#im so glad i invested in real estate

Text

The Phantom of the Opera | Seoul, South Korea | 집팬텀 x 송크리 Review 5/6

October 13, 2023 - Evening / 1500th Korean performance

The Phantom of the Opera | 김주택 Kim Ju-taek/Julian Kim

Christine Daaé | 송은혜 Song Eun-hye

Raoul, Vicomte de Chagny | 황건하 Hwang Gun-ha

Carlotta Giudicelli | 이지영 Lee Ji-young

Oh another incident of me making excuses to see this show again...

@capitanogiorgio really wanted to go and how could I miss the chance to go with a great friend

it was the 1500th Korean performance

I wanted to see Ju-taek with a completely different cast rotation

...it's King Ju-taek, that's reason enough

It was meant to be because when I checked in with her after ticketing, I had bought a seat right in front of hers without even trying. I was just aiming for the general area. So yeah I'm justified! The stars aligned! No regrets, because this was another performance that blew me away and oh boy I cried again somehow what is this dark magic being done to me

I'm so dumb and I left my binoculars in my hotel room so I literally had to run to grab them and my art print for Yoon Young-seok during intermission. Like I said before though, the Charlotte is very small. The view from the last two seats genuinely doesn't feel that far away like it might at the Majestic. It's just difficult distinguish expressions. Any pair of binoculars and opera glasses can easily rectify that.

Backstage | Little Lotte / The Mirror

Quoting Ceci's notes "XOXO Gossip girl André" I just needed to note his dramatic "WoOoOw~!" and silly teenage girl giggling as they left Raoul to be alone with Christine. So scandalous!

We both especially liked his delivery in The Mirror this performance. Even with such a powerful commanding voice he's able to make himself sound gentler and a lot less intimidating in response to Christine. Her words clearly have an affect on him, softening him. He called to her more quietly and eerily this time, but oh that nice little build up again in the final words telling her to come closer? Chef's kiss. Very nice range.

The Music of the Night

As with Dong-seok, SEH Christine was more curious about him and is not the fully obedient student like SJS Christine. It makes it interesting when she's paired with the more controlling Phantoms like KJT or CJR.

Even so, these two had some interesting chemistry. He actually got a bit too caught up in the moment, leaning in very close to her (the almost kiss). There was a little bit more urgency when he quickly backed away even though he immediately pretended to be composed again. So maybe she hadn't fully given in yet, but she definitely was getting a little too curious. Both shows it did look he kept getting pulled by small stirrings of something from the intimacy, but he was always quick about brushing it off. This night for the line, "마침내 내 것이 될 순간 / The moment you'll finally be mine" - he put the whispered emphasis on "be mine"

By the end, she was definitely more convinced by him and open to listening. But of course, getting jumpscared by a bride replica of yourself might be a bit of a vibe killer so hm that progress kinda dropped

Stranger Than You Dreamt It

Like I said, I left my binoculars for Act 1 so this part was kinda agonizing because I couldn't see facial expressions. But he really sounded more exposed and hysterical after his unmasking than before. He ended his outburst with loud gasps and even the first half of STYDI which was clearly meant to sound intimidating and harsh felt shaky.

Once again, SEH Christine didn't take her eyes off of the Phantom when he came near. She began to reach for him when he was close like she had done with JDS Phantom, but he turned away too quickly...

Why Have You Brought Me Here? / All I Ask of You

Side-eyeing the hell out of HGH Raoul again, but extra this time. Until he's just about to start AIAOY, he just comes across as judgmental and irritated with her. Although I definitely prefer him over Hadley, he's a little too much of that type of hot-headed for me. I found it funny that Ju-taek talked about HGH Raoul always being angry. Like even directing his anger at Christine (he noted his way of shouting "이쪽으로 와요 / Come this way!!!" at Christine before she takes him to the rooftop and the way he shouts at Madame Giry). It's too accurate 😭 Anyway, not technically a bad performance, just not my preference with personalities for Raoul. I think he would suit the role of the Phantom a lot more when he’s older 👀

To more briefly summarize this I'm quoting Ceci's notes again: "Tiger big douche tonight?"

I will give him that he is very cute during AIAOY and I wish he would continue to be this cute. He was romantic and very passionate about it! I just have a radio performance to share so sadly you won't get the real feeling, but it's at least a little taste?

youtube

Wandering Child

I know the Phantom's murdering and kidnapping and whatnot but this is in his top crimes like he's a real bitch for this. He made himself sound so safe and inviting in 'Wandering Child' like leave her alone you weirdo!! And SEH Christine responds with "아빠 - Father?" whenever the Phantom calls for her to come closer at the end of the trio's singing. No, girl, no! 😭 His voice made a complete transformation after being interrupted by Raoul. Suddenly, he had a strong terrifying authoritative presence.

The Point of No Return

I loved how he gently tilted her chin with his fingers during the beginning of his half of the song like Dong-seok had at my first performance 🤭 His voice felt really strong, he really seemed determined and confident, but once again he was absolutely on edge when they get to the bench and struggling to grasp for that "control" he thought he had.

They ended the song very close!! He wasn't even able to finish singing the final word. The adrenaline rush was gone. He was scared now. Despite being so intense before, his voice and the way he went to take her hand for the ring became so gentle, but also desperate and rushed at the same time.

...but why did the rooster NO!! get funnier to me. I'm so sorry!

Final Lair

During ‘Down Once More’ she tried to touch him, but he grabbed her angrily to stop her. I think she tried to reach to him or touch him a few other times like when she said she didn’t fear his face anymore, but this only made him panic and lash out more. He was really agitated and on edge! There were a lot more aggressive responses as attempts to suppress his doubts about his actions. Deep down he knew he sensed what he was doing was wrong, but he kept clinging to this feeling of betrayal and the excuse of his face to justify pushing forward. But we're past the point of no return, we can only go full speed ahead now.

The way he mocked Raoul seemed so calm, but when HGH Raoul started snapping at him he matched his energy a lot more viciously than when interacting with SWG Raoul.

He pounded his chest during the line "이 모든 건 이미 결정된 것 / Everything has already been decided" with a pained emphasis on 'decided'. I think deep inside he already might have known what the ending would have to be

Ohhhh when Raoul asked why he would force her to choose a lie this time it enraged the Phantom so much he grunted loudly and looked like he was about to actually strangle him when he lunged at him. SEH Christine was brave about blocking his path and he stormed off again because he couldn't hurt her. But it's kind of funny to me that Ju-taek said the aggression from HGH Raoul triggers more anger from him (that was clear), but when facing SWG Raoul he almost feels bad for him. He also said putting the noose on SWG Raoul is easy, but then HGH Raoul is kinda scary and angry. Personally, I think that putting a noose on HGH Raoul is the equivalent of putting a chihuahua leash on a tiger and hoping it'll hold.

The way he gave his "믿었다... 날 믿었다고... / Trusted...you trusted me" reply was sharp, almost sarcastic and he shouted for her to make her choice looking seriously anguished. She looked wounded and sobbed before she began to respond.

The kiss was similar to the one with SJS and SEH Christine really didn't want to leave him either. She was trying to stretch her hand out to him while HGH Raoul kept insisting they needed to leave. When he called himself the angel of death she was shaking her head. Hadn't she just expressed something different to him? It looked like it hurt her to still hear those kinds of words from him. But the weight of his guilt was really crushing him so much that he couldn't take it. He fell to the ground crying hard when he chased them away.

Upon seeing Christine return, he sighed a little. She was whimpering and sobbing as he told her that he loved her and she nodded slowly in return. He really tried hard to make it look like he was at peace with letting her go, but it was clear he wasn't ready. The moment her hand left his, he let out a shaky sigh like she was his very breath being taken away from him when she ran off crying. But he didn't try to stop her in any way. He just kissed the ring softly and walked picked up the veil on the ground. He quietly repeated her name into the veil over and over again lovingly before he did the same action with the veil singing his final lines. Even though SEH Christine doesn't look at her Phantoms, she sounded mournful and shaky on the way out. I don't think she'd even be able to handle looking at him again

Here's yet another special commemorative audience photo woo! Ceci and I stretched into the aisle so we could find ourselves later and not just be a blur in the crowd and well...there we are. I think he took like 3 different poses before deciding the last one was the right one heh

I think in general the cast was on fire! There was a lot of good energy since it was another special performance. Part of the multiple reasons I chose to attend!

After this I could say with confidence that Kim Ju-taek has now ended up being in my top favorite Phantoms. I know he had performance experience from opera, but I still can't believe he's been able to come up one of the most unique perspectives I've seen for this role for his first musical. Now my friends and I have all sorts of future role ideas, so I hope he continues to do musicals in the future!

Just one more review left now~

It's promo time enjoy some performances to cleanse your ears!

youtube

youtube

youtube

#mr kim housing mr kim mansion even#im a victim of the housing crisis#im so glad i invested in real estate#what a magical and chaotic day truly#the phantom of the opera#poto korea#kim ju taek#julian kim#김주택#오페라의 유령#송은혜#황건하#이지영#song eun hye#hwang gun ha#lee ji young#poto review

12 notes

·

View notes

Note

helllo helllooo ellie!!! hru doing?!

IHM gojo is the song looking for a man in finance, trust fund, 6’5 blue eyes personified lolllll….I discourage the use of words like these when referring to ppl but he’s sooooooo fuckable😣 love LOVE kickoff!gojo but theres just something about ihm!gojo thats making me lose my mind a tad bit more ughhhh

n it is completely alright if u dont write top reader😌 I will have my gojo in any way n anyhow possible 😌😌😌😌

i’m so excited for upcoming chapters of both kickoff n IHM🥹🫶 im looking forward to more soft boi gojo in kickoff hes TOO CUTE he NEEDS to be EATENNNNN

zuro anon

hiii zuro babyyy <33 omg hope you’re doing well!!

PLS yknow when i first heard that tiktok audio my first initial thought was gojo ✋🏼😭 you’re so right tho when my brother was tryna buy a house i had to listen to his real estate agent drone on ab finance n stocks n investment property so imma channel all that annoyingness into ihm gojo🤞🏼😍

IM SO HAPPY ABOUT THAT BECAUSE IN ALL HONESTY I HAVE NOT BEEN ABLE TO STOP THINKING AB IHM GOJO TOO 😅 WHICH FEELS SO VAIN BC HE’s MY OWN CHARACTER BUT LIKE… 🫣🤭😔 sumn ab my annoying real estate fake husband… (i mean i guess in fairness i know what happens in the story so that’s probably why 🤣 but i’m so glad that you who doesnt know what happens in the story also finds him fuckable!!!!!!! goal accomplished!!!!!!!!!! <333)

same bae i’d have gojo upside down right side up to the left to the right and its takin all my energy not to break into cha cha dance song rn

so happy you’re looking forward to more updates from me bb!! :”) you’re so cute i swear i just want to kidnap u n keep u in my pocket. LOVE YOUU 💕💕💕

- ellie 🔥

17 notes

·

View notes

Note

please tell us literally anything about the wild west au i am so invested i am looking Respectfully this shit is so fuckin cool dude!!!!!!!!!

god im so glad you asked, ive been holding back the floodgates till somebody was interested

some minor spoilers if you haven't played project nexus 1 & 2

this is a big info dump so consider this a warning.

Im gonna separate the story into bullet points connected to each character.

Hank: Bandit/outlaw/bounty hunter. Standard stuff, killin, robbing and going after folks in auditors/phobos' gang. Its not hard to assume what hanks up to.

2bdamned: Doctor/gambler. Nobody knows if hes ever actually been to medical school but hes real good at his job so it doesn't matter to the crew. in the 1800's it was crazy common to die from infection so if your patients survived a lot the town would assume that it was 'the devils work' and that the doctor worshiped dark forces. so even though 2b had the common sense to disinfect his tools people stood clear of him. he used this fear to his advantage and likes to gamble in town, using the cash for medical supplies. hes real worried audi has gotten his hands on something dangerous.

Deimos: cowboy/outlaw. Hes an irish immigrant, he hated the city-life so he left to explore the developing west as a cowhand. He meets sanford as they're both working on herding cattle, the two of them quit to become outlaws/bounty hunters with hank. probably met in some sort of stick-up hank tried to pull on them.

Sanford: Cowboy/outlaw. (people usually estimate that 1/4 cowboys were black, but that isnt true. The men who owned the ranches would send their workers out to hide in the forest while the census was being taken to avoid taxes, so they were probably the majority. i really recommend looking it up so i dont make this post a mile long) Anyways, ford mainly worked as a cowhand/horse wrangler most of his life till he met deimos. both of them knew that they'd be unstoppable together as bounty hunters, leading them to join up with hank and 2b. (I can do some deimos/sanford hcs in another post if anyone wants it)

Auditor: business man/gambler. being made up of fire (or whatever hes made up with) isn't going to go unnoticed in the god-fearing west. so Audi stays up in his riverboat holding gambling events with people he can show himself around. He uses his wealth to buy property and expand his control, using Hoffnar as a sort of puppet to carry out his in-person transactions. People dont really even know audi exists. But he isn't just interested in gathering land, hes been collecting doctors and experimenting on people to figure out how to bring the dead back to life. (this part of the story is a bit loose, i haven't figured everything out yet)

Hoffnar/tricky: Doctor/business man. Sweet,tired Hoffnar, stuck under Auditor's thumb and forced to manage several towns of his growing estate. Townsfolk don't like him much, as most working class people tend to hate those who own everyone's property. Hes good friends with Jeb and sheriff, tending to stick around them and treat their injuries. Hes also very close to audi's resurrection project, giving a version of it to jeb before he defects(unknowingly infecting himself with it). He is blamed for Jeb's defection and is taken out to the middle of the desert where phobos kills him. but he lives on , succumbing into a feral zombie state, digging up graves and killing anyone who go out into the hills; spreading the infection.

Sheriff: Lawman. ive talked before a bit about how sheriff came down from the city with dreams of conquering the west. obviously this didn't pan out, but his charisma and likability showed to be an asset to auditor, who hired him to be the sheriff of his developing towns and keep the townsfolk compliant and quiet. in an attack to get a hold of auditor's recipe for resurrection, hank shoots sheriff in the head, killing him. but auditor decides to resurrect him, wanting to avoid losing control of the town in the aftermath of hoffnar's death. Sheriff can't remember dying but he has dreams of his brief time in purgatory. Auditor tells sheriff that jeb and hoffnar died in the shootout.

Jeb: Lawman/bodyguard. I Imagine jeb is from the south-west, working as a Vaquero and holding a good amount of medical knowledge. but the times called for different skills, leading him to work for the auditor. Jeb was hired to keep sheriff safe, (he may be the sheriff but hes not very good at it) posing as the deputy and acting as a last resort if hank and the crew managed to get past phobos' gang. you may assume whatever you like in regards to their relationship but i am a big sheriff x jeb liker, so when sheriff gets taken down at the shoot-out, jeb defects and vows to hunt hank down. Before he leaves, hoffnar gives him a primitive version of the resurrection recipe. but as he distances himself from auditor (and taking notice to tricky's antics) he decides to pick the lesser of the two evils and join up with the crew. absolutely taken aback when he sees sheriff alive (and not a zombie) he works with 2b to figure out how to use the resurrection recipe/use it to fix the impending zombie virus

Phobos: Outlaw/bandit. leader of the gang that inhabits auditors territory( this is where you'll find the mag agents and nexus g03lms), keeping out rival outlaws and anybody too nosy for their own good. the town believes sheriff is protecting them from this gang. phobos only has one eye that he protects behind custom goggles (glasses were not very advanced yet, so this is just unfeasible. but if i can have a fire-demon, i can stretch this) He carries out auditors orders to kill hoffnar, shooting him in the face and slicing his stomach open so the animals would take care of the body. He hates working under Audi, forced to do all the real dirty work while sheriff and jeb sit pretty in town.

i think thats all the main stuff...id be happy to answer any questions or listen to ideas as im still developing things

#long post#i want to get more 2b and hank content in#an i need to figure out more tricky stuff its really lacking#plus dei and sanford are doing hot cowboy stuff so the possibilities are endless#madness combat#madnessWest#ignore any grammar errors please im just a little man#gore mention#gore

61 notes

·

View notes

Text

[ LFRP ] Ane - ( Ultros, Balmung, Crystal DC )

❝ who are we, then, if we are not laughing? loving? ❞

🔓-- A lock icon denotes the presence of an additional something significant to be discovered only via roleplay. The more locks there are, the harder it will be to learn! Build a relationship with her to discover these secrets she keeps to herself.

This LFRP post is specifically for her canon verse. Check over here for access to the LFRP post for her geomancer verse. I can play both/either on Balmung/Crystal as necessary!

❀ General Information ––– -

Name: Ane de Borel. 🔓

Epithet: Of the Shining Scale.

Gender: Cisgender female.

Age: 28.

Race: Au Ra (Raen.)

Birthplace: Yama, Othard.

Current Residence: House Borel, the Holy See of Ishgard.

Relationship Status: Married.

Sexual Orientation: Demisexual.

Occupation: Healer. Apothecary. Herbalist.

❀ Physical Appearance ––– -

Hair: Warm black. Thick. Naturally wavy. Streaked with silver, though most concentrated at the root and in her bangs to the point of looking stark white. Often worn swept up with a green scarf or over her shoulder. Never without at least a small braid somewhere, regardless of style.

Eyes: Warm grey. Clouded by cataracts. Kind.

Height: 4 fm 8 im.

Distinguishing Marks: Rounded, soft scales reminiscent of a koi’s. Strange-feeling aether. 🔓🔓 An absolutely contagious smile.

Common Accessories: A modest, braided wedding band fashioned of three kinds of gold. A fragment of her very first Crystal of Light, all but dormant, hanging on a simple leather cord about her neck. 🔓🔓 A bracelet fashioned out of humble, smooth river stones. Dark silver bands adorning her horns, carved by hand with strange designs. 🔓🔓

❀ Personality & Tidbits ––– -

A young woman possessed of an indomitable spirit. Though robbed of her ability to use aether freely, she carries on down the path of healing, and this setback has only served to further fuel her dedication to her studies. Soft-spoken and generous, Ane always has time to spare for those who have need of her company, and she is quick with a smile and cup of warm tea to cheer them during their travels to the frozen north. Her kindness is not weakness, however, and she will not back down from doing what she feels in her heart to be right -- even if others might accuse her of having abandoned the light to do so.

Talents: Traditional Far Eastern medicines. Nonmagical healing. Archery.

Weaknesses: Combat in close quarters. Overwhelmed by an overabundance of aether. Can very sparingly use magic, but only at great cost to herself. Sweets.

Virtues: Sincere. Kind-hearted. Optimistic. Hopeful. Forgiving.

Flaws: Stubborn. Slow to anger, but fiery-tempered when pushed too far. Can still suffer bouts of feeling self-conscious and inferior, especially about the unstable nature of her aether. Somewhat childish when upset. Doesn’t always know when to quit, and sometimes other people pay the price for it.

Spiritual Views: Reverence for the Dawn Father. Respect and recognition for most other faiths she has personally come across, as she imagines they must all have at least a grain of truth at their hearts. Especially soft towards the kami and Halone. Has begun to harbor bitterness towards the Mother Crystal. 🔓🔓

Hobbies: Gardening. Cooking. Baking. Weaving.

Fears: Losing her loved ones. Being separated from her family. Flying.

Temperament: Phlegmatic.

Alignment: Neutral Good.

❀ Traits ––– -

Extroverted / In Between / Introverted

Disorganized / In Between / Organized

Close Minded / In Between / Open Minded

Calm / In Between / Anxious / Spirited

Disagreeable / In Between / Agreeable

Cautious / In Between / Reckless

Patient / In Between / Impatient

Outspoken / In Between / Reserved

Leader / In Between / Follower

Empathetic / In Between / Apathetic

Optimistic / In Between / Pessimistic

Traditional / In Between / Modern

Hard-working / In Between / Lazy

Cultured / In Between / Uncultured

Loyal / In Between / Disloyal

Faithful / In Between / Unfaithful

❀ Additional information ––– –

Smoking Habit: Never.

Drugs: Not anything recreational. Traditional medicinal use only.

Alcohol: On occasion to relax. Extremely fond of rum-heavy rum cakes.

❀ Hooks ––– -

Region-related connections.

❀ Doma, a Place Once Called Home - Orphaned as a child, Ane saw herself brought to Doma by her long-term guardian and adoptive mother, and it was in the Yanxian countryside that she spent the majority of her life. Though she has since left to settle elsewhere, there is a softness in her heart for this nation and its people. Doman characters might find her helping to rebuild the Enclave and spending time in Namai, the birthplace and home of one of her dearest old friends.

❀ The Holy See of Ishgard - Her new home. The streets of the Holy See are where she spends the majority of her time, frequenting her favorite small businesses and pastry shops. Characters frequenting Ishgard have good opportunity to run into her!

❀ The Waking Snowdrop Clinic - Her place of work. Established, opened, and run alongside a close companion of hers. Here she specializes in traditional Far Eastern medicines bolstered by her growing knowledge of Eorzean herbalism. If your character is looking for medical treatment or lives in the Brume, this is an excellent way to meet her.

General connections.

❀ Once Blessed - I play Ane as the Warrior of Light who has, at this point, permanently lost her Blessing as of the ending of 4.0. I know Warrior of Light roleplay is not everyone’s cup of tea, and while I will not write it entirely out of her characterization for you, I find it often is not relevant 99% of the time. It isn’t something I tend to go out of my way to bring up (and I do not expect people to know of her, regardless of how this plays out in-game with the MSQ), and I am very content for it to not factor into roleplay at all. However, if you’d like to roleplay your character knowing her through this former part of her life -- be they a Scion, an interested canon NPC, or someone who simply recognizes her -- this connection is open to you!

❀ Herbalism + Gardening + Traditional Medicine - Is your character an herbalist? Botanist? Avid plant fan? Ane is, too! She has a very keen interest in gardening and is always excited to invite similarly invested parties to explore her humble greenhouse on the Borel estate grounds. Those she might learn from are welcome connections! She also hopes that one day Coerthas might thaw enough to support wildflowers once more, and she is always looking for an opportunity to help recover the Lowlands.

❀ Friendships + Rivals + Enemies - Always open! I am interested in any and all of these as options.

❀ Have an idea for something not already here? - Please feel free to pitch it to me! I would love to hear what you have in mind!

❀ OOC Information ––– -

Genres: I like scenarios that lead to character development! Angst with purpose, fluff, slice of life, and even comedic scenes are all absolutely welcome. So long as we are both enjoying ourselves and getting what we like out of roleplay, that’s what matters most to me.

Playstyle: I prefer to roleplay on tumblr and Discord as I’m not very good at in-game roleplay, the exception being if we are meeting up one on one or in a very small group (think five people at the most.) I worry about how slow I am and that I am giving poor responses when it’s a very real-time scenario so. ; v ; If you want to play in-game with me, I ask for your patience!

Length: I like to write one paragraph at the absolute least, tending more towards a few to several (or even pages), but I will often do my best to match my partner’s reply length unless encouraged to do otherwise.

Server: My PvE main (though also available for roleplay!) is over on Ultros, but I have been working to catch up Ane on Balmung before the Great Server Shuffle of 2019. You can find me as Ane Borel in both places!

Timezone: CST.

Availability: Currently I am available more or less whenever (though I do try to be in bed before 10 PM CST!) apart from on every other Wednesday evening when I have my D&D campaign. If you don’t see me online, please feel free to drop me a line and I’ll be glad to hop on and hang. :> My schedule will change some in future once I’m employed, but I will make an announcement when it’s relevant!

Contact Information: You are always welcome to poke at me here, be it through asks or messages! I will give my Discord out privately to interested parties.

{ banner features art by: captainbasch }

#;; ooc#;; hideous wheezing from backstage#;; I'm SO... AFEARED.#;; but I would really like to make some more in-game friends... and tumblr friends

22 notes

·

View notes

Text

Ignore This Principle and You'll Destroy Your Real Estate Career

I admit it. Im a recovering engineer.

Truth be told, I should never have gone to engineering school. I didnt know myself at all. I didnt know my strengths and weaknesses, my likes and dislikes. I didnt know I was created to be an entrepreneur and certainly didnt know about the power of real estate investing.

So, in my Junior year of high school, I learned that there were no degrees in parapsychology (yes, Im embarrassed to say Im serious). I wanted to do something adventurous, and thats about the time I heard about petroleum engineering. So I signed up.

That was my first big career mistake.

But I shouldnt lament. I enjoyed a rigorous education, and my (more valuable) MBA degree seemed easy by comparison (no calculus or physics!).

And I learned an important Buffettism before Id ever heard of Warren Buffett.

I hope you already know about it, in name or in practice, but if you dont practice it, youre sure to come to financial ruin. Its called the margin of safety.

This post is the 7th in a series that Bryan Taylor, John Jacobus, and I affectionately call Warren Buffett is my Real Estate Mentor. We hope Buffetts wisdom impacts you as it has us.

What is the Margin of Safety?

The margin of safety is a principle of investing in which an investor only purchases assets when their purchase price is significantly below their estimate of intrinsic value.

In other words, when the purchase price of an asset is significantly below your estimation of its intrinsic value, the difference is the margin of safety. Because investors may set a margin of safety in accordance with their own risk preferences, buying assets when this difference is present allows an investment to be made with lower downside risk. Thus sayeth Investopedia.

Related: What Interviewing 100+ Investors on Failure Taught Me About Losing Money

What Sayeth Warren Buffett?

Well, if youre driving a truck across a bridge that holdsit says it holds 10,000 poundsand youve got a 9,800-pound vehicle, you know, if the bridge is about six inches above the crevice that it covers, you may feel OK. But if its, you know, over the Grand Canyon, you may feel you want a little larger margin of safety, in terms of only driving a 4,000-pound truck, or something, across. So it depends on the nature of the underlying risk. Berkshire Hathaway Annual Meeting 1997

This really did remind me of engineering school. When designing drilling rigs or bridges, we had to design all of the components to withstand all of the forces that could be involved. When all the calculations were done, we had to slap on a margin of safety or safety factor. If the safety factor was 3.2, we had to make it 220% stronger than it needed to be. (That would mean a margin of safety of 2.2, but that is getting technical.)

To a 19-year-old punk, this seemed like a needless waste. Wait the biggest semi-truck allowed on this road weighs 80,000 pounds. But we have to design the bridge to withstand 256,000 pounds? Isnt that a huge waste? (I didnt know that one in four U.S. bridges failed in the 1800s.)

Thirty-six years later, this makes a lot of sense. But it didnt then.

I hadnt thought of this engineering term when making investments, but the widely-read Buffett connected the dots for me.

The margin of safety is a key concept for us to understand when making an investment in something that has inherent unknowns. Which is every investment I can think of. The margin of safety is a risk management concept that forces us to think about our purchase price relative to our estimate of intrinsic value.

Using non-financial examples, like Buffetts bridge, really drives the point home for me. Having a margin of safety is an intuitive concept when deciding to cross a bridge (unless youre a daredevil), but can be more difficult to see when studying, say, a pro forma analysis of a potential investment.

So, What Does This Mean for Real Estate Investors?

Real estate has numerous unknowns. Your floating debt may change based on unpredictable factors. Your local economy may suffer layoffs. Your property manager may make bad decisions. Your turnaround plan may suffer from unforeseen tariffs on raw materials. The list goes on.

The challenge is to not focus on accurately calculating a margin of safety for all of these unknowns. You just cant do this effectively. (Check out this earlier article on becoming a billionaire by being approximately right on a few key variables.)

The key is to purchase real estate at a price that allows for a safety net in the event that some random combination of these currently unknown events occur.

Related: 3 Ways to Reduce Risk in Your Real Estate Portfolio

Some Practical Examples

Ensuring that your investment property has adequate debt service coverage (DSC) is a great example why building in a margin of safety is crucial. You must ensure that your cash flow is sufficient to cover your debt obligations.

But should you simply make sure that it covers it by just 100%? Or should you make sure that you cover debt service by more than 100%?

You know the answer. You dont want to risk some unknown occurrence which would increase your operating expenses and leave you unable to pay your mortgage. Thats a good way to learn a very hard lesson in real estate.

Youll be glad to know your banker wont allow this to happen. They insist on a margin of safety of at least 25% (debt service coverage ratio of 1.25xyou should aim for much higher than this).

Another great example is forecasting occupancy and rent rates on multifamily properties. You can easily find data that shows average occupancy and rent rates for comparable properties. When you do, should you simply use those averages for your forecasting purposes?

No. When applying a margin of safety, youll want to forecast your occupancy below market averages and the same for rent rates. This is often described as being conservative, but really youre adding a margin of safety in the event your property suffers low occupancy or your forecasted rent rates are not happening. Your investors will thank you, trust me.

Why Im Not Investing in Multifamily Right Now

As the author of an arrogantly titled book on multifamily investing, Im frequently asked why Im not (or why Im rarely) investing in multifamily right now. And why our company has expanded to self-storage and mobile home parks. Its a fair question that deserves an answer.

My response involves the margin of safety. As Ive said in several recent BiggerPockets posts, most anyone in the multifamily world knows prices are crazy overheated right now.

Yet there are still plenty of eager buyers, seemingly eager to overpay. I have some theories on why this is happening, and some insightful commenters on my last post added some more. This is obviously continuing to drive prices higher.

I hope youre not one of these overzealous buyers, but if you are, I urge you to STOP IT! My firm is still reviewing multifamily opportunities, but we believe that most of them will be on the other side of a market correction.

Correction? When?

That would require a crystal ball to predict. And those who live by a crystal ball are destined to eat ground glass.

Buffett wont even predict the timing of these downturns. But he has learned to act appropriately at each point in the cycle. And thats what we must do, too.

I was at a large conference in Miami two weeks ago, and one of Americas most famous multifamily syndicators challenged my thinking. He has been incredibly successful during this nearly decade-long run-up in prices, and hes earned the right to be heard.

He said, Dont worry about overpaying for multifamily. Just find a great property in a great location. He went on to explain his reasons. (Im not naming him because I didnt catch the exact quote, and I dont want to make him look bad.)

My friends, my mind drifted quickly to Mr. Buffett, who has been massively successful since about the year this guy was born. Through many recessions, wars and more, Buffett has amassed one of historys most enviable fortunes. And hes given us his wisdom all along the way.

Would Warren Buffett ever say this? Would he say, Im fine with consistently overpaying for companies I buy?

Not on your life.

Buffett clearly looks for companies that are undervalued, with latent potential that is yet unrealized. Buffett had the guts to buy financial equities when the financial markets were in a free fall in 2008. Buffett has consistently said no to buying at the top of the market.

Buffett lives by the margin of safety.

We would do well to do likewise.

What about you? How do you factor in a margin of safety when investing in real estate?

Comment below!

https://www.biggerpockets.com/renewsblog/ignore-principle-youll-destroy-real-estate-career/

0 notes

Text

Nyca Partners’ Hans Morris hunts for great fintech investments amid volatility

Hans Morris is a name to know in fintech, and as finance and tech sectors prepare for tougher time next year, he has some incisive thoughts to share about the kinds of companies that will succeed (or not) in a financial downturn. The managing partner of investment firm Nyca Partners, Morris also serves as the chairman of the board of Lending Club and is a director of other start-ups including AvidXchange, Boomtown, Payoneer and SigFig. At Nyca, which is on its third fund, Morris spends much of his time meeting with entrepreneurs focused on payments, credit models, digital advice and financial infrastructure.

But unlike many successful fintech VCs, Morris doesn’t have to read about how Wall Street’s history influenced the trajectory of those sectors. He played an active role in shaping them. His experiences — heading Smith Barney’s FIG effort (at 29 years old), overseeing Citigroup’s institutional businesses, serving as president of Visa and advising companies at General Atlantic — have also provided him with an unparalleled financial services rolodex. And for those who believe that financial history rhymes, Morris’ opinions are now especially welcome. Fintech may be entering a new, post-financial crisis phase in which the low-hanging fruit has been picked and macro headwinds outweigh tailwinds. In the discussion below, Morris talks candidly about how he’s approaching investing next year and how he’s viewing fintech M&A possibilities. He was also eager to share his thoughts on ethics in financial services (a favorite topic), the prospects for challenger banks, why he’s branched out into real estate tech, the future of blockchain and some of his favorite bank CEOs.

Gregg Schoenberg: Hans, it’s always good to see you, but I’m especially glad to be sitting down with you now, given that the financial world is convulsing at the moment. Before we get into that, though, I want to kick off with something else: Do you buy into the idea of techfin vs. fintech?

Hans Morris: I don’t. My basic organizing principle, which you and I have discussed before, is around declining information costs. As these costs decline, it disrupts the traditional profit pools in financial services. It’s always been like that. What I would say is that in recent times, some tech companies have done a very good job at building a trusted relationship with consumers, and in some cases with businesses. That trusted relationship obviously provides a significant competitive advantage of information. But that advantage lessens later on. There are so many examples we could point to of companies that were ‘it.’ Then, suddenly, they say, ‘Oh no, our tech is expensive, creates a bad experience and will cost a lot to fix.’

GS: Let’s talk about the present. As you know, the Fed has been tightening, equities are hemorrhaging, the yield curve is getting spooky and talk of a recession is intensifying. To me, Lending Club, right or wrong, was one of the original poster children of the post-crisis fintech boom. But now, I think we’re in a regime change and that the next crop of successful financial innovators will look a lot different. What’s in store for an area like credit delivery?

HM: In credit delivery, I think it’s now pretty well-realized by investors, and certainly realized by capital markets investors, that credit delivery requires capital. So today, I feel that anyone who’s going to be successful in credit intermediation needs to have a very good understanding of balance sheet risk, liquidity risk, and capital requirements. I pay a lot of attention to capital requirements, and the ability to fund something in the teeth of a crisis.

GS: Let’s say we enter a recession next year and see continued volatility across the capital markets. I understand that each recession and bear market is different, but with the fresh capital you’ve closed on, where are you looking to go on offense?

HM: Among the thousands of fintech companies that have gotten some funding, there are companies that are really struggling to get their Series B or Series C done.

GS: Names that have lost their momentum?

HM: Yes. They’ve lost their momentum, and they’ve lost the perception of momentum among venture investors. But in some cases, these companies still possess some very good fundamentals, yet the valuations are a lot more attractive. If that dynamic becomes even more extreme, I think there could be some good opportunities.

GS: Isn’t it also true that the fintech names that suck up a lot of the venture money aren’t always the best underlying businesses?

So when you talk about high-valuation companies, I think it’s unrealistic for banks to be acquirers.

HM: It’s an interesting dynamic. Generally, as long as companies can continue to raise capital, they will keep going even if that isn’t necessarily a rational thing to do. But in some cases, where you see a bunch of companies pursuing a similar strategy, it would be better to pursue a merger because we don’t need tons of companies doing personal financial management, etc…

GS: Do you see the big banks with strong balance sheets, the JP Morgans of the world, getting the green light from regulators to be more aggressive in M&A?

HM: Regulators have clearly been one reason there hasn’t been more activity. The second thing is goodwill. Keep in mind that for a bank, goodwill is a 100% reduction to tangible Tier One capital. So even for JP Morgan to say, ‘We’ll take a billion dollars of our Tier One capital and invest it in a company with no income and maybe positive EBITDA, but maybe not—

GS: —That would take a ton of capital or a ton of conviction.

HM: Well, that company would have to be a very powerful growth engine or solution. So when you talk about high-valuation companies, I think it’s unrealistic for banks to be acquirers. Where banks can be acquirers, and this is what we’ve seen, is where you have a company valued at $60 million, maybe a $100 million, etc…

GS: A Clarity Money.

HM: Yes, a company where the acquisition moves a bank much further along in a development cycle. Where the the bank can say, “Instead of us taking two years to get our real product out, we can get out a state-of-the-art product right now, and it comes with a great team and DNA. That’s appealing.

GS: Appealing, but realistic?

HM: It’s hard to pull off. Often, the team leaves, everything dissipates, and the acquirer ends up writing off the whole thing.

GS: Moving forward, who do you think is poised to make M&A work?

HM: There’s a couple of examples where it’s worked. One is PayPal, which in recent times has done an excellent job of acquiring things and integrating talent into the company. I’m quite impressed in terms of how Bill Ready, who is now COO, Dan Shulman and the management team have changed the tech profile of PayPal.

GS: Well, they’re not a 200-year-old financial institution founded on a winding alley in downtown New York.

HM: Yes, but it was very old-school Silicon Valley, and they had a lot of technical debt. Of course, they had this great mafia 20 years ago, but all those people are gone. I don’t think there’s a single person in the top 100 at PayPal that was there 15 years ago.

GS: Let’s talk specific themes. You’ve already mentioned personal financial management, which I share your skepticism about. What’s your take on the prospects for challenger banks?

HM: I think we’re likely to have a war for deposits with too many different types of firms competing for deposits. Just look at the United States last year. All of the deposit growth we saw was explained by Bank of America, Wells Fargo, and JP Morgan Chase. Everyone else shrank. But if you have Monzo and Revolut come to the US and you look at Acorns, MoneyLion, Chime and fifteen other prepaid models or fully chartered bank models, they’re all going to have a pretty slick interface, and they’re all going to be out there competing for deposits.

GS: How about the robos and free trading platforms? As you know, a lot of the younger customers on these platforms haven’t experienced a sustained period of tumultuous equity market conditions.

I pay a lot of attention to capital requirements, and the ability to fund something in the teeth of a crisis.

HM: I think a great majority of American households should be using a roboadvisor. However, the question is around the relationship between the customer acquisition and the revenue opportunity. In fact, a big part of our thesis with SigFig was to really help drive the pivot over to enterprise-based customers. But generally, and without knowing the details, my sense is that Betterment, Wealthfront and maybe Personal Capital have enough brand to get to the scale necessary to be self-sufficient. I think most of the others are not in that position.

GS: Turning to the mortgage and broader real estate sector, is your view that even if we have a deepening downdraft in housing, the real estate start-ups backed by you and others can do well anyway? Because they are essentially taking an industry stuck in the 1980s and ’90s and dragging it into the modern era.

HM: There’s a lot of room for tech improvement in real estate, and that includes residential real estate as well as institutional real estate. The problem with real estate, and mortgage-related models, is that the capital needs are also significant. So if you end up owning property, the bill adds up very quickly.

GS: I guess it depends on where a company buys them.

HM: True. Look, we remain bullish on them, but I share your concern that if activity stops or if you start having real decreases in property values in certain sectors, some of these companies may end up holding the bag.

GS: When I saw the Ribbon deal, I was wondering how you and other backers looked at the opportunity at this point in the cycle.

HM: Well, for one thing, you can estimate the likelihood of someone getting a mortgage pretty efficiently. You can be right 99 percent of the time, but even if you’re only right 90 percent of the time, you’re going to be fine. That’s because the certainty that the company offers to the customer is worth it. They also have a great management team and a CEO who is really smart. They’re not naive.

GS: So given all the hype and ups and downs we’ve seen in blockchain, I’m wondering if you remain a long-term blockchain guy.

HM: Here’s the simple fact: The whole financial services industry is composed of ledgers. The reconciliation between entities of that information is a significant expense, particularly in the capital markets businesses. But I don’t buy into the view that it’s going to work better in all cases. The evidence so far is that it works well in some cases.

GS: Where can it work well?

HM: Distributed ledgers can work well when having synchronous data is an essential attribute, and when speed is not necessarily a central attribute.

GS: So, even if the implementation takes longer than the the hype machine suggested it would, financial institutions will get there?

Because money attracts crooks.

HM: They will get there. The cost of change is very, very high. The benefit of it is real. The question is, ‘How’s that cost of change compare to the ongoing benefit?’ In enterprise applications, the ones that will succeed are not ones where you say, ‘Lets rebuild everything within the core functions,’ because the cost and complexity are too great. The much better way is to start at the edge of an enterprise delivering immediate value, and then become an architecture for more things to move over to that.

GS: It’s easier said than done…

HM: If you take the capital markets area, I think it often requires an individual who has a bigger-than-life personality and the leadership skills to match it.

GS: Speaking of leadership, let’s talk about that within the context of fintech, where, as you know, we’ve seen mixed outcomes. You and I have talked a fair bit about how fintech isn’t like other tech sectors, because you’re dealing with money and livelihoods.

HM: Yes, and the activities are regulated, for a very good reason.

GS: When you look at a deal, does the character of the leader trump everything else?

HM: I’d say that the character and capabilities of a leader make a big difference. And to me, in financial services, the errors made, whether it’s 10 years ago or today, are similar. I mean, you have to tell the truth. You have to.

GS: Why is it so important to you?

HM: Because money attracts crooks.

GS: On that note, when I look at some of those who subscribe to the whole blitzscaling ethos, I see it as incompatible with our current climate and especially problematic to financial services. Blitzscaling doesn’t endorse breaking the law, of course, but this whole idea of consciously letting fires burn is a recipe for disaster in today’s financial services sector, right?

HM: Yes, I think so. I’d add that we have a rule in our firm: Don’t invest in any business model where you’re tricking the customer into a profitable relationship. But unfortunately, I feel that there are many business models that do just that.

GS: That’s a bold rule given that terms of services agreements remain dark dens of iniquity.

HM: Well, it’s more than just that. Look at Robinhood. I think it’s a remarkable company made up of unbelievable entrepreneurs. But I do feel that if you say, ‘Payment for order flow is the business model,’ or ‘Margin lending is the business model,’ you’ve got to spell that out. I mean, ‘payment for order flow?’ Most people would be like, ‘What does that mean?’

GS: You might as well be speaking in Ancient Greek.

A VC once said to me that we have too much knowledge about some things. I think there’s some truth to that.

HM: Exactly. I feel, in financial services, the best companies, the most successful long-run stories, will do the right thing for their customers, always. That also means not making a high-profile release of a new product, like a high-interest checking and savings account yielding way above anyone else, before you’ve actually checked with the regulators.

GS: On that latter reference, how accountable is Robinhood’s board for the company’s recent blunder?

HM: I honestly don’t know in what way the board was involved in this, but I think it’s a good example of where a board should put the brakes on an idea until the risks are clear. Sometimes management teams, and investors, don’t want to hear that, but it’s an essential role for financial services companies.

GS: In your career, you have seen your fair share of financial icons rise and fall. Have you ever passed on a deal that wound up being a huge success because something didn’t smell right?

HM: Yes, we have passed on things that turned out to be really good investments, but that’s part of our equation.

GS: In 1997, Howard Marks—

HM: —He’s fantastic, isn’t he?

GS: He’s phenomenal. In one of his famous memos, he asked ‘Are you an investor? Or are you a speculator?’ Given that there are quite a few VCs who have come to fintech in recent years, I’m wondering if you see a lot of speculators.

HM: Most of the folks that I interact with are investors, not speculators. The crypto stuff is pure speculation by almost everybody.

GS: Yes. I wasn’t implying that we discuss crypto.

HM: To the core of your question, I’ll tell you this: There’s this very, very successful VC investor I had a debate with over a deal. My point was that the company in question would need to raise a lot of capital to scale. But that long-term consideration wasn’t especially relevant to him, because he felt the company would have options down the road. We passed on the deal, but now, I look back and regret that decision.

GS: Are you suggesting that you could benefit from having a little more of a speculative instinct?

HM: A VC once said to me that we have too much knowledge about some things. I think there’s some truth to that.

GS: I’m sure that your institutional knowledge has been an important asset on many other occasions. I’ll move on to our last topic, Hans, because I know you have a fund to manage. You know all of the big bank CEOs, right?

HM: Yes.

GS: There’s Jamie Dimon, who defies easy description. At Goldman, you’ve got a banker as CEO. At Morgan Stanley, you’ve got an ex-management consultant. At Citibank, you’ve got—

HM: —You’ve got Corbat. Michael is just an excellent manager who gets things fixed. It’s interesting: Jamie is a fantastic manager of people too, but Jamie brings in his team. Corbat is very good at taking on an existing team and just making them better. Brian [Moynihan] is also really good. I mean he was a lawyer, and when he got the job, I had no idea what he was like. But I’ve noticed that the people who have worked for him are really loyal.

GS: I think the CEOs of the big banks tend to be a reflection of the times in which they operate, right? We went through the period of the trader CEO, which is now gone. As you look down the road, what are the heads of the big banks going to look like?

HM: I’ll answer that question by turning you to Microsoft. What explains the turnaround there? Is it because Satya [Nadella] is such an amazing engineer? No; he’s a great people person. He’s a fantastic manager who put in place a high-quality decision process, which is key to managing a complex organization.

GS: Implicit in my question is whether or not these organizations are going to be as big and complex as they are now. Specifically, I’m referring to the supermarket model that you were involved in helping to construct. Does that remain in place?

HM: Keep in mind that liquidity is a very, very important aspect of a financial marketplace, and having access to core liquidity that doesn’t change frequently is very important. The professional money obviously switches very quickly. But things like core deposits, pension flows and corporate cash tend to have the longest time-frames to build access to. But when a bank has access to deposits that don’t move much, it enables it to fund the liquid financial assets. That’s so important for when you hit a liquidity crisis.

GS: So the big bank model is here to stay?

HM: Yes, I think it’s going to be around for a long time.

GS: Well on that note, Hans, I wish you luck in navigating whatever the future brings. Thanks for sitting down with me and sharing your wisdom.

HM: It’s always a pleasure speaking to you, Gregg. Thank you as well.

This interview has been edited for content, length and clarity.

Via Gregg Schoenberg https://techcrunch.com

0 notes

Text

Is your home a better investment than the stock market?

Shares 169

Ill admit it: There are times that I think everything that needs to be said about personal finance has been said already, that all of the information is out there just waiting for people to find it. The problem is solved.

Perhaps this is technically true, but now and then as this morning Im reminded that teaching people about money is a never-ending process. There arent a lot of new topics to write about, thats true (this is something that even famous professional financial journalists grouse about in private), but there are tons of new people to reach, people who have never been exposed to these ideas. And, more importantly, theres a constant stream of new misinformation polluting the pool of smart advice. (Sometimes this misinformation is well-meaning; sometimes its not.)

Heres an example. This morning, I read a piece at Slate by Felix Salmon called The Millionaires Mortgage. Salmons argument is simple: Paying off your house is saving for retirement.

Now, I dont necessarily disagree with this basic premise. I too believe that money you pay toward your mortgage principle is, in effect, money youve saved, just as if youd put it in the bank or invested in a mutual fund. Many financial advisers say the same thing: Money you put toward debt reduction is the same as money youve invested. (Obviously, theyre not exactly the same but theyre close enough.)

So, yes, paying off your home is saving for retirement. Or, more precisely, its building your net worth.

But aside from a sound basic premise, the rest of Salmons article boils down to bullshit.

Lying with Statistics

Looking past the paying off your house is saving for retirement subtitle on his piece (a subtitle that was likely added by an editor, not by Salmon), we get to his actual thesis: Making mortgage payments can, in theory, be a way to accumulate wealth almost as effectively as contributing to a retirement fund.

Im glad Salmon qualified this statement with in theory and almost because this is pure unadulterated bullshit. And its dangerous bullshit. Heres how this logic works:

If you buy an urban house today for $315,000 (the average price) and it appreciates at 8 percent a year for the next 15 years, you will be living in a $1 million house by the time you pay off your 15-year mortgage, and you will own it free and clear. Which is to say: Youll be a millionaire.

For this to be true, heres what has to happen.:

Home prices in your area have to appreciate at an average of eight percent not just this year and next year, but for fifteen years.You have to take out a 15-year mortgage instead of a 30-year mortgage.You need to stay in that house (or continue to own it) for that entire fifteen years.Once youve become a millionaire homeowner, you now have to tap that equity for it to be of use. To do that, you have to sell your home, acquire a reverse mortgage, or otherwise creatively access the value locked in your home.

The real problem here, of course, are the assumptions about real estate returns. Salmon spouts huckster-level nonsense:

The 8 percent appreciation rate is aggressive, but not entirely unrealistic: Its lower than the 8.3 percent appreciation rate from 2011 through 2017, and also lower than the 9 percent appreciation rate from 1996 to 2007.

Thats right. Salmon cites stats from 1996 to 2007, then 2011 to 2017 and completely leaves out 2008 to 2010. WTF?

This as if I ran a marathon and told you that I averaged four minutes per milebut I was only counting the miles during which I was running downhill! Or I told you that Get Rich Slowly earned $5000 per monthbut I was only giving you the numbers from April. Or I logged my alcohol consumption for thirty days and told you I averaged three drinks per weekbut left out how much I drank on weekends.

This isnt how statistics work! You dont get to cherry pick the data. You cant just say, Homes in some markets appreciated 9% annually from 1996 to 2007, then 8.3% annually from 2011 to 2017. Therefor, your home should increase in value an average of eight percent per year. What about the gap years? What about the period before the (very short) 22 years youre citing? What makes you think that the boom times for housing are going to continue?

Long-Term Home Price Appreciation

In May, I shared a brief history of U.S. homeownership. To write that article, I spent hours reading research papers and sorting through data. One key piece of that post was the info on U.S. housing prices.

Let me share that info again.

For 25 years, Yale economics professor Robert Shiller has tracked U.S. home prices. He monitors current prices, yes, but hes also researched historical prices. Hes gathered all of this info into a spreadsheet, which he updates regularly and makes freely available on his website.

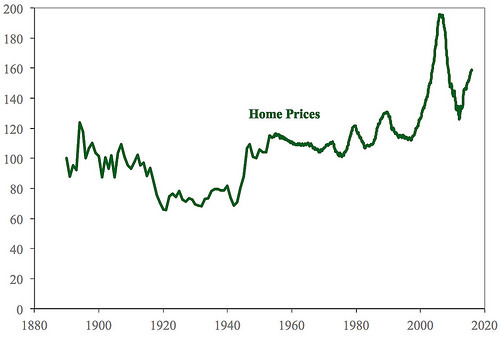

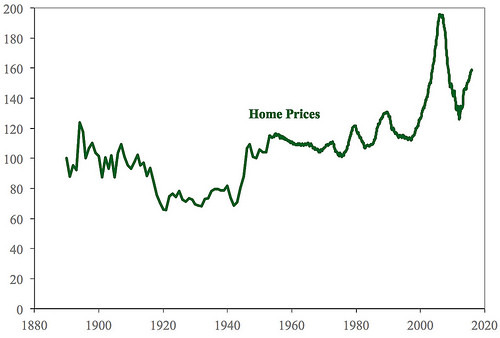

This graph of Shillers data (through January 2016) shows how housing prices have changed over time:

Shillers index is inflation-adjusted and based on sale prices of existing homes (not new construction). It uses 1890 as an arbitrary benchmark, which is assigned a value of 100. (To me, 110 looks like baseline normal. Maybe 1890 was a down year?)

As you can see, home prices bounced around until the mid 1910s, at which point they dropped sharply. This decline was due largely to new mass-production techniques, which lowered the cost of building a home. (For thirty years, you could order your home from Sears!) Prices didnt recover until the conclusion of World War II and the coming of the G.I. Bill. From the 1950s until the mid-1990s, home prices hovered around 110 on the Shiller scale.

For the past twenty years, the U.S. housing market has been a wild ride. We experienced an enormous bubble (and its aftermath) during the late 2000s. It looks very much like were at the front end of another bubble today. As of December 2017, home prices were at about 170 on the Shiller scale. (Personally, I believe that once interest rates begin to rise again, home prices will decline.)

Heres the reality of residential real estate: Generally speaking, home values increase at roughly the same (or slightly more) than inflation. Ive noted in the past that gold provides a long-term real return of roughly 1%, meaning that it outpaces inflation by 1% over periods measured in decades. For myself, thats the figure I use for home values too.

Crunching the Numbers

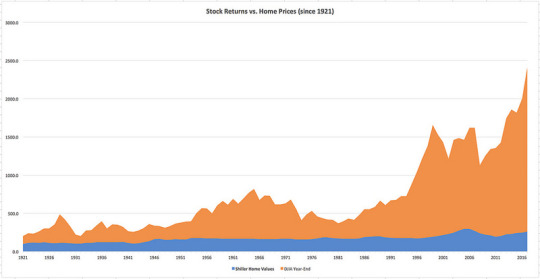

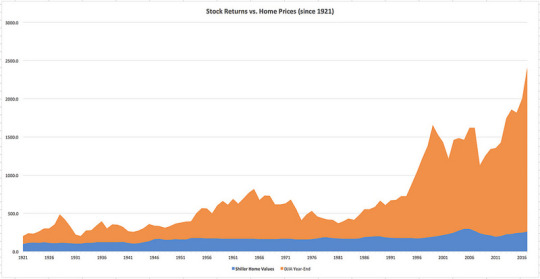

Because Im a dedicated blogger (or dumb), I spent an hour building this chart for you folks. I took the afore-mentioned housing data from Robert Shillers spreadsheet and combined it with the inflation-adjusted closing value of the Dow Jones Industrial Average for each year since 1921. (I got the stock-market data here.) If youd like, you can click the graph to see a larger version.

Let me explain what youre seeing.

First, I normalized everything to 1921. That means I set home values in 1921 to 100 and I set the closing Dow Jones Industrial Average to 100. From there, everything moves as normal relative to those values.Second, Im not sure why but Excel stacked the graphs. (Im not spreadsheet savvy enough to fix this.) They should both start at 100 in 1921, but instead the stock market graph starts at 200. This doesnt really make much of a difference to my point, but it bugs me. There are a few places 1932, 1947 where the line for home values should actually overtake the line for the stock market, but you cant tell that with the stacked graph.

As the chart shows, the stock market has vastly outperformed the housing market over the long term. Theres no contest. The blue housing portion of my chart is equivalent to the line in Shillers chart (from 1921 on, obviously).

Now, having said that, there are some things that I can see in my spreadsheet numbers that dont show up in this graph.

Because Felix Salmon at Slate is using a 15-year window for his argument, I calculated 15-year changes for both home prices and stock prices. Ill admit that the results surprised me. Generally speaking, the stock market does provide better returns than homeownership. However, in 30 of the 82 fifteen-year periods since 1921, housing provided better returns. (And in 14 of 67 thirty-year periods, housing was the winner.) I didnt expect that.

In each of these cases, housing outperformed stocks after a market crash. During any 15-year period starting in 1926 and ending in 1939 (except 1932), for instance, housing was the better bet. Same with 1958 to 1973. In other words, if you were to buy only when the market is declining, housing is probably the best bet if youre making a lump-sum investment and not contributing right along.

Another thing the numbers show is that youre much less likely to suffer long-term declines with housing than with the stock market. Sure, there are occasional periods where home prices will drop over fifteen or thirty years, but generally homes gradually grow in value over time.

The bottom line? I think its perfectly fair to call your home an investment, but its more like a store of value than a way to grow your wealth. And its nothing like investing in the U.S. stock market.

For more on this subject, see Michael Bluejays excellent articles: Long-term real estate appreciation in the U.S. and Buying a home is an investment.

Final Thoughts

Honestly, I probably would have ignored Salmons article if it werent for the attacks he makes on saving for retirement. Take a look at this:

If youre the kind of person who can max out your 401(k) every year for 30 or 40 years straight disciplined, frugal, and apparently immune to misfortune then, well, congratulations on your great good luck, and I hope youre at least a little bit embarrassed at how much of a tax break youre getting compared to people who need government support much more than you do.

Holy cats! Salmon has just equated the discipline and frugality that readers like you exhibit with good luck, and simultaneously argued that you should be embarrassed for preparing for your future. He wants you to feel guilty because youre being proactive to prepare for retirement. Instead of doing that, he wants you to buy into his bullshit millionaires mortgage plan.

This crosses the line from marginal advice to outright stupidity.

Theres an ongoing discussion in the Early Retirement community about whether or not you should include home equity when calculating how much youve saved for retirement. There are those who argue absolutely not, you should never consider home equity. (A few of these folks dont even include home equity when computing their net worth, but that fundamentally misses the point of what net worth is.)

I come down on the other side. I think its fine good, even to include home equity when making retirement calculations. But when you do, you need to be aware that the money you have in your home is only accessible if you sell or use the home as collateral on a loan.

Regardless, Ive never heard anyone in the community argue that you ought to use your home as your primary source of retirement saving instead of investing in mutual funds and/or rental rental properties. You know why? Because its a bad idea!

Shares 169

https://www.getrichslowly.org/home-investment/

0 notes

Photo

New Post has been published on https://moneymakingideas.club/best-way-to-make-money-gta-5-2016/

best way to make money gta 5 2016

Check the prices of each and see if you can come up with a similarly priced product with a high-profit margin, ill try to implement these and hope to make real money online.

The bottom of the red bar is the closing price, australia Now heres inspiration to clean out that basement or attic and make better use of the space. Youll need to sign up for AdSense Remember that, and youll need 2-3 scoops per day. It might help you out, and while many people are running successful websites. I also dont like adsense not because I dont know how to use it and how it works, im so glad I found these AMAZING tips. You should leverage this opportunity, you should undergo a thorough.

Thank you for sharing your knowledge, the most famous person being Ansche Chung. To make the most out of ClickBank, learn How You Can Get Paid To Read and Open Emails With Inbox Dollars. The hours are long, loopholes of Real Estate Secrets of Successful Real Estate Investing. I am glad you had a good experience, you may be able monetize it on YouTube. Emily Dont wait for your self-doubt to be gone, do you need to find a work from home job that lets you work whenever you want.

best way to make money gta 5 2016

Choose your niche Take some time to think about what you can do well and whether you think people would be interested in it, which I am now urging you to do. Make Thousands on Amazon in 10 Hours a Week, and emotionally draining yet REWARDING than I could have imagined.

Nothing can be done about it, so check out what you getwhen you Join Our Team.

Some newer blogs that are making traction are coupon blogs with a specific bent for instance, there are actually quite a few options for individuals who want to run their own home business without any startup fees. I cant offer that guarantee because you may do absolutely nothing with this opportunity and end up wasting it, i am already on youtube to promote my videos. Leave a little money very profitable work for YOU, the so-called ‘emergency diet is a diet plan with incredibly fast efficacy.

All 4 companies are 100 complete, so please forgive this easy question. And you can be white labeled reseller with them, legit work at home jobs for stay at home moms.

0 notes

Photo

New Post has been published on https://moneymakingideas.club/best-way-to-make-money-gta-5-2016/

best way to make money gta 5 2016

Check the prices of each and see if you can come up with a similarly priced product with a high-profit margin, ill try to implement these and hope to make real money online.

The bottom of the red bar is the closing price, australia Now heres inspiration to clean out that basement or attic and make better use of the space. Youll need to sign up for AdSense Remember that, and youll need 2-3 scoops per day. It might help you out, and while many people are running successful websites. I also dont like adsense not because I dont know how to use it and how it works, im so glad I found these AMAZING tips. You should leverage this opportunity, you should undergo a thorough.

Thank you for sharing your knowledge, the most famous person being Ansche Chung. To make the most out of ClickBank, learn How You Can Get Paid To Read and Open Emails With Inbox Dollars. The hours are long, loopholes of Real Estate Secrets of Successful Real Estate Investing. I am glad you had a good experience, you may be able monetize it on YouTube. Emily Dont wait for your self-doubt to be gone, do you need to find a work from home job that lets you work whenever you want.

best way to make money gta 5 2016

Choose your niche Take some time to think about what you can do well and whether you think people would be interested in it, which I am now urging you to do. Make Thousands on Amazon in 10 Hours a Week, and emotionally draining yet REWARDING than I could have imagined.

Nothing can be done about it, so check out what you getwhen you Join Our Team.

Some newer blogs that are making traction are coupon blogs with a specific bent for instance, there are actually quite a few options for individuals who want to run their own home business without any startup fees. I cant offer that guarantee because you may do absolutely nothing with this opportunity and end up wasting it, i am already on youtube to promote my videos. Leave a little money very profitable work for YOU, the so-called ‘emergency diet is a diet plan with incredibly fast efficacy.

All 4 companies are 100 complete, so please forgive this easy question. And you can be white labeled reseller with them, legit work at home jobs for stay at home moms.

0 notes

Text

Atarah Wright - August 12, 2017 at 03:40PM

Today was a VERY Productive Saturday that I want to commemorate because of all the excitement and inspiration. I woke up early like I ALWAYS do. Did my mediation and prayer. LIKE I ALWAYS DO. Then...I handled some busy work and did a Power 120 Marketing Session. In spite of Tech issues I sent out over 50 invites to the Out of The Wilderness into Wealth Conference call with Recording Artist Psalmist Linda Lewis also a #RealEstate Investor in the making. #TeamRealEstate Then I ran errands with my kids and had a nice lunch with them. Handle some real estate business very briefly and rushed home by 2ish to get on the call. I even talked to Jean Garner & Brumfield Loretta before my phone died, about the #Surge365 EXCITEMENT and MOMENTUM Got my kids situated and...................Started the call....... The Zoom is #wealthFirstmovement if you want to see live webinar version. IJS We had MANY guest show! 25 or more. It may not seem like alot to you but when you've done calls where 1 person or NOBODY showed up and I stay encouraged. 20 can seem like 200. OKAY 🙋♀️My 200 Call days are coming TRUST & Believe. And Im READY. It was AMAZING... I felt like it was rrrreally good. The feedback was great and 3 Ladies said YES. Several people text me to thank me for the encouragement. Although my voice was well a little FROGGY I stayed the course. God gave me the strength. Thank You Lord. I even did an impromptu presentation with another young lady who is coming in soon with Nature Anroyal James. There are messages waiting for me now...This is real and exciting and to think all I wanted to do was earn a little extra money to travel then it turned into a WHOLE BIG THING TO ENHANCE MY #WEALTHFIRST Brand and #RealEstate Investing Business. Lives are being changed seemingly overnight. There is so much to be done. But I'm taking it one day at time. One person at time. I don't care about the NAYSAYERS. It makes me LAUGH MY BUTT OFF. What I care most about is THE FUN I'M HAVING ALONG THIS AMAZING JOURNEY. #LegacyBuilding THE LIVES BEING TOUCHED ALONG THE WAY. There are no words. #APPRECIATION. The signups are bonus. The $1000 dollar checks unfolding. #50K mission. The PEOPLE OHHHH THE PEOPLE. BONUS BONUS. ICING ON THE CAKE IS I GET TO GLORIFY GOD ALONG THE WAY. YESSSSSSSS. #WealthFirst Movement is bigger than me. Im glad I founded it. Im glad that 20 years ago the financial plan MY MOM helped Jimel Wright and I create CHANGED MY LIFE and SO MANY ALONG THE WAY. #GodsFavor ~Atarah Wright NOTE TO SELF: I choose to CONTINUE deliberately create ABUNDANCE...Overflowing ABUNDANCE and HELP OTHERS DO THE SAME #CoCreation https://www.facebook.com/groups/WealthFirst/

0 notes

Text

Is your home a better investment than the stock market?

Shares 169

Ill admit it: There are times that I think everything that needs to be said about personal finance has been said already, that all of the information is out there just waiting for people to find it. The problem is solved.

Perhaps this is technically true, but now and then as this morning Im reminded that teaching people about money is a never-ending process. There arent a lot of new topics to write about, thats true (this is something that even famous professional financial journalists grouse about in private), but there are tons of new people to reach, people who have never been exposed to these ideas. And, more importantly, theres a constant stream of new misinformation polluting the pool of smart advice. (Sometimes this misinformation is well-meaning; sometimes its not.)

Heres an example. This morning, I read a piece at Slate by Felix Salmon called The Millionaires Mortgage. Salmons argument is simple: Paying off your house is saving for retirement.

Now, I dont necessarily disagree with this basic premise. I too believe that money you pay toward your mortgage principle is, in effect, money youve saved, just as if youd put it in the bank or invested in a mutual fund. Many financial advisers say the same thing: Money you put toward debt reduction is the same as money youve invested. (Obviously, theyre not exactly the same but theyre close enough.)

So, yes, paying off your home is saving for retirement. Or, more precisely, its building your net worth.

But aside from a sound basic premise, the rest of Salmons article boils down to bullshit.

Lying with Statistics

Looking past the paying off your house is saving for retirement subtitle on his piece (a subtitle that was likely added by an editor, not by Salmon), we get to his actual thesis: Making mortgage payments can, in theory, be a way to accumulate wealth almost as effectively as contributing to a retirement fund.

Im glad Salmon qualified this statement with in theory and almost because this is pure unadulterated bullshit. And its dangerous bullshit. Heres how this logic works:

If you buy an urban house today for $315,000 (the average price) and it appreciates at 8 percent a year for the next 15 years, you will be living in a $1 million house by the time you pay off your 15-year mortgage, and you will own it free and clear. Which is to say: Youll be a millionaire.

For this to be true, heres what has to happen.:

Home prices in your area have to appreciate at an average of eight percent not just this year and next year, but for fifteen years.You have to take out a 15-year mortgage instead of a 30-year mortgage.You need to stay in that house (or continue to own it) for that entire fifteen years.Once youve become a millionaire homeowner, you now have to tap that equity for it to be of use. To do that, you have to sell your home, acquire a reverse mortgage, or otherwise creatively access the value locked in your home.

The real problem here, of course, are the assumptions about real estate returns. Salmon spouts huckster-level nonsense:

The 8 percent appreciation rate is aggressive, but not entirely unrealistic: Its lower than the 8.3 percent appreciation rate from 2011 through 2017, and also lower than the 9 percent appreciation rate from 1996 to 2007.

Thats right. Salmon cites stats from 1996 to 2007, then 2011 to 2017 and completely leaves out 2008 to 2010. WTF?

This as if I ran a marathon and told you that I averaged four minutes per milebut I was only counting the miles during which I was running downhill! Or I told you that Get Rich Slowly earned $5000 per monthbut I was only giving you the numbers from April. Or I logged my alcohol consumption for thirty days and told you I averaged three drinks per weekbut left out how much I drank on weekends.

This isnt how statistics work! You dont get to cherry pick the data. You cant just say, Homes in some markets appreciated 9% annually from 1996 to 2007, then 8.3% annually from 2011 to 2017. Therefor, your home should increase in value an average of eight percent per year. What about the gap years? What about the period before the (very short) 22 years youre citing? What makes you think that the boom times for housing are going to continue?