#ifsc code meaning

Text

An IFSC Code Meaning is a unique identification code that is used to identify the bank and branch of any particular bank account and is used in bank transfer systems like NEFT, RTGS, and IMPS. IFSC stands for ‘Indian Financial System Code’ and forms an essential part of the Indian banking infrastructure.

0 notes

Text

A Meaning of IFSC Code is a unique identification code that is used to identify the bank and branch of any particular bank account and is used in bank transfer systems like NEFT, RTGS, and IMPS. IFSC stands for ‘Indian Financial System Code’ and forms an essential part of the Indian banking infrastructure.

0 notes

Text

What is the Process for Sending Money Within India?

In India, sending money domestically is a streamlined process thanks to the country’s robust financial infrastructure and advanced technology. Various methods and channels are available for domestic money transfer, each catering to different needs and preferences. Here, we will explore the process of sending money within India, highlighting key methods, steps, and considerations.

1. Bank Transfers

One of the most common methods for domestic money transfer in India is through bank transfers. This process involves transferring funds directly from one bank account to another. Here’s how it typically works:

Initiation: The sender logs into their online banking account via a bank’s website or mobile app. Alternatively, they can visit a branch or use an ATM to initiate the transfer.

Details Entry: The sender enters the recipient's bank account number, branch details, and the amount to be transferred. For online transactions, they may also need to provide the recipient's IFSC (Indian Financial System Code) code, which identifies the specific branch of the bank.

Verification: The sender may be required to enter a transaction password or OTP (One-Time Password) sent to their mobile number for verification.

Processing: Once verified, the bank processes the transaction, which typically completes within a few hours or the same day, depending on the type of transfer (e.g., NEFT, RTGS, IMPS).

2. National Electronic Funds Transfer (NEFT)

NEFT is a widely used method for domestic money transfers in India. It is managed by the Reserve Bank of India (RBI) and allows for secure, electronic transfers between banks.

Batch Processing: NEFT operates in batches, with transactions being processed in hourly intervals. This means that transfers are not instantaneous but are completed in the batch cycle.

Limitations: NEFT does not have any minimum or maximum limit, making it suitable for both small and large transactions.

Availability: NEFT is available 24x7, including weekends and holidays, providing flexibility for users.

3. Real Time Gross Settlement (RTGS)

RTGS is designed for high-value transactions and is ideal for urgent and time-sensitive transfers. Here’s how RTGS operates:

Immediate Settlement: Unlike NEFT, RTGS processes transactions in real time, ensuring that the funds are transferred instantly between banks.

Minimum Limit: RTGS transactions usually have a minimum limit (e.g., ₹2 lakhs) and no upper limit, making it suitable for large-value transfers.

Availability: RTGS is available during banking hours and is generally used for transactions requiring immediate settlement.

4. Immediate Payment Service (IMPS)

IMPS offers a fast and convenient way to transfer money instantly, 24x7. It is managed by the National Payments Corporation of India (NPCI) and operates through various channels.

Instant Transfer: IMPS allows for immediate fund transfers between bank accounts, making it ideal for urgent transactions.

Accessibility: Users can access IMPS through mobile banking apps, internet banking, and even ATMs.

Limits: IMPS typically has transaction limits set by individual banks, which can vary.

5. Mobile Wallets and Payment Apps

The rise of digital wallets and payment apps has revolutionized domestic money transfers. Apps like Paytm, Google Pay, PhonePe, and others offer a user-friendly interface for sending money quickly.

Linking Accounts: To use these apps, users need to link their bank accounts or credit/debit cards to their digital wallet.

Sending Money: Users can transfer money by entering the recipient's mobile number or UPI (Unified Payments Interface) ID. The process is generally straightforward and involves entering the amount and authorizing the transaction with a PIN or biometric verification.

Instant Transactions: Transfers using these apps are usually instant, providing immediate credit to the recipient’s account.

Considerations and Security

When sending money domestically within India, there are several important considerations:

Transaction Fees: While some methods like NEFT and IMPS may have minimal or no fees, others like RTGS or certain payment apps may charge fees depending on the amount and frequency of transactions.

Security: Ensure that you use secure and verified channels for transactions. Avoid sharing sensitive information and use strong passwords and two-factor authentication to protect your financial data.

Recipient Details: Double-check the recipient’s details before confirming the transaction to avoid errors and potential loss of funds.

Conclusion

The process of sending money within India is versatile and efficient, offering various methods to suit different needs. Whether using traditional bank transfers, NEFT, RTGS, IMPS, or modern mobile wallets and payment apps, users have access to a range of options that ensure swift and secure domestic money transfers. Understanding each method’s features and selecting the appropriate one based on the transaction’s urgency, amount, and convenience can enhance the overall experience and effectiveness of money transfers in India.

1 note

·

View note

Text

Bank Key In Sap Hr

Understanding Bank Keys in SAP HR

In the SAP Human Resources (HR) world, the bank key plays a crucial role in streamlining employee payroll processes. It is a unique identifier that links an employee’s bank account details and the SAP system. In this blog, let us explore bank keys, their importance, and how they are managed within the SAP HR environment.

What is a Bank Key?

Simply put, a bank key is a code that represents a specific bank within the SAP HR system. This code is country-dependent—meaning it is designed according to the banking conventions of the country where the bank operates.

The bank key and other essential details, such as the employee’s bank account number, facilitate the electronic transfer of salaries, reimbursements, and other payments directly into the employee’s bank account.

Why are Bank Keys Important?

Accurate Payments: Bank keys guarantee that payments are routed to the correct bank. They eliminate the possibility of errors caused by manual data entry, thus ensuring employees receive their payments on time and in the correct account.

Automation: Bank keys enable the automation of payment processes within the SAP HR system. This streamlines payroll operations, reduces manual effort, and saves valuable time for HR teams.

Compliance: Many countries have specific regulations regarding the format of bank account numbers and other banking details. Bank keys help ensure that SAP HR adheres to these standards, maintaining compliance and avoiding potential penalties.

How are Bank Keys Used in SAP HR?

Employee Master Data: When you create an employee record in SAP HR, a crucial part of the setup involves entering the employee’s bank details. This includes the bank key, bank account number, and potentially other information like the SWIFT/BIC code (for international transfers).

Payment Runs: During automated payment runs, the SAP HR system relies on the bank key stored in the employee’s master data to identify the correct financial institution for the payment transfer.

How to Find and Maintain Bank Keys

Bank keys are usually maintained by SAP functional consultants or HR specialists who have the necessary configuration knowledge. You can typically find and manage bank keys in the SAP system through the following steps:

Transaction Codes: Use transaction codes like FI01 (Create Bank) to view, create, or modify bank keys.

SAP Configuration (SPRO): You can also access relevant bank critical settings via the SPRO transaction under the path IMG -> Financial Accounting -> Bank Accounting -> Banks.

Additional Considerations

Bank keys are often based on established banking codes within a country. For example, the IFSC code might be part of India’s essential bank structure.

It is essential to keep bank keys up-to-date. If a bank changes its code or new banks are added to the company’s payment network, the bank critical information within SAP HR must be adjusted accordingly.

In Conclusion

Bank keys form an integral part of the payroll process within SAP HR. By understanding their function and importance, HR teams can ensure the smooth and efficient processing of employee payments, maintaining accuracy and minimizing potential errors.

youtube

You can find more information about SAP HR in this SAP HR Link

Conclusion:

Unogeeks is the No.1 IT Training Institute for SAP HR Training. Anyone Disagree? Please drop in a comment

You can check out our other latest blogs on SAP HR here – SAP HR Blogs

You can check out our Best In Class SAP HR Details here – SAP HR Training

———————————-

For Training inquiries:

Call/Whatsapp: +91 73960 33555

Mail us at: [email protected]

Our Website ➜ https://unogeeks.com

Follow us:

Instagram: https://www.instagram.com/unogeeks

Facebook: https://www.facebook.com/UnogeeksSoftwareTrainingInstitute

Twitter: https://twitter.com/unogeeks

0 notes

Text

Demystifying IFSC Codes

In the realm of banking and online transactions, there exists a seemingly cryptic yet vital code known as the IFSC code. Whether you're transferring funds or setting up automatic bill payments, understanding what an IFSC code is and how it functions can streamline your financial interactions and ensure smooth transactions. So, let's dive into the intricacies of IFSC codes, unraveling their significance and demystifying their operation.

What is an IFSC Code?

An IFSC (Indian Financial System Code) is an alphanumeric code that uniquely identifies a bank branch participating in electronic fund transfers within India. Essentially, it serves as a distinctive address for each bank branch involved in the NEFT (National Electronic Funds Transfer) and RTGS (Real Time Gross Settlement) systems.

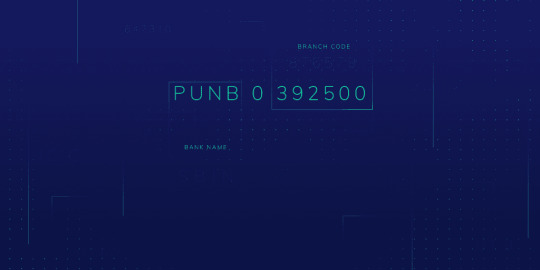

Breaking Down the Components of an IFSC Code

Each IFSC code comprises 11 characters, offering specific information about the bank and its branch. Let's break down these characters to understand their significance:

First Four Characters: These represent the bank's name, often in abbreviated form.

Fifth Character: It is always a zero (0) and is reserved for future use.

Last Six Characters: These digits denote the specific branch of the bank.

How Does an IFSC Code Work?

Imagine an IFSC code as a GPS coordinate for your bank branch in the digital realm. When you initiate a funds transfer or any other transaction online, the system utilizes the recipient's IFSC code to pinpoint the exact destination where the funds need to be routed.

The Role of IFSC Codes in Online Transactions

Whether you're sending money to a friend, paying bills, or conducting business transactions, IFSC codes ensure that your funds reach the intended recipient's bank account accurately and securely. Without the correct IFSC code, transactions can get delayed or even fail to process.

Why Are IFSC Codes Important?

IFSC codes play a pivotal role in facilitating seamless electronic transactions across various banking channels. Here's why they are indispensable:

Ensures Accuracy: By providing a unique identifier for each bank branch, IFSC codes minimize the risk of errors in fund transfers.

Facilitates Interbank Transactions: IFSC codes enable interoperability between different banks, allowing customers to transact effortlessly across various banking platforms.

Supports Digital Banking Initiatives: In the age of digital banking, IFSC codes are instrumental in promoting cashless transactions and expanding the reach of online banking services.

How to Find an IFSC Code?

Finding the IFSC code of a particular bank branch is a straightforward process. Here are some common methods:

Bank's Website: Most banks list their IFSC codes on their official websites, making it easy for customers to access this information.

Cheque Book: IFSC codes are often printed on the leaves of a bank's cheque book, along with other essential details.

Online Search: Several online platforms provide comprehensive databases of IFSC codes, allowing users to search by bank name, branch, or location.

FAQs

1. What is the significance of the fifth character in an IFSC code?

The fifth character in an IFSC code is always a zero (0) and is reserved for future use. It currently holds no specific meaning in the code's structure.

2. Can an IFSC code be changed?

Yes, IFSC codes can be changed due to reasons such as bank mergers, branch closures, or relocations. In such cases, customers are typically notified in advance to update their banking information accordingly.

3. Are IFSC codes case-sensitive?

No, IFSC codes are not case-sensitive. Whether entered in uppercase or lowercase, the system recognizes them as valid identifiers for bank branches.

4. Can an IFSC code be used internationally?

No, IFSC codes are specific to domestic electronic fund transfers within India. For international transactions, other codes such as SWIFT codes are used.

5. How long does it take for a transaction using an IFSC code to be processed?

The processing time for transactions using IFSC codes varies depending on the banking system and the type of transfer (NEFT or RTGS). Generally, NEFT transactions are settled in batches and may take up to a few hours, while RTGS transactions are processed in real-time.

In the digital landscape of banking and financial transactions, IFSC codes serve as the linchpin that connects senders and recipients, ensuring the seamless transfer of funds across different banking channels. By understanding the fundamentals of IFSC codes and their significance, you can navigate online transactions with confidence and ease.

Next time you initiate an online transfer or set up automatic payments, remember the humble IFSC code—a small yet indispensable component that keeps the wheels of digital banking turning smoothly.

0 notes

Text

Demat account and why is one necessary?

What is a Demat account and why is one necessary?

Demat account, short for “Dematerialized Account,” is an account that holds securities and investments in an electronic or dematerialized form. It is the equivalent of a bank account but is used for holding and trading financial instruments such as stocks, bonds, government securities, and mutual funds in electronic format. A Demat account is required to deal in shares electronically. Securities are held in this account in an electronic format that has been dematerialized. An investor is unable to trade stocks on the stock market without a Demat account

Importance of Demat Account:

Maintain a record of every transaction.

Minimize paperwork to facilitate easy liquidity.

Facilitates transactions that are quicker and simpler.

Provides a secure and safe place to store securities.

Removes the possibility of certificates being altered / faked / lost / damaged.

Avoids delays in the securities transfer process.

Dematerialization of shares: Dematerialization of shares refers to the process of transferring financial products, such stocks and bonds, from their physical certificates into an electronic or digital format. In the context of securities and investments, dematerialization involves eliminating the need for physical paper documents by representing ownership and transactions in a digital format.

Features of a Demat Account

Here are some essential elements to help you better grasp what a demat account means-

Simple to Reach: Via net banking, it offers quick and simple access to all of your investments and statements.

Simple Securities Dematerialization: All of your physical certificates can be converted to electronic form with the assistance of the depository participant (DP), and vice versa.

Getting Dividends & Benefits on Stock: It makes advantage of simple and quick ways to get dividends, interest, and refunds. Everything is automatically credited to the account. Additionally, it updates investor accounts with stock splits, bonus issues, rights, public issues, etc. using the Electronic Clearing Service (ECS).

Simple Share Transfers:The usage of a demat account has made share transfers considerably quicker and simpler.

Share Liquidity: Selling shares has never been easier, faster, or more convenient thanks to Demat Accounts.

Advance Against Securities: One can also apply for a loan against the securities held in their demat account after opening one.

Demat Account Freezing: For a predetermined duration of time, one can freeze a specific type or number of securities in their demat account. This will eventually prevent funds from being sent into your account from any debit or credit card.

How Demat Account works

The specifics of the shares and other securities registered in your name are kept in a Demat Account. In order to buy and sell shares, a trading account must be opened. The availability of Trading Accounts with online trading capabilities by numerous banks and brokers facilitates the participation of regular investors in the stock market.

Types of Demat Account:

Documents Required to Open:

Proof of Identity (PoI): Aadhaar Card, Passport, Voter ID, Driving License

Proof of Address (PoA): Aadhaar Card, Passport, Voter ID, Driving License, Recent utility bills (electricity, water, gas), Bank statements.

Passport Size Photographs: Two passport-size photographs are required.

PAN Card: In order to open a Demat account, you must have a Permanent Account Number (PAN) card..

Income Proof (for trading in derivatives): Salary slips, Income Tax Returns (ITR), Form 16

Bank Account Details: A canceled cheque or a copy of your bank statement with the account number and IFSC code.

KYC Documents: Know Your Customer (KYC) documents may include additional forms provided by the Depository Participant (DP) or the brokerage

How to use Demat Account:

Using your client ID or account number, access your online Demat account.

All of your holdings, whether they be bonds, mutual funds, stocks, or securities, will be visible to you in your portfolio.

To trade, you must obtain a trading account after opening a demat account.

You must link your bank account, trading account, and Demat account after opening an account.

Before you may begin trading after linking your accounts, you must submit an order request through your trading account. After that, your broker will put you in touch with the suitable trading platform so you may place your trade.

The exchange will handle your order online.

Depending on the transaction you complete, your Demat account will then be credited or debited, and you will receive a confirmation message via SMS and email.

Using your client ID or account number, access your online Demat account.

All of your holdings, whether they be bonds, mutual funds, stocks, or securities, will be visible to you in your portfolio.

To trade, you must obtain a trading account after opening a demat account.

You must link your bank account, trading account, and Demat account after opening an account.

Before you may begin trading after linking your accounts, you must submit an order request through your trading account. After that, your broker will put you in touch with the suitable trading platform so you may place your trade.

The exchange will handle your order online.

Depending on the transaction you complete, your Demat account will then be credited or debited, and you will receive a confirmation message via SMS and email.

Visit Company Webpage: https://glcwealth.com/blog/what-is-demat-account-and-why-is-one-necessary/

0 notes

Text

Domestic Money Transfer API

Introduction

In today's fast-paced world, the need for quick and efficient money transfer services is more important than ever. With the rise of digital banking and e-commerce, people are constantly looking for reliable ways to send and receive funds. This is where Rainet comes in - a leading provider of domestic money transfer API services. Our platform offers seamless integration with your existing systems, allowing you to easily facilitate transactions between customers and businesses. In this article, we'll take a closer look at why Rainet is the best choice for your domestic money transfer needs.

Rainet is the company for domestic money transfer api.

Rainet Technology Pvt. Ltd. is a leading provider of domestic money transfer API services in India. With our DMT API, you can easily transfer money to any bank account in India using just the recipient's bank account number and IFSC code. Our DMT API works just like our multi-recharge software, with the only difference being that instead of collecting the recipient's mobile number, you need to collect their bank account details and the amount to be transferred from your walk-in customers.

At Rainet, we pride ourselves on providing reliable and secure domestic money transfer services that are easy to use and integrate into your existing business operations. We also offer other API services like PAN API, BBPS API, and multi-recharge API to help businesses streamline their payment processes and improve customer satisfaction. Contact us today to learn more about how our DMT API can benefit your business!

Rainet is best in bharat bill pay api.

Rainet Technology Pvt Ltd is a leading provider of Fintech software, including Bharat Bill Payment System (BBPS) API Integration. The BBPS is an initiative of the Reserve Bank of India (RBI) and the National Payments Corporation of India (NPCI) that allows consumers to pay their bills seamlessly and securely. Rainet Technology Pvt Ltd is best in Bharat Bill Pay API as they provide affordable prices for their services all over India [1]. They offer BBPS API, AEPS API, PAN API, and digital marketing services to their clients [2].

Rainet Technology Pvt Ltd provides Bharat Bill Payment System BBPS API all over India at very affordable prices. They have unlimited production capacity and deliver within two days [3]. With their expertise in Fintech software, Rainet Technology Pvt Ltd has established itself as a reliable and efficient provider of domestic money transfer APIs.

Why choose a domestic money transfer api?

When it comes to domestic money transfer, there are several options available in the market. However, choosing a reliable and efficient provider is crucial for ensuring smooth transactions. This is where Rainet's Domestic Money Transfer API comes into play. With Rainet's platform, transactions can be completed in as little as 15 seconds, making it one of the fastest services available in India [4].

Rainet's Domestic Money Transfer API also offers intelligent payment routing for minimum cost and maximum profit, making it an excellent choice for website owners, SMEs and any other organization looking to generate additional revenue [5]. Moreover, Rainet is a leading AEPS API service provider company in India, offering multiple API services like PAN API, Multi Recharge API, BBPS API and more [6]. This means that customers can rely on Rainet for all their financial needs.

We are the best education portal development service company.

At Rainet, we are not only the best in providing domestic money transfer API services but also excel in education portal development. Our team of experts has years of experience in developing educational portals that cater to the needs of students and educators alike. We understand the importance of a user-friendly interface and provide customized solutions that meet the specific requirements of our clients.

Our education portal development services include features such as online course management, student enrollment, fee payment integration, and more. We use the latest technology to ensure that our portals are responsive, secure, and scalable. Our aim is to provide a seamless experience for both students and educators.

With our expertise in both domestic money transfer API services and education portal development, we are confident that we can provide the best solutions for your business needs. Contact us today to learn more about how we can help you achieve your goals.

Reason why we are the best domestic money transfer api company?

At Rainet, we take pride in being the best domestic money transfer API company in India. Our platform is designed to enable transactions to be completed in as little as 15 seconds, allowing money to be transferred to any bank account in India using the source's mobile number. We collaborate with various banking institutions in India to provide our customers with a seamless and secure money transfer experience.

Our team of experts is dedicated to providing quick support and real-time reports and settlement for all our customers. We understand the importance of timely payments, which is why we offer a complete payment solution in one API account. With Rainet, you can rest assured that your money transfers will be fast, secure, and hassle-free.

We have been providing online transactional services like AEPS, DMT, recharge, and more since 2018. Our experience and expertise make us the go-to choice for anyone looking for a reliable domestic money transfer API provider. Choose Rainet for all your money transfer needs and experience the best service available in India.

Conclusion

In conclusion, Rainet is the leading provider of domestic money transfer API in India. Our expertise in Bharat Bill Pay API and education portal development services makes us stand out from our competitors. We understand the importance of secure and reliable transactions, which is why we have developed a robust platform that ensures seamless money transfers for our clients. Our commitment to delivering exceptional customer service has earned us a reputation as the go-to company for domestic money transfer API solutions. Choose Rainet for all your domestic money transfer needs and experience the convenience of hassle-free transactions.

Visit Website: https://rainet.co.in/Domestic-Money-Transfer.php

#domestic money transfer agency#money transfer portal#money transfer software#domestic money transfer#money transfer services#money transfer api#international money transfer app#money transfer app for business#best money transfer app for business#domestic money transfer portal development company in Noida

0 notes

Text

Online GST Registration: A brief Guide

Online GST Registration Process in Steps

The following is a description of the GST Registration application process:

Step 1: Go to www.gst.gov.in to access the GST website.

Step 2: Next, you must click on the "Register Now" button that can be found after selecting the "Taxpayers" tab.

Step 3: After that, choose the 'New Registration' option.

Step 4: After that, you must fill out the information listed below:

You must choose "Taxpayer" from the drop-down menu next to the textbox in the "I am a" section.

Select your district and state next.

Afterward, state the name of your company.

Enter the business's PAN information here.

Post the identical code in the areas that the page's text directs you to for your email address and mobile number. This email address and telephone number must remain active because they will shortly get OTPs from the portal.

When finished, click 'Proceed' after entering the Captcha.

Step 5: On the following screen, you must input the OTP that you received on your email address and mobile number (which will later become one of your RMNs) in the appropriate fields.

Step 6: After entering the necessary information, click "Proceed."

Step 7: A numerical value known as your Temporary Reference Number (or TRN) will be displayed on the page that follows. Make a note of this because you will need it later.

Step 8: Next, go back to the GST portal and select the "Register" button that is located under the "Taxpayers" menu.

Step 9: Select "Temporary Reference Number (TRN)" from the menu.

Step 10: Enter the case-sensitive captcha and the aforementioned TRN.

Step 11: Select "Proceed" to continue.

Step 12: Another OTP will be sent to your points of contact. The next page requires you to input the OTP before clicking "Proceed."

Step 13: The following page will show the status of your GST Registration application. You should be able to see a "Edit" icon on the right side, so click it.

Step 14: The following page will include 10 sections. The required information must be fully completed, together with the required paperwork. The following list of supporting papers is required to be submitted with the form in question:

Your Photos in Passport Size

evidence of a company address

evidence of a company address

Banking details including your account number, bank name, branch location, and IFSC code for each are provided.

An authorization type

The charter of the taxpayer

Step 15: Next, you must go to the 'Verification' page, after which you must review the declaration. Finish the procedure by submitting the application using one of the approaches listed below:

by means of an EVC (Electronic Verification Code). The mobile number you originally provided, which is now the registered mobile number, or RMN, will get this message.

By digitally signing the same: To use this approach, you must enter an OTP to the phone number you registered with UIDAI, the government agency with last word on all matters pertaining to Aadhaar.

The Digital Signature Certificate (DSC) must be submitted with the application form when registering a company.

Step 16: Following the completion of the previous step, a success message will appear on the screen. You will be given an Application Reference Number (ARN), which you will get on both the email address and phone number you registered with the GST Council.

Step 17: After that, you can monitor the ARN's progress on the GST portal until it is processed. Be aware that processing the new GST registration application form may require some time.

Qualifications for GST Registration:

The following qualifications must be met in order to register for online GST registration:

According to the Goods and Service Tax Act of 2017, any industry of business with a turnover of at least Rs. 40 lakhs must register for GST.

Any industry that transports goods from one state to another needs to register for GST.

Anyone who provides taxable products or services inside the nation's taxable territory must register for GST. This includes casual/non-resident taxpayers.

Those who use an e-commerce platform to sell products or services and have annual sales of more than Rs. 20 lakh should register for GST.

Documents Needed to Register for GST

A list of the documents needed to complete the online GST registration can be seen below.

PAN Card

ID card, Aadhaar

a record of the company's address

the account statement for your bank and a voided cheque

Your company's incorporation certificate or other evidence of registration

If you intend to use the DSC technique, a digital signature certificate and a picture of your signature are required.

the promoter's and the directors' identification documents, documentation of their addresses, and a photo

A letter of authorization from the board or a resolution that has been approved by it and is signed by the authorized signatory

Online GST Registration Process for A New Business:

Step 1: Go to www.gst.gov.in to access the GST website.

Step 2: Begin completing part-A of the registration form 1.

Step 3: A reference number for your application will now be sent to you through email and mobile device.

Step 4: Complete the second section of the registration form and upload the necessary paperwork based on the type of business.

Step 5: Get a registration certificate from the GST portal.

Step 6: Submit the necessary paperwork and the GST REG-04 within seven working days.

Step 7: Read the email carefully and scan it for faults. Your application may be denied if there are any mistakes, and you will be informed of this in form GST REG-05 of registration under GST.

0 notes

Text

What is upi and How does it work?

What is Unified payment interface?

A single window allows you to transfer money between bank accounts through the unified payment interface, or UPI. This means that you can shop, pay bills, or authorize payments by sending or receiving money or by scanning a quick response (QR) code to pay a person, a business, or a service provider.

All you need to allow mobile payments is a mobile payment application and the payee’s virtual address, for example fullname@xyzbank. This suggests that payments can be made in a single step directly to a vendor’s or a person’s accounts. There is no repetitive step involved. For instance, entering your bank account information or other sensitive data every time you need to make a payment. Today IPB one of the best banking training institute will let you know more about what is UPI and how does it work

How Do UPI Transactions Work?

With the use of the Unified Payments Interface (UPI), customers can link several bank accounts in a single smartphone app and send money without giving their IFSC or account numbers.

In this real-time payment system, money are instantly credited in real-time.

How does UPI work?

READ MORE.....

1 note

·

View note

Text

How to open CSC Center and what is it?

What is the work in CSC?

Many works are being done through the CSC service. Let us tell you, the government has decided to provide more than 300 services under this scheme in the coming days. With this scheme, along with the benefits to the government of our country, many youths will be able to get employment in the country. Let us know, what work can be done through the CSC service center. like,

Adhar Card

pan card

Birth Certificate

death certificate

Caste Certificate

Residential Certificate

Income Certificate

driving license

recharge

Insurance

Agriculture

education

health

Banking

Entertainment etc.

Apart from this, you will be able to get many other works done through the CSC center, and in the coming days, manymoreworks will be done in it which are necessary for us. Apart from this, you can also apply online for any government or private job with the help of CSC service.

Now then you have come to know what is CSC and what work can be done through the CSC center. If you like this scheme of the Government of India, then you can also open a CSC center. Let us know, how to open the CSC center.

How to open the CSC center? How to apply for CSC Center?

If you can spend some money then you can do the work of the CSC center in collaboration with the government. If you are thinking of doing any business then this is a very good option for you. Yes, you can serve people and earn money by joining the VLE service started by the government.

But for this, you have to invest first. First of all, you need a place to open your CSC center. Also, you will need a computer, printer, camera, inverter, operating system, application software, and an internet connection. Meaning, to open a CSC center, you will have to spend up to 2 lakhs.

If you can invest this much then you can open a CSC center and become a village-level entrepreneur. Apart from this, you will also need some documents to avail of CSC service. like,

Aadhar card

You must be 18 years old

Basic knowledge of computer

knowledge of the English language

If you can clear all these documents and eligibility then you can apply for the CSC center. Let us know how to apply for the CSC center.

Aadhar card

You must be 18 years old

Basic knowledge of computer

knowledge of the English language

If you can clear all these documents and eligibility then you can apply for the CSC center. Let us know how to apply for the CSC center.

How to apply for the CSC center?

If you want to become a VLE i.e. start your own CSC center then you can apply for a CSC center by following the steps given below. Let us know, how to register for CSC Center.

First of all, go to the official website of CSC.

Click on the New VLE Registration option.

On clicking on the registration option, a window will open in front of you. Fill name, Aadhaar number (certificate number), mobile number, and captcha code, and click on submit.)

After clicking on the submit button, a page will open, in which you have to click on the kiosk tab.

In this tab fill in Kiosk and personal information like name, address, bank account, documents, etc., and click on next.

After this, you have to fill in your bank details like the account holder’s name, branch, IFSC code, etc. Also, you have to fill in the details of the required documents like PAN Card, Aadhaar Card, Photo of CSC Centre, Bank Pass Book, etc. After that click on next.

After that fill in the details of Basic facilities.

Check, all the information is filled in correctly, then click on the submit button.

In this way, you can apply for the CSC center. We have told you about the CSC registration process step by step so that it is easy for you to understand.

After sending the application form, you will receive an Acknowledgment email on your email id, and mobile number, in which you will know whether your application is passed or not, if passed then you will be invited to open the CSC center. Apart from this, you can also get its information from the CSC website.

What are the benefits of CSC?

There are many benefits of the CSC scheme, it has made the work of many people easier and cheaper. Let us know the benefits of CSC center service. like,

The biggest advantage is that now people will get CSC centers in different places. There are many people, who live far away from government offices, and they find it difficult to get much work done.

With the help of CSC, now people will not have to face corruption and trouble.

Through the CSC center, people will be able to know about the schemes being run by the Government of India.

With the help of CSC service, people will not have to travel far and wide to government offices to get their work done online.

Another good advantage of the CSC center is that it saves both time and money for the people.

People living in far-flung rural areas will get a lot of benefits from CSC i.e. Jan Seva Kendra. The common service center scheme is a very good service under the Bharat program. Today CSC centers are being opened in every village and city, with the help of this people living far away from government offices will be able to get all kinds of digital services.

conclusion,

Friends, in this article we told you about CSC (Common Service Center) Common Public Service Center. Like what is CSC, how to open a CSC center, what is needed to open a CSC center, and how much will it cost. Also, we have also told you about the registration process for CSC, and how to apply for the CSC center. Apart from this, we have also told you the advantages of CSC service.

We hope, after reading this article till the end, you must have got complete information about CSC service. If you still have any questions related to this, then you can tell me in the comment.

Another good advantage of the CSC center is that it saves both time andmoneyfor the people.

People living in far-flung rural areas will get a lot of benefits from CSC i.e. Jan Seva Kendra. The common service center scheme is a very good service under the Bharat program. Today CSC centers are being opened in every village and city, with the help of this people living far away from government offices will be able to get all kinds of digital services.

Conclusion

Friends, in this article we told you about CSC (Common Service Center) Common Public Service Center. Like what is CSC, how to open a CSC center, what is needed to open a CSC center, and how much will it cost. Also, we have also told you about the registration process for CSC, and how to apply for the CSC center. Apart from this, we have also told you the advantages of CSC service.

We hope, after reading this article till the end, you must have got complete information about CSC service. If you still have any questions related to this, then you can tell me in the comment.

For thelatest tech news and reviews from around the world on best recharge, and exclusive offers on popular mobiles, follow us on Facebook, and Twitterfor the latest updates. Search for Digital Marketing, SEO services, Website Designers, and Web Hosting Companies here.

#Increase blog traffic simply#traffic#blog#increase traffic#blog traffic#organic traffic#social media traffic#tier 2 traffic#visitors#5 thousand visitor daily#website traffic#5k visitor daily#Google Question Hub#backlink#do follow#no follow#business#seo#digital marketing

0 notes

Text

Things You Would Love to Know About UPI

Unified Payment Interface is a payment method developed by the National Payment Corporation of India. With the invention of this payment method, India has inched closer towards becoming a cashless economy. The payment method doubles up your smartphone as a virtual debit card. Using this payment method you can instantly send or receive money. It is a far better option than NEFT, RTGS, and IMPS. This means you do not need to type in the card or bank details. You can directly pay using the UPI ID.

What is UPI?

It can be referred to as an email address for your money. It is a unique identifier that is used to transfer or make payments. It is based on the concept of IMPS. However, it is even less tedious than IMPS. It is available 24*7, unlike other transfer methods. You do not need a wallet or a bank card. All you need is a smartphone and internet connectivity.

How does it work?

If you want to transfer money using conventional methods, you will have to at least spend 30 minutes. You have to start with the bank website and adding of a beneficiary, if not already. You will also have to provide the IFSC code, account number, and bank name of the beneficiary. If you are adding a beneficiary then you might have to wait for some more time. These many steps also increase the chance of errors. UPI does away with all these steps. The interface allows the account holder to send or receive money from their smartphones. Now, these interfaces can be your bank app or some other UPI app. The function will remain the same.

Features of UPI:

UPI is useful because it is easier to use. It is easier than a credit card or a debit card. Apart from being easy, UPI boasts of several other features

Reliability: It is launched by NPCI. Hence, reliability is its biggest feature. Customers have greater control over their transfers. They do not have to worry about their money getting lost along the way.

Real-time Transactions: Another important feature of UPI is the fact that transactions take place in real-time. As soon as the sender clicks on the send button, the beneficiary receives the money in a matter of seconds. As a result, day-to-day chores have become immensely easier.

No Minimum Amount Needed: Unlike physical transfers and payments, it does not have any minimum amount limit. You can send or receive any amount you want.

1 note

·

View note

Text

0 notes

Text

An IFSC code meaning is a unique identification code that is used to identify the bank and branch of any particular bank account and is used in bank transfer systems like NEFT, RTGS, and IMPS. IFSC stands for ‘Indian Financial System Code’ and forms an essential part of the Indian banking infrastructure.

0 notes

Text

IFSC Code (Indian Financial System Code)

IFSC (Indian Financial System Code) is an 11 digit alphanumeric code which is used to identify the bank branch of your account. The first 4 characters of IFSC code represent the name of bank, fifth character is 0 and the last 6 numbers define the branch code of the bank. This code is used at the time of online fund transfer facilities like NEFT (National Electronic Fund Transfer), RTGS (Real Time Gross Settlement) and IMPS (Immediate Payment System). IFSC code reduces the scope of error at the time of transaction.

Where can I search for IFSC Code?

You can search for the IFSC Code of a bank in multiple ways:

You can search for the IFSC code on the cheque and passbook provided by the bank

By visiting website of the respective bank

Search for IFSC code at RBI’s website

Find IFSC code easily at MyLoanCare website. Select Bank, State, District and then branch.

What are the features of IFSC Code and its importance?

IFSC code helps identify a bank’s branch. It is an important tool that makes various online banking operations easy and hassle-free. IFSC enables instant fund transfer, and error-free NEFT and RTGS transfer of money with quick validation and confirmation to the customers. Some features of IFSC are listed as follows:

IFSC enables easy branch location and identification

Eases digitalization of bank operations

Quick transfer of funds

Promotes safety and saves time

Aids NEFT and RTGS

MICR Code

MICR Code (Magnetic Ink Character Recognition Code) is a 9 digit code printed at the bottom of the cheque. The first three digits define the city code, next three represent the bank code and last three digits are the code of your bank branch. A special machine is used to read these charatcers and can also be read by humans. MICR Code helps in identifying the authenticity of cheques and making cheque processing simpler and faster. Each bank branch has unique MICR code that helps RBI to identify the bank branch.

Where can I find the MICR Code?

You can identify the MICR Code of a bank in multiple ways:

You can find the code at the bottom of the cheque and passbook provided by the bank

You can get this code on the website of respective bank

What are the methods of online fund transfer using IFSC Code?

IFSC code is used to transfer funds online by using three main quick payment systems in India such as IMPS, NEFT and RTGS. These 3 fund transfer techniques can be used through net banking or mobile banking.

NEFT - NEFT means National Electronic Fund Transfer is an electronic payment system used in India for quick interbank transfer of funds. Under NEFT, the fund transfer time can range between 1-2 hours. The key benefits of NEFT are there is no limit on minimum and maximum amount transaction and is offered by all banks in India. The money transfer occurs between 8 AM to 6:30 PM from Monday to Fridays and 8 AM to 1 PM on working Saturdays. There are charges on NEFT fund transfer which vary from bank to bank. The charges are in the range of Rs. 2.5 to Rs. 25 plus GST depending upon the transaction amount.

RTGS - RTGS means Real Time Gross Settlement is one of the fastest interbank money transfer facility in India. It allows transfer of money on real time basis within 1 hour. As per RBI, there is a minimum transaction limit of Rs. 2 lakh. This facility is available on RTGS enabled bank branches. The fund can be transferred on bank working days between 8 AM to 4 PM from Monday to Friday and working Saturdays. A charge of up to Rs. 60 plus GST is levied on fund transfer depending upon the transaction amount.

IMPS – IMPS means Immediate Payment System is an electronic money transfer facility where money is transferred to the beneficiary's account within few seconds. IMPS fund transfer is secure and uses two- step verification process to perform transactions. There is no minimum limit on fund transfer but maximum limit is different for different banks. This facility is available when customer has a mobile banking or internet banking facility. The fund can be transferred 24*7 hassles free even on bank holidays. The charges attached to this facility are up to Rs. 15 plus GST depending upon fund transfer amount.

1 note

·

View note

Text

Udyog Aadhar Registration - Answering What, Who, How and Why of It

The Government of India offers little and medium-sized business an extraordinary number and endorsement that perceives and ensures them as endeavors. It is known as the Udyog Aadhar enlistment. Recently known as the MSME enlistment process, any of the accompanying organizations can settle on it:

A sole owner substance

A LLP venture

A private constrained organization

Or then again some other enterprise

To enlist, a 12-digit Aadhar Number is required which can be given by:

The proprietor of the firm

The chief of the endeavor

The owner of the element

Udyog Aadhar - Who Should Opt for It?

Any business, exchange or element that meets the predetermined criteria of miniaturized scale, little or medium endeavor can apply for MSME enlistment. In the event that the organization can be delegated MSME, it can settle on Udyog Aadhar. The kind of big business can include:

Ownership

Organization Firm

Constrained Company

Creation Company

One-Person Company

Co-Operative Societies

Hindu Undivided Family

Private Limited Company

Constrained Liability Partnership

Other than the ones recorded over, some other relationship of individuals or undertaking can likewise enlist for Udyog Aadhar.

How to Register for Udyog Aadhar?

In the previous couple of years, the administration patched up the SSI and MSME enrollment procedure to make it a lot less difficult. The revived framework is direct and doesn't require an excessive amount of information. It ought to be noticed that the online entry must be utilized by people who have an Aadhar Card and have an endeavor.

An individual who needs to enlist as MSME yet doesn't claim an Aadhar number needs to petition for Udyog Aadhaar Memorandum (UAM) with the General Manager of the necessary District Industries Center. Here are the means to take for the individuals who have an Aadhar number:

1. Udyog Aadhar has an official enlistment entry. The initial step is to visit it.

2. When the site is open, fill in two specifics:

The total name of the individual petitioning for enrollment.

Their 12-digit one of a kind Aadhar Number.

After this snap on the 'Approve and Generate OTP' button. The one-time secret word will be sent to the versatile number enlisted with Aadhar Card. Utilize the OTP to fill in the social class. There will be four classes:

SC

ST

OBC

General

3. Presently every one of the subtleties of the business or undertaking should be filled in. Keep in mind the space for the name must be filled in with the name of the business and not the individual filling the application. For the correspondence subtleties, type in the whole postal location of the business. This would include:

Area

Stick Code

State

Email Address

Portable Number

4. Next comes the convey forward data which requires information, for example,

The date the element began activities. (Utilize the schedule to fill the exact date)

Any past enrollment information. (This incorporates SSI enlistment, EM1, EM2 and UAM enrollment number)

5. The structure will currently request bank subtleties. Enter the financial balance number and IFSC code of the bank office. If you don't mind guarantee that the record is enrolled under the undertaking's name. To discover the IFSC code, go to the site of the bank.

6. The accompanying advance is to determine the fundamental business of the ventures. Udyog Aadhar offers two decisions - assembling and administrations. For an organization that does both, the most ideal situation is to pick the choice that comprises the critical piece of tasks. For instance, in the event that the venture is 70% assembling and 30% administrations, at that point assembling would be the correct choice.

7. The last detail the structure requests is the quantity of workers as of now joined up with the business and the full speculation sum.

8. The last advance of the system is to pick the District Industry Center. Utilize the drop-down rundown to pick one. After this acknowledge the announcement and present the application.

On the off chance that an individual has more than one endeavor, they should fill a different Udyog Aadhar structure for every last one of them.

Why Register Under Udyog Aadhar?

A basic procedure that requires nil administrative work isn't the most important motivator for enrolling an undertaking for Udyog Aadhar. The plan offers a plenty of recompenses and favorable circumstances to little, smaller scale and medium-sized organizations. To give some examples:

The organization gets an extract exclusion.

The exchange can select credit assurance plot.

The firm is additionally excluded from direct assessment laws.

Since business requests a great deal of power, an enrolled venture can profit concession on power bills.

In the event that the substance documents for trademarks or licenses, it gets a decrease in expense.

When a firm is assigned as a MSME, it can benefit numerous administration plans, for example,

simple credits

credits without ensure

low-financing costs on credits

Another road for expanding the income of the business is endowments that are appreciated by enlisted MSMEs.

At the point when the venture chooses to take an interest in global and remote expos, it gets money related help from the legislature of India.

A Udyog Aadhar firm gets exceptions when they apply for any tenders gave by the legislature. Click here aadhar card download by name and date of birth without otp

The main authoritative report expected to enlist an exchange under Udyog Aadhar is the Aadhar card which makes the procedure exceedingly straightforward. However, filling the structure expects scrupulousness and assurance that no missteps are made. An accurately filled application can ensure that the element use every one of the advantages the administration gives to MSME. It is the reason it is prescribed to pick a built up firm like VakilSearch for Udyog Aadhar enlistment.

1 note

·

View note

Text

Heartfelt Appeal For Help

I am Suman Jyoty Bhante, a Buddhist monk from Mizoram, a small state in northeast India. I come from the Chakma community. After becoming a monk in 2006 I stayed in a meditation center at Bangladesh learning Vipassana meditation under the tutelage of the renowned meditation teacher Ben. Tejabangsha Mahathera . In 2008 I returned to Mizoram to stay in a monastery in the town of Demagiri. I travelled offering discourses and continued my personal practise of meditation during the next few years. It was during this time that I began to form some of the observations that would shape my present plans. The Chakma ethnic group form a Buddhist community in Mizoram, and though many nurture great faith and devotion towards Buddhism, very few have had the opportunity to learn and practise meditation. I noticed the acute suffering, materially and physiologically of ordinary people with whom I came to contact and I witnessed that there is an immense need or necessity for people to have the chance to make real and lasting contact with living dhamma and to learn how to apply it in their daily lives. My Discourses managed to arose interest and enthusiasm in the hearers, but I felt sincerely that this was not enough. People require much more substantial knowledge and experience of Vipassana meditation, in order that their lives maybe truly transformed. With all of this in mind, I began searching around Mizoram for a suitable place where it might be possible to found a meditation center wherein anybody would be welcome to come and learn Vipassana. Finally I found a wonderful place about 18km far from Demagiri, Which I named Arjogiri Sugh. It comprises 16acres of land spread across lush jungle. It offers panoramic views of the beautiful surrounding mountainous terrain, and it's high altitude means that the climate remains always pleasant and cool; a perfect environment for meditation. After this land was donated to me I moved here in 2017 and have remained here since that time, living in a small Kuti (hut) where I practise Vipassana in solitude. My dream remains to found a meditation center that maybe available for the use of both the nearby community and indeed anyone else from far or wide who might desire to come and learn the dhamma. Unfortunately though the local population graciously donated this land to me they are largely unable to contribute financially. I feel more strongly than ever that the practical application of the Buddha's teaching, provides the best means of improving and uplifting the lives of individuals and the wider society life is often a struggle for many of the people of Mizoram, and we are afflicted by many difficulties and social problems particular to a poor, impoverished and predominantly uneducated locality. Taking all of this into consideration I would like to make a heartfelt appeal for any monetary donation large or small which may go towards the founding and construction of a meditation center. How will the fund be used? Any monetary donations are warmly welcomed and will be used only towards the upkeep and growth of the Ariyagiri Vipassana Foundation for the benefit of all meditators. My Contrivance is to develop Buddhism through Vipassana Meditation all over the Mizoram, India and all over the world. The projects made

1. to built a Large Buddha statue of 85ft height.

2. Pagoda of 120 ft,

3. Large Meditation Hall, for 1000 people

4. Bhikkhu Sangha Nivasa for, 500 monks

5. Shamanera Nivasa for 500

6. Upasaka Nivasa for 500

7. Upasika Nivasa for 500

8. Tipitaka Library

9. Buddha Vihara

10. Dhamma Hall

11. Dhamma training Hall, with separated room (like a dhamma school) to learn Buddhism.

12. Kitchen

13. Dining hall for Bhikkhu Sangha and Shamanera for 1000

14. Dining hall for Upasaka and Upasika for 1000

15. Resort Centre for tourist.

16. Parking Place.

We are accepting donation to built Aĺl the mentioned, we will try to built within 2030. So please help me to help the people to understand dharma and practice Vipassana Meditation.

But at first we need your help to raise funds of $4000 USD for making level the land to sculpting Buddha statue of 85ft height and to built a meditation centre here in Mizoram India.

Donations can be made to the following bank account.

Kiran Baran Chakma

Ac/Number: 30926766458SWIFT CODE: SBININBB477

IFSC CODE: SBIN0005819

STATE BANK OF INDIA, TLABUNG BRANCH

Demagiri 796751 India.

With Metta and Goodwill to all living beings.

Yours In Dhamma Suman Jyoty Bhante President Ariyagiri Vipassana Foundation.

1 note

·

View note