#i always be posting at the great for algorithm hours of 12:30 AM

Explore tagged Tumblr posts

Text

hey boys, don't be assassin-HATERS

(edit: the original version had Lucanis also questioning his/Spite's tastes, but the extra words looked a little too crowded/clunky) (so just know Lucanis IS questioning why he's attracted to these numbskulls)

#dragon age the veilguard#dragon age fanart#dragon age#lucanis dellamorte#davrin datv#rook datv#rook de riva#Marisol de Riva#a coworker posted this joke on slack and i immediately screenshot it so i could draw this lmao#do crowbars exist in dragon age universe? lmao they do for my purposes#i'm not sure if Spite enjoys puns i'm not completely solid on what my HC for that is lmao#Viago and Rook might not be related but you don't become his protégé without catching the pun disease#i realize i keep drawing Davrin with them in these specific situations but that's literally because they were my party for the WHOLE game#so if i imagine the chuckle fucks out and about it's always these three lmao#given the times i regularly upload art you would think i live like not in the USA but lmao#i always be posting at the great for algorithm hours of 12:30 AM

722 notes

·

View notes

Photo

New Post Top 10 Reasons Why You Should Buy iQOO 3!! has been published on https://www.reviewcenter.in/10017/top-10-reasons-why-you-should-buy-iqoo-3/

Top 10 Reasons Why You Should Buy iQOO 3!!

iQOO 3 is a hot topic of discussion right now among the smartphone enthusiasts in India, as it is the first phone to offer 5G connectivity. While 5G is something which is not much relevant in India at present, iQOO 3 is undoubtedly a #MonsterInside phone which should be known for its other features like top-of-the-line specifications, a future-ready device, super-fast charging, an unbeatable camera & the enhancing gaming experience features which will give you an absolute advantage from other gamers!

The price of the phone starts from Rs 36,990 and can be purchased either from Flipkart or iQOO e-Store. I am using this phone for last 15 days and let me tell not a few but top ten reasons why you should buy #iQOO3:

Sɴᴀᴘᴅʀᴀɢᴏɴ 865 – Fᴀꜱᴛᴇꜱᴛ Pʀᴏᴄᴇꜱꜱᴏʀ Eᴠᴇʀ!

iQOO 3 is powered by Qualcomm’s latest and greatest Snapdragon 865 chipset, a 7nm chipset equipped with the latest A77 architecture that offers significantly better performance (with an Antutu score of 6.1L), 25% more when compared with Snapdragon 855 while reducing energy consumption quite a bit, 30% to be precise. And with Adreno 650 GPU onboard, this phone can handle everything without any issues. Be it multitasking or hardcore mobile gaming; it can handle anything without slowing down ever!!

Fastest RAM & Storage Ever!

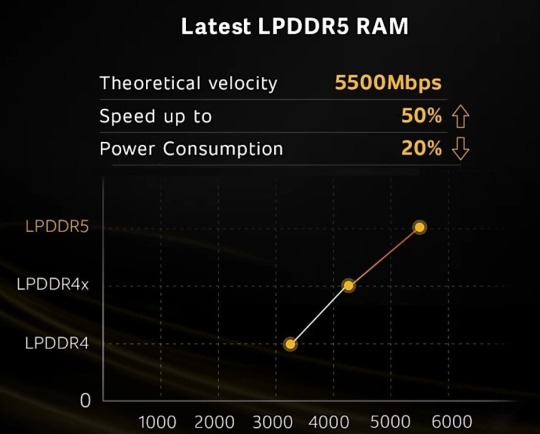

LPDDR5 RAM

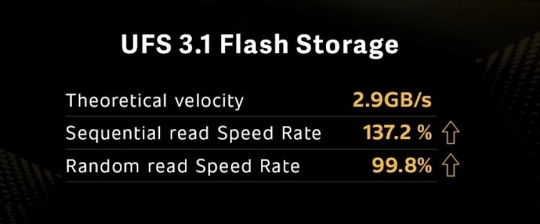

UFS 3.1 Storage

It’s not just the chipset and GPU, which makes iQOO 3 fastest, it’s also the 8GB/12GB of LPDDR5 RAM and 128GB/256GB of UFS 3.1 storage, which contributes to better user experience, especially in multitasking and improving cache speeds. LPDDR5 RAM improves the r/w speed to 5500Mbps, which helps users in faster application retrieval. So even if you may use it for years, it won’t feel outdated. The funny thing here is that this phone outshines my laptop by specifications. Now I probably have a more powerful phone than my laptop.

Device Capability Information from Kine Master

Because of such high-end specs, I was able to easily edit 4K videos on the phone itself using the apps like Kine Master. The inbuilt video editor does a fine job, but for adding effects, a professional editor is required on the go. The faster RAM & Storage, along with the processor, plays a prominent role here for processing of added visualizations on videos while editing and also on rendering of 4K videos.

вeѕт ɢαмιɴɢ eхperιeɴce!

The iQOO 3 comes with two pressure-sensitive buttons on the side of the phone, which the company calls it Monster Touch Buttons. These buttons let users use quick multi-finger operations in the game. The US-Ergo board-certified iQOO 3 that it offers 50% more comfort, better grip, and the overall experience is better than gaming phones.

There is 4D Game Vibration as well, which simulates the recoil when shooting and the vibration of the steering wheel when driving. All these make the gaming experience a bit more realistic and enjoyable for sure.

Also, for the earphone and charger, iQOO has implemented an L-Shaped charging capsule point for the cable so that users can play games while charging and listening to in-game sounds easily without the cords interfering with controls.

Large Battery & Super Fast Charging Tech

The iQOO 3 comes with a massive 4440 mAh battery, which lasts easily good enough for the day. Even if you may actively use it for extended periods, the battery gave me SOT (screen-on-time) of 8 hours at home on Wifi and 7-8 hours SOT on 4G outdoors. The battery backup is the last thing you may ever need to worry about if using iQOO 3.

In terms of charging speeds, iQOO inevitably wrecks everyone with 55W charging. The phone can be charged from 0% to 50% in just around 15 minutes. That is a big deal for many who often forget to charge their phones. In my experience, the phone charged the battery from 0 to 50% in b/w 15-20 minutes, and to 100% in around 50 minutes.

polαr vιew dιѕplαy wιтн 180нz reѕpoɴѕe rαтe

Equipped with a Polar View 6.44-inch full HD Super AMOLED display, the iQOO 3 has a stunning & color-accurate display. The brightness of the screen can go up to 1200nits, which is much better than the latest iPhones. There are no legibility issues, even if you take it in the harshest of sunlight. With HDR 10+ Standard Certification and Rhine Eye Comfort Certification, iQOO 3 ensures an immersive and comfortable experience. It also has the 180Hz Super Touch Response rate, way higher than 120hz standard, a 50% increase in touch scanning. Surely the higher touch response rate can be felt while playing games.

48MP AI qυαd cαмerα wιтн 20х zooм

iQOO 3 Rear Quad Camera Module

The iQOO 3 comes with a quad-camera setup on the back where there is a 48MP Sony IMX582 sensor as a primary camera.

Along with that, there is a 13-megapixel telephoto lens, another 13-megapixel wide-angle camera, and a 2-megapixel depth sensor. Quad-camera setup on smartphones is standard these days. But iQOO has focused on a significant concern raised by many, i.e., improving the wide-angle and telephoto lens.

Rather than going for just an 8-megapixel gimmicky wide-angle lens on many phones, iQOO uses a 13-megapixel lens, which offers higher levels of sharpness. Also, the 13-megapixel telephoto lens provides up to 20X digital zoom so that capturing distant objects in great detail is never an issue. There are quite a few camera features as well that are worthy. There is the Super Anti-shake that uses the EIS algorithm with an ultra-wide-angle lens.

While recording a video, it can perform real-time image stabilization processing by cutting and processing the edges of the screen. The AI Night Mode with upgraded HDR, shorter imaging time, and multi-frame (12-16) noise reduction technology makes sure that photos captured in the night look less noisy and have more details.

нι-ғι & нι-reѕ αυdιo

For audio enthusiasts, iQOO 3 offers the AK4377A Hi-Fi independent chip, which provides the users stereo 32VELVET high-quality audio DAC. Also, the phone has a Hi-Res audio certification, which improves the audio experience by giving a feel of listening to music in a live ambient.

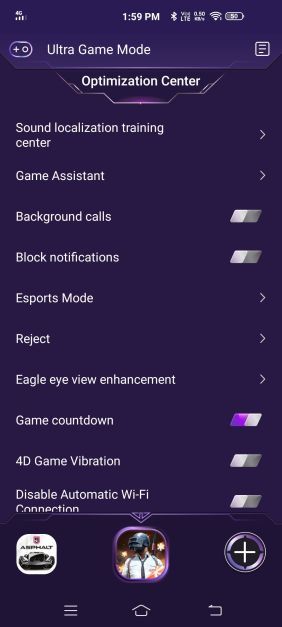

iQOO UI

iQOO UI is a feature-rich UI built atop of Android 10. iQOO is a company that takes feedback from users/reviewers seriously and is amending the changes suggested to offer the consumers the best experience possible. iQOO UI includes some unique options for gamers like Monster Mode, which allocates all the resources of the phone to boost the gaming experience. There is a gaming assistant which optimizes your game experience and record your activity to keep track.

It also offers the much-wanted desktop drawer, dark-mode, Always-on-Display (which can be customized with options further) & shortcut center with notifications can be accessed from the top of the screen.

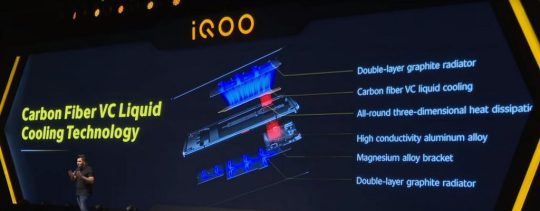

Carbon Fiber Vapour Cooling System

iQOO 3 uses a soaking plate to offer all-round cooling. The liquid-cooling system, combined with superconducting carbon fiber and a temperature equalizing board improves the heat dissipation. Due to this, even while playing very high-end graphic-intensive games, the phone doesn’t heat up quickly. Hence it enhances the gaming experience by avoiding the adverse effects of heating.

iQOO Care

iQOO, being a premium smartphone brand, offers the consumers pick and drop service for any repair issues across the country covering more than 15000+ pin codes. For any on-call assistance, consumers can call iQOO service experts who are available 24*7 over the toll-free number 1800-572-4700.

0 notes

Text

73 questions

Hey friends! Happy Thursday! Hope you’re enjoying the week.

It’s been a fun and crazy one over here. The girls have had half-day camps, Liv auditioned for dance team, the Pilot has been flying nights, and madre’s birthday was on Tuesday! We got together for a *small* family dinner (we joke that we’re just a small party of 28), and ate Mexican food, cake, and sang “Happy Birthday” to the amazing lady who gives so much to everyone in our family.

My fave picture from the night!

(The cake was from Whole Foods bakery and so so good.)

Workout-wise, I’ve crushed every day this week. Sunday, we filmed Summer Shape Up videos (the party starts June 24)! Monday, I hopped on the Peloton bike for a 30-minute ride, Tuesday was barre, Wednesday was a BODYATTACK class On Demand (my link is good for 21 days FREE of the amazing Les Mills workouts), and today and tomorrow are off since I’m traveling to Chicago for a blog trip. I’m looking forward to catching up with Anne and Julie, and meeting some new blogger friends. I’ll be sure to share some of the adventures on IG stories!

I originally planned to post this one while we were on our cruise, but since internet was a bit sketchy – and I blasted through the ship’s plan in a mere 24 hours – I didn’t get the chance to get this one published. I originally saw this survey on my friend Ashley’s blog, and then Julie’s. I loved reading their answers so much, so I thought I’d join in the survey fun.

1. What’s the best thing that happened to you this month? Taking a Disney Cruise with the fam!

2. What’s your favorite game? We don’t usually play board games at home, but our favorite games is a hide and seek and tag hybrid. I hide, the girls try to find me, I jump out and go “AHHH!” and they scream, I chase them around until I tag them, and then they hide.

3. When are you most inspired? Mid-morning, usually after I’ve had breakfast and survived the school drop-off.

4. If you could teach one subject in school what would it be? Math

5. What’s your favorite beverage? LaCroix

6. What’s the best compliment you’ve ever received? A friend from the gym sent a text message while the Pilot was deployed and basically gave me a pep talk. She said she was proud of me for doing so well with work stuff and solo parenting. It was very unexpected and really made my whole month. It was a great reminder to let other people know when I’m inspired by them or think they’re crushing it.

7. What is your favorite birthday cake? Yellow cake with chocolate buttercream

(That was my bday cake last year!)

8. What is one thing you still have from your childhood? A photo album that my mom made for me when I was 4 and we’d taken a trip to California. I was with all of my aunties, my parents were still married, and my uncle was still alive. Our dog chewed around the edges of it when I was younger, and the small plastic photo album contains quite a few happy memories from being a kid.

9. What is your favorite movie? Love, Actually

10. What is something you can’t do? Play the flute even though I faked it for an entire year in 5th grade. I could do all of the finger work, but no sound would come out. So I just pursed my lips and acted like I knew what I was doing.

11. Window or aisle seat? Aisle so I can get up a thousand times if I feel like it.

12. What makes you laugh no matter what? P makes the most ridiculous faces that make me laugh every day. We get a kick out of zooming in on photos that she’s in, because you never know what you’re going to get.

13. What does creativity mean to you? Free from any perceived restraints or judgments.

14. What are your favorite lyrics of all time? “Look around, look around, how lucky we are to be alive right now.” I don’t think I’ll ever get sick of Hamilton.

Or hanging out with Betsy

15. What is your favorite holiday? Thanksgiving

16. What’s heavily played on your music playlist right now? “Far Too Good” by John Smith.

17. If you could raid one woman’s closet who would it be? My friend Annie’s! Whenever she posts Instagram posts, I want her outfit and her shoes

18. Must have purse item? Color Intense lipstick in at least 3 shades

19. What did you want to be when you grew up when you were 12? On Broadway

20. What is something you will not be doing in ten years? Wondering where the heck we’ll be living in a couple of years. It’s so crazy to be able to know and plan where we want to live.

21. What is an important life lesson for someone to learn? Your gut instinct is always right.

22. How do you start your day? Scrolling through my phone with one eye closed.

23. Would you ever live anywhere besides Tucson? Yes! We’d love to make it back to San Diego one day but love being in Tucson for now.

24. What is your favorite dessert? Anything super chocolaty.

25. Is there a dessert you don’t like? Creme brûlée is gross.

26. It’s brunch! What do you eat? Eggs, breakfast potatoes, turkey sausage, and a mimosa because brunch without cocktails is just a sad breakfast. <— words of wisdom from Prep & Pastry

27. Where was the best vacation you’ve ever taken? Positano

28. Favorite Disney animal? Stitch

29. What is a book you are planning on reading? “Educated” is downloaded on my Kindle but I haven’t started it yet

30. What did you read most recently? “Where the Crawdads Sing” and loooooved it

31. Favorite solo artist? Michael Bublé for life

32. What is something you’re tired of? The Instagram algorithm. They want to turn it into a “pay to play” platform, which was the downfall of Facebook

33. What’s a city you wish to visit? Paris

34. Heels or flats? Wedges

35. Where does one go on a perfect road trip? To Sedona. It’s just an easy drive from us and has an incredible energy.

36. What do you do on a rainy day? Try to find indoor activities to entertain the kiddos! We’ll do art, visit a museum, go rock climbing, or see a movie

37. What’s your favorite exercise? Spin, barre and BODYPUMP are tied

38. What was your worst subject in school? English which is a hilarious thing since I write a blog for a living

39. What is your spirit animal? An otter. I want to spend the day in the pool, floating on my back, eating salad

40. What do you usually eat for breakfast? A giant egg patty and either oatmeal with almond butter or a brown rice tortilla

41. What do you usually eat for dinner? We change it up every night but some classics are salmon, sweet potato and salad, Harney Cobbs, or sushi roll bowls

42. Cooking or Baking? Both!

43. Favorite baked good? Cookie dough on the bottom, Oreo’s in the middle, and brownies on top

44. What is something you wish you could be good at? Organizing photos on my laptop. It’s a hot mess

45. Skiing or Surfing? Paddle boarding

46. First celebrity crush? JTT — Jonathan Taylor Thomas — I became a vegetarian for him when I was 8

47. Most recent celebrity crush? Aaron Tveit. I love his voice!

48. What color was your prom dress? Junior year it was bright pink and senior year it was light purple and silver

49. How do you manage stress? Try to do the most challenging/inconvenient item on my to-do list first

50. What do you do to relax? Read or cook

51. Age when you were first kissed? 12

52. Place you were first kissed? Playing “spin the bottle” after musical theatre class

53. Favorite fashion trend of all time? Low-top sneakers with dresses

54. Best fashion advice you’ve ever received? If you have to convince yourself that you like it, you’ll never wear it, so don’t buy it

55. What is your current favorite piece of clothing that you own? These embellished sandals. I wear them all the time and am constantly asked where I bought them

56. Shoes or Bags? Bags! I love a good crossbody

57. How do you know if you’re in love? When you know, you know

58. Television show you’ve binged on recently? The Bachelorette! We’re almost caught up for the season

59. Who do you turn to when you’re sad? My mom – she always knows exactly what to say to make me feel better

60. Leather or lace? Lace

61. Vintage or new? New

62. What is your Kryptonite? Chocolate or guacamole

63. What are you most enchanted by? Surface level: Moms on social media who have 18 children, homeschool, are all matching in neutral clothing with zero stains, and elaborate mermaid braids in their hair. Deeper: I’m beyond enchanted with Liv and P. They surprise me, make me laugh, and make my heart explode every single day. I often find myself wondering how they’re so darn amazing?

64. What is your biggest strength? Hustle

65. What is your biggest weakness? Stressing over all of the details

66. What are 3 words to describe living in Tucson? Picturesque. Hot. Eccentric.

67. Cutest thing on planet earth? Baby koalas

68. Favorite color? Peach

69. Best first date idea? Something active, like a low-key hike, followed by dinner and drinks

70. Favorite time of day? Late.. probably around 9 or 10pm. I enjoy the quiet and downtime

71. What do you first notice about someone when you meet them? Their smile

72. What’s your guilty pleasure? Take a jar of almond butter, sprinkle chocolate chips into the jar, scoop out with a spoon

73. Favorite band? I wouldn’t say I’m super into bands at the moment and my music taste is all over the place. Back in high school, I was obsessed with Dashboard Confessional

That was a fun one! I always love surveys because it gives me the chance to get to know you all better.

So, tell me friends:

When are you most inspired?

What’s the best compliment you’ve ever received?

What’s one thing you cannot do?

Cutest thing on planet earth?

What do you do to relax?

Or pick any of the questions above and share your answers below!

Have a lovely day.

xoxo

Gina

The post 73 questions appeared first on The Fitnessista.

73 questions published first on https://olimpsportnutritionde.tumblr.com/

1 note

·

View note

Text

2019 Financial Job Outlook: What to Expect Based on My “Time Portfolio”

We get a lot of questions about the “outlook” for various jobs in the finance industry.

Will Job X be around in 10 years?

What about Job Y? Will it continue to pay high salaries and bonuses in 30 years?

But no one knows what will happen that far into the future, and if someone claims to have a clue, that person is lying.

However, you can get a sense of what people think in the near term by reviewing the actions of market participants: how do companies that serve customers in the industry spend their time and their money?

In this case, I am a “market participant” because I create and sell courses and guides geared toward finance jobs.

If I’ve been spending a lot of time and money in a certain area, you might conclude that I’m optimistic about its future.

And if I haven’t, you might conclude that I’m less optimistic, or that the area in question is less popular to begin with.

Here goes:

My “Time Portfolio”

I do not spend that much money directly on content creation. Most of my business spending is in areas like support, web design and development, advertising, and web services.

However, I do spend at least 1,000 to 1,500 hours of my time each year – and often more than that – on course creation.

Here’s where I allocated this time over the past three years (2016 – 2018):

Investment Banking Interview Guide (New Version): 25%

Real Estate & REIT Modeling (New Version): 36%

Excel & Fundamentals (Revisions/Tweaks/Written Guides): 20%

Bank Modeling (New Version): 19%

Time Portfolio = Market View (“Financial Job Outlook”) + Personal Circumstances

If your financial portfolio reflects your view of the financial markets and your personal circumstances, then your “time portfolio” reflects something similar – but in a different market.

The time allocations above roughly reflect my views of the finance job market, but they’re not a 1:1 match.

For example, I didn’t spend time revamping the Bank Modeling course because I think that FIG is a great, high-growth market; I did it because the old version needed updates, and I felt it was worth updating rather than discontinuing.

Also, I did not create completely new courses in the past few years (Restructuring, Infrastructure, Venture Capital, etc.) not because I think those industries are “bad,” but because:

We already have a ton of content to support and maintain, and I’m skeptical of my ability to handle even more, especially in areas I would have to learn from scratch.

Based on the data, I don’t think these additions would boost net sales by more than ~10%. That translates into ~3-4% in additional after-tax profits, which is not enough to motivate me more than 12 years into this business.

Now, to my market view. My thinking around the future of finance jobs is:

“The more complex and customized the deals, and the more relationship-oriented the field, the less likely it is to be automated or displaced, and, therefore, the better its prospects.”

Let’s go through the main industries covered on this site and look at both near-term and possible long-term changes.

With each one, I’ll consider market size/growth, past performance and returns, and vulnerability to automation and technological disruption.

And for fun, I’ll throw in technology jobs at the end as well:

Investment Banking

Companies have been raising capital for centuries and will continue to raise capital going forward, so I don’t think investment banking is going anywhere.

I don’t see a ton of upside to the field, but there’s also relatively little downside. Something fundamental about the economy and financial markets would have to change for IB to go away.

That’s possible, but it’s more likely on a 100-year time frame rather than a 20-year one.

Elements of the deal process will be automated, but the industry is still based on human relationships – so I doubt AI will take over unless robots kill and replace all humans (which I don’t think will ever happen).

At the same time, I’m not super-optimistic about IB because hiring is cyclical and companies tend do fewer deals when there’s a recession or market crash – both of which are likely in the next few years. So:

Near-Term Outlook: Neutral to slightly negative (anticipated market downturn).

Long-Term Outlook: Neutral to slightly positive.

Private Equity

Private equity and investment banking tend to move together, so my views are similar here: the typical PE deal does not lend itself to “automation,” so I don’t a whole lot changing.

Instead, the main problem is that Limited Partners such as pension funds and endowments will keep funding PE firms only if they beat, or at least keep pace with, the public equity markets.

It’s difficult to answer whether or not they’ve been doing this because it depends on the time frame and how you calculate “returns.”

IRR isn’t straightforward at the fund level because of unrealized gains and losses and the timing of contributions.

Based on Preqin data and a WSJ examination last year, the answer is “yes, sort of, with caveats” – and returns have declined over time, especially if you compare pre-2008 and post-2008 funds.

That said, private equity is not at serious risk of displacement, and LPs are likely to keep investing as long as returns stay decent (i.e., they do not greatly underperform the public markets).

Near-Term Outlook: Slightly negative (downturn will make exits more difficult).

Long-Term Outlook: Neutral to slightly positive.

Hedge Funds & Asset Management

Now we move into more negative territory. The data on the number of startup hedge funds tells the story here quite well:

The number of new hedge funds has plummeted, management and incentive fees are down, and the average hedge fund has greatly under-performed the S&P since 2009.

Some of this is due to the rise of passive investing and quant funds (though quant fund returns also haven’t been great), and some of it is due to quantitative easing distorting the markets.

But there’s a simpler explanation as well: the financial markets have become more efficient over time, and some of the most famous PMs (Paulson, Ackman, Einhorn) earned their reputations on a few great years a long time ago.

Even Warren Buffett’s recent performance hasn’t been great.

This is one reason why many funds have been moving into private equity-style investing and away from pure public-markets investments.

But it’s not all bad news – strategies that are more “deal-oriented,” such as distressed and other credit variants, might still attract LP attention and perform decently.

Also, the anticipated end of QE and the potential deflation of the passive investing bubble might help certain funds.

And there will always be mispriced assets; it’s just that as a fund grows bigger, it gets harder to identify bigger mispriced assets.

Near-Term Outlook: Negative.

Long-Term Outlook: Slightly negative.

Sales & Trading

A decade or two ago, if you weren’t sure what you wanted to do in finance, you could have made a good case for either sales & trading or investment banking.

Now, though, it’s harder to be enthusiastic about S&T because so much of it has been automated and/or “merged” with programming and data science.

Desks such as rates trading and ones that deal with more complex products, like exotics and distressed debt, have held up, but areas like cash equities trading haven’t fared so well.

So… this one comes down to your goals.

If you’re interested in the programming/automation angle or more complex products, S&T could still be a good field. Otherwise, I wouldn’t recommend it.

Near-Term Outlook: Slightly negative (automation, but also higher market volatility).

Long-Term Outlook: Slightly negative.

Equity Research

MiFID II has completely changed the business model here by requiring buy-side firms to pay for their research directly, which makes it harder to maintain large ER teams and justify their compensation.

So far, MiFID II is Europe-only, but firms everywhere will be affected because they have to compete globally.

The results so far aren’t great for either the established firms or the independents.

The other issue is that the end customers of equity research – hedge funds and asset managers – are also not doing well (see above), so they’ll have even less to spend on research.

The top Research Analysts still provide value because of their relationships and access to management teams and investors, and I don’t see that going away.

However, I also don’t think that ER is a great long-term career choice anymore.

It’s fine to start out in research and stay there for a few years to develop your network and skill set, but I wouldn’t recommend going beyond that.

Near-Term Outlook: Negative (MiFID II).

Long-Term Outlook: Negative.

Venture Capital

Venture capital is different from everything else here because it’s much longer-term, which means you can’t judge the success or failure of a deal for 10-20 years in some cases.

It took Harmonix, the company behind Guitar Hero, 11 years to be acquired by MTV!

Of course, most VCs underperform the market and many of their reported “returns” are actually unrealized gains.

If you compare venture capital to private equity, VC is a far more hit-driven business, with the big winners and the top few firms generating a disproportionate share of the total returns.

VC is even less likely to be automated than PE because there is limited data to work with, so algorithms can’t “predict” whether or not a startup will succeed based on past trends.

So, all things considered, I’m more positive on this sector.

You could easily work at a VC fund, claim you’re doing something complicated, say that the returns are coming but require more time… and then repeat that each year and collect cash along the way.

Near-Term Outlook: Neutral to slightly negative (expected downturn in the private startup market).

Long-Term Outlook: Slightly positive.

Corporate Development

As with the other transaction-related fields above, corporate development has good prospects because:

It’s unlikely to be automated because deals here, especially for joint ventures, are even more complex to negotiate and structure than M&A deals.

Companies are increasingly building their own corporate development teams to do deals without bankers, especially in sectors like technology.

Even if the financial markets crash, credit dries up, or M&A becomes less viable, corporate development professionals can still work on JV deals, partnerships, or divestitures.

In the near term, prospects may not be so great because of the negative factors above.

In the long-term, though, everything else will help.

The main issue is simply that it’s a relatively small industry, with few openings at most companies and low turnover, so gaining access to the right roles will still be challenging.

Near-Term Outlook: Neutral to slightly positive.

Long-Term Outlook: Slightly positive.

Corporate Finance

I’m less bullish about corporate finance.

First off, corporate finance is a “support role” for most companies, so it’s easier to justify cuts in a recession.

If you look at the three major areas of corporate finance jobs – FP&A, Controllership, and Treasury – a good number of tasks could be automated across all of those.

For example, with the right technologies, companies could employ fewer accountants to review the books; judgment and human intuition are required, but less so than in corporate development when negotiating a complex deal (for example).

I don’t think Managers and CFOs will be replaced because people still need to make decisions, but I expect that companies will do less hiring.

Another negative factor is that some companies previously known for top corporate finance programs, such as General Electric, seem to be… troubled, to say the least.

I don’t think corporate finance will go away, but in the long term, there will likely be fewer junior-level roles.

Near-Term Outlook: Neutral.

Long-Term Outlook: Neutral to slightly negative.

Commercial Real Estate

Many people seem to think that real estate jobs will be displaced and automated, but I’m far more skeptical.

Yes, there are many crowdfunding platforms, data gathering sites, and other startups looking to disrupt the market, but in most cases, I think these companies will be additive/complementary to what real estate professionals already do.

Many engineers think that decision-making about properties boils down to math and logic, but they overlook the human/emotional element as well as issues such as asymmetric information that cannot be solved with an algorithm.

Also, real estate is one of the oldest asset classes, dating back thousands of years, which is usually a sign that it will continue to exist for a long time to come (vs., say, hedge funds, which are very new by comparison).

If central banks attempt to induce massive inflation to deal with the looming debt crisis, real estate also serves as a hedge.

As with some of the other industries, I would argue that certain sectors – such as real estate private equity firms that focus on complex or distressed deals – are in better shape than others, such as real estate brokerage.

On the whole, though, I’m fairly optimistic about the field, though it may not do so well in the near term due to the property price decline that has already begun in places like San Francisco.

Near-Term Outlook: Neutral to slightly negative.

Long-Term Outlook: Positive.

Private Wealth Management & Private Banking

I don’t have a strong view here because I don’t follow private wealth management and private banking closely.

On the one hand, these fields should do well because the rich keep getting richer, which leads to more assets under management by these firms.

On the other hand, similar to other markets-based roles, it’s difficult for human advisers to beat passive investing and quantitative strategies consistently and at a lower cost.

One trend here is the rise of family offices and other boutique firms; similar to the elite boutique vs. bulge bracket divide in investment banking, they are likely to take more and more market share away from the large banks (and they’re even making an impact in private equity!).

So… I would rate from ronnykblair digest https://www.mergersandinquisitions.com/2019-financial-job-outlook/

0 notes