#ico marketing company

Text

Launchpad Strategies for Smart Investors: How to Maximize Your Gains and Minimize Risks

The Launchpad phenomenon has taken the crypto world by storm, offering exciting opportunities for investors to get in on groundbreaking projects early. But navigating this dynamic landscape requires more than just FOMO (fear of missing out). To truly thrive in the Launchpad arena, you need a strategic approach that balances potential gains with calculated risk management.

So, how do you become a Launchpad master? Here are some key strategies to guide you:

1. Do Your Due Diligence:

Never invest blindly. Research the project thoroughly. Dive into the whitepaper, analyze the team's expertise, and scrutinize their past performance. Look for reputable Launchpads known for their stringent vetting processes. Remember, just because a project is on a Launchpad doesn't guarantee its success.

2. Understand the Tokenomics:

Tokenomics, the structure and distribution of the token, is crucial. How many tokens will be issued? What's the lockup schedule? What utility does the token offer? A well-designed tokenomics model fosters long-term project growth and aligns investor interests with the project's success.

3. Master the Allocation Game:

Most Launchpads employ tiered participation systems. Understand the requirements for each tier and invest strategically to maximize your allocation. Look for platforms offering merit-based allocation, rewarding active participation and early engagement.

4. Diversify and Stay Patient:

Don't put all your eggs in one basket. Spread your investments across different projects on diverse Launchpads. Remember, Launchpad projects are early-stage ventures, and success is not guaranteed. Patience is key; don't expect overnight riches.

5. Be Risk-Aware:

Launchpad investments, despite their potential, inherently carry risks. The crypto market is volatile, and projects can fail. Never invest more than you can afford to lose, and consider setting stop-loss orders to mitigate potential losses.

6. Stay Informed and Connected:

The Launchpad landscape is constantly evolving. Stay updated on industry trends, platform updates, and project news. Join Launchpad communities to network with other investors and exchange insights. Remember, knowledge is power in this rapidly changing space.

7. Prioritize Security and Trust:

Only invest through reputable Launchpads known for their rigorous security measures. Use strong passwords and enable two-factor authentication to protect your investments. Be wary of scams and phishing attempts; never share your private keys with anyone.

8. Understand the Regulatory Landscape:

Regulation around Launchpads is still in flux. Stay informed about evolving regulatory frameworks and adapt your investment strategies accordingly.

9. Don't Chase Hype:

Resist the allure of hot projects backed by aggressive marketing campaigns. Stick to your research and invest in projects with sound fundamentals and long-term potential.

10. Enjoy the Journey:

Launchpad investing can be a thrilling experience. Approach it with a learning mindset, embrace the inherent risks, and celebrate the successes. Remember, it's not just about maximizing gains; it's about participating in the fascinating evolution of the crypto ecosystem.

By following these strategies, you can navigate the Launchpad landscape with confidence, minimizing risks and maximizing your chances of reaping the rewards of this exciting new frontier in crypto.

Read More:https://www.mobiloitte.com/blockchain/initial-coin-offering/

#ICO Marketing Services#ico marketing#ico marketing agency#ico marketing company#best ico marketing company#best ico marketing companies#best ico marketing agency#ico marketing services#ico promotion services#best ico marketing

0 notes

Text

Get prepared To Launch Your ICO Development Token

In the present technological growing era, Everything and anything remains possible with an effort added to it. No matter how hard it turns out to be, With a first step, you are almost halfway through to your destination. You get to apply the same phenomenon to your growing business idea/ideas too. What if the idea you possess is related to cryptocurrency and its application? The idea-only factor might not be sufficient for the growth factor that follows hurdles such as inconsistent revenue flow, Lack of funds, etc.,

The Initial Coin Offering (ICO) might turn out to be the saving factor for the project through a crypto-based crowdfunding mechanism that eventually increases the liquidity pool of the project. This ensures to lift the project from relegation and involves in enhancing its visibility.

With integration into the blockchain, These coins are nothing but a cryptocurrency in the form of native coin that will be purchased by the investors and other crypto-based entrepreneurs as a commodity or share of the project where their investment from surfing the project’s whitepaper becomes the liquidity of the platform and pushes it further for succession making the investors a.k.a shareholders have accessibility to the succeeded project drilling higher revenue.

Summing Up:

The hurdle factor such as insufficient funds and dull visibility of your project could be shut down by initiating an ICO Native token from a renowned ICO Development Company; By changing the path of your project from the professionals, you could witness professional growth in the future.

#ICO Development#ICO Development Agency#ICO Token Development Company#ICO Launch Services#ico development#ico marketing company#ico marketing services#business#entrepreneur#blockchain#design#finance#ico#ico script

0 notes

Text

Become greedy about announcing your ICO - Marketing Solutions

Never the faith or trust in obtaining funds through a fundraising model like ICO is broken. Getting your ICO to the globe to bring various potential investors is not a tedious task now! You can now stretch and concrete yourselves with the best ICO marketing company that can embellish your goals. Availing of the services like website development, SEO, PR marketing, video marketing, content marketing, e-mail marketing, and influencer marketing are lucrative ones.

0 notes

Video

undefined

tumblr

Make your crypto coin viral with our super marketing strategies.

Contact us for ICO marketing services

0 notes

Text

Best feature and functionality you should have in your travelling agency or business software

The yearly income for the travel and tourism sector is roughly 63% derived from online reservations.

You can handle online bookings effectively with a competent hotel reservation system. By automating reservation procedures, the possibility of human mistakes and financial losses in the hotel industry is decreased.

A simplified booking process also enables hoteliers to give customers a more user-friendly booking experience. While selecting a hotel reservation software, take into account the following factors.

The mechanism for booking hotels online :

A user-friendly interface that benefits both visitors and employees is a must for an effective hotel reservation system.

The reservation procedure will be greatly facilitated by a practical calendar front-desk perspective. The program must contain a plugin or JavaScript that can be integrated into the website for your hotel. It should also be able to link visitors to a portal or microsite where they can finalize their bookings online.

Without having to navigate through your website, the booking engine should give your visitors all the details they would need, such as rates, packages, hotel kinds, add-ons, inclusions, and other information.

Learn more: https://www.inspironlabs.com/

#mobile app developer company#reactjs angular#best app development company#web and mobile app development companies#best mobile app developers#angular react js#Full stack developer#eretail software#banking software#quality control#core java developer#ecommerce development company#ecommerce development companies#Business Intelligence#Blockchain app development companies#Chatbot development companies#ios & android application development companies#custom software development company#Big Data Analytics services & Digital Marketing services services#ICO development companies

0 notes

Text

The AI hype bubble is the new crypto hype bubble

Back in 2017 Long Island Ice Tea — known for its undistinguished, barely drinkable sugar-water — changed its name to “Long Blockchain Corp.” Its shares surged to a peak of 400% over their pre-announcement price. The company announced no specific integrations with any kind of blockchain, nor has it made any such integrations since.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/03/09/autocomplete-worshippers/#the-real-ai-was-the-corporations-that-we-fought-along-the-way

LBCC was subsequently delisted from NASDAQ after settling with the SEC over fraudulent investor statements. Today, the company trades over the counter and its market cap is $36m, down from $138m.

https://cointelegraph.com/news/textbook-case-of-crypto-hype-how-iced-tea-company-went-blockchain-and-failed-despite-a-289-percent-stock-rise

The most remarkable thing about this incredibly stupid story is that LBCC wasn’t the peak of the blockchain bubble — rather, it was the start of blockchain’s final pump-and-dump. By the standards of 2022’s blockchain grifters, LBCC was small potatoes, a mere $138m sugar-water grift.

They didn’t have any NFTs, no wash trades, no ICO. They didn’t have a Superbowl ad. They didn’t steal billions from mom-and-pop investors while proclaiming themselves to be “Effective Altruists.” They didn’t channel hundreds of millions to election campaigns through straw donations and other forms of campaing finance frauds. They didn’t even open a crypto-themed hamburger restaurant where you couldn’t buy hamburgers with crypto:

https://robbreport.com/food-drink/dining/bored-hungry-restaurant-no-cryptocurrency-1234694556/

They were amateurs. Their attempt to “make fetch happen” only succeeded for a brief instant. By contrast, the superpredators of the crypto bubble were able to make fetch happen over an improbably long timescale, deploying the most powerful reality distortion fields since Pets.com.

Anything that can’t go on forever will eventually stop. We’re told that trillions of dollars’ worth of crypto has been wiped out over the past year, but these losses are nowhere to be seen in the real economy — because the “wealth” that was wiped out by the crypto bubble’s bursting never existed in the first place.

Like any Ponzi scheme, crypto was a way to separate normies from their savings through the pretense that they were “investing” in a vast enterprise — but the only real money (“fiat” in cryptospeak) in the system was the hardscrabble retirement savings of working people, which the bubble’s energetic inflaters swapped for illiquid, worthless shitcoins.

We’ve stopped believing in the illusory billions. Sam Bankman-Fried is under house arrest. But the people who gave him money — and the nimbler Ponzi artists who evaded arrest — are looking for new scams to separate the marks from their money.

Take Morganstanley, who spent 2021 and 2022 hyping cryptocurrency as a massive growth opportunity:

https://cointelegraph.com/news/morgan-stanley-launches-cryptocurrency-research-team

Today, Morganstanley wants you to know that AI is a $6 trillion opportunity.

They’re not alone. The CEOs of Endeavor, Buzzfeed, Microsoft, Spotify, Youtube, Snap, Sports Illustrated, and CAA are all out there, pumping up the AI bubble with every hour that god sends, declaring that the future is AI.

https://www.hollywoodreporter.com/business/business-news/wall-street-ai-stock-price-1235343279/

Google and Bing are locked in an arms-race to see whose search engine can attain the speediest, most profound enshittification via chatbot, replacing links to web-pages with florid paragraphs composed by fully automated, supremely confident liars:

https://pluralistic.net/2023/02/16/tweedledumber/#easily-spooked

Blockchain was a solution in search of a problem. So is AI. Yes, Buzzfeed will be able to reduce its wage-bill by automating its personality quiz vertical, and Spotify’s “AI DJ” will produce slightly less terrible playlists (at least, to the extent that Spotify doesn’t put its thumb on the scales by inserting tracks into the playlists whose only fitness factor is that someone paid to boost them).

But even if you add all of this up, double it, square it, and add a billion dollar confidence interval, it still doesn’t add up to what Bank Of America analysts called “a defining moment — like the internet in the ’90s.” For one thing, the most exciting part of the “internet in the ‘90s” was that it had incredibly low barriers to entry and wasn’t dominated by large companies — indeed, it had them running scared.

The AI bubble, by contrast, is being inflated by massive incumbents, whose excitement boils down to “This will let the biggest companies get much, much bigger and the rest of you can go fuck yourselves.” Some revolution.

AI has all the hallmarks of a classic pump-and-dump, starting with terminology. AI isn’t “artificial” and it’s not “intelligent.” “Machine learning” doesn’t learn. On this week’s Trashfuture podcast, they made an excellent (and profane and hilarious) case that ChatGPT is best understood as a sophisticated form of autocomplete — not our new robot overlord.

https://open.spotify.com/episode/4NHKMZZNKi0w9mOhPYIL4T

We all know that autocomplete is a decidedly mixed blessing. Like all statistical inference tools, autocomplete is profoundly conservative — it wants you to do the same thing tomorrow as you did yesterday (that’s why “sophisticated” ad retargeting ads show you ads for shoes in response to your search for shoes). If the word you type after “hey” is usually “hon” then the next time you type “hey,” autocomplete will be ready to fill in your typical following word — even if this time you want to type “hey stop texting me you freak”:

https://blog.lareviewofbooks.org/provocations/neophobic-conservative-ai-overlords-want-everything-stay/

And when autocomplete encounters a new input — when you try to type something you’ve never typed before — it tries to get you to finish your sentence with the statistically median thing that everyone would type next, on average. Usually that produces something utterly bland, but sometimes the results can be hilarious. Back in 2018, I started to text our babysitter with “hey are you free to sit” only to have Android finish the sentence with “on my face” (not something I’d ever typed!):

https://mashable.com/article/android-predictive-text-sit-on-my-face

Modern autocomplete can produce long passages of text in response to prompts, but it is every bit as unreliable as 2018 Android SMS autocomplete, as Alexander Hanff discovered when ChatGPT informed him that he was dead, even generating a plausible URL for a link to a nonexistent obit in The Guardian:

https://www.theregister.com/2023/03/02/chatgpt_considered_harmful/

Of course, the carnival barkers of the AI pump-and-dump insist that this is all a feature, not a bug. If autocomplete says stupid, wrong things with total confidence, that’s because “AI” is becoming more human, because humans also say stupid, wrong things with total confidence.

Exhibit A is the billionaire AI grifter Sam Altman, CEO if OpenAI — a company whose products are not open, nor are they artificial, nor are they intelligent. Altman celebrated the release of ChatGPT by tweeting “i am a stochastic parrot, and so r u.”

https://twitter.com/sama/status/1599471830255177728

This was a dig at the “stochastic parrots” paper, a comprehensive, measured roundup of criticisms of AI that led Google to fire Timnit Gebru, a respected AI researcher, for having the audacity to point out the Emperor’s New Clothes:

https://www.technologyreview.com/2020/12/04/1013294/google-ai-ethics-research-paper-forced-out-timnit-gebru/

Gebru’s co-author on the Parrots paper was Emily M Bender, a computational linguistics specialist at UW, who is one of the best-informed and most damning critics of AI hype. You can get a good sense of her position from Elizabeth Weil’s New York Magazine profile:

https://nymag.com/intelligencer/article/ai-artificial-intelligence-chatbots-emily-m-bender.html

Bender has made many important scholarly contributions to her field, but she is also famous for her rules of thumb, which caution her fellow scientists not to get high on their own supply:

Please do not conflate word form and meaning

Mind your own credulity

As Bender says, we’ve made “machines that can mindlessly generate text, but we haven’t learned how to stop imagining the mind behind it.” One potential tonic against this fallacy is to follow an Italian MP’s suggestion and replace “AI” with “SALAMI” (“Systematic Approaches to Learning Algorithms and Machine Inferences”). It’s a lot easier to keep a clear head when someone asks you, “Is this SALAMI intelligent? Can this SALAMI write a novel? Does this SALAMI deserve human rights?”

Bender’s most famous contribution is the “stochastic parrot,” a construct that “just probabilistically spits out words.” AI bros like Altman love the stochastic parrot, and are hellbent on reducing human beings to stochastic parrots, which will allow them to declare that their chatbots have feature-parity with human beings.

At the same time, Altman and Co are strangely afraid of their creations. It’s possible that this is just a shuck: “I have made something so powerful that it could destroy humanity! Luckily, I am a wise steward of this thing, so it’s fine. But boy, it sure is powerful!”

They’ve been playing this game for a long time. People like Elon Musk (an investor in OpenAI, who is hoping to convince the EU Commission and FTC that he can fire all of Twitter’s human moderators and replace them with chatbots without violating EU law or the FTC’s consent decree) keep warning us that AI will destroy us unless we tame it.

There’s a lot of credulous repetition of these claims, and not just by AI’s boosters. AI critics are also prone to engaging in what Lee Vinsel calls criti-hype: criticizing something by repeating its boosters’ claims without interrogating them to see if they’re true:

https://sts-news.medium.com/youre-doing-it-wrong-notes-on-criticism-and-technology-hype-18b08b4307e5

There are better ways to respond to Elon Musk warning us that AIs will emulsify the planet and use human beings for food than to shout, “Look at how irresponsible this wizard is being! He made a Frankenstein’s Monster that will kill us all!” Like, we could point out that of all the things Elon Musk is profoundly wrong about, he is most wrong about the philosophical meaning of Wachowksi movies:

https://www.theguardian.com/film/2020/may/18/lilly-wachowski-ivana-trump-elon-musk-twitter-red-pill-the-matrix-tweets

But even if we take the bros at their word when they proclaim themselves to be terrified of “existential risk” from AI, we can find better explanations by seeking out other phenomena that might be triggering their dread. As Charlie Stross points out, corporations are Slow AIs, autonomous artificial lifeforms that consistently do the wrong thing even when the people who nominally run them try to steer them in better directions:

https://media.ccc.de/v/34c3-9270-dude_you_broke_the_future

Imagine the existential horror of a ultra-rich manbaby who nominally leads a company, but can’t get it to follow: “everyone thinks I’m in charge, but I’m actually being driven by the Slow AI, serving as its sock puppet on some days, its golem on others.”

Ted Chiang nailed this back in 2017 (the same year of the Long Island Blockchain Company):

There’s a saying, popularized by Fredric Jameson, that it’s easier to imagine the end of the world than to imagine the end of capitalism. It’s no surprise that Silicon Valley capitalists don’t want to think about capitalism ending. What’s unexpected is that the way they envision the world ending is through a form of unchecked capitalism, disguised as a superintelligent AI. They have unconsciously created a devil in their own image, a boogeyman whose excesses are precisely their own.

https://www.buzzfeednews.com/article/tedchiang/the-real-danger-to-civilization-isnt-ai-its-runaway

Chiang is still writing some of the best critical work on “AI.” His February article in the New Yorker, “ChatGPT Is a Blurry JPEG of the Web,” was an instant classic:

[AI] hallucinations are compression artifacts, but — like the incorrect labels generated by the Xerox photocopier — they are plausible enough that identifying them requires comparing them against the originals, which in this case means either the Web or our own knowledge of the world.

https://www.newyorker.com/tech/annals-of-technology/chatgpt-is-a-blurry-jpeg-of-the-web

“AI” is practically purpose-built for inflating another hype-bubble, excelling as it does at producing party-tricks — plausible essays, weird images, voice impersonations. But as Princeton’s Matthew Salganik writes, there’s a world of difference between “cool” and “tool”:

https://freedom-to-tinker.com/2023/03/08/can-chatgpt-and-its-successors-go-from-cool-to-tool/

Nature can claim “conversational AI is a game-changer for science” but “there is a huge gap between writing funny instructions for removing food from home electronics and doing scientific research.” Salganik tried to get ChatGPT to help him with the most banal of scholarly tasks — aiding him in peer reviewing a colleague’s paper. The result? “ChatGPT didn’t help me do peer review at all; not one little bit.”

The criti-hype isn’t limited to ChatGPT, of course — there’s plenty of (justifiable) concern about image and voice generators and their impact on creative labor markets, but that concern is often expressed in ways that amplify the self-serving claims of the companies hoping to inflate the hype machine.

One of the best critical responses to the question of image- and voice-generators comes from Kirby Ferguson, whose final Everything Is a Remix video is a superb, visually stunning, brilliantly argued critique of these systems:

https://www.youtube.com/watch?v=rswxcDyotXA

One area where Ferguson shines is in thinking through the copyright question — is there any right to decide who can study the art you make? Except in some edge cases, these systems don’t store copies of the images they analyze, nor do they reproduce them:

https://pluralistic.net/2023/02/09/ai-monkeys-paw/#bullied-schoolkids

For creators, the important material question raised by these systems is economic, not creative: will our bosses use them to erode our wages? That is a very important question, and as far as our bosses are concerned, the answer is a resounding yes.

Markets value automation primarily because automation allows capitalists to pay workers less. The textile factory owners who purchased automatic looms weren’t interested in giving their workers raises and shorting working days.

‘

They wanted to fire their skilled workers and replace them with small children kidnapped out of orphanages and indentured for a decade, starved and beaten and forced to work, even after they were mangled by the machines. Fun fact: Oliver Twist was based on the bestselling memoir of Robert Blincoe, a child who survived his decade of forced labor:

https://www.gutenberg.org/files/59127/59127-h/59127-h.htm

Today, voice actors sitting down to record for games companies are forced to begin each session with “My name is ______ and I hereby grant irrevocable permission to train an AI with my voice and use it any way you see fit.”

https://www.vice.com/en/article/5d37za/voice-actors-sign-away-rights-to-artificial-intelligence

Let’s be clear here: there is — at present — no firmly established copyright over voiceprints. The “right” that voice actors are signing away as a non-negotiable condition of doing their jobs for giant, powerful monopolists doesn’t even exist. When a corporation makes a worker surrender this right, they are betting that this right will be created later in the name of “artists’ rights” — and that they will then be able to harvest this right and use it to fire the artists who fought so hard for it.

There are other approaches to this. We could support the US Copyright Office’s position that machine-generated works are not works of human creative authorship and are thus not eligible for copyright — so if corporations wanted to control their products, they’d have to hire humans to make them:

https://www.theverge.com/2022/2/21/22944335/us-copyright-office-reject-ai-generated-art-recent-entrance-to-paradise

Or we could create collective rights that belong to all artists and can’t be signed away to a corporation. That’s how the right to record other musicians’ songs work — and it’s why Taylor Swift was able to re-record the masters that were sold out from under her by evil private-equity bros::

https://doctorow.medium.com/united-we-stand-61e16ec707e2

Whatever we do as creative workers and as humans entitled to a decent life, we can’t afford drink the Blockchain Iced Tea. That means that we have to be technically competent, to understand how the stochastic parrot works, and to make sure our criticism doesn’t just repeat the marketing copy of the latest pump-and-dump.

Today (Mar 9), you can catch me in person in Austin at the UT School of Design and Creative Technologies, and remotely at U Manitoba’s Ethics of Emerging Tech Lecture.

Tomorrow (Mar 10), Rebecca Giblin and I kick off the SXSW reading series.

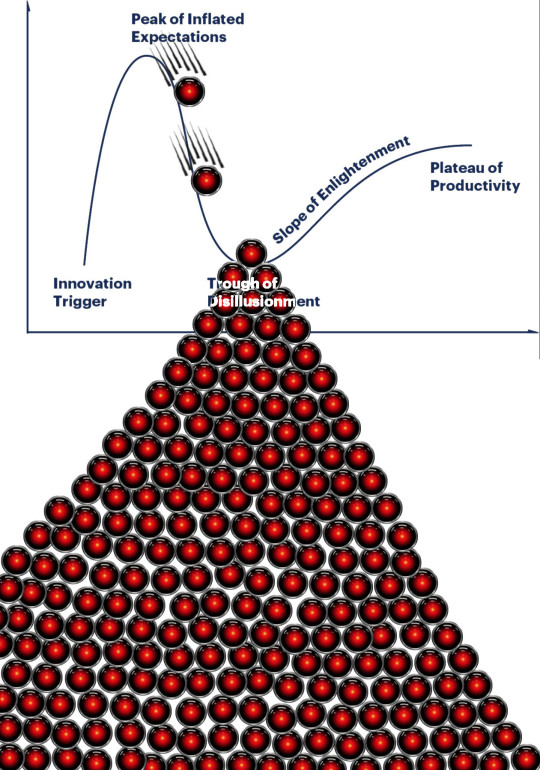

Image:

Cryteria (modified)

https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0

https://creativecommons.org/licenses/by/3.0/deed.en

[Image ID: A graph depicting the Gartner hype cycle. A pair of HAL 9000's glowing red eyes are chasing each other down the slope from the Peak of Inflated Expectations to join another one that is at rest in the Trough of Disillusionment. It, in turn, sits atop a vast cairn of HAL 9000 eyes that are piled in a rough pyramid that extends below the graph to a distance of several times its height.]

#pluralistic#ai#ml#machine learning#artificial intelligence#chatbot#chatgpt#cryptocurrency#gartner hype cycle#hype cycle#trough of disillusionment#crypto#bubbles#bubblenomics#criti-hype#lee vinsel#slow ai#timnit gebru#emily bender#paperclip maximizers#enshittification#immortal colony organisms#blurry jpegs#charlie stross#ted chiang

2K notes

·

View notes

Text

ICO Development Company - A Trustable Source for ICO Development

You might be familiar with the concept of crowdfunding. The phenomenon that helped many budding entrepreneurs reach their mark, and as a matter of fact, it still does. The Initial Coin Offering (ICO) is one such phenomenon having the best possible way to initiate funds to your growing project. And the development of a Crypto-based native ICO Token could be developed by ICO Development Services, which comes with professional care in developing your token.

Link: https://www.foxpublication.com/ico-development-services-what-are-the-benefits/

Contact Details: [email protected]

Call: +91 9384801116

#ICO Development Services#ICO Development Agency#ICO Token Development Company#ICO Launch Services#ico development#ico marketing company#ico marketing services#business#entrepreneur#blockchain#design#finance#ico#ico script#discord#nftmarketing#openseanft#opensea#nfts#nftplatform#defiprojects#definews#defimarketing#marketingandadvertising#marketing#branding#influencermarketing#projects#team#socialmediamarketing

0 notes

Text

Signs of Bull Market in Crypto: Is Bear Market Comming to an End?

For many cryptocurrency investors, the past few years have been a frustrating time. After the explosive growth of 2017, the market has seen a steady decline, leading many to wonder if the bear market will ever end. While it's impossible to predict the future with certainty, there are a few key indicators that could signal the end of the bear market and the beginning of a new bull market. In this article, we'll explore these Signs of Bull Market in Crypto and discuss what they could mean for the future of the crypto market.

Mainstream Adoption

One of the key indicators to watch is the level of mainstream adoption. It could be one of the Signs of Bull Market, as more and more businesses and institutions begin to accept cryptocurrencies, it can be a sign that the market is stabilizing and becoming more mainstream. This can increase the overall demand for crypto, potentially leading to price increases.

For example, in recent years we've seen a growing number of major retailers and payment processors begin to accept cryptocurrencies as a form of payment. This includes companies like Overstock, Expedia, and PayPal, all of which have begun to allow customers to pay with cryptocurrencies for goods and services.

In addition to retailers, we've also seen a number of financial institutions begin to experiment with cryptocurrencies and blockchain technology. This includes banks, asset managers, and even central banks, all of which are exploring the potential uses of cryptocurrencies and blockchain for everything from cross-border payments to securities settlement.

As more and more mainstream players begin to embrace cryptocurrencies, it can be a sign that the market is becoming more mature and stable. This can increase investor confidence and drive demand for crypto, potentially leading to price increases.

Innovation and Development

Another factor to consider is the level of development and innovation within the crypto space. As new projects and technologies emerge, it can drive interest and investment in the market. This can be especially true if the projects have strong potential for real-world use cases, as it can demonstrate the practical value of cryptocurrencies.

For example, we've seen a number of projects in the crypto space that are focused on solving specific problems or addressing specific needs. This includes projects like Ripple, which is focused on improving cross-border payments, and Ethereum, which is focused on building a decentralized computing platform.

By solving real-world problems and addressing specific needs, these projects can demonstrate the practical value of cryptocurrencies and drive demand for them. This, in turn, can lead to increased investment and price increases.

Regulatory Clarity

Another indicator to keep an eye on is the level of regulatory clarity. As governments and regulatory bodies around the world continue to develop frameworks for the crypto industry, it can provide more certainty for investors and encourage more mainstream participation. This can also lead to increased institutional investment, as more traditional financial players feel comfortable entering the market.

In recent years, we've seen a number of countries begin to develop clear regulatory frameworks for the crypto industry. This includes countries like the United States, which has begun to roll out specific regulations for cryptocurrency exchanges and initial coin offerings (ICOs).

As regulatory frameworks continue to evolve and become more clear, it can provide more certainty for investors and encourage more mainstream participation. This, in turn, can lead to increased demand for crypto and potentially drive price increases.

Sentiment Within the Crypto Community

Finally, it's worth paying attention to the overall sentiment within the crypto community. If there is a growing sense of optimism and excitement about the future of the market, it could be a sign that the bear market is coming to an end.

One way to gauge sentiment within the crypto community is to follow social media platforms, forums, and other online communities where crypto enthusiasts gather. By keeping an eye on these platforms, you can get a sense of the overall mood of the market and whether there is a growing sense of optimism or pessimism.

Level of Activity

It's also worth paying attention to the level of activity within the crypto space. If there is a growing level of interest and engagement from both retail and institutional investors, it could be a Signs of Bull Markett is starting to turn around. This could be reflected in increased trading volume, more ICOs and new projects, and a general sense of excitement about the future of the market.

Conclusion

While it's impossible to know for sure when the bear market will end, keeping an eye on these key indicators can give investors a better understanding of the health and direction of the market. By paying attention to mainstream adoption, innovation and development, regulatory clarity, and sentiment within the crypto community, investors can get a better sense of where the market is headed and whether the bear market is coming to an end.

Of course, it's important to remember that the crypto market is highly volatile and prone to sudden changes. Even if these indicators suggest that the bear market is coming to an end, there is no guarantee that a bull market will follow. It's always important to do your own research and make informed investment decisions based on your own risk tolerance and investment goals.

That being said, with a little patience and careful analysis, it may be possible to spot the signs of a new bull market on the horizon. By keeping an eye on these key indicators, investors can be better prepared to take advantage of any potential market upturns and maximize their returns.

Source: Crypto Coins Insights

3 notes

·

View notes

Text

Advance your expedition in Crypto software development solutions

We are providing innovative solutions to clientele across the furthest ends of business and scale spectrum. Our expertise in blockchain development enables us to provide custom blockchain based solutions for applications in various industries. Decentralize and automate processes and save operational costs with strategically designed ICO, Smart contract, MLM software and other blockchain based solutions.

We Are Offering All Kinds of IT Solutions Services

Web Development

Digital Marketing

Blockchain Development

Clone Script

Token Develpment

Crypto Solutions

Contact Us:

Mail ID: [email protected]

Mobile Number: +919790033633

Website:

2 notes

·

View notes

Text

#mobile app developer company#reactjs angular#best app development company#web and mobile app development companies#best mobile app developers#angular react js#Full stack developer#eretail software#banking software#quality control#core java developer#ecommerce development company#ecommerce development companies#Business Intelligence#Blockchain app development companies#Chatbot development companies#ios & android application development companies#custom software development company#Big Data Analytics services & Digital Marketing services services#ICO development companies

0 notes

Text

This day in history

#20yrsago Ed Felten’s radical technology agenda https://web.archive.org/web/20021127140640/https://www.chronicle.com/free/v49/i14/14a02701.htm

#20yrsago Harry Potter/Luke Skywalker/Frodo Baggins https://craphound.com/images/frodoharryskywalker_furymix.jpg

#15yrsago How Your Creepy Ex-Co-Workers Will Kill Facebook https://web.archive.org/web/20071128035044/http://informationweek.com/news/showArticle.jhtml?articleID=204203573

#15yrsago Facebook privacy meltdown: company removed opt-out prior to launch https://web.archive.org/web/20081202155556/http://www.news.com/the-social/8301-13577_3-9823063-36.html

#15yrsago Voice of the London Underground canned for blogging funny fake announcement audio https://www.metafilter.com/66883/The-Voice-of-the-Underground-is-silenced

#15yrsago Mr Splashy Pants in the lead for Greenpeace whale-naming competition https://web.archive.org/web/20071121164456/http://vote.greenpeace.org/11/12/results

#15yrsago Universal Music CEO: Record industry can’t tell when geeks are lying to us about technology https://www.vulture.com/2007/11/universal_music_ceo_doug_morris.html

#10yrsago Toronto mayor Rob Ford is out https://www.cbc.ca/news/canada/toronto/mayor-rob-ford-will-fight-removal-ruling-tooth-and-nail-1.1187334

#10yrsago Internet of the Dead: the net’s collision course with death https://locusmag.com/2012/11/cory-doctorow-the-internet-of-the-dead/

#5yrsago Reverse-engineering a connected Furby toy, revealing its disturbing security defects https://web.archive.org/web/20171124134624/https://www.contextis.com/blog/dont-feed-them-after-midnight-reverse-engineering-the-furby-connect

#5yrsago Rightscorp finished Sept 2017 with $3,147 in the bank, warns investors it will likely have to shut down without more cash https://torrentfreak.com/rightscorp-revenue-from-piracy-settlements-down-48-in-2017-171125/

#5yrsago Arrogant overreach: Ajit Pai’s plan to totally destroy net neutrality may doom him in court https://www.nytimes.com/2017/11/22/opinion/courts-net-neutrality-fcc.html">

#5yrsago A generation after American “libertarians” helped with mass disappearances, torture and murder of left-wing activists, Frente Amplio surge in Chilean elections https://www.bloomberg.com/news/articles/2017-11-21/from-street-protests-to-kingmaker-chile-s-new-left-comes-of-age

#5yrsago Investigators claim that Oxbridge and other top UK universities are operating a massive, illegal surveillance dragnet aimed at students/alumni and their friends and families https://qz.com/1133808/universities-including-oxford-and-cambridge-are-accused-of-illegal-spying

#5yrsago For the next year, TV, newspapers, and the web will run massive ads from tobacco companies admitting that their products kill people, that they were engineered to be addictive, and that they covered this up https://www.abc.net.au/news/2017-11-26/big-tobacco-forced-to-advertise-admissions-in-us/9194960

#5yrsago Melt a Nazi with the Major Toht candle https://web.archive.org/web/20171204030654/https://firebox.com/Melting-Toht-Candle/p6706

#1yrago UK ICO: surveillance advertising is dead https://pluralistic.net/2021/11/26/ico-ico/#market-structuring

4 notes

·

View notes

Text

How to invest in cryptocurrencies?

If you decide to invest in cryptocurrencies, you should first determine how much money you want to put into it. Then, you’ll need to choose a wallet where you can store your coins safely. Finally, you’ll need to learn how to trade. Here are some tips to help you get started:

• Choose a wallet that works best for you. There are two main types of wallets — desktop and mobile. Desktop wallets require software installed on your computer, whereas mobile wallets work via apps downloaded to your phone. Both options offer similar functionality, but each has advantages and disadvantages.

• Determine whether you want to invest in cryptocurrencies directly or indirectly. Direct investment means you purchase actual cryptocurrencies, whereas indirect investment means you invest in an exchange that trades those cryptocurrencies. An example of direct investment would be purchasing bitcoin with cash; an example of indirect investment would be trading shares of a company that produces bitcoins.

• Decide whether you want to invest using paper or electronic methods. Paper methods involve writing down your investment plan on a piece of paper and keeping track of your holdings. Electronic methods mean you keep your portfolio online.

• Learn how to read charts. Charts are graphs that show the performance of a particular asset over time. Knowing how to read charts helps you understand trends and predict future movements.

• Find out how to invest in cryptocurrencies. There are various ways to invest in cryptocurrencies. You can buy them directly, invest in exchanges, or invest in ICOs.

Understand how to trade. Trading involves buying and selling assets based on current market conditions. You can either trade manually or use automated tools.

Red in this article Top 5 cryptocurrencies to invest in right now

3 notes

·

View notes

Link

Hey, Have you entered this competition to win PAREX [PRX] | Bridge Giveaway | AVALANCHE yet? If you refer friends you get more chances to win :) https://wn.nr/DtVCdg

2 notes

·

View notes

Link

1 note

·

View note

Text

Case Studies: Successful Cryptocurrency Projects by Our Agency

In the rapidly evolving world of cryptocurrency, navigating the complexities of launching and sustaining successful projects can be daunting. At Crypto Development Agency, we have successfully spearheaded several cryptocurrency ventures, each with its unique challenges and triumphs. This article delves into how our agency strategized and executed these projects, showcasing what sets us apart in this competitive industry.

Understanding Cryptocurrency Project Success

Launching a cryptocurrency project involves meticulous planning, strategic implementation, and agile adaptation to market dynamics. It's not just about creating a coin or token; it's about creating value and building trust within the community.

Project 1:

Background and Challenges

Crypto aimed to revolutionize [specific niche or industry] through blockchain technology. One of the primary challenges was gaining initial traction and establishing credibility in a saturated market.

Our Approach

Thorough Market Research: We conducted extensive research to identify key competitors and target audience preferences.

Strategic Positioning: By emphasizing [unique feature or benefit], we positioned [Project Name] as a game-changer.

Community Engagement: We fostered a robust community through transparent communication and active engagement on social media platforms.

Results

Through our efforts, Crypto achieved a successful ICO, raising [amount] and garnering widespread media coverage. The project is now [current status or achievement], with a growing user base and positive market sentiment.

Project 2:

Background and Challenges

Crypto sought to tackle [specific problem or industry inefficiency] using blockchain technology. The challenge here was regulatory uncertainty and educating the market about the project's benefits.

Our Approach

Regulatory Compliance: We worked closely with legal experts to ensure compliance with global regulations.

Educational Campaigns: Through webinars, blog posts, and infographics, we simplified complex concepts and explained the benefits of Crypto.

Partnerships: Strategic partnerships with [relevant industry players] enhanced Crypto's credibility and reach.

Results

Crypto successfully secured partnerships with [notable companies or organizations], validating its potential. The project's token value has seen [percentage increase] growth since its launch, reflecting market confidence.

Conclusion

The success of these cryptocurrency projects underscores our agency's commitment to innovation and execution excellence in the blockchain space. By prioritizing strategic planning, community engagement, and continuous adaptation, we enable our clients to achieve their vision in a rapidly evolving digital landscape. Whether you're launching a new coin, planning an ICO, or seeking to enhance market presence, [Your Agency Name] is your trusted partner for cryptocurrency success.

0 notes

Text

CREAT’OR is paving the way for a more transparent, efficient, and inclusive investment landscape.

In recent years, cryptocurrency has taken the world by storm, with more and more individuals and businesses jumping on the bandwagon to invest in this digital currency. As a result, there has been a surge in the number of cryptocurrency crowdfunding platforms, all vying for a piece of the market share. One platform that has been making waves in this space is CREAT’OR.

CREAT’OR, short for Crypto Related Equity And Token Operational Resources, has positioned itself as a leader in the cryptocurrency crowdfunding industry by providing a platform that connects the cryptocurrency community with enterprises in need of finance. The platform has successfully bridged the gap between investors and companies, allowing them to come together and support each other in a mutually beneficial way.

What sets CREAT’OR apart from other crowdfunding platforms is its commitment to transparency and efficiency. By leveraging blockchain technology, CREAT’OR ensures that all transactions are secure, transparent, and immutable. This not only boosts investor confidence but also streamlines the entire crowdfunding process, making it easier for companies to raise funds quickly and efficiently.

But perhaps the most revolutionary aspect of CREAT’OR is its democratic values. Unlike traditional investment models that often favor large institutional investors, CREAT’OR gives everyone, regardless of their financial background, the opportunity to participate in the investment process. This democratization of finance is empowering individuals and businesses alike, leveling the playing field and creating a more inclusive investment ecosystem.

In addition to its commitment to transparency, efficiency, and democratic values, CREAT’OR also offers a wide range of resources to help both investors and companies navigate the complex world of cryptocurrency crowdfunding. From educational materials and expert guidance to technical support and marketing services, CREAT’OR provides the tools and resources needed to ensure a successful crowdfunding campaign.

Tokenomic Summary

Token Ticker: CRET

Network: Ethereum (Arbitrum/Mainnet)

Total Supply: 500,000,000

Initial Marketcap: $9,964,480

ICO Phases

· Phases one through three of the token sale, including all relevant information such as prices, total tokens offered, and bonuses.

· From the start of the beta until the third stage, the schedule is 16 weeks.

Detention and Vesting

· Periods of Lockup: The project management sets a term during which investors are unable to sell or trade their tokens. This is done to avoid early dumping and keep the market stable following a launch or token sale.

· Expiration Dates: The release schedule and method of tokens are being discussed here. Token vesting is a method of acquiring complete ownership rights to a cryptocurrency token over time. This is done to encourage long-term investment, discourage short-term gains, and keep the token’s value stable.

Professional Engagement and Marketing Strategy

Web3-Proficient in Marketing

Expanding CREAT’OR’s marketing plan to include our relationship with Coinband strengthens our resolve to actively participate in the crowdfunding sector. With Coinband, you can take advantage of a whole new level of growth-focused techniques, including targeted online advertising, content marketing, community management, influencer marketing, SEO, PPC, and public relations. We also position ourselves as thought leaders in De-Fi and crowdfunding.

Through creative campaigns and strategic branding, our partnership not only strengthens our community-building efforts but also increases the reach of our message. We are reaching out to marketing specialists to help us change the crowdfunding scene with value-driven partnerships and all-encompassing assistance. By working together with Coinband and utilizing innovative marketing strategies, we want to revolutionize the way the sector does business.

CONCLUSION

CREAT’OR is revolutionizing the investing industry by providing a platform that is not only cutting-edge and secure but also founded on democratic principles. By harnessing the power of blockchain technology, CREAT’OR is paving the way for a more transparent, efficient, and inclusive investment landscape. Whether you are a seasoned investor or a budding entrepreneur, CREAT’OR offers a unique opportunity to be a part of this exciting new frontier in finance.

FOR MORE INFORMATION

Official Website: https://creat-or.io/

Whitepaper: https://whitepaper.creat-or.io/

Twitter: https://twitter.com/Creator_CRET

LinkedIn: https://www.linkedin.com/company/creator-cret

Discord: https://discord.gg/jdUeq3Se3k

Telegram Announcements: https://t.me/creator_announcements

Telegram Community: https://t.me/creator_community

YouTube: https://www.youtube.com/@Creator-CRET

AUTHOR

Forum Username: bimbimabimanyu

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=3443739

Telegram Username: @bimbimabi5

ETH Wallet Address: 0xDBFC561A3202DeFB76980c5E9dAB98386e0fcEDb

0 notes