there are limits on how much Bitcoin you can withdraw.

The Cash App BTC withdrawal limit is set as follows:

Daily BTC Withdrawal Limit: Cash App users can withdraw up to $2,000 worth of Bitcoin in 24 hours.

Weekly BTC Withdrawal Limit: Users can withdraw up to $5,000 worth of Bitcoin in seven days.

It's important to note that these limits are separate from the cash withdrawal limits, and they are specifically for Bitcoin transfers. For users who are actively engaged in trading or transferring Bitcoin to external wallets, understanding these limits is crucial to managing your cryptocurrency assets effectively.

Bitcoin transactions on the Cash App also come with fees, generally based on the network's congestion and the transaction size. Always check the applicable fees before withdrawing to ensure you get the best transaction value.

How to Increase Cash App Withdrawal Limit?

One simplest and most effective way to increase Cash App withdrawal limit is to verify your identity on the platform. Unverified users have significantly lower limits, but once you provide the necessary information, Cash App may raise your withdrawal limits.

Open Cash App and go to your account settings.

Provide your full name, date of birth, and the last four digits of your Social Security number.

Sometimes, you may be asked to provide additional documents, such as a government-issued ID.

Once verified, you may see an increase in your withdrawal limits for ATMs and Bitcoin transactions.

Reach Out to Customer Support

If you've followed all the steps above and still find the withdrawal limits restrictive, consider contacting Cash App's customer support team. In some cases, they may be able to adjust your withdrawal limits based on your specific needs, especially if you're a long-time user with a solid transaction history.

While support may not immediately raise your limits, it's worth trying if you need to access more cash or cryptocurrency through the platform.

FAQs

1. What is the Cash App withdrawal limit per day?

The Cash App daily withdrawal limit from ATMs is $310. This limit applies to Cash Card withdrawals and resets every 24 hours.

2. What is the Cash App weekly withdrawal limit?

Cash App allows users to withdraw up to $1,000 weekly from ATMs. This limit is spread over a rolling seven-day period and refreshes based on the timing of your withdrawals.

3. How can I increase my Cash App withdrawal limit?

You can increase your Cash App withdrawal limit by verifying your identity, linking your bank account, setting up direct deposits, and maintaining regular account activity. Verified users with direct deposits often have higher limits.

4. What is the Cash App BTC withdrawal limit?

Cash App users can withdraw up to $2,000 worth of Bitcoin daily and up to $5,000 weekly. These limits apply specifically to cryptocurrency transactions.

5. Are there fees associated with Cash App ATM withdrawals?

Yes, Cash App charges a standard $2.50 fee for ATM withdrawals. However, this fee can be reimbursed if you receive at least $300 in direct deposits to your Cash App account monthly.

6. Can I withdraw over $310 from the Cash App in one day?

No, the maximum daily withdrawal limit from an ATM using Cash App is $310. However, you may be able to increase this limit by verifying your identity and setting up direct deposits.

Conclusion

Understanding the Cash App withdrawal limit is essential for anyone who frequently uses the platform for financial transactions. Whether withdrawing funds from an ATM using the Cash Card or transferring Bitcoin to an external wallet, knowing the daily and weekly limits ensures you won't face unexpected restrictions.

By verifying your identity, maintaining an active account, and setting up direct deposits, you can increase your Cash App withdrawal limit and access significant amounts of cash or cryptocurrency when needed. With these strategies, you can make the most out of Cash App's features while enjoying the convenience of digital transactions.

Remember, withdrawal limits are put in place for security and compliance reasons, but with a few simple steps, you can manage these limits and raise them to suit your financial needs.

#cash app atm withdrawal limit#increase cash app withdrawal limit#cash app atm withdrawal limit per day#cash app daily atm withdrawal limit#cash app withdrawal limit#cash app card atm withdrawal limit per week

2 notes

·

View notes

Text

What Are the Cash App Limits? Complete Guide for 2024-2025

When using Cash App, understanding its various limits is crucial to making the most of the platform. Cash App has established a series of limits on transactions to ensure security and compliance with financial regulations. These limits vary based on the type of transaction, the user's verification status, and the method of payment or transfer. In this comprehensive guide, we will cover all aspects of Cash App limits, including daily, weekly, monthly, withdrawal, and Bitcoin-related limits. Whether you are new to Cash App or an experienced user, this article will help you navigate these limits effectively.

What Is the Cash App Daily Limit?

Cash App’s daily limit refers to the maximum amount you can send or spend in a single day. For unverified accounts, the Cash App daily sending limit is typically capped at $250. However, once you verify your account by providing additional personal information, this limit can be significantly increased. The Cash App daily limit for verified accounts can go up to $7,500, allowing you to send or spend more money in a single day.

What Is the Cash App Weekly Limit?

The weekly limit on Cash App is the maximum amount you can send or spend within a week. For unverified accounts, this limit is generally set at $1,000 per week. Verified accounts enjoy a much higher weekly limit, often reaching up to $7,500. This Cash App weekly limit is critical for those who use Cash App for regular transactions, ensuring they can manage their finances effectively.

What Is the Cash App Monthly Limit?

The monthly limit on Cash App encompasses the total amount of money you can spend, spend, or withdraw over a 30-day period. For unverified accounts, this limit is typically around $4,000. However, once you verify your account, you can significantly increase this limit. Verified users can enjoy a Cash App monthly limit of up to $17,500, depending on their transaction history and account activity.

When Does Cash App Weekly Limit Reset?

Understanding when your Cash App weekly limit resets is crucial for planning your transactions. Cash App's weekly limit resets exactly one week after the first transaction of the week. For instance, if you made a transaction at 10 AM on a Monday, your limit would reset at 10 AM the following Monday. this rolling reset system ensures that users have a continuous, seven-day cycle to manage their spending.

What Are Cash App Withdrawal Limits?

Cash App also imposes withdrawal limits for transferring money from your Cash App balance to your linked bank account. For unverified accounts, the Cash App daily withdrawal limit is usually capped at $2,500. Verified users can increase this limit significantly, often up to $25,000 per week. This higher limit is particularly beneficial for those who need to transfer large amounts of money to their bank accounts regularly.

What Are Cash App ATM Withdrawal Limits?

For those who use the Cash App Card to withdraw money from ATMs, understanding the Cash App ATM withdrawal limits is essential. The daily ATM withdrawal limit is generally set at $310 per transaction and $1,000 per week. Verified users can request an increase, though the exact limits may vary depending on their account activity and transaction history.

What Are Cash App Bitcoin Withdrawal Limits?

If you’re using Cash App to buy and sell Bitcoin, you’ll need to be aware of the Bitcoin withdrawal limits. For unverified users, the Cash App daily Bitcoin withdrawal limit is typically around $2,000, with a weekly limit of $5,000. Verified users can significantly increase these limits, with some enjoying a daily Bitcoin withdrawal limit of up to $10,000 and a weekly limit of $50,000.

What Are Cash App Sending Limits?

The sending limits on Cash App dictate how much money you can send to other users. For unverified accounts, the Cash App daily sending limit is typically $250, with a weekly limit of $1,000. After verification, these limits can increase to $7,500 per week, making it easier to send money to friends, family, or businesses.

What Are Cash App Transfer Limits?

Cash App's transfer limits are similar to its sending limits, but they apply specifically to transferring money from your Cash App balance to your linked bank account. The Cash App daily transfer limit for unverified users is usually $2,500, with a weekly limit of $7,500. Verified users can request an increase to accommodate larger transfers.

How Much Can You Send on Cash App After Verification?

After verifying your account, you can send up to $7,500 per week on Cash App. Verification requires providing your full name, date of birth, and the last four digits of your Social Security number. Once verified, you can also enjoy increased limits for receiving, withdrawing, and transferring funds, making Cash App a more versatile financial tool.

Can You Send $5,000 Through Cash App?

Yes, you can send $5,000 through Cash App, but only if your account is verified. Unverified accounts have a much lower Cash App sending limit, so it’s essential to complete the verification process if you need to send larger amounts of money.

How to Increase Cash App Limits?

Increasing your Cash App limits involves verifying your account. To do this, open the app and navigate to your profile. From there, you’ll be prompted to enter your full name, date of birth, and the last four digits of your Social Security number. Once verified, your limits for sending, receiving, and withdrawing money will increase significantly.

Conclusion

Cash App offers a versatile financial platform, but understanding its limits is essential for maximizing its benefits. Whether you're new to Cash App or a seasoned user, staying informed about these limits and how to increase them can enhance your experience. Always prioritize security by verifying your account and following best practices to protect your financial information. By managing these limits effectively, you can fully enjoy the benefits of Cash App with confidence.

2 notes

·

View notes

Text

Increasing Higher ATM Withdrawal Limits on Cash App: Essential Tips

Cash App has revolutionised the way people manage their finances by providing a seamless and user-friendly platform for sending, receiving, and withdrawing money. One of the most common features users inquire about is how to increase the Cash App ATM limit. Whether you're a frequent traveller, a business owner, or simply someone who often uses ATMs, understanding the limits imposed on withdrawals and knowing how to increase them can be crucial.

In this comprehensive guide, we will break down everything you need to know about the Cash App ATM withdrawal limit, the factors that affect your withdrawal capabilities, and, most importantly, how you can maximise your withdrawal limit to meet your needs.

What is the Cash App ATM Withdrawal Limit?

Before we dive into the steps for increasing your withdrawal limit, it’s essential to understand what the Cash App ATM withdrawal limit is and how it works.

Cash App provides a Cash Card, a customizable debit card that allows users to withdraw cash from ATMs. While convenient, there are certain limits set on how much you can withdraw from an ATM daily, weekly, and monthly. These limits are in place to protect your account from fraud while ensuring the platform remains secure.

Here’s a breakdown of the basic cash app withdrawal limits:

Daily Withdrawal Limit: Cash App users can withdraw up to $310 per day.

Weekly Withdrawal Limit: Users can withdraw a maximum of $1,000 per week.

Monthly Withdrawal Limit: The limit for monthly withdrawals is $1,250.

While these limits are sufficient for many users, those who need higher withdrawal limits may find them restrictive. Fortunately, there are ways to increase your Cash App ATM withdrawal limit, and we’ll cover those in detail.

How to Increase Cash App ATM Withdrawal Limit?

Increasing your Cash App ATM withdrawal limit is a relatively straightforward process, but it requires verification of your account and responsible usage. Below are the steps you can follow to boost your withdrawal limit.

Step 1: Verify Your Account

The first and most crucial step to increasing your withdrawal limit is verifying your Cash App account. Unverified accounts have much lower limits compared to verified ones. To verify your account, Cash App will require some personal information, including:

Full legal name

Date of birth

The last four digits of your Social Security Number (SSN)

To do this:

Open Cash App and navigate to your profile by tapping the icon in the top right corner.

Scroll down and select "Personal."

Enter the required information, including your SSN.

Follow the prompts to submit your information for verification.

Once your account is verified, you will notice a significant increase in your withdrawal limit, including your ATM withdrawal limits.

Step 2: Order a Cash App Card

To take advantage of ATM withdrawals, you need to have a Cash App Cash Card. This card allows you to use your Cash App balance at any ATM that accepts Visa. If you haven’t already ordered one, follow these steps:

Open the Cash App and tap the Cash Card icon.

Follow the prompts to customize and order your Cash Card.

Once your Cash Card arrives, activate it in the app.

Having an active Cash Card is necessary for ATM withdrawals and is a key component in increasing your Cash App card ATM withdrawal limit.

Step 3: Monitor Your Transaction Behaviour

Cash App often increases your withdrawal limit over time as it monitors your usage patterns and transaction history. Consistently using the platform responsibly—such as making regular deposits, avoiding flagged transactions, and maintaining a good balance—can lead to higher limits being granted.

If you regularly use the Cash App for various transactions, Cash App’s algorithm may recognize this behavior and automatically offer you higher limits. Keep in mind that maintaining a good transaction record plays a role in earning trust with the platform.

Step 4: Contact Cash App Support

If you have a verified account and still find that your Cash App daily withdrawal limit is too low, it’s worth reaching out to Cash App support. While they won’t necessarily increase your limit upon request, they may offer guidance on what you can do to qualify for higher limits.

Open Cash App and tap your profile icon.

Scroll down to “Support” and select “Something Else.”

Follow the prompts to submit a query about increasing your ATM withdrawal limit.

Support can help clarify any specific steps you need to take to qualify for higher limits, or they may assess your account activity to determine if an increase is possible.

Step 5: Link a Bank Account for Larger Withdrawals

If increasing your Cash App withdrawal limit per day ATM is not feasible, linking a bank account to your Cash App can provide a workaround. By transferring funds directly from your Cash App to a linked bank account, you can withdraw larger amounts from your bank’s ATM without being bound by Cash App’s limits.

This method is particularly useful for users who need to access higher sums of money than the Cash App withdrawal limit allows.

Additional Limits to Be Aware Of

Apart from ATM withdrawal limits, there are other transaction limits within Cash App that you should know, especially if you use Cash App for other types of payments:

Cash App Bitcoin Withdrawal Limit: If you deal with Bitcoin, you can withdraw up to $2,000 worth of Bitcoin per day and up to $5,000 per week.

Cash App Sending Limits: Verified users can send up to $7,500 per week. Unverified users are limited to $250 per week.

Cash App Receiving Limits: There is no limit on how much money you can receive on Cash App, regardless of verification status.

FAQ About Increasing Cash App ATM Withdrawal Limits

1. What is the withdrawal limit for Cash App?

The standard Cash App ATM withdrawal limit is $310 per day, $1,000 per week, and $1,250 per month. Verified users may have access to higher limits.

2. Can I increase my Cash App ATM withdrawal limit?

Yes, by verifying your account and demonstrating responsible transaction behavior, you can increase your cash app withdrawal limit over time. Ordering a Cash Card and contacting support may also help.

3. How long does it take to verify a Cash App account?

Verification typically takes up to 24-48 hours. Once verified, your limits will automatically increase, allowing for higher withdrawals and transfers.

4. Is there a limit on Bitcoin withdrawals?

Yes, Cash App has a Bitcoin withdrawal limit of $2,000 per day and $5,000 per week.

5. How do I get a Cash App Cash Card?

You can order a Cash Card directly through the Cash App. Tap the Cash Card icon in the app and follow the instructions to customise and receive your card.

6. Can I withdraw more than $310 from an ATM using a Cash App?

No, the daily CashApp ATM limit is set at $310. However, verified users may have access to increased limits for other types of withdrawals.

Conclusion

Understanding how to increase Cash App ATM withdrawal limit can make a significant difference in how you manage your finances through the platform. While Cash App's standard limits are sufficient for many users, those with higher withdrawal needs can benefit from account verification, consistent usage, and responsible transaction habits.

By following the steps outlined in this guide, you can unlock higher withdrawal limits and take full advantage of everything Cash App has to offer. Whether you're withdrawing cash from an ATM or managing large transactions, Cash App provides the flexibility and convenience that makes it a popular choice for millions of users. Don’t let withdrawal limits hold you back—take control of your Cash App experience today!

2 notes

·

View notes

Text

FULL STORY OF THE SAGA OF THE EXPLOSIVE PHONE AND THE ELECTRONICS STORE THAT TRIED TO GET ME TO COMMIT DOMESTIC TERRORISM! -

This is going to take a hot minute to type, so be patient

on June 18th 2024 I was out running errands, and picked up dinner, in doing so I overdrew the credit union account, I THOUGHT I had zeroed it out, but it had actually overdrawn.

I didn't find out until after the bank had closed, and since the 19th was Juneteenth (a federal holiday in the states) the CU was closed.

I THOUGHT I could sign the account up through Zelle and/or cashapp and just transfer money directly into the account, but Zelle continually failed, and cash app let me enroll it, but not transfer the money to the account.

Continually they said the issue was with the DEBIT CARD, not the account and told me to call the bank. I couldn't.

On the 20th, I woke up early enough to call the bank, and began the arduous process of verifying over the phone with my dad just so I could talk to them, and Zelle, and try to figure out why the everloving hell the zelle system said there was something wrong with the card and not letting me even sign up so I could transfer money into the account.

I spent four hours on this. Calling one, calling the other, being on hold. and NO ONE could fix the problem.

I repeated myself so many times I was tired of hearing myself. I got one person who said it was the carrier, so I had to call t-mobile, except it wasn't tmobile it was mint, and tmobile transferred me to aura and not mint, and finally to mint who said 'oh that feature is already unlocked on the account you need to call the banking institution or zelle.

On the final call to zelle, the new tech was refusing to accept the verification. and starts going through her little trapper keeper script of why she was refusing to accept the verification when we had all the answers all the info and had ACTIVELY BEEN VERIFYING FOR FOUR HOURS until this point when she says, off handedly during her script read (she was literally just reading the fucking bullet points, I could HEAR the pauses as she shifted line down) "Your account must have more than a dollar in it to enroll"

I spin, looking at the phone only to realize that the phone my dad is holding has expanded, and popped the back of itself off. And immediately begin internally panicking but externally I'm just being frustrated because THAT was the problem for the past four hours, not me entering info wrong, not the information being incorrect with the bank, not the debit card being mislinked, not a system error THE ACCOUNT WAS ALREADY OVER DRAWN AND IT TOOK FOUR HOURS AND WIGHT TECHS TO TELL ME THIS CONDITION?!

I tell dad to immediately hang up the phone and give it to me, I'm ready to rip my hair out and he thinks I'm going to throw the phone and kind of clings to it. I say, firmer. "Give me that timebomb NOW" and he goes 'what is the pro- what the fuck is that?"

I saiod "That is a spicy pillow and you need to give itt to me -now-. I'm taking it to best buy it should still be under warranty." "Yeah, yeah.." and he handed me the phone "When did that happen?" "When you took the phone out of the case to talk to zelle a second ago. It's blowing out, and It doesn't need to be here." "Yeah you go handle... this..."

I explain the zelle issue why it wouldn't enroll, and go get dressed, grab the spicy ravioli and run out the door with the idea that I'll go to the credit union two cities over, fix the overdraft and then take care of the phone return. While driving it's still expanding so I reprioritize and decide to return the phone first.

In my mind, this is a simple thing. I know the phone is under warranty, it has become a safety issue, their standard practice of "keep this and send it off" is not a viable option so it will HAVE to be a refund/in store exchange.

I know this because I've had to do this once before in the past. I know how their policies work, I know the standard returns but more importantly I know the severity of a bloated li-ion battery and how fucking important it is to get it into a safe disposal unit to be picked up by hazardous waste techs with a fireproof vehicle

I go in, at this point I am forwardly professional, I am not panicked, excitable or anything I have my mask of professionalism on and I'm all fucking business. I go to customer service and say 'I need to make a return but before that, do you have a fire blanket or fire suppressant for this fire hazard" and I gently set the phone on the counter. My only thought is to safely contain this ACTIVELY EXPANDING lithium battery.

She looks down, eye go wide and goes "I don't know let me check" and runs to the back, I hear from the back "We have a bucket of sand" and I retort "That will do, this needs to be contained immediately please"

They come get it, and take the potential fire hazard to be buried in the sand bucket. NOW we may commence the return process. I immediately put on the customer service interaction mask, and give them the information for the account, I joke that my receipt for the purchase had bleached out in the car (It had, I keep it in the sunglasses holder and it had legitimated denatured) and we agree that is why they have everything digital.

The CS says it's a rapid exchange in store for this, I said yay, that's actually really nice, because 'express' is not great. She agrees, and sends me to the mobile department, I say take all the time they need, I'll pick a new phone and confirm it's what my dad wants, and I know the paperwork is going to take a hot minute.

I confirm dad doesn't care as long as it's functional, so I pick out the same type, but updated model of phone (Moto G Stylus 2023 model to replace the 2021 model that is buried in sand in the back)

I talk to mobile, connecting with the associate over customer horror stories and the like while the new phone that he, customer service, geek squad techs, and two other associates and a manager have seen, agreed this is going to be an instore exchange because of the circumstances.

We begin setting up the phone and I realize the sim card is still in the bomb. I roll back over in my wheelchair to ask if it's safe to get the sim card. And they say they have to check the IMEI anyway and I bawk. We've already confirmed it's probably not safe to turn the phone on right now, and they say it's okay, it's on the sim tray. I didn't know that, good information. And I ask, cautiously, if it'd be okay to turn it on BRIEFLY so I can get only the login email on it to know which email my dad used for logging into google so I can get his contacts and account synched

the tech says "I don't recommend it" I asked if it would be okay to do so knowingly against advice to turn it on, get the info, turn it off and rebury the thing?

By now, it's been confirmed the battery is no longer expanding, and it's not actively leaking, smoking or heating up. We all agree it's a compromised cell within the battery but it hasn't been breeched, so it's safe-ISH to handle, briefly, but it shouldn't be agitated too much just in case.

I suggest removing the back fully so there's no pressure points. I'm ignored.

I get the info, turn off the fire bomb and hand it back, where it's taken back to what I assume is the sand bucket.

after a little while, the replacement phone is ready for login, I begin setting up the phone for my dad and logging in his information so it'll be set up and ready to go. They begin the return paperwork for the other phone.

At this point it's been about 45 minutes. It's been a smooth process where everyone was on the same side of 'we do not want to agitate the bomb, and Asrya should be leaving with a functional phone and NOT a fire hazard."

when they try to do the return, the SKU (sales identification number) comes up as dead meaning that the store chain doesn't carry that model any more, and the system won't accept the item as a return for cash, credit, or refund. It just -won't- . Initially, I tell them I've had to do this only twice before (I didn't mention it was spread out over like twelve years that I've been using this specific protection plan with Best Buy) and that they may have to store manager override it.

I've had to utilize this process before with laptops I had to exchange due to manufacture defects... so I actually do know how the policy works, the former general manager of the store had explained it to me YEARS ago.

So I tell them that it happens, and to take their time, I know it's a pain in the ass and I'm sorry I'm taking up so much resources, but it's really okay and as long as the end result is good, I don't mind waiting.

At this point it's 1 in the afternoon.

I've been at the best buy for an hour.

The manager comes up after a while, telling me that it's physically impossible. And I'm going to have to use the 'express return' system, it's the only solution that their system is allowing them to process.

I start getting frustrated, which means I start crying because I am fighting the urge to begin yelling. I've now been here for over an hour, I was in the middle of handling the situation and I NEED the phone in order to process the banking issue this all started with so my dad doesn't get charged overdraft fees.

I explain I can't wait a week for a new phone and what am I supposed to do with the bloated phone?

they explain this process, and get snippy telling me "It's 2-3 days not a week" I tell them it's 2-3 BUSINESS days "well... yeah" "This is THURSDAY, at the earliest it'll process Friday then ship out on Monday, if I'm LUCKY it'll arrive on TUESDAY at the earliest, and maybe not until Thursday of next week! During that whole time my dad's account will have overdraft fees being applied to it for each day! We can't afford that! On top of that you want me to pay a 70$ deposit just to do this! We do not have that money right now"

I was told I could apply for and use the best buy credit card.

I asked for a phone number to call, that there HAD to be an alternative solution, I said I didn't want to take the fire hazard home with me.

By now they had REMOVED THE PHONE FROM THE BUCKET and were walking around with it after me, trying to get me to take the fucking compromised battery.

I tell them to put that thing back in the sand bucket. And they give me 'corporate's number' a 1877 number. I ask if that's the number to call to talk to a supervisor or manager because this is an exception to the policy if ever there was one. If anyone would have the directions for overriding this dead sku problem, it should be the store manager's area or district manager

I am told there is no area or district manager.

I am FLOORED, I realize I've not been around this system for a couple of years but that information just... baffles me. I ask who THEY call when they have a situation come up that can't be handled in store.

They tell me they call the 1877 number.

I am BAFFLED by this, but I call the 1877 number, the call id comes up as 'best buy express kiosk" and I groan because I recognize this as the trunk line call center. I brace for and prepare to handle this for an hour. I am still trying to be as professional as possible.

I have now been here for going on two hours.

I roll out into the entry way, they CHASE ME with the fucking firebomb of a phone and ask if I'm leaving. I look back at them holding this fucking bloated phone and say no I'm just trying to get out of everyone's way so I can call the number and would they PLEASE put that thing back again and leave it in the safe bucket!

I spend the better part of hour three struggling to get through these customer service techs, explaining the situation and begging for them to transfer me to a manager or supervisor. I'm being denied this at every turn until I get to "returns" and am told to ask THEM for a manager by a tech who seemed to understand the situation and why I was calling.

I'm transferred, the tech listens, agrees that I should NOT be handed a firebomb to go home with, and should not be expected to ship a bloated li-ion battery in the mail and that it should be an in store return with store credit. I ask her to please explain this to the manager and go to remove my headset and put her on speaker so the manager can hear it from corporate

the call disconnected

I break

I begin crying, as quietly as I can, and the manager goes 'well' and I explain the call disconnected... I have to get back to that point.. and roll back into the entry way to begin the process again.

I'm crying, I just need this to work.

I've been here for nearly three hours.

The new tech that answers refuses to confirm the account and begins insisting I give my personal number and email to him. Refusing to accept the account information.

He puts me on hold. I call the corporate number again, merge the calls, and he has me on a mute hold. I get another tech that sound like the same guy, who also eventually puts me on hold, and then disconnects the call.

I'm sobbing and breaking down at this point, I'm having a panic attack, and struggling to maintain any type of composure at this point. I tell them I'm going out to my car so I'm not causing a scene in their store and is the manager positive there is no other option. I need to be leaving with a working phone, or at least I do NOT need to be leaving with a fucking FIRE HAZARD that they are expecting me to ship in the mail it is ILLEGAL to ship compromised batteries in the mail.

this fucking manager looks me dead in the face and says I can purchase a new phone to use, and just bring it back after the 'express return' is finished, or I can just do the express return, but there is NO WAY at all physically for her to do the return, in any shape, form or fashion, that I will have to take the fire hazard phone with me and ship it to their facility when the new phone comes in the mail in five days or so

I say I do not feel comfortable holding onto a FIRE HAZARD for a week, much less being without the ability to do the banking and is best buy going to cover the overdraft fees I'll be incurring and what am I supposed to do with a fucking bloated phone that could explode?!

Her solution? "You can go to walmart and buy a bucket and sand and put it in there if you don't feel safe with it, I hear that sand is good for batteries like this"

I snap... I just.. break down and begin crying because at this point I've been here for three hours, I know what she's suggesting is absolutely wrong, she's lied to me about not having an area/district manager, and she's standing over me like some fucking goon while telling me to take a BOMB home and then send it in the federal post in a week!

I break down, I take the stupid fucking bomb, they make me factory reset the phone I had been working on previously, I take the sim card, and I ask again if there is ANYONE I can call to talk to that will help. Who do THEY call when there's a situation because there HAS to be SOMEONE. They insist that nope, there's ONLY the 1877 number to the call centre.

I'm bawling, I'm broken, and crying I'm having heart issues, my head is screaming, my face feels burnt, and I roll out to the car and put the chair away. While unpacking the chair I realize I had actually put a pack of switch thumbsticks in the cart because I had been hoping to buy them with the leftover store credit I'd have when they all thought it was going to be a store credit exchange.

With my legs SCREAMING in pain, and barely able to walk, I limp back in on my crutches, unintelligibly sobbing and return the nearly-pilfered item, then go back to the truck. St this point I've set the phone on my driver's seat, I begin working on possibly loading the chair back on the truck when there's a loud, gunshot-like POP noise

and for a brief, horrifying moment, I think the battery has just exploded in my truck. Only to realize the heat had actually boiled a bottle of soda, and THAT was what had just exploded.

I'm determined, angry, frustrated, pissed, and petty... I don't want this fucking bomb in my possession, I know for a goddamn fact I am not supposed to have this bomb in my possession, I know that if it goes off and causes damages that best buy will be liable for it, and frankly, while the payout might be nice the inconvenience of having to deal with the damage, replacement, insurance, lawyers, and court costs and investigation are too much for me to handle. I don't want to go through it I JUST want a phone that works, the bank situation to be fixed and to NOT HAVE A FUCKING BOMB IN MY POSSISSION

I begin calling the useless as fuck call centre again, and for the next three and a half hours (totaling seven now) I continually try to explain, repeat, get transferred, sobbing, crying and getting hung up on by asshole techs. and I'm losing more and more composure as it goes on.

I FINALLY get a tech who says 'it should be store credit' I said I need the instructions on how to do that because the manager is claiming to not know how to do it. and I beg her to talk to the manager. Success. I go back in side, clinging to this tiny spider thread of hope that they'll fix it.

the manager takes my phone, asks if she can step tot he side, I say yes, and she comes back and they're both just repeating that the only solution is for me to send this bomb in the mail

I tell them it's ILLEGAL to send it, it's literally a federal crime. It CANNOT be policy to do this. None of them will budge. None will do the override, they're INSISTING I have to wait for a phone to come in, and then send a BOMB in the mail. I tell them this is probably why we've had mail trucks catch fire if they're telling people to do this it's ILLEGAL

The fucking manager says 'it's not actively leaking, it's not smoking or how it SHOULD be legal to send it in the mail' I ask for the salary person she mentioned. I go tot the mobile guy I'd been talking to six hours ago. I ask HIM to get me the salary person. This woman comes over and stands over me, arms crossed, with them angrily standing in front of me, arms crossed, like they're trying to intimidate me out of the store for trying to run a scam.

they continue to tell me there's no other option that they wouldn't spend six hours to tell me know they'd help if they could that I'm going to have to use the mail system.

I ask the salary manager who they call. She says corporate. I say that is horseshit. She gets offended and I clarify. That if their new policies is to call the call center number they gave me that is a horse shit policy and THEY are in danger of running into DANGEROUS situations like this without a way of getting out or around it. Who do I call to complain about that policy then?

"You can complain but it won't do anything to change the answer"

"Who do I call?!"

They give me no answer.

I leave

after seven hours of fighting with them. I leave, in possession of a fire hazard, my head pounding, feeling sick, having now gone through MULTIPLE break downs, melt downs, and panic attacks over the past seven hours of being on site trying to get them to do the right things.

I go home and explain to my parents what happened, I unload the tiny amount of groceries I'd picked up (twenty bucks of emergency cash) and realize how much bullshit it is what had happened. So I begin calling the local investigative news stations to see if they want to look into this.

One of the news stations is VERY interested in the fact this store told me to buy a bucket of sand to put a dangerous fire/explosive into. They're interested that the store can't be called with inbound calls, that there's apparently no area or district manager to call, that the store sent me home with an explosive and told me to send it in the mail.

I send the store to the news station. I call other stations, they're not as interested. That's fine. I'm advised to call the attorney general of commerce and leave them the story. I do.