#ifsc code

Explore tagged Tumblr posts

Text

Locate Bank of Baroda Bareilly Office and get the nearest Office details like Address, phone no. & Office timing with just one click.

0 notes

Text

FAQs Concerning MICR and IFSC Codes

What is the IFSC's complete form? Indian Financial System Code is the full form of the acronym IFSC

Why is IFSC applied? The Reserve Bank of India uses the Indian Financial System identifier (IFSC), an 11-digit alphanumeric identifier, to identify each bank branch within the National Electronic Funds Transfer (NEFT) network individually.

How do I use my IFSC code to look for a bank's name? Using the IFSC code, locating the bank name is quite simple. In the IFSC code, the bank name appears in the first four characters. For example, the IFSC code will resemble HDFC0004053 if the bank is called HDFC.

How does a MICR code represent something? The acronym for Magnetic Ink Character Recognition is MICR. This particular ink reacts to magnetic fields. A check has it printed on the bottom. Read more

1 note

·

View note

Text

Donate today to help those in need and make a difference in their lives."

#Donate Now#Bank Account Details#Account Holder : WE FOR EDUCATION WELFARE SOCIETY#Account No. : 922020002147540#IFSC Code : UTIB0001100#https://www.weforsociety.

1 note

·

View note

Text

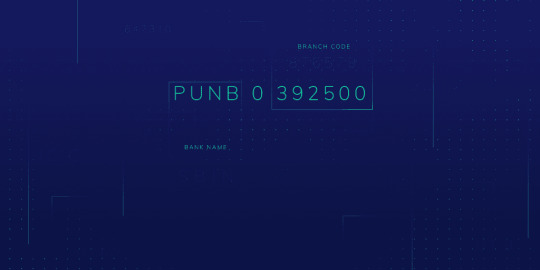

Seamless Banking In Kaimur Madhya Bihar Gramin Bank IFSC Code PUNB0MBGB06 Unveiled

Unlock the gateway to hassle-free transactions in Kaimur with Madhya Bihar Gramin Bank's IFSC Code PUNB0MBGB06. Our comprehensive guide on Urban Pincode provides you with the key details for secure and swift fund transfers.

0 notes

Text

Navigating Digital Transactions: Demystifying the ICICI Bank Limited IFSC Code

In the era of digital finance, where speed and accuracy are paramount, the ICICI Bank Limited IFSC Code emerges as a crucial element facilitating seamless online transactions. Let's delve into the intricacies of the ICICI Bank Limited IFSC Code, understand its significance, and explore how it plays a pivotal role in the digital banking landscape.

Decoding the ICICI Bank Limited IFSC Code:

The Indian Financial System Code (IFSC) is an alphanumeric code uniquely assigned to each bank branch by the Reserve Bank of India (RBI). For ICICI Bank Limited, one of India's leading private sector banks, the IFSC Code serves as a distinctive identifier, ensuring precision in electronic fund transfers and other digital transactions.

The ICICI Bank Limited IFSC Code follows a standardized structure where the first four characters represent the bank code, the fifth character is a reserved space, and the last six characters identify the specific branch. This unique code is instrumental in routing funds accurately to the intended recipient's account during online transactions.

Significance of ICICI Bank Limited IFSC Code:

Ensuring Transaction Accuracy: The primary role of the ICICI Bank Limited IFSC Code is to ensure the accuracy of online transactions. Whether customers are initiating fund transfers or engaging in digital banking activities, the correct IFSC Code is crucial for directing funds to the precise recipient's account.

Minimizing Errors: In a vast banking network with numerous branches, each having a unique IFSC Code, the potential for errors is inherent. The ICICI Bank Limited IFSC Code acts as a safeguard, minimizing the risk of errors and ensuring that funds are directed to the intended branch with precision.

Facilitating Interbank Transactions: The IFSC Code is particularly significant for interbank transactions. It enables seamless communication between banks, allowing for the swift and secure transfer of funds across different financial institutions.

Locating the ICICI Bank Limited IFSC Code:

For customers seeking the ICICI Bank Limited IFSC Code, the process is user-friendly and accessible:

Official Website: ICICI Bank provides an official online tool on its website where customers can easily locate the IFSC Code. By entering details such as the state, city, and branch name, customers can retrieve the specific code they need.

Mobile App: The ICICI Bank mobile app offers a convenient platform for customers to access the IFSC Code. It provides a seamless interface where users can input branch details and swiftly obtain the accurate code.

Online IFSC Code Finder Tools: Various online platforms offer dedicated IFSC Code Finder tools. These tools are designed to provide users with quick and accurate information by simply entering relevant details.

Elevating Digital Banking with ICICI Bank Limited IFSC Code

In the realm of digital transactions, the ICICI Bank Limited IFSC Code stands as a pillar of accuracy and security. It not only facilitates smooth fund transfers but also reflects ICICI Bank's commitment to providing customers with a robust and reliable digital banking experience. As customers navigate the digital financial landscape, the ICICI Bank Limited IFSC Code becomes their trusted companion, ensuring that each transaction is executed with precision and integrity.

0 notes

Text

An IFSC Code Meaning is a unique identification code that is used to identify the bank and branch of any particular bank account and is used in bank transfer systems like NEFT, RTGS, and IMPS. IFSC stands for ‘Indian Financial System Code’ and forms an essential part of the Indian banking infrastructure.

0 notes

Text

Cyber Fraud: Rs. 20,000 Theft Case Analysis

Cyber fraud of Rs. 20,000 from the account of Pramod Kumar Kusvaha S/O Rambali village Godasar Sarpati, Post Kalna, District Mirzapur. Most respected Sir the following is the bank details of Pramod Kumar Kusvaha S/O Rambali. state Bank of India 12355, IFSC: SBINO, Branch Code: 15131, Date of Issue: 20/08/2019 State Bank of India, LOTUS SAVING BANK AL OVD CHQ CIF No: 90388251816, CHHANBEY…

3 notes

·

View notes

Text

"Donate today to help those in need and make a difference in their lives."

Donate Now

Bank Account Details

Account Holder : WE FOR EDUCATION WELFARE SOCIETY

Account No.: 922020002147540

IFSC Code: UTIB0001100

instagram

4 notes

·

View notes

Text

Angel One Pe Demat Account Kaise Khole – Full Online Guide

Angel One Pe Demat Account Kaise Khole – Easy Guide with Full Documents List

Starting your investment journey has never been easier, especially with platforms like Angel One offering a seamless and fully online experience. If you're wondering Angel One Pe Demat Account Kaise Khole, you're in the right place. This guide walks you through the entire account opening process along with the necessary Angel One Account Opening Documents, so you can get started within just 30 to 60 minutes from the comfort of your home.

Why Choose Angel One for Your Demat Account?

Before diving into Angel One Pe Demat Account Kaise Khole, let’s understand why Angel One is a preferred choice for many investors. First and foremost, Angel One charges zero brokerage on equity delivery, making it ideal for long-term investors. For intraday and F&O trading, the brokerage is capped at Rs. 20 per order, offering excellent value to active traders.

Additionally, Angel One does not charge any annual maintenance fee for the first year, making it a budget-friendly option for beginners. It also includes AI-powered tools like ARQ Prime for smart stock recommendations, and SmartAPI for algorithmic trading. With such features, it’s no surprise that thousands of investors trust Angel One to manage their market investments.

Angel One Pe Demat Account Kaise Khole – Step-by-Step Process

Let’s now answer the key question: Angel One Pe Demat Account Kaise Khole? Follow these simple steps to complete your application smoothly:

Enter Your Mobile Number: Start by visiting Angel One’s official website. Enter your mobile number to receive an OTP and verify your identity.

Submit Personal Information: Enter your full name, email ID, and referral code (if any). Validate your email using the OTP sent.

Provide PAN and Aadhaar Details: Enter your PAN number and Aadhaar-linked mobile number to continue the e-KYC process.

Use DigiLocker for Quick KYC: Connect your DigiLocker account to auto-fetch your Aadhaar details. This saves time and avoids manual errors.

Add Bank Details or UPI ID: Input your bank account number and IFSC code or simply add your UPI ID to enable smooth fund transfers.

Capture a Live Selfie: Use your phone or webcam to take a live selfie. This helps with real-time identity verification.

Upload Your Signature: You can draw or upload a digital version of your signature that matches your official ID.

Submit Income Proof (If Applicable): If you plan to trade in F&O, upload your salary slip or bank statement as income proof.

Choose Plan & Employment Type: Pick the iTrade Prime plan and specify your employment status – student, salaried, or self-employed.

Final E-Sign via Aadhaar OTP: Finally, e-sign the application using OTP sent to your Aadhaar-linked mobile number.

By following these steps, you now know Angel One Pe Demat Account Kaise Khole using a 100% paperless and digital method.

Angel One Account Opening Documents – What You’ll Need

To complete the process efficiently, keep the following Angel One Account Opening Documents ready in digital format:

PAN Card (mandatory)

Aadhaar Card linked with mobile number

Bank statement or a cancelled cheque

Digital signature

Income proof (only if opting for derivatives/F&O trading)

If your Aadhaar address is outdated, you can use other documents like passport, voter ID, or utility bills for address verification. Having these Angel One Account Opening Documents handy ensures your application doesn’t face delays.

What Happens After Submitting the Application?

Once you’ve completed the online form, the application goes through a quick verification process. Typically, your account will be activated within 24 to 72 hours. You’ll receive login credentials via SMS and email, after which you can start trading in stocks, mutual funds, IPOs, and more.

Post-Activation Benefits of Angel One Demat Account

After your account is active, you gain access to several advanced features that enhance your trading experience:

Real-time portfolio tracking

Secure transactions via NSDL Speed-e

Option to freeze your account for safety

Facility to get a loan against your demat holdings

Seamless demat/remat requests

These tools make managing investments both easy and secure, whether you’re a beginner or a seasoned trader.

Final Words

To sum it up, if you’re still asking Angel One Pe Demat Account Kaise Khole, the process is fully digital, fast, and designed for all types of investors. With added benefits like zero AMC for the first year, low brokerage, and powerful trading tools, Angel One makes stock market entry not just simple, but smart.

Gather your Angel One Account Opening Documents, follow the above steps, and you’ll be all set to invest with confidence. So don’t wait — open your Angel One demat account today and start your journey toward financial growth.

0 notes

Text

Locate Bank of Baroda Rajkot Main Branch and get the nearest Branch details like Address, phone no. & Branch timing with just one click.

0 notes

Text

How to Do Bank Account Opening Online Zero Balance: A Complete Beginner’s Guide

In today’s digital world, opening a bank account online zero balance has become incredibly easy. Whether you're a student, a working professional, or just someone looking for a hassle-free banking experience, a zero balance account is a smart choice. In this guide, we’ll show you how to open one step by step.

What is a Zero Balance Bank Account?

A zero balance bank account is a type of savings account where you're not required to maintain any minimum balance. This makes it perfect for anyone who wants a basic account without worrying about penalties for low balances. These accounts offer the same features as regular accounts—like UPI, ATM cards, net banking, and more.

Benefits of Bank Account Opening Online Zero Balance

Choosing to do your bank account opening online zero balance has many advantages:

No minimum balance required

Free digital banking features

Quick and paperless process

Accessible from anywhere

Instant UPI setup and fund transfers

Step-by-Step Guide to Open a Zero Balance Bank Account Online

1. Choose the Right Bank

Select a trusted bank that offers zero balance online account opening. Most major banks provide this facility on their website or app.

2. Go to the Bank’s Website or App

Visit the official website or download the mobile banking app of the bank. Look for the option to open savings bank account online.

3. Fill Out the Application Form

You’ll need to enter your personal details like:

Name

Mobile number

Email ID

PAN and Aadhar numbers

Make sure all information is correct.

4. Complete Your KYC Online

Many banks allow video KYC or Aadhar-based eKYC. Keep your documents ready and follow the instructions carefully.

5. Submit and Get Started

After submitting your form, your account is usually activated within minutes. You’ll receive your account number, IFSC code, and can start using your online savings bank account instantly.

Documents Required for Online Savings Account Opening

To complete your saving account opening, you’ll need:

Aadhar Card (linked with mobile number)

PAN Card

A smartphone or computer with an internet connection

Tips for a Smooth Online Experience

Use a stable internet connection

Fill details carefully

Use only official websites or apps

Keep scanned copies of your ID handy

Common Mistakes to Avoid

Using incorrect personal details

Skipping KYC process

Using third-party or fake apps

Forgetting to note your login credentials

Conclusion

Opening a bank account online zero balance is fast, safe, and simple. You don’t have to visit a branch, fill out piles of paperwork, or worry about maintaining a minimum balance. Just choose your bank, complete the KYC, and you’re ready to go.Whether you want to open a bank account online free, start saving, or manage your finances better, an online savings bank account is the perfect first step.

#bank account online open#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure#bank account opening process#bank balance app download

0 notes

Link

IFSC Code to Bank Converter

0 notes

Text

Step-by-Step Guide to Open a Demat Account Online in India

In today's tech-driven world, getting started with stock market investments has become remarkably simple. Whether you’re a beginner exploring investment opportunities or a seasoned investor looking to diversify, the first step is having a Demat account. This digital account is essential to buy, sell, and hold securities in India.

In this guide, we'll walk you through the process of opening a Demat account online, from understanding its purpose to completing your application with ease. Let’s begin.

What is a Demat Account?

A Demat account, short for dematerialised account, is a digital storage system for your securities. Instead of dealing with physical share certificates, your investments—whether in stocks, mutual funds, ETFs, or bonds—are held electronically in this account.

Think of it like a digital vault for your financial assets, similar to how a savings account holds your money. In India, anyone looking to trade on the NSE or BSE must have a Demat account.

Why is a Demat Account Important?

If you plan to invest in the Indian stock market, a Demat account is non-negotiable. Here are some compelling reasons why:

Ease of Use: Manage your investments from anywhere with just a few clicks.

Enhanced Security: Eliminate risks associated with theft, loss, or damage of paper certificates.

Speedy Transactions: Settlements happen faster in electronic form.

Reduced Costs: No stamp duty is applicable on electronic transfers.

All-in-One Access: A single account to hold different investment instruments like stocks, mutual funds, and bonds.

What You Need Before You Begin

Before you start the online application, ensure you have the following documents and details ready:

PAN Card (compulsory for all investors)

Proof of Identity – Aadhaar, Passport, Voter ID, or Driving Licence

Proof of Address – Aadhaar, Passport, recent utility bill, or bank statement

Bank Account Details – Account number, IFSC code, and a cancelled cheque or passbook

Passport-sized Photograph – In a digital format

Scanned Signature – On plain white paper

Additionally, make sure your mobile number is linked with your Aadhaar card for a smooth OTP-based eKYC process.

Picking the Right Depository Participant (DP)

A Depository Participant is the intermediary between you and the depository (NSDL or CDSL). These DPs can be banks, stockbrokers, or financial institutions. The quality of services varies, so it's wise to choose carefully.

Key factors to consider:

Reputation and credibility

User-friendly web and mobile platforms

Transparent pricing and low brokerage

Prompt customer service

Additional features like research tools and investment tracking

Popular options include Zerodha, Groww, 5paisa, Upstox, and Kotak Securities.

How to Open a Demat Account Online – A Simple Breakdown

Step 1: Go to the DP’s Website or App

Begin by visiting the official website or downloading the mobile app of the DP you’ve selected. Look for the “Open Demat Account” or “Get Started” option.

Step 2: Enter Your Basic Details

You’ll be asked to fill in some personal information:

Full Name

Mobile Number

Email Address

PAN Number

Date of Birth

Ensure the information matches your official documents to avoid verification delays.

Step 3: Link Your Bank Account

Provide your bank details to enable seamless transactions. Typically, you’ll need:

Bank Account Number

IFSC Code

A cancelled cheque or scanned passbook

Step 4: Complete KYC (Know Your Customer)

The KYC process is mandatory and mostly digital now. You’ll need to:

Upload ID and address proof

Click a selfie or record a short video

eSign your form using Aadhaar-linked OTP

Most platforms complete this step in minutes using AI and DigiLocker.

Step 5: In-Person Verification (If Required)

Some DPs may require an In-Person Verification (IPV), especially if eKYC is incomplete. This can be done through:

A live video call

Uploading a video with your ID proof

Step 6: Digital Signature

After verification, sign your application electronically using Aadhaar OTP or through platforms like DigiLocker.

Step 7: Final Submission and Approval

Once you submit the application, it is reviewed and processed. You’ll typically receive confirmation and account access within 24 to 72 hours.

What Happens After Your Account is Active?

Once your Demat account is set up, you’ll receive:

BO ID or Client ID (your unique account number)

Login credentials for the trading platform

Access to start investing in equities, mutual funds, bonds, and more

Explore the app or dashboard, understand its features, and review the fee structure before you begin trading.

Typical Charges Involved

While many brokers offer zero account opening charges, some other costs may apply:

Opening Charges: Usually free

Annual Maintenance Charges (AMC): Varies; some brokers waive it for the first year

Brokerage Fees: Charged per trade

Pledge Fees: Applicable if you pledge securities for a loan or margin

Make sure to go through the pricing policies carefully.

Tips to Keep Your Demat Account Secure

Your Demat account is like a digital locker—security is critical. Here’s how to keep it safe:

Never share your login credentials

Activate two-factor authentication

Monitor your account activity regularly

Keep your contact information up to date

Avoid accessing your account from public or unsecured networks

Final Thoughts

Opening a Demat account online in India is quick, convenient, and doesn't require stepping out of your home. With just your PAN, Aadhaar, and a smartphone, you can complete the process in under 30 minutes.

Whether your goal is long-term wealth creation or short-term trading, this is the first step to becoming an active market participant. Choose a reliable DP, prepare your documents, and take your first step toward financial empowerment.

Frequently Asked Questions (FAQs)

1. Is a PAN card necessary to open a Demat account? Yes, it’s mandatory under SEBI regulations.

2. How much time does it take to open the account? Usually between 24 to 48 hours, provided your documents and KYC details are in order.

3. Do I need to maintain a minimum balance in my Demat account? No, there’s no minimum balance requirement for Demat accounts.

4. Can I hold more than one Demat account? Yes, multiple accounts are allowed across different brokers using the same PAN.

5. Are there any charges for closing a Demat account? Most brokers do not charge for closure. Just ensure you have no dues or holdings left.

6. What’s the difference between a Demat account and a trading account? A Demat account stores your securities, while a trading account enables buying and selling them. Both are typically linked for seamless transactions.

1 note

·

View note

Text

Find My Ifsc Code

Find My IFSC Code" is a crucial tool for individuals navigating the complexities of online banking and financial transactions. The IFSC (Indian Financial System Code) is a unique alphanumeric code assigned to each bank branch in India. This online service simplifies the process of locating this essential code by offering a user-friendly interface. Users can effortlessly search for their bank's IFSC code, enabling seamless electronic fund transfers, NEFT, RTGS, and other banking transactions. By providing accurate and up-to-date information, "Find My IFSC Code" empowers users to ensure the precision and security of their financial dealings, enhancing the overall efficiency of online banking experiences.

0 notes

Text

Seamless Banking In Kaimur Madhya Bihar Gramin Bank IFSC Code PUNB0MBGB06 Unveiled

Unlock the gateway to hassle-free transactions in Kaimur with Madhya Bihar Gramin Bank's IFSC Code PUNB0MBGB06. Our comprehensive guide on Urban Pincode provides you with the key details for secure and swift fund transfers.

0 notes